Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TUESDAY MORNING CORP/DE | tm2031653d1_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - TUESDAY MORNING CORP/DE | tm2031653d1_ex99-1.htm |

Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE NORTHERN DISTRICT OF TEXAS

DALLAS DIVISION

|

In re:

Tuesday Morning Corporation, et al.,1

Debtors.

|

§ § § § §

|

Chapter 11

Case No. 20-31476-HDH-11

Jointly Administered

|

DISCLOSURE STATEMENT IN SUPPORT OF THE JOINT PLAN OF REORGANIZATION OF TUESDAY MORNING CORPORATION, ET AL. PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

Ian T. Peck

State Bar No. 24013306

Jarom J. Yates

State Bar No. 24071134

Jordan E. Chavez

State Bar No. 24109883

HAYNES AND BOONE, LLP

2323 Victory Avenue, Suite 700

Dallas, TX 75219

Telephone: 214.651.5000

Facsimile: 214.651.5940

Email: ian.peck@haynesboone.com

Email: jarom.yates@haynesboone.com

Email: jordan.chavez@haynesboone.com

ATTORNEYS FOR DEBTORS

Dated: September 23, 2020

1 The Debtors in these Chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, include: Tuesday Morning Corporation (8532) (“TM Corp.”); TMI Holdings, Inc. (6658) (“TMI Holdings”); Tuesday Morning, Inc. (2994) (“TMI”); Friday Morning, LLC (3440) (“FM LLC”); Days of the Week, Inc. (4231) (“DOTW”); Nights of the Week, Inc. (7141) (“NOTW”); and Tuesday Morning Partners, Ltd. (4232) (“TMP”). The location of the Debtors’ service address is 6250 LBJ Freeway, Dallas, TX 75240.

TABLE OF CONTENTS

| ARTICLE I. INTRODUCTION | 1 |

| A. | Summary of Plan | 1 | |

| B. | Filing of the Debtors’ Chapter 11 Cases | 4 | |

| C. | Purpose of Disclosure Statement | 4 | |

| D. | Hearing on Approval of the Disclosure Statement | 5 | |

| E. | Hearing on Confirmation of the Plan | 5 | |

| F. | Disclaimers | 5 |

| ARTICLE II. EXPLANATION OF CHAPTER 11 | 7 |

| A. | Overview of Chapter 11 | 7 | |

| B. | Chapter 11 Plan | 7 |

| ARTICLE III. VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS | 8 |

| A. | Ballots and Voting Deadline | 8 | |

| B. | Voting Procedures for Tuesday Morning Corporation Interests | 9 | |

| C. | Holders of Claims Entitled to Vote | 10 | |

| D. | Definition of Impairment | 11 | |

| E. | Classes Impaired or Unimpaired Under the Plan | 11 | |

| F. | Information on Voting and Vote Tabulations | 12 | |

| G. | Confirmation of Plan | 16 |

| ARTICLE IV. BACKGROUND OF THE DEBTORS | 19 |

| A. | Description of Debtors’ Businesses | 19 | |

| B. | Corporate Information | 23 | |

| C. | Events Leading to the Chapter 11 Cases | 25 | |

| D. | The Debtors’ Prepetition Restructuring Initiatives | 27 |

| ARTICLE V. DEBTORS’ ASSETS AND LIABILITIES | 28 |

| A. | Prepetition Secured Debt | 28 | |

| B. | Unsecured Debt | 29 | |

| C. | Equity Interests | 29 | |

| D. | Debtors’ Scheduled Amount of Claims | 29 |

| ARTICLE VI. BANKRUPTCY CASE ADMINISTRATION | 30 |

| A. | First and Second Day Motions | 30 | |

| B. | Bar Date for Filing Proofs of Claim | 31 | |

| C. | Meeting of Creditors | 31 | |

| D. | Official Committee of Unsecured Creditors | 31 | |

| E. | Debtor-In-Possession Financing and Use of Cash Collateral | 32 | |

| F. | Professionals Employed by the Debtors | 37 | |

| G. | Store Closing Sales and Lease Rejections | 37 | |

| H. | Lease Negotiations | 39 | |

| I. | Contingent Liquidation Motion | 39 | |

| J. | Motion to Appoint an Equity Committee | 40 | |

| K. | Motion to Sell Phoenix Distribution Center Equipment | 41 | |

| L. | Sale Process and Bidding Procedures | 41 |

i

| ARTICLE VII. DESCRIPTION OF THE PLAN | 42 |

| A. | Introduction | 42 | |

| B. | Classification in General | 42 | |

| C. | Grouping of Debtors for Convenience Only | 42 | |

| D. | Designation of Claims and Interests/Impairment | 43 | |

| E. | Allowance and Treatment of Administrative Claims and Priority Claims | 44 | |

| F. | Allowance and Treatment of Classified Claims and Interests | 46 | |

| G. | Procedures for Resolving Contingent, Unliquidated, and Disputed Claims | 49 | |

| H. | Treatment of Executory Contracts and Unexpired Leases | 51 | |

| I. | Plan Supplement | 54 |

| ARTICLE VIII. MEANS FOR EXECUTION AND IMPLEMENTATION OF THE PLAN | 54 |

| A. | Corporate Existence | 54 | |

| B. | Reorganized Debtors | 55 | |

| C. | Restructuring Transactions | 55 | |

| D. | Reinstatement of Tuesday Morning Corporation Interests | 55 | |

| E. | Sources of Plan Distributions | 56 | |

| F. | Cancellation of Certain Existing Agreements | 57 | |

| G. | Corporate Action | 58 | |

| H. | New Organizational Documents | 59 | |

| I. | Directors and Officers of the Reorganized Debtors | 59 | |

| J. | Effectuating Documents; Further Transactions | 59 | |

| K. | Bankruptcy Code § 1146 Exemption | 60 | |

| L. | Director and Officer Liability Insurance | 60 | |

| M. | Management Incentive Plan | 60 | |

| N. | Employee and Retiree Benefits | 60 | |

| O. | Retained Causes of Action | 61 | |

| P. | Releases, Exculpation, Injunctions, and Related Provisions | 61 | |

| Q. | Retention of Jurisdiction | 65 | |

| R. | Modifications and Amendments, Revocation, or Withdrawal of the Plan | 65 |

| ARTICLE IX. LEGAL PROCEEDINGS | 66 |

| A. | Recovery on Preference Actions and Other Avoidance Actions | 66 | |

| B. | Retained Causes of Action | 67 |

| ARTICLE X. DISTRIBUTIONS TO CREDITORS | 67 |

| A. | Allowed Administrative Claims | 67 | |

| B. | Allowed Priority Unsecured Tax Claims and Allowed Secured Tax Claims | 67 | |

| C. | Allowed Other Priority Unsecured Claims | 68 | |

| D. | Allowed Other Secured Claims | 68 | |

| E. | Allowed Existing First Lien Credit Facility Claims | 68 | |

| F. | Allowed General Unsecured Claims | 68 | |

| G. | Potential Alternative to General Unsecured Bonds | 68 |

| ARTICLE XI. PROVISIONS GOVERNING DISTRIBUTIONS | 69 |

| A. | Timing and Calculation of Amounts to Be Distributed | 69 | |

| B. | Disbursing Agent | 69 | |

| C. | Rights and Powers of Disbursing Agent | 69 | |

| D. | Delivery of Distributions and Undeliverable or Unclaimed Distributions | 70 |

ii

| E. | Manner of Payment | 71 | |

| F. | Distributions to Holders of Class 5 General Unsecured Claims | 71 | |

| G. | Bankruptcy Code § 1145 Exemption | 71 | |

| H. | Compliance with Tax Requirements | 72 | |

| I. | Allocations | 72 | |

| J. | No Postpetition Interest on Claims | 72 | |

| K. | Foreign Currency Exchange Rate | 72 | |

| L. | Setoffs and Recoupment | 72 | |

| M. | Claims Paid or Payable by Third Parties | 73 |

| ARTICLE XII. ALTERNATIVES TO THE PLAN | 74 |

| A. | Chapter 7 Liquidation | 74 | |

| B. | Liquidation Pursuant to the Contingent Liquidation Order | 75 | |

| C. | Dismissal | 75 | |

| D. | Exclusivity and Alternative Plan Potential | 75 | |

| E. | Going-Concern Sale | 75 |

| ARTICLE XIII. FINANCIAL PROJECTIONS AND FEASIBILITY | 76 |

| A. | Financial Projections and Feasibility | 76 |

| ARTICLE XIV. CERTAIN RISK FACTORS TO BE CONSIDERED | 76 |

| A. | Bankruptcy Related Risk Factors | 77 | |

| B. | Failure to Confirm or Consummate the Plan | 79 | |

| C. | Claim Estimates May Be Incorrect | 79 | |

| D. | Risks Related to Debtors’ Business and Industry Conditions | 80 | |

| E. | Risks Relating to the Reinstated Tuesday Morning Corporation Interests | 82 | |

| F. | Inability to Obtain Exit Financing | 83 | |

| G. | The Debtors May Not Be Able to Generate Sufficient Cash to Service All of Their Indebtedness | 83 | |

| H. | Certain Tax Implications of the Plan | 84 |

| ARTICLE XV. CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 84 |

| A. | U.S. Federal Income Tax Consequences Under the Plan | 85 | |

| B. | Federal Income Tax Consequences to Holders of Claims | 89 | |

| C. | Other Considerations for U.S. Holders – Accrued Interest | 89 | |

| D. | Information Reporting and Back-Up Withholding | 90 | |

| E. | Consequences of Ownership and Disposition of the Reinstated Tuesday Morning Corporation Interests | 90 | |

| F. | U.S. Federal Income Tax Consequences for Non-U.S. Holders | 91 |

| ARTICLE XVI. SECURITIES LAW CONSIDERATIONS | 91 |

| A. | Transfer Restrictions and Consequences under Federal Securities Law | 91 | |

| B. | Listing; SEC Filings | 93 |

| ARTICLE XVII. CONCLUSION | 93 |

iii

EXHIBITS TO THE DISCLOSURE STATEMENT

| Chapter 11 Plan | Exhibit 1 |

| Notice of Confirmation Hearing | Exhibit 2 |

| Liquidation Analysis | Exhibit 3 |

| Financial Projections | Exhibit 4 |

iv

ARTICLE I.

INTRODUCTION

The Debtors2 hereby submit this Disclosure Statement for use in the solicitation of votes on the Plan of Reorganization of Tuesday Morning Corporation, et al., Pursuant to Chapter 11 of the Bankruptcy Code (i.e., the Plan). The Plan is annexed as Exhibit 1 to this Disclosure Statement.

This Disclosure Statement sets forth certain relevant information regarding the Debtors’ prepetition operations and financial history, the need to seek chapter 11 protection, significant events that have occurred during the Chapter 11 Cases, and the resultant analysis of the expected return to the Debtors’ Creditors. This Disclosure Statement also describes terms and provisions of the Plan, including certain alternatives to the Plan, certain effects of confirmation of the Plan, certain risk factors associated with the Plan, and the manner in which distributions will be made under the Plan. Additionally, this Disclosure Statement discusses the confirmation process and the voting procedures that holders of Claims and Interests must follow for their votes to be counted.

All descriptions of the Plan set forth in this Disclosure Statement are for summary purposes only. To the extent of any inconsistency between this Disclosure Statement and the Plan, the Plan shall control. You are encouraged to review the Plan in full.

YOU ARE BEING SENT THIS DISCLOSURE STATEMENT BECAUSE YOU ARE A CREDITOR OR OTHER PARTY IN INTEREST OF THE DEBTORS. THIS DOCUMENT DESCRIBES A CHAPTER 11 PLAN WHICH, WHEN CONFIRMED BY THE BANKRUPTCY COURT, WILL GOVERN HOW YOUR CLAIM OR INTEREST WILL BE TREATED. THE DEBTORS URGE YOU TO REVIEW THE DISCLOSURE STATEMENT AND THE PLAN CAREFULLY. THE DEBTORS BELIEVE THAT ALL CREDITORS SHOULD VOTE IN FAVOR OF THE PLAN.

A. Summary of Plan

The Plan provides for the resolution of Claims against and Interests in the Debtors and implements a distribution scheme pursuant to the Bankruptcy Code. Distributions under the Plan shall be made with: (1) Cash on hand, including Cash from operations; (2) the New ABL Credit Facility; (3) the New Real Estate Credit Facility; (4) the issuance of the General Unsecured Bonds; and (5) Reinstatement of the Tuesday Morning Corporation Interests, as applicable.

Under the Plan, Claims and Interests are classified, and each class has its own treatment. The table below describes each class of Claims and Interests, which holders of Claims and Interests belong in each class, the treatment of each class of Claims or Interests, and the expected recovery of each holder of Claims or Interests in the respective class.3

2 Except as otherwise provided in this Disclosure Statement, capitalized terms herein have the meaning ascribed to them in the Plan. Any capitalized term used herein that is not defined in the Plan shall have the meaning ascribed to that term in the Bankruptcy Code or Bankruptcy Rules, whichever is applicable.

3 The estimated totals contained in the Summary of Plan Treatment are based upon the Debtors’ Schedules of Assets and Liabilities, unless otherwise provided.

1

Summary of Plan Treatment

| Class Description | Voting and Treatment |

| Class 1 - Other Priority Unsecured Claims |

Class 1 is Impaired under the Plan. Holders of Allowed Claims in Class 1 are entitled to vote to accept or reject the Plan.

At the option of the applicable Debtor, each holder of an Allowed Other Priority Unsecured Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Other Priority Unsecured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Other Priority Unsecured Claim, the following: (i) Payment in full in Cash of its Allowed Class 1 Claim; or (ii) Such other treatment as is consistent with the requirements of Bankruptcy Code section 1129(a)(9).

Estimated total Allowed Class 1 Claims: $0

Projected recovery: 100% |

| Class 2 – Other Secured Claims |

Class 2 is Impaired under the Plan. Holders of Allowed Claims in Class 2 are entitled to vote to accept or reject the Plan.

At the option of the applicable Debtor, each holder of an Allowed Other Secured Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Other Secured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Other Secured Claim, the following: (i) Payment in full in Cash of its Allowed Class 2 Claim; (ii) The collateral securing its Allowed Class 2 Claim; provided, however, any collateral remaining after satisfaction of such Allowed Class 2 Claim shall revest in the applicable Reorganized Debtor pursuant to the Plan; or (iii) Reinstatement of its Allowed Class 2 Claim.

Estimated total Allowed Class 2 Claims: $200,000

Projected recovery: 100% |

| Class 3 – Secured Tax Claims |

Class 3 is Impaired under the Plan. Holders of Allowed Claims in Class 3 are entitled to vote to accept or reject the Plan.

At the option of the applicable Debtor, each holder of an Allowed Secured Tax Claim shall receive, on or after the Effective Date, except to the extent that a holder of an Allowed Secured Tax Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Secured Tax Claim, the following: (i) Payment in full in Cash of its Allowed Class 3 Claim; (ii) The collateral securing its Allowed Class 3 Claim; provided, however, any collateral remaining after satisfaction of such Allowed Class 3 Claim shall revest in the applicable Reorganized Debtor pursuant to the Plan; or (iii) Such other treatment consistent with the requirements of Bankruptcy Code section 1129(a)(9).

Estimated total Allowed Class 3 Claims: $0 (Tax claims are generally being paid in the ordinary course of business)

Projected recovery: 100% |

2

| Class Description | Voting and Treatment |

| Class 4 – Existing First Lien Credit Facility Claims |

Class 4 is Impaired under the Plan. Holders of Allowed Claims in Class 4 are entitled to vote to accept or reject the Plan.

Each holder of an Allowed Existing First Lien Credit Facility Claim shall receive, except to the extent that a holder of an Allowed Existing First Lien Credit Facility Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Allowed Existing First Lien Credit Facility Claim, Payment in Full, in Cash, of its Allowed Class 4 Claim plus any and all fees, interest (both pre and post-Petition Date), and reimbursement of expenses, and any other amounts owed or arising under the Existing First Lien Credit Documents through the time of Payment in Full, in three equal installments to be paid on the 30th, 60th, and 90th days after the Effective Date (each a “Payment Date”). If a Payment Date does not fall on a Business Day, such Payment Date shall be extended to the next Business Day. All liens and security interests granted to secure such Allowed Existing First Lien Credit Facility Claims shall be retained until such payments shall have been made. Further, in the event that the Existing First Lien Agent is the agent for the New ABL Credit Facility, it shall retain the lines and security interests securing the Existing First Lien Credit Facility Claims after such payments are made and have such liens and security interests secure the New ABL Credit Facility. The estimated total amount of Allowed Class 4 Claims is $100,000.

Estimated total Allowed Class 4 Claims: $100,000

Projected recovery: 100% |

| Class 5 - General Unsecured Claims |

Class 5 is Impaired under the Plan. Holders of Allowed Claims in Class 5 are entitled to vote to accept or reject the Plan.

Except to the extent that a holder of an Allowed General Unsecured Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Existing General Unsecured Claim, each holder of an Allowed Class 5 Claim shall receive its Pro Rata share of (i) the General Unsecured Cash Fund and (ii) the General Unsecured Bonds.

Estimated total Allowed Class 5 Claims: $116,700,000

Projected recovery: 100% |

| Class 6 – Convenience Claims |

Class 6 is Impaired under the Plan. Holders of Allowed Claims in Class 6 are entitled to vote to accept or reject the Plan.

Except to the extent that a holder of an Allowed Convenience Claim agrees to a less favorable treatment, in full and final satisfaction, compromise, settlement, release, and discharge of and in exchange for each Convenience Claim, each holder of an Allowed Class 6 Claim shall receive the Convenience Claim Distribution.

Estimated total Allowed Class 6 Claims: $8,300,000

Projected recovery: 100% |

3

| Class Description | Voting and Treatment |

| Class 7 - Intercompany Claims |

Class 7 is Unimpaired if the Class 7 Claims are Reinstated or Impaired if the Class 7 Claims are cancelled. Holders of Class 7 Claims are conclusively deemed to have accepted or rejected the Plan pursuant to Bankruptcy Code §§ 1126(f) or 1126(g). Holders of Class 7 Claims are not entitled to vote to accept or reject the Plan

On the Effective Date, Class 7 Claims shall be, at the option of the Debtors, either Reinstated or cancelled and released without any distribution |

|

Class 8 - Tuesday Morning Corporation Interests |

Class 8 is Impaired under the Plan. Holders of Allowed Interests in Class 8 are entitled to vote to accept or reject the Plan.

On the Effective Date, Class 8 Interests shall be Reinstated, subject to dilution as otherwise provided for in the Plan.

Projected recovery: Reinstated |

| Class 9 - Intercompany Interests |

Class 9 is Unimpaired under the Plan. Holders of Class 9 Interests are deemed to accept the Plan.

Intercompany Interests shall receive no distribution and shall be Reinstated for administrative purposes only at the election of the Reorganized Debtors. |

B. Filing of the Debtors’ Chapter 11 Cases

On May 27, 2020 (i.e., the Petition Date), the Debtors Filed voluntary petitions for relief under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Northern District of Texas, Dallas Division. The Debtors Filed the Chapter 11 Cases to preserve the value of their estates and to restructure their financial affairs. To such end, the Debtors have continued to manage their properties and are operating and managing their businesses as debtors in possession in accordance with Bankruptcy Code §§ 1107 and 1108. No trustee or examiner has been appointed in the Chapter 11 Cases.

C. Purpose of Disclosure Statement

Bankruptcy Code § 1125 requires the Debtors to prepare and obtain court approval of the Disclosure Statement as a prerequisite to soliciting votes on the Plan. The purpose of the Disclosure Statement is to provide information to holders of Claims and Interests that will assist them in deciding how to vote on the Plan.

Approval of this Disclosure Statement does not constitute a judgment by the Bankruptcy Court as to the desirability of the Plan or as to the value or suitability of any consideration offered thereunder. The Bankruptcy Court’s approval does indicate, however, that the Bankruptcy Court has determined that the Disclosure Statement contains adequate information to permit a Creditor to make an informed judgment regarding acceptance or rejection of the Plan.

4

D. Hearing on Approval of the Disclosure Statement

The Bankruptcy Court has set October 29, 20202 at 9:00 a.m. (prevailing Central Time) (the “Disclosure Statement Hearing”), as the time and date for the hearing to consider approval of this Disclosure Statement. Once commenced, the Disclosure Statement Hearing may be adjourned or continued by announcement in open court with no further notice.

E. Hearing on Confirmation of the Plan

The Bankruptcy Court has set December 15, 2020 at 9:00 a.m. (prevailing Central Time) (the “Confirmation Hearing”), as the date and time for a hearing to determine whether the Plan has been accepted by the requisite number of holders of Claims, and whether the other standards for confirmation of the Plan have been satisfied. Once commenced, the Confirmation Hearing may be adjourned or continued by announcement in open court with no further notice.

F. Disclaimers

THIS DISCLOSURE STATEMENT IS PROVIDED FOR USE SOLELY BY HOLDERS OF CLAIMS AND INTERESTS AND THEIR ADVISERS IN CONNECTION WITH THEIR DETERMINATION TO ACCEPT OR REJECT THE PLAN. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE RELIED UPON OR USED BY ANY OTHER ENTITY FOR ANY OTHER PURPOSE.

THIS DISCLOSURE STATEMENT CONTAINS IMPORTANT INFORMATION THAT MAY BEAR ON YOUR DECISION REGARDING ACCEPTING THE PLAN. PLEASE READ THIS DOCUMENT WITH CARE.

FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS THE REPRESENTATION OF THE DEBTORS ONLY AND NOT OF THEIR ATTORNEYS, ACCOUNTANTS OR OTHER PROFESSIONALS. FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN SUBJECTED TO AN AUDIT BY AN INDEPENDENT CERTIFIED PUBLIC ACCOUNTANT. THE FINANCIAL PROJECTIONS AND OTHER FINANCIAL INFORMATION, WHILE PRESENTED WITH NUMERICAL SPECIFICITY, NECESSARILY WERE BASED ON A VARIETY OF ESTIMATES AND ASSUMPTIONS THAT ARE INHERENTLY UNCERTAIN AND MAY BE BEYOND THE CONTROL OF THE DEBTORS’ MANAGEMENT.

THE DEBTORS ARE NOT ABLE TO CONFIRM THAT THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT DOES NOT INCLUDE ANY INACCURACIES. HOWEVER, THE DEBTORS HAVE MADE THEIR BEST EFFORT TO PROVIDE ACCURATE INFORMATION AND ARE NOT AWARE OF ANY INACCURACY IN THIS DISCLOSURE STATEMENT.

5

THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS NOT BEEN INDEPENDENTLY INVESTIGATED BY THE BANKRUPTCY COURT AND HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT. IN THE EVENT THIS DISCLOSURE STATEMENT IS APPROVED, SUCH APPROVAL DOES NOT CONSTITUTE A DETERMINATION BY THE BANKRUPTCY COURT OF THE FAIRNESS OR MERITS OF THE PLAN OR OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT.

THE ONLY REPRESENTATIONS THAT ARE AUTHORIZED BY THE DEBTORS CONCERNING THE DEBTORS, THE VALUE OF THEIR ASSETS, THE EXTENT OF THEIR LIABILITIES, OR ANY OTHER FACTS MATERIAL TO THE PLAN ARE THE REPRESENTATIONS MADE IN THIS DISCLOSURE STATEMENT. REPRESENTATIONS CONCERNING THE PLAN OR THE DEBTORS OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT ARE NOT AUTHORIZED BY THE DEBTORS.

HOLDERS OF CLAIMS AND INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND ALL SUCH HOLDERS OF CLAIMS AND INTERESTS SHOULD CONSULT WITH THEIR OWN ADVISERS.

THE DEBTORS HAVE NO ARRANGEMENT OR UNDERSTANDING WITH ANY BROKER, SALESMAN, OR OTHER PERSON TO SOLICIT VOTES FOR THE PLAN. NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS IN CONNECTION WITH THE PLAN OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS SHOULD NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE DEBTORS. THE DELIVERY OF THIS DISCLOSURE STATEMENT SHALL NOT UNDER ANY CIRCUMSTANCES CREATE ANY IMPLICATION THAT THE INFORMATION CONTAINED HEREIN IS CORRECT AS OF ANY TIME AFTER THE DATE HEREOF OR THAT THERE HAS BEEN NO CHANGE IN THE INFORMATION SET FORTH HEREIN OR IN THE AFFAIRS OF THE DEBTORS SINCE THE DATE HEREOF. ANY ESTIMATES OF CLAIMS AND INTERESTS SET FORTH IN THIS DISCLOSURE STATEMENT MAY VARY FROM THE FINAL AMOUNTS OF CLAIMS OR INTERESTS ALLOWED BY THE BANKRUPTCY COURT. SIMILARLY, THE ANALYSIS OF ASSETS AND THE AMOUNT ULTIMATELY REALIZED FROM THEM MAY DIFFER MATERIALLY.

THE DESCRIPTION OF THE PLAN CONTAINED HEREIN IS INTENDED TO BRIEFLY SUMMARIZE THE MATERIAL PROVISIONS OF THE PLAN AND IS SUBJECT TO AND QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE PROVISIONS OF THE PLAN.

THE DEBTORS ARE MAKING THE STATEMENTS AND PROVIDING THE FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT AS OF THE DATE HEREOF, UNLESS OTHERWISE SPECIFICALLY NOTED. ALTHOUGH THE DEBTORS MAY SUBSEQUENTLY UPDATE THE INFORMATION IN THIS DISCLOSURE STATEMENT, THE DEBTORS HAVE NO AFFIRMATIVE DUTY TO DO SO, AND EXPRESSLY DISCLAIM ANY DUTY TO PUBLICLY UPDATE ANY FORWARD LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE. HOLDERS OF CLAIMS OR INTERESTS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER THAT, AT THE TIME OF THEIR REVIEW, THE FACTS SET FORTH HEREIN HAVE NOT CHANGED SINCE THIS DISCLOSURE STATEMENT WAS FILED. INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION, MODIFICATION, OR AMENDMENT. THE DEBTORS RESERVE THE RIGHT TO FILE AN AMENDED OR MODIFIED PLAN AND RELATED DISCLOSURE STATEMENT FROM TIME TO TIME, SUBJECT TO THE TERMS OF THE PLAN.

6

ARTICLE II.

EXPLANATION OF CHAPTER 11

A. Overview of Chapter 11

Chapter 11 is the principal reorganization chapter of the Bankruptcy Code. Under chapter 11, a debtor in possession may seek to reorganize its business or to sell the business for the benefit of the debtor’s Creditors and other interested parties.

The commencement of a chapter 11 case creates an estate comprising all of the debtor’s legal and equitable interests in property as of the date the petition is filed. Unless the bankruptcy court orders the appointment of a trustee, a chapter 11 debtor may continue to manage and control the assets of its estate as a “debtor in possession,” as the Debtors have done in the Chapter 11 Cases since the Petition Date.

Formulation of a chapter 11 plan is the principal purpose of a chapter 11 case. Such plan sets forth the means for satisfying the Claims of Creditors against, and interests of equity security holders in, the debtor.

B. Chapter 11 Plan

After a plan has been filed, the holders of claims against, or equity interests in, a debtor are permitted to vote on whether to accept or reject the plan. Chapter 11 does not require that each holder of a claim against, or equity interest in, a debtor vote in favor of a plan in order for the plan to be confirmed. At a minimum, however, a plan must be accepted by a majority in number and two-thirds in dollar amount of those claims actually voting from at least one class of claims impaired under the plan. The Bankruptcy Code also defines acceptance of a plan by a class of equity interests as acceptance by holders of two-thirds of the number of shares actually voted.

Classes of claims or equity interests that are not “impaired” under a chapter 11 plan are conclusively presumed to have accepted the plan, and therefore are not entitled to vote. A class is “impaired” if the plan modifies the legal, equitable, or contractual rights attaching to the claims or equity interests of that class. Modification for purposes of impairment does not include curing defaults and reinstating maturity or payment in full in cash. Conversely, classes of claims or equity interests that receive or retain no property under a plan of reorganization are conclusively presumed to have rejected the plan, and therefore are not entitled to vote.

7

Even if all classes of claims and equity interests accept a chapter 11 plan, the bankruptcy court may nonetheless deny confirmation. Bankruptcy Code § 1129 sets forth the requirements for confirmation and, among other things, requires that a plan be in the “best interests” of impaired and dissenting Creditors and interest holders and that the plan be feasible. To comply with the “best interests” requirement, the value of the consideration to be distributed to impaired and dissenting Creditors and interest holders under a plan may not be less than those parties would receive if the debtor were liquidated under a hypothetical liquidation occurring under chapter 7 of the Bankruptcy Code. A plan must also be determined to be “feasible,” which generally requires a finding that there is a reasonable probability that the debtor will be able to perform the obligations incurred under the plan and that the debtor will be able to continue operations without the need for further financial reorganization or liquidation.

The bankruptcy court may confirm a chapter 11 plan even though fewer than all of the classes of impaired Claims and equity interests accept it. The bankruptcy court may do so under the “cramdown” provisions of Bankruptcy Code § 1129(b). In order for a plan to be confirmed under the cramdown provisions, despite the rejection of a class of impaired claims or interests, the proponent of the plan must show, among other things, that the plan does not discriminate unfairly and that it is fair and equitable with respect to each impaired class of claims or equity interests that has not accepted the plan.

The bankruptcy court must further find that the economic terms of the particular plan meet the specific requirements of Bankruptcy Code § 1129(b) with respect to the subject objecting class. If the proponent of the plan proposes to seek confirmation of the plan under the provisions of Bankruptcy Code § 1129(b), the proponent must also meet all applicable requirements of § 1129(a) (except § 1129(a)(8)). Those requirements include the requirements that (i) the plan comply with applicable Bankruptcy Code provisions and other applicable law, (ii) that the plan be proposed in good faith, and (iii) that at least one impaired class of Creditors or interest holders has voted to accept the plan.

ARTICLE III.

VOTING PROCEDURES AND CONFIRMATION REQUIREMENTS

A. Ballots and Voting Deadline

Holders of Claims and Interests entitled to vote on the Plan will receive instructions for submitting a Ballot to vote to accept or reject the Plan. After carefully reviewing the Disclosure Statement, including all exhibits, each holder of a Claim or Interest (or its authorized representative) entitled to vote should follow the instructions to indicate its vote on the Ballot. All holders of Claims or Interests (or their authorized representatives) entitled to vote must (i) carefully review the Ballot and the instructions for completing it, (ii) complete all parts of the Ballot, and (iii) submit the Ballot by the deadline (i.e., the Voting Deadline) for the Ballot to be considered. Holders of Claims or Interests entitled to vote must mail the Ballot(s) to Epiq (i.e., the Claims and Balloting Agent) at the following address: if by First Class Mail: Tuesday Morning – Ballot Processing Center c/o Epiq Corporate Restructuring, LLC, P.O. Box 4422, Beaverton, OR 97076-4422; if by Overnight Courier or Overnight Mail: Tuesday Morning – Ballot Processing Center, c/o Epiq Corporate Restructuring, LLC, 10300 SW Allen Boulevard, Beaverton, OR 97005. Holders of Claims or Interests may contact the Claims and Balloting Agent by telephone at (855) 917-3492, or by email at Tuesdaymorninginfo@epiqglobal.com.

8

The Bankruptcy Court has directed that, in order to be counted for voting purposes, Ballots for the acceptance or rejection of the Plan must be received by the Claims and Balloting Agent by no later than November 30, 2020 at 4:00 p.m. prevailing Central Time.

BALLOTS SUBMITTED IN PAPER FORM MUST BE SUBMITTED SO AS TO BE ACTUALLY RECEIVED BY THE CLAIMS AND BALLOTING AGENT NO LATER THAN NOVEMBER 30, 2020 AT 4:00 P.M. PREVAILING CENTRAL TIME. ANY BALLOTS SUBMITTED AFTER THE VOTING DEADLINE WILL NOT BE COUNTED.

B. Voting Procedures for Tuesday Morning Corporation Interests

The Debtors are providing a notice (which contains a link to the Plan, Disclosure Statement, and Disclosure Statement Approval Order, including any amendment, attachment, exhibit, or supplement related thereto) and related materials and a Ballot (i.e., the Solicitation Materials) to record holders (as of the Voting Record Date) of the Claims in Classes 1 through 6.

Record holders of Tuesday Morning Corporation Interests may include Nominees. Nominees may hold such claims as beneficial holders or may be record holders holding such Claims for their beneficial holder in “street name.” The Debtors propose the procedures below regarding Nominees and beneficial holders of the Tuesday Morning Interests. Such holders shall have Tuesday Morning Corporation Interests in Class 8.

Any holder of Tuesday Morning Corporation Interests will receive a Ballot allowing such holder to vote its Allowed Tuesday Morning Corporation Interests. Each beneficial holder of Tuesday Morning Corporation Interests must submit its own Ballot as described below.

| 1. | Beneficial Holder who is also a Record Holder |

A beneficial holder who holds Tuesday Morning Corporation Interests as a record holder in its own name should vote on the Plan by completing and signing the Beneficial Holder Ballot and returning it directly to the Claims and Balloting Agent on or before the Voting Deadline using the enclosed self-addressed, postage-paid envelope.

| 2. | Nominees |

A Nominee that, on the Voting Record Date, is the record holder of Tuesday Morning Corporation Interests for one or more beneficial holders shall obtain the votes of the beneficial holders, consistent with customary practices for obtaining the votes of securities held in “street name.” The Nominee shall forward to the beneficial holder of Tuesday Morning Corporation Interests Beneficial Holder Ballots, together with the Solicitation Materials, a pre-addressed, postage-paid return envelope provided by, and addressed to, the Nominee, and other materials requested to be forwarded by the Debtors. Each such beneficial holder must then indicate its vote on the Beneficial Holder Ballot, complete the information requested on the Beneficial Holder Ballot, review the certifications contained on the Beneficial Holder Ballot, execute the Beneficial Holder Ballot, and return the Beneficial Holder Ballot to the Nominee. After collecting the Beneficial Holder Ballots, the Nominee should, in turn, complete a Master Ballot compiling the votes and other information from the Beneficial Holder Ballots, execute the Master Ballot, and deliver the Master Ballot to the Claims and Balloting Agent so that it is received by the Claims and Balloting Agent on or before the Voting Deadline. All copies of Beneficial Holder Ballots returned by beneficial holders should be kept by the Nominee for one year after the Voting Deadline. Nominees may transmit all documents to record holders electronically in accordance with their customary practice.

9

| 3. | Beneficial Holder who holds in “Street Name” through a Nominee |

A beneficial holder who holds Tuesday Morning Corporation Interests in “street name” through a Nominee may indicate its vote on the Beneficial Holder Ballot, complete the information requested on the Beneficial Holder Ballot, review the certifications contained on the Beneficial Holder Ballot, execute the Beneficial Holder Ballot, and return the Beneficial Holder Ballot to the Nominee as promptly as possible and in sufficient time to allow the Nominee to process and return a completed Master Ballot to the Claims and Balloting Agent by the Voting Deadline. The beneficial holder must comply with the Nominee’s deadline by which to return the Beneficial Holder Ballot to the Nominee.

Any Beneficial Holder Ballot returned to a Nominee by a beneficial holder will not be counted for purposes of acceptance or rejection of the Plan until such Nominee properly and timely completes and delivers to the Claims and Balloting Agent a Master Ballot casting the vote of such beneficial holder.

| 4. | Beneficial Holder who holds in “Street Name” through multiple Nominees |

If any beneficial holder holds Tuesday Morning Corporation Interests through more than one Nominee, such beneficial holder may receive multiple mailings containing the Beneficial Holder Ballots. The beneficial holder shall execute a separate Beneficial Holder Ballot for each block of the Tuesday Morning Corporation Interests that it holds through any particular Nominee and return each Beneficial Holder Ballot to the respective Nominee in the return envelope provided therewith (or otherwise follow each Nominee’s instructions). Beneficial holders who execute multiple Beneficial Holder Ballots with respect to Tuesday Morning Corporation Interests held through more than one Nominee must indicate on each Beneficial Holder Ballot the names of all such other Nominees and the additional amounts of such Tuesday Morning Corporation Interests so held and voted. A beneficial holder who executes multiple Beneficial Holder Ballots must vote the same on each Beneficial Holder Ballot for the votes to be counted.

C. Holders of Claims Entitled to Vote

Any holder of a Claim of the Debtors whose Claim is Impaired under the Plan is entitled to vote if either (i) the Claim has been listed in the Schedules of Assets and Liabilities in an amount greater than zero (and the Claim is not scheduled as disputed, contingent, or unliquidated) or (ii) the holder of a Claim has Filed a Proof of Claim (that is not contingent or in an unknown amount) on or before the Voting Record Date.

Any holder of a Claim as to which an objection has been Filed (and such objection is still pending) is not entitled to vote, unless the Bankruptcy Court (on motion by a party whose Claim is subject to an objection) temporarily allows the Claim in an amount that it deems proper for the purpose of accepting or rejecting the Plan. Such motion must be heard and determined by the Bankruptcy Court on or before the Voting Deadline.

10

In addition, a vote may be disregarded if the Bankruptcy Court determines that the acceptance or rejection was not solicited or procured in good faith or in accordance with the applicable provisions of the Bankruptcy Code.

D. Definition of Impairment

Under Bankruptcy Code § 1124, a class of Claims or equity interests is impaired under a chapter 11 plan unless, with respect to each Claim or equity interest of such class, the plan:

| (1) | leaves unaltered the legal, equitable, and contractual rights to which such Claim or interest entitles the holder of such Claim or interest; or |

| (2) | notwithstanding any contractual provision or applicable law that entitles the holder of such Claim or interest to demand or receive accelerated payment of such Claim or interest after the occurrence of a default: |

| (a) | cures any such default that occurred before or after the commencement of the case under this title, other than a default of a kind specified in Bankruptcy Code § 365(b)(2) or of a kind that § 365(b)(2) expressly does not require to be cured; |

| (b) | reinstates the maturity of such Claim or interest as such maturity existed before such default; |

| (c) | compensates the holder of such Claim or interest for any damages incurred as a result of any reasonable reliance by such holder on such contractual provision or such applicable law; |

| (d) | if such Claim or such interest arises from any failure to perform a nonmonetary obligation, other than a default arising from failure to operate a nonresidential real property lease subject to Bankruptcy Code § 365(b)(1)(A), compensates the holder of such Claim or such interest (other than the debtor or an insider) for any actual pecuniary loss incurred by such holder as a result of such failure; and |

| (e) | does not otherwise alter the legal, equitable, or contractual rights to which such Claim or interest entitles the holder of such Claim or interest. |

E. Classes Impaired or Unimpaired Under the Plan

Classes 1, 2, 3, 4, 5, 6, and 8 are Impaired under the Plan. Therefore, holders of Claims in Classes 1, 2, 3, 4, 5, 6, and 8 are eligible, subject to the voting requirements described above, to vote to accept or reject the Plan.

11

Classes 1, 2, 3, 4, 5, 6, and 8 are Impaired because one or more of the proposed potential alternative treatments of Classes 1, 2, 3, 4, 5, 6, and 8 alters the legal, equitable, or contractual rights of holders of Allowed Claims in such Classes.

Class 7 may be Impaired or Unimpaired, based on the treatment provided to such holders at the option of the Debtors. To the extent that such holders of Claims are Impaired, such holders will not receive a distribution under the Plan and, therefore, will be conclusively presumed to reject the Plan pursuant to Bankruptcy Code § 1126(g). To the extent that such holders of Claims are Unimpaired, such holders will have their Claims Reinstated, and, therefore, will be conclusively presumed to accept the Plan pursuant to Bankruptcy Code § 1126(f).

Interests in Class 9 are Unimpaired because holders of Interests in Class 9 will have their Interests Reinstated, and, therefore, will be conclusively presumed to accept the Plan and will not be entitled to vote on the Plan pursuant to Bankruptcy Code § 1126(f).

F. Information on Voting and Vote Tabulations

| 1. | Transmission of Ballots to Holders of Claims and Interests |

Instructions for completing and submitting Ballots are being provided to all holders of Claims entitled to vote on the Plan in accordance with the Bankruptcy Rules. Those holders of Claims or Interests whose Claims or Interests are Unimpaired under the Plan are conclusively presumed to have accepted the Plan under Bankruptcy Code § 1126(f), and therefore need not vote with regard to the Plan. Under Bankruptcy Code § 1126(g), holders of Claims or Interests who do not either receive or retain any property under the Plan are deemed to have rejected the Plan. In the event a holder of a Claim or Interest does not vote, the Bankruptcy Court may deem such holder of a Claim or Interest to have accepted the Plan.

| 2. | Ballot Tabulation Procedures |

The Claims and Balloting Agent shall count all Ballots filed on account of (1) Claims in the Schedules of Assets and Liabilities, that are not listed as contingent, unliquidated or disputed, and are listed in an amount in excess of $0.00; and (2) Proofs of Claim Filed by the Voting Record Date that are not asserted as contingent or unliquidated, and are asserted in an amount in excess of $0.00. If no Claim is listed in the Schedules of Assets or Liabilities, and no Proof of Claim is Filed by the Voting Record Date, such Creditor shall not be entitled to vote on the Plan on account of such Claim, subject to the procedures below. Further, the Claims and Balloting Agent shall not count any votes on account of Claims that are subject to an objection which has been Filed (and such objection is still pending), unless and to the extent the Court has overruled such objection by the Voting Record Date. The foregoing general procedures will be subject to the following exceptions and clarifications:

| (a) | if a Claim is Allowed under the Plan or by order of the Court, such Claim is Allowed for voting purposes in the Allowed amount set forth in the Plan or the order; |

| (b) | if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is not listed or asserted as contingent, unliquidated, or disputed, and is listed or asserted in an amount in excess of $0.00, such Claim is temporarily Allowed for voting purposes in the amount set forth in the Debtors’ Schedules of Assets and Liabilities or as asserted in the Proof of Claim; |

12

| (c) | if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is only partially listed or asserted as contingent, unliquidated, or disputed, such Claim is temporarily Allowed for voting purposes only in the amount not listed or asserted as contingent, unliquidated or disputed in the Debtors’ Schedules of Assets and Liabilities or in the Proof of Claim; |

| (d) | if a Claim is listed in the Debtors’ Schedules of Assets and Liabilities or a Proof of Claim is timely Filed by the Voting Record Date, and such Claim is listed or asserted as contingent, unliquidated, or disputed, or is listed or asserted for $0.00 or an undetermined amount, such Claim shall not be counted for voting purposes; |

| (e) | if a Claim is not listed in the Debtors’ Schedules of Assets and Liabilities and a Proof of Claim is Filed after the Voting Record Date, such Claim is temporarily Allowed for voting purposes only if such Creditor obtains an order of the Court temporarily allowing the Claim for voting purposes prior to the Voting Deadline; |

| (f) | any Claim to which there remains a pending objection as of the Voting Deadline, or an order has been entered granting such objection, such Claim shall not be counted for voting purposes; |

| (g) | if a Creditor has Filed duplicate Proofs of Claim by the Voting Record Date against one or more Debtors, such Creditor’s Claim shall only be counted once for the Debtor at which the Creditor’s Claim is pending for voting purposes unless the Debtors determine there is a Claim pending against multiple Debtors; and |

| (h) | if a Proof of Claim has been amended by a later-Filed Proof of Claim, the earlier-Filed Claim will not be entitled to vote, and to the extent the later-Filed Proof of Claim is filed after the Voting Record Date, such later-Filed Proof of Claim must have been temporarily allowed for voting purposes by the Voting Record Date to be counted. |

The following procedures shall apply for tabulating votes:

| (a) | any Ballot that is otherwise timely completed, executed, and properly cast to the Claims and Balloting Agent but does not indicate an acceptance or rejection of the Plan, or that indicates both an acceptance and rejection of the Plan, shall not be counted; if no votes to accept or reject the Plan are received with respect to a particular Class that is entitled to vote on the Plan, such Class shall be deemed to have voted to accept the Plan; |

13

| (b) | a Creditor who holds Claims in Classes 5 or 6 against more than one Debtor, shall cast a single Ballot, which shall be counted separately with respect to each such Debtor; |

| (c) | if a Creditor casts more than one (1) Ballot voting the same Claim before the Voting Deadline, the last properly cast Ballot received before the Voting Deadline shall be deemed to reflect the voter’s intent and thus supersede any prior Ballots; |

| (d) | Creditors must vote all of their Claims within a particular Class to either accept or reject the Plan, and may not split their votes within a particular Class and thus a Ballot (or group of Ballots) within a particular Class that partially accepts and partially rejects the Plan shall not be counted; |

| (e) | a Creditor who votes an amount related to a Claim that has been paid or otherwise satisfied in full or in part shall only be counted for the amount that remains unpaid or not satisfied, and if such Claim has been fully paid or otherwise satisfied, such vote will not be counted for purposes of amount or number; and |

| (f) | for purposes of determining whether the numerosity and amount requirements of Bankruptcy Code §§ 1126(c) and 1126(d) have been satisfied, the Debtors will tabulate only those Ballots received by the Voting Deadline. For purposes of the numerosity requirement of Bankruptcy Code § 1126(c), separate Claims held by a single Creditor in a particular Class shall be aggregated as if such Creditor held one (1) Claim against the Debtors in such Class, and the votes related to such Claims shall be treated as a single vote to accept or reject the Plan. |

The following Ballots shall not be counted or considered for any purpose in determining whether the Plan has been accepted or rejected:

| (a) | any Ballot received after the Voting Deadline, unless the Debtors, in their discretion, grant an extension of the Voting Deadline with respect to such Ballot; |

| (b) | any Ballot that is illegible or contains insufficient information to permit identification of the voter; |

| (c) | any Ballot cast by a Person that does not hold a Claim or Interest in a Class that is entitled to vote to accept or reject the Plan; |

| (d) | any duplicate Ballot will only be counted once; |

14

| (e) | any unsigned Ballot or paper Ballot that does not contain an original signature; and |

| (f) | any Ballot transmitted to the Claims and Balloting Agent by facsimile or electronic mail, unless the Debtors, in their discretion, consent to such delivery method. |

| 3. | Execution of Ballots by Representatives |

To the extent applicable, if a Ballot is submitted by trustees, executors, Nominees, administrators, guardians, attorneys-in-fact, officers of corporations, or others acting in a fiduciary or representative capacity, such Persons must indicate their capacity when submitting the Ballot and, at the Debtors’ request, must submit proper evidence satisfactory to the Debtors of their authority to so act. For purposes of voting tabulation, a Ballot submitted by a representative shall account for the total number of represented parties with respect to the numerosity requirement set forth in this Article.

| 4. | Waivers of Defects and Other Irregularities Regarding Ballots |

Unless otherwise directed by the Bankruptcy Court, all questions concerning the validity, form, eligibility (including time of receipt), acceptance, and revocation or withdrawal of Ballots will be determined by the Debtors in their sole discretion, whose determination will be final and binding. The Debtors reserve the right to reject any and all Ballots not in proper form, the acceptance of which would, in the opinion of the Debtors or their counsel, be unlawful. The Debtors further reserve the right to waive any defects or irregularities or conditions of delivery as to any particular Ballot. Unless waived, any defects or irregularities in connection with deliveries of Ballots must be cured within such time as the Debtors (or the Bankruptcy Court) determine. Neither the Debtors nor any other Person will be under any duty to provide notification of defects or irregularities with respect to deliveries of Ballots, nor will any of them incur any liability for failure to provide such notification; provided, however, that the Debtors will indicate on the ballot summary the Ballots, if any, that were not counted, and will provide copies of such Ballots with the ballot summary to be submitted at the Confirmation Hearing. Unless otherwise directed by the Bankruptcy Court, delivery of such Ballots will not be deemed to have been made until any irregularities have been cured or waived. Unless otherwise directed by the Bankruptcy Court, Ballots previously furnished, and as to which any irregularities have not subsequently been cured or waived, will be invalidated.

| 5. | Withdrawal of Ballots and Revocation |

The Debtors may allow any claimant who submits a properly completed Ballot to supersede or withdraw such Ballot on or before the Voting Deadline. In the event the Debtors do permit such supersession or withdrawal, the claimant, for cause, may change or withdraw its acceptance or rejection of the Plan in accordance with Bankruptcy Rule 3018(a).

15

G. Confirmation of Plan

| 1. | Solicitation of Acceptances |

The Debtors are soliciting your vote.

NO REPRESENTATIONS OR ASSURANCES, IF ANY, CONCERNING THE DEBTORS OR THE PLAN ARE AUTHORIZED BY THE DEBTORS, OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT. ANY REPRESENTATIONS OR INDUCEMENTS MADE BY ANY PERSON TO SECURE YOUR VOTE, OTHER THAN THOSE CONTAINED IN THIS DISCLOSURE STATEMENT, SHOULD NOT BE RELIED ON BY YOU IN ARRIVING AT YOUR DECISION, AND SUCH ADDITIONAL REPRESENTATIONS OR INDUCEMENTS SHOULD BE REPORTED TO DEBTORS’ COUNSEL FOR APPROPRIATE ACTION.

THIS IS A SOLICITATION SOLELY BY THE DEBTORS, AND IS NOT A SOLICITATION BY ANY SHAREHOLDER, ATTORNEY, ACCOUNTANT, OR OTHER PROFESSIONAL FOR THE DEBTORS. THE REPRESENTATIONS, IF ANY, MADE IN THIS DISCLOSURE STATEMENT ARE THOSE OF THE DEBTORS AND NOT OF SUCH SHAREHOLDERS, ATTORNEYS, ACCOUNTANTS, OR OTHER PROFESSIONALS, EXCEPT AS MAY BE OTHERWISE SPECIFICALLY AND EXPRESSLY INDICATED.

| 2. | Requirements for Confirmation of the Plan |

At the Confirmation Hearing, the Bankruptcy Court shall determine whether the requirements of Bankruptcy Code § 1129 have been satisfied, in which event the Bankruptcy Court shall enter an order confirming the Plan. The Debtors believe that the Plan satisfies all the statutory requirements of the Bankruptcy Code for confirmation because, among other things:

| (a) | The Plan complies with the applicable provisions of the Bankruptcy Code; |

| (b) | The Debtors have complied with the applicable provisions of the Bankruptcy Code; |

| (c) | The Plan has been proposed in good faith and not by any means forbidden by law; |

| (d) | Any payment or distribution made or promised by the Debtors or by a Person issuing securities or acquiring property under the Plan for services or for costs and expenses in connection with the Plan has been disclosed to the Bankruptcy Court, and any such payment made before the confirmation of the Plan is reasonable, or if such payment is to be fixed after confirmation of the Plan, such payment is subject to the approval of the Bankruptcy Court as reasonable; |

| (e) | The Debtors will have disclosed the identity and affiliation of any individual proposed to serve, after confirmation of the Plan, as a director, officer or voting trustee of the Debtors, an affiliate of the Debtors participating in a joint plan with the Debtors, or a successor to the Debtors under the Plan; the appointment to, or continuance in, such office of such individual is consistent with the interests of holders of Claims and Interests and with public policy; |

16

| (f) | Any government regulatory commission with jurisdiction (after confirmation of the Plan) over the rates of the Debtors has approved any rate change provided for in the Plan, or such rate change is expressly conditioned on such approval; |

| (g) | With respect to each Impaired Class of Claims or Interests, either each holder of a Claim or Interest of the Class will have accepted the Plan, or will receive or retain under the Plan on account of that Claim or Interest, property of a value, as of the Effective Date, that is not less than the amount that such holder would so receive or retain if the Debtors were liquidated on such date under chapter 7 of the Bankruptcy Code. If Bankruptcy Code § 1111(b)(2) applies to the Claims of a Class, each holder of a Claim of that Class will receive or retain under the Plan on account of that Claim property of a value, as of the Effective Date, that is not less than the value of that holder’s interest in the Debtors’ interest in the property that secures that Claim; |

| (h) | Each Class of Claims or Interests will have accepted the Plan or is not Impaired under the Plan, subject to the Debtors’ right to seek cramdown of the Plan under Bankruptcy Code § 1129(b); |

| (i) | Except to the extent that the holder of a particular Claim has agreed to a different treatment of such Claim, the Plan provides that administrative expenses and priority Claims, other than Priority Unsecured Tax Claims, will be paid in full on the Effective Date or as soon as reasonably practicable thereafter (or if a Claim is not an Allowed Claim on the Effective Date, on the date that such Claim becomes an Allowed Claim, or as soon as reasonably practicable thereafter), and that Priority Unsecured Tax Claims will receive either payment in full on the Effective Date or as soon as reasonably practical thereafter, or deferred cash payments over a period not exceeding five years after the Petition Date, of a value, as of the Effective Date of the Plan, equal to the Allowed amount of such Claims; |

| (j) | With respect to an Other Secured Claim, the holder of that Claim will receive on account of such Claim either (i) a payment equal to 100% of its Allowed Class 2 Claim in Cash on the Effective Date; (ii) the collateral securing its Allowed Class 2 Claim; provided, however, any collateral remaining after satisfaction of such Allowed Class 2 Claim shall re-vest in the applicable Reorganized Debtor pursuant to the Plan, or (iii) Reinstatement of its Allowed Class 2 Claim; |

| (k) | If a Class of Claims or Interests is Impaired under the Plan, at least one such Class of Claims or Interests will have accepted the Plan, determined without including any acceptance of the Plan by any insider holding a Claim or Interest of that Class; |

17

| (l) | Confirmation of the Plan is not likely to be followed by the liquidation or the need for further financial reorganization of the Debtors or any successor to the Debtors under the Plan, unless such liquidation or reorganization is proposed in the Plan; |

| (m) | All court fees, as determined by the Bankruptcy Court at the Confirmation Hearing, will have been paid or the Plan provides for the payment of such fees on the Effective Date; and |

| (n) | The Plan provides that all transfers of property shall be made in accordance with applicable provisions of nonbankruptcy law that govern the transfer of property by a corporation or trust that is not a moneyed, business, or commercial corporation or trust. |

The Debtors assert that they have proposed the Plan in good faith and they believe that they have complied, or will have complied, with all the requirements of the Bankruptcy Code governing confirmation of the Plan.

| 3. | Acceptances Necessary to Confirm the Plan |

Voting on the Plan by each holder of an Impaired Claim or Interest (or its authorized representative) is important. Chapter 11 of the Bankruptcy Code does not require that each holder of a Claim or Interest vote in favor of the Plan in order for the Bankruptcy Court to confirm the Plan. Generally, under the acceptance provisions of Bankruptcy Code § 1126(a), each Class of Claims or Interests has accepted the Plan if holders of at least two-thirds in dollar amount and more than one-half in number of the Allowed Claims of such Class actually voting in connection with the Plan vote to accept the Plan. With regard to a Class of Interests, more than two-thirds of the shares actually voted must accept to bind that Class. Even if all Classes of Claims and Interests accept the Plan, the Bankruptcy Court may refuse to confirm the Plan.

| 4. | Cramdown |

In the event that any Impaired Class of Claims or Interests does not accept the Plan, the Bankruptcy Court may still confirm the Plan at the request of the Debtors if, as to each Impaired Class that has not accepted the Plan, the Plan “does not discriminate unfairly” and is “fair and equitable.” A chapter 11 plan does not discriminate unfairly within the meaning of the Bankruptcy Code if no Class receives more than it is legally entitled to receive for its Claims or Interests. “Fair and equitable” has different meanings for holders of secured and unsecured Claims and Interests.

With respect to a Secured Claim, “fair and equitable” means either (i) the Impaired secured Creditor retains its Liens to the extent of its Allowed Claim and receives deferred Cash payments at least equal to the allowed amount of its Claims with a present value as of the effective date of the plan at least equal to the value of such Creditor’s interest in the property securing its Liens; (ii) property subject to the Lien of the Impaired secured Creditor is sold free and clear of that Lien, with that Lien attaching to the proceeds of sale, and such Lien proceeds must be treated in accordance with clauses (i) and (iii) hereof; or (iii) the Impaired secured Creditor realizes the “indubitable equivalent” of its Claim under the plan.

18

With respect to an Unsecured Claim, “fair and equitable” means either (i) each Impaired Creditor receives or retains property of a value equal to the amount of its Allowed Claim or (ii) the holders of Claims and Interests that are junior to the Claims of the dissenting class will not receive any property under the Plan.

With respect to Interests, “fair and equitable” means either (i) each Impaired Interest receives or retains, on account of that Interest, property of a value equal to the greater of the allowed amount of any fixed liquidation preference to which the holder is entitled, any fixed redemption price to which the holder is entitled, or the value of the Interest, or (ii) the holder of any Interest that is junior to the Interest of that Class will not receive or retain under the Plan, on account of that junior equity interest, any property.

The Debtors believe that the Plan does not discriminate unfairly and is fair and equitable with respect to each impaired Class of Claims and Interests. In the event at least one Class of Impaired Claims or Interests rejects or is deemed to have rejected the Plan, the Bankruptcy Court will determine at the Confirmation Hearing whether the Plan is fair and equitable and does not discriminate unfairly against any rejecting Impaired Class of Claims or Interests.

| 5. | Conditions Precedent to Confirmation and Effectiveness of the Plan |

In addition to the requirements of the Bankruptcy Code, Article IX of the Plan contains certain conditions to confirmation and effectiveness of the Plan.

ARTICLE IV.

BACKGROUND OF THE DEBTORS

A. Description of Debtors’ Businesses

| 1. | History |

The Debtors operate under the trade name “Tuesday Morning” and are one of the original “off-price” retailers specializing in providing unique home and lifestyle goods at bargain values. Tuesday Morning was founded in Dallas, Texas in 1974 by Lloyd Ross. Under the original business model, Mr. Ross purchased leftover inventory from name-brand manufacturers and retailers and then sold it from a single warehouse in Dallas in a “garage-sale” format. The first such sale was conducted on a Tuesday morning, because Mr. Lloyd considered that to be the first positive part of the week, and the name stuck even as the business grew beyond its original warehouse format. The business quickly expanded from the Tuesday morning “garage sale” format to a “pop-up shop” format with four six-week sales a year, to the establishment of the first permanent Tuesday Morning store location in 1979.

By 1984 the company had grown to 57 stores and was taken public for the first time. In 1997, the company had expanded to 315 locations and was acquired in a private acquisition by Madison Dearborn. Two years later in 1999, with 354 stores, Tuesday Morning again went public and has been publicly-traded ever since. As of the Petition Date, the common stock of Tuesday Morning Corporation traded on the NASDAQ under the trading symbol “TUES”.4 The Debtors also operate a primary distribution facility in Dallas, Texas. The Debtors’ corporate offices are located in Dallas, Texas.

19

| 2. | The Debtors’ Business Operations |

The Debtors operate one of the premier off-price retailers in the U.S. and specialize in selling high-quality products at prices generally below the prices in department stores, specialty shops, and online retailers. The Debtors’ in-store inventory generally falls within the following key categories: upscale home textiles, home furnishings, housewares, gourmet food, toys, and seasonal décor. The Debtors’ revenues come from direct in-store sales.

| (a) | The Debtors’ Business Model and Geographic Footprint |

The Debtors’ business model is focused on making opportunistic inventory purchases from various sources including manufacturers, closeout sellers, and other retailers, and re-selling the inventory at discount prices. The Debtors are known in the industry as a reliable outlet for manufacturers, distributors, and other retailers who need to sell excess inventory resulting from manufacturing overruns, bankruptcies, order cancellations, or other unanticipated circumstances. The Debtors also direct-order certain of their products from manufacturers or secondary distributors.

Through creative sourcing, the Debtors are able to offer high-quality goods to their own customers at discounted prices. The Debtors’ ability to consistently provide their customers with high quality at bargain prices has allowed the Debtors’ to establish a loyal customer base. In recent years, the Debtors have worked to improve the in-store experience for customers by offering a clean, simple, no-frills environment. As part of their improvement strategy, the Debtors have also focused on closing less productive locations and seeking opportunities in more desirable locations with increased square footage, improved lighting, and more appealing fixtures.

On the Petition Date the Debtors operated 687 stores in 40 states and distribution centers in Phoenix and Dallas. The Debtors’ largest store concentrations are in Texas, Florida, California, Virginia, Georgia, and North Carolina. Since filing, the Debtors have commenced store closing sales at approximately 200 store locations and have closed their Phoenix distribution facility.

| (b) | The Debtors Supply and Distribution Chain |

The Debtors have historically sourced approximately 80% of their inventory from U.S. vendors and the remaining 20% from foreign vendors. As an off-price retailer, the majority of the Debtors’ inventory acquisitions are opportunistic. However, the Debtors have cultivated long-standing relationships with many key vendors and are at the top of their vendors’ list for buyers in off-price transactions. The Debtors also direct-source a smaller percentage of their inventory from certain vendors and/or manufacturers. The Debtors’ expert merchant team is responsible for keeping and maintaining relationships with the Debtors’ broad vendor base. The Debtors’ relationships with their vendors, as well as the Tuesday Morning reputation in the market as a preferred off-price inventory buyer, is crucial to the Debtors’ ongoing success.

4 As discussed more fully in Section V.C of the Disclosure Statement, Tuesday Morning Corporation’s common stock has been suspended from trading and delisted from the NASDAQ and currently trades over the counter in the OTC Pink Market under the symbol “TUESQ”.

20

Once inventory has been purchased, the Debtors rely on their distribution chain to facilitate inventory deliveries in a timely and cost-effective manner. In addition to the Debtors’ owned distribution center in Dallas, the Debtors also contract with various third-party logistics providers that provide transportation and warehousing services. One of the Debtors’ key initiatives in recent years has been improving supply-chain efficiency. Improving efficiency allows the Debtors to reduce costs and the time between inventory purchases and in-store placement. The Debtors’ prepetition improvements in this area have further strengthened relationships with suppliers by simplifying the purchase and acquisition process and incentivizing the Debtors’ suppliers to come to the Debtors first to liquidate excess inventory. The Debtors anticipate that the planned reduction in store count will create further supply-chain efficiencies.

| (c) | The Debtors’ Peak Sales and Distribution Season |

Like many retailers, the Debtors’ peak sales season generally occurs in the quarter ending in December. During the peak selling season, the Debtors experience strong revenues that substantially exceed the Debtors’ fixed and variable costs. The Debtors also have a peak distribution season which typically spans from June through November. During the peak distribution season, the Debtors are focused on sourcing, shipping, and warehousing key inventory to supply the increased customer demand during the peak selling season.

| (d) | The Debtors’ Cost Structure |

Like most businesses, the Debtors’ cost structure is comprised of certain fixed and variable costs. The Debtors’ largest expense categories are employee-related costs, inventory costs, the costs of shipping and delivering inventory, and costs associated with the Debtors’ real estate leases and similar arrangements. Other key expense categories include taxes, advertising, insurance, and other miscellaneous items. Due to the seasonal nature of the retail industry, the Debtors’ costs fluctuate in certain key categories depending on the time of year.

On the Petition Date, the Debtors employed approximately 1,858 individuals on a full-time basis and 7,151 individuals on a part time basis. Once the Debtors have closed the approximately 200 stores they have either closed or intend to close, the number of the Debtors’ employees will be significantly reduced. Most of the Debtors’ employees work at the Debtors’ stores and the Debtors’ remaining employees primarily work at the Dallas distribution center or the Debtors’ corporate office. During the Debtors’ peak sales season in November and December, the Debtors typically increase their employee headcount in their stores. Similarly, during the peak distribution season the Debtors typically increase their employee headcount in their Dallas distribution center. The Debtors satisfy these seasonal needs by hiring a combination of part-time employees and temporary staff that are typically sourced through a staffing agency. In addition to paying employee wages and salaries, the Debtors also contribute to a number of employee benefit plans providing medical, pharmacy, and other ancillary benefits to qualifying employees. The Debtors’ payroll and other benefit obligations for their employees constitute one of the Debtors’ largest expense categories.

21

The Debtors own the real property associated with the Dallas distribution center and their corporate offices but lease all of their store locations (other than Store 3 at the Dallas distribution center). One of the Debtors’ largest expense categories is the cost of leasing and otherwise renting space at the stores. Prior to the Petition Date, the Debtors’ average monthly lease obligations were approximately $10 million per month. The Debtors have negotiated with many of their landlords and through those negotiations have obtained a reduction in the monthly rent obligations in connection with many of their leases, subject to assumption of leases. Those negotiated reductions, plus the closure of approximately 200 stores will result in considerable cost savings for the Debtors’ business on a go-forward basis. Other than employee-related costs and lease expenses, the Debtors’ most significant expenses are the costs of acquiring and transporting inventory.

22

B. Corporate Information

| 1. | The Debtors’ Corporate Structure |

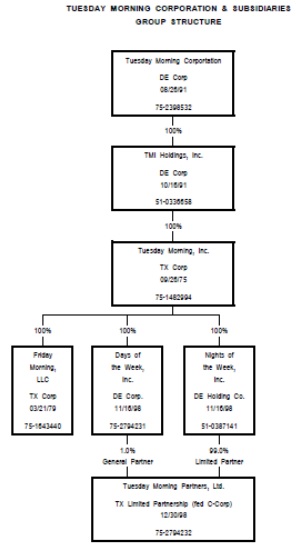

The chart below depicts the Debtors’ current corporate structure.

| 2. | Relationship of Debtors and Description of Operations |

Tuesday Morning Corporation (“TM Corp.”) is the parent corporation of TMI Holdings. All other Tuesday Morning legal entities operate below TMI Holdings. TM Corp. is otherwise inactive in all taxing jurisdictions. The common stock in Debtor Tuesday Morning Corporation was traded on the NASDAQ under the symbol “TUES” until June 8, 2020 when trading was suspended. The Tuesday Morning Corporation common stock has since been delisted from the NASDAQ and currently trades over the counter in the OTC Pink Market under the symbol “TUESQ”.

23

TMI Holdings, Inc. (“TMI Holdings”) is an intermediate holding company and is the parent corporation of TMI. TMI Holdings is otherwise inactive in all taxing jurisdictions.

Tuesday Morning, Inc. (“TMI”) is a wholly-owned subsidiary of TMI Holdings. TMI indirectly owns a combined 100 percent interest in TMP (defined below) through its subsidiaries DOTW and NOTW (defined below). TMI functions as an operator of the Tuesday Morning stores and also performs certain strategic functions such as site selection, lease management, advertising, and senior management guidance.

Days of the Week, Inc. (“DOTW”) is a wholly owned subsidiary of TMI and is the general partner of TMP.

Nights of the Week, Inc. (“NOTW”) is a wholly owned subsidiary of TMI and is the limited partner of TMP.

Tuesday Morning Partners, Ltd. (“TMP”) is a limited partnership. TMP is 1-percent owned by DOTW (its general partner) and 99-percent owned by NOTW (its limited partner). TMP provides operational and strategic services to TMI, including merchandising, store design and lay-out, sales planning and allocation, warehousing, and logistics.

Friday Morning, LLC (“FM LLC”) owns the real property associated with the Dallas Distribution Center and the Tuesday Morning corporate offices. Additionally, FM LLC (i) issues and sells prepaid and stored value cards and similar items (in paper, plastic, electronic or other format) that can be redeemed by owners of such cards for the purchase of merchandise and/or services at Tuesday Morning stores and (ii) provides services related to the management and operation of prepaid and stored value card programs, including card processing, manufacturing and regulatory compliance services.

| 3. | Debtors’ Board of Directors and Management |

As of the Petition Date, the following individuals were officers and directors of Tuesday Morning Corporation:

Officers

| Name | Title |

| Steven Becker | Chief Executive Officer |

| Stacie Shirley | Chief Financial Officer |

| Phillip Hixon | Executive Vice President, Store Operations |

| Bridgett Zeterberg | General Counsel |

| Catherine Davis | Senior Vice President, Marketing |

24

Directors

| Name | Title |

| Terry Burman | Chairman of the Board |

| Steven Becker | Director |

| James Corcoran | Director |

| Barry Gluck | Director |

| Frank Hamlin | Director |

| Reuben Slone | Director |

| Sherry Smith | Director |

| Richard Willis | Director |

C. Events Leading to the Chapter 11 Cases

| 1. | COVID-19 Related Disruptions and Store Closures |

The key driver for the filing of the Debtors’ Chapter 11 Cases is the COVID-19 pandemic and its related fallout. In March 2020, all of the Debtors’ stores, along with the Debtors’ distribution centers, corporate headquarters, and critical components of the Debtors’ distribution chain, including certain facilities operated by the Debtors’ third party logistics providers, were forced to close due to a combination of health and safety concerns for employees and customers, supply chain disruptions, and government rules and regulations intended to stop or otherwise slow the spread of COVID-19.

The impact of COVID-19 on the Debtors’, their employees, their customers, and many of their vendors and other service providers has imposed unprecedented operational and financial strains on the Debtors and their business. The Debtors do not have an online presence and rely exclusively on in-store sales, and the fallout from COVID-19 resulted in a total cessation of new revenue beginning in March 2020. To address this precipitous decline in revenue, the Debtors immediately began to implement cost-saving measures and to seek alternative sources of liquidity.

Despite the Debtors’ best efforts to control costs, conserve cash, and obtain additional funding, the impact of the pandemic was devastating to the Debtors’ financial status by cutting off the Debtors’ revenues, diminishing the Debtors’ assets, and significantly increasing the Debtors’ liabilities.

| 2. | Employee Furloughs |

The near-cessation of business operations resulting from COVID-19 substantially decreased the Debtors’ labor demands, and the Debtors furloughed most of their store employees, distribution center employees, and many employees working in the Debtors’ corporate headquarters. By furloughing over 95% of their employees, the Debtors were able to materially reduce their operating costs. However, the Debtors still incurred significant COVID-19 related employee costs without the benefit of offsetting sales revenues. For example, even though the Debtors ceased operations during the month of March, the Debtors determined that it was critical to pay benefits for their employees through the end of May or until the Furlough ended. The Debtors also continued to incur costs and obligations in connection with various employee benefit plans, including insurance premiums, claims administration, and other administrative expenses, in order to keep the infrastructure in place to allow the Debtors’ to quickly recommence operations, when appropriate.

25

| 3. | Negotiations with Landlords |

Rent on the majority of the Debtors’ leases comes due on the first day of each month and is applied to the month in which the rent is paid – i.e. a March 1 rent payment covers the Debtors’ rent obligation for the month of March. The Debtors were current on their March lease obligations when the March closures occurred. By April 1, 2020, when the Debtors’ April rent obligations generally became due, the Debtors had closed all of their leased locations. Moreover, by April 1, 2020, the Debtors, like many other retail businesses, were in a severe liquidity crisis due to the store closings and associated cessation of revenues.