Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AAON, INC. | aaon20200922pressrelea.htm |

| 8-K - 8-K - AAON, INC. | aaon-20200921.htm |

AAON, Inc. Investor Presentation Gary Fields Scott Asbjornson President & CEO Vice President & CFO Q2 2020

Safe Harbor Statement Certain statements and information set forth in this presentation contains “forward-looking statements” and “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995. Except for statements of historical fact, certain information contained herein constitutes forward-looking statements which include management’s assessment of future plans and operations and are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Forward-looking statements are provided to allow potential investors the opportunity of management’s beliefs and opinions in respect of the future so that they may use such beliefs and opinions as one factor in evaluating an investment. Some of the forward-looking statements may be identified by words such as “may”, “plan”, “foresee”, “will”, “should”, “could”, “anticipate,” ”believe,” “expect,” “intend,” “potential,” “continue,” and similar expressions. While the Company’s management believes that these forward-looking statements are reasonable as and when made, these statements are not guarantees of future performance and undue reliance should not be placed on them. The Company’s forward-looking statements involve significant risks and uncertainties (some of which are beyond the Company’s control) and assumptions that could cause actual future results to differ materially from the Company’s historical experience and its present expectations or projections. For additional information regarding known material factors that could cause the Company’s results to differ from its projected results, please see its filings with the SEC, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. The reader is cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statement after they are made, whether as a result of new information, future events, or otherwise. 2

AAON AAON is a premium provider of commercial heating, ventilation and air conditioning (HVAC) products. Company Position Market Opportunities AAON provides designs of Energy efficiency and the highest quality and green features currently performance that lead the drive the market – AAON HVAC industry is a leader in both AAON offers innovative and differentiated Markets increasingly products demand features offered by AAON, leading to Provide more than just equipment; provide increased market share solutions 3

Manufacturing Locations Three Facilities: Tulsa, Oklahoma (Headquarters) 1.51M Sq. Ft. WSHP Manufacturing Began Production Oct 2016 Tulsa - Rooftop Units, Outdoor Mechanical Rooms, R&D Laboratory - 134,000 Sq. Ft Large Split Systems and Geothermal/Water-Source Began Operation in 2018 Heat Pumps Longview, Texas 263,000 Sq. Ft. New Building 220,000 Sq. Ft Broke Ground August 2019 Parkville - AAON Controls Parkville, Missouri Longview - Split Systems, Small Chillers, 48,000 Sq. Ft. Self-Contained Units and Coils Acquisition of Longtime Controls Supplier - Feb 2018 4 Accelerating AAON Controls Product Development

Product Families 5

AAON Business Strategy Mass customization Uses flexible computer-aided manufacturing systems to produce custom outputs Combines the low unit costs of mass production processes with the flexibility of individual customization Collaborative effort AAON sales offices work with individual customers to determine the precise product offering that best serves the customer's needs Information gathered is used to specify and manufacture a product that suits that specific customer 6

AAON Market Strategy Focus upon underserved market niches Establish manufacturing methodologies to support market niche products Develop company culture focused upon customer satisfaction Reduce product delivery channel time and cost Continue with the goal of product and manufacturing technology leadership AAON, WITH A FOCUS ON ENERGY EFFICIENCY, THE ENVIRONMENT, AND AIR QUALITY = GROWTH AND PROFIT HEAVY INVESTMENT IN RESEARCH & DEVELOPMENT ($13.0M, $13.5M & $14.8M in 2017, 2018 & 2019, respectively) 7

AAON Served Market Growth Rooftops $ 4.1 B Chillers $ 0.9 B Air Handling Units $ 3.0 B Split Systems $ 7.4 B * Geothermal/WSHP $ 0.5 B ** 2019 Served Market - $ 15.9 B 1988 Served Market - $ 50 M Based on AHRI sales reporting * AHRI data includes both commercial and residential systems. Residential systems likely account for a large portion of this number 8 ** Entered the mass produced geothermal/water-source heat pump market in 2016. Units began shipping November 2016.

AAON Sales Mix by Business Segment Manufacturing 17% Other Religious New vs Replacement 5% 1% Lodging 50% New Construction 8% Educational 50% Replacement 23% Office Health Care 18% 10% Commercial 19% May not add to 100% due to rounding 9

Units Sold – Product Mix 10

Product Mix – Units vs Dollars 11

U.S. Construction - 2008 to 2019 U.S. Census Bureau Value of Construction (Annual) - AAON Sales Segments - http://www.census.gov/construction/c30/c30index.html Annual Value of Construction (Millions $) Year Construction Type 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Lodging 35,806 25,499 11,635 9,129 10,836 13,585 16,124 21,728 27,122 28,463 31,913 33,513 Office 68,563 51,908 37,850 36,011 37,800 37,620 46,056 55,188 68,935 68,679 72,939 79,022 Commercial 86,212 54,737 40,100 42,816 47,335 50,992 62,708 66,924 74,242 86,953 89,719 85,913 Health Care 46,902 44,845 39,344 40,204 42,544 41,484 38,410 40,734 41,415 39,986 42,081 43,870 Educational 104,890 103,202 88,405 84,985 84,672 77,996 79,700 83,517 88,690 91,668 94,524 98,051 Religious 7,225 6,192 5,288 4,239 3,846 3,678 3,248 3,667 3,735 3,210 3,032 2,937 Manufacturing 54,105 57,895 41,178 40,559 47,741 47,945 57,761 78,178 74,829 65,833 64,887 73,291 Total 403,703 344,278 263,800 257,943 274,774 273,300 304,007 349,936 378,968 384,792 399,094 416,597 AAON Sales (Millions $) 279.7 245.3 244.6 266.2 303.1 321.1 356.3 358.6 384.0 405.2 433.9 469.3 12

U.S. Construction - 2008 to 2019 U.S. Census Bureau Value of Construction (Annual) - AAON Sales Segments - http://www.census.gov/construction/c30/c30index.html Percent Change of 2008 Spending Year Construction Type 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Lodging 100% 71% 32% 25% 30% 38% 45% 61% 76% 79% 89% 94% Office 100% 76% 55% 53% 55% 55% 67% 80% 101% 100% 106% 115% Commercial 100% 63% 47% 50% 55% 59% 73% 78% 86% 101% 104% 100% Health Care 100% 96% 84% 86% 91% 88% 82% 87% 88% 85% 90% 94% Educational 100% 98% 84% 81% 81% 74% 76% 80% 85% 87% 90% 93% Religious 100% 86% 73% 59% 53% 51% 45% 51% 52% 44% 42% 41% Manufacturing 100% 107% 76% 75% 88% 89% 107% 144% 138% 122% 120% 135% Total 100% 85% 65% 64% 68% 68% 75% 87% 94% 95% 99% 103% AAON 100% 88% 87% 95% 108% 115% 127% 128% 137% 145% 155% 168% Differential 2% 22% 31% 40% 47% 52% 42% 43% 50% 56% 65% 13

U.S. Construction – 6 Months 2008 to 2020 U.S. Census Bureau Value of Construction - AAON Sales Segments - http://www.census.gov/construction/c30/c30index.html Value of Construction (Millions $) 6 Months Construction Type 6M 2008 6M 2011 6M 2018 6M 2019 6M 2020 Lodging 35,647 8,518 31,246 34,056 30,205 Office 71,441 34,216 71,713 78,086 82,181 Commercial 89,844 41,848 92,138 85,972 84,502 Health Care 44,881 39,229 42,299 44,223 47,431 Educational 102,527 82,363 93,251 97,207 105,632 Religious 6,992 4,293 3,107 2,948 3,185 Manufacturing 56,679 33,138 63,438 71,195 74,358 Total 408,011 243,605 397,193 413,688 427,493 AAON Sales (Millions $) 140.2 129.0 208.7 233.3 263.1 14

U.S. Construction – 6 Months 2008 to 2020 U.S. Census Bureau Value of Construction - AAON Sales Segments - http://www.census.gov/construction/c30/c30index.html Percent Change of 2008 Spending 6 Months Construction Type 6M 2008 6M 2011 6M 2018 6M 2019 6M 2020 Lodging 100% 24% 88% 96% 85% Office 100% 48% 100% 109% 115% Commercial 100% 47% 103% 96% 94% Health Care 100% 87% 94% 99% 106% Educational 100% 80% 91% 95% 103% Religious 100% 61% 44% 42% 46% Manufacturing 100% 58% 112% 126% 131% Total 100% 60% 97% 101% 105% AAON 100% 92% 149% 166% 188% Differential 32% 52% 65% 83% 15

U.S. Construction - Since 2008 U.S. Census Bureau Value of Construction $480,000 $480.0 $469.3 $460,000 $460.0 $440,000 $440.0 $433.9 $420,000 $420.0 $405.2 ) $400,000 $400.0 $380,000 $380.0 $356.3 $384.0 $360,000 $360.0 $358.6 $340,000 $340.0 $321.1 $320,000 $320.0 $303.1 $300,000 $300.0 AAON Net Sales (millions) Total Construction (millions Total Construction $279.7 $280,000 $266.2 $280.0 $260,000 $260.0 $262.5 $240,000 $240.0 $245.3 $244.6 $220,000 $220.0 Office, Commercial, Health Care, Educational, Manufacturing, Lodging, & Religious 16 Non-residential Segments

Sales Performance – 2008 to 2019 Net Income (millions) Sales (millions) 500 100 450 90 469.3 400 356.3 433.9 80 405.2 350 384.0 70 358.6 300 321.1 60 250 303.1 50 Net Sales (millions) 279.7 200 245.3 244.6 266.2 40 150 53.8 53.7 30 44.9 53.0 100 36.7 43.1 42.3 20 28.6 27.7 27.5 50 21.9 14.0 10 0 0 Net Income (millions) Year 17

Sales Performance – 6 Months 6M Net Income (millions) 6M Sales (millions) 6M 2016 6M 2017 6M 2018 6M 2019 6M 2020 300 100 90 250 263.1 80 200 233.3 70 208.7 60 187.7 150 187.4 50 Net Sales (millions) 40 100 30 50 39.7 20 24.8 23.0 22.1 14.9 10 0 0 6M 2016 6M 2017 6M 2018 6M 2019 6M 2020 Net Income (millions) Year 18

Sales Dollars Per Capita – 2005 to 2019 U.S. Population (millions) Sales (millions) Sales $ per Capita 500 1.5 $1.428 $1.326 1.4 (millions) 450 $1.244 1.3 $1.185 Sales 400 $1.117 $1.116 1.2 and and 350 $1.015 1.1 $0.965 1 300 $0.854 $0.791 0.9 0.8 Population Population 250 $0.628 0.7 200 0.6 150 0.5 Capita per $ Year2005 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2005 Pop. = 294.99 M 2018 Pop. = 327.17 M - 1% Increase 2019 Pop. = 328.76 M - 1% Increase 2005 Sales = $185.20 M 2018 Sales = $433.95 M - 7.1% Inc 2019 Sales = $469.33 M - 5.5% Inc 19 2005 $0.628 per Capita 2018 $1.362 per Capita - $0.082 Inc 2019 $1.428 per Capita - $0.101 Inc

Company Backlog – 2008 to 2019 June 30, Order Backlog (millions) 2020 160.0 backlog of 140.0 $103.5M 120.0 100.0 June 30, 80.0 151.8 2019 57.1 81.2 60.0 48.8 142.7 backlog of 40.0 $179.6 M 44.0 45.3 49.1 20.0 45.2 38.4 43.6 32.2 - 20

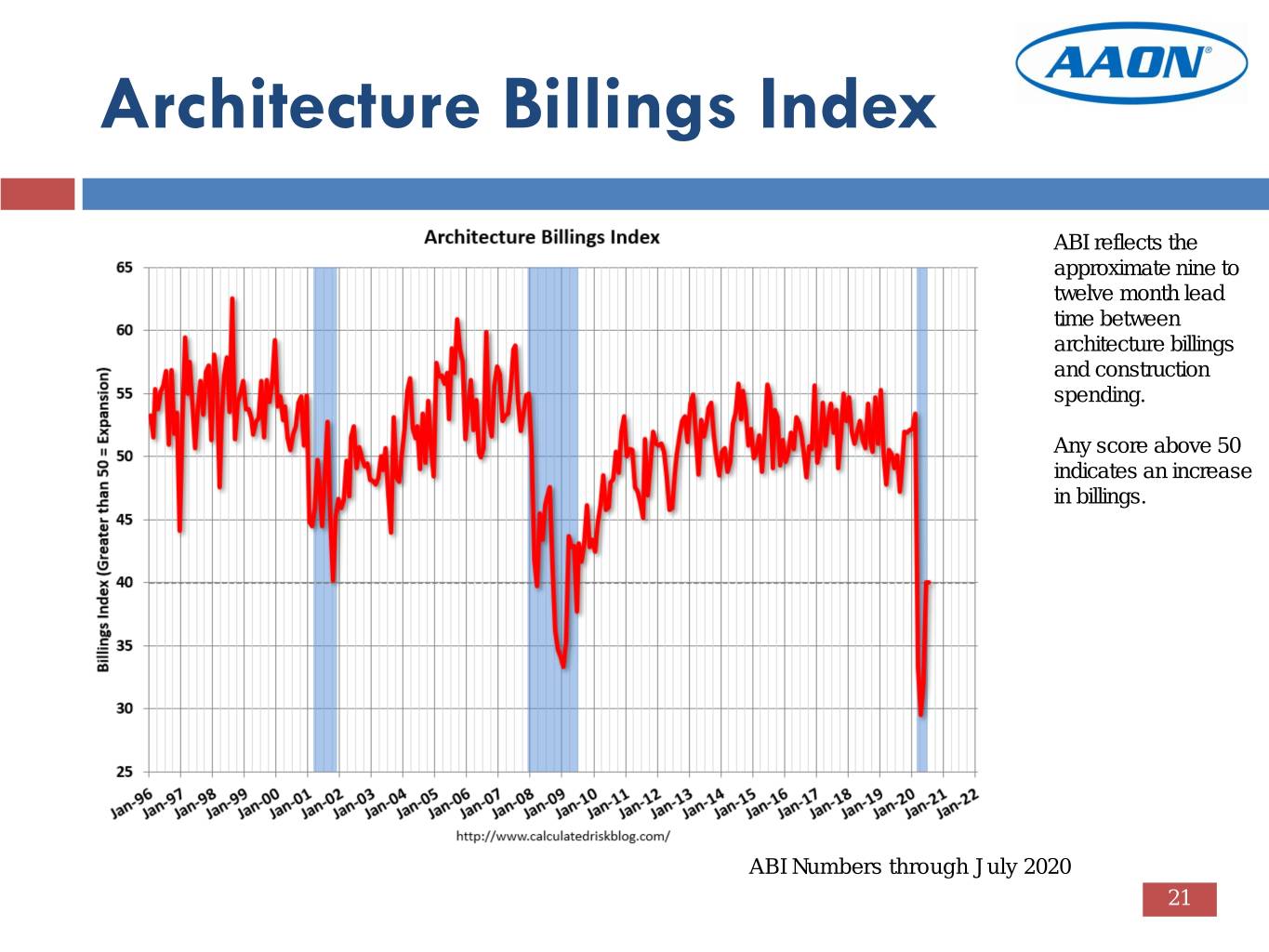

Architecture Billings Index ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. Any score above 50 indicates an increase in billings. ABI Numbers through July 2020 21

Financial Information 6 Months 2015 2016 2017 2018 2019 2020 CASH FLOW FROM OPERATIONS $55,355 $63,923 $57,994 $54,856 $97,925 $62,762 (in thousands) CAPITAL EXPENDITURES $20,967 $26,604 $41,713 $37,268 $37,166 $33,510 (in thousands) 1 1 2 DIVIDENDS (in thousands) $11,857 $12,676 $13,663 $16,728 $16,645 $9,923 STOCK BUYBACKS Dollars (in millions) $37.1 M $20.1 M $18.2 M $27.9 M $20.8 M $17.0 M Shares Bought 1,576,090 736,171 522,134 783,776 454,430 334,440 Shares Outstanding 53,012,363 52,651,448 52,422,801 51,991,242 52,078,515 52,234,119 Shares Bought 2.97% 1.40% 1.00% 1.51% 0.87% 0.64% Shares Outstanding 1 Semi-Annual Cash Dividend increased to $0.16/share, starting with the July 6, 2018 payment date 2 Declared Semi-Annual Cash Dividend increased to $0.19/share, starting with the July 1, 2020 payment date 22

Ratio Analysis 6 Months Profitability 2015 2016 2017 2018 2019 2020 Gross Profit % 30.2% 30.8% 30.5% 23.9% 25.4% 30.8% Return on Average Equity 25.2% 27.2% 24.1% 17.3% 19.9% 12.9% Return on Average Assets 19.6% 21.7% 19.5% 14.0% 15.8% 9.9% Pre-Tax Income on Sales 19.5% 20.7% 18.4% 12.8% 14.3% 19.0% Net Income on Sales 12.5% 13.8% 13.3% 9.8% 11.4% 15.1% Debt Management Total Liabilities to Equity 28.5% 23.0% 24.1% 23.5% 28.0% 33.2% Liquidity Quick Ratio1 2.0 2.4 1.7 1.3 2.0 1.7 Current Ratio 2.9 3.7 3.1 3.0 3.3 2.9 Market Value Year-End Price Earnings Ratio 28 33 36 44 48 - 1 (Cash and cash investments + receivables)/current liabilities 23 23

Financial Performance Equity per Share $6.10 58,000 $6.0 $5.51 $4.74 $5.0 $5.43 $4.94 $4.0 Stock Price per Share/10 $3.51 $3.0 Weighted Average Shares Outstanding $2.0 52,668 52,635 $ Price Per Share $ Price Per 52,885 Shares Outstanding Shares $1.0 $1.02 $0.75 $0.80 Earnings per Share $0.0 51,000 2015 2016 2017 2018 2019 6 Months 2020 EPS Fully Diluted (Adjusted for splits)(Left scale) Stock Price/10 (Adjusted for dividends and splits) (Left scale) Stockholders' Equity Per Share (Adjusted for splits) Fully Diluted (Left scale) Weighted Average Shares Outstanding (thousands) Fully Diluted (Adjusted for splits)(Right scale) 24

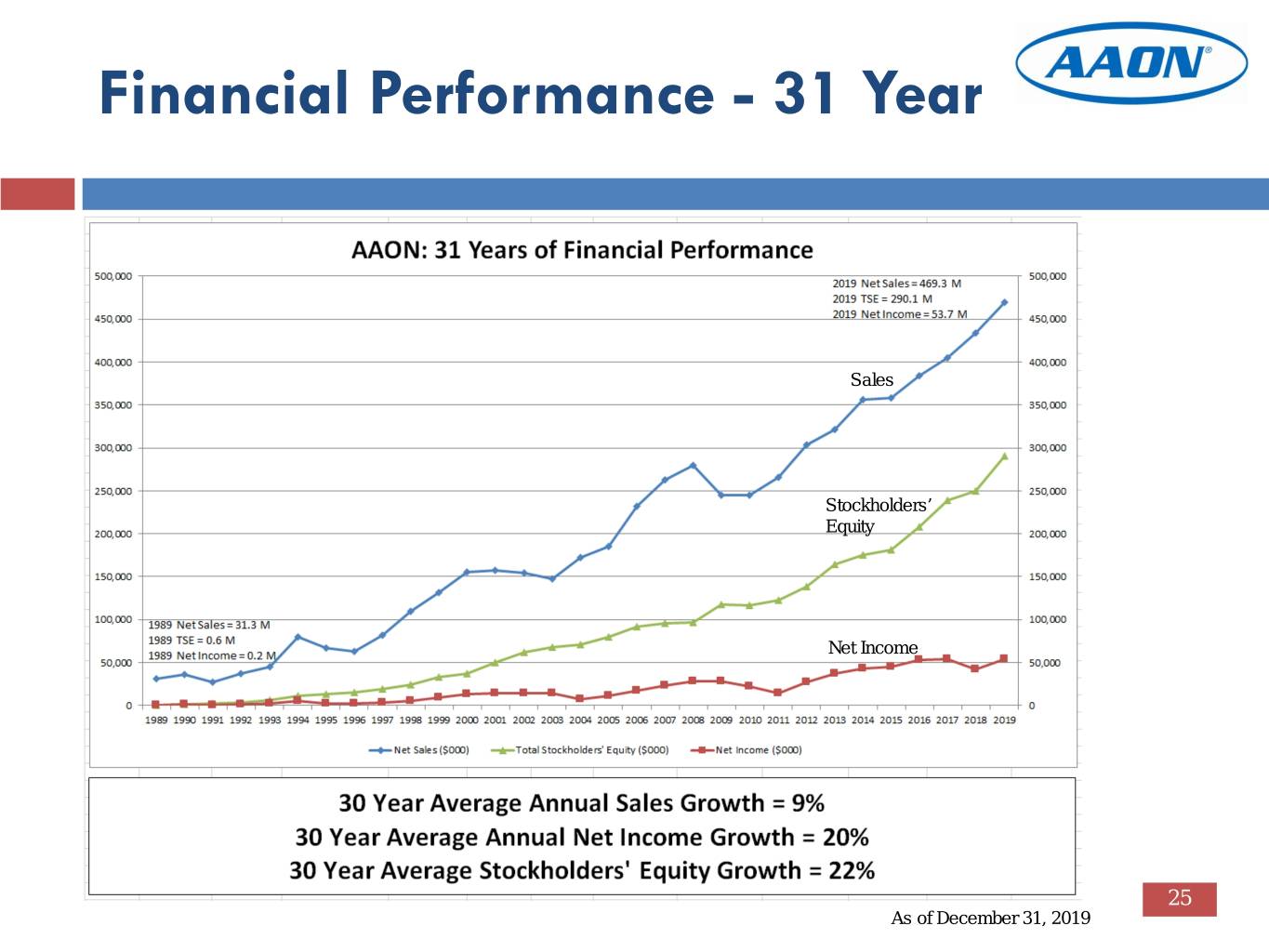

Financial Performance - 31 Year Sales Stockholders’ Equity Net Income 25 As of December 31, 2019

Stock Performance – 25+ year AAON, Inc. (NASDAQ:AAON) AAON Increase (39,637%) Comparison with - GSPC = S&P 500 (687%) - INXC = NASDAQ (1,542%) AAON Stock Performance Shown with Stock Splits and Dividends Stock Price 1991 = ~ 0.10 Stock Price September 9, 2020 = 55.90 Chart available from www.yahoo.com/finance 26

AAON Defining Quality. Building Comfort. 27