Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - FIRST MID BANCSHARES, INC. | exh_991.htm |

| EX-2.1 - EXHIBIT 2.1 - FIRST MID BANCSHARES, INC. | exh_21.htm |

| 8-K - FORM 8-K - FIRST MID BANCSHARES, INC. | f8k_092620.htm |

EXHIBIT 99.2

Acquisition of LINCO Bancshares, Inc. September 28, 2020

Forward Looking Statements Forward Looking Statements This document may contain certain forward - looking statements about First Mid Bancshares, Inc. (“First Mid”) and LINCO Bancshares, Inc., a Missouri corporation (“LINCO”), such as discussions of First Mid’s and LINCO’s pricing and fee trends, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned schedules. First Mid and LINCO intend such forward - looking statements to be covered by the safe harbor provisions for forward - looking statements contained in the Private Securities Litigation Reform Act of 1955. Forward - looking statements, which are based on certain assumptions and describe future plans, strategies and expectations of First Mid and LINCO, are identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could differ materially from the results indicated by these statements because the realization of those results is subject to many risks and uncertainties, including, among other things, the possibility that any of the anticipated benefits of the proposed transactions between First Mid and LINCO will not be realized or will not be realized within the expected time period; the risk that integration of the operations of LINCO with First Mid will be materially delayed or will be more costly or difficult than expected; the inability to complete the proposed transactions due to the failure to obtain the required stockholder approval; the failure to satisfy other conditions to completion of the proposed transactions, including receipt of required regulatory and other approvals; the failure of the proposed transactions to close for any other reason; the effect of the announcement of the transaction on customer relationships and operating results; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in interest rates; general economic conditions and those in the market areas of First Mid and LINCO; legislative/regulatory changes; monetary and fiscal policies of the U.S. Government, including policies of the U.S. Treasury and the Federal Reserve Board; the quality or composition of First Mid’s and LINCO’s loan or investment portfolios and the valuation of those investment portfolios; demand for loan products; deposit flows; competition, demand for financial services in the market areas of First Mid and LINCO; accounting principles, policies and guidelines; the severity, magnitude and duration of COVID - 19 pandemic, the direct and indirect impact of such pandemic, including responses to the pandemic by the government, businesses customers' businesses, the disruption of global, national, state and local economies associated with the COVID - 19 pandemic, which could affect First Mid’s and LINCO’s liquidity and capital positions, impair the ability of First Mid’s and LINCO’s borrowers to repay outstanding loans, impair collateral values, and further increase the allowance for credit losses, and the impact of the COVID - 19 pandemic on First Mid’s and LINCO’s financial results, including possible lost revenue and increased expenses (including cost of capital), as well as possible goodwill impairment charges. Additional information concerning First Mid, including additional factors and risks that could materially affect First Mid’s financial results, are included in First Mid’s filings with the SEC, including its Annual Reports on Form 10 - K and Quarterly Reports on Form 10 - Q. Forward - looking statements speak only as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC, we do not undertake any obligation to update or review any forward - looking information, whether as a result of new information, future events or otherwise. 2

Transaction Highlights Creates a $ 5 . 3 billion (excluding PPP loans) Midwest Community Bank with with deep community ties matching First Mid’s culture and like - minded commitment to customers, communities, and shareholders Accelerates growth in the St. Louis metro market consistent with our long - standing strategic initiative and expands geographic presence outside of Illinois and into markets comparable to existing footprint with Columbia and Jefferson City and provides higher growth opportunities in Grapevine, Texas Key executive management and senior lenders to be retained Significantly accretive to EPS reaching ~20% in the first full year (2022) Manageable tangible book value dilution earned back in ~2.25 years (crossover method). Pre CECL earn - back ~1.75 years Achievable operating synergies ~33% (75% of that expected in 2021) Opportunity to drive revenue enhancements with expansion of First Mid’s Wealth Management and Insurance business lines (not included in pro - forma model) Thorough due diligence process completing review of 85% of the non - consumer portfolio, excluding PPP and specialty products Reviewed 100% of loans over $2.5 million and 100% of classified loans over $500k LINCO had 3 rd party loan review of ~$340 million in June with no downgrades Reduces exposure to COVID - 19 vulnerable sectors Strategi c al l y Compelling F i na n c i al l y Attractive Strong Credit P r of i le 3

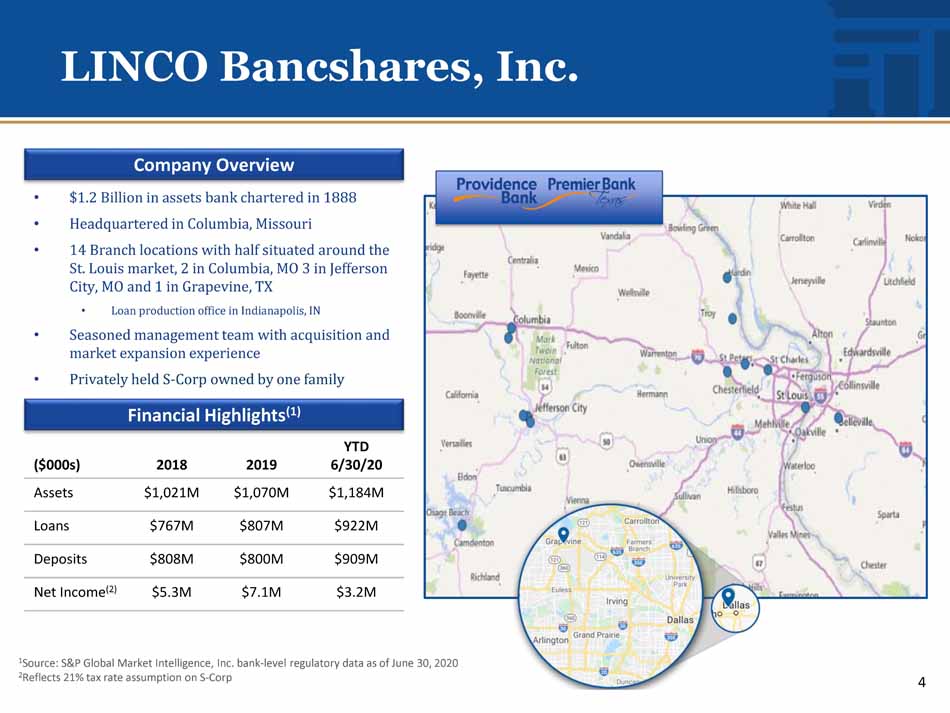

LINCO Bancshares, Inc. Company Overview • $ 1 . 2 Billion in assets bank chartered in 1888 • Headquartered in Columbia, Missouri • 14 Branch locations with half situated around the St . Louis market, 2 in Columbia, MO 3 in Jefferson City, MO and 1 in Grapevine, TX • Loan production office in Indianapolis, IN • Seasoned management team with acquisition and market expansion experience • Privately held S - Corp owned by one family Financial Highlights (1) ($000s) 2018 2019 YTD 6/30/20 Assets $1,021M $1,070M $1,184M Loans $767M $807M $922M Deposits $808M $800M $909M Net Income (2) $5.3M $7.1M $3.2M 1 Source: S&P Global Market Intelligence, Inc. bank - level regulatory data as of June 30, 2020 2 Reflects 21% tax rate assumption on S - Corp 4

• First Mid shareholder approval is not needed; LINCO shareholders to approve shortly after announcement • Anticipated closing in Q1 2021 with conversion likely during Q2 2021 • Subject to customary regulatory approvals Transaction Overview & Assumptions • Transaction value (1) of $144.9 million • Consideration mix: 20% stock / 80% cash • First Mid to issue fixed number of common shares: 1,262,246 (1) Value equals an FMBH price of $22.50 multiplied by 1,262,246 plus cash paid (2) Excludes one - time merger costs and day two CECL provision • Price to Tangible Book Value: 97% • Price to 2020E earnings: 20.3x • Price to 2020E earnings after cost saves: 9.7x • EPS accretion (2 ) : ~20% in first full year (2022) • TBV earn - back (crossover method): 2.25 years with CECL (pre - CECL 1.75 years) • Cost savings of 33% (75% realized in 2021 and 100% by 2022) • $15.5 million in estimated pre - tax deal costs • Core deposit intangible 0.75% • First Mid to add a board member from LINCO board • ~93% FMBH / 7% LINCO Deal Structure Valuation Multiples Key Assumptions Pro - forma Ownership & Board Timing & Approvals • $36.5 million in total (credit mark + CECL): ~4.2% of $861 million loans, excluding PPP, as of 6/30/2020 • Gross credit mark of $18.4 million and Day 2 CECL Reserve of $18.1 million • PCD credit mark of $4.4 million and non - PCD credit mark of $13.7 million • No interest rate mark Credit Mark & CECL Assumptions 5

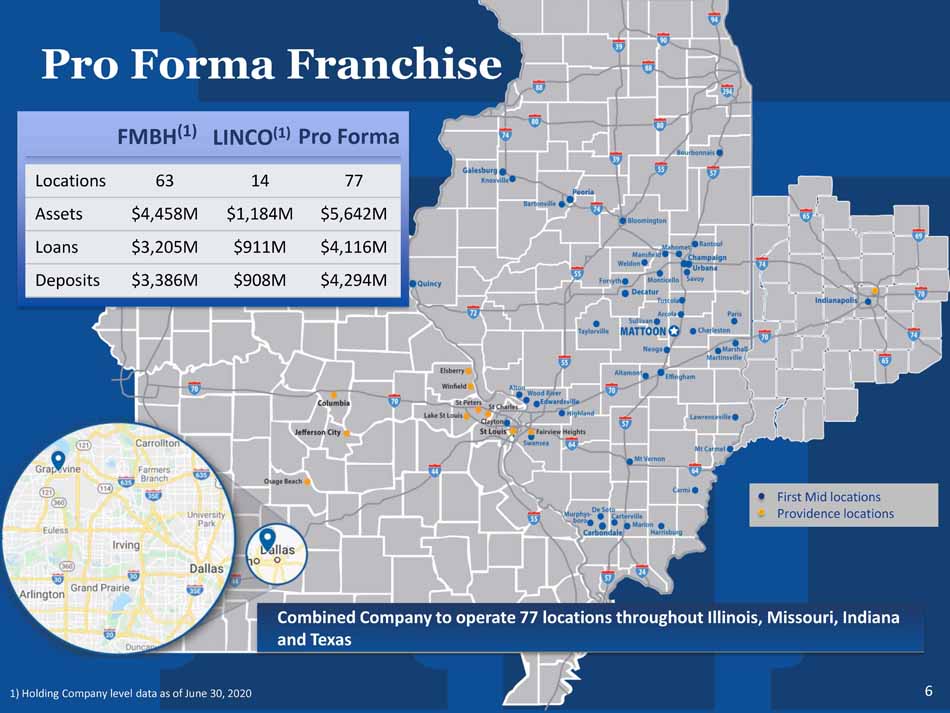

Pro Forma Franchise 1) Holding Company level data as of June 30, 2020 Combined Company to operate 77 locations throughout Illinois, Missouri, Indiana and Texas Locations 63 14 77 Assets $4,458M $1,184M $5,642M Loans $3,205M $911M $4,116M Deposits $3,386M $908M $4,294M FMBH (1) LINCO (1) Pro Forma • First Mid locations • Providence locations 6

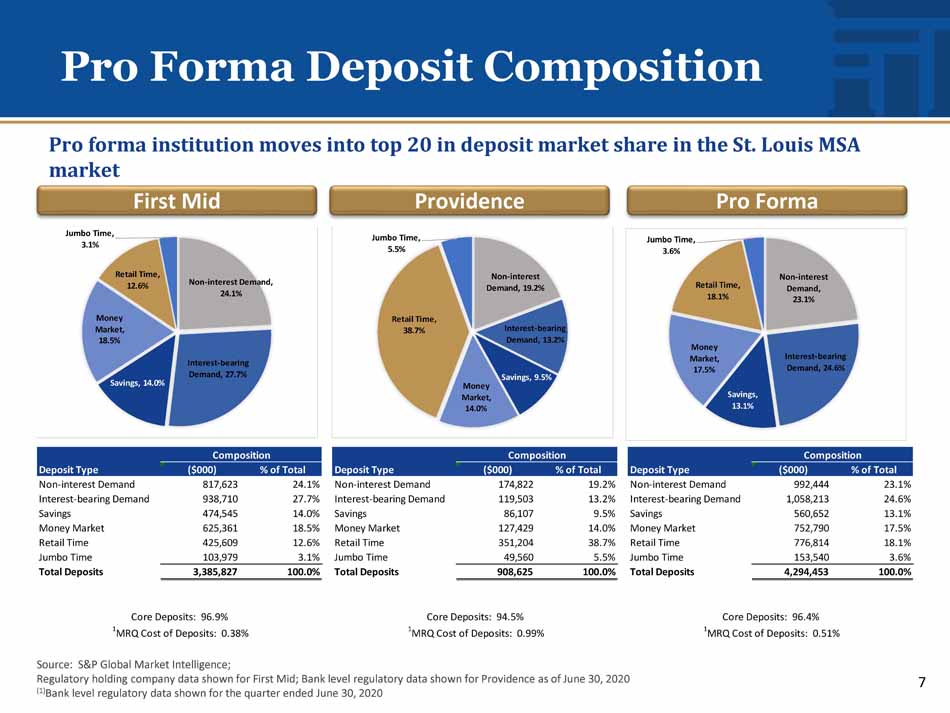

Pro Forma Deposit Composition Source: S&P Global Market Intelligence; Regulatory holding company data shown for First Mid; Bank level regulatory data shown for Providence as of June 30, 2020 (1) Bank level regulatory data shown for the quarter ended June 30, 2020 Pro forma institution moves into top 20 in deposit market share in the St. Louis MSA market First Mid Providence Pro Forma 7 C ompo s ition C ompo s ition C ompo s ition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non - interest Demand 817,623 24 . 1 % Non - interest Demand 174,822 19 . 2 % Non - interest Demand 992,444 23 . 1 % Interest - bearing Demand 938,710 27 . 7 % Interest - bearing Demand 119,503 13 . 2 % Interest - bearing Demand 1,058,213 24 . 6 % Savings 474,545 14 . 0 % Savings 86,107 9 . 5 % Savings 560,652 13 . 1 % Money Market 625,361 18 . 5 % Money Market 127,429 14 . 0 % Money Market 752,790 17 . 5 % Retail Time 425,609 12 . 6 % Retail Time 351,204 38 . 7 % Retail Time 776,814 18 . 1 % Jumbo Time 103,979 3.1% Jumbo Time 49,560 5.5% Jumbo Time 153,540 3.6% Total Deposits 3,385,827 100.0% Total Deposits 908,625 100.0% Total Deposits 4,294,453 100.0% Core Deposits: 96.9% 1 MRQ Cost of Deposits: 0.38% Core Deposits: 94.5% 1 MRQ Cost of Deposits: 0.99% Core Deposits: 96.4% 1 MRQ Cost of Deposits: 0.51% Non - interest Demand, 24.1% Interest - bearing Demand, 27.7% Savings, 14.0% Money M ar k e t , 18 . 5 % Retail Time, 12.6% Jumbo Time, 3.1% Non - interest Demand, 19.2% Interest - bearing Demand, 13.2% Savings, 9.5% Money M a r k e t , 14 . 0 % Retail Time, 38.7% Jumbo Time, 5.5% Non - i n t e r e st Demand, 23.1% Interest - bearing Demand, 24.6% S a v ing s, 13.1% Money M ar k e t , 17 . 5 % Retail Time, 18.1% Jumbo Time, 3.6%

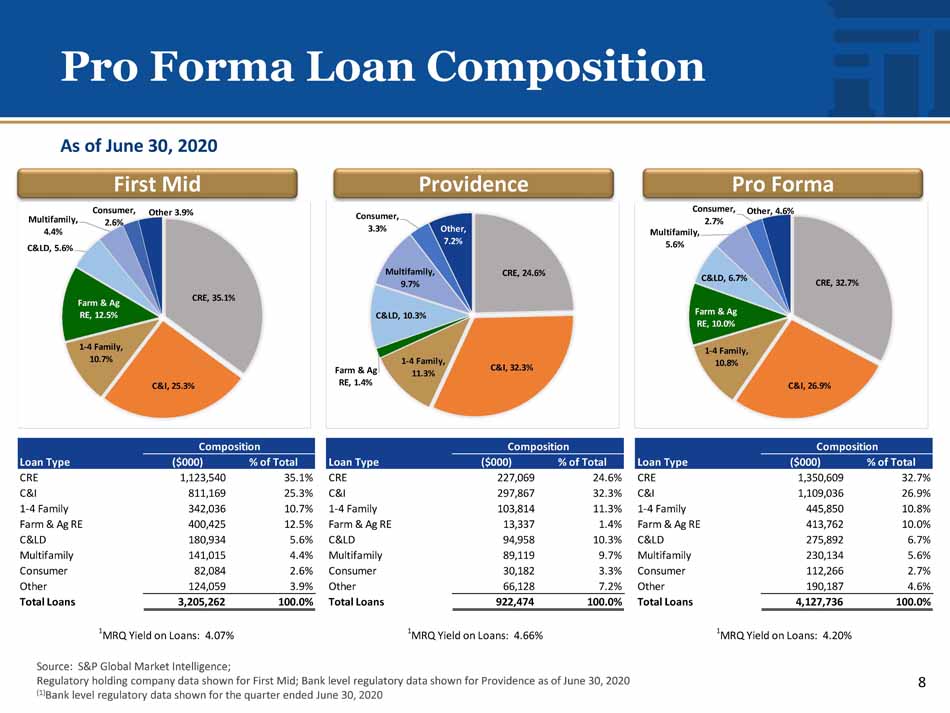

Pro Forma Loan Composition As of June 30, 2020 First Mid Providence Pro Forma Composition Composition C ompo s ition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total CRE 1 , 123 , 54 0 35 . 1 % CRE 227 , 06 9 24 . 6 % CRE 1,350,609 32 . 7 % C&I 811 , 16 9 25 . 3 % C&I 297 , 86 7 32 . 3 % C&I 1,109,036 26 . 9 % 1 - 4 Family 342 , 03 6 10 . 7 % 1 - 4 Family 103 , 81 4 11 . 3 % 1 - 4 Family 445,850 10 . 8 % Farm & Ag RE 400 , 42 5 12 . 5 % Farm & Ag RE 13 , 33 7 1 . 4 % Farm & Ag RE 413,762 10 . 0 % C&LD 180 , 93 4 5 . 6 % C&LD 94 , 95 8 10 . 3 % C&LD 275,892 6 . 7 % Multifamily 141 , 01 5 4 . 4 % Multifamily 89 , 11 9 9 . 7 % Multifamily 230,134 5 . 6 % Consumer 82 , 08 4 2 . 6 % Consumer 30 , 18 2 3 . 3 % Consumer 112,266 2 . 7 % Other 124,059 3.9% Other 66,128 7.2% Other 190,187 4.6% Total Loans 3,205,262 100.0% Total Loans 922,474 100.0% Total Loans 4,127,736 100.0% 1 MRQ Yield on Loans: 4.07% 1 MRQ Yield on Loans: 4.66% Source: S&P Global Market Intelligence; Regulatory holding company data shown for First Mid; Bank level regulatory data shown for Providence as of June 30, 2020 (1) Bank level regulatory data shown for the quarter ended June 30, 2020 1 MRQ Yield on Loans: 4.20% CRE, 35.1% C&I, 25.3% 1 - 4 Family, 10.7% Farm & Ag RE, 12.5% M u l t if a mil y , 4.4% C&LD, 5.6% Consumer, 2.6% Other 3.9% CRE, 24.6% C&I, 32.3% 1 - 4 Family, 11.3% Farm & Ag RE, 1.4% C&LD, 10.3% M u l t if a m il y , 9.7% Consumer, 3.3% O t h e r , 7.2% CRE, 32.7% C&I, 26.9% 1 - 4 Family, 10.8% Farm & Ag RE, 10.0% C&LD, 6.7% Consumer, 2.7% Multifamily, 5.6% Other, 4.6% 8

Extensive Due Diligence First Mid’s Senior Management team completed multiple diligence sessions with LINCO over the last year First Mid is an experienced and disciplined acquirer of community banks with a long history and successful track record of both growth and earnings In - depth diligence process that began in 2019 with key leadership from both FMBH and LINCO deeply vested to ensure a successful combination Collaborative and detailed review of revenue and expense structure to determine anticipated synergies Thorough review of all regulatory, compliance, legal and operational risks In - light - of the ongoing pandemic, a comprehensive and conservative approach was taken to identify potential risks in the lending portfolio with detailed review beyond any past acquisition Credit due diligence process was completed multiple times over the last year both pre - COVID as well as within the last two weeks by First Mid’s most experienced senior management review team Reviewed 85% of the non - consumer portfolio, excluding PPP and specialty products and 100% of loans over $2.5 million Stress testing completed in consistent manner for vulnerable sectors 9

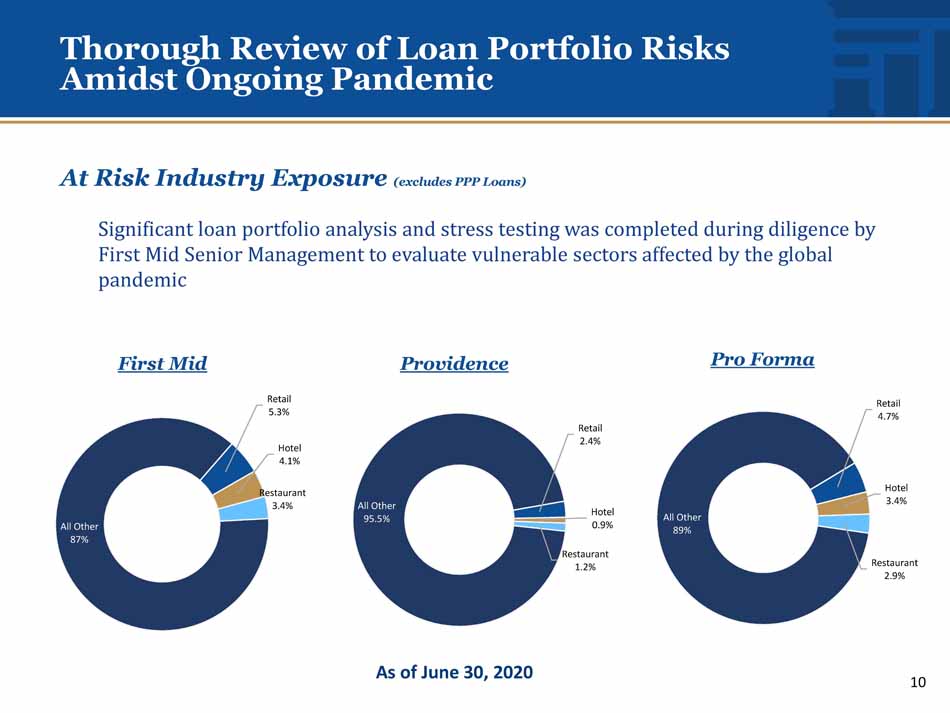

Thorough Review of Loan Portfolio Risks Amidst Ongoing Pandemic At Risk Industry Exposure (excludes PPP Loans) Significant loan portfolio analysis and stress testing was completed during diligence by First Mid Senior Management to evaluate vulnerable sectors affected by the global pandemic Re t a i l 5.3% H o t e l 4.1% Res t a ur a n t 3.4% All Other 87% Re t a i l 2.4% H o t e l 0.9% Res t a ur a n t 1.2% All Other 95.5% Re t a i l 4.7% H o t e l 3.4% Res t a ur a n t 2.9% All Other 89% First Mid Providence Pro Forma As of June 30, 2020 10

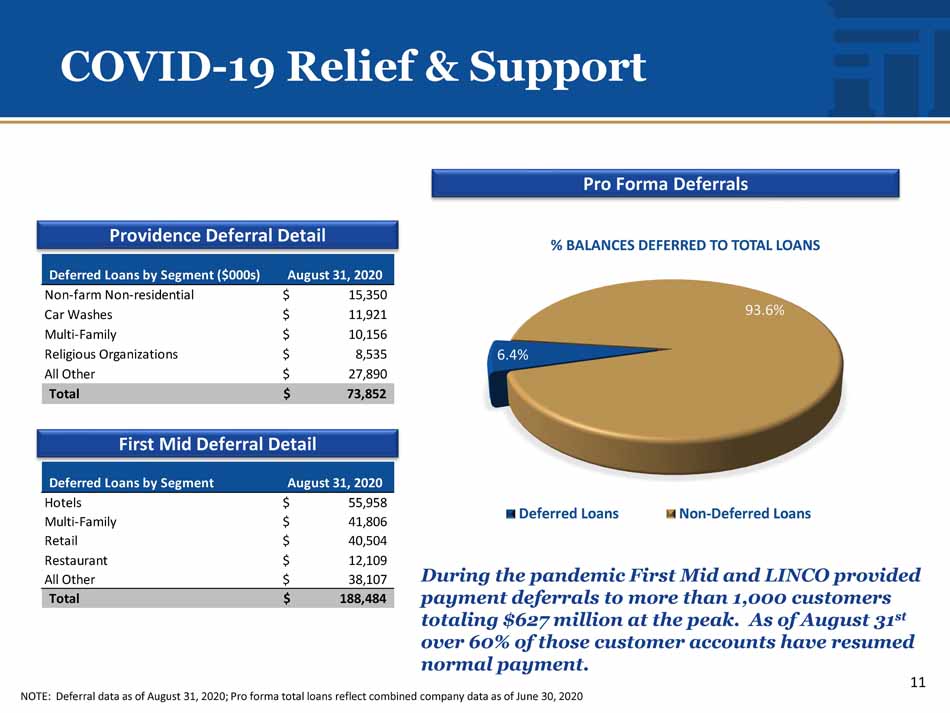

COVID - 19 Relief & Support NOTE: Deferral data as of August 31, 2020; Pro forma total loans reflect combined company data as of June 30, 2020 During the pandemic First Mid and LINCO provided payment deferrals to more than 1,000 customers totaling $627 million at the peak. As of August 31 st over 60% of those customer accounts have resumed normal payment. 11 Providence Deferral Detail First Mid Deferral Detail 9 3 .6% Deferred Loans by Segment ($000s) August 31, 2020 Non - farm Non - residential $ 15,350 Car Washes $ 11,921 Multi - Family $ 10,156 Religious Organizations $ 8,535 6.4% All Other $ 27,890 Total $ 73,852 % BALANCES DEFERRED TO TOTAL LOANS Deferred Loans Non - Deferred Loans Pro Forma Deferrals Deferred Loans by Segment August 31, 2020 Hotels $ 55 , 95 8 Multi - Family $ 41 , 80 6 Retail $ 40 , 50 4 Restaurant $ 12 , 10 9 All Other $ 38 , 10 7 Total $ 188 , 48 4

Estimated Pro Forma Allowance Reserve Significant CECL Allowance for Credit Loss Coverage FMBH LINCO Pro Forma $2,946,000 $861,000 $3,807,000 Loan Balances (1) 1 Excludes PPP loans of approx. $259 million for FMBH and $62 million for LINCO, as of 6/30/2020 ($ in 000’s) FMBH Allowance for Credit Losses $38 , 381 Credit Mark and CECL Reserve Created $36 , 500 Existing ACL plus Credit Mark and CECL Reserve Created $74 , 881 Pro Forma Credit Risk Coverage with ACL and Credit Mark 1.97% 12

Experienced Growth Through Recent M&A Transactions St i f el B a nk T r a n sacti o n Date Closed 8 / 1 4 / 1 5 Closed 9 / 0 8 / 1 6 Closed 5 / 0 1 / 1 8 Closed 1 1 / 1 5 / 18 Closed 4 / 2 1 / 2 0 An n ou nc ed 9/28/20 T r a n sacti o n Value $16 Million $89 Million $72 Million $70 Million - - - $145 Million Deal Type Branch W h o le Bank W h o le Bank W h o le Bank Loan Book and Team Whole Bank Assets ($000s) $441 Million $659 Million $475 Million $458 Million - - - $1.18 Billion Loans ($000s) $156 Million $449 Million $371 Million $254 Million $183 Million $922 Million Deposits ($000s) $453 Million $535 Million $384 Million $341 Million $60 Million $909 Million # of Branches 12 7 7 10 - - - 14 Figures noted above exclude fair value adjustments made at closing Providence Bank transaction reflects Holding Company data as of June 30, 2020 13

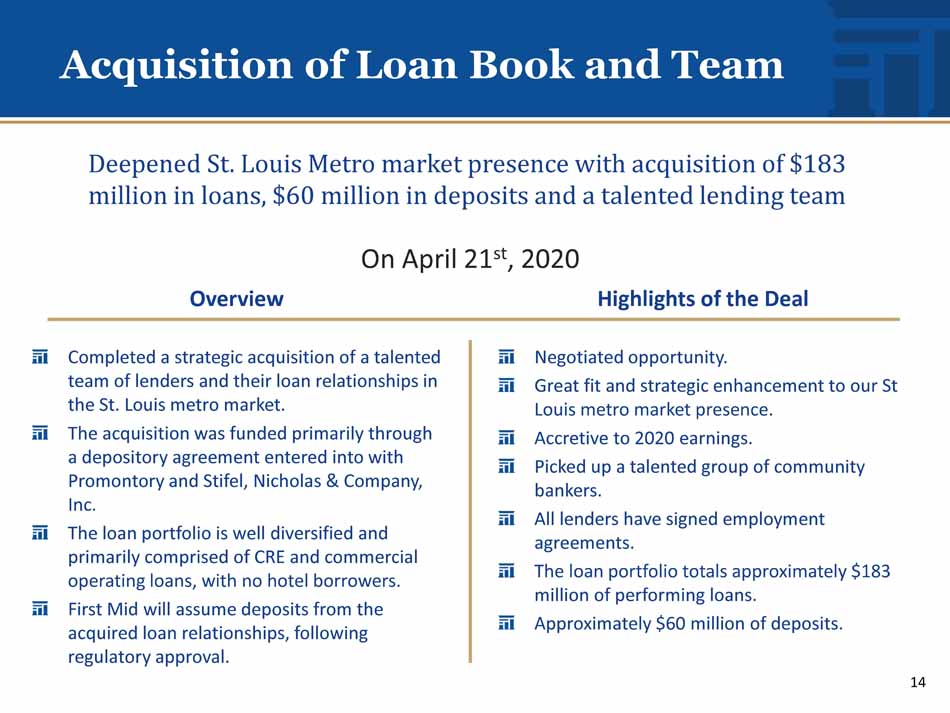

Acquisition of Loan Book and Team Deepened St. Louis Metro market presence with acquisition of $183 million in loans, $60 million in deposits and a talented lending team On April 21 st , 2020 O v e r view Highlights of the Deal Completed a strategic acquisition of a talented team of lenders and their loan relationships in the St . Louis metro market . The acquisition was funded primarily through a depository agreement entered into with Promontory and Stifel, Nicholas & Company, Inc. The loan portfolio is well diversified and primarily comprised of CRE and commercial operating loans, with no hotel borrowers. First Mid will assume deposits from the acquired loan relationships, following regulatory approval. Negotiated opportunity. Great fit and strategic enhancement to our St Louis metro market presence. Accretive to 2020 earnings. Picked up a talented group of community bankers. All lenders have signed employment agreements. The loan portfolio totals approximately $183 million of performing loans. Approximately $60 million of deposits. 14

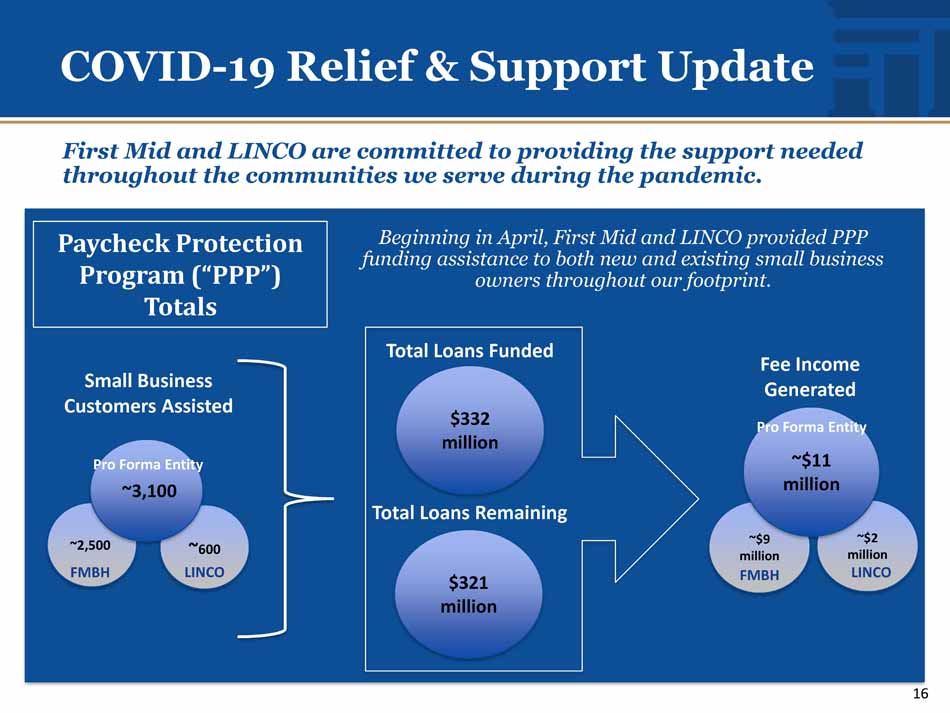

Addressing COVID - 19 Management teams at First Mid and LINCO were proactive from the onset of pandemic, shifting branch traffic to drive - thru, by appointment and online services to maintain customer service while providing social distancing measures to the benefit of our employees and customers. First Mid and LINCO both provided enhanced digital capabilities to allow customers to continue to receive the strong support and service without direct lobby contact. Additional social distance measures were implemented including allowing a significant number of workforce to work remotely. Comprehensive due - diligence has been conducted surrounding the effects and future impact of the ongoing pandemic Both First Mid and LINCO provided key funding services to the communities they serve through the Payment Protection Program (PPP). Together the companies provided support to thousands of small business owners resulting in approximately combined $332 million in PPP funded with the SBA. 15

First Mid and LINCO are committed to providing the support needed throughout the communities we serve during the pandemic. COVID - 19 Relief & Support Update Total Loans Funded Fee Income Generated Small Business Customers Assisted Paycheck Protection Program (“PPP”) Totals Beginning in April, First Mid and LINCO provided PPP funding assistance to both new and existing small business owners throughout our footprint. $332 m i l l ion ~$11 m i l l ion $321 m i l l ion Total Loans Remaining ~ 2 , 5 00 FMBH ~ 600 L IN C O Pro Forma Entity ~3,100 ~$9 milli o n F M BH ~$2 million LINCO Pro Forma Entity 16

Achievements through Performance: