Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - CVS HEALTH Corp | ss182410_8k.htm |

Fall 2020 Stockholder Engagement

2 Cautionary statement concerning forward - looking statements Non - GAAP financial measures This presentation includes forward - looking statements. The Private Securities Litigation Reform Act of 1995 provides a safe harb or for forward - looking statements made by or on behalf of CVS Health Corporation. By their nature, all forward - looking statements are n ot guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or q uan tify. Actual results may differ materially from those contemplated by the forward - looking statements due to the risks and uncertainties relat ed to the COVID - 19 pandemic, the geographies impacted by, and the severity and duration of, the pandemic, the pandemic’s impact on the U.S. and global economies and consumer behavior and health care utilization patterns, and the timing, scope and impact of sti mul us legislation and other federal, state and local governmental responses to the pandemic, as well as the risks and uncertainties described in our Securities and Exchange Commission filings, including those set forth in the Risk Factors section and under the heading “Cautionary Statement Concerning Forward - Looking Statements” in our most recently filed Annual Report on Form 10 - K, our most recently filed Quarterly Report on Form 10 - Q, and our recently filed Current Reports on Form 8 - K. This presentation includes non - GAAP financial measures that we use to describe our company’s performance. In accordance with SEC regulations, you can find the definitions of these non - GAAP measures, as well as reconciliations to the most directly compar able GAAP measures, in the Events and Presentations section of the Investor Relations portion of our website. A link is provided bel ow. Link to the Events and Presentations portion of our website

3 Executive Summary Strategic Priorities The environment surrounding COVID - 19 is accelerating our transformation, giving us new opportunities to demonstrate the power of our integrated offering and to deliver solutions at scale that meet client and consumer needs COVID - 19 Response Our COVID - 19 response focused resources on the wellbeing and safety of employees, consumers and the communities we serve and we are uniquely positioned to help the country going forward Engaged and Effective Board Our 13 - member Board has a relevant and balanced set of experiences as well as skills and qualifications to carry out effective o versight; continued refreshment is expected in the coming year in accordance with our retirement age policy Compensation Program In response to low support we received on Say - on - Pay at our 2020 Annual Meeting, our Board is continuing its long - standing pract ice of soliciting feedback to incorporate stockholder perspectives into the executive compensation program Transform Health 2030 We engaged key stakeholders to arrive at our new CSR strategy focused on the four pillars of healthy people, business, commun ity , and planet in order to advance our purpose of helping people on their path to better health

4 Transforming health care to meet people where they are We are a different kind of health company with a powerful combination of expertise and health services that is making health car e more affordable, simpler and better Industry leading managed care organization Innovating to make health care simpler, easier, and more convenient for payors and patients Best in class pharmacy benefit manager With the ability to impact patients, members, payors and providers with innovative, channel agnostic solutions Unmatched local community touchpoints As the foundation to build healthy communities and transform the delivery of care Executing on strategic priorities • Consumer focused – be local, make it simple, improve health Grow and differentiate our businesses Deliver transformational products and services Create a consumer - centric technology infrastructure Modernize enterprise functions and capabilities

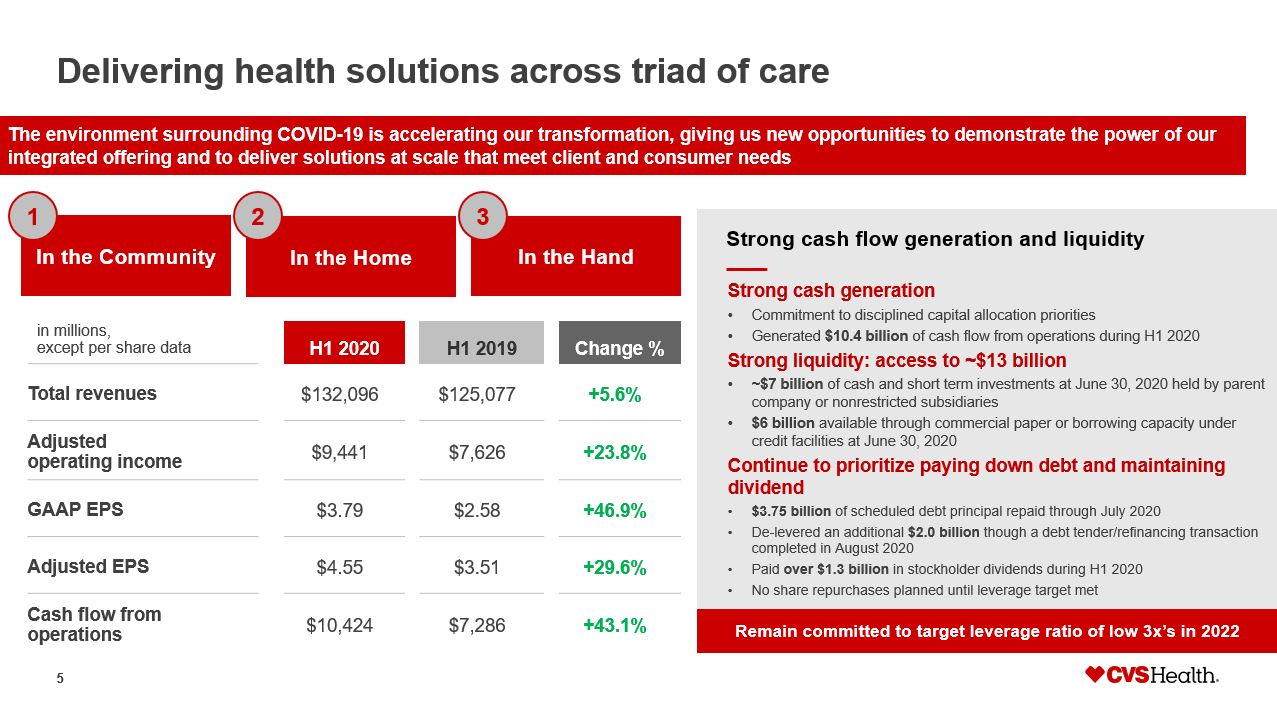

5 Delivering health solutions across triad of care H1 2020 H1 2019 Change % Total revenues $132,096 $125,077 +5.6% Adjusted operating income $9,441 $7,626 +23.8% GAAP EPS $3.79 $2.58 +46.9% Adjusted EPS $4.55 $3.51 +29.6% Cash flow from operations $10,424 $7,286 +43.1% in millions, except per share data Strong cash flow generation and liquidity Remain committed to target leverage ratio of low 3x’s in 2022 Strong cash generation • Commitment to disciplined capital allocation priorities • Generated $10.4 billion of cash flow from operations during H1 2020 Strong liquidity: access to ~$13 billion • ~$7 billion of cash and short term investments at June 30, 2020 held by parent company or nonrestricted subsidiaries • $6 billion available through commercial paper or borrowing capacity under credit facilities at June 30, 2020 Continue to prioritize paying down debt and maintaining dividend • $3.75 billion of scheduled debt principal repaid through July 2020 • De - levered an additional $2.0 billion though a debt tender/refinancing transaction completed in August 2020 • Paid over $1.3 billion in stockholder dividends during H1 2020 • No share repurchases planned until leverage target met The environment surrounding COVID - 19 is accelerating our transformation, giving us new opportunities to demonstrate the power of our integrated offering and to deliver solutions at scale that meet client and consumer needs In the Community 1 In the Home 2 In the Hand 3

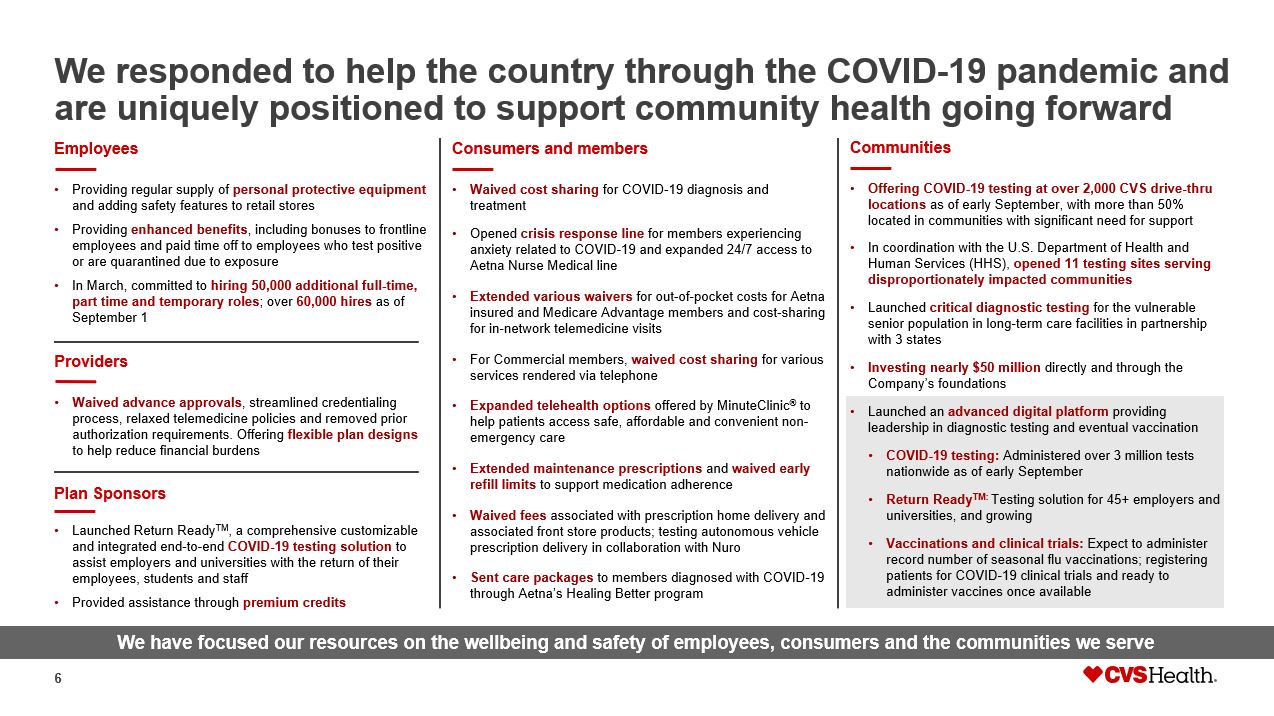

6 We have focused our resources on the wellbeing and safety of employees, consumers and the communities we serve Providers • Waived advance approvals , streamlined credentialing process, relaxed telemedicine policies and removed prior authorization requirements. Offering flexible plan designs to help reduce financial burdens Communities • Offering COVID - 19 testing at over 2,000 CVS drive - thru locations as of early September, with more than 50% located in communities with significant need for support • In coordination with the U.S. Department of Health and Human Services (HHS), opened 11 testing sites serving disproportionately impacted communities • Launched critical diagnostic testing for the vulnerable senior population in long - term care facilities in partnership with 3 states • Investing nearly $50 million directly and through the Company’s foundations • Launched an advanced digital platform providing leadership in diagnostic testing and eventual vaccination • COVID - 19 testing: Administered over 3 million tests nationwide as of early September • Return Ready TM : Testing solution for 45+ employers and universities, and growing • Vaccinations and clinical trials: Expect to administer record number of seasonal flu vaccinations; registering patients for COVID - 19 clinical trials and ready to administer vaccines once available We responded to help the country through the COVID - 19 pandemic and are uniquely positioned to support community health going forward Employees • Providing regular supply of personal protective equipment and adding safety features to retail stores • Providing enhanced benefits , including bonuses to frontline employees and paid time off to employees who test positive or are quarantined due to exposure • In March, committed to hiring 50,000 additional full - time, part time and temporary roles ; over 60,000 hires as of September 1 Consumers and members • Waived cost sharing for COVID - 19 diagnosis and treatment • Opened crisis response line for members experiencing anxiety related to COVID - 19 and expanded 24/7 access to Aetna Nurse Medical line • Extended various waivers for out - of - pocket costs for Aetna insured and Medicare Advantage members and cost - sharing for in - network telemedicine visits • For Commercial members, waived cost sharing for various services rendered via telephone • Expanded telehealth options offered by MinuteClinic ® to help patients access safe, affordable and convenient non - emergency care • Extended maintenance prescriptions and waived early refill limits to support medication adherence • Waived fees associated with prescription home delivery and associated front store products; testing autonomous vehicle prescription delivery in collaboration with Nuro • Sent care packages to members diagnosed with COVID - 19 through Aetna’s Healing Better program Plan Sponsors • Launched Return Ready TM , a comprehensive customizable and integrated end - to - end COVID - 19 testing solution to assist employers and universities with the return of their employees, students and staff • Provided assistance through premium credits

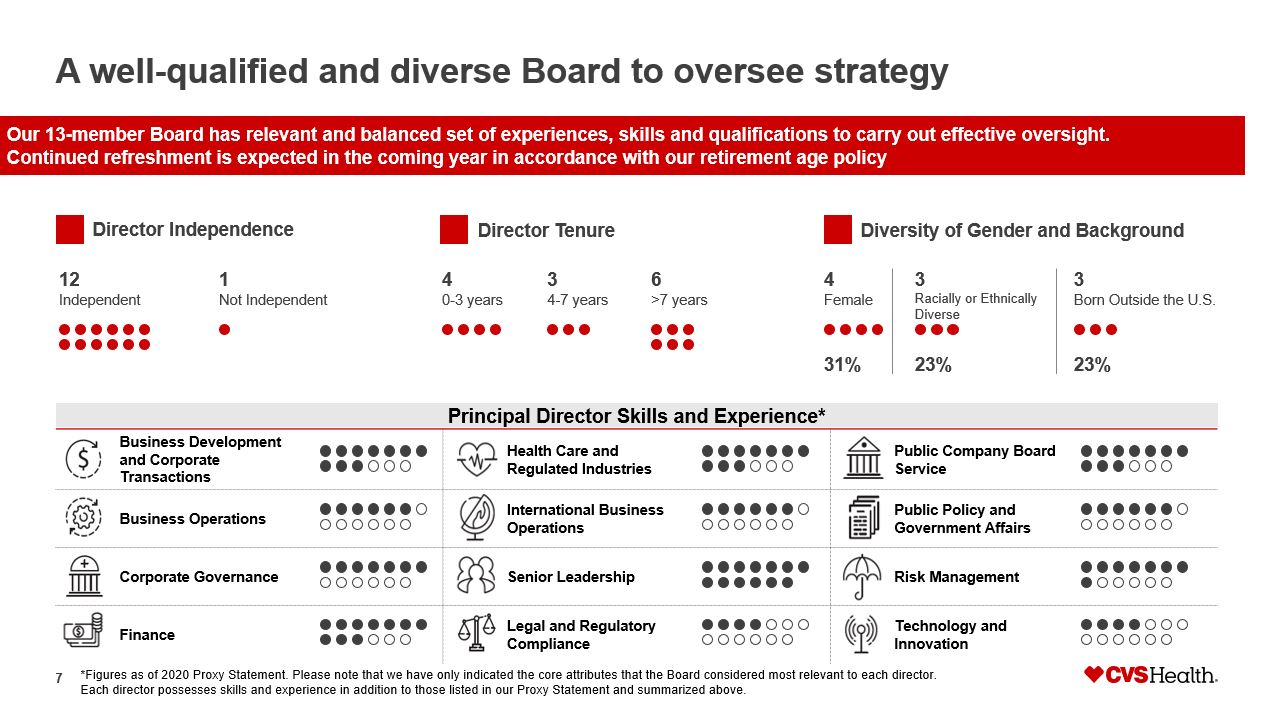

7 A well - qualified and diverse Board to oversee strategy Business Development and Corporate Transactions Health Care and Regulated Industries Public Company Board Service Business Operations International Business Operations Public Policy and Government Affairs Corporate Governance Senior Leadership Risk Management Finance Legal and Regulatory Compliance Technology and Innovation Principal Director Skills and Experience* *Figures as of 2020 Proxy Statement. Please note that we have only indicated the core attributes that the Board considered mo st relevant to each director. Each director possesses skills and experience in addition to those listed in our Proxy Statement and summarized above. Our 13 - member Board has relevant and balanced set of experiences, skills and qualifications to carry out effective oversight. Continued refreshment is expected in the coming year in accordance with our retirement age policy Director Independence Director Tenure Diversity of Gender and Background 12 Independent 1 Not Independent 4 0 - 3 years 3 4 - 7 years 6 >7 years 4 Female 3 Born Outside the U.S. 31% 3 Ethnically Diverse 23% 23%

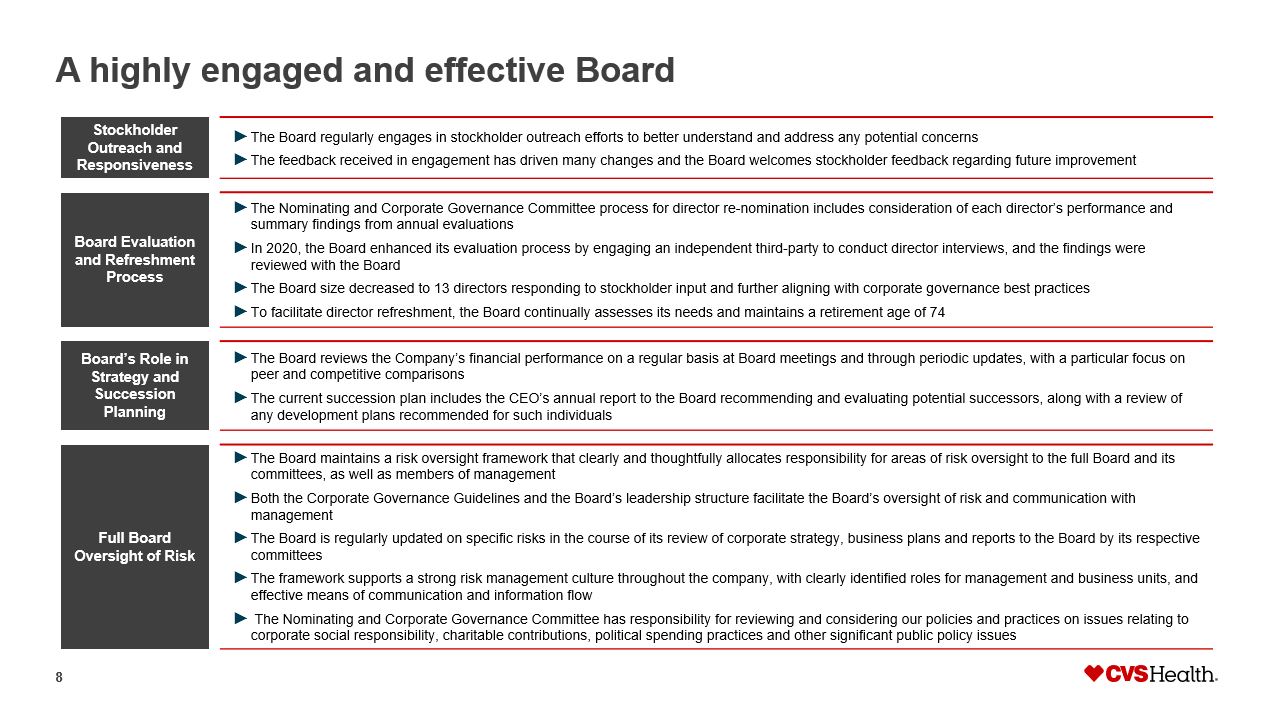

8 A highly engaged and effective Board ► The Board regularly engages in stockholder outreach efforts to better understand and address any potential concerns ► The feedback received in engagement has driven many changes and the Board welcomes stockholder feedback regarding future improvement Stockholder Outreach and Responsiveness ► The Nominating and Corporate Governance Committee process for director re - nomination includes consideration of each director’s performance and summary findings from annual evaluations ► In 2020, the Board enhanced its evaluation process by engaging an independent third - party to conduct director interviews, and th e findings were reviewed with the Board ► The Board size decreased to 13 directors responding to stockholder input and further aligning with corporate governance best prac tic es ► To facilitate director refreshment, the Board continually assesses its needs and maintains a retirement age of 74 Board Evaluation and Refreshment Process ► The Board reviews the Company’s financial performance on a regular basis at Board meetings and through periodic updates, with a particular focus on peer and competitive comparisons ► The current succession plan includes the CEO’s annual report to the Board recommending and evaluating potential successors, a lon g with a review of any development plans recommended for such individuals Board’s Role in Strategy and Succession Planning ► The Board maintains a risk oversight framework that clearly and thoughtfully allocates responsibility for areas of risk overs igh t to the full Board and its committees, as well as members of management ► Both the Corporate Governance Guidelines and the Board’s leadership structure facilitate the Board’s oversight of risk and co mmu nication with management ► The Board is regularly updated on specific risks in the course of its review of corporate strategy, business plans and report s t o the Board by its respective committees ► The framework supports a strong risk management culture throughout the company, with clearly identified roles for management and business units, and effective means of communication and information flow ► The Nominating and Corporate Governance Committee has responsibility for reviewing and considering our policies and practices on issues relating to corporate social responsibility, charitable contributions, political spending practices and other significant public policy i ssu es Full Board Oversight of Risk

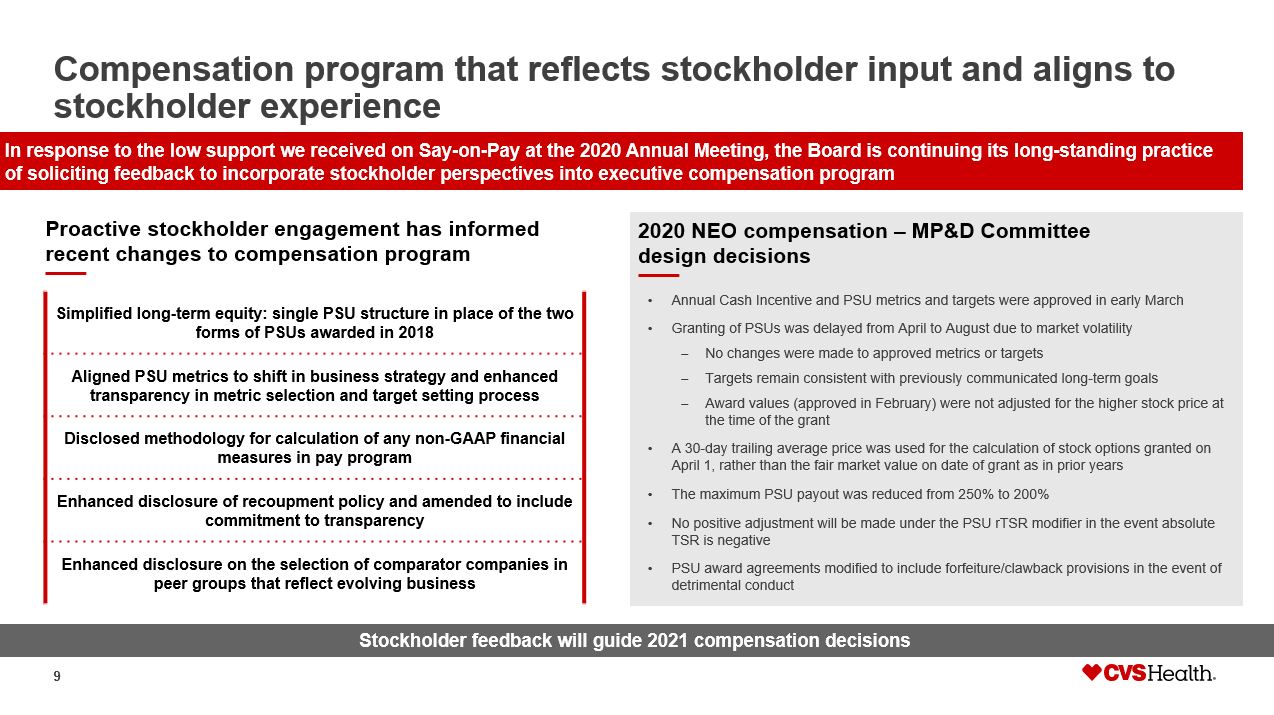

9 Compensation program that reflects stockholder input and aligns to stockholder experience Proactive stockholder engagement has informed recent changes to compensation program Simplified long - term equity: single PSU structure in place of the two forms of PSUs awarded in 2018 Aligned PSU metrics to shift in business strategy and enhanced transparency in metric selection and target setting process Disclosed methodology for calculation of any non - GAAP financial measures in pay program Enhanced disclosure of r ecoupment policy and amended to include commitment to transparency Enhanced disclosure on the s election of comparator companies in peer groups that reflect evolving business In response to the low support we received on Say - on - Pay at the 2020 Annual Meeting, the Board is continuing its long - standing p ractice of soliciting feedback to incorporate stockholder perspectives into executive compensation program • Annual Cash Incentive and PSU metrics and targets were approved in early March • Granting of PSUs was delayed from April to August due to market volatility – No changes were made to approved metrics or targets – Targets remain consistent with previously communicated long - term goals – Award values (approved in February) were not adjusted for the higher stock price at the time of the grant • A 30 - day trailing average price was used for the calculation of stock options granted on April 1, rather than the fair market value on date of grant as in prior years • The maximum PSU payout was reduced from 250% to 200% • No positive adjustment will be made under the PSU rTSR modifier in the event absolute TSR is negative • PSU award agreements modified to include forfeiture/ clawback provisions in the event of detrimental conduct 2020 NEO compensation – MP&D Committee design decisions Stockholder feedback will guide 2021 compensation decisions

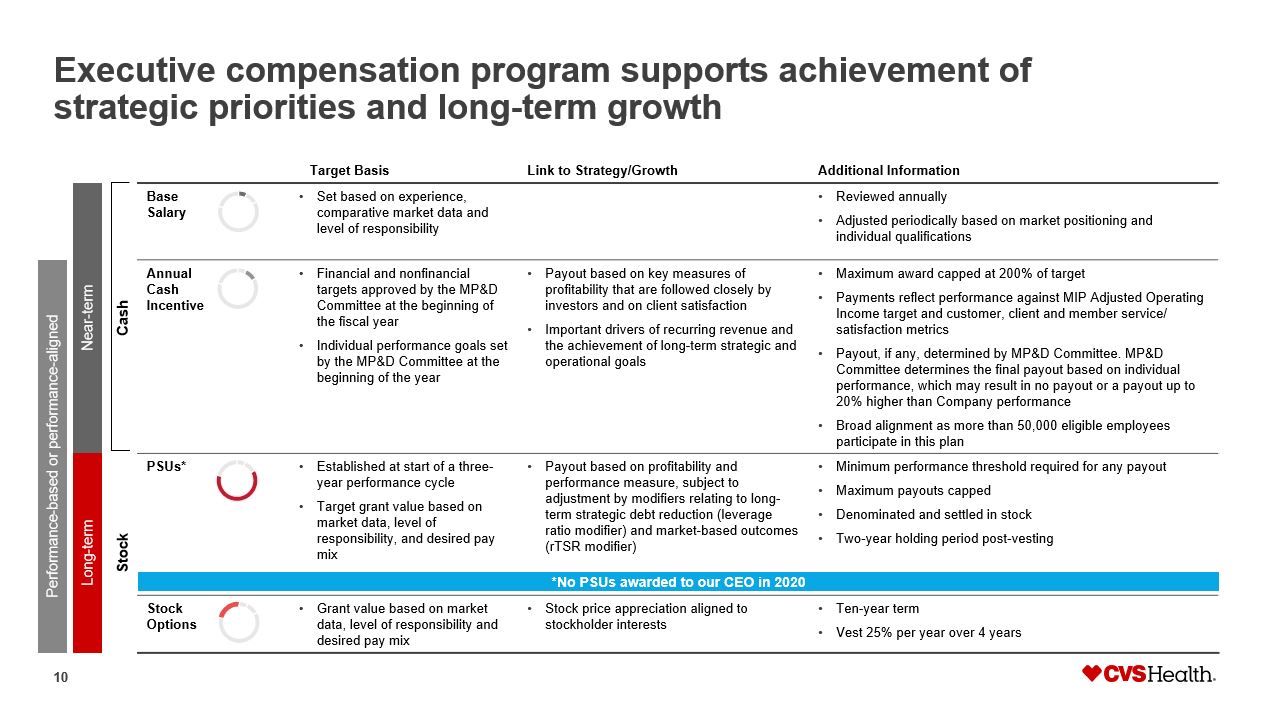

10 Executive compensation program supports achievement of strategic priorities and long - term growth Target Basis Link to Strategy /Growth Additional Information Near - term Cash Base Salary • Set based on experience, comparative market data and level of responsibility • Reviewed annually • Adjusted periodically based on market positioning and individual qualifications Performance - based or performance - aligned Annual Cash Incentive • Financial and nonfinancial targets approved by the MP&D Committee at the beginning of the fiscal year • Individual performance goals set by the MP&D Committee at the beginning of the year • Payout based on key measures of profitability that are followed closely by investors and on client satisfaction • Important drivers of recurring revenue and the achievement of long - term strategic and operational goals • Maximum award capped at 200% of target • Payments reflect performance against MIP Adjusted Operating Income target and customer, client and member service/ satisfaction metrics • Payout, if any, determined by MP&D Committee. MP&D Committee determines the final payout based on individual performance, which may result in no payout or a payout up to 20% higher than Company performance • Broad alignment as more than 50,000 eligible employees participate in this plan Long - term Stock PSUs* • Established at start of a three - year performance cycle • Target grant value based on market data, level of responsibility, and desired pay mix • Payout based on profitability and performance measure, subject to adjustment by modifiers relating to long - term strategic debt reduction (leverage ratio modifier) and market - based outcomes ( rTSR modifier) • Minimum performance threshold required for any payout • Maximum payouts capped • Denominated and settled in stock • Two - year holding period post - vesting Stock Options • Grant value based on market data, level of responsibility and desired pay mix • Stock price appreciation aligned to stockholder interests • Ten - year term • Vest 25% per year over 4 years *No PSUs awarded to our CEO in 2020

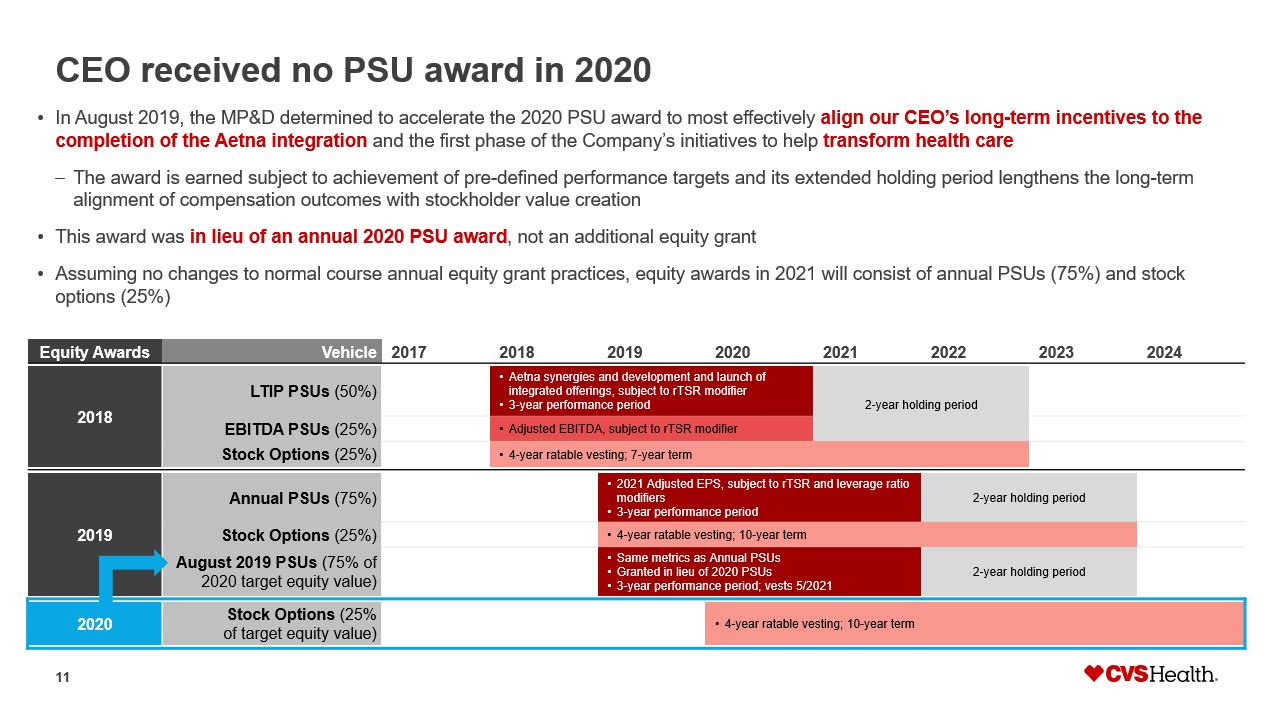

11 CEO received no PSU award in 2020 Equity Awards Vehicle 2017 2018 2019 2020 2021 2022 2023 2024 2018 LTIP PSUs (50%) • Aetna synergies and development and launch of integrated offerings, subject to rTSR modifier • 3 - year performance period 2 - year holding period EBITDA PSUs (25%) • Adjusted EBITDA, subject to rTSR modifier Stock Options (25%) • 4 - year ratable vesting; 7 - year term 2019 Annual PSUs (75%) • 2021 Adjusted EPS, subject to rTSR and leverage ratio modifiers • 3 - year performance period 2 - year holding period Stock Options (25%) • 4 - year ratable vesting; 10 - year term August 2019 PSUs (75% of 2020 target equity value) • Same metrics as Annual PSUs • Granted in lieu of 2020 PSUs • 3 - year performance period; vests 5/2021 2 - year holding period 2020 Stock Options (25% of target equity value) • 4 - year ratable vesting; 10 - year term • In August 2019, the MP&D determined to accelerate the 2020 PSU award to most effectively align our CEO’s long - term incentives to the completion of the Aetna integration and the first phase of the Company’s initiatives to help transform health care – The award is earned subject to achievement of pre - defined performance targets and its extended holding period lengthens the long - term alignment of compensation outcomes with stockholder value creation • This award was in lieu of an annual 2020 PSU award , not an additional equity grant • Assuming no changes to normal course annual equity grant practices, equity awards in 2021 will consist of annual PSUs (75%) a nd stock options (25%)

12 Transform Health 2030 Healthy People How we’re delivering on our purpose of helping people on their path to better health across all touchpoints Healthy Business We are committed to fostering a business that creates value for our colleagues, stockholders, partners and supply chain Healthy Community We are delivering significant social impacts to support the health of communities across the U.S. and improve health outcomes in the communities we serve Healthy Planet The health of our environment is inextricably linked to human health and we’re committed to doing our part as a health care leader We engaged key stakeholders to arrive at our new CSR strategy: Transform Health 2030 . In 2021, we will share targets and commitments in line with the four pillars below to advance our purpose of helping people on their path to better health This process and our strategy is overseen by Board, including directors with significant ESG expertise • Our efforts to transform health align with Goal 3 of the UN SDGs, see pages 12 and 13 of our CSR Report for more information on our alignment with the UN SDGs

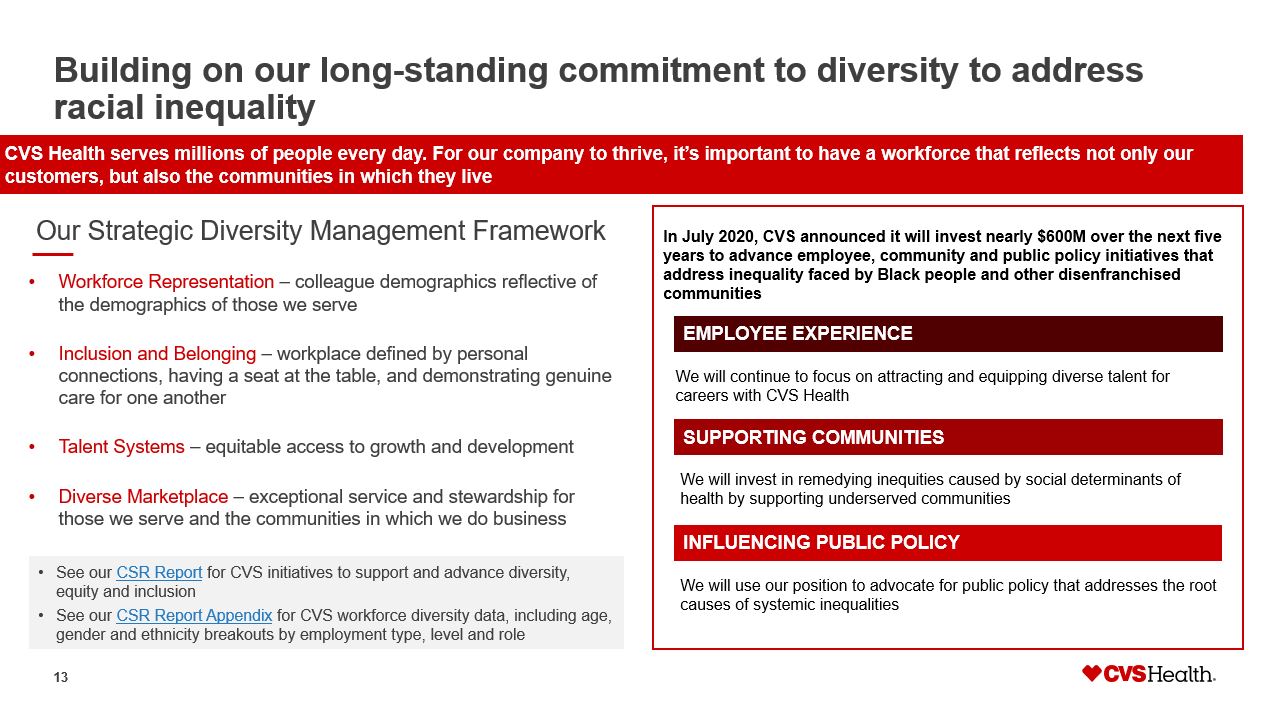

13 Building on our long - standing commitment to diversity to address racial inequality EMPLOYEE EXPERIENCE We will continue to focus on attracting and equipping diverse talent for careers with CVS Health SUPPORTING COMMUNITIES We will invest in remedying inequities caused by social determinants of health by supporting underserved communities We will u se our position to advocate for public policy that addresses the root causes of systemic inequalities INFLUENCING PUBLIC POLICY CVS Health serves millions of people every day. For our company to thrive, it’s important to have a workforce that reflects n ot only our customers, but also the communities in which they live In July 2020, CVS announced it will invest nearly $600M over the next five years to advance employee, community and public policy initiatives that address inequality faced by Black people and other disenfranchised communities Our Strategic Diversity Management Framework • Workforce Representation – colleague demographics reflective of the demographics of those we serve • Inclusion and Belonging – workplace defined by personal connections, having a seat at the table, and demonstrating genuine care for one another • Talent Systems – equitable access to growth and development • Diverse Marketplace – exceptional service and stewardship for those we serve and the communities in which we do business • See our CSR Report for CVS initiatives to support and advance diversity, equity and inclusion • See our CSR Report Appendix for CVS workforce diversity data, including age, gender and ethnicity breakouts by employment type, level and role

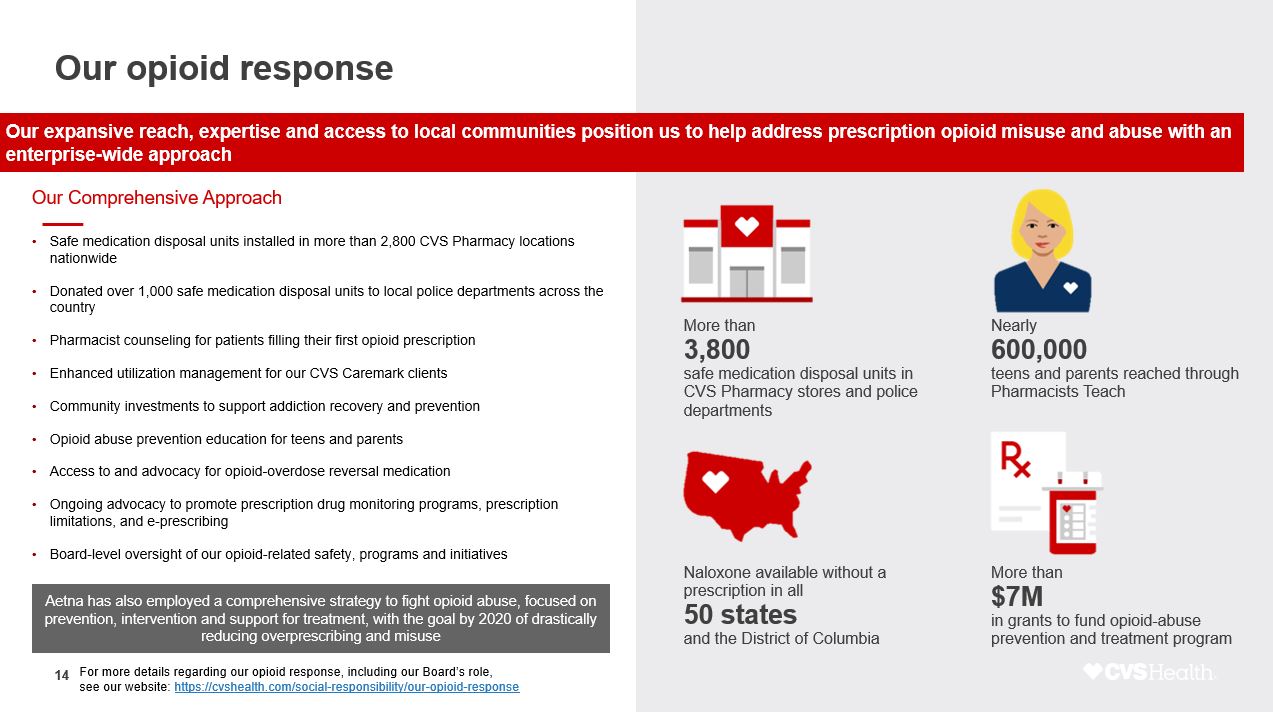

14 Our opioid response Our expansive reach, expertise and access to local communities position us to help address prescription opioid misuse and abu se with an enterprise - wide approach More than 3,800 safe medication disposal units in CVS Pharmacy stores and police departments Nearly 600,000 teens and parents reached through Pharmacists Teach Naloxone available without a prescription in all 50 states and the District of Columbia More than $7M in grants to fund opioid - abuse prevention and treatment program Our Comprehensive Approach • Safe medication disposal units installed in more than 2,800 CVS Pharmacy locations nationwide • Donated over 1,000 safe medication disposal units to local police departments across the country • Pharmacist counseling for patients filling their first opioid prescription • Enhanced utilization management for our CVS Caremark clients • Community investments to support addiction recovery and prevention • Opioid abuse prevention education for teens and parents • Access to and advocacy for opioid - overdose reversal medication • Ongoing advocacy to promote prescription drug monitoring programs, prescription limitations, and e - prescribing • Board - level oversight of our opioid - related safety, programs and initiatives For more details regarding our opioid response, including our Board’s role, see our website: https://cvshealth.com/social - responsibility/our - opioid - response Aetna has also employed a comprehensive strategy to fight opioid abuse, focused on prevention, intervention and support for treatment, with the goal by 2020 of drastically reducing overprescribing and misuse

15