Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HEALTHPEAK PROPERTIES, INC. | tm2029828-1_8k.htm |

Exhibit 99.1

Investor Presentation Healthpeak Properties September 3, 2020 The Post Boston, MA

Disclaimers This Healthpeak Properties, Inc . (the “Company”) presentation is solely for your information, is subject to change and speaks only as of the date hereof . This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings . No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented . Forward - Looking Statements Statements contained in this presentation, as well as statements made by management, that are not historical facts are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof . Examples of forward - looking statements include, among other things, (i) demographic, industry, market and segment forecasts, (ii) timing, outcomes and other details relating to current, pending or contemplated acquisitions, dispositions, developments, redevelopments, joint venture transactions, capital recycling and financing activities, and other transactions and terms and conditions thereof described in this presentation, (iii) pro forma or expected operating income, operator concentration, segment concentration, yield, capitalization rate, balance sheet, credit profile, credit metrics and private pay percentage, (iv) financial forecasts, financing plans and expected impact of transactions, (v) economic guidance, framework, outlook, insights and assumptions, and (vi) the impact of COVID - 19 on the Company’ business, financial condition and results of operations . You should not place undue reliance on these forward - looking statements . Forward - looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations . While forward - looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained . Further, we cannot guarantee the accuracy of any such forward - looking statement contained in this presentation, and such forward - looking statements are subject to known and unknown risks and uncertainties that are difficult to predict . These risks and uncertainties include, but are not limited to : the severity and duration of the COVID - 19 pandemic ; actions that have been taken and may continue to be taken by governmental authorities to contain the COVID - 19 pandemic or to treat its impact ; the impact of the COVID - 19 pandemic and health and safety measures taken to reduce the spread ; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures ; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations ; the imposition of laws or regulations prohibiting eviction of our tenants or operators, including new governmental efforts in response to COVID - 19 ; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans ; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries ; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance ; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith ; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected ; the potential impact of uninsured or underinsured losses, including as a result of hurricanes, earthquakes and other natural disasters, pandemics such as COVIID - 19 , acts of war and/or terrorism and other events that may cause such losses and/or performance declines by the Company or its tenants and operators ; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation ; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases ; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions ; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections ; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments ; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators ; the Company’s ability to foreclose on collateral securing its real estate - related loans ; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions ; changes in global, national and local economic and other conditions, including epidemics or pandemics such as the COVID - 19 pandemic ; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness ; competition for skilled management and other key personnel ; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches ; the Company’s ability to maintain its qualification as a real estate investment trust ; and other risks and uncertainties described from time to time in the Company’s SEC filings . Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward - looking statements, which speak only as of the date on which they are made . Non - GAAP Financial Measures This presentation contains certain supplemental non - GAAP financial measures . While the Company believes that non - GAAP financial measures are helpful in evaluating its operating performance, the use of non - GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP . We caution you that there are inherent limitations associated with the use of each of these supplemental non - GAAP financial measures as an analytical tool . Additionally, the Company’s computation of non - GAAP financial measures may not be comparable to those reported by other REITs . You can find reconciliations of the non - GAAP financial measures to the most directly comparable GAAP financial measures in the second quarter 2020 Discussion and Reconciliation of Non - GAAP Financial Measures available on our website . Investor Presentation - September 3, 2020 2

Introduction to Healthpeak The Cove San Francisco, CA

5.4% DIVIDEND YIELD (2) Healthpeak Properties Other Public REIT s Other owners of healthcare real estate Total Addressable U.S. Healthcare Real Estate Market (4) SH NNN 9% SHOP 9% CCRC 11% Life Science 36% Medical Office 30% Other 5% Healthpeak’s Portfolio Income (5) Healthpeak at a Glance Key Statistics Key Differentiators ■ High - quality private - pay portfolio in Life Science, Medical Office and Senior Housing real estate ■ $1.0 billion development pipeline that is 59% pre - leased ■ Deep relationships with industry leading health systems, life science tenants and operating partners ■ Investment grade balance sheet with ample liquidity ■ Global leader in sustainability Well Positioned to Serve the Aging Baby Boomer Population Investor Presentation - September 3, 2020 PEAK NYSE 633 PROPERTIES 10M SF (3) Life Science 22M SF (3) Medical Office 30K Units Senior Housing $1.2 Trillion $23B Enterprise Value (1) $1.2 Trillion Market Provides Path to Sustained Growth (1) Based on Healthpeak’s share price of $27.46 on 09/01/20 and total consolidated debt and Healthpeak’s share of unconsolidated JV debt as of 06/30/20. (2) Based on share price as of 09/01/20. (3) Includes active development pipeline. (4) Source: JLL Research. (5) Portfolio income represents Cash NOI plus interest income plus our pro rata share of Cash NOI from our unco nso lidated JVs less noncontrolling interests' pro rata share of Cash NOI from consolidated JVs. $23BN ENTERPRISE VALUE (1) BBB+/BAA1 INVESTMENT GRADE 4

Seasoned Leadership Team Tom Herzog Chief Executive Officer Joined June 2016 Tom Klaritch Chief Development and Operating Officer Joined October 2003 Lisa Alonso Chief Human Resources Officer Joined November 2014 Investor Presentation - September 3, 2020 Scott Brinker President and Chief Investment Officer Joined March 2018 Troy McHenry Chief Legal Officer and General Counsel Joined December 2010 Jeff Miller Executive Vice President – Senior Housing Joined November 2018 Peter Scott Chief Financial Officer Joined February 2017 Shawn Johnston Chief Accounting Officer Joined August 2017 Experienced Team Fresh Perspective 5

Focused, High - Quality Real Estate Portfolio We are well - positioned to serve the aging baby boomer demographic and capture growth Investor Presentation - September 3, 2020 Long - term demographics support growth in our three primary asset classes: Life Science, Medical Office and Senior Housing The Shore | San Francisco, CA HealthOne Sky Ridge Medical Center | Denver, CO Oakmont Whittier | Los Angeles MSA Life Science Medical Office Senior Housing ■ Focus on the three major Life Science markets ■ Assemble clusters of assets through acquisitions, development and redevelopment ■ Grow existing relationships by providing expansion opportunities to our tenants ■ Grow relationships with premium hospitals and health systems ■ Pursue on - campus and select off - campus assets with strong hospitals and health systems in relevant markets ■ Redevelop certain older, on - campus assets ■ Focus on locations with strong demographics ■ Align management contracts with top - tier operating partners ■ Active asset management including redevelopment and capital recycling New and innovative drugs, treatments, and healthcare devices, which will be created in our life science portfolio Outpatient services and specialist doctor visits performed more efficiently in a medical office building setting Communities offering social activities, daily living assistance and coordination with outside healthcare providers 6

Healthpeak’s Premier Real Estate Portfolio Nine strategic campuses / portfolios represent ~30% of total company Cash NOI (1) Investor Presentation - September 3, 2020 Life Science Medical Office Senior Housing Hayden Research Campus | Boston, MA | Value - Add / Dev. The Cove at Oyster Point | San Francisco, CA | Stabilized / Dev. Britannia Oyster Point | San Francisco, CA | Stabilized CCRC Portfolio | Various | Stabilized Oakmont Portfolio | Los Angeles, MSA | Stabilized Discovery Portfolio | FL, GA, TX | Stabilized Medical City Dallas | Dallas, TX | Stabilized Centennial Campus | Nashville, TN | Stabilized Swedish First Hill Campus | Seattle, WA | Stabilized (1) Based on three months ended June 30, 2020. 7

Total Cost to Remaining Percent Est. Initial Costs ($M) Date ($M) (2) Costs ($M) Leased Occupancy Ridgeview San Diego $18 $16 $2 81 SF 100% 4Q 2020 The Shore Ph. I San Francisco $98 $88 $10 92 SF 100% 4Q 2020 75 Hayden Boston $160 $98 $62 214 SF 100% 4Q 2020 The Boardwalk (3) San Diego $164 $66 $99 190 SF 39% 3Q 2021 The Shore Ph. II San Francisco $321 $154 $168 298 SF 61% 4Q 2021 The Shore Ph. III San Francisco $94 $27 $66 103 SF -- 1Q 2022 HCA Development Program Various $184 $49 $136 635 SF 49% Various Total/Weighted Average (4) $1,040 $498 $541 1,613 SF 59% Project Market Leasable Area (000s) Active Development Pipeline (1) Note: Total Costs minus Cost to Date may not equal Remaining Costs due to rounding. (1) Total Costs, Remaining Costs and Estimated Date of Stabilized Occupancy are based on management’s estimates and are forward - look ing. (2) Cost to Date represents placed - in - service and construction in process balance on 06/30/20. (3) The Boardwalk includes the redevelopment of 10275 Science Center Drive. Cost to date includes land and the net book value of the redeveloped building upon commencement of the project totaling $34 million. (4) Represents total for Total Costs, Cost to Date, Remaining Costs and Leasable Area. Percent Leased is weighted by leasable are a. Investor Presentation - September 3, 2020 Development pipeline 59% pre - leased in total, and 100% pre - leased for all major developments delivering in the near - term 8

$14 $63 $23 $397 $1,407 $1,375 $757 $36 $70 $652 $752 $617 $399 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 Thereafter Senior Unsecured Notes Secured Debt Unsecured Term Loan Revolver / CP Revolver Capacity $300M Redemption (1) Balance Sheet and Liquidity ■ ~$2.65B of liquidity as of Aug 31 □ ~$150M of Cash □ Full capacity on $2.5B revolver ■ Revolver maturity with extension options in 2024 ■ Minimal debt maturing next 3+ years ■ Less than $490M of consolidated secured debt ■ 7 year weighted average debt maturity (1) On July 9, 2020, Healthpeak repaid the $300 million 3.15% senior unsecured notes due August 2022. Liquidity Takeaways Debt Maturity Schedule $ in millions Next bond maturity not until November 2023 ■ Leverage stats here Investor Presentation - September 3, 2020 9

Recent Updates Aegis Dana Point Dana Point, CA

2Q 2020 and Recent Highlights (1) Investor Presentation - September 3, 2020 2Q 2020 ■ Earnings □ FFO as Adjusted of $0.40 per share and blended year - over - year Same - Store Cash NOI results of (2.2%) ▪ MOB +1.3% ▪ Life Science +7.3% ▪ Senior Housing (21.2%) ▪ Other +2.9% □ Net Debt to Adjusted EBITDAre of 5.4x □ Declared quarterly dividend of $0.37 per share ■ Transactions □ Closed on the sale of the three Frost Street MOBs in San Diego ($106M; 6.0% cash cap rate) □ Closed on the acquisition of The Post in Boston ($320M; 5.1% cash cap rate) ■ Development □ Delivered a 52,000 SF, three - story class A medical office building located on Lee’s Summit Medical Center Campus in Lee’s Summit (51% leased to HCA) □ Signed two leases totaling 60,000 SF at our 75 Hayden development project in Boston, bringing the development to 100% leased □ Signed a 74,000 SF, 17 - year lease at our Boardwalk development project in San Diego, bringing the development to 39% pre - leased Recent Highlights ■ $2.65B of total liquidity ($150M cash and $2.5B revolver availability) as of August 31 11 (1) Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non - GAAP financial measu res used in this presentation can be found at http://ir.healthpeak.com/quarterly - results

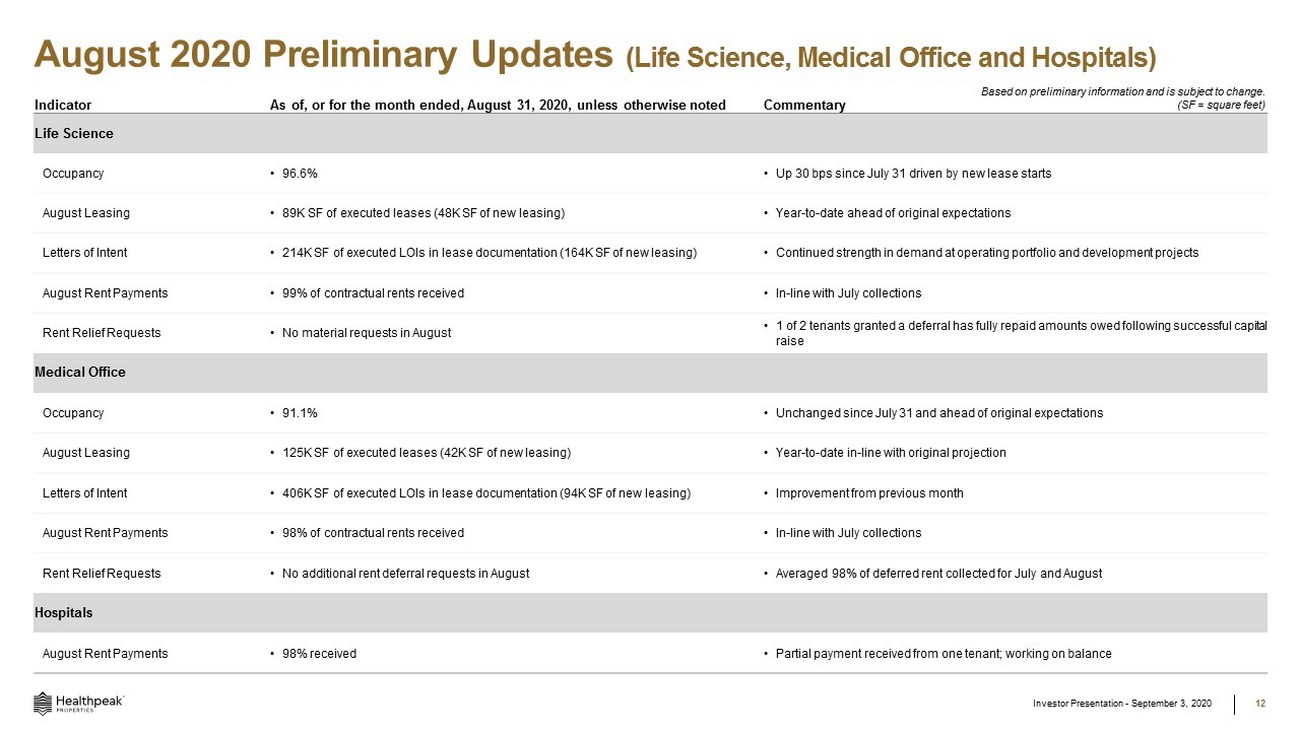

August 2020 Preliminary Updates (Life Science, Medical Office and Hospitals) Investor Presentation - September 3, 2020 12 Indicator As of, or for the month ended, August 31, 2020, unless otherwise noted Commentary Life Science Occupancy • 96.6% • Up 30 bps since July 31 driven by new lease starts August Leasing • 89K SF of executed leases (48K SF of new leasing) • Year - to - date ahead of original expectations Letters of Intent • 214K SF of executed LOIs in lease documentation (164K SF of new leasing) • Continued strength in demand at operating portfolio and development projects August Rent Payments • 99% of contractual rents received • In - line with July collections Rent Relief Requests • No material requests in August • 1 of 2 tenants granted a deferral has fully repaid amounts owed following successful capital raise Medical Office Occupancy • 91.1% • Unchanged since July 31 and ahead of original expectations August Leasing • 125K SF of executed leases (42K SF of new leasing) • Year - to - date in - line with original projection Letters of Intent • 406K SF of executed LOIs in lease documentation (94K SF of new leasing) • Improvement from previous month August Rent Payments • 98% of contractual rents received • In - line with July collections Rent Relief Requests • No additional rent deferral requests in August • Averaged 98% of deferred rent collected for July and August Hospitals August Rent Payments • 98% received • Partial payment received from one tenant; working on balance Based on preliminary information and is subject to change. (SF = square feet)

August 2020 Preliminary Updates (Senior Housing) (1) Properties that are held for sale, in redevelopment or in development are excluded from reporting statistics. (2) Move - in and move - out data excludes skilled nursing beds given the Medicare residents usually have lengths of stay of 30 days or less. Investor Presentation - September 3, 2020 13 Indicator As of, or for the month ended, August 31, 2020, unless otherwise noted Commentary Senior Housing: SHOP (1)(2) Total Occupancy • Spot occupancy declined 100 bps vs July 31 • Average Daily Census declined 90 bps vs July, better than our August Outlook ( - 150 bps) Move - ins • Declined 43% vs. August 2019; Increased 22 % vs. July 2020 • 90 % of our properties are now accepting move - ins Move - outs • Declined 5% vs. August 2019; Increased 19% vs. July 2020 • Continue to trend in - line with expectations Leads • Declined 31% vs. August 2019; Increased 3% vs. July 2020 • Operators continue to prioritize digital marketing platforms Tours • Declined 44% vs. August 2019; Increased 4% vs. July 2020 • Certain operators are starting to do limited in person tours Senior Housing: CCRC (1)(2) IL/AL/MC Occupancy SNF Occupancy Total Occupancy • Total spot occupancy increased 60 bps vs July 31 • Total Average Daily Census increased 60 bps vs July. The increase was driven by SNF which increased 490 bps vs July. IL/AL/MC Average Daily Census declined 30 bps vs July, better than our August Outlook ( - 75bps) IL/AL/MC Move - ins • Declined 73% vs. August 2019; Declined 39% vs. July 2020 • 93% of our IL/AL/MC properties are now accepting move - ins IL/AL/MC Move - outs • Declined 46% vs. August 2019; Declined 21 % vs. July 2020 • August is the third consecutive month move - outs declined IL/AL/MC Leads • Declined 33% vs. August 2019; Declined 15% vs. July 2020 • Leads for the first 2 months of 3Q (Jul - Aug) are 44% higher than the first 2 months of 2Q (Apr - May) IL/AL/MC Tours • Increased 28% vs. August 2019; Declined 11% vs. July 2020 • Starting to do limited in person tours. Tours for first 2 months of 3Q (Jul - Aug) are 132% higher than the first 2 months of 2Q (Apr - May) Senior Housing (SHOP and CCRC) Expense Update July Expense Results (August not yet available) • Total expenses declined (2.5%) vs. original expectations, significantly beating the range provided in our August Outlook (0 - 5% increase). The decline in expenses was driven by lower than expected compensation and COVID related expenses • Based on July actuals and recent trending we believe expenses going forward will be on the low end of our 0 - 5% August Outlook range and below our 2Q20 run - rate • CCRC and SHOP expenses were (2.7%) and (1.2%) lower, respectively, than their 2Q20 monthly averages Senior Housing: NNN Tenant Updates August Rent Payments • 97% received + 3 % deferred (with Capital Senior Living, as previously announced) Senior Housing: Known COVID - 19 Positive Cases Based on the reports Healthpeak receives from its operators across 216 properties, as of August 31, 2020, Healthpeak had 125 properties managed by 16 different operators that have had confirmed resident COVID - 19 cases at some point during the pandemic, and 71 of those affected properties had experienced resident deaths • New COVID positive resident cases in our senior housing facilities as of late August have declined by nearly 70% from the peak in mid - April. 91% of our 216 properties are 14 or more days from the most recent exposure or never had an exposure Based on preliminary information and is subject to change. Spot Occupancy (August 31) Average Daily Census (August) 77.1% 76.8% 82.5% 82.6% 67.3% 80.0% 65.1% 79.7% Spot Occupancy (August 31) Average Daily Census (August)