Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - CONX Corp. | tm2029435d5_ex23-1.htm |

| EX-10.7 - EXHIBIT 10.7 - CONX Corp. | tm2029435d5_ex10-7.htm |

| EX-10.6 - EXHIBIT 10.6 - CONX Corp. | tm2029435d5_ex10-6.htm |

| S-1 - S-1 - CONX Corp. | tm2029435-4_s1.htm |

Exhibit 3.1

|

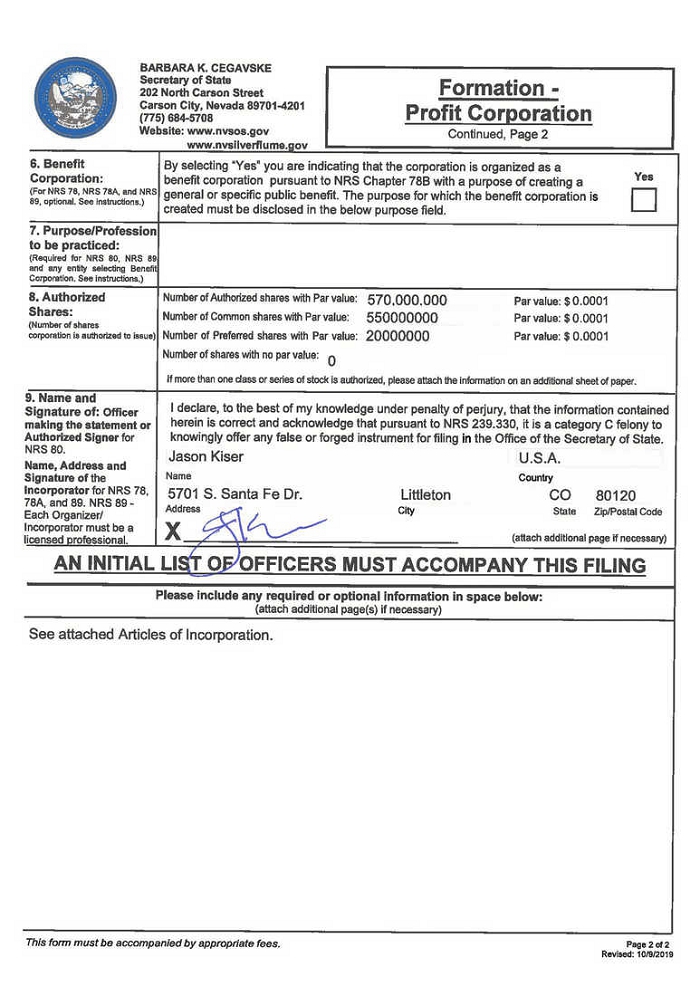

Exhibit 3.1 BARBARA K. CEGAVSKE Secretary of State 202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708 Website: www.nvsos.gov www.nvsilverflume.gov ABOVE SPACE IS FOR OFFICE USE ONLY 3URIHVVLRQDO &RUSRUDWLRQ Agent (name and address below) (WLWOH and address below) Agent:(QDPH RQO\ EHORZ) unable to sign the Articles of Incorporation, submit a separate signed Registered Agent Acceptance form. Appointment of CO 5E. , GHFODUH WKLV HQWLW\ LV LQ JRRG VWDQGLQJ LQ 3DJH 1 RI 2 5HYLVHG: 10/9/2019 This form must be accompanied by appropriate fees. Formation - 3URILW &RUSRUDWLRQ 156 78 - $UWLFOHV RI ,QFRUSRUDWLRQ 'RPHVWLF &RUSRUDWLRQ156 80 - )RUHLJQ &RUSRUDWLRQNRS 89 - $UWLFOHV RI ,QFRUSRUDWLRQ 78$ Formation - &ORVH &RUSRUDWLRQ (1DPH RI &ORVH &RUSRUDWLRQ 0867 DSSHDU LQ WKH EHORZ KHDGLQJ) $UWLFOHV RI )RUPDWLRQ RI BBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBB D FORVH FRUSRUDWLRQ (156 78$) 7<3( 25 35,17 - USE '$5. INK ONLY - DO NOT HIGHLIGHT 1. Name of (QWLW\: (,I IRUHLJQ QDPH LQ KRPH MXULVGLFWLRQ) 2. Registered Agent for Service of Process: (&heck only one box) 2D. Certificate of Acceptance of Registered Agent: CONX Corp. Commercial RegisteredNoncommercial RegisteredOffice or Position with Entity Name of Registered Agent OR Title of Office or Position with Entity Nevada Street AddressCityZip Code Nevada Mailing Address (if different from street address)CityZip Code I hereby accept appointment as Registered Agent for the above named Entity. If the registered agent is ; BBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBBB Authorized Signature of Registered Agent or On Behalf of Registered Agent EntityDate 3. Governing Board: (156 78$ FORVH FRUSRUDWLRQ RQO\ check one box; if yes, complete article 4 below) 7KLV FRUSRUDWLRQ LV D FORVH FRUSRUDWLRQ RSHUDWLQJ ZLWK D ERDUG RI GLUHFWRUV <HV 251R 4. 1DPHV DQG $GGUHVVHV RI WKH %RDUG RI 'LUHFWRUV/ 7UXVWHHV RU 6WRFNKROGHUV (156 78: %RDUG RI 'LUHFWRUV/ 7UXVWHHV LV UHTXLUHG. 156 78D: 5HTXLUHG LI WKH &ORVH &RUSRUDWLRQ LV JRYHUQHG E\ D ERDUG RI GLUHFWRUV. 156 89: 5HTXLUHG WR KDYH WKH 2ULJLQDO VWRFNKROGHUV DQG GLUHFWRUV. $ FHUWLILFDWH IURP WKH UHJXODWRU\ ERDUG PXVW EH VXEPLWWHG VKRZLQJ WKDW HDFK LQGLYLGXDO LV OLFHQVHG DW WKH WLPH RI ILOLQJ. 6HH LQVWUXFWLRQV) 5. -XULVGLFWLRQ RI ,QFRUSRUDWLRQ: (156 80 RQO\) 1) NameCRXQWU\ Street AddressCity6WDWH =LS/3RVWDO &RGH 2) NameCRXQWU\ CO Street AddressCity6WDWH =LS/3RVWDO &RGH 3) NameCRXQWU\ Street AddressCity6WDWH =LS/3RVWDO &RGH 5D. -XULVGLFWLRQ RI LQFRUSRUDWLRQ: WKH MXULVGLFWLRQ RI LWV LQFRUSRUDWLRQ. Littleton 80120 5701 S. Santa Fe Dr. U.S.A. Jason Kiser 80120 Littleton 5701 S. Santa Fe Dr. U.S.A. Charles W. Ergen 8/26/2020 C T Corporation System |

|

6. Benefit Corporation: D generalor specific public benefit. The purpose for which the benefrt corporation is created must be disclosed in the below purpose field. (For NRS 78,NRs 78A. and NRS 89 • optional. seeInstructions.) (Number of shares Ideclare, to the best of my knowledge under penalty of perjury, that the information contained Signature of:Officer knowingly offer any false or forged instrument for filing in the Office of the Secretary of State. Authorized Signer for Name,Address and co Incorporator for NRS 78, 5701 S.Santa Fe Dr. Littleton 80120 Each Organizer/ (attach additional page If necessary) licensed rotessional. This form must be accompanied by appropriate fees. Page 2 of2 Revised: 101912019 BARBARA K.CEGAVSKE Secretary of State 202 North Carson Street Carson City,Nevada 89701-4201 (n5) 684-5708 Website:www.nvsos.gov www.nvsllverflume. ov Formation Profit Corporation Continued, Page 2 By selecting ·ves• you are indicating that the corporation is organized as a benefit corporation pursuant to NRS Chapter 788 with a purpose of creating a Yes 7.Purpose/Profession to be practiced: (Required for NRS 80, NRS 89 .nd any entity seleding Beneti Corporation.See instructions.) B.Authorized Number of Authorized shares with Par value: 570.000.000Par value: $0.0001 Shares:Number of Common shares with Par value:550000000Par value: $ 0.0001 corporation Is aulhorlzed tc issue) Number of Preferred shares with Par value: 20000000Par value: $ 0.0001 Number of shares with no par value: O If more than one dass or series of stock is authorized, please attach the infonnation on an additionalsheet of paper. 9. Name and making the statement or herein is correct and acknowledge that pursuant to NRS 239.330,it is a category C felony to NRS80. Jason KiserU.S.A. Signature of theNameCountry 78A, and 89.NRS 89 -CityStateZip/PostalCode Incorporator must be a AN INITIAL LlOFFICERS MUST ACCOMPANY THIS FILING Please include any required or optionalInformation in space below: (attach additional page(s) if necessary) See attached Articles of Incorporation. |

ARTICLES OF INCORPORATION

OF

CONX CORP.

August 26, 2020

ARTICLE I

NAME

The name of the corporation is CONX Corp. (the “Corporation”).

ARTICLE II

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the Nevada Revised Statutes (the “NRS”). In addition to the powers and privileges conferred upon the Corporation by law and those incidental thereto, the Corporation shall possess and may exercise all the powers and privileges that are necessary or convenient to the conduct, promotion or attainment of the business or purposes of the Corporation, including, but not limited to, effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination involving the Corporation and one or more businesses (a “Business Combination”).

ARTICLE III

REGISTERED AGENT

The address of the Corporation’s registered office in the State of Nevada is 701 S Carson St Suite 200, Carson City, NV 89701-5239. The name of the Corporation’s registered agent at such address is C T Corporation System. Either the registered office or the registered agent may be changed in the manner permitted by law.

ARTICLE IV

CAPITALIZATION

Section 4.1 Authorized Capital Stock. The total number of shares of all classes of capital stock, each with a par value of $0.0001 per share, which the Corporation is authorized to issue is 570,000,000 shares, consisting of (a) 550,000,000 shares of common stock (the “Common Stock”), of which (i) 500,000,000 shares shall be Class A Common Stock (the “Class A Common Stock”) and (ii) 50,000,000 shares shall be Class B common stock (the “Class B Common Stock”), and (b) 20,000,000 shares of preferred stock (the “Preferred Stock”).

Section 4.2 Preferred Stock. The board of directors of the Corporation (the “Board”) is hereby expressly authorized to provide, out of the unissued shares of the Preferred Stock, one or more series of Preferred Stock, and to establish from time to time the number of shares to be included in each such series and to fix the voting powers, designations, preferences, limitations, restrictions and relative or other rights, if any, of each such series, as shall be stated in the resolution or resolutions adopted by the Board providing for the issuance of such series and included in a certificate of designation (a “Preferred Stock Designation”) filed pursuant to the NRS, and the Board is hereby expressly vested with the authority to the full extent provided by law, now or hereafter, to adopt any such resolution or resolutions.

1

Section 4.3 Common Stock.

(a) Voting.

(i) Except as otherwise required by law or these Articles of Incorporation (these “Articles”) (including any Preferred Stock Designation), the holders of the Common Stock shall exclusively possess all voting power with respect to the Corporation.

(ii) Except as otherwise required by law or these Articles (including any Preferred Stock Designation), the holders of shares of Common Stock shall be entitled to one vote for each such share on each matter properly submitted to the stockholders on which the holders of the Common Stock are entitled to vote.

(iii) Except as otherwise required by law or these Articles (including any Preferred Stock Designation), at any annual or special meeting of the stockholders of the Corporation, holders of the Class A Common Stock and holders of the Class B Common Stock, voting together as a single class, shall have the exclusive right to vote for the election of directors and on all other matters properly submitted to a vote of the stockholders. Notwithstanding any other provision of these Articles to the contrary, so long as shares of Class A Common Stock are outstanding and shares of Class B Common Stock are outstanding, the Corporation shall not amend, alter or repeal any provision of these Articles so as to adversely affect the relative rights, preferences, qualifications, limitations or restrictions of either such class of Common Stock as compared to those of the other class of Common Stock without the affirmative vote of the holders of a majority of the voting power of the outstanding shares of each class of Common Stock whose relative rights, preferences, qualifications, limitations or restrictions are so affected.

(b) Class B Common Stock.

(i) Shares of Class B Common Stock shall be convertible into shares of Class A Common Stock on a one-for-one basis (the “Initial Conversion Ratio”) automatically concurrently with or immediately following the closing of the Business Combination (as defined below).

(ii) Notwithstanding the Initial Conversion Ratio, in the case that additional shares of Class A Common Stock, or equity-linked securities, are issued or deemed issued in excess of the amounts sold in the Corporation’s initial public offering of securities (the “Offering”) and related to or in connection with the closing of the initial Business Combination, all issued and outstanding shares of Class B Common Stock shall automatically convert into shares of Class A Common Stock at the time of the closing of the Corporation’s initial Business Combination, the ratio for which the shares of Class B Common Stock shall convert into shares of Class A Common Stock will be adjusted so that the number of shares of Class A Common Stock issuable upon conversion of all shares of Class B Common Stock will equal, in the aggregate, 25% of the sum of (a) the total number of all shares of Class A Common Stock issued in the Offering (including any shares of Class A Common Stock issued pursuant to the underwriter’s over-allotment option) plus (b) the sum of (i) all shares of Class A Common Stock issued or deemed issued or issuable upon conversion or exercise of any equity-linked securities or rights issued or deemed issued in connection with or in relation to the consummation of a Business Combination (including any shares of Class A Common Stock issued pursuant to a forward purchase agreement), excluding any shares of Class A Common Stock or equity-linked securities or rights issued, or to be issued, to any seller in a Business Combination, any private placement warrants issued to Charles W. Ergen (the “Sponsor”), or an affiliate of the Sponsor or the Corporation’s officers and directors upon the conversion of working capital loans made to the Corporation and any warrants issued pursuant to a forward purchase agreement, minus (ii) the number of shares of Class A Common Stock redeemed in connection with a Business Combination, provided that such conversion of shares of Class B Common Stock shall never be less than the Initial Conversion Ratio.

2

Notwithstanding anything to the contrary contained herein, (i) the foregoing adjustment to the Initial Conversion Ratio may be waived as to any particular issuance or deemed issuance of additional shares of Class A Common Stock or equity-linked securities by the written consent or agreement of holders of a majority of the shares of Class B Common Stock then outstanding consenting or agreeing separately as a single class in the manner provided in Section 4.3(b)(iii), and (ii) in no event shall the Class B Common Stock convert into Class A Common Stock at a ratio that is less than one-for-one.

The foregoing conversion ratio shall also be adjusted to account for any subdivision (by stock split, subdivision, exchange, stock dividend, reclassification, recapitalization or otherwise) or combination (by reverse stock split, exchange, reclassification, recapitalization or otherwise) or similar reclassification or recapitalization of the outstanding shares of Class A Common Stock into a greater or lesser number of shares occurring after the original filing of these Articles without a proportionate and corresponding subdivision, combination or similar reclassification or recapitalization of the outstanding shares of Class B Common Stock.

Each share of Class B Common Stock shall convert into its pro rata number of shares of Class A Common Stock pursuant to this Section 4.3(b). The pro rata share for each holder of Class B Common Stock will be determined as follows: Each share of Class B Common Stock shall convert into such number of shares of Class A Common Stock as is equal to the product of one (1) multiplied by a fraction, the numerator of which shall be the total number of shares of Class A Common Stock into which all of the issued and outstanding shares of Class B Common Stock shall be converted pursuant to this Section 4.3(b) and the denominator of which shall be the total number of issued and outstanding shares of Class B Common Stock at the time of conversion.

(iii) Voting. Except as otherwise required by law or these Articles (including any Preferred Stock Designation), for so long as any shares of Class B Common Stock shall remain outstanding, the Corporation shall not, without the prior vote or written consent of the holders of a majority of the shares of Class B Common Stock then outstanding, voting separately as a single class, amend, alter or repeal any provision of these Articles, whether by merger, consolidation or otherwise, if such amendment, alteration or repeal would alter or change the powers, preferences or relative, participating, optional or other or special rights of the Class B Common Stock. Any action required or permitted to be taken at any meeting of the holders of Class B Common Stock may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken, shall be signed by the holders of the outstanding Class B Common Stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares of Class B Common Stock were present and voted and shall be delivered to the Corporation by delivery to its registered office in the State of Nevada, its principal place of business, or an officer or agent of the Corporation having custody of the book in which minutes of proceedings of stockholders are recorded. Delivery made to the Corporation’s registered office shall be by hand or by certified or registered mail, return receipt requested. Prompt written notice of the taking of corporate action without a meeting by less than unanimous written consent of the holders of Class B Common Stock shall, to the extent required by law, be given to those holders of Class B Common Stock who have not consented in writing and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if the record date for notice of such meeting had been the date that written consents signed by a sufficient number of holders of Class B Common Stock to take the action were delivered to the Corporation.

3

(c) Dividends. Subject to applicable law, the rights, if any, of the holders of any outstanding series of the Preferred Stock, the holders of shares of Common Stock shall be entitled to receive such dividends and other distributions (payable in cash, property or capital stock of the Corporation) when, as and if declared thereon by the Board from time to time out of any assets or funds of the Corporation legally available therefor and shall share equally on a per share basis in such dividends and distributions.

(d) Liquidation, Dissolution or Winding Up of the Corporation. Subject to applicable law, the rights, if any, of the holders of any outstanding series of the Preferred Stock, in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Corporation, after payment or provision for payment of the debts and other liabilities of the Corporation, the holders of shares of Common Stock shall be entitled to receive all the remaining assets of the Corporation available for distribution to its stockholders, ratably in proportion to the number of shares of Common Stock held by them.

Section 4.4 Rights and Options. The Corporation has the authority to create and issue rights, warrants and options entitling the holders thereof to acquire from the Corporation any shares of its capital stock of any class or classes, with such rights, warrants and options to be evidenced by or in instrument(s) approved by the Board. The Board is empowered to set the exercise price, duration, times for exercise and other terms and conditions of such rights, warrants or options; provided, however, that the consideration to be received for any shares of capital stock issuable upon exercise thereof may not be less than the par value thereof.

ARTICLE V

INCORPORATOR

The name and mailing address of the sole incorporator of the Corporation are as follows:

| Name | Address | |||

| Jason Kiser | 5701 S. Santa Fe Dr. | |||

| Littleton, CO 80120 |

ARTICLE VI

INITIAL BOARD OF DIRECTORS

The name and mailing address of each of the initial board members of the Corporation are as follows:

| Name | Address | |||

| Charles W. Ergen | 5701 S. Santa Fe Dr. | |||

| Littleton, CO 80120 | ||||

| Jason Kiser | 5701 S. Santa Fe Dr. | |||

| Littleton, CO 80120 |

ARTICLE VII

BOARD OF DIRECTORS

Section 7.1 Board Powers. The business and affairs of the Corporation shall be managed by, or under the direction of, the Board. In addition to the powers and authority expressly conferred upon the Board by statute, these Articles or the Bylaws (the “Bylaws”) of the Corporation, the Board is hereby empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation, subject, nevertheless, to the provisions of the NRS, these Articles and any Bylaws adopted by the stockholders; provided, however, that no Bylaws hereafter adopted by the stockholders shall invalidate any prior act of the Board that would have been valid if such Bylaws had not been adopted.

4

Section 7.2 Number, Election and Term.

(a) The number of directors of the Corporation, other than those who may be elected by the holders of one or more series of the Preferred Stock voting separately by class or series, shall be fixed from time to time exclusively by the Board pursuant to a resolution adopted by a majority of the Board.

(b) A director shall hold office until the annual meeting for the year in which his or her term expires and until his or her successor has been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification or removal.

(c) Unless and except to the extent that the Bylaws shall so require, the election of directors need not be by written ballot.

Section 7.3 Newly Created Directorships and Vacancies. Newly created directorships resulting from an increase in the number of directors and any vacancies on the Board resulting from death, resignation, retirement, disqualification, removal or other cause may be filled solely and exclusively by a majority vote of the remaining directors then in office, even if less than a quorum or by a sole remaining director (and not by stockholders), and any director so chosen shall hold office for the remainder of the full term of the class of directors to which the new directorship was added or in which the vacancy occurred and until his or her successor has been elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, disqualification or removal.

Section 7.4 Removal. Any or all of the directors may be removed from office at any time, with or without cause, by the affirmative vote of holders of not less than two-thirds of the voting power of all then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class.

Section 7.5 Quorum. A quorum for the transaction of business by the directors shall be set forth in the Bylaws.

ARTICLE VIII

BYLAWS

In furtherance and not in limitation of the powers conferred upon it by law, the Board shall have the power and is expressly authorized to adopt, amend, alter or repeal the Bylaws. The affirmative vote of a majority of the Board shall be required to adopt, amend, alter or repeal the Bylaws. The Bylaws also may be adopted, amended, altered or repealed by the stockholders; provided, however, that in addition to any vote of the holders of any class or series of capital stock of the Corporation required by law or by these Articles (including any Preferred Stock Designation), the affirmative vote of the holders of at least a majority of the voting power of all then outstanding shares of capital stock of the Corporation entitled to vote generally in the election of directors, voting together as a single class, shall be required for the stockholders to adopt, amend, alter or repeal the Bylaws; and provided further, however, that no Bylaws hereafter adopted by the stockholders shall invalidate any prior act of the Board that would have been valid if such Bylaws had not been adopted.

ARTICLE IX

LIMITED LIABILITY; INDEMNIFICATION

Section 9.1 Limitation of Liability. To the fullest extent permitted by Section 78.138 of the NRS or any successor provision of Nevada law, no director or officer shall be personally liable to the Corporation or its stockholders or creditors for any damages as a result of any act or failure to act in his or her capacity as a director or officer.

Section 9.2 Indemnification. The Corporation is authorized to indemnify and to advance expenses to each current, former or prospective director, officer, employee or agent of the Corporation to the fullest extent permitted by Sections 78.7502 and 78.751 of the NRS, or any successor provision of Nevada law allowing greater indemnification or advancement of expenses.

5

Section 9.3 Subsequent Amendments. No amendment to, or modification or repeal of, this Article IX shall adversely affect any right or protection of a director or of any officer, employee or agent of the Corporation existing hereunder or under the Bylaws with respect to any act or omission occurring prior to such amendment, modification or repeal.

ARTICLE X

CORPORATE OPPORTUNITY

Section 10.1 Certain Acknowledgements; Definitions. The provisions of this Article X shall, to the fullest extent permitted by law, delineate the doctrine of “corporate opportunities,” as it applies to the Corporation, define the conduct of certain affairs of the Corporation and its Subsidiaries and the Corporation’s and its Subsidiaries’ directors and officers as they may involve DISH Network Corporation (“DISH”) and its Subsidiaries or EchoStar Holding Corporation (“EchoStar”) and its Subsidiaries, and the powers, rights, duties and liabilities of the Corporation and its Subsidiaries and the Corporation’s and its Subsidiaries’ directors, officers and employees in connection therewith. In recognition and anticipation that (a) directors and officers of the Corporation and its Subsidiaries may serve as directors, officers and employees of DISH and its Subsidiaries and EchoStar and its Subsidiaries, (b) the Corporation and its Subsidiaries, directly or indirectly, may engage and continue to engage in the same, similar or related lines of business as those engaged in by DISH and its Subsidiaries and EchoStar and its Subsidiaries and other business activities that overlap with those in which DISH and its Subsidiaries or EchoStar and its Subsidiaries may engage or otherwise have an interest, (c) the Corporation and its Subsidiaries may have an interest in the same areas of business opportunity as DISH and its Subsidiaries and EchoStar and its Subsidiaries, (d) the Corporation and its Subsidiaries may engage in business transactions with DISH and its Subsidiaries and or EchoStar and its Subsidiaries, including, without limitation, receiving services from, providing services to or being a significant customer or supplier to DISH and its Subsidiaries and EchoStar and its Subsidiaries, and that the Corporation, DISH, EchoStar and/or one or more of their respective Subsidiaries may benefit from such transactions, and (e) as a consequence of the foregoing, it is in the best interests of the Corporation that the rights of the Corporation and its Subsidiaries, and the duties of any directors or officers of the Corporation or any of its Subsidiaries, be determined and delineated in respect of (x) any transactions between the Corporation and its Subsidiaries, on the one hand, and DISH and its Subsidiaries or EchoStar and its Subsidiaries, on the other hand, and (y) any potential transactions or matters that may be presented to officers and directors of the Corporation and its Subsidiaries, or of which such officers or directors may otherwise become aware, which potential transactions or matters may constitute business opportunities of the Corporation or any of its Subsidiaries, and in recognition of the benefits to be derived by the Corporation and its Subsidiaries through its continued contractual, corporate and business relations with DISH and its Subsidiaries or EchoStar and its Subsidiaries and of the benefits to be derived by the Corporation and its Subsidiaries by the possible service as directors or officers of the Corporation and its Subsidiaries of persons who may also serve from time to time as directors, officers and employees of DISH, EchoStar or any of their Subsidiaries, the provisions of this Article X shall, to the fullest extent permitted by law, regulate and define the conduct of the business and affairs of the Corporation and its Subsidiaries in relation to DISH and its Subsidiaries and EchoStar and its Subsidiaries, and as such conduct and affairs may involve DISH’s and its Subsidiaries’ or and EchoStar’s and its Subsidiaries’ directors, officers and employees, and the powers, rights, duties and liabilities of the Corporation and its Subsidiaries and their respective officers and directors in connection therewith and in connection with any potential business opportunities of the Corporation and its Subsidiaries. Any person purchasing or otherwise acquiring any shares of capital stock of the Corporation, or any interest therein, shall be deemed to have notice of and to have consented to the provisions of this Article X. For purposes of this Article X, “Control” and derivative terms means the possession of the power to direct or cause the direction of the management and policies of a person, whether through the possession of voting securities, by contract or otherwise; and “Subsidiary” means, with respect to any person, any other person that such first person directly or indirectly Controls. References in this Article X to “directors,” “officers” or “employees” of any person shall be deemed to include those persons who hold similar positions or exercise similar powers and authority with respect to any such person that is a limited liability company, partnership, joint venture or other non-corporate entity or any close corporation governed directly by its stockholders.

6

Section 10.2 Renouncement. In addition to, and notwithstanding the other provisions of this Article X, to the fullest extent permitted by law, the doctrine of corporate opportunity, or any other analogous doctrine, shall not apply with respect to the Corporation or any of its officers or directors, or any of their respective affiliates, in circumstances where the application of any such doctrine would conflict with any fiduciary duties or contractual obligations they may have as of the date of these Articles or in the future, and the Corporation renounces any expectancy that any of the directors or officers of the Corporation will offer any such corporate opportunity of which he or she may become aware to the Corporation, except, the doctrine of corporate opportunity shall apply if all of the following conditions are satisfied: (A) the Corporation has expressed an interest in such business opportunity as determined from time to time by the Corporation’s Board as evidenced by resolutions appearing in the Corporation’s minutes; (B) such opportunity relates to a line of business in which the Corporation or any Subsidiary of the Corporation is then directly engaged; (C) the director or officer is permitted to refer such opportunity to the Corporation without violating any legal obligation; and (D) in the case of a director or officer who, at the time such opportunity is presented, has a fiduciary relationship to DISH, EchoStar or any of their Subsidiaries, and such opportunity relates to a line of business in which DISH, EchoStar or any of their Subsidiaries is then engaged or has expressed an interest, such director or officer has first referred such opportunity to DISH, EchoStar or any of their Subsidiaries, as applicable, and such entity has declined to pursue such opportunity.

Section 10.3 Certain Agreements and Transactions Permitted. The Corporation may from time to time enter into and perform, and cause or permit any of its Subsidiaries to enter into and perform, one or more contracts, agreements, arrangements or transactions (or amendments, modifications or supplements thereto) with DISH, EchoStar or any of their Subsidiaries pursuant to which the Corporation or a Subsidiary thereof, on the one hand, and DISH, EchoStar or any of their Subsidiaries, on the other hand, agree to engage in contracts, agreements, arrangements or transactions of any kind or nature with each other, or agree to compete, or to refrain from competing or to limit or restrict their competition, with each other, including to allocate and cause their respective directors, officers and employees (including any such persons who are directors, officers or employees of both) to allocate opportunities between, or to refer opportunities to, each other. To the fullest extent permitted by law, no such contract, agreement, arrangement or transaction (nor any such amendments, modifications or supplements), nor the performance thereof by the Corporation, DISH, EchoStar or any Subsidiary of the Corporation, DISH or EchoStar, shall be considered contrary to any fiduciary duty owed to the Corporation (or to any Subsidiary of the Corporation, or to any stockholder of the Corporation or any of its Subsidiaries) by any director or officer of the Corporation (or by any director or officer of any Subsidiary of the Corporation) who is also a director, officer or employee of DISH or EchoStar or any of their Subsidiaries. To the fullest extent permitted by law, no director or officer of the Corporation or any Subsidiary of the Corporation who is also a director, officer or employee of DISH, EchoStar or any of their Subsidiaries shall have or be under any fiduciary duty to the Corporation (or to any Subsidiary of the Corporation, or to any stockholder of the Corporation of any of its Subsidiaries) to refrain from acting on behalf of the Corporation, DISH or EchoStar, or any of their respective Subsidiaries, in respect of any such contract, agreement, arrangement or transaction or performing any such contract, agreement, arrangement or transaction in accordance with its terms and each such director or officer of the Corporation or any Subsidiary of the Corporation who is also a director, officer or employee of DISH, EchoStar or any of their Subsidiaries shall be deemed to have acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, and shall be deemed not to have breached his or her duties of loyalty to the Corporation and their respective stockholders, and not to have derived an improper personal benefit therefrom.

7

Section 10.4 Duties of Directors and Officers Regarding Potential Business Opportunities; No Liability for Certain Acts or Omissions. If a director or officer of the Corporation or any Subsidiary of the Corporation is offered, or otherwise acquires knowledge of, a potential transaction or matter that may constitute or present a business opportunity for the Corporation or any of its Subsidiaries (any such transaction or matter, and any such actual or potential business opportunity, a “Potential Business Opportunity”), such director or officer shall have no duty or obligation to refer such Potential Business Opportunity to the Corporation or any of its Subsidiaries, or to refrain from referring such Potential Business Opportunity to any other person, or to give any notice to the Corporation or any of its Subsidiaries regarding such Potential Business Opportunity (or any matter relating thereto), and such director or officer shall not be liable to the Corporation or any of its Subsidiaries, as a director, officer, stockholder or otherwise, for any failure to refer such Potential Business Opportunity to the Corporation or any of its Subsidiaries, or for referring such Potential Business Opportunity to any other person, or for any failure to give any notice to the Corporation or any of its Subsidiaries regarding such Potential Business Opportunity or any matter relating thereto, unless all of the following conditions are satisfied: (A) the Corporation has expressed an interest in such business opportunity as determined from time to time by the Corporation’s Board as evidenced by resolutions appearing in the Corporation’s minutes; (B) such opportunity relates to a line of business in which the Corporation or any Subsidiary of the Corporation is then directly engaged; (C) the director or officer is permitted to refer such opportunity to the Corporation without violating any legal obligation; and (D) in the case of a director or officer who, at the time such opportunity is presented, has a fiduciary relationship to DISH, EchoStar or any of their Subsidiaries, and such opportunity relates to a line of business in which DISH, EchoStar or any of their Subsidiaries is then engaged or has expressed an interest, such director or officer has first referred such opportunity to DISH, EchoStar or any of their Subsidiaries, as applicable, and such entity has declined to pursue such opportunity. In the event the preceding conditions are satisfied with respect to a particular Potential Business Opportunity, then such Potential Business Opportunity shall be offered first to the Corporation. In the event the preceding conditions are satisfied and the Corporation declines to pursue such Potential Business Opportunity, the directors, officers and other members of management of the Corporation shall be free to engage in such Potential Business Opportunity on their own and this paragraph shall not limit the right of any director, officer or other member of management of the Corporation to continue a business existing prior to the time that such area of interest is designated by the Corporation. This paragraph shall not be construed to release any employee of this Corporation (other than a director, officer or member of management) from any duties which may be owed to this Corporation. For the avoidance of doubt, the Corporation may pursue a Potential Business Opportunity jointly with an entity to which one of the Corporation’s officers or directors has a fiduciary or contractual obligation, which may include DISH, EchoStar or any of their subsidiaries.

Section 10.5 Amendment of Article X. No alteration, amendment or repeal, or adoption of any provision inconsistent with, any provision of this Article X shall have any effect upon (a) any agreement between the Corporation or a Subsidiary thereof and DISH, EchoStar or any of their Subsidiaries that was entered into before such time or any transaction entered into in connection with the performance of any such agreement, whether such transaction is entered into before or after such time, (b) any transaction entered into between the Corporation or a Subsidiary thereof and DISH, EchoStar or any of their Subsidiaries before such time, (c) the allocation of any business opportunity between the Corporation or a Subsidiary thereof and DISH, EchoStar or any of their Subsidiaries before such time, or (d) any duty or obligation owed by any director or officer of the Corporation or any Subsidiary of the Corporation (or the absence of any such duty or obligation) with respect to any potential business opportunities of the Corporation or any Subsidiary of the Corporation which such director or officer was offered, or of which such director or officer otherwise became aware, before such time.

Section 10.6 Termination. Notwithstanding anything in these Articles to the contrary, the provisions of Sections 10.3 and 10.5(a)-(c) of this Article X shall automatically terminate, expire and have no further force and effect from and after the date on which no Corporation director or officer is also an EchoStar or DISH director, officer or employee.

Section 10.7 Deemed Notice. Any person or entity purchasing or otherwise acquiring or obtaining any interest in any capital stock of the Corporation shall be deemed to have notice and to have consented to the provisions of this Article X.

Section 10.8 Severability. The invalidity or unenforceability of any particular provision, or part of any provision, of this Article X shall not affect the other provisions or parts hereof, and this Article X shall be enforced to the maximum extent permissible, and the remaining provisions of this Article X shall be unaffected thereby and will remain in full force and effect.

8

ARTICLE XI

EXCLUSIVE FORUM FOR CERTAIN LAWSUITS

Section 11.1 Forum. Unless the Corporation consents in writing to the selection of an alternative forum, the Eighth Judicial District Court of Clark County, Nevada, shall, to the fullest extent permitted by law, be the exclusive forum for any or all actions, suits, proceedings, whether civil, administrative or investigative or that asserts any claim or counterclaim (each, an “Action”), (a) brought in the name or right of the Corporation or on its behalf; (b) asserting a claim for breach of any fiduciary duty owed by any director, officer, employee or agent of the Corporation to the Corporation or the Corporation’s stockholders; (c) arising or asserting a claim pursuant to any provision of NRS Chapters 78 or 92A or any provision of these Articles or the Bylaws of the Corporation; (d) to interpret, apply, enforce or determine the validity of these Articles or the Bylaws of the Corporation; or (e) asserting a claim governed by the internal affairs doctrine. In the event that the Eighth Judicial District Court of Clark County, Nevada does not have jurisdiction over any such Action, then any other state district court located in the State of Nevada shall be the exclusive forum for such Action. In the event that no state district court in the State of Nevada has jurisdiction over any such Action, then a federal court located within the State of Nevada shall be the exclusive forum for such Action. Any person or entity that acquires any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to all of the provisions of this Article XI. Notwithstanding the foregoing, this Section 11.1 shall not apply to suits brought to enforce a duty or liability created by (x) the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction and (y) the Securities Act.

Section 11.2 Consent to Jurisdiction. If any action the subject matter of which is within the scope of Section 11.1 immediately above is filed in a court other than a court located within the State of Nevada (a “Foreign Action”) in the name of any stockholder, such stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the State of Nevada in connection with any action brought in any such court to enforce Section 11.1 immediately above (an “FSC Enforcement Action”) and (ii) having service of process made upon such stockholder in any such FSC Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

Section 11.3 Severability. If any provision or provisions of this Article XI shall be held to be invalid, illegal or unenforceable as applied to any person or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and enforceability of such provisions in any other circumstance and of the remaining provisions of this Article XI (including, without limitation, each portion of any sentence of this Article XI containing any such provision held to be invalid, illegal or unenforceable that is not itself held to be invalid, illegal or unenforceable) and the application of such provision to other persons or entities and circumstances shall not in any way be affected or impaired thereby. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to the provisions of this Article XI.

ARTICLE XII

AMENDMENT OF ARTICLES OF INCORPORATION

The Corporation reserves the right at any time and from time to time to amend, alter, change, add or repeal any provision contained in these Articles (including any Preferred Stock Designation), and other provisions authorized by the laws of the State of Nevada at the time in force that may be added or inserted, in the manner now or hereafter prescribed by these Articles and the NRS; and except as set forth in Section 9.3 and Section 10.5, all rights, preferences and privileges of whatever nature herein conferred upon stockholders, directors or any other persons by and pursuant to these Articles in its present form or as hereafter amended are granted subject to the right reserved in this Article XII.

9