Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SLM Corp | slm-20200914.htm |

Exhibit 99.1 Barclays Global Financial Conference September 14, 2020 Jonathan Witter, CEO 1

Forward-Looking Statements and Disclaimer Cautionary Note Regarding Forward-Looking Statements The following information is current as of September 14, 2020 (unless otherwise noted) and should be read in connection with the press release of SLM Corporation (the “Company”) announcing its financial results for the quarter ended June 30, 2020, the Form 10-Q for the quarter ended June 30, 2020 filed with the Securities and Exchange Commission (“SEC”) on July 22, 2020, and subsequent reports filed with the SEC. This Presentation contains “forward-looking” statements and information based on management’s current expectations as of the date of this Presentation. Statements that are not historical facts, including statements about the Company’s beliefs, opinions, or expectations and statements that assume or are dependent upon future events, are forward-looking statements. This includes, but is not limited to: statements regarding future developments surrounding COVID-19 or any other pandemic, including, without limitation, statements regarding the potential impact of COVID-19 or any other pandemic on the Company’s business, results of operations, financial condition, and/or cash flows; the Company’s expectation and ability to pay a quarterly cash dividend on its common stock in the future, subject to the determination by the Company’s Board of Directors, and based on an evaluation of the Company’s earnings, financial condition and requirements, business conditions, capital allocation determinations, and other factors, risks, and uncertainties; the Company’s 2020 guidance; the Company’s three-year horizon outlook; the Company’s expectation and ability to execute loan sales and share repurchases; the Company’s projections for originations, earnings, and balance sheet position; and any estimates related to accounting standard changes. Forward-looking statements are subject to risks, uncertainties, assumptions, and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in Item 1A. “Risk Factors” and elsewhere in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2019 (filed with the SEC on Feb. 28, 2020) and subsequent filings with the SEC; the societal, business, and legislative/regulatory impact of pandemics and other public heath crises; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; failure to comply with consumer protection, banking, and other laws; changes in accounting standards and the impact of related changes in significant accounting estimates, including any regarding the measurement of the Company’s allowance for loan losses and the related provision expense; any adverse outcomes in any significant litigation to which the Company or any subsidiary is a party; credit risk associated with the Company’s (or any subsidiary's) exposure to third parties, including counterparties to the Company’s (or any subsidiary's) derivative transactions; and changes in the terms of education loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). The Company could also be affected by, among other things: changes in its funding costs and availability; reductions to its credit ratings; cybersecurity incidents, cyberattacks, and other failures or breaches of its operating systems or infrastructure, including those of third-party vendors; damage to its reputation; risks associated with restructuring initiatives, including failures to successfully implement cost-cutting programs and the adverse effects of such initiatives on the Company’s business; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students, and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; changes in banking rules and regulations, including increased capital requirements; increased competition from banks and other consumer lenders; the creditworthiness of customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of earning assets versus funding arrangements; rates of prepayments on the loans owned by the Company and its subsidiaries; changes in general economic conditions and the Company’s ability to successfully effectuate any acquisitions; and other strategic initiatives. The preparation of the Company’s consolidated financial statements also requires management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this Presentation are qualified by these cautionary statements and are made only as of the date of this Presentation. The Company does not undertake any obligation to update or revise these forward-looking statements to conform such statements to actual results or changes in its expectations. The Company reports financial results on a GAAP basis and also provides certain non-GAAP “Core Earnings” performance measures. The difference between the Company’s “Core Earnings” and GAAP results for the periods presented were the unrealized, mark-to-fair value gains/losses on derivative contracts (excluding current period accruals on the derivative instruments), net of tax. These are recognized in GAAP, but not in “Core Earnings” results. The Company provides “Core Earnings” because it is one of several measures management uses when making management decisions regarding the Company’s performance and the allocation of corporate resources. The Company’s “Core Earnings” are not defined terms within GAAP and may not be comparable to similarly titled measures reported by other companies. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations –’Core Earnings’” in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2020 for a further discussion. 2

Presented by: Today’s Discussion Points: • Sallie Mae is an outstanding franchise • Our business model’s resiliency has been proven while navigating the challenges from COVID-19 • Our investment thesis is simple • We have a clear strategy to create value Jonathan Witter CEO 3

Sallie Mae is an Outstanding Franchise Sallie Mae is the market-leading brand for private education loans driven by brand recognition, rigorous underwriting methodology and industry-leading customer service. Top ranked and highly recognized brand 2,400+ actively managed university relationships Industry leading and award-winning across the U.S. technologies Largest salesforce in the industry JD Power certification of customer 1 % service Appears on 98 of preferred lender lists Well funded with sufficient liquidity and loan loss reserves 52% 21% 6% 87% 746 1.2% Market share Return on Annual Private Annual Average Annual Net Charge-offs* of private Equity* Education Loan Cosigner FICO at education loan Originations Rate* Approval* originations2 Growth* * Full year 2019 Metrics 4

Proven Resiliency During the COVID-19 Pandemic Credit Return to School3 And Originations4 • Forbearance as a % of loans in repayment and • 97% of our top schools have announced plans for forbearance has been reduced from the mid-teen the 2020/2021 Academic Year. peak in Q2 2020, to 5.72% on Aug. 31, 2020 (vs 4.1% at the end of 2019). • 28% on campus, 15% remote, and 57% hybrid programs to be utilized. • As of 8/31/20, 86% of the customers who initially received COVID-19 related disaster forbearance are • Full-year 2020 originations expected to be $5.3 no longer in disaster forbearance status. billion, 6% lower YOY, driven by COVID-19 impact • Q2 2020 loan loss provision of $352 million based on • Expect opportunity from competitor’s decision to a Q2 2021 weighted average unemployment forecast scale back participation in industry. of 11.3% and Q4 2021 weighted average • Average loan size increased, driven by lower state unemployment forecast of 10.6%; $243 million this subsidies and family contributions.3 provision increase driven by macroeconomic environment versus growth. The Sallie Mae business Operating Performance and Balance Sheet4 model resilience has been • Net Income of $277 million in the first half of 2020 despite increasing loan loss provision by $243 million in Q2 proven while navigating the 2020. challenges from COVID-19 • $18 million in expense reductions identified as of June 30, 2020. • 2020 year-end Private Education Loan portfolio expected to be flat to 2019 year-end as lower prepayments and lower consolidations are partially offsetting lower originations. 5

Simple But Powerful Investment Thesis Attractive • Consistent earnings growth is driven by top line growth and efficiency Earnings Profile • Sallie Mae is the leader in the private education loan market that is growing 6+% a year • Well-proven and disciplined underwriting model leveraging data and experience through Manageable the last recession Risk • Despite headlines on student lending and federal student loan performance, we are well equipped to manage the perceived political risk to our business Disciplined Capital • Core loan product generates very attractive ROE’s Allocation • Utilizing a hybrid hold/sell model to create capital that can be used to buy back undervalued stock 6

Clear Strategy to Ensure Appropriate Valuation Maximize the Optimize the value Maintain a rigorous Change the profitability and of our brand and and predictable narrative around growth of our core our attractive client capital allocation private student business base and return program lending to address to create real and perceived shareholder value political risk 7

Maximize the Profitability and Growth of the Core Business Maximize Revenue Manage Unit Costs Drive penetration at all schools Strong fixed cost discipline Increase market share by fully meeting Efficiency effectiveness across all areas student funding needs We will focus on top- Enhanced risk-adjusted pricing and Improved third-party vendor line growth and underwriting cost management efficiency opportunities to create value Improved marketing, digital, and data capabilities 8

Optimize the Value of the Brand and Attractive Client Base % 2M 91 We know our customers’ finances, Borrowers and Customers complete payment patterns, indebtedness cosigners their program We have the relationship and knowledge Graduates who benefit from the investment5 to assist our customers with their next step: post-graduation plans, jobs, future $52,600 31% ~698 financial needs Own a Self-reported Average annual fico score comp home We are there for our customers during their important transition to adulthood What We Will Do Build products and Ensure products and Heavily favor Look for services that services are partnerships and opportunities to leverage our consistent with our other capital optimize ROI customer affiliation core mission and efficient avenues of drive customer value growth 9

Maintain Rigorous Capital Allocation and Return Program Invest in High ROE Growth Share Repurchase • Continue to focus on high-quality Private • Completed 2019 share repurchase Education Loan originations, including program in Q1 2020 deeper penetration of graduate school market • $3.1B in Private Education Loan sales completed in Q1 2020, which enabled • Offer credit cards to high-quality return of excess capital to shareholders customer base • In Q1 2020, entered into ASR • Build other sources of revenue in capital agreement for $525 million in common and expense efficient way stock • Expect to continue the general share Embracing a Hybrid repurchase strategy going forward Hold / Sell Loan Model We will allocate capital Quarterly Common with discipline • Expect to sell assets to optimize Stock Dividend growth in required capital • The expected result is a balance • Paid $0.03 quarterly common stock sheet that will remain flat despite dividend on 6/15/20 loan sales • Expect to continue to pay dividend, subject to Board approval6 10

Changing the Narrative In the current political narrative regarding student loan reform, there have been three main areas of focus that include free college, debt forgiveness and bankruptcy reform. We expect our business to perform well even under leading reform proposals. Free College Debt Forgiveness • Benefits of subsidizing college tuition for Forgiving all the federal student those who would otherwise not be able loans will cost $1.5 trillion, likely too to attend high a cost for the policy to succeed. A need-based approach may be • Promotes social equity, equality of more responsible and achievable. opportunity and economic mobility • State-wide programs exist in 19 states, Bankruptcy Reform and 18 additional states have county, municipal, or school specific free college Sallie Mae has long been supportive of programs prospectively allowing the discharge of student loan debt in bankruptcy, provided • In the first year of the New York program, there is a period of post-graduation our originations in the SUNY system payments to prevent incentivizing went down 3% and have grown every bankruptcy simply to avoid student loan year since then repayments after graduation. 11

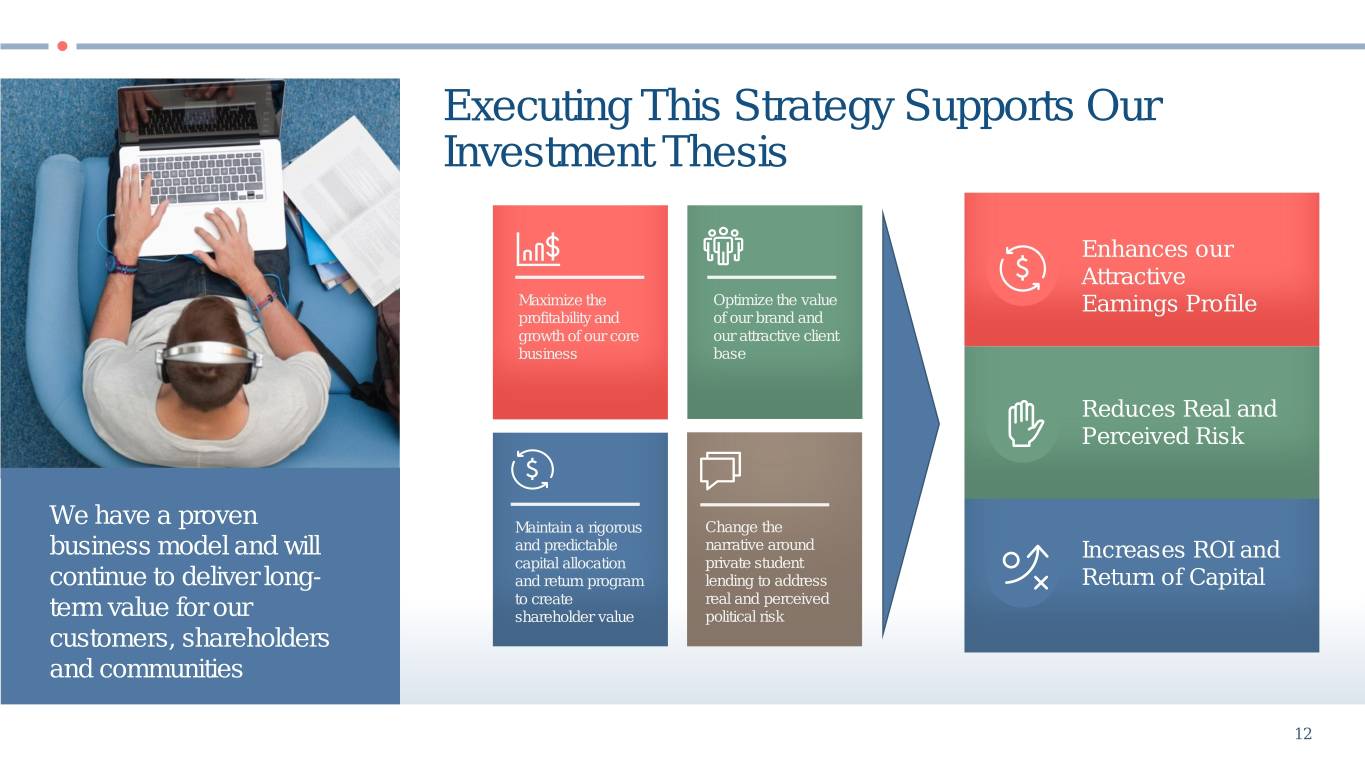

Executing This Strategy Supports Our Investment Thesis Enhances our Attractive Maximize the Optimize the value Earnings Profile profitability and of our brand and growth of our core our attractive client business base Reduces Real and Perceived Risk We have a proven Maintain a rigorous Change the business model and will and predictable narrative around Increases ROI and capital allocation private student continue to deliver long- and return program lending to address Return of Capital to create real and perceived term value for our shareholder value political risk customers, shareholders and communities 12

Footnotes 1. J.D. Power 2019 Certified Customer Service Program recognition is based on successful completion of an evaluation and exceeding a customer satisfaction benchmark through a survey of recent servicing interactions. For more information, visit www.jdpower.com/ccc. 2. Source: MeasureOne CBA Report as of March 2020. 3. Based on internal Company statistics. 4. The information on this page constitutes forward-looking statements. See page 2 of this Presentation for a cautionary note regarding forward-looking statements. 5. Source: Sallie Mae sponsored research among repayment borrowers under age 35; December 2018 and March 2019; all data except the % who completed their program is based on borrowers who have earned at least a Bachelor's degree. 6. The Company’s expectation and ability to pay a quarterly cash dividend on its common stock in the future will be subject to the determination by, and discretion of, the Company’s Board of Directors, and any determination by the Board will be based on an evaluation of the Company’s earnings, financial condition and requirements, business conditions, capital allocation determinations, and other factors, risks and uncertainties. 13