Attached files

Exhibit 10.18

LEASE AGREEMENT

BY AND BETWEEN:

Cedar Brook 2005, LP

“Landlord”

and -

PMV Pharmaceuticals, Inc.

“Tenant”

PREMISES: 8 Clarke Drive, Cranbury, NJ 08512

DATED: February , 2015

| Contents | ||||||

| 1. |

LEASED PREMISES |

1 | ||||

| 2. |

TERM OF LEASE |

1 | ||||

| 3. |

CONSTRUCTION OF THE TENANT IMPROVEMENTS |

2 | ||||

| 4. |

RENT |

2 | ||||

| 5. |

PARKING AND USE OF EXTERIOR AREA |

3 | ||||

| 6. |

USE |

3 | ||||

| 7. |

REPAIRS AND MAINTENANCE |

3 | ||||

| 8. |

COMMON AREA EXPENSES, TAXES AND INSURANCE |

5 | ||||

| 9. |

SIGNS |

8 | ||||

| 10. |

ASSIGNMENT AND SUBLETTING |

8 | ||||

| 11. |

FIRE AND CASUALTY |

9 | ||||

| 12. |

COMPLIANCE WITH LAWS, RULES AND REGULATIONS |

10 | ||||

| 13. |

INSPECTION BY LANDLORD |

14 | ||||

| 14. |

DEFAULT BY TENANT |

15 | ||||

| 15. |

DAMAGES |

17 | ||||

| 16. |

NOTICES |

18 | ||||

| 17. |

NON-WAIVER BY LANDLORD |

18 | ||||

| 18. |

ALTERATIONS |

19 | ||||

| 19. |

NON-LIABILITY OF LANDLORD |

20 | ||||

| 20. |

RESERVATION OF EASEMENT |

20 | ||||

| 21. |

STATEMENT OF ACCEPTANCE |

20 | ||||

| 22. |

FORCE MAJEURE |

20 | ||||

| 23. |

STATEMENT BY TENANT |

20 | ||||

| 24. |

CONDEMNATION |

21 | ||||

| 25. |

LANDLORD’S RIGHTS |

21 | ||||

| 26. |

OUIET ENJOYMENT |

21 | ||||

| 27. |

SURRENDER OF PREMISES; HOLDOVER |

22 | ||||

| 28. |

INDEMNITY |

22 | ||||

| 29. |

BIND AND CONSTRUE CLAUSE |

23 | ||||

| 30. |

INCLUSIONS |

23 | ||||

| 31. |

DEFINITION OF TERM “LANDLORD” |

23 | ||||

| 32. |

COVENANTS OF FURTHER ASSURANCES |

23 | ||||

| 33. |

COVENANT AGAINST LIENS |

24 | ||||

| 34. |

SUBORDINATION |

24 | ||||

| 35. |

EXCULPATION OF LANDLORD |

24 | ||||

| 36. |

NET RENT |

25 | ||||

| 37. |

SECURITY |

25 | ||||

| 38. |

BROKERAGE |

26 | ||||

| 39. |

LATE CHARGES |

26 | ||||

| 40. |

PRESS RELEASES |

26 | ||||

| 41. |

WAIVER OF JURY TRIAL |

26 | ||||

| 42. |

LAWS OF NEW JERSEY |

26 | ||||

| 43. |

RENEWAL |

27 | ||||

| 44. |

TENANT REPRESENTATION |

27 | ||||

| 45. |

RIGHT OF FIRST OFFER |

27 | ||||

| 46. |

REASONABLE |

27 | ||||

-ii-

AGREEMENT, made February , 2015, between Cedar Brook 2005, LP, 4A Cedar Brook Drive, Cranbury, New Jersey 08512, “Landlord”; and PMV Pharmaceuticals, Inc., 497 Seaport Court, Suite 101, Redwood City, CA 94063, “Tenant”.

RECITALS:

WHEREAS, the Landlord intends to lease to the Tenant a portion of 8 Clarke Drive, Cranbury, New Jersey, 08512 (“Building”) constituting a portion of the office/industrial park known as Cedar Brook Corporate Center (“Office Park” or “Property”); and WHEREAS, the parties hereto wish to mutually define their rights, duties and obligations in connection with the Lease;

NOW THEREFORE, in consideration of the promises set forth herein, the Landlord leases unto the Tenant and the Tenant rents from the Landlord the leased premises described in Paragraph 1, and the Landlord and Tenant do hereby mutually covenant and agree as follows:

| 1. | LEASED PREMISES |

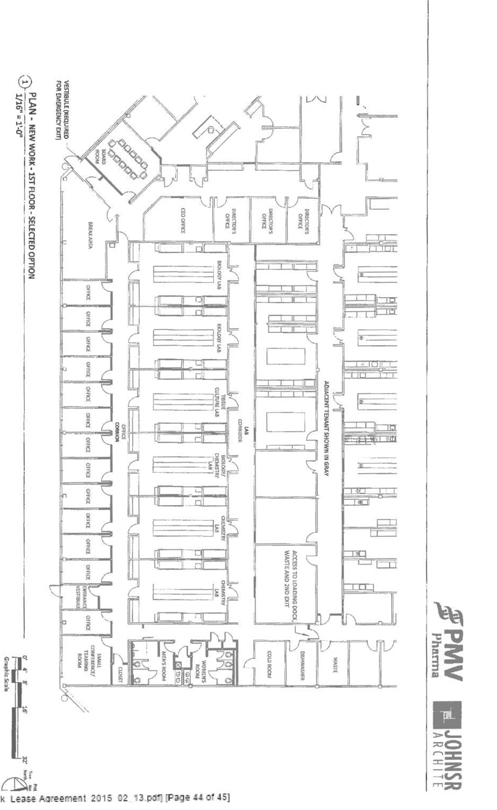

1.1 The leased premises shall consist of 12,652 rentable square feet of laboratory and office space (“Leased Premises”) as measured from outside of exterior walls to centerline of common walls, together with the right to use all common areas all as shown on Attachment A of this Lease Agreement, along with all improvements to be constructed thereon by the Landlord for the use of the Tenant, and all easements, tenements, appurtenances, hereditaments, rights and privileges appurtenant thereto, and any and all fixtures and equipment which currently exist or are to be installed in the Leased Premises by the Landlord for the use of the Tenant in its occupancy of the Leased Premises. Tenant shall also have the right to use all common areas (“Common Areas”) defined as those areas and facilities of the Office Park which are available for the use of tenants of the Building in common with Landlord, including parking areas, pedestrian walkways, and landscaped areas in the Office Park. Tenant may use all Common Areas only for their intended purposes. Landlord shall have exclusive control of all Common Areas at all times and may make such changes to the Common Areas as Landlord deems appropriate, provided that Landlord shall maintain the Common Areas in a condition comparable to existing conditions as the date of signing and use commercially reasonable efforts to minimize disruption of Tenant’s use and occupancy of the Leased Premises or Common Areas.

| 2. | TERM OF LEASE |

2.1 The term of the Lease (“Term”) shall be 5 (five) years, to commence on (the “Commencement Date”) which shall be the later to occur of (i) March 1, 2015, and (ii) the date by which all of the following have occurred: (a) Landlord has substantially completed the Tenant Improvements in accordance with this Lease; (b) Landlord has delivered possession of the Leased Premises to Tenant in the required condition; and (c) Landlord has obtained a temporary certificate of occupancy (“TCO”), a certificate of occupancy (“CO”), or a certificate of acceptance (“CA”) for the legal occupancy of the Leased Premises for the permitted use, and to end on the day before the fifth anniversary of the Commencement Date (“Expiration Date”). If the Commencement Date has not occurred by September 1, 2015, Tenant may terminate this Lease, upon prior written notice, and all amounts paid by Tenant to Landlord shall be refunded promptly to Tenant. In the event that Landlord

is able to achieve items (i) and (ii) above prior to March 1, 2015 and Tenant occupies the Leased Premises, Tenant shall be obligated to pay all Base Rent and Additional Rent as of the date of its occupancy.

| 3. | CONSTRUCTION OF THE TENANT IMPROVEMENTS |

Landlord shall construct, at its sole cost and expense, the improvements described in Attachment B hereto (the “Tenant Improvements”). The Tenant Improvements shall be constructed in accordance with plans timely approved by Tenant and all applicable laws, in a good and workmanlike manner, free of defects and using materials and equipment of good quality. Tenant shall have the right to submit a written “punch list” to Landlord, setting forth any defective item of construction, and Landlord shall promptly cause such items to be corrected. Landlord shall use commercially reasonable efforts to deliver the Leased Premises in the required condition on or before March 1, 2015. Landlord shall deliver possession of the Leased Premises to Tenant with the Tenant Improvements substantially complete, in good, vacant, broom clean condition, with all building systems in good working order and the roof water-tight, and in compliance with all applicable laws. Tenant shall have the right to access the Leased

Premises prior to the Commencement Date to prepare the Leased Premises for occupancy, so long as such access does not unreasonably interfere with Landlord’s construction of the Tenant Improvements. Such access shall be subject to the terms of this Lease, except no Rent shall be payable.

| 4. | RENT |

4.1 Tenant shall pay, as rent for the Leased Premises, an annual base rent of $20.00 per square foot, for an aggregate annual base rent of $253,040.00 (“Base Rent”), payable monthly in the sum of $21,086.67. Notwithstanding anything to the contrary in this Lease, provided Tenant is not in monetary default under this Lease after the expiration of all notice and grace periods, Base Rent shall abate for the one (1) month period during the thirtieth (30th) full calendar month of the Term.

4.2 Tenant shall pay the following which shall be referred to herein as “Additional Rent”:

(a) Common Area Expenses as hereafter defined in paragraph 8.1.

(b) Any other charges as provided in this Lease. The Base Rent and Additional Rent shall be referred to hereafter as “Rent”.

4.3 Tenant covenants to pay the Rent in lawful money of the United States which shall be legal tender for the payment of all debts, public and private, at the time of payment. Such Rent shall be paid to Landlord at its office address hereinabove set forth, or at such other place as Landlord may, from time to time, designate by notice to Tenant.

4.4 The Rent shall be payable by Tenant without any set-off or deduction of any kind or nature whatsoever and without notice or demand.

-2-

| 5. | PARKING AND USE OF EXTERIOR AREA |

The Tenant shall have the right to use its pro rata share of the parking spaces in the lot serving the Building on an unreserved basis in common with other tenants of the Building. The Landlord and Tenant mutually agree that they will not block, hinder or otherwise obstruct the access driveways and parking areas so as to impede the free flow of vehicular traffic on the property. In connection with the use of the loading platforms, if any, Tenant agrees that it will not use the same so as to unreasonably interfere with the use of the access driveways and parking areas. Tenant shall not park or store trailers or other vehicles on any portion of the access driveways or parking areas, and may not utilize any portion of the land, Office Park, or Building outside of the Leased Premises for any purpose without the prior written consent of Landlord; provided, however, Tenant shall have the right to install and use a generator outside the Building in a location reasonably designated by Tenant and reasonably approved by Landlord and subject to Cranbury Township approval to serve the Leased Premises. Subject to the reasonable approval by Landlord as to the location thereof and subject to Cranbury Township approval, Tenant shall also have the right, at its expense, to locate, install and maintain HVAC and other equipment on the roof of the Building at no additional rent provided such equipment is installed within the roof screens and conforms to applicable codes.

| 6. | USE |

The Tenant covenants and agrees to use and occupy the Leased Premises only for office, laboratory and research and development use, which use is expressly subject to all applicable zoning ordinances, rules and regulations of any governmental instrumentalities, boards or bureaus having jurisdiction thereof. Tenant’s use of the Leased Premises shall not interfere with the peaceable and quiet use and enjoyment by other tenants at their respective leased premises located at the Building or in the Office Park, nor shall Tenant’s activities cause Landlord to be in default under its leases with such other tenants. Tenant’s use must comply with all present and future statutes, laws, codes, regulations, ordinances, orders, rules, bylaws, administrative guidelines, requirements, directives and actions of any federal, state or local governmental or quasi-governmental authority, and other legal requirements of whatever kind or nature (“Legal Requirements”). Tenant shall not cause or permit Tenant or its agents, employees or contractors to cause any conduct or condition which may endanger, disturb or otherwise interfere with any other Building occupant’s normal operations or with the management of the Building. Tenant shall not commit any nuisance or excessive noise, and will dispose of all garbage and waste in compliance with laws and in a manner that minimizes emissions of dirt, fumes, odors or debris.

| 7. | REPAIRS AND MAINTENANCE |

7.1 Tenant shall generally monitor, maintain and repair the Leased Premises, in a good and workmanlike manner, and shall, at the expiration of the term, deliver the Leased Premises in good order and condition, damages by fire or casualty, the elements, condemnation, repairs that are not Tenant’s responsibility hereunder and ordinary wear and tear excepted. Tenant covenants and agrees that it shall not cause or permit any waste, damage or disfigurement to the Leased Premises, or any overloading of the floors. Tenant shall maintain and make all repairs to the floor surface, plumbing and electrical systems including all ballasts and fluorescent fixtures located within and exclusively serving the Leased Premises. Landlord shall be responsible for repairs necessary to the Building

-3-

structure, roof, exterior windows, doors and load-bearing walls, and electric and plumbing and other Building systems to the point where they enter the Leased Premises, and the maintenance of the HVAC systems located in the common mechanical room and on the roof along with the other mechanical systems located in the common mechanical room provided, however, that Landlord shall not be required to make, and Tenant shall be responsible for, any repairs occasioned by the acts or omissions of Tenant, its agents, employees, contractors or subcontractors. Tenant shall promptly report in writing to Landlord any defective condition which Landlord is required to repair, and Landlord’s obligation to repair, except as to routine maintenance, is conditioned upon receipt by Landlord of such prior written notice. Landlord’s obligation to repair is also conditioned, at Landlord’s option, upon Tenant not then being in default under this Lease after notice and expiration of the applicable cure period. Landlord shall have no other maintenance or repair obligations whatsoever with respect to the Leased Premises except that Landlord shall perform and construct any repair, maintenance or improvements (a) necessitated by the acts or omissions of Landlord or its agents, employees or contractors, (b) for which Landlord has a warranty, or (c) which could be treated as a “capital expenditure” under generally accepted accounting principles. Except for the foregoing, Tenant shall keep and maintain in good order, condition and repair the Leased Premises and every part thereof, including, without limitation, the interior surfaces of the exterior walls, interior doors, door frames, door checks, interior windows and window frames, all wall and floor coverings, all building systems and components thereof which exclusively service the Leased Premises including, without limitation, mechanical, plumbing, electrical, all lighting fixtures and all bathrooms within the Leased Premises, and alterations, additions or improvements (“Alterations”) made by or on behalf of Tenant and shall make all other interior non-structural repairs, replacements, renewals and restorations, ordinary and extraordinary, foreseen and unforeseen, required to be made in and to the Leased Premises. The term “repair” as used in this Section shall include replacements when necessary. Landlord agrees to maintain the Leased Premises at a minimum temperature of 45 degrees to prevent the freezing of domestic water and sprinkler pipes and no higher than 78 degrees to prevent humidity, mold and mildew. Landlord will provide Tenant’s desired comfortable office temperature so long as the same is within the temperature range set forth above.

7.2 The Tenant shall, at its own cost and expense, pay all utility charges, including telephone and cable service, and to the extent provided in Section 7.4, gas and electric, servicing the Leased Premises. Landlord shall have the option, at Landlord’s sole cost, to install, at its own cost, separate water meter and invoice Tenant directly for its water/sewer usage. Tenant shall not store any items outside the Leased Premises, and shall deliver its garbage and recyclables to the central receiving area on the lot. Tenant shall dispose of all hazardous/medical waste with an approved hauler at its own cost and in compliance with all applicable laws, ordinances or rules and regulations.

7.3 Landlord does not warrant that any services Landlord or any public utilities supply will not be interrupted. Services may be interrupted because of accidents, repairs, alterations, improvements or any other reason beyond the reasonable control of Landlord and Landlord shall not be subject to liability as a result thereof. Notwithstanding the foregoing, if the Leased Premises should become not reasonably suitable for Tenant’s use as a consequence of cessation of utilities, interference with access to the Leased Premises, legal restrictions or the presence of any Hazardous Material which does not result from Tenant’s release or emission of such Hazardous Material, and in any of the foregoing cases the interference with Tenant’s use of the Leased Premises persists for ten (10) business days, then Tenant shall be entitled to an equitable abatement of rent to the extent of the interference with Tenant’s use of the Leased Premises occasioned thereby. If the interference persists for more than ninety (90) days, Tenant shall have the right to terminate this Lease.

-4-

7.4 Landlord shall charge and Tenant shall pay for natural gas and electric utility charges at the rate of $7.50 per rentable square foot of the Leased Premises per year. This amount shall be adjusted as of the end of each year as follows: the budget will be compared to actual bills with any differential from that year’s billing being reconciled at that time via either credit to Tenant or payment to Landlord.

| 8. | COMMON AREA EXPENSES, TAXES AND INSURANCE |

8.1 The Tenant shall pay to the Landlord, monthly, as Additional Rent the cost of the following items all of which shall be known as Common Area Expenses in monthly installments at the same time Base Rent is due:

(a) The costs incurred by the Landlord for the operation, maintenance or repair of the following items in the Office Park, which costs shall be fixed at $3.00/square foot of the Leased Premises for the year 2015 and shall increase by 3% each January 1st commencing on January 1, 2016 (“Operating Costs”):

(1) lawns and landscaping;

(2) standard water/sewer usage and standby sprinkler charges;

(3) exterior and interior common area Building lighting;

(4) exterior sewer lines;

(5) exterior utility lines;

(6) repair and maintenance of any signs serving the Office Park;

(7) snow removal;

(8) standard garbage disposal and recycling;

(9) general ground maintenance;

(10) parking lot, driveways and walkways;

(11) maintenance contracts for the roof;

(12) pest control;

(13) central station monitoring for fire sprinkler system; and

(14) other ordinary maintenance expenses normally incurred by Landlord relating to the Building and common areas of the Office Park;

-5-

The $3.00/square foot, as increased annually, shall include the cost of the annual insurance premiums charged to the Landlord for insurance coverage which insure the buildings in the Office Park. The insurance shall be for the full replacement value of all insurable improvements in the Building, including the Tenant Improvements and any Alterations with any customary extensions of coverage including, but not limited to, vandalism, malicious mischief, sprinkler damage and comprehensive liability, on an “all risk” or “special causes” form and insurance for one year’s rent. The Landlord shall maintain said insurance in effect at all times hereunder. Any increase in the insurance premiums due to a change in rating of the Building to the extent attributable to Tenant’s particular use, or due to special Tenant equipment, shall be paid entirely by the Tenant. Tenant expressly acknowledges that Landlord shall not maintain insurance on Tenant’s furniture, fixtures, machinery, inventory, equipment or other personal property; and

(b) Tenant’s Proportionate Share (as defined herein) of the real estate and personal property taxes assessed against the Office Park for land, building and improvements, along with any levy for the installation of local improvements affecting the Office Park assessed by any governmental body having jurisdiction thereof (“Taxes”), provided however, that Tenant shall be entitled to Tenant’s Proportionate Share of any refund obtained by Landlord with respect to any Taxes, after having deducted therefrom Landlord’s expenses in obtaining any such refund. Tenant’s Proportionate Share shall be a fraction, the numerator of which shall be the rentable square footage of the Leased Premises, and the denominator of which shall be the total square footage of all occupied or previously occupied space in the Office Park. Taxes shall be adjusted as of each January 1st of each year during the term, based on actual tax bills. Tenant’s Proportionate Share of Common Area Expenses for any calendar year, part of which falls within the term of this Lease and part of which does not, shall be appropriately prorated. In addition to Tenant’s Proportionate Share of the above items, Tenant shall pay directly any additional assessments on any Alterations made by Tenant or at Tenant’s expense that exceed standard improvements. If at any time during the term of this Lease the method or scope of taxation prevailing at the commencement of the Term shall be altered, Tenant’s Proportionate Share of such substituted tax or imposition shall be payable and discharged by the Tenant in the manner required pursuant to the law which shall authorize such change. Tenant shall pay before delinquent all taxes levied or assessed upon, measured by, or arising from: (a) the conduct of Tenant’s business; (b) Tenant’s leasehold estate; or (c) Tenant’s property. Additionally, Tenant shall pay to Landlord all sales, use, transaction privilege, or other excise tax that may at any time be levied or imposed upon, or measured by, any amount payable by Tenant under this Lease. Anything in this Section or elsewhere in this Lease to the contrary notwithstanding, Tenant shall not be obligated to pay any part of (1) any taxes on the income of the Landlord or the holder of an underlying mortgage and any taxes on the income of the lessor under any underlying lease, (2) any corporation, unincorporated business or franchise taxes, (3) any estate, gift, succession or inheritance taxes, (4) any capital gains, mortgage recording or transfer taxes, (5) any taxes or assessments attributable to any sign attached to, or located on, the Building or the land, (6) any similar taxes imposed on the Landlord, the holder of any underlying mortgage or the lessor under any underlying lease, (7) taxes levied on Landlord’s rental income, unless such tax or assessment is imposed in lieu of real property taxes or (8) taxes and assessments in excess of the amount which would be payable if such tax or assessment expense were paid in installments over the longest permitted term. Monthly payments on account of Taxes shall be paid at the same time and in the same manner as payments of Base Rent, in an amount equal to 1/12 of Landlord’s good faith estimate for the then-current calendar year. Any estimate given by Landlord under this Section may be modified at any time upon written notice to Tenant and monthly

-6-

payments shall be adjusted after Landlord’s receipt of the applicable tax bill. Any adjustment for underpayment shall be paid by Tenant within 30 days after Landlord’s notice and any credit for overpayment shall be applied to the next Rent coming due. Landlord represents that Taxes are currently estimated to be $2.93 per square foot of the Leased Premises; and

(c) A management fee of 3% of the Tenant’s Base Rent.

(d) A charge of $0.67 per square foot for the maintenance of the common HVAC and other mechanical systems servicing the modules as indicated on Attachment A. This amount shall be adjusted as of the end of the each year. The budget will be compared to actual bills with any differential from that year’s billing being reconciled at that time via either credit to Tenant or payment to Landlord; however, in no event shall such amount increase by more than fifteen percent (15%).

8.2 Tenant’s Share of Common Area Expenses for any calendar year, part of which falls within the term of this Lease and part of which does not, shall be appropriately prorated.

8.3 If at any time during the term of this Lease the method or scope of taxation prevailing at the commencement of the lease term shall be altered, Tenant’s Proportionate Share of such substituted tax or imposition shall be payable and discharged by the Tenant in the manner required pursuant to the law which shall authorize such change.

8.4 Tenant, at all times and at its expense, shall keep in effect commercial general liability insurance, including contractual liability insurance, covering Tenant’s use of the Leased Premises, with a $2,000,000 combined single limit with a $5,000,000 general aggregate limit (which general aggregate limit may be satisfied by an umbrella liability policy) for bodily injury or property damage and no less than $300,000.00 for property damage, with a deductible of no more than $20,000.00; however, such limits shall not limit Tenant’s liability hereunder. The policy shall name Landlord, and at Landlord’s request, any mortgagee(s), as additional insureds, shall be written on an “occurrence” basis and not on a “claims made” basis and shall be endorsed to provide that it is primary to any policies carried by Landlord and to provide that it shall not be cancelable or reduced without at least 30 days prior notice to Landlord. The insurer shall be authorized to issue such insurance, licensed to do business and admitted in the state in which the Office Park is located and rated at least A-VII in the most current edition of Best’s Insurance Reports. Tenant shall deliver to Landlord on or before the Commencement Date or any earlier date on which Tenant accesses the Leased Premises, and at least 10 days prior to the date of each policy renewal, a certificate of insurance evidencing such coverage. Tenant shall at all times, at its own cost and expense, carry sufficient “All Risk” property insurance on a replacement cost basis to avoid any coinsurance penalties in applicable policies on all of Tenant’s furniture, furnishings, fixtures, machinery, equipment and installations as well as any Tenant Alterations. Such coverage is to include property undergoing additions and alterations, and shall cover the value of equipment and supplies awaiting installations.

Notwithstanding anything to the contrary in this Lease, Landlord and Tenant each waive, and release each other from and against, all claims for recovery against the other for any loss or damage to the property of such party arising out of fire or other casualty coverable by the insurance required to be maintained under the Lease. This waiver and release is effective regardless of whether

-7-

the releasing party actually maintains said insurance and is not limited to the amount of insurance actually carried, or to the actual proceeds received after a loss. Each party shall have its insurance company that issues its property coverage waive any rights of subrogation, and shall have the insurance company include an endorsement acknowledging this waiver, if necessary. All of Landlord’s and Tenant’s repair and indemnity obligations under this Lease shall be subject to the waiver contained in this paragraph.

| 9. | SIGNS |

Tenant shall not place any signs in the Office Park without the prior consent of Landlord, other than an identification sign with Tenant’s name on the entry door to the Leased Premises, and signs that are located wholly within the interior of the Leased Premises, at Tenant’s sole cost and expense. Tenant shall maintain all signs installed by Tenant in good condition. Tenant shall remove its signs at the termination of this Lease, shall repair any resulting damage. Landlord shall provide Tenant with a listing on the Building monument sign.

| 10. | ASSIGNMENT AND SUBLETTING |

10.1 (a) Except as provided below, Tenant shall not enter into nor permit (i) any assignment, transfer, pledge or other encumbrance of all or a portion of Tenant’s interest in this Lease, (ii) any sublease, license or concession of all or a portion of Tenant’s interest in the Leased Premises or (iii) any transfer of more than fifty percent (50%) of the ownership interests in Tenant in one or more related transactions voluntarily or by operation of law (other than pursuant to an initial public offering of stock or an equity financing) (collectively, “Transfer”) without the prior written consent of Landlord or Landlord’s affiliate. Landlord shall not unreasonably withhold its consent if the following conditions are satisfied (i) the proposed transferee is not an existing tenant of Landlord, (ii) the business, business reputation or creditworthiness of the proposed transferee is acceptable to Landlord, and (iii) Tenant is not in default under this Lease. Consent to one Transfer shall not be deemed to be consent to any subsequent Transfer. In no event shall any Transfer relieve Tenant from any obligation under this Lease. Landlord’s acceptance of Rent from any person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be consent to any Transfer. Any Transfer not in conformity with this Section shall be void at the option of Landlord. Notwithstanding the above, Tenant will not be permitted to sublease any space to an existing tenant within the Office Park or at Eastpark at 8A.

(b) Landlord’s consent shall not be required in the event of a deemed Transfer due to a transfer of ownership interests as described in Section 10.1(a)(iii) or any Transfer by Tenant to an Affiliate (defined as (i) any entity controlling, controlled by, or under common control of, Tenant, (ii) any successor to Tenant by merger, consolidation or reorgani7ation, and (iii) any purchaser of all or substantially all of the assets of Tenant as a going concern) provided that (i) the transferee (or Tenant, following a deemed Transfer due to a transfer of ownership interests) has a tangible net worth at least equal to that of Tenant as of the date of this Lease, (ii) Tenant provides Landlord notice of the Transfer at least 15 days prior to the effective date, together with current financial statements of the transferee certified by an executive officer of the transferee, and (iii) in the case of an assignment, Tenant delivers to Landlord an assumption agreement reasonably acceptable to Landlord executed by Tenant and the transferee.

-8-

(c) The provisions of subsection (a) above notwithstanding, if Tenant proposes to Transfer all of the Leased Premises (other than to an Affiliate), Landlord may terminate this Lease by delivering written notice thereof to Tenant within the above time period, and Landlord may condition the termination of this Lease on execution of a new lease between Landlord and the proposed transferee within thirty (30) days after Landlord’s delivery of its notice. If this Lease is not so terminated or amended, Tenant shall pay to Landlord monthly, 50% of the excess of (i) all compensation received by Tenant for the Transfer over (ii) the Rent allocable to the Leased Premises transferred, less Tenant’s reasonable expenses of marketing the space and paying brokerage commissions and reasonable legal fees.

(d) If Tenant requests Landlord’s consent to a Transfer, Tenant shall provide Landlord with current financial statements of the transferee certified by an executive officer of the transferee, a complete copy of the proposed Transfer documents, and any other information Landlord reasonably requests. Landlord shall notify Tenant within 30 days after receipt of the foregoing, whether Landlord is granting or withholding consent, or, if (c) applies, whether Landlord elects to terminate the Lease. Immediately following any approved assignment, Tenant shall deliver to Landlord an assumption agreement reasonably acceptable to Landlord executed by Tenant and the transferee, together with a certificate of insurance evidencing the transferee’s compliance with the insurance requirements of Tenant under this Lease. Tenant agrees to reimburse Landlord for reasonable administrative and reasonable attorneys’ fees in connection with the processing and documentation of any Transfer for which Landlord’s consent is requested.

10.2 In the event of any assignment or subletting permitted by the Landlord, the Tenant shall remain and be directly and primarily responsible for payment and performance of the within Lease obligations, and the Landlord reserves the right, at all times, to require and demand that the Tenant pay and perform the terms and conditions of this Lease. In the case of a complete recapture, Tenant shall be released from all further liability with respect to the recaptured space. No such assignment or subletting shall be made to any Tenant who shall occupy the Leased Premises for any use other than that which is permitted to the Tenant, or for any use which may be deemed inappropriate for the Building or extra hazardous, or which would in any way violate applicable laws, ordinances or rules and regulations of governmental boards and bodies having jurisdiction.

| 11. | FIRE AND CASUALTY |

11.1 In case of any damage to or destruction of any portion of the Building of which the Leased Premises is a part by fire or other casualty occurring during the term of this Lease (or prior thereto), which shall render at least 1/3 of the floor area of the Leased Premises or portions of the building required for Tenant’s use of the Leased Premises untenantable or unfit for occupancy, which damage cannot be repaired within 180 days from the happening of such casualty, using reasonable diligence (“Total Destruction”) then the term hereby created shall, at the option of the Landlord, upon written notice to the Tenant within 15 days of such fire or casualty, cease and become null and void from the date of such Total Destruction. In such event the Tenant shall immediately surrender the Leased Premises to the Landlord and this Lease shall terminate. The Tenant shall only pay Rent to the time of such Total Destruction. However, in the event of Total Destruction if the Landlord shall elect not to cancel this Lease within the 15 day period the Landlord shall repair and restore the Building to substantially the same condition as it was prior to the damage or destruction, with reasonable speed

-9-

and dispatch. The Rent shall not be accrued after said damage or while the repairs and restorations are being made, but shall recommence immediately after the Leased Premises are substantially restored as evidenced by the issuance of a TCO/CO/CA by municipal authorities. In any case where Landlord must restore, consideration shall be given for delays under the Force Majeure paragraph in this Lease, but such delays shall not impact Tenant’s rent abatement or termination rights hereunder, if any. Whether or not this Lease has been terminated as a result of a casualty, in every instance, all property insurance proceeds payable as a result of damage or destruction to the Building shall be paid to Landlord as its sole and exclusive property.

11.2 In the event of any other casualty which shall not be tantamount to Total Destruction the Landlord shall repair and restore the Building and the Leased Premises to substantially the same condition as they were prior to the damage or destruction, but not Tenant’s personal property, furnishings, inventory, fixtures or equipment, with reasonable speed and dispatch. Such repairs will not exceed 180 days from the issuance of a construction permit. The Rent shall abate or shall be equitably apportioned as to any portion of the Leased Premises which shall be unfit for occupancy by the Tenant, or which cannot be used by the Tenant to conduct its business. The Rent shall recommence immediately upon substantial restoration of the Leased Premises as evidenced by the issuance of a TCO/CO/CA by municipal authorities.

11.3 In the event of any casualty to the Leased Premises or portion of the Building required for Tenant’s use of the Leased Premises caused by an event which is not covered by Landlord’s insurance policy required under this Lease, the restoration of which would cost more than ten percent (10%) of the replacement cost of the Building; the Landlord may elect to treat the casualty as though it had insurance or it may terminate the Lease. If it treats the casualty as though it had insurance then the provisions of paragraph 11.2 shall apply. The Landlord shall serve a written notice upon the Tenant within 15 days of the casualty specifying the election which it chooses to make.

11.4 In the event the Landlord rebuilds, the Tenant agrees, at its cost and expense, to forthwith remove any and all of its equipment, fixtures, stock and personal property as needed in order to permit Landlord to expedite the construction. The Tenant shall assume at its sole risk the responsibility for damage to or security of such fixtures and equipment in the event that any portion of the Building area has been damaged and is not secure.

11.5 If the Leased Premises are damaged by any peril and Landlord does not terminate this Lease, then Tenant shall have the option to terminate this Lease if the Leased Premises cannot be, or are not in fact, fully restored by Landlord to their prior condition within one hundred eighty (180) days after the damage.

| 12. | COMPLIANCE WITH LAWS, RULES AND REGULATIONS |

12.1 (a) Tenant covenants and agrees that, except as otherwise set forth in this Section 12, it will, at its own cost, promptly comply with and carry out all Legal Requirements, including, but not limited to Environmental Laws, as defined below, to the extent that same apply to the manner of Tenant’s occupation or use of the Leased Premises, the conduct of Tenant’s business therein, the construction of any Alterations to the Leased Premises by or on behalf of Tenant, any termination of this Lease and surrender of possession by Tenant, or any acts, omissions or other

-10-

activities of Tenant in or on the Office Park. Subject to the foregoing, to the extent that any Legal Requirements require modifications to the Leased Premises or the Building, in order to bring same into compliance with Legal Requirements and such Legal Requirements were in effect prior to the date of this Lease, Landlord shall be responsible for the compliance of such items with such Legal Requirements at Landlord’s cost. Notwithstanding anything to the contrary in this Lease, Landlord shall be responsible for, and Tenant shall not be required to comply with or cause the Leased Premises to comply with, any laws, rules, regulations or insurance requirements that require the construction of alterations unless such compliance is necessitated solely due to Tenant’s particular manner of use of or alterations to the Leased Premises.

(b) The Tenant agrees, at its own cost and expense, to comply with such regulations or requests as may be required by the fire or liability insurance carriers providing insurance for the Leased Premises, and the Board of Fire Underwriters, in connection with Tenant’s use and occupancy of the Leased Premises.

(c) In case the Tenant shall fail to comply with Legal Requirements, then Landlord may, after 10 days’ notice (except for emergency repairs, which may be made immediately), enter the Leased Premises and take any reasonable actions to comply with them, at the cost and expense of the Tenant. In addition to Landlord’s rights and remedies by reason of default by Tenant, the cost thereof shall be added to the next month’s Rent and shall be due and payable as such.

(d) “Environmental Laws” are defined herein as all applicable present or future federal, state or local laws, ordinances, rules, executive orders or regulations (including the rules and regulations of the federal Environmental Protection Agency and comparable state agency) relating to the protection of human health or the environment including, but not limited to the Comprehensive Environmental Response Compensation and Liability Act of 1980, 42 U.S.C. 9601 et seq. (“CERCLA”); the Industrial Site Recovery Act, N.J. S.A. 13:1K-6 et seq., (“ISRA”); the New Jersey Spill Compensation and Control Act, N.J.S.A. 58:10-23.11 et seq., (“Spill Act”): the Solid Waste Management Act, N.J.S.A. 13:1E-1 et seq., (“SWMA”); the Resource Conservation and Recovery Act, 42 U.S.C. 6901 et seq., (“RCRA”); the New Jersey Underground Storage of Hazardous Substances Act, NJ. S.A. 58:10A-21 et seq., (“USTA”); the Clean Air Act, 42 U.S.C. Section 7401 et seq., (“CAA”); the Air Pollution Control Act, NJ.S.A. 26:2C-1 et seq., (“APCA”); the New Jersey Water Pollution Control Act, N.J.S.A. 58:10A-1 et seq., (“WPCA”); and any rules or regulations promulgated thereunder or in any other applicable federal, state or local law, rule or regulation dealing with environmental protection. For purposes of Environmental Laws, to the extent authorized by law and as between Landlord and Tenant, Tenant is and shall be deemed to be the responsible party as “operator” of Tenant’s “facility” and die “owner” of all Hazardous Materials brought on the Leased Premises and/or Property by Tenant, its agents, employees, contractors or invitees, and the wastes, by-products, or residues generated, resulting, or produced therefrom. Tenant agrees that (i) no activity will be conducted on the Leased Premises that will use or produce any pollutants, contaminants, toxic or hazardous wastes or other materials the removal of which is required or the use of which is regulated, restricted, or prohibited by any Environmental Law (“Hazardous Materials,”) except for activities which are part of the ordinary course of Tenant’s business and are conducted in accordance with all Environmental Laws, (“Permitted Activities”); “Hazardous Materials” includes any pollutant, toxic substances, any hazardous chemical, hazardous substance, hazardous pollutant, hazardous waste or any similar term as defined in or pursuant to the (i) CERCLA; (ii) RCRA; (iii) ISRA; (iv) Spill Act;

-11-

(v) WPCA; (vi) APCA; (vii) SWMA; (viii) CAA; and (ix) USTA and any rules or regulations promulgated thereunder or in any other applicable federal, state or local Iaw, rule or regulation dealing with environmental protection; it is understood and agreed that the provisions contained in this Lease shall be applicable notwithstanding whether any substance shall not have been deemed to be a Hazardous Material at the time of its use or “Release” (as defined below); (ii) the Leased Premises will not be used for storage of any Hazardous Materials, except for materials used in the Permitted Activities which are properly stored in a manner and location complying with all Environmental Laws; (iii) no portion of the Leased Premises or Property will be used by Tenant or Tenant’s employees, agents, or contractors (“Tenant’s Agents”) for disposal of Hazardous Materials in violation of Environmental Laws or any other applicable rule or regulation; (iv) Tenant will deliver to Landlord copies of all Material Safety Data Sheets and other written information prepared by manufacturers, importers or suppliers of any chemical on compact disks or electronic format acceptable to Landlord; and (v) Tenant will immediately notify Landlord of any violation by Tenant or Tenant’s Agents of any Environmental Laws or the Release or suspected Release of Hazardous Materials in, under or about the Leased Premises by Tenant or Tenant’s Agents, and Tenant shall immediately deliver to Landlord a copy of any notice, filing or permit sent or received by Tenant with respect to the foregoing. “Release” shall mean the spilling, leaking, disposing, pumping, pouring, discharging, emitting emptying, ejecting, depositing, injecting, leaching, escaping or dumping however defined, and whether intentional or unintentional, of any Hazardous Material. Tenant shall take immediate steps to halt, remedy or cure any Release of a Hazardous Material in under or about the Leased Premises caused by the Tenant or Tenant’s Agents. If at any time during or after the Term, any portion of the Property is found to be contaminated by Tenant or Tenant’s Agents or subject to conditions prohibited in this Lease caused by Tenant or Tenant’s Agents or Tenant’s invitees, Tenant will indemnify, defend and hold Landlord harmless from all claims, demands, actions, liabilities, costs, expenses, attorneys’ fees, damages and obligations of any nature arising from or as a result thereof, and Landlord shall have the reasonable right to approve remediation activities, all of which shall be performed at Tenant’s cost and in a manner and to a level permitted by Environmental Laws. Tenant shall perform such work at any time during the period of the Lease upon written request by Landlord or, in the absence of a specific request by Landlord, before Tenant’s right to possession of the Leased Premises and/or Property terminates or expires. Tenant’s obligations pursuant to this subsection shall survive the expiration or termination of this Lease. If Tenant fails to perform such work within the reasonable time period specified by Landlord or before Tenant’s right to possession terminates or expires (whichever is earlier), Landlord may at its discretion, and without waiving any other remedy available under this Lease or at law or equity (including without limitation an action to compel Tenant to perform such work), perform such work at Tenant’s cost. Tenant shall pay all costs incurred by Landlord in performing such work within ten (10) days after Landlord’s request therefor. Such work performed by Landlord is on behalf of Tenant and Tenant remains the owner, generator, operator, transporter, and/or arranger of such Hazardous Materials for purposes of Environmental Laws. Tenant agrees not to enter into any agreement with any person, including without limitation any governmental authority, regarding the removal of Hazardous Materials that have been released onto or from the Leased Premises without the written approval of the Landlord.

(e) To the extent applicable, and subject to the provisions of Section 12.1 (h) below, Tenant shall comply with the Industrial Site Recovery Act (N.J.S.A. 13:1k-6 et seq., herein “ISRA”), the regulations promulgated thereunder and any amending and successor legislation and regulations (including, without limitation, the New Jersey Site Remediation Reform Act, N.J.S.A.

-12-

58:10C-1 et seq., referred to herein as “SRRA”) in connection with a “Tenant Triggering Event” (as defined below), by obtaining a de minimus quantity exemption or a Response Action Outcome with respect to the Leased Premises (an “ISRA Clearance”). For purposes of the Lease, the term “Tenant Triggering Event” shall mean any action taken by Tenant which triggers the requirements of ISRA with respect to the Leased Premises, including without limitation, a “closing of operations” (as such term is defined under ISRA) by Tenant at the Leased Premises, a transfer of Tenant’s operations or business or a change in ownership of Tenant. Landlord shall cooperate with Tenant in connection with Tenant’s compliance with ISRA pursuant to this subsection. Tenant shall make all submissions to, provide all information to, and comply with all requirements of, the New Jersey Department of Environmental Protection (“NJDEP”) and a Licensed Site Remediation Professional (as this term is defined under SRRA, herein referred to as an “LSRP”) as selected by Tenant as necessary to accomplish ISRA Clearance. Landlord shall cooperate with Tenant and its LSRP by providing them with information in Landlord’s possession or control that Tenant requires in order to make its submissions. In the event that ISRA Clearance is not delivered to the Landlord prior to surrender of the Leased Premises by the Tenant to the Landlord, it is understood and agreed that the Tenant shall be liable to promptly and diligently take such steps as shall be required by Tenant to obtain such ISRA Clearance and deliver a copy thereof to Landlord after the surrender of the Leased Premises, subject to the provision of Section 12.1(g) below, together with any costs and expenses incurred by Landlord in enforcing Tenant’s obligations under this paragraph. In addition to the above, and subject to the provisions of Section 12.1 (g) below, Tenant agrees that it shall cooperate with Landlord in the event ISRA is applicable to any portion of the Property. In such case, Tenant agrees that it shall fully cooperate with Landlord in connection with any information or documentation in Tenant’s possession or control which may be requested by the NJDEP or the relevant LSRP with respect to the Leased Premises. The parties acknowledge and agree that pursuant to the provisions of ISRA, after the Lease Commencement Date, the Tenant shall be, and is hereby, designated the party responsible to comply with the requirements of ISRA that apply to Tenant’s use and operations of the Leased Premises in connection with a Tenant Triggering Event. In addition, any failure of Tenant to provide any information and submission within a reasonable time as required under ISRA and which is not cured within five (5) business days of notice of non-compliance shall constitute a default under this Lease. In the event that any remediation of the Property is required to be performed by Tenant pursuant to this Section 12.1 in connection with the conduct by Tenant of its business at the Leased Premises, Tenant expressly covenants and agrees that it shall, subject to the provision of Section 12.1(g) and (h) below, be responsible for the remediation to the extent attributable to the Tenant’s operation at the Leased Premises and Tenant shall, at Tenant’s own expense, prepare and submit the required plans, remediation funding source(s) and financial assurances, and carry out the approved remediation plans to the extent required pursuant to Environmental Laws. Without limitation of, but subject to, the foregoing, Tenant’s obligations to obtain ISRA Clearance in connection with a Tenant Triggering Event shall include (i) the proper filing, with the NJDEP, of an initial notice under NJ.S.A. 13:1K-9(a) and (ii) the performance of all remediation and other requirements of ISRA, including without limitation all requirements of N.J.S.A. 13:1K-9(b) through and including (1). Tenant hereby represents and warrants that its North American Industrial Classification System Code is 541711, and that Tenant shall not generate, manufacture, refine, transport, treat, store, handle or dispose of “hazardous substances” as the same are defined under ISRA and the regulations promulgated pursuant thereto, except in strict compliance with all governmental rules, regulations and procedures. Tenant hereby agrees that it shall promptly inform Landlord of any change in its NAICS number and obtain

-13-

Landlord’s consent for any change in the nature of the business to be conducted in the Leased Premises from that permitted pursuant to the Lease. Tenant shall indemnify, defend and hold Landlord harmless from and against any and all losses (including, without limitation, diminution in value of the Premises or the Property), claims, demands, actions, suits, damages (excluding punitive damages from the indemnification to the extent that such damages result from acts or omissions of Landlord), expenses (including, without limitation, remediation, removal, repair, corrective action, or clean up expenses), and costs (including, without limitation, actual attorneys’ fees, consultant fees or expert fees) which are brought or are recoverable against, or suffered or incurred by Landlord as a result of any Release of Hazardous Materials or any breach of the requirements under this Section 12 by Tenant, its agents, employees, contractors, subtenants, assignees or invitees, regardless of whether Tenant had knowledge of such non-compliance. The within covenants shall survive the expiration or earlier termination of the Lease term.

(f) The Leased Premises are not presently subject to ISRA, and to the best of Landlord’s knowledge have never been subject to ISRA.

(g) Notwithstanding anything in this Lease to the contrary, the liability of the Tenant, and any indemnities provided by the Tenant hereunder, shall not extend to Hazardous Materials that were placed on the Leased Premises, in the Building, or on the Office Park by Landlord, or by any of Landlord’s Agents. In addition, Landlord shall not include in Additional Rent or Common Area Expenses, or pass on to Tenant directly or indirectly, the cost incurred by Landlord in monitoring, reporting, testing, abating and/or removing Hazardous Materials that were contained in the Leased Premises, in the Building and/or on the Office Park prior to the date hereof. As of the date hereof, to the knowledge of Landlord, no Hazardous Material is present the Office Park or the soil, surface water or groundwater thereof, and under no circumstance shall Tenant be liable for, and Landlord shall indemnify, defend, protect and hold harmless Tenant, its agents, contractors, stockholders, directors, successors, representatives, and assigns from and against, all losses, costs, claims, liabilities and damages (including attorneys’ and consultants’ fees) arising out of any Hazardous Material present prior to Tenant’s occupancy on or about the Office Park or the soil, air, improvements, groundwater or surface water thereof, except to the extent due to the Release of Hazardous Material by Tenant or Tenant’s Agents in violation of applicable Environmental Laws.

| 13. | INSPECTION BY LANDLORD |

Tenant agrees that Landlord shall have the right to enter into the Leased Premises at all reasonable hours for the purpose of examining the same upon reasonable advance notice of not less than 1 business day (except in the event of emergency), or to make such repairs as are necessary, to exhibit the Leased Premises to mortgagees or prospective mortgagees or purchasers, and during the last 12 months of the Term, to prospective tenants. Tenant agrees that, if Tenant and any subtenant have ceased business operations in the Leased Premises, Landlord shall have the right to enter into the Leased Premises at all hours for any reason without notice, including the showing of the space to other prospective tenants. Any entry or repair shall not unduly interfere with Tenant’s use of the Leased Premises and shall comply with Tenant’s reasonable security measures. If Tenant or any subtenant vacates the Leased Premises, Tenant shall immediately give Landlord a copy of all keys and swipe cards and Landlord shall have the right to enter the Leased Premises at any time.

-14-

| 14. | DEFAULT BY TENANT |

14.1 Each of the following shall be deemed a default (“Event of Default”) by Tenant and a breach of this Lease:

(a) (1) filing of a petition by the Tenant for adjudication as a bankrupt, or for reorganization, or for an arrangement under any federal or state statute, except in a Chapter 11 Bankruptcy where the Rent stipulated herein is being paid and the terms of the Lease are being complied with;

(2) dissolution or liquidation of the Tenant;

(3) appointment of a permanent receiver or a permanent trustee of all or substantially all of the property of the Tenant, if such appointment shall not be vacated within 60 days, provided the Rent stipulated herein is being paid and the terms of the Lease are being complied with, during said 60 day period;

(4) taking possession of the property of the Tenant by a governmental officer or agency pursuant to statutory authority for dissolution, rehabilitation, reorganization or liquidation of the Tenant if such taking of possession shall not be vacated within 60 days, provided the Rent stipulated herein is being paid and the terms of the Lease are being complied with, during said 60 day period; and

(5) making by the Tenant of an assignment for the benefit of creditors.

(b) if Tenant defaults in the payment of Rent or any other sums due under the Lease when due and such default continues for five days after written notice thereof from Landlord, provided however, that if Landlord has delivered two such notices of default to Tenant in any 12-month period, then any subsequent default in the payment of Rent or any other sums due under the Lease shall constitute an Event of Default without requirement of any written notice of nonpayment or opportunity to cure.

(c) if Tenant shall, whether by action or inaction, be in default of any other obligations under this Lease for 15 days after written notice thereof from Landlord. The foregoing notwithstanding, if (i) such default cannot reasonably be cured within such 15-day period despite Tenant’s due diligence, (ii) the continuance of the cure period beyond 15 days after Landlord’s default notice will not subject Landlord or any mortgagee of Landlord to prosecution for a crime or any other civil or criminal fine or charge, or otherwise violate applicable Laws, subject the Office Park, or any part thereof, to being condemned or vacated, subject the Office Park, or any part thereof, to any lien or encumbrance, or result in the foreclosure of any mortgage or deed of trust on the Office Park, (iii) no emergency exists, and (iv) Tenant advises Landlord in writing within the initial 15 day period of Tenant’s intention to take all steps necessary to cure such default and duly commences and thereafter diligently and continuously prosecutes to completion all steps necessary to cure such default, then

-15-

such 15-day cure period shall be extended for a reasonable period of time as necessary under the circumstances for Tenant to cure such default (but in no event shall the cure period be extended beyond 60 days after the date of Landlord’s default notice to Tenant).

(d) if Tenant shall assign this Lease or sublet the Leased Premises or any portion thereof in violation of the requirements of the Lease and such violation continues for 10 days after written notice thereof from Landlord.

14.2 Upon the occurrence of an Event of Default, Landlord shall have the following remedies, in addition to any and all other rights and remedies provided by law or otherwise provided in this Lease, any one or more of which Landlord may resort to cumulatively, consecutively, or in the alternative:

(a) Landlord may continue this Lease in full force and effect, and collect Rent when due.

(b) Landlord may terminate this Lease upon written notice to Tenant to such effect, in which event this Lease (and all of Tenant’s rights hereunder) shall immediately terminate, but such termination shall not affect those obligations of Tenant which are intended by their terms to survive the expiration or termination of this Lease, nor Tenant’s obligation to pay damages as set forth below. This Lease may also be terminated by a judgment specifically providing for termination.

(c) Landlord may terminate Tenant’s right of possession without terminating this Lease upon written notice to Tenant to such effect, in which event Tenant’s right of possession of the Leased Premises shall immediately terminate, but this Lease shall continue subject to the effect of this Section. Landlord may, but shall not be obligated to, perform any defaulted obligation of Tenant, and to recover from Tenant, as Additional Rent, the reasonable and actual costs incurred by Landlord in performing such obligation. Notwithstanding the foregoing, or any other notice and cure period set forth herein, Landlord may exercise its rights under this Section without prior notice or upon shorter notice than otherwise required hereunder (and as may be reasonable under the circumstances) in the event of any one or more of the following circumstances is present: (i) there exists a reasonable risk of prosecution of Landlord unless such obligation is performed sooner than the stated cure period; (ii) there exists an emergency arising out of the defaulted obligation; or (iii) the Tenant has failed to obtain insurance required by this Lease, or such insurance has been canceled by the insurer without being timely replaced by Tenant, as required herein.

(d) Landlord shall have the right to recover damages from Tenant, as set forth in the following Section. Upon any termination of this Lease or of Tenant’s right of possession, Landlord, at its sole election, may (i) re-enter and take possession of the Leased Premises and all the remaining improvements or property, (ii) eject Tenant or any of the Tenant’s subtenants, assignees or other person or persons claiming any right under or through Tenant, (iii) remove all property from the Leased Premises and store the same in a public warehouse or elsewhere at Tenant’s expense, and/or (iv) deem such property to be abandoned, and, in such event, Landlord may dispose of such property at Tenant’s expense, free from any claim by Tenant or anyone claiming by, through or under Tenant. Landlord may, but shall not be obligated, to relet the Leased Premises after recovering possession of the Leased Premises. It shall not constitute a constructive or other termination of this Lease or Tenant’s

-16-

right to possession if Landlord (A) exercises its right to repair or maintain the Leased Premises, (B) performs any unperformed obligations of Tenant, (C) stores or removes Tenant’s property from the Leased Premises after Tenant’s dispossession, (D) attempts to relet the Leased Premises or (E) seeks the appointment of a receiver on Landlord’s initiative to protect Landlord’s interest under this Lease.

| 15. | DAMAGES |

(a) Upon any termination of this Lease or Tenant’s right of possession, or any reentry by Landlord under the provisions of the Lease, or under any summary dispossession or other proceeding or action or any provision of law by reason of any Event of Default by Tenant, then in addition to the aggregate amount of Rent which Tenant has failed to pay under this Lease through the date of termination or re-entry (as the case may be) and any other damages recoverable by Landlord under applicable state law or this Lease, Tenant shall pay to Landlord as damages, at Landlord’s election, either:

(i) a lump sum which shall be immediately due and payable by Tenant and which, at the time of termination of this Lease or any such reentry by Landlord, as the case may be, represents the excess of (a) the aggregate amount of the Base Rent and Additional Rent which would have been payable by Tenant (conclusively presuming that the average monthly Additional Rent is the same as was payable for the 12 calendar months prior to such termination or reentry, or if less than 12 calendar months have elapsed since the Rent Commencement Date, then all of the calendar months preceding such termination or reentry) for the period commencing with such termination or reentry, as the case may be, and ending with the Expiration Date, over (b) the aggregate amount of Rent that Tenant proves should reasonably have been received by Landlord for the same period (taking into account an appropriate vacancy period to seek and obtain a replacement tenant and fit the Leased Premises out for such tenant’s occupancy, during which Landlord cannot reasonably be expected to receive rent), which excess amount shall be discounted to present value using a discount rate equal to the lesser of (A) the prime rate of interest announced from time to time in the “Money Rates” column of The Wall Street Journal (or any successor column published by The Wall Street Journal, or if there be none, such index of the then prevailing “prime rate” of interest as designated by Landlord) plus 1%, or (B) 6% per annum;

(ii) sums equal to the Base Rent and Additional Rent provided for in this Lease which would have been payable by Tenant had this Lease not been terminated, or Landlord had not so reentered, payable upon the due dates specified herein for such payments following such termination or reentry until the Expiration Date.

(b) In addition, Tenant shall immediately become liable to Landlord for all damages proximately caused by Tenant’s breach of its obligations under this Lease, including all costs Landlord incurs in reletting (or attempting to relet) the Leased Premises or any part thereof, including, without limitation, to the extent allocable to the remaining Term, brokers’ commissions, expenses of cleaning, altering and preparing the Leased Premises for new tenants, legal fees and all other like expenses properly chargeable against the Leased Premises and the rental received therefrom and like costs. If Landlord does elect to relet the Leased Premises (or any portion thereof), such reletting may be for a period shorter or longer than the remaining Term, and upon such terms and conditions as Landlord deems appropriate, in its sole and absolute discretion, and Tenant shall have no interest in

-17-

any sums collected by Landlord in connection with such reletting except to the extent expressly set forth herein. Landlord shall use commercially reasonable efforts to mitigate its damages hereunder, provided that Landlord (i) shall not be obligated to show preference for reletting the Leased Premises over any other vacant space in the Building; (ii) may divide the Leased Premises, as Landlord deems appropriate, (iii)may relet the whole or any portion of the Leased Premises upon such terms as it deems appropriate, and may grant any rental or other lease concessions as it reasonably deems advisable under prevailing market conditions, including free rent; and (iv) Landlord’s obligation to mitigate damages shall be deemed satisfied by its providing adequate information to a commercial broker as to the availability of such space (based on a customary brokerage fee being earned by such broker), having the Leased Premises available for inspection by prospective tenants during reasonable business hours, and by acceptance of a commercially reasonable offer for the Leased Premises from a creditworthy person or entity based on a form of lease agreement which is substantially the same as the form utilized for other space tenants in the Building. If Landlord shall succeed in reletting the Leased Premises during the period in which Tenant is paying monthly rent damages, Landlord shall credit Tenant with the net rents collected by Landlord from such reletting, after first deducting from the gross rents, as and when collected by Landlord, (A) all expenses incurred or paid by Landlord in collecting such rents, and (B) any theretofore unrecovered costs associated with the termination of this Lease or Landlord’s reentry into the Leased Premises, including any theretofore unrecovered expenses of reletting and other damages payable hereunder. If the Leased Premises or any portion thereof be relet by Landlord for the unexpired portion of the Term before presentation of proof of such damages to any court, commission or tribunal, the amount of rent reserved upon such reletting shall, prima facie, constitute the fair and reasonable rental value for the Leased Premises, or part thereof, so relet for the term of the reletting. Landlord shall not be liable in any way whatsoever for its failure or refusal to relet the Leased Premises, or if the Leased Premises or any part are relet, for its failure to collect the rent under such reletting, and no such refusal or failure to relet or failure to collect rent shall release or affect Tenant’s liability for damages or otherwise under this Lease.

| 16. | NOTICES |

Any notice, consent or other communication under this Lease shall be in writing and addressed to Landlord or Tenant at their respective addresses specified on page 1 (or to such other address as either may designate by notice to the other and, for notices to Tenant, to the attention of Tenant’s Chief Financial Officer) with a copy to any mortgagee or other party designated by Landlord. Each notice or other communication shall be deemed given if sent by prepaid overnight delivery service or by certified mail, return receipt requested, postage prepaid, with delivery in any case evidenced by a receipt, and shall be deemed to have been given on the day of actual delivery to the intended recipient or on the business day delivery is refused. The giving of notice by Landlord’s or Tenant’s attorneys, representatives and agents under this Section shall be deemed to be the acts of Landlord or Tenant, respectively.

| 17. | NON-WAIVER BY LANDLORD |

The failure of Landlord to insist upon the strict performance of any of the terms of this Lease, or to exercise any option contained herein, shall not be construed as a waiver of any such term. Acceptance by Landlord of performance of anything required by this Lease to be performed, with the knowledge of the breach of any term of this Lease, shall not be deemed a waiver of such breach, nor

-18-

shall acceptance of Rent in a lesser amount than is due (regardless of any endorsement on any check, or any statement in any letter accompanying any payment of Rent) be construed either as an accord and satisfaction or in any manner other than as payment on account of the earliest Rent then unpaid by Tenant. No waiver by Landlord of any term of this Lease shall be deemed to have been made unless expressed in writing and signed by Landlord.

| 18. | ALTERATIONS |

Tenant may not make any Alterations to the Leased Premises without Landlord’s consent, which shall not be unreasonably withheld; provided, however, Landlord’s consent shall not be required for Alterations that cost less than $10,000.00 (provided the same do not impact other tenants in the Building) and (i) are non-structural, (ii) are not visible from the exterior of the Leased Premises, (iii) do not affect any Building system or the structural strength of the Building, (iv) do not require penetrations into the floor, ceiling or walls, and (v) do not require work within the walls, below the floor or above the ceiling. With respect to any Alterations that will exceed a cost of $10,000.00 (other than the installation of Tenant’s security system, which Tenant shall have the right to perform with its own contractors provided the same does not impact other tenants in the Building). Landlord shall have the right, at its option, to perform such work at Tenant’s expense so long as such work can be performed in a timely, good and workmanlike manner at a competitive price. At the time Tenant requests Landlord’s consent, Tenant shall deliver plans and specifications to Landlord. Landlord shall notify Tenant, within ten (10) days after receipt of Tenant’s plans and specifications, whether Landlord elects to perform the Alterations, along with a draft construction budget and schedule as required above. Tenant shall notify Landlord within five business days whether Tenant wishes to proceed with the Alterations. In the event Landlord consents to the Alterations but elects not to perform the work, Tenant shall comply with the following: (i) not less than 5 days prior to commencing any Alteration, Tenant shall deliver to Landlord final plans, specifications and necessary permits for the Alteration, together with certificates evidencing that Tenant’s contractors and subcontractors have adequate insurance coverage naming Landlord, and any other associated or affiliated entity as their interests may appear as additional insureds, (ii) Tenant shall obtain Landlord’s prior written approval of any contractor or subcontractor, and (iii) the Alteration shall be constructed with new materials, in a good and workmanlike manner, and in compliance with all Legal Requirements and the plans and specifications delivered to, and approved by Landlord. If Landlord is not the contractor, Tenant shall provide Landlord with as-built plans, in both CAD and PDF format, along with back-up disks, upon completion of the work. All Alterations shall become part of the realty immediately upon installation and, except for Alterations which Landlord requires Tenant to remove pursuant to this Lease, shall be surrendered with the Leased Premises without payment by Landlord. Tenant’s trade fixtures, furniture, equipment and other personal property installed in the Leased Premises (“Tenant’s Property”) shall at all times be and remain Tenant’s property. Except for Alterations which cannot be removed without structural injury to the Leased Premises, at any time Tenant may remove Tenant’s Property from the Leased Premises, provided that Tenant repairs all damage caused by such removal. Landlord shall have no lien or other interest in any item of Tenant’s Property. If Tenant leases equipment to be used within the Leased Premises (other than equipment paid for or provided by Landlord), Landlord shall execute the commercially reasonable agreements required by Tenant’s equipment lessors waiving all rights to such equipment. Removal of Alterations or improvements at the end of the Lease term shall be governed by the provisions of Article 27 hereof.

-19-

| 19. | NON-LIABILITY OF LANDLORD |

Tenant agrees to assume all risk of damage to its property, equipment and fixtures occurring in or about the Leased Premises, whatever the cause of such damage or casualty. Landlord shall not be liable for any damage or injury to property or person caused by or resulting from steam, electricity, gas, water, rain, ice or snow, or any leak or flow from or into any part of the Building, or from any damage or injury resulting or arising from any other cause or happening whatsoever, except if the same is due to Landlord’s negligent acts or omissions.

| 20. | RESERVATION OF EASEMENT |

There shall be excepted and reserved from the Leased Premises all equipment and fixtures serving the Leased Premises and other portions of the Building now or hereafter installed in a manner that minimizes interference with Tenant’s use of the Leased Premises; and space for the installation of pipes, wires, conduits and ducts to serve the Leased Premises and/or other parts of the Building. Landlord reserves the right, easement and privilege to enter on the Leased Premises in order to install, at its own cost and expense, any utility lines and services in connection therewith as may be required by the Landlord, subject to Paragraph 13. It is understood and agreed that if such work as may be required by Landlord requires any interior installation, or displaces any exterior paving or landscaping, the Landlord shall at its own cost and expense, restore such items, to substantially the same condition as they were before such work. The Landlord covenants that the foregoing work shall not unreasonably interfere with the normal operation of Tenant’s business.

| 21. | STATEMENT OF ACCEPTANCE |

Upon the delivery of the Leased Premises to the Tenant the Tenant covenants and agrees that it will furnish to Landlord a statement which shall set forth the Date of Commencement and the Date of Expiration of the lease term promptly upon Landlord’s request.

| 22. | FORCE MAJEURE |

Except for the obligation of the Tenant to pay Rent and other charges, the period of time during which the Landlord or Tenant is prevented from performing any act required to be performed under this Lease by reason of fire, catastrophe, strikes, lockouts, civil commotion, weather conditions, acts of God, government prohibitions or preemptions or embargoes, inability to obtain material or labor by reason of governmental regulations, the act or default of the other party, or other events beyond the reasonable control of Landlord or Tenant, as the case may be, shall be added to the time for performance of such act; provided, however, the foregoing shall not delay any rent abatement that may be applicable to Tenant or termination rights under its Lease.

| 23. | STATEMENT BY TENANT |

Tenant and Landlord each shall at any time and from time to time upon not less than 5 days’ prior notice from the other to execute, acknowledge and deliver to the party requesting same, a statement in writing, certifying that this Lease is unmodified and in full force and effect (or if there have been modifications, that the same is in full force and effect as modified and stating the modifications), that it is not in default (or if claimed to be in default, stating the amount and nature of the default) and specifying the dates to which the Rent and other charges have been paid in advance.

-20-

| 24. | CONDEMNATION |

24.1 If (a) all of the Leased Premises are taken by a public authority having the power of eminent domain by condemnation or conveyance in lieu of condemnation, (b) so much of the Leased Premises or Common Areas is so taken and the remainder is insufficient in Landlord’s opinion for the reasonable operation of Tenant’s business, or (c) any material portion of the Office Park is so taken, and, in Landlord’s opinion, it would be impractical or the condemnation proceeds are insufficient to restore the remainder, then this Lease shall terminate as of the date the condemning authority takes possession. If this Lease is not terminated, Landlord shall restore the Building to a condition as near as reasonably possible to the condition prior to the taking, the Rent shall be abated for the period of time all or a part of the Leased Premises is untenantable or inaccessible in proportion to the square foot area untenantable or inaccessible, and this Lease shall be amended appropriately. The compensation awarded for a taking shall belong to Landlord. Except for any relocation benefits, the value of any Tenant’s Property and the unamortized value of any improvements paid for by Tenant to which Tenant may be entitled, and which do not diminish Landlord’s claim. Tenant hereby assigns all claims against the condemning authority to Landlord, including, but not limited to, any claim relating to Tenant’s leasehold estate.

| 25. | LANDLORD’S RIGHTS |

25.1 The rights and remedies given to the Landlord in this Lease are distinct, separate and cumulative remedies, and no one of them, whether or not exercised by the Landlord, shall be deemed to be in exclusion of any of the others.

25.2 In addition to any other legal remedies for violation or breach of this Lease by the Tenant or by anyone holding or claiming under the Tenant such violation or breach shall be restrainable by injunction at the suit of the Landlord.