Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST FINANCIAL CORP /IN/ | thff-20200908.htm |

Thirty-two consecutive years of increased shareholder dividends : THFF September 9, 2020

Forward-looking Information This presentation contains future oral and written statements of the Company and its management, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of the Company. Forward-looking statements are generally identifiable by the use of words such as “believe”, “expect”, “anticipate”, “estimate”, “could”, and other similar expressions. All statements in this presentation, including forward-looking statements, speak only as of today’s date, and the Company undertakes no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond the ability of the Company to control or predict, could cause actual results to differ materially from those in its forward-looking statements. Additional information is included in the Company’s filings with the Securities and Exchange Commission. Factors that could have a material adverse effect on the Company’s financial condition, results of operations and future prospects can be found in the “Risk Factors” section in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and elsewhere in the Company’s periodic and current reports filed with the Securities and Exchange Commission. These factors include, but are not limited to, the effects of future economic, business and market conditions and changes, domestic and foreign, including competition, governmental policies and seasonality; legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and their application by Company regulators, and changes in the scope and cost of FDIC insurance and other coverages; the risks of changes in interest rates on the levels, composition and costs of deposits, loan demand and other interest sensitive assets and liabilities; the failure of assumptions and estimates underlying the establishment of reserves for possible loan losses, analysis of capital needs and other estimates; changes in borrowers’ credit risks and payment behaviors; and changes in the availability and cost of credit and capital.

Norman L. Lowery Chairman, Chief Executive Officer, President Norman D. Lowery Chief Operating Officer, SVP Rodger A. McHargue Chief Financial Officer, SVP Steve Holliday Chief Credit Officer, SVP

Indiana’s first $4.4 billion in assets Illinois Multi-bank holding company June 30, 2020 32 locations Established 1984 $1.2 billion Indiana 86 banking locations Trust and Assets Under Management 34 locations Illinois, Indiana, Kentucky, Tennessee 82 banking centers First Financial Bank 4 loan production offices Primary subsidiary founded in 1834 Oldest national bank in Indiana Terre Haute, Indiana 5th oldest national bank in the United States Indianapolis Headquarters One of America’s Best Banks 5-Star Rating BauerFinancial Kentucky 11 locations Best Bank Top 100 Publicly Top 100 Farm 11 Years in a Row Traded U.S. Bank Lender in America Tribune-Star Readers’ Choice Bank Director Magazine FDIC Tennessee Nashville 9 locations

Our Vision To enhance our clients’ abilities to spend, save, borrow and invest. Our Mission To deliver financial solutions that are simple, fast and easy. Our Values We build strong relationships and treat each other with dignity and respect. We embrace the diversity of our customers and co-workers. We apply the highest standards of excellence to everything we do. We work as a team to deliver world-class customer service. We get involved in our communities. We recognize profitability is essential to our future success. 5

Value Proposition Capital to Support Increasing Strong Risk Strategic Growth Shareholder Management Value Experienced Management Team Proven Earnings Well-positioned Balance Sheet & Strong Asset Quality 180+ year Operating Track Record 6

Covid-19 Impact Loan Modifications • $321.8 million commercial credit requests granted ✓ Most 90-day interest only • $8.7 million mortgage credit requests granted • $13.0 million consumer credit requests granted • Initially, 12.9% of loan portfolio with some kind of modification; 100% remain modified as of 6/30/2020 Payroll Protection Program • 1,743 Payroll Protection Loans • $170 million outstanding • $97,930 average loan size • $6.2 million fees generated 7

Covid-19 Impacted Industries Hotels • 19 relationships with $77.58 million outstanding (3.99% of Commercial Loans) • Average loan size $2.5 million • Average LTV at origination is 75% • Hilton Garden Inn, Home Suites, Holiday Inn Express, Quality Inn, Hampton Inn Restaurants • 200 transactions with $47.88 million outstanding (2.46% of Commercial Loans) • Average loan size $239,400 Non-owner Occupied Retail • 78 borrowers with $90.68 million outstanding (4.67% of Commercial Loans) • 21 borrowers with $20.76 million with Investment Grade Tenants • 57 borrowers with $69.92 million with Non-investment Grade Tenants • Overall average loan size $1.163 million 8

Strong Capital TCE Key Capital Ratios and Per 14.00% Share Data as of June 30, 2020 10.50% • Total Risk Based 16.17% 7.00% • Tier 1 Risk Based 15.44% 3.50% 0.00% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2Q20 • Tier 1 Leverage 11.64% • Book Value $43.04 TBV • Tangible Book Value $36.59 $40.00 CAGR 7.5% $30.00 $20.00 $10.00 $0.00 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2Q20 9

History of Earnings and Dividend Growth Earnings and Dividends Per Share 4.00 3.80 3.80 CAGR 2000 - 2019 EPS 6.36% 3.12 3.00 2.83 Dividends 5.37% 2.55 2.48 2.50 2.37 2.35 2.38 2.14 2.10 2.07 2.00 1.95 1.94 1.89 1.72 1.78 1.72 1.77 1.73 1.02 1.03 0.93 0.94 0.96 0.97 0.98 0.99 1.00 0.84 0.86 0.88 0.90 0.91 0.75 0.80 0.60 0.65 0.51 0.56 '- 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 EPS Dividends Paid 10

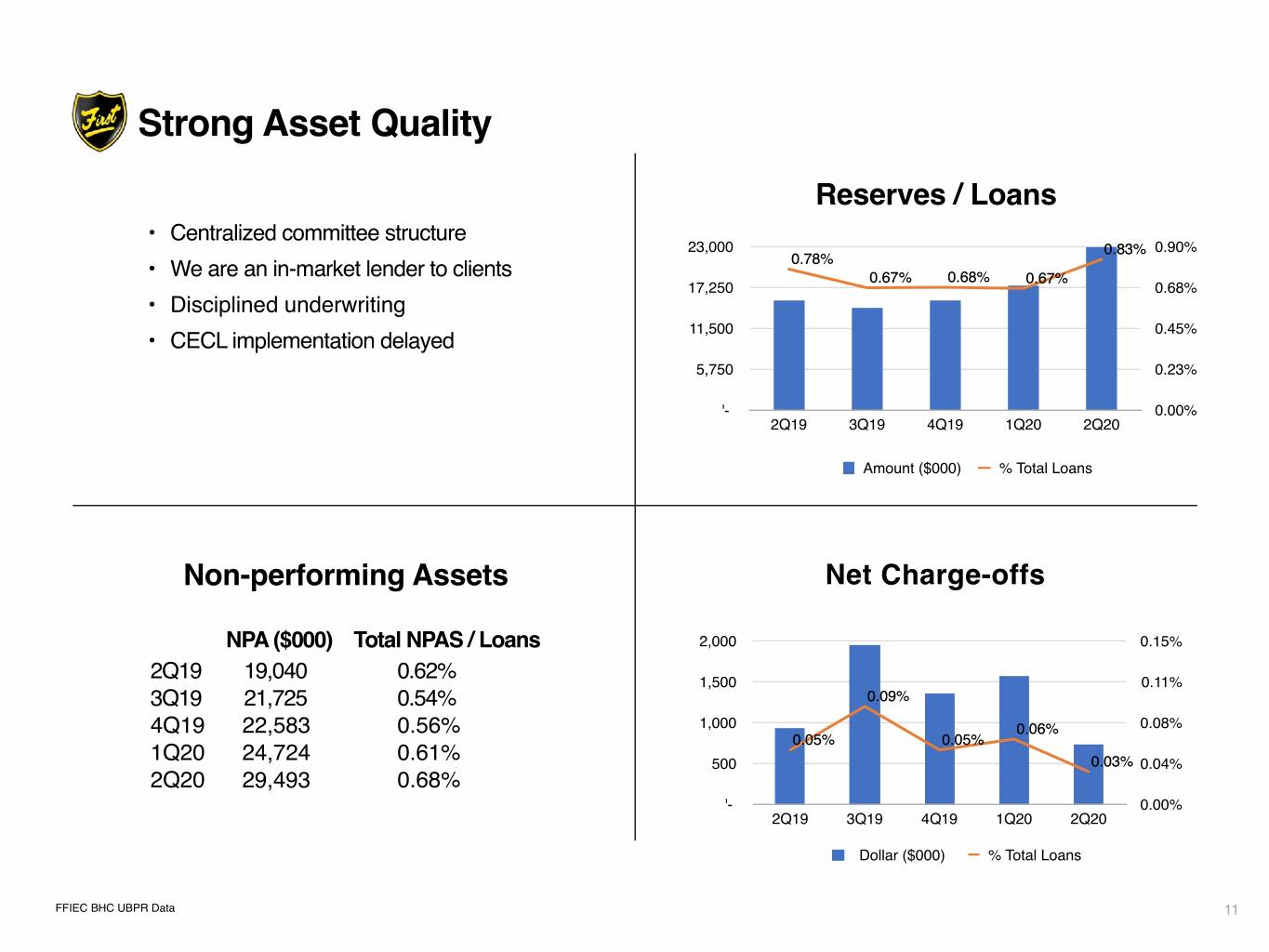

Strong Asset Quality Reserves / Loans • Centralized committee structure 23,000 0.83% 0.90% 0.78% • We are an in-market lender to clients 0.67% 0.68% 0.67% 17,250 0.68% • Disciplined underwriting 11,500 0.45% • CECL implementation delayed 5,750 0.23% '- 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 Amount ($000) % Total Loans Non-performing Assets Net Charge-offs NPA ($000) Total NPAS / Loans 2,000 0.15% 2Q19 19,040 0.62% 1,500 0.11% 3Q19 21,725 0.54% 0.09% 4Q19 22,583 0.56% 1,000 0.06% 0.08% 0.05% 0.05% 1Q20 24,724 0.61% 500 0.03% 0.04% 2Q20 29,493 0.68% '- 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 Dollar ($000) % Total Loans FFIEC BHC UBPR Data 11

Better than Peer Performance Non-interest Income % Avg Assets Return on Assets 1.60 1.56 1.70 1.61 1.42 1.30 1.38 1.33 1.32 1.21 1.22 1.20 1.12 1.28 1.22 1.19 1.12 1.01 0.98 0.92 0.95 0.80 0.91 0.92 0.92 0.85 0.93 0.93 0.91 0.93 0.9 0.9 0.89 0.70 0.43 0.40 '- - 2014 2015 2016 2017 2018 2019 1Q20 2014 2015 2016 2017 2018 2019 1Q20 FFIEC BHC UBPR Data FFC Peer FFIEC BHC UBPR Data FFC Peer 12

Net Interest Income

Loan Growth Driving Growth in Income $’s in (000’s) NII 4.42% CAGR NIM 140,000 131,652 6.00 116,579 107,832 104,507 104,973 107,857 105,000 5.00 72,245 4.32 72,245 70,000 4.25 4.00 4.08 4.04 4.04 4.11 4.05 35,000 3.00 '- 2.00 2014 2015 2016 2017 2018 2019 YTD 6/30/20 13

Loan Portfolio ($000) Balance Percent Commercial 1,953,465 61% Diversified Loan Portfolio Consumer 543,276 15% Residential 280,893 24% Total 2,777,634 100% Loan Portfolio Balance ($000) Commercial Loans By State IL Commercial Commercial 13% 61% $1,953,465 IN 48% KY Consumer 8% 15% TN 10% Consumer Residential $543,276 Other 24% Residential 21% $280,893 Total $2,777,634 14

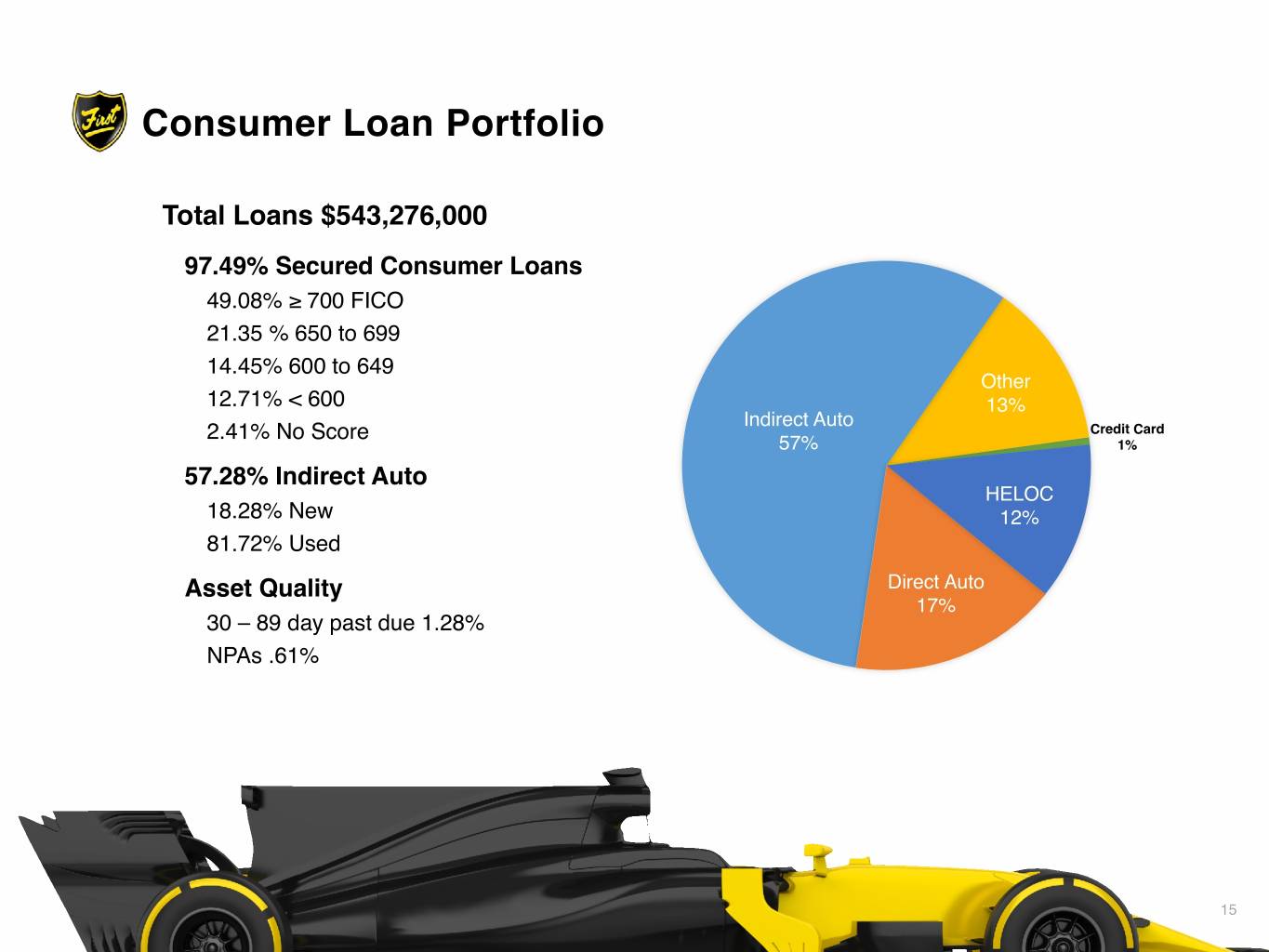

Consumer Loan Portfolio Total Loans $543,276,000 97.49% Secured Consumer Loans 49.08% ≥ 700 FICO 21.35 % 650 to 699 14.45% 600 to 649 Other 12.71% < 600 13% Indirect Auto 2.41% No Score Credit Card 57% 1% 57.28% Indirect Auto HELOC 18.28% New 12% 81.72% Used Asset Quality Direct Auto 17% 30 – 89 day past due 1.28% NPAs .61% 15

Mortgage Loan Portfolio Total Loans $280,893,000 83% YTD Production Sold • Primarily in-market lender Portfolio Adjustable Fixed 58% 42% • Underwritten to FHLMC Guidelines • 82.92% with credit scores > 650 • Average LTV 60.78% Asset Quality • 24 monthly average past due 2.20% 16

Commercial Real Estate Mix Non-owner Occupied CRE as % of Total Commercial Real Estate Loans Total Commercial Real Estate Loans Owner Occupied CRE $179.093 MM Residential Multi-family 18.88% Residential Multi-family $148.684 MM Retail 11.53% NOO Retail $90.765 MM Student Housing 11.00% Student Housing $86.684 MM Hotel 9.85% Hotel $77.577 MM Medical Office 4.00% Residential & Non-residential $58.137 MM Property Management Other 12.81% Medical Office $31.486 MM Land Development $14.197 MM Single Family Housing $7.185 MM Other $100.918 MM Total $787.541 MM 17

C&I Loans as a % of Total Commercial Loans Amusement & Recreation 2% Agriculture 26.90% $265,385,527 Religious Organizations Construction 9.06% $ 89,397,232 2% Other Health Services 8.61% $ 84,966,979 Forestry, Oil/Gas & Energy 8% 3% Banking & Financial Services 5.90% $ 58,203,186 Schools Agriculture Floor Plans 5.21% $ 51,433,965 3% 27% Retail Eating Establishments 4.87% $ 48,086,142 Government Entities 4% Other Retail+Convenience 4.82% $ 47,577,002 Personal Services Transportation 4.43% $ 43,698,764 4% Manufacturing 4.19% $ 41,330,365 Manufacturing 4% Construction Personal Services 4.07% $ 40,191,685 9% Transportation Government Entities 3.75% $ 37,018,779 4% Schools 3.28% $ 32,311,738 Health Services 9% Forestry, Oil/Gas & Energy 2.85% $ 28,096,698 Religious Organizations 1.94% $ 19,185,109 Amusment & Recreation 1.92% $ 18,925,796 Other Retail+Convenience Floor Plans 5% 5% Other 8.17% $ 80,622,781 Retail Eating Establishments Total 100.00% $986,431,748 5% Banking & Financial Services 6% 18

Strong Core Deposit Franchise Cost of Deposits 1.40% 1.30% Deposit Mix 1.05% 0.87% 0.70% 0.63% 0.56% 0.45% 0.38% 0.37% 0.35% 0.25% 0.25% Demand and Savings 0.19% 0.16% 0.17% 64.5% 0.00% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD Time 16.0% BHC UBPR Interest Expense Non-interest bearing 1.10 1.02 Brokered CDs 19.1% 0.87 0.4% 0.81 0.83 0.54 0.57 0.58 0.55 0.46 0.43 0.45 0.36 0.23 0.28 0.20 0.16 0.16 '- 2014 2015 2016 2017 2018 2019 1Q20 YTD FFIEC BHC UBPR Data FFC Peer 19

Disciplined Expense Management Non-interest Expense Efficiency 110000 1.83% CAGR $104,348 80 $98,398 $95,584 $91,289 $90,308 $88,747 82500 70.99 71.25 69.81 68.42 68.39 $54,437 63.68 55000 64.73 62.21 62.5 61.22 61.65 61.62 61.23 60.94 59.4 58.43 27500 53.75 0 2014 2015 2016 2017 2018 2019 2Q20 45 2014 2015 2016 2017 2018 2019 1Q20 FFIEC BHC UBPR Data FFC Peer 20

Trust and Asset Management $1.2 billion Trust assets under management Trust Services include: • Professional Farm Management 2019 YTD 2020 • Trust Administration Revenue ($000) 5,155 2,628 • Estate Administration Income before Tax 1,542 672 • Retirement Services • Corporate Trust Services 21

New Opportunities Kentucky and Tennessee The Nashville region is defined by a diverse economy, low costs of living and doing business, a creative culture and a well-educated population. A thriving job market (38% job growth since 2009) and an exploding entertainment scene bring thousands of residents to work in healthcare at the area's large hospitals and research centers, small startups, and business accelerator programs. Fifty miles north of Nashville lies Clarksville, Money Magazine’s #1 Best Place to Live in 2019. The average age of a Clarksville resident is only 29 and according to the Clarksville Chamber of Commerce, the city is ranked #3 in the nation for millennial home sales. Approximately one in every two Clarksville mortgages was closed by a millennial. Thousands of Nashville commuters live in Clarksville and more are moving there every day. In between Clarksville, Tennessee and Hopkinsville, Kentucky lies Fort Campbell. With 180,000 active duty and retired military and their family members living on or around the base, it is one of the largest military installations in the world. Source: Money Magazine, Business Insider, Clarksville Chamber of Commerce, Nashville Chamber of Commerce 22

Key Investment Points Well-positioned for sustainable and profitable growth • Diversified business model with strong risk management • High-caliber team members focused on customer service and technology optimization • Expanding presence in larger growth markets • Commercial banking focus with quality core deposits • Demonstrated ability to successfully complete mergers and acquisitions • Unblemished track record of delivering shareholder value • Thirty-two consecutive years of increased shareholder dividends 23

3 Year Financial Highlights Tax Cuts & Jobs Act 2017 2018 2019 2Q 2020 Net Interest Income 107,857 116,579 131,652 72,245 Provision 5,295 5,768 4,700 5,655 Non-interest Income 35,938 38,206 38,452 17,871 Non-interest Expense 88,747 91,289 104,348 54,437 Net Income 29,131 46,583 48,872 24,105 Earnings Per Share (diluted) 2.38 3.80 3.80 1.76 Total Assets 3,000,668 3,008,718 4,023,250 4,368,112 Net Interest Margin 4.11 4.32 4.25 4.05 Return on Average Assets 0.98 1.57 1.42 1.16 Return on Average Equity 6.69 10.98 9.83 8.30 Dollars in millions except per share data 24

Norman L. Lowery Rodger A. McHargue Chairman, Chief Executive Officer, President Chief Financial Officer, SVP 812.238.6487 / lowerynl@first-online.com 812.238.6334 / rmchargue@first-online.com Norman D. Lowery Steve Holliday Chief Operating Officer, SVP Chief Credit Officer, SVP 812.238.6185 / lowerynd@first-online.com 812.238.6264 / sholliday@first-online.com Thank You!