Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atkore Inc. | atkr-20200909.htm |

Investor Presentation & Company Overview September 9, 2020 1

Cautionary Statements This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K and the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. We present Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net Sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month (“TTM”) basis) to help us describe our operating and financial performance. Adjusted EBITDA, Adjusted EBITDA margin, Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio are non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of operating performance. Adjusted EBITDA, Adjusted EBITDA margin, Net debt, Adjusted Net Income Per Share, and Leverage ratio, as defined by us may not be comparable to similar non-GAAP measures presented by other issuers. Our presentation of such measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of Adjusted EBITDA to net income, Adjusted EBITDA Margin, Adjusted Net Income Per Share to Net Income Per Share, net debt to total debt, and Leverage Ratio. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters end on the last Friday in December, March and June. Any information contained in the following slides that has been previously publicly presented by Atkore speaks as of the date that it was originally presented, as indicated. Atkore is not updating or affirming any of such information as of today’s date. The provision of this information shall not imply that the information has not changed since it was originally presented. 2

Atkore: a Compelling Investment A values-based organization with a focus on continuous improvement driven by the Atkore Business System Strong track record of earnings growth, increasing free cash flow and excellent return on capital With a commitment to quality, service and safety, we produce infrastructure solutions to power and protect the world around us, and to help our customers build better together We offer a broad platform of must-stock products to the electrical distribution channel, and our leading market positions and strong brands will be supported through both organic growth and M&A Our sound financial profile combined with our focus on environment, social and governance promotes long-term sustainable growth 3

Our Foundation is the Atkore Business System 4

Atkore at a Glance A leading manufacturer of electrical, mechanical, and safety infrastructure solutions 1959 2016 Harvey, IL ~3,900 65 Founded IPO (NYSE: ATKR) Headquarters Employees Global Facilities FY2019 Financial Highlights FY2019 Net Sales Breakdown, $1.9B Change $ Millions (except per share amounts) FY2019 vs. PY By Segment By Geography By End Market Net Sales $1,916.5 +4.4% Intl. Other Intl. 12% 6% 12% Net Income $139.1 +1.8% Mechanical Products & Adjusted EBITDA(1) $324.4 +19.5% Solutions 25% OEM U.S. Adjusted EBITDA 16.9% +210 bps 14% Construction Margin Electrical 68% (1) Raceway Adjusted EPS $3.62 +30.2% United States 75% 88% Free Cash Flow(1) $174.8 +63.1% Return on Capital(1) 17.0% +160 bps 1. See non-GAAP reconciliation in appendix 5

Strong Earnings Growth, Cash Flow and ROC% Adjusted EBITDA1, $M Free Cash Flow1, $M Return on Capital1 (ROC), % +13% CAGR +15% CAGR +1,360 bps 324 207 17.0 317 16.3 15.4 272 175 235 12.2 228 140 10.7 114 164 107 97 2.7 FY2015 FY2016 FY2017 FY2018 FY2019 TTM FY2015 FY2016 FY2017 FY2018 FY2019 TTM FY2015 FY2016 FY2017 FY2018 FY2019 TTM Jun Jun Jun 2020 2020 2020 1. See non-GAAP reconciliation in appendix 6

History of Positively Managing Input Costs Input Cost Volatility Solid Financial Results Indexed Prices of Key Input Cost Categories1 Annual Price vs. Cost Benefit to Adjusted EBITDA, $M 39 FY2017 FY2018 FY2019 FY2020 YTD 30 190 180 170 8 160 0 150 FY2017 FY2018 FY2019 FY2020 YTD 140 - 9 months Revenue & Adjusted EBITDA2, $M 130 1,917 Revenue 120 1,835 110 Adjusted EBITDA 1,504 100 1,288 90 272 324 80 228 228 70 09/30/2016 09/30/2017 09/30/2018 09/30/2019 FY2017 FY2018 FY2019 FY2020 YTD - 9 months Steel Copper Aluminum Zinc PVC Resin Adjusted EBITDA 15.1% 14.8% 16.9% 17.7% 1. Source: S&P Capital IQ and Atkore Analysis. Margin % 2. See non-GAAP reconciliation in appendix 7

Our Products Are All Around You Everyday Wire Basket Cable Related Segment Armored Cable Tray & Fittings Electrical Raceway Mechanical Products & Solutions Flexible Electrical Conduit Electrical & Liquidtight Conduit Prefabrication Cable Tray, Industrial Flexible Ladder & Fittings Electrical Conduit Metal Electrical Metal Framing & Fittings Conduit (Including Seismic) Roller Tube for Conduit & Cable Conveyor Fittings Specialty Electrical Perimeter Security Conduit: Stainless Steel, Solutions PVC-Coated & Aluminum Security Bollards PVC Trunking PVC Electrical Telescoping Sign Conduit & Fittings Support System 8

U.S. Construction Market Sales Breakdown % of Atkore FY19 Net Sales U.S. Construction End-Market Review By End Market 68% Commercial & . Key sub-categories1: Industrial • Offices & Data Centers • Warehouses & Regional Serve a diversified Distribution Facilities • Retail mix of end-markets Other Intl. 35% • Hotels 6% 12% with exposure to both • Manufacturing new construction (~53% of FY19 sales) OEM as well as repair & . Key sub-categories1: 14% U.S. Institutional remodel (~15% of • Education Construction 17% FY19 sales) by selling 68% • Healthcare • Transportation our products Residential . Key sub-categories1: primarily through a 12% • Single Family Homes solid customer base • Multifamily Units of electrical 4% Infrastructure . Key sub-categories1: distributors % of • Highways and Bridges ATKR • Power Utilities FY2019 Net Sales 1. Sub-categories listed in order of estimated size. 9

U.S. Construction Forecasted Market Trends Consensus Construction Forecast1 Market Observations & Trends Calendar 2021 Estimated Nonresidential Total Market % Change vs. 2020 by Data Provider Positive market trends in data centers, Associated Construct Dodge FMI IHS Markstein Moody’s Wells Builders & Connect Data & Economics Advisors Analytics Fargo warehouses, residential construction, Contractors Analytics Securities renewable energy projects and recreational -1.4% -1.6% equipment -2.0% -3.1% -3.2% Weaker market trends in hospitality and Avg. -4.8% retail construction as well as manufacturing -6.4% and heavy industrial markets Anticipate similar trends to continue into -9.4% 2021 with potential recovery in select -11.0% verticals such as education and hospitality 1. Source: The American Institute of Architects – July 2020 Construction Forecast. 10

Electrical Raceway Segment: Quick Facts: FY 2019 Q3 FY20 Key Brands: Net Sales, $M $1,443.5 $286.0 Adjusted EBITDA, $M $292.6 $57.5 Adjusted EBITDA Margin, % 20.3% 20.1% MARKET AND MARKET POSITION Electrical products that deploy, isolate and protect a structure’s electrical circuitry from the original power source to the final outlet PVC Conduit #1 Atkore products are a staple for electrical distributors and Atkore’s brands are must stock products Steel #2 Conduit Comprehensive product portfolio enables solution selling and the ability to bundle Armored Cable #2 Differentiated market position: Quality, market coverage and co-loading Flexible and capability Liquidtight #3 Conduit Organic growth opportunities driven through new product innovation, Cable Tray, focused product category growth and digital enablement for customers, Cable Ladder #2 & Fittings distributors and designers 11

Mechanical Products & Solutions Segment: Quick Facts: FY 2019 Q3 FY20 Key Brands: Net Sales, $M $474.3 $99.5 Adjusted EBITDA, $M $70.0 $12.2 Adjusted EBITDA Margin, % 14.8% 12.3% MARKET AND MARKET POSITION Mechanical products and services that frame, support and secure In-line component parts in a broad range of structures, equipment and systems in Galvanized Mechanical #1 electrical, industrial and construction applications Tube Global distribution capabilities for our broad portfolio of Safety & Security focused products and metal framing systems Barbed Tape #1 Market leader of in-line galvanized tubular products; preferred option for corrosion protection Metal Framing and Related #2 Fittings Value-added engineering, installation and pre-fabrication services Organic growth opportunities driven through new product innovation, Security Top global category expansion and improving the customer experience by Bollards 10 providing additional value-add services 12

Levers to Drive Organic Growth Recent Example & Highlights Organic Growth Drivers Commercialized over 30 new products in the past two years Drove high single digit revenue growth in Electrical Global Raceway “Focused Product Categories” in FY2019 Category Expansion Digital Focused Expanding global distribution and product capabilities Capabilities Product for safety and security product solutions & Categories Resources Increasing digital offerings and tools for our products such as BIM Models (Building Information Modeling) which help design professionals during the planning New Improving process Product Organic Customer Innovation Growth Experience Strategically aligned to several mega-trends such as electrification, growth in digital infrastructure, and safely protecting both people and critical assets 13

M&A Strategy Focused on Profitable Growth Bolt-On Acquisition Playbook Quick Facts: Target Profile Strategy Value Creation Spent $285 million of cash on . Privately held small to . Strategic fit from a product . Leverage global spend for medium sized businesses or category perspective, or key raw material input acquisitions since FY2017 . Build and foster long-term fills a portfolio gap categories to reduce costs relationships . Identified path to synergy & . Add products into Atkore Added over $400 million in profitable . Avoid auctions or value creation sales & distribution competitive bidding . Debt responsible umbrella for “One order, revenue through M&A activities since situations where possible . Within existing one shipment, one invoice” 2012 . Sales and distribution management bandwidth . Drive 1-2 turns of synergy through similar or existing and capacity channels for Atkore Exited over $400 million in breakeven proforma revenue since 2012 Successful Track Record of Portfolio Management 2013 2015 2017 2019 Acquired Heritage Plastics Acquired American Pipe & Plastics Acquired Marco Acquired Vergokan Closed manufacturing location in France Acquired SCI Acquired Flexicon Acquired U.S. Tray Closed manufacturing location in Brazil Closed manufacturing location in Ohio Acquired Rocky Mountain Colby Pipe Acquired FlyTec Systems Fiscal Year Related Segment 2014 2016 2018 2020 Electrical Raceway Acquired Ridgeline Pipe Ceased operations for fence & Acquired CalPipe Closed manufacturing Mechanical Products & Manufacturing sprinkler business Divested Flexhead location in Wales Solutions 14

Strong Financial Profile Ready for the Future Net Debt to TTM Adjusted EBITDA Debt Structure Debt Structure, $M As of 6/26/20 Cash and Cash Equivalents $237.3 2.9x 2.8x 2.6x Senior Secured 1st Term Loan Matures 2023 $846.1 2.2x 2.1x 2.1x Total Debt $846.1 1.9x Total Net Debt $608.8 Note: Undrawn Asset Based Loan of $325M (Matures 2023) Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Disciplined Approach to Capital Allocation Ready to Support Future Growth Manage Reinvest in the Mergers & Return Cash to Leverage Business Acquisitions Stockholders Target ~2x times for Maintain and grow the Structured approach; Target to offset dilution; Net Debt to TTM business with smart focused on bolt-on $35M authorization Adjusted EBITDA investments targets remaining as of June 26th 1. Click to add footnotes 15

Focused on Environment, Social & Governance We seek to utilize sustainable business principles and processes that achieve a balance between profitability and protection of all stakeholders, while reducing our impact on the environment and climate. Our Focus 32% 14% People and Community: We seek to protect people and communities in Reduction in recordable Less total water incident rate since 2015 purchased since 2016 which our facilities are located. Energy and Climate: We are committed to safeguarding climate and ecosystems through preventive practices. Natural Resources: We promote social and environmental stewardship 6% 21% Reduction in Less tons of material throughout our supply chain. greenhouse gas emitted waste rate avoided since since 2016 2015 Material Efficiency: We strive to prevent or minimize activities and conditions that pose a threat to human health and the environment. Strong Governance: We are dedicated to creating an organizational structure that is aligned with industry best practices and stockholder interests 33% 89% such as a separate independent Chairman and Delaware incorporation. Percentage of female or Percentage of minority members of the Independent members of Board of Directors the Board of Directors 16

Stable Business Model Supports Future Growth Disciplined Operational Focus Driven by the Atkore Business System Not a commodity company; proven track record of Input Cost Management successfully managing input cost changes and value selling Leading market share in key product categories with a Market Leadership portfolio of must-stock products for electrical distributors Strong liquidity position with a significant reduction in net Strong Financial Profile leverage over the past two years Multiple levers and opportunities to drive both organic and Opportunities for Growth inorganic growth 17

Third Quarter 2020 Earnings Presentation As Presented on August 4, 2020 18

Financial Results & Business Update Strong operating results and excellent cash generation in the third quarter 2020 Key Items Delivered Net Income of $24.1M and Adjusted EBITDA1 of $63.7M in the quarter Net sales declined 22.0%, and decremental margin impacts performed better than expectations Ended Q3 with a very strong cash balance of $237.3M; net leverage ratio2 improved to 1.9x Ratified a new four year labor agreement with the United Steelworkers at our Harvey, IL manufacturing site in July Given continued market volatility and uncertainty, we expect our FY2020 Net Sales, Adjusted EBITDA and Adjusted EPS to be down approximately 10% relative to FY2019 1. See non-GAAP reconciliation in appendix. 2. Leverage ratio and TTM Adjusted EBITDA reconciliations can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020. 19

Q3 Income Statement Summary Y/Y % Q3 2020 Q3 2019 Y/Y Change ($’s in millions) Change Net Sales $384.9 $493.5 ($108.6) (22.0%) Operating Income $41.6 $59.2 ($17.6) (29.7%) Net Income $24.1 $36.6 ($12.5) (34.1%) Adjusted EBITDA1 $63.7 $88.5 ($24.8) (28.0%) Adjusted EBITDA Margin2 16.6% 17.9% (130 bps) - Net Income per Share (Diluted) $0.49 $0.75 ($0.26) (34.7%) Adjusted Net Income per Share1 (Diluted) $0.67 $1.04 ($0.37) (35.6%) 1. See non-GAAP reconciliation in appendix 2. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net sales 20

Consolidated Atkore Q3 2020 Bridges Q3 Net Sales Bridge Net Sales Growth $494M Volume/Mix (20.7%) $5 $385M Price (1.8%) $103 $10 $1 Acquisitions/Divestitures +1.0% FX/Other (0.5%) Total (22.0%) 2019 Volume/Mix Price M&A FX/Other 2020 Q3 Adjusted EBITDA Bridge Highlights $88M Decremental adjusted EBITDA margin of ~23% $10 $2 $64M supported by strong cost control $0 $35 $1 Excellent commercial execution in a challenging market environment 2019 Volume/Mix Price M&A Productivity/ FX/Other 2020 vs. Cost Investment/ Inflation 21

Electrical Raceway Q3 Highlights Solid execution and performance with Adjusted Q3 Q3 Y/Y EBITDA margins of 20.1% in the quarter 2020 2019 Change ($’s in millions) Volume declines were mixed between different Net Sales $286.0 $373.2 (23.4%) product categories and geographies; experienced better than expected volumes in our Focused Product Adjusted EBITDA $57.5 $76.7 (25.1%) Categories Adjusted EBITDA Margin 20.1% 20.6% (50 bps) Expanded our dedicated schedule delivery program across our network of regional distribution centers in Q3 Net Sales Bridge the U.S. $373M $5 $0 $286M $88 $4 2019 Volume/Mix Price M&A FX/Other 2020 22

Mechanical Products & Solutions Q3 Highlights Net sales declined 17.5%; large renewable energy Q3 Q3 Y/Y projects and demand for recreational equipment, 2020 2019 Change ($’s in millions) partially offset declines in volume associated with overall market conditions Net Sales $99.5 $120.6 (17.5%) Adjusted EBITDA margins were 12.3%; down 480 bps Adjusted EBITDA $12.2 $20.6 (40.6%) vs. prior year which had several higher margin Adjusted EBITDA Margin 12.3% 17.1% (480 bps) security projects Launched Unistrut Seismic Bracing Solution in our Q3 Net Sales Bridge metal framing product line $121M $0 $99M $15 $6 $1 2019 Volume/Mix Price M&A FX/Other 2020 23

Key Balance Sheet & Cash Flow Metrics ($’s in millions) As of 6/26/2020 Debt & Liquidity Review Cash and cash equivalents $237.3 Senior secured term loan of $846.1M (net of Total Debt $846.1 deferred financing costs) due in December 2023 Net Debt $608.8 No scheduled principal payments prior to maturity YTD Net cash from operating activities $156.0 Asset Based Loan (ABL) capacity of $247.8M as YTD Capital expenditures $25.6 of June 26th; facility expires in December 2021 Facility was undrawn during the quarter YTD Free cash flow1 $130.4 TTM Adjusted EBITDA2 $317.2 YTD Stock repurchases $15.0 Leverage Ratio1 Total debt / TTM Adjusted EBITDA2 2.7 Net debt / TTM Adjusted EBITDA2 1.9 1. Free Cash Flow defined as Net cash from operating activities less capital expenditures. 2. Leverage ratio and TTM Adjusted EBITDA reconciliations can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020 24

Cash and Leverage Ratio Trends Cash & Cash Equivalents, $M +$137M vs. Prior Year 237.3 164.1 123.4 137.2 100.7 75.9 51.5 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Leverage Ratio1: Net Debt to TTM Adj. EBITDA Reduced by 0.7x 2.9 2.8 2.6 2.2 2.1 2.1 1.9 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 1. Leverage ratio and TTM Adjusted EBITDA reconciliations for all periods above can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020, May 5, 2020, February 4, 2020, November 22, 2019, August 8, 2019, May 7, 2019, or February 6, 2019. 25

Financial Outlook Summary Information is as presented on August 4, 2020 Given continued uncertainty and challenging market conditions, our primary operating assumption for Q4 is a net sales decline of approximately 15% versus prior year Outlook Summary Outlook Items for Changes to Prior FY2020 YTD FY2020 FY2020 Outlook – Note / Comment Consolidated Atkore Actual Results Outlook Favorable / (Unfavorable) Net Sales $1,288.0M Anticipating Net Sales, Adjusted EBITDA and Adjusted EPS to each be Down +0 to 500 bps 1 $228.4M down approximately 10% vs. prior year; however, estimate may vary due to Adjusted EBITDA ~10% vs. FY2019 vs. prior estimate changes in assumptions or market conditions Adjusted EPS1 $2.60 Interest Expense $30.6M $40 – $42M $0M / $3M Outlook based on amounts related to term loan Tax Rate 22.9% ~24% – Capital Expenditures $25.6M $28 – $32M ($8M) / ($7M) Up from prior estimate of $20 – $25M Diluted Shares Outstanding2 48.1 ~48 – 1. Reconciliation of the forward-looking full-year 2020 outlook for Adjusted EBITDA and Adjusted EPS is not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. 26 2. Represents weighted-average shares outstanding in millions used in calculation of Adjusted EPS outlook.

Our New Logo and Tagline Building Better Together. It’s more than a tagline. It’s how we think, how we conduct business and is a true commitment to our employees, customers, suppliers, shareholders and society that we will build better together. 27

APPENDIX 28

SegmentAdjusted Information Earnings Per Share Reconciliation Three months ended June 26, 2020 June 28, 2019 Adjusted Adjusted Adjusted EBITDA Adjusted EBITDA (in thousands) Net sales EBITDA Margin Net sales EBITDA Margin Electrical Raceway $ 286,046 $ 57,455 20.1 % $ 373,229 $ 76,721 20.6 % Mechanical Products & Solutions 99,487 12,243 12.3 % 120,596 20,595 17.1 % Eliminations (634) (334) Consolidated operations $ 384,899 $ 493,491 Fiscal year ended September 30, 2019 September 30, 2018 Adjusted Adjusted Adjusted EBITDA Adjusted EBITDA (in thousands) Net sales EBITDA Margin Net sales EBITDA Margin Electrical Raceway $ 1,443,493 $ 292,585 20.3 % $ 1,366,611 $ 255,260 18.7 % MP&S 474,260 $ 70,040 14.8 % 470,153 $ 51,339 10.9 % Eliminations (1,215) (1,625) Consolidated operations $ 1,916,538 $ 1,835,139 29

Adjusted Earnings Per Share Reconciliation Consolidated Atkore International Group Inc. Three Months Ended Fiscal Year Ended September 30, September 30, (in thousands, except per share data) June 26, 2020 June 28, 2019 2019 2018 Net income $ 24,078 $ 36,550 $ 139,051 $ 136,645 Stock-based compensation 1,656 4,120 11,798 14,664 Intangible asset amortization 8,026 7,868 32,876 32,104 Gain on purchase of business — — (7,384) — Gain on sale of a business — — — (27,575) Certain legal matters — — — (4,833) Other (a) 984 5,371 7,501 4,194 Pre-tax adjustments to net income 10,666 17,359 44,791 18,554 Tax effect (2,667) (4,253) (10,974) (4,824) Adjusted net income $ 32,078 $ 49,656 $ 172,868 $ 150,375 Weighted-Average Diluted Common Shares Outstanding 47,819 47,557 47,777 54,089 Net income per diluted share $ 0.49 $ 0.75 $ 2.83 $ 2.48 Adjusted net income per diluted share $ 0.67 $ 1.04 $ 3.62 $ 2.78 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 30

Net Income to Adjusted EBITDA Reconciliation Consolidated Atkore International Group Inc. Three Months Ended Fiscal Year Ended June 26, June 28, September September September September September (in thousands) 2020 2019 30, 2019 30, 2018 30, 2017 30, 2016 30, 2015 Net income $ 24,078 $ 36,550 $ 139,051 $ 136,645 $ 84,639 $ 58,796 $ (4,955) Income tax expense (benefit) 8,672 11,106 45,618 29,707 41,486 27,985 (2,916) Depreciation and amortization 18,316 17,760 72,347 66,890 54,727 55,017 59,465 Interest expense, net 9,421 12,789 50,473 40,694 26,598 41,798 44,809 Loss (gain) on extinguishment of debt — — — — 9,805 (1,661) — Restructuring & impairments 474 709 3,804 1,849 1,256 4,096 32,703 Net periodic pension benefit cost — — — — — 441 578 Stock-based compensation 1,656 4,120 11,798 14,664 12,788 21,127 13,523 Gain on purchase of a business — — (7,384) — — — — Gain on sale of a business — — — (27,575) — — — Gain on sale of a joint venture — — — — (5,774) — — ABF product liability impact — — — — — 850 (216) Consulting fees — — — — — 15,425 3,500 Certain legal matters — — — (4,833) 7,551 1,382 — Transaction costs 122 76 1,200 9,314 4,779 7,832 6,039 Impact of Fence and Sprinkler exit — — — — — 811 (2,885) Other (a) 984 5,371 7,501 4,194 (10,247) 1,103 14,305 Adjusted EBITDA $ 63,723 $ 88,481 $ 324,408 $ 271,549 $ 227,608 $ 235,002 $ 163,950 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 31

Trailing Twelve Month Adjusted EBITDA Consolidated Atkore International Group Inc. TTM Three months ended June 26, June 26, March 27, December September (in thousands) 2020 2020 2020 27, 2019 30, 2019 Net income $ 144,058 $ 24,078 $ 39,193 $ 34,790 $ 45,997 Interest expense, net 42,801 9,421 10,564 10,620 12,196 Income tax expense 45,217 8,672 13,100 7,340 16,105 Depreciation and amortization 73,810 18,316 18,478 18,730 18,286 Restructuring charges 3,962 474 2,645 220 623 Stock-based compensation 12,164 1,656 4,523 3,123 2,862 Transaction costs 1,016 122 6 51 837 Gain on purchase of a business (7,384) — — — (7,384) Other(a) 1,605 984 (1,503) 2,836 (712) Adjusted EBITDA $ 317,249 $ 63,723 $ 87,006 $ 77,710 $ 88,810 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 32

Net DebtAdjusted to Total Earnings Debt Per and Share Leverage Reconciliation Ratio Consolidated Atkore International Group Inc. June 26, March 27, December September June 28, March 29, December ($ in thousands) 2020 2020 27, 2019 28, 2019 2019 2019 28, 2018 Short-term debt and current maturities of long-term debt $ — $ — $ — $ — $ — $ — $ 26,561 Long-term debt 846,145 845,694 845,243 845,317 884,503 884,095 878,094 Total debt 846,145 845,694 845,243 845,317 884,503 884,095 904,655 Less cash and cash equivalents 237,309 137,202 $ 164,135 123,415 100,734 51,498 75,919 Net debt $ 608,836 $ 708,492 $ 681,108 $ 721,902 $ 783,769 $ 832,597 $ 828,736 TTM Adjusted EBITDA (a) $ 317,249 $ 342,007 $ 332,095 $ 324,408 $ 306,656 $ 294,839 $ 283,086 Total debt/TTM Adjusted EBITDA 2.7 x 2.5 x 2.5 x 2.6 x 2.9 x 3.0 x 3.2 x Net debt/TTM Adjusted EBITDA 1.9 x 2.1 x 2.1 x 2.2 x 2.6 x 2.8 x 2.9 x 33

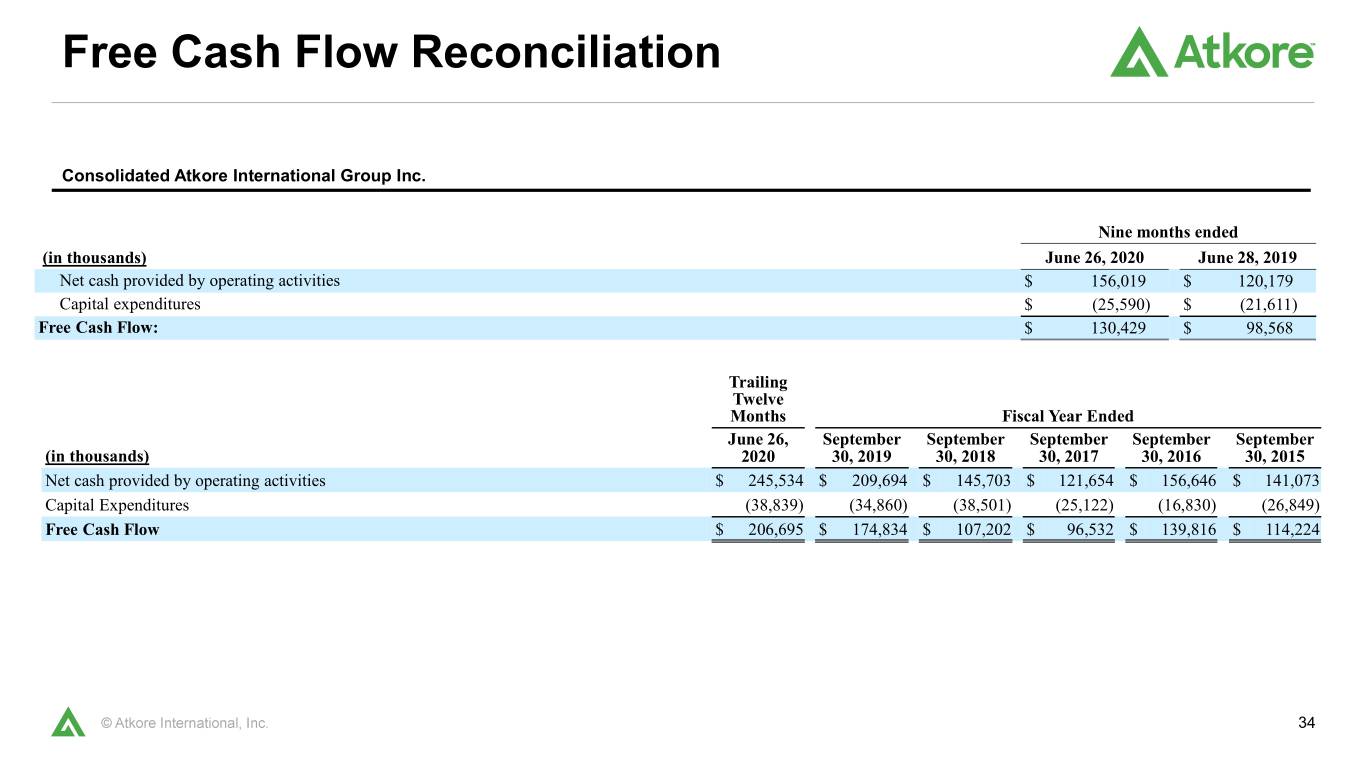

Free Cash Flow Reconciliation Consolidated Atkore International Group Inc. Nine months ended (in thousands) June 26, 2020 June 28, 2019 Net cash provided by operating activities $ 156,019 $ 120,179 Capital expenditures $ (25,590) $ (21,611) Free Cash Flow: $ 130,429 $ 98,568 Trailing Twelve Months Fiscal Year Ended June 26, September September September September September (in thousands) 2020 30, 2019 30, 2018 30, 2017 30, 2016 30, 2015 Net cash provided by operating activities $ 245,534 $ 209,694 $ 145,703 $ 121,654 $ 156,646 $ 141,073 Capital Expenditures (38,839) (34,860) (38,501) (25,122) (16,830) (26,849) Free Cash Flow $ 206,695 $ 174,834 $ 107,202 $ 96,532 $ 139,816 $ 114,224 34

Return on Capital Calculation Consolidated Atkore International Group Inc. Trailing Fiscal Year Ended Twelve Months June 26, September 30, September 30, September 30, September 30, September 30, (in thousands) 2020 2019 2018 2017 2016 2015 Income (Loss) Before Taxes $ 189,275 $ 184,669 $ 166,352 $ 126,125 $ 86,781 $ (7,871) Income Tax Expense (Benefit) 45,217 45,618 29,707 41,486 27,985 (2,916) Tax Rate % [Income Tax Expense (Benefit) ÷ Income (Loss) Before Taxes] 23.9% 24.7% 17.9% 32.9% 32.2% 37.0% Operating Income $ 221,558 $ 223,664 $ 179,698 $ 155,953 $ 125,466 $ 36,938 Estimated Taxes on Operating Income [Tax Rate % x Operating Income] 52,929 55,251 32,090 51,297 40,460 13,685 Net Operating Profit After Taxes [Operating Income – Estimated Taxes on Operating Income] $ 168,629 $ 168,413 $ 147,608 $ 104,656 $ 85,006 $ 23,253 Total Assets $ 1,491,777 $ 1,436,995 $ 1,324,060 $ 1,215,092 $ 1,164,568 $ 1,113,799 Cash 237,309 123,415 126,662 45,718 200,279 80,598 Current Liabilities 229,486 287,534 272,747 211,837 204,822 210,498 Short-Term Debt & Current Maturities of Long-Term Debt — — 26,561 4,215 1,267 2,864 Capital Base [Total Assets – Cash – Current Liabilities + Short-Term Debt & Current Maturities of Long-Term $ 1,024,982 $ 1,026,046 $ 951,212 $ 961,752 $ 760,734 $ 825,567 Debt] Average Capital Base [Average of Prior Period Capital Base and Current Period Capital Base] $ 1,034,122 $ 988,629 $ 956,482 $ 861,243 $ 793,151 $ 873,363 Return on Capital Percentage [Net Operating Profit After Taxes ÷ Average Capital Base] 16.3% 17.0% 15.4% 12.2% 10.7% 2.7% 35

Thank You! atkore.com 16100 South Lathrop Avenue, Harvey, IL 60426