Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ConnectOne Bancorp, Inc. | f8k_090920.htm |

Exhibit 99.1

CNOB September 9, 2020 Investor Presentation

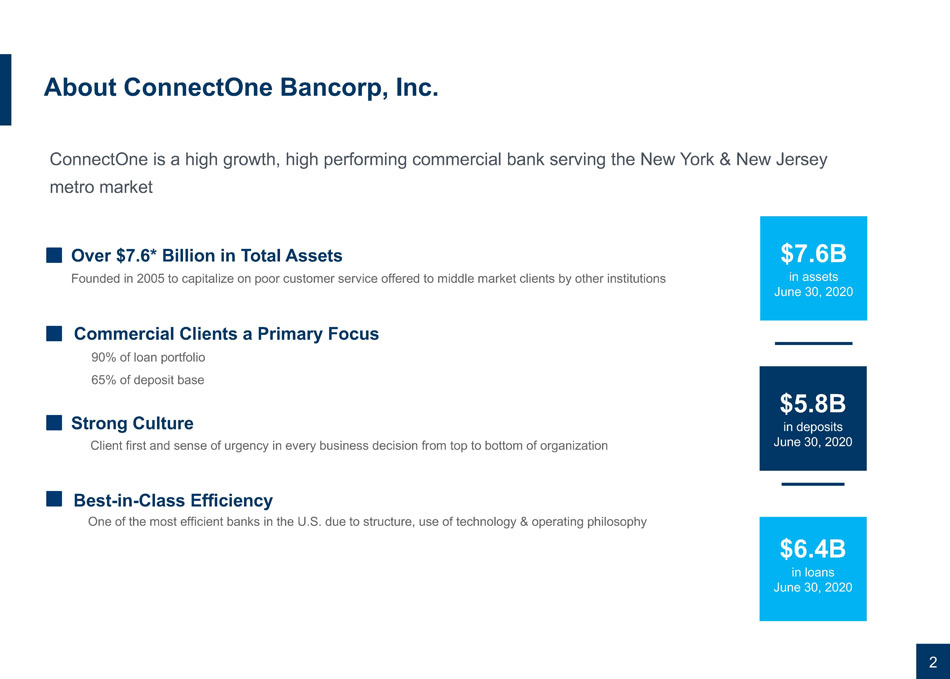

About ConnectOne Bancorp, Inc. o Client first and sense of urgency in every business decision from top to bottom of organization Strong Culture Founded in 2005 to capitalize on poor customer service offered to middle market clients by other institutions Over $7.6* Billion in Total Assets ConnectOne is a high growth, high performing commercial bank serving the New York & New Jersey metro market 2 o One of the most efficient banks in the U.S. due to structure, use of technology & operating philosophy Best - in - Class Efficiency o 90% of loan portfolio o 65% of deposit base Commercial Clients a Primary Focus $ 7.6B in assets June 30, 2020 $ 5.8B in deposits June 30, 2020 $ 6.4B in loans June 30, 2020

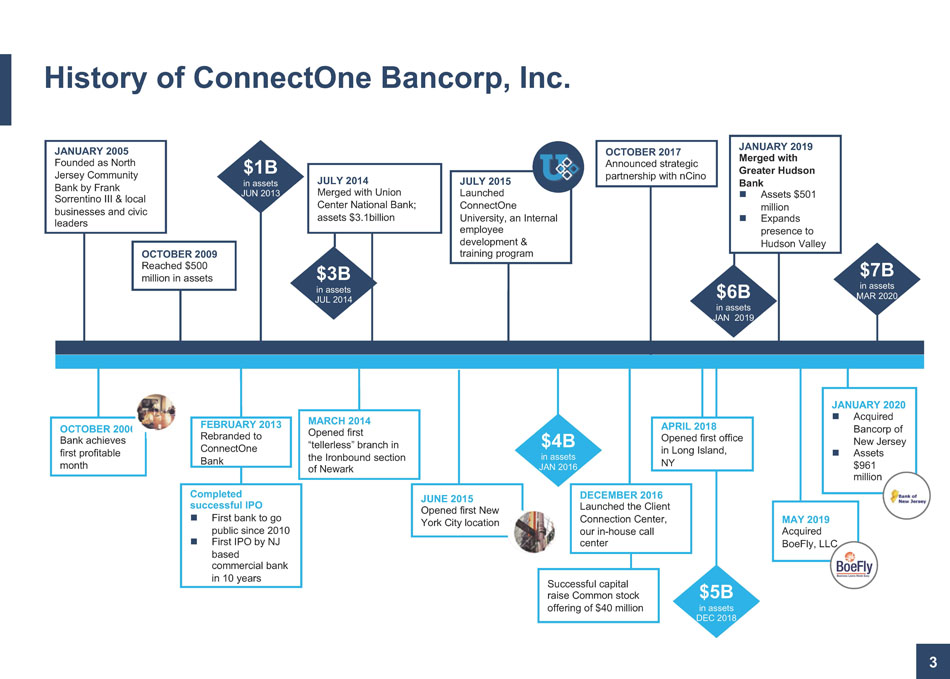

History of ConnectOne Bancorp, Inc. 3 JANUARY 2005 Founded as North Jersey Community Bank by Frank Sorrentino III & local businesses and civic leaders JULY 2014 Merged with Union Center National Bank; assets $3.1billion JULY 2015 Launched ConnectOne University, an Internal employee development & training program OCTOBER 2017 Announced strategic partnership with nCino JANUARY 2019 Merged with Greater Hudson Bank Assets $501 million Expands presence to Hudson Valley DECEMBER 2016 Launched the Client Connection Center, our in - house call center Successful capital raise Common stock offering of $40 million JUNE 2015 Opened first New York City location MARCH 2014 Opened first “tellerless” branch in the Ironbound section of Newark FEBRUARY 2013 Rebranded to ConnectOne Bank Completed successful IPO First bank to go public since 2010 First IPO by NJ based commercial bank in 10 years OCTOBER 2006 Bank achieves first profitable month OCTOBER 2009 Reached $500 million in assets $1B in assets JUN 2013 $3B in assets JUL 2014 $6B in assets JAN 2019 $5B in assets DEC 2018 $4B in assets JAN 2016 $7B in assets MAR 2020 JANUARY 2020 Acquired Bancorp of New Jersey Assets $961 million MAY 2019 Acquired BoeFly, LLC APRIL 2018 Opened first office in Long Island, NY

Diversified and Granular Loan Portfolio Franchise Overview 4 Robust Profitability and Capital Generation Solid Capital Base with Significant Cushion Above Well - capitalized Levels Robust Core Net Interest Margin Quality Deposit Franchise with Branch - Lite Distribution Model Best - In - Class Efficiency Strong Liquidity Profile High Quality Asset Composition and Reserves Strong Underwriting Culture

Strong Markets, Attractive Franchise Strategically placed offices throughout NY/NJ metro area 5 The market we operate in accounts for approximately $1.7 trillion of the $21 trillion United States GDP Market is largely dominated by the largest institutions in the country, leaving tremendous opportunity for banks catering to middle market businesses Strategic Growth in the New York Market Densely populated, lucrative markets Strong demand for personalized service among small to mid - sized business owners o Represents about 25% of our balance sheet. o Office additions in Manhattan, Long Island, and Astoria, Queens expand reach. o Acquisition provided immediate presence in Hudson Valley. Diverse economy provides numerous avenues for revenue expansion, while also insulating from severe economic downturns Strategic Growth in the New York Market

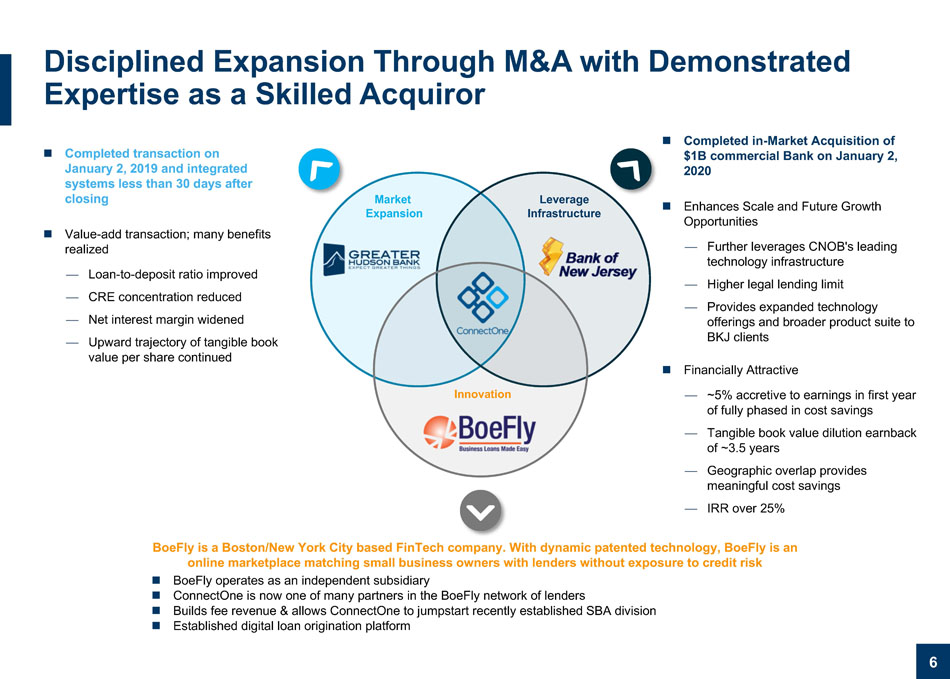

6 Completed transaction on January 2, 2019 and integrated systems less than 30 days after closing Value - add transaction; many benefits realized — Loan - to - deposit ratio improved — CRE concentration reduced — Net interest margin widened — Upward trajectory of tangible book value per share continued Completed in - Market Acquisition of $1B commercial Bank on January 2, 2020 Enhances Scale and Future Growth Opportunities — Further leverages CNOB's leading technology infrastructure — Higher legal lending limit — Provides expanded technology offerings and broader product suite to BKJ clients Financially Attractive — ~5% accretive to earnings in first year of fully phased in cost savings — Tangible book value dilution earnback of ~3.5 years — Geographic overlap provides meaningful cost savings — IRR over 25% BoeFly is a Boston/New York City based FinTech company. With dynamic patented technology, BoeFly is an online marketplace matching small business owners with lenders without exposure to credit risk BoeFly operates as an independent subsidiary ConnectOne is now one of many partners in the BoeFly network of lenders Builds fee revenue & allows ConnectOne to jumpstart recently established SBA division Established digital loan origination platform Leverage Infrastructure Market Expansion Innovation Disciplined Expansion Through M&A with Demonstrated Expertise as a Skilled Acquiror

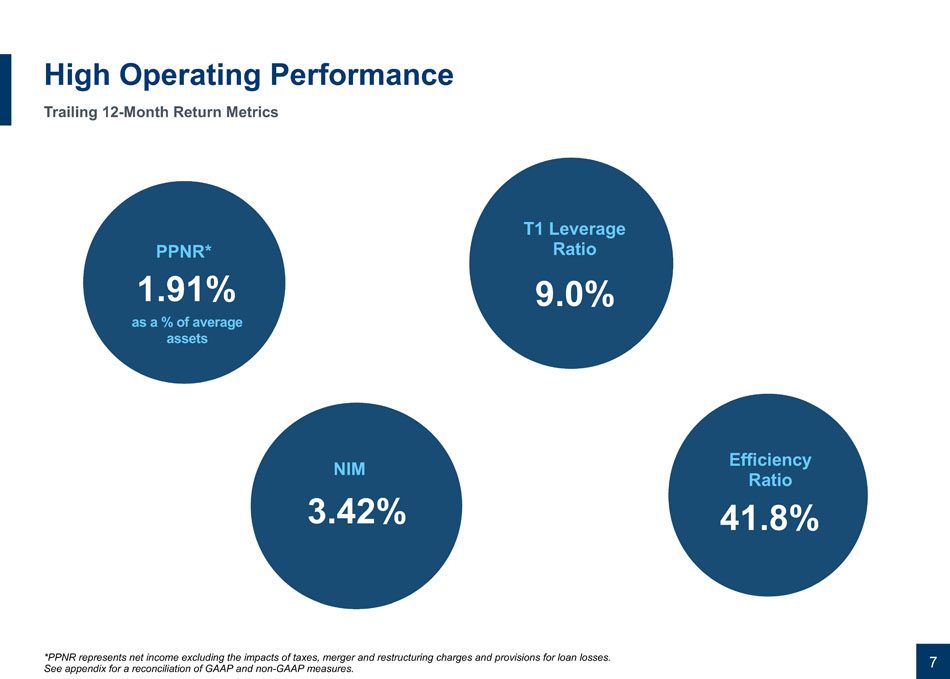

High Operating Performance PPNR * 7 1.91% 41.8% 3.42% 9.0% Trailing 12 - Month Return Metrics T1 Leverage Ratio NIM Efficiency Ratio * PPNR represents net income excluding the impacts of taxes, merger and restructuring charges and provisions for loan losses. See appendix for a reconciliation of GAAP and non - GAAP measures. as a % of average assets

8 COVID - 19 Response & PPP Initially, 90% of our staff are working from home. Started pilot program in June for return to work Retail offices pivoted to a leaner contactless environment Temporarily closed certain branch locations and directing branch clients to drive - thru windows and online banking services. Additional branches to be permanently closed. In the spirit of showing our support for our teams during this crisis, we increased certain employee benefits to help address their needs Quickly transitioned and mobilized our team to be an early and active participant in the SBA’s Paycheck Protection Program Technological capabilities and cloud - based infrastructure facilitated seamless transition to remote working environment Through the initial funding round, we have assisted ~2,200 companies and their ~45,600+ workers — As of June 30,2020 secured nearly $470M in funding, representing ~2,200 loans — Total origination fees recorded just over $15mm — Our nCino platform has the client facing forgiveness portal up and running — First forgiveness application already received Our FinTech subsidiary, BoeFly has benefitted substantially from PPP — BoeFly is an online marketplace matching small business owners with lenders, but does not bear any credit risk — BoeFly’s client base (both business owners and lenders) have expanded significantly as a result of PPP — Well positioned to benefit from small business expansion as the recovery accelerates Organization and People Paycheck Protection Program (“PPP”)

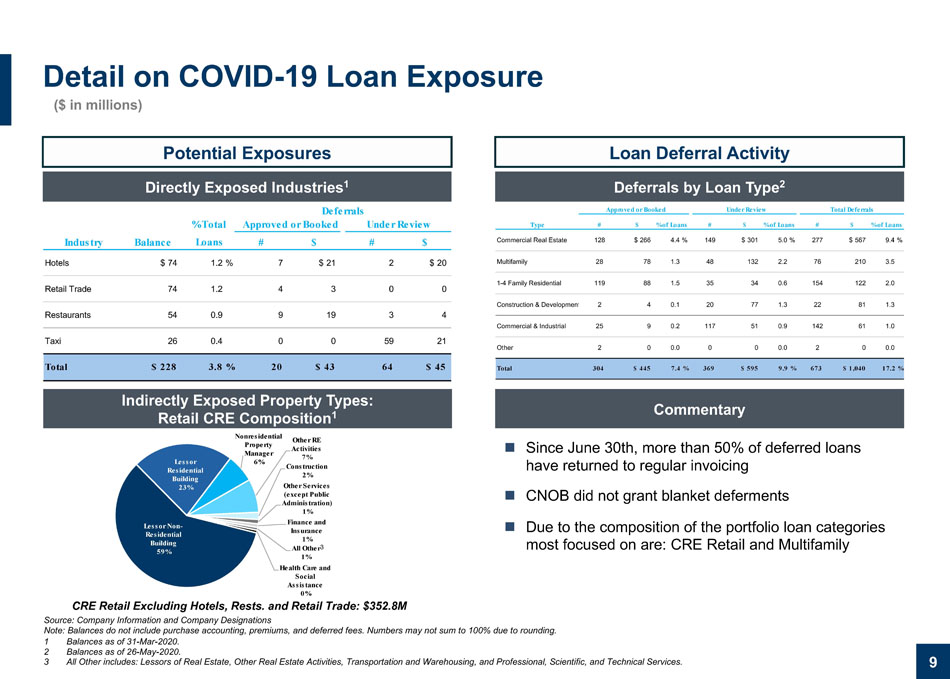

9 ($ in millions) Directly Exposed Industries 1 Deferrals by Loan Type 2 Commentary Indirectly Exposed Property Types: Retail CRE Composition 1 Source: Company Information and Company Designations Note: Balances do not include purchase accounting, premiums, and deferred fees. Numbers may not sum to 100% due to rounding. 1 Balances as of 31 - Mar - 2020. 2 Balances as of 26 - May - 2020. 3 All Other includes: Lessors of Real Estate, Other Real Estate Activities, Transportation and Warehousing, and Professional, S cie ntific, and Technical Services. CRE Retail Excluding Hotels, Rests. and Retail Trade: $352.8M 3 Since June 30th, more than 50% of deferred loans have returned to regular invoicing CNOB did not grant blanket deferments Due to the composition of the portfolio loan categories most focused on are: CRE Retail and Multifamily Approved or Booked Under Review Total Deferrals Type # $ % of Loans # $ % of Loans # $ % of Loans Commercial Real Estate 128 $266 4.4% 149 $301 5.0% 277 $567 9.4% Multifamily 28 78 1.3 48 132 2.2 76 210 3.5 1-4 Family Residential 119 88 1.5 35 34 0.6 154 122 2.0 Construction & Development 2 4 0.1 20 77 1.3 22 81 1.3 Commercial & Industrial 25 9 0.2 117 51 0.9 142 61 1.0 Other 2 0 0.0 0 0 0.0 2 0 0.0 Total 304 $445 7.4% 369 $595 9.9% 673 $1,040 17.2% Potential Exposures Loan Deferral Activity Deferrals % Total Approved or Booked Under Review Industry Balance Loans # $ # $ Hotels $74 1.2% 7 $21 2 $20 Retail Trade 74 1.2 4 3 0 0 Restaurants 54 0.9 9 19 3 4 Taxi 26 0.4 0 0 59 21 Total $228 3.8% 20 $43 64 $45 Detail on COVID - 19 Loan Exposure Lessor Non - Residential Building 59% Lessor Residential Building 23% Nonresidential Property Manager 6% Other RE Activities 7% Construction 2% Other Services (except Public Administration) 1% Finance and Insurance 1% All Other 1% Health Care and Social Assistance 0%

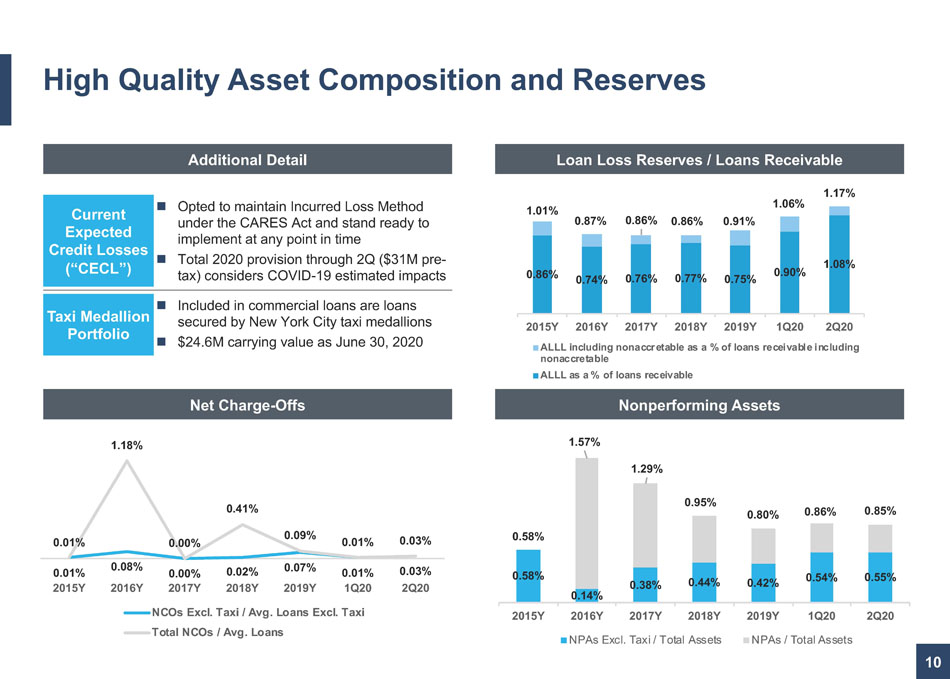

10 Loan Loss Reserves / Loans Receivable Nonperforming Assets Additional Detail Current Expected Credit Losses (“CECL”) Opted to maintain Incurred Loss Method under the CARES Act and stand ready to implement at any point in time Total 2020 provision through 2Q ($31M pre - tax) considers COVID - 19 estimated impacts Taxi Medallion Portfolio Included in commercial loans are loans secured by New York City taxi medallions $24.6M carrying value as June 30, 2020 High Quality Asset Composition and Reserves Net Charge - Offs 0.01% 0.08% 0.00% 0.02% 0.07% 0.01% 0.03% 0.01% 1.18% 0.00% 0.41% 0.09% 0.01% 0.03% 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 NCOs Excl. Taxi / Avg. Loans Excl. Taxi Total NCOs / Avg. Loans 0.86% 0.74% 0.76% 0.77% 0.75% 0.90% 1.08% 1.01% 0.87% 0.86% 0.86% 0.91% 1.06% 1.17% 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 ALLL including nonaccretable as a % of loans receivable including nonaccretable ALLL as a % of loans receivable 0.58% 0.14% 0.38% 0.44% 0.42% 0.54% 0.55% 0.58% 1.57% 1.29% 0.95% 0.80% 0.86% 0.85% 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 NPAs Excl. Taxi / Total Assets NPAs / Total Assets

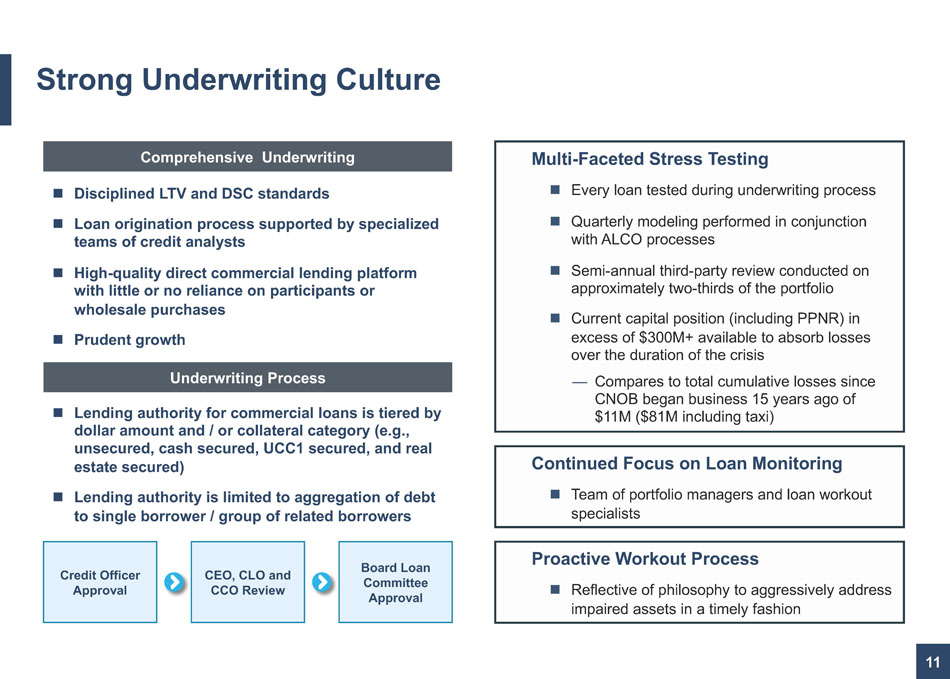

11 Strong Underwriting Culture Disciplined LTV and DSC standards Loan origination process supported by specialized teams of credit analysts High - quality direct commercial lending platform with little or no reliance on participants or wholesale purchases Prudent growth Multi - Faceted Stress Testing Every loan tested during underwriting process Quarterly modeling performed in conjunction with ALCO processes Semi - annual third - party review conducted on approximately two - thirds of the portfolio Current capital position (including PPNR) in excess of $300M+ available to absorb losses over the duration of the crisis — Compares to total cumulative losses since CNOB began business 15 years ago of $11M ($81M including taxi) Continued Focus on Loan Monitoring Team of portfolio managers and loan workout specialists Proactive Workout Process Reflective of philosophy to aggressively address impaired assets in a timely fashion Underwriting Process Lending authority for commercial loans is tiered by dollar amount and / or collateral category (e.g., unsecured, cash secured, UCC1 secured, and real estate secured) Lending authority is limited to aggregation of debt to single borrower / group of related borrowers Credit Officer Approval CEO, CLO and CCO Review Board Loan Committee Approval Comprehensive Underwriting

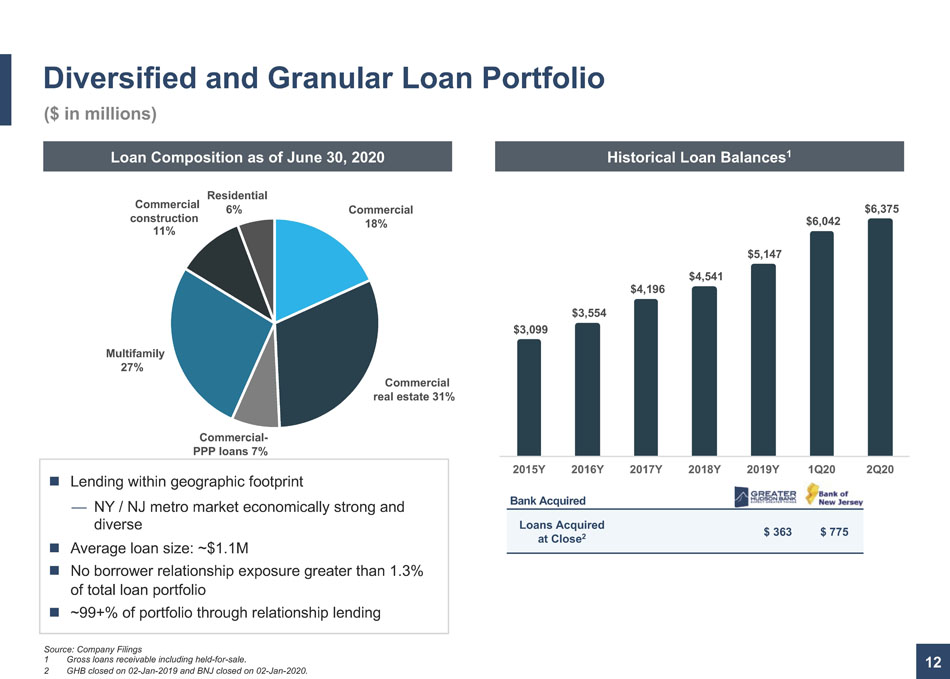

Lending within geographic footprint — NY / NJ metro market economically strong and diverse Average loan size: ~$1.1M No borrower relationship exposure greater than 1.3% of total loan portfolio ~99+% of portfolio through relationship lending 12 Diversified and Granular Loan Portfolio ($ in millions) Bank Acquired Loans Acquired at Close 2 $ 363 $ 775 Historical Loan Balances 1 Loan Composition as of June 30, 2020 $3,099 $3,554 $4,196 $4,541 $5,147 $6,042 $6,375 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 Commercial 18% Commercial real estate 31% Commercial - PPP loans 7% Multifamily 27% Commercial construction 11% Residential 6% Source: Company Filings 1 Gross loans receivable including held - for - sale. 2 GHB closed on 02 - Jan - 2019 and BNJ closed on 02 - Jan - 2020.

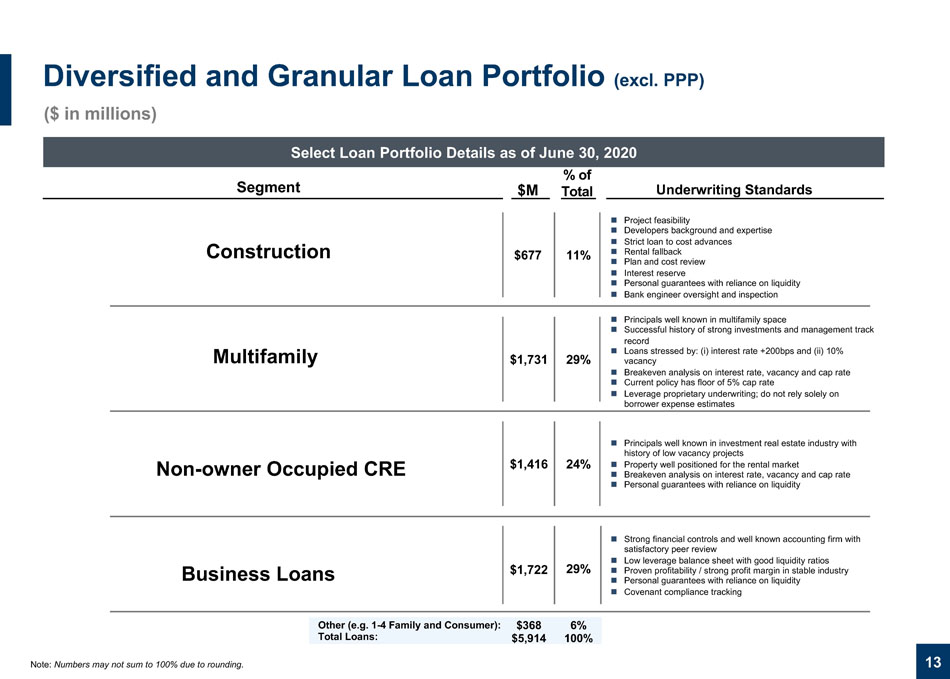

Project feasibility Developers background and expertise Strict loan to cost advances Rental fallback Plan and cost review Interest reserve Personal guarantees with reliance on liquidity Bank engineer oversight and inspection 13 Diversified and Granular Loan Portfolio (excl. PPP) ($ in millions) Select Loan Portfolio Details as of June 30, 2020 $M % of Total Underwriting Standards $677 $1,731 $1,416 $1,722 11% 29% 24% 29% Segment Note: Numbers may not sum to 100% due to rounding. Principals well known in multifamily space Successful history of strong investments and management track record Loans stressed by: (i) interest rate +200bps and (ii) 10% vacancy Breakeven analysis on interest rate, vacancy and cap rate Current policy has floor of 5% cap rate Leverage proprietary underwriting; do not rely solely on borrower expense estimates Principals well known in investment real estate industry with history of low vacancy projects Property well positioned for the rental market Breakeven analysis on interest rate, vacancy and cap rate Personal guarantees with reliance on liquidity Strong financial controls and well known accounting firm with satisfactory peer review Low leverage balance sheet with good liquidity ratios Proven profitability / strong profit margin in stable industry Personal guarantees with reliance on liquidity Covenant compliance tracking Other (e.g. 1 - 4 Family and Consumer): Total Loans: Multifamily Business Loans Non - owner Occupied CRE $5,914 $368 100% 6% Construction

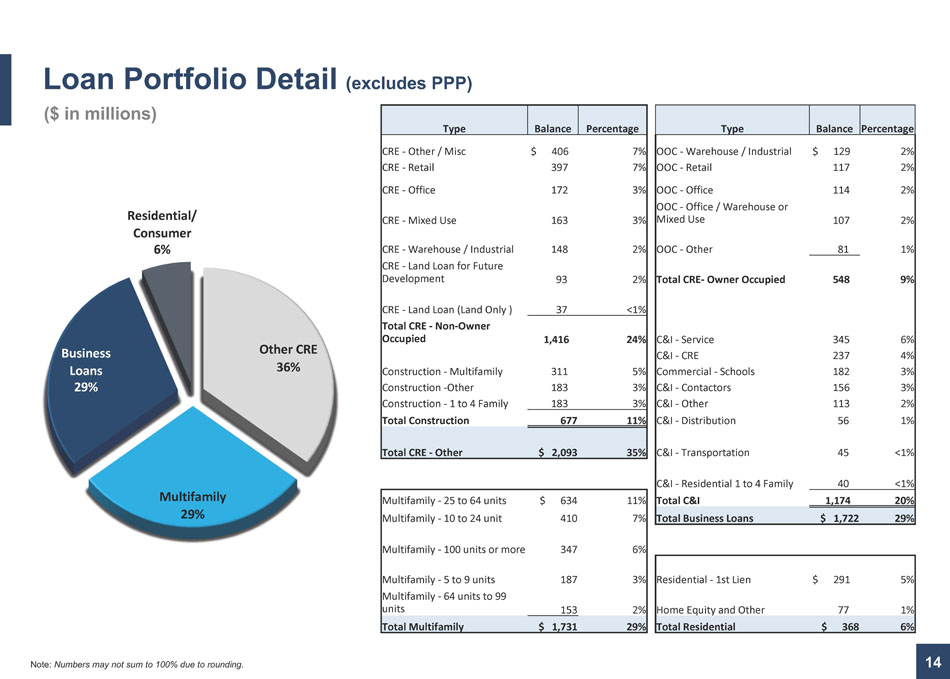

14 Loan Portfolio Detail (excludes PPP) ($ in millions) Note: Numbers may not sum to 100% due to rounding. Other CRE 36% Multifamily 29% Business Loans 29% Residential/ Consumer 6% Type Balance Percentage Type Balance Percentage CRE - Other / Misc $ 406 7% OOC - Warehouse / Industrial $ 129 2% CRE - Retail 397 7% OOC - Retail 117 2% CRE - Office 172 3% OOC - Office 114 2% CRE - Mixed Use 163 3% OOC - Office / Warehouse or Mixed Use 107 2% CRE - Warehouse / Industrial 148 2% OOC - Other 81 1% CRE - Land Loan for Future Development 93 2% Total CRE - Owner Occupied 548 9% CRE - Land Loan (Land Only ) 37 <1% Total CRE - Non - Owner Occupied 1,416 24% C&I - Service 345 6% C&I - CRE 237 4% Construction - Multifamily 311 5% Commercial - Schools 182 3% Construction - Other 183 3% C&I - Contactors 156 3% Construction - 1 to 4 Family 183 3% C&I - Other 113 2% Total Construction 677 11% C&I - Distribution 56 1% Total CRE - Other $ 2,093 35% C&I - Transportation 45 <1% C&I - Residential 1 to 4 Family 40 <1% Multifamily - 25 to 64 units $ 634 11% Total C&I 1,174 20% Multifamily - 10 to 24 unit 410 7% Total Business Loans $ 1,722 29% Multifamily - 100 units or more 347 6% Multifamily - 5 to 9 units 187 3% Residential - 1st Lien $ 291 5% Multifamily - 64 units to 99 units 153 2% Home Equity and Other 77 1% Total Multifamily $ 1,731 29% Total Residential $ 368 6%

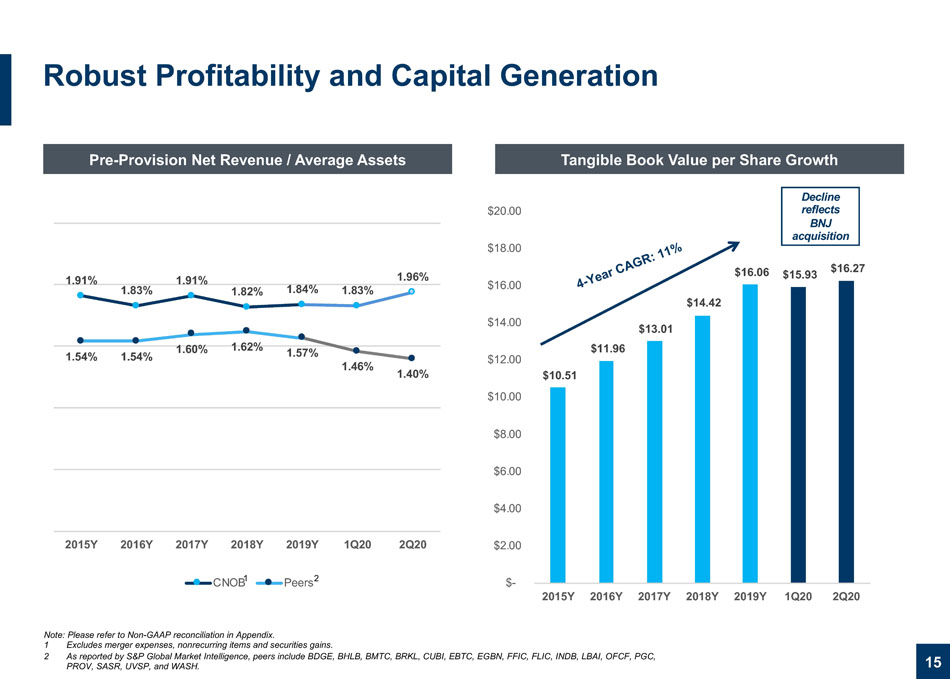

15 Robust Profitability and Capital Generation Note: Please refer to Non - GAAP reconciliation in Appendix. 1 Excludes merger expenses, nonrecurring items and securities gains. 2 As reported by S&P Global Market Intelligence, peers include BDGE, BHLB, BMTC, BRKL, CUBI, EBTC, EGBN, FFIC, FLIC, INDB, LBAI , O FCF, PGC, PROV, SASR, UVSP, and WASH. Tangible Book Value per Share Growth Pre - Provision Net Revenue / Average Assets Decline reflects BNJ acquisition 1.91% 1.83% 1.91% 1.82% 1.84% 1.83% 1.96% 1.54% 1.54% 1.60% 1.62% 1.57% 1.46% 1.40% 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 CNOB Peers 2 1 $10.51 $11.96 $13.01 $14.42 $16.06 $15.93 $16.27 $- $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 $20.00 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20

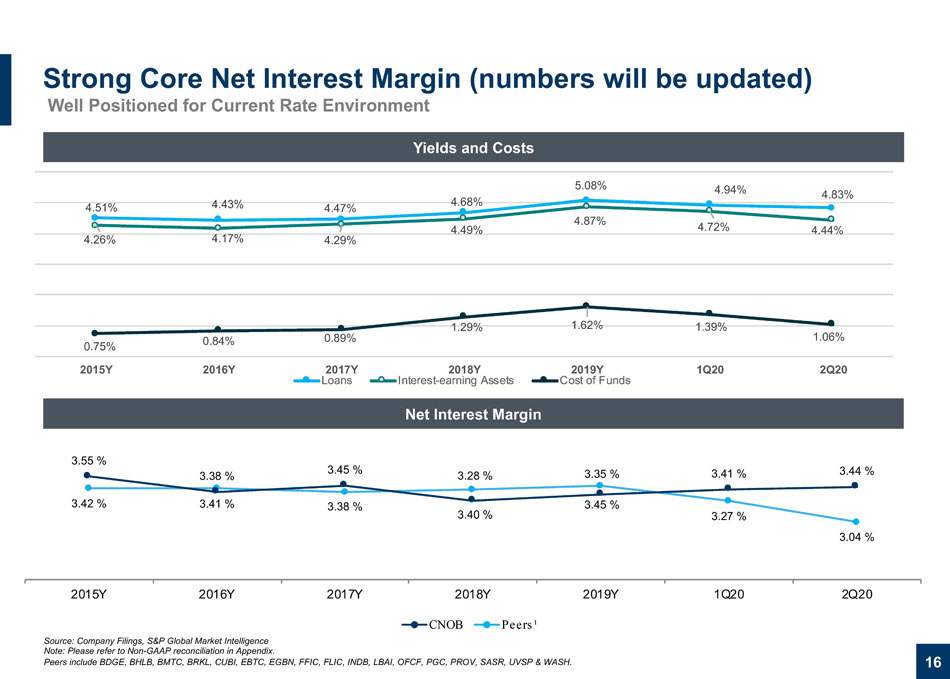

Yields and Costs 16 Strong Core Net Interest Margin (numbers will be updated) Net Interest Margin 13.5 % 9.1 % 10.7 % 13.8 % 13.6 % 10.5 % 10.9 % 10.3 % 12.0 % 12.6 % 2015 2016 2017 2018 2019 CNOB Peers¹ Source: Company Filings, S&P Global Market Intelligence Note: Please refer to Non - GAAP reconciliation in Appendix. Peers include BDGE, BHLB, BMTC, BRKL, CUBI, EBTC, EGBN, FFIC, FLIC, INDB, LBAI, OFCF, PGC, PROV, SASR, UVSP & WASH. Well Positioned for Current Rate Environment 3.42 % 3.41 % 3.38 % 3.40 % 3.45 % 3.27 % 3.04 % 3.55 % 3.38 % 3.45 % 3.28 % 3.35 % 3.41 % 3.44 % 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 4.51% 4.43% 4.47% 4.68% 5.08% 4.94% 4.83% 4.26% 4.17% 4.29% 4.49% 4.87% 4.72% 4.44% 0.75% 0.84% 0.89% 1.29% 1.62% 1.39% 1.06% 2015Y 2016Y 2017Y 2018Y 2019Y 1Q20 2Q20 Loans Interest-earning Assets Cost of Funds

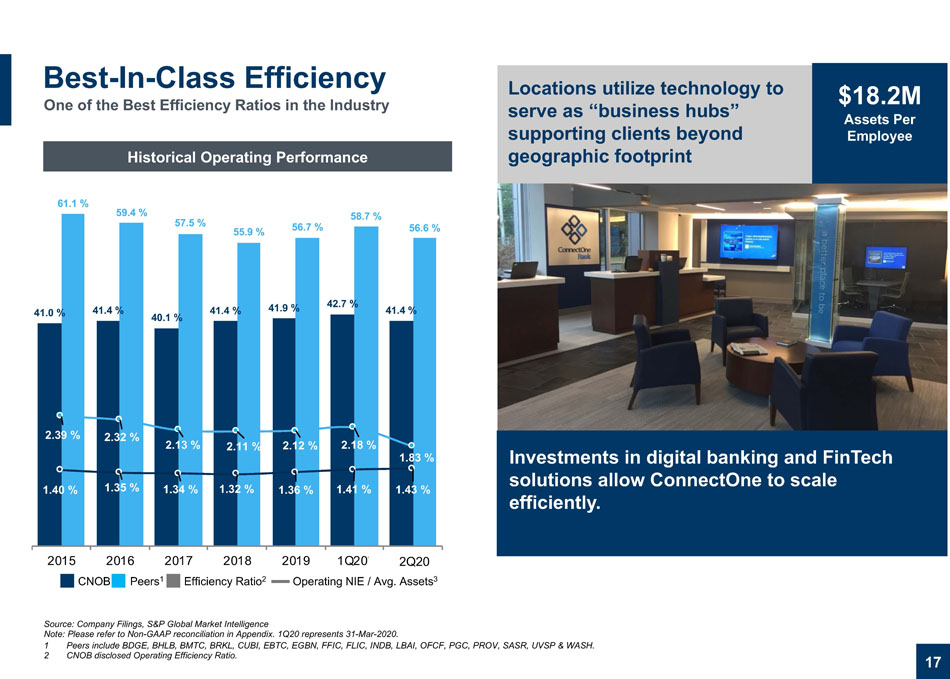

17 Best - In - Class Efficiency $1 8.2 M Assets Per Employee Investments in digital banking and FinTech solutions allow ConnectOne to scale efficiently. Locations utilize technology to serve as “business hubs” supporting clients beyond geographic footprint Historical Operating Performance Source: Company Filings, S&P Global Market Intelligence Note: Please refer to Non - GAAP reconciliation in Appendix. 1Q20 represents 31 - Mar - 2020. 1 Peers include BDGE , BHLB , BMTC , BRKL , CUBI , EBTC , EGBN , FFIC , FLIC, INDB , LBAI , OFCF , PGC , PROV , SASR , UVSP & WASH. 2 CNOB disclosed Operating Efficiency Ratio. Historical Operating Performance Peers 1 CNOB Operating NIE / Avg. Assets 3 Efficiency Ratio 2 One of the Best Efficiency Ratios in the Industry 41.0 % 41.4 % 40.1 % 41.4 % 41.9 % 42.7 % 41.4 % 61.1 % 59.4 % 57.5 % 55.9 % 56.7 % 58.7 % 56.6 % 1.40 % 1.35 % 1.34 % 1.32 % 1.36 % 1.41 % 1.43 % 2.39 % 2.32 % 2.13 % 2.11 % 2.12 % 2.18 % 1.83 % 2015 2016 2017 2018 2019 1Q20¹ 2Q20

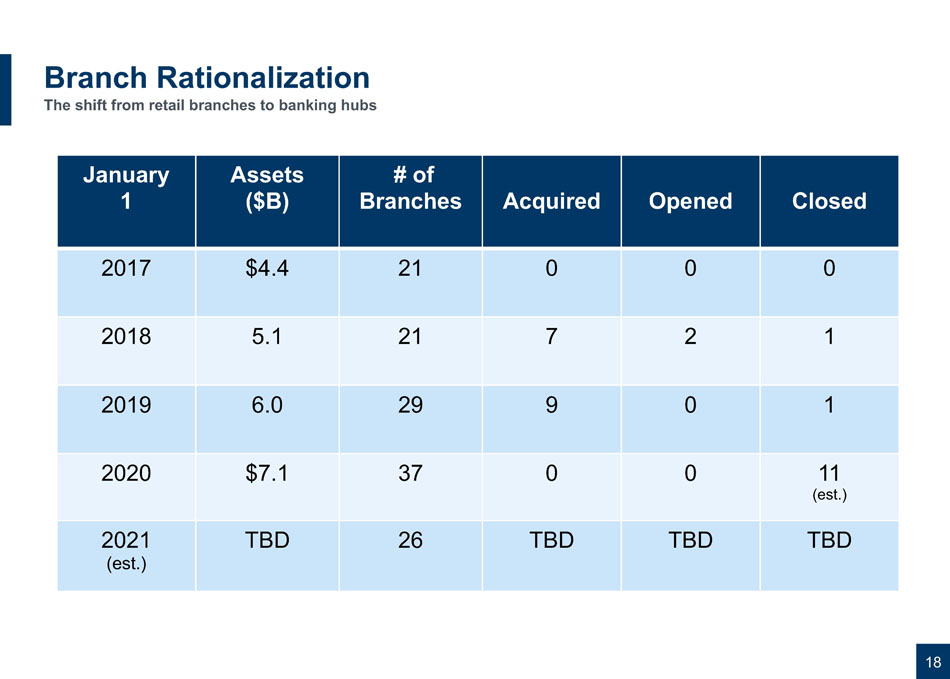

Branch Rationalization 18 January 1 Assets ($B) # of Branches Acquired Opened Closed 2017 $4.4 21 0 0 0 2018 5.1 21 7 2 1 2019 6.0 29 9 0 1 2020 $7.1 37 0 0 11 (est.) 2021 (est.) TBD 26 TBD TBD TBD The shift from retail branches to banking hubs

Strategy & Vision ConnectOne Believes It Remains Well - positioned To Execute: 19 Achieving Prudent Growth Increasing & Expanding Commercial Client Relationships Enhancing Our Presence in the New York & New Jersey Metro Market Further Improving Best - in - Class Efficiency Sustaining Robust Profitability & Strong Capital Foundation Continuing Branch Rationalization & Transformation Strategy Ongoing Enhancement to Digital Channels

“ ,, ,, ConnectOne Bank was our recipe for success! Their responsive and creative management team offered us all the necessary ingredients to expand and serve our community of chefs, restaurants & food lovers. “ Client Testimonials 20 President | James Beard Foundation Susan Ungaro “ ,, The responsiveness and general business acumen of the Executive Management and Client Service teams is unparalleled. I can’t imagine a better bank to partner with to grow our firm. The ConnectOne team responds to client needs with a sense of urgency. The ability to craft timely, custom solutions is extremely valuable in our line of business. Bart Mongelli, ESQ DeCotiis, Fitzpatrick & Cole, LLP They understand construction, from the Chairman to the lending team. This has allowed us to fast track our projects in order to meet the current strong market. “ ,, Ken Hollenbeck Managing Partner | Scarini & Hollenbeck, LLC Joe Cotter Natural Resources

21

Appendix

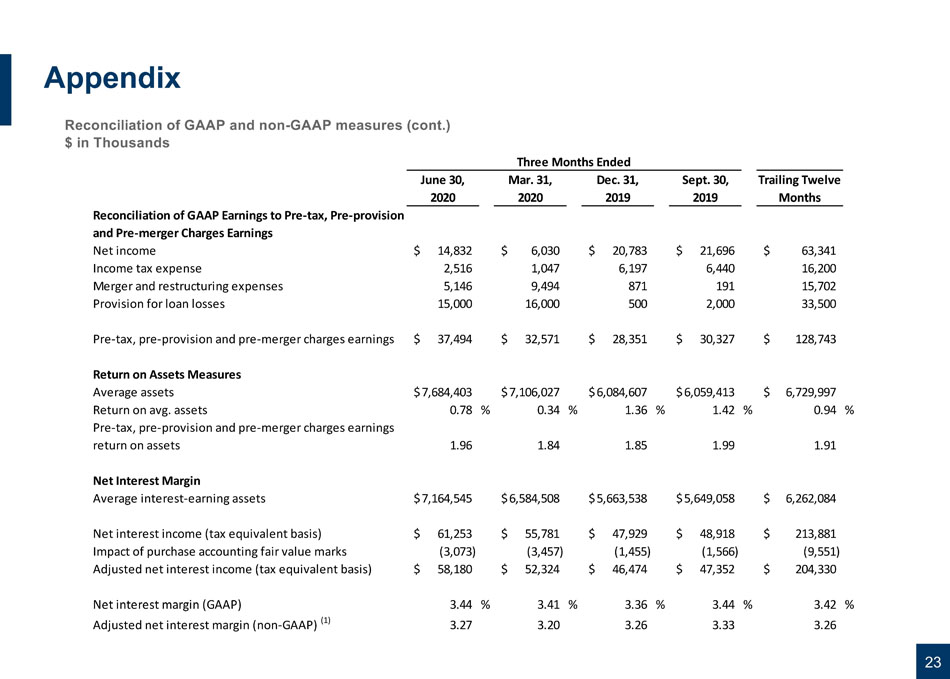

23 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands June 30, Mar. 31, Dec. 31, Sept. 30, Trailing Twelve 2020 2020 2019 2019 Months Reconciliation of GAAP Earnings to Pre-tax, Pre-provision and Pre-merger Charges Earnings Net income 14,832$ 6,030$ 20,783$ 21,696$ 63,341$ Income tax expense 2,516 1,047 6,197 6,440 16,200 Merger and restructuring expenses 5,146 9,494 871 191 15,702 Provision for loan losses 15,000 16,000 500 2,000 33,500 Pre-tax, pre-provision and pre-merger charges earnings 37,494$ 32,571$ 28,351$ 30,327$ 128,743$ Return on Assets Measures Average assets 7,684,403$ 7,106,027$ 6,084,607$ 6,059,413$ 6,729,997$ Return on avg. assets 0.78 % 0.34 % 1.36 % 1.42 % 0.94 % Pre-tax, pre-provision and pre-merger charges earnings return on assets 1.96 1.84 1.85 1.99 1.91 Net Interest Margin Average interest-earning assets 7,164,545$ 6,584,508$ 5,663,538$ 5,649,058$ 6,262,084$ Net interest income (tax equivalent basis) 61,253$ 55,781$ 47,929$ 48,918$ 213,881$ Impact of purchase accounting fair value marks (3,073) (3,457) (1,455) (1,566) (9,551) Adjusted net interest income (tax equivalent basis) 58,180$ 52,324$ 46,474$ 47,352$ 204,330$ Net interest margin (GAAP) 3.44 % 3.41 % 3.36 % 3.44 % 3.42 % Adjusted net interest margin (non-GAAP) (1) 3.27 3.20 3.26 3.33 3.26 Three Months Ended

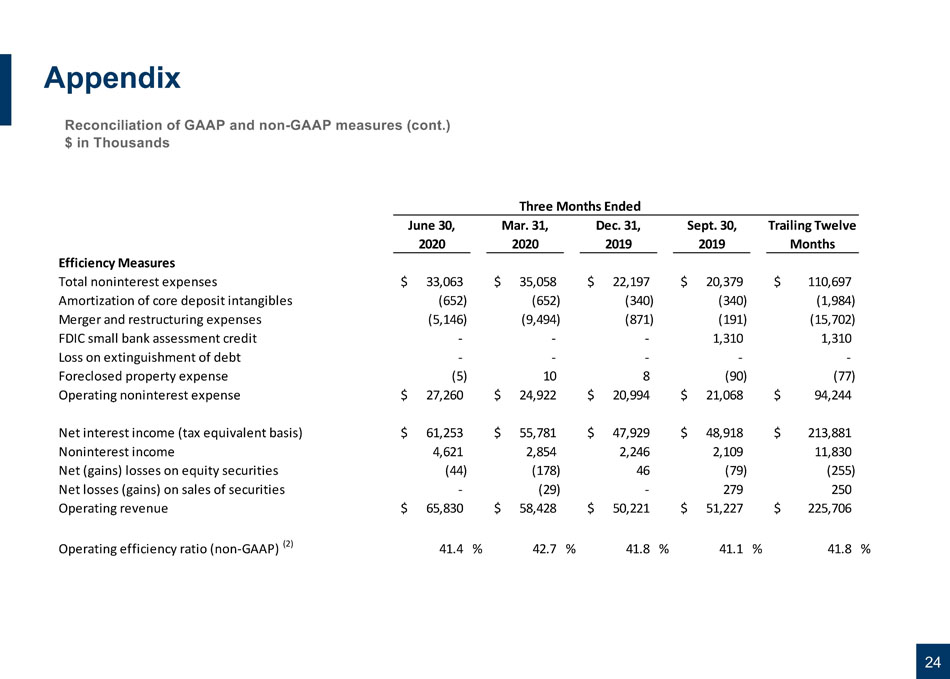

24 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands June 30, Mar. 31, Dec. 31, Sept. 30, Trailing Twelve 2020 2020 2019 2019 Months Efficiency Measures Total noninterest expenses 33,063$ 35,058$ 22,197$ 20,379$ 110,697$ Amortization of core deposit intangibles (652) (652) (340) (340) (1,984) Merger and restructuring expenses (5,146) (9,494) (871) (191) (15,702) FDIC small bank assessment credit - - - 1,310 1,310 Loss on extinguishment of debt - - - - - Foreclosed property expense (5) 10 8 (90) (77) Operating noninterest expense 27,260$ 24,922$ 20,994$ 21,068$ 94,244$ Net interest income (tax equivalent basis) 61,253$ 55,781$ 47,929$ 48,918$ 213,881$ Noninterest income 4,621 2,854 2,246 2,109 11,830 Net (gains) losses on equity securities (44) (178) 46 (79) (255) Net losses (gains) on sales of securities - (29) - 279 250 Operating revenue 65,830$ 58,428$ 50,221$ 51,227$ 225,706$ Operating efficiency ratio (non-GAAP) (2) 41.4 % 42.7 % 41.8 % 41.1 % 41.8 % Three Months Ended

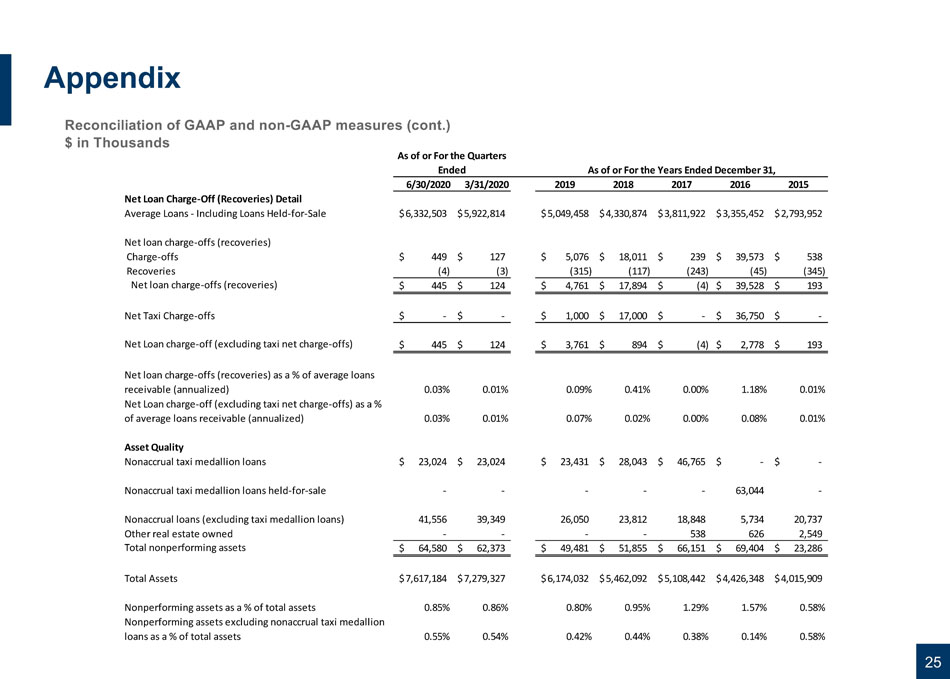

25 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands 6/30/2020 3/31/2020 2019 2018 2017 2016 2015 Net Loan Charge-Off (Recoveries) Detail Average Loans - Including Loans Held-for-Sale 6,332,503$ 5,922,814$ 5,049,458$ 4,330,874$ 3,811,922$ 3,355,452$ 2,793,952$ Net loan charge-offs (recoveries) Charge-offs 449$ 127$ 5,076$ 18,011$ 239$ 39,573$ 538$ Recoveries (4) (3) (315) (117) (243) (45) (345) Net loan charge-offs (recoveries) 445$ 124$ 4,761$ 17,894$ (4)$ 39,528$ 193$ Net Taxi Charge-offs -$ -$ 1,000$ 17,000$ -$ 36,750$ -$ Net Loan charge-off (excluding taxi net charge-offs) 445$ 124$ 3,761$ 894$ (4)$ 2,778$ 193$ Net loan charge-offs (recoveries) as a % of average loans receivable (annualized) 0.03% 0.01% 0.09% 0.41% 0.00% 1.18% 0.01% Net Loan charge-off (excluding taxi net charge-offs) as a % of average loans receivable (annualized) 0.03% 0.01% 0.07% 0.02% 0.00% 0.08% 0.01% Asset Quality Nonaccrual taxi medallion loans 23,024$ 23,024$ 23,431$ 28,043$ 46,765$ -$ -$ Nonaccrual taxi medallion loans held-for-sale - - - - - 63,044 - Nonaccrual loans (excluding taxi medallion loans) 41,556 39,349 26,050 23,812 18,848 5,734 20,737 Other real estate owned - - - - 538 626 2,549 Total nonperforming assets 64,580$ 62,373$ 49,481$ 51,855$ 66,151$ 69,404$ 23,286$ Total Assets 7,617,184$ 7,279,327$ 6,174,032$ 5,462,092$ 5,108,442$ 4,426,348$ 4,015,909$ Nonperforming assets as a % of total assets 0.85% 0.86% 0.80% 0.95% 1.29% 1.57% 0.58% Nonperforming assets excluding nonaccrual taxi medallion loans as a % of total assets 0.55% 0.54% 0.42% 0.44% 0.38% 0.14% 0.58% As of or For the Years Ended December 31, As of or For the Quarters Ended

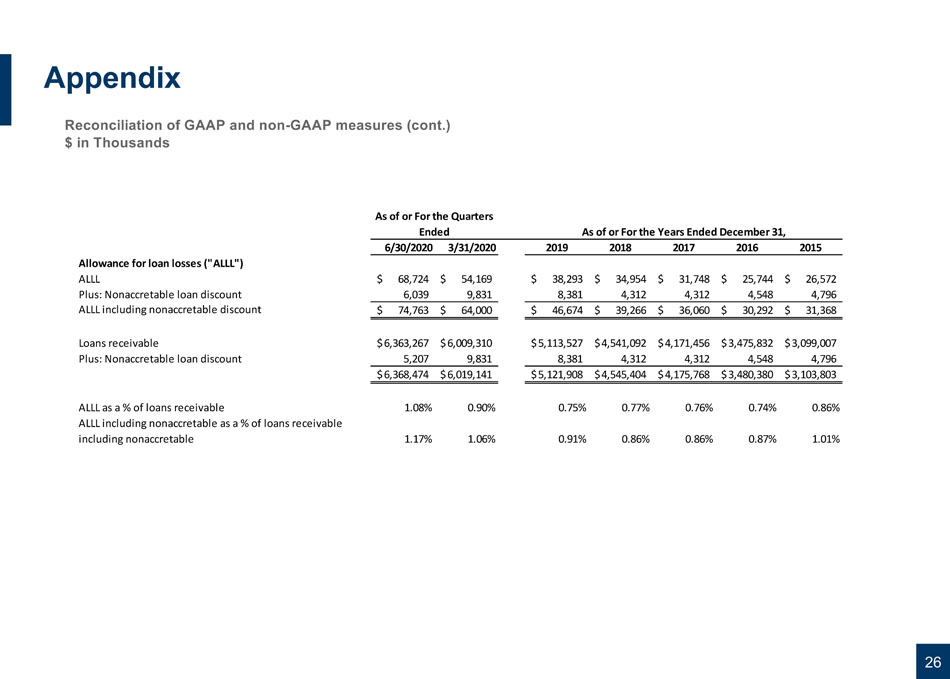

26 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands 6/30/2020 3/31/2020 2019 2018 2017 2016 2015 Allowance for loan losses ("ALLL") ALLL 68,724$ 54,169$ 38,293$ 34,954$ 31,748$ 25,744$ 26,572$ Plus: Nonaccretable loan discount 6,039 9,831 8,381 4,312 4,312 4,548 4,796 ALLL including nonaccretable discount 74,763$ 64,000$ 46,674$ 39,266$ 36,060$ 30,292$ 31,368$ Loans receivable 6,363,267$ 6,009,310$ 5,113,527$ 4,541,092$ 4,171,456$ 3,475,832$ 3,099,007$ Plus: Nonaccretable loan discount 5,207 9,831 8,381 4,312 4,312 4,548 4,796 6,368,474$ 6,019,141$ 5,121,908$ 4,545,404$ 4,175,768$ 3,480,380$ 3,103,803$ ALLL as a % of loans receivable 1.08% 0.90% 0.75% 0.77% 0.76% 0.74% 0.86% ALLL including nonaccretable as a % of loans receivable including nonaccretable 1.17% 1.06% 0.91% 0.86% 0.86% 0.87% 1.01% As of or For the Quarters Ended As of or For the Years Ended December 31,

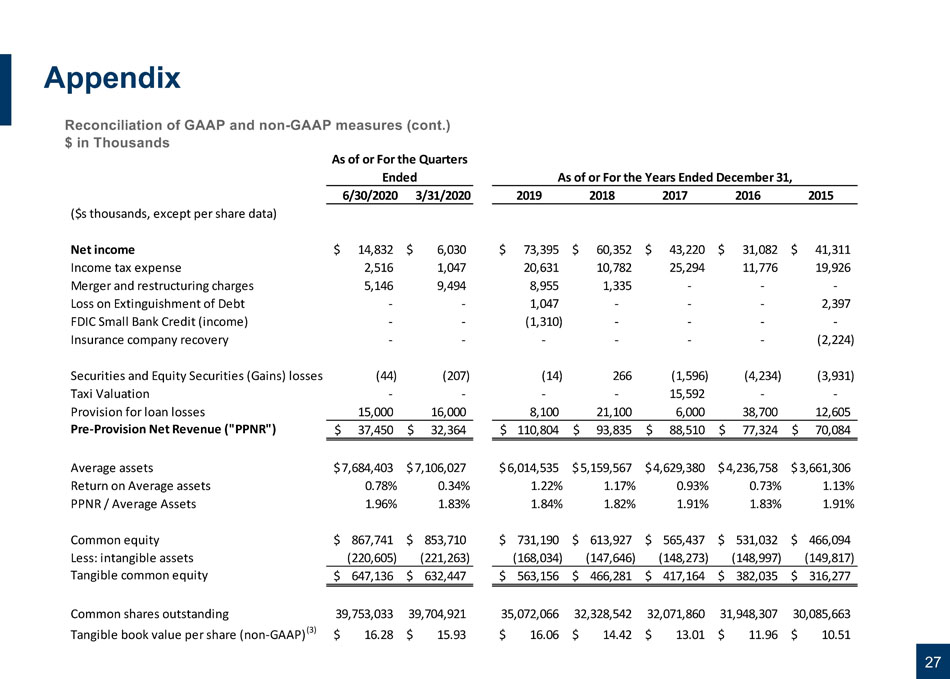

27 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands 6/30/2020 3/31/2020 2019 2018 2017 2016 2015 ($s thousands, except per share data) Net income 14,832$ 6,030$ 73,395$ 60,352$ 43,220$ 31,082$ 41,311$ Income tax expense 2,516 1,047 20,631 10,782 25,294 11,776 19,926 Merger and restructuring charges 5,146 9,494 8,955 1,335 - - - Loss on Extinguishment of Debt - - 1,047 - - - 2,397 FDIC Small Bank Credit (income) - - (1,310) - - - - Insurance company recovery - - - - - - (2,224) Securities and Equity Securities (Gains) losses (44) (207) (14) 266 (1,596) (4,234) (3,931) Taxi Valuation - - - - 15,592 - - Provision for loan losses 15,000 16,000 8,100 21,100 6,000 38,700 12,605 Pre-Provision Net Revenue ("PPNR") 37,450$ 32,364$ 110,804$ 93,835$ 88,510$ 77,324$ 70,084$ Average assets 7,684,403$ 7,106,027$ 6,014,535$ 5,159,567$ 4,629,380$ 4,236,758$ 3,661,306$ Return on Average assets 0.78% 0.34% 1.22% 1.17% 0.93% 0.73% 1.13% PPNR / Average Assets 1.96% 1.83% 1.84% 1.82% 1.91% 1.83% 1.91% Common equity 867,741$ 853,710$ 731,190$ 613,927$ 565,437$ 531,032$ 466,094$ Less: intangible assets (220,605) (221,263) (168,034) (147,646) (148,273) (148,997) (149,817) Tangible common equity 647,136$ 632,447$ 563,156$ 466,281$ 417,164$ 382,035$ 316,277$ Common shares outstanding 39,753,033 39,704,921 35,072,066 32,328,542 32,071,860 31,948,307 30,085,663 Tangible book value per share (non-GAAP) (3) 16.28$ 15.93$ 16.06$ 14.42$ 13.01$ 11.96$ 10.51$ As of or For the Years Ended December 31, As of or For the Quarters Ended

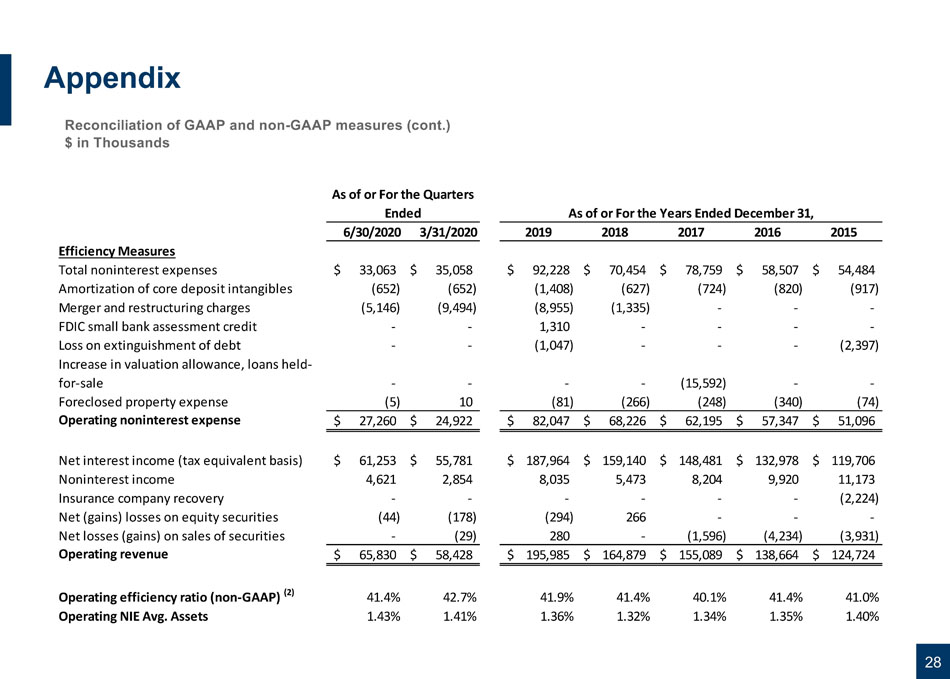

28 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands 6/30/2020 3/31/2020 2019 2018 2017 2016 2015 Efficiency Measures Total noninterest expenses 33,063$ 35,058$ 92,228$ 70,454$ 78,759$ 58,507$ 54,484$ Amortization of core deposit intangibles (652) (652) (1,408) (627) (724) (820) (917) Merger and restructuring charges (5,146) (9,494) (8,955) (1,335) - - - FDIC small bank assessment credit - - 1,310 - - - - Loss on extinguishment of debt - - (1,047) - - - (2,397) Increase in valuation allowance, loans held- for-sale - - - - (15,592) - - Foreclosed property expense (5) 10 (81) (266) (248) (340) (74) Operating noninterest expense 27,260$ 24,922$ 82,047$ 68,226$ 62,195$ 57,347$ 51,096$ Net interest income (tax equivalent basis) 61,253$ 55,781$ 187,964$ 159,140$ 148,481$ 132,978$ 119,706$ Noninterest income 4,621 2,854 8,035 5,473 8,204 9,920 11,173 Insurance company recovery - - - - - - (2,224) Net (gains) losses on equity securities (44) (178) (294) 266 - - - Net losses (gains) on sales of securities - (29) 280 - (1,596) (4,234) (3,931) Operating revenue 65,830$ 58,428$ 195,985$ 164,879$ 155,089$ 138,664$ 124,724$ Operating efficiency ratio (non-GAAP) (2) 41.4% 42.7% 41.9% 41.4% 40.1% 41.4% 41.0% Operating NIE Avg. Assets 1.43% 1.41% 1.36% 1.32% 1.34% 1.35% 1.40% As of or For the Quarters Ended As of or For the Years Ended December 31,

29 Appendix Reconciliation of GAAP and non - GAAP measures (cont.) $ in Thousands (2) Operating noninterest expense divided by operating revenue. (3) Tangible common equity divided by common shares outstanding at period-end. (1) Adjusted net interest margin excludes impact of purchase accounting fair value