Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRIPLE-S MANAGEMENT CORP | brhc10015026_8k.htm |

Exhibit 99.1

Investor Presentation September 2020

*This document contains forward-looking statements, as defined in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include information about possible or assumed future sales, results of operations, developments, regulatory approvals or other circumstances. Sentences that include "believe", "expect", "plan",

"intend", "estimate", "anticipate", "project", "may", "will", "shall", "should" and similar expressions, whether in the positive or negative, are intended to identify forward-looking statements.All forward-looking statements in this news

release reflect management's current views about future events and are based on assumptions and subject to risks and uncertainties. Consequently, actual results may differ materially from those expressed here as a result of various factors,

including all the risks discussed and identified in public filings with the U.S. Securities and Exchange Commission (SEC).In addition, the Company operates in a highly competitive, constantly changing environment, influenced by very large

organizations that have resulted from business combinations, aggressive marketing and pricing practices of competitors, and regulatory oversight. The following factors, if markedly different from the Company's planning assumptions (either

individually or in combination), could cause Triple-S Management's results to differ materially from those expressed in any forward-looking statements shared here: Safe Harbor Statement 2 Trends in health care costs and utilization

ratesAbility to secure sufficient premium rate increasesCompetitor pricing below market trends of increasing costsRe-estimates of policy and contract liabilitiesChanges in government laws and regulations of managed care, life insurance or

property and casualty insuranceSignificant acquisitions or divestitures by major competitorsIntroduction and use of new prescription drugs and technologiesA downgrade in the Company's financial strength ratingsLitigation or legislation

targeted at managed care, life insurance or property and casualty insurance companiesAbility to contract with providers consistent with past practiceAbility to successfully implement the Company's disease management, utilization management

and Star ratings programsAbility to maintain Federal Employees, Medicare and Medicaid contractsVolatility in the securities markets and investment losses and defaultsGeneral economic downturns, major disasters, and epidemics This list is not

exhaustive. Management believes the forward-looking statements in this release are reasonable. However, there is no assurance that the actions, events or results anticipated by the forward-looking statements will occur or, if any of them do,

what impact they will have on the Company's results of operations or financial condition. In view of these uncertainties, investors should not place undue reliance on any forward-looking statements, which are based on current expectations. In

addition, forward-looking statements are based on information available the day they are made, and (other than as required by applicable law, including the securities laws of the United States) the Company does not intend to update or revise

any of them in light of new information or future events.Readers are advised to carefully review and consider the various disclosures in the Company's SEC reports.

Strong balance sheet Well regulated market = strong barrier to entry Upgrading technology and

information systems to improve healthcare management and outcomes Management team with deep managed care expertise leveraging 60+ year experience and brand equity Well positioned to grow business as premier healthcare company in Puerto

Rico 3 Investment Highlights

Introduction to Triple-S Who we are Most experienced managed care organization (MCO) in Puerto

RicoExclusive BCBS licensee for Puerto Rico, Costa Rica and U.S. Virgin IslandsNYSE: GTS Premiums earned 5-year CAGR of 8.9%2019 medical loss ratio (MLR) of 84.6%As of June 30, 2020, approximately $141 million in cash and cash equivalents

and only $55 million of long-term debt on balance sheet Solid Financials Recent Progress Four consecutive years of 4.0 Star rating or higher for Medicare Advantage (MA) HMO productGrew MA membership by over 8,200 members during 2020 open

enrollment, expanded MA market share to 22%Established ambulatory clinic network in Puerto Rico 4

Deep Senior Management Expertise 5 Roberto García-RodríguezPresident & CEO 25+ years of

health care / legal industry experienceHas held various roles since joining Triple-S in 2008, including COO from 2013-2016Member of the Board of Directors of the Blue Cross Blue Shield Association Juan José Román-JiménezCFO & Executive

VP, Ancillary Business 30+ years of financial and health care industry experience, CPAPrior to rejoining Triple-S, was CFO of EVERTEC, a NYSE-listed payments services companyPreviously spent 15 years at Triple-S in various

positions Madeline Hernández-UrquizaCOO & Executive VP, Managed Care 30+ years of health care and financial industry experienceWas Chief Risk Officer for Commercial and Medicaid businessesSuccessfully reorganized Medicare Advantage

subsidiary, leading to upgraded HMO rating Arturo Carrión-Crespo PresidentTriple-S Vida 30+ years of life/health insurance industry experiencePresident of Triple-S Vida since 1998Also spent 11 years at Great American Life Assurance

Company of Puerto Rico José Del Amo-MojicaPresident Triple-S Propiedad 30+ years of property and casualty insurance experienceJoined Triple-S in 1998Grew through the ranks from Surety Manager to Sr. VP of Underwriting and

Claims Juan Serrano Chief Strategy Officer and EVP, Healthcare Delivery Joined in July 2020 30+ years of broad multi-sectorial experience in the health plan, care delivery and risk management fields across the Medicare Advantage,

Medicaid and commercial insurance segments.

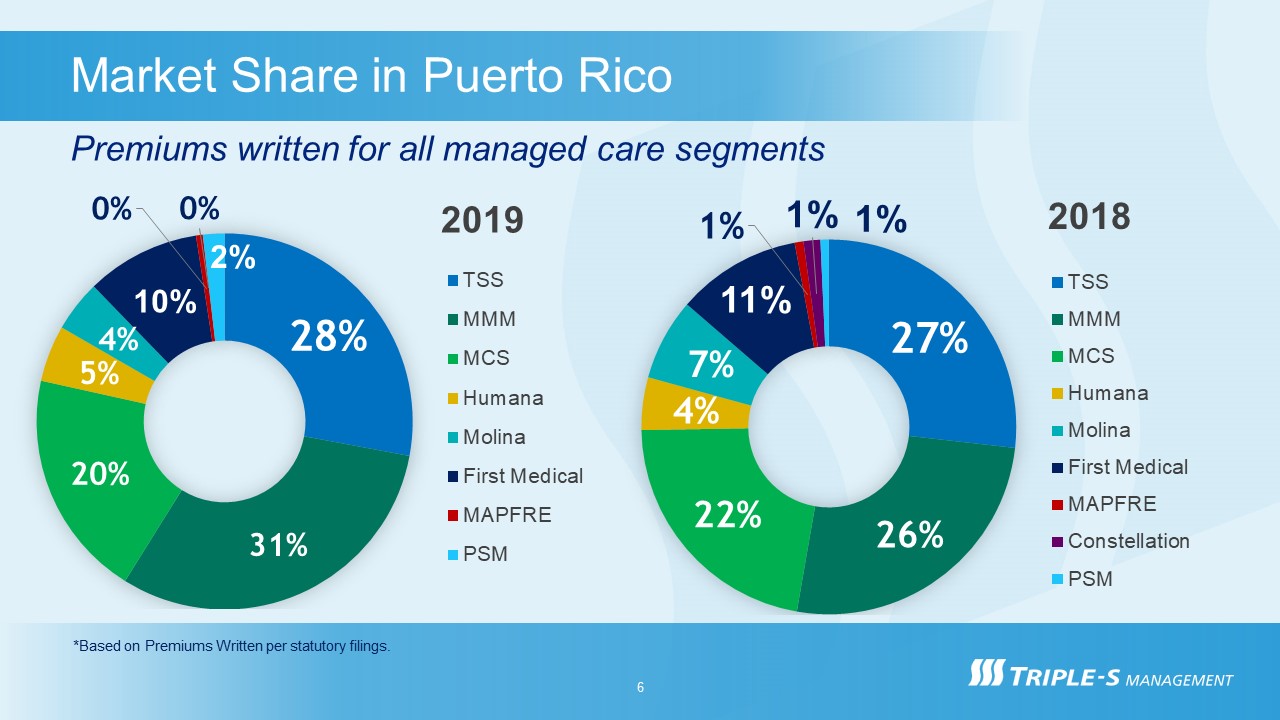

Market Share in Puerto Rico Premiums written for all managed care segments 6 *Based on Premiums

Written per statutory filings.

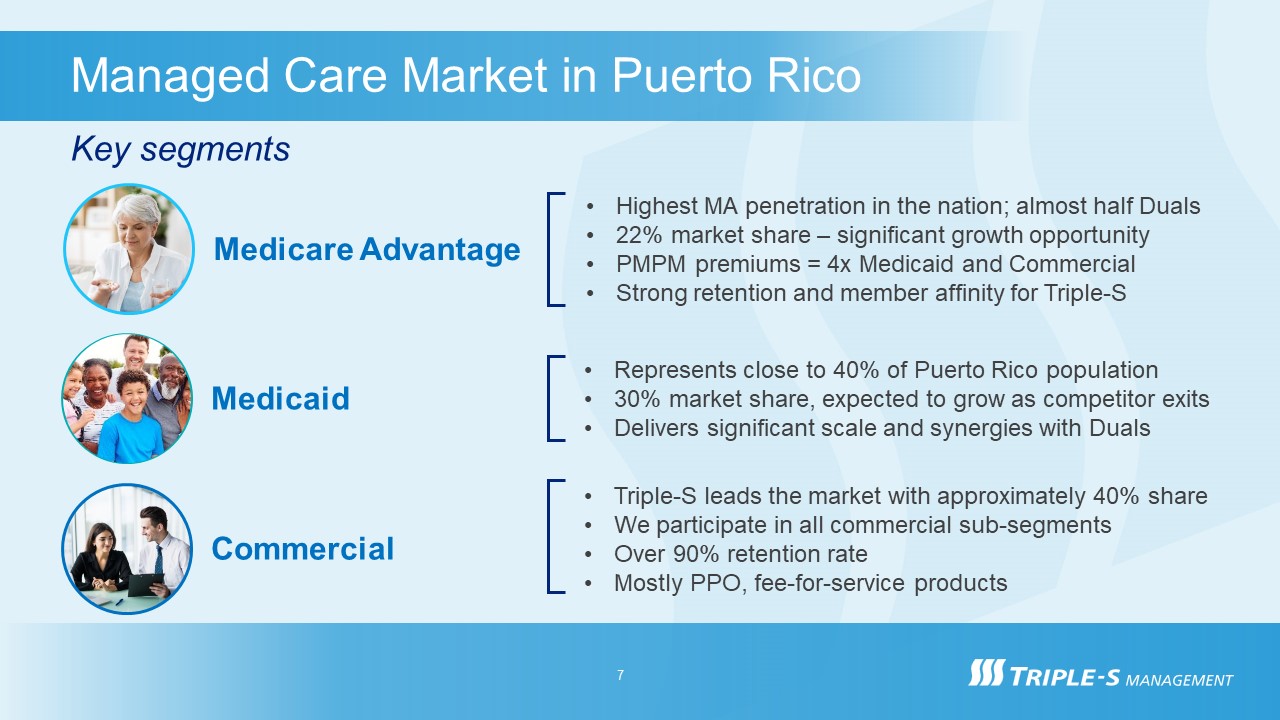

Managed Care Market in Puerto Rico Commercial Triple-S leads the market with approximately 40%

shareWe participate in all commercial sub-segmentsOver 90% retention rateMostly PPO, fee-for-service products Medicare Advantage Highest MA penetration in the nation; almost half Duals22% market share – significant growth opportunityPMPM

premiums = 4x Medicaid and CommercialStrong retention and member affinity for Triple-S Medicaid Represents close to 40% of Puerto Rico population30% market share, expected to grow as competitor exitsDelivers significant scale and synergies

with Duals 7 Key segments

Significantly Upgraded Medicare Advantage Product Inconsistent productLack of cost

control HMO Plan offerings with at least a 4-star rating Reposition Reorganize Legacy 2013-2016 2016-2019 2020 Further expanded market share following 2020 AEP; 2nd consecutive year with the highest enrollment growth rate in Puerto

Rico 8

Competitive MA Offering Expands Growth Opportunities… Consistency Benefits design

consistent YOY but adding innovation Choice 75% of eligible consumers choose an MA plan Cash Designation provides additional premium in 2020 Value Continuing to optimize costs in segment to drive stronger bottom

line Competitive Attractive benefits and superior provider network Four consecutive years of at least 4.0-star designation in HMO product - provides company with growth engine 9

…Yielding Strong Performance Premiums25% growth in MA premiums in 2019 vs. 20189% growth in MA

premiums in 1H20 vs. 1H19 Membership134,600 MA members enrolled as of June 30, 2020 24% increase from 2018 year-end membership Medical Loss Ratio (MLR)78.1% recasted MLR in 1H20320 bps improvement from prior year 10

Growth in Re-designed Medicaid Program Puerto Rico government established new model in November 2018,

with a single, island-wide region where beneficiaries can choose their MCOGrew from initial membership of 288k to 364k in 2nd quarter of 2020, or 30% of the 1.2 million program beneficiariesExpected to reach 400k members by December 2020, as

competitor exits the programContract negotiations in progress, with expected increase in rates retroactive to July 1, 2020 11 estimate

*Adjusts for effect of prior period reserve developments and hurricanes; hurricane favorable impact on

utilization in 2017 accounted for 330 basis points Focused on disciplined underwriting Triple-S maintains significant market share in Commercial segment in Puerto RicoFocused last couple of years on methodically reducing membership to clean

up portfolio and remove unprofitable accounts, thus improving MLRWith portfolio underwriting improving, have carefully restarted growth initiatives Commercial Fully- Insured Members(as of year-end) Annual Medical Loss Ratio

(MLR) Adjusted Annual Medical Loss Ratio (MLR)* 2015 367,278 84.2% 86.6% 2016 335,643 85.2% 83.6% 2017 321,571 77.5% 76.7% 2018 311,222 82.4% 82.8% 2019 322,973 82.4% 82.9% Optimizing Commercial Segment 12

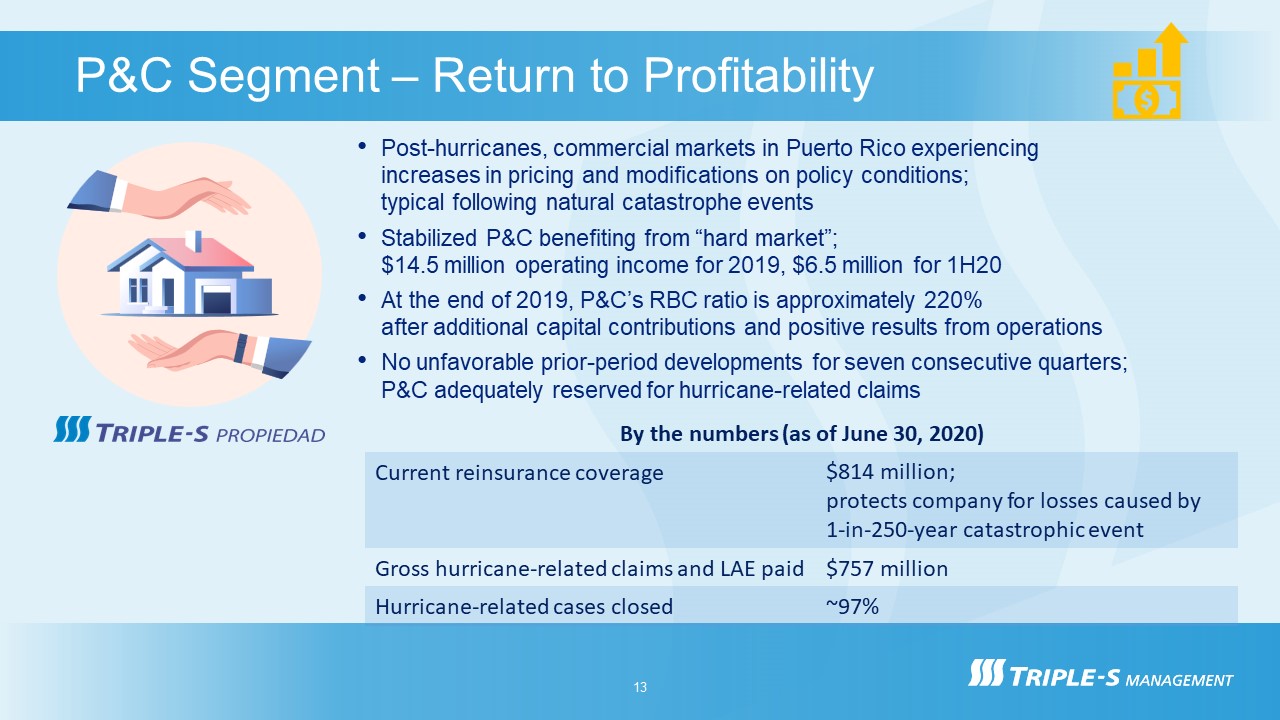

P&C Segment – Return to Profitability 13 Post-hurricanes, commercial markets in Puerto Rico

experiencing increases in pricing and modifications on policy conditions; typical following natural catastrophe eventsStabilized P&C benefiting from “hard market”; $14.5 million operating income for 2019, $6.5 million for 1H20At the end

of 2019, P&C’s RBC ratio is approximately 220% after additional capital contributions and positive results from operationsNo unfavorable prior-period developments for seven consecutive quarters; P&C adequately reserved for

hurricane-related claims By the numbers (as of June 30, 2020) Current reinsurance coverage $814 million; protects company for losses caused by 1-in-250-year catastrophic event Gross hurricane-related claims and LAE paid $757

million Hurricane-related cases closed ~97%

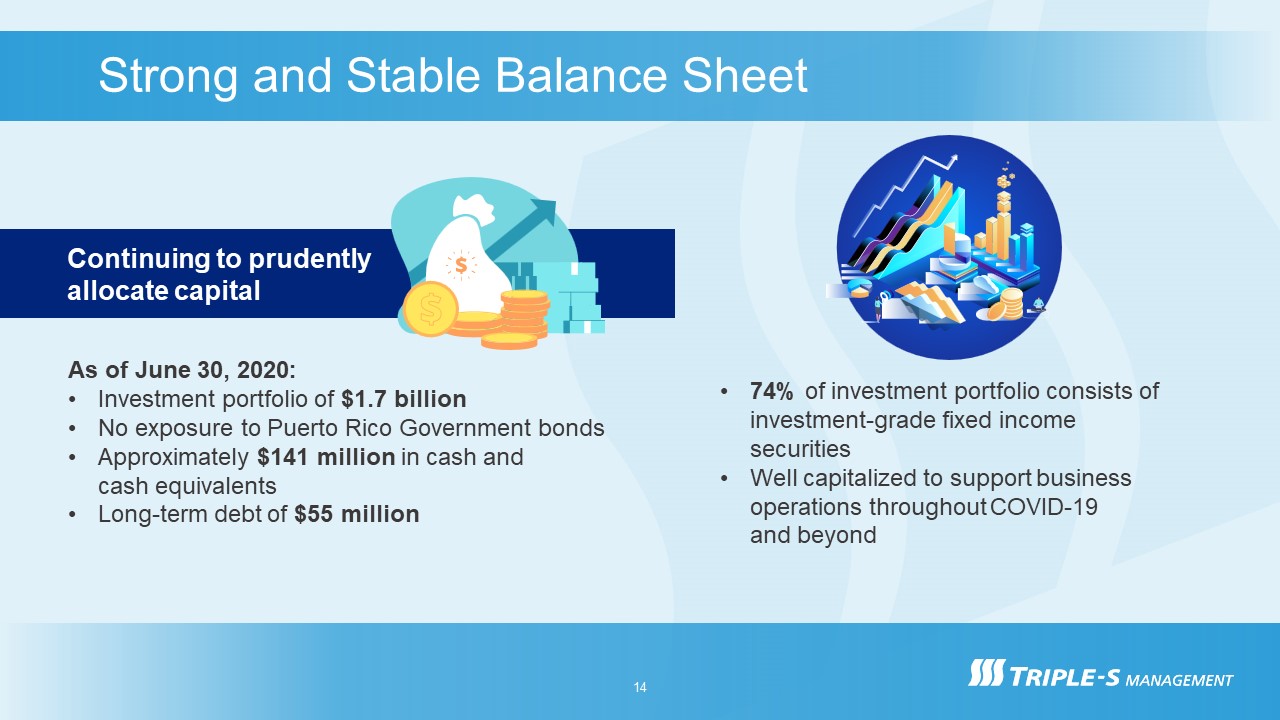

Continuing to prudently allocate capital 74% of investment portfolio consists of investment-grade

fixed income securitiesWell capitalized to support business operations throughout COVID-19 and beyond As of June 30, 2020:Investment portfolio of $1.7 billionNo exposure to Puerto Rico Government bondsApproximately $141 million in cash and

cash equivalentsLong-term debt of $55 million Strong and Stable Balance Sheet 14

Pivoting to Long Term Growth Creating long-term value by growing within Puerto Rico Expand

Medicare Advantage client base by focusing on best-in-class care coordination, clinical outcomes, enhanced benefits, and superior customer experienceContinue modernizing IT, integrating data and enhancing analytics to improve service, reduce

costs and create PHM capabilitiesSponsor the integration of healthcare delivery by:Building on our investments in IPA, ambulatory clinic network and urgent care facilitiesCreating team-based clinical programs for specific

populationsDeveloping high performing, value-based networks 15

Ultimate goal of providing members with seamless access to high-quality, affordable and holistic

careAlignment of clinical and financial outcomes around quality of care Providing Seamless Access to High Quality Care Integrated Delivery of Care –Long-Term Value Creation 16 Proposed new slide Focus Primary Care

relationships on value-based outcomes and cost managementDevelop High Performance Health Networks and Centers of ExcellenceRamp investments on connectivity and informatics to drive PHM and enhance care management performance Integrated

Healthcare and PHM Primary Care Select Specialty Care Prevention and SDOH Ancillary – Imaging, Lab Virtual Healthcare Pharmacy Services

Focused on keeping members engaged and satisfied to drive retention COVID-19: Supporting our

Community 17 Business continuity plan seamlessly activated85% of workforce remote with minimal interruptionEnabling members to pay premiums via mobile and electronic fund transfer Expanded nurse triage service and telehealth availability /

accessLaunched prescription drug home delivery serviceMembers able to interact and meet healthcare needs safely and remotely Triple-S Foundation addressing food insecurity and aiding seniorsOffering grace periods and deferrals for members

who are struggling financially

Strong balance sheet Well regulated market = strong barrier to entry Upgrading technology and

information systems to improve healthcare management and outcomes Management team with deep managed care expertise leveraging 60+ year experience and brand equity Well positioned to grow business as premier healthcare company in Puerto

Rico 18 Investment Highlights

Appendix

Consolidated Premiums Earned, net 20 ($ in millions)

Managed Care Premiums Earned, net 21 ($ in millions)

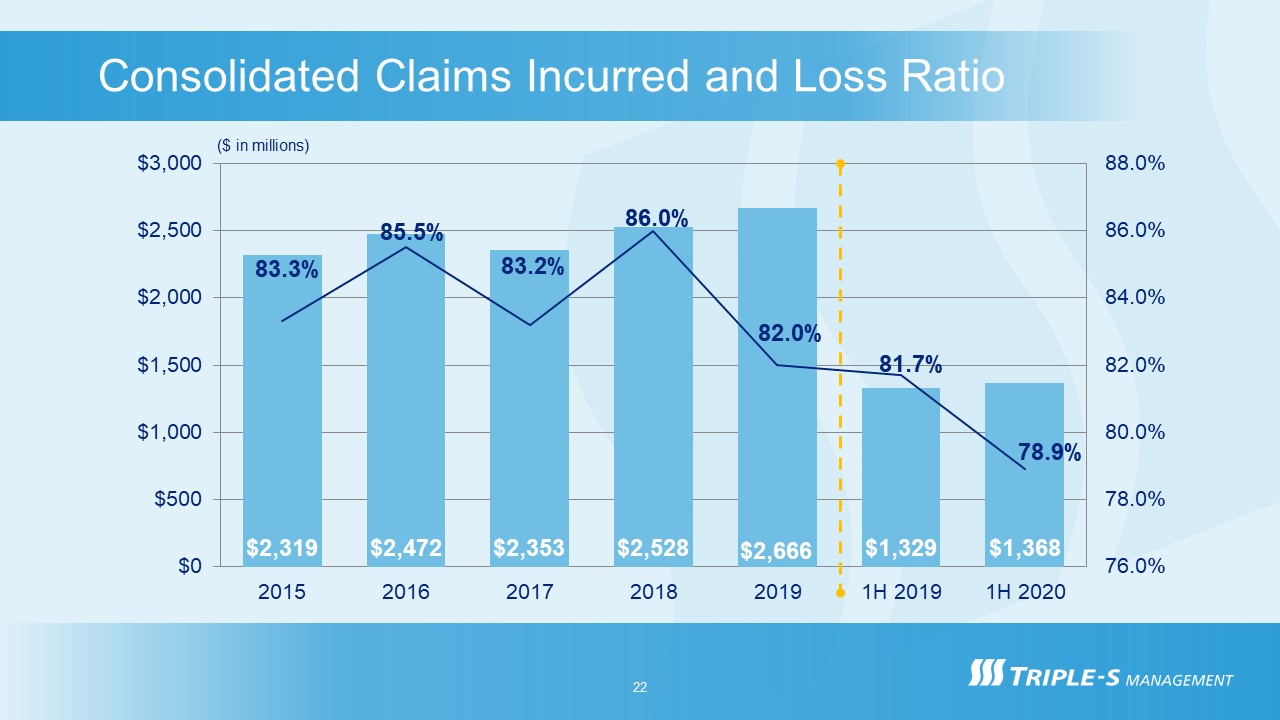

Consolidated Claims Incurred and Loss Ratio 22 ($ in millions)

Consolidated Operating Expenses and Expense Ratio 23 ($ in millions)