Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GENERAL CANNABIS CORP | tm2031548-1_8k.htm |

Exhibit 99.1

|

GENERAL CANNABIS September 2020 |

|

Forward Looking Statement Disclaimer This presentation contains forward-looking statements within the meaning of the federal securities laws including statements related to our expectations about future developments in the regulated cannabis industry and markets, future products and services we anticipate providing, our future plans, our expectations regarding new businesses and markets in which we may expand and future acquisitions, our expec tations regarding improving retail performance, and any statements or assumptions underlying any of the foregoing. Such statements are based o n management’s current expectations and are subject to a number of uncertainties and risks that could cause actual results to differ materially from those described in the forward-looking statements. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan, ” “intend,” “believe,” “may,” “will,” “should,” “likely” and other words and terms of similar meaning in connection with any discussion of the timin g or nature of future events. We cannot assure you that these future developments affecting us will be those that we have anticipated. Important risks and uncertainties that could cause actual results to differ materially from our expectations include, among others, those risks and uncertainties disclose d in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” sections of our most recent Form 10-K and Form 10-Q filed with the Securities and Exchange Commission, and similar disclosures in subsequent reports filed with the Securities an d Exchange Commission. Any forward-looking statement made by us in this presentation speaks only as of the date on which we made it. We und ertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws. The content of this presentation is provided for information purposes only and is not intended for trading or investment purposes. This presentation also contains market data and other statistical information from third-party sources, including independent industry publications and other independent sources. Some market data and statistical information are also the Company’s good faith estimates, which are derived from management’s knowledge or its industry sources. Although the Company believes that this statistical information is reliable a s to its respective dates, the Company has not independently verified the accuracy or completeness of this information. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or inst rument or related derivative, of the Company. This presentation is for informational purposes only and is subject to change. The information contained herein does not purp ort to be all-inclusive. This material is not for the benefit of and does not convey any rights or remedies for the benefit of, any holder of securiti es or any other person. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjuncti on with, the reports filed by the Company with the Securities and Exchange Commission. 2 |

|

• General Cannabis Corp is a publicly traded company (OTCQB: CANN) with deep domain expertise in cannabis • General Cannabis seeks to identify and acquire undervalued and/or underperforming cultivation, manufacturing and retail cannabis facilities in Colorado. The company has assembled a team with extensive experience inside and outside of cannabis Overview • The company owns and operates Next Big Crop (“NBC”), a full-service cannabis consulting firm with expertise in the application, design, buildout and operation of cultivation facilities. NBC has a proven track record of servicing its clients and provides the company with a strategic advantage • In May, the company acquired SevenFive Farm, a 17,000 square foot light deprivation greenhouse cultivation facility in Boulder, Colorado well known for its high quality cannabis products • In June, the company completed a $3 million equity transaction with Hershey Strategic Capital and Shore Venture III 3 |

|

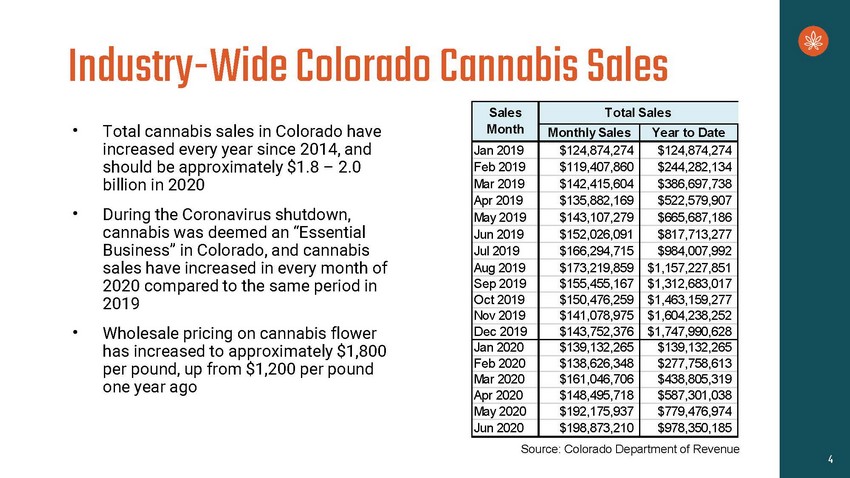

Industry-Wide Colorado increased every year since 2014, and should be approximately $1.8 – 2.0 billion in 2020 Cannabis Sales • Total cannabis sales in Colorado have • During the Coronavirus shutdown, cannabis was deemed an “Essential Business” in Colorado, and cannabis sales have increased in every month of 2020 compared to the same period in 2019 Wholesale pricing on cannabis flower has increased to approximately $1,800 per pound, up from $1,200 per pound one year ago • Source: Colorado Department of Revenue 4 Sales Month Total Sales Monthly Sales Year to Date Jan 2019 $124,874,274 $124,874,274 Feb 2019 $119,407,860 $244,282,134 Mar 2019 $142,415,604 $386,697,738 Apr 2019 $135,882,169 $522,579,907 May 2019 $143,107,279 $665,687,186 Jun 2019 $152,026,091 $817,713,277 Jul 2019 $166,294,715 $984,007,992 Aug 2019 $173,219,859 $1,157,227,851 Sep 2019 $155,455,167 $1,312,683,017 Oct 2019 $150,476,259 $1,463,159,277 Nov 2019 $141,078,975 $1,604,238,252 Dec 2019 $143,752,376 $1,747,990,628 Jan 2020 $139,132,265 $139,132,265 Feb 2020 $138,626,348 $277,758,613 Mar 2020 $161,046,706 $438,805,319 Apr 2020 $148,495,718 $587,301,038 May 2020 $192,175,937 $779,476,974 Jun 2020 $198,873,210 $978,350,185 |

|

Market Fragmentation in Colorado The Colorado market is highly fragmented: • There are approximately 600 active retail dispensaries in Colorado. The top 3 operators collectively operate only 8% of these dispensaries There are over 1,000,000 cannabis plants cultivated for cannabis sales each year. A typical 15,000 – 20,000 square foot grow contains approximately 5,000 – 7,500 plants Until this year, public companies were not allowed to own licensed cannabis facilities. HB1090, which was passed in November 2019 and enacted in January 2020, allows, for the first time, public companies that have been deemed suitable by the Colorado Marijuana Enforcement Division to acquire licensed cannabis assets • • Source: Colorado Marijuana Enforcement Division 5 |

|

General Cannabis Growth Through Asset Selection and Execution 6 COMPANY OVERVIEW ▪EXPERIENCED MANAGEMENT TEAM ▪DIFFERENTIATED INVESTMENT THESIS ▪OTCQB LISTED ▪SARBANES-OXLEY COMPLIANT |

|

Current Business Lines 7 |

|

Next Big Crop is a team of nationally known cultivation experts that design, build and manage cultivation facilities across the country. NBC has helped growers win competitive licenses in 14 states and designed and/or operated over 100 cultivation facilities across the country. NBC generates revenue primarily by: • Designing, building out and reselling equipment for cultivation facilities • Providing cultivation consulting services • Establishing long-term partnerships with growers, whereby NBC receives fees for contributing its expertise to improve productivity 8 8 |

|

Client is a multi-state operator with cultivation, dispensary and processing operations in Maryland, dispensary operations in Ohio, cultivation operations in Pennsylvania, and cultivation and dispensary operations in Virginia. NBC’s team wrote applications, designed and built out facilities, implemented systems, hired and trained staff, aided in inspections, created operational SOPs and operated facilities, as follows: CASE STUDY Maryland o ▪ ▪ NBC worked with Client to secure one of 15 cultivation licenses Designed, supported the construction of and operated 30,000 sq ft pharmaceutical grade facility for 18 months, producing over 10,000 lbs of cannabis during that time. As Client acquired additional dispensary and processing operations in MD, NBC assisted with start-up operations and training, solidifying Client as a top vertically integrated operator in the state Pennsylvania o ▪ ▪ Secured one of 13 cultivation licenses Designed and constructed 90,000 sq ft facility, producing 77,000 lbs annually Ohio ▪ ▪ o Secured one of 56 dispensary licenses Designed facility Virginia o ▪ ▪ Secured one of 5 pharmaceutical processor licenses Designed & constructed 80,000 sq ft, vertically integrated facility, producing 16,500 lbs annually 9 9 |

|

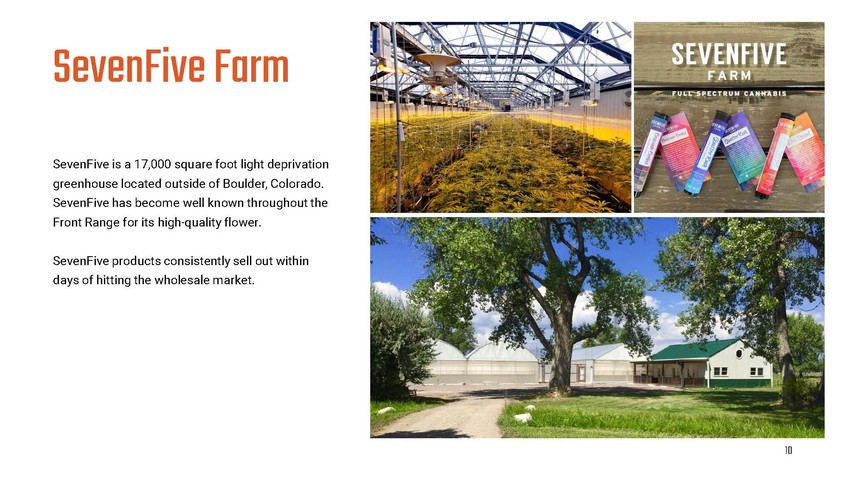

SevenFive Farm SevenFive is a 17,000 square foot light deprivation greenhouse located outside of Boulder, Colorado. SevenFive has become well known throughout the Front Range for its high-quality flower. SevenFive products consistently sell out within days of hitting the wholesale market. 10 |

|

Suitability Approval • The Colorado Marijuana Enforcement Division (“MED”) must approve all potential buyers or acquirors of licensed cannabis facilities by granting a “Suitability Approval” • General Cannabis received its Suitability Approval from the MED on May 1, 2020, becoming one of the only public companies to receive such approval • The Suitability Approval speaks to the strength of the company and its relationship with the MED, and it enables it to execute on its rollup strategy 11 |

|

2020 Key Milestones The company has made significant progress towards its goals in 2020, including: January May May June Refined business model Received Suitability Approval from MED Acquired SevenFive Farm Closed $3 million equity transaction 12 |

|

Leadership 13 |

|

Steve Gutterman CEO and Board Member Steve Gutterman brings more than two decades of success building and leading high growth businesses in highly regulated industries, with an extraordinary record of having increased annual revenue and market capitalization of the companies he has led by over $500 million and $2 billion, respectively. Most recently, Mr. Gutterman served as President of Harvest Health & Recreation (CSE:HARV), one of the largest cannabis multi-state operators in US, where he was instrumental in taking the company public and led its global operations. Prior to that, he served as CEO of market research company Mobile Accord. The company developed a database of over 400 million users and served customers like Coca Cola, Unilever, P&G, the World Bank, the State Department and the CDC. Before that, Mr. Gutterman served as President and Managing Director of MBH Enterprises, a private equity company that specialized in infrastructure and financial services. Mr. Gutterman also served as Executive Vice President and Chief Operating Officer of E*TRADE Bank (NASDAQ: ETFC), a $35 billion federally regulated thrift. Mr. Gutterman holds a JD/MBA from Columbia University and BA in Political Science from Tufts University. 14 |

|

Diane Jones Chief Financial Officer Diane Jones joins General Cannabis with deep experience in accounting and financial planning. Prior to her appointment as Chief Financial Officer, Ms. Jones owned her own consulting firm, where she provided accounting and finance consulting services to numerous public and private companies. While consulting, Ms. Jones was responsible for her clients’ accounting and valuation for business mergers, acquisitions and divestitures, SEC filings, technical accounting and process improvements. Ms. Jones served as Senior Director of Shared Financial Services of Arrow Electronics, Inc. and as Worldwide Controller of Arrow Electronics Computing Solutions, a division of Arrow Electronics, Inc., where she was responsible for back office accounting operations, acquisition integration, and oversight of accounting functions. Prior to that, Ms. Jones served as Assistant Corporate Controller of Ball Corporation, a public packaging company, where she was responsible for SEC filings, Sarbanes-Oxley compliance, management reporting and oversight of all accounting functions. Ms. Jones also has eight years of experience as an auditor with big four audit firms as a senior manager, serving both public and private companies. Ms. Jones is a licensed certified public accountant in the state of Colorado and holds a bachelor’s of business administration in marketing from Texas A&M University and an MBA with an emphasis in accounting from the University of Houston. 15 |

|

Adam Hershey Chief Strategy Advisor and Board Member Adam Hershey has over 25 years of investing experience in the public and private markets. He is currently the founder, Managing Partner and Portfolio Manager of Hershey Strategic Capital, LP an opportunistic, alternative asset manager focused on active investing in small cap, public companies, since inception in July 2009 to the present. He invests in both public and private companies, covering multiple industries with a typical investment time frame of 3-5 years focused on fundamental, long term absolute returns across the capital structure. He is the founder and Managing Member of Shore Ventures I, LP, Shore Ventures II, LP & Shore Ventures III, LP subsidiaries of Hershey Management. Mr. Hershey was a Partner and Chief Investment Officer (CIO) at SIAR Capital, LLC. a single-family office specializing in undervalued and emerging growth companies based in New York City from September 2007-December 2016. At SIAR Capital, he invested in public and private companies and worked closely with management in those companies to create economic value. SIAR Capital broadened its investment mandate to include opportunistic investments across asset classes. Mr. Hershey graduated with a BSM from Tulane University’s A.B. Freeman School of Business. 16 |

|

Other Board Members Carl Williams – Chairman of the Board and Independent Director Mr. Williams’s career in financial services spans 30 years and includes several high-profile industry positions. Mr. Williams served as a director of Planet Payment, Inc. [Nasdaq: PLPM], a company which processes merchant payments internationally, beginning in August 2013 before being elevated in February 2014 to Chairman and CEO, which positions he held until it was sold in 2018 to the Fintrax Group, a leader in payment processing. Before that, from 2004 until 2009, Mr. Williams was President of World Wide Payment Processing for Global Payments [NYSE: GPN], and served as its Advisor to Global Payments on Business Development and International Operations from 2009 to 2013. He also served as Managing Director of Pay Anywhere, LLC from 2012 until 2013. He also served as President of the Merchant Services Division of National Processing Company, one of the nation’s largest processors of credit card, debit and check transactions. He holds a BA from La Salle University. Richard Travia – Independent Director Mr. Travia is an experienced cannabis investor and company builder who founded Wildcat Advisory Group in 2017 and Wildcat Investment Management in 2018. Wildcat Advisory Group is a diversified business and investment consultant that advises small and medium size public and private companies, institutional investors such as family offices, private equity funds and hedge funds, and institutional-quality service providers. Wildcat Investment Management provides investment management services. Prior to launching Wildcat, Mr. Travia co-founded Tradex Global Advisors in 2004 and Tradex Global Advisory Services in 2014. While at Tradex, Mr. Travia served as the COO and Compliance Officer of the firm, Director of Research for the fund of hedge funds business and Head of Risk Management for the single hedge fund business. He holds a BA from Villanova University. Barker Dalton – Director John Barker Dalton joins the Company’s Board of Directors as a Board member and as a member of the Nominating and Corporate Governance Committee. Mr. Dalton is the Founder and has served as Managing Director of Dalton Adventures, LLC (“Dalton Adventures”) since 2010. The assets of Dalton Adventures that constitute the business of SevenFive Farm, a purpose-built cannabis greenhouse facility in Boulder County, Colorado, were acquired by the Company in May 2020 (as described below). Mr. Dalton has over a decade of experience in the cannabis industry. Mr. Dalton created SevenFive Farm after living 5 years in Costa Rica working in sustainable development. His focus was on site study, master design and material sourcing. Prior to working in Costa Rica, Mr. Dalton co-owned and operated Robb’s Music, an iconic music instrument store in Boulder, Colorado. 17 |

|

THANK YOU |