Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | czwi-20200908.htm |

Filed Pursuant to Rule 433 Registration Statement No. __________ Issuer Free Writing Prospectus Dated October __, 2015 Relating to Preliminary Prospectus Supplement Dated October __, 2015 Citizens Community Bancorp Inc. Janney 2020 Virtual Community Bank Forum 2020 Second Quarter Results 1

Cautionary Notes and Additional Disclosures DATES AND PERIODS PRESENTED Unless otherwise noted, “20YY” refers to either the corresponding fiscal year-end date or the corresponding 12-months (i.e. fiscal year) then ended. “MMM-YY” refers to either the corresponding quarter-end date, or the corresponding three-month period then ended. CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements include, but are not limited to, descriptions of the financial condition, results of operations, asset and credit quality trends, profitability, projected earnings, future plans, strategies and expectations of Citizens Community Bancorp, Inc. (“CZWI” or the “Company”) and its subsidiary, Citizens Community Federal, National Association (“CCFBank”) . The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and is including this statement for purposes of complying with those safe harbor provisions. Forward-looking statements, which are based on certain assumptions of the Company, are generally identifiable by use of the words “believe,” “expect,” “estimates,” “intend,” “anticipate,” “estimate,” “project,” “seek,” “target,” “potential,” “focus,” “may,” “preliminary,” “could,” “should” or similar expressions. These forward-looking statements express management’s current expectations or forecasts of future events, and by their nature, are subject to risks and uncertainties. Therefore, there are a number of factors that might cause actual results to differ materially from those in such statements. These uncertainties include conditions in the financial markets and economic conditions generally; adverse impacts to the Company or CCFBank arising from the COVID-19 pandemic; the possibility of a deterioration in the residential real estate markets; interest rate risk; lending risk; the sufficiency of loan allowances; changes in the fair value or ratings downgrades of our securities; competitive pressures among depository and other financial institutions; our ability to maintain our reputation; our ability to realize the benefits of net deferred tax assets; our ability to maintain or increase our market share; acts of terrorism and political or military actions by the United States or other governments; legislative or regulatory changes or actions, or significant litigation, adversely affecting the Company or CCFBank; increases in FDIC insurance premiums or special assessments by the FDIC; disintermediation risk; our inability to obtain needed liquidity; risks related to the ongoing integration of F. & M. Bancorp. Of Tomah Inc. into the Company’s operations; our ability to successfully execute our acquisition growth strategy; risks posed by acquisitions and other expansion opportunities, including difficulties and delays in integrating the acquired business operations or fully realizing the cost savings and other benefits; our ability to raise capital needed to fund growth or meet regulatory requirements; the possibility that our internal controls and procedures could fail or be circumvented; our ability to attract and retain key personnel; our ability to keep pace with technological change; cybersecurity risks; changes in federal or state tax laws; changes in accounting principles, policies or guidelines and their impact on financial performance; restrictions on our ability to pay dividends; and the potential volatility of our stock price. Stockholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward- looking statements. Such uncertainties and other risks that may affect the Company's performance are discussed further in Part I, Item 1A, "Risk Factors," in the Company's Form 10-K, for the year ended December 31, 2019 filed with the Securities and Exchange Commission ("SEC") on March 10, 2020, the Company’s Form 10-Qs for the quarters ended March 31, 2020 and June 30, 2020, filed with the SEC on May 11, 2020 and August 6, 2020, and the Company's subsequent filings with the SEC. The Company undertakes no obligation to make any revisions to the forward-looking statements contained herein or to update them to reflect events or circumstances occurring after the date hereof. NON-GAAP FINANCIAL MEASURES These slides may contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of the registrant's historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Non·GAAP financial measures referred to herein include net income as adjusted, EPS as adjusted, ROAA as adjusted, ROATCE, tangible book value per share, efficiency ratio, efficiency ratio as adjusted and tangible common equity / tangible assets. Reconciliations of all Non·GAAP financial measures used herein to the comparable GAAP financial measures in the appendix at the end of this presentation. Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. CZWI’s Form 10-K, for the year ended December 31, 2019 filed with the Securities and Exchange Commission ("SEC") on March 10, 2020, the Company’s Form 10-Qs for the quarters ended March 31, 2020 and June 30, 2020, filed with the SEC on May 11, 2020 and August 6, 2020, and any other documents filed by CZWI with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from CZWI's website at www.ccf.us, or by directing a request to CZWI’s CFO, Jim Broucek at Citizens Community Bancorp, Inc., 2174 EastRidge Center, Eau Claire, Wisconsin 54701, Attention: James S. Broucek or by e-mail at jbroucek@ccf.us. 2

Investment Summary . Diversification across geographies and industries reduces risk and enhances growth potential . Improving earnings profile, leveraging infrastructure and growth to drive efficiency . Strong credit metrics in CCF originated loan portfolio and improving asset quality in acquired loan portfolios . Strong liquidity risk profile . Strong Bank capital levels and improving holding company capital ratios . Acquisition and organic deposit growth have diversified core deposit base and helped lower cost of deposits . Well-managed net interest margin . Disciplined and proven acquirer 3

Mission, Vision and Values Mission Provide the best products, service, and ideas to our customers every interaction every day. Vision Values Make more possible for our Our six main values are: customers, colleagues, integrity, commitment, communities, and shareholders! innovation, collaboration, focus, and sustainability. 4

Key Market Differentiators • Serving small to mid-sized • Experienced, energetic entrepreneurs leadership team • Responsive professionals • Accountability for doing the right thing and getting results • Products to compete vs. big banks, superior to • Entrepreneurial spirit, smaller community banks BUSINESS CULTURE winning attitude MODEL • Loan and deposit growth STRATEGIC CREDIT • Prudent risk taking through prudent M&A GROWTH • Process driven, transparent • Robust commercial loan and deposit growth • Nimble, centralized approval process • Quality and quantity of • Proactive risk management earnings improving 5

Strategic Objectives Increase Tangible Targeted growth in TBV of 8-10%, increase in TCE to Tangible Assets Book and > 8% and achieve ROA and ROE in the upper half of its peer group Shareholder Value Reduced NPA’s & Aggressively reduce problem assets from acquired banks, manage Classified Loans to the originated book prudently, and build the allowance to absorb Peer Group Median potential COVID-19 related issues Achieve efficiency ratio in the mid 60% range by reducing branch Increase Operating and support expenses, optimize commercial portfolios and increase Leverage non-interest income sources Consistency Apply software and API’s to increase productivity and support future In growth, while proactively managing operating and credit risk Culture 6

Franchise Footprint Minnesota Wisconsin Source: S&P Global Market Intelligence 7

Recent Franchise Expansion CZWI has been focused on transforming the Company away from a consumer-based bank into a commercial focused operation, creating a strengthened franchise value through this process 2 Central Bank branches July 2019 February 2016 Assets: $192mm Deposits: $27mm Tomah, WI Northwestern WI October 2018 Assets: $269mm Osseo, WI August 2017 $1,608 Assets: $269mm $1,531 Wells, MN May 2016 $1,281 $1,272 Assets: $154mm $1,177 $1,196 Rice Lake, WI $941 $975 $759 $696 $733 $743 $747 $574 $558 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 . Loans Receivable . Total Deposits . Total Assets Source: S&P Global Market Intelligence, company filings 8

Market Demographics CZWI operates in diverse markets within the northwestern region of Wisconsin, metro Twin Cities and the Mankato, Minnesota MSA Eau Claire: . Features a broad-based, diverse economy, which is driven by commercial, retail and medical industries Mankato: . The Mankato market also possesses a broad-based, diverse economy Eau Claire Area Employers Mankato Area Employers Source: S&P Global Market Intelligence, eauclairedevelopment.com, greatermankato.com, Google Images 9

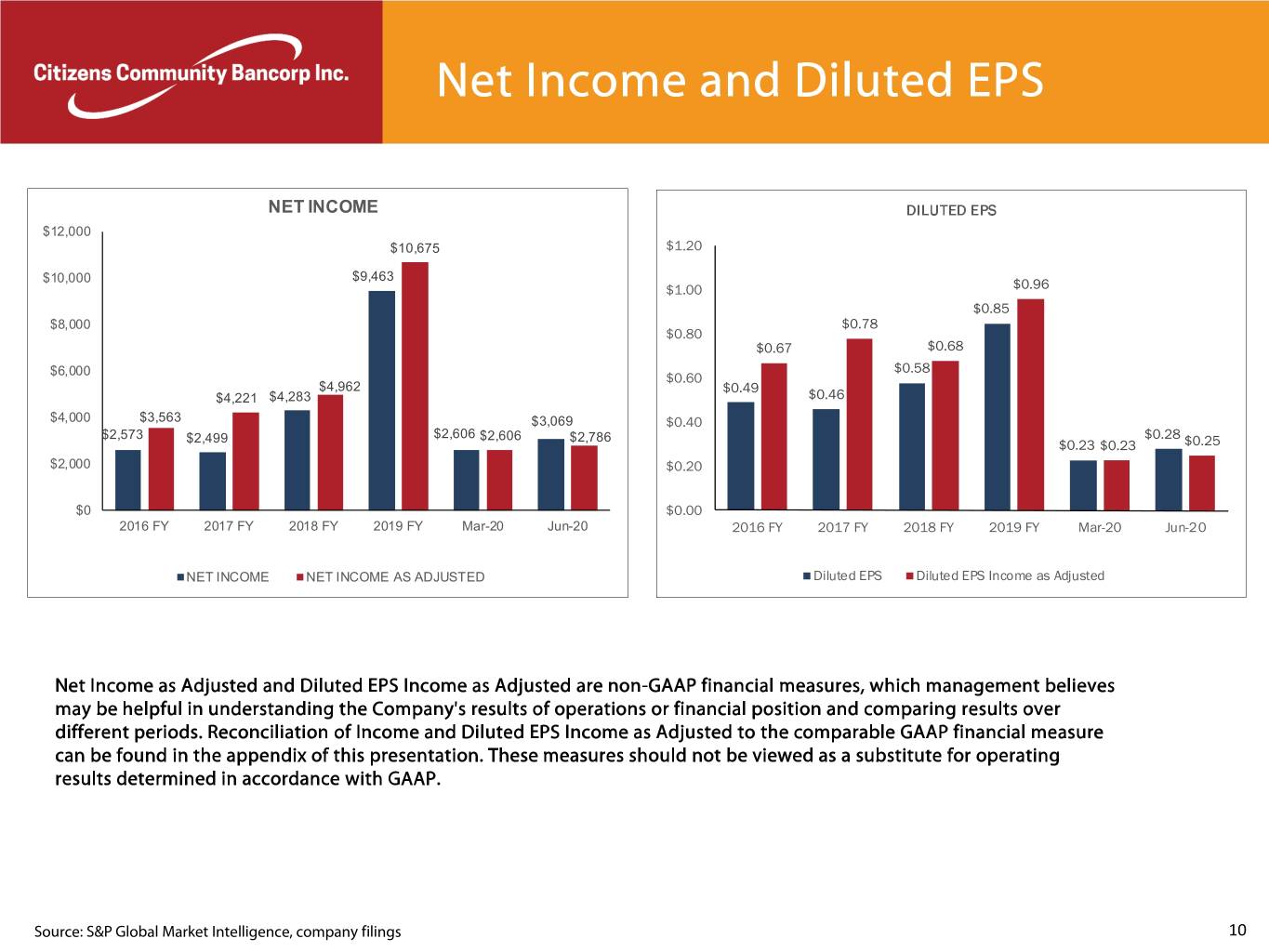

Net Income and Diluted EPS NET INCOME DILUTED EPS $12,000 $10,675 $1.20 $10,000 $9,463 $1.00 $0.96 $0.85 $8,000 $0.78 $0.80 $0.67 $0.68 $6,000 $0.58 $0.60 $4,962 $0.49 $4,221 $4,283 $0.46 $4,000 $3,563 $3,069 $0.40 $2,573 $2,499 $2,606 $2,606 $2,786 $0.28 $0.23 $0.23 $0.25 $2,000 $0.20 $0 $0.00 2016 FY 2017 FY 2018 FY 2019 FY Mar-20 Jun-20 2016 FY 2017 FY 2018 FY 2019 FY Mar-20 Jun-20 NET INCOME NET INCOME AS ADJUSTED Diluted EPS Diluted EPS Income as Adjusted Net Income as Adjusted and Diluted EPS Income as Adjusted are non-GAAP financial measures, which management believes may be helpful in understanding the Company's results of operations or financial position and comparing results over different periods. Reconciliation of Income and Diluted EPS Income as Adjusted to the comparable GAAP financial measure can be found in the appendix of this presentation. These measures should not be viewed as a substitute for operating results determined in accordance with GAAP. Source: S&P Global Market Intelligence, company filings 10

Book Value and Tangible Book Value BOOK VALUE AND TANGIBLE BOOK VALUE PER SHARE $16.00 $13.70 $14.00 $13.36 $13.27 $12.27 $12.48 $12.45 $12.00 $11.22 $11.05 $10.31 $9.78 $9.89 $9.80 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00 2016 FY 2017 FY 2018 FY 2019 FY Mar-20 Jun-20 TANGIBLE BOOK VALUE PER SHARE BOOK VALUE PER SHARE Tangible book value per share is a non-GAAP measure which management believes may be helpful in better assessing capital adequacy. The reconciliation of Tangible book value per share can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Source: S&P Global Market Intelligence, company filings 11

Return on Average Assets and Return on Average Tangible Common Equity ROAA ROATCE 1.40% 20.0% 1.20% 1.00% 15.0% 0.76% 0.78% 0.80% 0.69% 0.69% 0.71% 11.0% 0.68% 10.1% 9.5% 10.0% 0.56% 0.58% 10.0% 9.0% 9.5% 0.60% 0.52% 7.2% 0.40% 0.45% 6.2% 5.6% 0.40% 0.34% 4.4% 4.3% 4.8% 5.0% 0.20% 0.00% 0.0% 2016 2017 2018 2019 Mar-20 Jun-20 2016 2017 2018 2019 Mar-20 Jun-20 ROAA ROAA INCOME AS ADJUSTED ROATCE ROATCE INCOME AS ADJUSTED Return on average assets (ROAA), return on average assets as adjusted, return on average tangible common equity (ROATCE) and return on average tangible common equity as adjusted are non-GAAP measures, which management believes may be helpful in better understanding the underlying business performance trends related to average assets and average tangible equity. Reconciliations of ROAA as adjusted and ROTCE as adjusted can be found in the appendix of this presentation. These measures should not be viewed as substitutes for operating results determined in accordance with GAAP. Source: SEC filings and Company documents 12

Efficiency Ratio and Net Interest Margin EFFICIENCY RATIO NET INTEREST MARGIN 90% 4.00% 84% 85% 85% 79% 77% 78% 80% 75% 73% 3.80% 75% 68% 3.64% 70% 66% 66% 66% 67% 65% 3.60% 60% 3.42% 55% 3.37% 3.40% 3.31% 3.34% 50% 3.27% 45% 3.20% 40% 2016 2017 2018 2019 Mar-20 Jun-20 3.00% EFFICIENCY RATIO EFFICIENCY RATIO AS ADJUSTED 2016 2017 2018 2019 Mar-20 Jun-20 The efficiency ratio, efficiency ratio as adjusted is a non-GAAP measure, which management believes may be helpful in better understanding the underlying business performance trends related to non-interest expense. A reconciliation of the efficiency ratio as adjusted to its comparable financial measure can be found in the appendix of this presentation. This measure should not be viewed as a substitute for operating results determined in accordance with GAAP. Note: Net Interest Margin excluding realized non-accretable difference and schedule accretion on purchased loans was 3.19% for the quarter ended June 30, 2020, compared to 3.27% for the quarter ended March 31, 2020. 13

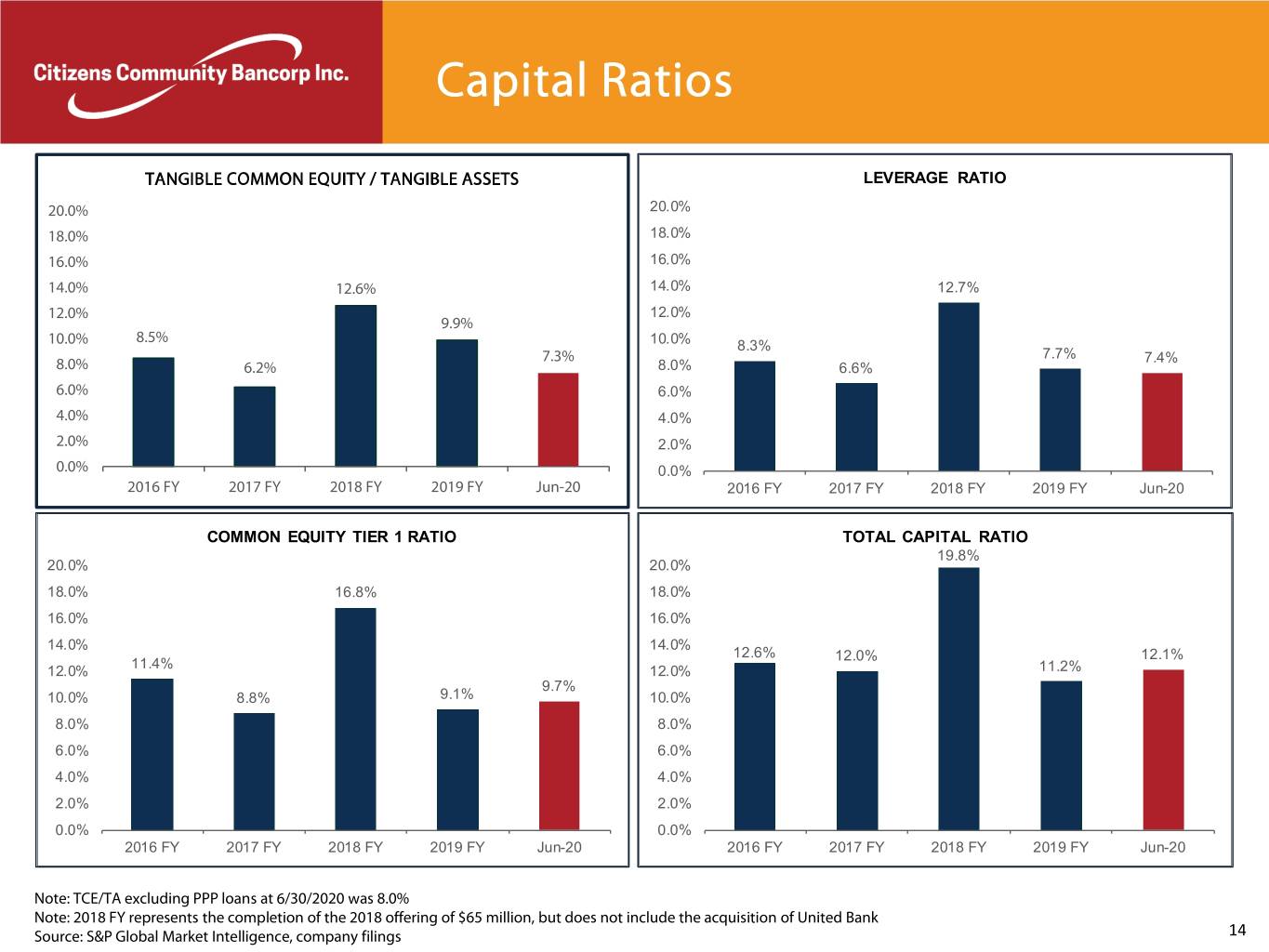

Capital Ratios TANGIBLE COMMON EQUITY / TANGIBLE ASSETS LEVERAGE RATIO 20.0% 20.0% 18.0% 18.0% 16.0% 16.0% 14.0% 12.6% 14.0% 12.7% 12.0% 12.0% 9.9% 10.0% 8.5% 10.0% 8.3% 7.3% 7.7% 7.4% 8.0% 6.2% 8.0% 6.6% 6.0% 6.0% 4.0% 4.0% 2.0% 2.0% 0.0% 0.0% 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 COMMON EQUITY TIER 1 RATIO TOTAL CAPITAL RATIO 19.8% 20.0% 20.0% 18.0% 16.8% 18.0% 16.0% 16.0% 14.0% 14.0% 12.6% 12.0% 12.1% 11.4% 12.0% 12.0% 11.2% 9.7% 10.0% 8.8% 9.1% 10.0% 8.0% 8.0% 6.0% 6.0% 4.0% 4.0% 2.0% 2.0% 0.0% 0.0% 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 Note: TCE/TA excluding PPP loans at 6/30/2020 was 8.0% Note: 2018 FY represents the completion of the 2018 offering of $65 million, but does not include the acquisition of United Bank Source: S&P Global Market Intelligence, company filings 14

Asset Quality . ALL AND NON-ACCRETABLE DIFF TO TOTAL LOANS Building allowance to absorb 2.50% any COVID-19 related issues 2.00% 1.49% 1.42% . Strong credit quality on CCF 1.50% 1.31% 1.31% 1.11% originated loan portfolio 1.00% . Actively reducing NPAs on 0.50% 0.00% acquired loan portfolio 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 ALL AS A % OF TOTAL LOANS NON-ACCRETABLE DIFF ON PCI LOANS NCOS/ AVERAGE LOANS NPAs / ASSETS 1.00% 2.50% 0.80% 2.00% 1.49% 0.60% 1.50% 1.41% 1.14% 1.08% 0.40% 1.00% 0.62% 0.20% 0.50% 0.10% 0.07% 0.07% 0.08% 0.11% 0.00% 0.00% 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 2016 FY 2017 FY 2018 FY 2019 FY Jun-20 NCOS / AVERAGE LOANS CCF ORIGINATED NPA/ASSETS CCF ACQUIRED NPA/ASSETS Source: S&P Global Market Intelligence, company filings 15

Paycheck Protection Program . Originated over $137 million in loans . Total fees collected, net of $5.2 million . Over 1,600 loans funded . Saved approximately 18,000 local jobs Source: company documents 16

COVID-19 Related Loan Deferrals Dollars In Thous ands Modification T ypes Balances of Loans P&I Payments % of Total C ategory Loan C ategory Interes t O nly Modified Deferred Loans Commercial Real Estate $ 147,235 34.1% 40.5% 11.4% Agric ulture R eal E s tate $ 2,289 0.0% 1.2% 0.2% Multifamily $ 14,835 3.5% 4.0% 1.2% C ons truction & Development $ 16,795 3.0% 5.5% 1.3% C ommercial & Indus trial $ 12,493 4.4% 1.9% 1.0% Agriculture Operation $ 66 0.0% 0.0% 0.0% R es idential R eal E s tate $ 3,054 0.0% 1.5% 0.2% C ons umer Ins tallment & Indirect O rginated $ 544 0.0% 0.3% 0.0% T otal $ 197,311 45.0% 55.0% 15.3% Balances of Loans P&I Payments High E xposure Commercial S egments Interes t O nly Modified Deferred Hotel $ 78,151 17.8% 21.8% R estaurant $ 24,657 8.6% 3.9% R etail $ 1,712 0.7% 0.1% T otal $ 104,520 27.1% 25.8% All loan deferments qualified for . No completed COVID-19 related modifications/deferrals temporary suspension of troubled debt processed as of March 31, 2020 restructuring requirements pursuant to . Over 97% COVID-19 modifications occurred in April and section 4013 of the CARES Act. May Source: S&P Global Market Intelligence, company filings 17

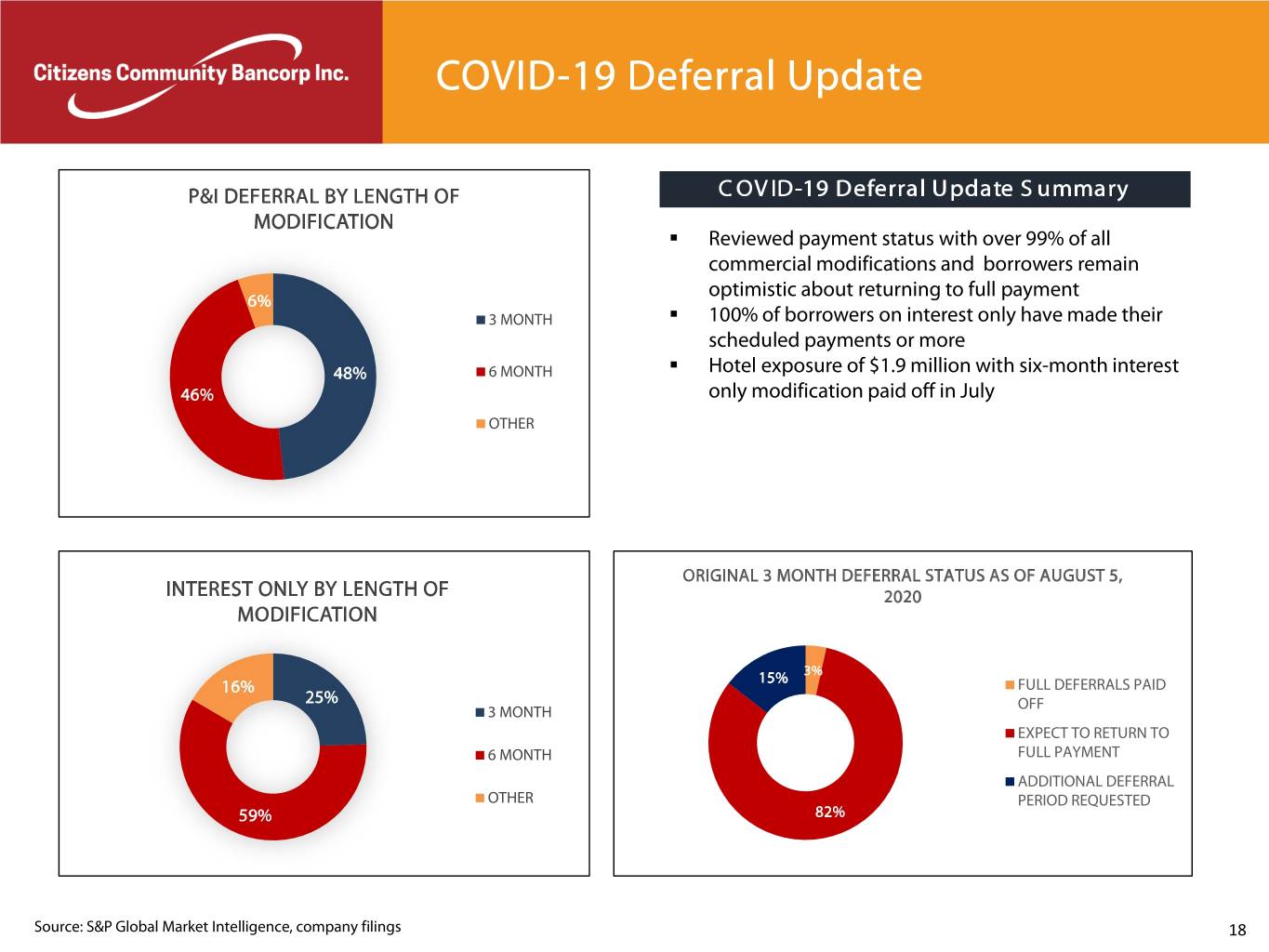

COVID-19 Deferral Update P&I DEFERRAL BY LENGTH OF COVID-19 Deferral Update S ummary MODIFICATION . Reviewed payment status with over 99% of all commercial modifications and borrowers remain optimistic about returning to full payment 6% 3 MONTH . 100% of borrowers on interest only have made their scheduled payments or more 48% 6 MONTH . Hotel exposure of $1.9 million with six-month interest 46% only modification paid off in July OTHER ORIGINAL 3 MONTH DEFERRAL STATUS AS OF AUGUST 5, INTEREST ONLY BY LENGTH OF 2020 MODIFICATION 15% 3% 16% FULL DEFERRALS PAID 25% OFF 3 MONTH EXPECT TO RETURN TO 6 MONTH FULL PAYMENT ADDITIONAL DEFERRAL OTHER PERIOD REQUESTED 59% 82% Source: S&P Global Market Intelligence, company filings 18

Loan Portfolio . CZWI has transformed its loan portfolio 9/30/2016 6/30/2020 through organic growth and acquisitions Consumer 4% . Change has occurred from a primarily consumer focused portfolio to a Residential diversified mix consisting of commercial CRE, C&I, Ag. & HELOC Consumer Related, C&D 12% real estate, agricultural and commercial 33% 34% business loans . Credit quality remains a focus in CRE, C&I, Ag. conjunction with loan growth Related, Residential & C&D HELOC . Transformation of the loan portfolio has 33% 84% occurred through both acquisitions and organic growth Note: Transformation charts exclude PPP loans Source: S&P Global Market Intelligence, company filings 19

Non – Owner Occupied CRE Non – Owner Portfolio Characteristics 9% Occupied 4% 27% Non - Owner Occupied CRE CRE 4% 5% 5% Loan Balance Outstanding In Millions $303 5% Number of Loans 850 6% 7% 28% Average Loan Size In Thousands $356 Approximate Weighted Average LTV 55% Investor Residential Hotel Retail Senior Living Office Industrial/Manufacturing Approximate Weighted Average DSCR 2.1x Restaurant Warehouse/Mini Storage Mixed Use Seasoning In Months 43 Other 2019 Net Charge-Offs 0.00% By Geography 12% Portfolio Fundamentals • Typically well seasoned investors with multiple projects, track record of 49% success and personal financial strength (net worth/Liquidity) 39% • Maximum LTV =<80% with recourse to owners with >20% interest • Term of 5-10 years with 20 to 25-year amortizations depending on property type, markets and strength and liquidity of sponsors • Minimum DSC and/or Global DSC covenant required to monitor performance ranging from 1.15x-1.25x • Conservative underwriting approach emphasizing actual results or Wisconsin Minnesota Other market data • Appropriate use of SBA 504/7a for lower cash injection or special use projects Source: Internal Company Documents 20

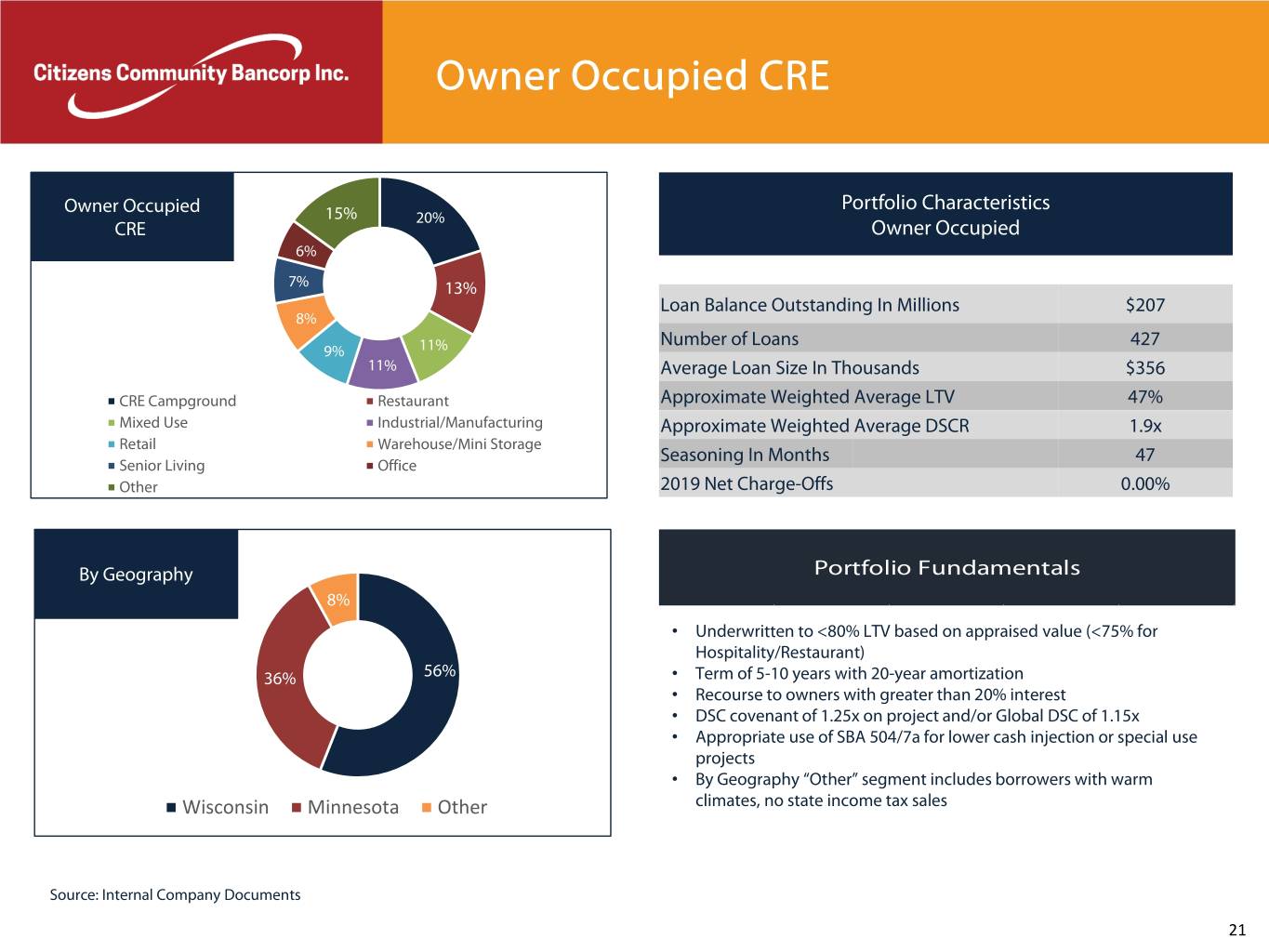

Owner Occupied CRE Owner Occupied Portfolio Characteristics 15% 20% CRE Owner Occupied 6% 7% 13% Loan Balance Outstanding In Millions $207 8% Number of Loans 427 9% 11% 11% Average Loan Size In Thousands $356 CRE Campground Restaurant Approximate Weighted Average LTV 47% Mixed Use Industrial/Manufacturing Approximate Weighted Average DSCR 1.9x Retail Warehouse/Mini Storage Seasoning In Months 47 Senior Living Office Other 2019 Net Charge-Offs 0.00% By Geography Portfolio Fundamentals 8% • Underwritten to <80% LTV based on appraised value (<75% for Hospitality/Restaurant) 36% 56% • Term of 5-10 years with 20-year amortization • Recourse to owners with greater than 20% interest • DSC covenant of 1.25x on project and/or Global DSC of 1.15x • Appropriate use of SBA 504/7a for lower cash injection or special use projects • By Geography “Other” segment includes borrowers with warm Wisconsin Minnesota Other climates, no state income tax sales Source: Internal Company Documents 21

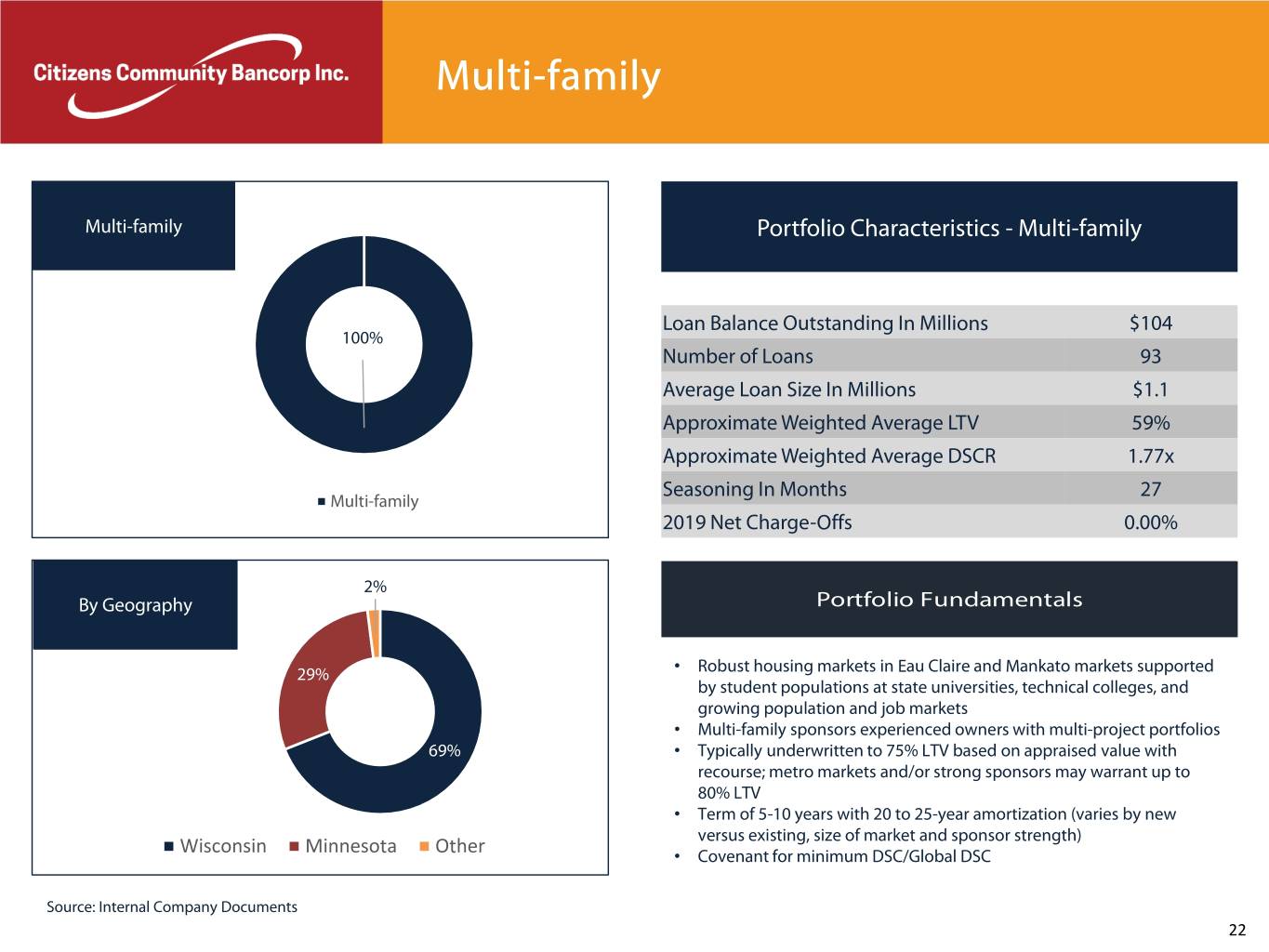

Multi-family Multi-family Portfolio Characteristics - Multi-family Loan Balance Outstanding In Millions $104 100% Number of Loans 93 Average Loan Size In Millions $1.1 Approximate Weighted Average LTV 59% Approximate Weighted Average DSCR 1.77x Seasoning In Months 27 Multi-family 2019 Net Charge-Offs 0.00% 2% By Geography Portfolio Fundamentals 29% • Robust housing markets in Eau Claire and Mankato markets supported by student populations at state universities, technical colleges, and growing population and job markets • Multi-family sponsors experienced owners with multi-project portfolios 69% • Typically underwritten to 75% LTV based on appraised value with recourse; metro markets and/or strong sponsors may warrant up to 80% LTV • Term of 5-10 years with 20 to 25-year amortization (varies by new versus existing, size of market and sponsor strength) Wisconsin Minnesota Other • Covenant for minimum DSC/Global DSC Source: Internal Company Documents 22

Commercial & Industrial Loans 2% 2% 3% Commercial & 3% Industrial Portfolio Characteristics - Commercial & Industrial 4% 14% 4% 5% 12% 6% Loan Balance In Millions $110 7% 11% Number of Loans 864 8% 10% Average Loan Size In Thousands $127 8% Approximate Weighted Average DSCR 2.6 Manufacturing Public Administration Construction Real Estate, Rental and Leasing Seasoning in months 34 Transportation and Warehousing Other Services Wholesale Trade Retail Trade Administrative Services Professional Services 2019 Net Charge-Offs 0.00% Other Services Finance and Insurance Educational Services Agriculture Committed Line, if collateral 65 Accomodation Services 3% By Geography Portfolio Fundamentals 13% • Highly diversified, secured loan portfolio underwritten with recourse • Lines of credit reviewed annually and may have borrowing base certificates governing line usage • Fixed asset LTV’s based on age and type of equipment; <5-year amortization 84% • Use of SBA Guaranty Program (Preferred Lender or General Processing) as appropriate • “Retail Trade” segment consists of Farm Supply, Franchised Hardware, Wisconsin Minnesota Other Franchised Auto Parts, Franchised and Non-franchised Auto Dealers and Repair Shops, Convenience Stores/Gas Stations Source: Internal Company Documents 23

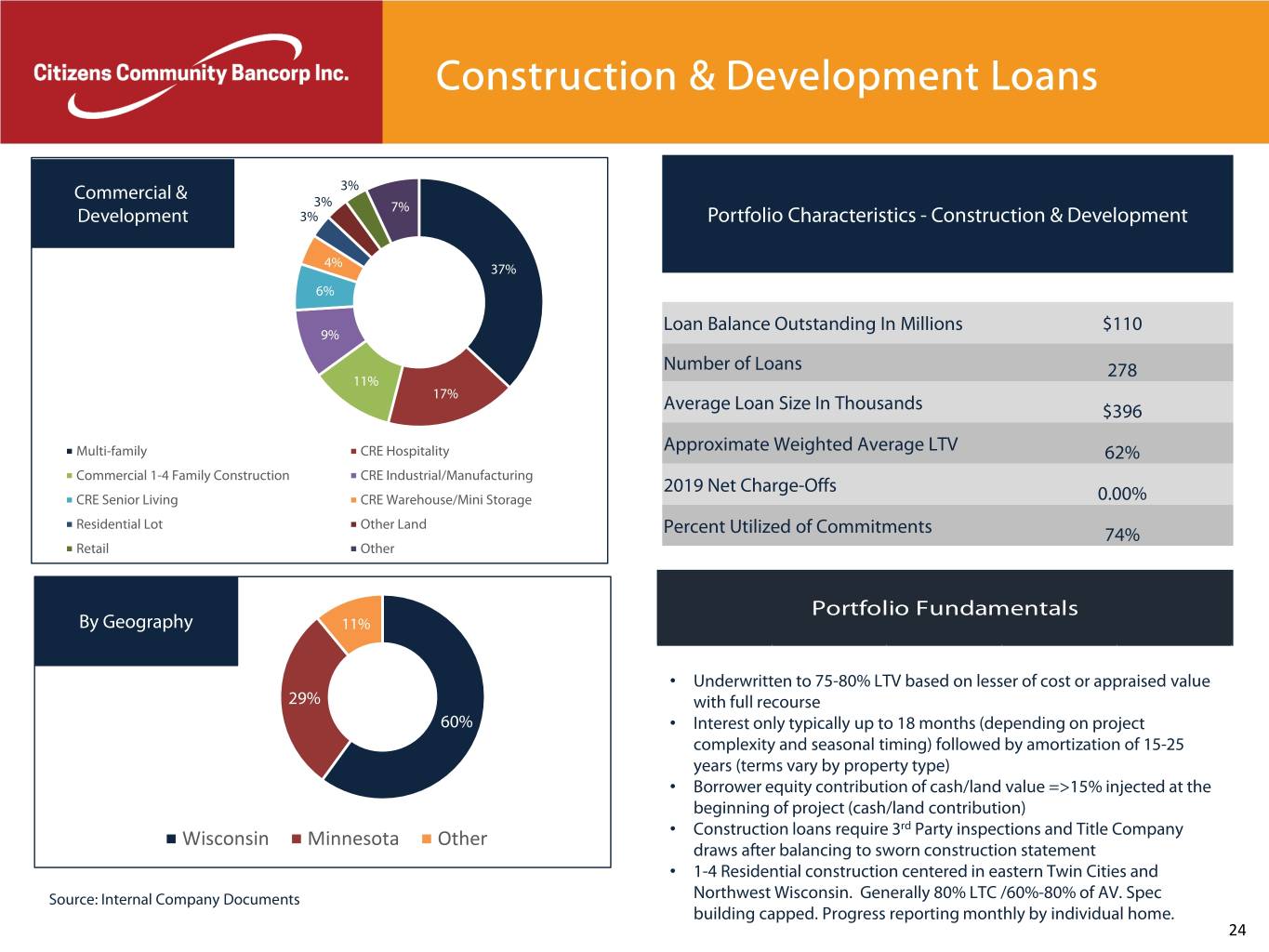

Construction & Development Loans Commercial & 3% 3% 7% Development 3% Portfolio Characteristics - Construction & Development 4% 37% 6% Loan Balance Outstanding In Millions $110 9% Number of Loans 278 11% 17% Average Loan Size In Thousands $396 Multi-family CRE Hospitality Approximate Weighted Average LTV 62% Commercial 1-4 Family Construction CRE Industrial/Manufacturing 2019 Net Charge-Offs CRE Senior Living CRE Warehouse/Mini Storage 0.00% Residential Lot Other Land Percent Utilized of Commitments 74% Retail Other Portfolio Fundamentals By Geography 11% • Underwritten to 75-80% LTV based on lesser of cost or appraised value 29% with full recourse 60% • Interest only typically up to 18 months (depending on project complexity and seasonal timing) followed by amortization of 15-25 years (terms vary by property type) • Borrower equity contribution of cash/land value =>15% injected at the beginning of project (cash/land contribution) • Construction loans require 3rd Party inspections and Title Company Wisconsin Minnesota Other draws after balancing to sworn construction statement • 1-4 Residential construction centered in eastern Twin Cities and Source: Internal Company Documents Northwest Wisconsin. Generally 80% LTC /60%-80% of AV. Spec building capped. Progress reporting monthly by individual home. 24

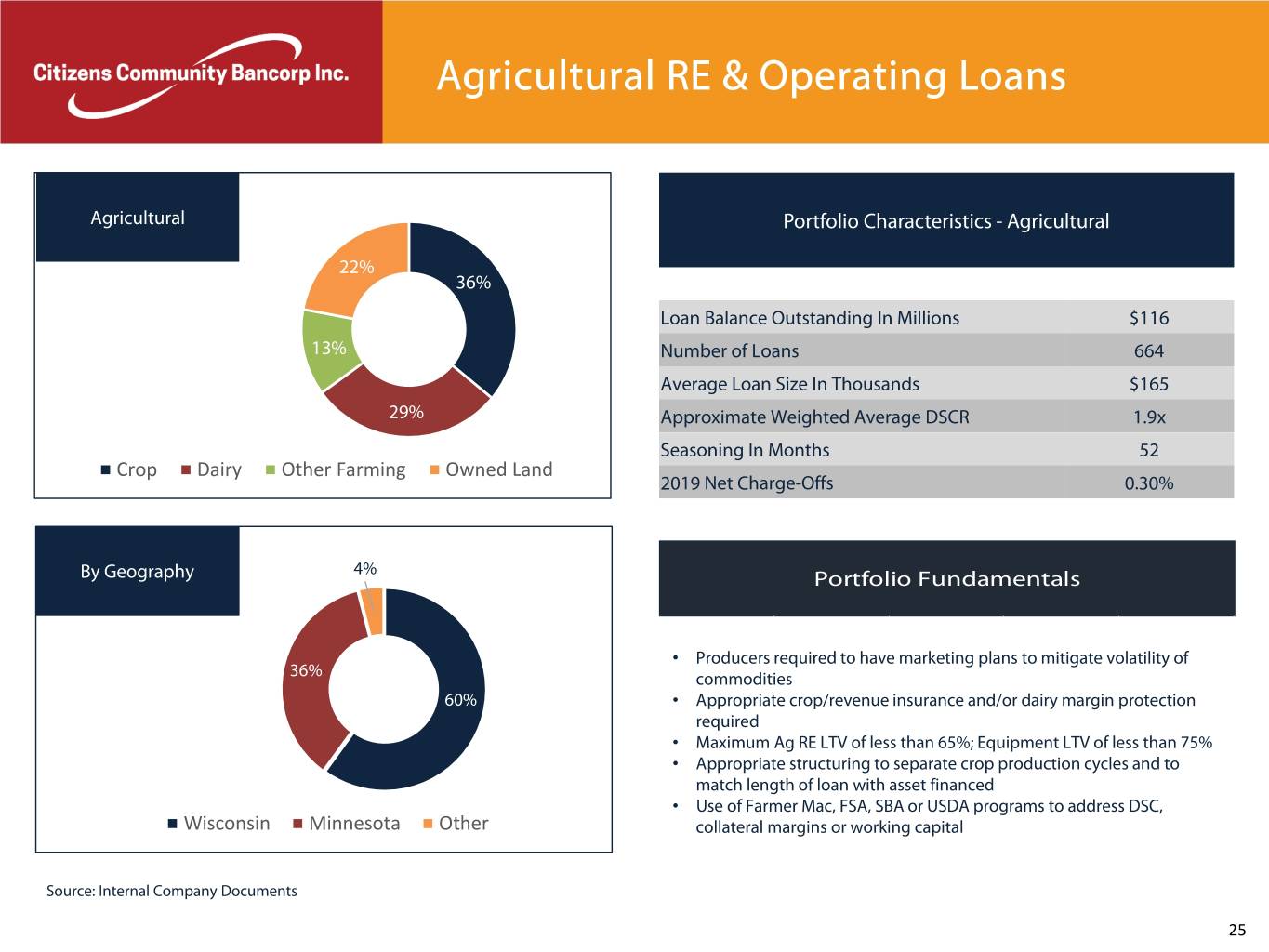

Agricultural RE & Operating Loans Agricultural Portfolio Characteristics - Agricultural 22% 36% Loan Balance Outstanding In Millions $116 13% Number of Loans 664 Average Loan Size In Thousands $165 29% Approximate Weighted Average DSCR 1.9x Seasoning In Months 52 Crop Dairy Other Farming Owned Land 2019 Net Charge-Offs 0.30% 4% By Geography Portfolio Fundamentals • Producers required to have marketing plans to mitigate volatility of 36% commodities 60% • Appropriate crop/revenue insurance and/or dairy margin protection required • Maximum Ag RE LTV of less than 65%; Equipment LTV of less than 75% • Appropriate structuring to separate crop production cycles and to match length of loan with asset financed • Use of Farmer Mac, FSA, SBA or USDA programs to address DSC, Wisconsin Minnesota Other collateral margins or working capital Source: Internal Company Documents 25

Hotel Loans Hotels Portfolio Characteristics - Hotels 8% 12% Loan Balance Outstanding In Millions $109 Number of Loans 43 Average Loan Size In Millions $2.3 21% 59% Approximate Weighted Average LTV 64% Approximate DSCR - Non-Construction 1.6x 2019 Net Charge Offs 0.00% Construction Loan Balance In Millions $19 Flagged Historic Boutique Wisconsin Dells Area Other Percent Utilized of Commitments 84% By Geography Portfolio Fundamentals 15% 41% • Mainly experienced multi project hoteliers and guarantors with strong personal financial statements (net worth and liquidity) • Mainly flagged properties, Historic hotels, including two hotels in Minneapolis 44% • Wisconsin Dells Area projects were acquired from F&M • One Historic project is approved for SBA 504 structure and there is a flagged project approved with the SBA 504 structure; both nearing completion of construction Wisconsin Minnesota Illinois • Underwriting consistent with management's conservative approach to Investor CRE, emphasizing actual results in underwriting Source: Internal Company Documents 26

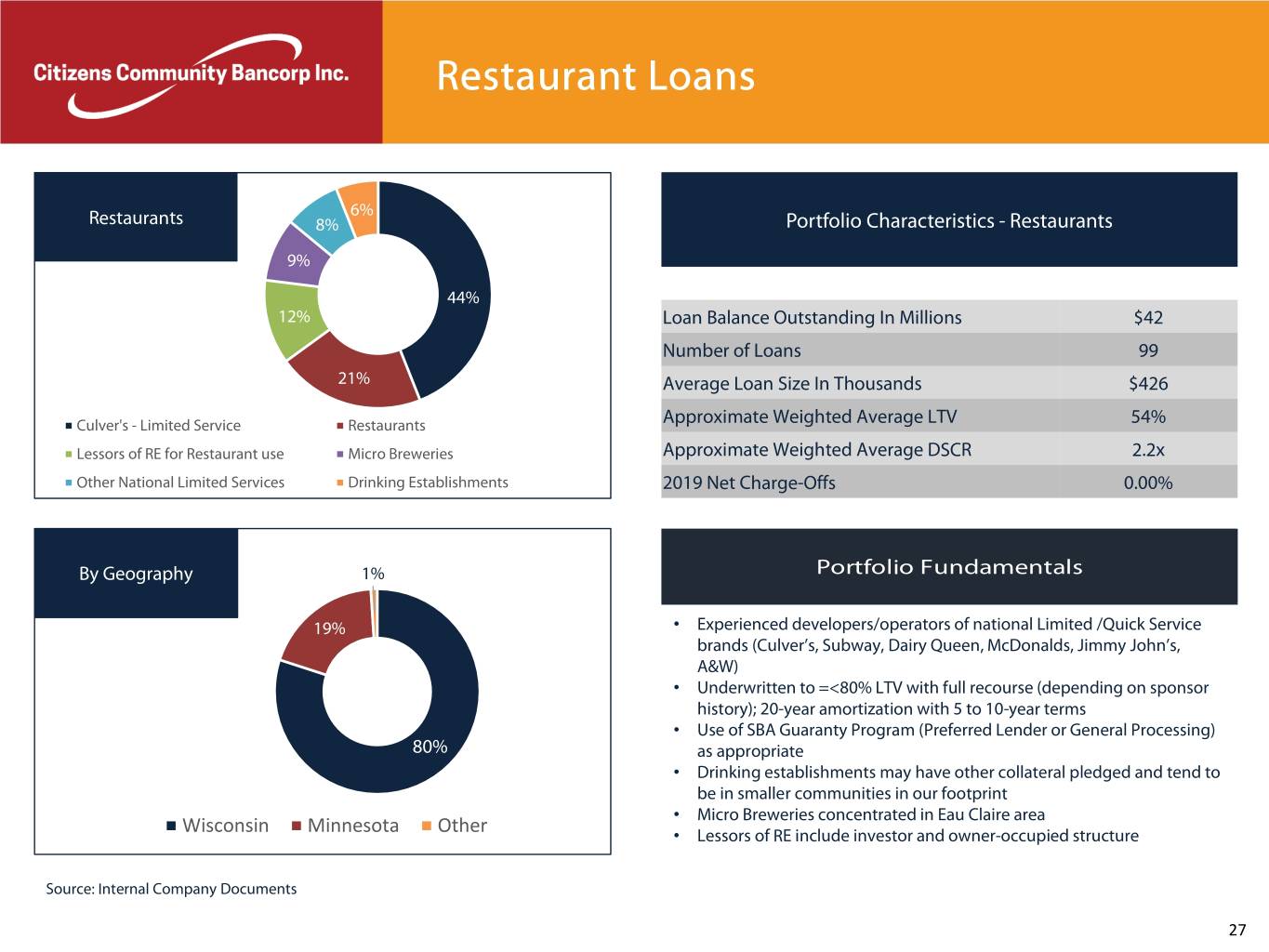

Restaurant Loans 6% Restaurants 8% Portfolio Characteristics - Restaurants 9% 44% 12% Loan Balance Outstanding In Millions $42 Number of Loans 99 21% Average Loan Size In Thousands $426 Culver's - Limited Service Restaurants Approximate Weighted Average LTV 54% Lessors of RE for Restaurant use Micro Breweries Approximate Weighted Average DSCR 2.2x Other National Limited Services Drinking Establishments 2019 Net Charge-Offs 0.00% By Geography 1% Portfolio Fundamentals 19% • Experienced developers/operators of national Limited /Quick Service brands (Culver’s, Subway, Dairy Queen, McDonalds, Jimmy John’s, A&W) • Underwritten to =<80% LTV with full recourse (depending on sponsor history); 20-year amortization with 5 to 10-year terms • Use of SBA Guaranty Program (Preferred Lender or General Processing) 80% as appropriate • Drinking establishments may have other collateral pledged and tend to be in smaller communities in our footprint • Micro Breweries concentrated in Eau Claire area Wisconsin Minnesota Other • Lessors of RE include investor and owner-occupied structure Source: Internal Company Documents 27

Deposit Composition 9/30/2016 6/30/2020 Non Interest . Focus has been on Bearing Demand transforming the deposit 8% Interest Non Interest composition to core deposits Bearing Bearing Demand CDs Demand 27% . Deposit transformation and 9% 18% CDs Interest growth has been achieved 49% Bearing through both acquisitions and Demand MMDA & 21% organic initiatives Savings MMDA & 34% Savings 34% Deposit Composition - Quarter Lookback ($000) S ep-16 S ep-17 S ep-18 Dec-19 Ma r-20 J un-20 Non-interes t-bearing demand depos its $45,408 $75,318 $87,495 $168,157 $150,139 $223,536 Interest bearing demand deposits $48,934 $147,912 $139,276 $223,102 $242,824 $270,116 MRQ S avings accounts $52,153 $102,756 $97,329 $156,599 $161,038 $185,816 Cost of Deposits Money market accounts $137,234 $125,749 $109,314 $246,430 $243,715 $242,536 0.84% C ertificate accounts $273,948 $290,769 $313,115 $401,414 $382,339 $350,193 Total Deposits $557,677 $742,504 $746,529 $1,195,702 $1,180,055 $1,272,197 Source: S&P Global Market Intelligence, company filings 28

Appendix 29

Colleague Assistance, Safety & Readiness Taking Care of Colleagues Location & Readiness Benefits • Daily attendance & work location tracking • Emergency Sick Leave for employees of colleagues diagnosed, quarantined or lost daycare for • Readiness plan to remediate COVID children exposure at a bank facility • Permit PTO accrual for employees to go negative if additional time is needed • Appreciation Pay (monthly stipend) for employees who work at bank facilities 42% Health & Safety Spacing and masks based on State guidelines • 58% • Remote work capabilities expanded • Assign colleagues of essential departments to multiple locations (operations/accounting etc.) • Hand sanitizers and wipes, gloves and periodic deep cleaning in all locations Staff at CCF Location Remote Staff 30

Net Interest Margin Analysis Quarter ended June 30, 2020 Quarter ended March 31, 2020 Quarter ended December 31, 2019 Interest Average Interest Average Interest Average Average Inc ome / Yie ld/ Average Inc ome / Yie ld/ Average Inc ome / Yie ld/ ($ D olla rs in Thous a nds ) Balance E xpens e R a te Balance E xpens e R a te Balance E xpens e R a te Average interest earning assets: C a s h a nd ca s h equiva lents $ 19,995 $ 5 0.10% $ 31,069 $ 118 1.53% $ 31,327 $ 122 1.55% Loans receivable (1) 1,266,273 14,687 4.66% 1,172,246 15,459 5.30% 1,136,330 14,611 5.10% Interest-bearing deposits 3,788 23 2.44% 4,362 27 2.49% 4,904 30 2.43% Investment securities (2) 174,875 988 2.27% 179,287 1,131 2.54% 185,920 1,222 2.62% Non-marketable equity securities, at cost 15,160 183 4.86% 15,006 173 4.64% 14,209 161 4.50% T ota l inte re s t e a rning a s s e ts $ 1,480,091 $ 15,886 4.32% $ 1,401,970 $ 16,908 4.85% $ 1,372,690 $ 16,146 4.67% Average interes t-bearing liabilities : T ota l de pos its $ 1,052,638 $ 2,607 1.00% $ 1,022,678 $ 3,180 1.25% $ 990,347 $ 3,284 1.32% F HL B A dva nces & Other B orrowings 186,191 976 2.11% 146,810 1,057 2.90% 165,660 1,087 2.60% Total interest bearing liabilities $ 1,238,829 $ 3,583 1.16% $ 1,169,488 $ 4,237 1.46% $ 1,156,007 $ 4,371 1.50% Ne t inte re s t inc ome $ 12,303 $ 12,671 $ 11,775 Interest R ate Spread 3.16% 3.39% 3.17% Net interes t margin 3.34% 3.64% 3.41% (1) The decrease is primarily related to higher realized non-accretable difference, included in loan interest income, due to the payoff of certain purchased credit impaired loans in the prior quarter. (2) Fully taxable equivalent. The average yield on tax exempt securities is computed on a tax equivalent basis using a tax rate of 21% for the quarters ended June 30, 2020, March 31, 2020 and December 31, 2019. Source: S&P Global Market Intelligence, company filings 31

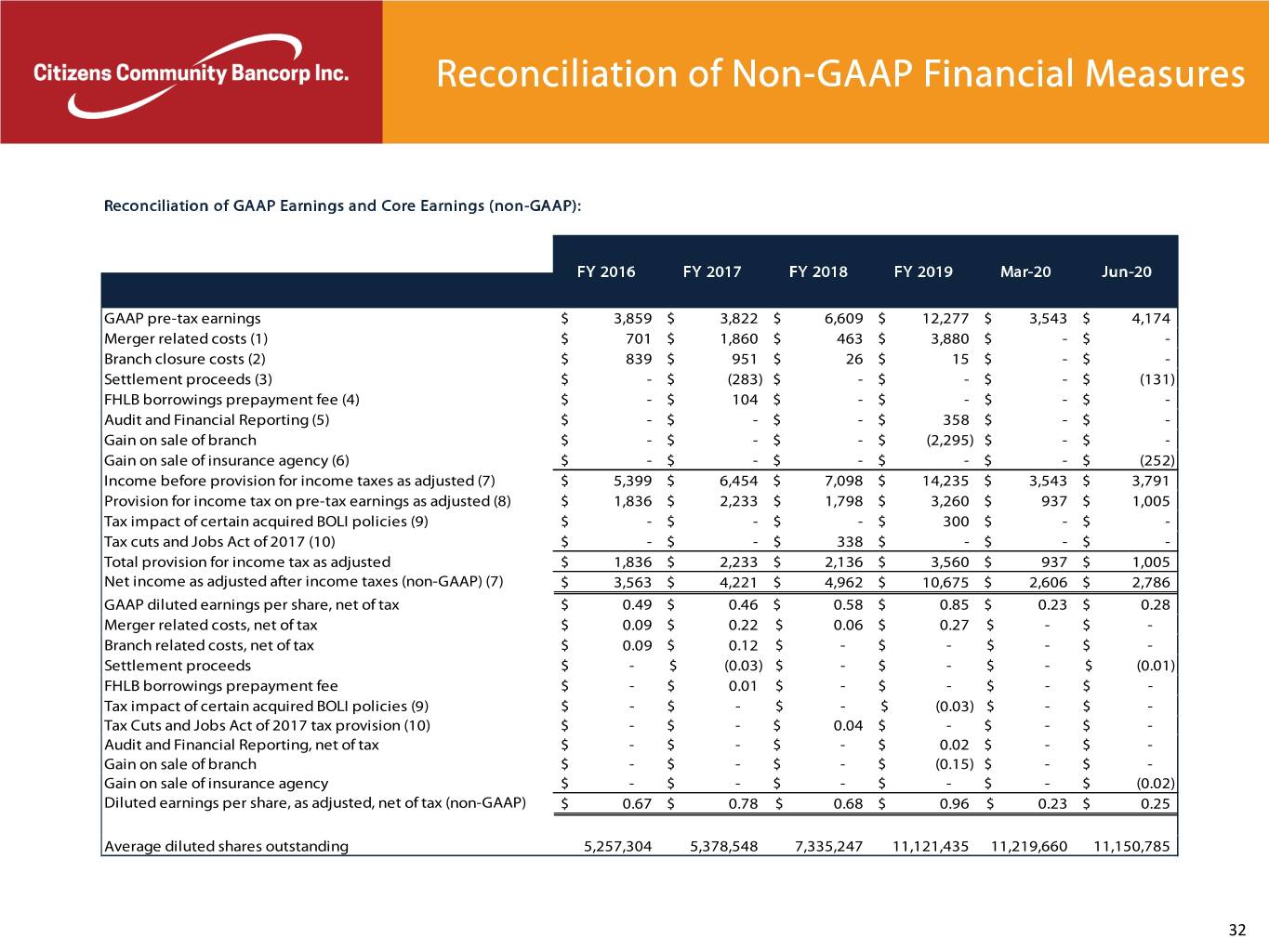

Reconciliation of Non-GAAP Financial Measures Reconciliation of GAAP Earnings and Core Earnings (non-GAAP): FY 2016 FY 2017 FY 2018 FY 2019 Mar-20 Jun-20 GAAP pre-tax earnings $ 3,859 $ 3,822 $ 6,609 $ 12,277 $ 3,543 $ 4,174 Merger related costs (1) $ 701 $ 1,860 $ 463 $ 3,880 $ - $ - Branch closure costs (2) $ 839 $ 951 $ 26 $ 15 $ - $ - Settlement proceeds (3) $ - $ (283) $ - $ - $ - $ (131) FHLB borrowings prepayment fee (4) $ - $ 104 $ - $ - $ - $ - Audit and Financial Reporting (5) $ - $ - $ - $ 358 $ - $ - Gain on sale of branch $ - $ - $ - $ (2,295) $ - $ - Gain on sale of insurance agency (6) $ - $ - $ - $ - $ - $ (252) Income before provision for income taxes as adjusted (7) $ 5,399 $ 6,454 $ 7,098 $ 14,235 $ 3,543 $ 3,791 Provision for income tax on pre-tax earnings as adjusted (8) $ 1,836 $ 2,233 $ 1,798 $ 3,260 $ 937 $ 1,005 Tax impact of certain acquired BOLI policies (9) $ - $ - $ - $ 300 $ - $ - Tax cuts and Jobs Act of 2017 (10) $ - $ - $ 338 $ - $ - $ - Total provision for income tax as adjusted $ 1,836 $ 2,233 $ 2,136 $ 3,560 $ 937 $ 1,005 Net income as adjusted after income taxes (non-GAAP) (7) $ 3,563 $ 4,221 $ 4,962 $ 10,675 $ 2,606 $ 2,786 GAAP diluted earnings per share, net of tax $ 0.49 $ 0.46 $ 0.58 $ 0.85 $ 0.23 $ 0.28 Merger related costs, net of tax $ 0.09 $ 0.22 $ 0.06 $ 0.27 $ - $ - Branch related costs, net of tax $ 0.09 $ 0.12 $ - $ - $ - $ - Settlement proceeds $ - $ (0.03) $ - $ - $ - $ (0.01) FHLB borrowings prepayment fee $ - $ 0.01 $ - $ - $ - $ - Tax impact of certain acquired BOLI policies (9) $ - $ - $ - $ (0.03) $ - $ - Tax Cuts and Jobs Act of 2017 tax provision (10) $ - $ - $ 0.04 $ - $ - $ - Audit and Financial Reporting, net of tax $ - $ - $ - $ 0.02 $ - $ - Gain on sale of branch $ - $ - $ - $ (0.15) $ - $ - Gain on sale of insurance agency $ - $ - $ - $ - $ - $ (0.02) Diluted earnings per share, as adjusted, net of tax (non-GAAP) $ 0.67 $ 0.78 $ 0.68 $ 0.96 $ 0.23 $ 0.25 Average diluted shares outstanding 5,257,304 5,378,548 7,335,247 11,121,435 11,219,660 11,150,785 32

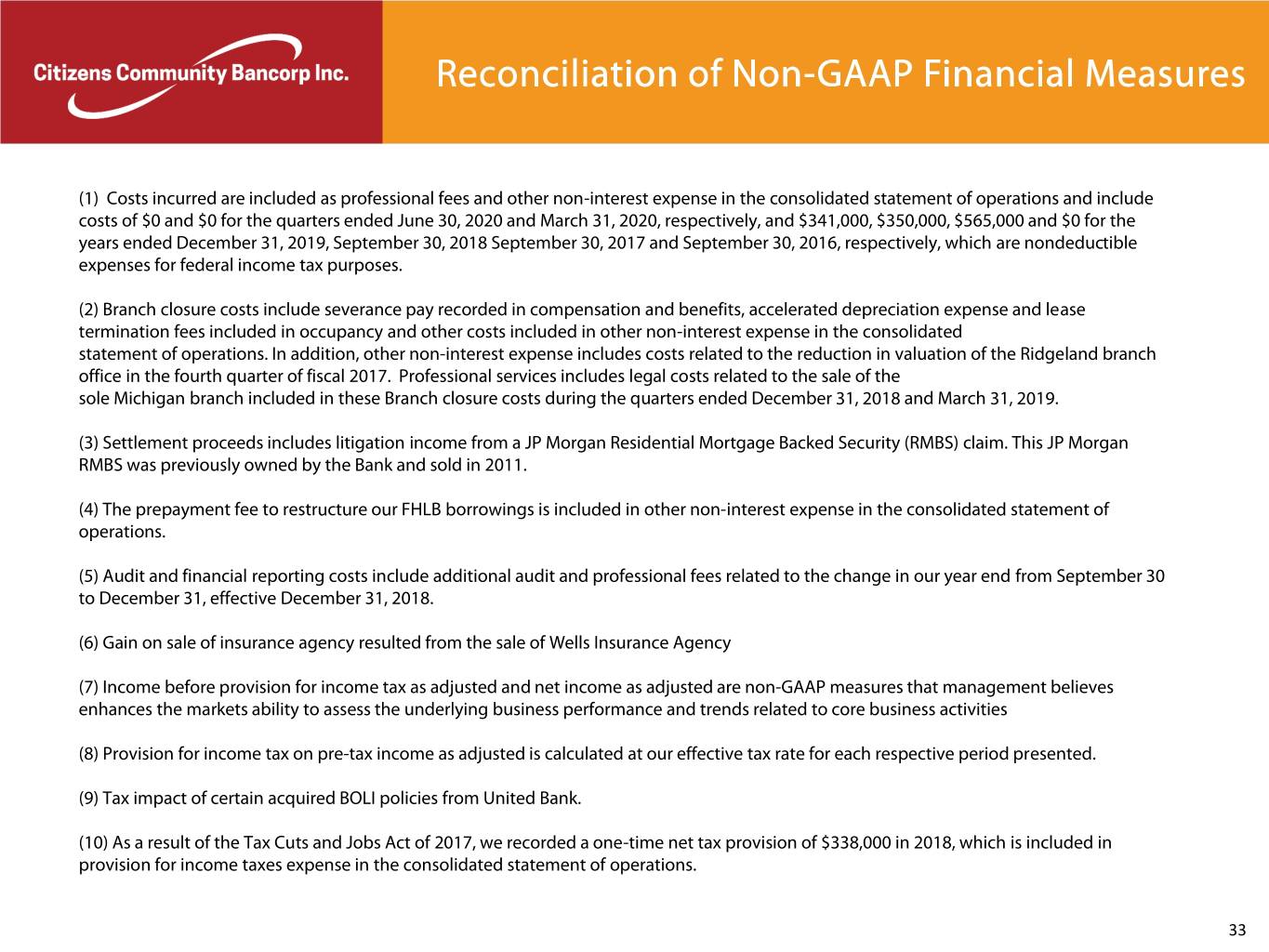

Reconciliation of Non-GAAP Financial Measures (1) Costs incurred are included as professional fees and other non-interest expense in the consolidated statement of operations and include costs of $0 and $0 for the quarters ended June 30, 2020 and March 31, 2020, respectively, and $341,000, $350,000, $565,000 and $0 for the years ended December 31, 2019, September 30, 2018 September 30, 2017 and September 30, 2016, respectively, which are nondeductible expenses for federal income tax purposes. (2) Branch closure costs include severance pay recorded in compensation and benefits, accelerated depreciation expense and lease termination fees included in occupancy and other costs included in other non-interest expense in the consolidated statement of operations. In addition, other non-interest expense includes costs related to the reduction in valuation of the Ridgeland branch office in the fourth quarter of fiscal 2017. Professional services includes legal costs related to the sale of the sole Michigan branch included in these Branch closure costs during the quarters ended December 31, 2018 and March 31, 2019. (3) Settlement proceeds includes litigation income from a JP Morgan Residential Mortgage Backed Security (RMBS) claim. This JP Morgan RMBS was previously owned by the Bank and sold in 2011. (4) The prepayment fee to restructure our FHLB borrowings is included in other non-interest expense in the consolidated statement of operations. (5) Audit and financial reporting costs include additional audit and professional fees related to the change in our year end from September 30 to December 31, effective December 31, 2018. (6) Gain on sale of insurance agency resulted from the sale of Wells Insurance Agency (7) Income before provision for income tax as adjusted and net income as adjusted are non-GAAP measures that management believes enhances the markets ability to assess the underlying business performance and trends related to core business activities (8) Provision for income tax on pre-tax income as adjusted is calculated at our effective tax rate for each respective period presented. (9) Tax impact of certain acquired BOLI policies from United Bank. (10) As a result of the Tax Cuts and Jobs Act of 2017, we recorded a one-time net tax provision of $338,000 in 2018, which is included in provision for income taxes expense in the consolidated statement of operations. 33

Reconciliation of Non-GAAP Financial Measures Return on Average Assets (ROAA) as Adjusted (In thousands except R OAA and R OAA as adjusted) 2016 2017 2018 2019 Mar-20 J un-20 Net Inc ome $ 2,573 $ 2,499 $ 4,283 $ 9,463 $ 10,481 $ 12,343 Net Income as adjusted $ 3,563 $ 4,221 $ 4,962 $ 10,675 $ 10,481 $ 11,205 Average assets $ 638,007 $ 731,407 $ 954,912 $ 1,398,482 $1,516,957 $1,585,421 R eturn on average assets 0.40% 0.34% 0.45% 0.68% 0.69% 0.78% R eturn on average assets as adjusted 0.56% 0.58% 0.52% 0.76% 0.69% 0.71% Return on Average Tangible Common Equity (ROATCE) (In thousands except R OATCE and R OATCE as adjusted) 2016 2017 2018 2019 Mar-20 J un-20 C ommon E quity $ 64,544 $ 73,483 $ 135,847 $ 150,553 $ 147,933 $ 152,790 Les s : Goodwill (4,663) (10,444) (10,444) (31,498) (31,498) (31,498) Less: Core Deposit and other intangibles (872) (5,449) (4,805) (7,587) (7,175) (6,293) Tangible Common Equity (TCE) $ 59,009 $ 57,590 $ 120,598 $ 111,468 $ 109,260 $ 114,999 Average Tangible Common E quity $ 57,891 $ 58,300 $ 89,094 $ 105,340 $ 110,364 $ 112,130 Net Inc ome $ 2,573 $ 2,499 $ 4,283 $ 9,463 $ 10,481 $ 12,343 Net Income as adjusted $ 3,563 $ 4,221 $ 4,962 $ 10,675 $ 10,481 $ 11,205 R OAT C E 4.4% 4.3% 4.8% 9.0% 9.5% 11.0% R OATCE as adjusted 6.2% 7.2% 5.6% 10.1% 9.5% 10.0% Note: All quarterly periods are annualized for net income / net income as adjusted. 34

Reconciliation of Non-GAAP Financial Measures Efficiency Ratio as Adjusted (In thousands except Efficiency Ratio and Efficiency Ratio as adjusted) 2016 2017 2018 2019 Ma r-20 J un-20 Non-interest E xpense (GAAP) $ 20,058 $ 22,878 $ 29,764 $ 42,686 $ 10,731 $ 11,392 Merger related costs (701) (1,860) (463) (3,880) - - B ranch C los ure cos ts (839) (951) (26) (15) - - Audit and financial reporting - - - (358) - - Prepayment fee - (104) - - - - Non-interest expense as adjusted $ 18,518 $ 19,963 $ 29,275 $ 38,433 $ 10,731 $ 11,392 Non-interes t income $ 3,915 $ 4,751 $ 7,370 $ 14,975 $ 3,603 $ 5,013 Net interes t margin 20,077 22,268 30,303 43,513 12,671 12,303 E fficiency ratio denominator (GAAP ) 23,992 27,019 37,673 58,488 16,274 17,316 G ain on s ale of branch - - - (2,295) - - G ain on s ale of ins urance agency - - - - - (252) S ettlement proceeds - (283) - - - (131) E fficiency ratio denominator as adjus ted $ 23,992 $ 26,736 $ 37,673 $ 56,193 $ 16,274 $ 16,933 Efficiency ratio 84% 85% 79% 73% 66% 66% Efficiency ratio as adjusted 77% 75% 78% 68% 66% 67% Tangible Book Value Per Share (TBVPS) as Adjusted (In thousands except Shares Outstanding, Book Value and TBVPS ) 2016 2017 2018 2019 Ma r-20 J un-20 Total S tockholders ' equity $ 64,544 $ 73,483 $ 135,847 $ 150,553 $ 147,933 $ 152,790 Les s : G oodwill (4,663) (10,444) (10,444) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (872) (5,449) (4,805) (7,587) (7,175) (6,293) Tangible common equity (non-GAAP) $ 59,009 $ 57,590 $ 120,598 $ 111,468 $ 109,260 $ 114,999 S hares outs tanding 5,260,098 5,888,816 10,913,853 11,266,954 11,151,009 11,150,695 B ook V alue $ 12.27 $ 12.48 $ 12.45 $ 13.36 $ 13.27 $ 13.70 TBVPS $ 11.22 $ 9.78 $ 11.05 $ 9.89 $ 9.80 $ 10.31 Tangible Common Equity / Tangible Assets (In thousands except Tangible Common Equity / Tangible Asets) 2016 2017 2018 2019 Ma r-20 J un-20 Total As s ets $ 695,865 $ 940,664 $ 975,409 $ 1,167,060 $ 1,505,164 $ 1,607,514 Les s : G oodwill (4,663) (10,444) (10,444) (31,498) (31,498) (31,498) Less: Core deposit and intangibles (872) (5,449) (4,805) (7,587) (7,175) (6,293) Tangible Assets (non-GAAP) $ 690,330 $ 924,771 $ 960,160 $ 1,127,975 $ 1,466,491 $ 1,569,723 Tangible Common Equity / Tangible Assets 8.5% 6.2% 12.6% 9.9% 7.5% 7.3% Note: All quarterly periods are annualized for net income / net income as adjusted 35

Disciplined Acquisition Strategy Strategic consolidation of community banks Areas of Potential Acquisition Opportunities . Provides scale and operating efficiencies CZWI Locations . Adds experienced and knowledgeable banking talent . Opportunity to continue commercial loan growth Potential Markets . Opportunity to drive down cost of funds . Adds portfolios of seasoned loans Maintain disciplined approach Duluth . Low loan to deposit ratio Superior . Low-cost deposit funding Rice Lake . Attractive market share Eau Claire . Compelling noninterest income Minneapolis Wausau St. Paul Enhance the performance of acquired banks . Developed core competency evaluating, structuring, acquiring and integrating target banks Mankato Target markets – Select Midwest Markets . Wisconsin – Northwestern/Western/North Central Mason City . Minnesota – Areas in or in close proximity to micropolitan or metropolitan markets . Iowa – Northern Iowa only La Crosse Size Criteria Winona . Banks with assets between $200 million and $1.0 billion Rochester There are 90 banks within our target markets that meet our size criteria Total Banks Median Asset Size Banks $200M - $500M 62 296,152 Banks $500M - $750M 21 577,814 Banks $750M $1.0B 7 917,832 Source: S&P Global Market Intelligence 36

Leadership Team Mr. Stephen M. Bianchi, also known as Steve, has been the Chief Executive Officer and President of Citizens Community Bancorp, Inc. and Citizens Community Federal since June 24, 2016. He has been Chairman of Citizens Community Bancorp, Inc. since October 2018 and Citizens Community Federal National Association. As a 34-year banking veteran, Mr. Bianchi served in several senior management positions at Wells Fargo Bank and with Associated Bank. He served as the Chief Executive Officer at HF Financial Corp. from October 2011 and its President from April 2010 to May 2015. Mr. Bianchi served as the Chief Executive Officer and President of Home Federal Bank, a subsidiary of HF Financial Corp. from August 2012 to May 2015. He served as the Interim Chief Executive Officer and Interim President of HF Financial Corp. from October 2011 until July 2012. Mr. Bianchi served as Senior Vice President at Associated Bank, where he Stephen M. Bianchi served as Minnesota Regional President and Minnesota Regional Commercial Banking Manager from July Chairman of the Board 2006 to April 2010. Before that, he served as Twin Cities Business Banking Manager for Wells Fargo Bank, President & CEO where he held several other management positions over 14 years. He has been a Director of Citizens Community Bancorp, Inc. since May 25, 2017. He has been a Director of Citizens Community Federal since June 24, 2016. Mr. Bianchi received his B.S. degree in Finance and M.B.A. from Providence College. Mr. James S. Broucek has been Chief Financial Officer and Principal Accounting Officer at Citizens Community Bancorp, Inc. since October 31, 2017 and serves as its Treasurer since January 17, 2018. He serves as Executive Vice President and Secretary of Citizens Community Bancorp, Inc. He serves as Executive Vice President, Treasurer and Secretary at Citizens Community Federal National Association. He has been Chief Financial Officer and Principal Accounting Officer of Citizens Community Federal National Association since October 31, 2017. He served as a Senior Manager of Wipfli LLP (“Wipfli”) from December 2013 to October 2017. Before joining Wipfli, Mr. Broucek held several positions with TCF Financial Corporation (“TCF James S. Broucek Financial”) and its subsidiaries from 1995 to 2013, with his last position being Treasurer of TCF Financial. Executive VP, CFO Principal Prior to joining TCF Financial, Mr. Broucek served as the Controller of Great Lakes Bancorp. He currently Accounting Officer, Treasurer serves as a Member of the Strategic Issues Council of the Financial Manager Society, Inc. Mr. Broucek holds a & Secretary B.A. in mathematics and business administration with a concentration in accounting from Hope College. 37