Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AKORN INC | tm2030426d1_8k.htm |

Exhibit 99.1

Updated 2020 Forecast September 2020

Disclaimer By reading or reviewing the presentation slides, you agree to be bound by the following limitations. This presentation has been prepared for informational and background purposes only and the information contained herein (unle ss otherwise indicated) has been provided by Akorn, Inc. (together with its subsidiaries, the “Company”). It is confidential and does not constitute or form p art of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any securities of the Company or any of its affiliates or enter into any other transaction, nor should it or any part of it form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any sec uri ties of the Company or any of its affiliates, or with any other contract or commitment whatsoever. This presentation does not constitute an information or offering memorandum or a security purchase agreement in whole or in p art . Neither this presentation nor any part of it may be reproduced or redistributed, passed on, or the contents otherwise divulged, directly or indirectly, to any oth er person (excluding the recipient’s professional advisers) or published in whole or in part for any purpose without the prior written consent of the Company. This presentation does not purport to be all - inclusive or to contain all of the information that a person considering the purcha se of any securities may require to make a full analysis of the matters referred to herein. Each recipient of this presentation must make its own independent investig ati on and analysis of, or entering into any other transaction, any securities or other transaction and its own determination of the suitability of any investment, with p art icular reference to its own investment objectives and experience and any other factors which may be relevant to it in connection with such investment. Any assumptions, views or opinions (including statements, projections, forecasts or other forward - looking statements) contained in this presentation represent the assumptions, views or opinions of the Company as at the date indicated and are subject to change without notice. All informat ion not separately sourced is from internal Company data and estimates. The information contained in this presentation has not been independently verified and no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information contained herein and no reliance should be placed on it. None of the Co mpany or any of its affiliates, advisers, connected persons or any other person accept any liability for any loss howsoever arising (in negligence or otherwi se) , directly or indirectly, from this presentation or its contents or otherwise arising in connection with this presentation. This shall not, however, restrict or exc lude or limit any duty or liability to a person under any applicable law or regulation of any jurisdiction that may not lawfully be disclaimed. 2

Disclaimer (Continued) Cautionary Note Regarding Forward - Looking Statements This presentation includes statements that may constitute “forward - looking statements,” including statements regarding the Chap ter 11 Cases, the Company’s continued engagement in discussions with certain of its lenders regarding the Sale, the Company’s long - term business plan and ou tlook, the Company’s ability to complete the Sale and its ability to continue operating in the ordinary course while the Chapter 11 Cases are pending, other sta tements regarding the Company’s plans and strategy and the potential impact of the spread of coronavirus (also known as COVID - 19). When used in this presentatio n, the words “will,” “expect,” “continue,” “believe,” “seek,” “anticipate,” “estimate,” “intend,” “could,” “would,” “strives” and similar expressions are ge ner ally intended to identify forward - looking statements. These statements are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as am ended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). A number of important factors could cause actual results of th e Company and its subsidiaries to differ materially from those indicated by such forward - looking statements. These factors include, but are not limited to: (i) th e Company’s ability to consummate the Sale; (ii) potential adverse effects of the Chapter 11 Cases on the Company’s liquidity and results of operations; (iii) the Com pany’s ability to obtain timely approval by the Court with respect to the motions filed in the Chapter 11 Cases; (iv) objections that could protract the Chapter 11 Ca ses ; (v) employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties; (vi) the Com pan y’s ability to comply with the restrictions imposed by the terms and conditions of the DIP Facility and other financing arrangements; (vii) the Company’s ab ili ty to maintain relationships with suppliers, customers, employees and other third parties and regulatory authorities as a result of the Chapter 11 Cases; (viii ) t he effects of the Chapter 11 Cases on the Company and on the interests of various constituents, including holders of the Company’s common stock; (ix) the Court’s r uli ngs on the outcome of the Chapter 11 Cases generally; (x) the length of time that the Company will operate under Chapter 11 protection and the continued availa bil ity of operating capital during the pendency of the Chapter 11 Cases; (xi) risks associated with third party motions in the Chapter 11 Cases, which may interfere wi th the Company’s ability to consummate the Sale or an alternative transaction; (xii) increased administrative and legal costs related to the Chapter 11 p roc ess; potential delays in the Chapter 11 process due to the effects of the COVID - 19 virus; (xiii) other litigation and inherent risks involved in a bankruptcy process; a nd (xiv) such other risks and uncertainties outlined in the risk factors detailed in Part I, Item 1A, “Risk Factors,” of the Company’s Annual Report on Form 10 - K for the fi scal year ended December 31, 2019 (as filed with the SEC on February 26, 2020), Part II, Item 1A, “Risk Factors,” of the Company’s Quarterly Reports on Form 10 - Q for the fiscal quarters ended March 31, 2020 (as filed with the SEC on May 11, 2020) and June 30, 2020 (as filed with the SEC on August 7, 2020), and other risk fact ors identified from time to time in the Company’s filings with the SEC. Readers should carefully review these risk factors, and should not place undue reliance on th e C ompany’s forward - looking statements. These forward - looking statements are based on information, plans and estimates at the date of this presentation. The Company undertakes no obligation to update any forward - looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. Non - GAAP Financial Measures This presentation includes certain non - GAAP financial measures, including Adjusted Gross Margin, Adjusted Operating Income, EBIT DA, Adjusted EBITDA, Unlevered Free Cash Flow From Operations and Unlevered Free Cash Flow. While the Company believes these are useful measures f or investors, they are not presented in accordance with GAAP. You should not consider non - GAAP measures in isolation or as a substitute for net income, net cash (used in) provided by operating activities or any other items calculated in accordance with GAAP. In addition, each of EBITDA and Adjusted EBITDA h as inherent material limitations as a performance measure because it adds back certain expenses to net income, resulting in those expenses not being taken into acc oun t in the applicable financial measure. Because not all companies use identical calculations, the presentation herein of non - GAAP financial measures may not be comparable to other similarly titled measures of other companies. Reconciliations of the non - GAAP financial measures included in this presentation to amounts reported under GAAP appear in the Appendix of this presentation. Projections of GAAP measures are not provided for 2021 because such figures are not availa ble on a forward - looking basis and reconciliations of projected non - GAAP measures to their closest respective GAAP measures for 2021 are not provided because they could not be derived without unreasonable effort. 3

Disclaimer (Continued) This presentation is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or re sid ent or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation of such j uri sdiction or which would require any registration or licensing within such jurisdiction. This presentation or any part thereof is not for publication, release or dis tribution in the United States, Australia, Canada or Japan. Any failure to comply with these restrictions may constitute a violation of the laws of other jurisdictions. Th is presentation must not be acted on or relied on by persons who are not eligible to invest in securities. Any investment or investment activity to which this presen tat ion relates is available only to persons eligible to invest in securities and will be engaged in only with such persons. This presentation may include information from the S&P Capital IQ Platform Service. Such information is subject to the follow ing : “Copyright © 2019, S&P Capital IQ (and its affiliates, as applicable). This may contain information obtained from third parties, including ratings from credit rat ings agencies such as Standard & Poor’s. Reproduction and distribution of third party content in any form is prohibited except with the prior written permission of th e r elated third party. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. THIRD PAR TY CONTENT PROVIDERS GIVE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. THIRD PARTY CONTENT PROVIDERS SHALL NOT BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, EXEMPLARY, COMPENSATORY, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES, COSTS, EXPENSES, LEGAL FEES, OR LOSSES (INCLUDING LOST INCOME OR PROFITS AND OPPORTUNITY COSTS OR LOSSES CAUSED BY NEGLIGENCE) IN CONNECTION WITH ANY USE OF THEIR CONTENT, INCLUDING RATINGS. Credit ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sel l s ecurities. They do not address the suitability of securities or the suitability of securities for investment purposes, and should not be relied on as investment ad vice”. This presentation may include information from SNL Financial LC. Such information is subject to the following: “CONTAINS COPY RIG HTED AND TRADE SECRET MATERIAL DISTRIBUTED UNDER LICENSE FROM SNL. FOR RECIPIENT’S INTERNAL USE ONLY”. The information contained in this presentation is provided as at the date of this presentation and is subject to change witho ut notice. 4

Important Information By accepting this presentation, the recipient agrees to use the information herein in accordance with its compliance policies , c ontractual obligations (including, but not limited to, the provisions of that certain confidentiality agreement entered into between the recipient and Akorn, Inc. (the “Co mpany”)), applicable law, including United States federal and state, United Kingdom and other applicable securities laws. This presentation may contain material non - public information concerning the company and its subsidiaries or other affiliates o r the securities of any of the foregoing. By accepting this presentation, the recipient agrees, with respect to any such information, that it will not trade or effect oth er transactions to which such information may be relevant until such time as the information is made generally available or is no longer relevant. The recipient agrees th at this restriction will apply to its entire firm other than any personnel who are permitted to trade by such recipient’s legal or compliance department due to the existe nce of information barriers that restrict the recipient’s firm from trading on the basis of material non - public information. 5

Table of Contents • 2020 Updated Forecast • Appendix: GAAP to Adjusted Reconciliations 6

Key Drivers of July Performance and 2H 2020 Outlook 7 July Performance 2H 2020 Outlook • July performance was impacted by slower than anticipated demand recovery, competitive pressures, and supply disruptions • Divergence between recovery in pull - thru and wholesaler reordering • Slower than originally expected demand recovery from COVID - 19 as health care providers adapt to the current environment o The ultimate effects of COVID - 19 are highly uncertain and difficult to forecast given the unknown trajectory of recovery from the pandemic • Current competitive dynamics and contract positions • New product revenue reflects current expectations for approval and launch readiness

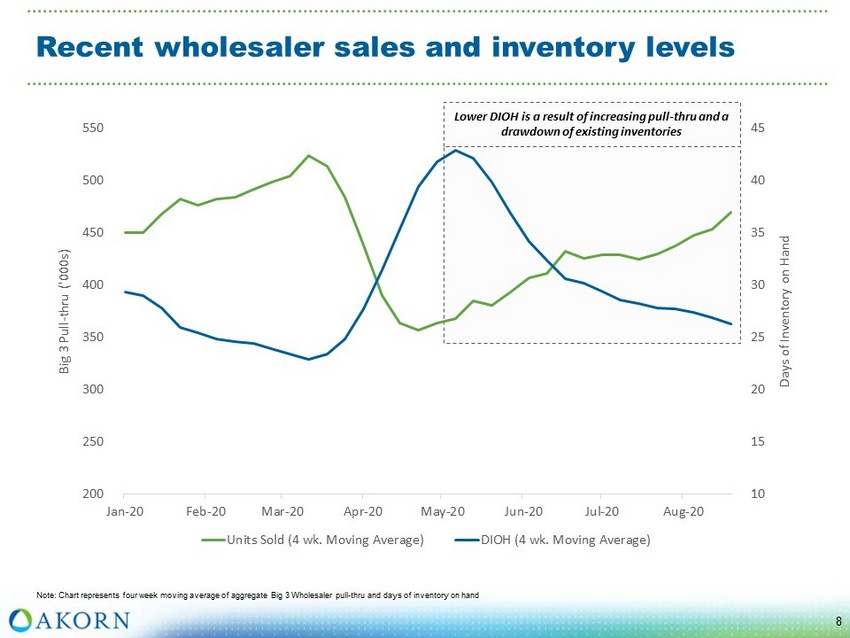

Lower DIOH is a result of increasing pull - thru and a drawdown of existing inventories Recent wholesaler sales and inventory levels 8 Note: Chart represents four week moving average of aggregate Big 3 Wholesaler pull - thru and days of inventory on hand 10 15 20 25 30 35 40 45 200 250 300 350 400 450 500 550 Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Days of Inventory on Hand Big 3 Pull - thru ('000s) Units Sold (4 wk. Moving Average) DIOH (4 wk. Moving Average)

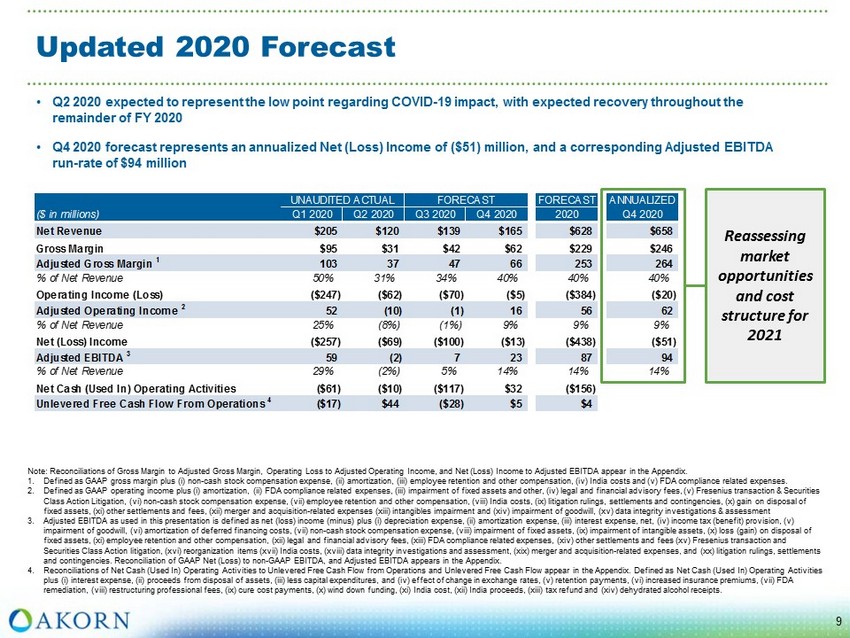

UNAUDITED ACTUAL FORECAST FORECAST ANNUALIZED ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 Q4 2020 Net Revenue $205 $120 $139 $165 $628 $658 Gross Margin $95 $31 $42 $62 $229 $246 Adjusted Gross Margin 1 103 37 47 66 253 264 % of Net Revenue 50% 31% 34% 40% 40% 40% Operating Income (Loss) ($247) ($62) ($70) ($5) ($384) ($20) Adjusted Operating Income 2 52 (10) (1) 16 56 62 % of Net Revenue 25% (8%) (1%) 9% 9% 9% Net (Loss) Income ($257) ($69) ($100) ($13) ($438) ($51) Adjusted EBITDA 3 59 (2) 7 23 87 94 % of Net Revenue 29% (2%) 5% 14% 14% 14% Net Cash (Used In) Operating Activities ($61) ($10) ($117) $32 ($156) Unlevered Free Cash Flow From Operations 4 ($17) $44 ($28) $5 $4 Updated 2020 Forecast • Q2 2020 expected to represent the low point regarding COVID - 19 impact, with expected recovery throughout the remainder of FY 2020 • Q4 2020 forecast represents an annualized Net (Loss) Income of ($51) million, and a corresponding Adjusted EBITDA run - rate of $94 million 9 Note: Reconciliations of Gross Margin to Adjusted Gross Margin, Operating Loss to Adjusted Operating Income, and Net (Loss) I nco me to Adjusted EBITDA appear in the Appendix. 1. Defined as GAAP gross margin plus (i) non - cash stock compensation expense, (ii) amortization, (iii) employee retention and other compensation, (iv) India costs and (v) FDA compliance related expenses. 2. Defined as GAAP operating income plus (i) amortization, (ii) FDA compliance related expenses, (iii) impairment of fixed asset s a nd other, (iv) legal and financial advisory fees, (v) Fresenius transaction & Securities Class Action Litigation, (vi) non - cash stock compensation expense, (vii) employee retention and other compensation, (viii) India costs, (ix) litigation rulings, settlements and contingencies, (x) gain on disposal of fixed assets, (xi) other settlements and fees, (xii) merger and acquisition - related expenses (xiii) intangibles impairment and ( xiv) impairment of goodwill, (xv) data integrity investigations & assessment 3. Adjusted EBITDA as used in this presentation is defined as net (loss) income (minus) plus (i) depreciation expense, (ii) amor tiz ation expense, (iii) interest expense, net, (iv) income tax (benefit) provision, (v) impairment of goodwill, (vi) amortization of deferred financing costs, (vii) non - cash stock compensation expense, (viii) impairm ent of fixed assets, (ix) impairment of intangible assets, (x) loss (gain) on disposal of fixed assets, (xi) employee retention and other compensation, (xii) legal and financial advisory fees, (xiii) FDA compliance rel ated expenses, (xiv) other settlements and fees (xv) Fresenius transaction and Securities Class Action litigation, (xvi) reorganization items (xvii) India costs, (xviii) data integrity investigations and ass essment, (xix) merger and acquisition - related expenses, and (xx) litigation rulings, settlements and contingencies. Reconciliation of GAAP Net (Loss) to non - GAAP EBITDA, and Adjusted EBITDA appears in the Appendix. 4. Reconciliations of Net Cash (Used In) Operating Activities to Unlevered Free Cash Flow from Operations and Unlevered Free Cas h F low appear in the Appendix. Defined as Net Cash (Used In) Operating Activities plus (i) interest expense, (ii) proceeds from disposal of assets, (iii) less capital expenditures, and (iv) effect of change in exchange rates, (v) retention payments, (vi) increased insurance premiums, (vii) FDA remediation, (viii) restructuring professional fees, (ix) cure cost payments, (x) wind down funding, (xi) India cost, (xii) I ndi a proceeds, (xiii) tax refund and (xiv) dehydrated alcohol receipts. Reassessing market opportunities and cost structure for 2021

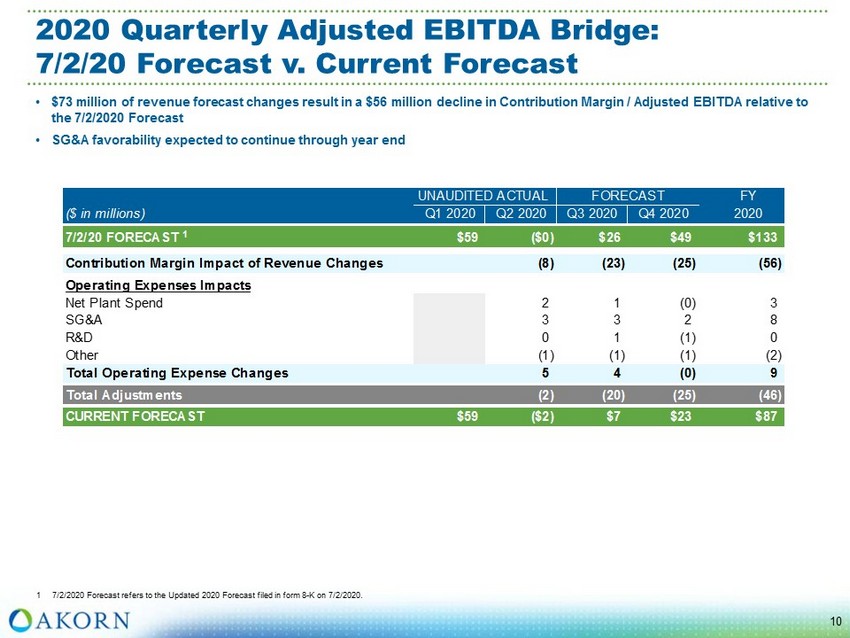

2020 Quarterly Adjusted EBITDA Bridge: 7/2/20 Forecast v. Current Forecast 1 7/2/2020 Forecast refers to the Updated 2020 Forecast filed in form 8 - K on 7/2/2020. 10 • $73 million of revenue forecast changes result in a $56 million decline in Contribution Margin / Adjusted EBITDA relative to the 7/2/2020 Forecast • SG&A favorability expected to continue through year end UNAUDITED ACTUAL FORECAST FY ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 7/2/20 FORECAST 1 $59 ($0) $26 $49 $133 Contribution Margin Impact of Revenue Changes (8) (23) (25) (56) Operating Expenses Impacts Net Plant Spend 2 1 (0) 3 SG&A 3 3 2 8 R&D 0 1 (1) 0 Other (1) (1) (1) (2) Total Operating Expense Changes 5 4 (0) 9 Total Adjustments (2) (20) (25) (46) CURRENT FORECAST $59 ($2) $7 $23 $87

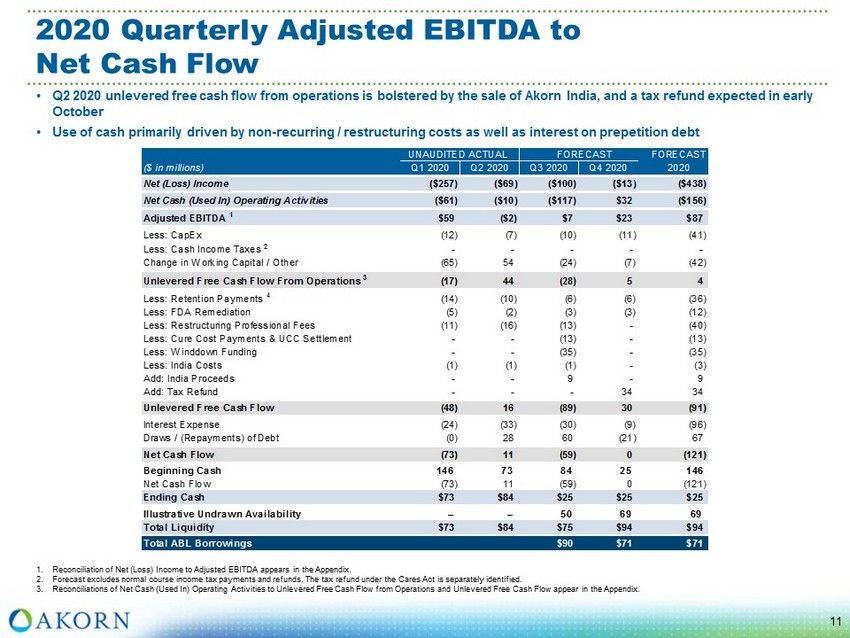

2020 Quarterly Adjusted EBITDA to Net Cash Flow 1. Reconciliation of Net (Loss) Income to Adjusted EBITDA appears in the Appendix. 2. Forecast excludes normal course income tax payments and refunds. The tax refund under the Cares Act is separately identified. 3. Reconciliations of Net Cash (Used In) Operating Activities to Unlevered Free Cash Flow from Operations and Unlevered Free Cas h F low appear in the Appendix. 11 • Q2 2020 unlevered free cash flow from operations is bolstered by the sale of Akorn India, and a tax refund expected in early October • Use of cash primarily driven by non - recurring / restructuring costs as well as interest on prepetition debt UNAUDITED ACTUAL FORECAST FORECAST ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 Net (Loss) Income ($257) ($69) ($100) ($13) ($438) Net Cash (Used In) Operating Activities ($61) ($10) ($117) $32 ($156) Adjusted EBITDA 1 $59 ($2) $7 $23 $87 Less: CapEx (12) (7) (10) (11) (41) Less: Cash Income Taxes 2 - - - - - Change in Working Capital / Other (65) 54 (24) (7) (42) Unlevered Free Cash Flow From Operations 3 (17) 44 (28) 5 4 Less: Retention Payments 4 (14) (10) (6) (6) (36) Less: FDA Remediation (5) (2) (3) (3) (12) Less: Restructuring Professional Fees (11) (16) (13) - (40) Less: Cure Cost Payments & UCC Settlement - - (13) - (13) Less: Winddown Funding - - (35) - (35) Less: India Costs (1) (1) (1) - (3) Add: India Proceeds - - 9 - 9 Add: Tax Refund - - - 34 34 Unlevered Free Cash Flow (48) 16 (89) 30 (91) Interest Expense (24) (33) (30) (9) (96) Draws / (Repayments) of Debt (0) 28 60 (21) 67 Net Cash Flow (73) 11 (59) 0 (121) Beginning Cash 146 73 84 25 146 Net Cash Flow (73) 11 (59) 0 (121) Ending Cash $73 $84 $25 $25 $25 Illustrative Undrawn Availability – – 50 69 69 Total Liquidity $73 $84 $75 $94 $94 Total ABL Borrowings $90 $71 $71

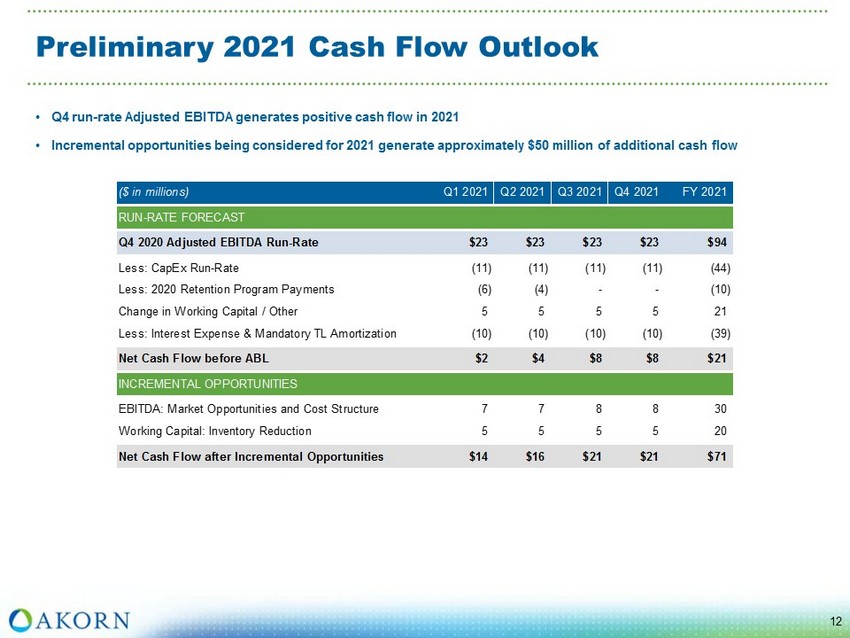

Preliminary 2021 Cash Flow Outlook 12 • Q4 run - rate Adjusted EBITDA generates positive cash flow in 2021 • Incremental opportunities being considered for 2021 generate approximately $50 million of additional cash flow ($ in millions) Q1 2021 Q2 2021 Q3 2021 Q4 2021 FY 2021 RUN-RATE FORECAST Q4 2020 Adjusted EBITDA Run-Rate $23 $23 $23 $23 $94 Less: CapEx Run-Rate (11) (11) (11) (11) (44) Less: 2020 Retention Program Payments (6) (4) - - (10) Change in Working Capital / Other 5 5 5 5 21 Less: Interest Expense & Mandatory TL Amortization (10) (10) (10) (10) (39) Net Cash Flow before ABL $2 $4 $8 $8 $21 INCREMENTAL OPPORTUNITIES EBITDA: Market Opportunities and Cost Structure 7 7 8 8 30 Working Capital: Inventory Reduction 5 5 5 5 20 Net Cash Flow after Incremental Opportunities $14 $16 $21 $21 $71

Table of Contents • 2020 Updated Forecast • Appendix: GAAP to Adjusted Reconciliations 13

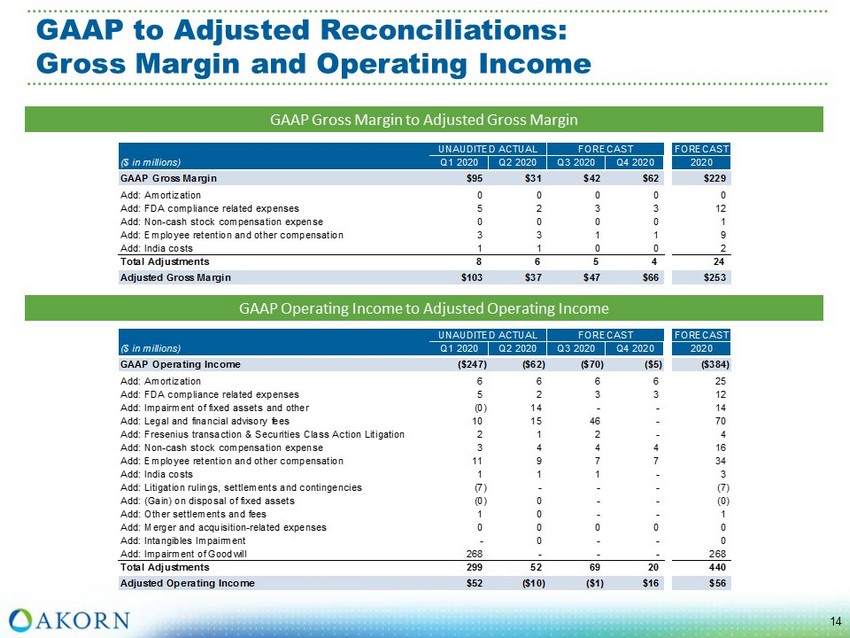

GAAP to Adjusted Reconciliations: Gross Margin and Operating Income 14 GAAP Gross Margin to Adjusted Gross Margin GAAP Operating Income to Adjusted Operating Income UNAUDITED ACTUAL FORECAST FORECAST ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 GAAP Gross Margin $95 $31 $42 $62 $229 Add: Amortization 0 0 0 0 0 Add: FDA compliance related expenses 5 2 3 3 12 Add: Non-cash stock compensation expense 0 0 0 0 1 Add: Employee retention and other compensation 3 3 1 1 9 Add: India costs 1 1 0 0 2 Total Adjustments 8 6 5 4 24 0 0 0 0 0 Adjusted Gross Margin $103 $37 $47 $66 $253 UNAUDITED ACTUAL FORECAST FORECAST ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 GAAP Operating Income ($247) ($62) ($70) ($5) ($384) Add: Amortization 6 6 6 6 25 Add: FDA compliance related expenses 5 2 3 3 12 Add: Impairment of fixed assets and other (0) 14 - - 14 Add: Legal and financial advisory fees 10 15 46 - 70 Add: Fresenius transaction & Securities Class Action Litigation 2 1 2 - 4 Add: Non-cash stock compensation expense 3 4 4 4 16 Add: Employee retention and other compensation 11 9 7 7 34 Add: India costs 1 1 1 - 3 Add: Litigation rulings, settlements and contingencies (7) - - - (7) Add: (Gain) on disposal of fixed assets (0) 0 - - (0) Add: Other settlements and fees 1 0 - - 1 Add: Merger and acquisition-related expenses 0 0 0 0 0 Add: Intangibles Impairment - 0 - - 0 Add: Impairment of Goodwill 268 - - - 268 Total Adjustments 299 52 69 20 440 Adjusted Operating Income $52 ($10) ($1) $16 $56

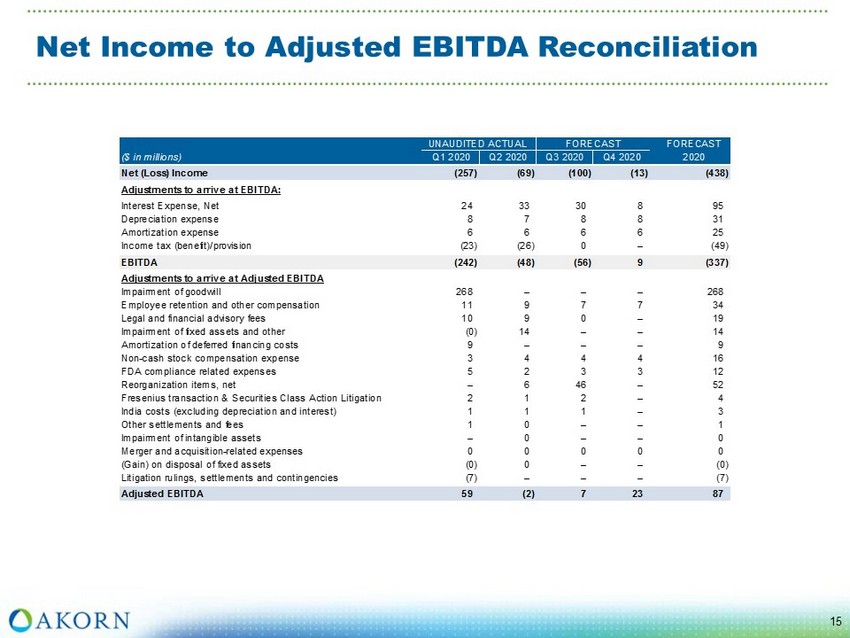

Net Income to Adjusted EBITDA Reconciliation 15 UNAUDITED ACTUAL FORECAST FORECAST ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 Net (Loss) Income (257) (69) (100) (13) (438) Adjustments to arrive at EBITDA: Interest Expense, Net 24 33 30 8 95 Depreciation expense 8 7 8 8 31 Amortization expense 6 6 6 6 25 Income tax (benefit)/provision (23) (26) 0 – (49) EBITDA (242) (48) (56) 9 (337) Adjustments to arrive at Adjusted EBITDA Impairment of goodwill 268 – – – 268 Employee retention and other compensation 11 9 7 7 34 Legal and financial advisory fees 10 9 0 – 19 Impairment of fixed assets and other (0) 14 – – 14 Amortization of deferred financing costs 9 – – – 9 Non-cash stock compensation expense 3 4 4 4 16 FDA compliance related expenses 5 2 3 3 12 Reorganization items, net – 6 46 – 52 Fresenius transaction & Securities Class Action Litigation 2 1 2 – 4 India costs (excluding depreciation and interest) 1 1 1 – 3 Other settlements and fees 1 0 – – 1 Impairment of intangible assets – 0 – – 0 Merger and acquisition-related expenses 0 0 0 0 0 (Gain) on disposal of fixed assets (0) 0 – – (0) Litigation rulings, settlements and contingencies (7) – – – (7) Adjusted EBITDA 59 (2) 7 23 87

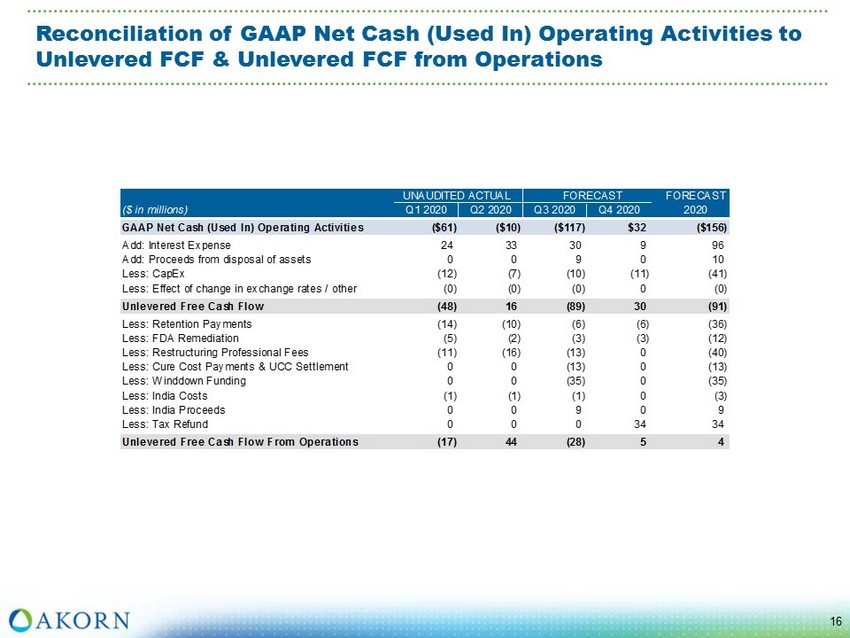

Reconciliation of GAAP Net Cash (Used In) Operating Activities to Unlevered FCF & Unlevered FCF from Operations 16 UNAUDITED ACTUAL FORECAST FORECAST ($ in millions) Q1 2020 Q2 2020 Q3 2020 Q4 2020 2020 GAAP Net Cash (Used In) Operating Activities ($61) ($10) ($117) $32 ($156) Add: Interest Expense 24 33 30 9 96 Add: Proceeds from disposal of assets 0 0 9 0 10 Less: CapEx (12) (7) (10) (11) (41) Less: Effect of change in exchange rates / other (0) (0) (0) 0 (0) Unlevered Free Cash Flow (48) 16 (89) 30 (91) Less: Retention Payments (14) (10) (6) (6) (36) Less: FDA Remediation (5) (2) (3) (3) (12) Less: Restructuring Professional Fees (11) (16) (13) 0 (40) Less: Cure Cost Payments & UCC Settlement 0 0 (13) 0 (13) Less: Winddown Funding 0 0 (35) 0 (35) Less: India Costs (1) (1) (1) 0 (3) Less: India Proceeds 0 0 9 0 9 Less: Tax Refund 0 0 0 34 34 Unlevered Free Cash Flow From Operations (17) 44 (28) 5 4