Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Senseonics Holdings, Inc. | tm2030809-1_8k.htm |

Exhibit 99.1

Analyst & Investor Event September 15, 2020 confidently live life with ease

Cautionary Note Regarding Forward - looking Statements This presentation contains forward - looking statements, as defined in the Private Securities Litigation Reform Act of 1995, inclu ding statements regarding managements plans, objectives and goals for future operations, including preliminary targets for future financial p erf ormance and cash projections of Senseonics Holdings, Inc. (the “Company”). Such forward - looking statements may be identified by the use of words such as “believe,” expect,” anticipate, “plan,” “estimate,” “project,” “target” or other similar expressions. These forward - looking statements are based on management’s current expectations and projections about future events, and such statements are, by their nature subject to uncertainties. Add itionally, the preliminary projections of key financial targets and cash projections have been developed based on the model for the partnership with Asc ens ia, as reviewed and approved by the Senseonics Board of Directors. The Company expects to further refine such projections following the completio n o f the Company’s 2021 budgeting process and the development of more formal financial guidance that it intends to disclose along with its full yea r 2020 financial results in early 2021. This more formal guidance and actual performance could vary materially from the preliminary projections inclu ded in this presentation. The risks and uncertainties that may cause actual results, levels of activity, performance or achievements to differ material ly from the Company’s current expectations include uncertainties related to the timing of the submission of the application for regulatory approval of the up to 180 - day product to the U.S. Federal Drug Administration (“FDA”), the receipt of approval from the FDA with respect to the up to 180 - day product, and the timing of any such approval; the timing of the initiation of Ascensia’s commercial activities, including the timing of U.S. commercial launch of the up to 180 - day product; the success of the transition of commercial activities to Ascensia, the risks attendant to the launch and commercial iza tion of a new product in a competitive market, the availability of capital to fund the Company’s continued operations and execute its business plan, a nd such other factors that are more fully described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K for the year ended December 3 1, 2019, as filed with the Securities and Exchange Commission (“SEC”) on March 16, 2020, the Company’s Quarterly Report on Form 10 - Q for the quart er ended June 30, 2020, as filed with the SEC on August 10, 2020, and its other filings with the SEC. Statements made in this presentation sp eak only as of the date of this presentation and should not be relied upon as of any subsequent date, and the Company assumes no obligation to update an y such forward - looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Analyst and Investor Event Tim Goodnow CEO Corporate strategy, operations and product roadmap Robert Schumm President, Ascensia Worldwide distribution initiatives Francine Kaufman, MD CMO Clinical integration of Eversense implantable CGM technology Nick Tressler CFO Financial performance and outlook Q&A 5:10 4:30 4:40 4:50 5:00 Virtual event September 15, 2020 senseonics.com/investor - relations/events - and - publications/

• Commercial Integration – Initiated August 10 th 2020 – Initiate Eversense Commercial activities • U.S. by 10/1/20 • O.U.S. by 2/1/21 – Positive coverage progress (~ 80%) • Commercial payers • Medicare – Minimum 5 - year Global Commercialization Agreement • Senseonics: Manufacturing, R&D, Regulatory • Ascensia : Sales, Marketing, Reimbursement, Distribution, Customer Support Senseonics and Ascensia Diabetes Care

• Economic Considerations – Revenue split, tiered & changes with installed base (mid - teens to mid - forties) – Senseonics Investment • Manufacturing & Product Development – Ascensia Diabetes Care Investment • Dedicated Commercial Staff & Infrastructure • Sales Reps, Marketing, Reimbursement Staff, Commercial Support Staff Senseonics and Ascensia Diabetes Care

• Senseonics Model Economics – Annual Revenue Target – Margin – Cash utilization – Breakeven Senseonics Business Model

• U.S. – 180 Day Sensor – FDA Submission • Performance • Reduced Calibration • Timeline Senseonics Product Development

Company Confidential Introducing Ascensia Diabetes Care Rob Schumm, President September 15, 2020

Company Confidential | Footer Introducing Ascensia Diabetes Care A LEADER in blood glucose monitoring systems with heritage of almost 80 YEARS of innovative diabetes care products Our products are sold in more than 125 COUNTRIES and help approximately 10 MILLION PEOPLE WORLDWIDE EVERY DAY Approximately 1,700 employees with operations in 31 COUNTRIES Approximately $1 BILLION USD in global 2019 sales

Company Confidential | Footer Why is this Partnership Important to Ascensia? EVERSENSE IS AN EXCELLENT PRODUCT: Differentiated and high quality product portfolio – market leading accuracy EXPANSION INTO CGM IS CRITICAL STRATEGIC DRIVER: Ability to enter CGM market and establish a presence, especially in the U.S. and Europe EXCITED BY THE PIPELINE: 365 - day sensor with once a week calibration and additional innovative features

Company Confidential | Footer What Does Ascensia Bring to this Partnership? Partnership is a top priority, company focused only on diabetes, lead story for our business Commitment to making material investment into commercialization and prioritizing resources to support CGM Mature global organization with strong operational and commercial capabilities Strength in T1 diabetes market, strong customer relationships and positive reputation

THANK YOU

Fran Kaufman, M.D. CMO

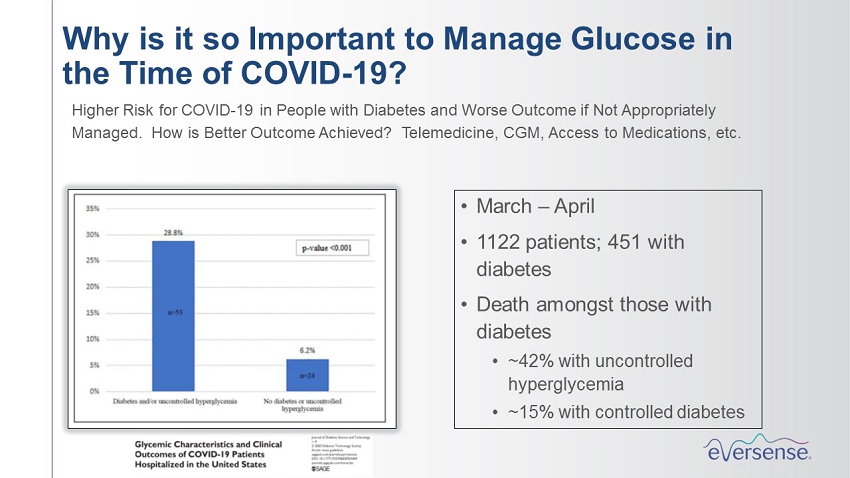

• March – April • 1122 patients; 451 with diabetes • Death amongst those with diabetes • ~42% with uncontrolled hyperglycemia • ~15% with controlled diabetes Why is it so Important to Manage Glucose in the Time of COVID - 19? Higher Risk for COVID - 19 in People with Diabetes and Worse Outcome if Not Appropriately Managed. How is Better Outcome Achieved? Telemedicine, CGM, Access to Medications, etc.

• AIC has been the driver of diabetes management for 3 decades • CGM is the new game changer • From CGM, obtain glucometrics • Calculate GMI, an estimation of the A1C • Can use Time in Range as long term outcome measure Telehealth Visits and the Role of CGM For every 10% change in %TIR 0.8% change in A1C Glucometrics replaced A1C during the pandemic and these measures are here to stay

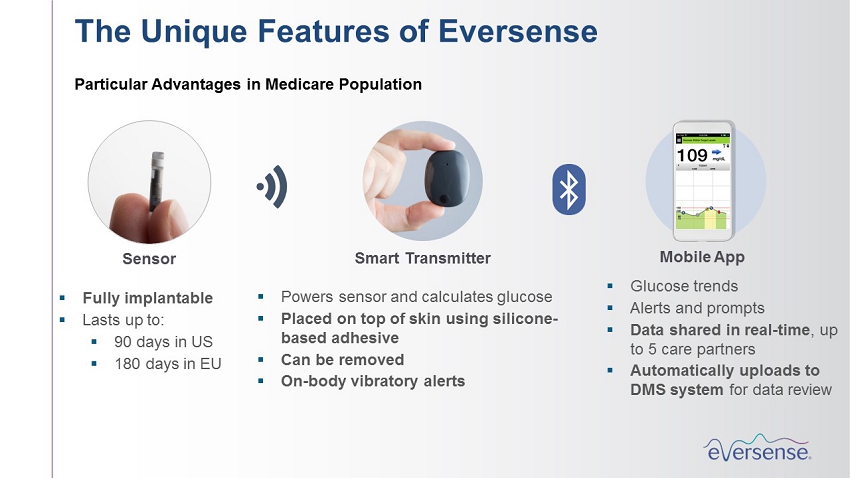

Mobile App Smart Transmitter Sensor ▪ Fully implantable ▪ Lasts up to: ▪ 90 days in US ▪ 180 days in EU ▪ Powers sensor and calculates glucose ▪ Placed on top of skin using silicone - based adhesive ▪ Can be removed ▪ On - body vibratory alerts ▪ Glucose trends ▪ Alerts and prompts ▪ Data shared in real - time , up to 5 care partners ▪ Automatically uploads to DMS system for data review The Unique Features of Eversense Particular Advantages in Medicare Population

19 Widespread Adoption of CGM by payers Eversense now covered for ~200 million Americans, including through Medicare and Medicare Advantage Three published LCDs and others to follow Data in Support of Eversense Particular Advantages in Medicare Population doi.org/10.2337/db20 - 878 - P Real - World Data form U.S. Patients Using a Long - Term Implantable Continuous Glucose Sensor Presented at ADA 2020 Age N of users Median wear time % SG mg/dL SD mg/dL CV %GMI 70 - 180 mg/dL <54 mg/dL <70 mg/dL >180 mg/dL >250 mg/dL All ~1600 82.0 161.7 57.8 0.36 7.17 62.0 1.2 4.4 33.6 11.1 > 65 ~90 87.0 153.7 51.9 0.34 6.97 69.0 0.9 3.4 27.6 7.2

Prospective, Multicenter , Independent Study of Health Outcomes in 100 Eversense Patients Using the 180 Day System • Significant reduction in A1C • Improvement in Time in Range • CGM Naïve patients had greatest improvements, but so did those coming from another CGM • 180 Day System 2 0 Irace C et al. Clincal Use of a 180 - day implantable glucose senor improves glycated hemoglobin and time in range in patients wit h type 1 diabetes. Diabetes Obes Metab . 2020;1 – 6. wileyonlinelibrary.com DOI: 10.1111/dom.13993 Evidence from an Independent Study - 180 Day System All Patients MDI CGM Naïve (34) CSII CGM Naïve (21) MDI Prior CGM (10) CSII Prior CGM (35) %A1C baseline 7.4 7.6 7.8 7.0 7.0 6 months 6.9 7.1 7.1 6.8 6.8 Change - 0.43 - 0.53 - 0.74 - 0.22 - 0.22 p value <0.0001 0.001 0.0001 0.33 0.03 %TIR baseline 63 60 56 70 68 6 months 69 67 69 68 70 p value <0.0001 0.01 0.0001 0.69 0.23

• Already Virtually Training Patients • Now Health Care Provider Training • ~400 HCPs certified and 200 in process • Here to Stay! Truly Scalable! Virtual Device Trainings Future Will Heavily Leverage Remote Tools Proven Effective During COVID

Copyright 2020 Senseonics Wear Time 92% TIR 72% Wear Time 94% TIR 84% 5.7% 10.9% 4.2% 4.2% 1.3% 2.1% 77.1% 90.6% 76.1% 37.0% 49.5% 90.1% 6.3% 5.1% 23.7% 56.4% 36.9% 7.0% 0.3% 0.9% 12.3% 0.8% 12AM 4AM - 8AM 8AM - 12PM 12PM - 4PM 4PM - 8PM 8PM - 12AM Very low (<54mg/dL) Low (≥54<70mg/dL) Within target (70-180mg/dL) High (>180≤250mg/dL)2 Very high (>250mg/dL) 1.5% 0.4% 0.3% 76.1% 77.7% 93.1% 71.2% 80.2% 96.4% 23.9% 20.8% 1.5% 28.5% 19.5% 3.6% 12AM 4AM - 8AM 8AM - 12PM 12PM - 4PM 4PM - 8PM 8PM - 12AM Very low (<54mg/dL) Low (≥54<70mg/dL) Within target (70-180mg/dL) High (>180≤250mg/dL)2 Very high (>250mg/dL) Data from CGM Gets Patient to Goal

Summary • COVID - 19 has shown us the promise of telemedicine and the value of CGM • CGM gives sufficient data during virtual visits to change treatment, address patient behaviors, and importantly improve outcomes • Eversense CGM has unique features, many of which resonate in the Medicare population • Real - World and prospective data shows improved metrics • Virtual training - possible and here to stay

Nick Tressler , CFO

Cash Projections* • For the remainder of 2020 cash used in operations is projected to average $3.5M to $4.5M per month • For 2021 cash used in operations is projected to be less than $60M • If we close on the sale of all $42M of additional preferred stock to PHC and Masters, as previously publicly described, we project our available financial resources would fund operations through 2021 • We project an additional ~ $150M in capital to reach cash flow breakeven in 2025 (of which $42M is potentially available fro m PHC and Masters as previously disclosed.) Key Financial Targets* (Preliminary Projections) * These projections are based on a number of key assumptions, the most significant of which are detailed on Appendix A. Thes e p rojections are also subject to a number of material risks and uncertainties. See slide titled "Cautionary Note Regarding Forward - looking Statements" for more information. Accordingly, the projected financial information included on this slide should be read in conjunction with, and in light of, such additional i nfo rmation. Key Financial Targets* 2021E 2022E 2023E SENS Global Net Revenue $10M to $15M $30M to $40M $60M to $75M GM% -25% to -35% -10% to 0% 5% to 15% OpEx (Excludes COGS) $40M to $45M $45M to $55M $45M to $55M

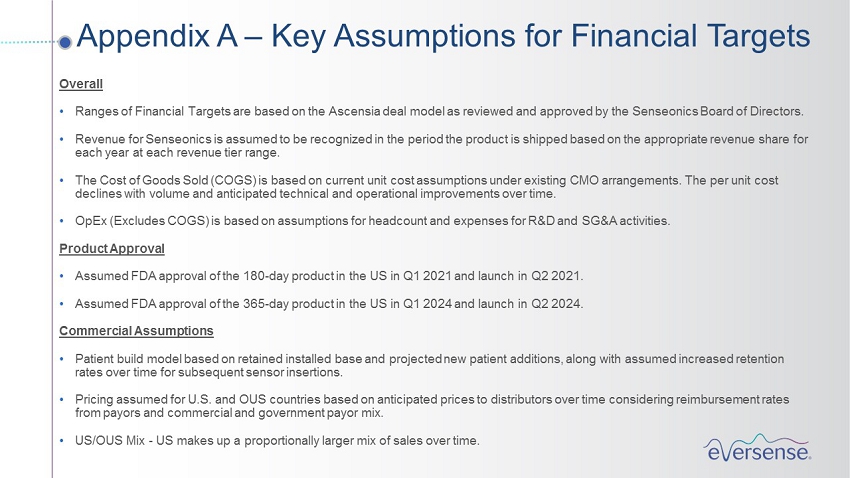

Overall • Ranges of Financial Targets are based on the Ascensia deal model as reviewed and approved by the Senseonics Board of Directors. • Revenue for Senseonics is assumed to be recognized in the period the product is shipped based on the appropriate revenue share for each year at each revenue tier range. • The Cost of Goods Sold (COGS) is based on current unit cost assumptions under existing CMO arrangements. The per unit cost declines with volume and anticipated technical and operational improvements over time. • OpEx (Excludes COGS) is based on assumptions for headcount and expenses for R&D and SG&A activities. Product Approval • Assumed FDA approval of the up to 180 - day product in the US in Q1 2021 and launch in Q2 2021. Commercial Assumptions • Patient build model based on retained installed base and projected new patient additions, along with assumed increased retention rates over time for subsequent sensor insertions. • Pricing assumed for U.S. and OUS countries based on anticipated prices to distributors over time considering reimbursement rates from payors and commercial and government payor mix. • US/OUS Mix - US makes up a proportionally larger mix of sales over time. Appendix A – Key Assumptions for Financial Targets