Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WSFS FINANCIAL CORP | wsfs-20200922.htm |

Exhibit 99.1 WSFS Financial Corporation 2Q 2020 Investor Update1 September 22, 2020 1 Page 9 updated as of September 15, 2020

Forward Looking Statements and Non-GAAP Financial Measures Forward Looking Statements This presentation contains estimates, predictions, opinions, projections and other "forward-looking statements" as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, references to the Company's predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management's outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations. The words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project” and similar expressions, among others, generally identify forward-looking statements. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company's control) and are subject to significant risks and uncertainties (which change over time) and other factors, including the uncertain effects of the COVID-19 pandemic and actions taken in response thereto on our business, results of operations, capital and liquidity, which could cause actual results to differ materially from those currently anticipated. Such risks and uncertainties are discussed in detail the Company's Form 10-K for the year ended December 31, 2019 and other documents filed by the Company with the Securities and Exchange Commission from time to time. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date on which they are made, and the Company disclaims any duty to revise or update any forward-looking statement, whether written or oral, that may be made from time to time by or on behalf of the Company for any reason, except as specifically required by law. As used in this presentation, the terms "WSFS", "the Company", "registrant", "we", "us", and "our" mean WSFS Financial Corporation and its subsidiaries, on a consolidated basis, unless the context indicates otherwise. Non-GAAP Financial Measures This presentation contains financial measures determined by methods other than in accordance with accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures include core pre-provision net revenue (“PPNR”), core PPNR to average assets ratio and related measures. The Company’s management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Company’s management believes that investors may use these non-GAAP measures to analyze the Company’s financial performance without the impact of unusual items or events that may obscure trends in the Company’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. See Appendix slides 41-46 for a reconciliation of these non-GAAP measures to their comparable GAAP measures, 2

Table of Contents 2Q 2020 Earnings Supplement Page 4 WSFS Franchise and Markets Page 19 Lines of Business and Technology Page 25 Selected Financial Information Page 33 Appendix: Non-GAAP Financial Information Page 41 3

2Q 2020 Earnings Release Supplement

2Q 2020 Earnings Supplement - Table of Contents 2Q 2020 Financial Highlights Page 6 PPP Loans Page 7 CECL Page 8 Credit Risk Management Page 9 Balance Sheet and Commercial Loan Composition Page 10 Hotel Portfolio Page 12 Food Services Portfolio Page 13 Retail Portfolio Page 14 2H 2020 Outlook Net Interest Margin Outlook Page 15 Core Pre-Provision Net Revenue (PPNR) Outlook Page 16 Capital Position Page 17 Balance Sheet Growth Page 18 5

2Q 2020 Financial Highlights Solid Core operating performance with pre-provision net revenue (PPNR)1 at 1.96% of average assets Significant ACL reserve build, excess capital levels, and a $0.12 dividend approved in the quarter 2Q 2020 (1) • Core results include $94.8 million of provision expense reducing core EPS by $1.49 $ in millions (expect per share amounts) Core and core ROA by 2.33% for 2Q 2020 EPS ($0.46) • ACL coverage ratio of 2.73% excluding PPP loans and 3.26% including (1) PPNR $63.5 estimated credit mark on acquired loans ROA (0.73%) • COVID-19 impact on “at-risk” (hotel, food services, and retail) portfolio credit ROTCE(1) (6.72%) migration and economic forecasts drove 2Q provision and ACL build NIM 3.93% • Excluding PPP loans of $945.1 million and purposeful run-off portfolios, gross loans were flat compared to 1Q 2020 and grew $223.0 million, or 3% year-over-year Fee Income/Total Revenue(2) 26.2% Efficiency Ratio 58.7% • Customer funding increased $1.4 billion from 1Q 2020 primarily due to an estimated $700 million from PPP customers and impact of government stimulus ACL Coverage Ratio 2.45% checks, delayed tax payments and lower overall customer spending Loan to Deposit Ratio 86% • Excluding $3.0 million of pre-tax net income from PPP, Core PPNR1 was $60.5 Common Equity Tier 1 Capital 12.68% million in 2Q 2020, or 1.98% of average assets (1) This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix and our Earnings Release filed at Exhibit 99.1 to our July 23, 2020 8-K filing for a summary of our 2Q 2020 GAAP results and a reconciliation of non-GAAP financial information to results reported in accordance with GAAP. 6 (2) Tax-equivalent

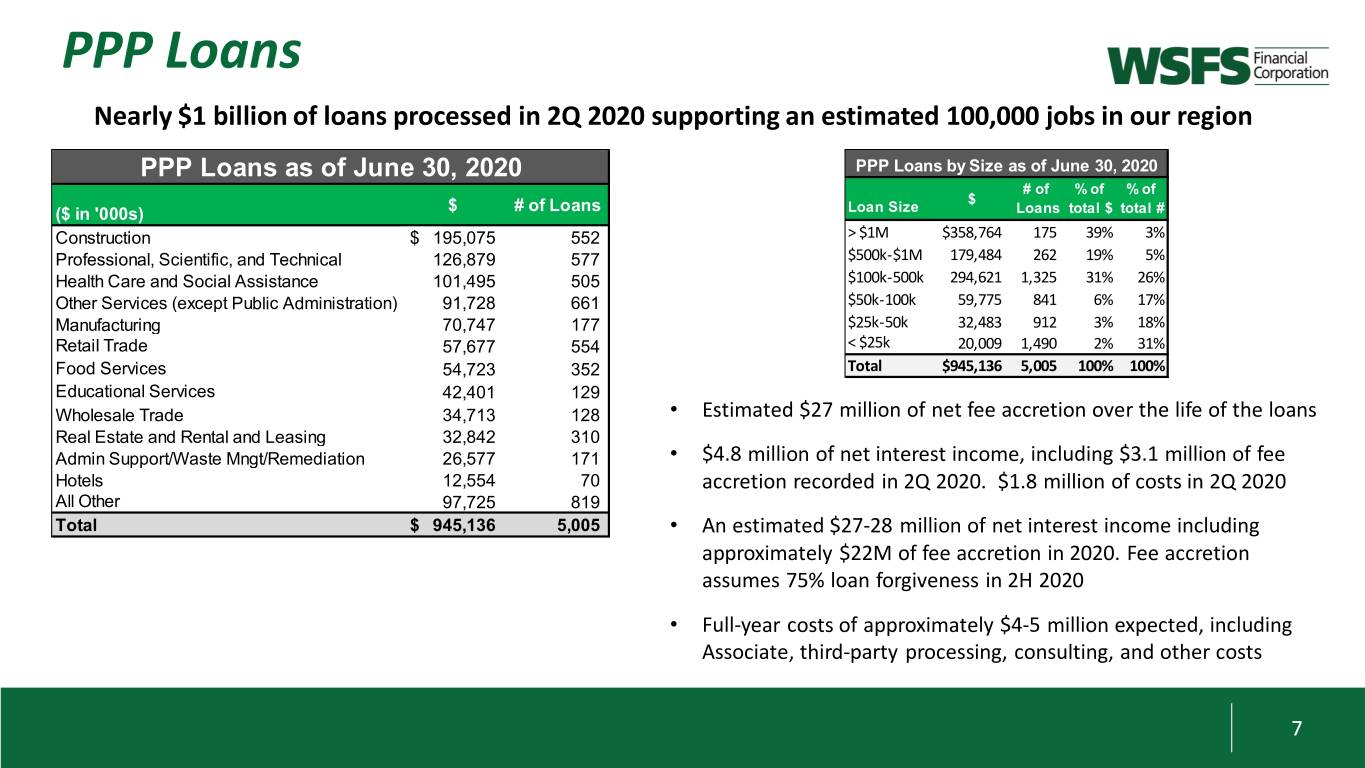

PPP Loans Nearly $1 billion of loans processed in 2Q 2020 supporting an estimated 100,000 jobs in our region PPP Loans as of June 30, 2020 PPP Loans by Size as of June 30, 2020 # of % of % of $ $ # of Loans Loan Size ($ in '000s) Loans total $ total # Construction $ 195,075 552 > $1M $358,764 175 39% 3% Professional, Scientific, and Technical 126,879 577 $500k-$1M 179,484 262 19% 5% Health Care and Social Assistance 101,495 505 $100k-500k 294,621 1,325 31% 26% Other Services (except Public Administration) 91,728 661 $50k-100k 59,775 841 6% 17% Manufacturing 70,747 177 $25k-50k 32,483 912 3% 18% Retail Trade 57,677 554 < $25k 20,009 1,490 2% 31% Food Services 54,723 352 Total $945,136 5,005 100% 100% Educational Services 42,401 129 Wholesale Trade 34,713 128 • Estimated $27 million of net fee accretion over the life of the loans Real Estate and Rental and Leasing 32,842 310 Admin Support/Waste Mngt/Remediation 26,577 171 • $4.8 million of net interest income, including $3.1 million of fee Hotels 12,554 70 accretion recorded in 2Q 2020. $1.8 million of costs in 2Q 2020 All Other 97,725 819 Total $ 945,136 5,005 • An estimated $27-28 million of net interest income including approximately $22M of fee accretion in 2020. Fee accretion assumes 75% loan forgiveness in 2H 2020 • Full-year costs of approximately $4-5 million expected, including Associate, third-party processing, consulting, and other costs 7

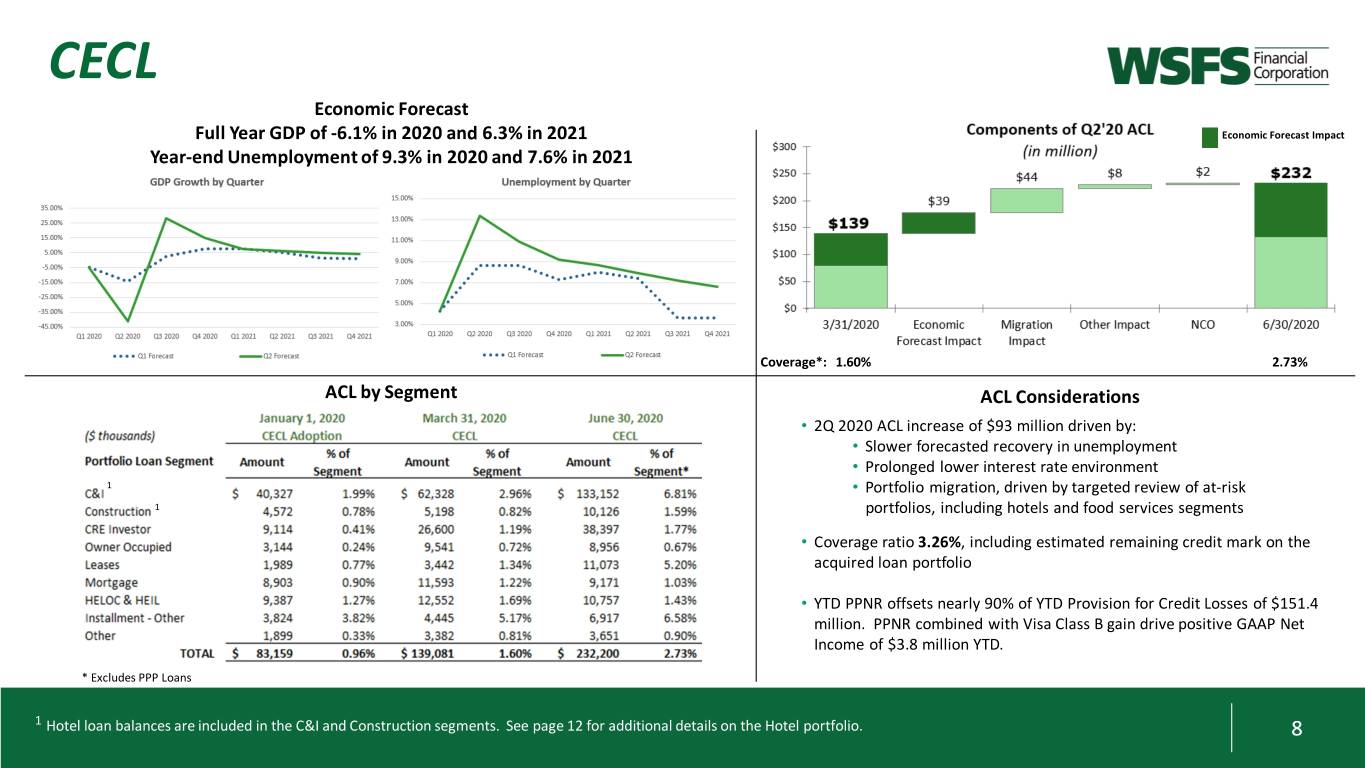

CECL Economic Forecast Full Year GDP of -6.1% in 2020 and 6.3% in 2021 Economic Forecast Impact Year-end Unemployment of 9.3% in 2020 and 7.6% in 2021 Coverage*: 1.60% 2.73% ACL by Segment ACL Considerations • 2Q 2020 ACL increase of $93 million driven by: • Slower forecasted recovery in unemployment • Prolonged lower interest rate environment 1 • Portfolio migration, driven by targeted review of at-risk 1 portfolios, including hotels and food services segments • Coverage ratio 3.26%, including estimated remaining credit mark on the acquired loan portfolio • YTD PPNR offsets nearly 90% of YTD Provision for Credit Losses of $151.4 million. PPNR combined with Visa Class B gain drive positive GAAP Net Income of $3.8 million YTD. * Excludes PPP Loans 1 Hotel loan balances are included in the C&I and Construction segments. See page 12 for additional details on the Hotel portfolio. 8

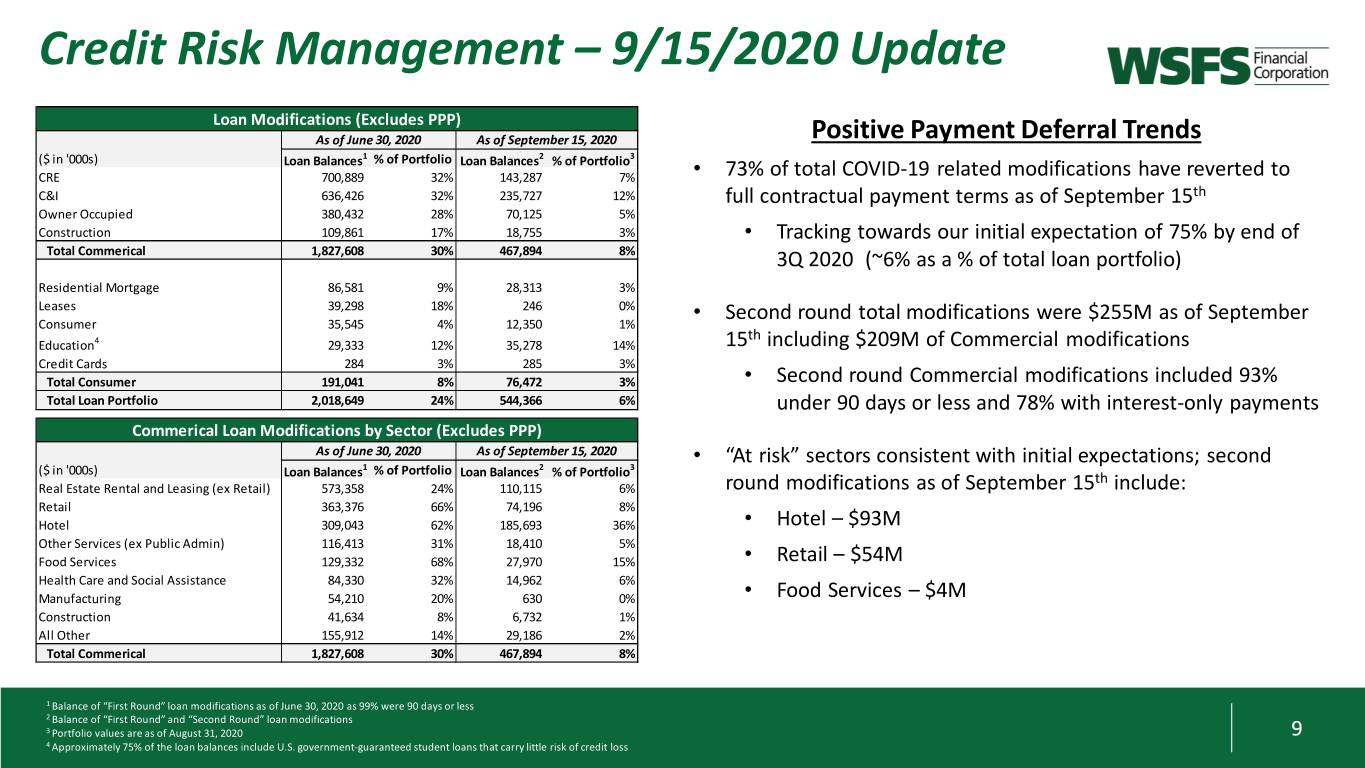

Credit Risk Management – 9/15/2020 Update Loan Modifications (Excludes PPP) As of June 30, 2020 As of September 15, 2020 Positive Payment Deferral Trends ($ in '000s) Loan Balances1 % of Portfolio Loan Balances2 % of Portfolio3 CRE 700,889 32% 143,287 7% • 73% of total COVID-19 related modifications have reverted to C&I 636,426 32% 235,727 12% full contractual payment terms as of September 15th Owner Occupied 380,432 28% 70,125 5% Construction 109,861 17% 18,755 3% • Tracking towards our initial expectation of 75% by end of Total Commerical 1,827,608 30% 467,894 8% 3Q 2020 (~6% as a % of total loan portfolio) Residential Mortgage 86,581 9% 28,313 3% Leases 39,298 18% 246 0% Second round total modifications were $255M as of September Consumer 35,545 4% 12,350 1% • th Education4 29,333 12% 35,278 14% 15 including $209M of Commercial modifications Credit Cards 284 3% 285 3% Total Consumer 191,041 8% 76,472 3% • Second round Commercial modifications included 93% Total Loan Portfolio 2,018,649 24% 544,366 6% 3 under 90 days or less and 78% with interest-only payments Commerical Loan Modifications by Sector (Excludes PPP) As of June 30, 2020 As of September 15, 2020 • “At risk” sectors consistent with initial expectations; second ($ in '000s) 1 2 3 Loan Balances % of Portfolio Loan Balances % of Portfolio th Real Estate Rental and Leasing (ex Retail) 573,358 24% 110,115 6% round modifications as of September 15 include: Retail 363,376 66% 74,196 8% Hotel 309,043 62% 185,693 36% • Hotel – $93M Other Services (ex Public Admin) 116,413 31% 18,410 5% Food Services 129,332 68% 27,970 15% • Retail – $54M Health Care and Social Assistance 84,330 32% 14,962 6% Manufacturing 54,210 20% 630 0% • Food Services – $4M Construction 41,634 8% 6,732 1% All Other 155,912 14% 29,186 2% Total Commerical 1,827,608 30% 467,894 8% 1 Balance of “First Round” loan modifications as of June 30, 2020 as 99% were 90 days or less 2 Balance of “First Round” and “Second Round” loan modifications 3 Portfolio values are as of August 31, 2020 9 4 Approximately 75% of the loan balances include U.S. government-guaranteed student loans that carry little risk of credit loss

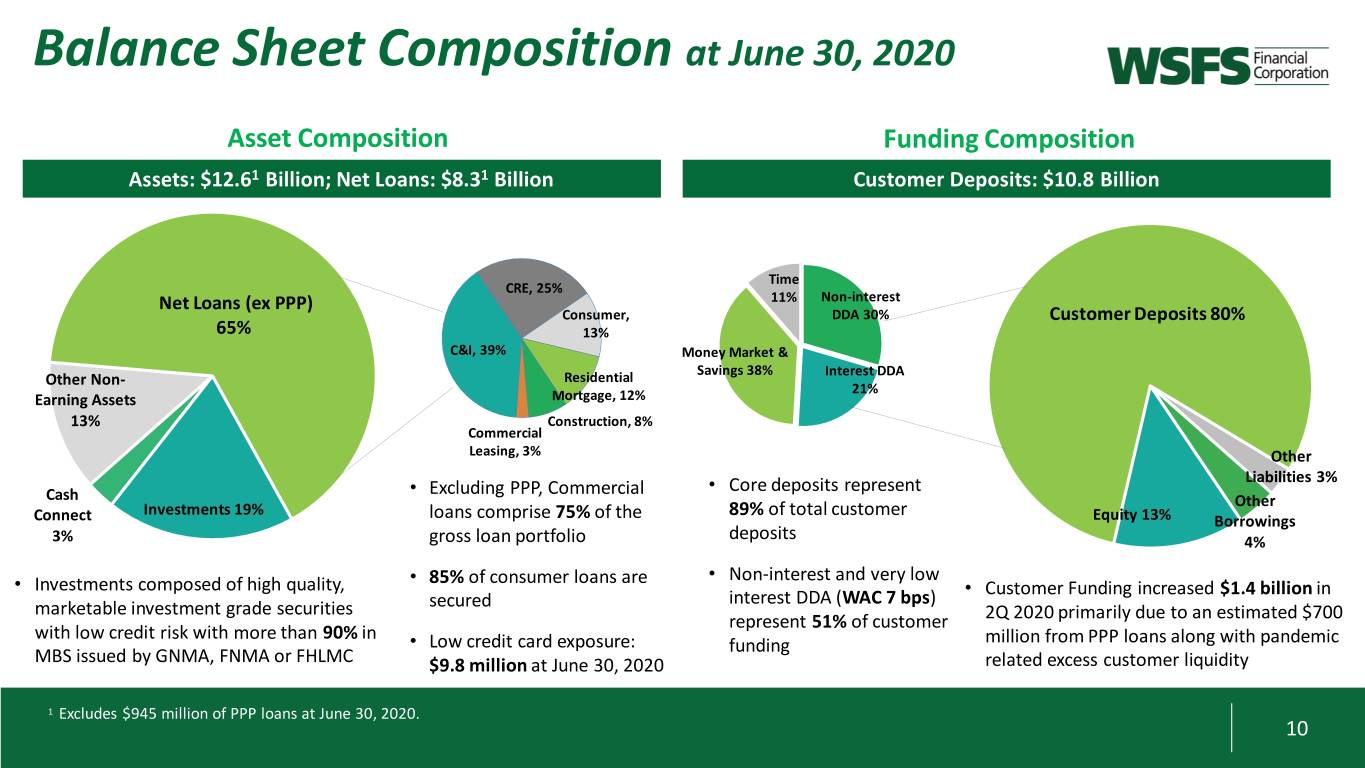

Balance Sheet Composition at June 30, 2020 Asset Composition Funding Composition Assets: $12.61 Billion; Net Loans: $8.31 Billion Customer Deposits: $10.8 Billion Time CRE, 25% Net Loans (ex PPP) 11% Non-interest Consumer, DDA 30% Customer Deposits 80% 65% 13% C&I, 39% Money Market & Savings 38% Interest DDA Other Non- Residential 21% Earning Assets Mortgage, 12% 13% Construction, 8% Commercial Leasing, 3% Other Liabilities 3% • Excluding PPP, Commercial • Core deposits represent Cash Other Investments 19% 89% of total customer Connect loans comprise 75% of the Equity 13% Borrowings 3% gross loan portfolio deposits 4% • 85% of consumer loans are • Non-interest and very low • Investments composed of high quality, • Customer Funding increased $1.4 billion in secured interest DDA (WAC 7 bps) marketable investment grade securities 2Q 2020 primarily due to an estimated $700 represent 51% of customer with low credit risk with more than 90% in • Low credit card exposure: funding million from PPP loans along with pandemic MBS issued by GNMA, FNMA or FHLMC $9.8 million at June 30, 2020 related excess customer liquidity 1 Excludes $945 million of PPP loans at June 30, 2020. 10

Commercial Loan Portfolio (ex PPP) at June 30, 2020 C&I and Owner Occupied - $3.4 billion4 CRE Investor and Construction - $2.8 billion Real Estate Rental Special Use & Mixed Use, Flex, Warehouse, Well Diversified and Granular and Leasing, 10% Other, 8% 2% Self-Storage, Other, 20% General Industrial, • No single industry, CRE, project, or 9% individual borrower concentrations Hotels , 13% Residential • House Limit: $70 million at Wholesale Multi-Family, Trade, 5% 6/30/2020 (1 Relationship) 26% Office, 18% Food Services, • 5 relationships >$50 million Professional, 6% 1 Scientific and • CRE - 208% Technical • CLD2 - 59% Services, 5% Other Services (except Public Health Care and Administration), • In compliance with all 20 Board Social Assistance, 7% 10% Residential 1-4, Retail, 26% approved concentration limits at Construction, Retail Trade, 12% Manufacturing, 8% June 30, 2020 8% 8% No or Low Exposure Industries3: • No direct exposure to Energy, Casinos & Gambling, and Cruise Lines • Less than $15 million combined exposure to Movie Theaters, Amusement, and Aviation 1 Defined as the sum of CRE and Construction (excluding owner occupied) exposures divided by the sum of Tier-1 Capital and ACL. 2 Defined as Construction and land development (excluding owner occupied) exposure divided by the sum of Tier-1 Capital and ACL. 3 As defined by the North American Industry Classification System (NAICS). 11 4 Excludes $945 million of PPP loans as of June 30, 2020.

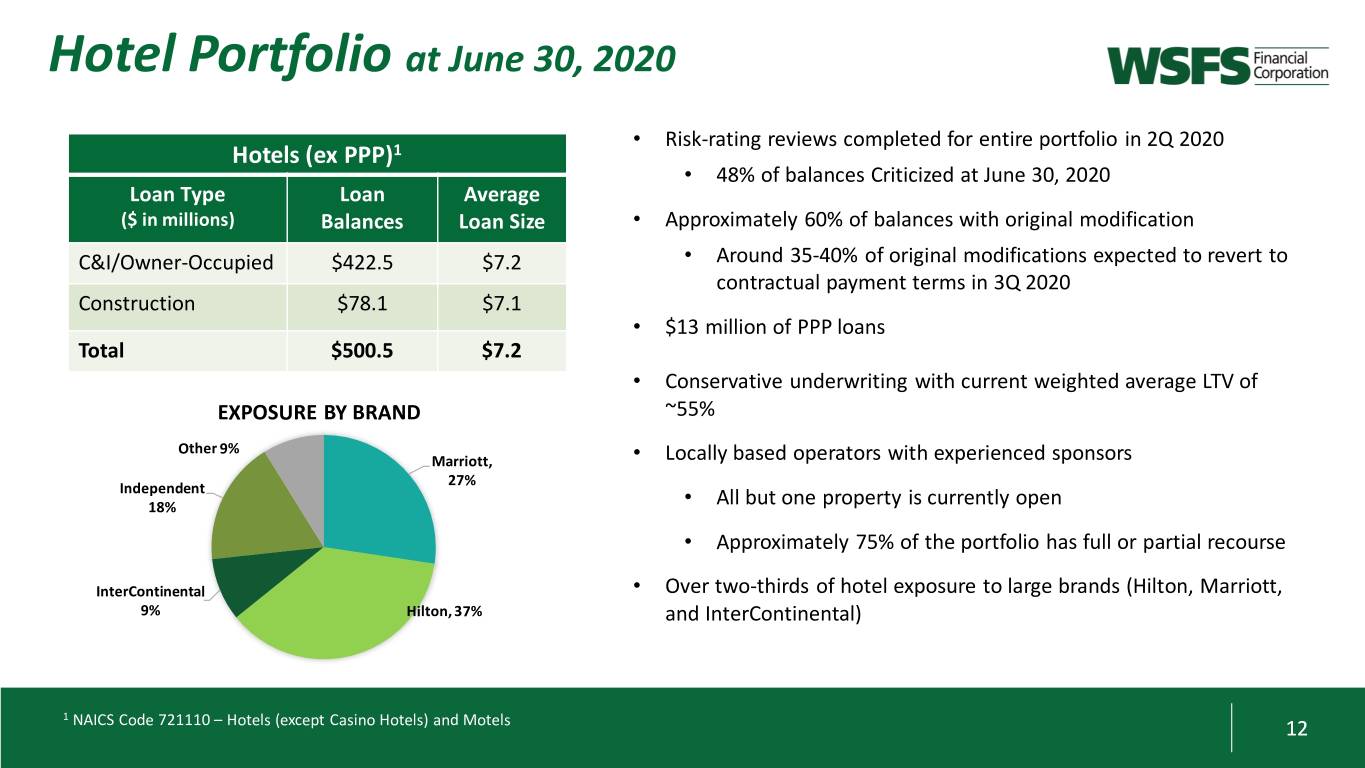

Hotel Portfolio at June 30, 2020 • Risk-rating reviews completed for entire portfolio in 2Q 2020 Hotels (ex PPP)1 • 48% of balances Criticized at June 30, 2020 Loan Type Loan Average ($ in millions) Balances Loan Size • Approximately 60% of balances with original modification C&I/Owner-Occupied $422.5 $7.2 • Around 35-40% of original modifications expected to revert to contractual payment terms in 3Q 2020 Construction $78.1 $7.1 • $13 million of PPP loans Total $500.5 $7.2 • Conservative underwriting with current weighted average LTV of EXPOSURE BY BRAND ~55% Other 9% Marriott, • Locally based operators with experienced sponsors 27% Independent 18% • All but one property is currently open • Approximately 75% of the portfolio has full or partial recourse InterContinental • Over two-thirds of hotel exposure to large brands (Hilton, Marriott, 9% Hilton, 37% and InterContinental) 1 NAICS Code 721110 – Hotels (except Casino Hotels) and Motels 12

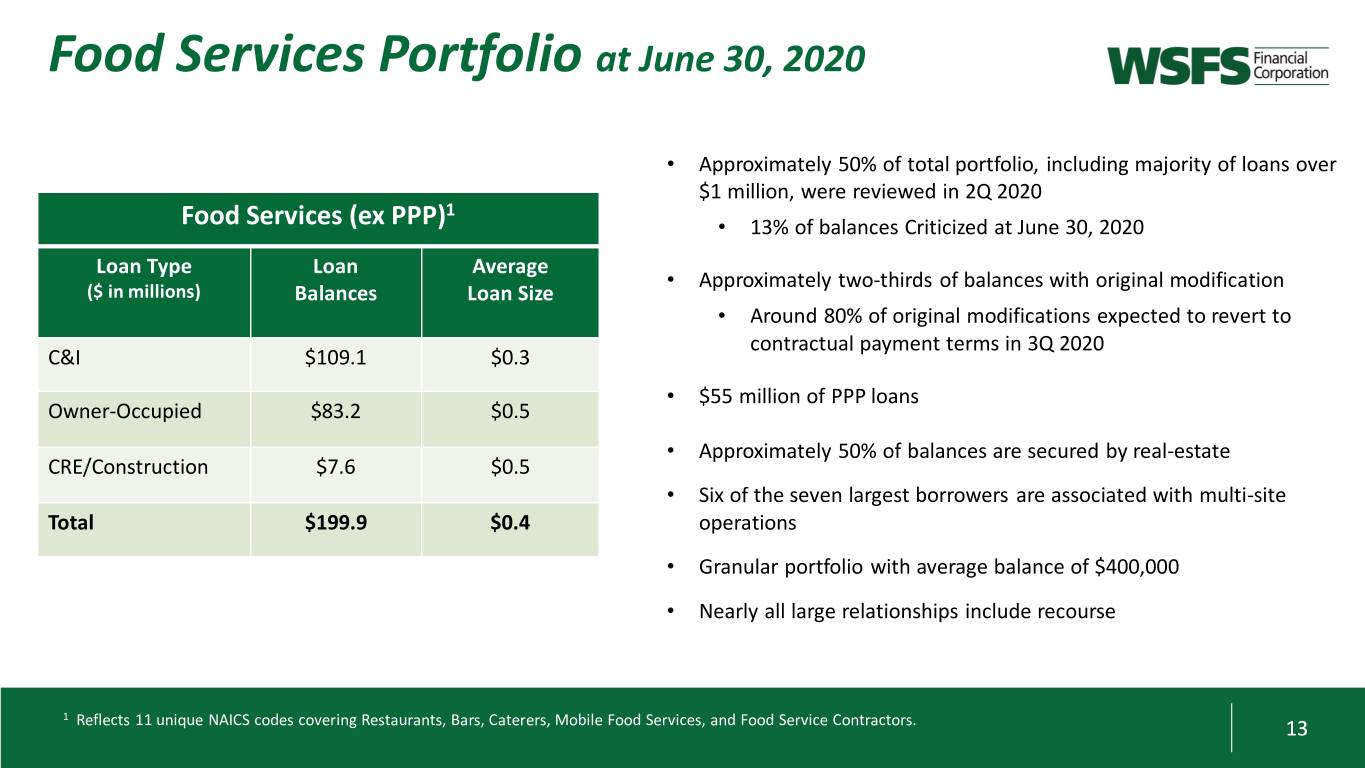

Food Services Portfolio at June 30, 2020 • Approximately 50% of total portfolio, including majority of loans over $1 million, were reviewed in 2Q 2020 1 Food Services (ex PPP) • 13% of balances Criticized at June 30, 2020 Loan Type Loan Average • Approximately two-thirds of balances with original modification ($ in millions) Balances Loan Size • Around 80% of original modifications expected to revert to contractual payment terms in 3Q 2020 C&I $109.1 $0.3 • $55 million of PPP loans Owner-Occupied $83.2 $0.5 • Approximately 50% of balances are secured by real-estate CRE/Construction $7.6 $0.5 • Six of the seven largest borrowers are associated with multi-site Total $199.9 $0.4 operations • Granular portfolio with average balance of $400,000 • Nearly all large relationships include recourse 1 Reflects 11 unique NAICS codes covering Restaurants, Bars, Caterers, Mobile Food Services, and Food Service Contractors. 13

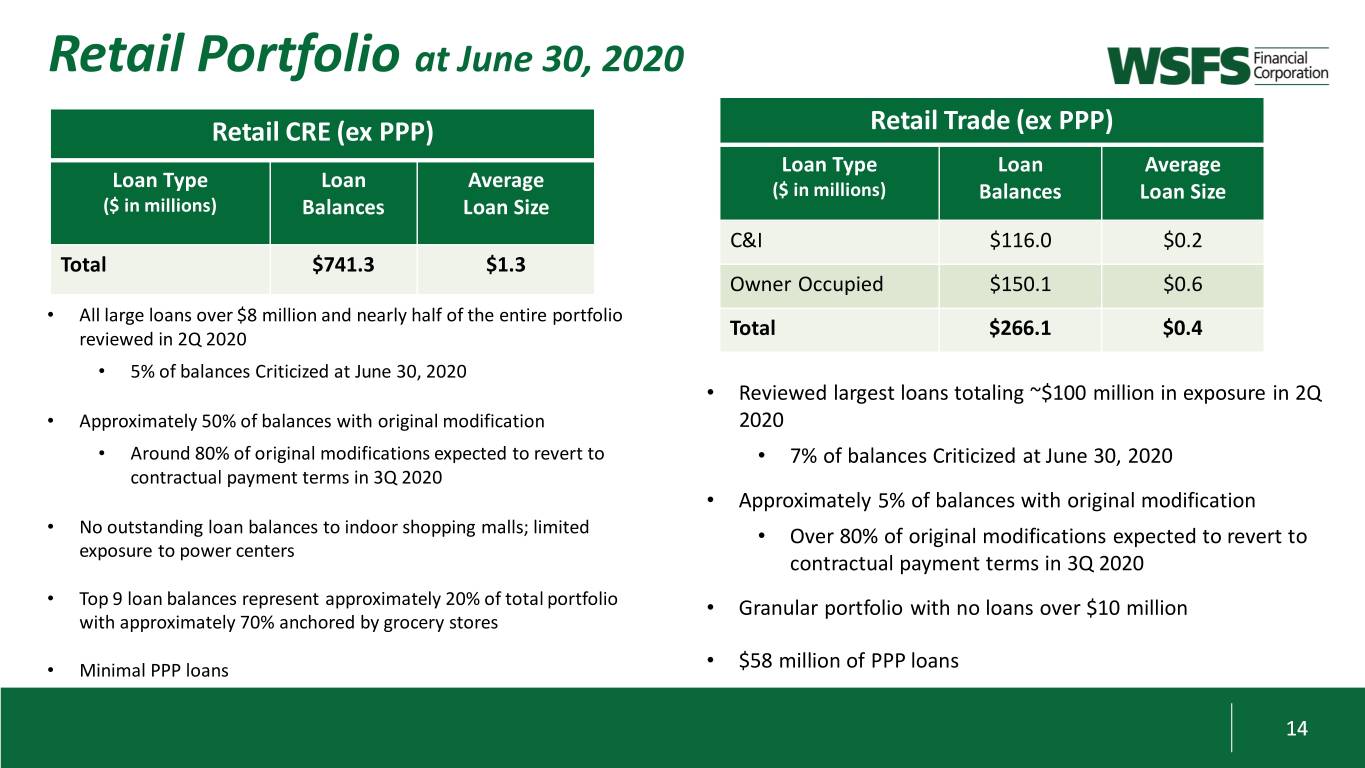

Retail Portfolio at June 30, 2020 Retail CRE (ex PPP) Retail Trade (ex PPP) Loan Type Loan Average Loan Type Loan Average ($ in millions) Balances Loan Size ($ in millions) Balances Loan Size C&I $116.0 $0.2 Total $741.3 $1.3 Owner Occupied $150.1 $0.6 • All large loans over $8 million and nearly half of the entire portfolio reviewed in 2Q 2020 Total $266.1 $0.4 • 5% of balances Criticized at June 30, 2020 • Reviewed largest loans totaling ~$100 million in exposure in 2Q • Approximately 50% of balances with original modification 2020 • Around 80% of original modifications expected to revert to • 7% of balances Criticized at June 30, 2020 contractual payment terms in 3Q 2020 • Approximately 5% of balances with original modification • No outstanding loan balances to indoor shopping malls; limited • Over 80% of original modifications expected to revert to exposure to power centers contractual payment terms in 3Q 2020 • Top 9 loan balances represent approximately 20% of total portfolio • Granular portfolio with no loans over $10 million with approximately 70% anchored by grocery stores • Minimal PPP loans • $58 million of PPP loans 14

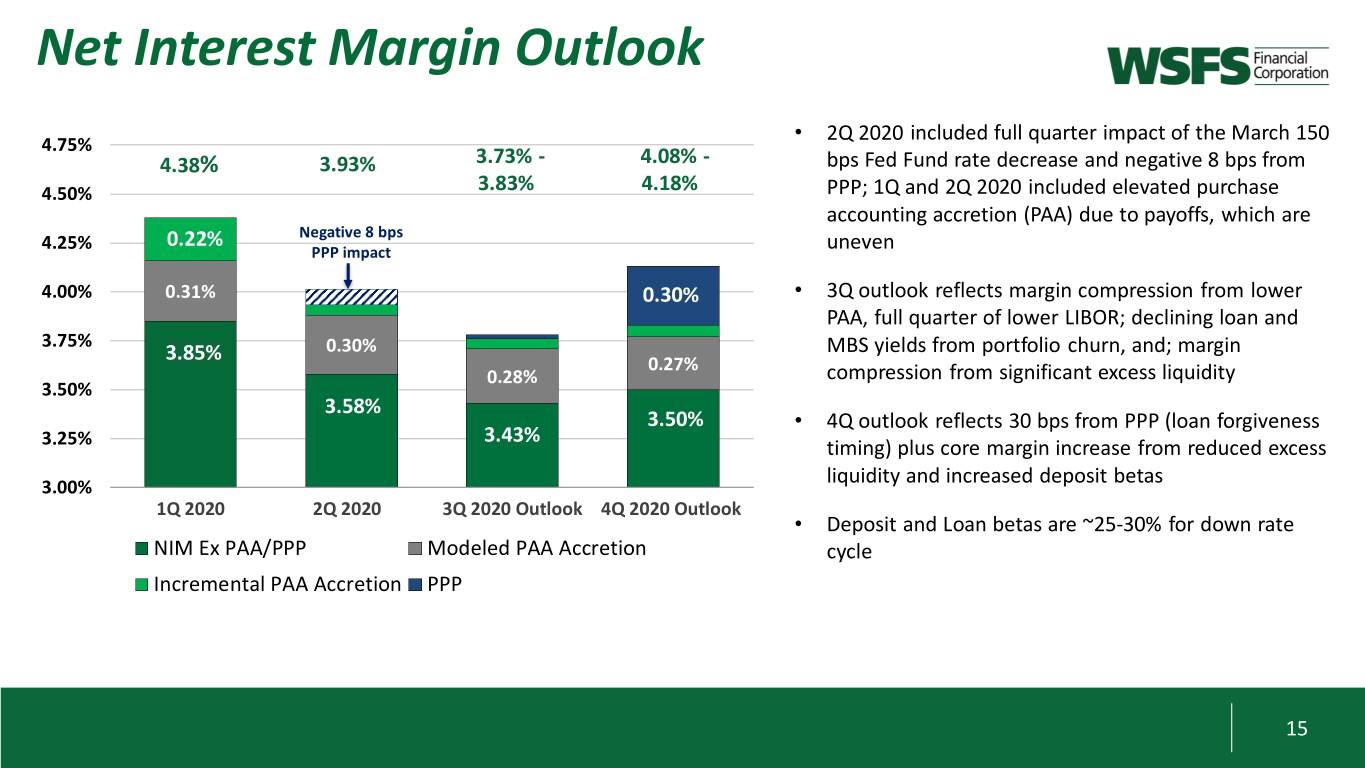

Net Interest Margin Outlook • 2Q 2020 included full quarter impact of the March 150 4.75% 3.73% - 4.08% - bps Fed Fund rate decrease and negative 8 bps from 4.38% 3.93% 15 4.50% 3.83% 4.18% PPP; 1Q and 2Q 2020 included elevated purchase 0 accounting accretion (PAA) due to payoffs, which are 0.22% Negative 8 bps 4.25% PPP impact uneven 4.00% 0.31% 0.30% • 3Q outlook reflects margin compression from lower PAA, full quarter of lower LIBOR; declining loan and 3.75% 0.30% MBS yields from portfolio churn, and; margin 3.85% 0.27% 0.28% compression from significant excess liquidity 3.50% 3.58% 3.50% • 4Q outlook reflects 30 bps from PPP (loan forgiveness 3.43% 3.25% timing) plus core margin increase from reduced excess liquidity and increased deposit betas 3.00% 1Q 2020 2Q 2020 3Q 2020 Outlook 4Q 2020 Outlook • Deposit and Loan betas are ~25-30% for down rate NIM Ex PAA/PPP Modeled PAA Accretion cycle Incremental PAA Accretion PPP 15

Core PPNR1 Outlook $ in million’s 120.0 2.50% 2.36% • Outlook assumes no Fed rate changes and continued 1.93% - gradual reopening of the economy 100.0 1.98% 1.77% - 2.15% 1.98% 2.00% • Excluding PPP, core PPNR as a percentage of average 1.96% 1.66%- 1 80.0 1.70%- 1.83% assets is expected to decline in 3Q and 4Q 2020 due 71.5 1.85% 1.50% primarily to the following: 63.5 59 – 66 61 – 68 3.0 60.0 2 Decline in NIM from factors described in the NIM outlook 7 – 9 11 –132 • on page 15 1.00% 40.0 • Approximately $2.5 to $3.0 lower quarterly interchange 71.5 60.5 52- 57 50 – 55 revenue due to Durbin (Effective July 2020) 0.50% 20.0 • Lower mortgage revenue compared to 2Q 2020 due to expected decline in refinancing volume 0.0 0.00% • Above declines partially offset by expected lower 1Q 2020 2Q 2020 3Q 2020 4Q 2020 noninterest expenses, including non-provision credit costs PPNR (ex PPP) PPP PPNR % Assets PPNR % Assets (ex PPP) 1 This is a non-GAAP financial measure and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for a reconciliation of Core PPNR and Core PPNR as a percentage of assets to their comparable GAAP measures. 16 2 PPP pre-tax net income forecasted to grow in 3Q and 4Q based on anticipated loan forgiveness timing.

Capital Position Common Equity Tier-1 (CET1) Capital Ratio Scenario1 ACL Capacity1 Six Quarter PPNR Run-Rate and ACL Capacity to Remain “Well” Capitalized (Six Quarters Ending 4Q 2021) $ in millions 1 Common Equity Tier 1 Capital - 2Q20 $ 1,292 PPNR Run-Rate (after-tax)1 263 Dividend Run-Rate (36) Capacity to Absorb Additional ACL (858) "Well" Capitalized Minimum - 4Q21 $ 661 • PPNR (after-tax) run-rate1 provides approximately 43 bps of CET1 per quarter. After estimated routine dividends, the Bank could absorb approximately $858 million of additional provision for credit losses and remain well capitalized • Incremental $858 million is an addition to $232 million ACL at June 30, 2020 and estimated $45 million of remaining • Quarterly cash dividend of $0.12 per share of common stock to be paid credit mark on acquired loan portfolio August 2020 • PPNR run-rate fully absorbs “severely adverse” loss scenario • Share repurchases temporarily suspended • Excess capacity can absorb 3 times the “severely” adverse loss scenario 1 Assumed PPNR Run-Rate reflects 2H 2020 Outlook on page 16 and an estimated $55 million quarterly PPNR (pre-tax) per quarter scenario for 2021. 17

2Q 2020 Loan and Deposit Growth Loans - 2Q'20 vs 1Q'20 and 2Q'19 Mar Jun 2Q'20 $ Annualized YOY $ YOY % ($ in millions) Jun 2020 2020 2019 Growth % Growth Growth Growth • We continue to execute our strategy to optimize our C & I Loans $ 3,354 $ 3,412 $ 3,421 $ (58) -7% (67) -2% PPP Loans 945 0 0 945 100% 945 100% loan mix towards relationship-based, higher yielding C&I Commercial Mortgages 2,166 2,223 2,281 (58) -10% (116) -5% Construction Loans 638 626 540 12 8% 98 18% loans Commercial Leases 213 202 156 11 22% 57 37% Total Commercial Loans 7,316 6,463 6,398 853 53% 918 14% Residential Mortgage (HFS/HFI/Rev Mgt) 1,012 1,055 1,134 (43) -16% (122) -11% Consumer Loans 1,133 1,118 1,131 15 5% 2 0% • Excluding PPP loans of $945.1 million and purposeful Total Gross Loans 9,461 8,636 8,665 825 38% 796 9% Run-Off Portfolios run-off portfolios, gross loans were flat compared to 1Q Residential Mortgage (HFI) 892 955 1,070 (63) -27% (177) -17% Student Loans Acquired from BNCL 119 123 133 (3) -10% (14) -11% 2020 and grew $223.0 million, or 3% year-over-year Auto Loans Acquired From BNCL 33 40 69 (7) -70% (36) -52% Participation portfolios (CRE) from BNCL 169 210 253 (41) -79% (84) -33% Leveraged Loans (C&I) from BNCL 12 12 72 0 0% (60) -83% Total Run-Off Portfolios 1,225 1,340 1,597 (115) -35% (372) -23% • Customer funding increased $1.4 billion from 1Q 2020 Gross Loans ex Run-Off Portfolios 8,236 7,296 7,068 940 52% 1,168 17% PPP Loans 945 0 0 945 100% 945 100% and $1.5 billion year-over-year primarily due to an Gross Loans ex Run-Off & PPP Portfolios 7,291 7,296 7,068 (5) 0% 223 3% estimated $700 million from PPP customers and impact Deposits - 2Q'20 vs 1Q'20 and 2Q'19 of government stimulus checks, delayed tax payments Mar Jun 2Q'20 $ Annualized YOY $ YOY % ($ in millions) Jun 2020 2020 2019 Growth % Growth Growth Growth and lower overall customer spending Noninterest Demand $ 3,189 $ 2,315 $ 2,190 $ 874 152% 999 46% Interest Demand Deposits 2,302 2,093 2,092 209 40% 210 10% Savings 1,732 1,595 1,625 137 35% 107 7% Money Market 2,333 2,149 2,005 184 34% 328 16% Total Core Deposits 9,556 8,152 7,912 1,404 69% 1,645 21% Customer Time Deposits 1,228 1,272 1,359 (44) -14% (131) -10% Total Customer Deposits1 10,784 9,424 9,271 1,359 58% 1,513 16% 18

WSFS Franchise and Markets

The WSFS Franchise - Overview • Largest independent bank and trust co. HQ in Delaware and greater Philadelphia region(1) • $13.6 billion in assets • $20.8 billion in fiduciary assets, including $2.6 billion in assets under management • 115 offices • Founded in 1832, WSFS is one of the ten oldest banks in the U.S. • Major business lines • Commercial • Retail • Wealth Management * • Cash Connect® * • Equipment Leasing * * National presence (1) As of 6/30/2020 20

The WSFS Franchise - Our Markets Philadelphia-Camden-Wilmington MSA Regional Employment Composition(1) Regional Statistics Diversity of industries drives stable and favorable employment and economic growth in our markets • Population: ~6.1 million • Number of Households: ~2.3 million • Unemployment 13.4%(2) • (US Unemployment Rate 13.3%) • Median Household Income: ~$71,000 • (approx. 10% higher than the US overall) • Median Home Value (owner-occupied housing units): ~$256,000 • (approx. 10% higher than the US median) • Per Capita Income: ~$38,400 • (approx. 10% higher than the US overall) Sources: U.S. Census Bureau , U.S Bureau of Labor Statistics (1)Chart Data Source: Bureau of Labor Statistics: Employees on nonfarm payrolls by industry supersector, Philadelphia-Camden-Wilmington MSA, not seasonally adjusted; May 2020. 21 (2) Unemployment rate is for the Philadelphia-Camden-Wilmington MSA. Preliminary, not seasonally adjusted – May 2020.

The WSFS Franchise - Strategic Growth Opportunity At $13.6 billion in assets at 06/30/2020, WSFS fills a long-standing service gap in our market between larger regional/national banks and smaller community banks MSA: Philadelphia-Camden-Wilmington (PA/NJ/DE/MD) Total Deposits • 4th largest metro in the Northeast –$444 billion regional economy # Institution Name ($MM) Market Share 1 Wells Fargo Bank NA $30,865 18.75% • 4th largest depository MSA in the U.S. (2) 2 TD Bank NA $28,192 17.13% th 3 Bank of America NA $15,805 9.60% • 6 largest MSA population in the U.S. 4 PNC Bank NA $15,168 9.21% 5 Citizens Bank NA $11,373 6.91% • Major Industries: life sciences, energy and manufacturing, 6 WSFS Bank $8,697 5.28% technology, and financial services 7 M & T Bank $8,204 4.98% (1) 8 BB & T $4,667 2.84% • Unemployment rate 05/2019 (3.8%) – 05/2020 (13.4%) 9 Univest Bank and Trust Co. $3,656 2.22% • 4th largest university population among all U.S. metro areas (over 10 Bryn Mawr Trust Co. $3,483 2.12% 100 colleges and universities) 11 Santander Bank NA $3,134 1.90% 12 Fulton Bank NA $3,046 1.85% • 14 major health systems with over 100 hospitals 13 Republic First Bank $2,526 1.53% 14 Firstrust Savings Bank $2,402 1.46% • Major transportation hub, conveniently located along I-95 corridor, 15 KeyBank NA $2,400 1.46% Amtrak’s Northeast Regional Line, access to Delaware River ports, and home to Philadelphia International Airport WSFS has more than twice the market share of the next largest local community bank in our MSA Note: Market Share data excludes brokered deposits and non-traditional banks (e.g. credit card companies). Market share data as of June 30, 2019; Source: FDIC Sources: U.S Bureau of Economic Analysis, S&P Global Market Intelligence, U.S. Census Bureau, Select Greater Philadelphia Council, U.S Bureau of Labor Statistics 22 (1) Not seasonally adjusted – May 2020 (2) Excludes Credit Unions

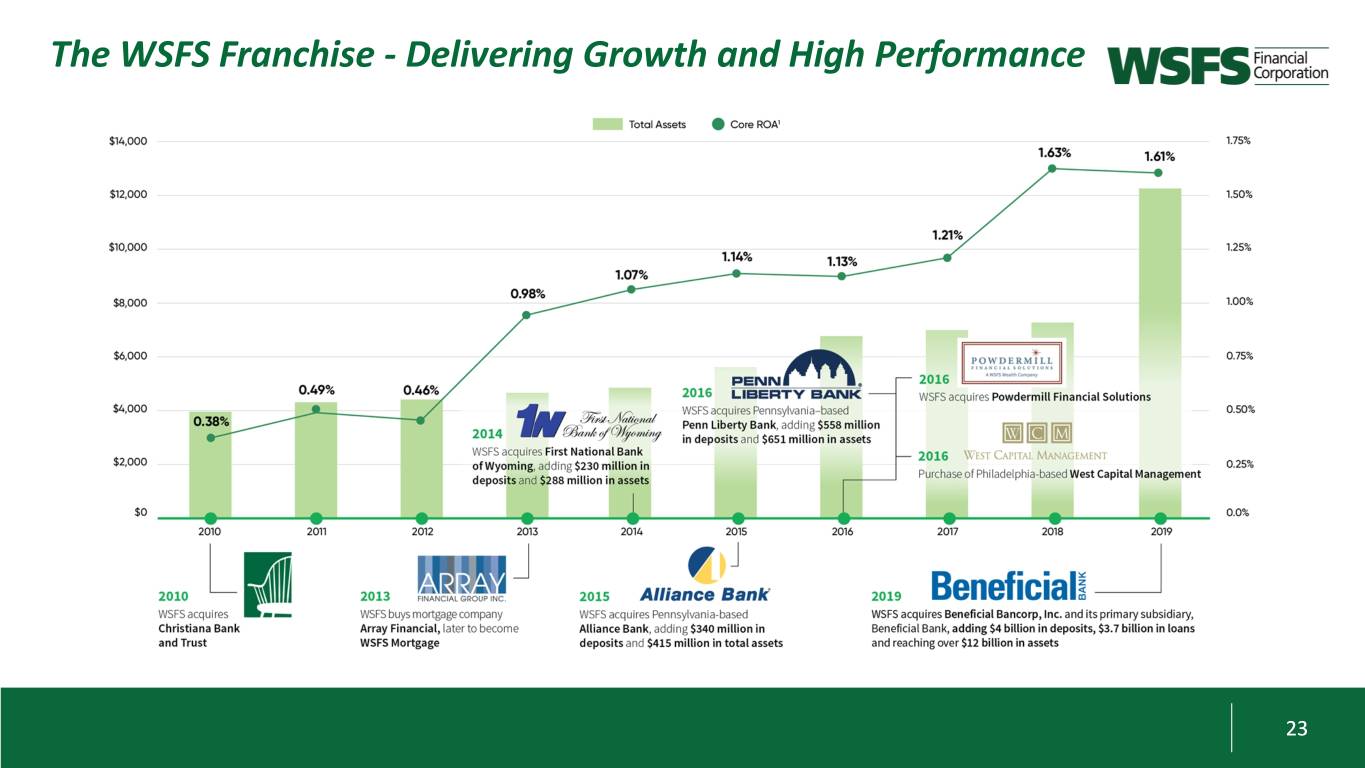

The WSFS Franchise - Delivering Growth and High Performance 23

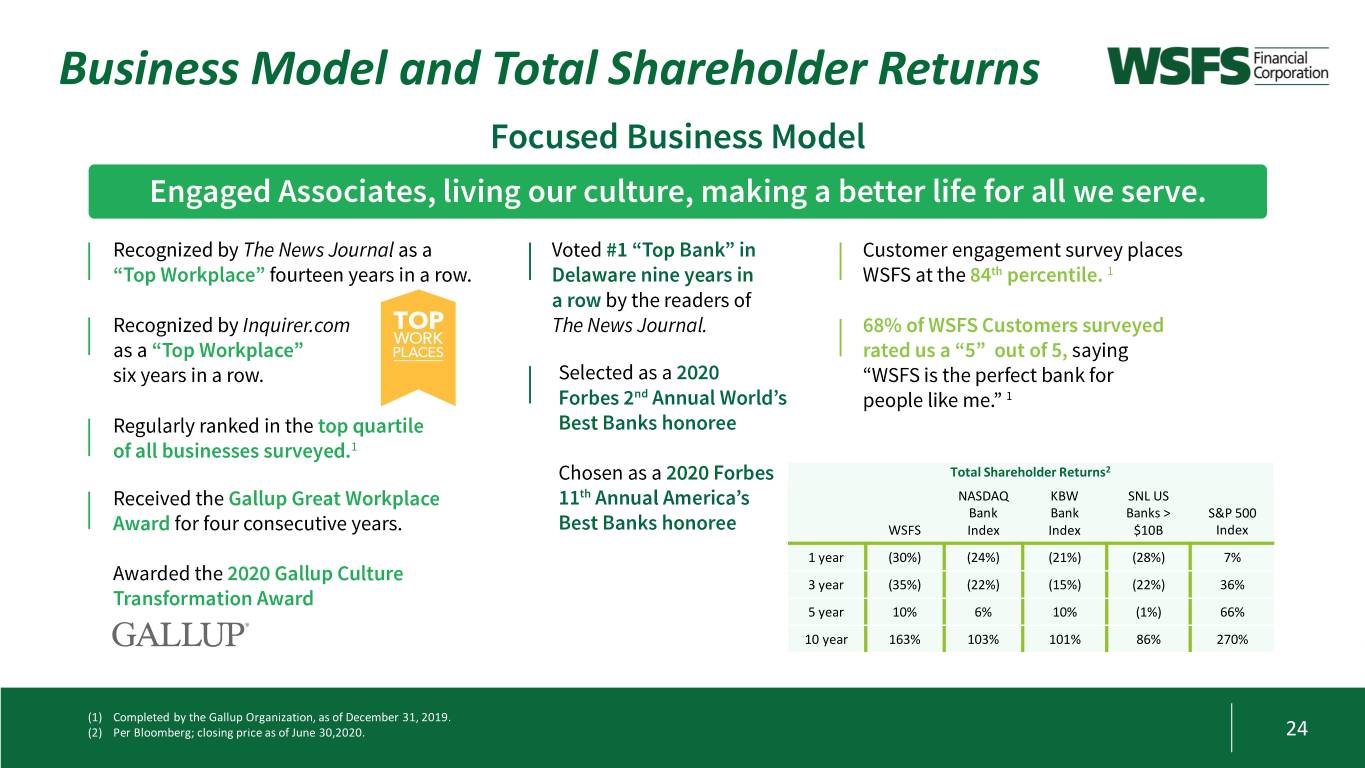

Business Model and Total Shareholder Returns Total Shareholder Returns2 NASDAQ KBW SNL US Bank Bank Banks > S&P 500 WSFS Index Index $10B Index 1 year (30%) (24%) (21%) (28%) 7% 3 year (35%) (22%) (15%) (22%) 36% 5 year 10% 6% 10% (1%) 66% 10 year 163% 103% 101% 86% 270% (1) Completed by the Gallup Organization, as of December 31, 2019. (2) Per Bloomberg; closing price as of June 30,2020. 24

Lines of Business and Technology

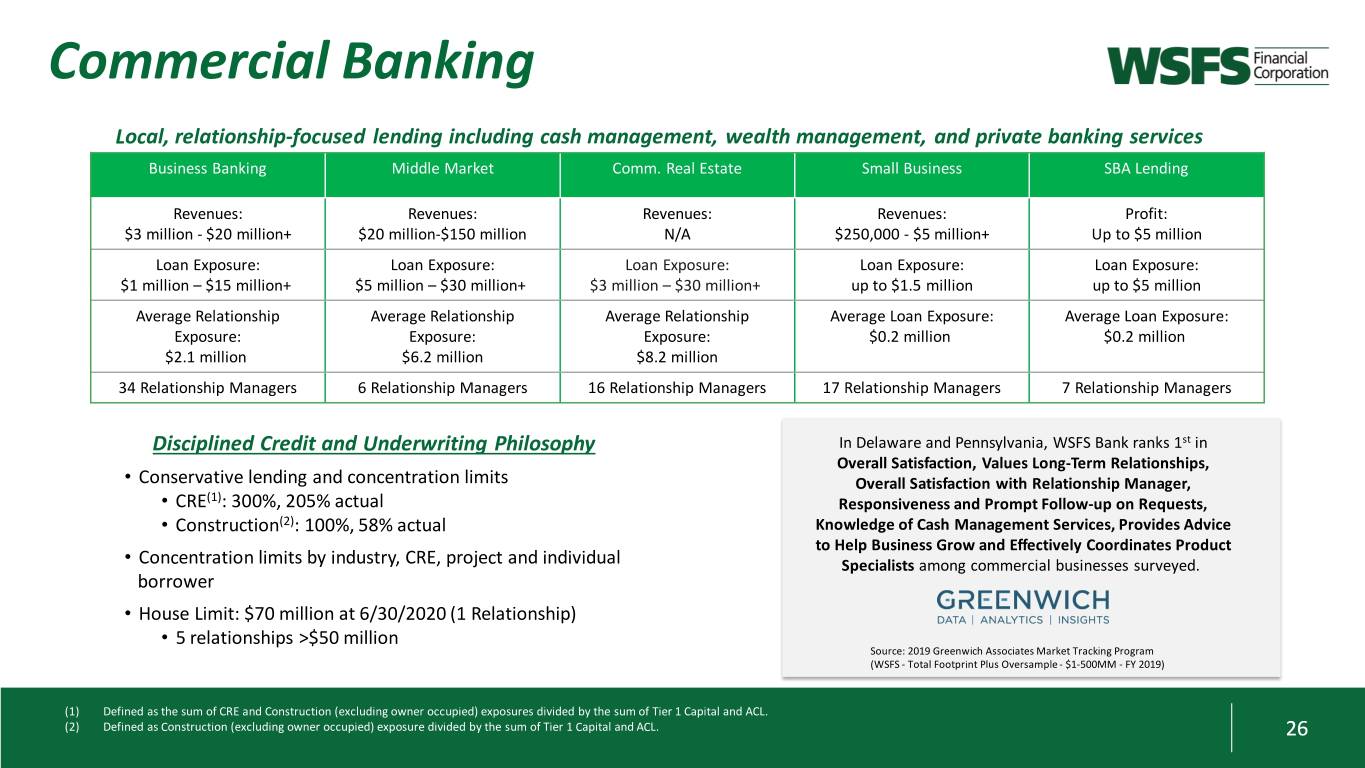

Commercial Banking Local, relationship-focused lending including cash management, wealth management, and private banking services Business Banking Middle Market Comm. Real Estate Small Business SBA Lending Revenues: Revenues: Revenues: Revenues: Profit: $3 million - $20 million+ $20 million-$150 million N/A $250,000 - $5 million+ Up to $5 million Loan Exposure: Loan Exposure: Loan Exposure: Loan Exposure: Loan Exposure: $1 million – $15 million+ $5 million – $30 million+ $3 million – $30 million+ up to $1.5 million up to $5 million Average Relationship Average Relationship Average Relationship Average Loan Exposure: Average Loan Exposure: Exposure: Exposure: Exposure: $0.2 million $0.2 million $2.1 million $6.2 million $8.2 million 34 Relationship Managers 6 Relationship Managers 16 Relationship Managers 17 Relationship Managers 7 Relationship Managers Disciplined Credit and Underwriting Philosophy In Delaware and Pennsylvania, WSFS Bank ranks 1st in Overall Satisfaction, Values Long-Term Relationships, • Conservative lending and concentration limits Overall Satisfaction with Relationship Manager, • CRE(1): 300%, 205% actual Responsiveness and Prompt Follow-up on Requests, • Construction(2): 100%, 58% actual Knowledge of Cash Management Services, Provides Advice to Help Business Grow and Effectively Coordinates Product • Concentration limits by industry, CRE, project and individual Specialists among commercial businesses surveyed. borrower • House Limit: $70 million at 6/30/2020 (1 Relationship) • 5 relationships >$50 million Source: 2019 Greenwich Associates Market Tracking Program (WSFS - Total Footprint Plus Oversample - $1-500MM - FY 2019) (1) Defined as the sum of CRE and Construction (excluding owner occupied) exposures divided by the sum of Tier 1 Capital and ACL. (2) Defined as Construction (excluding owner occupied) exposure divided by the sum of Tier 1 Capital and ACL. 26

Retail Banking Relationship-focused community banking model with 90 banking offices & 571 ATMS(1) Recently optimized retail footprint through reduction of branch locations Branch & ATM Online & Mobile Banking Borrowing Mortgage COVID-19 Network Response Our Associates health, Offering a full range of well-being and safety is Locations across Over 128K active online Providing Customers with Meeting Customers’ mortgage products with our top priority, and Delaware, southeastern banking users and over a wide range of options to borrowing needs through national capabilities, we are caring for our Pennsylvania and 80K active mobile banking make banking simple, in-house originations and world-class service and Customers and our southern New Jersey users intuitive and seamless strategic partnerships local-decision making Communities Highly rated mobile Operates universal banking application that Deposit Products: Consumer Loan Products: Phased Reopening… 80 banking model to provides a range of • Noninterest DDA • Installment Significant contributor to out of 90 offices open maximize staffing functionality including • Interest DDA • HELOC fee income through our including 71 drive- efficiencies while WSFS SnapShot Deposit, • Savings • Personal Lines originate and sell thru/office hours and 9 providing a superior Zelle®, MyWSFS and • Money Market • Credit Cards mortgage model with office hours only Customer experience WSFS Mobile Cash • Time Deposits • Student Loans Voted #1 “Top Bank” in 68% of WSFS Customers Delaware eight years in a row by surveyed rated us a “5” out of 5, readers of The News Journal saying “WSFS is the perfect bank for people like me.” (2) (1) The large increase in ATMs in driven by the branded partnership that we agreed to with the Bancorp to wrap and whitelist our BINs to increase our non-branch ATM footprints at 3/31/2020 (2) Completed by the Gallup Organization, as of December 31, 2019 27

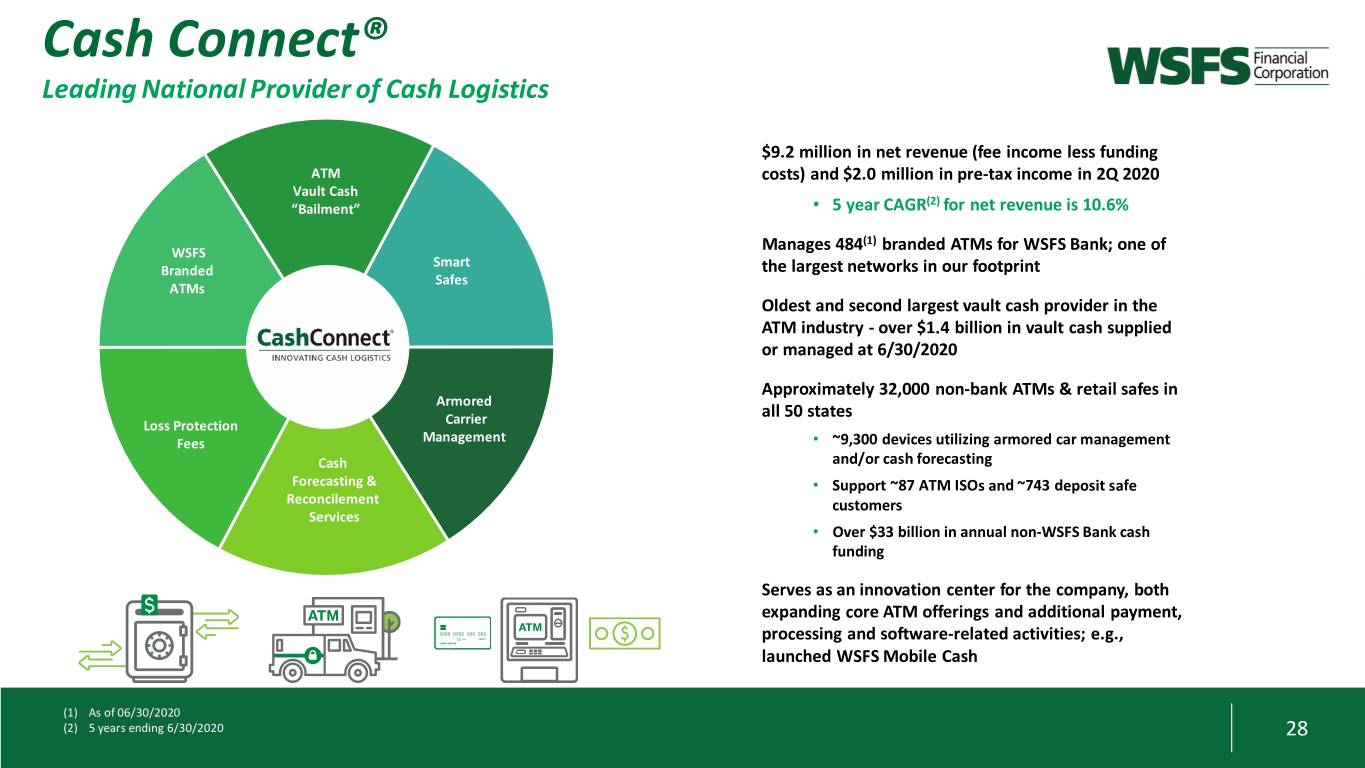

Cash Connect® Leading National Provider of Cash Logistics $9.2 million in net revenue (fee income less funding ATM costs) and $2.0 million in pre-tax income in 2Q 2020 Vault Cash (2) “Bailment” • 5 year CAGR for net revenue is 10.6% (1) WSFS Manages 484 branded ATMs for WSFS Bank; one of Smart Branded the largest networks in our footprint Safes ATMs Oldest and second largest vault cash provider in the ATM industry - over $1.4 billion in vault cash supplied or managed at 6/30/2020 Approximately 32,000 non-bank ATMs & retail safes in Armored all 50 states Loss Protection Carrier Fees Management • ~9,300 devices utilizing armored car management Cash and/or cash forecasting Forecasting & • Support ~87 ATM ISOs and ~743 deposit safe Reconcilement customers Services • Over $33 billion in annual non-WSFS Bank cash funding Serves as an innovation center for the company, both expanding core ATM offerings and additional payment, processing and software-related activities; e.g., launched WSFS Mobile Cash (1) As of 06/30/2020 (2) 5 years ending 6/30/2020 28

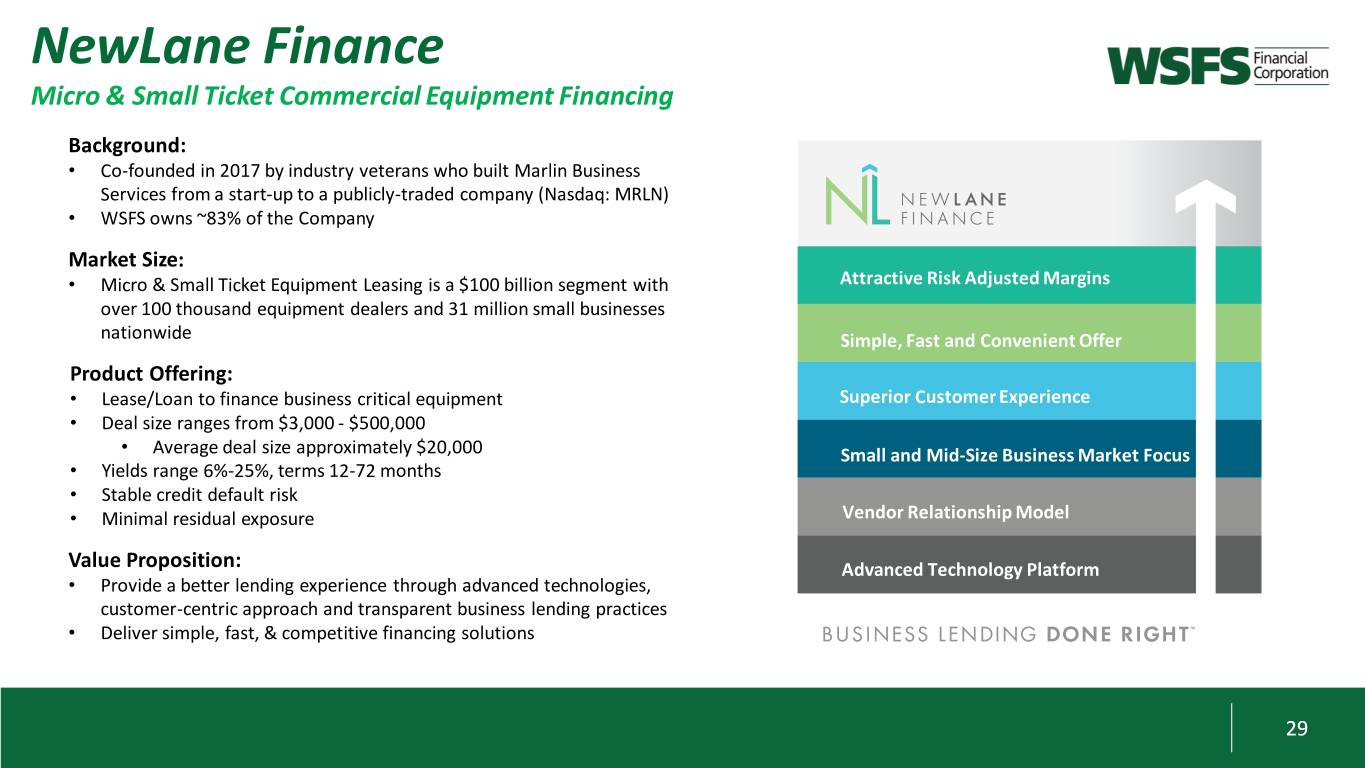

NewLane Finance Micro & Small Ticket Commercial Equipment Financing Background: • Co-founded in 2017 by industry veterans who built Marlin Business Services from a start-up to a publicly-traded company (Nasdaq: MRLN) • WSFS owns ~83% of the Company Market Size: • Micro & Small Ticket Equipment Leasing is a $100 billion segment with Attractive Risk Adjusted Margins over 100 thousand equipment dealers and 31 million small businesses nationwide Simple, Fast and Convenient Offer Product Offering: • Lease/Loan to finance business critical equipment Superior Customer Experience • Deal size ranges from $3,000 - $500,000 • Average deal size approximately $20,000 Small and Mid-Size Business Market Focus • Yields range 6%-25%, terms 12-72 months • Stable credit default risk • Minimal residual exposure Vendor Relationship Model Value Proposition: Advanced Technology Platform • Provide a better lending experience through advanced technologies, customer-centric approach and transparent business lending practices • Deliver simple, fast, & competitive financing solutions 29

WSFS Wealth Full-Service, Relationship-based Wealth Management Financial Highlights 2Q 2020 Net Revenue: $13.8 million 2Q 2020 Pre-tax Income: $2.3 million $20.8 billion in fiduciary assets, including $2.6 billion in assets under management at 6/30/2020 Private Banking Services for Commercial Customers Wealth Management Services for Retail Customers 30

Delivery Transformation 2020 Program Focus and Outlook Full-Year Gross Investment of $15.2mm; $9.7mm Net Expense; $8.2mm Net of Revenue Lift Customer Acquisition Expected Benefits from 2020 Initiatives • Expand nCino capabilities • Grow Customer acquisitions at lower CTA • Initiate implementation of enterprise-wide CRM, piloting Wealth, Middle Markets and Mortgage • Enhance and expedite onboarding process • Advanced Customer targeting & marketing strategies based on Customer segmentation • Deepen and strengthen Customer relationships Customer Experience • Capture cross-sell opportunities • Launch improved online and new mobile account opening solutions • Improve Customer retention • Automated & guided sales / onboarding tool leveraging tablet interface with dynamic customized experience • Timely and deeper insights from Customer feedback • Integrated real-time, transaction-specific Customer experience surveys in mobile/online channels • Digitize & automate processes Infrastructure • Increase Associate productivity and engagement • Implement enterprise-wide middleware platform • Evolve infrastructure for increased flexibility and • Begin transformation of architecture expedite future technology integrations • Scope and design sales and service platform 2021 and beyond: Continue to invest in our digital capabilities and provide best-in-class solutions consistent with our brand, for our Customers and Associates. 31

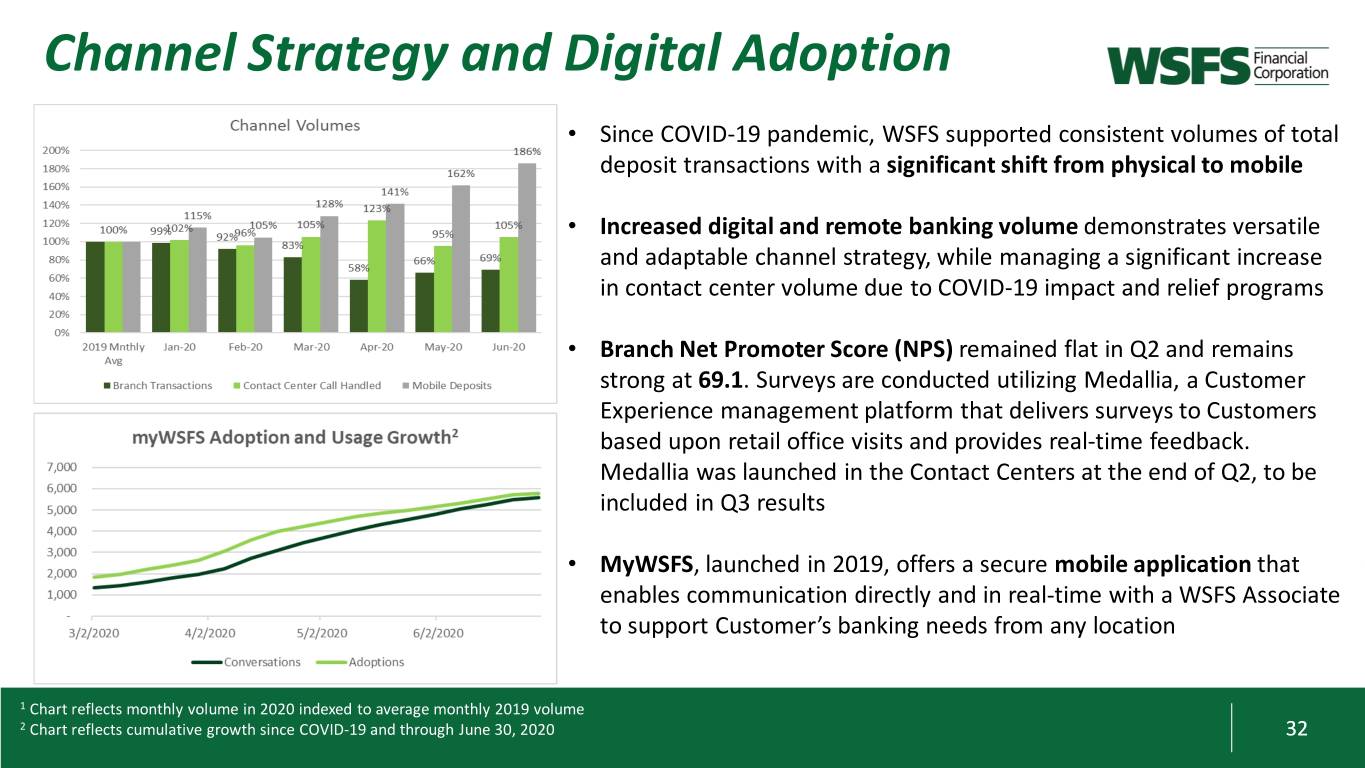

Channel Strategy and Digital Adoption • Since COVID-19 pandemic, WSFS supported consistent volumes of total deposit transactions with a significant shift from physical to mobile • Increased digital and remote banking volume demonstrates versatile and adaptable channel strategy, while managing a significant increase in contact center volume due to COVID-19 impact and relief programs • Branch Net Promoter Score (NPS) remained flat in Q2 and remains strong at 69.1. Surveys are conducted utilizing Medallia, a Customer Experience management platform that delivers surveys to Customers based upon retail office visits and provides real-time feedback. Medallia was launched in the Contact Centers at the end of Q2, to be included in Q3 results • MyWSFS, launched in 2019, offers a secure mobile application that enables communication directly and in real-time with a WSFS Associate to support Customer’s banking needs from any location 1 Chart reflects monthly volume in 2020 indexed to average monthly 2019 volume 2 Chart reflects cumulative growth since COVID-19 and through June 30, 2020 32

Selected Financial Information

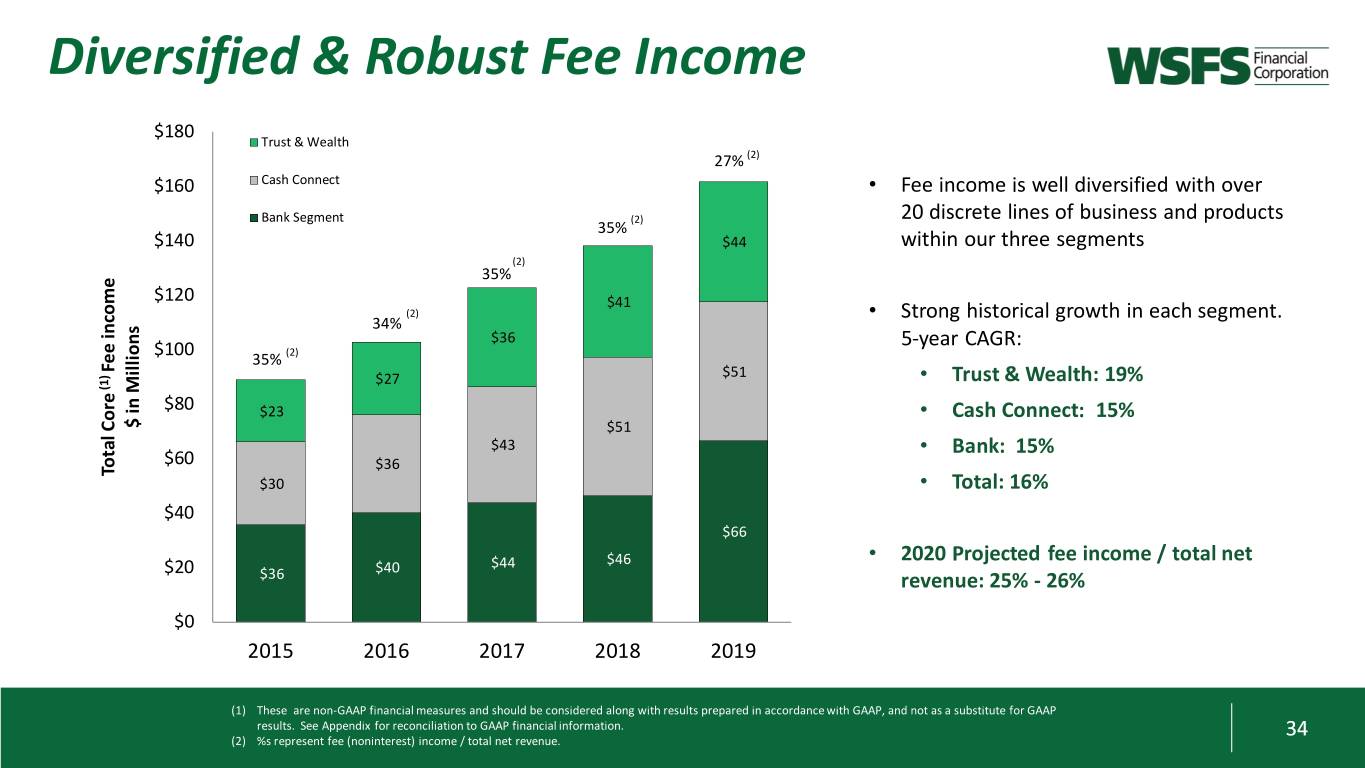

Diversified & Robust Fee Income $180 Trust & Wealth 27% (2) $160 Cash Connect • Fee income is well diversified with over Bank Segment (2) 20 discrete lines of business and products 35% $140 $44 within our three segments (2) 35% $120 $41 (2) • Strong historical growth in each segment. 34% $36 5-year CAGR: $100 (2) 35% Fee income Fee $27 $51 • Trust & Wealth: 19% (1) (1) $80 $23 • Cash Connect: 15% $ in Millions in $ Millions $51 $43 • Bank: 15% $60 $36 Total Core Total $30 • Total: 16% $40 $66 $46 • 2020 Projected fee income / total net $20 $40 $44 $36 revenue: 25% - 26% $0 2015 2016 2017 2018 2019 (1) These are non-GAAP financial measures and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. See Appendix for reconciliation to GAAP financial information. 34 (2) %s represent fee (noninterest) income / total net revenue.

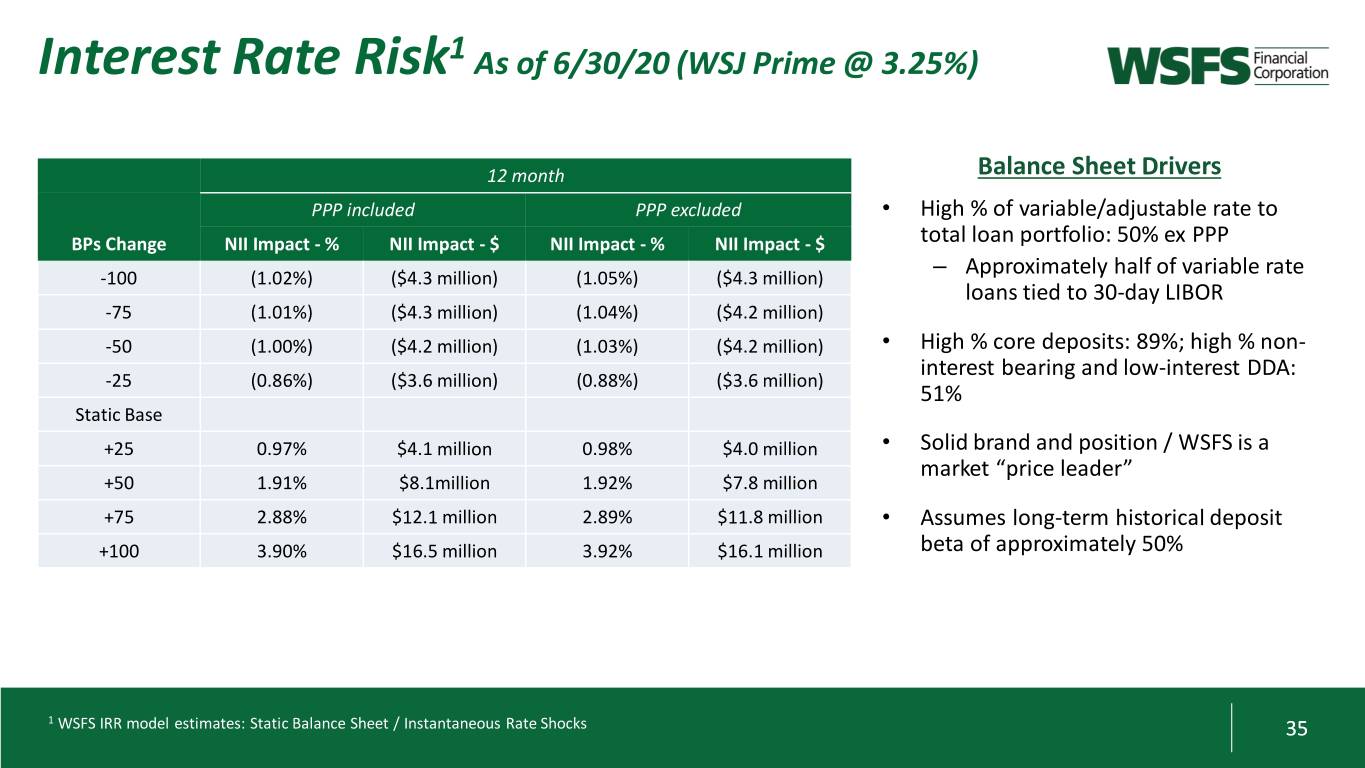

Interest Rate Risk1 As of 6/30/20 (WSJ Prime @ 3.25%) 12 month Balance Sheet Drivers PPP included PPP excluded • High % of variable/adjustable rate to BPs Change NII Impact - % NII Impact - $ NII Impact - % NII Impact - $ total loan portfolio: 50% ex PPP -100 (1.02%) ($4.3 million) (1.05%) ($4.3 million) – Approximately half of variable rate loans tied to 30-day LIBOR -75 (1.01%) ($4.3 million) (1.04%) ($4.2 million) -50 (1.00%) ($4.2 million) (1.03%) ($4.2 million) • High % core deposits: 89%; high % non- interest bearing and low-interest DDA: -25 (0.86%) ($3.6 million) (0.88%) ($3.6 million) 51% Static Base +25 0.97% $4.1 million 0.98% $4.0 million • Solid brand and position / WSFS is a market “price leader” +50 1.91% $8.1million 1.92% $7.8 million +75 2.88% $12.1 million 2.89% $11.8 million • Assumes long-term historical deposit +100 3.90% $16.5 million 3.92% $16.1 million beta of approximately 50% 1 WSFS IRR model estimates: Static Balance Sheet / Instantaneous Rate Shocks 35

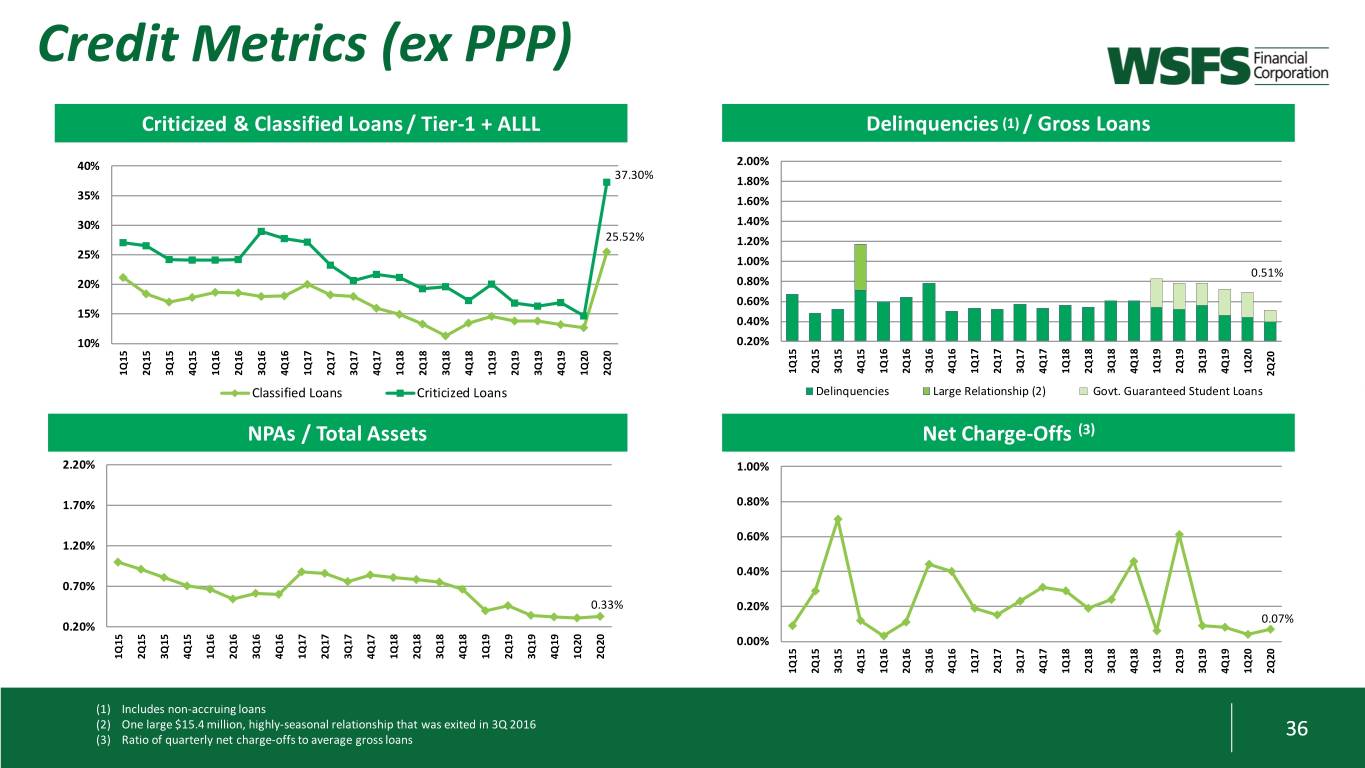

Credit Metrics (ex Metrics PPP) Credit 0.20% 0.70% 1.20% 1.70% 2.20% 10% 15% 20% 25% 30% 35% 40% (3) (2) (1) Ratio of quarterly netcharge One large $15.4 million, highly non- Includes 1Q15 1Q15 Criticized& Classified Loans 2Q15 2Q15 3Q15 3Q15 accruing loans accruing 4Q15 4Q15 1Q16 1Q16 2Q16 2Q16 NPAsTotal/ Assets Classified Loans Classified 3Q16 3Q16 - offs to average gross loansoffs toaverage - seasonal relationship that was exited in 3Q 2016 2016 3Q in exited was that relationship seasonal 4Q16 4Q16 1Q17 1Q17 2Q17 2Q17 3Q17 3Q17 4Q17 4Q17 1Q18 1Q18 Tier / 2Q18 Criticized Loans 2Q18 3Q18 3Q18 - 4Q18 +1 ALLL 4Q18 1Q19 1Q19 2Q19 2Q19 3Q19 3Q19 4Q19 4Q19 1Q20 0.33% 1Q20 2Q20 25.52% 2Q20 37.30% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 1Q15 1Q15 2Q15 Delinquencies 2Q15 3Q15 3Q15 4Q15 4Q15 Delinquencies 1Q16 1Q16 2Q16 2Q16 Net Charge Net 3Q16 Large Relationship (2) 3Q16 4Q16 4Q16 1Q17 1Q17 2Q17 2Q17 (1) / GrossLoans 3Q17 - 3Q17 Offs Offs 4Q17 4Q17 1Q18 1Q18 (3) 2Q18 Loans Student Govt. Guaranteed 2Q18 3Q18 3Q18 4Q18 4Q18 1Q19 1Q19 2Q19 2Q19 3Q19 3Q19 4Q19 4Q19 1Q20 1Q20 0.51% 0.07% 2Q20 2Q20 36

Capital Management – Bank Disciplined capital management providing flexibility to grow & return profits to shareholders Tier 1 Capital ($000s) Common Equity Tier 1 Capital ($000s) Tier 1 Leverage Ratio ($000s) Total Risk Based Capital ($ 000s) 37

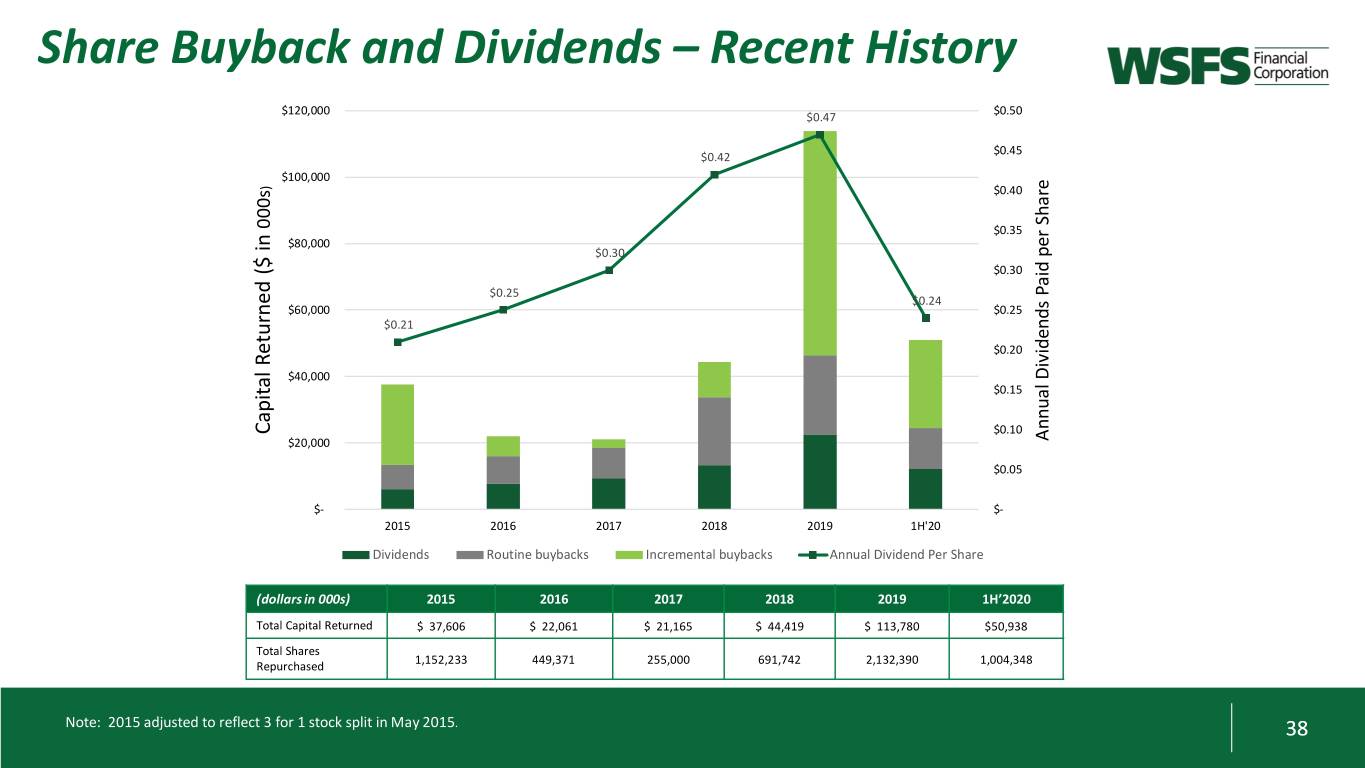

Share Buyback and Dividends – Recent History $120,000 $0.50 $0.47 $0.45 $0.42 $100,000 ) $0.40 000s $0.35 $80,000 $0.30 $0.30 $0.25 $0.24 $60,000 $0.25 $0.21 $0.20 $40,000 $0.15 Capital Returned ($ in ($ Returned Capital $0.10 $20,000 Annual Dividends Paid per Share $0.05 $- $- 2015 2016 2017 2018 2019 1H'20 Dividends Routine buybacks Incremental buybacks Annual Dividend Per Share (dollars in 000s) 2015 2016 2017 2018 2019 1H’2020 Total Capital Returned $ 37,606 $ 22,061 $ 21,165 $ 44,419 $ 113,780 $50,938 Total Shares 1,152,233 449,371 255,000 691,742 2,132,390 1,004,348 Repurchased Note: 2015 adjusted to reflect 3 for 1 stock split in May 2015. 38

Strong Alignment / Capital Management • Executive management bonuses and equity awards based on bottom-line performance ROA, ROTCE and EPS growth – equally weighted • Insider ownership1 is approximately 2% Board of Directors and Executive Management ownership guidelines in place and followed • WSFS repurchased $38.7 million, or 1,004,348 shares of our common stock during 1Q 2020, completing our current authorization. No share repurchases in 2Q 2020. During 1Q 2020, the Board approved a new share repurchase authorization of 15% of outstanding shares as of March 31, 2020; however, we have temporarily suspended all share repurchases until we have a clearer view of the impact of COVID- 19 on the economy and our performance • The Board of Directors approved a quarterly cash dividend of $0.12 per share of common stock which was paid in May 2020 and is scheduled to be paid in August 2020 1 As defined in our most recent proxy 39

WSFS Mission, Vision, Strategy and Values 40

Appendix: Non-GAAP Financial Information

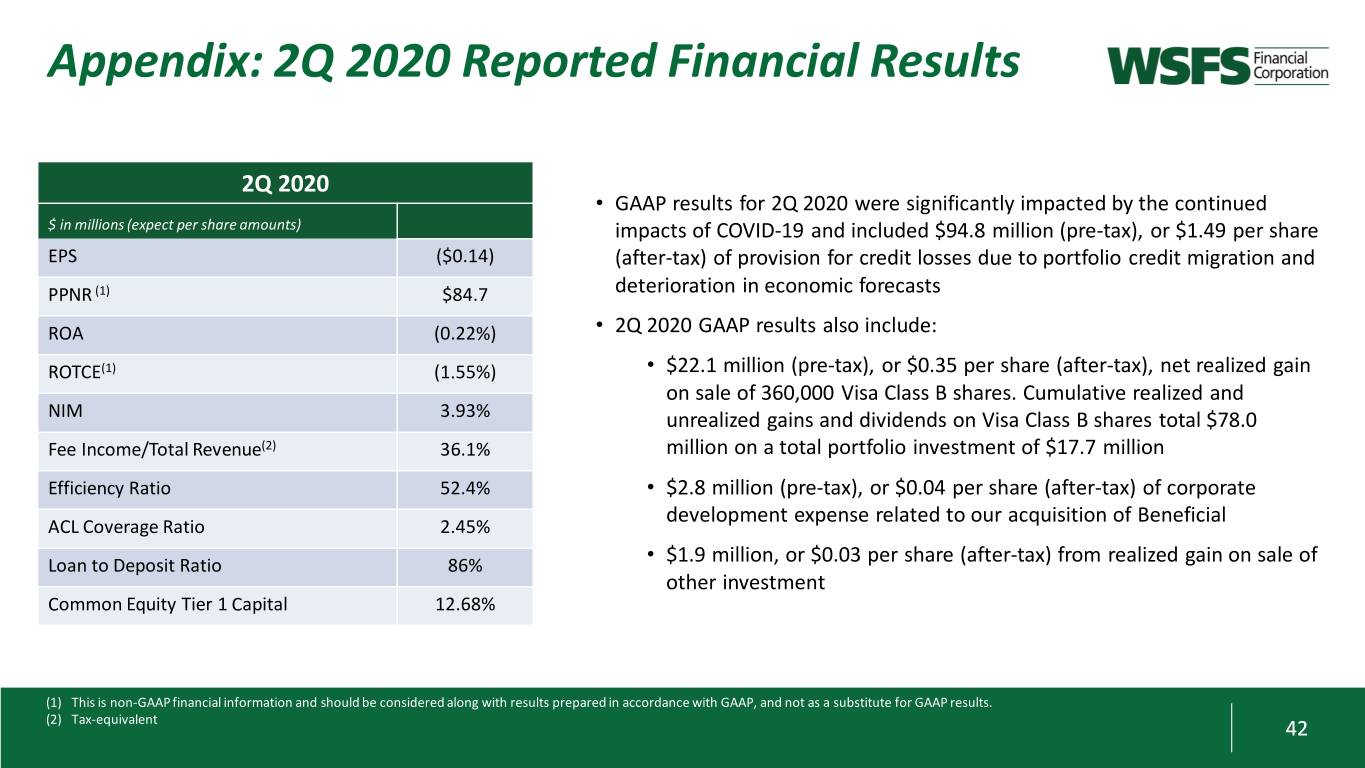

Appendix: 2Q 2020 Reported Financial Results 2Q 2020 • GAAP results for 2Q 2020 were significantly impacted by the continued $ in millions (expect per share amounts) impacts of COVID-19 and included $94.8 million (pre-tax), or $1.49 per share EPS ($0.14) (after-tax) of provision for credit losses due to portfolio credit migration and PPNR (1) $84.7 deterioration in economic forecasts ROA (0.22%) • 2Q 2020 GAAP results also include: ROTCE(1) (1.55%) • $22.1 million (pre-tax), or $0.35 per share (after-tax), net realized gain on sale of 360,000 Visa Class B shares. Cumulative realized and NIM 3.93% unrealized gains and dividends on Visa Class B shares total $78.0 Fee Income/Total Revenue(2) 36.1% million on a total portfolio investment of $17.7 million Efficiency Ratio 52.4% • $2.8 million (pre-tax), or $0.04 per share (after-tax) of corporate development expense related to our acquisition of Beneficial ACL Coverage Ratio 2.45% Loan to Deposit Ratio 86% • $1.9 million, or $0.03 per share (after-tax) from realized gain on sale of other investment Common Equity Tier 1 Capital 12.68% (1) This is non-GAAP financial information and should be considered along with results prepared in accordance with GAAP, and not as a substitute for GAAP results. (2) Tax-equivalent 42

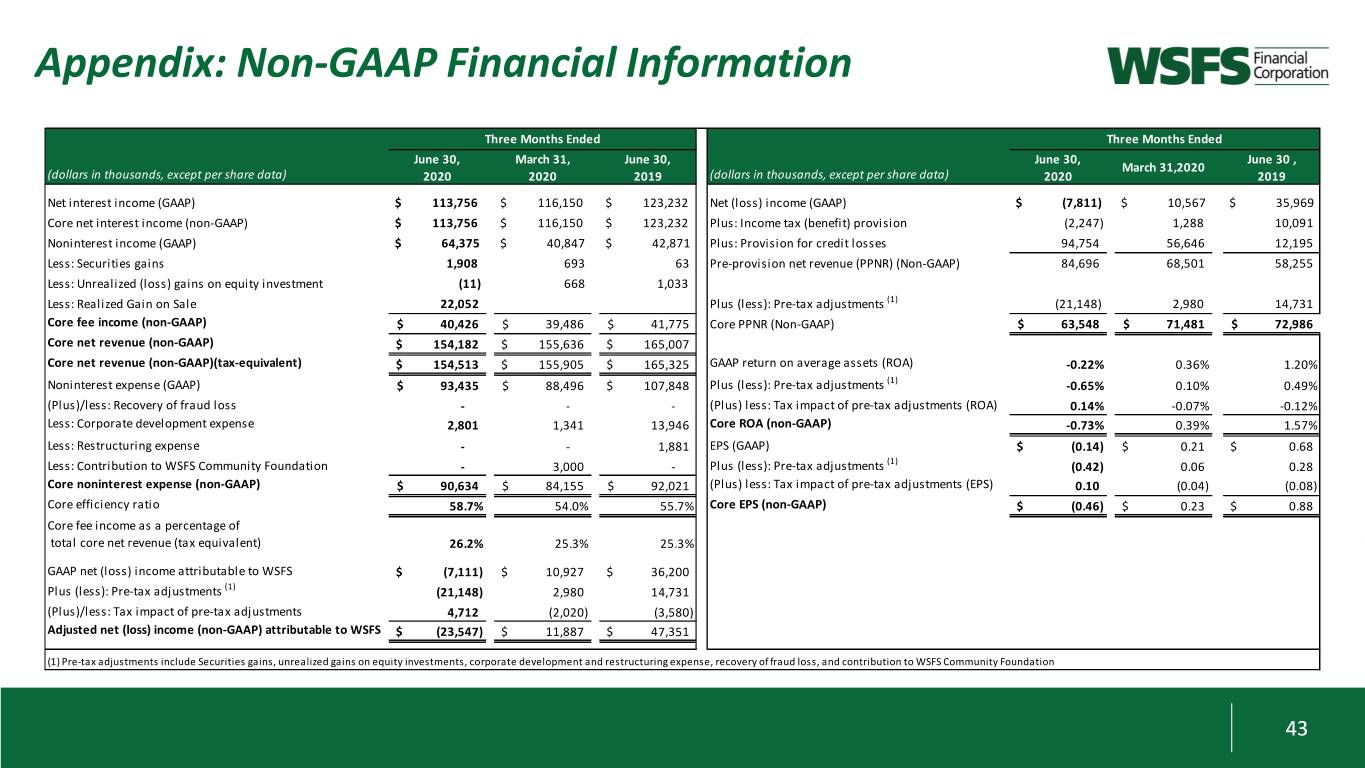

Appendix: Non-GAAP Financial Information Three Months Ended Three Months Ended June 30, March 31, June 30, June 30, June 30 , March 31,2020 (dollars in thousands, except per share data) 2020 2020 2019 (dollars in thousands, except per share data) 2020 2019 Net interest income (GAAP) $ 113,756 $ 116,150 $ 123,232 Net (loss) income (GAAP) $ (7,811) $ 10,567 $ 35,969 Core net interest income (non-GAAP) $ 113,756 $ 116,150 $ 123,232 Plus: Income tax (benefit) provision (2,247) 1,288 10,091 Noninterest income (GAAP) $ 64,375 $ 40,847 $ 42,871 Plus: Provision for credit losses 94,754 56,646 12,195 Less: Securities gains 1,908 693 63 Pre-provision net revenue (PPNR) (Non-GAAP) 84,696 68,501 58,255 Less: Unrealized (loss) gains on equity investment (11) 668 1,033 Less: Realized Gain on Sale 22,052 Plus (less): Pre-tax adjustments (1) (21,148) 2,980 14,731 Core fee income (non-GAAP) $ 40,426 $ 39,486 $ 41,775 Core PPNR (Non-GAAP) $ 63,548 $ 71,481 $ 72,986 Core net revenue (non-GAAP) $ 154,182 $ 155,636 $ 165,007 Core net revenue (non-GAAP)(tax-equivalent) $ 154,513 $ 155,905 $ 165,325 GAAP return on average assets (ROA) -0.22% 0.36% 1.20% (1) Noninterest expense (GAAP) $ 93,435 $ 88,496 $ 107,848 Plus (less): Pre-tax adjustments -0.65% 0.10% 0.49% (Plus)/less: Recovery of fraud loss - - - (Plus) less: Tax impact of pre-tax adjustments (ROA) 0.14% -0.07% -0.12% Less: Corporate development expense 2,801 1,341 13,946 Core ROA (non-GAAP) -0.73% 0.39% 1.57% Less: Restructuring expense - - 1,881 EPS (GAAP) $ (0.14) $ 0.21 $ 0.68 (1) Less: Contribution to WSFS Community Foundation - 3,000 - Plus (less): Pre-tax adjustments (0.42) 0.06 0.28 Core noninterest expense (non-GAAP) $ 90,634 $ 84,155 $ 92,021 (Plus) less: Tax impact of pre-tax adjustments (EPS) 0.10 (0.04) (0.08) Core efficiency ratio 58.7% 54.0% 55.7% Core EPS (non-GAAP) $ (0.46) $ 0.23 $ 0.88 Core fee income as a percentage of total core net revenue (tax equivalent) 26.2% 25.3% 25.3% GAAP net (loss) income attributable to WSFS $ (7,111) $ 10,927 $ 36,200 (1) Plus (less): Pre-tax adjustments (21,148) 2,980 14,731 (Plus)/less: Tax impact of pre-tax adjustments 4,712 (2,020) (3,580) Adjusted net (loss) income (non-GAAP) attributable to WSFS $ (23,547) $ 11,887 $ 47,351 (1) Pre-tax adjustments include Securities gains, unrealized gains on equity investments, corporate development and restructuring expense, recovery of fraud loss, and contribution to WSFS Community Foundation 43

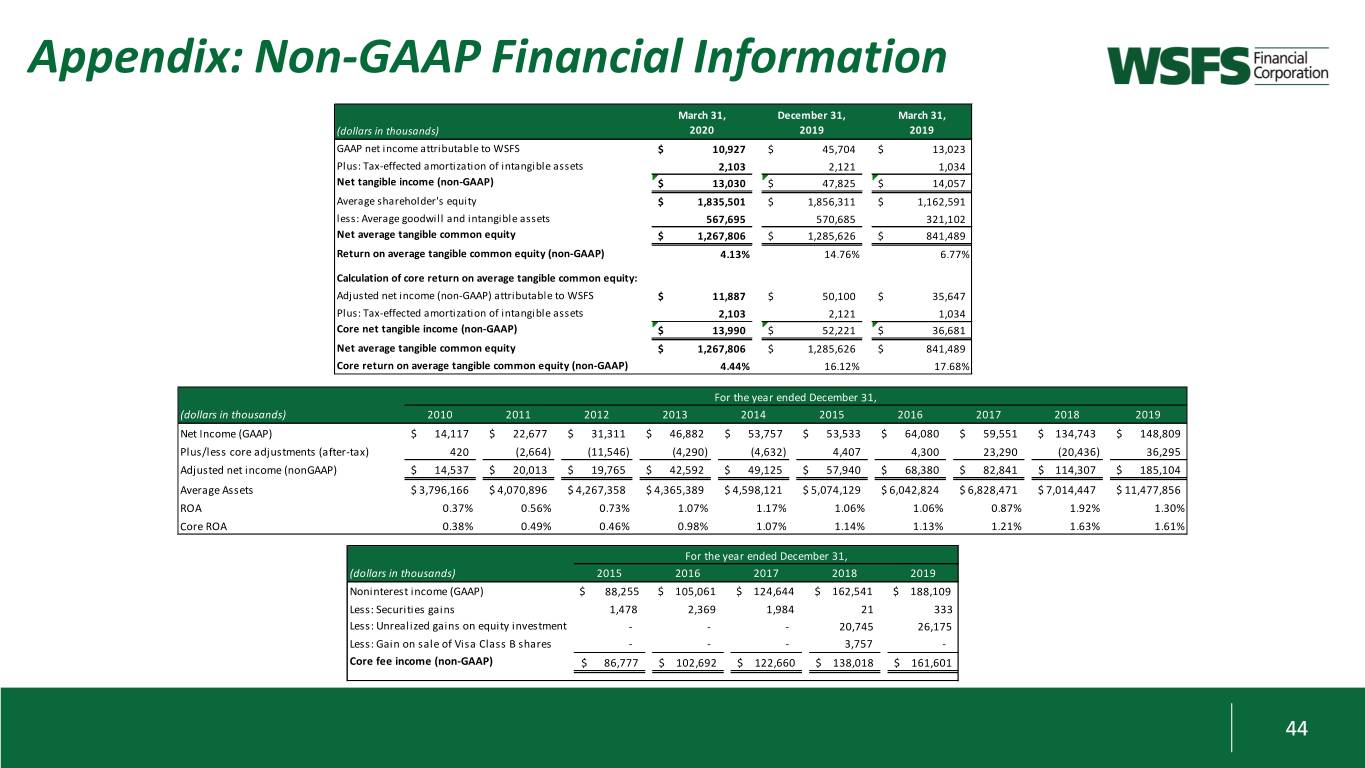

Appendix: Non-GAAP Financial Information March 31, December 31, March 31, (dollars in thousands) 2020 2019 2019 GAAP net income attributable to WSFS $ 10,927 $ 45,704 $ 13,023 Plus: Tax-effected amortization of intangible assets 2,103 2,121 1,034 Net tangible income (non-GAAP) $ 13,030 $ 47,825 $ 14,057 Average shareholder's equity $ 1,835,501 $ 1,856,311 $ 1,162,591 less: Average goodwill and intangible assets 567,695 570,685 321,102 Net average tangible common equity $ 1,267,806 $ 1,285,626 $ 841,489 Return on average tangible common equity (non-GAAP) 4.13% 14.76% 6.77% Calculation of core return on average tangible common equity: Adjusted net income (non-GAAP) attributable to WSFS $ 11,887 $ 50,100 $ 35,647 Plus: Tax-effected amortization of intangible assets 2,103 2,121 1,034 Core net tangible income (non-GAAP) $ 13,990 $ 52,221 $ 36,681 Net average tangible common equity $ 1,267,806 $ 1,285,626 $ 841,489 Core return on average tangible common equity (non-GAAP) 4.44% 16.12% 17.68% For the year ended December 31, (dollars in thousands) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Net Income (GAAP) $ 14,117 $ 22,677 $ 31,311 $ 46,882 $ 53,757 $ 53,533 $ 64,080 $ 59,551 $ 134,743 $ 148,809 Plus/less core adjustments (after-tax) 420 (2,664) (11,546) (4,290) (4,632) 4,407 4,300 23,290 (20,436) 36,295 Adjusted net income (nonGAAP) $ 14,537 $ 20,013 $ 19,765 $ 42,592 $ 49,125 $ 57,940 $ 68,380 $ 82,841 $ 114,307 $ 185,104 Average Assets $ 3,796,166 $ 4,070,896 $ 4,267,358 $ 4,365,389 $ 4,598,121 $ 5,074,129 $ 6,042,824 $ 6,828,471 $ 7,014,447 $ 11,477,856 ROA 0.37% 0.56% 0.73% 1.07% 1.17% 1.06% 1.06% 0.87% 1.92% 1.30% Core ROA 0.38% 0.49% 0.46% 0.98% 1.07% 1.14% 1.13% 1.21% 1.63% 1.61% For the year ended December 31, (dollars in thousands) 2015 2016 2017 2018 2019 Noninterest income (GAAP) $ 88,255 $ 105,061 $ 124,644 $ 162,541 $ 188,109 Less: Securities gains 1,478 2,369 1,984 21 333 Less: Unrealized gains on equity investment - - - 20,745 26,175 Less: Gain on sale of Visa Class B shares - - - 3,757 - Core fee income (non-GAAP) $ 86,777 $ 102,692 $ 122,660 $ 138,018 $ 161,601 44

Appendix: Non-GAAP Financial Information $ in 000's 1Q'19 2Q'19 3Q'19 4Q'19 TTM 4Q'19 1Q'20 2Q'20 Net Income $ 12,930 $ 35,969 $ 53,595 $ 45,424 $ 147,918 $ 10,567 $ (7,811) Plus: Income Tax Provision 6,260 10,091 15,902 14,199 46,452 1,288 (2,247) Plus: Provision for Credit Losses 7,654 12,195 4,121 1,590 25,560 56,646 94,754 Plus/Less: Core Adjustments (1) 27,176 14,731 (2,467) 5,419 44,859 2,980 (21,148) Core Pre-Provision Net Revenue $ 54,020 $ 72,986 $ 71,151 $ 66,632 $ 264,789 $ 71,481 $ 63,548 PPP Income - - - - - - 4,836 PPP Expense - - - - - - (1,814) PPP - - - - - - 3,022 Core Pre-Provision Net Revenue, Less PPP $ 54,020 $ 72,986 $ 71,151 $ 66,632 $ 264,789 $ 71,481 $ 60,526 Average Assets $ 9,099,176 $ 12,122,966 $ 12,418,420 $ 12,226,162 $ 11,466,681 $ 12,159,524 $ 13,020,715 PPP Average Assets $ 727,377 Average Assets less PPP $ 12,293,338 PPNR/Avg Assets (annualized) 2.41% 2.41% 2.27% 2.16% 2.31% 2.36% 1.96% PPNR less PPP/Avg Assets (annualized) 2.41% 2.41% 2.27% 2.16% 2.31% 2.36% 1.98% 1 For detail on our core adjustments for 2Q'20, 1Q'20 and 2Q'19 refer to our Earnings Release filed at Exhibit 99.1 to our July 23, 2020 8-K filing. For detail on our core adjustments for 4Q'19 and 1Q'19, refer to our Earnings Release filed at Exhibit 99.1 to our April 27,2020 8-K filing. For detail on our core adjustments for 3Q'19, refer to our Earnings Release filed at Exhibit 99.1 to our 45 October 22,2019 8-K filing.

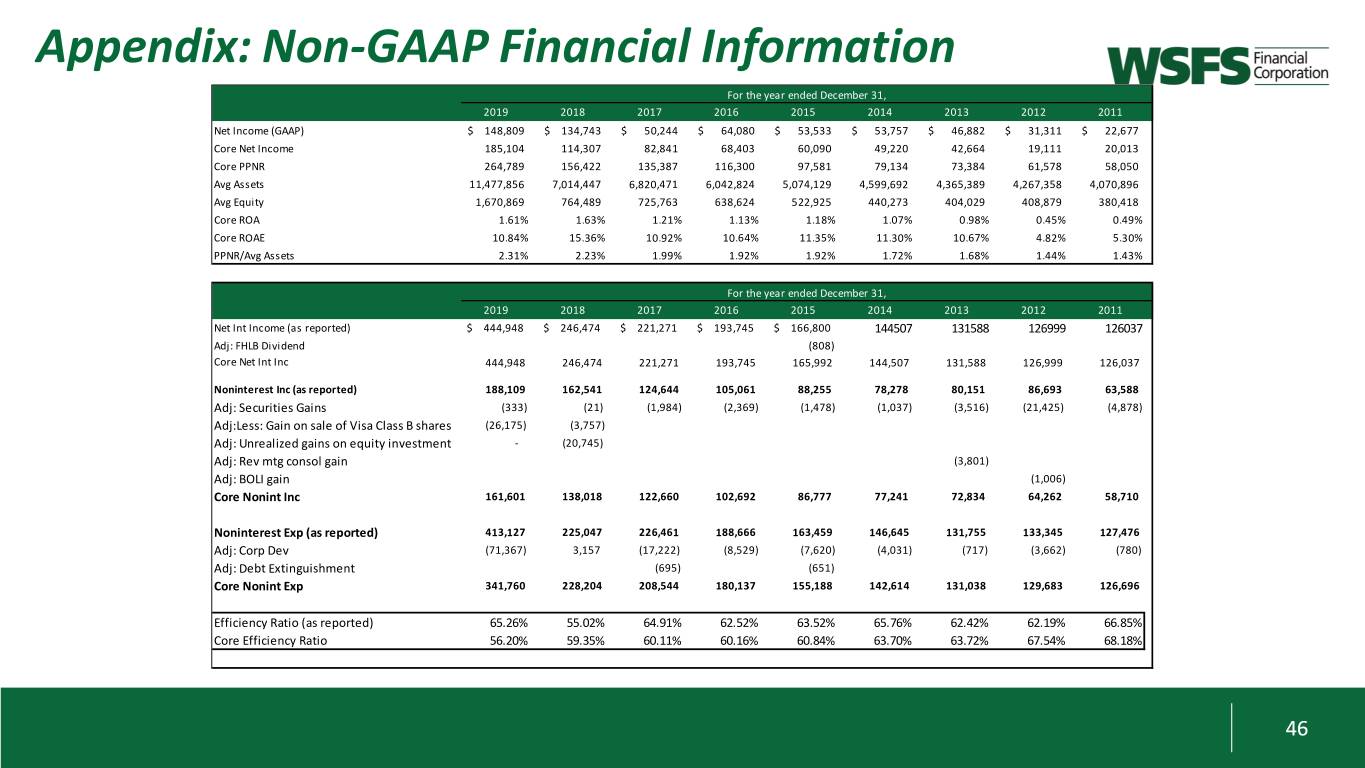

Appendix: Non-GAAP Financial Information For the year ended December 31, 2019 2018 2017 2016 2015 2014 2013 2012 2011 Net Income (GAAP) $ 148,809 $ 134,743 $ 50,244 $ 64,080 $ 53,533 $ 53,757 $ 46,882 $ 31,311 $ 22,677 Core Net Income 185,104 114,307 82,841 68,403 60,090 49,220 42,664 19,111 20,013 Core PPNR 264,789 156,422 135,387 116,300 97,581 79,134 73,384 61,578 58,050 Avg Assets 11,477,856 7,014,447 6,820,471 6,042,824 5,074,129 4,599,692 4,365,389 4,267,358 4,070,896 Avg Equity 1,670,869 764,489 725,763 638,624 522,925 440,273 404,029 408,879 380,418 Core ROA 1.61% 1.63% 1.21% 1.13% 1.18% 1.07% 0.98% 0.45% 0.49% Core ROAE 10.84% 15.36% 10.92% 10.64% 11.35% 11.30% 10.67% 4.82% 5.30% PPNR/Avg Assets 2.31% 2.23% 1.99% 1.92% 1.92% 1.72% 1.68% 1.44% 1.43% For the year ended December 31, 2019 2018 2017 2016 2015 2014 2013 2012 2011 Net Int Income (as reported) $ 444,948 $ 246,474 $ 221,271 $ 193,745 $ 166,800 144507 131588 126999 126037 Adj: FHLB Dividend (808) Core Net Int Inc 444,948 246,474 221,271 193,745 165,992 144,507 131,588 126,999 126,037 Noninterest Inc (as reported) 188,109 162,541 124,644 105,061 88,255 78,278 80,151 86,693 63,588 Adj: Securities Gains (333) (21) (1,984) (2,369) (1,478) (1,037) (3,516) (21,425) (4,878) Adj:Less: Gain on sale of Visa Class B shares (26,175) (3,757) Adj: Unrealized gains on equity investment - (20,745) Adj: Rev mtg consol gain (3,801) Adj: BOLI gain (1,006) Core Nonint Inc 161,601 138,018 122,660 102,692 86,777 77,241 72,834 64,262 58,710 Noninterest Exp (as reported) 413,127 225,047 226,461 188,666 163,459 146,645 131,755 133,345 127,476 Adj: Corp Dev (71,367) 3,157 (17,222) (8,529) (7,620) (4,031) (717) (3,662) (780) Adj: Debt Extinguishment (695) (651) Core Nonint Exp 341,760 228,204 208,544 180,137 155,188 142,614 131,038 129,683 126,696 Efficiency Ratio (as reported) 65.26% 55.02% 64.91% 62.52% 63.52% 65.76% 62.42% 62.19% 66.85% Core Efficiency Ratio 56.20% 59.35% 60.11% 60.16% 60.84% 63.70% 63.72% 67.54% 68.18% 46

Stockholders or others seeking information regarding the Company may call or write: WSFS Financial Corporation Investor Relations WSFS Bank Center 500 Delaware Avenue Wilmington, DE 19801 302-504-9857 stockholderrelations@wsfsbank.com www.wsfsbank.com Rodger Levenson Dominic C. Canuso Chairman, President and CEO Chief Financial Officer 302-571-7296 302-571-6833 rlevenson@wsfsbank.com dcanuso@wsfsbank.com 47