Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - US Ecology, Inc. | usecology_i8k.htm |

Exhibit 99.1

1 Stifel “Virtual” Investor Tour: September 30, 2020 Investor Presentation: Gulf Operations

2 Safe Harbor These slides contain (and the accompanying oral discussion will contain) “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward looking statements are only predictions and are not guarantees of performance . These statements are based on management’s beliefs and assumptions, which in turn are based on currently available information . Important assumptions include, among others, those regarding demand for the Company’s services, expansion of service offerings geographically or through new or expanded service lines, the timing and cost of planned capital expenditures, competitive conditions and general economic conditions . These assumptions could prove inaccurate . Forward looking statements also involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward looking statement . Many of these factors are beyond our ability to control or predict . Such factors include developments related to the COVID - 19 pandemic, fluctuations in commodity markets related to our business, the integration of NRC’s operations, the loss or failure to renew significant contracts, competition in our markets, adverse economic conditions, our compliance with applicable laws and regulations, potential liability in connection with providing oil spill response services and waste disposal services, the effect of existing or future laws and regulations related to greenhouse gases and climate change, the effect of our failure to comply with U . S . or foreign anti - bribery laws, the effect of compliance with laws and regulations, an accident at one of our facilities, incidents arising out of the handling of dangerous substances, our failure to maintain an acceptable safety record, our ability to perform under required contracts, limitations on our available cash flow as a result of our indebtedness, liabilities arising from our participation in multi - employer pension plans, the effect of changes in the method of determining the London Interbank Offered Rate (“LIBOR”) or the replacement thereto, risks associated with our international operations, the impact of changes to U . S . tariff and import and export regulations, a change in NRC’s classification as an Oil Spill Removal Organization, cyber security threats, unanticipated changes in tax rules and regulations, loss of key personnel, a deterioration in our labor relations or labor disputes, our reliance on third - party contractors to provide emergency response services, our access to insurance, surety bonds and other financial assurances, our litigation risk not covered by insurance, the replacement of non - recurring event projects, our ability to permit and contract for timely construction of new or expanded disposal space, renewals of our operating permits or lease agreements with regulatory bodies, our access to cost - effective transportation services, lawsuits, our implementation of new technologies, fluctuations in foreign currency markets and foreign affairs, our integration of acquired businesses, our ability to pay dividends or repurchase stock, anti - takeover regulations, stock market volatility, the failure of the warrants to be in the money or their expiration worthless and risks related to our compliance with maritime regulations (including the Jones Act) . Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission (the “SEC”), we are under no obligation to publicly update or revise any forward looking statements, whether as a result of new information, future events or otherwise . You should not place undue reliance on our forward - looking statements . Although we believe that the expectations reflected in forward looking statements are reasonable, we cannot guarantee future results or performance . Such statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company and its subsidiaries, conditions affecting the Company’s customers, competitor responses to the Company’s products and services, the overall market acceptance of such products and services, the integration of acquisitions, and other factors disclosed in the Company’s periodic reports filed with the Securities and Exchange Commission (“SEC”) . We refer investors to review such factors in our 2019 Form 10 - K filed with the SEC on March 2 , 2020 . Such statements may include, but are not limited to, statements about the Company’s business outlook and financial guidance and other statements that are not historical facts including any statements, expectations or impacts of the COVID - 19 pandemic . Consequently such forward looking statements should be regarded as the Company’s current plans, estimates and beliefs . The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward - looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events .

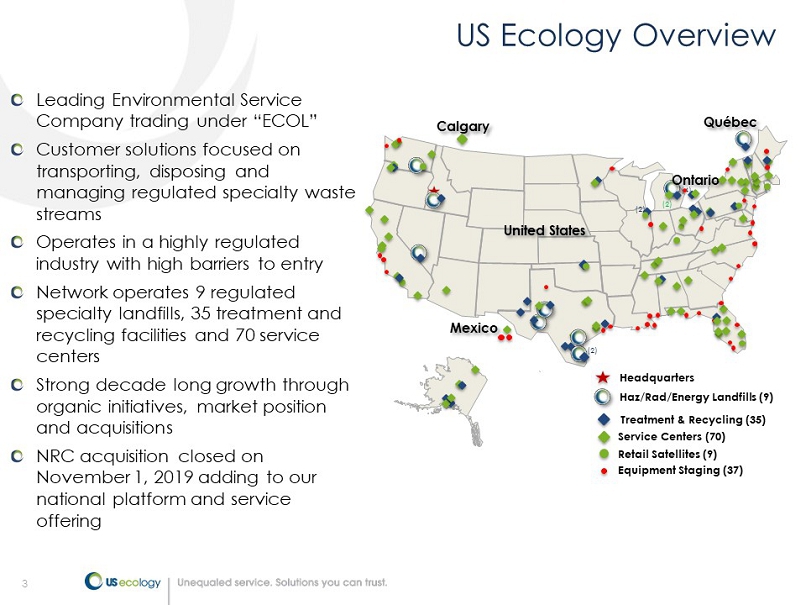

3 US Ecology Overview (4) Mexico Québec (2) (2) United States (2) Ontario Equipment Staging (37) Haz/Rad/Energy Landfills (9) Treatment & Recycling (35) Service Centers (70) Headquarters Retail Satellites (9) Calgary Leading Environmental Service Company trading under “ECOL” Customer solutions focused on transporting, disposing and managing regulated specialty waste streams Operates in a highly regulated industry with high barriers to entry Network operates 9 regulated specialty landfills, 35 treatment and recycling facilities and 70 service centers Strong decade long growth through organic initiatives, market position and acquisitions NRC acquisition closed on November 1, 2019 adding to our national platform and service offering

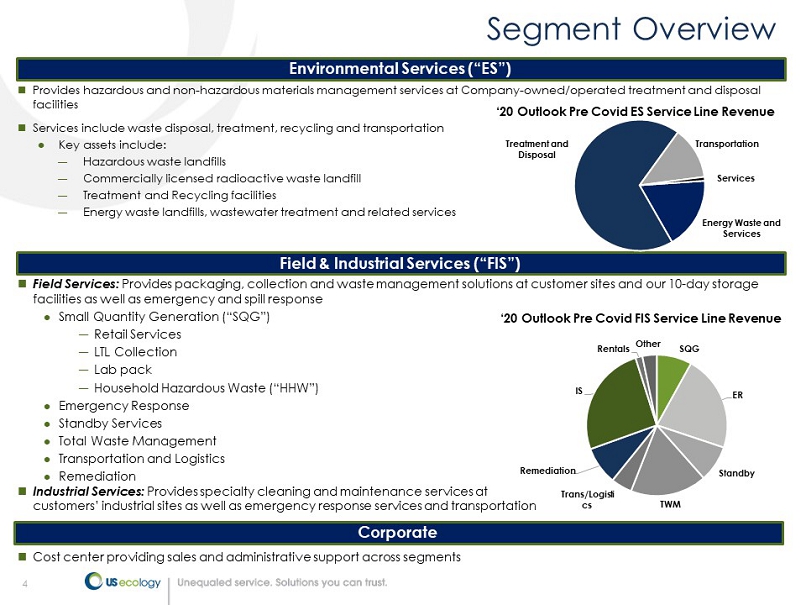

4 Provides hazardous and non - hazardous materials management services at Company - owned/operated treatment and disposal facilities Services include waste disposal, treatment, recycling and transportation Key assets include: ― Hazardous waste landfills ― Commercially licensed radioactive waste landfill ― Treatment and Recycling facilities ― Energy waste landfills, wastewater treatment and related services 4 Field Services: Provides packaging, collection and waste management solutions at customer sites and our 10 - day storage facilities as well as emergency and spill response Small Quantity Generation (“SQG”) ― Retail Services ― LTL Collection ― Lab pack ― Household Hazardous Waste (“HHW”) Emergency Response Standby Services Total Waste Management Transportation and Logistics Remediation Industrial Services: Provides specialty cleaning and maintenance services at customers’ industrial sites as well as emergency response services and transportation Cost center providing sales and administrative support across segments Segment Overview Environmental Services (“ES”) Field & Industrial Services (“FIS”) Corporate Energy Waste and Services Treatment and Disposal Transportation Services ‘20 Outlook Pre Covid ES Service Line Revenue SQG ER Standby TWM Trans/Logist ics Remediation IS Rentals Other ‘20 Outlook Pre Covid FIS Service Line Revenue

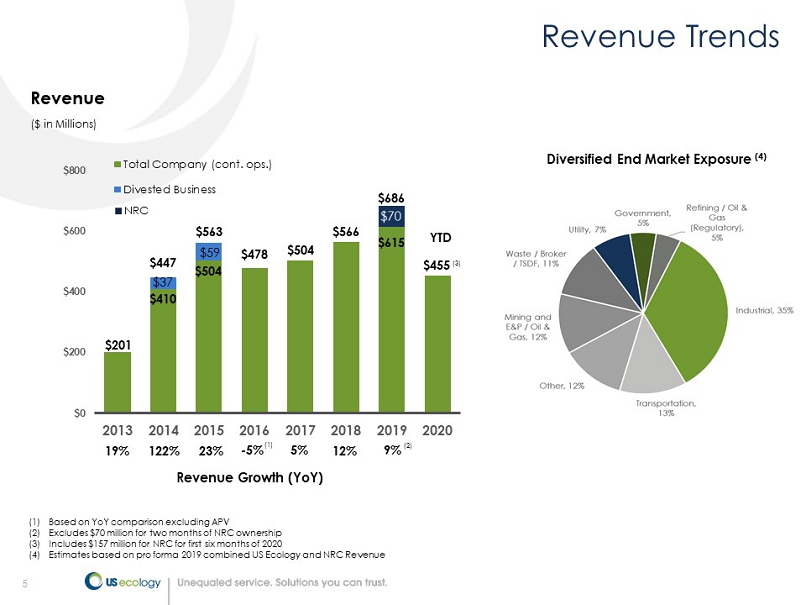

5 ($ in Millions) Revenue Growth (YoY) $201 $504 $566 $615 $455 $0 $200 $400 $600 $800 2013 2014 2015 2016 2017 2018 2019 2020 Total Company (cont. ops.) Divested Business YTD Revenue 19% 122% 23% - 5% (1) Based on YoY comparison excluding APV (2) Excludes $70 million for two months of NRC ownership (3) Includes $157 million for NRC for first six months of 2020 (4) Estimates based on pro forma 2019 combined US Ecology and NRC Revenue Revenue Trends $410 $37 $504 $59 $478 $447 $563 5% (1) 12% ■ NRC 9% (2) $686 Diversified End Market Exposure (4) (3)

6 NRC Merger Closed November 1, 2019

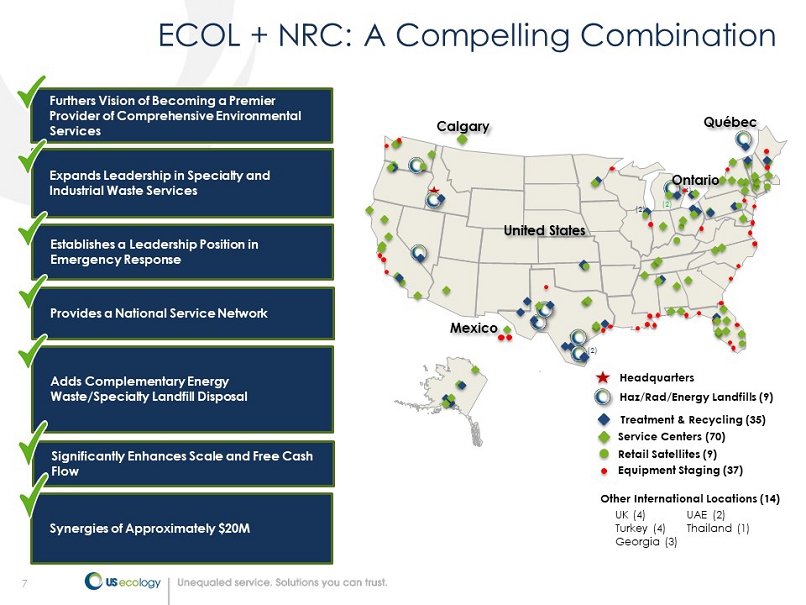

7 ECOL + NRC: A Compelling Combination (4) Mexico Québec (2) (2) United States (2) Ontario Equipment Staging (37) Haz/Rad/Energy Landfills (9) Treatment & Recycling (35) Service Centers (70) Headquarters Retail Satellites (9) Furthers Vision of Becoming a Premier Provider of Comprehensive Environmental Services Expands Leadership in Specialty and Industrial Waste Services Establishes a Leadership Position in Emergency Response Significantly Enhances Scale and Free Cash Flow Provides a National Service Network Adds Complementary Energy Waste/Specialty Landfill Disposal Synergies of Approximately $20M Calgary Other International Locations (14) UK (4) UAE (2) Turkey (4) Thailand (1) Georgia (3)

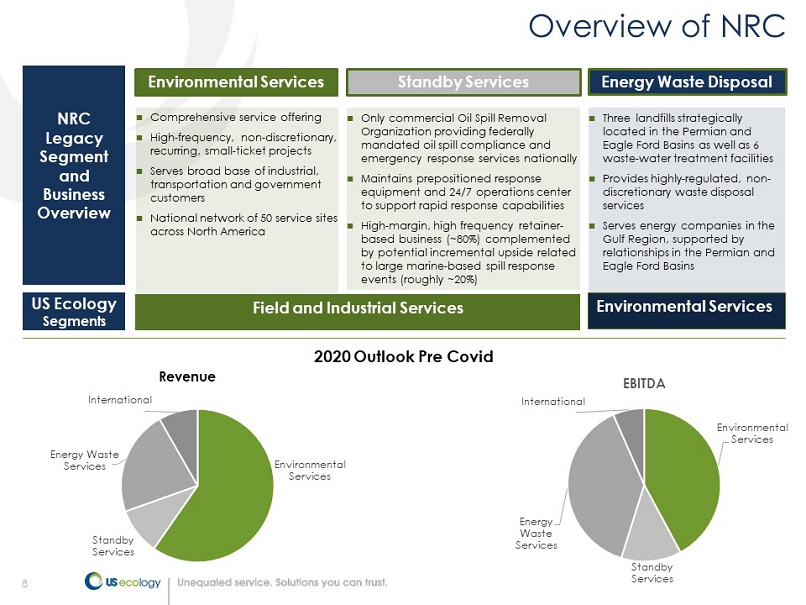

8 Environmental Services Standby Services Energy Waste Services International EBITDA NRC Legacy Segment and Business Overview Comprehensive service offering High - frequency, non - discretionary, recurring, small - ticket projects Serves broad base of industrial, transportation and government customers National network of 50 service sites across North America Three landfills strategically located in the Permian and Eagle Ford Basins as well as 6 waste - water treatment facilities Provides highly - regulated, non - discretionary waste disposal services Serves energy companies in the Gulf Region, supported by relationships in the Permian and Eagle Ford Basins Only commercial Oil Spill Removal Organization providing federally mandated oil spill compliance and emergency response services nationally Maintains prepositioned response equipment and 24/7 operations center to support rapid response capabilities High - margin, high frequency retainer - based business (~80%) complemented by potential incremental upside related to large marine - based spill response events (roughly ~20%) Overview of NRC Environmental Services Energy Waste Disposal Standby Services US Ecology Segments Field and Industrial Services Environmental Services Environmental Services Standby Services Energy Waste Services International Revenue 2020 Outlook Pre Covid

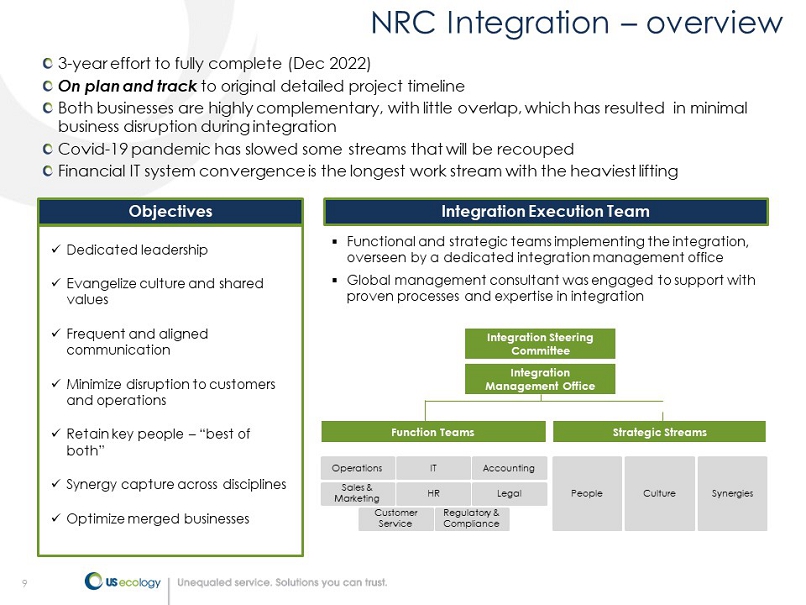

9 3 - year effort to fully complete (Dec 2022) On plan and track to original detailed project timeline Both businesses are highly complementary, with little overlap, which has resulted in minimal business disruption during integration Covid - 19 pandemic has slowed some streams that will be recouped Financial IT system convergence is the longest work stream with the heaviest lifting Objectives x Dedicated leadership x Evangelize culture and shared values x Frequent and aligned communication x Minimize disruption to customers and operations x Retain key people – “best of both” x Synergy capture across disciplines x Optimize merged businesses Integration Execution Team ▪ Functional and strategic teams implementing the integration, overseen by a dedicated integration management office ▪ Global management consultant was engaged to support with proven processes and expertise in integration Integration Steering Committee Integration Management Office Function Teams Operations IT Accounting Sales & Marketing HR Legal Customer Service Regulatory & Compliance Strategic Streams People Culture Synergies NRC Integration – overview

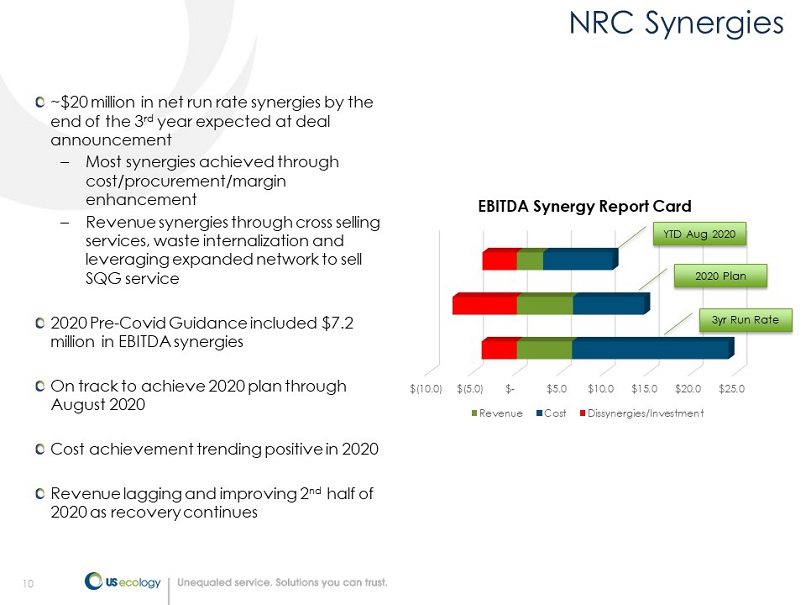

10 ~$20 million in net run rate synergies by the end of the 3 rd year expected at deal announcement – Most synergies achieved through cost/procurement/margin enhancement – Revenue synergies through cross selling services, waste internalization and leveraging expanded network to sell SQG service 2020 Pre - Covid Guidance included $7.2 million in EBITDA synergies On track to achieve 2020 plan through August 2020 Cost achievement trending positive in 2020 Revenue lagging and improving 2 nd half of 2020 as recovery continues NRC Synergies $(10.0) $(5.0) $- $5.0 $10.0 $15.0 $20.0 $25.0 EBITDA Synergy Report Card Revenue Cost Dissynergies/Investment YTD Aug 2020 2020 Plan 3yr Run Rate

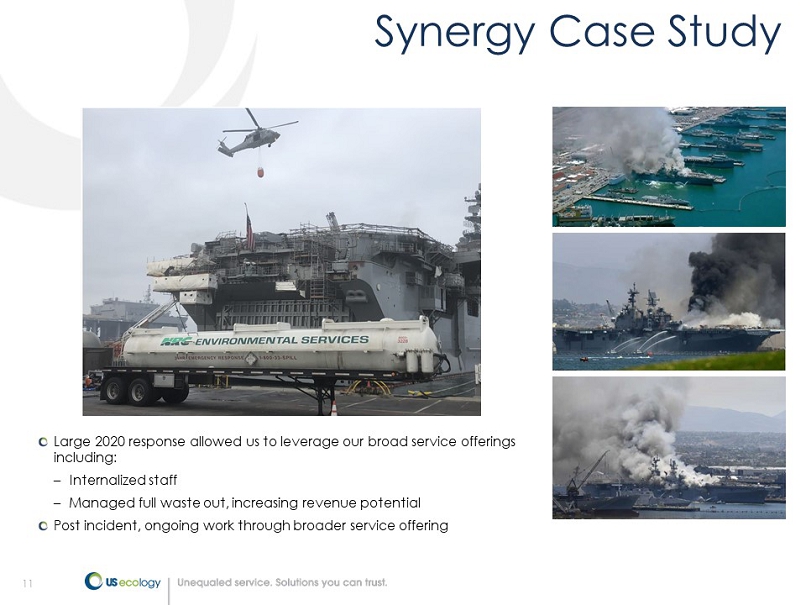

11 Synergy Case Study Large 2020 response allowed us to leverage our broad service offerings including: – Internalized staff – Managed full waste out, increasing revenue potential Post incident, ongoing work through broader service offering

12 Gulf Region

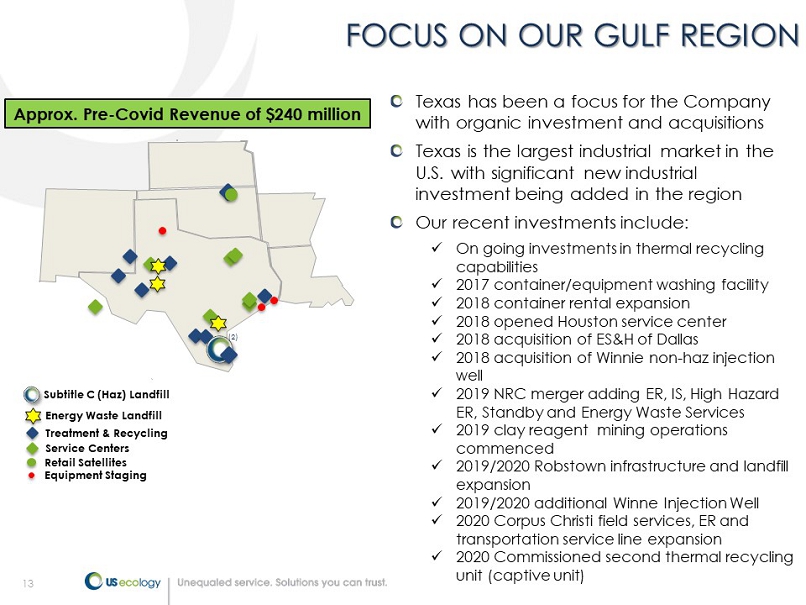

13 FOCUS ON OUR GULF REGION Texas has been a focus for the Company with organic investment and acquisitions Texas is the largest industrial market in the U.S. with significant new industrial investment being added in the region Our recent investments include: x On going investments in thermal recycling capabilities x 2017 container/equipment washing facility x 2018 container rental expansion x 2018 opened Houston service center x 2018 acquisition of ES&H of Dallas x 2018 acquisition of Winnie non - haz injection well x 2019 NRC merger adding ER, IS, High Hazard ER, Standby and Energy Waste Services x 2019 clay reagent mining operations commenced x 2019/2020 Robstown infrastructure and landfill expansion x 2019/2020 additional Winne Injection Well x 2020 Corpus Christi field services, ER and transportation service line expansion x 2020 Commissioned second thermal recycling unit (captive unit) Treatment & Recycling Equipment Staging Subtitle C (Haz) Landfill Service Centers Retail Satellites Energy Waste Landfill Approx. Pre - Covid Revenue of $240 million (2)

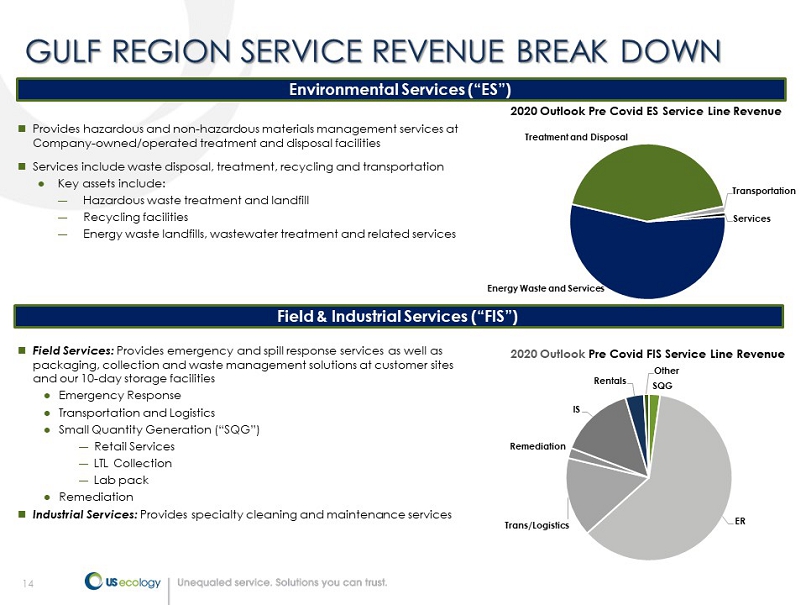

14 GULF REGION SERVICE REVENUE BREAK DOWN Provides hazardous and non - hazardous materials management services at Company - owned/operated treatment and disposal facilities Services include waste disposal, treatment, recycling and transportation Key assets include: ― Hazardous waste treatment and landfill ― Recycling facilities ― Energy waste landfills, wastewater treatment and related services Field Services: Provides emergency and spill response services as well as packaging, collection and waste management solutions at customer sites and our 10 - day storage facilities Emergency Response Transportation and Logistics Small Quantity Generation (“SQG”) ― Retail Services ― LTL Collection ― Lab pack Remediation Industrial Services: Provides specialty cleaning and maintenance services Environmental Services (“ES”) Field & Industrial Services (“FIS”) Energy Waste and Services Treatment and Disposal Transportation Services 2020 Outlook Pre Covid ES Service Line Revenue SQG ER Trans/Logistics Remediation IS Rentals Other 2020 Outlook Pre Covid FIS Service Line Revenue

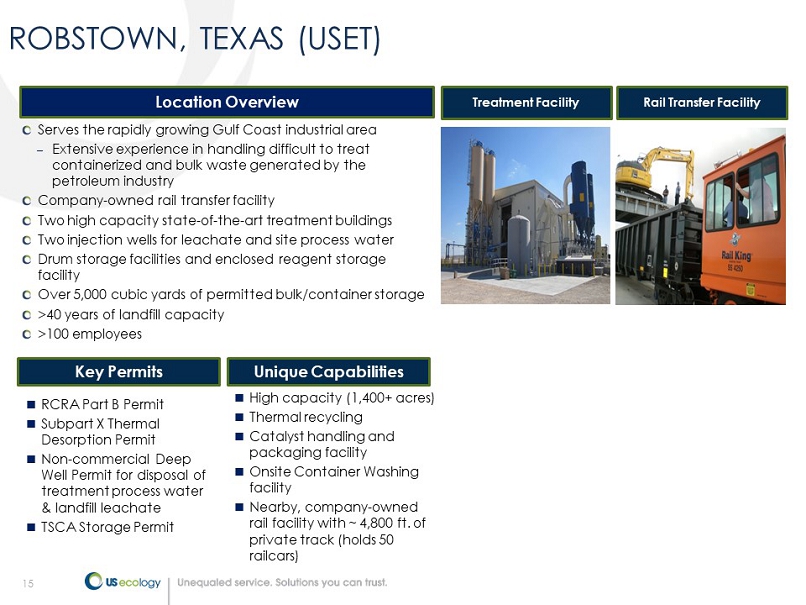

15 Serves the rapidly growing Gulf Coast industrial area – Extensive experience in handling difficult to treat containerized and bulk waste generated by the petroleum industry Company - owned rail transfer facility Two high capacity state - of - the - art treatment buildings Two injection wells for leachate and site process water Drum storage facilities and enclosed reagent storage facility Over 5,000 cubic yards of permitted bulk/container storage >40 years of landfill capacity >100 employees Treatment Facility Key Permits Rail Transfer Facility Unique Capabilities RCRA Part B Permit Subpart X Thermal Desorption Permit Non - commercial Deep Well Permit for disposal of treatment process water & landfill leachate TSCA Storage Permit High capacity (1,400+ acres) Thermal recycling Catalyst handling and packaging facility Onsite Container Washing facility Nearby, company - owned rail facility with ~ 4,800 ft. of private track (holds 50 railcars) Location Overview ROBSTOWN, TEXAS (USET)

16 ROBSTOWN, TEXAS (USET) New Landfill Roll - Off Box Storage Pad Improvements to Stabilization Building #2 Completed Phase I Construction of the New Landfill

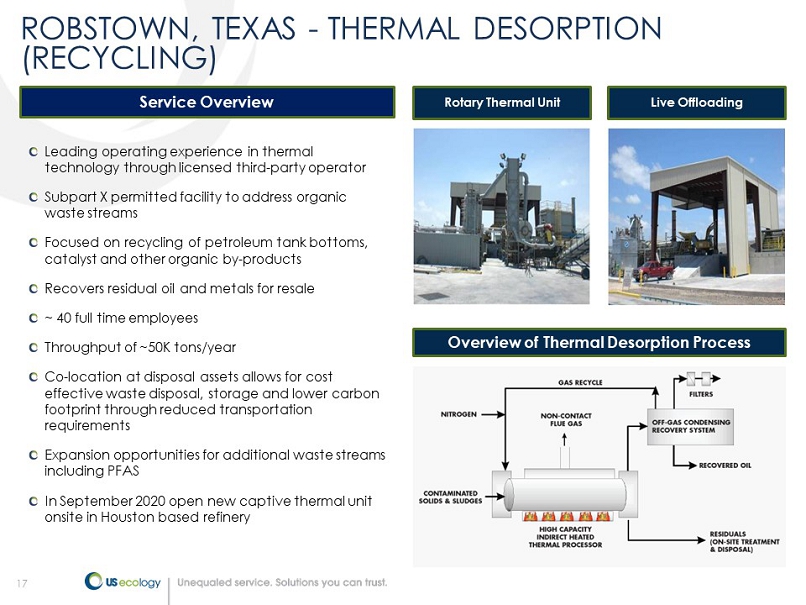

17 Rotary Thermal Unit Live Offloading Leading operating experience in thermal technology through licensed third - party operator Subpart X permitted facility to address organic waste streams Focused on recycling of petroleum tank bottoms, catalyst and other organic by - products Recovers residual oil and metals for resale ~ 40 full time employees Throughput of ~50K tons/year Co - location at disposal assets allows for cost effective waste disposal, storage and lower carbon footprint through reduced transportation requirements Expansion opportunities for additional waste streams including PFAS In September 2020 open new captive thermal unit onsite in Houston based refinery Overview of Thermal Desorption Process Service Overview ROBSTOWN, TEXAS - THERMAL DESORPTION (RECYCLING)

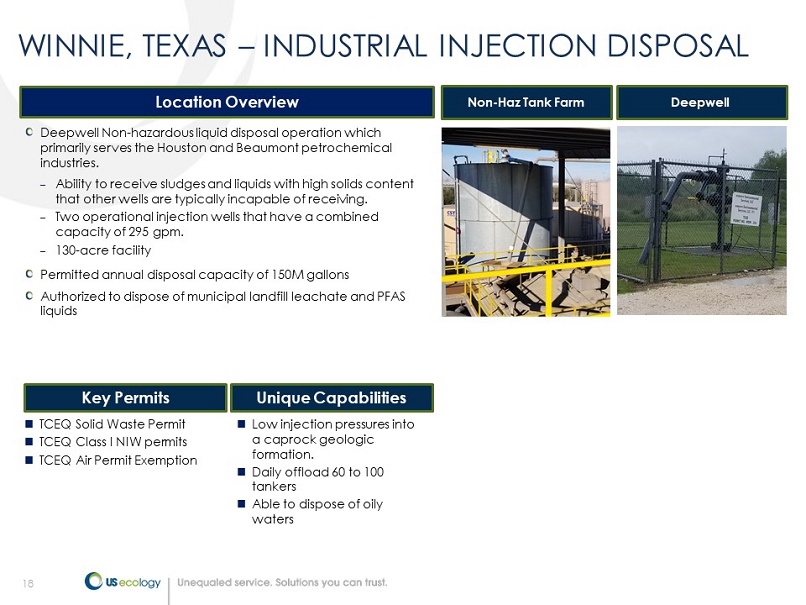

18 Grand Vi( Deepwell Non - hazardous liquid disposal operation which primarily serves the Houston and Beaumont petrochemical industries. – Ability to receive sludges and liquids with high solids content that other wells are typically incapable of receiving. – Two operational injection wells that have a combined capacity of 295 gpm. – 130 - acre facility Permitted annual disposal capacity of 150M gallons Authorized to dispose of municipal landfill leachate and PFAS liquids Location Overview Non - Haz Tank Farm Key Permits Deepwell Unique Capabilities TCEQ Solid Waste Permit TCEQ Class I NIW permits TCEQ Air Permit Exemption Low injection pressures into a caprock geologic formation. Daily offload 60 to 100 tankers Able to dispose of oily waters WINNIE, TEXAS – INDUSTRIAL INJECTION DISPOSAL

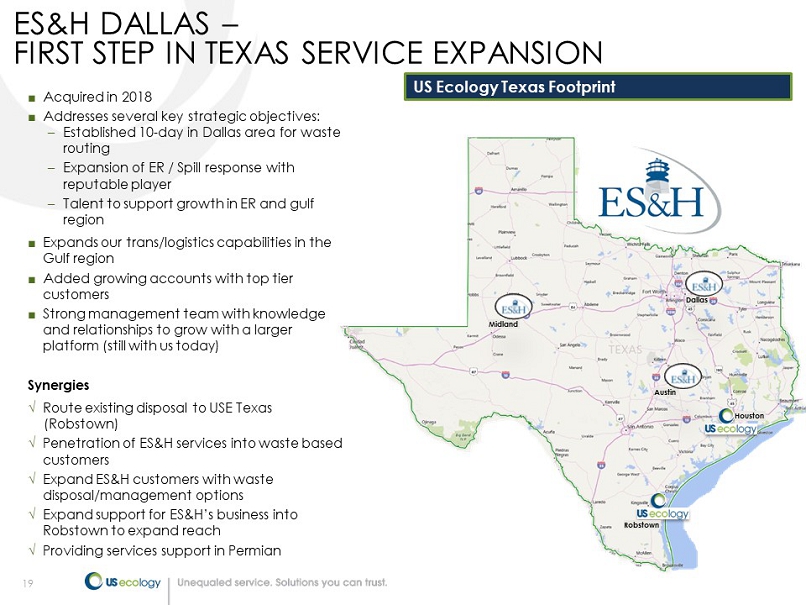

19 ES&H DALLAS – FIRST STEP IN TEXAS SERVICE EXPANSION ■ Acquired in 2018 ■ Addresses several key strategic objectives: – Established 10 - day in Dallas area for waste routing – Expansion of ER / Spill response with reputable player – Talent to support growth in ER and gulf region ■ Expands our trans/logistics capabilities in the Gulf region ■ Added growing accounts with top tier customers ■ Strong management team with knowledge and relationships to grow with a larger platform (still with us today) Synergies √ Route existing disposal to USE Texas (Robstown) √ Penetration of ES&H services into waste based customers √ Expand ES&H customers with waste disposal/management options √ Expand support for ES&H’s business into Robstown to expand reach √ Providing services support in Permian Houston Robstown Austin Dallas Midland US Ecology Texas Footprint

20 GLOBAL RESPONSE OPERATIONS CENTER Consolidated USE/NRC Global Emergency Response Center (G - ROC) Located in Grand Prairie, TX supporting: – All legacy company ER programs into a singular program – Merged/merging all subcontractor networks into singular network (ICN) – Develop call center training, ICN & service center QC program, and customer onboarding process. – Consistent quality of services Services as backup to our Standby Call Center in Great River, NY Staffed with skilled team members with working knowledge of ER related services and project management support Dedicated phone lines for our national customers (no waiting in queue) Rapid response dispatch to broaden our service network with goal of 75% internal response rate Integration benefits from the combination of 3 programs allows us to respond more rapidly, internalize within US Ecology workforce, respond more rapidly through expanded network and sell to larger national accounts

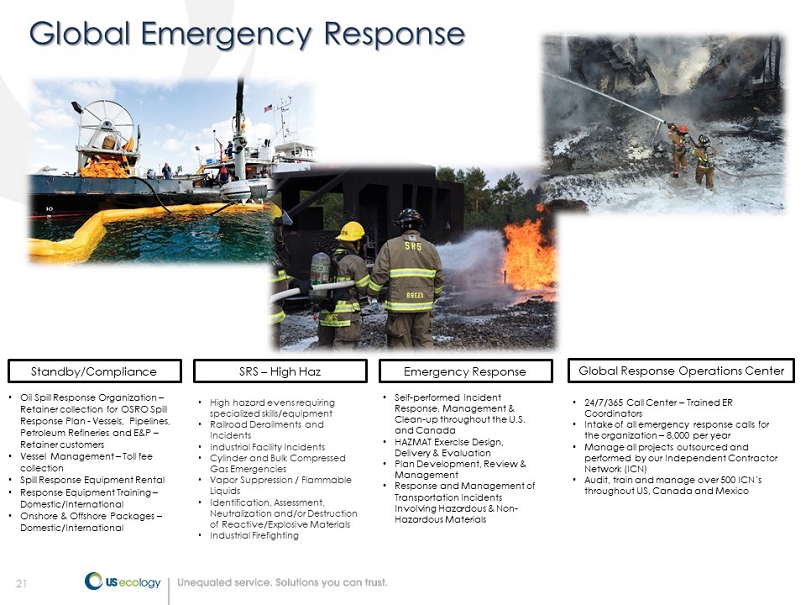

21 Emergency Response SRS – High Haz Global Response Operations Center Standby/Compliance • Oil Spill Response Organization – Retainer collection for OSRO Spill Response Plan - Vessels, Pipelines, Petroleum Refineries and E&P – Retainer customers • Vessel Management – Toll fee collection • Spill Response Equipment Rental • Response Equipment Training – Domestic/International • Onshore & Offshore Packages – Domestic/International • 24/7/365 Call Center – Trained ER Coordinators • Intake of all emergency response calls for the organization – 8,000 per year • Manage all projects outsourced and performed by our Independent Contractor Network (ICN) • Audit, train and manage over 500 ICN’s throughout US, Canada and Mexico • High hazard evens requiring specialized skills/equipment • Railroad Derailments and Incidents • Industrial Facility Incidents • Cylinder and Bulk Compressed Gas Emergencies • Vapor Suppression / Flammable Liquids • Identification, Assessment, Neutralization and/or Destruction of Reactive/Explosive Materials • Industrial Firefighting • Self - performed Incident Response, Management & Clean - up throughout the U.S. and Canada • HAZMAT Exercise Design, Delivery & Evaluation • Plan Development, Review & Management • Response and Management of Transportation Incidents Involving Hazardous & Non - Hazardous Materials Global Emergency Response

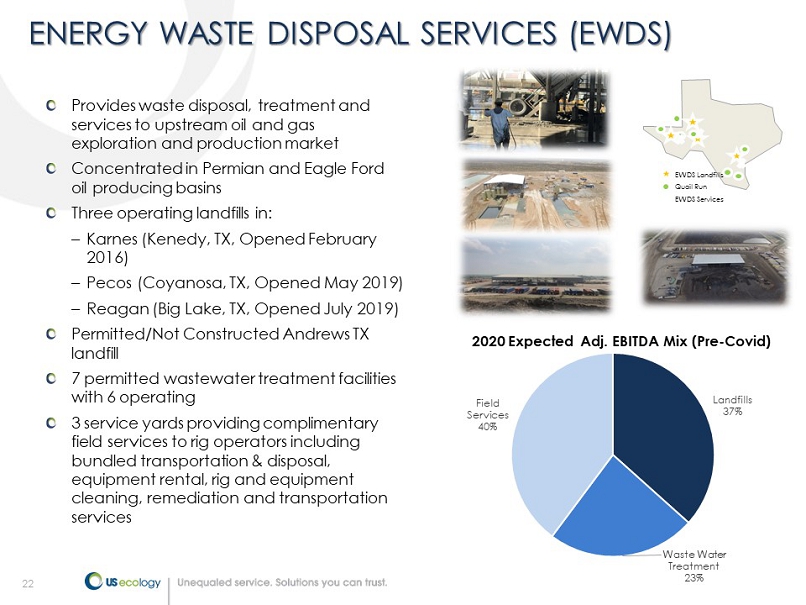

22 22 ENERGY WASTE DISPOSAL SERVICES (EWDS) Provides waste disposal, treatment and services to upstream oil and gas exploration and production market Concentrated in Permian and Eagle Ford oil producing basins Three operating landfills in: – Karnes (Kenedy, TX, Opened February 2016) – Pecos (Coyanosa, TX, Opened May 2019) – Reagan (Big Lake, TX, Opened July 2019) Permitted/Not Constructed Andrews TX landfill 7 permitted wastewater treatment facilities with 6 operating 3 service yards providing complimentary field services to rig operators including bundled transportation & disposal, equipment rental, rig and equipment cleaning, remediation and transportation services Landfills 37% Waste Water Treatment 23% Field Services 40% 2020 Expected Adj. EBITDA Mix (Pre - Covid) EWDS Landfills Quail Run EWDS Services

23 Technology Investments

• Version 2.0 released, June 2020 • Cloud - based Customer interface system • Profiling, scheduling and data management • Waste, ER, TWM, Industrial Services, Retail Services covered for data management • New modules added • Lab Pack System (LPx) developed in - house • Algorithmic engine provides industry automated intelligence • Increases – Safety – Compliance – P roficiency • Provides critical data to Customers • Equity investment • Retail AI software • On truck and prem system • Increases accuracy in waste compliance • Reduces training time for techs • D rives compliance • Provides for sustainable disposal and re - use options

25 US Ecology Partners with Smarter Sorting