Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - nDivision Inc. | ndvn_8k.htm |

EXHIBIT 99.1

Accelerating IT Transformation Towards Cloud Innovation SEPTEMBER 28, 2020 Investor Presentation RECURRING REVENUES HIGH GROWTH POSITIVE ADJUSTED EBITDA CASH FLOW POSITIVE MARQUEE CLIENTS LARGE ADDRESSABLE MARKET NDVN

JULY 2020 Investor Presentation DISCLAIMERS This presentation of nDivision Inc. ("nDivision" or the “nD”) is for informational purposes only and shall not constitute an offer to buy, sell, issue or subscribe for, or the solicitation of an offer to buy, sell or issue, or subscribe for any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The information contained herein is subject to change without notice and is based on publicly available information, internally developed data and other sources. Where any opinion or belief is expressed in this presentation, it is based on the assumptions and limitations mentioned herein and is an expression of present opinion or belief only. This presentation should not be construed as legal, financial or tax advice to any individual, as each individual’s circumstances are different. Readers should consult with their own professional advisors regarding their particular circumstances. CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation includes forward-looking information and forward-looking statements within the meaning of applicable Canadian and United States securities laws. Statements containing the words “believe”, “expect”, “intend”, “should”, “seek”, “anticipate”, “will”, “positioned”, “project”, “risk”, “plan”, “may”, “estimate” or, in each case, their negative and words of similar meaning are intended to identify forward-looking information. Forward-looking information involves risks and uncertainties including, but not limited to, nD’s anticipated business strategies, anticipated trends in nD’s business and anticipated market share, factors that could cause actual results or events to differ materially from those expressed or implied by the forward-looking information, general business, economic and competitive uncertainties, regulatory risks, risks associated with acquisitions and expansion, risks inherent in the information technology (IT) and internet sectors, other general risks of the IT industry as well as those risk factors disclosed elsewhere below. Such statements are based upon the current beliefs and expectations of nD’s management and are subject to significant business, social, economic, political, regulatory, competitive and other risks, uncertainties, contingencies and other factors. Many assumptions are based on factors and events that are not within the control of nD. Actual future results may differ materially from historical results or current expectations. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein. In addition, even if the outcome and financial effects of the plans and events described herein are consistent with the forward-looking information contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. Although nD has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended. Forward-looking information contained in this presentation is based on nD’s current estimates, expectations and projections, which nD believes are reasonable as of the current date. nD can give no assurance that these estimates, expectations and projections will prove to have been correct. You should not place undue reliance on forward-looking information, which is based on the information available as of the date of this presentation. Forward-looking information contained in this presentation is as of the date of this presentation and, except as require by applicable law, nD assumes no obligation to update or revise them to reflect new events or circumstances. Historical statements should not be taken as a representation that such trends will be replicated in the future. No statement in this presentation is intended to be nor may be construed as a profit forecast. To the extent any forward-looking information in this Presentation constitutes “future-oriented financial information” or “financial outlooks” within the meaning of applicable securities laws, such information is being provided to demonstrate the anticipated market penetration and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such future-oriented financial information and financial outlooks. Future-oriented financial information and financial outlooks, as with forward-looking information generally, are, without limitation, based on the assumptions and subject to the risks set out above under the heading “Cautionary Note Regarding Forward Looking Statements”. nDivision’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, the nD’s revenue and expenses may differ materially from the revenue and expense profiles provided in this Presentation. Such information is presented for illustrative purposes only and may not be an indication of nDivision’s actual financial position or results of operations. Forward Looking Statements 2

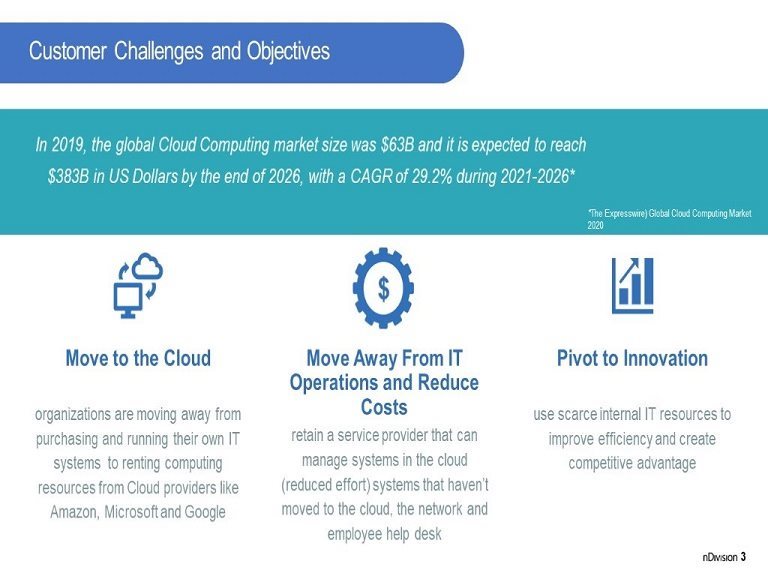

Customer Challenges and Objectives 3

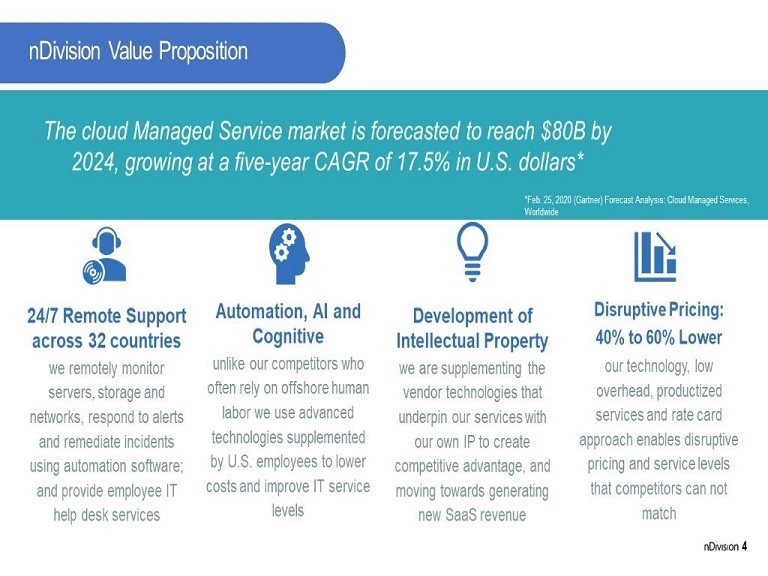

nDivision Value Proposition 4

Examples of Intelligent Automations Disk Space Filling Up Weather Related Outages for Oil Rigs 5

We Automate at Scale 6

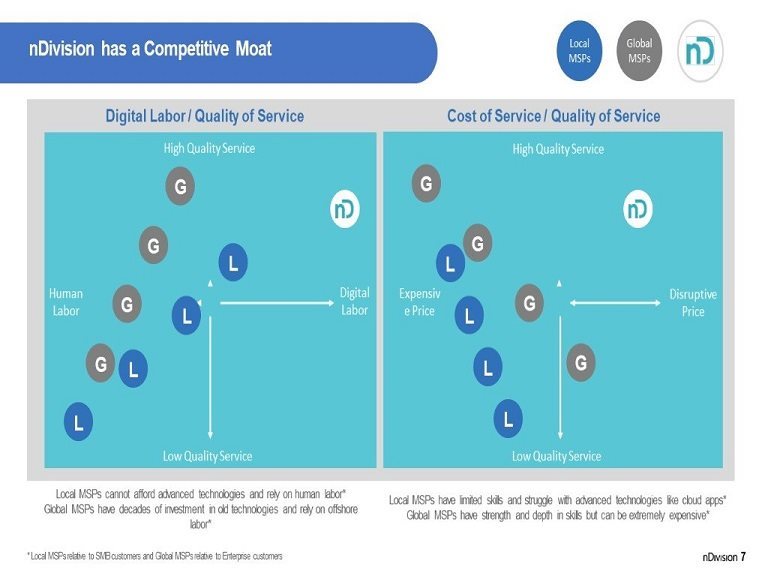

nDivision has a Competitive Moat Low Quality Service High Quality Service 7 Digital Labor / Quality of Service Cost of Service / Quality of Service Local MSPs cannot afford advanced technologies and rely on human labor* Global MSPs have decades of investment in old technologies and rely on offshore labor* Local MSPs have limited skills and struggle with advanced technologies like cloud apps* Global MSPs have strength and depth in skills but can be extremely expensive* Low Quality Service High Quality Service * Local MSPs relative to SMB customers and Global MSPs relative to Enterprise customers Expensive Price Human Labor Digital Labor Disruptive Price

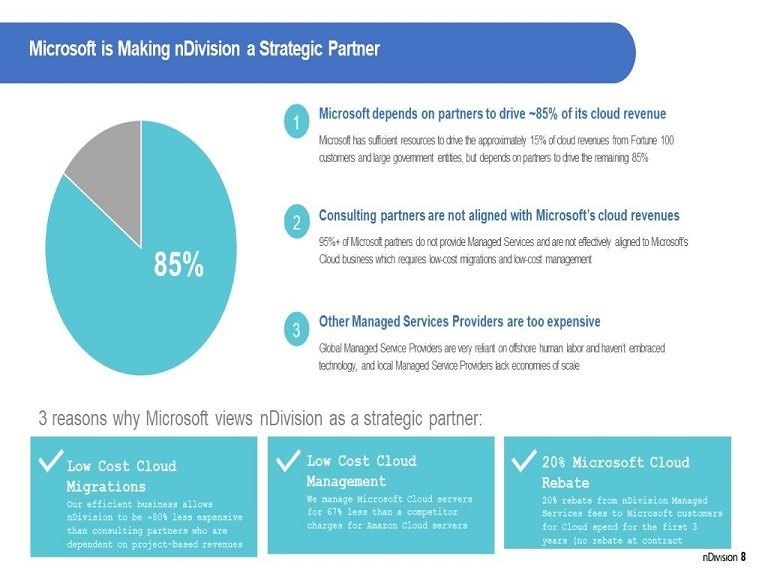

Microsoft is Making nDivision a Strategic Partner 8 3 reasons why Microsoft views nDivision as a strategic partner:

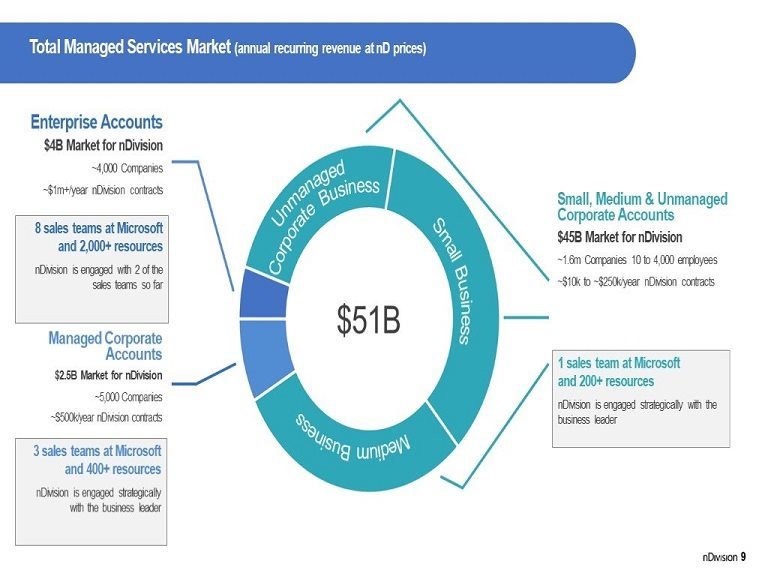

Total Managed Services Market (annual recurring revenue at nD prices) $51B 1 sales team at Microsoft and 200+ resources nDivision is engaged strategically with the business leader 3 sales teams at Microsoft and 400+ resources nDivision is engaged strategically with the business leader 8 sales teams at Microsoft and 2,000+ resources nDivision is engaged with 2 of the sales teams so far 9

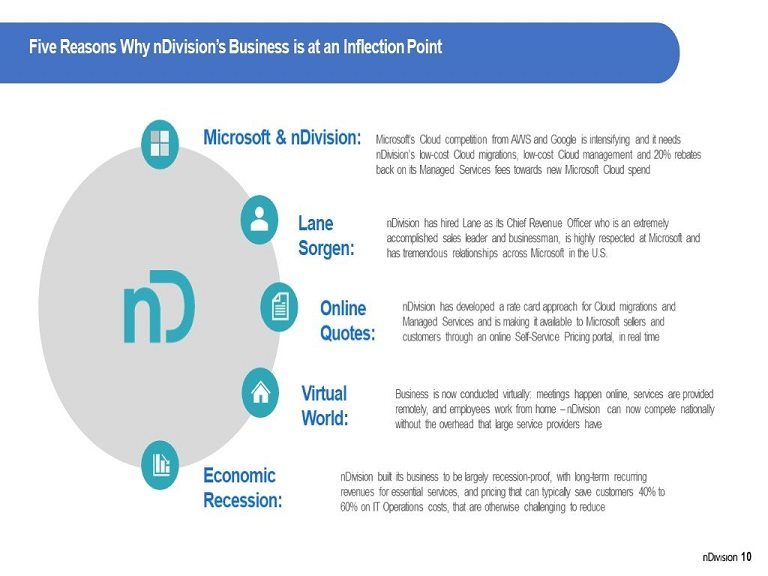

Five Reasons Why nDivision’s Business is at an Inflection Point 10

Alan Hixon CEO / Director Lane Sorgen CRO / Director Mike Beavers CCO / Director ~ 40 years of industry experience serving as CEO for three separate IT companies. Built an $80m IT services company with 500 employees from start-up, in five years. Responsible for strategy, key partnerships, finance, sales & marketing. 24 years at Microsoft, generating $18b of revenues. As the Regional Vice President for Microsoft’s South Central Region, responsible for $2.bB of revenues, 350 enterprise customers and 450 direct reports across 6 states. Built the delivery capability for a Managed Services Provider that grew from start-up to $40m in 2.5 years. Responsible for service delivery, spearheading large client opportunities and driving recurring revenue growth. Andy Nordstrud CFO / Director Justin Roby CTO Brad Wiggins CAO More than twenty years of professional experience, including over 12 years as a public company Chief Financial Officer at three separate companies. Several years’ M&A experience at Grant Thornton and PwC. Built an IT reseller business. Responsible for corporate governance, business process development, overseeing compliance and taking a leading role in strategic projects, such as the development of nDivision’s Self-Service Portal. Built a computer services business. One of the most certified consultants in the U.S. Responsible for driving efficiency gains and competitive advantage, through the use of state-of-the-art technology Leadership Team 11

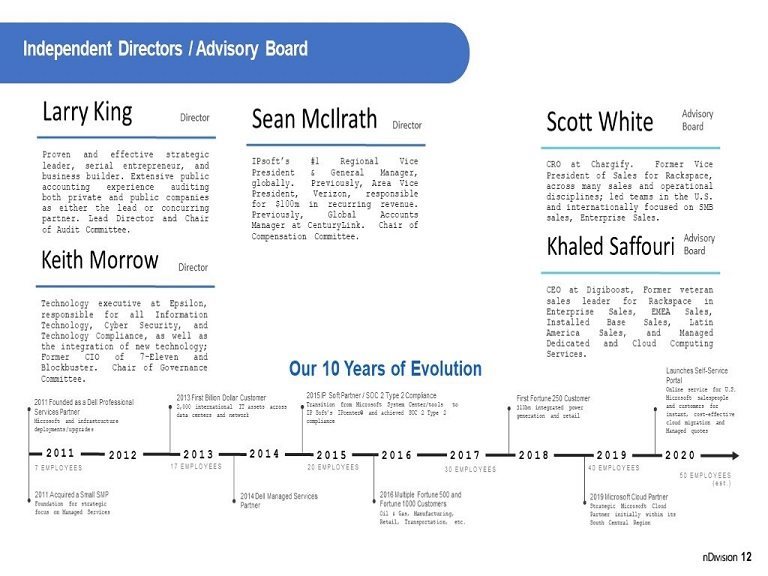

2011 Founded as a Dell Professional Services Partner Microsoft and infrastructure deployments/upgrades 2011 Acquired a Small SMP Foundation for strategic focus on Managed Services 7 EMPLOYEES 2013 First Billion Dollar Customer 2,000 international IT assets across data centers and network 2014 Dell Managed Services Partner 2015 IP Soft Partner / SOC 2 Type 2 Compliance Transition from Microsoft System Center/tools to IP Soft’s IPcenter® and achieved SOC 2 Type 2 compliance 2016 Multiple Fortune 500 and Fortune 1000 Customers Oil & Gas, Manufacturing, Retail, Transportation, etc. First Fortune 250 Customer $13bn integrated power generation and retail 17 EMPLOYEES 20 EMPLOYEES 40 EMPLOYEES 2019 Microsoft Cloud Partner Strategic Microsoft Cloud Partner initially within its South Central Region Our 10 Years of Evolution 12 Launches Self-Service Portal Online service for U.S. Microsoft salespeople and customers for instant, cost-effective cloud migration and Managed quotes 30 EMPLOYEES 50 EMPLOYEES (est.) Independent Directors / Advisory Board

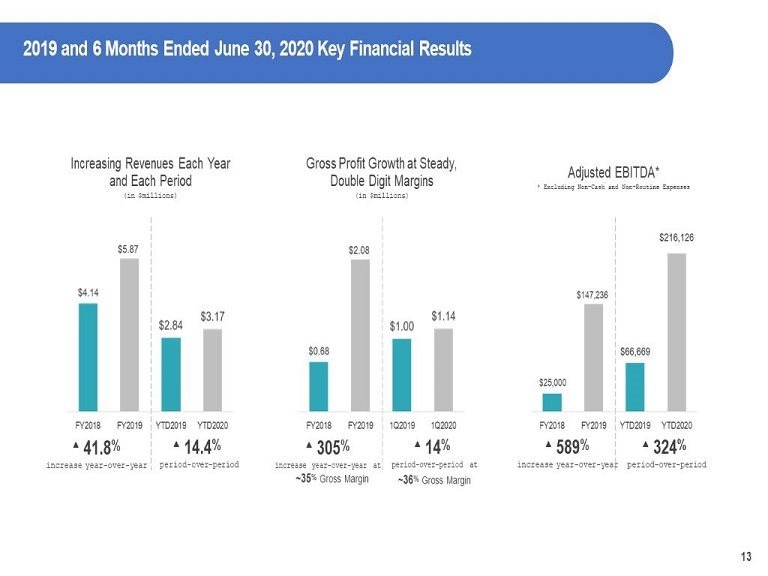

Increasing Revenues Each Year and Each Period (in $millions) 41.8% increase year-over-year 14.4% period-over-period Gross Profit Growth at Steady, Double Digit Margins (in $millions) 305% increase year-over-year at 14% period-over-period at Adjusted EBITDA* * Excluding Non-Cash and Non-Routine Expenses 589% increase year-over-year 324% period-over-period ~35% Gross Margin ~36% Gross Margin 13 2019 and 6 Months Ended June 30, 2020 Key Financial Results

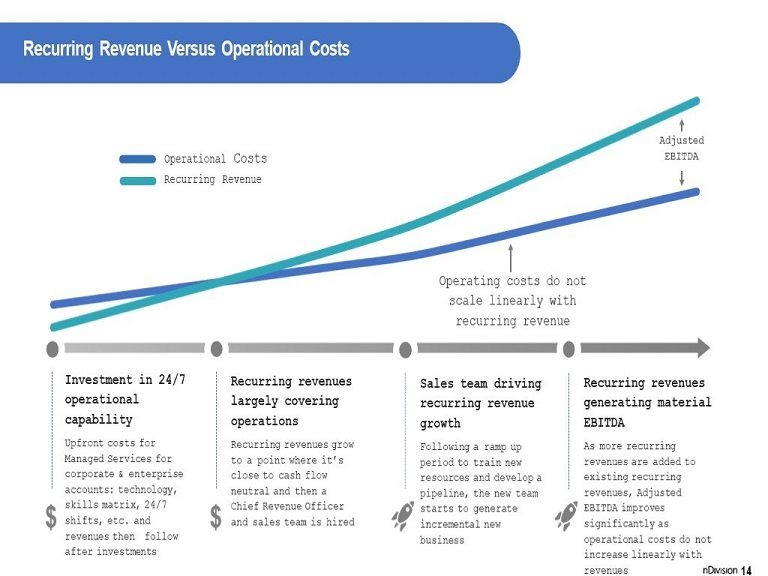

Recurring Revenue Versus Operational Costs 14 Operational Costs Recurring Revenue

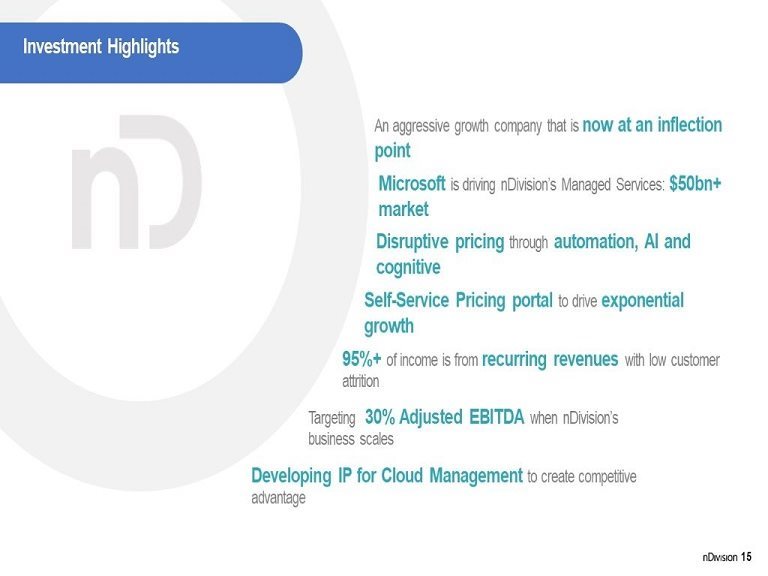

Investment Highlights 15 An aggressive growth company that is now at an inflection point Disruptive pricing through automation, AI and cognitive Targeting 30% Adjusted EBITDA when nDivision’s business scales Self-Service Pricing portal to drive exponential growth 95%+ of income is from recurring revenues with low customer attrition Developing IP for Cloud Management to create competitive advantage Microsoft is driving nDivision’s Managed Services: $50bn+ market

Questions? 16

Thank You 17 Alan Hixon ahixon@ndivision.com 469-360-2981 linkedin.com/in/alan-hixon-92867bb/

Additional Information 18

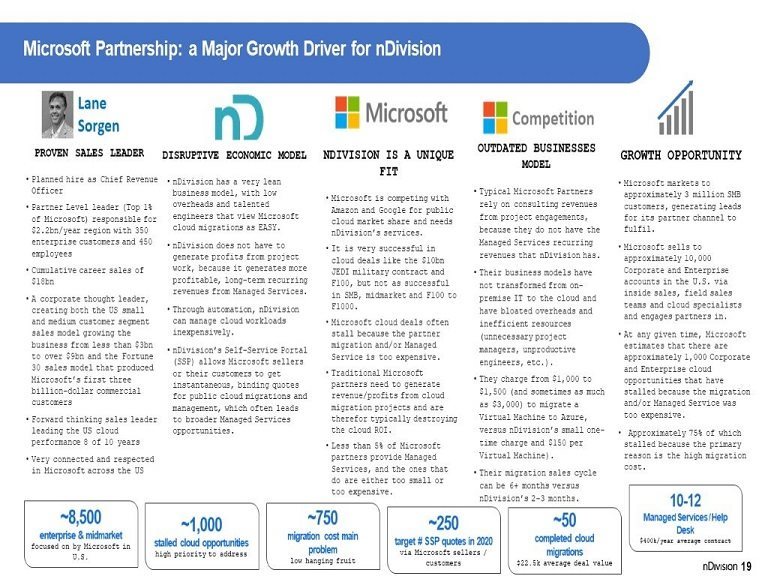

Microsoft Partnership: a Major Growth Driver for nDivision 19 NDIVISION IS A UNIQUE FIT Microsoft is competing with Amazon and Google for public cloud market share and needs nDivision’s services. It is very successful in cloud deals like the $10bn JEDI military contract and F100, but not as successful in SMB, midmarket and F100 to F1000. Microsoft cloud deals often stall because the partner migration and/or Managed Service is too expensive. Traditional Microsoft partners need to generate revenue/profits from cloud migration projects and are therefor typically destroying the cloud ROI. Less than 5% of Microsoft partners provide Managed Services, and the ones that do are either too small or too expensive. OUTDATED BUSINESSES MODEL Typical Microsoft Partners rely on consulting revenues from project engagements, because they do not have the Managed Services recurring revenues that nDivision has. Their business models have not transformed from on-premise IT to the cloud and have bloated overheads and inefficient resources (unnecessary project managers, unproductive engineers, etc.). They charge from $1,000 to $1,500 (and sometimes as much as $3,000) to migrate a Virtual Machine to Azure, versus nDivision’s small one-time charge and $150 per Virtual Machine). Their migration sales cycle can be 6+ months versus nDivision’s 2-3 months. GROWTH OPPORTUNITY Microsoft markets to approximately 3 million SMB customers, generating leads for its partner channel to fulfil. Microsoft sells to approximately 10,000 Corporate and Enterprise accounts in the U.S. via inside sales, field sales teams and cloud specialists and engages partners in. At any given time, Microsoft estimates that there are approximately 1,000 Corporate and Enterprise cloud opportunities that have stalled because the migration and/or Managed Service was too expensive. Approximately 75% of which stalled because the primary reason is the high migration cost. PROVEN SALES LEADER Planned hire as Chief Revenue Officer Partner Level leader (Top 1% of Microsoft) responsible for $2.2bn/year region with 350 enterprise customers and 450 employees Cumulative career sales of $18bn A corporate thought leader, creating both the US small and medium customer segment sales model growing the business from less than $3bn to over $9bn and the Fortune 30 sales model that produced Microsoft’s first three billion-dollar commercial customers Forward thinking sales leader leading the US cloud performance 8 of 10 years Very connected and respected in Microsoft across the US DISRUPTIVE ECONOMIC MODEL nDivision has a very lean business model, with low overheads and talented engineers that view Microsoft cloud migrations as EASY. nDivision does not have to generate profits from project work, because it generates more profitable, long-term recurring revenues from Managed Services. Through automation, nDivision can manage cloud workloads inexpensively. nDivision’s Self-Service Portal (SSP) allows Microsoft sellers or their customers to get instantaneous, binding quotes for public cloud migrations and management, which often leads to broader Managed Services opportunities.

Microsoft: Small, Medium & Unmanaged Corporate (SMC) Businesses 20 There is a potentially significant opportunity in the SMC marketplace through a joint campaign with Microsoft, promoting an nDivision rebate equal to 20% of its monthly Managed Services fees (for 3 years) to the customer for Microsoft Cloud spend.

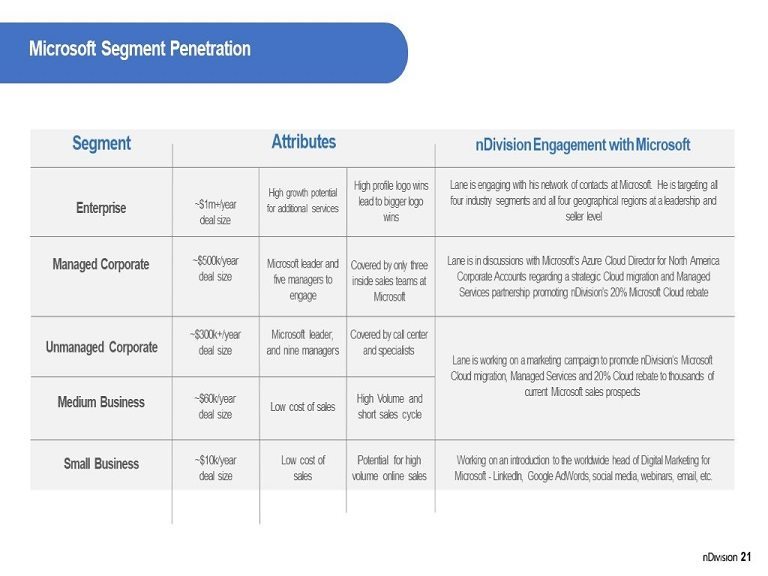

Microsoft Segment Penetration 21 Enterprise Managed Corporate Medium Business Small Business Attributes Segment ~$1m+/year deal size High growth potential for additional services ~$500k/year deal size Covered by only three inside sales teams at Microsoft High Volume and short sales cycle Low cost of sales Low cost of sales Potential for high volume online sales High profile logo wins lead to bigger logo wins Microsoft leader and five managers to engage ~$60k/year deal size ~$10k/year deal size nDivision Engagement with Microsoft Lane is engaging with his network of contacts at Microsoft. He is targeting all four industry segments and all four geographical regions at a leadership and seller level Lane is in discussions with Microsoft’s Azure Cloud Director for North America Corporate Accounts regarding a strategic Cloud migration and Managed Services partnership promoting nDivision’s 20% Microsoft Cloud rebate Working on an introduction to the worldwide head of Digital Marketing for Microsoft - LinkedIn, Google AdWords, social media, webinars, email, etc. Unmanaged Corporate ~$300k+/year deal size Covered by call center and specialists Microsoft leader, and nine managers Lane is working on a marketing campaign to promote nDivision’s Microsoft Cloud migration, Managed Services and 20% Cloud rebate to thousands of current Microsoft sales prospects

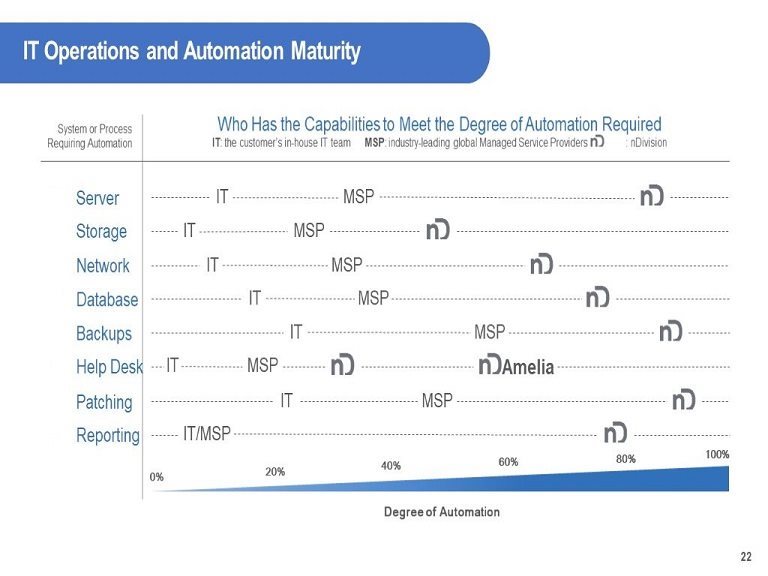

22 0% 100% Degree of Automation 20% 40% 60% 80% Storage IT MSP Server IT MSP Database IT MSP Network IT MSP Backups IT MSP Help Desk IT MSP Patching IT MSP Reporting IT/MSP System or Process Requiring Automation Who Has the Capabilities to Meet the Degree of Automation Required IT: the customer’s in-house IT team MSP: industry-leading global Managed Service Providers : nDivision IT Operations and Automation Maturity

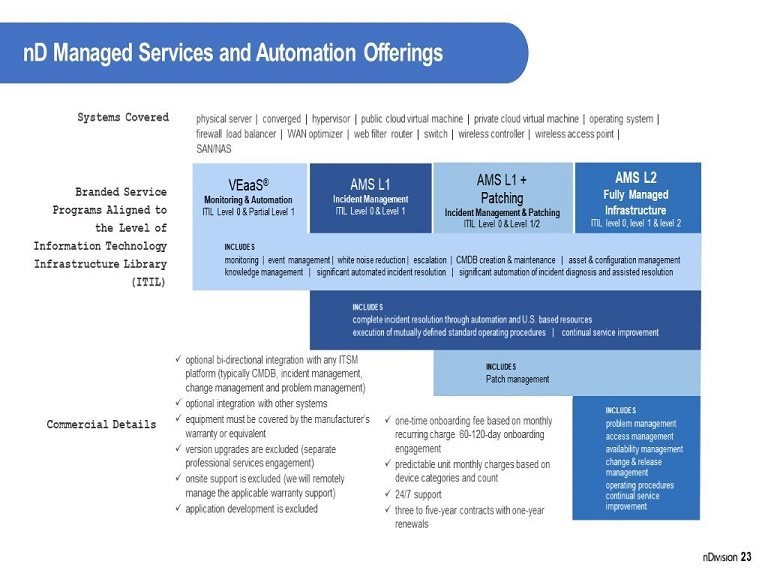

nD Managed Services and Automation Offerings 23 physical server | converged | hypervisor | public cloud virtual machine | private cloud virtual machine | operating system | firewall load balancer | WAN optimizer | web filter router | switch | wireless controller | wireless access point | SAN/NAS one-time onboarding fee based on monthly recurring charge 60-120-day onboarding engagement predictable unit monthly charges based on device categories and count 24/7 support three to five-year contracts with one-year renewals Systems Covered Branded Service Programs Aligned to the Level of Information Technology Infrastructure Library (ITIL) Commercial Details optional bi-directional integration with any ITSM platform (typically CMDB, incident management, change management and problem management) optional integration with other systems equipment must be covered by the manufacturer’s warranty or equivalent version upgrades are excluded (separate professional services engagement) onsite support is excluded (we will remotely manage the applicable warranty support) application development is excluded INCLUDES Patch management

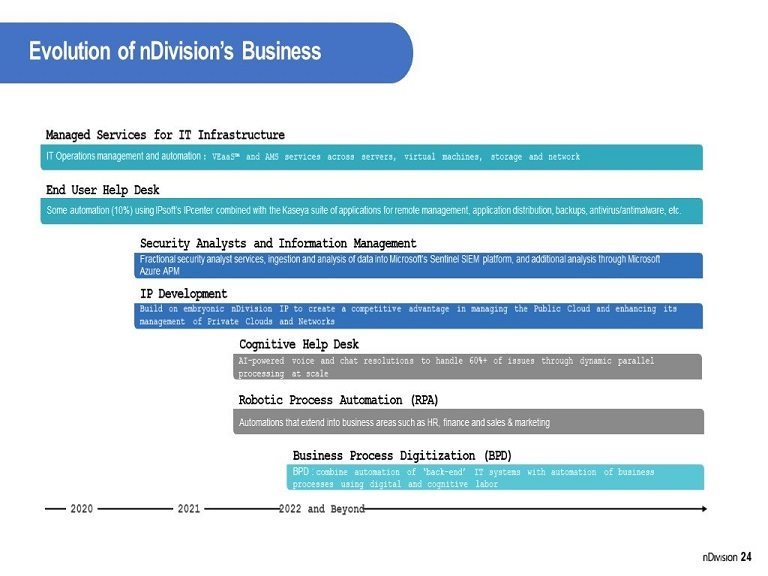

24 Evolution of nDivision’s Business 2020 2021 2022 and Beyond

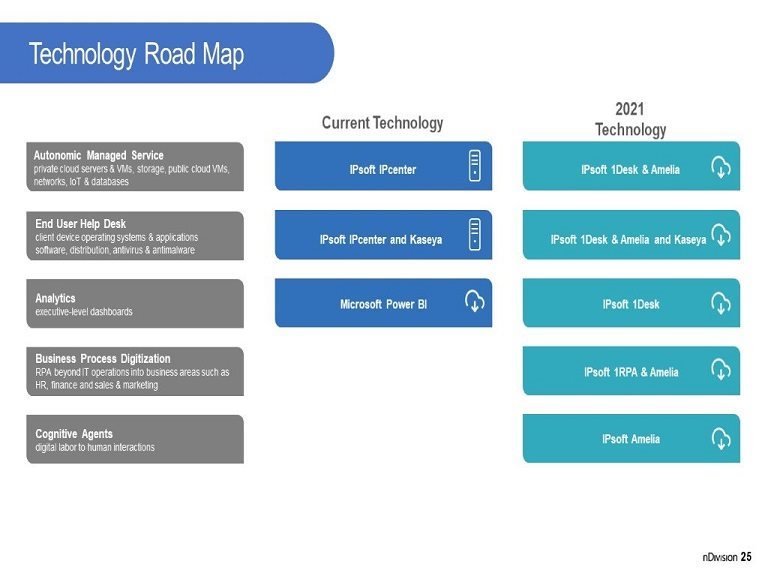

Current Technology 2021 Technology Technology Road Map 25

| &nb

|