Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BED BATH & BEYOND INC | form8-k100120q2fy20.htm |

| EX-99.1 - EXHIBIT 99.1 - BED BATH & BEYOND INC | exhibit991-pressreleas.htm |

October 1, 2020 Fiscal 2020 Q2 Results June-July-August (May 31st – August 29th) BED BATH & BEYOND

forward looking statements This press release contains forward-looking statements, including, but not limited to, the Company’s progress and anticipated progress towards its long-term objectives, the future impact of the novel coronavirus (COVID-19), the potential impact and success of its strategic restructuring program, and its current estimates and expectations for financial performance for future periods. Many of these forward-looking statements can be identified by use of words such as may, will, expect, anticipate, approximate, estimate, assume, continue, model, project, plan, goal, preliminary, and similar words and phrases, although the absence of those words does not necessarily mean that statements are not forward- looking. The Company’s actual results and future financial condition may differ materially from those expressed in any such forward-looking statements as a result of many factors. Such factors include, without limitation: general economic conditions including the housing market, a challenging overall macroeconomic environment and related changes in the retailing environment; risks associated with COVID-19 and the governmental responses to it, including its impacts across the Company's businesses on demand and operations, as well as on the operations of the Company's suppliers and other business partners, and the effectiveness of the Company's actions taken in response to these risks; consumer preferences, spending habits and adoption of new technologies; demographics and other macroeconomic factors that may impact the level of spending for the types of merchandise sold by the Company; civil disturbances and terrorist acts; unusual weather patterns and natural disasters; competition from existing and potential competitors across all channels; pricing pressures; liquidity; the ability to achieve anticipated cost savings, and to not exceed anticipated costs, associated with organizational changes and investments, including the Company's strategic restructuring program; the ability to attract and retain qualified employees in all areas of the organization; the cost of labor, merchandise and other costs and expenses; potential supply chain disruption due to trade restrictions, and other factors such as natural disasters, such as pandemics, including the COVID-19 pandemic, political instability, labor disturbances, product recalls, financial or operational instability of suppliers or carriers, and other items; the ability to find suitable locations at acceptable occupancy costs and other terms to support the Company’s plans for new stores; the ability to establish and profitably maintain the appropriate mix of digital and physical presence in the markets it serves; the ability to assess and implement technologies in support of the Company’s development of its omnichannel capabilities; the ability to effectively and timely adjust the Company's plans in the face of the rapidly changing retail and economic environment, including in response to the COVID-19 pandemic; uncertainty in financial markets; volatility in the price of the Company’s common stock and its effect, and the effect of other factors, including the COVID-19 pandemic, on the Company’s capital allocation strategy; risks associated with the ability to achieve a successful outcome for its business concepts and to otherwise achieve its business strategies; the impact of intangible asset and other impairments; disruptions to the Company’s information technology systems including but not limited to security breaches of systems protecting consumer and employee information or other types of cybercrimes or cybersecurity attacks; reputational risk arising from challenges to the Company’s or a third party product or service supplier’s compliance with various laws, regulations or standards, including those related to labor, health, safety, privacy or the environment; reputational risk arising from third-party merchandise or service vendor performance in direct home delivery or assembly of product for customers; changes to statutory, regulatory and legal requirements, including without limitation proposed changes affecting international trade; changes to, or new, tax laws or interpretation of existing tax laws; new, or developments in existing, litigation, claims or assessments; changes to, or new, accounting standards; and foreign currency exchange rate fluctuations. Except as required by law, the Company does not undertake any obligation to update its forward-looking statements. BED BATH & BEYOND 2

participants Mark Tritton Gustavo Arnal President & CEO CFO & Treasurer Cindy Davis John Hartmann John Hartmann COO;CBO; President, President, buybuy Decorist BABY COO; President, buybuy Baby BED BATH & BEYOND 3

agenda 1) Performance Highlights & Strategic Update (CEO) 2) FY 2020 Q2 Results (May-June-July) (CFO) 3) Commercial Update (CBO) 4) Operations Update (COO) 5) Q&A BED BATH & BEYOND 4

Q2 performance highlights & strategy update BED BATH & BEYOND 5

Q2 PERFORMANCE HIGHLIGHTS & STRATEGIC UPDATE significant improvement in key performance metrics Comp Sales Digital Comp Adj. Gross Margin Adj. EBITDA Growth Growth +6% +89% +200bps +36% vs vs vs vs LY LY LY LY Cash Generation Gross Debt Strong Liquidity ~30% Reduction ~2x $>750M vs Higher FY20 Q1 than Debt BED BATH & BEYOND 6

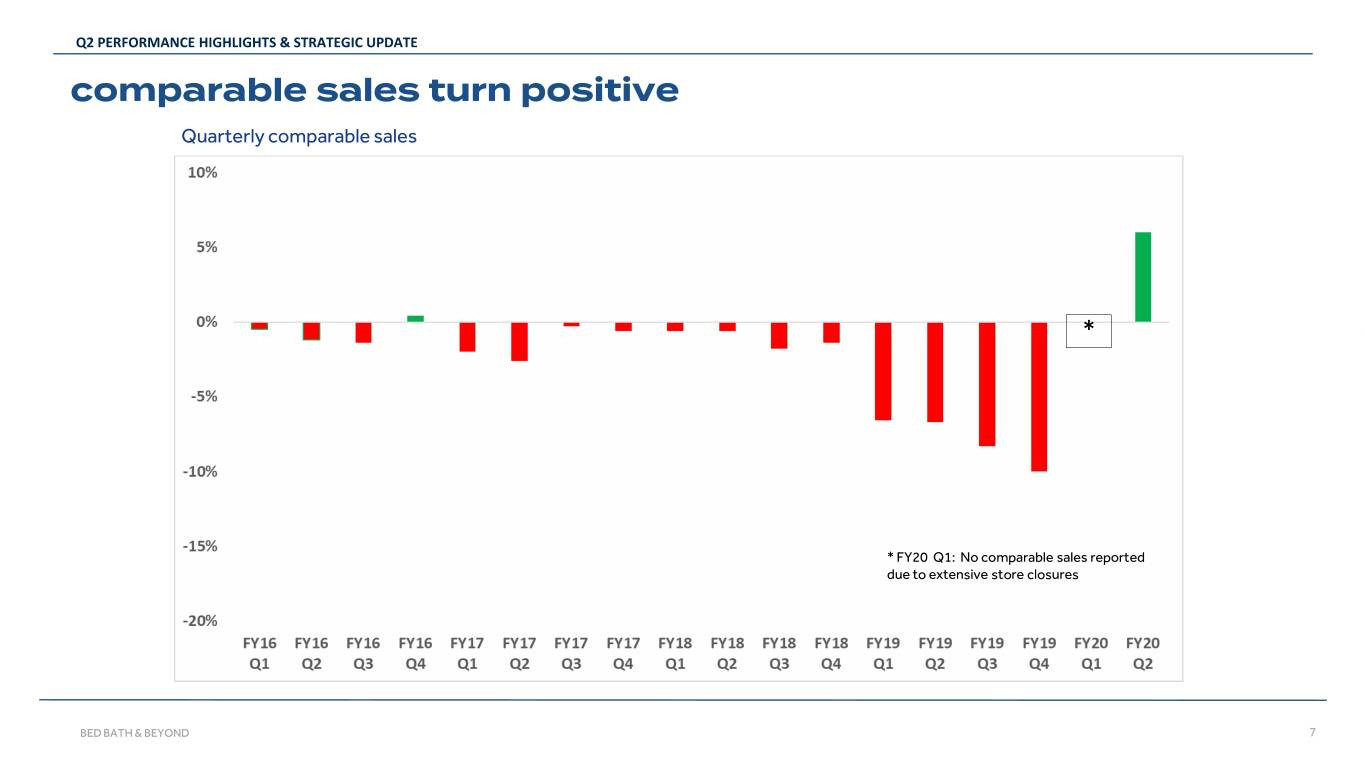

Q2 PERFORMANCE HIGHLIGHTS & STRATEGIC UPDATE comparable sales turn positive Quarterly comparable sales * * FY20 Q1: No comparable sales reported due to extensive store closures BED BATH & BEYOND 7

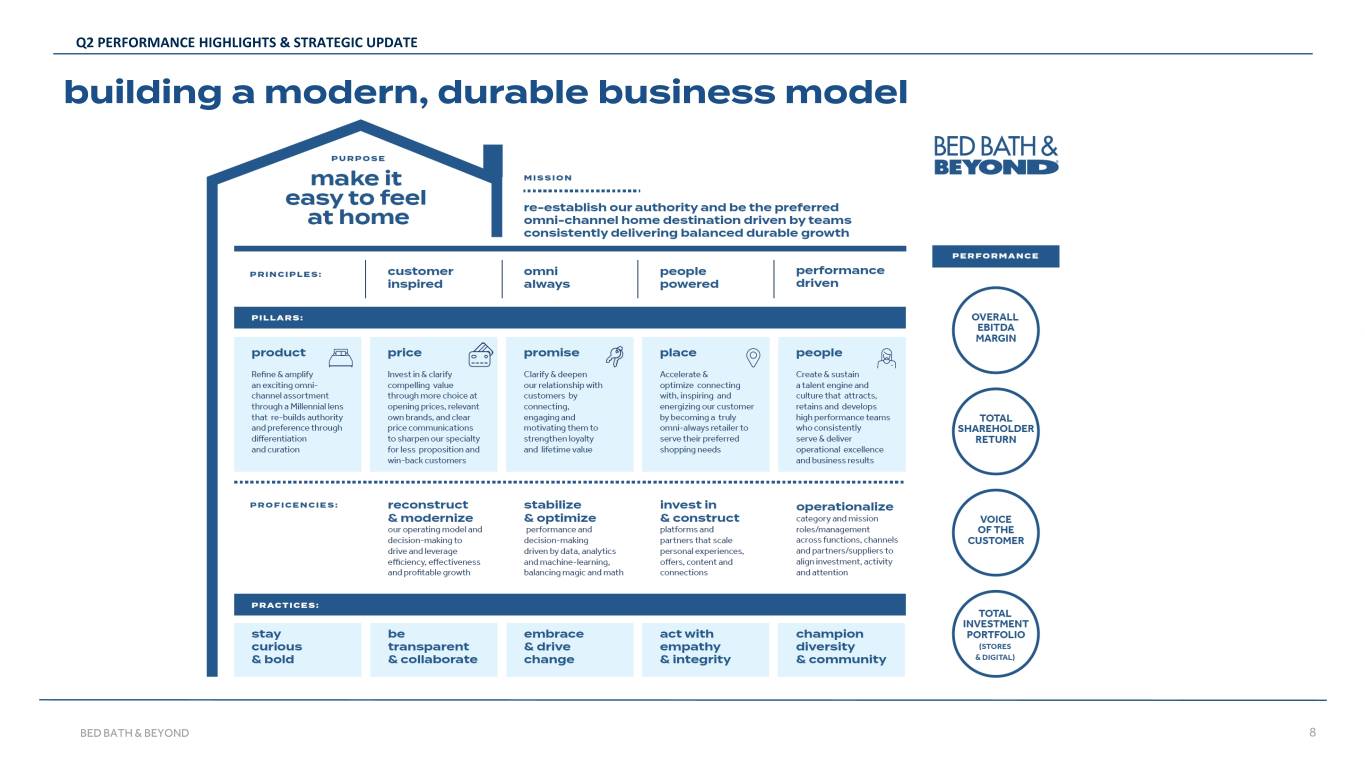

Q2 PERFORMANCE HIGHLIGHTS & STRATEGIC UPDATE building a modern, durable business model BED BATH & BEYOND 8

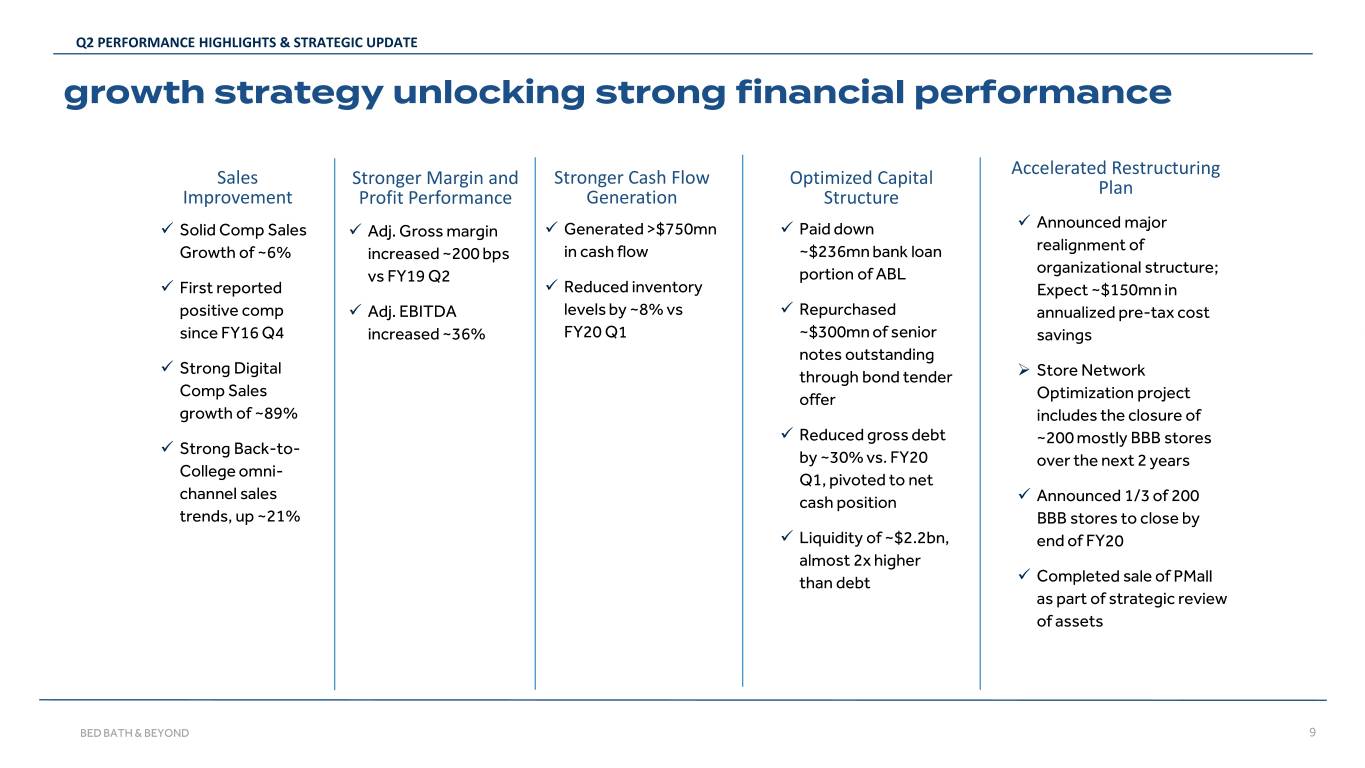

Q2 PERFORMANCE HIGHLIGHTS & STRATEGIC UPDATE growth strategy unlocking strong financial performance Sales Stronger Cash Flow Accelerated Restructuring Stronger Margin and Optimized Capital Plan Improvement Profit Performance Generation Structure Announced major Solid Comp Sales Adj. Gross margin Generated >$750mn Paid down realignment of Growth of ~6% increased ~200 bps in cash flow ~$236mn bank loan organizational structure; vs FY19 Q2 portion of ABL First reported Reduced inventory Expect ~$150mn in positive comp Adj. EBITDA levels by ~8% vs Repurchased annualized pre-tax cost since FY16 Q4 increased ~36% FY20 Q1 ~$300mn of senior savings notes outstanding Strong Digital through bond tender Store Network Comp Sales offer Optimization project growth of ~89% includes the closure of Reduced gross debt ~200 mostly BBB stores Strong Back-to- by ~30% vs. FY20 over the next 2 years College omni- Q1, pivoted to net channel sales cash position Announced 1/3 of 200 trends, up ~21% BBB stores to close by Liquidity of ~$2.2bn, end of FY20 almost 2x higher than debt Completed sale of PMall as part of strategic review of assets BED BATH & BEYOND 9

Q2 results June-July-August (May 31st – August 29th) BED BATH & BEYOND 10

Q2 2020 FINANCIAL RESULTS financial performance • Solid comparable sales growth of ~6%, led by significantly strong digital comp sales growth of ~89% • Adj. Gross Margin increased ~200bps, driven primarily by: ‐ Favorable product mix, including lower coupon expense and better optimization of promotion & markdowns ‐ Leverage of distribution and fulfillment costs ‐ Partially offset by higher digital channel mix, including higher net direct-to-customer shipping expense • Adj. EBITDA increased by 36% to $199mn or 7.4% margin ‐ Improved cost of sales ‐ Adj. SG&A expenses decreased • Strong cash flow generation >$750mn • Enhanced balance sheet, including ~$2.2bn of liquidity and a ~30% reduction in gross debt vs FY20 Q1 ‐ Inventories (at cost) declined ~8% vs FY20 Q1 BED BATH & BEYOND 11

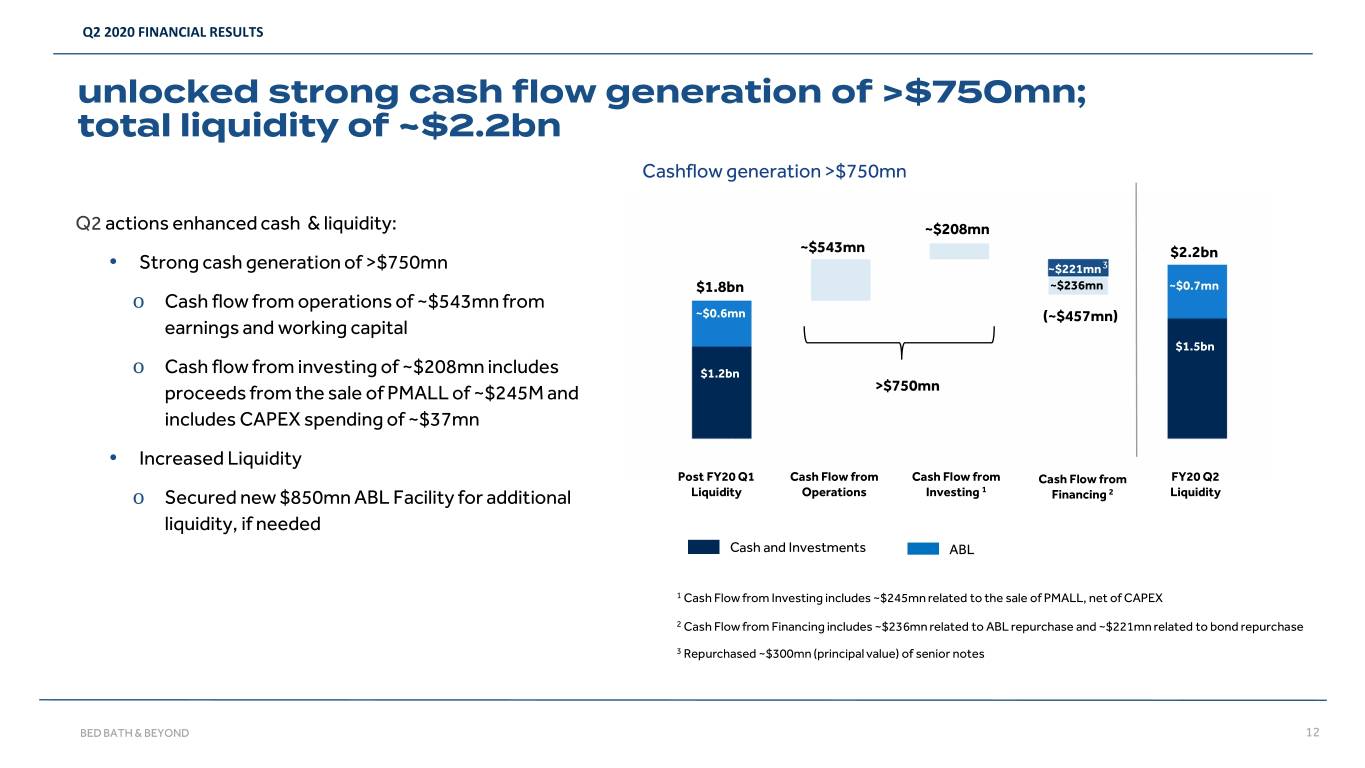

Q2 2020 FINANCIAL RESULTS unlocked strong cash flow generation of >$750mn; total liquidity of ~$2.2bn $0.2bn Cashflow$0.2bn generation >$750mn $0.2b Q2 actions enhanced cash & liquidity: n ~$208mn ~$543mn • $2.2bn Strong cash generation of >$750mn ~$221mn3 $1.8bn ~$236mn ~$0.7mn o Cash flow from operations of ~$543mn from ~$0.6mn (~$457mn)$1.2bn earnings and working capital ~$0.6mn $1.5bn o Cash flow from investing of ~$208mn includes $1.2bn proceeds from the sale of PMALL of ~$245M and >$750mn includes CAPEX spending of ~$37mn $1.2bn $0.2bn • Increased Liquidity Post FY20 Q1 Cash Flow from Cash Flow from Cash Flow from FY20 Q2 1 2 o Secured new $850mn ABL Facility for additional Liquidity Operations Investing Financing Liquidity liquidity, if needed Cash and Investments ABL 1 Cash Flow from Investing includes ~$245mn related to the sale of PMALL, net of CAPEX 2 Cash Flow from Financing includes ~$236mn related to ABL repurchase and ~$221mn related to bond repurchase 3 Repurchased ~$300mn (principal value) of senior notes BED BATH & BEYOND 12

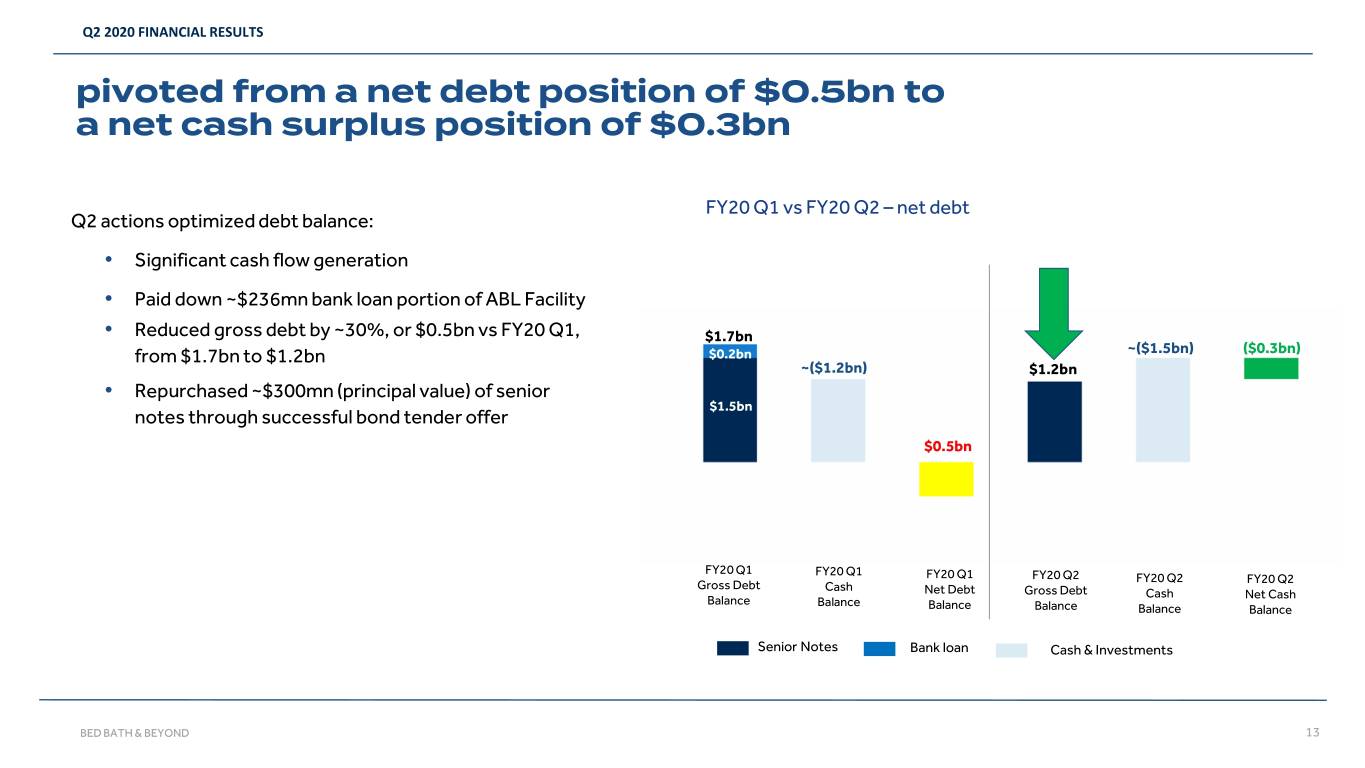

Q2 2020 FINANCIAL RESULTS pivoted from a net debt position of $0.5bn to a net cash surplus position of $0.3bn $0.2bnFY20 Q1 vs FY20 Q2 – net debt Q2 actions optimized debt balance: $0.2bn$0.2bn • Significant cash flow generation • Paid down ~$236mn bank loan portion of ABL Facility $0.2bn • Reduced gross debt by ~30%, or $0.5bn vs FY20 Q1, $1.7bn ~($1.5bn) ($0.3bn) from $1.7bn to $1.2bn $0.2bn ~($1.2bn) $1.2bn $0.2bn • Repurchased ~$300mn (principal value) of senior $1.5bn notes through successful bond tender offer $0.5bn FY20 Q1 FY20 Q1 FY20 Q1 FY20 Q2 FY20 Q2 FY20 Q2 Gross Debt Cash Net Debt Gross Debt Cash Net Cash Balance Balance Balance Balance Balance Balance $1.5bn Senior Notes Bank loan Cash & Investments BED BATH & BEYOND 13

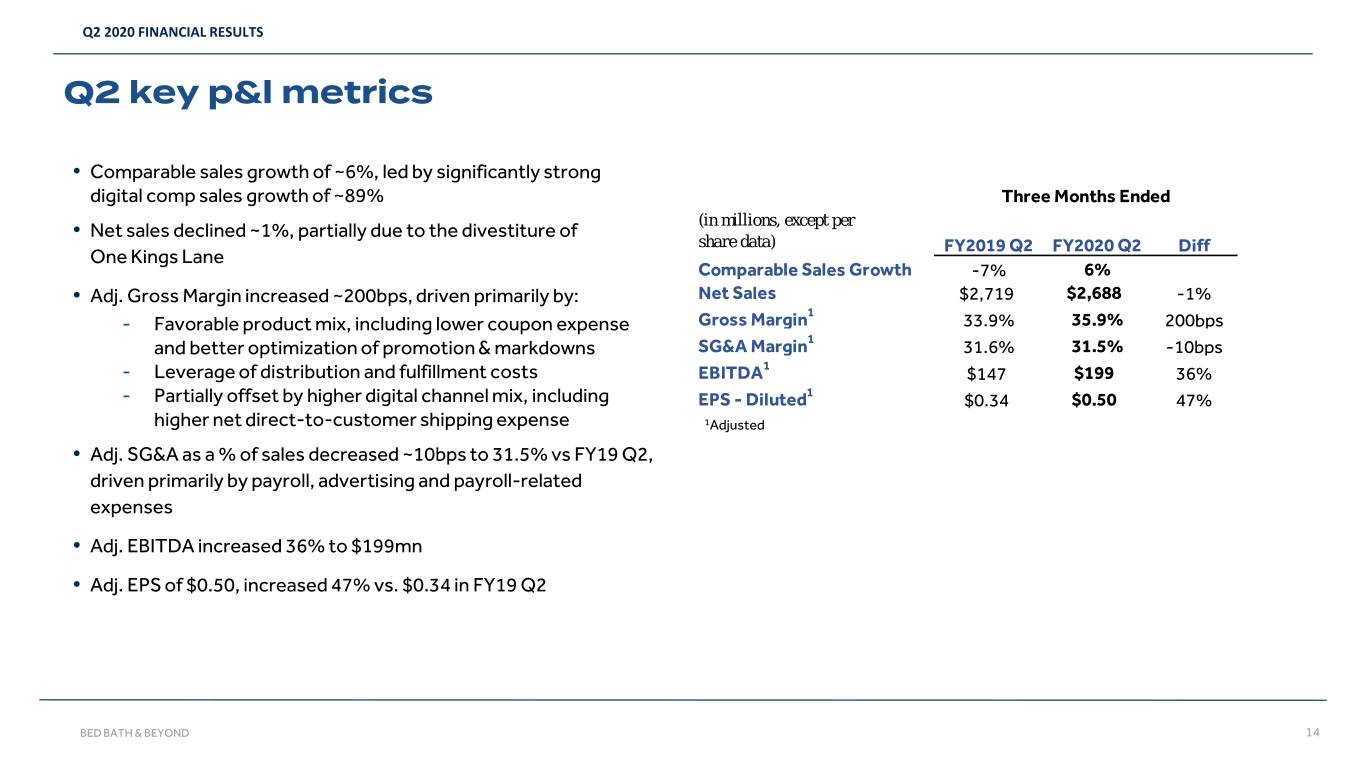

Q2 2020 FINANCIAL RESULTS Q2 key p&l metrics • Comparable sales growth of ~6%, led by significantly strong digital comp sales growth of ~89% Three Months Ended (in millions, except per • Net sales declined ~1%, partially due to the divestiture of share data) FY2019 Q2 FY2020 Q2 Diff One Kings Lane Comparable Sales Growth -7% 6% • Adj. Gross Margin increased ~200bps, driven primarily by: Net Sales $2,719 $2,688 -1% 1 ‐ Favorable product mix, including lower coupon expense Gross Margin 33.9% 35.9% 200bps 1 and better optimization of promotion & markdowns SG&A Margin 31.6% 31.5% -10bps 1 ‐ Leverage of distribution and fulfillment costs EBITDA $147 $199 36% 1 ‐ Partially offset by higher digital channel mix, including EPS - Diluted $0.34 $0.50 47% higher net direct-to-customer shipping expense 1Adjusted • Adj. SG&A as a % of sales decreased ~10bps to 31.5% vs FY19 Q2, driven primarily by payroll, advertising and payroll-related expenses • Adj. EBITDA increased 36% to $199mn • Adj. EPS of $0.50, increased 47% vs. $0.34 in FY19 Q2 BED BATH & BEYOND 14

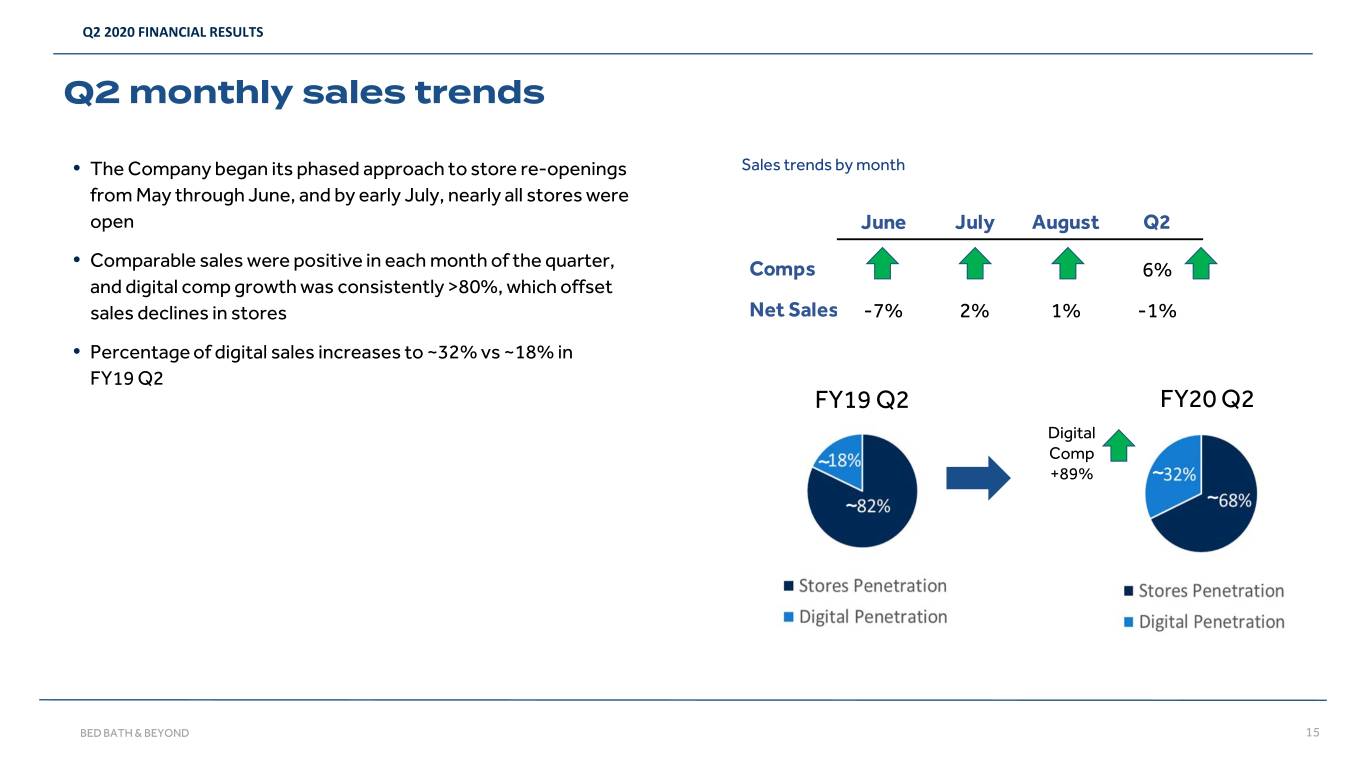

Q2 2020 FINANCIAL RESULTS Q2 monthly sales trends • The Company began its phased approach to store re-openings Sales trends by month from May through June, and by early July, nearly all stores were open June July August Q2 • Comparable sales were positive in each month of the quarter, Comps 6% and digital comp growth was consistently >80%, which offset sales declines in stores Net Sales -7% 2% 1% -1% • Percentage of digital sales increases to ~32% vs ~18% in FY19 Q2 FY19 Q2 FY20 Q2 Digital Comp +89% ~ ~ BED BATH & BEYOND 15

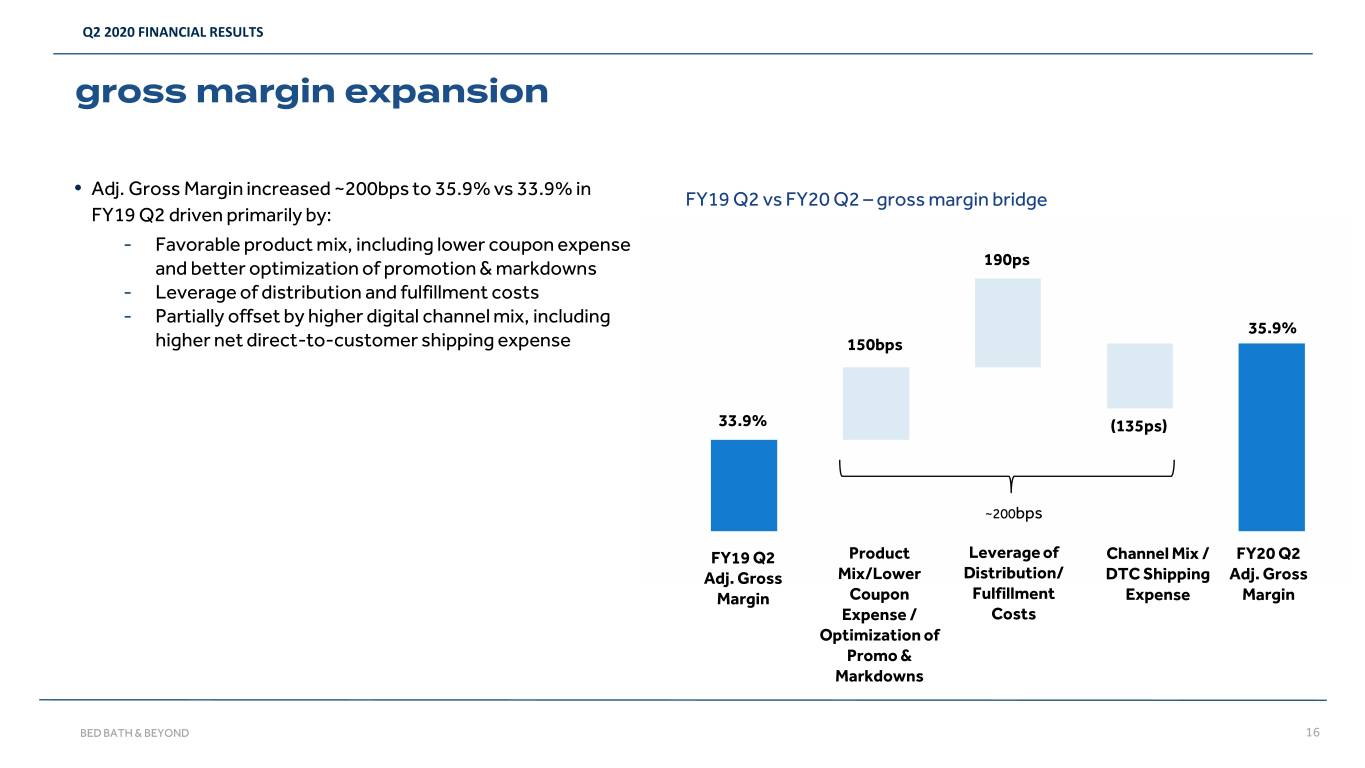

Q2 2020 FINANCIAL RESULTS gross margin expansion • Adj. Gross Margin increased ~200bps to 35.9% vs 33.9% in FY19 Q2 vs FY20 Q2 – gross margin bridge FY19 Q2 driven primarily by: ‐ Favorable product mix, including lower coupon expense 190ps and better optimization of promotion & markdowns ‐ Leverage of distribution and fulfillment costs ‐ Partially offset by higher digital channel mix, including 35.9% higher net direct-to-customer shipping expense 150bps 33.9% (135ps) ~200bps FY19 Q2 Product Leverage of Channel Mix / FY20 Q2 Adj. Gross Mix/Lower Distribution/ DTC Shipping Adj. Gross Margin Coupon Fulfillment Expense Margin Expense / Costs Optimization of Promo & Markdowns BED BATH & BEYOND 16

Q2 2020 FINANCIAL RESULTS transformation underway to re-establish authority in home • Transformation plan expected to deliver between $250mn to $350mn in annualized EBITDA improvement over the next 2 to 3 years vs fiscal 2019 • Significant workforce reduction and major organizational realignment in August 2020; estimated to generate future annual pre-tax cost savings of approximately $150mn, excluding one-time costs • Planned closure of ~200 mostly BBB stores over the next two years under Store Network Optimization Project expected to generate ~$100mn in annualized savings • Planned savings of ~$200mn from product sourcing through work with existing vendors • Reinvestment of between approximately $150mn to $200mn of the expected cost savings into future growth initiatives • Potential of between ~$350mn to ~$450mn to be unlocked through sale of non-core assets (including sale of PMall) • Further improvement of working capital through the removal of about $1B of inventory at retail ($0.5bn at cost) from within BBB stores over the next 24 months BED BATH & BEYOND 17

commercial update BED BATH & BEYOND 18

COMMERCIAL UPDATE destination for college Modern • Sales of college specific product increased 21% Glam season-to-date (5/1/20 – 9/8/20) • Back-to-College campaign designed to showcase new branding strategy and enhanced customer value proposition ‐ Informed by insights and market data ‐ Integrated merchandising and marketing plan included: . Better curated assortments . More competitive pricing and compelling value (in-store / online) . Enhanced storytelling and increased targeting ‐ Remained flexible and agile to pivot plans as season unfolded • Top trending product categories for college: ‐ Kitchen Electrics (+>160%), Kitchen Housewares (~+250%), Drinkware and Flatware (>+650%) • College from Home campaign provided inspiration to create authentic college spaces at home in addition to the value and ease of our Back to College experience BED BATH & BEYOND 19

operations update BED BATH & BEYOND 20

OPERATIONS UPDATE driving omni-always transformation • The end-to-end modernization of the Company’s technology infrastructure is driving substantial digital growth and strong customer adoption of new services like Buy-Online-Pickup-In- Store (BOPIS) and Curbside Pickup • Expanded relationship with Google Cloud to accelerate Company’s omni-always transformation and deliver a more agile, responsive, and customer-inspired shopping experience • Leveraging the Company’s unique data and insights in Home, Baby and Health & Wellness and deploy a range of platform solutions to: ‐ Further personalize the shopping experience for customers ‐ Enhance fulfilment capacity ‐ Optimize merchandise planning and demand forecasting BED BATH & BEYOND 21

WRAP UP inaugural (virtual) investor day oct. 28th @9am EDT Building a modern, durable platform for success How are we rebuilding authority in the Home? . Strategic framework of transformation . Experienced leadership team . Foundational capabilities What does value creation look like? . Multi-year financial plan . Strategic investments planned . Capital allocation framework BED BATH & BEYOND 22

WRAP UP Q2 performance – transformation is underway Comp Sales Adj. EBITDA Cash Generation Growth [+200] [+88%] bps +6% +36% vs vs $>750M LY LY BED BATH & BEYOND 23

appendix SEPTEMBER 30, 2020 BED BATH & BEYOND 24

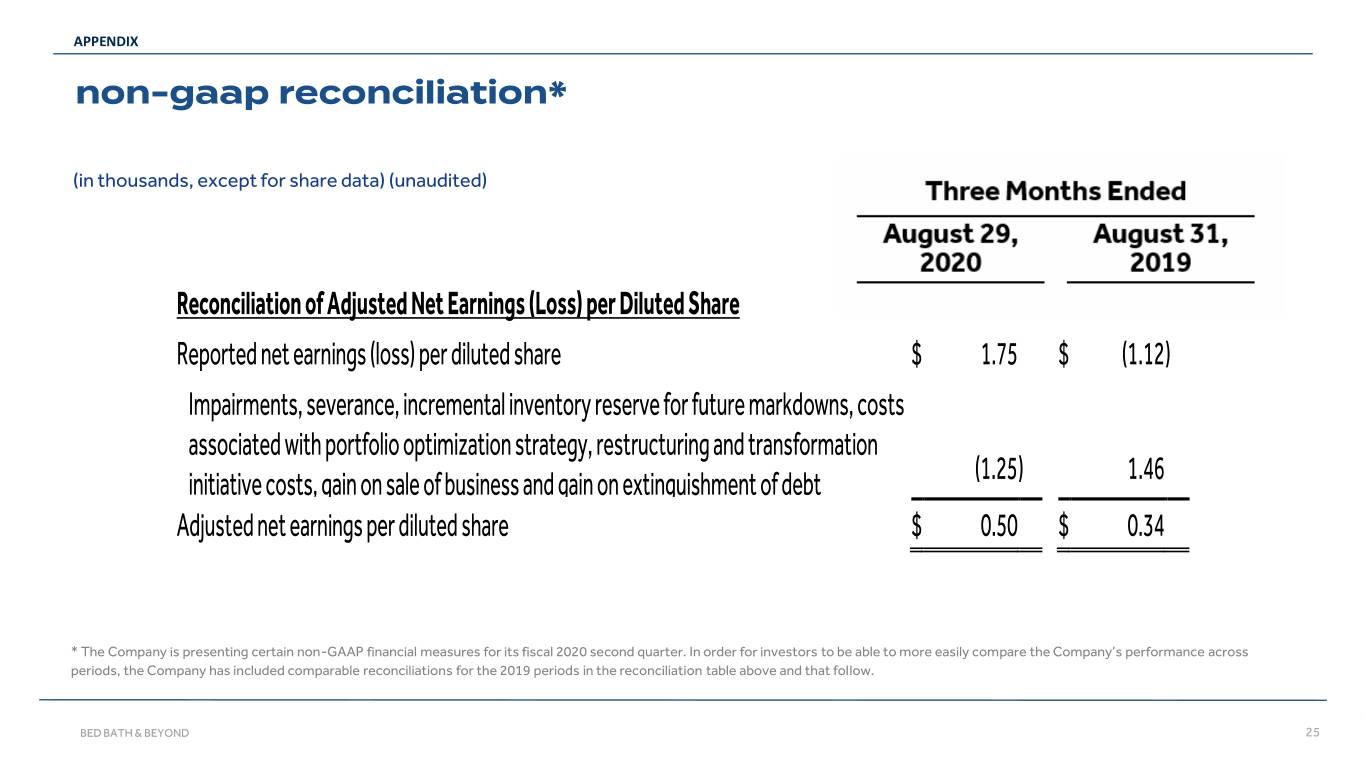

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Net Earnings (Loss) per Diluted Share Reported net earnings (loss) per diluted share $ 1.75 $ (1.12 ) Impairments, severance, incremental inventory reserve for future markdowns, costs associated with portfolio optimization strategy, restructuring and transformation initiative costs, gain on sale of business and gain on extinguishment of debt (1.25 ) 1.46 Adjusted net earnings per diluted share $ 0.50 $ 0.34 * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 25

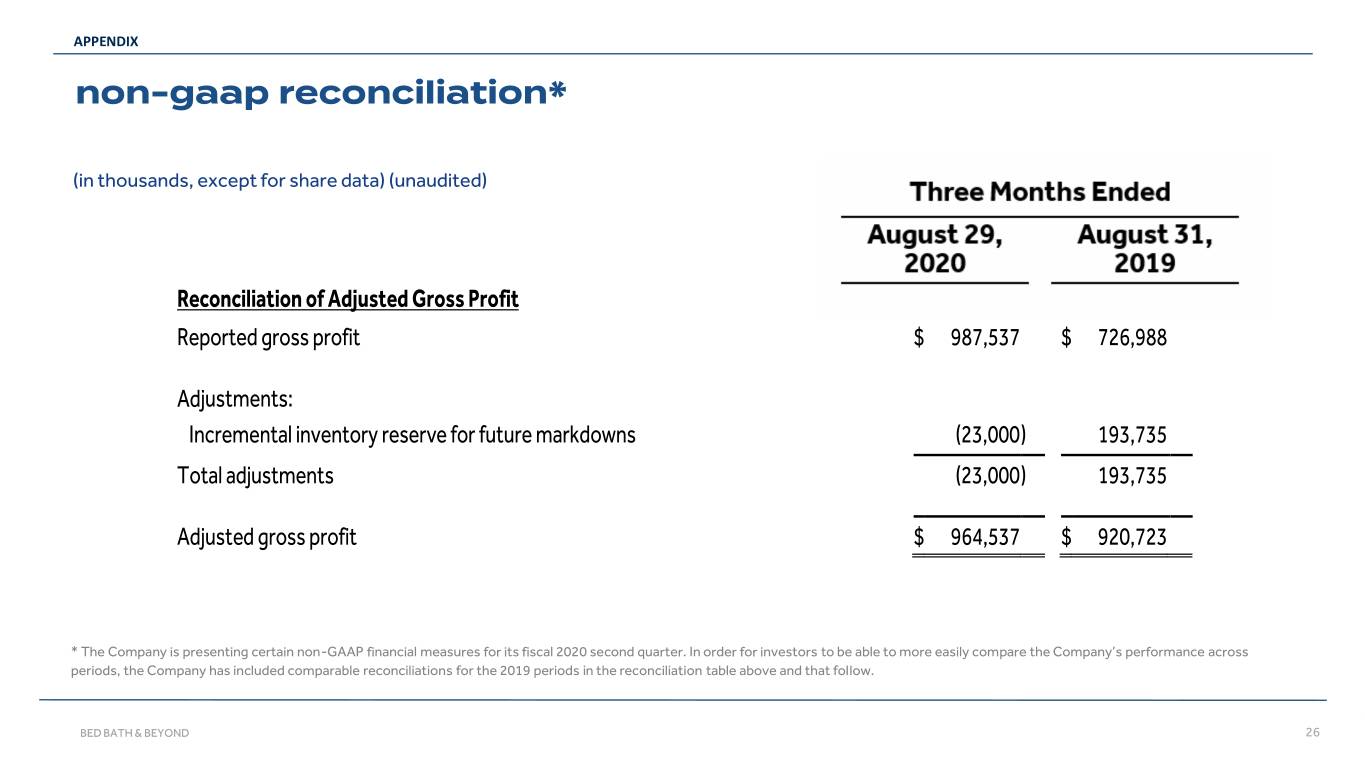

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Gross Profit Reported gross profit $ 987,537 $ 726,988 Adjustments: Incremental inventory reserve for future markdowns (23,000 ) 193,735 Total adjustments (23,000 ) 193,735 Adjusted gross profit $ 964,537 $ 920,723 * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 26

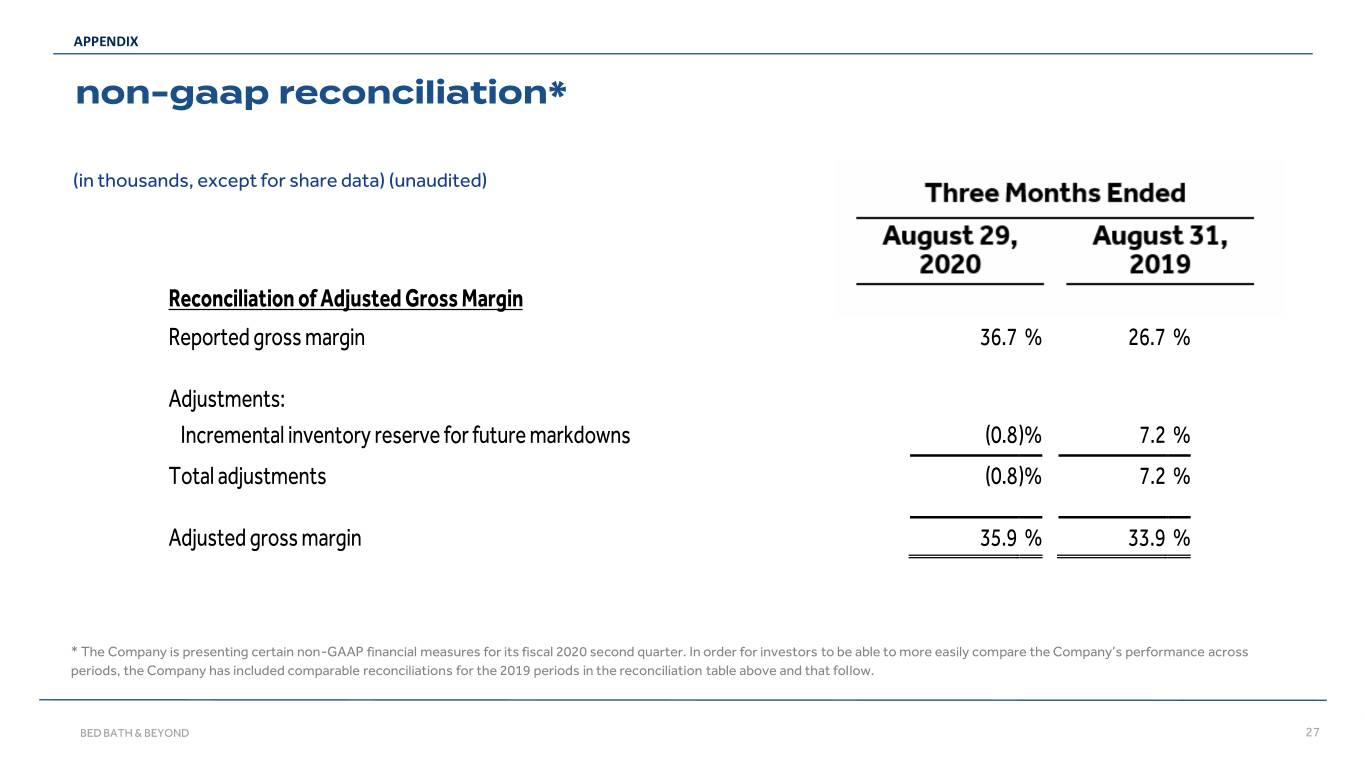

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Gross Margin Reported gross margin 36.7 % 26.7 % Adjustments: Incremental inventory reserve for future markdowns (0.8 )% 7.2 % Total adjustments (0.8 )% 7.2 % Adjusted gross margin 35.9 % 33.9 % * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 27

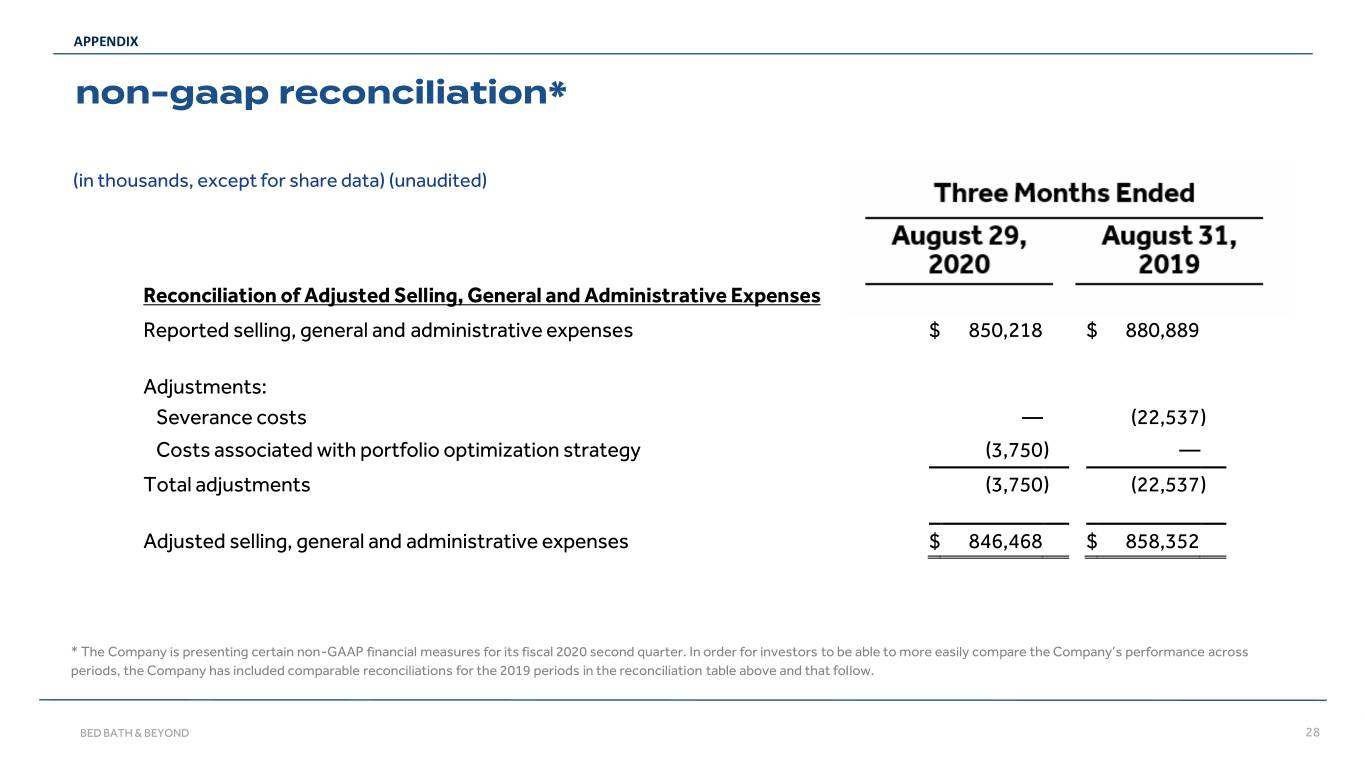

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Selling, General and Administrative Expenses Reported selling, general and administrative expenses $ 850,218 $ 880,889 Adjustments: Severance costs — (22,537 ) Costs associated with portfolio optimization strategy (3,750 ) — Total adjustments (3,750 ) (22,537 ) Adjusted selling, general and administrative expenses $ 846,468 $ 858,352 * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 28

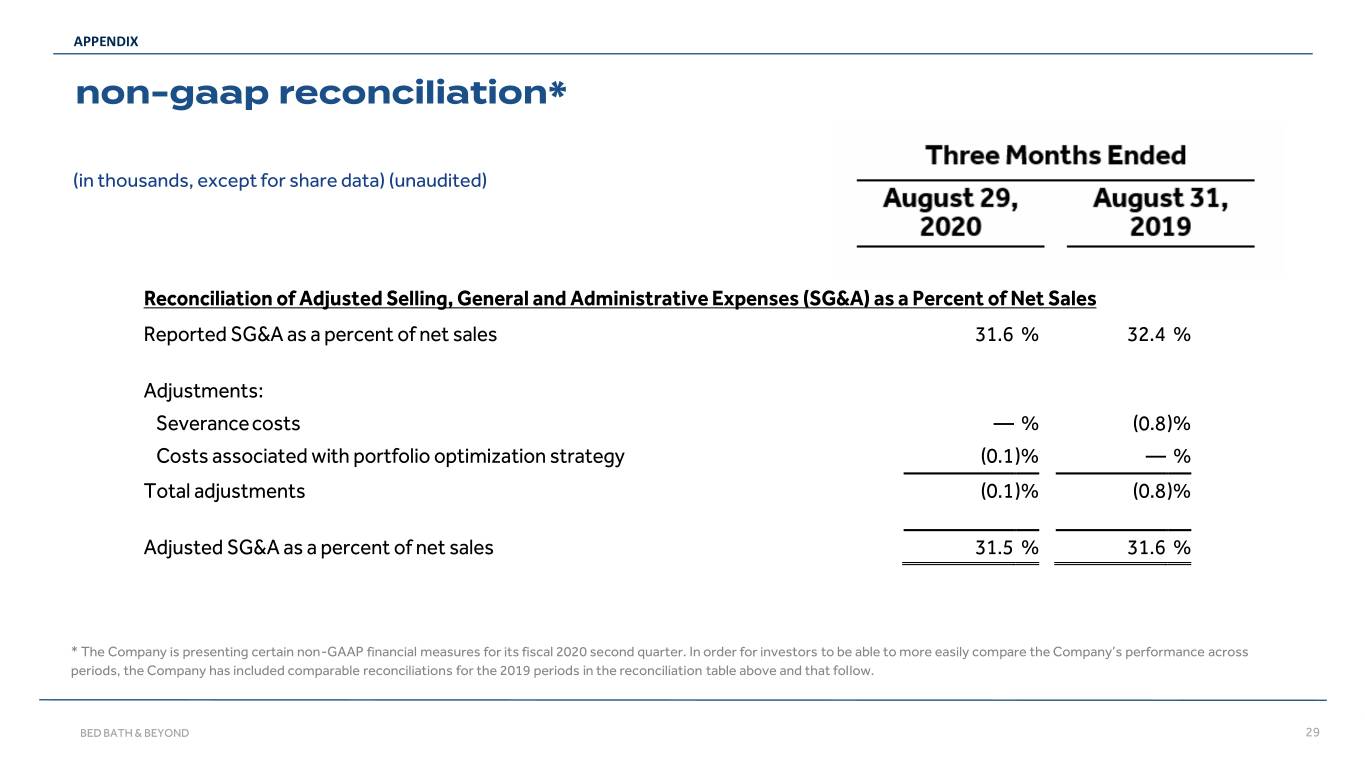

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Selling, General and Administrative Expenses (SG&A) as a Percent of Net Sales Reported SG&A as a percent of net sales 31.6 % 32.4 % Adjustments: Severance costs — % (0.8 )% Costs associated with portfolio optimization strategy (0.1 )% — % Total adjustments (0.1 )% (0.8 )% Adjusted SG&A as a percent of net sales 31.5 % 31.6 % * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 29

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Net Income (Loss) to EBITDA and Adjusted EBITDA Reported net earnings (loss) $ 217,900 $ (138,765 ) Depreciation and amortization 85,277 84,430 Interest expense, net 23,371 16,342 Gain on extinguishment of debt (77,038 ) — Provision (benefit) for income taxes 106,310 (59,835 ) EBITDA $ 355,820 $ (97,828 ) Pre-tax Adjustments: Incremental inventory reserve for future markdowns (23,000 ) 193,735 Impairments (a) 29,176 28,357 Restructuring and transformation initiative costs 23,128 — Severance costs — 22,537 Gain on sale of business (189,528 ) — Costs associated with portfolio optimization strategy 3,750 — Total pre-tax adjustments (156,474 ) 244,629 Adjusted EBITDA $ 199,346 $ 146,801 (a) Impairments include tradename and store asset impairments related to the North American Retail reporting unit. * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 30

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Effective Income Tax Rate Reported effective income tax rate 32.8 % 30.1 % Impairments, severance, incremental inventory reserve for future markdowns, costs associated with portfolio optimization strategy, restructuring and transformation 1.5 % (21.1 )% initiative costs, gain on sale of business and gain on extinguishment of debt Adjusted effective income tax rate 34.3 % 9.0 % * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 31

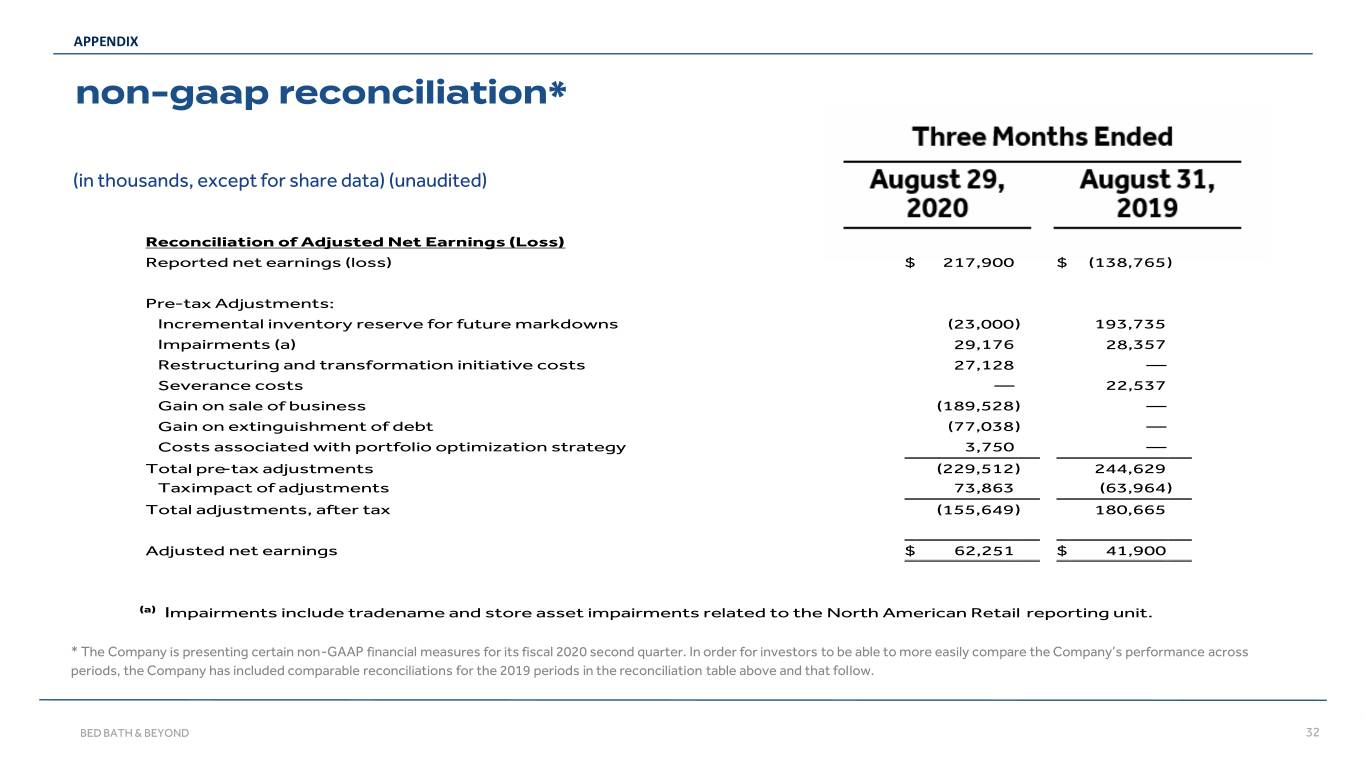

APPENDIX non-gaap reconciliation* (in thousands, except for share data) (unaudited) Reconciliation of Adjusted Net Earnings (Loss) Reported net earnings (loss) $ 217,900 $ (138,765 ) Pre-tax Adjustments: Incremental inventory reserve for future markdowns (23,000 ) 193,735 Impairments (a) 29,176 28,357 Restructuring and transformation initiative costs 27,128 — Severance costs — 22,537 Gain on sale of business (189,528 ) — Gain on extinguishment of debt (77,038 ) — Costs associated with portfolio optimization strategy 3,750 — Total pre-tax adjustments (229,512 ) 244,629 Tax impact of adjustments 73,863 (63,964 ) Total adjustments, after tax (155,649 ) 180,665 Adjusted net earnings $ 62,251 $ 41,900 (a) Impairments include tradename and store asset impairments related to the North American Retail reporting unit. * The Company is presenting certain non-GAAP financial measures for its fiscal 2020 second quarter. In order for investors to be able to more easily compare the Company’s performance across periods, the Company has included comparable reconciliations for the 2019 periods in the reconciliation table above and that follow. BED BATH & BEYOND 32