Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HollyFrontier Corp | hfcform8-krevisedrefin.htm |

Exhibit 99.1 Revised Refining Geographic Operating Data The Cheyenne Refinery ceased petroleum refining operations in the third quarter of 2020. Beginning in the fourth quarter of 2020, activities associated with the conversion of the Cheyenne Refinery to renewable diesel production will be reported in the Corporate and Other segment, and the disaggregation of our refining geographic operating data will be presented in two regions, Mid‐Continent and West, to best reflect the economic drivers of our refining operations. The Mid‐Continent region will continue to be comprised of the El Dorado and Tulsa refineries, and the new West region will be comprised of the Navajo and Woods Cross refineries. All prior period geographic operating data included below has been retrospectively adjusted to reflect the revised regional groupings that will be effective in the fourth quarter of 2020. Q1 2020 Q2 2020 1H 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Mid‐Continent Region (El Dorado & Tulsa refineries) Crude charge (BPD)(1) 252,380 206,950 229,670 213,180 264,290 294,380 243,400 254,010 227,690 289,820 262,550 216,870 249,240 Refinery throughput (BPD)(2) 270,920 220,010 245,470 230,050 278,710 307,720 256,790 268,500 246,070 300,030 276,560 236,240 264,730 Sales of produced refined products (BPD)(3) 259,240 216,280 237,760 217,600 273,010 290,930 254,950 259,310 253,080 270,710 255,840 243,680 255,800 Refinery utilization(4) 97.1% 79.6% 88.3% 82.0% 101.7% 113.2% 93.6% 97.7% 87.6% 111.5% 101.0% 83.4% 95.9% Average per produced barrel(5) Refinery gross margin$ 9.54 $ 6.31 $ 8.07 $ 11.14 $ 17.17 $ 14.61 $ 11.15 $ 13.71 $ 10.65 $ 11.90 $ 16.43 $ 19.01 $ 14.44 Refinery operating expenses(6) 5.30 5.68 5.47 6.66 5.02 5.05 6.66 5.77 5.17 4.89 5.48 6.55 5.51 Net operating margin$ 4.24 $ 0.63 $ 2.60 $ 4.48 $ 12.15 $ 9.56 $ 4.49 $ 7.94 $ 5.48 $ 7.01 $ 10.95 $ 12.46 $ 8.93 Refinery operating expenses per throughput barrel(7) $ 5.07 $ 5.58 $ 5.30 $ 6.30 $ 4.92 $ 4.77 $ 6.61 $ 5.58 $ 5.32 $ 4.41 $ 5.07 $ 6.76 $ 5.33 Feedstocks: Sweet crude oil 52% 61% 56% 50% 57% 59% 54% 55% 43% 58% 59% 56% 54% Sour crude oil 22% 16% 19% 26% 22% 21% 26% 24% 30% 23% 21% 25% 24% Heavy sour crude oil 19% 17% 19% 17% 16% 16% 15% 16% 20% 16% 15% 11% 16% Other feedstocks and blends 7% 6% 6% 7% 5% 4% 5% 5% 7% 3% 5% 8% 6% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Sales of produced refined products: Gasolines 51% 54% 53% 53% 51% 49% 53% 51% 55% 49% 49% 52% 51% Diesel fuels 32% 36% 33% 28% 34% 34% 30% 32% 30% 35% 34% 30% 33% Jet fuels 7% 1% 4% 9% 6% 6% 6% 7% 5% 6% 6% 7% 6% Fuel oil 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% 1% Asphalt 3% 3% 3% 3% 2% 4% 4% 3% 3% 3% 4% 3% 3% Base oils 4% 3% 4% 4% 4% 4% 3% 4% 4% 4% 4% 4% 4% LPG and other 2% 2% 2% 2% 2% 2% 3% 2% 2% 2% 2% 3% 2% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% West Region (Navajo & Woods Cross refineries) Crude charge (BPD)(1) 140,250 105,120 122,690 138,150 142,880 142,420 116,100 134,850 139,560 126,160 133,910 140,910 135,140 Refinery throughput (BPD)(2) 154,340 117,840 136,090 152,470 157,700 157,300 128,983 149,070 155,070 140,080 147,110 153,960 149,050 Sales of produced refined products (BPD)(3) 150,610 132,610 141,610 160,870 157,930 158,170 143,410 155,060 165,510 138,280 150,920 155,780 152,590 Refinery utilization(4) 96.7% 72.5% 84.6% 95.3% 98.5% 98.2% 80.1% 93.0% 96.2% 87.0% 92.4% 97.2% 93.2% Average per produced barrel(5) Refinery gross margin$ 13.68 $ 10.96 $ 12.41 $ 15.43 $ 24.11 $ 20.73 $ 18.12 $ 19.62 $ 9.89 $ 23.99 $ 23.04 $ 23.91 $ 19.96 Refinery operating expenses(6) 6.91 7.26 7.07 6.64 6.07 6.74 7.39 6.69 5.74 8.57 6.52 7.33 6.99 Net operating margin$ 6.77 $ 3.70 $ 5.34 $ 8.79 $ 18.04 $ 13.99 $ 10.73 $ 12.93 $ 4.15 $ 15.42 $ 16.52 $ 16.58 $ 12.97 Refinery operating expenses per throughput barrel(7) $ 6.74 $ 7.62 $ 7.36 $ 7.01 $ 6.07 $ 6.78 $ 8.22 $ 6.96 $ 6.13 $ 8.46 $ 6.69 $ 7.42 $ 7.15 Feedstocks: Sweet crude oil 27% 32% 29% 21% 28% 27% 28% 26% 33% 29% 27% 20% 27% Sour crude oil 52% 48% 50% 57% 51% 52% 49% 52% 45% 51% 52% 61% 52% Black wax crude oil 12% 9% 11% 13% 12% 12% 13% 12% 12% 10% 12% 11% 12% Other feedstocks and blends 9% 11% 10% 9% 9% 9% 10% 10% 10% 10% 9% 8% 9% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

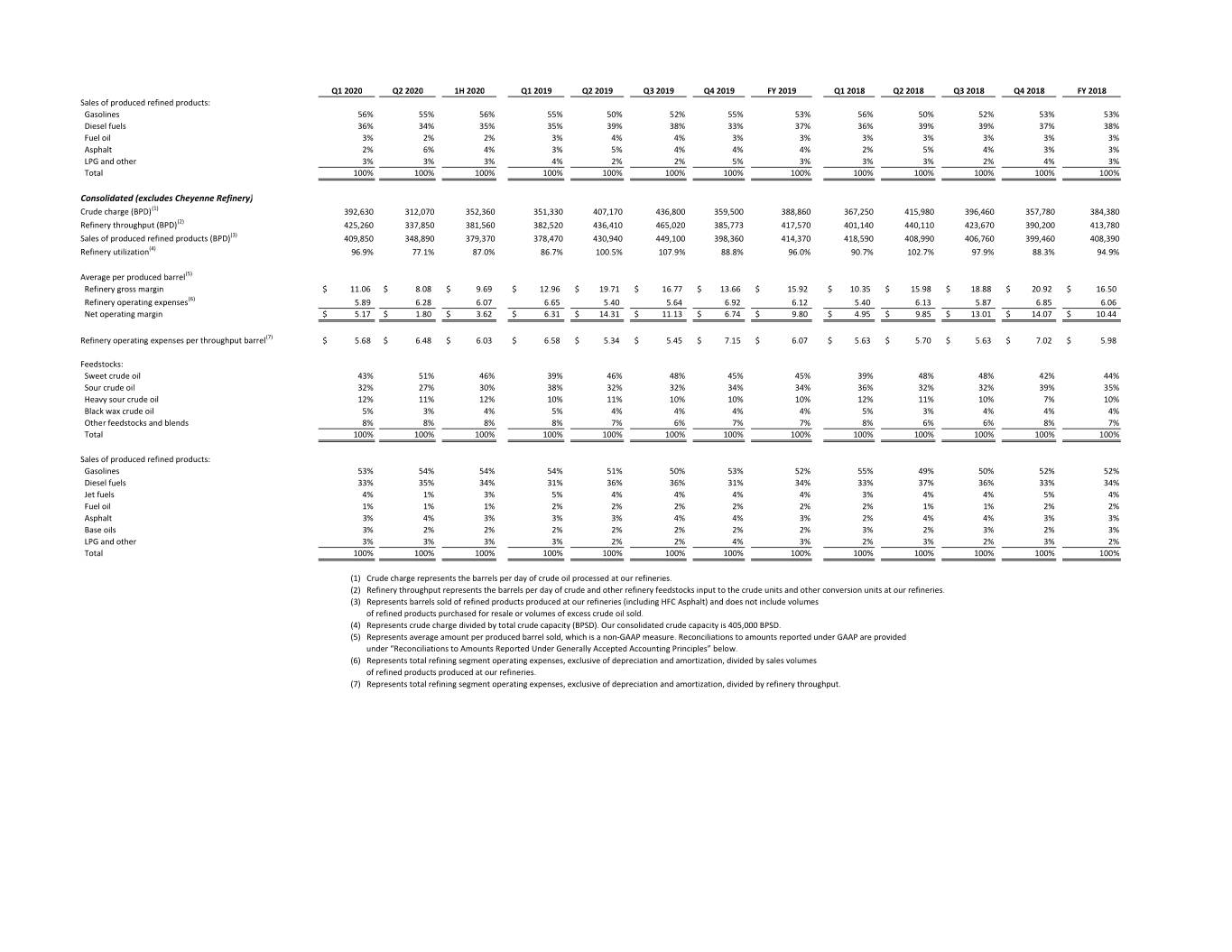

Q1 2020 Q2 2020 1H 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 Sales of produced refined products: Gasolines 56% 55% 56% 55% 50% 52% 55% 53% 56% 50% 52% 53% 53% Diesel fuels 36% 34% 35% 35% 39% 38% 33% 37% 36% 39% 39% 37% 38% Fuel oil 3% 2% 2% 3% 4% 4% 3% 3% 3% 3% 3% 3% 3% Asphalt 2% 6% 4% 3% 5% 4% 4% 4% 2% 5% 4% 3% 3% LPG and other 3% 3% 3% 4% 2% 2% 5% 3% 3% 3% 2% 4% 3% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Consolidated (excludes Cheyenne Refinery) Crude charge (BPD)(1) 392,630 312,070 352,360 351,330 407,170 436,800 359,500 388,860 367,250 415,980 396,460 357,780 384,380 Refinery throughput (BPD)(2) 425,260 337,850 381,560 382,520 436,410 465,020 385,773 417,570 401,140 440,110 423,670 390,200 413,780 Sales of produced refined products (BPD)(3) 409,850 348,890 379,370 378,470 430,940 449,100 398,360 414,370 418,590 408,990 406,760 399,460 408,390 Refinery utilization(4) 96.9% 77.1% 87.0% 86.7% 100.5% 107.9% 88.8% 96.0% 90.7% 102.7% 97.9% 88.3% 94.9% Average per produced barrel(5) Refinery gross margin$ 11.06 $ 8.08 $ 9.69 $ 12.96 $ 19.71 $ 16.77 $ 13.66 $ 15.92 $ 10.35 $ 15.98 $ 18.88 $ 20.92 $ 16.50 Refinery operating expenses(6) 5.89 6.28 6.07 6.65 5.40 5.64 6.92 6.12 5.40 6.13 5.87 6.85 6.06 Net operating margin$ 5.17 $ 1.80 $ 3.62 $ 6.31 $ 14.31 $ 11.13 $ 6.74 $ 9.80 $ 4.95 $ 9.85 $ 13.01 $ 14.07 $ 10.44 Refinery operating expenses per throughput barrel(7) $ 5.68 $ 6.48 $ 6.03 $ 6.58 $ 5.34 $ 5.45 $ 7.15 $ 6.07 $ 5.63 $ 5.70 $ 5.63 $ 7.02 $ 5.98 Feedstocks: Sweet crude oil 43% 51% 46% 39% 46% 48% 45% 45% 39% 48% 48% 42% 44% Sour crude oil 32% 27% 30% 38% 32% 32% 34% 34% 36% 32% 32% 39% 35% Heavy sour crude oil 12% 11% 12% 10% 11% 10% 10% 10% 12% 11% 10% 7% 10% Black wax crude oil 5% 3% 4% 5% 4% 4% 4% 4% 5% 3% 4% 4% 4% Other feedstocks and blends 8% 8% 8% 8% 7% 6% 7% 7% 8% 6% 6% 8% 7% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Sales of produced refined products: Gasolines 53% 54% 54% 54% 51% 50% 53% 52% 55% 49% 50% 52% 52% Diesel fuels 33% 35% 34% 31% 36% 36% 31% 34% 33% 37% 36% 33% 34% Jet fuels 4% 1% 3% 5% 4% 4% 4% 4% 3% 4% 4% 5% 4% Fuel oil 1% 1% 1% 2% 2% 2% 2% 2% 2% 1% 1% 2% 2% Asphalt 3% 4% 3% 3% 3% 4% 4% 3% 2% 4% 4% 3% 3% Base oils 3% 2% 2% 2% 2% 2% 2% 2% 3% 2% 3% 2% 3% LPG and other 3% 3% 3% 3% 2% 2% 4% 3% 2% 3% 2% 3% 2% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% (1) Crude charge represents the barrels per day of crude oil processed at our refineries. (2) Refinery throughput represents the barrels per day of crude and other refinery feedstocks input to the crude units and other conversion units at our refineries. (3) Represents barrels sold of refined products produced at our refineries (including HFC Asphalt) and does not include volumes of refined products purchased for resale or volumes of excess crude oil sold. (4) Represents crude charge divided by total crude capacity (BPSD). Our consolidated crude capacity is 405,000 BPSD. (5) Represents average amount per produced barrel sold, which is a non‐GAAP measure. Reconciliations to amounts reported under GAAP are provided under “Reconciliations to Amounts Reported Under Generally Accepted Accounting Principles” below. (6) Represents total refining segment operating expenses, exclusive of depreciation and amortization, divided by sales volumes of refined products produced at our refineries. (7) Represents total refining segment operating expenses, exclusive of depreciation and amortization, divided by refinery throughput.

Reconciliations of refinery operating information (non‐GAAP performance measures) to amounts reported under generally accepted accounting principles in financial statements Refinery gross margin and net operating margin are non‐GAAP performance measures that are used by our management and others to compare our refining performance to that of other companies in our industry. We believe these margin measures are helpful to investors in evaluating our refining performance on a relative and absolute basis. Refinery gross margin per produced barrel sold is total refining segment revenues less total refining segment cost of products sold, exclusive of lower of cost or market inventory valuation adjustments, divided by sales volumes of produced refined products sold. Net operating margin per barrel sold is the difference between refinery gross margin and refinery operating expenses per produced barrel sold. These two margins do not include the non‐cash effects of long‐lived asset impairment charges, lower of cost or market inventory valuation adjustments or depreciation and amortization. Each of these component performance measures can be reconciled directly to our consolidated statements of income. Other companies in our industry may not calculate these performance measures in the same manner. Below are reconcilations to our consolidated statements of income for refinery net operating and gross margin and operating expenses, in each case averaged per produced barrel sold. Due to rounding of reported numbers, some amounts may not calculate exactly. Reconciliation of average refining segment net operating margin per produced barrel sold to refinery gross margin to total sales and other revenues Consolidated Q1 2020 Q2 2020 1H 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 (Dollars in thousands, except for per barrel amounts) Net operating margin per produced barrel sold$ 5.17 $ 1.80 $ 3.62 $ 6.31 $ 14.31 $ 11.13 $ 6.74 $ 9.80 $ 4.95 $ 9.85 $ 13.01 $ 14.07 $ 10.44 Add average refinery operating expenses per produced barrel sold 5.89 6.28 6.07 6.65 5.40 5.64 6.92 6.12 5.40 6.13 5.87 6.85 6.06 Refinery gross margin per produced barrel sold $ 11.06 $ 8.08 $ 9.69 $ 12.96 $ 19.71 $ 16.77 $ 13.66 $ 15.92 $ 10.35 $ 15.98 $ 18.88 $ 20.92 $ 16.50 Times produced barrels sold (BPD) 409,850 348,890 379,370 378,470 430,940 449,100 398,360 414,370 418,590 408,990 406,760 399,460 408,390 Times number of days in period 91 91 182 90 91 92 92 365 90 91 92 92 365 Refining gross margin$ 412,498 $ 256,532 $ 669,049 $ 441,447 $ 772,938 $ 692,889 $ 500,627 $ 2,407,821 $ 389,917 $ 594,745 $ 706,526 $ 768,817 $ 2,459,529 Add (subtract) rounding 146 (115) 12 50 53 (10) 41 215 (147) (99) 98 (44) 285 West and Mid‐Continent Regions gross margin 412,644 256,417 669,061 441,497 772,991 692,879 500,668 2,408,036 389,770 594,646 706,624 768,773 2,459,814 Add West and Mid‐Continent Regions cost of products sold 2,287,109 1,335,427 3,622,535 2,730,138 3,190,747 2,943,538 3,198,238 12,062,661 3,022,510 3,111,231 3,302,465 2,877,327 12,313,533 Add Cheyenne Refinery sales and other revenues 235,113 135,660 370,774 275,775 333,522 310,553 206,242 1,126,091 336,905 373,104 363,080 330,128 1,403,216 Refining segment sales and other revenues 2,934,866 1,727,504 4,662,370 3,447,410 4,297,260 3,946,970 3,905,148 15,596,788 3,749,185 4,078,981 4,372,169 3,976,228 16,176,563 Add lubricants and specialty products segment revenue 526,603 357,287 883,890 493,334 545,346 537,718 516,130 2,092,528 444,840 467,689 475,886 424,288 1,812,703 Add HEP segment revenue 127,854 114,807 242,661 134,497 130,751 135,895 131,634 532,777 128,884 118,760 125,784 132,792 506,220 Add Corporate, Other and Eliminations Revenue (188,778) (136,668) (325,446) (177,994) (190,742) (195,755) (171,024) (735,515) (194,482) (194,194) (203,040) (189,104) (780,820) Sales and other revenues$ 3,400,545 $ 2,062,930 $ 5,463,475 $ 3,897,247 $ 4,782,615 $ 4,424,828 $ 4,381,888 $ 17,486,578 $ 4,128,427 $ 4,471,236 $ 4,770,799 $ 4,344,204 $ 17,714,666 Reconciliation of average refining segment operating expenses per produced barrel sold to total operating expenses Consolidated Q1 2020 Q2 2020 1H 2020 Q1 2019 Q2 2019 Q3 2019 Q4 2019 FY 2019 Q1 2018 Q2 2018 Q3 2018 Q4 2018 FY 2018 (Dollars in thousands, except for per barrel amounts) Average refining operating expenses per barrel sold$ 5.89 $ 6.28 $ 6.07 $ 6.65 $ 5.40 $ 5.64 $ 6.92 $ 6.12 $ 5.40 $ 6.13 $ 5.87 $ 6.85 $ 6.06 Times sales of products (BPD) 409,850 348,890 379,370 378,470 430,940 449,100 398,360 414,370 418,590 408,990 406,760 399,460 408,390 Times number of days in period 91 91 182 90 91 92 92 365 90 91 92 92 365 Refinery operating expenses$ 219,676 $ 199,384 $ 419,105 $ 226,514 $ 211,764 $ 233,029 $ 253,612 $ 925,620 $ 203,435 $ 228,147 $ 219,667 $ 251,740 $ 903,318 Add (subtract) rounding (22) (98) (165) 73 146 56 88 (338) (87) 156 (78) 176 (162) West and Mid‐Continent Regions operating expenses 219,654 199,286 418,940 226,587 211,910 233,085 253,700 925,282 203,348 228,303 219,589 251,916 903,156 Add Cheyenne Refinery operating expenses 39,520 40,073 79,593 37,910 40,805 43,784 47,707 170,206 36,499 34,255 42,421 38,878 152,053 Total refining segment operating expenses 259,174 239,359 498,533 264,497 252,715 276,869 301,407 1,095,488 239,847 262,558 262,010 290,794 1,055,209 Add lubricants and specialty products operating expenses 54,131 47,840 101,971 53,559 59,122 57,974 60,868 231,523 64,908 19,905 40,288 42,719 167,820 Add HEP operating expenses 34,981 34,737 69,718 37,513 40,608 44,924 38,951 161,996 36,203 34,533 35,995 39,699 146,430 Add Corporate, Other and Eliminations operating expenses (19,941) (18,577) (38,518) (23,977) (19,193) (34,189) (17,596) (94,955) (20,670) (20,781) (21,097) (21,073) (83,621) Operating expenses$ 328,345 $ 303,359 $ 631,704 $ 331,592 $ 333,252 $ 345,578 $ 383,630 $ 1,394,052 $ 320,288 $ 296,215 $ 317,196 $ 352,139 $ 1,285,838