Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUN COMMUNITIES INC | sui-20200914.htm |

VIZCAYA LAKES – PORT CHARLOTTE, FL INVESTOR PRESENTATION SEPTEMBER 2020

FORWARD-LOOKING STATEMENTS This presentation has been prepared for informational purposes only from information supplied by Sun Communities, Inc. (the “Company” or “Sun”) and from third-party sources indicated herein. Such third-party information has not been independently verified. The Company makes no representation or warranty, expressed or implied, as to the accuracy or completeness of such information. This presentation contains various “forward-looking statements” within the meaning of the United States Securities Act of 1933, as amended, and the United States Securities Exchange Act of 1934, as amended, and we intend that such forward-looking statements will be subject to the safe harbors created thereby. For this purpose, any statements contained in this presentation that relate to expectations, beliefs, projections, future plans and strategies, trends or prospective events or developments and similar expressions concerning matters that are not historical facts are deemed to be forward-looking statements. Words such as “forecasts,” “intends,” “intend,” “intended,” “goal,” “estimate,” “estimates,” “expects,” “expect,” “expected,” “project,” “projected,” “projections,” “plans,” “predicts,” “potential,” “seeks,” “anticipates,” “anticipated,” “should,” “could,” “may,” “will,” “designed to,” “foreseeable future,” “believe,” “believes,” “scheduled,” “guidance,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward looking statements contain these words. These forward-looking statements reflect our current views with respect to future events and financial performance, but involve known and unknown risks and uncertainties, both general and specific to the matters discussed in this presentation. These risks and uncertainties may cause our actual results to be materially different from any future results expressed or implied by such forward-looking statements. In addition to the risks disclosed under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2019, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and our other filings with the Securities and Exchange Commission from time to time, such risks and uncertainties include but are not limited to: ▪ outbreaks of disease, including the COVID-19 pandemic, and related stay-at-home orders, quarantine policies and restrictions on travel, trade and business operations; ▪ changes in general economic conditions, the real estate industry, and the markets win which we operate; ▪ difficulties in our ability to evaluate, finance, complete and integrate acquisitions, developments and expansions successfully; ▪ our liquidity and refinancing demands; ▪ our ability to obtain or refinance maturing debt; ▪ our ability to maintain compliance with covenants contained in our debt facilities; ▪ availability of capital; ▪ changes in foreign currency exchange rates, including between the U.S. dollar and each of the Canadian dollar and the Australian dollar; ▪ our ability to maintain rental rates and occupancy levels; ▪ our failure to maintain effective internal control over financial reporting and disclosure controls and procedures; ▪ increases in interest rates and operating costs, including insurance premiums and real property taxes; ▪ risks related to natural disasters such as hurricanes, earthquakes, floods and wildfires; ▪ general volatility of the capital markets and the market price of shares of our capital stock; ▪ our failure to maintain our status as a REIT; ▪ changes in real estate and zoning laws and regulations; ▪ legislative or regulatory changes, including changes to laws governing the taxation of REITs; ▪ litigation, judgments or settlements; ▪ competitive market forces; ▪ the ability of manufactured home buyers to obtain financing; and ▪ the level of repossessions by manufactured home lenders. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made. We undertake no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events, changes in our expectations or otherwise, except as required by law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. All written and oral forward-looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements. 2

COMPANY HIGHLIGHTS Leading owner and operator of manufactured housing (“MH”) and recreational vehicle (“RV”) communities Favorable demand drivers combined with supply constraints Consistent organic growth enhanced with embedded expansion opportunities HERITAGESUNSET RIDGE- TEMECULA, – PORTLAND, CA MI Industry consolidator with proven value creation from acquisitions Cycle-tested growth driven by attractive value proposition to residents and guests Focus on exceptional service supported by culture of accountability Proven executive management team with over 100 EAST FORK CROSSING – BATAVIA, OH combined years of industry experience RESERVE AT FOX CREEK - BULLHEAD CITY, AZ Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. 3

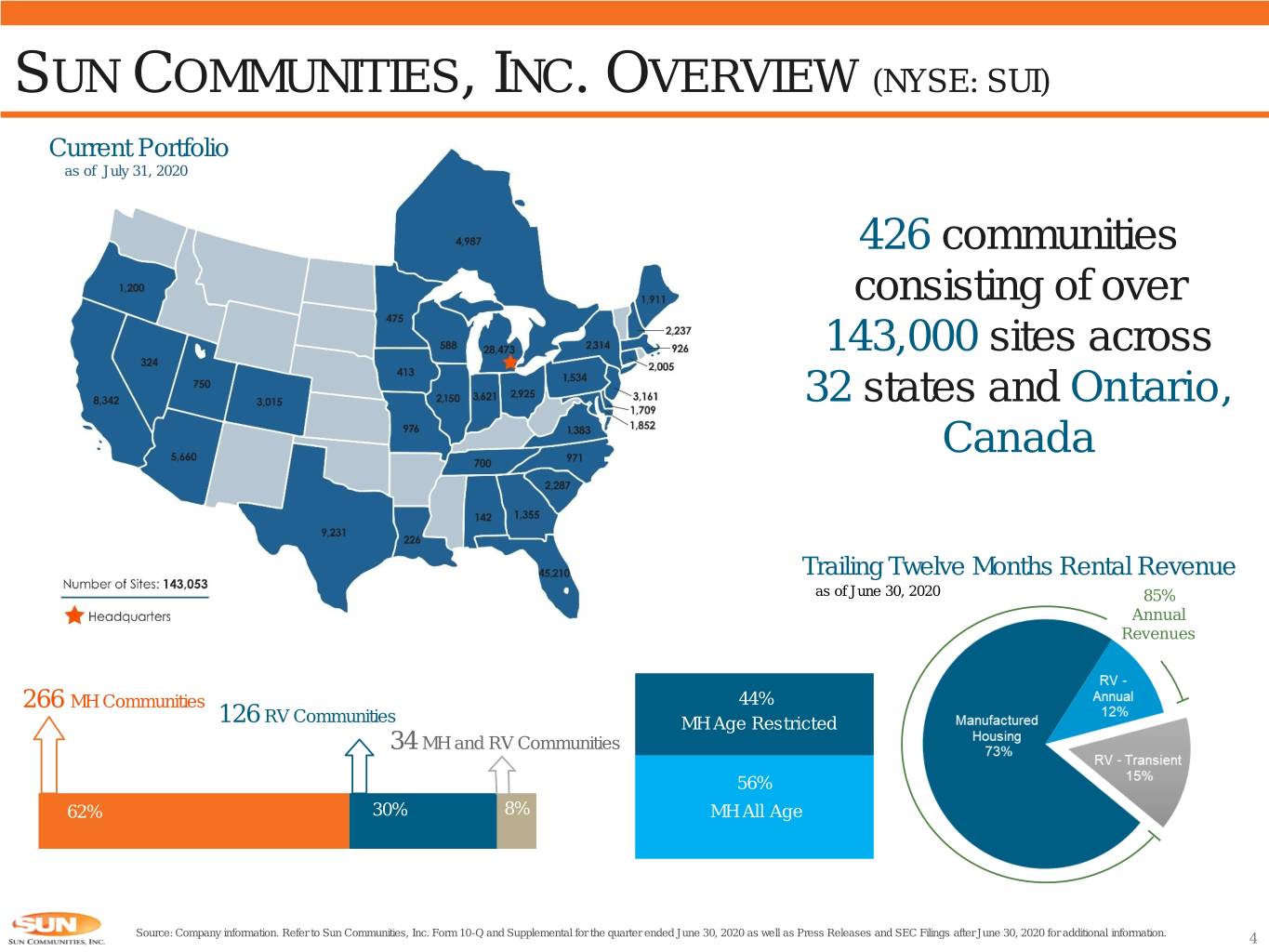

SUN COMMUNITIES, INC. OVERVIEW (NYSE: SUI) Current Portfolio as of July 31, 2020 426 communities consisting of over 143,000 sites across 32 states and Ontario, Canada Trailing Twelve Months Rental Revenue as of June 30, 2020 85% Annual Revenues 266 MH Communities 44% 126 RV Communities MH Age Restricted 34 MH and RV Communities 56% 12% 62% 30% 8% MH All Age Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. 4

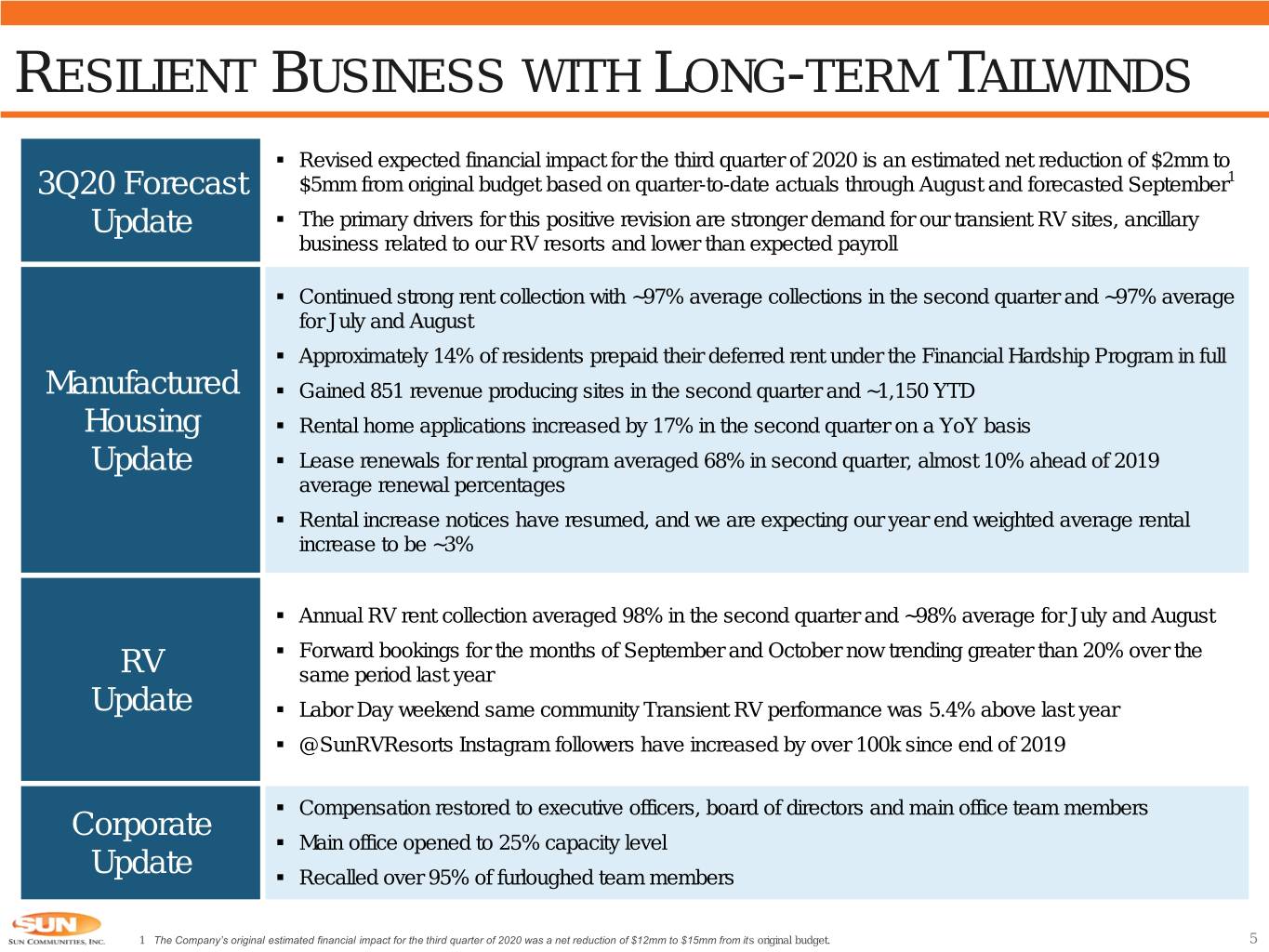

RESILIENT BUSINESS WITH LONG-TERM TAILWINDS ▪ Revised expected financial impact for the third quarter of 2020 is an estimated net reduction of $2mm to 3Q20 Forecast $5mm from original budget based on quarter-to-date actuals through August and forecasted September1 Update ▪ The primary drivers for this positive revision are stronger demand for our transient RV sites, ancillary business related to our RV resorts and lower than expected payroll ▪ Continued strong rent collection with ~97% average collections in the second quarter and ~97% average for July and August ▪ Approximately 14% of residents prepaid their deferred rent under the Financial Hardship Program in full Manufactured ▪ Gained 851 revenue producing sites in the second quarter and ~1,150 YTD Housing ▪ Rental home applications increased by 17% in the second quarter on a YoY basis Update ▪ Lease renewals for rental program averaged 68% in second quarter, almost 10% ahead of 2019 average renewal percentages ▪ Rental increase notices have resumed, and we are expecting our year end weighted average rental increase to be ~3% ▪ Annual RV rent collection averaged 98% in the second quarter and ~98% average for July and August ▪ Forward bookings for the months of September and October now trending greater than 20% over the RV same period last year Update ▪ Labor Day weekend same community Transient RV performance was 5.4% above last year ▪ @SunRVResorts Instagram followers have increased by over 100k since end of 2019 ▪ Compensation restored to executive officers, board of directors and main office team members Corporate ▪ Main office opened to 25% capacity level Update ▪ Recalled over 95% of furloughed team members 1 The Company’s original estimated financial impact for the third quarter of 2020 was a net reduction of $12mm to $15mm from its original budget. 5

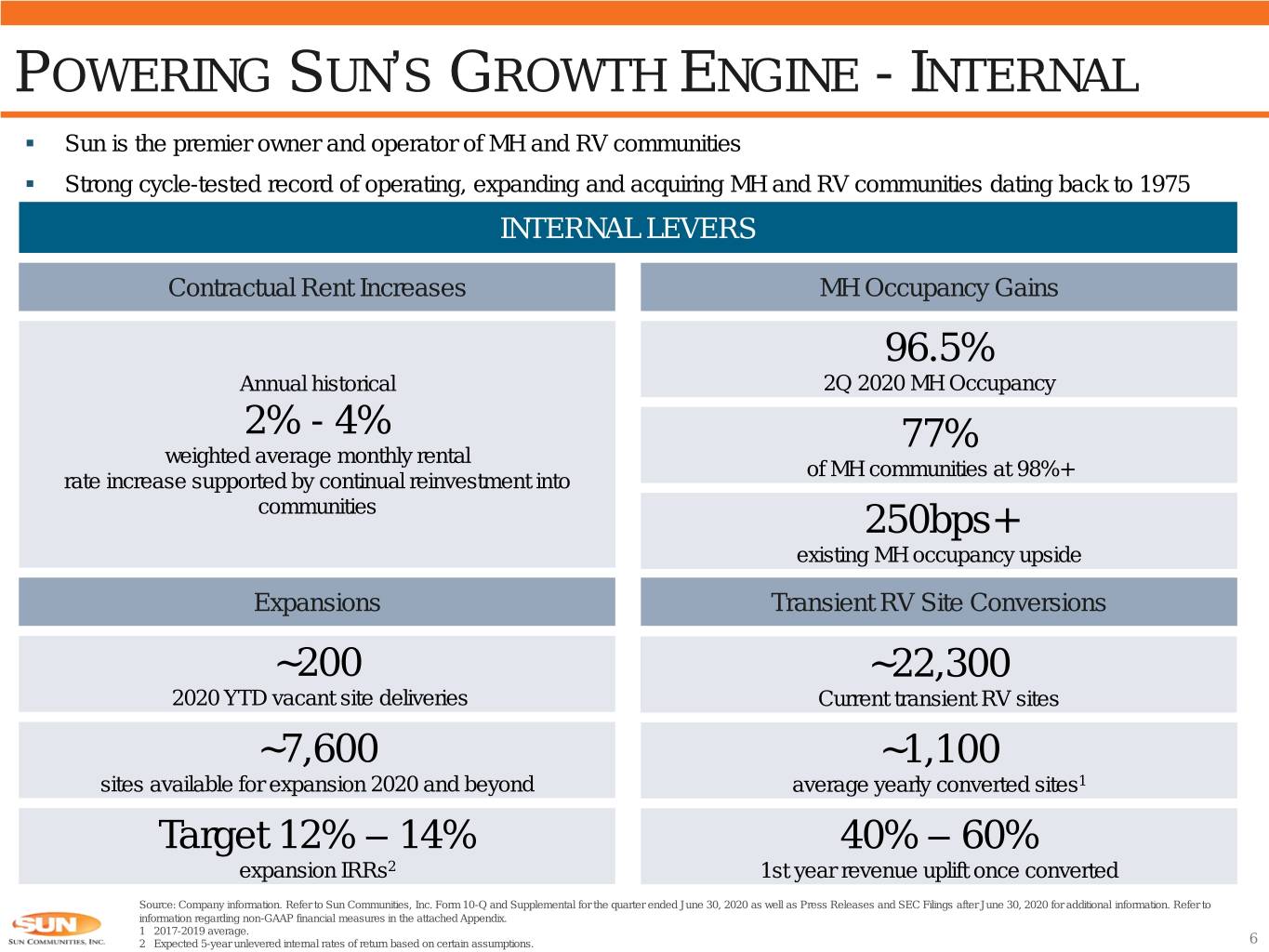

POWERING SUN’S GROWTH ENGINE - INTERNAL ▪ Sun is the premier owner and operator of MH and RV communities ▪ Strong cycle-tested record of operating, expanding and acquiring MH and RV communities dating back to 1975 INTERNAL LEVERS Contractual Rent Increases MH Occupancy Gains 96.5% Annual historical 2Q 2020 MH Occupancy 2% - 4% 77% weighted average monthly rental of MH communities at 98%+ rate increase supported by continual reinvestment into communities 250bps+ existing MH occupancy upside Expansions Transient RV Site Conversions ~200 ~22,300 2020 YTD vacant site deliveries Current transient RV sites ~7,600 ~1,100 sites available for expansion 2020 and beyond average yearly converted sites1 Target 12% – 14% 40% – 60% expansion IRRs2 1st year revenue uplift once converted Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 2017-2019 average. 2 Expected 5-year unlevered internal rates of return based on certain assumptions. 6

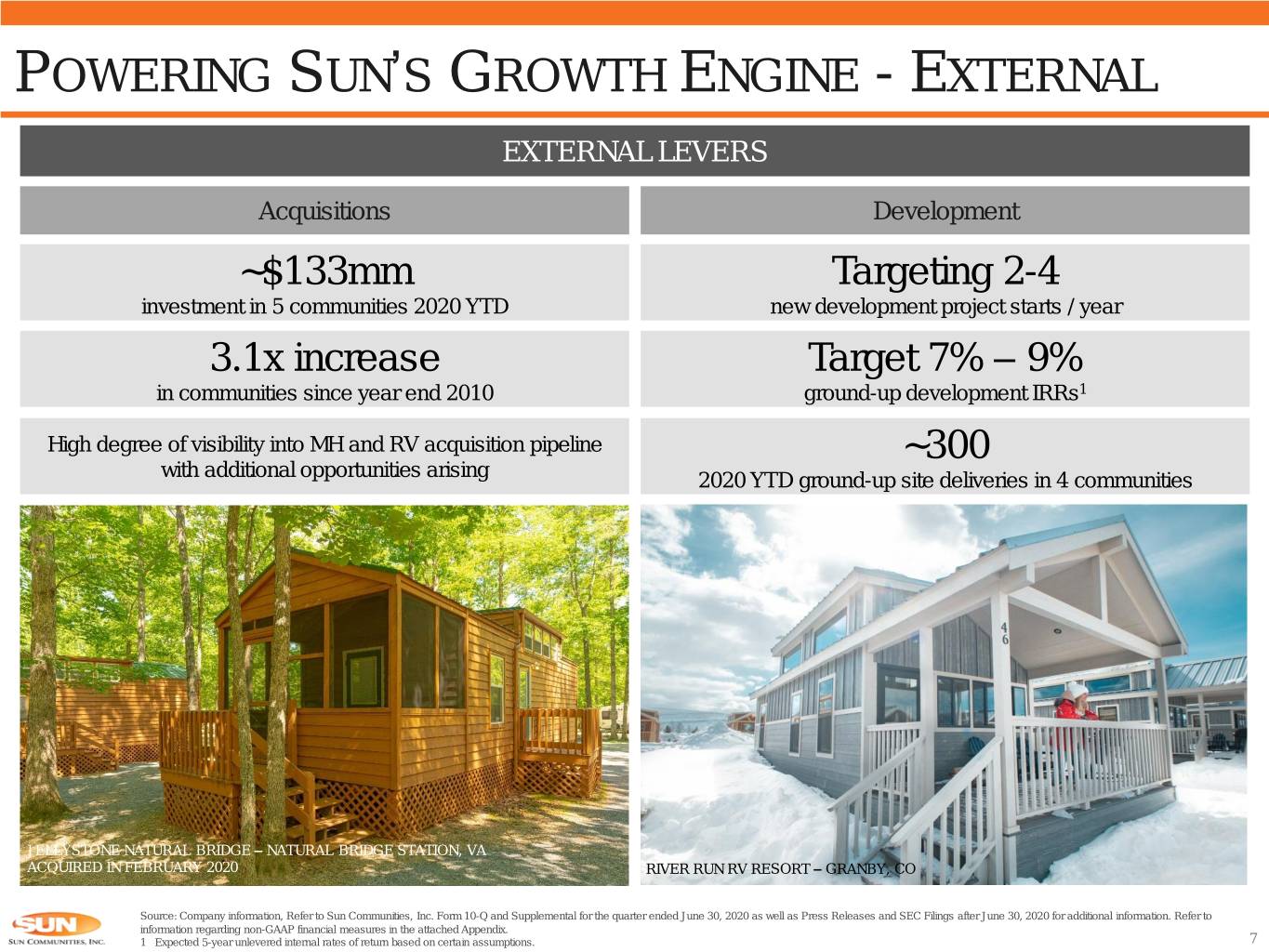

POWERING SUN’S GROWTH ENGINE - EXTERNAL EXTERNAL LEVERS Acquisitions Development ~$133mm Targeting 2-4 investment in 5 communities 2020 YTD new development project starts / year 3.1x increase Target 7% – 9% in communities since year end 2010 ground-up development IRRs1 High degree of visibility into MH and RV acquisition pipeline ~300 with additional opportunities arising 2020 YTD ground-up site deliveries in 4 communities OCEAN BREEZE – MARATHON, FL JELLYSTONE NATURAL BRIDGE – NATURAL BRIDGE STATION, VA ACQUIRED IN FEBRUARY 2020 RIVER RUN RV RESORT – GRANBY, CO Source: Company information, Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Expected 5-year unlevered internal rates of return based on certain assumptions. 7

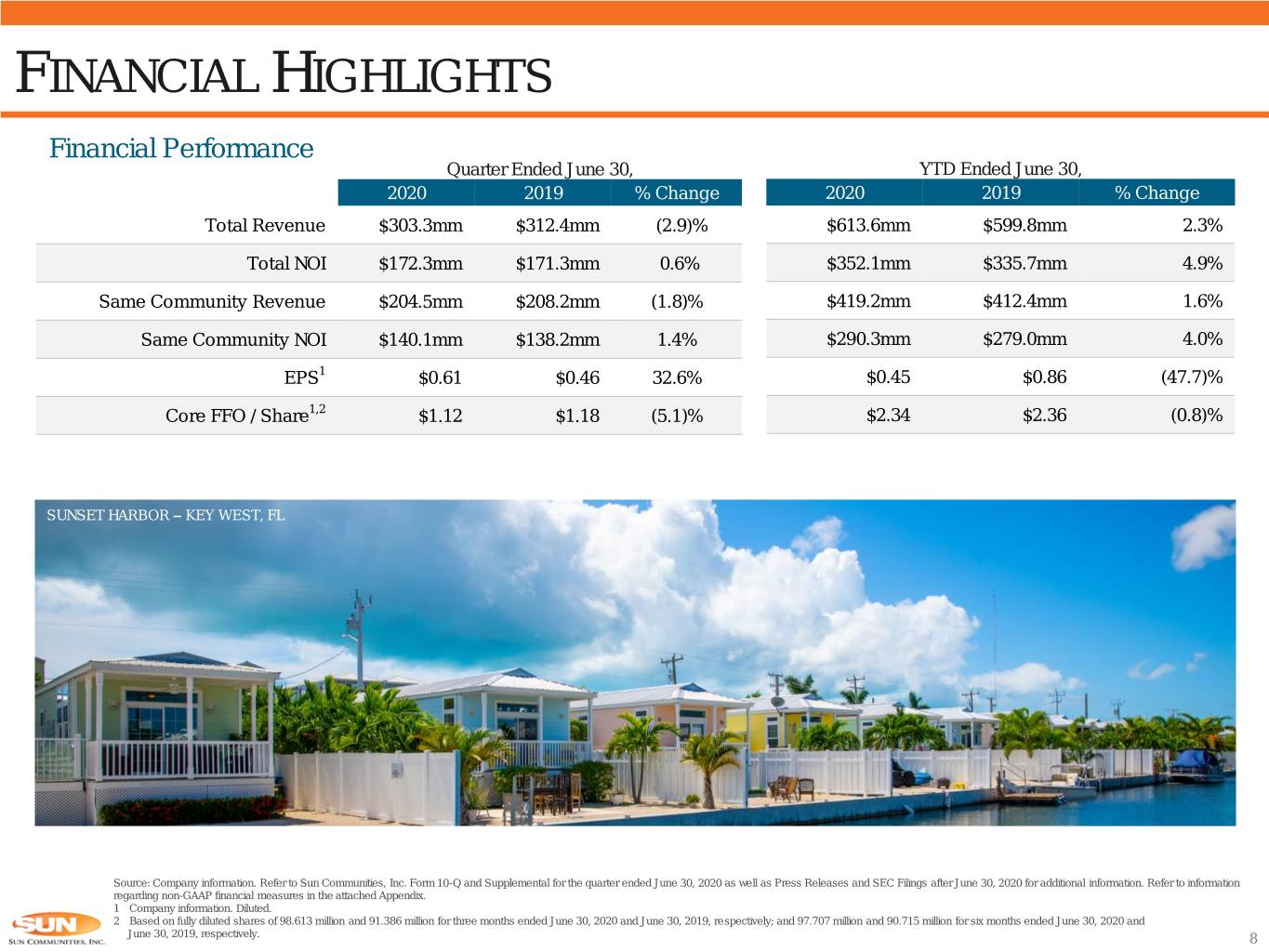

FINANCIAL HIGHLIGHTS Financial Performance Quarter Ended June 30, YTD Ended June 30, 2020 2019 % Change 2020 2019 % Change Total Revenue $303.3mm $312.4mm (2.9)% $613.6mm $599.8mm 2.3% Total NOI $172.3mm $171.3mm 0.6% $352.1mm $335.7mm 4.9% Same Community Revenue $204.5mm $208.2mm (1.8)% $419.2mm $412.4mm 1.6% Same Community NOI $140.1mm $138.2mm 1.4% $290.3mm $279.0mm 4.0% EPS1 $0.61 $0.46 32.6% $0.45 $0.86 (47.7)% Core FFO / Share1,2 $1.12 $1.18 (5.1)% $2.34 $2.36 (0.8)% SUNSET HARBOR – KEY WEST, FL SUN-N-FUN – SARASOTA, FL Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Company information. Diluted. 2 Based on fully diluted shares of 98.613 million and 91.386 million for three months ended June 30, 2020 and June 30, 2019, respectively; and 97.707 million and 90.715 million for six months ended June 30, 2020 and June 30, 2019, respectively. 8

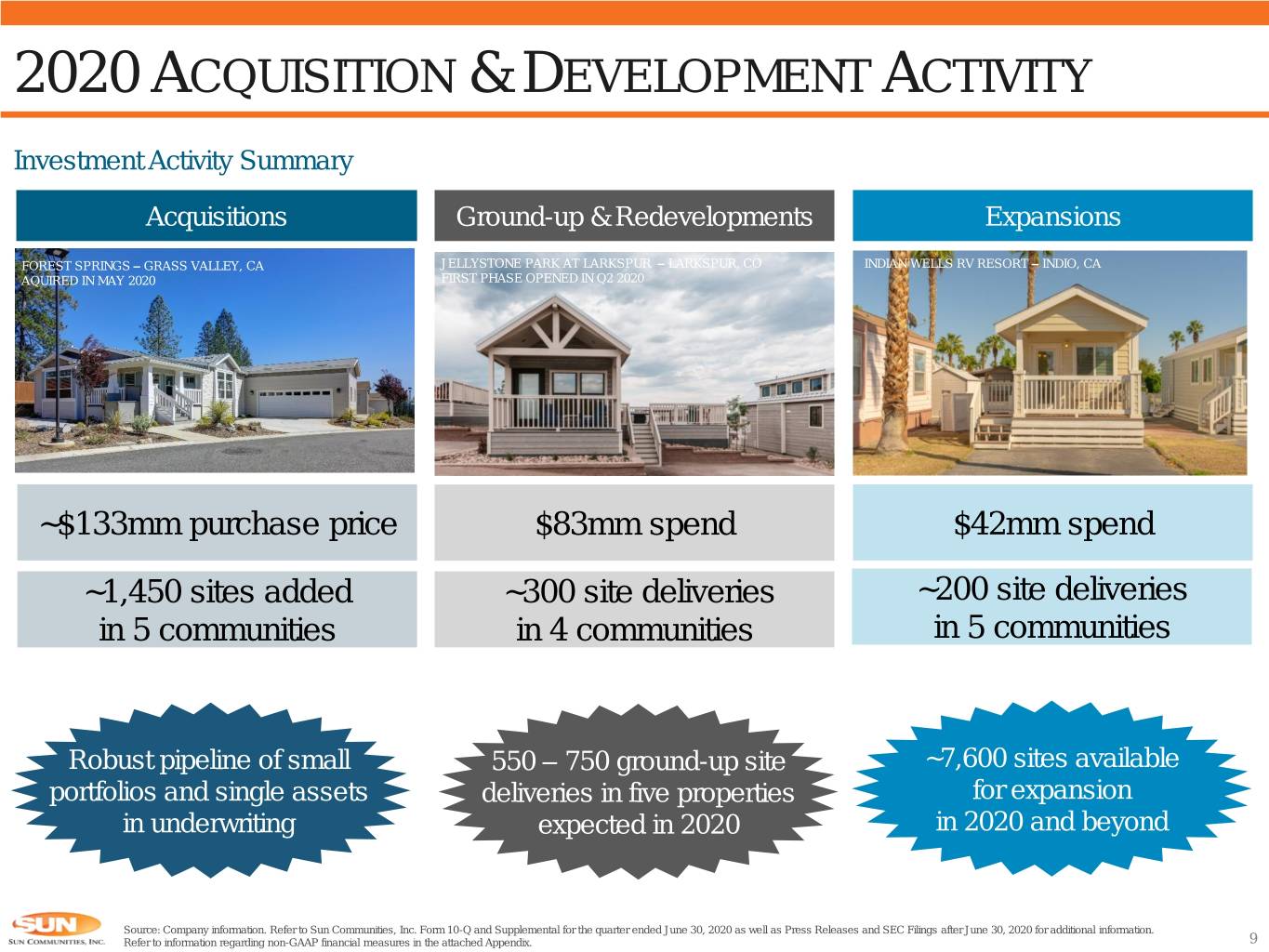

2020 ACQUISITION & DEVELOPMENT ACTIVITY Investment Activity Summary Acquisitions Ground-up & Redevelopments Expansions FORESTJELLYSTONE SPRINGS NATURAL – GRASS BRIDGE VALLEY, – NATURAL CA BRIDGE, VA JELLYSTONERIVER RUN RV PARK RESORT AT LARKSPUR – GRANBY, –COLARKSPUR, CO SHADOWINDIAN WELLS WOOD RV VILLAGE RESORT – HUDSON,– INDIO, CA FL AQUIREDACQUIRED IN INMAY FEBRUARY 2020 2020 FIRST PHASE OPENED IN Q2JULY 2020 2019 2 OPENED IN SEPTEMBER 2019 ~$133mm purchase price $83mm spend $42mm spend ~1,450 sites added ~300 site deliveries ~200 site deliveries in 5 communities in 4 communities in 5 communities Robust pipeline of small 550 – 750 ground-up site ~7,600 sites available portfolios and single assets deliveries in five properties for expansion in underwriting expected in 2020 in 2020 and beyond Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 9

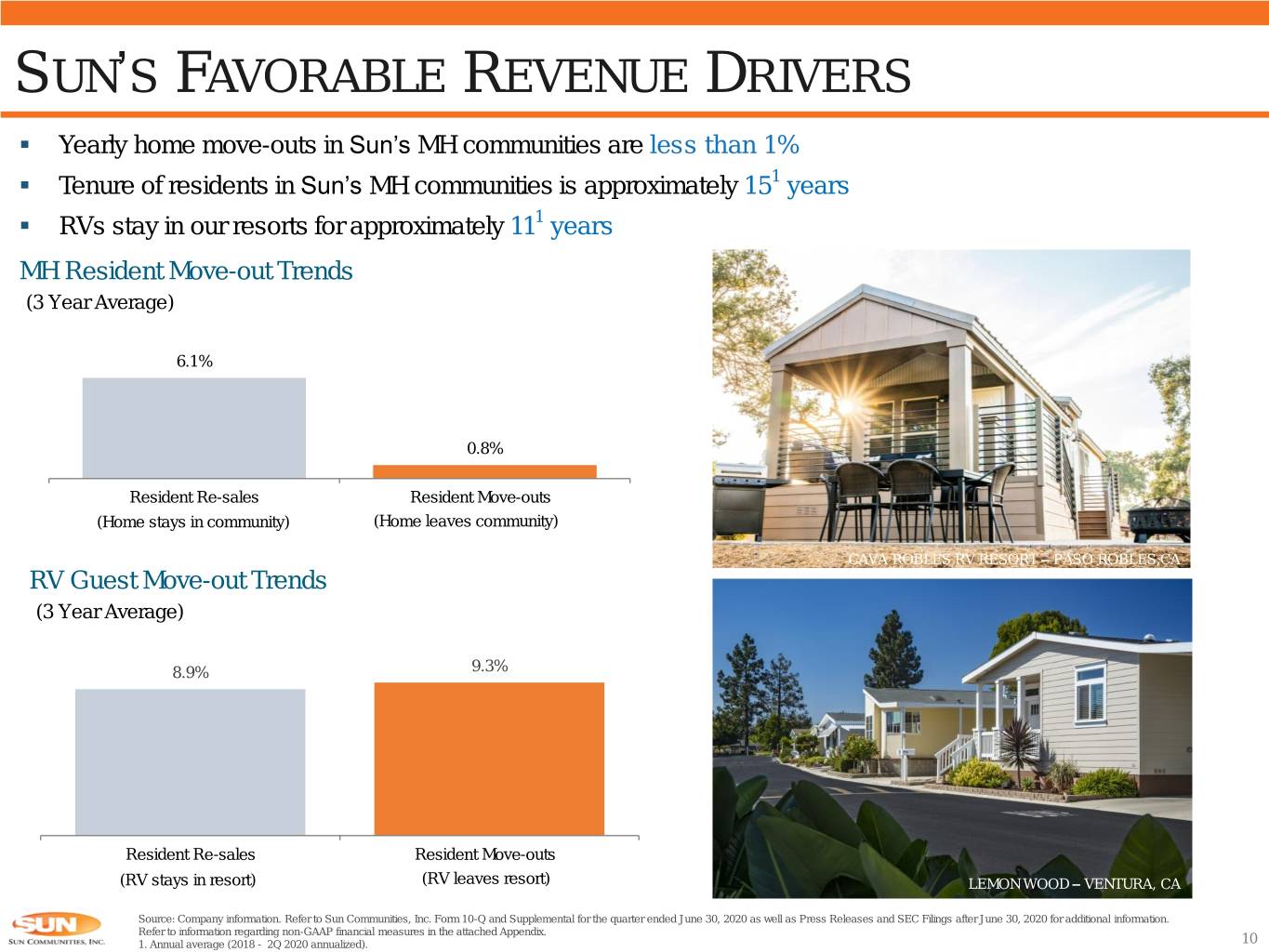

SUN’S FAVORABLE REVENUE DRIVERS ▪ Yearly home move-outs in Sun’s MH communities are less than 1% ▪ Tenure of residents in Sun’s MH communities is approximately 151 years ▪ RVs stay in our resorts for approximately 111 years MH Resident Move-out Trends MAJESTIC OAKS – ZEPHYRHILLS, FL (3 Year Average) 6.1% 0.8% Resident Re-sales Resident Move-outs (Home stays in community) (Home leaves community) CAVA ROBLES RV RESORT – PASO ROBLES,CA RV Guest Move-out Trends HOMOSASSA RIVER – HOMOSASSA SPRINGS, FL (3 Year Average) 8.9% 9.3% Resident Re-sales Resident Move-outs (RV stays in resort) (RV leaves resort) LEMON WOOD – VENTURA, CA Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1. Annual average (2018 - 2Q 2020 annualized). 10

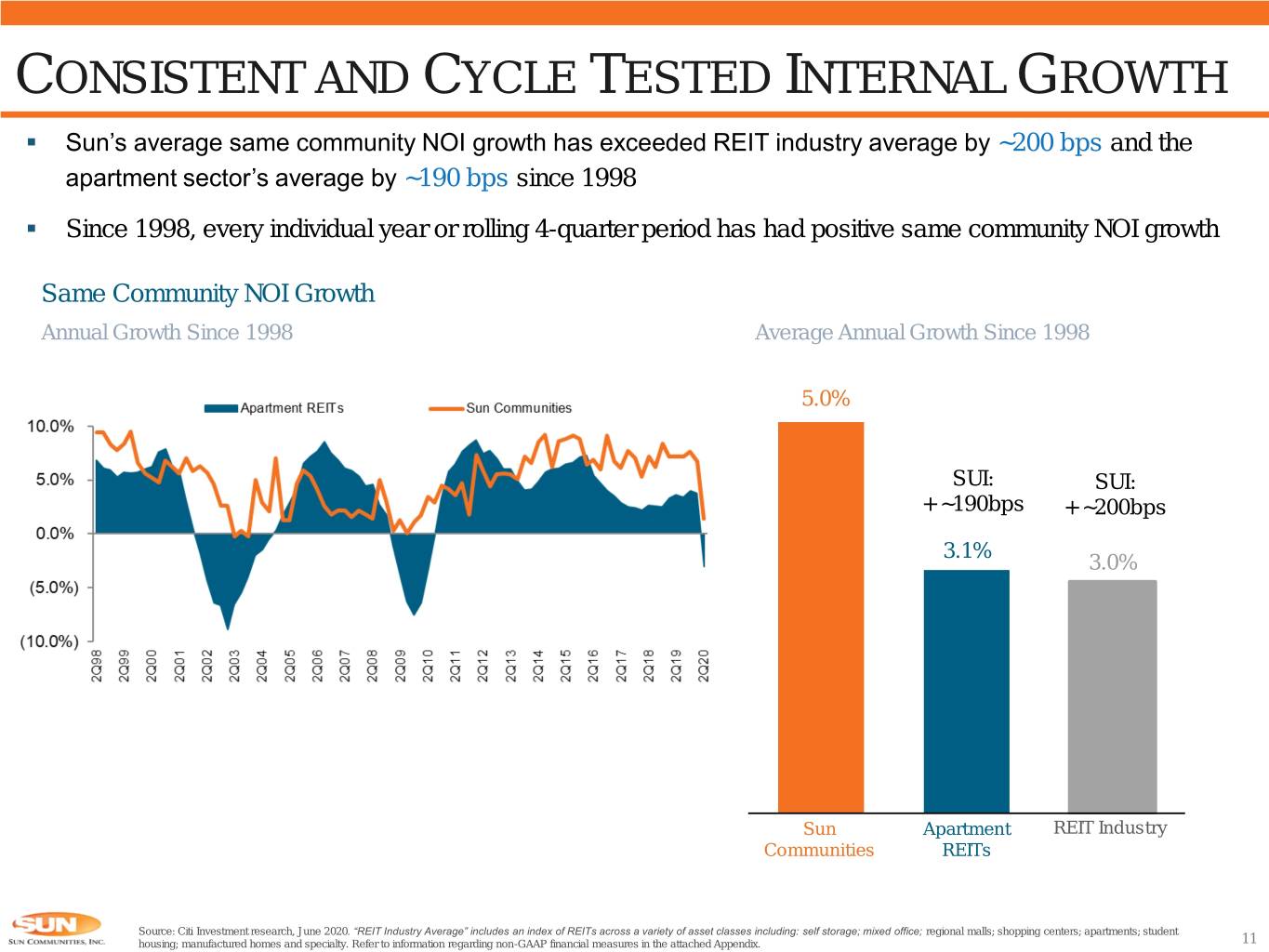

CONSISTENT AND CYCLE TESTED INTERNAL GROWTH ▪ Sun’s average same community NOI growth has exceeded REIT industry average by ~200 bps and the apartment sector’s average by ~190 bps since 1998 ▪ Since 1998, every individual year or rolling 4-quarter period has had positive same community NOI growth Same Community NOI Growth Annual Growth Since 1998 Average Annual Growth Since 1998 5.0% SUI: SUI: + ~190bps + ~200bps 3.1% 3.0% Sun Apartment REIT Industry Communities REITs Source: Citi Investment research, June 2020. “REIT Industry Average” includes an index of REITs across a variety of asset classes including: self storage; mixed office; regional malls; shopping centers; apartments; student housing; manufactured homes and specialty. Refer to information regarding non-GAAP financial measures in the attached Appendix. 11

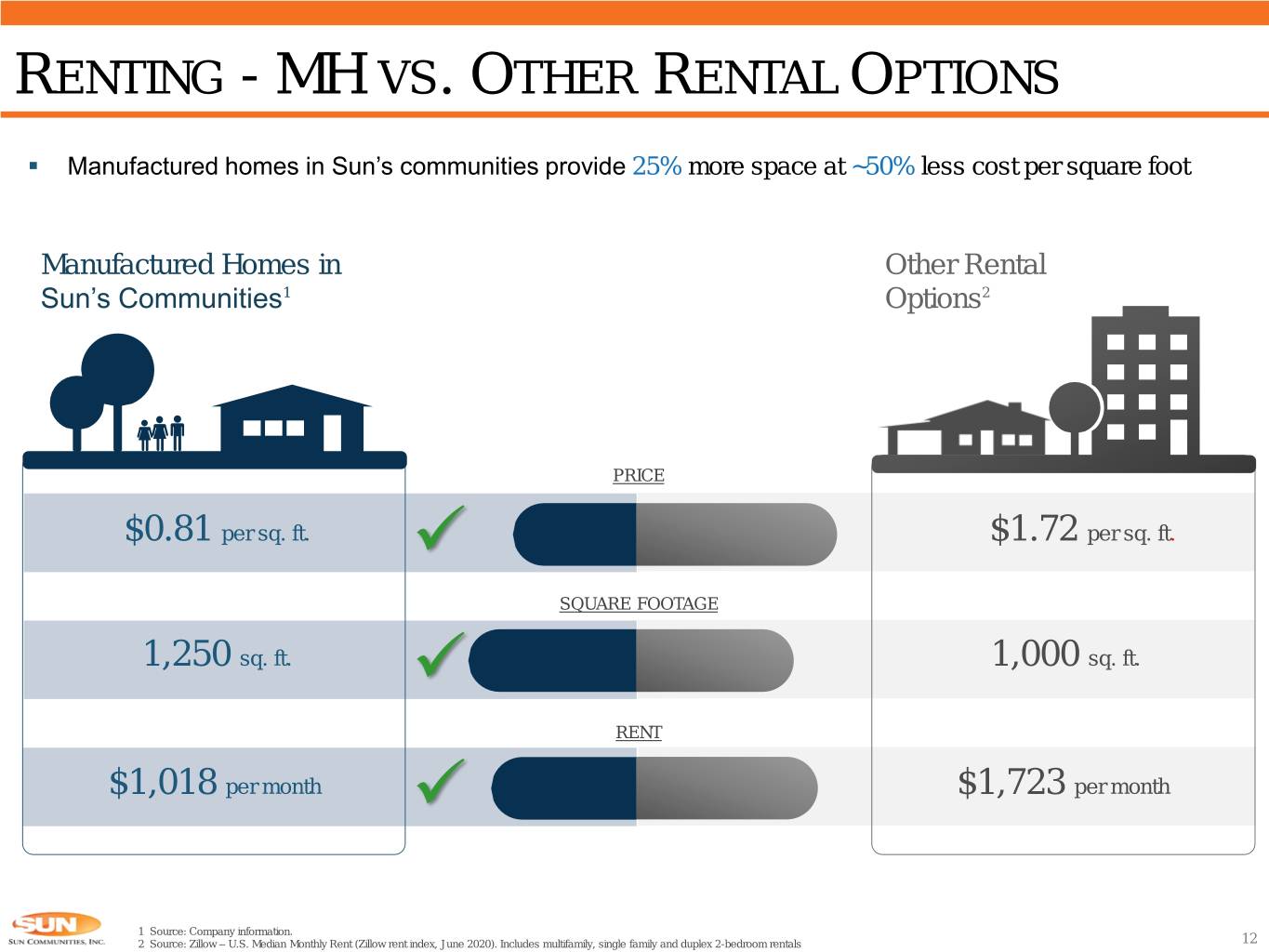

RENTING - MH VS. OTHER RENTAL OPTIONS ▪ Manufactured homes in Sun’s communities provide 25% more space at ~50% less cost per square foot Manufactured Homes in Other Rental Sun’s Communities1 Options2 PRICE $0.81 per sq. ft. ✓ $1.72 per sq. ft. SQUARE FOOTAGE 1,250 sq. ft. ✓ 1,000 sq. ft. RENT $1,018 per month ✓ $1,723 per month 1 Source: Company information. 2 Source: Zillow – U.S. Median Monthly Rent (Zillow rent index, June 2020). Includes multifamily, single family and duplex 2-bedroom rentals 12

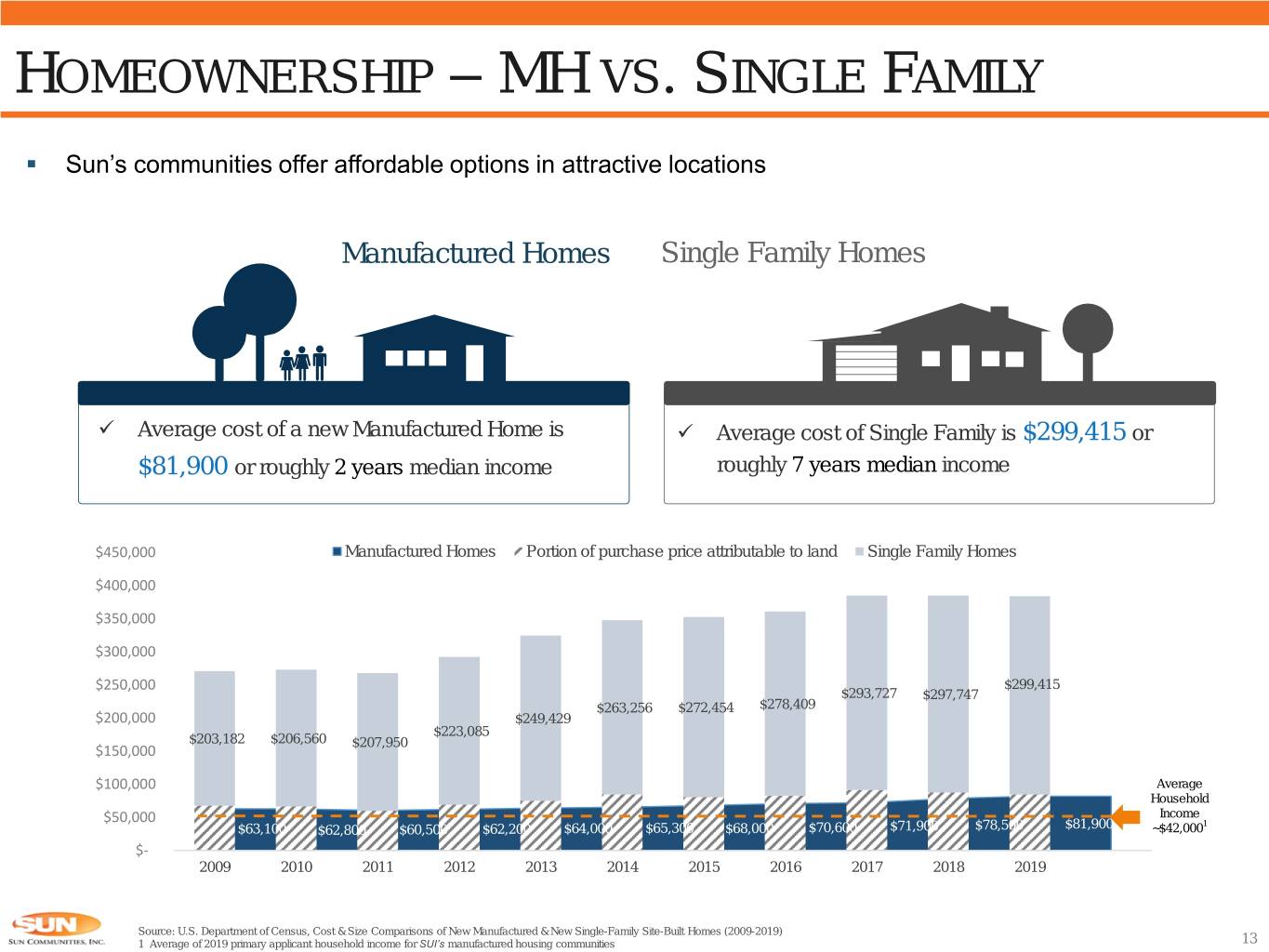

HOMEOWNERSHIP – MH VS. SINGLE FAMILY ▪ Sun’s communities offer affordable options in attractive locations Manufactured Homes Single Family Homes ✓ Average cost of a new Manufactured Home is ✓ Average cost of Single Family is $299,415 or $81,900 or roughly 2 years median income roughly 7 years median income $450,000 Manufactured Homes Portion of purchase price attributable to land Single Family Homes $400,000 $350,000 $300,000 $250,000 $299,415 $293,727 $297,747 $263,256 $272,454 $278,409 $200,000 $249,429 $223,085 $203,182 $206,560 $207,950 $150,000 $100,000 Average Household Income $50,000 1 $63,100 $62,800 $60,500 $62,200 $64,000 $65,300 $68,000 $70,600 $71,900 $78,500 $81,900 $81,900~$42,000 $- 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Source: U.S. Department of Census, Cost & Size Comparisons of New Manufactured & New Single-Family Site-Built Homes (2009-2019) 1 Average of 2019 primary applicant household income for SUI’s manufactured housing communities 13

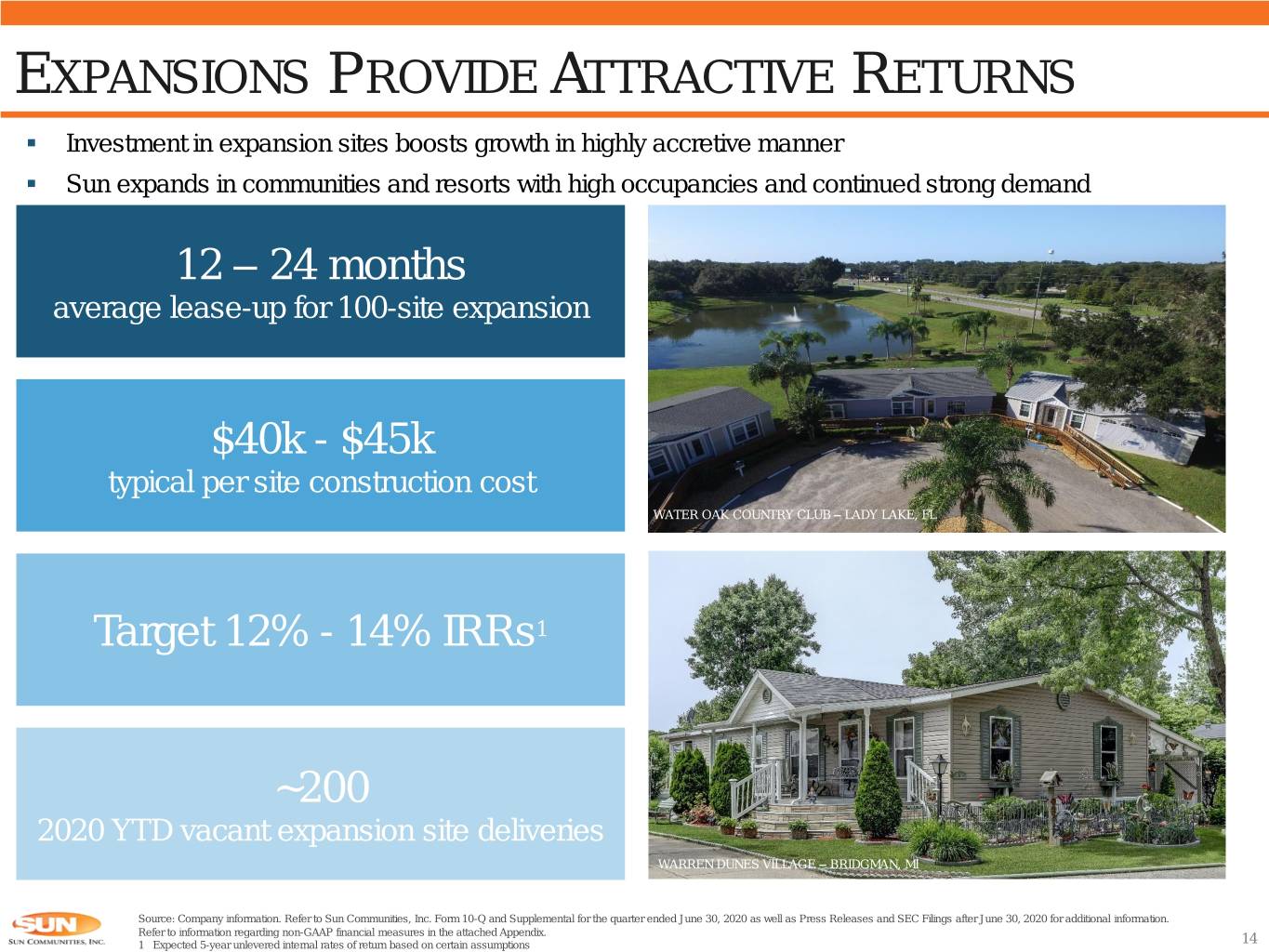

EXPANSIONS PROVIDE ATTRACTIVE RETURNS ▪ Investment in expansion sites boosts growth in highly accretive manner ▪ Sun expands in communities and resorts with high occupancies and continued strong demand 12 – 24 months average lease-up for 100-site expansion $40k - $45k typical per site construction cost WATER OAK COUNTRY CLUB – LADY LAKE, FL Target 12% - 14% IRRs1 ~200 2020 YTD vacant expansion site deliveries WARREN DUNES VILLAGE – BRIDGMAN, MI SHERKSTON SHORES – SHERKSTON, ON Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Expected 5-year unlevered internal rates of return based on certain assumptions 14

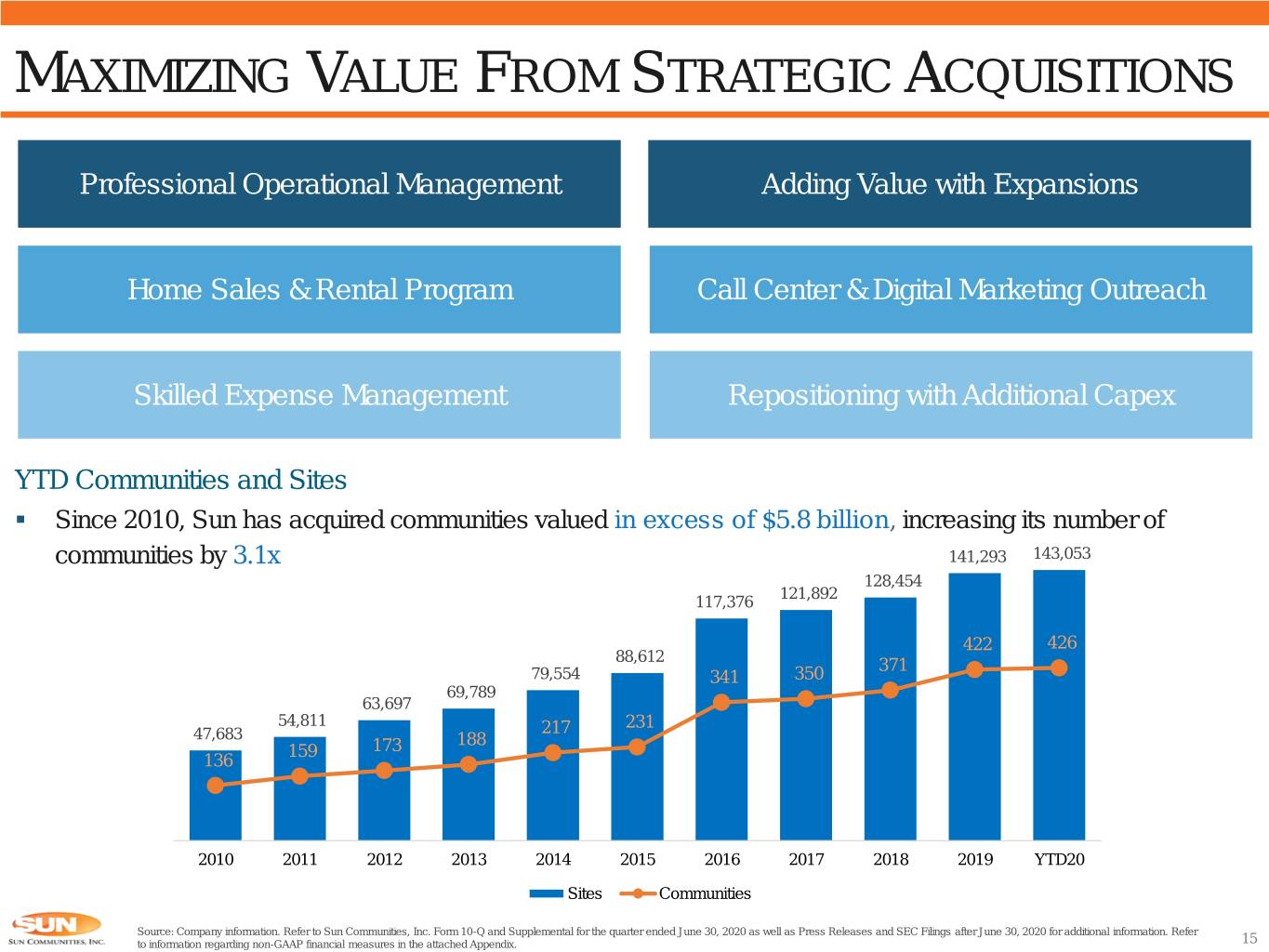

MAXIMIZING VALUE FROM STRATEGIC ACQUISITIONS Professional Operational Management Adding Value with Expansions Home Sales & Rental Program Call Center & Digital Marketing Outreach Skilled Expense Management Repositioning with Additional Capex YTD Communities and Sites ▪ Since 2010, Sun has acquired communities valued in excess of $5.8 billion, increasing its number of communities by 3.1x 141,293 143,053 128,454 121,892 117,376 422 426 88,612 371 79,554 341 350 69,789 63,697 54,811 217 231 47,683 188 159 173 136 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD20 Sites Communities Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 15

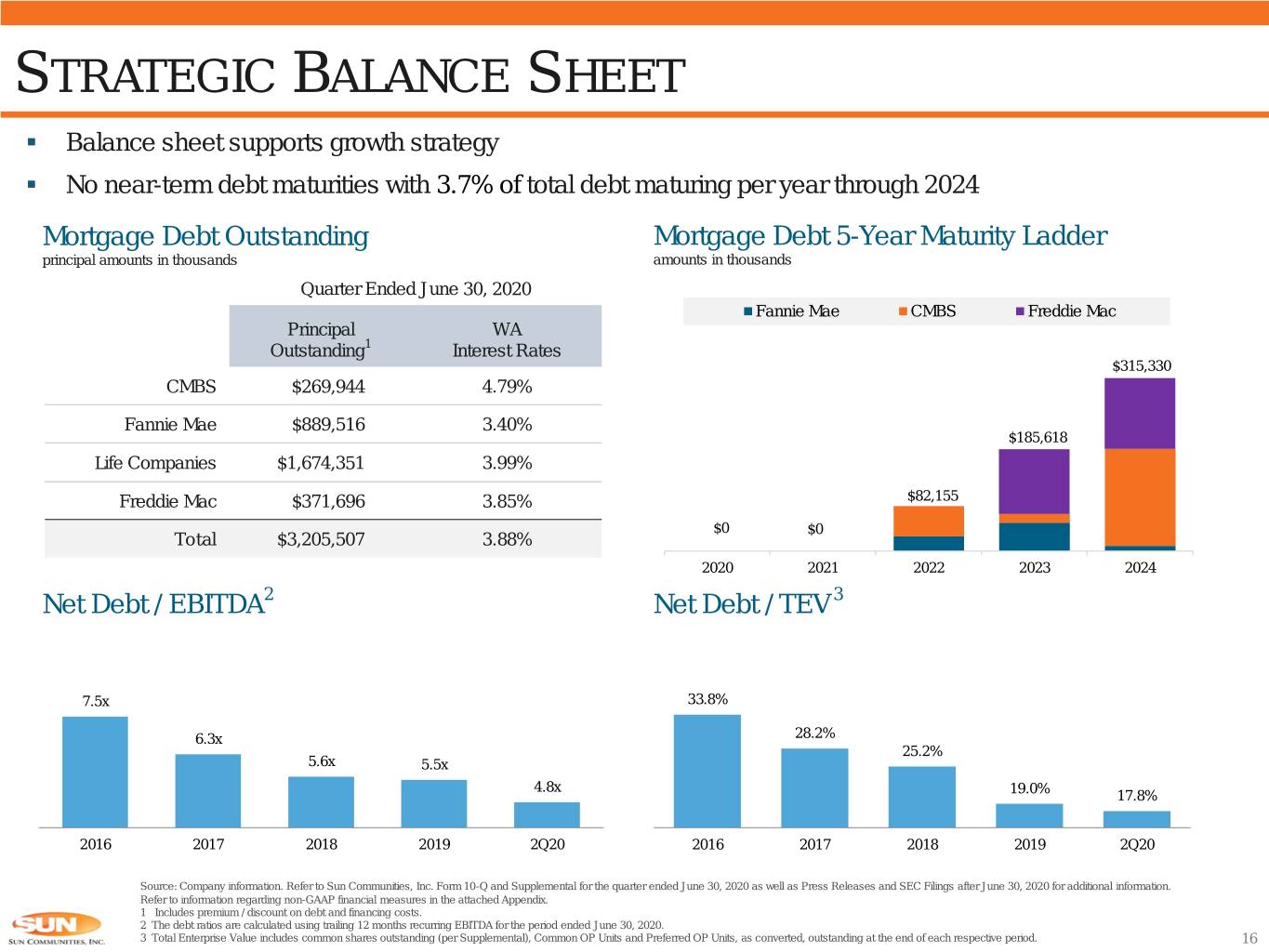

STRATEGIC BALANCE SHEET ▪ Balance sheet supports growth strategy ▪ No near-term debt maturities with 3.7% of total debt maturing per year through 2024 Mortgage Debt Outstanding Mortgage Debt 5-Year Maturity Ladder principal amounts in thousands amounts in thousands Quarter Ended June 30, 2020 Fannie Mae CMBS Freddie Mac Principal WA Outstanding1 Interest Rates $315,330 CMBS $269,944 4.79% Fannie Mae $889,516 3.40% $185,618 Life Companies $1,674,351 3.99% Freddie Mac $371,696 3.85% $82,155 $0 $0 Total $3,205,507 3.88% 2020 2021 2022 2023 2024 Net Debt / EBITDA2 Net Debt / TEV 3 7.5x 33.8% 6.3x 28.2% 25.2% 5.6x 5.5x 4.8x 19.0% 17.8% 2016 2017 2018 2019 2Q20 2016 2017 2018 2019 2Q20 Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Includes premium / discount on debt and financing costs. 2 The debt ratios are calculated using trailing 12 months recurring EBITDA for the period ended June 30, 2020. 3 Total Enterprise Value includes common shares outstanding (per Supplemental), Common OP Units and Preferred OP Units, as converted, outstanding at the end of each respective period. 16

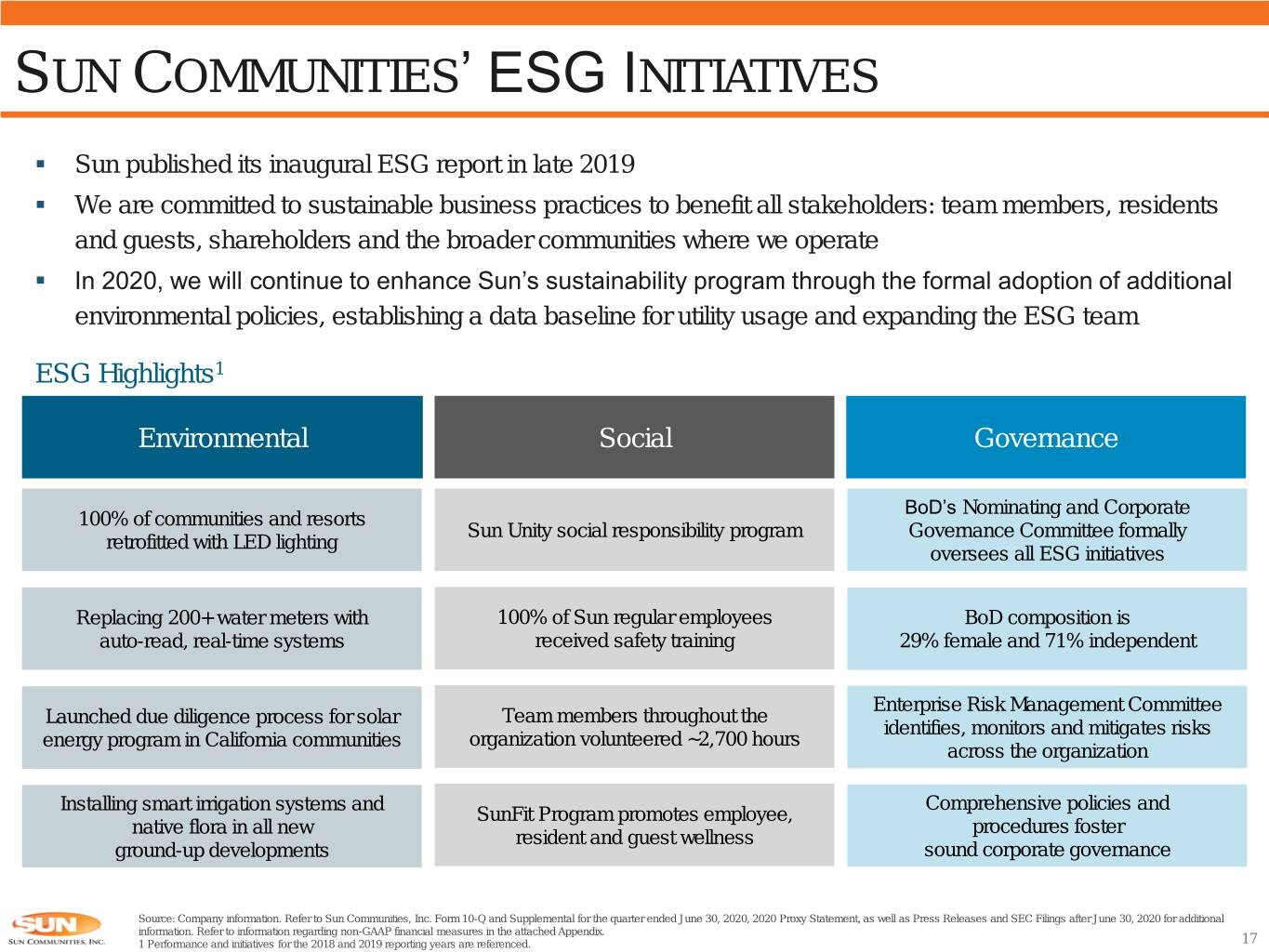

SUN COMMUNITIES’ ESG INITIATIVES ▪ Sun published its inaugural ESG report in late 2019 ▪ We are committed to sustainable business practices to benefit all stakeholders: team members, residents and guests, shareholders and the broader communities where we operate ▪ In 2020, we will continue to enhance Sun’s sustainability program through the formal adoption of additional environmental policies, establishing a data baseline for utility usage and expanding the ESG team ESG Highlights1 Environmental Social Governance BoD’s Nominating and Corporate 100% of communities and resorts Sun Unity social responsibility program Governance Committee formally retrofitted with LED lighting oversees all ESG initiatives Replacing 200+ water meters with 100% of Sun regular employees BoD composition is auto-read, real-time systems received safety training 29% female and 71% independent Enterprise Risk Management Committee Launched due diligence process for solar Team members throughout the identifies, monitors and mitigates risks energy program in California communities organization volunteered ~2,700 hours across the organization Installing smart irrigation systems and Comprehensive policies and SunFit Program promotes employee, native flora in all new procedures foster resident and guest wellness ground-up developments sound corporate governance Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020, 2020 Proxy Statement, as well as Press Releases and SEC Filings after June 30, 2020 for additional information. Refer to information regarding non-GAAP financial measures in the attached Appendix. 1 Performance and initiatives for the 2018 and 2019 reporting years are referenced. 17

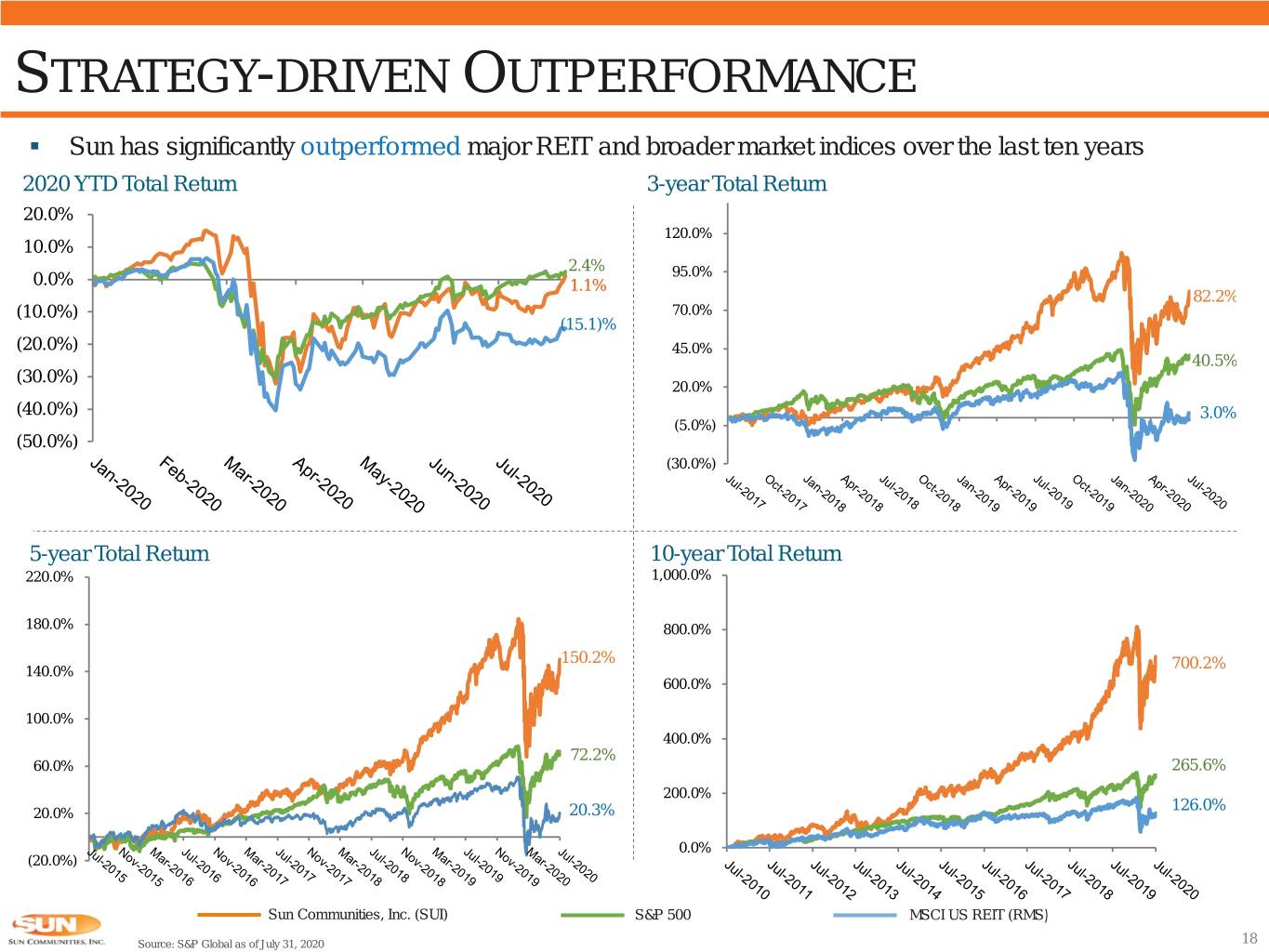

STRATEGY-DRIVEN OUTPERFORMANCE ▪ Sun has significantly outperformed major REIT and broader market indices over the last ten years 2020 YTD Total Return 3-year Total Return 20.0% 120.0% 10.0% 2.4% 95.0% 0.0% 1.1% 82.2% (10.0%) 70.0% (15.1)% (20.0%) 45.0% 40.5% (30.0%) 20.0% (40.0%) 3.0% (5.0%) (50.0%) (30.0%) 5-year Total Return 10-year Total Return 220.0% 1,000.0% 180.0% 800.0% 150.2% 700.2% 140.0% 600.0% 100.0% 400.0% 72.2% 60.0% 265.6% 200.0% 126.0% 20.0% 20.3% 0.0% (20.0%) Sun Communities, Inc. (SUI) S&P 500 MSCI US REIT (RMS) Source: S&P Global as of July 31, 2020 18

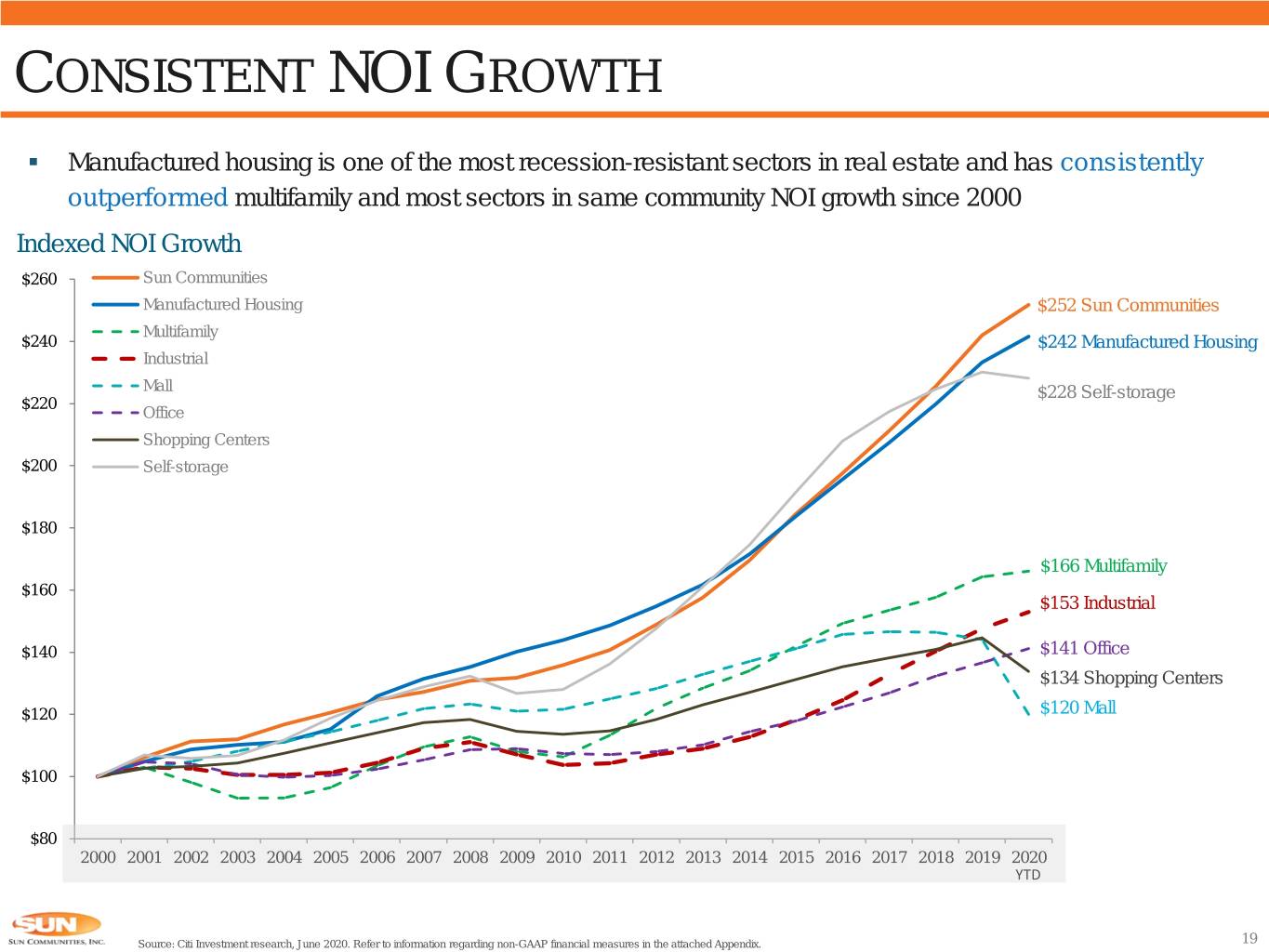

CONSISTENT NOI GROWTH ▪ Manufactured housing is one of the most recession-resistant sectors in real estate and has consistently outperformed multifamily and most sectors in same community NOI growth since 2000 Indexed NOI Growth $260 Sun Communities Manufactured Housing $252 Sun Communities Multifamily $240 $242 Manufactured Housing Industrial Mall $228 Self-storage $220 Office Shopping Centers $200 Self-storage $180 $166 Multifamily $160 $153 Industrial $140 $141 Office $134 Shopping Centers $120 $120 Mall $100 $80 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD Source: Citi Investment research, June 2020. Refer to information regarding non-GAAP financial measures in the attached Appendix. 19

APPENDIX PELICAN BAY – MICCO, FL

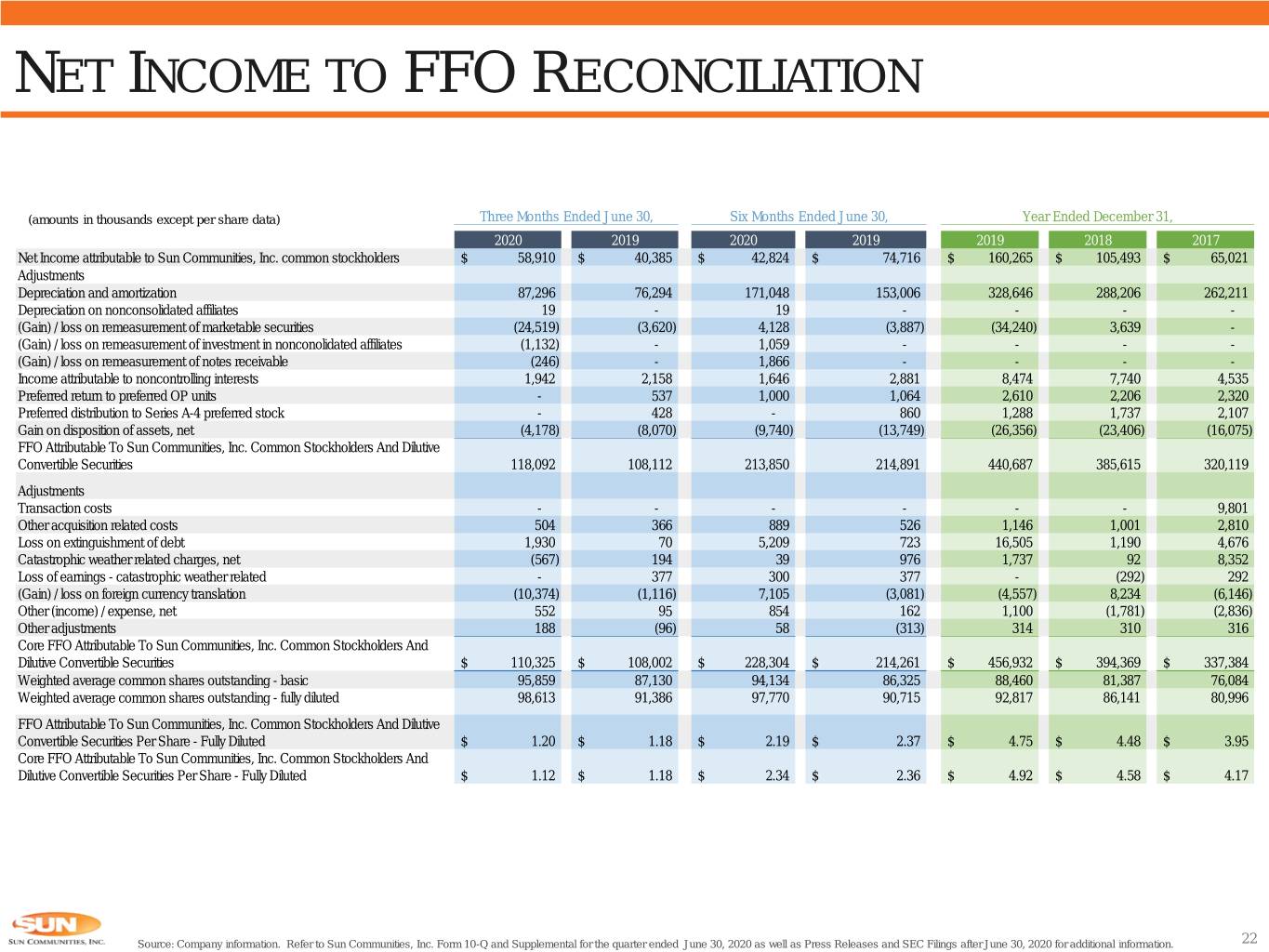

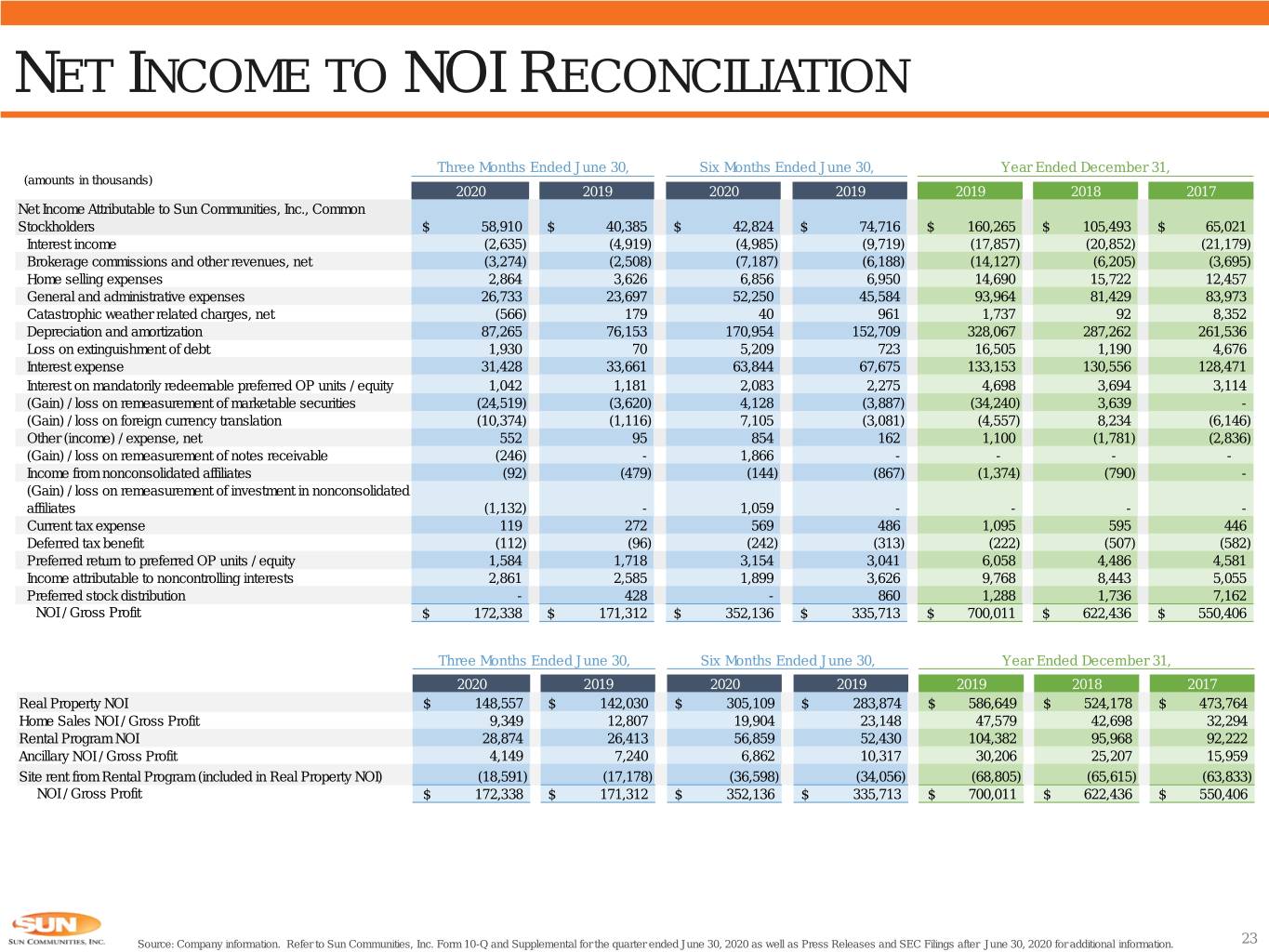

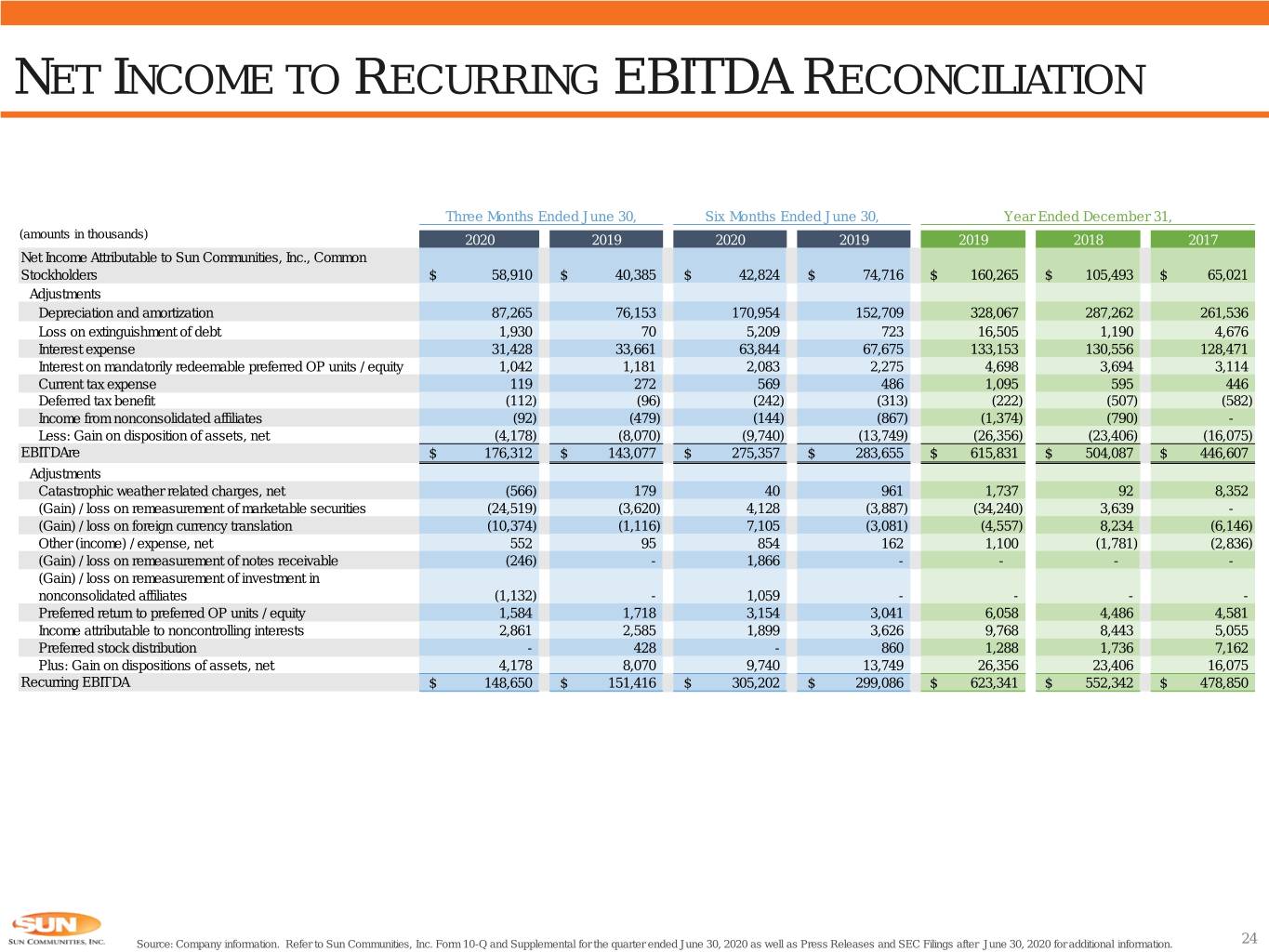

NON-GAAP TERMS DEFINED Investors in and analysts following the real estate industry utilize funds from operations (“FFO”), net operating income (“NOI”), and earnings before interest, tax, depreciation and amortization (“EBITDA”) as supplemental performance measures. The Company believes that FFO, NOI, and EBITDA are appropriate measures given their wide use by and relevance to investors and analysts. Additionally, FFO, NOI, and EBITDA are commonly used in various ratios, pricing multiples, yields and returns and valuation calculations used to measure financial position, performance and value. FFO, reflecting the assumption that real estate values rise or fall with market conditions, principally adjusts for the effects of generally accepted accounting principles (“GAAP”) depreciation and amortization of real estate assets. NOI provides a measure of rental operations that does not factor in depreciation, amortization and non-property specific expenses such as general and administrative expenses. EBITDA provides a further measure to evaluate ability to incur and service debt and to fund dividends and other cash needs. FFO is defined by the National Association of Real Estate Investment Trusts (“NAREIT”) as GAAP net income (loss), excluding gains (or losses) from sales of depreciable operating property, plus real estate- related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure that management believes is a useful supplemental measure of the Company’s operating performance. By excluding gains and losses related to sales of previously depreciated operating real estate assets, impairment and excluding real estate asset depreciation and amortization (which can vary among owners of identical assets in similar condition based on historical cost accounting and useful life estimates), FFO provides a performance measure that, when compared period-over-period, reflects the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing perspective not readily apparent from GAAP net income (loss). Management believes the use of FFO has been beneficial in improving the understanding of operating results of REITs among the investing public and making comparisons of REIT operating results more meaningful. The Company also uses FFO excluding certain gain and loss items that management considers unrelated to the operational and financial performance of our core business (“Core FFO”). The Company believes that Core FFO provides enhanced comparability for investor evaluations of period-over-period results. The Company believes that GAAP net income (loss) is the most directly comparable measure to FFO. The principal limitation of FFO is that it does not replace GAAP net income (loss) as a performance measure or GAAP cash flow from operations as a liquidity measure. Because FFO excludes significant economic components of GAAP net income (loss) including depreciation and amortization, FFO should be used as a supplement to GAAP net income (loss) and not as an alternative to it. Further, FFO is not intended as a measure of a REIT’s ability to meet debt principal repayments and other cash requirements, nor as a measure of working capital. FFO is calculated in accordance with the Company’s interpretation of standards established by NAREIT, which may not be comparable to FFO reported by other REITs that interpret the NAREIT definition differently. NOI is derived from revenues minus property operating expenses and real estate taxes. NOI is a non-GAAP financial measure that the Company believes is helpful to investors as a supplemental measure of operating performance because it is an indicator of the return on property investment, and provides a method of comparing property performance over time. The Company uses NOI as a key measure when evaluating performance and growth of particular properties and/or groups of properties. The principal limitation of NOI is that it excludes depreciation, amortization, interest expense and non-property specific expenses such as general and administrative expenses, all of which are significant costs. Therefore, NOI is a measure of the operating performance of the properties of the Company rather than of the Company overall. The Company believes that GAAP net income (loss) is the most directly comparable measure to NOI. NOI should not be considered to be an alternative to GAAP net income (loss) as an indication of the Company’s financial performance or GAAP cash flow from operating activities as a measure of the Company’s liquidity; nor is it indicative of funds available for the Company’s cash needs, including its ability to make cash distributions. Because of the inclusion of items such as interest, depreciation, and amortization, the use of GAAP net income (loss) as a performance measure is limited as these items may not accurately reflect the actual change in market value of a property, in the case of depreciation and in the case of interest, may not necessarily be linked to the operating performance of a real estate asset, as it is often incurred at a parent company level and not at a property level. EBITDA as defined by NAREIT (referred to as “EBITDAre”) is calculated as GAAP net income (loss), plus interest expense, plus income tax expense, plus depreciation and amortization, plus or minus losses or gains on the disposition of depreciated property (including losses or gains on change of control), plus impairment write-downs of depreciated property and of investments in unconsolidated affiliates caused by a decrease in value of depreciated property in the affiliate, and adjustments to reflect the entity’s share of EBITDAre of unconsolidated affiliates. EBITDAre is a non-GAAP financial measure that the Company uses to evaluate its ability to incur and service debt, fund dividends and other cash needs and cover fixed costs. Investors utilize EBITDAre as a supplemental measure to evaluate and compare investment quality and enterprise value of REITs. The Company also uses EBITDAre excluding certain gain and loss items that management considers unrelated to measurement of the Company’s performance on a basis that is independent of capital structure (“Recurring EBITDA”). The Company believes that GAAP net income (loss) is the most directly comparable measure to EBITDAre. EBITDAre is not intended to be used as a measure of the Company’s cash generated by operations or its dividend-paying capacity, and should therefore not replace GAAP net income (loss) as an indication of the Company’s financial performance or GAAP cash flow from operating, investing and financing activities as measures of liquidity. 21

NET INCOME TO FFO RECONCILIATION (amounts in thousands except per share data) Three Months Ended June 30, Six Months Ended June 30, Year Ended December 31, 2020 2019 2020 2019 2019 2018 2017 Net Income attributable to Sun Communities, Inc. common stockholders $ 58,910 $ 40,385 $ 42,824 $ 74,716 $ 160,265 $ 105,493 $ 65,021 Adjustments Depreciation and amortization 87,296 76,294 171,048 153,006 328,646 288,206 262,211 Depreciation on nonconsolidated affiliates 19 - 19 - - - - (Gain) / loss on remeasurement of marketable securities (24,519) (3,620) 4,128 (3,887) (34,240) 3,639 - (Gain) / loss on remeasurement of investment in nonconolidated affiliates (1,132) - 1,059 - - - - (Gain) / loss on remeasurement of notes receivable (246) - 1,866 - - - - Income attributable to noncontrolling interests 1,942 2,158 1,646 2,881 8,474 7,740 4,535 Preferred return to preferred OP units - 537 1,000 1,064 2,610 2,206 2,320 Preferred distribution to Series A-4 preferred stock - 428 - 860 1,288 1,737 2,107 Gain on disposition of assets, net (4,178) (8,070) (9,740) (13,749) (26,356) (23,406) (16,075) FFO Attributable To Sun Communities, Inc. Common Stockholders And Dilutive Convertible Securities 118,092 108,112 213,850 214,891 440,687 385,615 320,119 Adjustments Transaction costs - - - - - - 9,801 Other acquisition related costs 504 366 889 526 1,146 1,001 2,810 Loss on extinguishment of debt 1,930 70 5,209 723 16,505 1,190 4,676 Catastrophic weather related charges, net (567) 194 39 976 1,737 92 8,352 Loss of earnings - catastrophic weather related - 377 300 377 - (292) 292 (Gain) / loss on foreign currency translation (10,374) (1,116) 7,105 (3,081) (4,557) 8,234 (6,146) Other (income) / expense, net 552 95 854 162 1,100 (1,781) (2,836) Other adjustments 188 (96) 58 (313) 314 310 316 Core FFO Attributable To Sun Communities, Inc. Common Stockholders And Dilutive Convertible Securities $ 110,325 $ 108,002 $ 228,304 $ 214,261 $ 456,932 $ 394,369 $ 337,384 Weighted average common shares outstanding - basic 95,859 87,130 94,134 86,325 88,460 81,387 76,084 Weighted average common shares outstanding - fully diluted 98,613 91,386 97,770 90,715 92,817 86,141 80,996 FFO Attributable To Sun Communities, Inc. Common Stockholders And Dilutive Convertible Securities Per Share - Fully Diluted $ 1.20 $ 1.18 $ 2.19 $ 2.37 $ 4.75 $ 4.48 $ 3.95 Core FFO Attributable To Sun Communities, Inc. Common Stockholders And Dilutive Convertible Securities Per Share - Fully Diluted $ 1.12 $ 1.18 $ 2.34 $ 2.36 $ 4.92 $ 4.58 $ 4.17 Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. 22

NET INCOME TO NOI RECONCILIATION Three Months Ended June 30, Six Months Ended June 30, Year Ended December 31, (amounts in thousands) 2020 2019 2020 2019 2019 2018 2017 Net Income Attributable to Sun Communities, Inc., Common Stockholders $ 58,910 $ 40,385 $ 42,824 $ 74,716 $ 160,265 $ 105,493 $ 65,021 Interest income (2,635) (4,919) (4,985) (9,719) (17,857) (20,852) (21,179) Brokerage commissions and other revenues, net (3,274) (2,508) (7,187) (6,188) (14,127) (6,205) (3,695) Home selling expenses 2,864 3,626 6,856 6,950 14,690 15,722 12,457 General and administrative expenses 26,733 23,697 52,250 45,584 93,964 81,429 83,973 Catastrophic weather related charges, net (566) 179 40 961 1,737 92 8,352 Depreciation and amortization 87,265 76,153 170,954 152,709 328,067 287,262 261,536 Loss on extinguishment of debt 1,930 70 5,209 723 16,505 1,190 4,676 Interest expense 31,428 33,661 63,844 67,675 133,153 130,556 128,471 Interest on mandatorily redeemable preferred OP units / equity 1,042 1,181 2,083 2,275 4,698 3,694 3,114 (Gain) / loss on remeasurement of marketable securities (24,519) (3,620) 4,128 (3,887) (34,240) 3,639 - (Gain) / loss on foreign currency translation (10,374) (1,116) 7,105 (3,081) (4,557) 8,234 (6,146) Other (income) / expense, net 552 95 854 162 1,100 (1,781) (2,836) (Gain) / loss on remeasurement of notes receivable (246) - 1,866 - - - - Income from nonconsolidated affiliates (92) (479) (144) (867) (1,374) (790) - (Gain) / loss on remeasurement of investment in nonconsolidated affiliates (1,132) - 1,059 - - - - Current tax expense 119 272 569 486 1,095 595 446 Deferred tax benefit (112) (96) (242) (313) (222) (507) (582) Preferred return to preferred OP units / equity 1,584 1,718 3,154 3,041 6,058 4,486 4,581 Income attributable to noncontrolling interests 2,861 2,585 1,899 3,626 9,768 8,443 5,055 Preferred stock distribution - 428 - 860 1,288 1,736 7,162 NOI / Gross Profit $ 172,338 $ 171,312 $ 352,136 $ 335,713 $ 700,011 $ 622,436 $ 550,406 Three Months Ended June 30, Six Months Ended June 30, Year Ended December 31, 2020 2019 2020 2019 2019 2018 2017 Real Property NOI $ 148,557 $ 142,030 $ 305,109 $ 283,874 $ 586,649 $ 524,178 $ 473,764 Home Sales NOI / Gross Profit 9,349 12,807 19,904 23,148 47,579 42,698 32,294 Rental Program NOI 28,874 26,413 56,859 52,430 104,382 95,968 92,222 Ancillary NOI / Gross Profit 4,149 7,240 6,862 10,317 30,206 25,207 15,959 Site rent from Rental Program (included in Real Property NOI) (18,591) (17,178) (36,598) (34,056) (68,805) (65,615) (63,833) NOI / Gross Profit $ 172,338 $ 171,312 $ 352,136 $ 335,713 $ 700,011 $ 622,436 $ 550,406 Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. 23

NET INCOME TO RECURRING EBITDA RECONCILIATION Three Months Ended June 30, Six Months Ended June 30, Year Ended December 31, (amounts in thousands) 2020 2019 2020 2019 2019 2018 2017 Net Income Attributable to Sun Communities, Inc., Common Stockholders $ 58,910 $ 40,385 $ 42,824 $ 74,716 $ 160,265 $ 105,493 $ 65,021 Adjustments Depreciation and amortization 87,265 76,153 170,954 152,709 328,067 287,262 261,536 Loss on extinguishment of debt 1,930 70 5,209 723 16,505 1,190 4,676 Interest expense 31,428 33,661 63,844 67,675 133,153 130,556 128,471 Interest on mandatorily redeemable preferred OP units / equity 1,042 1,181 2,083 2,275 4,698 3,694 3,114 Current tax expense 119 272 569 486 1,095 595 446 Deferred tax benefit (112) (96) (242) (313) (222) (507) (582) Income from nonconsolidated affiliates (92) (479) (144) (867) (1,374) (790) - Less: Gain on disposition of assets, net (4,178) (8,070) (9,740) (13,749) (26,356) (23,406) (16,075) EBITDAre $ 176,312 $ 143,077 $ 275,357 $ 283,655 $ 615,831 $ 504,087 $ 446,607 Adjustments Catastrophic weather related charges, net (566) 179 40 961 1,737 92 8,352 (Gain) / loss on remeasurement of marketable securities (24,519) (3,620) 4,128 (3,887) (34,240) 3,639 - (Gain) / loss on foreign currency translation (10,374) (1,116) 7,105 (3,081) (4,557) 8,234 (6,146) Other (income) / expense, net 552 95 854 162 1,100 (1,781) (2,836) (Gain) / loss on remeasurement of notes receivable (246) - 1,866 - - - - (Gain) / loss on remeasurement of investment in nonconsolidated affiliates (1,132) - 1,059 - - - - Preferred return to preferred OP units / equity 1,584 1,718 3,154 3,041 6,058 4,486 4,581 Income attributable to noncontrolling interests 2,861 2,585 1,899 3,626 9,768 8,443 5,055 Preferred stock distribution - 428 - 860 1,288 1,736 7,162 Plus: Gain on dispositions of assets, net 4,178 8,070 9,740 13,749 26,356 23,406 16,075 Recurring EBITDA $ 148,650 $ 151,416 $ 305,202 $ 299,086 $ 623,341 $ 552,342 $ 478,850 Source: Company information. Refer to Sun Communities, Inc. Form 10-Q and Supplemental for the quarter ended June 30, 2020 as well as Press Releases and SEC Filings after June 30, 2020 for additional information. 24