Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Strategic Realty Trust, Inc. | srtr-20200915.htm |

StrategicStrategic Realty Realty Trust Trust is is a a nonnon-traded-traded real real estate estate Shareholder Newsletter investmentinvestment trust, trust, focused focused onon building building a a portfolio portfolio of of September 2020 highhigh quality quality urban urban and and streetstreet retail retail properties properties in in SRTREIT.COM majormajor west west coast coast marketsmarkets 2020 Overview National Events • The COVID-19 crisis has dramatically affected the economy of the United States. • Gross Domestic Product was down 31.7% year over year in the second quarter of 2020 following a 5.0% decline in the first quarter of 2020. • Unemployment reaches levels not seen since the Great Depression. • Retail sales were down 8.1% in the second quarter (page 5) • Retail vacancies up by over 14 million square feet (page 5) • Public stock markets were extremely volatile. According to BMO Capital markets 54 publicly listed REITS (including virtually all retail property REITS) suspended or reduced their dividends in response to the pandemic. • Total return for all REITs (as of 9/4/20) according to Raymond James was -14.9% for the last twelve months and -15.0% year to date and for retail property REITS (not including malls) the last twelve months saw -23.7% and year to date -24.3%. Company Events • The majority of the Company’s tenants have had to close their stores at one point or another and have had to operate with significant restrictions on their operations. Some tenants are still precluded from opening. • Many of the Company’s tenants have requested lease modifications and rent reductions due to reduced sales, while others have been less affected. Rent collections have been affected. (page 2 and 3) • The Board of Directors has approved an updated Net Asset Value per Share of $5.25, incorporating the valuation company’s post-COVID valuations of the operating portfolio. (page 6) • The Company was in contract to sell its property in Knoxville, TN (Turkey Creek), but the buyer cancelled the contract due to the uncertainty of the COVID-19 situation and the real estate lending and financial markets. • The Company’s Advisor and Manager implemented its business continuity plan and was able to transition all employees and operations to a remote work environment, beginning on March 16, 2020, Non-Essential office workers are still required to work from home in San Mateo County, CA, where the Company’s advisor’s headquarters are located. • The Company remains in compliance with financial obligations under its various loans, both direct obligations and those of its Joint Ventures. 1

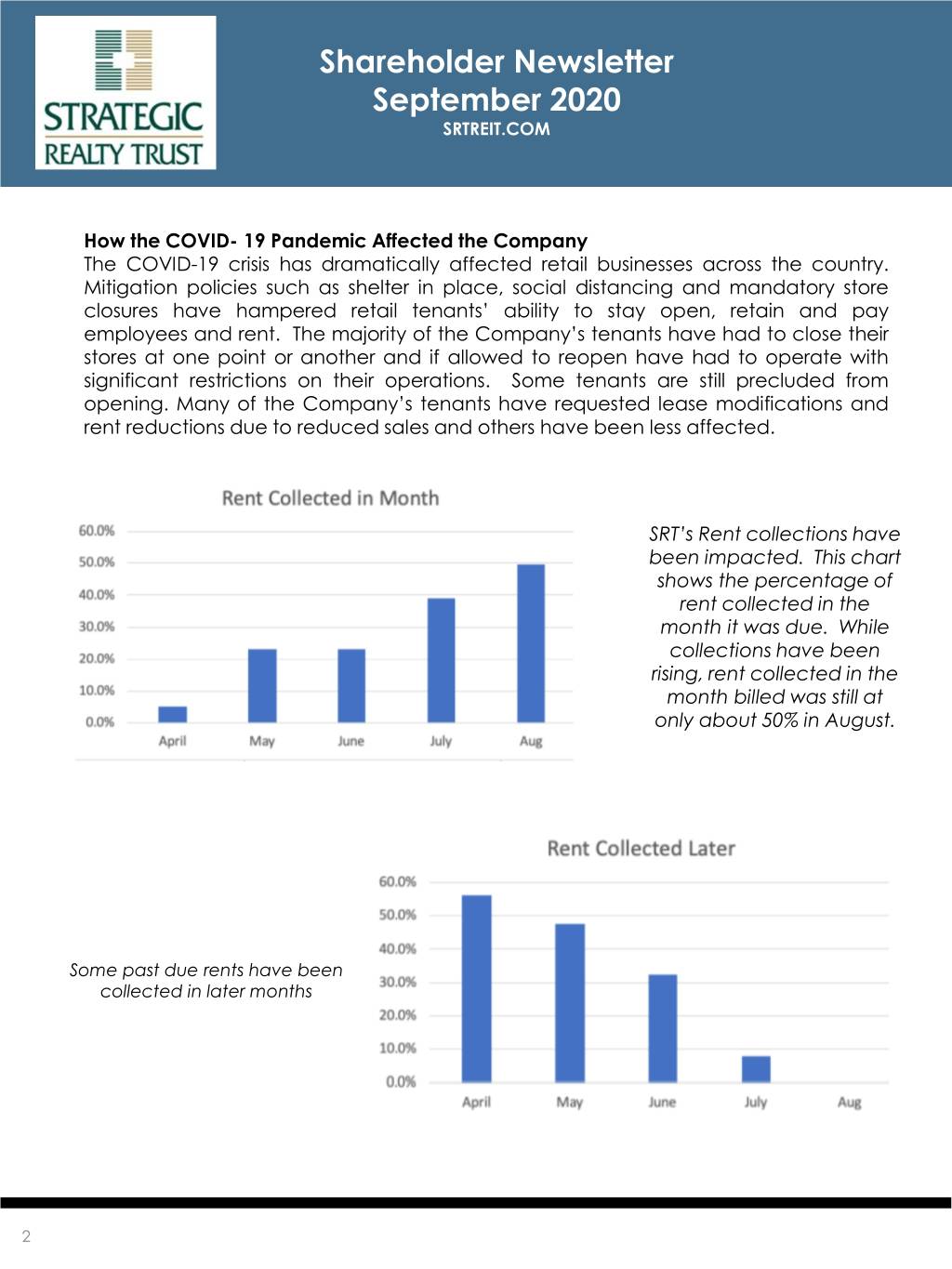

Shareholder Newsletter September 2020 SRTREIT.COM How the COVID- 19 Pandemic Affected the Company The COVID-19 crisis has dramatically affected retail businesses across the country. Mitigation policies such as shelter in place, social distancing and mandatory store closures have hampered retail tenants’ ability to stay open, retain and pay employees and rent. The majority of the Company’s tenants have had to close their stores at one point or another and if allowed to reopen have had to operate with significant restrictions on their operations. Some tenants are still precluded from opening. Many of the Company’s tenants have requested lease modifications and rent reductions due to reduced sales and others have been less affected. SRT’s Rent collections have been impacted. This chart shows the percentage of rent collected in the month it was due. While collections have been rising, rent collected in the month billed was still at only about 50% in August. Some past due rents have been collected in later months 2

Shareholder Newsletter September 2020 SRTREIT.COM The Company has completed a number of lease modifications and has more in negotiation, including one that was already modified in response to the pandemic. In general, these modifications have involved lease term extensions, use of security deposits, deferral of some or all of the base rent for a period of time, some rent abatement, and some percentage rent mechanisms to balance out the rent to sales during these difficult times to allow these businesses to survive. Helping to keep these businesses operating and paying common area expenses, property taxes and rent to the extent possible is best for all parties. There have been estimates that as many as one third of all restaurants or small businesses that close as a result of this pandemic will not reopen. The larger amount of deferrals and abatements in April and May relate to the early lease modifications completed. With more to go these numbers will likely rise again. The increase in outstanding rent will likely decrease as more lease modifications are completed. Some tenants have withheld payments until a deal could be reached. Many are restaurants who need to reopen before agreeing to temporary lease changes. 3

Shareholder Newsletter September 2020 SRTREIT.COM 3032 Wilshire Santa Monica, CA The renovation of the building is complete, and the project is 60% leased. The tenant improvements have been completed or are underway for two of the initial tenants. The anchor tenant, 7-Eleven is in planning and permitting and one of the other tenants provides fitness classes and is not able to open currently due to COVID restrictions in place. There are prospective tenants interested in the food hall portion of the property, with two of the suites having active leases under negotiation. These will be limited seating spaces (with patio seating also) and are also designed for carry out and deliver services. Now that the project is complete, we are hopeful that the leasing will pick up, however, it may be more challenging than in normal times given the current state of the economy and the effects of the pandemic in California. 4

Shareholder Newsletter September 2020 SRTREIT.COM Retail sales in the second quarter were off nationally by 8.1% According to the U. S. Dept. of Commerce. E- Commerce was up along with Grocery Stores and Home Improvement stores, all other retail segments saw significant declines. Source: CBRE Vacancy rates increased nationally to 6.4% with over 14 million square feet of increased vacancy. Over 10 million square feet of that increase was concentrated in neighborhood centers and community centers (grocery anchored centers) and strip centers 5 Source: CBRE

For more information please visit the Company’s website at www.srtreit.com. The Company is advised by SRT Advisors, LLC an affiliate of Glenborough, LLC. Glenborough also acts as the Company’s property manager. For more information please visit Glenborough’s website at www.glenborough.com. New Share Valuation The board of directors has set a new Net Will the COVID-19 Crisis affect the Asset Value (NAV) of $5.25 per share status of Company Distributions? based on a third-party valuation report Given the uncertainly of the present from Robert A. Stanger and Co., a environment and the financial issues national valuation firm. This represents a that mandated closures put on the 10% decrease from last year’s NAV of Company’s tenants, the Board of $5.86. Directors has, similar to many other public companies, voted to suspend The current market conditions caused by the distribution. Future distributions will the COVID-19 pandemic were the be reviewed each quarter and will primary reason for the valuation decline. depend on how fast the economy The valuation of the operating property regains momentum and how well the portfolio declined 11%. The value Company’s tenants perform. reductions resulted from the appraiser using higher return hurdles in their Will the COVID-19 Crisis affect the discounted cash flow models, reflecting status of Company Death and that investors need higher returns to invest Disability Redemption Program? in retail assets. On average the terminal The Company has also suspended the cap rates increased .57% from 5.46% to Death and Disability Program to further 6.04% and discount rates (internal rates of conserve cash. As the situation return) increased by 1.00% from 6.11% to changes, the Board of Directors will 7.11%. Combined these changes led to continue to review and may reopen higher going in cap rates that increased the program when warranted. by .54%. Future rent growth assumptions were also reduced from prior years due to the COVID pandemic. For further information regarding the updated Company NAV please see our 8-K filed with the SEC in September 2020 which is available on our website. The foregoing includes forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “hope”, “hopeful”, “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. The Company can provide no assurances as to its ability to acquire properties that are consistent with its strategic plan, sell properties in its current portfolio, enter into new leases or modify existing leases, successfully manage the existing properties in its portfolio, successfully develop its redevelopment projects and execute potential strategic alternatives. These statements also depend on factors such as future economic, competitive and market conditions and other risks identified in Part I, Item IA of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent periodic reports, as filed with the SEC. Actual events may differ materially from the anticipated events discussed above 6