Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FB Financial Corp | fbk-20200908.htm |

Third Quarter 2020 Investor Presentation September 9, 2020

Forward–Looking Statements Certain statements contained in this presentation may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, without limitation, statements regarding the projected impact of the COVID-19 global pandemic on FB Financial business operations, statements relating to the timing, benefits, costs, and synergies of the recently completed merger with Franklin Financial Network, Inc. and Franklin Synergy Bank (collectively, “Franklin”) (the “Franklin merger”) and of the recently completed merger with FNB Financial Corp. (“FNB”) (together with the Franklin merger, the “mergers”), and FB Financial’s future plans, results, strategies, and expectations. These statements can generally be identified by the use of the words and phrases “may,” “will,” “should,” “could,” “would,” “goal,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “aim,” “predict,” “continue,” “seek,” “projection,” and other variations of such words and phrases and similar expressions. These forward-looking statements are not historical facts, and are based upon current expectations, estimates, and projections, many of which, by their nature, are inherently uncertain and beyond FB Financial’s control. The inclusion of these forward-looking statements should not be regarded as a representation by FB Financial or any other person that such expectations, estimates, and projections will be achieved. Accordingly, FB Financial cautions shareholders and investors that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, and uncertainties that are difficult to predict. Although FB Financial believes that the expectations reflected in these forward-looking statements are reasonable as of the date of this presentation, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements including, without limitation, (1) current and future economic conditions, including the effects of declines in housing and commercial real estate prices, high unemployment rates, and any slowdown in economic growth in the local or regional economies in which we operate and/or the U.S. economy generally, (2) the effects of the COVID-19 pandemic, including the magnitude and duration of the pandemic and its impact on general economic and financial market conditions and on FB Financial’s business and FB Financial customers' businesses, results of operations, asset quality and financial condition, (3) changes in government interest rate policies, (4) our ability to effectively manage problem credits, (5) the risk that the cost savings and any revenue synergies from the mergers or another acquisition may not be realized or may take longer than anticipated to be realized, (6) disruption from the mergers with customer, supplier, or employee relationships, (7) the possibility that the costs, fees, expenses, and charges related to the mergers may be greater than anticipated, including as a result of unexpected or unknown factors, events, or liabilities, (8) the risks related to the integrations of the combined businesses following the mergers, including the risk that the integrations will be materially delayed or will be more costly or difficult than expected, (9) the diversion of management time on issues related to the mergers, (10) the ability of FB Financial to effectively manage the larger and more complex operations of the combined company following the Franklin merger, (11) the risks associated with FB Financial’s pursuit of future acquisitions, (12) reputational risk and the reaction of the parties’ respective customers to the mergers, (13) FB Financial’s ability to successfully execute its various business strategies, including its ability to execute on potential acquisition opportunities, (14) the risk of potential litigation or regulatory action related to the Franklin merger, and (15) general competitive, economic, political, and market conditions. Further information regarding FB Financial and factors that could affect the forward-looking statements contained herein can be found in FB Financial's Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020 and June 30, 2020, and its other filings with the SEC. Many of these factors are beyond FB Financial’s ability to control or predict. If one or more events related to these or other risks or uncertainties materialize, or if the underlying assumptions prove to be incorrect, actual results may differ materially from the forward-looking statements. Accordingly, shareholders and investors should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this presentation, and FB Financial undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for FB Financial to predict their occurrence or how they will affect the company. FB Financial qualifies all forward-looking statements by these cautionary statements. 1

Use of non-GAAP financial measures This presentation contains certain financial measures that are not measures recognized under U.S. generally accepted accounting principles (“GAAP”) and therefore are considered non-GAAP financial measures. These non‐GAAP financial measures include, without limitation, adjusted net income, adjusted diluted earnings per share, adjusted pro forma net income, adjusted pro forma diluted earnings per share, pre-tax, pre-provision earnings, adjusted pre-tax, pre- provision earnings, adjusted pre-tax, pre-provision earnings per share, core noninterest expense, core revenue, core noninterest income, core efficiency ratio (tax-equivalent basis), banking segment core efficiency ratio (tax-equivalent basis), mortgage segment core efficiency ratio (tax-efficiency basis), adjusted mortgage contribution, adjusted return on average assets and equity, pro forma return on average assets and equity, pro forma adjusted return on average assets, equity and tangible common equity and adjusted pre-tax, pre-provision return on average assets, equity and tangible common equity and adjusted allowance for credit losses to loans held for investment. Each of these non-GAAP metrics excludes certain income and expense items that FB Financial’s management considers to be non‐core/adjusted in nature. FB Financial refers to these non‐GAAP measures as adjusted or core measures. This presentation also presents tangible assets, tangible common equity, tangible book value per common share and tangible common equity to tangible assets. Each of these non-GAAP metrics excludes the impact of goodwill and other intangibles. FB Financial’s management uses these non-GAAP financial measures in their analysis of FB Financial’s performance, financial condition and the efficiency of its operations as management believes such measures facilitate period-to-period comparisons and provide meaningful indications of its operating performance as they eliminate both gains and charges that management views as non-recurring or not indicative of operating performance. Management believes that these non-GAAP financial measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant non-core gains and charges in the current and prior periods. FB Financial’s management also believes that investors find these non-GAAP financial measures useful as they assist investors in understanding FB Financial’s underlying operating performance and in the analysis of ongoing operating trends. In addition, because intangible assets such as goodwill and other intangibles, and the other items excluded each vary extensively from company to company, FB Financial believes that the presentation of this information allows investors to more easily compare FB Financial’s results to the results of other companies. However, the non-GAAP financial measures discussed herein should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. FB Financial strongly encourages interested parties to review the GAAP financial measures included in this presentation and not to place undue reliance upon any single financial measure. Moreover, the manner in which FB Financial calculates the non-GAAP financial measures discussed herein may differ from that of other companies reporting measures with similar names. You should understand how such other banking organizations calculate their financial measures similar or with names similar to the non-GAAP financial measures FB Financial has discussed herein when comparing such non-GAAP financial measures. The tables in the Appendix of this presentation provide a reconciliation of these measures to the most directly comparable GAAP financial measures. 2

Snapshot of FB Financial today Company overview Franchise map1 ◼ Second largest Nashville-headquartered bank and third largest Tennessee-based bank ◼ Originally chartered in 1906, one of the longest continually operated banks in Tennessee 100% stockholder of FirstBank ◼ Completed the largest bank IPO in Tennessee history in September 2016 ◼ Mr. James W. Ayers currently owns ~29% of FB Financial following the close of the Franklin Financial Network merger ◼ Attractive footprint in both high growth metropolitan markets and stable community markets ̶ Located in eight attractive metropolitan markets in Tennessee, Financial results for 2Q 2020 Alabama & Kentucky¹ ̶ Strong market position in sixteen community markets¹ Balance sheet ($mm) FBK FSB2 Pro Forma³ ̶ Mortgage offices located throughout footprint and strategically Total assets $7,256 $3,776 $11,032 across the southeast, with a national online platform Loans – HFI 4,827 2,795 7,622 ◼ Provides community banking, relationship-based, customer Total deposits 5,953 3,143 9,096 service with the products and capabilities of a larger bank Shareholder’s equity 805 422 1,227 ̶ Local people, local knowledge and local authority ̶ Personal banking, commercial banking, investment services, Key metrics (%) FBK 2Q 2020 trust and mortgage banking Tangible Common Equity / Tangible Assets (%) 8.7%4 ◼ Completed acquisition of FNB Financial Corporation in Scottsville, On-Balance Sheet Liquidity / Tangible Assets (%) 14.0% KY on February 14, 2020 (~$250 million in assets) Adjusted PTPP ROAA (%) 3.29%4 ◼ Completed acquisition of Franklin Financial Network, Inc. (NYSE: Adjusted PTPP ROATCE (%) 38.6%4 FSB) on August 15, 2020 (~$3.8 billion in assets) NIM (%) 3.50% ◼ Completed $100 million, 4.50% bank-level subordinated note 4 placement in 3Q 2020 Core Efficiency (%) 57.5% Note: Unaudited financial data as of June 30, 2020; presented on a consolidated basis. 1 Presented pro forma for the recently completed Franklin Financial Network merger. 2 Reported 2Q 2020 financial information for the acquisition target. 3 Simple summation; does not include purchase accounting adjustments. 4 Non-GAAP financial measure. See “Use of non-GAAP financial measures” and “Reconciliation of non-GAAP financial measures” in the Appendix hereto. 3

Recent corporate history 2015 2016 2017 2018 2019 YTD 2020 Awarded Awarded Awarded Awarded Awarded Awarded “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” “Top Workplaces” by the Tennessean by the Tennessean by the Tennessean by the Tennessean by the Tennessean by the Tennessean Adj. PTPPROAA1: 1.81% Adj. PTPPROAA1: 2.25% Adj. PTPPROAA1: 2.40% Adj. PTPPROAA1: 2.34% Adj. PTPPROAA1: 2.15% Adj. PTPPROAA1: 2.72% Adj. ROATCE1: 17.7% Adj. ROATCE1: 19.5% Adj. ROATCE1: 15.5% Adj. ROATCE1: 17.1% Adj. ROATCE1: 16.4% Adj. ROATCE1: 10.0% Year-End Assets: $2.9bn Year-End Assets: $3.3bn Year-End Assets: $4.7bn Year-End Assets: $5.1bn Total Assets: $6.1bn Total Assets: $11.0bn2 ◼ Completed acquisition of ◼ Converted core operating ◼ Completed acquisition of ◼ Initiated quarterly dividend ◼ Completed acquisition of ◼ Completed acquisition of Northwest Georgia Bank, platform to Jack Henry Clayton Bank & Trust and 10 net branches from FNB Financial adding $79 million in American City Bank, ◼ Completed secondary Atlantic Capital Bank; Corporation; enter th th loans and $246 million in ◼ Completed the largest adding $1.1 billion in offering of 3.7 million moved from 7 to 5 in Bowling Green MSA th deposits and increasing bank IPO in Tennessee loans and $1.0 billion in common shares Chattanooga MSA deposit ranked 7 in deposit st th Chattanooga deposit history; priced at $19.00 deposits; moved from 41 market share and 11 to market share th th th market share to 8 per share in Knoxville MSA to 10 ; 10 in Knoxville MSA 20%+ EPS accretion and deposit market share ◼ Converted online and tangible book neutral mobile consumer banking ◼ Converted treasury platforms ◼ Finalized integration of platform Clayton Bank & Trust and ◼ Completed acquisition of American City Bank ◼ Completed mortgage Franklin Financial acquisitions restructuring Network; on a pro forma basis moved from 12th to 6th in the Nashville MSA in deposit market share ◼ Raised $100 million of 4.50% subordinated debt 2015 2016 2017 2018 2019 2020 1 Pro forma net income and tax-adjusted return on average assets and return on average tangible common equity include a pro forma provision for federal income taxes using a combined effective income tax rate of 35.08% and 36.75% for the years ended December 31, 2015 and 2016, respectively, and also excludes the impact of a one-time tax charge to C Corp conversion in 3Q 2016 and the 4Q 2017 benefit from the 2017 Tax Cuts and Jobs Act. A combined effective tax rate of 26.06% is being applied in subsequent periods. See “Use of non-GAAP financial measures,” and “Reconciliation of non-GAAP financial measures” in the Appendix hereto. 2 Pro forma for the recently completed Franklin Financial Network merger; pro forma metrics calculated using publicly available information and are a simple summation that does not include purchase accounting adjustments. Note: Financial data presented on a consolidated basis. 4

A leading community bank headquartered in Tennessee Top 10 banks in Tennessee1 Top 10 banks under $30bn assets in Tennessee1,2 Deposit Percent of TN TN Deposit Percent of Branches market company Branches Rank Name Headquarters deposits Rank Name Headquarters deposits market share company (#) share deposits (#) ($bn) ($bn) (%) deposits (%) (%) (%) 1 Pinnacle Nashville, TN 48 13.5 8.5% 69.3% 1 First Horizon Memphis, TN 164 $25.0 15.6% 42.0% 2 FB Financial Nashville, TN 75 7.5 4.7% 91.9% 2 Regions Birmingham, AL 217 18.4 11.5% 18.7% 3 Wilson Bank & Trust Lebanon, TN 28 2.3 1.5% 100.0% 3 Truist Financial Corp Charlotte, NC 147 15.5 9.7% 4.7% 4 Reliant Bancorp Brentwood, TN 31 2.3 1.5% 100.0% 4 Pinnacle Nashville, TN 48 13.5 8.5% 69.3% 5 CapStar Financial Nashville, TN 22 2.1 1.3% 100.0% 5 Bank of America Charlotte, NC 58 12.6 7.9% 0.9% 6 Simmons First Pine Bluff, AR 42 2.0 1.3% 12.4% 6 FB Financial Nashville, TN 75 7.5 4.7% 91.9% 7 Home Federal Knoxville, TN 23 1.7 1.1% 100.0% 7 U.S. Bancorp Minneapolis, MN 90 3.5 2.2% 1.0% 8 SmartFinancial Knoxville, TN 23 1.7 1.1% 73.4% 8 Wilson Bank & Trust Lebanon, TN 28 2.3 1.5% 100.0% 9 Educational Loan Farragut, TN 14 1.6 1.0% 100.0% 9 Reliant Bancorp Brentwood, TN 31 2.3 1.5% 100.0% 10 Renasant Tupelo, MS 21 1.5 0.9% 14.7% 10 Fifth Third Cincinnati, OH 36 2.3 1.4% 1.8% #2 community bank in Tennessee2 1 Sorted by deposit market share, deposits are limited to Tennessee. 2 Community bank defined as banks with less than $30bn in assets. Source: SNL Financial. Note: Deposit data as of June 30, 2019. Pro forma for completed acquisitions since June 30, 2019, including the FSB merger. 5

Strategic drivers Experienced Senior Management Team Strategic M&A and Elite Financial Capital Optimization Performance Scalable Platforms Enabled by Great Place to Work Technology Empowered Teams Across Attractive Metro and Community Markets 6

Balance between community and metropolitan markets Our pro forma footprint1 Metropolitan markets Bowling Community markets Green MSA Nashville Knoxville MSA MSA Jackson MSA ◼ Market rank by deposits: ̶ Nashville (6th) ̶ Chattanooga (5th) Memphis MSA ̶ Knoxville (9th) Chattanooga ̶ Jackson (3rd) MSA Huntsville & Florence ̶ Bowling Green (7th) MSAs ̶ Memphis (28th) ̶ Huntsville (19th) ̶ Florence (13th) Total loans (excluding HFS)2 Total full service branches2 Total deposits2 - $4.8bn - 72 branches - $6.0bn Other Mortgage / Other 12% 7% Community 38% Community Metropolitan 18% 70% Metropolitan Metropolitan 61% 62% Community 32% 1 Source: SNL Financial. Statistics are based upon deposit data by MSA. Market data is as of June 30, 2019 and is presented on a pro forma basis for completed acquisitions since June 30, 2019. Size of bubble represents size of company deposits in a given market. 2 Financial and operational data as of June 30, 2020. 7

Well positioned in attractive metropolitan markets Chattanooga Nashville rankings: “The new ‘it’ City” – The New York Times1 ◼ 4th largest MSA in TN ◼ Diverse economy with over 24,000 businesses in Metropolitan Economic ◼ Employs over 260,000 people #1 #2 Best Place for New Businesses3 Strength Rankings2 Knoxville ◼ 3rd largest MSA in TN Best City for Young ◼ Approximately 14,000 warehousing and distribution jobs are in the area and account for Best City to Spend a Weekend5 an annual payroll of $3.8 billion #3 Professionals4 #4 ◼ Well situated to attract the key suppliers and assembly operations in the Southeast Select companies with major Nashville presence Jackson ◼ 8th largest MSA in TN ◼ 300,000 people make up Jackson’s workforce. Existing companies include Kellogg North America HQ Company, Gerdau, Stanley Black and Decker, Delta Faucet, & Ingram Publishing Group Bowling Green ◼ Expands FirstBank across Kentucky state borderlines Nashville growth ◼ No. 1 spot in Site Selection Magazine’s national ranking for economic development performance ◼ In 2019, the MSA announced $376.6MM in capital investment in expanded and new Population growth 2010 – 2019 (%) targeted businesses 17.0% Memphis 6.6% ◼ 2nd largest MSA in TN U.S. Nashville ◼ Known for the busiest cargo airport in North America ◼ In 2018, Entrepreneur magazine ranked Memphis #15 on its “25 Cities Worth Moving to if Projected population growth 2019 – 2024 (%) You Want to Launch a Business” 6.8% Huntsville 3.6% ◼ One of the strongest technology economies in the nation, with the highest concentration of engineers in the United States U.S. Nashville ◼ 6th largest county by military spending in the country Projected median HHI growth 2019 – 2024 (%) Florence 11.1% ◼ University town home to the University of North Alabama and Northwest Shoals 8.8% Community College ◼ Generally steady and diversified economy U.S. Nashville 1 January 9, 2013 “Nashville Takes its Turn in the Spotlight”. 2 Policom Corp., 2020. 3 SmartAdvisor, 2019. 4 SmartAsset, August 2019. 5 Thrillist, May 2019. Source: S&P Market Intelligence; Chattanooga, Knoxville, Memphis, Huntsville, Bowling Green Chambers of Commerce, U.S. Department of Labor, Bureau of Labor Statistics, NAICS. 8

Aggressively managing for impact of COVID-19 ▪No pandemic related reductions in force, and remote work environment has been effective Health and ▪Branch lobby service had been reinstated across the footprint with sneeze guards and social distancing Safety methods in place ▪Re-suspending lobby access in selected facilities as case counts rise ▪Annualized deposit growth of 43.1% in 2Q 2020, resulting in Loans HFI / Deposits of 81.1% ▪On balance sheet and contingent liquidity increased to $4.7 billion, an increase of $0.4 billion from Liquidity March 31, 2020, resulting in on balance sheet liquidity of 14.0% of tangible assets as of June 30, 2020 ▪Monitoring movement of recent influx of deposits ▪Strong capital position ▪Total Risk Based Capital ratio increased to 13.4% as of June 30, 2020 Capital ▪Increased Allowance for Credit Losses to 2.34% of Loans HFI, or 2.51% adjusted to exclude PPP loans1 ▪Issued $100 million of bank-level subordinated notes in Q3; receive tier 2 treatment at bank and hold co ▪Mortgage continues to capitalize on low rate environment, delivered $33.6 million in total mortgage direct contribution in the second quarter Profitability ▪Deposit costs continue to decline with a cost of total deposits for 2Q 2020 of 0.65% ▪$560.2 million in time deposits with a weighted average cost of 1.75% mature in 2H 2020 ▪Assessing growth opportunities while balancing capital preservation and asset quality ▪Continue to prioritize serving existing customer base Growth ▪Successful in converting select prospects into customers in various markets ▪Seeing anecdotal buoyancy in certain markets as re-opening efforts have been initiated ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP financial measures. 9

Markets have reopened for economic activity Government Guidance on Economic Activity Close Contact Entertainment Map Market Retail Restaurant Gyms Mask Orders Providers Venues Key Open w/ Open w/ Open w/ Open w/ Local jurisdictions, Tennessee1 50% Capacity Distancing Distancing Distancing Distancing no mandate Open w/ Open w/ Open w/ Open w/ Local jurisdictions, Georgia2 50% Capacity Distancing Distancing Distancing Distancing no mandate Open w/ Requirement, as of Kentucky3 50% Capacity 50% Capacity 50% Capacity 50% Capacity Distancing Aug. 6 Open w/ Open w/ Requirement, as of Alabama4 50% Capacity 50% Capacity 50% Capacity Distancing Distancing Jul. 29 Davidson 125 person Requirement, as of 75% Capacity 50% Capacity 50% Capacity 50% Capacity County5 maximum June 28 Open w/ Open w/ Open, 18 ft of Requirement, as of Shelby County6 50% Capacity 50% Capacity Distancing Distancing Distance July 3 FBK County Footprint Reopening Map 1 Source: tn.gov/governor/covid-19. Tennessee Pledge 2 Source: georgia.org/covid19bizguide#other. Governor Kemp’s Statewide Executive Order: Guidelines for Businesses. 3 Source: govstatus.egov.com. Healthy at Work – Reopening Kentucky. 4 Source: alabamapublichealth.gov. Order of the State Health Officer Amended June 30, 2020. 5 Source: asafenashville.org. Roadmap for Reopening Nashville: Phase 2 Guidance and Resources, updated September 1, 2020 6 Source: shelbycountytn.gov. Public Health Directive Updated September 3, 2020. 10

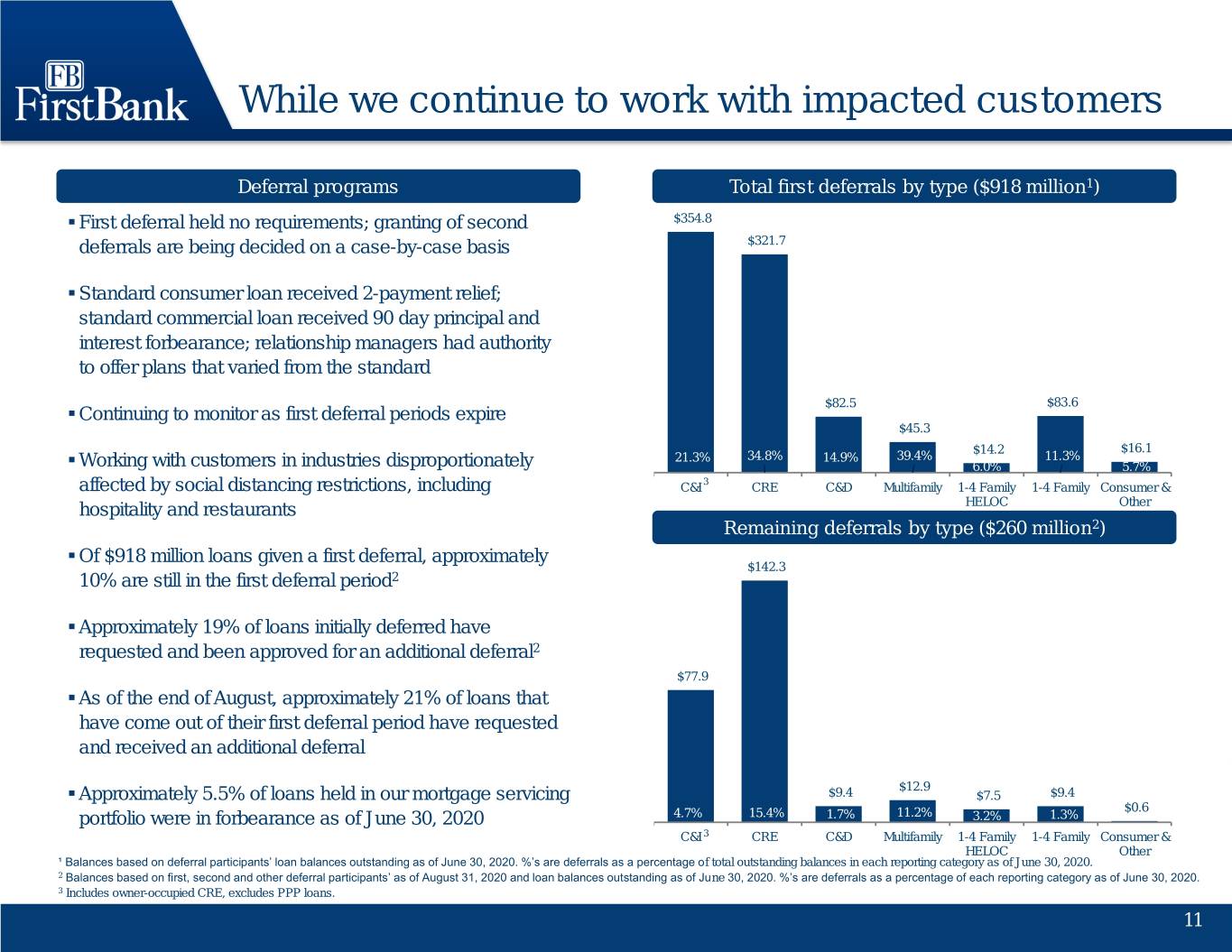

While we continue to work with impacted customers Deferral programs Total first deferrals by type ($918 million1) ▪ First deferral held no requirements; granting of second $354.8 deferrals are being decided on a case-by-case basis $321.7 ▪ Standard consumer loan received 2-payment relief; standard commercial loan received 90 day principal and interest forbearance; relationship managers had authority to offer plans that varied from the standard $82.5 $83.6 ▪ Continuing to monitor as first deferral periods expire $45.3 $14.2 $16.1 21.3% 34.8% 14.9% 39.4% 11.3% ▪ Working with customers in industries disproportionately 6.0% 5.7% affected by social distancing restrictions, including C&I 3 CRE C&D Multifamily 1-4 Family 1-4 Family Consumer & hospitality and restaurants HELOC Other Remaining deferrals by type ($260 million2) ▪ Of $918 million loans given a first deferral, approximately $142.3 10% are still in the first deferral period2 ▪ Approximately 19% of loans initially deferred have requested and been approved for an additional deferral2 $77.9 ▪ As of the end of August, approximately 21% of loans that have come out of their first deferral period have requested and received an additional deferral $12.9 ▪ Approximately 5.5% of loans held in our mortgage servicing $9.4 $7.5 $9.4 $0.6 portfolio were in forbearance as of June 30, 2020 4.7% 15.4% 1.7% 11.2% 3.2% 1.3% C&I 3 CRE C&D Multifamily 1-4 Family 1-4 Family Consumer & HELOC Other ¹ Balances based on deferral participants’ loan balances outstanding as of June 30, 2020. %’s are deferrals as a percentage of total outstanding balances in each reporting category as of June 30, 2020. 2 Balances based on first, second and other deferral participants’ as of August 31, 2020 and loan balances outstanding as of June 30, 2020. %’s are deferrals as a percentage of each reporting category as of June 30, 2020. 3 Includes owner-occupied CRE, excludes PPP loans. 11

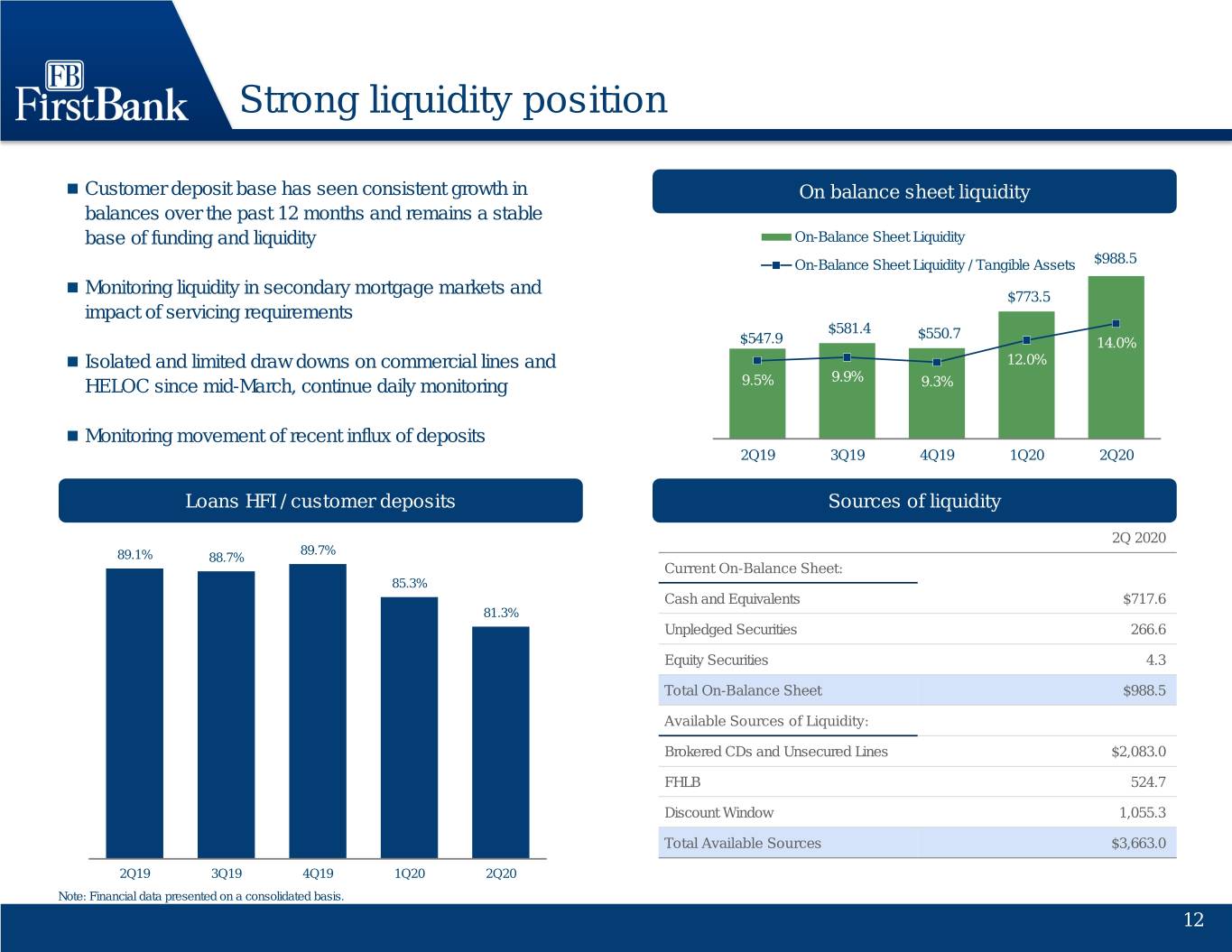

Strong liquidity position ◼ Customer deposit base has seen consistent growth in On balance sheet liquidity balances over the past 12 months and remains a stable base of funding and liquidity On-Balance Sheet Liquidity On-Balance Sheet Liquidity / Tangible Assets $988.5 $1,000.0 ◼ $900.0 Monitoring liquidity in secondary mortgage markets and $773.5 impact of servicing requirements $800.0 $700.0 $581.4 $550.7 $600.0 $547.9 14.0% ◼ Isolated and limited draw downs on commercial lines and $500.0 12.0% $400.0 9.5% 9.9% 9.3% HELOC since mid-March, continue daily monitoring $300.0 $200.0 $100.0 ◼ Monitoring movement of recent influx of deposits $- 2Q19 3Q19 4Q19 1Q20 2Q20 Loans HFI / customer deposits Sources of liquidity 2Q 2020 89.7% 89.1% 88.7% Current On-Balance Sheet: 85.3% Cash and Equivalents $717.6 81.3% Unpledged Securities 266.6 Equity Securities 4.3 Total On-Balance Sheet $988.5 Available Sources of Liquidity: Brokered CDs and Unsecured Lines $2,083.0 FHLB 524.7 Discount Window 1,055.3 Total Available Sources $3,663.0 2Q19 3Q19 4Q19 1Q20 2Q20 Note: Financial data presented on a consolidated basis. 12

Core deposit franchise provides stable liquidity Total deposits ($mm) Cost of deposits Customer deposits Brokered and internet time deposits Noninterest bearing (%) Cost of total deposits (%) 35.0% 29.8% $5,953 30.0% 24.7% 24.5% 24.8% $5,377 $15 25.0% 23.0% $4,843 $4,922 $4,935 $20 20.0% $25 $20 $30 1.14% 1.11% 15.0% 1.02% $5,938 0.94% $5,357 $4,915 10.0% $4,813 $4,897 0.65% 5.0% 0.0% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Noninterest bearing deposits1 ($mm) Deposit composition Time 20% Noninterest- bearing checking Savings 30% 5% $1,775 $1,336 Money market Interest-bearing $1,214 $1,208 checking $1,112 24% 21% 2Q19 3Q19 4Q19 1Q20 2Q20 51% Checking accounts ¹ Includes mortgage servicing-related deposits of $70.4mm, $121.4mm, $92.6mm, $110.1mm and $149.1mm for the quarters ended June 30, 2019, September 30, 2019, December 31, 2019, March 31, 2020 and June 30, 2020, respectively. Note: Financial data presented on a consolidated basis. 13

Well-capitalized headed into recession Capital position Tangible book value per share3 2Q19 1Q202 2Q201,2 Shareholder’s equity/Assets 12.1% 11.8% 11.1% $19.07 $18.35 TCE/TA² 9.2% 9.1% 8.7% $11.56 $11.58 Common equity 10.4% 11.0% 11.6% tier 1/Risk-weighted assets 3Q16 4Q16 1Q20 2Q20 Tier 1 capital/Risk-weighted 11.0% 11.6% 12.1% Simple capital structure assets Total capital/Risk-weighted 11.6% 12.5% 13.4% Tier 2 ACL assets Trust Preferred 9% 4% Tier 1 capital /Average 10.0% 10.3% 9.7% assets Common C&D loans subject to 100% 92% 86% 75% Equity Tier 1 4 Capital risk-based capital threshold 87% CRE loans subject to 100% 267% 231% 215% risk-based capital threshold4 Total regulatory capital: $7361 mm ¹ Total regulatory capital, FB Financial Corporation. 2 For regulatory capital purposes, the CECL impact over 2020 and 2021 is gradually phased-in from Common Equity Tier 1 Capital to Tier 2 capital. As of March 31 2020 and June 30, 2020, respectively, $31.8 million and $37.8 million are being added back to CET 1 and Tier 1 Capital, and $37.7 million and $43.7 million are being taken out of Tier 2 capital. 3 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 4 Risk-based capital at FirstBank as defined in Call Report. 14

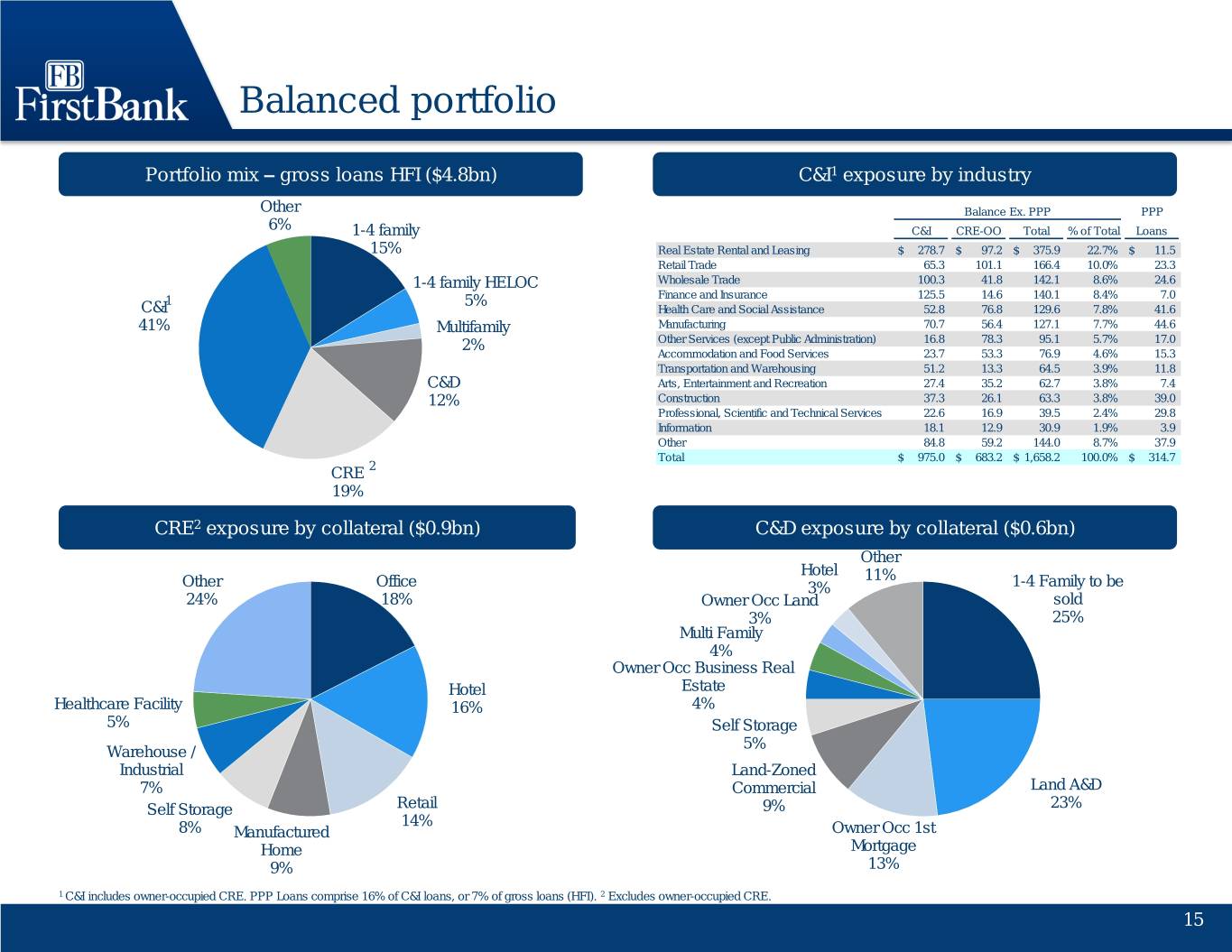

Balanced portfolio Portfolio mix – gross loans HFI ($4.8bn) C&I1 exposure by industry Other Balance Ex. PPP PPP 6% 1-4 family C&I CRE-OO Total % of Total Loans 15% Real Estate Rental and Leasing $ 278.7 $ 97.2 $ 375.9 22.7% $ 11.5 Retail Trade 65.3 101.1 166.4 10.0% 23.3 1-4 family HELOC Wholesale Trade 100.3 41.8 142.1 8.6% 24.6 1 5% Finance and Insurance 125.5 14.6 140.1 8.4% 7.0 C&I Health Care and Social Assistance 52.8 76.8 129.6 7.8% 41.6 41% Multifamily Manufacturing 70.7 56.4 127.1 7.7% 44.6 2% Other Services (except Public Administration) 16.8 78.3 95.1 5.7% 17.0 Accommodation and Food Services 23.7 53.3 76.9 4.6% 15.3 Transportation and Warehousing 51.2 13.3 64.5 3.9% 11.8 C&D Arts, Entertainment and Recreation 27.4 35.2 62.7 3.8% 7.4 12% Construction 37.3 26.1 63.3 3.8% 39.0 Professional, Scientific and Technical Services 22.6 16.9 39.5 2.4% 29.8 Information 18.1 12.9 30.9 1.9% 3.9 Other 84.8 59.2 144.0 8.7% 37.9 Total $ 975.0 $ 683.2 $ 1,658.2 100.0% $ 314.7 CRE 2 19% CRE2 exposure by collateral ($0.9bn) C&D exposure by collateral ($0.6bn) Other Hotel 11% Other Office 3% 1-4 Family to be 24% 18% Owner Occ Land sold 3% 25% Multi Family 4% Owner Occ Business Real Hotel Estate Healthcare Facility 16% 4% 5% Self Storage 5% Warehouse / Industrial Land-Zoned 7% Commercial Land A&D Self Storage Retail 9% 23% 14% 8% Manufactured Owner Occ 1st Home Mortgage 9% 13% 1 C&I includes owner-occupied CRE. PPP Loans comprise 16% of C&I loans, or 7% of gross loans (HFI). 2 Excludes owner-occupied CRE. 15

Industries of concern – pro forma as of June 30, 2020 FBK FSB Pro Forma¹ Industries of Industries of Industries of Concern Concern Concern 22.7% 20.9% 22.0% $4.8bn $2.8bn $7.6bn Other Other Other Industries Industries Industries 77.3% 79.1% 78.0% FBK % of FSB % of Pro Forma¹ % of Industries of Concern Loans HFI Industries of Concern Loans HFI Industries of Concern Loans HFI Retail 7.7% Retail 9.1% Retail 8.2% Healthcare 5.3% Healthcare 3.0% Healthcare 4.5% Hotel 4.0% Hotel 5.1% Hotel 4.4% Other Leisure 2.3% Other Leisure 0.5% Other Leisure 1.5% Transportation 2.1% Transportation 0.4% Transportation 1.6% Restaurant 1.3% Restaurant 2.8% Restaurant 1.9% Total (%) 22.7% Total (%) 20.9% Total (%) 22.0% Total ($bn) $1.1 Total ($bn) $0.6 Total ($bn) $1.7 Gross Loans HFI ($bn) $4.8 Gross Loans HFI ($bn) $2.8 Gross Loans HFI ($bn) $7.6 1 Simple summation of balances as of June 30, 2020; does not take into account potential impact of purchase accounting. Note: Loan, reserve and asset quality data is consistent between the bank level and consolidated level. 16

FBK Industries of concern ◼ Concentrations representative of community bankers Industry exposures / gross loans (HFI) serving customers across our communities 7.7% ◼ Focused on in-market relationship banking ◼ Trends better than expected to date as markets reopened 5.3% in late April / early May, continue monitoring in light of COVID case increases 4.0% ◼ Limited SNC exposure overall at 3 credits less than $100 2.3% million in aggregate, and none are in these industries of 2.1% concern 1.3% ◼ Summary: While satisfactory to date, continue to monitor closely Retail Healthcare Hotel Other Leisure Transportation Restaurant Deferral participants Remaining First Deferrals Second Deferrals Returned to Normal / Other Out 8/31/20 6/30/20 8/31/20 6/30/20 8/31/20 6/30/20 Participants Balances Participants Balances Participants Balances Retail 9 $ 7.2 11 $ 16.5 96 $ 118.2 Healthcare 7 18.1 2 0.5 76 37.3 Hotel 7 12.5 16 111.0 29 22.7 Other Leisure 14 12.3 5 10.3 22 17.2 Transportation - - 5 0.8 108 9.9 Restaurant 7 5.8 3 5.0 64 32.8 Total Industries of Concern 44 $ 55.9 42 $ 144.1 395 $ 238.1 Other Loans HFI 47 32.3 70 27.8 1,349 421.8 Total Loans HFI 91 $ 88.2 112 $ 171.9 1,744 $ 659.9 Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 15 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Industry exposures and credit quality percentages are as of June 30, 2020. 17

FBK Retail portfolio – 7.7% of gross loans HFI ◼ 53% C&I / CRE-OO and 47% CRE Non-OO and Other Portfolio overview ◼ CRE Non-owner occupied and Other – Generally smaller strip centers with backing of good Car, RV, Boat and guarantors; largest single loan <$8 million ATV Dealers 22% – High level of tenants paying as agreed; those not paying are working with our borrowers in developing payment Gas Stations and Non-Owner Occ / Other Convenience Stores plans as locales have reopened CRE 6% 47% – Summary: Continue to monitor for issues, so far Sporting goods continued satisfactory performance 3% Pharmacies and ◼ C&I / CRE-OO portfolio drug stores 2% – Auto dealerships are weathering the downturn; limited Other Retailers < 3% supply creating shortages in inventory 20% – Summary: Satisfactory performance, continue to monitor, especially regarding reopening trends Credit quality Deferral participants $118 94.8% $17 $7 2.2% 1.0% 1.9% $- Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Portfolio overview and credit quality percentages are as of June 30, 2020. 18

FBK Healthcare portfolio – 5.3% of loans HFI ◼ Assisted Living / Nursing Care continues to perform well; no Portfolio overview known COVID-19 outbreaks at this time Other Healthcare and Social Assisted Living / Assistance Nursing Care / ◼ Offices of Physicians benefitted from the majority of our 25% Continuing Care markets reopening in late April / early May 37% ◼ Summary: Satisfactory performance to date, continue to monitor Mental Health and Substance Abuse 14% Offices of Physicians 24% Credit quality Deferral participants 95.5% $34 $18 $3 3.0% 1.5% 0.0% $1 Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Portfolio overview and credit quality percentages are as of June 30, 2020. 19

FBK Hotel portfolio – 4.0% of gross loans HFI ◼ Occupancy rates vary widely across footprint, with Nashville hotels Outstanding by location at approximately 30% - 40%, while some geographies are as high as 80% ◼ Reports from operators reference leisure properties lead the way, Out of Market 8% Thursday through Sunday business has picked up Other Community 7% ◼ Confident in the underwriting of our portfolio and the strength of our borrowers Nashville MSA 36% ◼ Two legacy credits acquired in prior acquisitions totaling $4.8 million Other MSA in outstanding balances accounted for the majority of the increase in 13% substandard loans between 1Q 2020 and 2Q 2020. One other legacy property, highlighted in prior earnings call, continues to be reflected within substandard category with significant reserves recorded Bowling Green MSA ◼ 53 first deferral participants as of June 30th with $147 million 10% outstanding; 16 second deferral participants as of August 31st with Memphis MSA Atlanta MSA 16% $111 million in outstanding balances; 27 with $19.0 million in 10% outstanding balances have returned to normal ◼ Summary: Continue to remain concerned about the space, with heavy attention from our teams Credit quality Outstanding by flag Other 85.8% 11% Best Western / Choice Hilton / IHG / Marriott / / Red Lion / Red Roof Wyndham 12% 77% 7.2% 6.5% 0.5% Pass Watch Special Mention Substandard Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Outstanding by location, credit quality and outstanding by flag percentages are as of June 30, 2020. 20

FBK Other Leisure – 2.3% of gross loans HFI ◼ Confidence in portfolio due to current performance and Portfolio overview strong guarantors Other <5% Marinas ◼ Certain categories, such as marinas, have actually 18% 19% benefitted from current backdrop as safe recreational activities are sought Theaters ◼ Exercise operators report improved results since re- 8% openings RV Parks and Campgrounds ◼ Discussions with clients associated with professional sports Sports Teams and 17% Clubs or theater operators indicate plans to perform as agreed 10% upon coming out of deferral periods, including specific identified capital calls Historical Sites Fitness and Rec Sports 13% Centers ◼ Summary: Satisfactory performance, continue to monitor 15% Credit quality Deferral participants 96.3% $16 $12 $10 $2 2.0% 0.0% 1.7% Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Portfolio overview and credit quality percentages are as of June 30, 2020. 21

FBK Transportation and warehousing – 2.1% of gross loans HFI ◼ Overall satisfactory performance Portfolio overview Other ◼ Larger operators are improving Transportation and Warehousing 16% ◼ One small trucking operator with <$1.5 million in outstandings filed for bankruptcy during the quarter Consumer Charter Transportation ◼ Summary: Overall acceptable results, monitoring for 11% Trucking potential impact to smaller operators 50% Air Travel and Support 23% Credit quality Deferral participants 78.0% $10 21.0% $1 0.0% 1.3% $- $- Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Portfolio overview and credit quality percentages are as of June 30, 2020. 22

FBK Restaurant – 1.3% of gross loans HFI ◼ Overall satisfactory performance Portfolio overview ◼ Quick service seeing satisfactory results with drive through model Other ◼ Full service impacted more heavily given costs to re-open Bars 4% and concerns regarding potential further shut-downs. 6% Portfolio in this category benefit from backing of guarantors ◼ Largest exposure ($3.9 million) is to an operator currently benefitting from their model, which is a combination of fast casual and bar service Limited Service ◼ Summary: Satisfactory performance to date; continue to be 30% concerned about this space as operators face re- Full Service engineering their models long-term 60% ◼ Not included in this exposure disclosure is a diversified food company which also has certain retail outlets, exposure ~$25M; relationship accepted first deferral and not currently performing to par Credit quality Deferral participants 85.4% $31 $6 $5 10.6% $2 3.0% 1.1% Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other Deferrals Note: Exposures included will differ from “C&I Exposure by Industry” table on slide 19 due to inclusion of non-owner occupied and other balances as well as additional tangential exposures. Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Portfolio overview and credit quality percentages are as of June 30, 2020. 23

FSB portfolio overview Portfolio mix C&I1 exposure by industry Other Balance Ex. Non-Core Non-Core 0% C&I CRE-OO Total % of Total Loans 1-4 family 1 Real Estate Rental and Leasing $ 38.1 $ 70.8 $ 108.9 25.4% $ 12.6 C&I 15% Accommodation and Food Services 5.4 33.3 38.7 9.0% - 28% Retail Trade 5.4 27.9 33.3 7.7% - 1-4 family HELOC Health Care and Social Assistance 21.4 10.9 32.3 7.5% 185.5 7% Other Services (except Public Administration) 3.5 25.8 29.3 6.8% - Construction 10.1 16.6 26.8 6.2% - Multifamily Manufacturing 18.0 8.0 26.0 6.1% 44.1 Wholesale Trade 5.6 15.6 21.2 4.9% 37.8 2% Educational Services 6.7 12.0 18.7 4.4% - Professional, Scientific and Technical Services 7.0 9.7 16.8 3.9% 33.0 Finance and Insurance 10.4 5.3 15.7 3.7% 10.8 Mining 6.8 - 6.8 1.6% - Transportation and Warehousing 2.8 1.1 3.9 0.9% 16.7 C&D Other 18.4 32.8 51.2 11.9% 17.1 23% Total $ 159.6 $ 269.8 $ 429.4 100.0% $ 357.6 CRE 2 25% Non-Owner Occupied CRE ($0.7B) exposure by sector C&D exposure by type ($0.6B) Other Other Restaurant 7% 13% 4% Retail Hotel Health Care / 26% 3% Residential Spec Assisted Living Commercial Land 30% 7% 3% Assisted Living / Nursing Mixed Use 4% 9% Retail 4% Commercial Lot 5% Residential Warehouse/Industrial Office Custom 13% Residential Pre- 19% Sale 10% 9% Hotel Multifamily Commercial A&D 15% 9% 10% 1 C&I includes owner-occupied CRE. Note: C&I includes $357.6 million in Non-Core, Institutional loans, or 13% of loans HFI 2 Excludes owner-occupied CRE. Source: FSB internal documents. Information is as of June 30, 2020. 24

FSB Industries of concern ◼ Concentrations representative of community bankers Industry exposures / gross loans (HFI) serving customers across FSB’s communities 9.1% ◼ Core portfolio is focused on in-market relationship banking ◼ No shared national credits outside of the non-core portfolio ◼ Limited private equity backed relationships outside of the 5.1% non-core portfolio 3.0% ◼ Core healthcare portfolio is approximately evenly split 2.8% between C&I and CRE; largest non-owner occupied relationship is ~$11 million for a skilled nursing facility and a 0.5% 0.4% 69% LTV; largest C&I relationship is ~$4 million to a local day-care facility Retail Hotel Healthcare Restaurant Other Leisure Transportation Deferral participants Remaining First Deferrals Second Deferrals Returned to Normal / Other 8/31/20 6/30/20 8/31/20 6/30/20 8/31/20 6/30/20 Participants Balances Participants Balances Participants Balances Retail - $ - 1 $ 0.1 31 $ 122.2 Hotel 3 7.4 12 84.1 8 26.6 Healthcare 3 4.5 3 11.7 28 18.0 Restaurant 3 0.7 8 17.5 19 38.2 Other Leisure - - 3 4.1 6 3.0 Transportation - - 9 1.6 3 5.2 Total Industries of Concern 9 $ 12.6 36 $ 119.1 95 $ 213.3 Non-Core Institutional Portfolio 2 5.3 - - 18 79.7 Other Loans HFI 79 81.6 15 33.1 254 229.6 Total Loans HFI 90 $ 99.5 51 $ 152.2 367 $ 522.6 Source: FSB internal documents. Industry exposures and credit quality percentages are as of June 30, 2020. 25

FSB Retail portfolio – 9.1% of loans HFI ◼ Core business focuses primarily on local customers and Portfolio overview local projects 1 ◼ Focus on multiple sources of repayment (Primary, C&I 18% Secondary and Tertiary) ◼ 3 Non-Owner Occupied relationships over $10 million; largest loan is ~$34 million for an in-market regional mall at C&D ~55% LTV with a mix of retail and restaurants and Dillard’s 12% as the anchor tenant ◼ Median C&I loan is $0.3 million; largest relationship is ~$6 million to an auto dealer Non-Owner Occ / Other CRE 70% Credit quality Deferral participants2 95.2% $118 $5 1.8% 1.6% 1.4% $- $0 Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other 1 C&I includes owner-occupied CRE. Deferrals 2 Information as of August 31, 2020. Balances as of June 30, 2020. Source: FSB internal documents. Information is as of June 30, 2020. 26

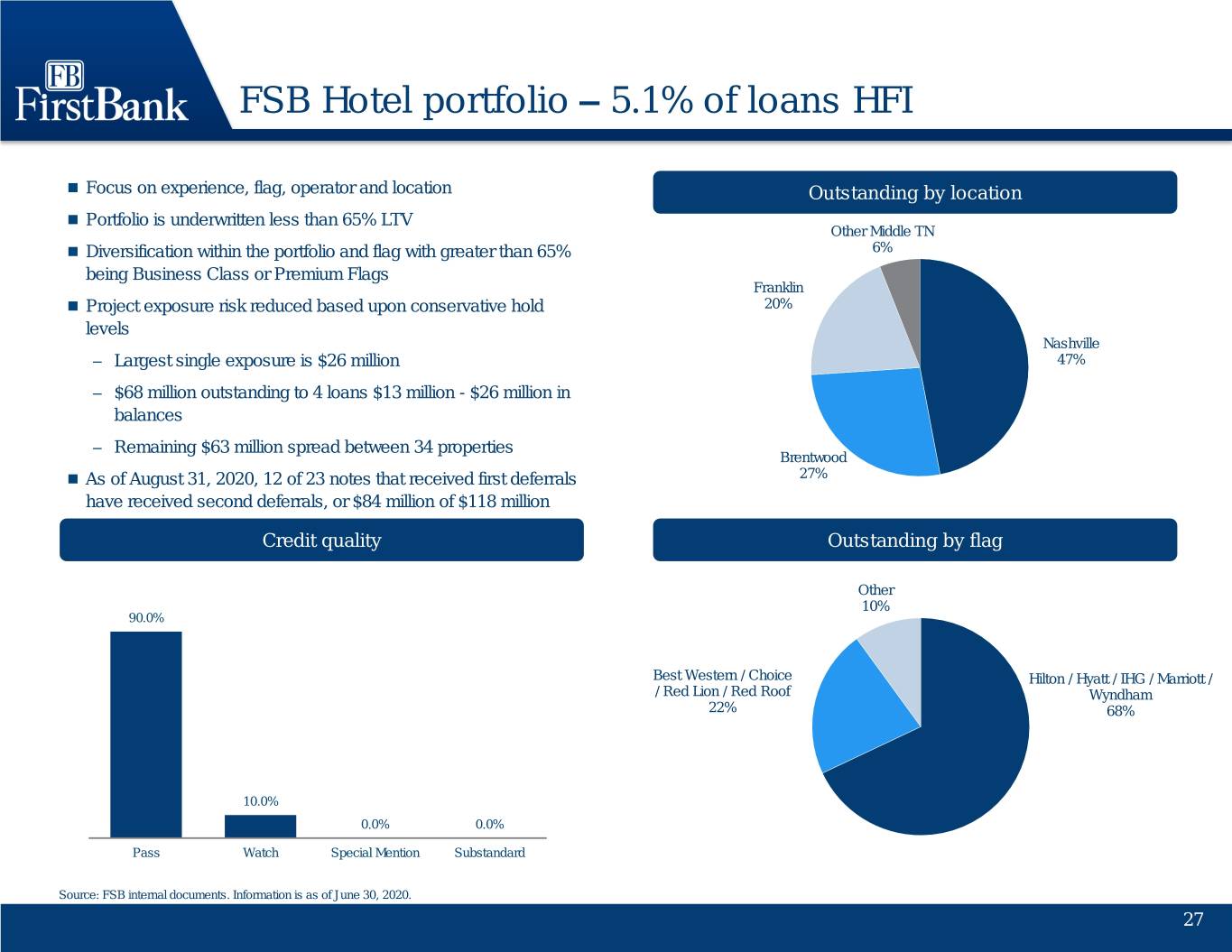

FSB Hotel portfolio – 5.1% of loans HFI ◼ Focus on experience, flag, operator and location Outstanding by location ◼ Portfolio is underwritten less than 65% LTV Other Middle TN ◼ Diversification within the portfolio and flag with greater than 65% 6% being Business Class or Premium Flags Franklin ◼ Project exposure risk reduced based upon conservative hold 20% levels Nashville – Largest single exposure is $26 million 47% – $68 million outstanding to 4 loans $13 million - $26 million in balances – Remaining $63 million spread between 34 properties Brentwood ◼ As of August 31, 2020, 12 of 23 notes that received first deferrals 27% have received second deferrals, or $84 million of $118 million Credit quality Outstanding by flag Other 10% 90.0% Best Western / Choice Hilton / Hyatt / IHG / Marriott / / Red Lion / Red Roof Wyndham 22% 68% 10.0% 0.0% 0.0% Pass Watch Special Mention Substandard Source: FSB internal documents. Information is as of June 30, 2020. 27

FSB Restaurant – 2.8% of loans HFI ◼ Over 50% of portfolio are for Fast-Casual/Sit Down Portfolio overview restaurants with local ownership and established operators ◼ Focus on relationship banking including personal, business, depository and treasury relationships ◼ Primary customer is an experienced local operator Non-Owner Occ / Other CRE 37% ◼ Largest C&I loan is ~$10 million restaurant space housing multiple popular local Fast-Casual concepts, real estate secured 1 ◼ Largest Non-Owner Occupied loan is ~$7 million to an C&I experienced local developer with 3 fast food restaurants as 63% the anchor tenants and 56% LTV ◼ Median C&I loan size $0.3 million, median non-owner occupied size $1.6 million Credit quality Deferral participants2 $36 92.0% $18 7.0% $3 0.8% 0.2% $1 Pass Watch Special Mention Substandard Remaining First Second Deferrals Returned to Normal Other 1 C&I includes owner-occupied CRE. Deferrals 2 Information as of August 31, 2020. Balances as of June 30, 2020. Source: FSB internal documents. Information is as of June 30, 2020. 28

FSB Non-core portfolio - $358 million as of 2Q 2020 ◼ The FSB “non-core” portfolio consists primarily of shared national credits and nationwide loans to private-equity backed companies, with a focus on healthcare ◼ FSB management has been unwinding this portfolio since 2019. There was $430 million in the portfolio at December 31, 2019. $409 million as of March 31, 2020 and $358 million as of June 30, 2020 ◼ This portfolio does not align with the combined company’s focus on in-market, relationship-based banking and is not part of the combined company’s future business strategy ◼ With a dislocated secondary market for these relationships due to the COVID-19 impact on the economy, this book may remain on the combined company’s balance sheet longer than anticipated at transaction announcement, which was an immediate divestiture post-transaction close ◼ A substantial mark will be taken on the remaining portfolio based on credit and liquidity conditions at closing, and the remainder will be moved from the combined company’s balance sheet as soon as is practicable Composition Loans criticized or worse Non-SNC SNC $262 $28 $64 $95 $198 $35 $60 $- Corporate Healthcare Corporate Healthcare 1 C&I includes owner-occupied CRE. 2 Excludes owner-occupied CRE. 3 Exclude HFS loans. Source: FSB internal documents. 29

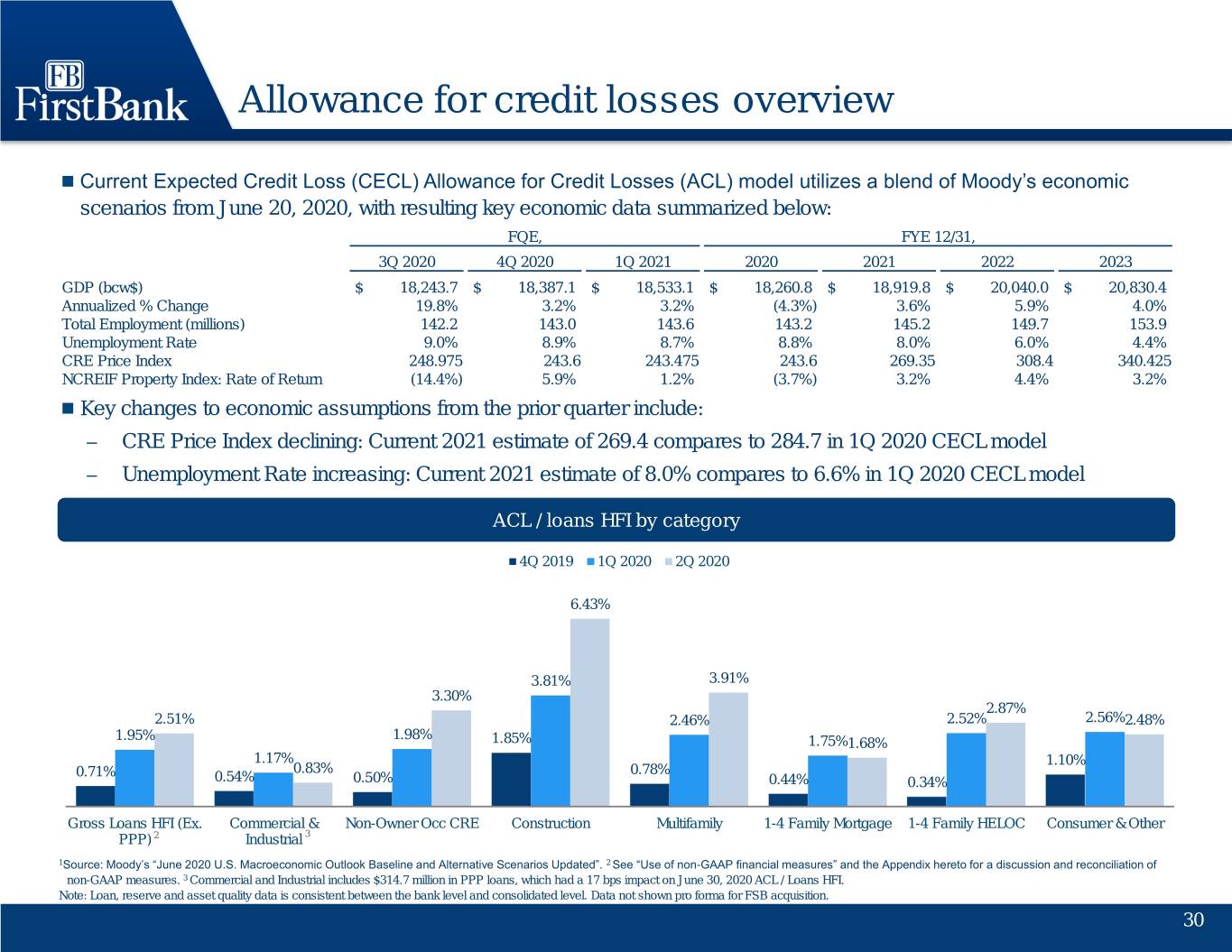

Allowance for credit losses overview ◼ Current Expected Credit Loss (CECL) Allowance for Credit Losses (ACL) model utilizes a blend of Moody’s economic scenarios from June 20, 2020, with resulting key economic data summarized below: FQE, FYE 12/31, 3Q 2020 4Q 2020 1Q 2021 2020 2021 2022 2023 GDP (bcw$) $ 18,243.7 $ 18,387.1 $ 18,533.1 $ 18,260.8 $ 18,919.8 $ 20,040.0 $ 20,830.4 Annualized % Change 19.8% 3.2% 3.2% (4.3%) 3.6% 5.9% 4.0% Total Employment (millions) 142.2 143.0 143.6 143.2 145.2 149.7 153.9 Unemployment Rate 9.0% 8.9% 8.7% 8.8% 8.0% 6.0% 4.4% CRE Price Index 248.975 243.6 243.475 243.6 269.35 308.4 340.425 NCREIF Property Index: Rate of Return (14.4%) 5.9% 1.2% (3.7%) 3.2% 4.4% 3.2% ◼ Key changes to economic assumptions from the prior quarter include: – CRE Price Index declining: Current 2021 estimate of 269.4 compares to 284.7 in 1Q 2020 CECL model – Unemployment Rate increasing: Current 2021 estimate of 8.0% compares to 6.6% in 1Q 2020 CECL model ACL / loans HFI by category 4Q 2019 1Q 2020 2Q 2020 6.43% 3.81% 3.91% 3.30% 2.87% 2.51% 2.46% 2.52% 2.56%2.48% 1.95% 1.98% 1.85% 1.75%1.68% 1.17% 1.10% 0.71% 0.83% 0.78% 0.54% 0.50% 0.44% 0.34% Gross Loans HFI (Ex. Commercial & Non-Owner Occ CRE Construction Multifamily 1-4 Family Mortgage 1-4 Family HELOC Consumer & Other PPP) 2 Industrial 3 1Source: Moody’s “June 2020 U.S. Macroeconomic Outlook Baseline and Alternative Scenarios Updated”. 2 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. 3 Commercial and Industrial includes $314.7 million in PPP loans, which had a 17 bps impact on June 30, 2020 ACL / Loans HFI. Note: Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Data not shown pro forma for FSB acquisition. 30

Asset quality remains solid Nonperforming ratios Classified loans ($mm) NPLs (HFI)/loans (HFI)1 NPAs/assets1,2 $88 0.77% $79 $80 0.74% 0.73% 0.71% $74 0.68% $69 0.59% 0.62% 0.60% 0.43% 0.47% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 LLR/loans HFI (excluding PPP loans)3 Net charge-offs/average loans 2.51% 0.30% 1.95% 0.19% 0.70% 0.72% 0.71% 0.05% 0.05% 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 ¹ Adoption of CECL resulted in approximately $5.5 million of former PCI loans being reportable as nonperforming loans in 1Q 2020. 2 Includes acquired excess land and facilities held for sale–see page 14 of the Quarterly Financial Supplement. 3 See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. Note: Loan, reserve and asset quality data is consistent between the bank level and consolidated level. Data not shown pro forma for FSB acquisition. 31

Core earnings power remains intact Adjusted pre-tax, pre-provision return on average assets¹ 2.72% 2.40% 2.34% 2.25% 2.15% 1.81% 2015 2016 2017 2018 2019 YTD 2020 Drivers of profitability Loans/deposits Net interest margin Noninterest income ($mm) Core efficiency ratio1 Loans excluding HFS Loans HFS 101% $145 $142 95% 95% $131 $135 88% 15% 88% $124 73.1% 81% 7% 6% 4.66% 7% 70.6% 11% 19% 4.46% $92 68.1% 4.34% 65.8% 65.4% 4.10% 89% 60.9% 86% 88% 81% 3.97% 70% 69% 3.70% 2015 2016 2017 2018 2019 2Q20 2015 2016 2017 2018 2019 YTD 2015 2016 2017 2018 2019 YTD 2015 2016 2017 2018 2019 YTD 2020 2020 2020 ¹ See “Use of non-GAAP financial measures” and the Appendix hereto for a discussion and reconciliation of non-GAAP measures. Note: Financial data presented on a consolidated basis. Data not shown pro forma for FSB acquisition. 32

Mortgage operations overview Highlights Quarterly mortgage production ◼ Record total Mortgage pre-tax contribution of $33.6mm for 2Q Consumer Direct 2020 Retail 2Q19 1Q20 2Q20 Wholesale ◼ Mortgage sale margins continue to be elevated due to industry capacity constraints and low interest rates ◼ Mortgage pipeline at the end of 2Q 2020 remains robust at $1.2 billion, as compared to $0.6 billion at the end of 2Q 2019 ◼ Mortgage banking income $72.2mm, up 194.3% from 2Q 2019 IRLC volume: $1,820mm $2,094mm $2,239mm and 120.4% from 1Q 2020 IRLC pipeline1: $609mm $1,085mm $1,206mm ◼ Mortgage structure allows team to capitalize on attractive rate Refinance %: 49% 78% 80% environments while weathering downturns Purchase %: 51% 22% 20% Mortgage banking income ($mm) Mark to market value and gain on sale margin 2Q19 1Q20 2Q20 Mark to Market Value 2 Gain on Sale Margin Gain on Sale $21.0 $30.4 $45.5 3.84% Fair value $3.3 $3.2 $34.8 changes 2.88% 2.92% 2.85% Servicing $4.0 $5.0 $5.1 2.29% Revenue 2.22% 2.20% 2.27% 1.67% Fair value 1.41% ($3.8) ($5.9) ($13.2) MSR changes Total $24.5 $32.7 $72.2 Income 2Q19 3Q19 4Q19 1Q20 2Q20 ¹ As of the respective period-end. ² Defined as pipeline net of hedge plus best efforts divided by hedge weighted volume. Note: Data not shown pro forma for FSB acquisition. 33

Appendix 34

Reconciliation of non-GAAP financial measures Adjusted diluted earnings per share 35

Reconciliation of non-GAAP financial measures Adjusted pro forma net income and diluted earnings per share1 Adjusted pre-tax, pre-provision earnings 1 2016 includes loss on sale of mortgage servicing rights, impairment of mortgage servicing rights, gain on sales or write-downs of other real estate owned and other assets and gain on sale of securities; 2015 includes bargain purchase gain and gain from securities; 2 The Company terminated its S-Corporation status and became a taxable corporate entity (“C Corporation”) on September 16, 2016 in connection with its initial public offering. Pro forma amounts for income tax expense, adjusted, and diluted earnings per share, adjusted, have been presented assuming the Company’s pro forma effective tax rate of 36.75% and 35.08% for the years ended December 31, 2016 and 2015, respectively, and also includes the exclusion of a one-time tax change from C Corp conversion in 3Q 2016 and the 4Q 2017 benefit from the 2017 Tax Cuts and Jobs Act. 2019 and 2018 use a marginal tax rate on adjustments of 26.06%; 2017 uses a marginal tax rate on adjustments of 39.23%. 36

Reconciliation of non-GAAP financial measures (cont’d) Tax-equivalent core efficiency ratio 1 Efficiency ratio (GAAP) is calculated by dividing non-interest expense by total revenue. 37

Reconciliation of non-GAAP financial measures (cont’d) Segment tax-equivalent core efficiency ratios 1 Includes mortgage segment other noninterest mortgage banking expense, depreciation, loss on sale of mortgage servicing rights and amortization and impairment of mortgage servicing rights. 38

Reconciliation of non-GAAP financial measures (cont’d) Tangible book value per common share and tangible common equity to tangible assets 39

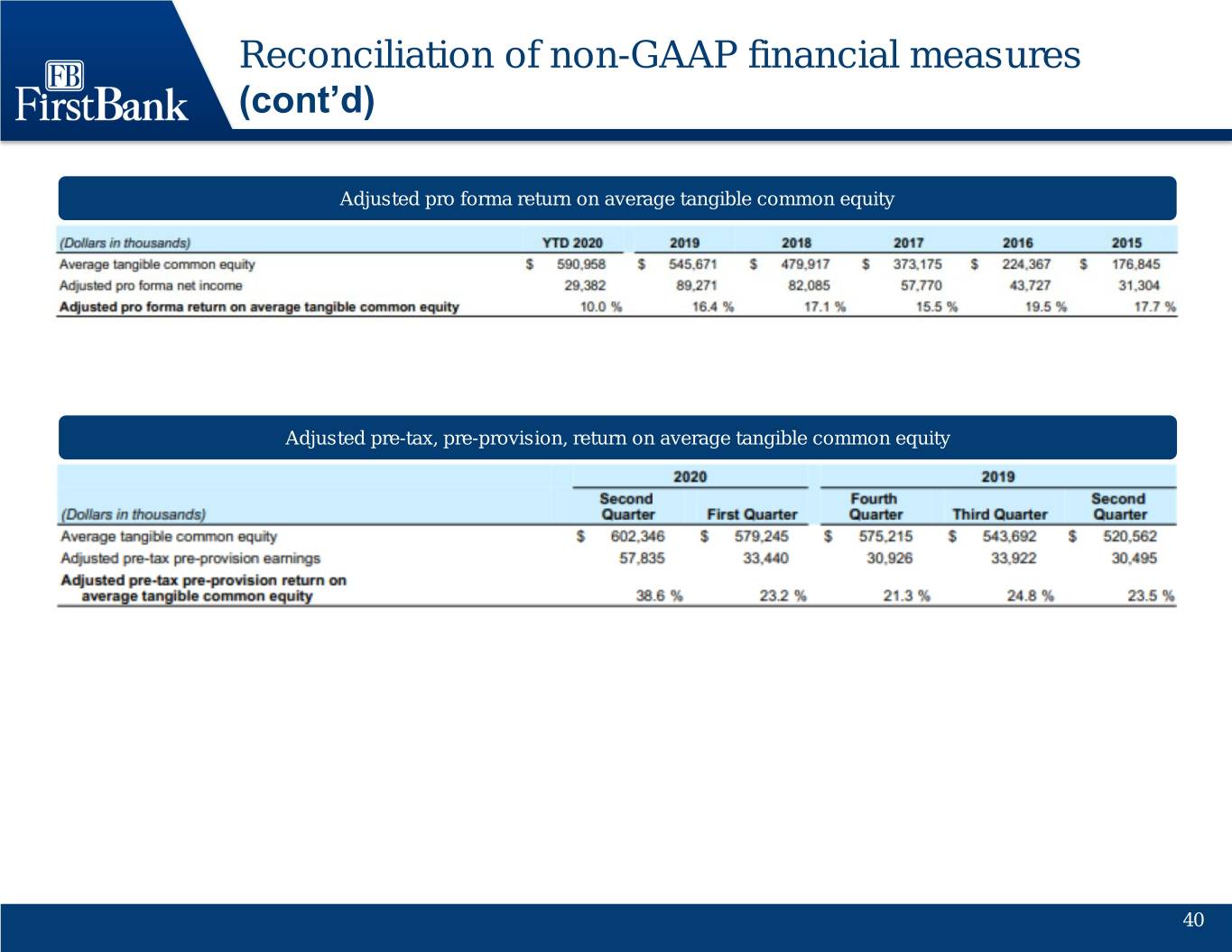

Reconciliation of non-GAAP financial measures (cont’d) Adjusted pro forma return on average tangible common equity Adjusted pre-tax, pre-provision, return on average tangible common equity 40

Reconciliation of non-GAAP financial measures (cont’d) Adjusted return on average assets and equity Adjusted pre-tax, pre-provision return on average assets and equity 41

Reconciliation of non-GAAP financial measures (cont’d) Adjusted pro forma return on average assets and equity Adjusted pro forma pre-tax, pre-provision return on average assets and equity 42

Reconciliation of non-GAAP financial measures (cont’d) Adjusted allowance for credit losses to loans held for investment 43