Attached files

Exhibit 99.4

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

Defined terms included below have the same meaning as terms defined elsewhere in this Current Report on Form 8-K (the “Super 8-K”). Unless the context otherwise requires the “Company” refers to Collier Creek Holdings as a Delaware corporation which, in accordance with the Domestication and the Business Combination, has changed its corporate name to “Utz Brands, Inc.”

Introduction

The following unaudited pro forma condensed combined balance sheet as of June 30, 2020 gives effect to the Business Combination consummated on August 28, 2020, as defined below, as if it was completed on June 30, 2020. The unaudited pro forma condensed combined statements of operations for the six months ended June 30, 2020 and the year ended December 31, 2019 give pro forma effect to the Business Combination as if it was completed on January 1, 2019. The unaudited pro forma condensed combined balance sheet does not purport to represent, and is not necessarily indicative of, what the actual financial condition of the combined company would have been had the Business Combination taken place on June 30, 2020, nor is it indicative of the financial condition of the combined company as of any future date. The unaudited pro forma condensed combined statements of operations do not purport to represent, and are not necessarily indicative of, what the actual results of operations of the combined company would have been had the Business Combination taken place on January 1, 2019, nor are they indicative of the results of operations of the combined company for any future period. The unaudited pro forma condensed combined financial information should be read in conjunction with the following:

| · | the accompanying notes to the unaudited pro forma condensed combined financial statements; |

| · | the historical audited financial statements of Collier Creek as of, and for the year ended, December 31, 2019, included in the Proxy Statement/Prospectus; |

| · | the historical unaudited financial statements of Collier Creek as of, and for the six months ended, June 30, 2020, included in the Quarterly Report on Form 10-Q filed by Collier Creek on August 10, 2020; |

| · | the historical audited financial statements of UM-U Intermediate, LLC (“UM-U”) and Subsidiaries and Affiliates, subsequently renamed Utz Brands Holdings, LLC, the direct parent of Utz Quality Foods, LLC, (collectively, “Utz”) as of, and for the fiscal year ended, December 29, 2019, included in the Proxy Statement/Prospectus; |

| · | the historical unaudited financial statements of Utz as of, and for the thirteen and twenty-six weeks ended, June 28, 2020, filed as Exhibit 99.3 to the Super 8-K; |

| · | the historical audited abbreviated financial statements of Kennedy Endeavors, LLC (“Kennedy”) as of, and for the fiscal year ended, May 26, 2019, and the unaudited abbreviated financial statements as of and for the three months ended August 25, 2019, included in the Proxy Statement/Prospectus; and |

| · | the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Quarterly Report on Form 10-Q filed by Collier Creek on August 10, 2020, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” filed as Exhibit 99.5 of the Super 8-K. |

The unaudited pro forma condensed combined financial information has been prepared to illustrate the effect of the Business Combination. It has been prepared in accordance with Article 11 of Regulation S-X and is for informational purposes only and is subject to a number of uncertainties and assumptions as described in the accompanying notes. The historical financial statements have been adjusted in the unaudited pro forma condensed combined financial information to give effect to pro forma events that are (1) directly attributable to the Business Combination, (2) factually supportable and (3) with respect to the statements of operations, expected to have a continuing impact on the results of the combined company.

The adjustments presented in the unaudited pro forma condensed combined financial statements have been identified and presented to provide relevant information necessary for an understanding of the combined entity upon completion of the Business Combination. The pro forma adjustments set forth in the unaudited pro forma condensed combined financial statements and described in the notes thereto reflect, among other things, the completion of the Business Combination, transaction costs in connection with the Business Combination, and the impact of certain pro forma adjustments (and their tax effect at the estimated effective income tax rate applicable to such adjustments).

On June 5, 2020, Collier Creek, Utz and the Sellers entered into the Business Combination Agreement. Pursuant to the terms and subject to the conditions set forth in the Business Combination Agreement, at the Closing, (a) Collier Creek effected the Domestication, and (b) the Company consummated the Business Combination. Considering actual shareholder redemptions and vesting of Retained Sponsor Shares and Retained Restricted Units as discussed in the Introductory Note to the Super 8-K in connection with the Closing, Collier Creek acquired 49.2% of the economic interests in Utz and 100% of the managing member interests of Utz, whereas the Sellers retained 50.8% of the economic interests in Utz and received Class V Common Stock in the Company that is commensurate with the economic interests retained by the Sellers in Utz at the Closing.

The unaudited pro forma condensed combined financial statements are presented based on actual shareholder redemptions of 5,950 Class A ordinary shares at a price of approximately $10.29 per share. The cash amount after Redemptions is sufficient to permit Collier Creek to satisfy the Minimum Cash Condition of the Business Combination. The unaudited pro forma condensed combined financial statements were prepared using the acquisition method of accounting under the provisions of Accounting Standards Codification (“ASC”) Topic 805, Business Combinations (“ASC 805”) on the basis of Collier Creek as the accounting acquirer and Utz as the accounting acquiree.

2

The following summarizes the ownership of Class A Common Stock of the Company at Closing, including, for the Sellers, those shares of Class A Common Stock issuable upon exchange of the Sellers’ Common Company Units (together with the cancellation of an equal number of shares of Class V Common Stock) into Class A Common Stock of the Company:

| Shares | % | |||||||

| Collier Creek’s Public Shareholders, less Shareholder Redemption(1) | 43,994,050 | 36.5 | % | |||||

| Sponsor and Collier Creek’s Independent Directors (including Forward Purchases)(2)(3) | 15,375,000 | 12.7 | % | |||||

| Sellers(4) | 61,249,000 | 50.8 | % | |||||

| Closing Shares | 120,618,050 | 100 | % | |||||

| (1) | Reflects 5,950 Public Shares which were redeemed by shareholders in connection with the Business Combination at a price of approximately $10.29 per share. |

| (2) | Includes 9,875,000 shares of Class A Common Stock issued upon conversion of the existing Collier Creek Class B ordinary shares in connection with the Domestication. Includes 2,000,000 shares of Class A Common Stock that were issued upon the automatic conversion of the Class B Common Stock concurrently with the consummation of the Business Combination due to the satisfaction of the performance conditions required for the conversion of all Restricted Sponsor Shares at Closing. |

| (3) | Includes 3,500,000 shares of Class A Common Stock of the Company issued to Collier Creek’s Sponsor and independent directors in connection with the Forward Purchase Agreements. |

| (4) | Represents 57,765,978 shares of Class A Common Stock issuable upon the exchange of Common Company Units (together with the cancellation of the same number of shares of Class V Common Stock) and 3,483,022 shares of Class A Common Stock issuable upon the exchange of Common Company Units (together with the cancellation of the same number of shares of Class V Common Stock) that were issued from the vesting of the Restricted Company Units held by the Sellers due to the satisfaction of the performance conditions required for the vesting of all Restricted Company Units at Closing. |

The unaudited pro forma condensed combined financial information presents Class A Common Stock ownership as if the Business Combination was completed on the pro forma balance sheet date of June 30, 2020. As the share price of Collier Creek was approximately $13.70 as of June 30, 2020, which was lower than $15.00, the unaudited pro forma condensed combined financial information assumes the vesting of 50% of the Restricted Sponsor Shares and Restricted Company Units, resulting in a 50.5% noncontrolling interest retained by the Sellers in the unaudited pro forma condensed combined financial information. Refer to tickmark (ee) to Note 3 for further discussion of the Restricted Sponsor Shares and Restricted Company Units.

3

The unaudited pro forma condensed combined financial information is for illustrative purposes only. You should not rely on the unaudited pro forma condensed combined financial information as being indicative of the historical results that would have been achieved had the Business Combination occurred on the dates indicated or the future results that the Company will experience. Utz and Collier Creek have not had any historical relationship prior to the Business Combination. Accordingly, no pro forma adjustments were required to eliminate activities between the companies.

The pro forma adjustments are based on the information currently available and the assumptions and estimates underlying the pro forma adjustments are described in the accompanying notes. Actual results may differ from the assumptions used to present the accompanying unaudited pro forma condensed combined financial statements. The Company will incur additional costs after the Business Combination is consummated in order to satisfy its obligations as a public company registrant. In addition, the Company adopted the EIP, which was approved by Collier Creek’s shareholders on August 27, 2020, in order to attract and retain employees, consultants and independent directors. No adjustments to the unaudited pro forma statement of operations have been made for these items as such amounts are not yet known.

The combined pro forma financial information does not reflect the realization of any expected synergies from Utz’s acquisitions of Kennedy in fiscal 2019 and Kitchen Cooked Inc. (“Kitchen Cooked”) in fiscal 2020, or incremental public company costs from the Business Combination. The Company currently estimates that synergies from the elimination of certain procurement, manufacturing, logistics, and selling and administrative expenses will result in annual combined integration-related cost savings of approximately $7.0 million from the acquisitions of Kennedy and Kitchen Cooked. In addition, the Company estimates it will incur incremental annual public company costs of approximately $3.0 million following the Business Combination. Although the Company believes that such synergies will be realized and incremental costs will be incurred, there can be no assurance that such synergies or cost estimates will be achieved, and therefore they have not been included as adjustments in the pro forma information.

4

UNAUDITED PRO FORMA CONDENSED

COMBINED BALANCE SHEET

JUNE 30, 2020

| (amounts in millions) | Collier Creek Holdings (Historical as of 6/30/20) | Utz Brands Holdings, LLC and Subsidiaries and Affiliates (Formerly UM-U Intermediate, LLC, as of 6/28/20) | Pro Forma Adjustments | Footnote Reference | Combined Pro Forma | |||||||||||||

| ASSETS | ||||||||||||||||||

| Current assets: | ||||||||||||||||||

| Cash and cash equivalents | $ | — | $ | 10 | $ | 453 | (a) | $ | 13 | |||||||||

| (378 | ) | (g), (k) | ||||||||||||||||

| (47 | ) | (b), (c) | ||||||||||||||||

| 35 | (i) | |||||||||||||||||

| (60 | ) | (j) | ||||||||||||||||

| Accounts receivable, net | — | 123 | — | 123 | ||||||||||||||

| Inventories, net | — | 54 | 3 | (o) | 57 | |||||||||||||

| Prepaid and other assets | — | 6 | — | 6 | ||||||||||||||

| Current portion of notes receivable | — | 7 | — | 7 | ||||||||||||||

| Total current assets | $ | — | $ | 200 | $ | 6 | $ | 206 | ||||||||||

| Goodwill | — | 207 | 66 | (d) | 345 | |||||||||||||

| 72 | (o) | |||||||||||||||||

| Intangible assets, net | — | 185 | 713 | (o) | 898 | |||||||||||||

| Property, plant and equipment, net | — | 166 | 105 | (o) | 271 | |||||||||||||

| Non-current portion of notes receivable | — | 25 | — | 25 | ||||||||||||||

| Marketable securities held in Trust Account | 453 | — | (453 | ) | (a) | — | ||||||||||||

| Other assets | — | 8 | — | 8 | ||||||||||||||

| Total assets | $ | 453 | $ | 791 | $ | 509 | $ | 1,753 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||||||

| Current liabilities: | ||||||||||||||||||

| Accounts payable | $ | — | $ | 56 | $ | — | $ | 56 | ||||||||||

| Accrued expenses | 2 | 50 | (3 | ) | (c) | 49 | ||||||||||||

| Current portion of other notes payable | — | 9 | — | 9 | ||||||||||||||

| Current portion of term debt | — | 6 | — | 6 | ||||||||||||||

| Total current liabilities | $ | 2 | $ | 121 | $ | (3 | ) | $ | 120 | |||||||||

| Long-term liabilities: | ||||||||||||||||||

| Non-current portion of term debt | — | 632 | (231 | ) | (g) | 401 | ||||||||||||

| Deferred underwriting commissions and legal fees | 16 | — | (16 | ) | (b) | — | ||||||||||||

| Non-current portion of other notes payable | — | 28 | — | 28 | ||||||||||||||

| Non-current accrued expenses and other | — | 26 | (16 | ) | (l) | 48 | ||||||||||||

| 38 | (m) | |||||||||||||||||

| Deferred tax liability | — | 22 | 41 | (h) | 63 | |||||||||||||

| Total liabilities | $ | 18 | $ | 829 | $ | (187 | ) | $ | 660 | |||||||||

| Commitments and contingencies: | ||||||||||||||||||

| Class A ordinary shares, 0.0001 par value; 41,835,134 shares subject to possible redemption at $10.29 per share at June 30, 2020 | 430 | — | (430 | ) | (e) | — | ||||||||||||

See accompanying notes to the unaudited pro forma condensed combined financial information.

5

| (amounts in millions) | Collier Creek Holdings (Historical as of 6/30/20) | Utz Brands Holdings, LLC and Subsidiaries and Affiliates (Formerly UM-U Intermediate, LLC, as of 6/28/20) | Pro Forma Adjustments | Footnote Reference | Combined Pro Forma | |||||||||||||

| Shareholders’ Equity: | ||||||||||||||||||

| Preferred shares, $0.0001 par value; 1,000,000 shares authorized; none issued and outstanding | — | — | — | — | ||||||||||||||

| Class A ordinary shares, $0.0001 par value; 400,000,000 shares authorized; 2,164,866 shares issued and outstanding (excluding 41,835,134 shares subject to possible redemption) at June 30, 2020 | — | — | — | (e), (f), (k), (j) | — | |||||||||||||

| Class B ordinary shares, $0.0001 par value; 50,000,000 shares authorized; 11,875,000 shares issued and outstanding as of June 30, 2020 | — | — | — | (f) | — | |||||||||||||

| Additional paid-in capital | — | — | 430 | (e) | 529 | |||||||||||||

| — | — | 35 | (i) | |||||||||||||||

| 48 | (p) | |||||||||||||||||

| — | — | 16 | (l) | |||||||||||||||

| Retained Earnings | 5 | — | (8 | ) | (c) | (3 | ) | |||||||||||

| Members deficit | — | (32 | ) | (20 | ) | (b), (c) | — | |||||||||||

| (8 | ) | (g) | ||||||||||||||||

| 60 | (d) | |||||||||||||||||

| Accumulated other comprehensive loss | — | (6 | ) | 6 | (d) | — | ||||||||||||

| Total Collier Creek’s shareholders equity and UM-U’s members; deficit | $ | 5 | $ | (38 | ) | $ | — | $ | — | |||||||||

| Total shareholders’ equity | $ | — | $ | — | $ | 559 | $ | 526 | ||||||||||

| Noncontrolling interest | $ | — | $ | — | $ | 567 | (n) | $ | 567 | |||||||||

| Total equity | $ | 5 | $ | (38 | ) | $ | 1,126 | $ | 1,093 | |||||||||

| Total liabilities and equity | $ | 453 | $ | 791 | $ | 509 | $ | 1,753 |

See accompanying notes to the unaudited pro forma condensed combined financial information.

6

UNAUDITED PRO FORMA CONDENSED

COMBINED STATEMENT OF OPERATIONS FOR

SIX MONTHS ENDED JUNE 30, 2020

| (amounts in millions, except for per share information) | Collier Creek Holdings (Historical for the six months ended 6/30/20) | Utz

Brands Holdings, LLC and Subsidiaries and Affiliates (Formerly UM-U Intermediate, LLC, for the twenty-six weeks ended 6/28/20) | Pro

Forma Adjustments | Footnote

Reference | Combined

Pro Forma | |||||||||||||||

| Net sales | — | 470 | — | 470 | ||||||||||||||||

| Cost of goods sold | — | 305 | 4 | (gg) | 309 | |||||||||||||||

| Gross Profit | — | 165 | (4 | ) | 161 | |||||||||||||||

| Selling and administrative expenses | ||||||||||||||||||||

| Selling | — | 98 | 1 | (gg) | 99 | |||||||||||||||

| Administrative | 2 | 38 | (9 | ) | (bb) | 51 | ||||||||||||||

| 20 | (gg) | |||||||||||||||||||

| Total selling and administrative expenses | 2 | 136 | 12 | 150 | ||||||||||||||||

| Gain on sale of assets | ||||||||||||||||||||

| Gain on disposal of property, plant and equipment | — | — | — | — | ||||||||||||||||

| Gain on sale of routes, net | — | 1 | — | 1 | ||||||||||||||||

| Total gain on sale of assets | — | 1 | — | 1 | ||||||||||||||||

| (Loss) income from operations | (2 | ) | 30 | (16 | ) | 12 | ||||||||||||||

| Other income (expense) | ||||||||||||||||||||

| Interest income (expense) | 2 | (20 | ) | (2 | ) | (aa) | (13 | ) | ||||||||||||

| 7 | (cc) | |||||||||||||||||||

| Other income (expense), net | — | 1 | — | 1 | ||||||||||||||||

| Other income (expense), net | 2 | (19 | ) | 5 | (12 | ) | ||||||||||||||

| Income (loss) before taxes | — | 11 | (11 | ) | — | |||||||||||||||

| Income tax expense (benefit) | — | 3 | (4 | ) | (dd) | (1 | ) | |||||||||||||

| Net income (loss) | — | 8 | (7 | ) | 1 | |||||||||||||||

| Net income (loss) attributable to noncontrolling interest | — | — | — | (ff) | — | |||||||||||||||

| Net income (loss) attributable to controlling interest | — | 8 | (7 | ) | 1 | |||||||||||||||

| Other comprehensive income | ||||||||||||||||||||

| Interest rate swap | — | (8 | ) | — | (8 | ) | ||||||||||||||

| Comprehensive (loss) income | — | — | (7 | ) | (7 | ) | ||||||||||||||

| Earnings per Share | ||||||||||||||||||||

| Weighted average shares outstanding of Class A ordinary shares/Common Stock, basic | 44,000,000 | 14,369,050 | (ee) | 58,369,050 | ||||||||||||||||

| Basic net income per share, Class A | 0.04 | 0.02 | ||||||||||||||||||

| Weighted average shares outstanding of Class A ordinary shares/Common Stock, diluted | 44,000,000 | 18,067,833 | (ee) | 62,067,833 | ||||||||||||||||

| Diluted net income per share, Class A | 0.04 | 0.02 | ||||||||||||||||||

| Weighted average shares outstanding of Class B ordinary shares/Common Stock | 11,875,000 | (11,875,000 | ) | (ee) | — | |||||||||||||||

| Basic and diluted net loss per share, Class B | (0.15 | ) | — |

See accompanying notes to the unaudited pro forma condensed combined financial information.

7

UNAUDITED PRO FORMA CONDENSED

COMBINED STATE OF OPERATIONS FOR

YEAR ENDED DECEMBER 31, 2019

| (Amounts in millions, except for per share information) | Collier Creek Holdings (Historical for the year ended 12/31/19) | Utz Brands Holdings, LLC and Subsidiaries and Affiliates (Formerly UM-U Intermediate, LLC, for the fiscal year ended 12/29/19)(A) | Pro Forma Pro Adjustments | Footnote Reference | Combined Pro Forma | |||||||||||||

| Net sales | — | 866 | — | 866 | ||||||||||||||

| Cost of goods sold | — | 579 | 11 | (gg) | 590 | |||||||||||||

| Gross Profit | — | 287 | (11 | ) | 276 | |||||||||||||

| Selling and administrative expenses | ||||||||||||||||||

| Selling | — | 184 | 2 | (gg) | 186 | |||||||||||||

| Administrative | 1 | 71 | — | (bb) | 114 | |||||||||||||

| 42 | (gg) | |||||||||||||||||

| Total selling and administrative expenses | 1 | 255 | 44 | 300 | ||||||||||||||

| Gain on sale of assets | ||||||||||||||||||

| Gain on disposal of property, plant and equipment | — | 6 | — | 6 | ||||||||||||||

| Gain on sale of routes, net | — | 7 | — | 7 | ||||||||||||||

| Total gain on sale of assets | — | 13 | — | 13 | ||||||||||||||

| (Loss) income from operations | (1 | ) | 45 | (55 | ) | (11 | ) | |||||||||||

| Other income (expense) | ||||||||||||||||||

| Interest income (expense) | 9 | (55 | ) | (9 | ) | (aa) | (29 | ) | ||||||||||

| 26 | (cc) | |||||||||||||||||

| Other (expense) income, net | — | (1 | ) | — | (1 | ) | ||||||||||||

| Other income (expense), net | 9 | (56 | ) | 17 | (30 | ) | ||||||||||||

| Income (loss) before taxes | 8 | (11 | ) | (38 | ) | (41 | ) | |||||||||||

| Income tax expense (benefit) | — | 3 | (10 | ) | (dd) | (7 | ) | |||||||||||

| Net income (loss) | 8 | (14 | ) | (28 | ) | (34 | ) | |||||||||||

| Net income (loss) attributable to noncontrolling interest | — | (3 | ) | 24 | (ff) | 21 | ||||||||||||

| Net income (loss) attributable to controlling interest | 8 | (17 | ) | (4 | ) | (13 | ) | |||||||||||

| Other comprehensive income | ||||||||||||||||||

| Interest rate swap | — | 1 | — | 1 | ||||||||||||||

| Comprehensive income (loss) | 8 | (16 | ) | (4 | ) | (12 | ) | |||||||||||

| Earnings per Share | ||||||||||||||||||

| Weighted average shares outstanding of Class A ordinary shares/Common Stock, basic | 44,000,000 | 14,369,050 | (ee) | 58,369,050 | ||||||||||||||

| Basic net income (loss) per share, Class A | 0.20 | (0.22 | ) | |||||||||||||||

| Weighted average shares outstanding of Class A ordinary shares/Common Stock, diluted | 44,000,000 | 18,067,833 | (ee) | 62,067,833 | ||||||||||||||

| Diluted net income (loss) per share, Class A | 0.20 | (0.22 | ) | |||||||||||||||

| Weighted average shares outstanding of Class B ordinary shares/Common Stock | 11,875,000 | (11,875,000 | ) | (ee) | — | |||||||||||||

| Basic and diluted net loss per share, Class B | (0.08 | ) | — | |||||||||||||||

| (A) | Represents pro forma combined results of operations which give effect to the acquisitions of Kennedy and Kitchen Cooked. Refer to Note 4 for pro forma statement of operations adjustments made to Utz. |

See accompanying notes to the unaudited pro forma condensed combined financial information.

8

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

Note 1 — Description of the Business Combination

Basis of presentation

The unaudited pro forma condensed combined financial statements have been prepared assuming the Business Combination is accounted for using the acquisition method of accounting with Collier Creek as the acquiring entity. Under the acquisition method of accounting, Collier Creek’s assets and liabilities will retain their carrying values and the assets and liabilities associated with Utz will be recorded at their fair values measured as of the acquisition date. The excess of the purchase price over the estimated fair values of the net assets acquired, if applicable, will be recorded as goodwill.

The acquisition method of accounting is based on ASC 805 and uses the fair value concepts defined in ASC Topic 820, Fair Value Measurements (“ASC 820”). In general, ASC 805 requires, among other things, that assets acquired and liabilities assumed be recognized at their fair values as of the acquisition date by Collier Creek, which was determined to be the accounting acquirer.

ASC 820 defines fair value, establishes a framework for measuring fair value, and sets forth a fair value hierarchy that prioritizes and ranks the level of observability of inputs used to develop the fair value measurements. Fair value is defined in ASC 820 as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Fair value measurements for a non-financial asset assume the highest and best use by these market participants. Many of these fair value measurements can be highly subjective, and it is possible that other professionals applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts.

For accounting purposes, the acquirer is the entity that has obtained control of another entity and, thus, consummated a business combination. The determination of whether control has been obtained begins with the evaluation of whether control should be evaluated based on the variable interest or voting interest model pursuant to ASC Topic 810, Consolidation (“ASC 810”). If the acquiree is a variable interest entity, the primary beneficiary would be the accounting acquirer.

The pro forma adjustments represent management’s estimates based on information available as of the date of the filing of the condensed combined financial statements and do not reflect possible adjustments related to restructuring or integration activities that have yet to be determined or transaction or other costs following the Business Combination that are not expected to have a continuing impact on the statement of operations. Further, one-time transaction-related expenses incurred prior to, or concurrently with the consummation of the Business Combination are not included in the unaudited pro forma condensed combined statements of operations. The impact of such transaction expenses incurred prior to the Business Combination are reflected in the unaudited pro forma condensed combined balance sheet as reductions to liabilities and a decrease to cash, whereas such transaction expenses incurred concurrently with the consummation of the Business Combination are reflected as an adjustment to retained earnings or members deficit and a decrease to cash. Such transaction expenses incurred and paid by Utz prior to the Business Combination have been adjusted as part of the Utz equity close out adjustment mentioned in Note 2, tickmark (d).

In conjunction with the consummation of the Business Combination, Collier Creek has adopted Utz’s accounting policies. As a result of the adoption, there are no significant changes in accounting policies expected and no pro forma adjustments related to the alignment of the accounting policies of Collier Creek and Utz. The combined company has adopted the fiscal year end date of Utz.

9

Description of Business Combination

On June 5, 2020 Collier Creek and Utz entered into an agreement for a business combination pursuant to which existing equity holders of Utz received a combination of cash and non-economic voting Class V Common Stock in the continuing public company and retained approximately 50.5% of the economic interests in Utz. The Business Combination is structured as a customary Up-C transaction, whereby the Sellers own equity in Utz and hold direct voting rights in Collier Creek.

Pursuant to and in connection with the Business Combination, the following transactions occurred:

| · | the Domestication; |

| · | the Forward Purchases; and |

| · | the adoption of the EIP by the Company. |

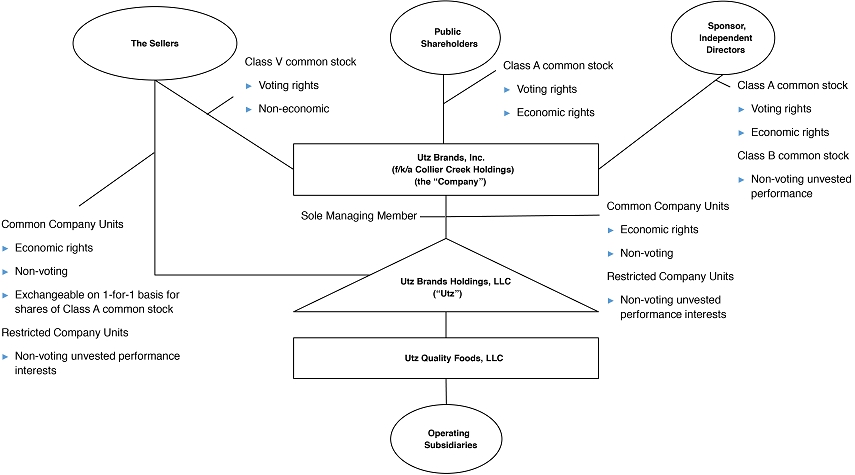

The diagram below depicts a simplified version of the Company’s organizational structure immediately following the completion of the Domestication and the Business Combination.

10

The table below represents the sources and uses of funds as it relates to the Business Combination as if the Business Combination had closed on June 30, 2020:

Sources and Uses (in millions)

| Sources | Uses | |||||||||

| Collier Creek Cash Held in Trust, less Shareholder Redemptions(1) | $ | 453 | Debt Paydown + Prepayment Fees(3) | $ | 239 | |||||

| Collier Creek Forward Purchase Agreement(2) | 35 | UPA Seller Preferred Units Acquisition(4) | 139 | |||||||

| Cash Consideration to Existing Utz Owners(5) | 60 | |||||||||

| Transaction Fees(6) | 50 | |||||||||

| Total Sources | $ | 488 | Total Uses | $ | 488 | |||||

| (1) | Represents the amount of the restricted investments and cash held in the trust account of Collier Creek, which holds the net proceeds from the initial public offering of certain securities of Collier Creek (the “Collier Creek IPO”) and certain of the proceeds from the sale of the Private Placement Warrants, together with interest earned thereon, less amounts released to pay taxes (the “Trust Account”) upon consummation of the Business Combination. This amount also excludes the cash remitted to Collier Creek shareholders due to the redemptions of 5,950 Class A ordinary shares which were redeemed at a price of approximately $10.29 per share. |

| (2) | Represents the proceeds from the forward purchase agreements entered into on September 7, 2018 with the Sponsor and Collier Creek’s independent directors to provide for the purchase of an aggregate of 3,500,000 shares of Class A Common Stock, plus an aggregate of 1,166,666 redeemable warrants to purchase one share of Class A Common Stock at $11.50 per share, for an aggregate purchase price of $35 million, or $10.00 per share of Class A Common Stock, in a private placement that closed concurrently with the closing of the Business Combination. |

| (3) | Represents the amount of existing Utz term debt that the combined company paid down upon closing of the Business Combination. This cash was applied to pay down the Utz Senior Secured First Lien Floating Rate Note due 2024 (the “Secured First Lien Note”) under the terms of the Note Purchase Agreement, fund the 2.0% prepayment penalty (approximately $3 million) due on the Secured First Lien Note, and pay down the First Lien Term Loan (“Utz First Lien Term Loan”) under the terms of the First Lien Term Loan Credit Agreement. No modifications to the terms of Utz remaining term debt occurred as part of the Business Combination. As of the closing of the Business Combination, an additional $1 million of funds was used to settle the interest accrued after the pro forma balance sheet date. |

| (4) | Represents the amount to purchase, from UPA Seller, the preferred units in the Sellers as of the Closing (which includes $125 million plus approximately $14 million of preferred return and early redemption costs), which was used by Collier Creek to acquire 100% of the preferred units in the Sellers owned by UPA Seller (which was immediately redeemed by the Sellers, in exchange for a portion of the Common Company Units and Restricted Company Units in Utz acquired by Collier Creek). |

| (5) | Represents $60 million paid by Collier Creek to the Sellers and UPA Seller for the acquisition of a portion of the Common Company Units and Restricted Company Units in Utz acquired by Collier Creek (including through the redemption of UPA Seller’s common units in the Sellers held by UPA Seller). |

| (6) | Represents the total estimated transaction fees and expenses incurred by Collier Creek and Utz as part of the Business Combination as of Closing. |

11

Note 2 — Unaudited pro forma condensed combined balance sheet adjustments

The pro forma adjustments to the unaudited pro forma condensed combined balance sheet as of June 30, 2020 are as follows:

| (a) | Represents the release of cash held in the Trust Account that becomes available to fund the Business Combination after shareholder redemptions, as discussed in item (1) to the Sources and Uses table above. |

| (b) | Represents payment of deferred underwriters’ and legal fees from the Collier Creek IPO, payable at the consummation of the Business Combination. |

| (c) | Reflects the payment of acquisition-related transaction costs incurred by Collier Creek and Utz (see Note 1 — Description of the Business Combination), excluding deferred underwriters’ fees from the Collier Creek IPO included in item (b). These costs are expensed as incurred. The unaudited pro forma condensed combined balance sheet reflects these costs that were paid concurrently with the consummation of the Business Combination as a reduction of cash, with a corresponding adjustment in retained earnings, members deficit, and accrued expenses. These costs are not included in the unaudited pro forma condensed combined statement of operations as they are directly related to the Business Combination and will be nonrecurring. |

| (d) | Represents the close out of the equity of Utz that is adjusted to goodwill. |

| (e) | Represents the reclassification of the Public Shares which were not redeemed by the Public Shareholders and the conversion of those Public Shares to Class A Common Stock in connection with the Business Combination. |

| (f) | Represents the conversion of Class B ordinary shares to Class A Common Stock in connection with the Business Combination, including shares of Class A Common Stock that are issued upon the automatic conversion of the Class B ordinary shares concurrently with the consummation of the Business Combination. There are 2,000,000 Class B ordinary shares which convert into the Series B-1 Common Stock and Series B-2 Common Stock of the Company in accordance with the Sponsor Side Letter Agreement, of which 1,000,000 Series B-1 Common Stock were converted as of the pro forma balance sheet date of June 30, 2020. |

| (g) | Reflects the paydown of Utz’s existing indebtedness as it relates to the Secured First Lien Note and First Lien Term Loan in conjunction with the consummation of the Business Combination. The Secured First Lien Note has a prepayment penalty of 2.0%, or approximately $3 million, which has been reflected as a reduction to cash and an adjustment to members deficit in the pro forma condensed combined balance sheet. The reduction in long-term debt balance due to paydown is offset by a write off of unamortized debt issuance costs which has been adjusted to members deficit. This is reflected in the table below: |

12

Long term debt, net of current portion adjustment

| (in millions) | ||||

| Debt paydown on Utz Secured First Lien Note | $ | (125 | ) | |

| Debt paydown on Utz First Lien Term Loan | $ | (112 | ) | |

| Less: Unamortized debt issuance costs | $ | 6 | ||

| Total long-term debt, net of current portion adjustment | $ | (231 | ) | |

| (h) | Represents adjustments to reflect applicable deferred tax. Refer to tickmark (o) for the purchase price allocation. The deferred taxes are primarily related to the difference between the financial statement and tax basis in the Utz partnership interests. This basis difference primarily results from the Business Combination where Collier Creek recorded a fair market value basis on all assets for financial accounting purposes and a fair value step-up on a portion of the assets for income tax purposes. The $41 million adjustment related to the deferred tax liability, representing a gross deferred tax asset of $10 million offset by a $51 million valuation allowance, is assuming: (1) Utz’s GAAP balance sheet as of June 28, 2020 adjusted for the pro forma entries described herein, (2) estimated tax basis as of June 28, 2020 adjusted for the pro forma entries described herein, (3) a valuation allowance of $51 million, (4) a constant federal income tax rate of 21.0% and a state tax rate of 4.4%, and (5) no material changes in tax law. The recorded valuation allowance relates to a portion of Collier Creek’s tax basis in excess of GAAP basis in its Utz limited liability company interests for which Collier Creek believes it is not more likely than not that it will realize a tax benefit in the future. |

| (i) | Represents the impact of the Forward Purchase Agreements to provide for the purchase of an aggregate of 3,500,000 Forward Purchase Shares, plus an aggregate of 1,166,666 Forward Purchase Warrants to purchase one share of Class A Common Stock at $11.50 per share, for an aggregate purchase price of $35 million, or $10.00 per share of Class A Common Stock, in a private placement that closed concurrently with the closing of the Business Combination. The proceeds of the sales of the Forward Purchase Shares and Forward Purchase Warrants are part of the Business Combination Consideration. |

| (j) | Represents $60 million paid by Collier Creek to the Sellers and UPA Seller for the acquisition of a portion of the Common Company Units and Restricted Company Units in Utz acquired by Collier Creek (including through the redemption of UPA Seller’s common units in the Sellers held by UPA Seller). This adjustment is recorded to reduce cash with corresponding impact recorded to goodwill. Refer to tickmark (o) for the purchase price allocation. |

13

| (k) | Represents the expected amount to purchase, from UPA Seller, the preferred units in the Sellers as of the Closing (which includes $125 million plus approximately $14 million of preferred return and early redemption costs), which was used by Collier Creek to acquire 100% of the preferred units in the Sellers owned by UPA Seller (which were immediately redeemed by the Sellers, in exchange for a portion of the Common Company Units and Restricted Company Units in Utz acquired by Collier Creek). |

| (l) | Represents the reclassification from liability to equity of the value of outstanding awards of active participants under the 2018 LTIP, calculated at June 30, 2020 in accordance with ASC 718. As a result of the Business Combination of Utz and Collier Creek and the election to convert to restricted stock units, these awards are no longer to be settled for cash and were converted to restricted stock units of the Public Company that were issued under the 2020 LTIP at the Closing of the Business Combination. |

| (m) | Under the terms of the Tax Receivable Agreement, the Company generally will be required to pay to the Sellers 85% of the applicable cash savings, if any, in U.S. federal and state income tax that the Company is deemed to realize in certain circumstances as a result of (i) certain increases in tax basis resulting from the Business Combination, (ii) certain tax attributes of Utz existing prior to the Business Combination, and (iii) tax benefits attributable to payments made under the Tax Receivable Agreement. The Company generally will retain the benefit of the remaining 15% of the applicable tax savings. The $38 million adjustment related to the tax receivable agreement assumes: (1) $199 million of cash paid to the equityholders of Utz immediately prior to Closing, (2) a share price equal to $10.29 per share, (3) a constant federal income tax rate of 21.0% and a state tax rate of 4.4%, (4) no material changes in tax law, (5) the ability to utilize tax attributes and (6) future payments under the Tax Receivable Agreement. The adjustments to the Tax Receivable Agreement have been recorded as an adjustment to goodwill. The Company anticipates that it will account for the income tax effects resulting from future taxable exchanges of Common Company Units by the Sellers for shares of Class A Common Stock or the cash equivalent thereof by recognizing an increase in deferred tax assets, based on enacted tax rates at the date of each exchange. Further, the Company will evaluate the likelihood that it will realize the benefit represented by the deferred tax asset, and, to the extent that the Company estimates that it is more likely than not that it will not realize the benefit, the Company will reduce the carrying amount of the deferred tax asset with a valuation allowance. |

| (n) | The adjustment represents the fair market value of non-controlling interest of 57,765,978 non-voting economic interest Common Company Units of Utz retained by the Sellers and an equal number of shares of Class V Common Stock of the Company that provide the Sellers with one vote per share, for each Common Company Unit the Sellers own based on the organization structure as a result of the Business Combination. Refer to tickmark (o) for details of the purchase considerations and the purchase price allocation. |

14

| (o) | Represents the adjustment for the estimated preliminary purchase price allocation for the Utz business resulting from the Business Combination. The preliminary calculation of total consideration and allocation of the purchase price to the fair value of Utz’s assets acquired and liabilities assumed is presented below as if the Business Combination was consummated on June 30, 2020. The Company has not completed the detailed valuations necessary to estimate the fair value of the assets acquired and the liabilities assumed and, accordingly, the adjustments to record the assets acquired and liabilities assumed at fair value reflect the best estimates of the Company based on the information currently available and are subject to change once additional analyses are completed. |

| Calculation of consideration per the Business Combination Agreement | ||||

| Estimated cash held in trust, less shareholder redemptions | $ | 453 | ||

| Proceed from the sale of 3,500,000 Class A ordinary shares through Forward Purchase Agreements | 35 | |||

| Less transaction costs incurred by Collier Creek | (26 | ) | ||

| Total cash consideration | $ | 462 | ||

| Tax Receivable Agreement obligations to the Sellers | 38 | |||

| Restricted Stock Units issued under 2020 LTIP | 16 | |||

| Seller’s Retained Restricted Units | 48 | |||

| Total consideration | $ | 564 | ||

| Non-controlling interest | $ | 567 | ||

| Net debt assumed | 407 | |||

| Total business enterprise value | $ | 1,538 | ||

| Recognized amounts of identifiable assets acquired and liabilities assumed | ||||

| Cash and cash equivalent | $ | 13 | ||

| Accounts receivable, net | 123 | |||

| Inventories, net | 57 | |||

| Prepaid and other assets | 6 | |||

| Notes receivable | 32 | |||

| Property, plant and equipment, net | 271 | |||

| Goodwill | 345 | |||

| Identifiable intangible assets | 898 | |||

| Deferred tax liabilities | (63 | ) | ||

| Other assets | 8 | |||

| Accounts payable | (56 | ) | ||

| Accrued expenses | (49 | ) | ||

| Notes payable | (37 | ) | ||

| Non-current accrued expenses and other | (10 | ) | ||

| Net assets acquired | $ | 1,538 | ||

15

Intangible Assets. Intangible assets were identified that met either the separability criterion or the contractual-legal criterion described in ASC 805. The trade name intangible assets represent the Power and Foundation brands that Utz originated or acquired that were valued using the relief-from-royalty method. The customer relationships intangible asset represents the existing customer relationships of Utz that were valued using a discounted cash flow model using projected sales growth and customer attrition. The developed technology intangible asset represents a manufacturing technology acquired by Utz for the purpose of generating income for Utz, which was valued using the relief-from-royalty method. Intangible assets of independent operator (“IO”) routes are presented at fair value using a deviation of income approach and determined by the present value of the debt service payments from the IO route purchases. Master distribution rights are presented based on the costs incurred to acquire such distribution rights.

| Identifiable intangible assets | Fair Value (in millions) | Useful life (in years) | ||||||

| Indefinite lived trade names | $ | 213 | n/a | |||||

| Finite lived trade names | 111 | 15 - 20 | ||||||

| Customer relationships | 554 | 15 | ||||||

| Technology | 1 | n/a | ||||||

| Master distribution rights | 16 | n/a | ||||||

| IO routes | 3 | n/a | ||||||

| Total | $ | 898 | ||||||

Goodwill. Approximately $345 million, has been allocated to goodwill. Goodwill represents the excess of the gross consideration transferred over the fair value of the underlying net tangible and identifiable intangible assets acquired. Qualitative factors that contribute to the recognition of goodwill include certain intangible assets that are not recognized as separate identifiable intangible assets. Goodwill represents future economic benefits arising from acquiring Utz primarily due to its strong market position and its assembled workforce that are not individually identified and separately recognized as intangible assets.

In accordance with ASC Topic 350, Goodwill and Other Intangible Assets, goodwill and indefinite lived intangible assets related to certain acquired brands will not be amortized, but instead will be tested for impairment at least annually or more frequently if certain indicators are present. In the event management of the combined company determines that the value of goodwill and/or indefinite/finite lived intangible assets has become impaired, an accounting charge for impairment during the quarter in which the determination is made may be recognized.

16

| (p) | Represents adjustment to record the estimated fair market value of Sellers’ Retained Restricted Units that is considered a contingent consideration in ASC 805 purchase accounting. Such Sellers’ Retained Restricted Units will be converted to Common Company Units of Utz when vested and will entitle the holders to participate in any ordinary distributions paid on an equivalent number of Common Company Units upon the achievement of targeted share prices of the public company. Fifty percent of the shares will be vested when 3-day volume weighted average price is at least at $12.50, and the other 50% of the shares will be vested when 3-day volume weighted average price is at least at $15.00, with such thresholds being reduced by an amount equal to the dividends paid on a share of Class A Common Stock between the date of Closing and the vesting date. The calculation of the fair market value of this contingent consideration is calculated by using the vesting stock prices multiplied by the number of shares in each vesting tranche. If any Sellers’ Retained Restricted Units do not vest within 10 years of the Closing, they will be cancelled for no consideration. The adjustment has been recorded as an adjustment to goodwill. Refer to tickmark (o) for the purchase price allocation. |

Note 3 — Unaudited pro forma condensed combined statements of operations adjustments

The pro forma adjustments included in the unaudited pro forma condensed combined statement of operations for the twelve month period ended December 31, 2019 and six month period ended June 30, 2020 are as follows:

| (aa) | Elimination of interest income on the Trust Account resulting from the release of cash held in the Trust Account that was used to fund the Business Combination. |

| (bb) | Reflects adjustments made to eliminate non-recurring transaction costs specifically incurred by Collier Creek and Utz as part of the Business Combination. |

| (cc) | Reflects the adjustment to interest expense associated with the paydown of the Utz’s existing indebtedness upon consummation of the Business Combination (see Note 2 above). The decreased interest expense reflects the interest expense on the historical Secured First Lien Note and First Lien Term Loan, less the change in interest expense as recalculated to reflect the debt paid down on the Secured First Lien Note and First Lien Term Loan, and incorporating the amortization of debt issuance costs recognized. The interest expense adjustment is reflected in the table below: |

| For the twelve months ended December 31, 2019 | ||||

| Outstanding Utz First Lien Term Loan | $ | 420 | ||

| Interest rate | 5.6 | % | ||

| Interest on Utz First Lien Term Loan | $ | 23 | ||

| Other interest expense | 6 | |||

| Total pro forma interest expense | 29 | |||

| Less: Interest on Utz historical debt and Kennedy pro forma interest adjustment | (55 | ) | ||

| Pro forma adjustment | $ | (26 | ) | |

17

| For the six months ended June 30, 2020 | ||||

| Outstanding Utz First Lien Term Loan | $ | 417 | ||

| Interest rate | 4.8 | % | ||

| Interest on Utz First Lien Term Loan | $ | 10 | ||

| Other interest expense | 3 | |||

| Total pro forma interest expense | 13 | |||

| Less: Interest on Utz historical debt | (20 | ) | ||

| Pro forma adjustment | $ | (7 | ) | |

| (dd) | Adjustment to eliminate the historical tax expense (benefit) of Collier Creek and Utz and to record the tax provisions of the combined entities on a pro forma basis using a pro forma effective tax rate of 15.9% for both periods, which was applied to the income attribute to the controlling interest as the income attributable to the non-controlling interest is pass-through income. However, the effective tax rate of the combined company could be different depending on post-Business Combination activities. |

| (ee) | As a result of the Business Combination, the pro forma basic number of shares is reflective of 58,369,050 shares of Class A Common Stock outstanding and the pro forma diluted number of shares is reflective of 62,067,833 shares of Class A Common Stock outstanding. Given that conversion of the Common Company Units results in no change to diluted EPS, the 59,507,489 shares of Common Company Units held by the Sellers are not included in the diluted number of shares. As the unvested Restricted Sponsor Shares and Retained Restricted Units are entitled to Collier Creek and Utz distributable earnings, respecitvely, they meet the definition of participating securities under ASC 260, Earnings Per Share, and profits attributable to these securities are excluded in the basic and diluted earnings per share calculations. |

| For the twelve months ended December 31, 2019 | Collier Creek Holdings (Historical for the | Pro Forma Adjustments | Reference | Pro Forma Consolidated | ||||||||||

| Earnings per Share | ||||||||||||||

| Weighted average shares outstanding of Class A | ||||||||||||||

| Common Stock, basic | 44,000,000 | 9,875,000 | (i) | 58,369,050 | ||||||||||

| 3,500,000 | (ii) | |||||||||||||

| (5,950 | ) | (iii) | ||||||||||||

| 1,000,000 | (iv) | |||||||||||||

| Basic net income (loss) per share, Class A (v) | 0.20 | — | (0.22 | ) | ||||||||||

| Weighted average shares outstanding of Class A | ||||||||||||||

| Common Stock, diluted | 44,000,000 | 9,875,000 | (i) | 62,067,833 | ||||||||||

| 3,500,000 | (ii) | |||||||||||||

| (5,950 | ) | (iii) | ||||||||||||

| 1,000,000 | (iv) | |||||||||||||

| 3,698,783 | (vi) | |||||||||||||

| Diluted net income (loss) per share, Class A (v) | 0.20 | — | (0.22 | ) | ||||||||||

| Weighted average shares outstanding of Class B | ||||||||||||||

| Common Stock | 11,875,000 | (9,875,000 | ) | (i) | — | |||||||||

| (2,000,000 | ) | (iv) | ||||||||||||

| Basic and diluted net loss per share, Class B | (0.08 | ) | — | — | ||||||||||

18

| For the six months ended June 30, 2020 | Collier Creek Holdings (Historical for the | Pro Forma Adjustments | Reference | Pro Forma Consolidated | ||||||||||

| Earnings per Share | ||||||||||||||

| Weighted average shares outstanding of Class A | ||||||||||||||

| Common Stock, basic | 44,000,000 | 9,875,000 | (i) | 58,369,050 | ||||||||||

| 3,500,000 | (ii) | |||||||||||||

| (5,950 | ) | (iii) | ||||||||||||

| 1,000,000 | (iv) | |||||||||||||

| Basic net income per share, Class A (v) | 0.04 | — | 0.02 | |||||||||||

| Weighted average shares outstanding of Class A | ||||||||||||||

| Common Stock, diluted | 44,000,000 | 9,875,000 | (i) | 62,067,833 | ||||||||||

| 3,500,000 | (ii) | |||||||||||||

| (5,950 | ) | (iii) | ||||||||||||

| 1,000,000 | (iv) | |||||||||||||

| 3,698,783 | (vi) | |||||||||||||

| Diluted net income per share, Class A (v) | 0.04 | — | 0.02 | |||||||||||

| Weighted average shares outstanding of Class B | ||||||||||||||

| Common Stock | 11,875,000 | (9,875,000 | ) | (i) | — | |||||||||

| (2,000,000 | ) | (iv) | ||||||||||||

| Basic and diluted net loss per share Class B | (0.15 | ) | — | — | ||||||||||

| i. | Represents 9,875,000 shares of Class A Common Stock issued upon conversion of the existing Collier Creek Class B ordinary shares. The ordinary shares automatically converted into shares of Class A Common Stock concurrently with the consummation of the initial Business Combination, or earlier at the option of the holder thereof, on a one-for-one basis. |

| ii. | Represents 3,500,000 shares of Class A Common Stock issued pursuant to the September 7, 2018 forward purchase agreements entered into by Collier Creek, the Sponsor and Collier Creek’s independent directors to provide for the purchase of an aggregate of 3,500,000 shares of Class A Common Stock, plus an aggregate of 1,166,666 redeemable warrants to purchase one share of Class A Common Stock at $11.50 per share, for an aggregate purchase price of $35 million, or $10.00 per share of Class A Common Stock, in a private placement that closed concurrently with the closing of the Business Combination. |

| iii. | Represents the 5,950 shares which were redeemed by shareholders in connection with the Business Combination and were not converted into Class A Common Stock. |

19

| iv. | Represents the exchange of 2,000,000 Class B shares for 2,000,000 Restricted Sponsor Shares to take place concurrently with the consummation of the Business Combination, convertible into shares of Class A Common Stock. These restricted shares will be non-transferable (subject to certain exceptions, including a dissolution of the Sponsor), unless and until they convert into shares of Class A Common Stock. The restricted shares will convert 50% when the shares of Class A Common Stock of the Company trade at or above $12.50 volume weighted average price (“VWAP”) in the prior 3 trading days and the remaining 50% when the shares of Class A Common Stock of the Company trade at or above $15.00 VWAP in the prior 3 trading days, which dollar thresholds will be decreased by the aggregate amount of dividends per share paid by the Company after the Closing; or in full upon a direct or indirect change of control to a third party unaffiliated with the Sponsor. Fifty percent of these Restricted Sponsor Shares have been considered in the denominator of the basic and diluted EPS calculation as the shares would have been issued as of the Pro Forma Balance Sheet date as the 3-day VWAP preceding the Pro Forma Balance Sheet date was greater than $12.50. |

| v. | Class A basic and diluted EPS also takes into account the vesting of 50% of the 3,483,022 shares of the non-voting Retained Restricted Units in Utz retained by the Sellers that were contingently issuable based on the same conditions as the Restricted Sponsor Shares. Fifty percent of these Retained Restricted Units have been considered in quantifying the numerator of the basic and diluted EPS calculations as the shares would have been issued as of the Pro Forma Balance Sheet date as the 3-day VWAP preceding the Pro Forma Balance Sheet date was greater than $12.50, and the vesting of 50% of such Retained Restricted Units will increase the percentage of pro forma income (loss) attributable to NCI. |

| vi. | Represents the dilutive effect of the 14,666,666 Public Warrants, 7,200,000 Private Placement Warrants, and 1,166,666 Forward Purchase Warrants. Each warrant has an exercise price of $11.50 to purchase one share of the Class A ordinary shares of Collier Creek that were registered in the Collier Creek IPO and will automatically be converted into warrants to acquire shares of Class A Common Stock of the Company upon the Domestication. Considering the share price of the Company on June 30, 2020, these warrants are dilutive to EPS. The adjustment reflects the number of incremental shares of Class A Common Stock that would be issued given the proceeds from the exercise of all the warrants less the assumed acquisition of shares in the market using those proceeds. |

| (ff) | Represents the pro forma adjustment to the noncontrolling interest in the Business Combination. |

| (in millions) | For the Six Months Ended June 30, 2020 | For the Twelve Months Ended December 31, 2019 | ||||||

| Pro forma income (loss) before taxes | $ | — | $ | (41 | ) | |||

| Pro forma income (loss) attributable to noncontrolling interest (50.5%) | $ | — | $ | (21 | ) | |||

| (gg) | Represents adjustments to incorporate additional tangible and intangible assets depreciation and amortization for the step up basis from purchase price accounting (“PPA”) at the closing of the Business Combination. This pro forma adjustment has been proposed assuming the Business Combination happened on the first day of the fiscal year 2019. The following table is a summary of information related to certain intangible assets acquired, including information used to calculate the pro forma change in amortization expenses that is adjusted to administrative expenses: |

20

| Identifiable intangible assets | Fair Value (in millions) | Useful Life (in years) | Amortization Expense for the twelve months ended December 31, 2019 | Amortization Expense for the six months ended June 30, 2020 | ||||||||||||

| Indefinite lived trade names | $ | 213 | n/a | n/a | n/a | |||||||||||

| Finite lived trade names | 111 | 15 - 20 | 7 | 4 | ||||||||||||

| Customer relationships | 554 | 15 | 37 | 18 | ||||||||||||

| Technology | 1 | n/a | n/a | n/a | ||||||||||||

| Master distribution rights | 16 | n/a | n/a | n/a | ||||||||||||

| IO routes | 3 | n/a | n/a | n/a | ||||||||||||

| Total | $ | 898 | $ | 44 | $ | 22 | ||||||||||

| Less: Historical amortization expenses | 6 | 4 | ||||||||||||||

| Pro forma adjustments | $ | 38 | $ | 18 | ||||||||||||

Pro forma adjustments for depreciation expenses to cost of goods sold are $8 million and $4 million, and to selling and administrative expenses are $6 million and $3 million respectively, for the twelve months ended December 31, 2019 and the six months ended June 30, 2020.

Note 4 — Reclassifications and Adjustments to Historical Information of Utz for the period ended December 29, 2019

Kennedy was acquired by Utz on October 21, 2019. Kitchen Cooked was acquired by Utz on December 30, 2019. The following table provides the pro forma statement of operations of Utz for the fiscal year ended December 29, 2019 as if Kennedy and Kitchen Cooked had been acquired on December 31, 2018. As Kennedy was acquired by Utz on October 21, 2019, the table includes the pre-acquisition period of Kennedy from December 31, 2018 to October 20, 2019. The table includes full fiscal year results of Kitchen Cooked, and no pro forma adjustment is included for Kitchen Cooked as any such adjustments are not material. The combined pro forma financial information does not reflect the realization of any expected synergies from the acquisitions of Kennedy in fiscal 2019 and Kitchen Cooked in fiscal 2020, or incremental public company costs from the Business Combination. The Company currently estimates that synergies from the elimination of certain procurement, manufacturing, logistics, and selling and administrative expenses will result in annual combined integration-related cost savings of approximately $7.0 million from the acquisitions of Kennedy and Kitchen Cooked. Although the Company believes that such synergies will be realized, there can be no assurance that such synergies or cost estimates will be achieved, and therefore they have not been included as adjustments in the pro forma information.

21

Pro forma statement of operations of Utz

| (Amounts in millions | Utz Brands Holdings, LLC (Formerly UM-U Intermediate, LLC, for the twelve months ended 12/29/19) | Kennedy Endeavors Inc. Acquisition (Unaudited for the period 12/31/18 to 10/20/19) | Kitchen Cooked Inc. Acquisition (Unaudited for the twelve months ended 12/31/19) | Pro Forma Adjustments | Footnote Reference | Utz Brands Holdings, LLC Pro Forma Combined (Formerly UMU Intermediate, LLC, for the twelve months ended 12/29/19) | ||||||||||||||||

| Net sales | 768 | 89 | 9 | — | 866 | |||||||||||||||||

| Cost of goods sold | 514 | 61 | 4 | — | 579 | |||||||||||||||||

| Gross profit | 254 | 28 | 5 | — | 287 | |||||||||||||||||

| Selling and administrative expenses | ||||||||||||||||||||||

| Selling | 163 | 18 | 3 | — | 184 | |||||||||||||||||

| Administrative | 65 | 3 | 3 | 3 | (aaa) | 71 | ||||||||||||||||

| (3 | ) | (bbb) | ||||||||||||||||||||

| Total selling and administrative expenses | 228 | 21 | 6 | — | 225 | |||||||||||||||||

| Gain on sale of assets | ||||||||||||||||||||||

| Gain on disposal of property, plant and equipment | 6 | — | — | — | 6 | |||||||||||||||||

| Gain on sale of routes, net | 7 | — | — | — | 7 | |||||||||||||||||

| Total gain on sale of assets | 13 | — | — | — | 13 | |||||||||||||||||

| Income from operations | 39 | 7 | (1 | ) | — | 45 | ||||||||||||||||

| Other expense | ||||||||||||||||||||||

| Interest expense | (48 | ) | — | — | (7 | ) | (ccc) | (55 | ) | |||||||||||||

| Other expenses | (1 | ) | (1 | ) | ||||||||||||||||||

| Other expense, net | (49 | ) | — | — | (7 | ) | (56 | ) | ||||||||||||||

| Income (loss) before taxes | (10 | ) | 7 | (1 | ) | (7 | ) | (11 | ) | |||||||||||||

| Income tax expense | 3 | 3 | ||||||||||||||||||||

| Net (loss) income | (13 | ) | 7 | (1 | ) | (7 | ) | (14 | ) | |||||||||||||

| Net income attributable to noncontrolling interest | (3 | ) | (3 | ) | ||||||||||||||||||

| Net (loss) income attributable to controlling interest | (16 | ) | 7 | (1 | ) | (7 | ) | (17 | ) | |||||||||||||

| Other comprehensive income: | ||||||||||||||||||||||

| Interest rate swap | 1 | — | — | — | 1 | |||||||||||||||||

| Comprehensive (loss) income | (15 | ) | 7 | (1 | ) | (7 | ) | (16 | ) | |||||||||||||

22

| (aaa) | The pro forma financials are adjusted to incorporate additional tangible and intangible asset depreciation and amortization for the step up fair value asset basis of the Kennedy acquisition that occurred on October 21, 2019. The allocation of purchase price and the final amortization of such tangible and intangible assets could be adjusted during the one year measurement period to reflect new information obtained about facts and circumstances that existed as of the acquisition dates that, if known, would have affected the measurement of the amounts recognized as of the acquisition dates. The following table is a summary of information related to certain tangible and intangible assets acquired, including information used to calculate the pro forma change in depreciation and amortization expenses: |

| (in millions) | Estimated Fair Value | Estimated Useful Life in Years | Amortization Expense for the period 12/31/18- | |||||||

| Customer Relationships | $ | 13 | 15 years | $ | 1 | |||||

| Trade Name and Trademark | 21 | 15-20 years | 1 | |||||||

| Property, Plant, and Equipment | 13 | 1-20 years | 4 | |||||||

| Building Improvement and Site Improvement | 4 | 2-40 years | ― | |||||||

| $ | 51 | 6 | ||||||||

| Less: Historical amortization expenses | $ | (3 | ) | |||||||

| Pro forma adjustment | $ | 3 | ||||||||

| (bbb) | Reflects adjustments made to eliminate non-recurring transaction costs specifically incurred by Utz and Kennedy as part of the Business Combination. |

| (ccc) | Reflects an adjustment to interest expense associated with the historical Secured First Lien Note which was a critical component of the financing arrangement to complete the Kennedy Acquisition on October 21, 2019. The increased interest expense reflects additional interest expense on the Secured First Lien Note as if the note was entered into as of January 1, 2019. |

23