Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Chewy, Inc. | chwyq22020exhibit991.htm |

| 8-K - 8-K - Chewy, Inc. | chwyq220208-k.htm |

Q2 Fiscal 2020 September 10, 2020 LETTER TO SHAREHOLDERS

Our mission To be the most trusted and convenient online destination for pet parents (and partners) everywhere. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 2

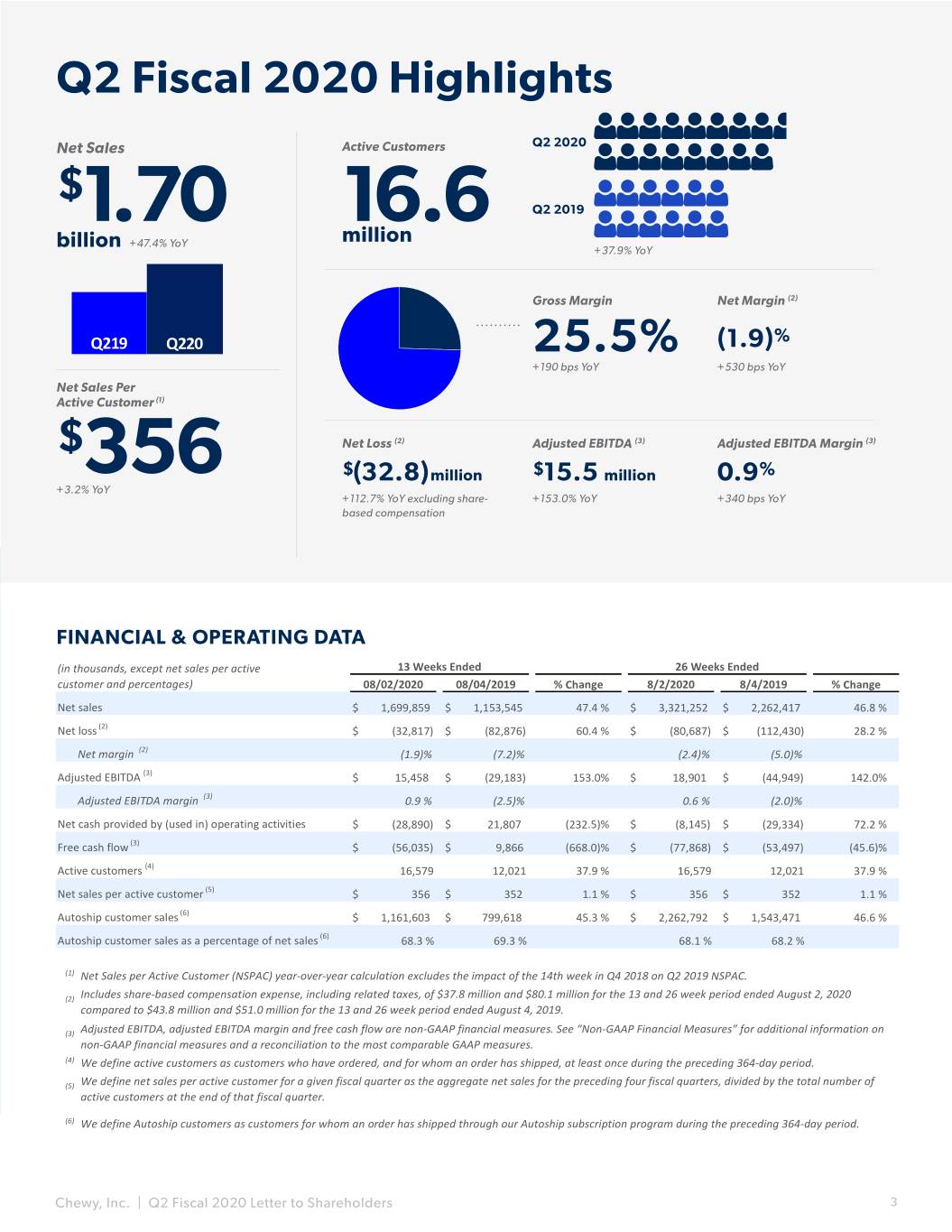

Q2 Fiscal 2020 Highlights Net Sales Active Customers Q2 2020 $ 1.70 16.6 Q2 2019 +47.4% YoY million billion +37.9% YoY Gross Margin Net Margin (2) % Q219 Q220 25.5% (1.9) +190 bps YoY +530 bps YoY Net Sales Per Active Customer (1) $ Net Loss (2) Adjusted EBITDA (3) Adjusted EBITDA Margin (3) 356 $(32.8)million $15.5 million 0.9% +3.2% YoY +112.7% YoY excluding share- +153.0% YoY +340 bps YoY based compensation FINANCIAL & OPERATING DATA (in thousands, except net sales per active 13 Weeks Ended 26 Weeks Ended customer and percentages) 08/02/2020 08/04/2019 % Change 8/2/2020 8/4/2019 % Change Net sales $ 1,699,859 $ 1,153,545 47.4 % $ 3,321,252 $ 2,262,417 46.8 % Net loss (2) $ (32,817) $ (82,876) 60.4 % $ (80,687) $ (112,430) 28.2 % Net margin (2) (1.9)% (7.2)% (2.4)% (5.0)% Adjusted EBITDA (3) $ 15,458 $ (29,183) 153.0% $ 18,901 $ (44,949) 142.0% Adjusted EBITDA margin (3) 0.9 % (2.5)% 0.6 % (2.0)% Net cash provided by (used in) operating activities $ (28,890) $ 21,807 (232.5)% $ (8,145) $ (29,334) 72.2 % Free cash flow (3) $ (56,035) $ 9,866 (668.0)% $ (77,868) $ (53,497) (45.6)% Active customers (4) 16,579 12,021 37.9 % 16,579 12,021 37.9 % Net sales per active customer (5) $ 356 $ 352 1.1 % $ 356 $ 352 1.1 % Autoship customer sales (6) $ 1,161,603 $ 799,618 45.3 % $ 2,262,792 $ 1,543,471 46.6 % Autoship customer sales as a percentage of net sales (6) 68.3 % 69.3 % 68.1 % 68.2 % (1) Net Sales per Active Customer (NSPAC) year-over-year calculation excludes the impact of the 14th week in Q4 2018 on Q2 2019 NSPAC. (2) Includes share-based compensation expense, including related taxes, of $37.8 million and $80.1 million for the 13 and 26 week period ended August 2, 2020 compared to $43.8 million and $51.0 million for the 13 and 26 week period ended August 4, 2019. (3) Adjusted EBITDA, adjusted EBITDA margin and free cash flow are non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures. (4) We define active customers as customers who have ordered, and for whom an order has shipped, at least once during the preceding 364-day period. (5) We define net sales per active customer for a given fiscal quarter as the aggregate net sales for the preceding four fiscal quarters, divided by the total number of active customers at the end of that fiscal quarter. (6) We define Autoship customers as customers for whom an order has shipped through our Autoship subscription program during the preceding 364-day period. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 3

Dear Shareholder, We are pleased to share our results for the second quarter ended August 2, 2020. Our 2020 momentum continued as we delivered net sales growth of over half a billion dollars, our net active customers reached new records, and we recorded a second consecutive quarter of positive adjusted EBITDA. Second-Quarter Financial Highlights: • Net sales reached $1.70 billion, an increase of 47.4 percent year-over-year • Gross margin improved 190 basis points year-over-year to 25.5 percent • Adjusted EBITDA was $15.5 million and our adjusted EBITDA margin improved 340 basis points to 0.9 percent Chewy’s mission is to be the most trusted and convenient online destination for pet parents (and partners) everywhere. We believe we are positively transforming the industry with a superior value proposition that keeps our customers at the center of everything we do, from our high-touch customer service, to our broad assortment of brands, to delivering on the core e-commerce tenets of speed and convenience. We are maniacally focused on providing a truly unique and personalized shopping experience that builds trust, brand loyalty, and drives repeat purchasing. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 4

Q2 Fiscal 2020 Business Highlights Another Quarter of Record Net Sales and New Customer Acquisition Chewy’s advantageous positioning in the pet industry’s race towards e-commerce, our culture of innovation, and our singular focus on customer experience resulted in another quarter of outperformance. We are proud of our teams, who continued to execute under difficult, pandemic-related circumstances, while again setting new records for both net sales growth and new customer additions, and producing our second consecutive quarter of positive adjusted EBITDA. As e-commerce undergoes meaningful changes, multi-year growth curves have been compressed into timeframes measured in quarters, if not months. Over the past few years, we have invested in technology, new businesses, fulfillment capacity, and in building an extraordinary team. This has prepared us to quickly adapt to the acceleration of our own growth curve. This preparation, agility and business athleticism enabled us to provide top-notch service to the growing millions of pet-owning households in the U.S. who depend on Chewy. We built Chewy by putting the customer at the center of everything we do. In a world of uncertainty, qualities like trust, convenience and customer service really matter, especially when it comes to caring for our family and loved ones, whether they’re people, pets, or both. We have taken these millions of customer relationships and built a large base of repeat business that enables our rapid scaling and fuels our profitability on an accelerated timetable. As empowering as all of this is, we are just getting started. 2020 is shaping up to be a transformational year for Chewy. Industry data provider Packaged Facts predicts that online pet product sales in the US will increase by $3.9 billion dollars this year, with online sales gaining five points of market share year-over-year to reach 27 percent of all pet product sales. Against that backdrop, the midpoint of our 2020 guidance has us growing our revenue by approximately $2.0 billion year-over-year. In doing so, we would capture over half of the total forecasted growth of online pet product sales this year. The Chewy team continues to execute against our strategic plan, and we have never been more steadfast in our mission of being the most trusted and convenient destination for pet parents (and partners) everywhere. We are proud that – despite all of the challenges our team members have faced on the job and in their personal lives – they remained focused on taking care of our customers and the pets who depend on them. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 5

Newest Customers Cohorts Continue to Outperform We continue to monitor the behavior of the post-COVID customer cohorts we acquired in the first and second quarter for any notable variances against our more mature pre-COVID customer cohorts and are encouraged to observe a high degree of consistency in customer behavior between the two. The first- quarter cohorts remained positively engaged and the initial engagement levels of the second-quarter cohorts matched their first-quarter peers. Overall customer acquisition rates remain above pre-pandemic levels, and other metrics such as basket sizes, re-order rates, and Autoship sign-up remain healthy and stable. We remain encouraged by these trends. The active customers we added in the first half of 2020 surpassed the active customers we added in all of 2019. These new cohorts are large, and given their initial engagement, they represent a potentially significant source of future revenue and profit. As was the case with their predecessors, we expect their NSPAC to increase over time, reaching approximately $500 per year by year two and over $700 per year by year five. An exciting new development with the newer cohorts is that, unlike their predecessors, who primarily purchased food and essentials, we now have the ability to expose our newest cohorts to a larger variety of purchase options earlier in their customer life-cycle. These include prescriptions, a wide variety of hardgoods options fueled by our expansion of private label offerings, and gift cards. These expanded offerings allow us to serve the customer more fully after their initial purchase and expedite the capturing of a greater share of their wallet. This in turn allows us to increase their lifetime value (LTV) above historical ranges. This focus on new businesses and product innovation is critical to our long-term success as each has been on the strategic roadmap that we’ve shared with our shareholders and investors since our IPO. It is also what will continue to amplify Chewy’s growth and profitability flywheel as we look forward. Expanding Our Distribution Network To Meet The Needs of A Growing Business Another important contributor to our ability to serve millions of customers is our dedicated fulfillment network, which continues to expand to meet the needs of our growing business. Our next fulfillment center launch will be the Archibald, Pennsylvania facility, which begins shipping orders by mid-October. Archibald will be our tenth fulfillment center overall, and our first automated facility. In addition to Archibald and our North Carolina fulfillment center, which were our planned fulfillment center launches for 2020, we expanded our network with the opening of a new limited catalog fulfillment center in Kansas City in early September. The incremental capacity added by Kansas City provides us the flexibility to effectively load balance across our other fulfillment centers and gives us available buffer capacity as we head into the busy second half of 2020. This new fulfillment center is a capital-light, high-velocity operation focused on fast fulfillment during peak demand periods. This facility was not part of our original network plan for 2020 and demonstrates our ability to improvise and adapt quickly to changing conditions in order to maintain business continuity and protect customer experience. Looking a little farther out, we also announced that we will be adding a second automated fulfillment center to our network in mid-2021. This one will also be located in Kansas City. This second center will give us option value as we scale operations in the Kansas City area from 2020 into 2021. By the end of 2020, our fulfillment network will consist of eleven centers with over 7 million square feet, plus three pharmacy-focused fulfillment centers. We believe this makes us one of the largest dedicated e-commerce fulfillment networks in the U.S. and is certainly unparalleled in the dedicated pet space. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 6

Q2 Fiscal 2020 Financial Highlights Chewy maintained strong momentum throughout the second quarter of 2020. We grew net sales 47.4 percent, expanded gross margin 190 basis points, added a record 1.6 million net active customers and generated the highest adjusted EBITDA in the company’s history. Net Sales ($Millions) $1,700 $1,621 Second-quarter net sales were $1.70 billion, reflecting 47.4 percent year-over-year growth. The key revenue $1,355 $1,230 drivers in the quarter were a 37.9 percent year-over- $1,154 year increase in active customers and a 3.2 percent increase in net sales per active customer, to $356, excluding the impact of the extra week in the fourth quarter of 2018. Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Autoship Customer Sales ($Millions) Second-quarter Autoship customer sales were $1.16 $1,162 billion, a year-over-year increase of 45.3 percent and $1,101 they surpassed $1 billion for the second quarter in a row. We define Autoship customers as customers for $954 whom an order has shipped through our Autoship $865 subscription program during the preceding 364- $800 day period. Autoship provides pet parents with convenient and flexible automatic reordering and delivery that makes meeting their recurring needs even easier. Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Gross Margin 25.5% Gross margin expanded 190 basis points to 25.5 23.6% 23.6% percent in the second quarter of 2020 compared to 23.6 percent in the second quarter of 2019, benefiting from a favorable mix of hardgoods and strong 20.2% contributions from private label and healthcare, 17.5% which together drove almost three-quarters of the year-over-year improvement. FY'17 FY'18 FY'19 Q2'19 Q2'20 NOTE: Gross Margin is defined as Gross Profit divided by Net Sales. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 7

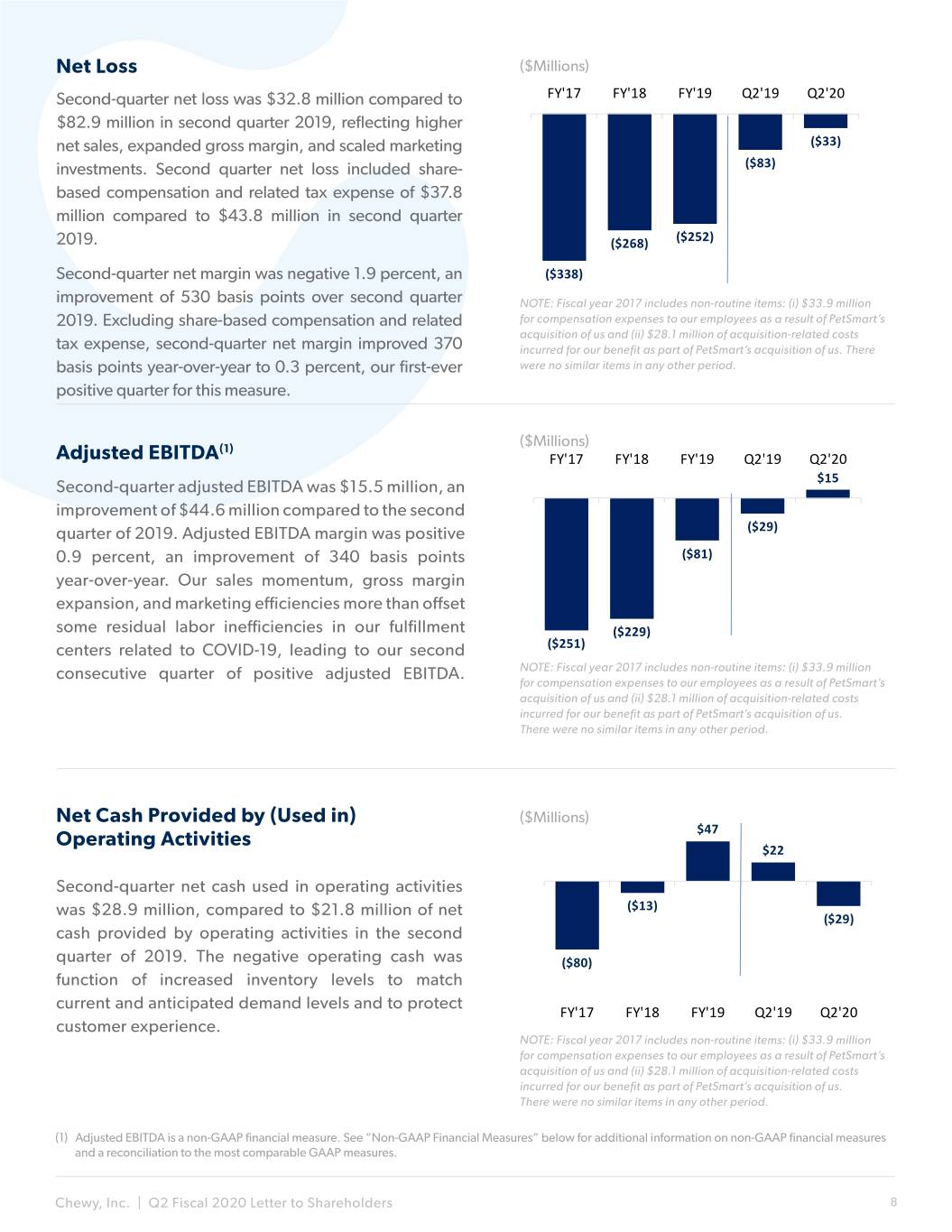

Net Loss ($Millions) Second-quarter net loss was $32.8 million compared to FY'17 FY'18 FY'19 Q2'19 Q2'20 $82.9 million in second quarter 2019, reflecting higher net sales, expanded gross margin, and scaled marketing ($33) investments. Second quarter net loss included share- ($83) based compensation and related tax expense of $37.8 million compared to $43.8 million in second quarter 2019. ($268) ($252) Second-quarter net margin was negative 1.9 percent, an ($338) improvement of 530 basis points over second quarter NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million 2019. Excluding share-based compensation and related for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs tax expense, second-quarter net margin improved 370 incurred for our benefit as part of PetSmart’s acquisition of us. There basis points year-over-year to 0.3 percent, our first-ever were no similar items in any other period. positive quarter for this measure. (1) ($Millions) Adjusted EBITDA FY'17 FY'18 FY'19 Q2'19 Q2'20 Second-quarter adjusted EBITDA was $15.5 million, an $15 improvement of $44.6 million compared to the second quarter of 2019. Adjusted EBITDA margin was positive ($29) 0.9 percent, an improvement of 340 basis points ($81) year-over-year. Our sales momentum, gross margin expansion, and marketing efficiencies more than offset some residual labor inefficiencies in our fulfillment ($229) centers related to COVID-19, leading to our second ($251) consecutive quarter of positive adjusted EBITDA. NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. Net Cash Provided by (Used in) ($Millions) Operating Activities $47 $22 Second-quarter net cash used in operating activities was $28.9 million, compared to $21.8 million of net ($13) ($29) cash provided by operating activities in the second quarter of 2019. The negative operating cash was ($80) function of increased inventory levels to match current and anticipated demand levels and to protect FY'17 FY'18 FY'19 Q2'19 Q2'20 customer experience. NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. (1) Adjusted EBITDA is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 8

Free Cash Flow(1) ($Millions) Second-quarter free cash flow was negative $56.0 FY'17 FY'18 FY'19 Q2'19 Q2'20 million compared to positive $9.9 million in the $10 second quarter of 2019. The components of second- quarter negative free cash flow were $28.9 million of ($2) cash used in operating activities and $27.1 million of capital investments. Our capital investments continue ($58) ($56) to be focused on building our distribution capacity, including our new fulfillment center in Archibald, PA that is scheduled to open in September 2020. ($120) NOTE: Fiscal year 2017 includes non-routine items: (i) $33.9 million for compensation expenses to our employees as a result of PetSmart’s acquisition of us and (ii) $28.1 million of acquisition-related costs incurred for our benefit as part of PetSmart’s acquisition of us. There were no similar items in any other period. (1) Free cash flow is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures Closing We will host a conference call and earnings webcast at 5:00 pm Eastern time today to discuss these results. Investors and participants can access the call by dialing (866) 270-1533 in the U.S. or (412) 317-0797 internationally, using the conference code 10147475. A live webcast will also be available on Chewy’s investor relations website at investor.chewy.com. Thank you for taking the time to review our letter, and we look forward to your questions on our call this afternoon. Sincerely, Sumit Singh, CEO Mario Marte, CFO Investor Contact: Media Contact: Robert A. LaFleur Diane Pelkey ir@chewy.com dpelkey@chewy.com Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 9

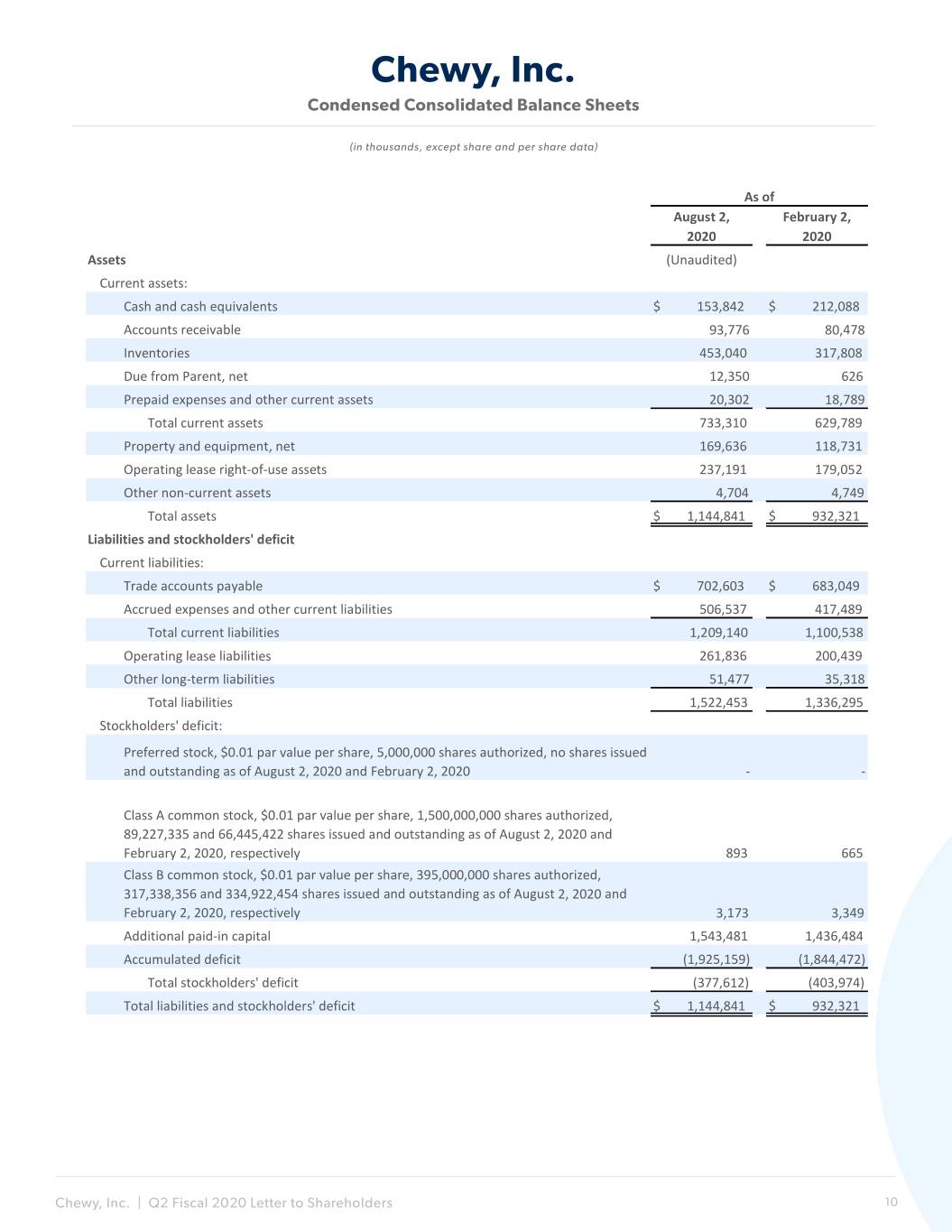

Chewy, Inc. Condensed Consolidated Balance Sheets (in thousands, except share and per share data) As of August 2, February 2, 2020 2020 Assets (Unaudited) Current assets: Cash and cash equivalents $ 153,842 $ 212,088 Accounts receivable 93,776 80,478 Inventories 453,040 317,808 Due from Parent, net 12,350 626 Prepaid expenses and other current assets 20,302 18,789 Total current assets 733,310 629,789 Property and equipment, net 169,636 118,731 Operating lease right-of-use assets 237,191 179,052 Other non-current assets 4,704 4,749 Total assets $ 1,144,841 $ 932,321 Liabilities and stockholders' deficit Current liabilities: Trade accounts payable $ 702,603 $ 683,049 Accrued expenses and other current liabilities 506,537 417,489 Total current liabilities 1,209,140 1,100,538 Operating lease liabilities 261,836 200,439 Other long-term liabilities 51,477 35,318 Total liabilities 1,522,453 1,336,295 Stockholders' deficit: Preferred stock, $0.01 par value per share, 5,000,000 shares authorized, no shares issued and outstanding as of August 2, 2020 and February 2, 2020 - - Class A common stock, $0.01 par value per share, 1,500,000,000 shares authorized, 89,227,335 and 66,445,422 shares issued and outstanding as of August 2, 2020 and February 2, 2020, respectively 893 665 Class B common stock, $0.01 par value per share, 395,000,000 shares authorized, 317,338,356 and 334,922,454 shares issued and outstanding as of August 2, 2020 and February 2, 2020, respectively 3,173 3,349 Additional paid-in capital 1,543,481 1,436,484 Accumulated deficit (1,925,159) (1,844,472) Total stockholders' deficit (377,612) (403,974) Total liabilities and stockholders' deficit $ 1,144,841 $ 932,321 Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 10

Chewy, Inc. Condensed Consolidated Statements of Operations (in thousands, except per share data. Unaudited) 13 Weeks Ended 26 Weeks Ended August 2, 2020 August 4, 2019 August 2, 2020 August 4, 2019 Net sales $ 1,699,859 $ 1,153,545 $ 3,321,252 $ 2,262,417 Cost of goods sold 1,266,503 881,310 2,509,187 1,736,292 Gross profit 433,356 272,235 812,065 526,125 Operating expenses: Selling, general and administrative 343,181 244,563 663,238 426,460 Advertising and marketing 122,446 110,752 228,584 213,015 Total operating expenses 465,627 355,315 891,822 639,475 Loss from operations (32,271) (83,080) (79,757) (113,350) Interest (expense) income, net (546) 204 (930) 920 Loss before income tax provision (32,817) (82,876) (80,687) (112,430) Income tax provision - - - - Net loss $ (32,817) $ (82,876) $ (80,687) $ (112,430) Net loss per share attributable to common Class A and Class B stockholders, basic and diluted $ (0.08) $ (0.21) $ (0.20) $ (0.28) Weighted average common shares used in computing net loss per share attributable to common Class A and Class B stockholders, basic and diluted 404,377 397,387 402,891 395,193 Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 11

Chewy, Inc. Condensed Consolidated Statements of Cash Flows (in thousands, Unaudited) 26 Weeks Ended August 2, 2020 August 4, 2019 Cash flows from operating activities Net loss $ (80,687) $ (112,430) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 15,336 14,579 Share-based compensation expense 75,380 51,013 Non-cash lease expense 11,082 8,964 Other 216 2,002 Net change in operating assets and liabilities: Accounts receivable (13,298) (11,257) Inventories (135,232) (67,300) Prepaid expenses and other current assets (2,010) (20,439) Other non-current assets (99) (2,002) Trade accounts payable 19,554 54,027 Accrued expenses and other current liabilities 92,650 55,536 Operating lease liabilities (7,196) (3,488) Other long-term liabilities 16,159 1,461 Net cash used in operating activities (8,145) (29,334) Cash flows from investing activities Capital expenditures (69,723) (24,163) Cash advances provided to Parent, net of reimbursements (3,918) 1,018 Net cash used in investing activities (73,641) (23,145) Cash flows from financing activities Proceeds from tax sharing agreement with Parent 23,213 - Proceeds from initial public offering, net of underwriting discounts, commissions and - 115,228 offering costs Payment of debt issuance costs - (781) Contribution from Parent 650 650 Principal repayments of finance lease obligations (323) (105) Net cash provided by financing activities 23,540 114,992 Net (decrease) increase in cash and cash equivalents (58,246) 62,513 Cash and cash equivalents, as of beginning of period 212,088 88,331 Cash and cash equivalents, as of end of period $ 153,842 $ 150,844 Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 12

Non-GAAP Financial Measures Adjusted EBITDA and Adjusted EBITDA Margin To provide investors with additional information regarding our financial results, we disclose adjusted EBITDA, a non-GAAP financial measure that we calculate as net loss excluding depreciation and amortization; share-based compensation expense and related taxes; income tax provision; interest income (expense), net management fee expense; transaction and other costs. We have provided a reconciliation below of adjusted EBITDA to net loss, the most directly comparable GAAP financial measure. We include adjusted EBITDA because it is a key measure used by our management and board of directors to evaluate our operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the exclusion of certain expenses in calculating adjusted EBITDA facilitates operating performance comparability across reporting periods by removing the effect of non-cash expenses and certain variable charges. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. We believe it is useful to exclude non-cash charges, such as depreciation and amortization, share-based compensation expense and management fee expense from our adjusted EBITDA because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations. We believe it is useful to exclude income tax provision; interest income (expense), net; and transaction and other costs as these items are not components of our core business operations. Adjusted EBITDA has limitations as a financial measure, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future and adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures; • adjusted EBITDA does not reflect share-based compensation and related taxes. Share-based compensation has been, and will continue to be for the foreseeable future, a recurring expense in our business and an important part of our compensation strategy; • adjusted EBITDA does not reflect interest income (expense), net; or changes in, or cash requirements for, our working capital; • adjusted EBITDA does not reflect transaction and other costs which are generally incremental costs that result from an actual or planned transaction and include transaction costs (i.e. IPO costs), integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems; and • other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider adjusted EBITDA and adjusted EBITDA margin alongside other financial performance measures, including various cash flow metrics, net loss, net margin, and our other GAAP results. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 13

The following table presents a reconciliation of net loss to adjusted EBITDA for each of the periods indicated. ($ in thousands, except percentages) 13 Weeks Ended 26 Weeks Ended Reconciliation of Net Loss to Adjusted EBITDA August 2, 2020 August 4, 2019 August 2, 2020 August 4, 2019 Net loss $ (32,817) $ (82,876) $ (80,687) $ (112,430) Add (deduct): Depreciation and amortization 8,083 7,630 15,336 14,579 Share-based compensation expense and related taxes 37,797 43,783 80,138 51,013 Interest expense (income), net 546 (204) 930 (920) Management fee expense(1) 325 325 650 650 Transaction related costs - 1,396 - 1,396 Other 1,524 763 2,534 763 Adjusted EBITDA $ 15,458 $ (29,183) $ 18,901 $ (44,949) Net sales $ 1,699,859 $ 1,153,545 $ 3,321,252 0 $ 2,262,417 Net margin (1.9)% (7.2)% (2.4)% (5.0)% Adjusted EBITDA margin 0.9 % (2.5)% 0.6 % (2.0)% (1) Management fee expense allocated to us by PetSmart for organizational oversight and certain limited corporate functions provided by its sponsors. Although we are not a party to the agreement governing the management fee, this management fee is reflected as an expense in our condensed consolidated financial statements. We define net margin as net loss divided by net sales and adjusted EBITDA margin as adjusted EBITDA divided by net sales. Free Cash Flow To provide investors with additional information regarding our financial results, we also disclose free cash flow, a non-GAAP financial measure that we calculate as net cash provided by (used in) operating activities less capital expenditures (which consist of purchases of property and equipment, including servers and networking equip- ment, capitalization of labor related to our website, mobile applications, and software development, and lease- hold improvements). We have provided a reconciliation below of free cash flow to net cash provided by (used in) operating activities, the most directly comparable GAAP financial measure. We include free cash flow because it is an important indicator of our liquidity as it measures the amount of cash we generate. Accordingly, we believe that free cash flow provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. Free cash flow has limitations as a financial measure, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. There are limitations to using non-GAAP financial measures, including that other companies, including companies in our industry, may calculate free cash flow differently. Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash provided by (used in) operating activities, capital expenditures and our other GAAP results. The following table presents a reconciliation of net cash provided by (used in) operating activities to free cash flow for each of the periods indicated. ($ in thousands) 13 Weeks Ended 26 Weeks Ended Reconciliation of Net Cash Provided by (Used in) Operating Activities to Free Cash Flow August 2, 2020 August 4, 2019 August 2, 2020 August 4, 2019 Net cash provided by (used in) operating activities $ (28,890) $ 21,807 $ (8,145) $ (29,334) Deduct: Capital expenditures (27,145) (11,941) (69,723) (24,163) Free Cash Flow $ (56,035) $ 9,866 $ (77,868) $ (53,497) Free cash flow may be affected in the near to medium term by the timing of capital investments (such as the launch of new fulfillment centers, customer service centers, and corporate offices and purchases of IT and other equipment), fluctuations in our growth and the effect of such fluctuations on working capital, and changes in our cash conversion cycle due to increases or decreases of vendor payment terms as well as inventory turnover. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 14

Guidance As we enter the back half of 2020, we have good visibility on a sizable share of our future sales due to the recurring nature of our Autoship program. At the same time, we acknowledge that opportunities and risks exist side-by-side in today’s unique operating environment, and we are prepared to capitalize on opportunities and mitigate risks as and when they arise. Our outlook for the third fiscal quarter, which ends November 1, 2020, and full-year fiscal 2020, which ends January 31, 2021 is as follows: Fiscal Third Quarter 2020 Guidance Net Sales $1.70 billion - $1.72 billion 38% to 40% year-over-year growth Fiscal Year 2020 Guidance Net Sales $6.775 billion - $6.825 billion 40% to 41% year-over-year growth Adjusted EBITDA Approximately breakeven for the year ±30 basis points Margin (1) (1) Adjusted EBITDA and adjusted EBITDA Margin are a non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures. It is important to note that the situation surrounding the COVID-19 outbreak remains unpredictable and significant risks still remain. See the section titled “Forward-Looking Statements” and the “Risk Factors” included in our periodic filings with the Securities and Exchange Commission. We have not reconciled our adjusted EBITDA outlook to GAAP net income (loss) because we do not provide an outlook for GAAP net income (loss) due to the uncertainty and potential variability of other income, net, and provision for (benefit from) income taxes, which are reconciling items between adjusted EBITDA and GAAP net income (loss). Because such items cannot be reasonably predicted, we are unable to provide a reconciliation of the non-GAAP financial measure outlook to the corresponding GAAP measure. However, such items could have a significant impact on GAAP net income (loss). Market, Ranking and Other Industry Data In this communication we refer to information regarding market data obtained from internal sources, market research, publicly available information, and industry publications. Estimates are inherently uncertain, involve risks and uncertainties, and are subject to change based on various factors, including those discussed in the section titled “Forward-Looking Statements” and the “Risk Factors” included in our periodic filings with the Securities and Exchange Commission. We believe that these sources and estimates are reliable as of the date of this communication but have not independently verified them and cannot guarantee their accuracy or completeness. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 15

Forward-Looking Statements This communication contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this communication, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning our ability to successfully manage risks relating to the spread of COVID-19, including any adverse impacts on our supply chain, workforce, facilities and operations; sustain our recent growth rates and manage our growth effectively; acquire new customers in a cost-effective manner and increase our net sales per active customer; accurately predict economic conditions and their impact on consumer spending patterns, particularly in the pet products market, and accurately forecast net sales and appropriately plan our expenses in the future; introduce new products or offerings and improve existing products; successfully compete in the pet products and services retail industry, especially in the e-commerce sector; source additional, or strengthen our existing relationships with, suppliers; negotiate acceptable pricing and other terms with third-party service providers, suppliers and outsourcing partners and maintain our relationships with such entities; optimize, operate and manage the expansion of the capacity of our fulfillment centers; provide our customers with a cost-effective platform that is able to respond and adapt to rapid changes in technology; maintain adequate cybersecurity with respect to our systems and ensure that our third-party service providers do the same with respect to their systems; successfully manufacture and sell our own private brand products; maintain consumer confidence in the safety and quality of our vendor-supplied and private brand food products and hardgood products; comply with existing or future laws and regulations in a cost-efficient manner; attract, develop, motivate and retain well- qualified employees; and adequately protect our intellectual property rights and successfully defend ourselves against any intellectual property infringement claims or other allegations that we may be subject to. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this communication primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in our filings with the Securities and Exchange Commission and elsewhere in this communication. Moreover, we operate in a very competitive and rapidly-changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this communication. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this communication. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this communication to reflect events or circumstances after the date of this communication or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments. Chewy, Inc. | Q2 Fiscal 2020 Letter to Shareholders 16