Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | cma-20200911.htm |

Comerica Incorporated Barclays Global Financials Conference September 14, 2020 Curt Farmer Jim Herzog Chief Executive Officer Chief Financial Officer Peter Sefzik Melinda Chausse Executive Director Chief Credit Officer Commercial Bank

Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,” “outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,” “outcome,” “continue,” “remain,” “maintain,” “on track,” “trend,” “objective,” “looks forward,” “projects,” “models” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or its management, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs and assumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do not purport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's management for future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance, including statements of profitability, business segments and subsidiaries as well as estimates of credit trends and global stability. Such statements reflect the view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more of these risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from those discussed. Factors that could cause or contribute to such differences include credit risks (unfavorable developments concerning credit quality; declines or other changes in the businesses or industries of Comerica's customers, in particular the energy industry; and changes in customer behavior); market risks (changes in monetary and fiscal policies; fluctuations in interest rates and their impact on deposit pricing; and transitions away from LIBOR towards new interest rate benchmarks); liquidity risks (Comerica's ability to maintain adequate sources of funding and liquidity; reductions in Comerica's credit rating; and the interdependence of financial service companies); technology risks (cybersecurity risks and heightened legislative and regulatory focus on cybersecurity and data privacy); operational risks (operational, systems or infrastructure failures; reliance on other companies to provide certain key components of business infrastructure; the impact of legal and regulatory proceedings or determinations; losses due to fraud; and controls and procedures failures); compliance risks (changes in regulation or oversight; the effects of stringent capital requirements; and the impacts of future legislative, administrative or judicial changes to tax regulations); financial reporting risks (changes in accounting standards and the critical nature of Comerica's accounting policies); strategic risks (damage to Comerica's reputation; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; competitive product and pricing pressures among financial institutions within Comerica's markets; the implementation of Comerica's strategies and business initiatives; management's ability to maintain and expand customer relationships; management's ability to retain key officers and employees; and any future strategic acquisitions or divestitures); and other general risks (changes in general economic, political or industry conditions; the effectiveness of methods of reducing risk exposures; the effects of catastrophic events; impacts from the COVID-19 global pandemic; and the volatility of Comerica’s stock price). Comerica cautions that the foregoing list of factors is not all-inclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to our filings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 12 of Comerica's Annual Report on Form 10-K for the year ended December 31, 2019 and "Item 1A. Risk Factors" beginning on page 65 of the Corporation's Quarterly Report on Form 10-Q for the quarter ended June 30, 2020. Forward-looking statements speak only as of the date they are made. Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the date the forward-looking statements are made. For any forward- looking statements made in this presentation or in any documents, Comerica claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. 2

Well positioned to navigate these challenging times And support customers as economy recovers CUSTOMER FOCUSED DIVERSIFIED CREDIT DISCIPLINE . Relationship banking strategy . Diverse geographic . Conservative underwriting . Long-tenured, experienced footprint in markets with standards team with deep expertise strong growth potential . Proactive problem resolution . Supporting customers’ . Balanced exposure to a . Superior credit performance financial needs for 170+ years wide variety of industries through last recession WELL CAPITALIZED ROBUST LIQUIDITY STRONG DEBT RATINGS A3 . 9.99% CET1 Ratio . $45B available liquidity Maintain strong ratings1 . 10.58% Tier 1 Ratio sources . Moody’s A3 . . $8.7B Total Capital . 79% Loan/ Deposit Ratio S&P BBB+ . Fitch A- 6/30/20 ● 1Holding company debt ratings as of 9/8/20; Debt Ratings are not a recommendation to buy, sell, or hold securities 3

3Q20 Loan Update Headwinds from National Dealer & Corporate Banking, partly offset by Mortgage Banker July & August Trends ($ in billions; Average) QTD average loans reflect1: ‒ $900MM National Dealer Services 53.5 52.1 . Low inventory levels due to OEM 50.9 50.5 shutdown & rebound in sales 49.6 ‒ $420MM Corporate Banking . At beginning of pandemic, lines drawn for liquidity buffer, which have since receded ‒ $320MM General Middle Market . Reduced working capital & capex + $250MM Mortgage Banker . Strong refi & home sales Outlook for 3Q20 average loans: ~$52B 3Q19 4Q19 1Q20 2Q20 3Q20 thru 8/31 3Q20 average balances through 8/31/20 are preliminary & subject to change ● Outlook as of 9/11/20● 1Comparisons of 3Q20 through 8/31/20 vs 2Q20 4

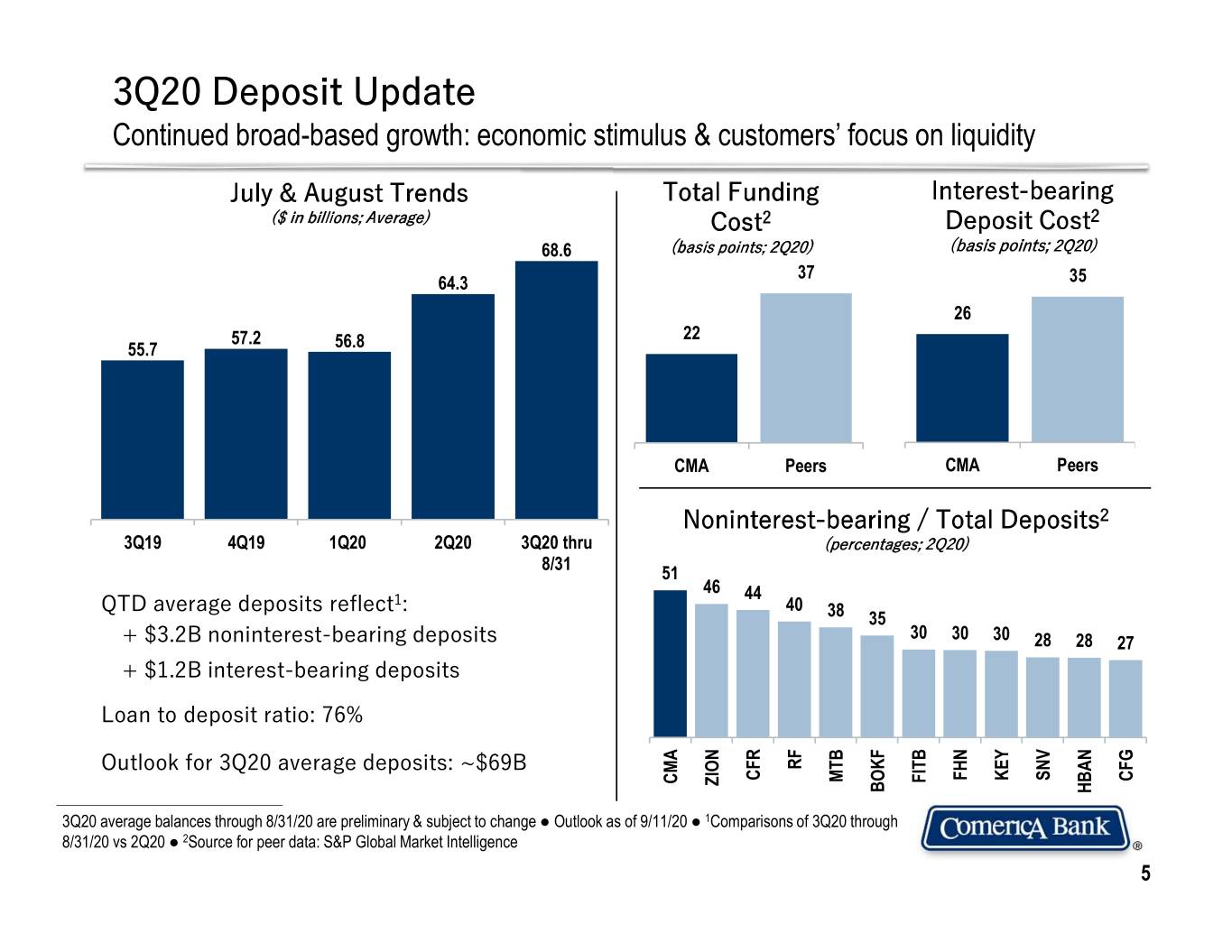

3Q20 Deposit Update Continued broad-based growth: economic stimulus & customers’ focus on liquidity July & August Trends Total Funding Interest-bearing ($ in billions; Average) Cost2 Deposit Cost2 68.6 (basis points; 2Q20) (basis points; 2Q20) 37 64.3 35 26 57.2 22 55.7 56.8 CMA Peers CMA Peers Noninterest-bearing / Total Deposits2 3Q19 4Q19 1Q20 2Q20 3Q20 thru (percentages; 2Q20) 8/31 51 46 44 QTD average deposits reflect1: 40 38 35 30 30 30 + $3.2B noninterest-bearing deposits 28 28 27 + $1.2B interest-bearing deposits Loan to deposit ratio: 76% Outlook for 3Q20 average deposits: ~$69B RF CFR FHN KEY SNV CFG MTB FITB CMA ZION BOKF HBAN 3Q20 average balances through 8/31/20 are preliminary & subject to change ● Outlook as of 9/11/20 ● 1Comparisons of 3Q20 through 8/31/20 vs 2Q20 ● 2Source for peer data: S&P Global Market Intelligence 5

Diverse Portfolio Supports consistent growth & reduces risk Other Energy Other Commercial Real 6% 6% Estate General Middle 4% 3% Market Equity Fund Services Business Banking 24% 4% Retail Banking 6% Retail Banking 35% Private Banking 5% 6% Mortgage Banker Corporate Banking Loans Deposits $53.5B 6% 7% Commercial $64.3B Real Estate Business 13% Banking 7% Tech. & Life Sciences 9% Corporate Banking National Dealer 9% General Middle 12% Private Banking Market 10% 28% . Diversity provides counterbalances as cyclical & . Retail Banking /consumer-based deposits seasonal factors impact growth & credit quality provide a low-cost, stable funding source . Several businesses are considered more . Relationship based: 96% of General Middle recession resilient, i.e. National Dealer, Corporate Market deposits tied to treasury Banking, Equity Fund Services, Private Banking & management products Mortgage Banker 2Q20 average balances 6

Net Interest Income Rate pressure diminishing Paycheck Protection Program3 3Q20 net interest income outlook1,2 . $3.8B loans . >14,700 applications processed ~$10-15MM estimated impact from rates . 74% of customers received loans4 <$150,000 alone on assuming: . ~2.25% average yield5 . Stable rates (30-day LIBOR 16-17 bps) . Contractual maturity 2 years; however, expect . Interest-bearing deposit rate of ~18 bps majority may be forgiven in 4Q20 & 1Q21 Other impacts: . Funding, operational expenses & charitable . Reduced loan volume, roughly offset by giving partially offset revenue lower wholesale borrowings (2Q20), improved loan spreads & additional day Increased Securities Portfolio in July/August Opportunities to offset headwinds over time Deployed portion of excess liquidity through . Loan pricing, including floors purchases . Deposit rates . $1.75B Treasuries; average yield 26 bps with . Larger securities book duration of ~4 years . Reduced wholesale funding . $500MM MBS; average yield 1.085% with duration of ~6 years . Purchases focused on underlying collateral with favorable prepayment characteristics Outlook as of 9/11/20 ● 13Q20 vs. 2Q20; Outcomes may differ due to many variables, including pace of LIBOR change, balance sheet movements (loan, deposit & wholesale funding levels), competition for deposits ● 2For standard methodology see the Company’s Form 10-Q, as filed with the SEC. Estimates are based on simulation modeling analysis ● 3As of 6/30/2020 ● 4By number of borrowers ● 5Contractual 1.00% interest rate, plus processing fee which is amortized over life of loan 7

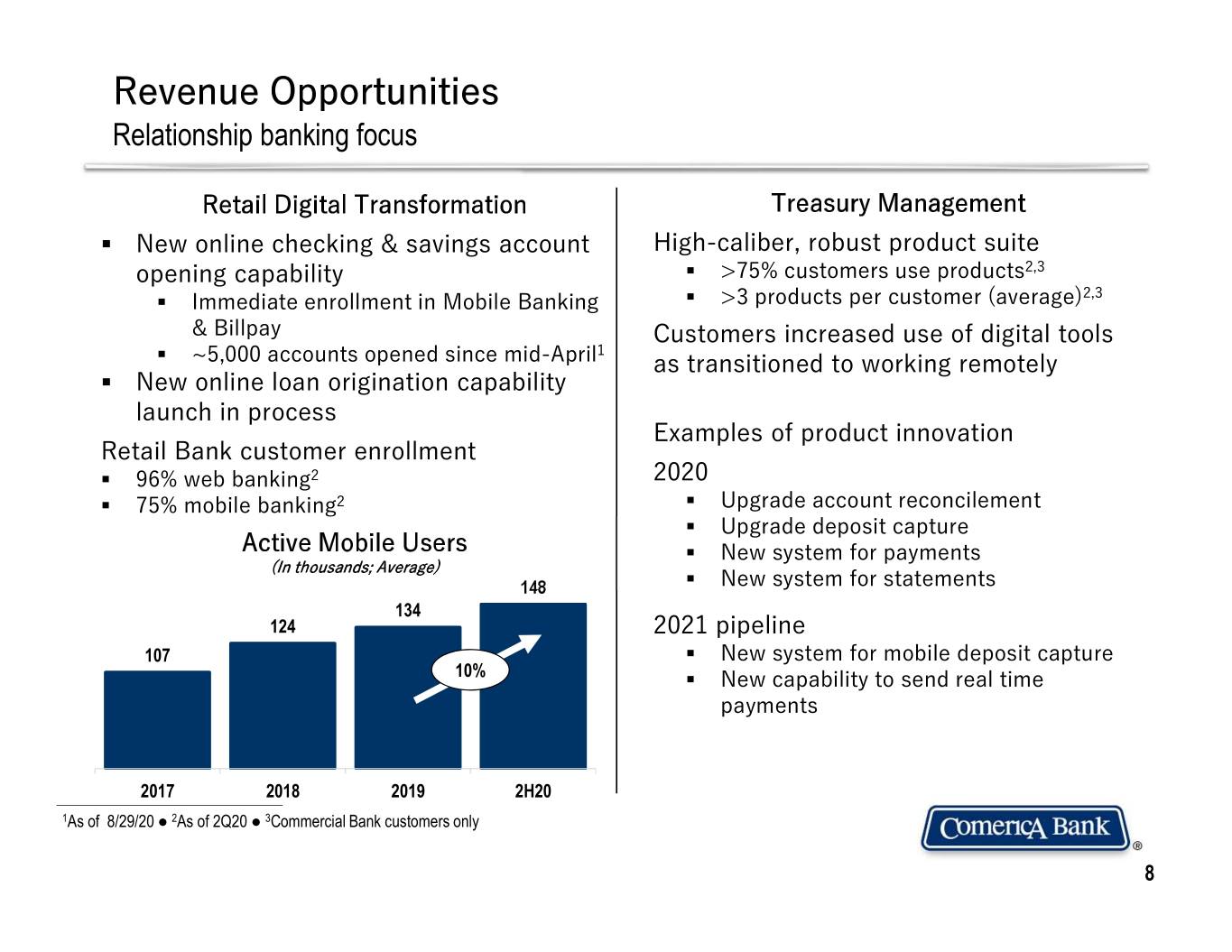

Revenue Opportunities Relationship banking focus Retail Digital Transformation Treasury Management . New online checking & savings account High-caliber, robust product suite opening capability . >75% customers use products2,3 . Immediate enrollment in Mobile Banking . >3 products per customer (average)2,3 & Billpay Customers increased use of digital tools 1 . ~5,000 accounts opened since mid-April as transitioned to working remotely . New online loan origination capability launch in process Examples of product innovation Retail Bank customer enrollment . 96% web banking2 2020 . 75% mobile banking2 . Upgrade account reconcilement . Upgrade deposit capture Active Mobile Users . New system for payments (In thousands; Average) 148 . New system for statements 134 124 2021 pipeline 107 . New system for mobile deposit capture 10% . New capability to send real time payments 2017 2018 2019 2H20 1As of 8/29/20 ● 2As of 2Q20 ● 3Commercial Bank customers only 8

Expense management Proven cost discipline Employees Loans + Deposits / Strong culture that drives efficiency (FTE) Employee1,2 Carefully managing workforce 9,035 (Average $ in millions) CMA Peer Avg. • Reallocating resources, as needed 7,777 15.1 Continuously optimizing footprint 10.3 12.6 • Consolidate or relocate banking centers • Utilizing flexible workspace to reduce 14% 7.5 square footage 2012 2Q20 2012 2Q20 Banking Deposits / Energy Use Real Estate 1,3 Centers Banking Center (Real Estate & Transport, MWh) (Sq. ft in millions) ($ in millions) 489 CMA Peer Avg. 5.55 156 153,210 434 4.34 107 135 105,699 11% 86 31% 22% 2012 2Q20 2012 2Q20 2012 2019 2012 2Q20 1Source for peer data: S&P Global Market Intelligence ● 22012 FTE for CFG not available ● 32Q20 CFR, CFG, & MTB Banking Centers are approximate & as of 12/31/2019, 2Q20 BOKF not available as of 9/11/20 9

Credit Quality Solid Credit migration manageable; Started cycle from position of strength Proactively managing portfolio Commercial Reserve2 NPAs2 (% of 2Q20 PE Commercial Loans) (% of 2Q20 PE Loans) . Long-tenured, experienced team with deep 0.83 expertise; Proactive, frequent customer 1.91 dialogue . Providing support, as warranted, including 1.78 0.53 payment deferrals & other accommodations . Adjusting risk ratings based on current & expected financial performance . Review liquidity & cashflow forecasts . Track receivable & inventory levels CMA Peers CMA Peers Net Charge-offs1 Largest Reserve as a % of NPAs1 (As a % of Average Loans) (percentages; 2Q20) 3.0 Total CMA 2.5 Peer Average 3.13 2.94 2.0 2.22 1.5 1.81 1.63 1.59 1.55 1.49 1.37 1.33 1.0 1.22 1.12 0.5 0.0 RF CFR SNV KEY FHN CFG MTB FITB 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 CMA ZION 2Q20 BOKF HBAN 6/30/20 ● 1Source for peer data: S&P Global Market Intelligence ● 2Source for peer data: 2Q20 peer financial release 10

Commercial Real Estate Line of Business Very strong credit quality Primarily Lower Risk Multifamily1 . Long history of working with well established, ($ in millions; Period-end) proven developers . Retail Office Single >90% of new commitments from existing 10% 8% Family customers 4% Other 3% . Substantial upfront equity required Industrial / Land Carry . 72% of Multifamily & 75% of Industrial/ Storage 5% 2 20% Total Multi use Storage are construction loans $5.8B 3% . Majority high growth markets within footprint: . 44% California Multifamily . 32% Texas 47% Credit Quality Multifamily by Class & Market1 No significant net charge-offs since 2014 ($ in millions; Period-end) ($ in millions) 3 NAL Criticized % Criticized/Loans 3.0% Other 106 Class B TX 17% 92 87 2.5% Class A 87 13% 33% MI 2.0% 86% 72 4% 1.9% Class Low Market 1.6% 1.5% FL 1.4% $2.8B Inc. $2.8B 1.3% 1% 1% 1.1% 1.0% 0.5% CA 4 2 2 2 3 0.0% 45% 2Q19 3Q19 4Q19 1Q20 2Q20 6/30/20 ● 1Excludes CRE line of business loans not secured by real estate ● 2Period-end loans ● 3Criticized loans are consistent with regulatory defined Special Mention, Substandard & Doubtful categories 11

Energy Line of Business Allocation of reserves for Energy loans >10% Period-end Loans . Exposure $3.4B / 60% utilization ($ in millions) . Spring redeterminations Services 3,559 Midstream . 20% average decrease in borrowing base Exploration & Production . 85% of customers’ borrowing bases lower 566 3,070 . Hedged 50% or more of production . At least one year: 73% of customers 480 454 . At least two years:Mixed 37% of customers 18% 2,250 2,221 . Focus on larger, sophisticated E&P 2,163 2,114 479 48 2,086 289 94 55 companies 1,836 50 298 432 364 374 195 374 Nonaccrual Loans 295 ($ in millions) 2,539 328 % NAL / Loans 20% 2,111 18% 1,771 1,741 1,695 1,662 16% 1,587 15% 14% 108 1,346 102 12% 10% 48 8% 6% 43 6% 5% 4% 2014 2015 2016 2017 2018 2019 1Q20 2Q20 2% 2% 2% 0% 2016 2017 2018 2019 6/30/20 6/30/20 12

Credit Exposure to “at risk” industries well reserved Period- % of total % Category % Category Category Comments end loans loans criticized1 nonaccrual2 Retail CRE $784 1.5% 0.0% 0.0% Well capitalized developers (low LTV) Hotels $564 1.1% 7.1% 0.0% Strong Liquidity; Well capitalized Arts / Recreation $357 0.7% 14.0% 0.0% Larger, well-established entities Retail goods & services $283 0.5% 8.2% 0.0% Granular portfolio Total all Other3 $1,038 1.9% 8.2% 0.4% 11 distinct categories Social Distancing Total $3,026 5.7% 6.6% 0.1% Auto Production $1,472 2.8% 21.1% 0.6% Primarily Tier 1 & Tier 2 suppliers Leveraged Loans4 $2,092 3.9% 17.8% 0.7% 86% are middle market companies Payment Deferral Update as of 8/31/20 Based on review of “at risk” segments, . Mainly for 90-day period removed Casinos & Sports Franchises . >90% of initial deferrals expired . Essentially no negative migration . <$350MM remain . Criticized & nonaccrual loans well below . Minimal new requests since early June total portfolio average . Few modifications to previously deferred loans . 2nd deferrals have been nominal . $300MM (200 customers), primarily consumer mortgage, middle market & small business 6/30/20; $ in millions ● 1Period-end category criticized loans / category loans ● 2Period-end category nonaccrual loans / category loans ● 3Includes airlines, restaurants/bars, childcare, coffee shops, cruise lines, education, gasoline/C stores, religious organizations, senior living, freight, travel arrangement 4Higher-risk commercial & industry total $2.4B, eliminated overlap with other categories ● 13

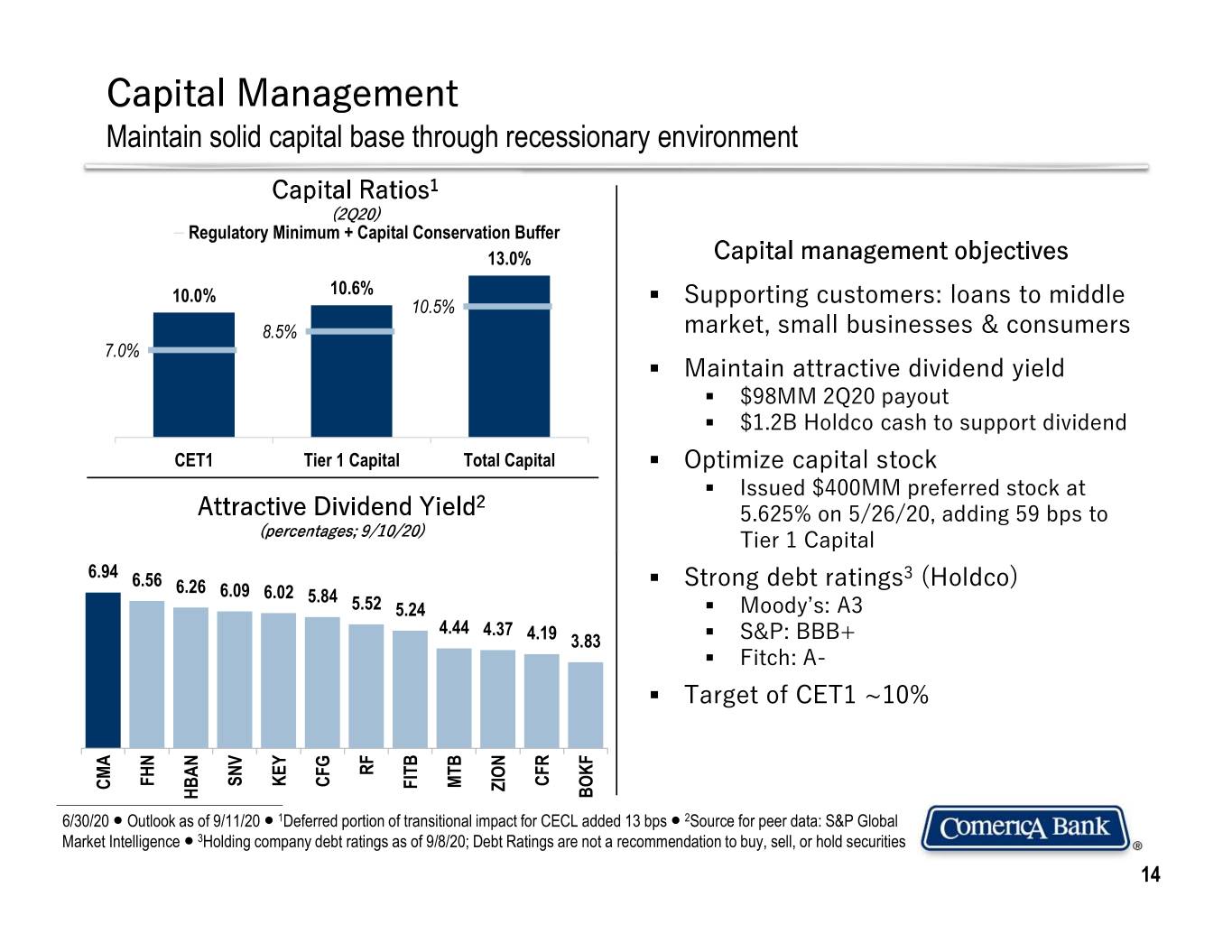

Capital Management Maintain solid capital base through recessionary environment Capital Ratios1 (2Q20) Regulatory Minimum + Capital Conservation Buffer 13.0% Capital management objectives 10.0% 10.6% 10.5% . Supporting customers: loans to middle 8.5% market, small businesses & consumers 7.0% . Maintain attractive dividend yield . $98MM 2Q20 payout . $1.2B Holdco cash to support dividend CET1 Tier 1 Capital Total Capital . Optimize capital stock . Issued $400MM preferred stock at 2 Attractive Dividend Yield 5.625% on 5/26/20, adding 59 bps to (percentages; 9/10/20) Tier 1 Capital 6.94 3 6.56 6.26 . Strong debt ratings (Holdco) 6.09 6.02 5.84 5.52 5.24 . Moody’s: A3 4.44 4.37 4.19 3.83 . S&P: BBB+ . Fitch: A- . Target of CET1 ~10% RF FHN CFR SNV KEY CFG MTB FITB CMA ZION BOKF HBAN 6/30/20 ● Outlook as of 9/11/20 ● 1Deferred portion of transitional impact for CECL added 13 bps ● 2Source for peer data: S&P Global Market Intelligence ● 3Holding company debt ratings as of 9/8/20; Debt Ratings are not a recommendation to buy, sell, or hold securities 14

Well positioned to navigate these challenging times And support customers as economy recovers CUSTOMER FOCUSED Continued to Provide Superior Returns 2,3 2,4 DIVERSIFIED ROA ROE (percentages; 2Q20) (percentages; 2Q20) 6.09 0.55 4.21 CREDIT DISCIPLINE 0.46 WELL CAPITALIZED CMA Peer Average CMA Peer Average ROBUST LIQUIDITY A3 STRONG DEBT RATINGS1 6/30/20 ● 1Holding company debt ratings as of 9/8/20; Debt Ratings are not a recommendation to buy, sell, or hold securities ● 2Source for peer data: S&P Global Market Intelligence ● 3Return on Average Assets ● 4Return on Average Common Equity 15

Appendix

2Q20 Results Record loan & deposit growth partly offsets lower interest rates & reserve build Change From Key Performance Drivers 2Q20 compared to 1Q20 (millions, except per share data) 2Q20 1Q20 2Q19 1Q20 2Q19 . Loan growth in the majority of Average loans $53,498 $49,604 $50,963 $3,894 $2,535 businesses; average PPP4 $2.6B Average deposits 64,282 56,768 54,995 7,514 9,287 . Deposit growth primarily noninterest-bearing driven by $471 $513 $603 $(42) $(132) Net interest income stimulus programs & customers Provision for credit losses 138 411 44 (273) 94 conserving cash Noninterest income1 247 237 250 10 (3) . Net interest income reflected lower interest rates Noninterest expenses1 440 425 424 15 16 . Net charge-offs, ex-Energy, 4 bps; Provision for income tax 27 (21) 87 48 (60) Provision includes further reserve build; ACL, ex-PPP, 2.15% Net income 113 (65) 298 178 (185) . Noninterest income included Earnings per share2 $0.80 $(0.46) $1.94 $1.26 $(1.14) higher card fees Average diluted shares 139.5 140.6 153.2 (1.1) (13.7) . Expenses reflect COVID-19 & PPP-related costs Book Value per Share3 53.28 53.24 48.89 0.04 4.39 . Strong capital level increased Tier 1 10.58 9.52 10.18 CET1 9.99 9.52 10.18 1Includes gain (loss) related to deferred comp plan of $2MM 2Q20, ($3MM) 1Q20, & -0- 2Q19 ● 2Diluted earnings per common share ● 3Common shareholders’ equity per share of common stock ● 4Paycheck Protection Program 17

Loans Increased 8% to Record Level Increase led by PPP & growth in the majority of businesses Average Loans ($ in billions) Loan Yields 53.5 53.5 53.4 Average loans increase $3.9B + $1,237MM Mortgage Banker 51.0 50.9 50.5 + $ 767MM Corporate Banking 49.6 + $ 737MM Middle Market General + $ 567MM Business Banking + $ 449MM Commercial Real Estate ‒ $ 535MM National Dealer Services 5.00 4.83 Loan yields reflect 4.43 4.19 ‒ Average 1-month LIBOR decreased 105 bps ‒ Mix shift with PPP 3.26 Committed Line Utilization 49% (1Q20 57%) 2Q19 3Q19 4Q19 1Q20 2Q20 1Q20 2Q20 Average Balances Period-end 2Q20 compared to 1Q20 18

Average Loans by Business and Market By Line of Business 2Q20 1Q20 2Q19 By Market 2Q20 1Q20 2Q19 Middle Market Michigan $13.0 $12.2 $12.7 General 12.7 12.0 12.4 Energy 2.2 2.2 2.5 California 18.7 18.0 18.8 National Dealer Services 6.2 6.8 7.9 Texas 11.2 10.6 10.7 Entertainment 0.7 0.7 0.8 Tech. & Life Sciences 1.5 1.2 1.3 Other Markets1 10.6 8.8 8.8 Equity Fund Services 2.3 2.6 2.6 TOTAL $53.5 $49.6 $51.0 Environmental Services 1.4 1.3 1.1 Total Middle Market $27.0 $26.7 $28.6 Corporate Banking Loan Portfolio US Banking 3.5 3.0 3.0 ($ in billions; 2Q20 Period-end) 2 International 1.5 1.2 1.3 Fixed Rate 26% Commercial Real Estate 6.7 6.2 5.5 Mortgage Banker Finance 3.3 2.0 2.0 Business Banking 4.0 3.4 3.5 Prime- based COMMERCIAL BANK $45.9 $42.6 $43.9 Total 1 Month 13% Retail Banking 2.5 2.1 2.1 $53.4 LIBOR 53% RETAIL BANK $2.5 $2.1 $2.1 >1 Month Private Banking 5.1 4.9 4.9 LIBOR WEALTH MANAGEMENT $5.1 $4.9 $4.9 8% TOTAL $53.5 $49.6 $51.0 $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes PPP Loans, Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets ● 2Fixed rate loans include $5.55B receive fixed / pay floating (30-day LIBOR) interest rate swaps 19

Deposits Grew 13% to Record Level Deposit rates decreased 50 basis points as prudently adjust pricing Average Deposits Average deposits increase $7.5B ($ in billions) + $5.9B noninterest-bearing 1 Deposit Rates + $1.6B interest-bearing 67.7 64.3 Loan to deposit ratio2 79% 57.2 56.8 57.4 55.0 55.7 Total funding costs 22 bps3, down 38 bps Beneficial Deposit Mix ($ in billions; 2Q20 Average) . Commercial 79% of noninterest-bearing . Retail 54% of interest-bearing Commercial Retail 0.94 0.99 Noninterest- 0.92 Noninterest- 0.76 bearing bearing 40% 11% Total 0.26 $64.3 Commercial Retail Interest- Interest- bearing 2Q19 3Q19 4Q19 1Q20 2Q20 1Q20 2Q20 bearing 22% Average Balances Period-end 27% 2Q20 compared to 1Q20 ● 1Interest costs on interest-bearing deposits ● 2At 6/30/2020 ● 3Interest incurred on liabilities as a percent of average noninterest–bearing deposits and interest-bearing liabilities 20

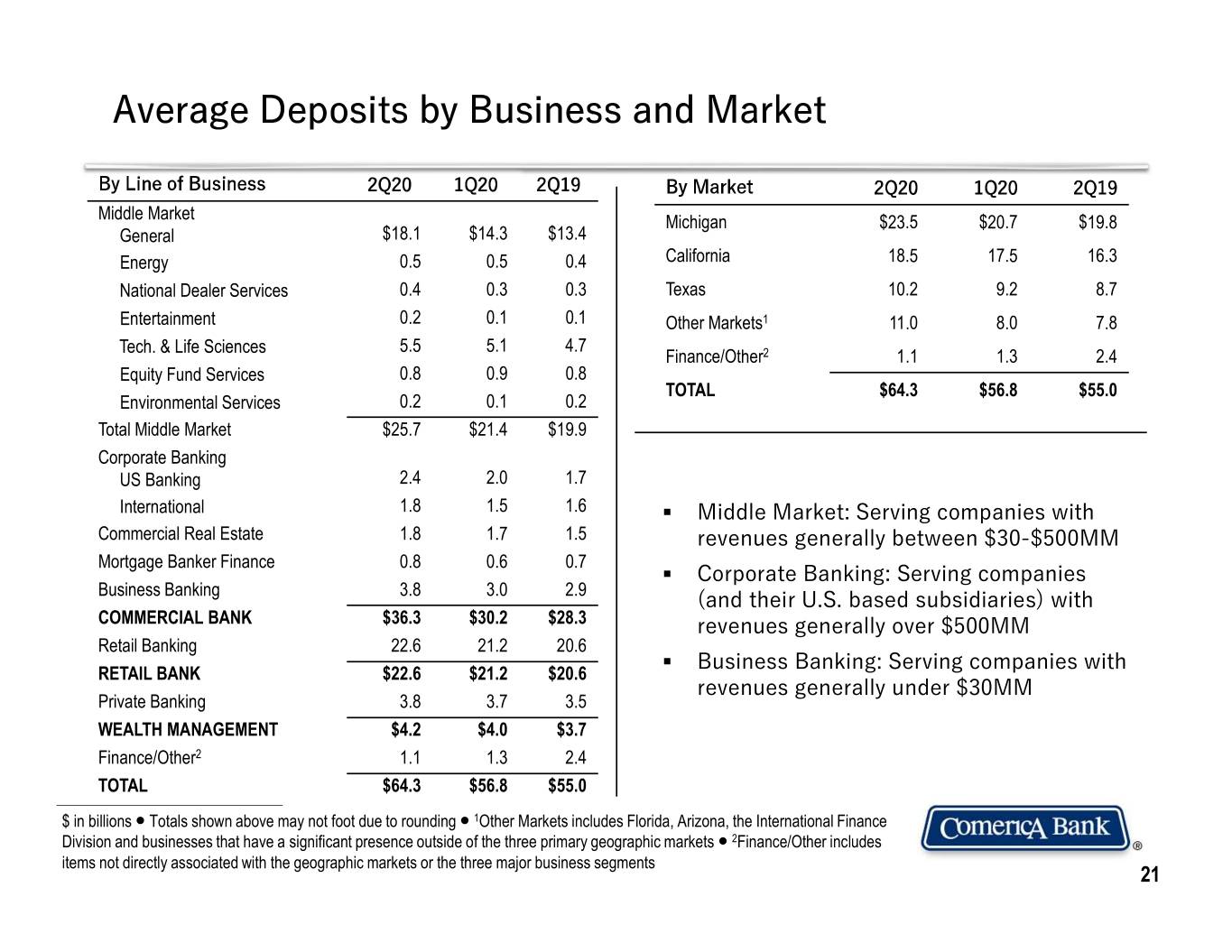

Average Deposits by Business and Market By Line of Business 2Q20 1Q20 2Q19 By Market 2Q20 1Q20 2Q19 Middle Market Michigan $23.5 $20.7 $19.8 General $18.1 $14.3 $13.4 Energy 0.5 0.5 0.4 California 18.5 17.5 16.3 National Dealer Services 0.4 0.3 0.3 Texas 10.2 9.2 8.7 Entertainment 0.2 0.1 0.1 Other Markets1 11.0 8.0 7.8 Tech. & Life Sciences 5.5 5.1 4.7 Finance/Other2 1.1 1.3 2.4 Equity Fund Services 0.8 0.9 0.8 TOTAL $64.3 $56.8 $55.0 Environmental Services 0.2 0.1 0.2 Total Middle Market $25.7 $21.4 $19.9 Corporate Banking US Banking 2.4 2.0 1.7 International 1.8 1.5 1.6 . Middle Market: Serving companies with Commercial Real Estate 1.8 1.7 1.5 revenues generally between $30-$500MM Mortgage Banker Finance 0.8 0.6 0.7 . Corporate Banking: Serving companies Business Banking 3.8 3.0 2.9 (and their U.S. based subsidiaries) with COMMERCIAL BANK $36.3 $30.2 $28.3 revenues generally over $500MM Retail Banking 22.6 21.2 20.6 . RETAIL BANK $22.6 $21.2 $20.6 Business Banking: Serving companies with revenues generally under $30MM Private Banking 3.8 3.7 3.5 WEALTH MANAGEMENT $4.2 $4.0 $3.7 Finance/Other2 1.1 1.3 2.4 TOTAL $64.3 $56.8 $55.0 $ in billions ● Totals shown above may not foot due to rounding ● 1Other Markets includes Florida, Arizona, the International Finance Division and businesses that have a significant presence outside of the three primary geographic markets ● 2Finance/Other includes items not directly associated with the geographic markets or the three major business segments 21

Mortgage Banker Finance 55+ years experience with reputation for consistent, reliable approach Average Loans ($ in millions) Actual MBA Mortgage Origination Volumes1 . Provide warehouse financing: bridge from 1000 residential mortgage origination to sale to 900 800 end market 700 600 500 . Extensive backroom provides collateral 400 3,278 300 2,681 2,544 monitoring and customer service 2,521 2,352 200 2,145 2,044 2,042 1,974 1,961 1,861 1,780 1,784 1,677 100 1,450 1,435 1,335 . Focus on full banking relationships 0 . Granular portfolio with ~100 relationships 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 As of 2Q20: MBA Mortgage Originations Forecast1 . Comerica: 46% purchase ($ in billions) Purchase Refinance 1 . Industry: 40% purchase 928 860 . Strong credit quality 635 579 . No charge-offs since 2010 502 . Period-end loans: $4.2B 2Q20 3Q20 4Q20 1Q21 2Q21 6/30/20 ● 1Source: Mortgage Bankers Association (MBA) Mortgage Finance Forecast as of 8/20/20; 2Q20 actuals 22

Technology & Life Sciences Deep expertise & strong relationships with top-tier investors Average Loans Average Deposits ($ in millions) ($ in millions) 5,471 5,149 5,126 4,652 4,637 1,517 1,305 1,251 1,181 1,193 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Customer Segment Overview1 . ~410 customers (Approximate; 2Q20 Period-end loans) . Manage concentration to numerous Growth verticals to ensure widely diversified 55% portfolio Late Stage Total . Closely monitor cash balances & 10% $1.5B maintain robust backroom operation . 11 offices throughout US & Canada Early Stage Leveraged 18% Finance 17% 6/30/20 ● 1Includes estimated distribution of PPP loans 23

recreational recreational vehicles, and non-floor plan loans) 6/30/20 Toyota/Lexus 70+ years70+ of floor planlending National Dealer Services ● 1 Other Other includes obligations where primary a franchise is indeterminable (rental car and leasing companies, heavy truck, 13% 15% Other Other Asian 1 Michigan 26% Other 10% Other Texas 7% 26% Michigan California 57% 14% (Based on period-end loan outstandings) Geographic Dispersion Franchise Distribution Other Other European $5.4B Total Honda/Acura 12% 15% Nissan/ Nissan/ Infiniti 4% Mercedes Ford 9% Fiat/Chrysler 3% GM 7% 8% 2Q16 4.0 6.5 . . . . 3Q16 3.8 6.3 and performance Robust ofmonitoring company inventory Strong credit quality dealerships in group) “Mega Focus on Dealer” (five or more tier Top strategy 4Q16 4.0 6.6 1Q17 4.1 6.8 2Q17 4.3 7.1 3Q17 3.9 6.9 Average Loans 4Q17 4.1 7.1 ($ ($ in billions) 1Q18 4.1 7.3 Plan Floor 2Q18 4.2 7.4 3Q18 3.8 7.0 4Q18 4.0 7.4 1Q19 4.4 7.8 2Q19 4.5 7.9 3Q19 4.1 7.5 4Q19 4.0 7.3 1Q20 3.6 6.8 24 2Q20 2.8 6.2

Equity Fund Services Deep expertise & strong relationships with top-tier investors Average Loans ($ in millions) . Customized credit, treasury management & investment solutions for venture capital 2,602 2,606 & private equity firms 2,549 2,498 . National scope with customers in 17 2,277 states & Canada . ~260 customers . Drive connectivity with other teams . Energy . Middle Market . TLS . Environmental Services . Private Banking . Strong credit profile . No charge-offs . No criticized loans 2Q19 3Q19 4Q19 1Q20 2Q20 6/30/20 25

Credit Quality Solid Credit migration manageable; Starting cycle from position of strength Net Charge-offs ex-Energy 4 bps1 Criticized Loans Reflect Environment2 ($ in millions) ($ in millions) All Other Energy % NCO/Avg Loans 1.00 $519MM Increase General Middle Market 84 0.90 $348MM Increase Energy 0.80 0.68 0.70 All Other Energy % Criticized/Loans 0.60 50 3,379 10.00 0.50 42 9.00 0.40 33 8.00 0.37 2,457 0.30 0.33 21 7.00 0.26 2,120 67 0.20 1,948 6.3 6.00 0.16 1,861 25 0.10 34 45 5.00 19 4.6 - 4.2 4.00 3.8 3.6 2Q19 3Q19 4Q19 1Q20 2Q20 3.00 2.00 Nonperforming Loans ex-Energy Declined 1,738 1,641 1,754 1,964 2,538 1.00 - ($ in millions) 2Q19 3Q19 4Q19 1Q20 2Q20 All Other Energy % NPL/Loans 1.00 271 0.90 Taking action 0.80 230 226 239 . Proactive, frequent customer dialogue 204 0.70 0.60 . Adjusting risk ratings based on current & 0.51 0.50 expected financial performance 0.44 0.44 0.45 0.40 0.40 . Review liquidity & cashflow forecasts 0.30 . 0.20 Track receivable & inventory levels 146 152 161 174 169 0.10 . Providing support, as warranted, including - payment deferrals & other accommodations 2Q19 3Q19 4Q19 1Q20 2Q20 6/30/20 ● 1Net credit-related charge-offs ● 2Criticized loans are consistent with regulatory defined Special Mention, Substandard, & Doubtful categories 26

Credit Quality Solid Increased reserves due to expected economic stress related to COVID-19 Reserve Build Significant in 1H20 CECL modeling ($ in millions) . Variety of economic forecasts considered 1,200 % ACL/Loans % Ex-PPP 2.15 2.6 . Forecasts with greatest weights feature 1,000 1.99 2.1 1.83 significant recession followed by slow 800 1.6 1.33 1.32 1.33 improvement 600 1.1 . Unemployment 10% 4Q20 to 7% 4Q21 978 1,066 400 0.6 . 4Q19 peak GDP recaptured by 4Q21 688 681 668 200 0.1 . Continued elevated qualitative reserves for - -0.4 Energy, Auto, Leverage & Social Distancing 2Q19 3Q19 4Q19 1Q20 2Q20 High Reserve Coverage & Low NPAs 2Q20 ACL / Stress Test Losses1 NPA/PE Loans (%) ACL/NPL (times) 76% 4.0 3.9 56% 3.0 48% 2.0 1.0 0.53 0.0 2017 DFAST 2017 2019 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2Q20 6/30/20 ● 1Stress results in severely adverse economic conditions; 2017 & 2019 company stress tests 27

Securities Portfolio Yields relatively stable Securities Portfolio ($ in billions; Average) Treasury Securities Mortgage-backed Securities (MBS) Securities Yields 1 13.0 Duration of 2.2 years 12.6 12.8 12.1 12.2 12.2 12.3 . Extends to 3.4 years under a 200 bps instantaneous rate increase1 Net unrealized pre-tax gain of $371MM 10.2 9.8 9.9 2 9.3 9.4 9.4 9.5 Net unamortized premium of $12MM 2.45 2.45 2.45 2.43 2.41 2Q19 3Q19 4Q19 1Q20 2Q20 1Q20 2Q20 Average Balances Period-end 6/30/20 ● 1Estimated as of 6/30/20 ● 2Net unamortized premium on the MBS portfolio 28

Net Interest Income Impacted by lower interest rates Net Interest Income $513MM 1Q20 3.06% ($ in millions) - 83MM Loans - 0.60 Net Interest Margin -105MM Lower rates - 0.57 603 586 - 2MM Nonaccrual interest - 0.01 544 513 + 15MM Higher balances - 0.07 471 + 7MM Fees + 0.04 + 2MM Portfolio dynamics + 0.01 - 15MM Fed Deposits - 0.26 - 16MM Lower yield - 0.09 3.66 3.52 + 1MM Higher balances - 0.17 3.20 3.06 + 36MM Deposits + 0.19 2.50 + 36MM Lower rates + 0.19 + 20MM Wholesale Funding + 0.11 + 18MM Lower rates + 0.10 + 2MM Lower balances + 0.01 2Q19 3Q19 4Q19 1Q20 2Q20 $471MM 2Q20 2.50% 2Q20 compared to 1Q20 29

Noninterest Income Strong card fees as transaction volumes increased with stimulus payments Noninterest Income1,2 ($ in millions) + $9MM Card fees + $8MM Securities trading (other) 266 256 250 247 + $5MM Deferred comp (other) 237 (offset in noninterest expense) + $2MM Securities gains + $2MM Customer derivative income (other) ‒ $7MM Deposit Service Charges ‒ $3MM Bank-owned Life Insurance (BOLI) ‒ $2MM Brokerage ‒ $2MM Fiduciary ‒ $2MM Foreign Exchange 2Q19 3Q19 4Q19 1Q20 2Q20 2Q20 compared to 1Q20 ● 1Losses related to repositioning of securities portfolio of $(8)MM in 2Q19 ● 2Includes gain(loss) related to deferred comp plan of -0- 2Q19, $3MM 3Q19, $3MM 4Q19, ($3MM) 1Q20 & $2MM 2Q20 (offset in noninterest expense) 30

Noninterest Expense Includes COVID-19 & PPP related costs Noninterest Expense ($ in millions) + $7MM Salaries & benefits + $8MM Salaries (merit & Promise Pay) 451 440 + $5MM Deferred Comp (offset in 424 435 425 noninterest income) ‒ $6MM Payroll taxes (seasonal) + $5MM Outside Processing + $2MM Software 2Q19 3Q19 4Q19 1Q20 2Q20 2Q20 compared to 1Q20 31

Capital Management CET1 Tier 1 Capital (percentages) (percentages) 12.5 11.4 12.5 11.8 11.4 10.2 10.0 9.8 11.2 11.0 10.9 9.7 9.6 9.5 10.7 10.7 10.6 10.5 10.4 9.3 9.1 8.9 8.9 10.2 CFR BOKF ZION CMA HBAN FITB CFG MTB FHN KEY RF SNV CFR HBAN BOKF ZION FITB CFG MTB FHN CMA KEY RF SNV 6/30/20 ● Source for peer data: S&P Global Market Intelligence 32

Commitment to Community, Diversity & Sustainability 2020 Environmental 237,000 meals provided in Goals reached1: conjunction with our community Shred Day events, which • 48% reduction in greenhouse gas gathered >882,000 lbs. of paper emissions (goal 20%) • 33% reduction in water consumption (goal 30%) >$8.4MM donated to charitable • organizations via more than 1,400 30% reduction in waste to landfill grants/sponsorships (goal 20%) • 56% reduction in office copy paper usage (goal 50%) 65% of U.S. employees are women Ranked 9th in Newsweek’s inaugural ranking of America’s 40% of U.S. employees are Most Responsible Companies racial/ethnic minorities Over 71,300 hours of 86% of colleagues enrolled in volunteer time donated by the voluntary Masters of colleagues to nonprofits Diversity Awareness training 12/31/19 ● 12019 results versus 2012 baseline 33

Holding Company Debt Rating Senior Unsecured/Long-Term Issuer Rating S&P Fitch Moody’s Cullen Frost A- - A3 M&T Bank A- A A3 BOK Financial BBB+ A A3 Comerica BBB+ A- A3 Fifth Third BBB+ A- Baa1 Huntington BBB+ A- Baa1 KeyCorp BBB+ A- Baa1 Regions Financial BBB+ BBB+ Baa2 Zions Bancorporation BBB+ BBB+ Baa2 Citizens Financial Group BBB+ BBB+ - First Horizon National Corp BBB- BBB Baa3 Synovus Financial BBB- BBB - As of 9/8/20 ● Source: S&P Global Market Intelligence ● Debt Ratings are not a recommendation to buy, sell, or hold securities ● Zions Bancorporation ratings are for the bank 34