Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CLARIVATE Plc | ccc-20200915.htm |

Public Lender Presentation September 2020 SPECIAL NOTICE REGARDING PUBLICLY AVAILABLE INFORMATION THE COMPANY HAS REPRESENTED THAT THE INFORMATION CONTAINED IN THIS LENDER PRESENTATION IS EITHER PUBLICLY AVAILABLE OR DOES NOT CONSTITUTE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES. THE RECIPIENT OF THIS LENDER PRESENTATION HAS STATED THAT IT DOES NOT WISH TO RECEIVE MATERIAL NON-PUBLIC INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES AND ACKNOWLEDGES THAT OTHER LENDERS HAVE RECEIVED A LENDER PRESENTATION THAT CONTAINS ADDITIONAL INFORMATION WITH RESPECT TO THE COMPANY OR ITS SECURITIES THAT MAY BE MATERIAL. NEITHER THE COMPANY NOR THE ARRANGERS TAKE ANY RESPONSIBILITY FOR THE RECIPIENT'S DECISION TO LIMIT THE SCOPE OF THE INFORMATION IT HAS OBTAINED IN CONNECTION WITH ITS EVALUATION OF THE COMPANY AND THE FACILITY. CONFIDENTIAL

Authorization Letter Citibank, N.A., BofA Securities, Inc., RBC Capital Markets, LLC, Barclays Bank PLC, HSBC Securities (USA) Inc., and JPMorgan Chase Bank, N.A. September 15, 2020 Attention: Prospective Incremental Term Loan Facility Lenders Ladies and Gentlemen: We refer to the proposed $1,600 million Incremental Senior Secured Term Loan B Facility (the "Facility") for Clarivate Plc (the "Company“, “we”, “us”, or “our”) that you are arranging at our request, and the Lender Presentation and other marketing materials prepared in connection therewith (collectively, the “Lender Presentation"). We have reviewed or participated in preparing the Lender Presentation and the information contained therein. The Company has reviewed the information contained in the Lender Presentation and represents and warrants that the information contained in the Lender Presentation (other than any projections, other forward-looking information and information of a general economic or general industry nature) does not contain any untrue statement of a material fact or omit to state a material fact necessary in order to make the statements contained therein, in light of the circumstances under which they were made, not materially misleading (after giving effect to all supplements and updates thereto). Any management projections or forward-looking statements included in the Lender Presentation are based on assumptions and estimates developed by management of the Company in good faith and management believes such assumptions and estimates to be reasonable as of the date of the Lender Presentation. Whether or not such projections or forward looking statements are in fact achieved will depend upon future events, some of which are not within the control of the Company. Accordingly, actual results may vary from the projections and such variations may be material. The Company represents and warrants that the information contained in the Lender Presentation is either publicly available information or does not constitute material information (although it may be sensitive and proprietary) with respect to the Company or its securities for purposes of United States federal and state securities laws. We request that you distribute the Lender Presentation to such financial institutions as you may deem appropriate to include in the Facility. We agree that we will rely on, and that you are authorized to rely on, the undertakings, acknowledgments and agreements contained in the Notice to and Undertaking by Recipients accompanying the Lender Presentation or otherwise acknowledged by recipients in connection with the Lender Presentation. Yours sincerely, ____________________ Richard Hanks Chief Financial Officer Clarivate Plc

Notice To and Undertaking by Recipients This Lender Presentation (the “Lender Presentation") has been prepared solely for informational purposes from information supplied by or on behalf of Clarivate Plc (the "Company"), and is being furnished by Citibank, N.A., BofA Securities, Inc., RBC Capital Markets, LLC, Barclays Bank PLC, HSBC Securities (USA) Inc., and JPMorgan Chase Bank, N.A. (the "Arrangers") to you in your capacity as a prospective lender (the "Recipient") in considering the proposed credit facility described in the Lender Presentation (the "Facility"). ACCEPTANCE OF THIS LENDER PRESENTATION CONSTITUTES AN AGREEMENT TO BE BOUND BY THE TERMS OF THIS NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE SET FORTH ON THE COVER PAGE HEREOF (THE “SPECIAL NOTICE”). IF THE RECIPIENT IS NOT WILLING TO ACCEPT THE LENDER PRESENTATION AND OTHER EVALUATION MATERIAL (AS DEFINED HEREIN) ON THE TERMS SET FORTH IN THIS NOTICE AND UNDERTAKING AND THE SPECIAL NOTICE, IT MUST RETURN THE LENDER PRESENTATION AND ANY OTHER EVALUATION MATERIAL TO THE ARRANGERS IMMEDIATELY WITHOUT MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF. I. Confidentiality As used herein: (a) "Evaluation Material" refers to the Lender Presentation and any other information regarding the Company or the Facility furnished or communicated to the Recipient by or on behalf of the Company in connection with the Facility (whether prepared or communicated by the Arrangers or the Company, their respective advisors or otherwise) and (b) "Internal Evaluation Material" refers to all memoranda, notes, and other documents and analyses developed by the Recipient using any of the information specified under the definition of Evaluation Material. The Recipient acknowledges that the Company considers the Evaluation Material to include confidential, sensitive and proprietary information and agrees that it shall use reasonable precautions in accordance with its established procedures to keep the Evaluation Material confidential; provided however that (i) it may make any disclosure of such information to which the Company gives its prior written consent and (ii) any of such information may be disclosed to it, its affiliates, and its and their respective partners, directors, officers, employees, agents, advisors and other representatives (collectively, "Representatives") (it being understood that such Representatives shall be informed by it of the confidential nature of such information and shall be directed by the Recipient to treat such information in accordance with the terms of this Notice and Undertaking and the Special Notice). The Recipient agrees to be responsible for any breach of this Notice and Undertaking or the Special Notice that results from the actions or omissions of its Representatives. The Recipient shall be permitted to disclose the Evaluation Material in the event that it is required by law or regulation or requested by any governmental agency or other regulatory authority (including any self-regulatory organization having or claiming to have jurisdiction) or in connection with any legal proceedings. The Recipient agrees that it will notify the Arrangers as soon as practical in the event of any such disclosure (other than as requested by a regulatory authority), unless such notification shall be prohibited by applicable law or legal process. The Recipient shall have no obligation hereunder with respect to any Evaluation Material to the extent that such information (i) is or becomes generally available to the public other than as a result of a disclosure by the Recipient in violation of this Notice and Undertaking, or (ii) was within the Recipient's possession prior to its being furnished pursuant hereto or is or becomes available to the Recipient on a non-confidential basis from a source other than the Company or its Representatives, provided that the source of such information was not known by the Recipient to be bound by a confidentiality agreement with, or other contractual, legal or fiduciary obligation of confidentiality to, the Company or any other party with respect to such information. In the event that the Recipient of the Evaluation Material decides not to participate in the Facility or transactions described herein, upon request of the Arrangers, such Recipient shall as soon as practicable return all Evaluation Material (other than Internal Evaluation Material) to the Arrangers or represent in writing to the Arrangers that the Recipient has destroyed all copies of the Evaluation Material (other than Internal Evaluation Material) unless prohibited from doing so by the Recipient's internal policies and procedures.

Notice To and Undertaking by Recipients (Cont’d) II. Information The Recipient acknowledges and agrees that (i) the Arrangers received the Evaluation Material from third party sources (including the Company) and it is provided to the Recipient for informational purposes, (ii) the Arrangers and their respective affiliates bear no responsibility (and shall not be liable) for the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation regarding the Evaluation Material is made by the Arrangers or any of their respective affiliates, (iv) neither the Arrangers nor any of their respective affiliates have made any independent verification as to the accuracy or completeness of the Evaluation Material, and (v) neither Arrangers nor any of their respective affiliates shall have any obligation to update or supplement any Evaluation Material or otherwise provide additional information. The Evaluation Material has been prepared to assist interested parties in making their own evaluation of the Company and the Facility and does not purport to be all-inclusive or to contain all of the information that a prospective participant may consider material or desirable in making its decision to become a lender. Each Recipient of the information and data contained herein should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the Facility or the transactions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to entities similar to the Company. The information and data contained herein are not a substitute for the Recipient's independent evaluation and analysis and should not be considered as a recommendation by the Arrangers or any of their respective affiliates that any Recipient enters into the Facility. The Evaluation Material may include certain forward looking statements and projections provided by the Company. Any such statements and projections reflect various estimates and assumptions by the Company concerning anticipated results. No representations or warranties are made by the Company or any of its affiliates as to the accuracy of any such statements or projections. Whether or not any such forward looking statements or projections are in fact achieved will depend upon future events, some of which are not within the control of the Company. Accordingly, actual results may vary from the projected results and such variations may be material. Statements contained herein describing documents and agreements are summaries only and such summaries are qualified in their entirety by reference to such documents and agreements. III. General It is understood that unless and until a definitive agreement regarding the Facility between the parties thereto has been executed, the Recipient will be under no legal obligation of any kind whatsoever with respect to the Facility by virtue of this Notice and Undertaking except for the matters specifically agreed to herein and in the Special Notice. The Recipient agrees that money damages would not be a sufficient remedy for breach of this Notice and Undertaking or of the Special Notice, and that in addition to all other remedies available at law or in equity, the Company and the Arrangers shall be entitled to equitable relief, including injunction and specific performance, without proof of actual damages. This Notice and Undertaking and the Special Notice together embody the entire understanding and agreement between the Recipient and the Arrangers with respect to the Evaluation Material and the Internal Evaluation Material and supersedes all prior understandings and agreements relating thereto. The terms and conditions of this Notice and Undertaking and the Special Notice shall apply until such time, if any, that the Recipient becomes a party to the definitive agreements regarding the Facility, and thereafter the provisions of such definitive agreements relating to confidentiality shall govern. If you do not enter into the Facility, the application of this Notice and Undertaking and the Special Notice shall terminate with respect to all Evaluation Material on the date falling one year after the date of the Lender Presentation. This Notice and Undertaking and the Special Notice shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of law (except Section 5-1401 of the New York General Obligation Law to the extent that it mandates that the law of the State of New York govern).

Forward-Looking Statements These materials contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, outlook, anticipated cost savings, anticipated events and trends, the economy, and other future conditions. Because forward-looking statements relate to the future, they are difficult to predict, and many are outside of our control. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include those factors discussed under the caption “Risk Factors” in our 2019 annual report on Form 10-K and our current report on Form 8-K filed on June 19, 2020, along with our other filings with the U.S. Securities and Exchange Commission (“SEC”). However, those factors should not be considered to be a complete statement of all potential risks and uncertainties. Forward-looking statements are based only on information currently available to our management and speak only as of the date of this press release. We do not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Please consult our public filings with the SEC or on our website at www.clarivate.com. Non-GAAP Financial Measures This presentation contains financial measures which have not been calculated in accordance with United States generally accepted accounting principles (“GAAP”), including Adjusted Revenues, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow, Adjusted Free Cash Flow, Standalone Adjusted EBITDA, and net debt because they are a basis upon which our management assesses our performance and we believe they reflect the underlying trends and indicators of our business. Although we believe these measures may be useful for investors for the same reasons, these financial measures should not be considered as an alternative to GAAP financial measures as a measure of the Company’s financial condition, profitability and performance or liquidity. In addition, these financial measures may not be comparable to similar measures used by other companies. At the Appendix to this presentation, we provide further descriptions of these non-GAAP measures and reconciliations of these non-GAAP measures to the corresponding most closely related GAAP measures. Basis of Presentation Certain financial information contained in this presentation, including Clarivate’s LTM 6/30/20 and FY 12/31/19 pro forma financial information, and CPA Global’s historical financial information (collectively the “Financial Information”), has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Regulation S-X and Item 10(e) of Regulation S-K, and it therefore does not reflect all of the adjustments that would be required to comply with Regulation S-X, Regulation S-K or any other rule or regulation promulgated by the Securities and Exchange Commission. The Financial Information does not purport to indicate the results that would have been obtained had Clarivate and CPA Global been operating as a combined company during the periods presented, or the results that may be realized in any future period. Required Reported Data We are required to report Standalone Adjusted EBITDA, which is identical to Consolidated EBITDA and EBITDA as such terms are defined under our credit agreement, dated as of October 31, 2019, governing the Company’s term loan facility and revolving credit facility, as amended and/or supplemented from time to time (the “Credit Agreement”) and the indenture (the “Indenture”) governing the Company’s 4.50% senior secured notes due 2026 (the “Notes”), respectively, pursuant to the reporting covenants contained in such agreements. In addition, management of the Company uses Standalone Adjusted EBITDA to assess compliance with various incurrence-based covenants in these agreements.

Key Management Presenters Jerre Stead Richard Hanks Daryl Barber Executive Chairman & Chief Financial Officer Senior Vice President & Treasurer Chief Executive Officer Agenda • Transaction Overview • Compelling Acquisition • Clarivate Business Overview Rationale • CPA Global Overview • Financial Highlights 6

Transaction Overview

Transaction Summary • On July 29th, Clarivate announced it had signed a definitive agreement to acquire CPA Global (“CPA”) in an all-stock transaction valued at ~$6.8 billion • Including the benefit of tax assets, transaction value implies ~16x 2020 EBITDA multiple inclusive of $75 million run rate cost savings • Transformative combination creates a true end-to-end global solution covering the entire innovation and intellectual property lifecycle while increasing the size and scale of Clarivate • Clarivate intends to raise an incremental $1.6 billion Term Loan B proceeds of which when combined with cash on hand will be used to refinance approximately $2.0 billion of CPA debt • Giving effect to the refinancing net leverage will be ~4.2x based on Pro Forma LTM Jun20 Standalone Adjusted EBITDA of $766 million • Transaction is expected to close in early October subject to customary regulatory approvals 8

Key Transaction Highlights 1 Transaction Creates Leader in Global IP Services • Highly complementary nature of Clarivate and CPA Global creates true end-to-end platform supporting the full IP lifecycle from idea generation to commercialization and protection • Unified workflow and analytics across idea management ecosystem - a market first 2 Highest Caliber CPA Offerings Immediately Enhance Clarivate Platform • Mission-critical software platform with 97% retention rates across its blue-chip customer base • Significant cross-sell opportunity across diverse combined client roster 3 Diversification, Scale and Growth Enhancement 4 Re-balances Clarivate’s Business Model • Pro forma Business mix split evenly across Intellectual Property and Sciences segments • Businesses aligned to long-term growth and cycle-insulated end markets 5 Robust Cash Flow Generation will allow Clarivate to hit Long-Term Leverage Targets • $617 million LTM 6/30/20 pro forma adjusted EBITDA less capex • Clarivate will use strong FCF generation to reduce debt towards long-term target of ~3.0x 9

Sources & Uses and Pro Forma Capitalization ($ in millions) Sources Amount Uses Amount Incremental Term Loan B $1,600 Purchase CPA Global Equity $6,323(1) (1) (2) Contributed Equity 6,323 CPA Debt Retirement 2,000 Cash from Balance Sheet 445 Estimated Fees, Expenses and OID 45 Total Sources $8,368 Total Uses $8,368 ($ in millions) As Adjusted Transaction Pro Forma PF x LTM Pro Forma Capitalization Maturity Rate 6/30/20 Adj. 6/30/20 Adj. EBITDA Cash and Cash Equivalents $609 ($299) $310(3) Revolving Credit Facility ($250 million)(4) Oct-24 L + 300 bps(5) -- -- Existing Term Loan B Oct-26 L + 300 bps(5) 1,254 1,254 Incremental Term Loan B Oct-26 -- -- 1,600 1,600 Existing Senior Secured Notes Nov-26 4.5% 700 700 Total Secured Debt $1,954 $3,554 4.6x Total Net Secured Debt 1,345 3,245 4.2x Total Debt $1,954 $3,554 4.6x Total Net Debt 1,345 3,245 4.2x Market Capitalization(6) 11,834 6,323 18,157 Total Capitalization $13,787 $21,710 28.3x Operating Statistics LTM Standalone Adjusted EBITDA $439 $327(7) $766 Note: CPA Global financials are converted to USD at a GBPUSD spot exchange rate of 1.24x at June 30, 2020 (4) As of June 30, 2020, there were no borrowings under the Revolving Credit Facility (1) Based on fixed 218.8 shares to CPA and Clarivate share price of $28.90 (5) Applicable margin steps down to L+300 bps if Total Net Leverage is less than 4.5x (2) CPA Global balance sheet as of 6/30; Includes breakage fees on CPA notes (6) Market Cap as of 8/28/2020, based on closing share price of $28.90 and shares outstanding of 409.5 million (3) Includes CPA cash balance of $146 million (7) CPA Global LTM Jun-20 pro forma adjusted EBITDA of $252 million and $75 million of run-rate synergies 10

Summary Terms: Incremental Term Loan B Borrower: “The Term Borrowers” (as defined in the Existing Credit Agreement)(1) (Same as the Existing Credit Agreement) Facility: $1,600 million Incremental Senior Secured Term Loan B Guarantors: Same as the Existing Credit Agreement, including the addition of the assets of the Acquired Business Security: Same as the Existing Credit Agreement, including the addition of the assets of the Acquired Business Maturity: October 31, 2026 (Same as the Existing Term Loan B) Amortization: 1.00% per annum, paid in equal quarterly installments Call Protection: 101 soft call for 6 months from closing Mandatory Prepayments: Same as the Existing Credit Agreement Financial Covenant: None Negative Covenants: Same as the Existing Credit Agreement (1) “Existing Credit Agreement” shall mean the Credit Agreement, dated October 31, 2019, by and among Camelot UK Holdco Limited, Camelot UK Bidco Limited, the Borrowers party thereto, the Subsidiary Guarantors party 11 thereto, the Lenders party thereto and Bank of America, N.A., as Administrative Agent.

Indicative Transaction Timeline September-2020 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Bank Market Holiday Key Syndication Date Date Event September 15th - Lender Call September 22nd - Commitments Due (5:00 pm ET) Early October - Anticipated funding & closing 12

Clarivate Business Overview

Clarivate has world-leading assets serving large and stable end-markets • Leading provider of intellectual property and scientific information, analytical tools & services • Products support customers’ critical decisions in discovery, protection and commercialization of ideas and brands • Global, diversified customer base • Portfolio of curated proprietary databases deeply embedded in customers’ workflows • Solutions to clients on digital basis and consumed anywhere • Experienced management team with proven track record • ~ 5,400 colleagues across 30+ countries 14

Path to continued long-term profitable growth remains clear Highly recurring subscription revenue with high Recurring revenue retention and revenue visibility + profitable Significant operating leverage from ‘build once, sell incremental growth many times’ Low capital requirements allow high cash flow = strong cash flow conversion and strong reinvestment capacity Attractive free cash flow profile support M&A and capital return = capacity to reinvest 15

Business Model to Weather Current Environment • “Must-have” products and services focused on B2B markets with unique content • Sell into durable end markets including government, research institutions and life sciences • Solutions to clients on digital basis and consumed anywhere • Highly resilient with ~80% recurring / re-occurring revenue streams • Strong revenue retention rates • Low levels of capital intensity and cash taxes 16

High quality products embedded with customer workflows A professor planning a research program accesses Web of Science {"WOS"} to evaluate the current state of research in her discipline, identifying trends within highly regarded and relevant academic journals A university provost evaluating her university's chemistry department accesses lnCites to measure the strength of the university's research output and benchmark it against comparable institutions An employee at a pharmaceutical firm evaluating the most effective manner to bring a newly developed drug to market uses DRG’s data-driven resources and analytics solutions to better understand critical commercial challenges. An analyst at a pharmaceutical firm evaluating several potential R&D programs will access Cortellis database to assess competitive products in the drug development pipeline, review clinical trial data and summarize regulatory information An employee developing a new product or idea (e.g., a chemical engineer or a product designer) will access the Derwent lnnovation database of patents to evaluate the novelty and determine the patentability of the new product or idea Innovation An attorney helps clear a trademark for a customer. First, they request a curated report from CompuMark Search to ensure the availability of the proposed trademark; then they subscribe to CompuMark Watch's trademark watching services to ensure that none of the trademarks are infringedupon An inhouse attorney can ensure the company’s domains are protected from security threats by using best-of-breed Domain management technology, security and expertise, and make smart registration decisions, maximize portfolio values and rein in costs 17

We have four strategic goals that will move us toward success Continue to Further increase improve colleague customer delight score engagement score Sustainability Provide superior Focus on investor returns strong top-and- bottom-line growth 18

Our recent colleague engagement survey had a response rate of 91%, up 10% from 2019 Engagement score = 76 2019 = 69 (Benchmark Average is 72) 2020 goal: 74 Company’s response to COVID-19 scored 93% favorable 19

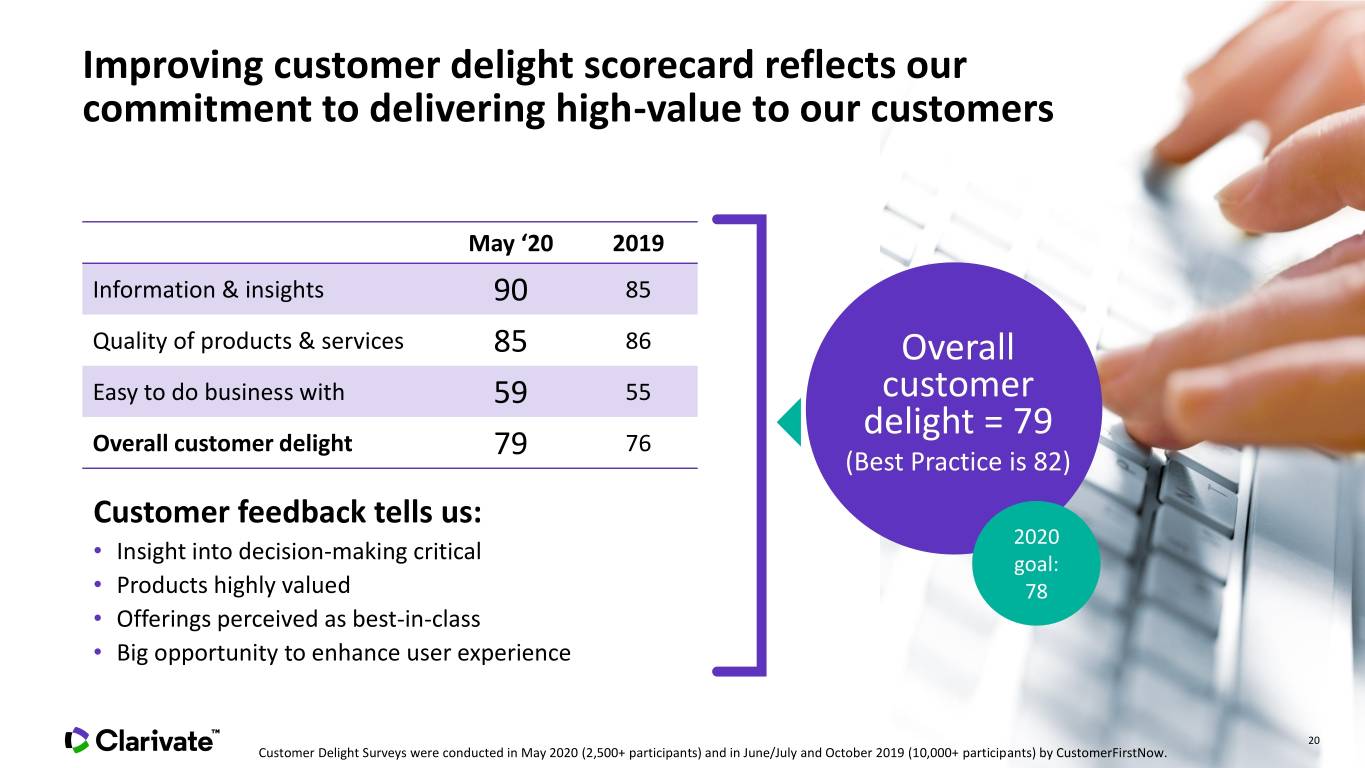

Improving customer delight scorecard reflects our commitment to delivering high-value to our customers May ‘20 2019 Information & insights 90 85 Quality of products & services 85 86 Overall Easy to do business with 59 55 customer delight = 79 Overall customer delight 79 76 (Best Practice is 82) Customer feedback tells us: 2020 • Insight into decision-making critical goal: • Products highly valued 78 • Offerings perceived as best-in-class • Big opportunity to enhance user experience 20 Customer Delight Surveys were conducted in May 2020 (2,500+ participants) and in June/July and October 2019 (10,000+ participants) by CustomerFirstNow.

Q2 Highlights Well-positioned business model to weather current environment SCIENCE GROUP: • New Web of Science beta released; New UI, Open Access content added to Journal Citation Reports • COVID Novel Super Virus data lake launched for advanced virology and infectious disease analytics Enhanced • Cortellis Drug Discovery Intelligence (Biomarkers and pharmacology analytical tools launched), Cortellis Generics Intelligence sourcing module launched Product • Decision Resources Group (“DRG”) organizational integration well advanced Portfolio IP GROUP: • Watch “lite” launched, client migration to new Derwent platform completed • Derwent content expansion; added full text from 45 new jurisdictions • CompuMark / Darts-ip content integration completed • Meeting or exceeding productivity and service level agreements despite COVID-19 customer workflow disruptions Efficiently • Implemented $30 million of cost savings initiatives to offset potential effects of COVID-19 • Delivering savings from existing $70-$75 million cost savings program; $45 million in 2020 Managing • Delivering DRG realized cost synergies of $10 million in 2020; running ahead of plan Business • DRG back office systems integration advanced • Significant resources of $609 million cash and untapped revolver of $250 million to re-invest in growth 21

Q2 Results Revenue growth driven by acquisitions, new business and pricing; reported revenue increased 13%, excluding divestitures adjusted revenue increased 21%(1) Reported Revenue Adjusted Revenue(1) Adjusted EBITDA(1) +13% actual f/x +14% actual f/x Adjusted EBITDA +14% constant f/x +16% constant f/x Margin(2) 36.2% up 595 basis points $274 $277 $242 $242 $100 $60 $40 Transactional $73 +52% +37% $217 $203 Subscription +7% Q2'19 Q2'20 Q2'19 Q2'20 Q2'19 Q2'20 ($ in millions, actual f/x) Excluding Divested Products at Constant F/X Adjusted revenue(1) +21% Adjusted subscription revenue(1) 15% Adjusted transactional revenue(1) 54% (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures. (2) Adjusted EBITDA Margin equals Adjusted EBITDA divided by Adjusted Revenue. See the Appendix for a reconciliation of GAAP to Non-GAAP measures. 22

Historical Annualized Contract Value (ACV)(1) • Q2 ’20 includes the acquisition of DRG completed on February 28, 2020 • All periods exclude divested products at actual F/X; divested on January 1, 2020 ($ in millions) $853 $820 + $112 mm YoY + 16% constant f/x Ongoing ACV +5% $759 $750 $741 $727 $723 $710 Q3 '18 Q4 '18 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 (1) Annualized Contract Value refers to the annualized value for a 12-month period following a given date of all subscription-based client license agreements, assuming that all license agreements that come up for renewal during that period are renewed at their current prices. 23

Efficiently Managing Cost Structure and Freeing up Resources Approximately $105-$110 million in permanent cost reductions ($ in millions) Total Savings Permanent Savings Timing NEW $30 million $5 million Q1-Q4 2020 COVID related $45 million in 2020; $70-75 million run- Cost savings 2019 $70-$75 million $70-$75 million rate exiting Q1 2021 $10 million in 2020; $30 million run-rate DRG synergies(1) $30 million $30 million within 18 months of close Total Cost Savings $130-$135 million $105-$110 million (1) DRG acquisition completed February 28, 2020. 24

CPA Global Overview

CPA Global – Leading global provider of IP management solutions Company overview Offerings • Automated patent and trademark • CPA Global provides IP portfolio (patents and trademarks) Patent & Trademark Processing Solutions processing solutions management and technology solutions • (~81% of revenue) Renewals, filing and prosecution • CPA enables corporate and law firm customers to navigate • Software solutions to automate workflows Lifecycle complex requirements across the IP lifecycle from innovation and adhere to legal requirements Management Technology • Productivity software incorporating data to protection and commercialization (~10% of revenue) and analytics • CPA’s core software platform automates industry workflows, seamlessly executes processes and transactions, and enables Information Services • IP analytics and data tools customers to make informed decisions via analytical tools (~9% of revenue) • Patent and trademark information services Business highlights ~12K ~3.4M ~97% 90%+ ~14% Subscription & Annualized EBITDA Growth Over Past 9 Customers Patent & Trademark Renewals1 Customer Retention2 Re-occurring Revenue Years3 Financial highlights (LTM Jun20) $575M $252M 44% $201M 80% Revenue PF Adj. EBITDA PF Adj. EBITDA Margin PF Adj. EBITDA less CapEx PF Adj. EBITDA less CapEx Conversion 1. Based on FY 2020 2. Retention calculated for Top 1,000 customers (~85% of group revenue) excl. ipan/Delegate 26 3. See the Appendix for a reconciliation of GAAP to Non-GAAP measures

Integrated offerings that span the IP lifecycle IP lifecycle management technology underpins delivery of information and execution of transactional tasks improving research, innovation, protection and commercialization of IP LIFECYCLE INFORMATION TRANSACTION PROCESSING MANAGEMENT TECHNOLOGY SERVICES SOLUTIONS (10%) (9%) (81%) Patent and Trademark Productivity Software Data & Analytics Renewals Filing & Prosecution Information Services • IP Management Software • Innography • Patent Search including PTO • Patent Renewals • Managed Filing and EP contracts Validations • IdeaScout • Filing Analytics • Trademark Renewals CPA Global Offerings • Trademark Watching • Connect Platform • IP Forecaster • IP Recordals • Domain Management • Software solutions to facilitate • ‘IP One’ global database, • Software-enabled, expert • Premium provider • Enables customers to obtain IP management of digital IP records aggregated, enriched and researchers rights from the desktop • Largest provider globally with a searchable CPA Proposition • Automated workflow management • Enables business decisions incl. network of 1,000+ agents • Combines specialist to improve efficiency and reduce risk • Analytics tools providing around R&D, product knowledge, process expertise, • Local customer service across premium information & insight development, licensing and people and technology all main IP Geographies commercialization Addressable $630m1 $504m2 $378m5 $1,630m3 $3,260m4 Opportunity Note: USD at a GBPUSD exchange rate of 1.26x Note: Offering split based on Jun 20 LTM 1. Internal management estimates, IPMS market spend of $282M and Innovation Management spend of $344M 2. $504M of $4.4B portfolio management spend estimated to be related to analytics activities 3. Patent Renewals market estimated spend in FY20 of $1,172M, with $315M spent on Trademark Renewals and $189M spent on IP Recordals (management estimates) 4. $252M opportunity for EP Validations and $1.8B for Docketing (50% of addressable) and estimated addressable direct opportunity for Connect of $1.3B (based on an average 7.5% margin applied to foreign filing invoices) 27 5. Based on outsourced spend with 3rd party providers only

CPA Global – Large, loyal & diverse customer base ~12K customers which includes ~1.7K lifecycle management software customers Jun 20 LTM CPA Global Revenue Jun 20 LTM CPA Global Revenue Representative Customers by Customer Type by Geography 20% 30% 47% 70% 33% 9/10 8/10 Top patent filers in Top patent filers in North America2 EMEA2 Corporate1 Americas Law Firms EMEA 10/10 47/50 APAC Top patent filers in Top R&D spenders APAC2 globally3 1. Corporate customers include NGB and USPTO 2. Top patent filers based on published PCT patent applications in 2018, Top 50 PCT applicants, WIPO Statistics Database 3. Top 50 world’s largest corporate R&D spenders 2018, https://www.strategyand.pwc.com/gx/en/insights/innovation1000.html 28

CPA Global Historical Overview – Strong revenue growth and profitability Revenue Adjusted EBITDA1 Adjusted EBITDA Less Capex1 $575M $575M $542M $201M $252M $188M $239M $461M $170M $444M $225M $163M $161M $208M $198M 2017 2018 2019 LTM PF Adj. 2017 2018 2019 LTM PF Adj. 2017 2018 2019 LTM PF Adj. Jun 20 LTM Jun 20 LTM Jun 20 LTM Jun 20 Jun 20 Jun 20 Note: CPA Global financials are converted to USD at average historical rates for respective periods Note: LTM Jun20 includes pro forma acquisition impact Note: 2017 reported under IFRS; 2018, 2019 and LTM Jun 20 figures within have been updated by CPA Global to draft US GAAP 29 1. See the Appendix for a reconciliation of GAAP to Non-GAAP measures

Compelling Acquisition Rationale

Transaction overview • All-stock transaction in which CPA Global shareholders will receive ~218M Clarivate shares, representing ~35% pro forma ownership of the combined Key Terms company & Structure • Represents ~$6.8B enterprise value based on Clarivate’s 30-day VWAP, which includes ~$900M of present value of tax assets • Including the benefit of tax assets, transaction value implies ~16x 2020 EBITDA multiple inclusive of $75M run-rate cost savings • Leonard Green & Partners (“LGP”) will have the right to appoint 2 directors to the Clarivate board • Certain CPA shareholders, including funds advised by majority owner LGP along with funds advised by Castik Capital and Partners Group, will be locked-up Governance from selling their Clarivate shares until October 1, 2021 • CPA’s world-class management will further strengthen Clarivate’s leadership Connecting the entire intellectual property Enable holistic view of intellectual property Broader, complementary product offering will lifecycle with insights, workflow software and creation, protection and commercialization, a present significant cross-selling opportunities tech-enabled services market first across combined customer base Idea Management Lifecycle Drafting & Opposition & Innovation Search Renewals Commercialization Prosecution Litigation 31

Combined company creates unparalleled value in the IP and Innovation management ecosystem $1,717M $766M $617M Pro Forma Pro Forma Pro Forma Adjusted EBITDA Adjusted Revenue1 Adjusted EBITDA1,2 Less Capex1,2 High-Single-Digits 45% 81% Pro Forma Pro Forma Pro Forma Adjusted EBITDA Organic Growth Rate Adjusted EBITDA Margin1,2 Less Capex Conversion1,2 Pro Forma Business Mix By Product Group By Type By Geography Science 17% Subscription 21% Americas 44% Group Re-Occurring 56% 56% 50% EMEA Intellectual 27% Transactional 29% APAC Property Group Note: CPA Global financials are converted to USD at a GBPUSD exchange rate of 1.26x Note: Figures reflect LTM Jun20 pro forma results Note: Pro forma financials reflect the full year impact of acquisitions, including CPA Global, and associated run-rate cost synergies wbh 1. See the Appendix for a reconciliation of GAAP to Non-GAAP measures 32 2. Includes $75M of expected EBITDA cost synergies. See the Appendix for a reconciliation of GAAP to Non-GAAP measures

Significant cost synergies to accelerate earnings growth $75M of Run-Rate Cost Synergies Fully Realized within 18 months Direct costs $80M $70M $60M Sales & marketing $50M $40M $30M Technology & data $20M $10M $ - Corporate & real estate 2021E 2022E 33

Substantial revenue synergy opportunities represent further upside Connecting product offerings will provide customers a unified “project” view across the idea management lifecycle Adding workflow integrations will improve customer efficiency Adding new product that neither company could create on its own Revenue synergy opportunity driven by Cross-Sell Retention Joint Offerings Combined ~30K1 customers with limited Customer retention upside from deeper Complementary IP workflow provides customer overlap relationships and combined value proposition opportunities for combined offerings 1. Combined customer count not de-duped 34

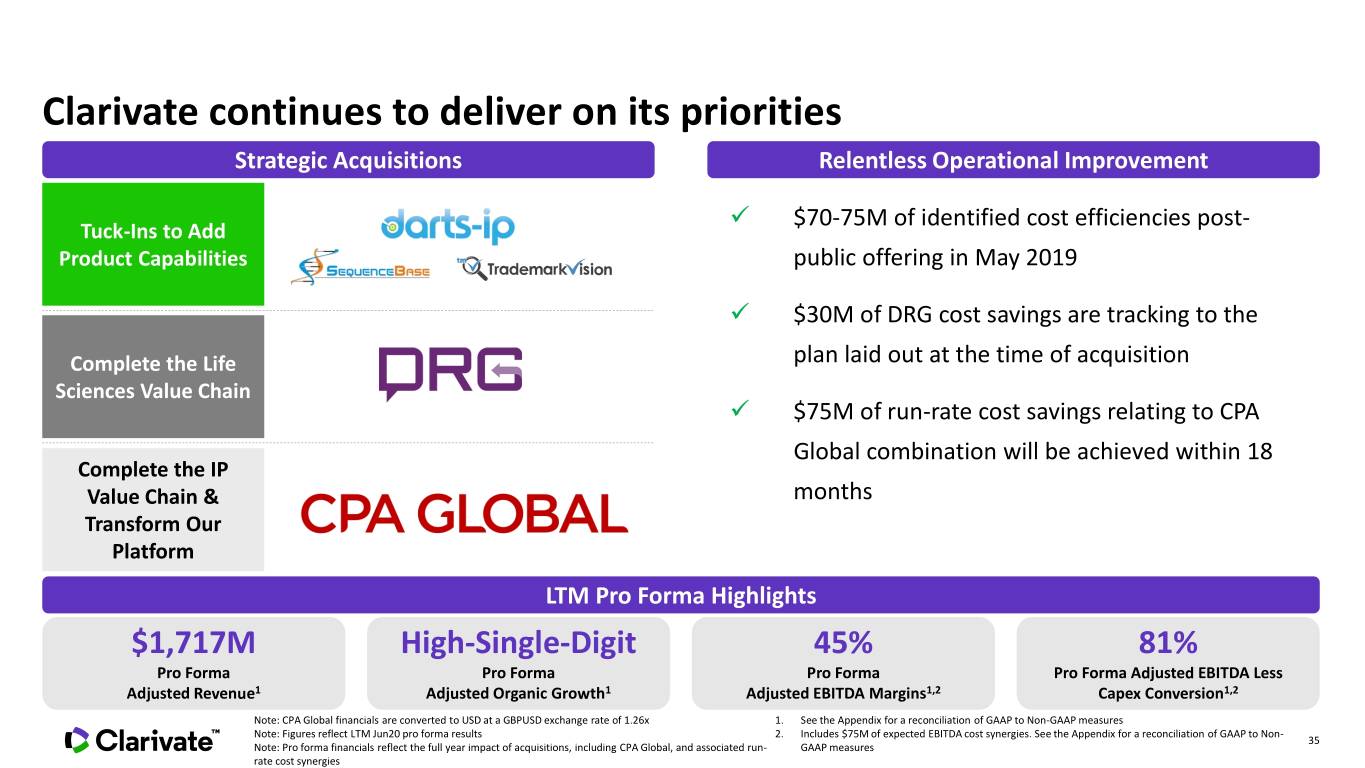

Clarivate continues to deliver on its priorities Strategic Acquisitions Relentless Operational Improvement $70-75M of identified cost efficiencies post- Tuck-Ins to Add Product Capabilities public offering in May 2019 $30M of DRG cost savings are tracking to the Complete the Life plan laid out at the time of acquisition Sciences Value Chain $75M of run-rate cost savings relating to CPA Global combination will be achieved within 18 Complete the IP Value Chain & months Transform Our Platform LTM Pro Forma Highlights $1,717M High-Single-Digit 45% 81% Pro Forma Pro Forma Pro Forma Pro Forma Adjusted EBITDA Less Adjusted Revenue1 Adjusted Organic Growth1 Adjusted EBITDA Margins1,2 Capex Conversion1,2 Note: CPA Global financials are converted to USD at a GBPUSD exchange rate of 1.26x 1. See the Appendix for a reconciliation of GAAP to Non-GAAP measures Note: Figures reflect LTM Jun20 pro forma results 2. Includes $75M of expected EBITDA cost synergies. See the Appendix for a reconciliation of GAAP to Non- 35 Note: Pro forma financials reflect the full year impact of acquisitions, including CPA Global, and associated run- GAAP measures rate cost synergies

Exceptional Leadership Team Jerre Stead Executive Chairman &Chief Executive Officer, Clarivate • Preeminent business operator with demonstrated success in shareholder value creation • Previously served as Chairman and CEO at IHS, IHS-Markit, Honeywell-Phillips Medical Electronics, Square D Company, AT&T Global Information Solutions, Legent Corporation and Ingram Micro Richard Hanks Chief Financial Officer, Clarivate • Experienced and effective financial executive • Previously served as CFO at BDP International Inc., EVP and CFO at Infogroup Inc. and Chief Commercial Officer and COO of the Enterprise Media Division of Dow Jones Simon Webster Chief Executive Officer, CPA Global • Experienced leader with a deep knowledge of and passion for the business, its customers, and the Intellectual Property Industry • Joined CPA Global in 2000, was appointed to executive team in 2003, the Board in 2010, and Group CEO in 2015 • Overseen ~20 mergers and acquisitions 36

Financial Highlights

Combined Company Historical Overview As Reported Revenue As Reported Adjusted EBITDA ($ in millions) ($ in millions) $1,587 $1,717 $1,429 $1,516 $766 $1,362 $579 $518 $481 $519 2017 2018 2019 LTM PF Adj. LTM 2017 2018 2019 LTM PF Adj. LTM Jun 20 Jun 20 Jun 20 Jun 20 % YoY Growth % Margin -- 5% 6% 5% 13% 38% 34% 34% 36% 45% As Reported Capex As Reported Adjusted EBITDA - Capex ($ in millions) ($ in millions) $617 $149 $149 $125 $445 $430 $92 $389 $394 $73 2017 2018 2019 LTM PF Adj. LTM 2017 2018 2019 LTM PF Adj. LTM Jun 20 Jun 20 % Revenue % Conversion Jun 20 Jun 20 5% 6% 8% 9% 9% 86% 81% 76% 74% 81% Note: CPA Global financials are converted to USD at a GBPUSD exchange rate of 1.26x Note: LTM figures through June 30, 2020 38 Note: As reported Consolidated Adjusted EBITDA

Financial Policy Leverage Liquidity Capital Allocation Strong free cash flow generation to be utilized for debt reduction Prioritize debt reduction to return Expected to de-lever ~4.0x at year- More than adequate liquidity in to target leverage levels end 2020 and <3.1x by year-end free cash flow and revolver to M&A execution to be oriented 2021 cover working capital needs towards providing end-to-end Longer term target net leverage of capability ~3.0x Clarivate’s policy is to maintain a conservative financial profile with disciplined focus on achieving deleveraging target of ~3.0x 39

APPENDIX

Q2 Financial Highlights… Solid topline growth and cost efficiencies drove double-digit Adjusted EBITDA(1) growth and significant margin expansion June 30, Excluding ($ in millions except per share data) 2020 2019 % Change Organic(2) Commentary Divestitures(2) Recent acquisitions, new business including several large contracts entered into Subscription revenue(1) $217 $203 7% 15% 4% during June ‘20, and price increases within both the Science and IP Product Groups, partially offset by the MarkMonitor divested products Recent acquisitions, partially offset by divested businesses, a decrease in backfile Transactional revenue(1) 60 40 52% 54% (13%) sales and lower CompuMarkTM search volumes primarily due to an overall decrease in demand driven by economic conditions resulting from COVID-19 pandemic Adjusted total revenues, net(1) 277 242 14% 21% 1% Annual Contract Value (“ACV”) 853 783 9% 16% 5% Addition of DRG , organic growth and annual price increases Revenue growth, acquisitions, portfolio rationalization and benefit of cost savings Adjusted EBITDA(1) 100 73 37% --- --- initiatives Adjusted EBITDA margin(1) 36% 30% 595bps --- --- Strong revenue flow-through and benefit of cost savings Other income, net 9 7 33% --- --- Primarily related to gains in foreign currency exchange Primarily difference in timing of the recognition of profits/losses at the mix of Benefit/(Provision) for income taxes 5 (4) 245% --- --- jurisdictions for the interim tax periods of Q2 ‘19 and Q2 ‘20 Q2 ‘19 - payments were made for prior tax years (2017 and 2018) of foreign Cash taxes 8 15 (45%) --- --- jurisdictions; Q2 ‘20, due to the COVID-19 pandemic, US Fed estimated tax payments were deferred until July 15th GAAP net loss (1.5) (77.8) 98% Adjusted net income(1) 70 N/A --- --- --- GAAP loss per share 0.00 (0.29) 100% Adjusted diluted EPS(1) $0.18 N/A --- --- --- (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures. 41 (2) At constant currency.

…Q2 Financial Highlights Continued Significant resources including $609 million in cash and untapped $250 million revolver to continue to invest in strategic growth opportunities June 30, December 31, ($ in millions) $ Change Commentary on Change 2020 2019 Proceeds of ~$278 million received from the voluntary exercise of ~24 million warrants in exchange Cash and cash equivalents $609 $76 $533 for ordinary shares of Clarivate in Q1 ’20 and ~$304 million from sale of ordinary shares in June 2020 $360 million incurred to fund a portion of the DRG acquisition offset by a $65 million repayment of the Total debt outstanding $1,954 $1,665 $289 revolver in full Net debt(1) $1,346 $1,589 ($243) Increase in cash partially offset by debt issuance June calculation includes proforma adjusted EBITDA for last twelve months for the acquisition of DRG Gross leverage ratio(1) 4.5x 5.0x (0.5x) completed end of Feb. 2020 Decline in leverage ratio due to increase in cash and higher standalone last twelve months adjusted Net leverage ratio(1) 3.1x 4.7x (1.6x) EBITDA YTD June 30, 2020 YTD June 30, 2019 Addition of DRG, acceleration of product development with significant cadence of new releases for Capital expenditures $53 $25 $28 renovated product, and with COVID more time spent on application development so higher proportion of time is capitalized Cash flow from operations $108 $43 $65 Driven by increased revenues and lower GAAP operating loss Free cash flow(1) $55 $18 $37 Revenue growth and expense control Driven by improvement in cash flow from operations. Primarily adds back cash paid for transaction, Adjusted free cash flow(1) $120 $45 $75 transition, transformation and integration expenses related to recent acquisitions, and streamlining operations by simplifying the organization following public offering in May 2019 (1) See the Appendix for a reconciliation of GAAP to Non-GAAP measures. 42

43 Presentation of certain non-GAAP financial measures excluding CPA This presentation contains financial measures which have not been calculated in accordance with GAAP, including Adjusted Revenues and Adjusted EBITDA, because they are a basis upon which our management assesses our performance and we believe they reflect the underlining trends and indicators of our business. Adjusted Revenues The Company presents Adjusted Revenues, which excludes the impact of the deferred revenue purchase accounting adjustment (recorded in connection with the separation from Thomson Reuters) and revenues from divestitures. The Company presents these measures because it believes it is useful to readers to better understand the underlying trends in our operations. Adjusted EBITDA Adjusted EBITDA is presented because it is a basis upon which our management assesses our performance and we believe it is useful for investors to understand the underlying trends of our operations. Adjusted EBITDA represents net loss before provision for income taxes, depreciation and amortization, interest income and expense adjusted to exclude acquisition or disposal-related transaction costs (such costs include net income from continuing operations before provision for income taxes, depreciation and amortization and interest income and expense from divestitures), losses on extinguishment of debt, stock-based compensation, unrealized foreign currency gains/(losses), costs associated with the transition services agreement with Thomson Reuters, which we entered into in connection with our separation from Thomson Reuters in 2016, separation and integration costs, transformational and restructuring expenses, acquisition- related adjustments to deferred revenues, costs related to our merger with Churchill Capital Corp in 2019, non-cash income/(loss) on equity and cost method investments, non-operating income or expense, the impact of certain non-cash, legal settlements and other items that are included in net income for the period that the Company does not consider indicative of its ongoing operating performance and certain unusual items impacting results in a particular period. Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by Adjusted Revenues. The Company's presentation of Adjusted EBITDA and Adjusted EBITDA margin should not be construed as an inference that its future results will be unaffected by any of the adjusted items, or that our projections and estimates will be realized in their entirety or at all. In addition, because of these limitations, Adjusted EBITDA should not be considered as a measure of liquidity or discretionary cash available to us to fund our cash needs, including investing in the growth of our business and meeting our obligations. You should compensate for these limitations by relying primarily on our U.S. GAAP results and only use Adjusted EBITDA and Adjusted EBITDA margin for supplementary analysis. Pro forma Adjusted Organic Growth Pro forma reflects the full year impact of acquisitions in the relevant period and is stated at constant currency.

44 Presentation of certain non-GAAP financial measures excluding CPA (continued) Adjusted Net Income and Adjusted Diluted EPS We have begun to use Adjusted net Income and Adjusted Diluted Earnings Per Share ("Adjusted Diluted EPS") in our analysis of the financial performance of the Company. We believe Adjusted Net Income and Adjusted Diluted EPS are meaningful measures of the performance of the Company because they adjust for items that do not directly affect our ongoing performance in this period. Adjusted Net Income is calculated using net income (loss), adjusted to exclude acquisition or disposal-related transaction costs (such costs include net income from continuing operations before provision for income taxes, depreciation and amortization and interest income and expense from the divested business), amortization related to acquired intangible assets, share-based compensation, unrealized foreign currency gains/(losses), Transition Services Agreement costs, separation and integration costs, transformational and restructuring expenses, acquisition-related adjustments to deferred revenues, debt extinguishment costs and refinancing related costs, non-cash income (loss) on equity and cost method investments, non-operating income or expense, the impact of certain non-cash and other items that are included in net income for the period that the Company does not consider indicative of its ongoing operating performance, certain unusual items impacting results in a particular period, and the income tax impact of any adjustments. We calculate Adjusted Diluted EPS by using Adjusted Net Income divided by diluted weighted average shares for the period. Standalone Adjusted EBITDA The Company is required to report Standalone Adjusted EBITDA, which is identical to Consolidated EBITDA and EBITDA as such terms are defined under the Company's credit facilities, dated as of October 31, 2019 and the indenture governing the Company's secured notes due 2026 issued by Camelot Finance S.A. and guaranteed by certain of our subsidiaries, respectively. In addition, the credit facilities and the indenture contain certain restrictive covenants that govern debt incurrence and the making of restricted payments, among other matters. These restrictive covenants utilize Standalone Adjusted EBITDA as a primary component of the compliance metric governing the Company's ability to undertake certain actions otherwise proscribed by such covenants. Standalone Adjusted EBITDA reflects further adjustments to Adjusted EBITDA for cost savings already implemented and excess standalone costs. Because Standalone Adjusted EBITDA is required pursuant to the terms of the reporting covenants under the credit facilities and the indenture and because this metric is relevant to lenders and noteholders, the Company's management considers Standalone Adjusted EBITDA to be relevant to the operation of its business. It is also utilized by management and the compensation committee of the Board as an input for determining incentive payments to employees. Excess standalone costs are the difference between the Company's actual standalone company infrastructure costs, and our estimated steady state standalone infrastructure costs. The Company makes an adjustment for the difference because the Company has had to incur costs under the transition services agreement, with Thomson Reuters after the Company had implemented the infrastructure to replace the services provided pursuant to the transition services agreement, thereby incurring dual running costs. Furthermore, there has been a ramp up period for establishing and optimizing the necessary standalone infrastructure. Since the Company's separation from Thomson Reuters, it has had to transition quickly to replace services provided under the transition services agreement, with optimization of the relevant standalone functions typically following thereafter. Cost savings reflect the annualized “run rate” expected cost savings, net of actual cost savings realized, related to restructuring and other cost savings initiatives undertaken during the relevant period. Standalone Adjusted EBITDA is calculated under the credit facilities and the indenture by using our Consolidated Net Loss for the trailing 12-month period (defined in the credit facilities and the indenture as the Company's U.S. GAAP net income adjusted for certain items specified in the credit facilities and the indenture) adjusted for items including: taxes, interest expense, depreciation and amortization, non-cash charges, expenses related to capital markets transactions, acquisitions and dispositions, restructuring and business optimization charges and expenses, consulting and advisory fees, run- rate cost savings to be realized as a result of actions taken or to be taken in connection with an acquisition, disposition, restructuring or cost savings or similar initiatives, “run rate” expected cost savings, operating expense reductions, restructuring charges and expenses and synergies related to the transition projected by us, costs related to any management or equity stock plan, other adjustments that were presented in the offering memorandum used in connection with the issuance of the secured notes due 2026 and earn-out obligations incurred in connection with an acquisition or investment. Free Cash Flow The Company uses free cash flow and adjusted free cash flow in its operational and financial decision-making and believes free cash flow and adjusted free cash flow are useful to investors because similar measures are frequently used by securities analysts, investors, ratings agencies and other interested parties to evaluate the Company's competitors and to measure the ability of companies to service their debt. The Company's presentations of free cash flow and adjusted free cash flow should not be construed as a measure of liquidity or discretionary cash available to it to fund its cash needs, including investing in the growth of our business and meeting its obligations. You should compensate for these limitations by relying primarily on our U.S. GAAP results. The Company defines free cash flow as net cash provided by operating activities less capital expenditures. We define adjusted free cash flow as free cash flow, less cash paid for transition services agreement, transition, transformation and integration expenses, transaction related costs and debt issuance costs offset by cash received for hedge accounting transactions.

Reconciliation of Non-GAAP Financial Measures and Required Reported Data The following tables present the amounts of our subscription and transactional revenues, including as a percentage of our total revenues, for the periods indicated, as well the drivers of the variances between periods. Variance Increase/(Decrease) Percentage of Factors Increase/(Decrease) Total Three Months Ended Variance Total Variance June 30, (Dollars) (Percentage) Acquisitive Disposal FX Impact Organic (in millions, except percentages) 2020 2019 Subscription revenues $ 216.5 $202.7 $13.8 6.8 % 11.4 % (6.9)% (1.3)% 3.6 % Transactional revenues 60.4 39.7 20.7 52.1 % 66.1 % (0.6)% (0.8)% (12.6)% 1 Deferred revenues adjustment(1) (3.4) (0.1) (3.3) NM NM — % — % 75.5 % Revenues, net 273.5 242.3 31.2 12.9 % 18.9 % (5.9)% (1.3)% 1.2 % 1 Deferred revenues adjustment(1) 3.4 0.1 3.3 NM NM — % — % (75.5)% Adjusted revenues, net $276.9 $242.4 $34.5 14.2 % 20.3 % (5.9)% (1.3)% 1.1 % (1) Reflects the deferred revenues adjustment made as a result of purchase accounting. 45

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Descriptions Three Months Ended June 30, Six Months Ended June 30, Adjusted EBITDA adjustments (in millions) 2020 2019 2020 2019 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes Net loss $(1.5) $(77.8) $(75.5) $(137.0) payments to Thomson Reuters under the Transition Services Agreement. Provision for income taxes (5.4) 3.7 9.4 4.0 2. Includes costs incurred in connection with and after our separation from Thomson Depreciation and amortization 56.1 43.1 107.6 101.2 Reuters in 2016 relating to the implementation of our standalone company infrastructure and related cost-savings initiatives. These costs include mainly transition Interest, net 21.1 37.5 52.1 70.6 consulting, technology infrastructure, personnel and severance expenses relating to our standalone company infrastructure, which are recorded in Transition, integration, and 1 Transition services agreement costs (0.8) 2.5 0.8 7.7 other line-item of our income statement, as well as expenses related to the restructuring 2 Transition, transformation and integration expense 1.3 11.3 3.6 13.8 and transformation of our business following our separation from Thomson Reuters in 2016, mainly related to the integration of separate business units into one functional 3 Deferred revenues adjustment 3.4 0.1 5.3 0.3 organization and enhancements in our technology. 4 Transaction related costs 8.5 23.2 35.2 33.4 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Share-based compensation expense 6.9 33.9 24.3 37.1 4. Includes costs incurred to complete business combination transactions, including 5 Restructuring 15.8 — 23.6 — acquisitions and dispositions, and typically include advisory, legal and other professional and consulting costs. 6 Other (5.3) (4.3) (8.1) 1.3 5. Reflects costs incurred in connection with the initiative, following our merger with Adjusted EBITDA $100.1 $73.2 $178.3 $132.4 Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. 6. Includes primarily the net impact of foreign exchange gains and losses related to the re- measurement of balances and other items that do not reflect our ongoing operating performance. 46

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Descriptions Twelve Months Adjusted EBITDA adjustments Ended June 30, (in millions) 2020 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes payments to Thomson Reuters Net loss $ (149.4) under the Transition Services Agreement. (Benefit) provision for income taxes 15.6 2. Includes cash payments in connection with and after our separation from Thomson Reuters in 2016 Depreciation and amortization 206.9 relating to the implementation of our standalone company infrastructure and related cost-savings Interest, net 139.2 initiatives. These cash payments include mainly transition consulting, technology infrastructure, personnel and severance expenses relating to our standalone company infrastructure, which are recorded 1 Transition Services Agreement costs 3.5 in Transition, integration, and other line-item of our income statement, as well as cash payments related 2 Transition, transformation and integration expense 14.1 to the restructuring and transformation of our business following our separation from Thomson Reuters in 2016 mainly related to the integration of separate business units into one functional organization and 3 Deferred revenues adjustment 5.5 enhancements in our technology. This also includes cash payments following our merger with Churchill 4 Transaction related costs 48.0 Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. Share-based compensation expense 38.6 5 Restructuring 39.3 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Legal settlement (39.4) 4. Includes costs incurred to complete business combination transactions, including acquisitions and dispositions, and typically include advisory, legal and other professional and consulting costs. Impairment on assets held for sale 18.4 6 Other (0.3) 5. Reflects costs incurred in connection with the initiative, following our merger with Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on two product groups. Adjusted EBITDA 340.0 Realized foreign exchange gain (6.8) 6. Includes primarily the net impact of foreign exchange gains and losses related to the re-measurement of balances and other items that do not reflect our ongoing operating performance. 7 DRG Adjusted EBITDA Impact 35.8 8 Cost savings 39.7 7. Represents DRG Adjusted EBITDA for the period beginning July 1, 2020 until the acquisition date of February 28, 2020 to reflect the company's Standalone EBITDA as though material acquisitions occurred at 9 Excess standalone costs 30.1 the beginning of the presented period Standalone Adjusted EBITDA $ 438.8 8. Reflects the estimated annualized run-rate cost savings, net of actual cost savings realized, related to restructuring and other cost savings initiatives undertaken during the period (exclusive of any cost reductions in our estimated standalone operating costs). 9. Reflects the difference between our actual standalone company infrastructure costs, and our estimated steady state standalone operating costs. 47

Reconciliation of Non-GAAP Financial Measures and Required Reported Data Descriptions Three Months Ended June 30, Six Months Ended June 30, Adjusted Net Income and Adjusted Diluted EPS Adjustments 2020 2020 1. In 2020, this is related to a new transition services agreement and offset by the reverse transition services agreement from the sale of MarkMonitor assets. In 2019, this includes payments to ($ in millions, except per share amounts) Amount Per Share Amount Per Share Thomson Reuters under the Transition Services Agreement. 2. Includes cash payments in connection with and after our separation from Thomson Reuters in Net loss ($1.5) -- ($75.5) ($0.21) 2016 relating to the implementation of our standalone company infrastructure and related cost- Dilutive impact of potential common shares -- -- -- 0.01 savings initiatives. These cash payments include mainly transition consulting, technology Net loss (1.5) -- (75.5) (0.20) infrastructure, personnel and severance expenses relating to our standalone company 1 Transition services agreement costs (0.8) -- 0.8 -- infrastructure, which are recorded in Transition, integration, and other related expenses line-item 2 Transition, transformation and integration expense 1.3 -- 3.6 0.01 of our income statement, as well as cash payments related to the restructuring and transformation of our business following our separation from Thomson Reuters in 2016 mainly 3 Deferred revenues adjustment 3.4 0.01 5.3 0.01 related to the integration of separate business units into one functional organization and Transaction related costs 8.5 0.02 35.2 0.09 4 enhancements in our technology. This also includes cash payments following our merger with Share-based compensation expense 6.9 0.02 24.3 0.06 Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and Amortization related to acquired intangible assets 47.6 0.12 87.7 0.23 focusing on two product groups. 5 Restructuring 15.8 0.04 23.6 0.06 3. Reflects the deferred revenues adjustment as a result of purchase accounting. Debt extinguishment costs and refinancing related costs -- -- 8.6 0.02 4. Includes costs incurred to complete business combination transactions, including acquisitions and 6 Other (5.5) (0.01) (8.0) (0.01) dispositions, and typically includes advisory, legal and other professional and consulting costs. Income tax impact of related adjustments (6.2) (0.02) (10.7) (0.03) 5. Reflects costs incurred in connection with the initiative, following our merger with Churchill Capital Corp in 2019, to streamline our operations by simplifying our organization and focusing on Adjusted Net income and Adjusted Diluted EPS $69.5 $0.18 $94.9 $0.25 two product groups. This also includes restructuring related costs following the acquisition of DRG in 2020. Weighted average ordinary shares (Diluted) 394,596,443 380,955,231 6. Includes primarily the net impact of foreign exchange gains and losses related to the re- measurement of balances and other items that do not reflect our ongoing operating performance. Six Months Ended June 30, Descriptions Free Cash Flow and Adjusted Free Cash Flow Adjustments ($ in millions) 2020 2019 1. Includes cash payments to Thomson Reuters under the Transition Services Agreement. These costs decreased substantially in 2019, as we were in the Net cash provided by operating activities $107.6 $42.9 final stages of implementing our standalone company infrastructure. In 2019, the Transition Services Agreement cash paid is offset by cash receipts Capital expenditures (52.7) (24.9) from the IPM Product Line divestiture. 2. Includes cash payments in connection with and after our separation from Thomson Reuters in 2016 relating to the implementation of our standalone Free cash flow 54.9 18.0 company infrastructure and related cost-savings initiatives. These cash payments include mainly transition consulting, technology infrastructure, 1 Cash paid for transition services agreement (2.2) 5.1 personnel and severance expenses relating to our standalone company infrastructure, which are recorded in Transition, integration, and other related 2 Cash paid for transition, transformation and integration expense 26.6 16.5 expenses line-item of our income statement, as well as cash payments related to the restructuring and transformation of our business following our separation from Thomson Reuters in 2016 mainly related to the integration of separate business units into one functional organization and 3 Cash paid for transaction related costs 34.3 33.0 enhancements in our technology. This also includes cash payments following our merger with Churchill Capital Corp in 2019, to streamline our Cash paid for debt issuance costs 7.7 -- operations by simplifying our organization and focusing on two product groups. Cash received for hedge accounting transactions (1.7) -- 3. Includes consulting and accounting costs associated with acquisitions and the sale of MarkMonitor Brand Protection, Antipiracy and Antifraud products. Adjusted free cash flow $119.6 $72.6 48

Pro Forma Selected Financial Data – LTM 6/30/2020 6/30/2020 Last Twelve Months Clarivate + CPA Global Combined Clarivate + CPA Global Pro Forma Revenues, net $1,587 $1,717 Operating costs and expenses: Cost of revenues, excluding depreciation and amortization (532) Selling, general and administrative costs, excluding depreciation and amortization (499) Share-based compensation expense (39) Depreciation (13) Amortization (282) Transaction expenses (53) Transition, integration and other related expenses (22) Legal Settlement 34 Restructuring and impairment (64) Other operating income (expense), net 22 Total operating expenses (1,448) Income (loss) from operations 139 Interest expense, (net) (216) Loss before income tax (77) Provision for income taxes (19) Net loss ($97) Cash Flow Data: Net cash (used in) provided by operating activities $305 Net cash (used in) provided by investing activities (1,108) Net cash (used in) provided by financing activities 1,425 Balance Sheet and Other Data: Cash and cash equivalents $756 Working capital 366 Total Assets 7,627 Total Debt, net 3,490 Net assets 2,654 49 Note: Cash and cash equivalents does not reflect the use of Clarivate’s cash to pay down debt and related expenses

2019 and LTM 6/30/2020 Pro Forma Combined Consolidated Adjusted EBITDA in $ millions 2019 LTM Jun20 Net loss $ (118.6) $ (35.5) (Benefit) provision for income taxes 18.1 19.0 Depreciation and amortization 274.1 295.0 Interest, net 165.0 152.0 Transition , transaction, TSA and integration costs 101.5 81.5 Deferred revenues adjustment 0.4 5.5 Share-based compensation expense 51.4 38.6 Restructuring 18.4 45.2 Legal settlement (33.9) (33.6) Impairment on assets held for sale 18.4 18.4 Other 24.2 (7.4) Adjusted EBITDA 519.1 578.8 Realized foreign exchange (gain) / loss (7.3) (3.0) DRG Adjusted EBITDA Impact 47.6 35.8 CPA Acquisition Adjusted EBITDA Impact 9.0 - Cost savings 141.9 123.9 Excess standalone costs 30.0 30.1 Pro Forma Combined Consolidated EBITDA $ 740.3 $ 765.6 50