Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TALOS ENERGY INC. | d89983dex991.htm |

| 8-K - 8-K - TALOS ENERGY INC. | d89983d8k.htm |

Exhibit 99.2 Barclays CEO Energy- Power Conference September 2020Exhibit 99.2 Barclays CEO Energy- Power Conference September 2020

Cautionary Statements Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements” for purposes of the federal securities laws. All statements, other than statements of historical fact included in this presentation, regarding our strategy, future operations, financial position, estimated capital expenditures, production, revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability of drilling and production equipment and services, environmental risks, COVID-19 impacts, failure to find, acquire or gain access to other discoveries and prospects or to successfully develop and produce from our current discoveries and prospects, geologic risk, drilling and other operating risks, well control risk, regulatory changes, the uncertainty inherent in estimating reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, risks related to the integration of recently acquired assets, including the possibility the possibility that the anticipated benefits of the acquisitions are not realized when expected or at all, as well as other factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019 and other filings with the Securities and Exchange Commission (“SEC”). Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All forward-looking statements speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, to reflect events or circumstances after the date of this presentation. Reserve Information Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions upward or downward of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. In addition, we use the terms gross and net resource potential in this presentation, neither of which is a measure of reserves prepared in accordance with SEC guidelines or permitted to be included in SEC filings. These resource estimates are inherently more uncertain than estimates of reserves prepared in accordance with SEC guidelines. Use of Non-GAAP Financial Measures This presentation includes the use of certain measures that have not been calculated in accordance with generally acceptable accounting principles (GAAP), including EBITDA, Free Cash Flow and PV-10. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. With respect to Free Cash Flow of recently acquired assets, the figures shown in this presentation were calculated as total revenues less direct operating expenditures and total revenues less direct operating and capital expenditures, respectively. Although we expect incremental general and administrative (“G&A”) expenses associated with the recently acquired assets to be relatively low, Free Cash Flow for the recently acquired assets does not account for any such G&A expenses related to the recently acquired assets or other operating expenses that we include, and that other companies generally include, in our and their respective calculations of EBITDA and Free Cash Flow and comparable financial measures. We anticipate that our ownership and operation of the recently acquired assets will necessitate the incurrence of incremental G&A expense that is not reflected in Free Cash Flow metrics presented herein with respect to the recently acquired assets. Accordingly, the Free Cash Flow metrics presented herein with respect to the recently acquired assets should not be considered on the same basis as our EBITDA and Free Cash Flow metrics and those of other companies within our industry, and should not be considered as alternatives to, or more meaningful than, financial measures determined in accordance with GAAP or as indicators of operating performance. Use of Projections This presentation contains projections including with respect to Free Cash Flow and year-end exit rate production volumes. Our independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being indicative of future results. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of our future performance after completion of the transaction or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. Industry and Market Data; Trademarks and Trade Names This presentation has been prepared by us and includes market data and other statistical information from sources we believe to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the independent sources described above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 2Cautionary Statements Cautionary Statement Regarding Forward-Looking Statements This presentation contains “forward-looking statements” for purposes of the federal securities laws. All statements, other than statements of historical fact included in this presentation, regarding our strategy, future operations, financial position, estimated capital expenditures, production, revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond our control. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability of drilling and production equipment and services, environmental risks, COVID-19 impacts, failure to find, acquire or gain access to other discoveries and prospects or to successfully develop and produce from our current discoveries and prospects, geologic risk, drilling and other operating risks, well control risk, regulatory changes, the uncertainty inherent in estimating reserves and in projecting future rates of production, cash flow and access to capital, the timing of development expenditures, risks related to the integration of recently acquired assets, including the possibility the possibility that the anticipated benefits of the acquisitions are not realized when expected or at all, as well as other factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019 and other filings with the Securities and Exchange Commission (“SEC”). Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. All forward-looking statements, expressed or implied, are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All forward-looking statements speak only as of the date hereof. Except as otherwise required by applicable law, we disclaim any duty to update any forward-looking statements, to reflect events or circumstances after the date of this presentation. Reserve Information Reserve engineering is a process of estimating underground accumulations of oil, natural gas and NGLs that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data, the interpretation of such data and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing and production activities may justify revisions upward or downward of estimates that were made previously. If significant, such revisions would change the schedule of any further production and development drilling. Accordingly, reserve estimates may differ significantly from the quantities of oil, natural gas and NGLs that are ultimately recovered. In addition, we use the terms gross and net resource potential in this presentation, neither of which is a measure of reserves prepared in accordance with SEC guidelines or permitted to be included in SEC filings. These resource estimates are inherently more uncertain than estimates of reserves prepared in accordance with SEC guidelines. Use of Non-GAAP Financial Measures This presentation includes the use of certain measures that have not been calculated in accordance with generally acceptable accounting principles (GAAP), including EBITDA, Free Cash Flow and PV-10. Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. With respect to Free Cash Flow of recently acquired assets, the figures shown in this presentation were calculated as total revenues less direct operating expenditures and total revenues less direct operating and capital expenditures, respectively. Although we expect incremental general and administrative (“G&A”) expenses associated with the recently acquired assets to be relatively low, Free Cash Flow for the recently acquired assets does not account for any such G&A expenses related to the recently acquired assets or other operating expenses that we include, and that other companies generally include, in our and their respective calculations of EBITDA and Free Cash Flow and comparable financial measures. We anticipate that our ownership and operation of the recently acquired assets will necessitate the incurrence of incremental G&A expense that is not reflected in Free Cash Flow metrics presented herein with respect to the recently acquired assets. Accordingly, the Free Cash Flow metrics presented herein with respect to the recently acquired assets should not be considered on the same basis as our EBITDA and Free Cash Flow metrics and those of other companies within our industry, and should not be considered as alternatives to, or more meaningful than, financial measures determined in accordance with GAAP or as indicators of operating performance. Use of Projections This presentation contains projections including with respect to Free Cash Flow and year-end exit rate production volumes. Our independent auditors have not audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, have not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being indicative of future results. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if our assumptions and estimates are correct, projections are inherently uncertain due to a number of factors outside our control. Accordingly, there can be no assurance that the projected results are indicative of our future performance after completion of the transaction or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person that the results contained in the projected information will be achieved. Industry and Market Data; Trademarks and Trade Names This presentation has been prepared by us and includes market data and other statistical information from sources we believe to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on our good faith estimates, which are derived from our review of internal sources as well as the independent sources described above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness. We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our businesses. This presentation also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with us or an endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. 2

Talos Energy at a Glance Attractive Operating Profile § 71-73 MBoe/d December 2020E Exit Rate Talos Blocks § ~70% Operated § ~70% Liquids Mississippi § ~70% Deepwater Canyon § Consistently generate free cash flow with high margins and a leading cost profile Green Canyon Strong Credit Offshore Mexico Gulf of Mexico § <1.5x Leverage (Net Debt / LTM EBITDA) Shelf Block 7 Zama § >$400 MM in liquidity Block 31 § Significant asset coverage of ~2.9x Proved PV-10 / Net Debt § Active and robust hedging program Positioned for Growth § Advancing world-class Zama discovery in offshore Mexico PDP 28% 30% 30% 35% Oil § Inventory of >130 prospects with >1.2 BN Boe (Net Potential) 71-73 269 269 PDNP Deepwater NGL MBoe/d MMBoe MMBoe § >1.5 MM gross acres for exploration (~20% State / 80% Federal) Shelf PUD Gas Net 2P Net 2P Net 6% 66% 70% Probable§ Globally transferrable conventional G&G, offshore operations 17% 19% skill sets Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl and $2.07 per MMBtu in perpetuity. Reserves figures based on internal management estimates and were not reviewed by an independent third party reserve engineer. Credit metrics calculated using June 30, 2020 debt and cash figures and Credit Facility LTM EBITDA. Production 3 figures based on December 2020E average daily production rate assuming no material unplanned downtime. Net resource potential is not a measure of reserves prepared in accordance with SEC guidelines.Talos Energy at a Glance Attractive Operating Profile § 71-73 MBoe/d December 2020E Exit Rate Talos Blocks § ~70% Operated § ~70% Liquids Mississippi § ~70% Deepwater Canyon § Consistently generate free cash flow with high margins and a leading cost profile Green Canyon Strong Credit Offshore Mexico Gulf of Mexico § <1.5x Leverage (Net Debt / LTM EBITDA) Shelf Block 7 Zama § >$400 MM in liquidity Block 31 § Significant asset coverage of ~2.9x Proved PV-10 / Net Debt § Active and robust hedging program Positioned for Growth § Advancing world-class Zama discovery in offshore Mexico PDP 28% 30% 30% 35% Oil § Inventory of >130 prospects with >1.2 BN Boe (Net Potential) 71-73 269 269 PDNP Deepwater NGL MBoe/d MMBoe MMBoe § >1.5 MM gross acres for exploration (~20% State / 80% Federal) Shelf PUD Gas Net 2P Net 2P Net 6% 66% 70% Probable§ Globally transferrable conventional G&G, offshore operations 17% 19% skill sets Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl and $2.07 per MMBtu in perpetuity. Reserves figures based on internal management estimates and were not reviewed by an independent third party reserve engineer. Credit metrics calculated using June 30, 2020 debt and cash figures and Credit Facility LTM EBITDA. Production 3 figures based on December 2020E average daily production rate assuming no material unplanned downtime. Net resource potential is not a measure of reserves prepared in accordance with SEC guidelines.

Gulf of Mexico Basin Contributions 2019 Jobs Impact of the Gulf of Mexico Oil and Gas Industry > 2 MILLION BOE/D PRODUCTION >340K JOBS ACROSS NATIONWIDE SUPPLY CHAIN >$28 BILLION U.S. GDP IMPACT >$5 BILLION (1) GOVERNMENT REVENUES 147,000 94,000 20,000 28,000 Jobs Supported Jobs Supported Jobs Supported Jobs Supported [Outer Continental Shelf] activity not only Texas Louisiana Mississippi Alabama “ supports our nation’s energy security, it also promotes economic stability and growth though the contributions of offshore operators who pay Western Central production royalties, annual rentals, bonus bids Planning Area Planning Area on the leases and inspection fees. These contributions from offshore oil and gas provide billions annually to the U.S. Treasury. ” - Scott A. Angelle, Director Bureau of Safety and Environmental Enforcement (BSEE) Source: National Ocean Industries Association. (1) Federal royalties fund Land & Water Conservation Fund, earmarked for National Parks. 4Gulf of Mexico Basin Contributions 2019 Jobs Impact of the Gulf of Mexico Oil and Gas Industry > 2 MILLION BOE/D PRODUCTION >340K JOBS ACROSS NATIONWIDE SUPPLY CHAIN >$28 BILLION U.S. GDP IMPACT >$5 BILLION (1) GOVERNMENT REVENUES 147,000 94,000 20,000 28,000 Jobs Supported Jobs Supported Jobs Supported Jobs Supported [Outer Continental Shelf] activity not only Texas Louisiana Mississippi Alabama “ supports our nation’s energy security, it also promotes economic stability and growth though the contributions of offshore operators who pay Western Central production royalties, annual rentals, bonus bids Planning Area Planning Area on the leases and inspection fees. These contributions from offshore oil and gas provide billions annually to the U.S. Treasury. ” - Scott A. Angelle, Director Bureau of Safety and Environmental Enforcement (BSEE) Source: National Ocean Industries Association. (1) Federal royalties fund Land & Water Conservation Fund, earmarked for National Parks. 4

Long-Term Value & Strong Credit Profile Talos has an attractive profile with equity upside and solid asset coverage $4,500 Key Highlights (1) § >130 prospects representing $1,344 $4,164 $4,000 >1.2 BN BOE net unrisked resource potential $3,500 § Numerous re-completions in $3,000 PDNP and low-risk PUD drilling opportunities $450 $2,820 $2,500 § Probables are primarily $548 performance-based (no $2,000 $1,822 additional capital requirements) ENTERPRISE $1,500 $1,473 VALUE § Expect Mexico resources from NET $1,000 $971 Zama and Xaxamani to DEBT convert into 2P reserves upon $500 FID (not currently in 2P) § >1.5 MM gross acres for $- future exploration PDP PDNP PUD 1P Probable 2P (1) Includes approximately 75 MMBoe of 2P MMBoe 93 51 46 189 80 269 resources from 46 locations included in 2P NAV. Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl and $2.07 per MMBtu in perpetuity. Enterprise Value calculated as of September 4, 5 2020 using June 30, 2020 debt and cash figures. All figures shown pre-tax. Resource is not a measure of reserves prepared in accordance with SEC guidelines. Pre-Tax PV-10 ($MM)Long-Term Value & Strong Credit Profile Talos has an attractive profile with equity upside and solid asset coverage $4,500 Key Highlights (1) § >130 prospects representing $1,344 $4,164 $4,000 >1.2 BN BOE net unrisked resource potential $3,500 § Numerous re-completions in $3,000 PDNP and low-risk PUD drilling opportunities $450 $2,820 $2,500 § Probables are primarily $548 performance-based (no $2,000 $1,822 additional capital requirements) ENTERPRISE $1,500 $1,473 VALUE § Expect Mexico resources from NET $1,000 $971 Zama and Xaxamani to DEBT convert into 2P reserves upon $500 FID (not currently in 2P) § >1.5 MM gross acres for $- future exploration PDP PDNP PUD 1P Probable 2P (1) Includes approximately 75 MMBoe of 2P MMBoe 93 51 46 189 80 269 resources from 46 locations included in 2P NAV. Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl and $2.07 per MMBtu in perpetuity. Enterprise Value calculated as of September 4, 5 2020 using June 30, 2020 debt and cash figures. All figures shown pre-tax. Resource is not a measure of reserves prepared in accordance with SEC guidelines. Pre-Tax PV-10 ($MM)

Environmental Stewardship Environmental Best Practices § Minimal flaring (only for occasional safety/operational reasons) § Zero overboard tolerance – Rigorous materials, equipment handling policies § All production flows directly into offshore pipelines (no trucking, rail, barge, etc.) § Robust water and waste management protocols Inaugural ESG Report § Subsea leak detection systems installed on to be published in 2020 subsea wells Talos strives to be an industry leader with responsible, sustainable operations and minimal environmental impact 6Environmental Stewardship Environmental Best Practices § Minimal flaring (only for occasional safety/operational reasons) § Zero overboard tolerance – Rigorous materials, equipment handling policies § All production flows directly into offshore pipelines (no trucking, rail, barge, etc.) § Robust water and waste management protocols Inaugural ESG Report § Subsea leak detection systems installed on to be published in 2020 subsea wells Talos strives to be an industry leader with responsible, sustainable operations and minimal environmental impact 6

Social and Corporate Responsibility Talos strives to enhance the quality of life for our employees and the communities where we work and live Community Involvement Top Workplace § Employee-led Community Outreach Committee organizes § Ranked a Top Workplace in the Houston Chronicle Top support for local, regional and national charitable Workplaces list every year since inception organizations with volunteer activities and Company- § Committed to cultivating and preserving a culture of matched contributions diversity and inclusion § Regularly host / sponsor major events supporting non- § Highly entrepreneurial culture and dynamic working profit organizations in our communities environment, according to employee surveys § Provide every employee with annual $500 allowance to encourage sponsoring of important causes in their local communities 7Social and Corporate Responsibility Talos strives to enhance the quality of life for our employees and the communities where we work and live Community Involvement Top Workplace § Employee-led Community Outreach Committee organizes § Ranked a Top Workplace in the Houston Chronicle Top support for local, regional and national charitable Workplaces list every year since inception organizations with volunteer activities and Company- § Committed to cultivating and preserving a culture of matched contributions diversity and inclusion § Regularly host / sponsor major events supporting non- § Highly entrepreneurial culture and dynamic working profit organizations in our communities environment, according to employee surveys § Provide every employee with annual $500 allowance to encourage sponsoring of important causes in their local communities 7

Investing Across the Asset Lifecycle Success driven by ability to invest across the asset lifecycle and consistently improve opportunity set Advanced Seismic Reprocessing Asset Management In-Field Drilling Exploitation Exploration § Invest in recompletions § Execute low-risk drilling to § Add new production with § Find material new resources and workovers to optimize maximize recovery from near-field drilling and production with step- existing production known fields opportunities, often at change potential for the § Right-size cost structure§ Achieve economies of scale material scale Company at facilities Production Curve Time 8 ProductionInvesting Across the Asset Lifecycle Success driven by ability to invest across the asset lifecycle and consistently improve opportunity set Advanced Seismic Reprocessing Asset Management In-Field Drilling Exploitation Exploration § Invest in recompletions § Execute low-risk drilling to § Add new production with § Find material new resources and workovers to optimize maximize recovery from near-field drilling and production with step- existing production known fields opportunities, often at change potential for the § Right-size cost structure§ Achieve economies of scale material scale Company at facilities Production Curve Time 8 Production

Key Operated Facilities Key assets have available capacity for future drilling and hosting third party production Phoenix Complex Green Canyon 18 Pompano Ram Powell Amberjack Block: Green Canyon 236 Block: Green Canyon 18 Block: Viosca Knoll 989 Block: Viosca Knoll 912 Block: Mississippi Canyon 109 Depth: ~2,200 ft Depth: ~750 ft Depth: ~1,300 ft Depth: ~3,200 ft Depth: ~1,100 ft Nameplate: 45 Mbo/d Nameplate: 20 Mbo/d Nameplate: 60 Mbo/d Nameplate: 60 Mbo/d Nameplate: 22 Mbo/d Spare Capacity: ~40% Spare Capacity: ~95% Spare Capacity: ~75% Spare Capacity: ~75% Spare Capacity: ~85% PHA Partners: Kosmos PHA Partners: EnVen, Otto PHA Partners: Beacon, Red PHA Partners: Beacon, Red PHA Partners: Fieldwood Willow, Ridgewood, LLOG, Willow, Ridgewood, LLOG, Original Discovery: Chevron / Original Discovery: ExxonMobil Original Discovery: BP Houston Energy, CL&F, Hunt, Houston Energy BHP Walter Original Discovery: Shell Original Discovery: BP 9Key Operated Facilities Key assets have available capacity for future drilling and hosting third party production Phoenix Complex Green Canyon 18 Pompano Ram Powell Amberjack Block: Green Canyon 236 Block: Green Canyon 18 Block: Viosca Knoll 989 Block: Viosca Knoll 912 Block: Mississippi Canyon 109 Depth: ~2,200 ft Depth: ~750 ft Depth: ~1,300 ft Depth: ~3,200 ft Depth: ~1,100 ft Nameplate: 45 Mbo/d Nameplate: 20 Mbo/d Nameplate: 60 Mbo/d Nameplate: 60 Mbo/d Nameplate: 22 Mbo/d Spare Capacity: ~40% Spare Capacity: ~95% Spare Capacity: ~75% Spare Capacity: ~75% Spare Capacity: ~85% PHA Partners: Kosmos PHA Partners: EnVen, Otto PHA Partners: Beacon, Red PHA Partners: Beacon, Red PHA Partners: Fieldwood Willow, Ridgewood, LLOG, Willow, Ridgewood, LLOG, Original Discovery: Chevron / Original Discovery: ExxonMobil Original Discovery: BP Houston Energy, CL&F, Hunt, Houston Energy BHP Walter Original Discovery: Shell Original Discovery: BP 9

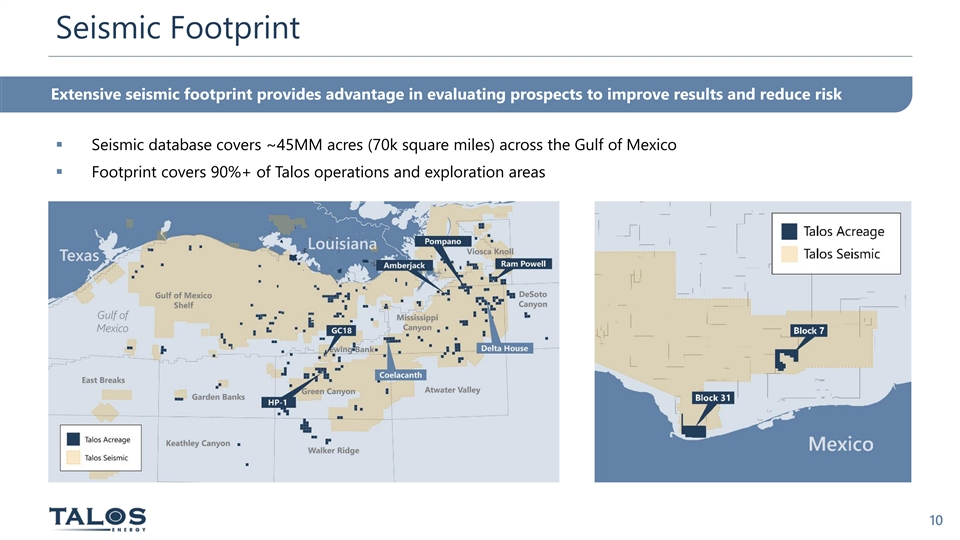

Seismic Footprint Extensive seismic footprint provides advantage in evaluating prospects to improve results and reduce risk § Seismic database covers ~45MM acres (70k square miles) across the Gulf of Mexico § Footprint covers 90%+ of Talos operations and exploration areas 10Seismic Footprint Extensive seismic footprint provides advantage in evaluating prospects to improve results and reduce risk § Seismic database covers ~45MM acres (70k square miles) across the Gulf of Mexico § Footprint covers 90%+ of Talos operations and exploration areas 10

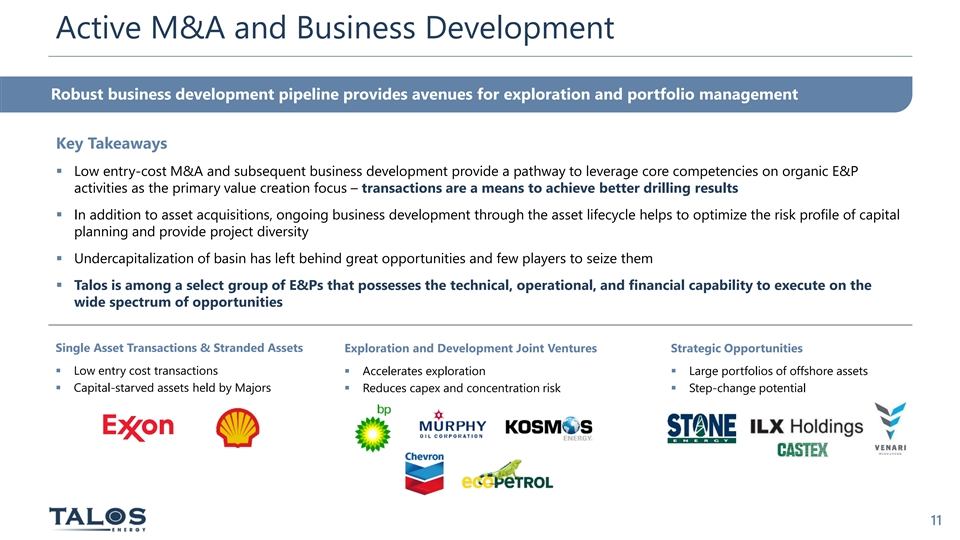

Active M&A and Business Development Robust business development pipeline provides avenues for exploration and portfolio management Key Takeaways § Low entry-cost M&A and subsequent business development provide a pathway to leverage core competencies on organic E&P activities as the primary value creation focus – transactions are a means to achieve better drilling results § In addition to asset acquisitions, ongoing business development through the asset lifecycle helps to optimize the risk profile of capital planning and provide project diversity § Undercapitalization of basin has left behind great opportunities and few players to seize them § Talos is among a select group of E&Ps that possesses the technical, operational, and financial capability to execute on the wide spectrum of opportunities Single Asset Transactions & Stranded Assets Exploration and Development Joint Ventures Strategic Opportunities § Low entry cost transactions§ Accelerates exploration§ Large portfolios of offshore assets § Capital-starved assets held by Majors§ Reduces capex and concentration risk§ Step-change potential 11Active M&A and Business Development Robust business development pipeline provides avenues for exploration and portfolio management Key Takeaways § Low entry-cost M&A and subsequent business development provide a pathway to leverage core competencies on organic E&P activities as the primary value creation focus – transactions are a means to achieve better drilling results § In addition to asset acquisitions, ongoing business development through the asset lifecycle helps to optimize the risk profile of capital planning and provide project diversity § Undercapitalization of basin has left behind great opportunities and few players to seize them § Talos is among a select group of E&Ps that possesses the technical, operational, and financial capability to execute on the wide spectrum of opportunities Single Asset Transactions & Stranded Assets Exploration and Development Joint Ventures Strategic Opportunities § Low entry cost transactions§ Accelerates exploration§ Large portfolios of offshore assets § Capital-starved assets held by Majors§ Reduces capex and concentration risk§ Step-change potential 11

Full-Cycle Regional Case Study – Green Canyon Technical expertise unlocks resource opportunity, leveraging infrastructure provides strong full-cycle value creation 1 2 3 3 1 2 3 Green Canyon 18 Phoenix Complex Geophysics & Business Development § Since acquiring asset in 2013 increased § Expertise in reprocessing typically leads to another § Acquired GC-18 for <$15mm in 2018 production from ~10 MBoe/d to up to ~43 round of drilling on acquired assets, enhancing § Existing asset has produced over 100 MMBoe historically MBoe/d in 2Q 2019 transaction economics § Unlocked drilling and business development § Discovered Tornado field§ Reprocessing projects around acquired assets led to opportunities business development activities with BP/Chevron on § Only independent to operate a Floating ― Drilled Bulleit discovery Puma West, the Antrim discovery and surrounding Production Unit in the U.S. GOM (Shell and ― Acquired Antrim discovery from ExxonMobil Middle Miocene sub-salt prospects Murphy operate one FPSO each) ― New blocks in federal lease sale 12Full-Cycle Regional Case Study – Green Canyon Technical expertise unlocks resource opportunity, leveraging infrastructure provides strong full-cycle value creation 1 2 3 3 1 2 3 Green Canyon 18 Phoenix Complex Geophysics & Business Development § Since acquiring asset in 2013 increased § Expertise in reprocessing typically leads to another § Acquired GC-18 for <$15mm in 2018 production from ~10 MBoe/d to up to ~43 round of drilling on acquired assets, enhancing § Existing asset has produced over 100 MMBoe historically MBoe/d in 2Q 2019 transaction economics § Unlocked drilling and business development § Discovered Tornado field§ Reprocessing projects around acquired assets led to opportunities business development activities with BP/Chevron on § Only independent to operate a Floating ― Drilled Bulleit discovery Puma West, the Antrim discovery and surrounding Production Unit in the U.S. GOM (Shell and ― Acquired Antrim discovery from ExxonMobil Middle Miocene sub-salt prospects Murphy operate one FPSO each) ― New blocks in federal lease sale 12

Full-Cycle Regional Case Study – Mississippi Canyon Technical expertise unlocks resource opportunity, leveraging infrastructure provides strong full-cycle value creation 1 1 3 3 2 1 3 2 3 1 2 3 Substantial Regional Infrastructure PHA Partners Access for Future Exploration § Stonefly discovery recently achieved first oil § Tie-back radius to operated facilities provides flow § Mississippi Canyon assets include several operated through Ram Powell platform assurance for future exploration activities facilities with significant spare capacity and overlapping tie-back footprints § Praline discovery advancing with future PHA § Eliminates need for long-lead, expensive new host through Pompano platform § Facilities acquired at low entry costs and optimized to extend field life and significantly defer P&A § PHAs provide fee-based cash flow and cover § Adding acreage and prospects via lease sales and substantial amount of fixed costs, making business development incremental Talos production very high margin 13Full-Cycle Regional Case Study – Mississippi Canyon Technical expertise unlocks resource opportunity, leveraging infrastructure provides strong full-cycle value creation 1 1 3 3 2 1 3 2 3 1 2 3 Substantial Regional Infrastructure PHA Partners Access for Future Exploration § Stonefly discovery recently achieved first oil § Tie-back radius to operated facilities provides flow § Mississippi Canyon assets include several operated through Ram Powell platform assurance for future exploration activities facilities with significant spare capacity and overlapping tie-back footprints § Praline discovery advancing with future PHA § Eliminates need for long-lead, expensive new host through Pompano platform § Facilities acquired at low entry costs and optimized to extend field life and significantly defer P&A § PHAs provide fee-based cash flow and cover § Adding acreage and prospects via lease sales and substantial amount of fixed costs, making business development incremental Talos production very high margin 13

Inventory Overview – Portfolio Summary Low risk portfolio to sustain and diversify production plus high impact targets for future growth § The Company maintains and continues to grow a deep, diverse inventory portfolio providing sustainable growth § Talos’s project inventory consists of over 130 projects with a net unrisked resource potential of ~1.2 billion Boe § Portfolio includes a significant inventory of low risk opportunities coupled with high impact exploration prospects Identified Projects By Core Area Identified Projects By Type Net Unrisked Resource By Type (MMBoe) 4 Miss. Canyon 165 In-Field/Dev. In-Field/Dev. 47 107 50 46 Green Canyon 55 133 133 1,208 Exploitation Exploitation Projects Projects MMBoe Shelf Exploration Exploration 936 31 33 Mexico Net unrisked resource is not a measure of reserves prepared in accordance with SEC guidelines. Note: Resource figures presented on unrisked basis. In-Field/Development includes four discovered 14 resources projects.Inventory Overview – Portfolio Summary Low risk portfolio to sustain and diversify production plus high impact targets for future growth § The Company maintains and continues to grow a deep, diverse inventory portfolio providing sustainable growth § Talos’s project inventory consists of over 130 projects with a net unrisked resource potential of ~1.2 billion Boe § Portfolio includes a significant inventory of low risk opportunities coupled with high impact exploration prospects Identified Projects By Core Area Identified Projects By Type Net Unrisked Resource By Type (MMBoe) 4 Miss. Canyon 165 In-Field/Dev. In-Field/Dev. 47 107 50 46 Green Canyon 55 133 133 1,208 Exploitation Exploitation Projects Projects MMBoe Shelf Exploration Exploration 936 31 33 Mexico Net unrisked resource is not a measure of reserves prepared in accordance with SEC guidelines. Note: Resource figures presented on unrisked basis. In-Field/Development includes four discovered 14 resources projects.

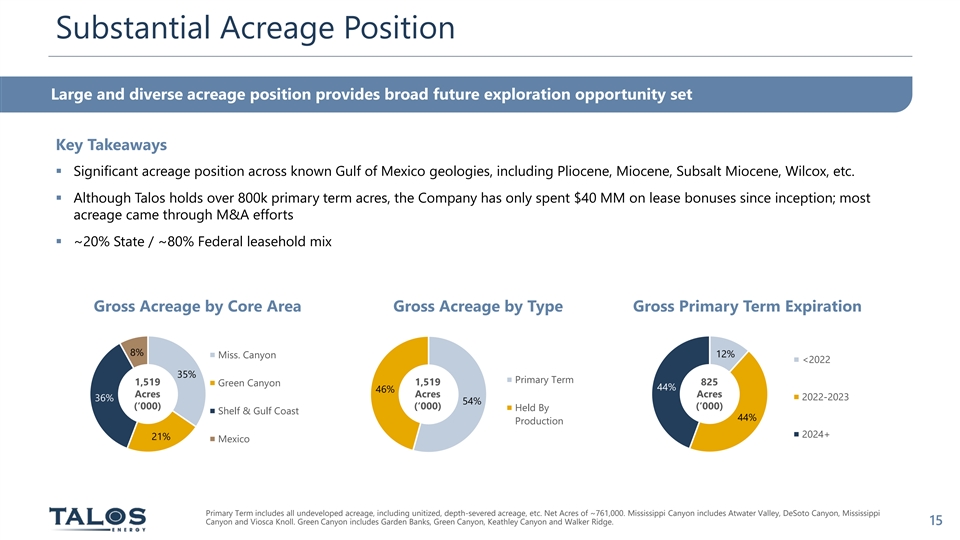

Substantial Acreage Position Large and diverse acreage position provides broad future exploration opportunity set Key Takeaways § Significant acreage position across known Gulf of Mexico geologies, including Pliocene, Miocene, Subsalt Miocene, Wilcox, etc. § Although Talos holds over 800k primary term acres, the Company has only spent $40 MM on lease bonuses since inception; most acreage came through M&A efforts § ~20% State / ~80% Federal leasehold mix Gross Acreage by Core Area Gross Acreage by Type Gross Primary Term Expiration 8% 12% Miss. Canyon <2022 35% Primary Term 1,519 1,519 825 Green Canyon 44% 46% Acres Acres Acres 2022-2023 36% 54% (‘000) (‘000) (‘000) Held By Shelf & Gulf Coast 44% Production 2024+ 21% Mexico Primary Term includes all undeveloped acreage, including unitized, depth-severed acreage, etc. Net Acres of ~761,000. Mississippi Canyon includes Atwater Valley, DeSoto Canyon, Mississippi Canyon and Viosca Knoll. Green Canyon includes Garden Banks, Green Canyon, Keathley Canyon and Walker Ridge. 15Substantial Acreage Position Large and diverse acreage position provides broad future exploration opportunity set Key Takeaways § Significant acreage position across known Gulf of Mexico geologies, including Pliocene, Miocene, Subsalt Miocene, Wilcox, etc. § Although Talos holds over 800k primary term acres, the Company has only spent $40 MM on lease bonuses since inception; most acreage came through M&A efforts § ~20% State / ~80% Federal leasehold mix Gross Acreage by Core Area Gross Acreage by Type Gross Primary Term Expiration 8% 12% Miss. Canyon <2022 35% Primary Term 1,519 1,519 825 Green Canyon 44% 46% Acres Acres Acres 2022-2023 36% 54% (‘000) (‘000) (‘000) Held By Shelf & Gulf Coast 44% Production 2024+ 21% Mexico Primary Term includes all undeveloped acreage, including unitized, depth-severed acreage, etc. Net Acres of ~761,000. Mississippi Canyon includes Atwater Valley, DeSoto Canyon, Mississippi Canyon and Viosca Knoll. Green Canyon includes Garden Banks, Green Canyon, Keathley Canyon and Walker Ridge. 15

2020 Activity Overview Mississippi Canyon Green Canyon § Claiborne #3 § Bulleit hook-up and first oil, PHA successfully drilled, on § Kaleidoscope #1 well at GC 18 production Coelacanth Ram Powell GC 18 Helix HP-1 § Tornado water flood initiation § Stonefly PHA first oil Shelf & Gulf Coast Mexico § 15-20 asset management / recompletion projects§ Targeting completion of Zama unitization § Various P&A activities § Xaxamani appraisal planning EW 305 Zama Xaxamani 162020 Activity Overview Mississippi Canyon Green Canyon § Claiborne #3 § Bulleit hook-up and first oil, PHA successfully drilled, on § Kaleidoscope #1 well at GC 18 production Coelacanth Ram Powell GC 18 Helix HP-1 § Tornado water flood initiation § Stonefly PHA first oil Shelf & Gulf Coast Mexico § 15-20 asset management / recompletion projects§ Targeting completion of Zama unitization § Various P&A activities § Xaxamani appraisal planning EW 305 Zama Xaxamani 16

Zama – Appraisal Program Overview Zama-2ST Zama-1 Zama-3 Pressure Samples § Clearly delineated 185 the reservoir and identified the oil/water contact’s 47 for Zone 3-5 and Zone 6-7 Pre-Appraisal Post-Appraisal Logs § Well test produced at 28 ~7,900 boe/d, increasing confidence on field deliverability 5 Pre-Appraisal Post-Appraisal § Obtained >1,400 feet of whole core and fluid Fluid Samples data, critical to the 60 design of the topsides and reservoir simulation models Zama Appraisal Program is complete, confirming a Gross Resource range of 1 670 – 1,010 MMBoe Pre-Appraisal Post-Appraisal Gross resource is not a measure of reserves prepared in accordance with SEC guidelines. 17Zama – Appraisal Program Overview Zama-2ST Zama-1 Zama-3 Pressure Samples § Clearly delineated 185 the reservoir and identified the oil/water contact’s 47 for Zone 3-5 and Zone 6-7 Pre-Appraisal Post-Appraisal Logs § Well test produced at 28 ~7,900 boe/d, increasing confidence on field deliverability 5 Pre-Appraisal Post-Appraisal § Obtained >1,400 feet of whole core and fluid Fluid Samples data, critical to the 60 design of the topsides and reservoir simulation models Zama Appraisal Program is complete, confirming a Gross Resource range of 1 670 – 1,010 MMBoe Pre-Appraisal Post-Appraisal Gross resource is not a measure of reserves prepared in accordance with SEC guidelines. 17

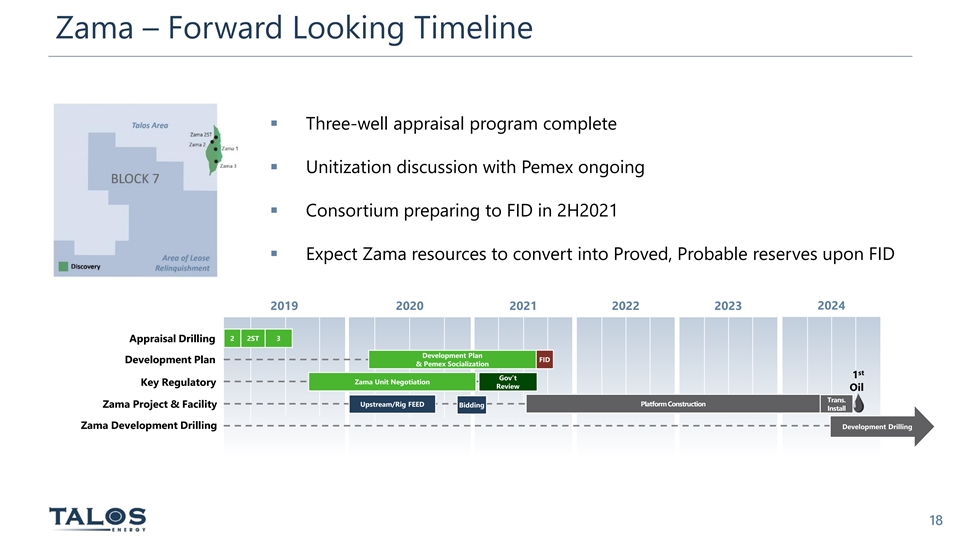

Zama – Forward Looking Timeline § Three-well appraisal program complete § Unitization discussion with Pemex ongoing § Consortium preparing to FID in 2H2021 § Expect Zama resources to convert into Proved, Probable reserves upon FID 2019 2020 2021 2022 2023 2024 2 2ST 3 Appraisal Drilling Development Plan FID Development Plan & Pemex Socialization st 1 Gov’t Zama Unit Negotiation Key Regulatory Review Oil Trans. Platform Construction Upstream/Rig FEED Zama Project & Facility Bidding Install Zama Development Drilling Development Drilling 18Zama – Forward Looking Timeline § Three-well appraisal program complete § Unitization discussion with Pemex ongoing § Consortium preparing to FID in 2H2021 § Expect Zama resources to convert into Proved, Probable reserves upon FID 2019 2020 2021 2022 2023 2024 2 2ST 3 Appraisal Drilling Development Plan FID Development Plan & Pemex Socialization st 1 Gov’t Zama Unit Negotiation Key Regulatory Review Oil Trans. Platform Construction Upstream/Rig FEED Zama Project & Facility Bidding Install Zama Development Drilling Development Drilling 18

Talos Financial Principles Conservative balance sheet combined with calculated risk-taking and an active hedging program Risk Management Leverage Liquidity Maturity Profile § Balance debt load to cash flow § Maintain ample liquidity§ Access market windows for § Grow high-quality, diverse and total capitalization refinancing opportunities asset base § Retain quick access to capital § Minimize borrowing costs and through sizeable RBL facility§ Improve ratings positioning § Hedge to fund base business financial leakage to increase attractiveness and capital program § Manage working capital cycles § Maintain attractive credit § Reduce or eliminate onerous § Minimize long-term contracts § Prioritize debt paydown in profile call premiums uncertain environments§ Optimize drilling capital § Maintain adequate insurance 19Talos Financial Principles Conservative balance sheet combined with calculated risk-taking and an active hedging program Risk Management Leverage Liquidity Maturity Profile § Balance debt load to cash flow § Maintain ample liquidity§ Access market windows for § Grow high-quality, diverse and total capitalization refinancing opportunities asset base § Retain quick access to capital § Minimize borrowing costs and through sizeable RBL facility§ Improve ratings positioning § Hedge to fund base business financial leakage to increase attractiveness and capital program § Manage working capital cycles § Maintain attractive credit § Reduce or eliminate onerous § Minimize long-term contracts § Prioritize debt paydown in profile call premiums uncertain environments§ Optimize drilling capital § Maintain adequate insurance 19

2020 Capital Expenditures & Other Cost Reductions § Talos revised its 2020 capital program downward Capital Expenditures ($MM) by approximately 40% from 2019 pro-forma capital $598 $600 expenditures and 30% from initial 2020 guidance $533 ― Drilling and completion consists of a one-well program at GC 18, hook-up and completion of the 2019 discovery (Bulleit) and the Tornado waterflood $500 ― Plan to perform approximately 10-15 recompletions during the year to increase margins on existing assets at low $/boe/d conversion rates § Talos has also aggressively cut costs, leading to over $50 $400 MM in savings across lease operating and G&A expenses $368 as compared to the Company’s initial 2020 guidance 15% $300 U.S. Drilling & Completions $200 13% Asset Management Plugging & Abandonment 60% $100 Other 12% $- PF 2019 2020 Initial Guidance Revised Guidance - Mid-Point 202020 Capital Expenditures & Other Cost Reductions § Talos revised its 2020 capital program downward Capital Expenditures ($MM) by approximately 40% from 2019 pro-forma capital $598 $600 expenditures and 30% from initial 2020 guidance $533 ― Drilling and completion consists of a one-well program at GC 18, hook-up and completion of the 2019 discovery (Bulleit) and the Tornado waterflood $500 ― Plan to perform approximately 10-15 recompletions during the year to increase margins on existing assets at low $/boe/d conversion rates § Talos has also aggressively cut costs, leading to over $50 $400 MM in savings across lease operating and G&A expenses $368 as compared to the Company’s initial 2020 guidance 15% $300 U.S. Drilling & Completions $200 13% Asset Management Plugging & Abandonment 60% $100 Other 12% $- PF 2019 2020 Initial Guidance Revised Guidance - Mid-Point 20

Flexibility in Capital Allocation Appropriate prioritization of capital spending ensures long-term success of the business § Prioritization of P&A and maintenance spending ensures the operational health of asset base § Seismic, Land and G&G spending provides the foundation for future investments § Asset Management optimizes recovery and extends field life § Drilling & Completions percentage allocation should increase over time, and can be risk-adjusted for various commodity environments and portfolio management objectives 100% Within D&C, a diverse prospect 80% portfolio allows Talos to adjust risk 59% 60% 60% - 65% 60% profile for any commodity price environment 40% 12% 12% 10% - 15% 13% 20% 15% 10% - 15% 16% 13% <15% 0% 2019A 2020E Revised 2021+ Guidance Midpoint Approximate Targets Plugging & Abandonment Other Asset Management U.S. Drilling & Completions 21Flexibility in Capital Allocation Appropriate prioritization of capital spending ensures long-term success of the business § Prioritization of P&A and maintenance spending ensures the operational health of asset base § Seismic, Land and G&G spending provides the foundation for future investments § Asset Management optimizes recovery and extends field life § Drilling & Completions percentage allocation should increase over time, and can be risk-adjusted for various commodity environments and portfolio management objectives 100% Within D&C, a diverse prospect 80% portfolio allows Talos to adjust risk 59% 60% 60% - 65% 60% profile for any commodity price environment 40% 12% 12% 10% - 15% 13% 20% 15% 10% - 15% 16% 13% <15% 0% 2019A 2020E Revised 2021+ Guidance Midpoint Approximate Targets Plugging & Abandonment Other Asset Management U.S. Drilling & Completions 21

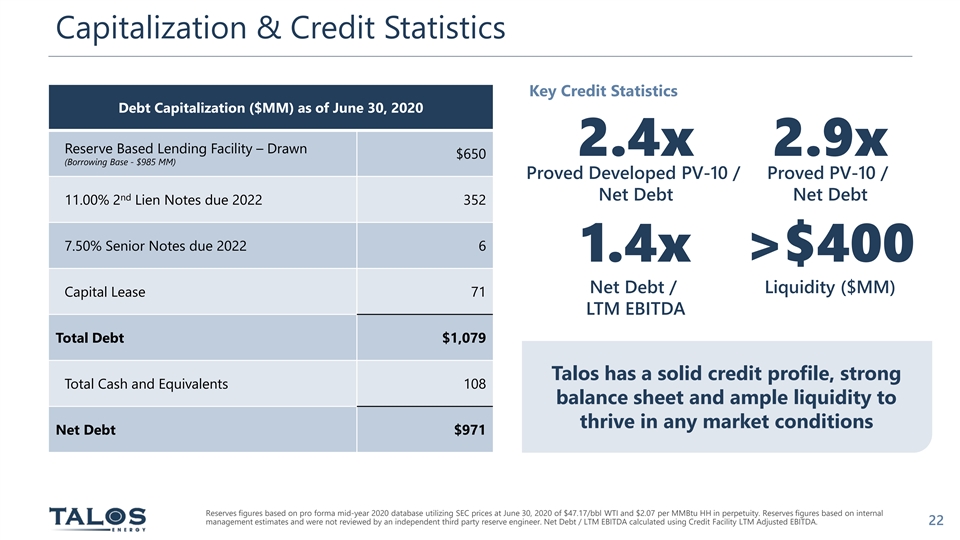

Capitalization & Credit Statistics Key Credit Statistics Debt Capitalization ($MM) as of June 30, 2020 Reserve Based Lending Facility – Drawn 2.4x 2.9x $650 (Borrowing Base - $985 MM) Proved Developed PV-10 / Proved PV-10 / nd Net Debt Net Debt 11.00% 2 Lien Notes due 2022 352 7.50% Senior Notes due 2022 6 1.4x >$400 Net Debt / Liquidity ($MM) Capital Lease 71 LTM EBITDA Total Debt $1,079 Talos has a solid credit profile, strong Total Cash and Equivalents 108 balance sheet and ample liquidity to thrive in any market conditions Net Debt $971 Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl WTI and $2.07 per MMBtu HH in perpetuity. Reserves figures based on internal management estimates and were not reviewed by an independent third party reserve engineer. Net Debt / LTM EBITDA calculated using Credit Facility LTM Adjusted EBITDA. 22Capitalization & Credit Statistics Key Credit Statistics Debt Capitalization ($MM) as of June 30, 2020 Reserve Based Lending Facility – Drawn 2.4x 2.9x $650 (Borrowing Base - $985 MM) Proved Developed PV-10 / Proved PV-10 / nd Net Debt Net Debt 11.00% 2 Lien Notes due 2022 352 7.50% Senior Notes due 2022 6 1.4x >$400 Net Debt / Liquidity ($MM) Capital Lease 71 LTM EBITDA Total Debt $1,079 Talos has a solid credit profile, strong Total Cash and Equivalents 108 balance sheet and ample liquidity to thrive in any market conditions Net Debt $971 Reserves figures based on pro forma mid-year 2020 database utilizing SEC prices at June 30, 2020 of $47.17/bbl WTI and $2.07 per MMBtu HH in perpetuity. Reserves figures based on internal management estimates and were not reviewed by an independent third party reserve engineer. Net Debt / LTM EBITDA calculated using Credit Facility LTM Adjusted EBITDA. 22

2323