Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - GENESCO INC | gco-ex991_8.htm |

| 8-K - 8-K - GENESCO INC | gco-8k_20200903.htm |

FY21 Second Quarter June 9, 2020 September 3, 2020 Exhibit 99.2

Genesco Inc. FY21 Q2 Earnings Summary Results September 3, 2020

Safe Harbor Statement This presentation contains forward-looking statements, including those regarding the performance outlook for the Company and its individual businesses (including, without limitation, those regarding back-to-school and holiday selling seasons and its ability to keep stores open, operate the stores safely and ensure the safety of customers and employees) and all other statements not addressing solely historical facts or present conditions. Actual results could vary materially from the expectations reflected in these statements. A number of factors could cause differences. These include adjustments to estimates and projections reflected in forward-looking statements, including as a result of the effects of COVID-19 on the Company’s business including whether there are periods of increases in the number of COVID-19 cases in locations in which the Company operates, further closures of stores due to COVID-19, weakness in store and shopping mall traffic, restrictions on operations imposed by government entities and landlords, changes in public safety and health requirements, the Company’s ability to adequately staff stores, limitations on the Company’s ability to provide adequate personal protective equipment to employees, and the Company’s ability to maintain social distancing requirements; stores closures and effects on the business as a result of civil disturbances; the level and timing of promotional activity necessary to maintain inventories at appropriate levels; the imposition of tariffs on products imported by the Company or its vendors as well as the ability and costs to move production of products in response to tariffs; the Company’s ability to obtain from suppliers products that are in-demand on a timely basis and effectively manage disruptions in product supply or distribution, including disruptions as a result of COVID-19; unfavorable trends in fuel costs, foreign exchange rates, foreign labor and material costs, and other factors affecting the cost of products; the effects of the British decision to exit the European Union and other sources of weakness in the U.K. market; the effectiveness of the Company's omnichannel initiatives; costs associated with changes in minimum wage and overtime requirements; wage pressure in the U.S. and the U.K.; weakness in the consumer economy and retail industry; competition and fashion trends in the Company's markets; risks related to the potential for terrorist events; risks related to public health and safety events, including for example, the COVID-19 coronavirus; changes in buying patterns by significant wholesale customers; retained liabilities associated with divestitures of businesses including potential liabilities under leases as the prior tenant or as a guarantor of certain leases; and changes in the timing of holidays or in the onset of seasonal weather affecting period-to-period sales comparisons. Additional factors that could cause differences from expectations include the ability to renew leases in existing stores and control or lower occupancy costs, and to conduct required remodeling or refurbishment on schedule and at expected expense levels; the Company’s ability to eliminate stranded costs associated with dispositions, including the sale of the Lids Sport Group business; the Company’s ability to realize anticipated cost savings, including rent savings; deterioration in the performance of individual businesses or of the Company's market value relative to its book value, resulting in impairments of fixed assets, operating lease right of use assets or intangible assets or other adverse financial consequences and the timing and amount of such impairments or other consequences; unexpected changes to the market for the Company's shares or for the retail sector in general; costs and reputational harm as a result of disruptions in the Company’s business or information technology systems either by security breaches and incidents or by potential problems associated with the implementation of new or upgraded systems; and the cost and outcome of litigation, investigations and environmental matters involving the Company. Additional factors are cited in the "Risk Factors," "Legal Proceedings" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of, and elsewhere in, the Company’s SEC filings, copies of which may be obtained from the SEC website, www.sec.gov, or by contacting the investor relations department of Genesco via the Company’s website, www.genesco.com. Many of the factors that will determine the outcome of the subject matter of this release are beyond Genesco's ability to control or predict. Genesco undertakes no obligation to release publicly the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Forward-looking statements reflect the expectations of the Company at the time they are made. The Company disclaims any obligation to update such statements.

Non-GAAP Financial Measures We report consolidated financial results in accordance with generally accepted accounting principles (“GAAP”). However, to supplement these consolidated financial results our presentation includes certain non-GAAP financial measures such as earnings and earnings per share and operating income. This supplemental information should not be considered in isolation as a substitute for related GAAP measures. We believe that disclosure of earnings and earnings per share from continuing operations and operating income adjusted for the items not reflected in the previously announced expectations will be meaningful to investors, especially in light of the impact of such items on the results. Reconciliations of the non-GAAP supplemental information to the comparable GAAP measures can be found in the Appendix.

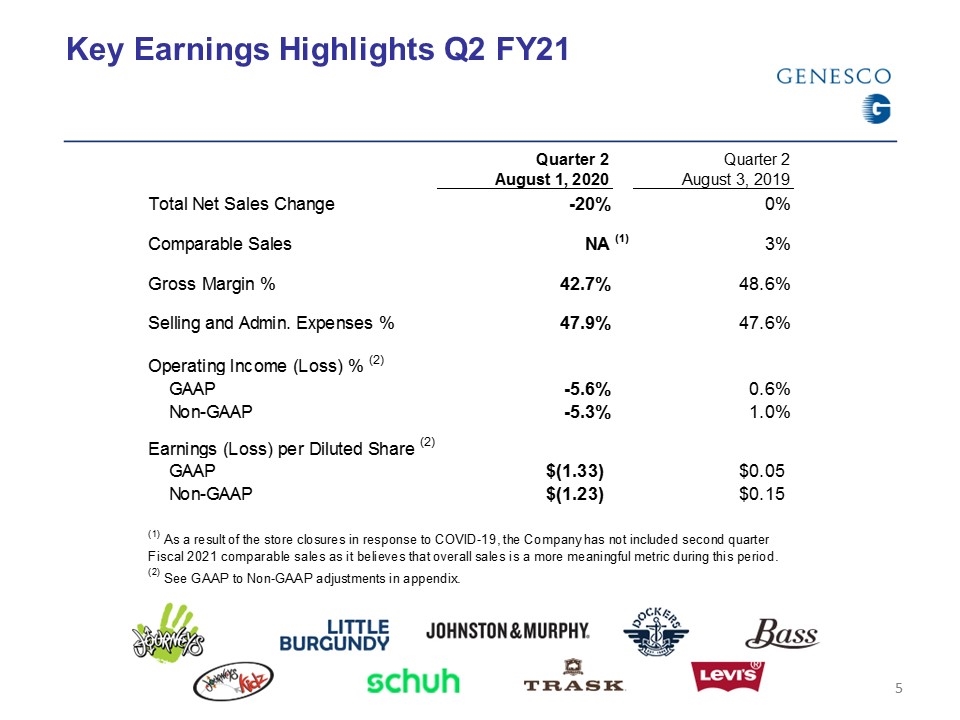

Key Earnings Highlights Q2 FY21

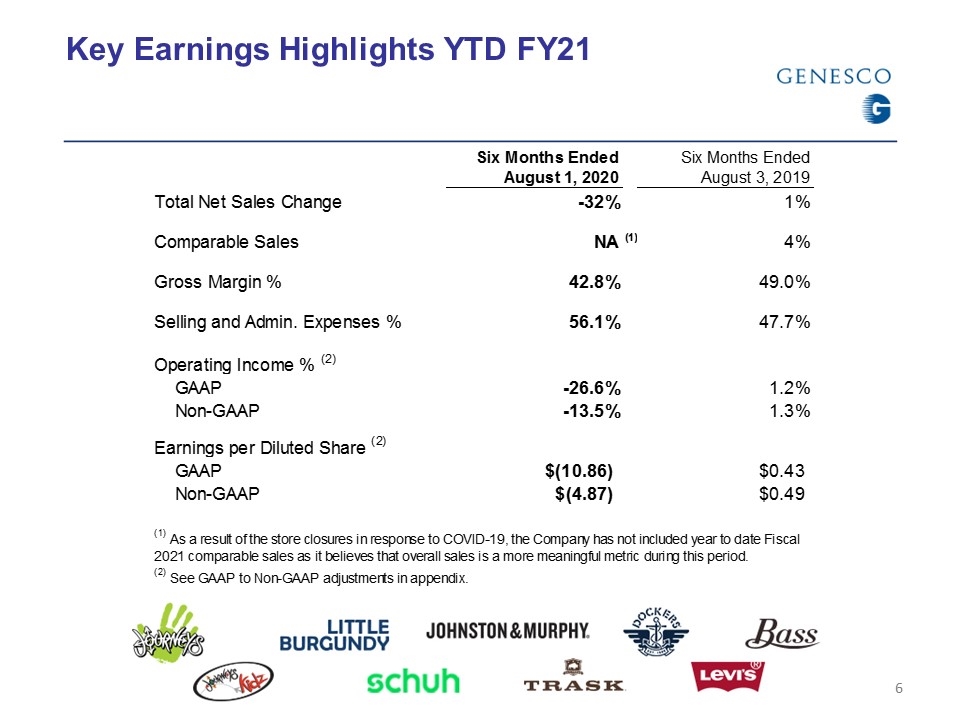

Key Earnings Highlights YTD FY21

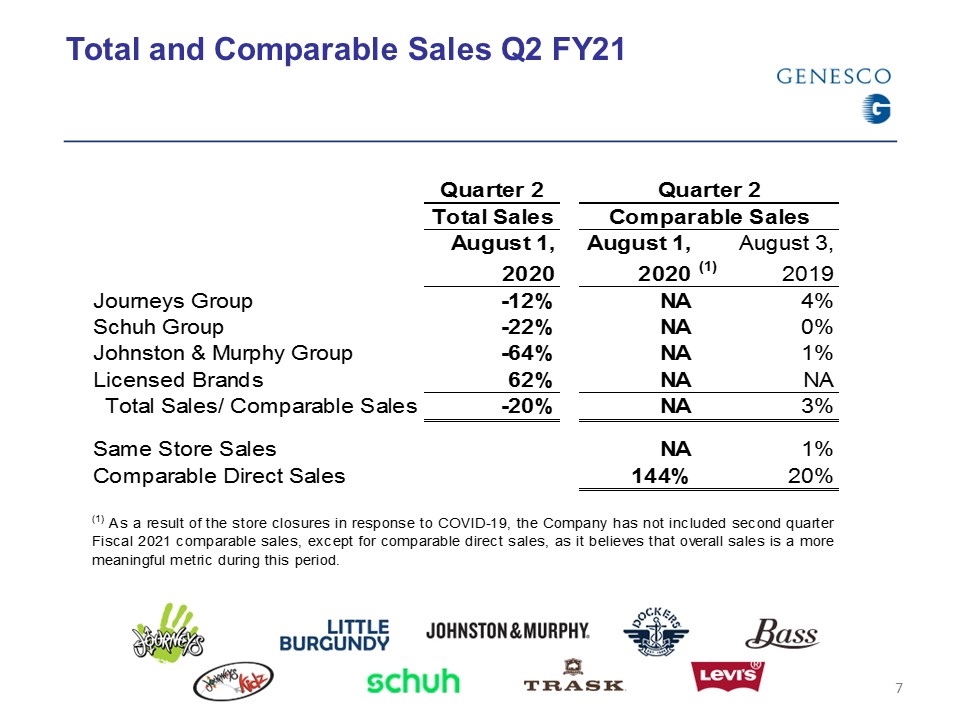

Total and Comparable Sales Q2 FY21

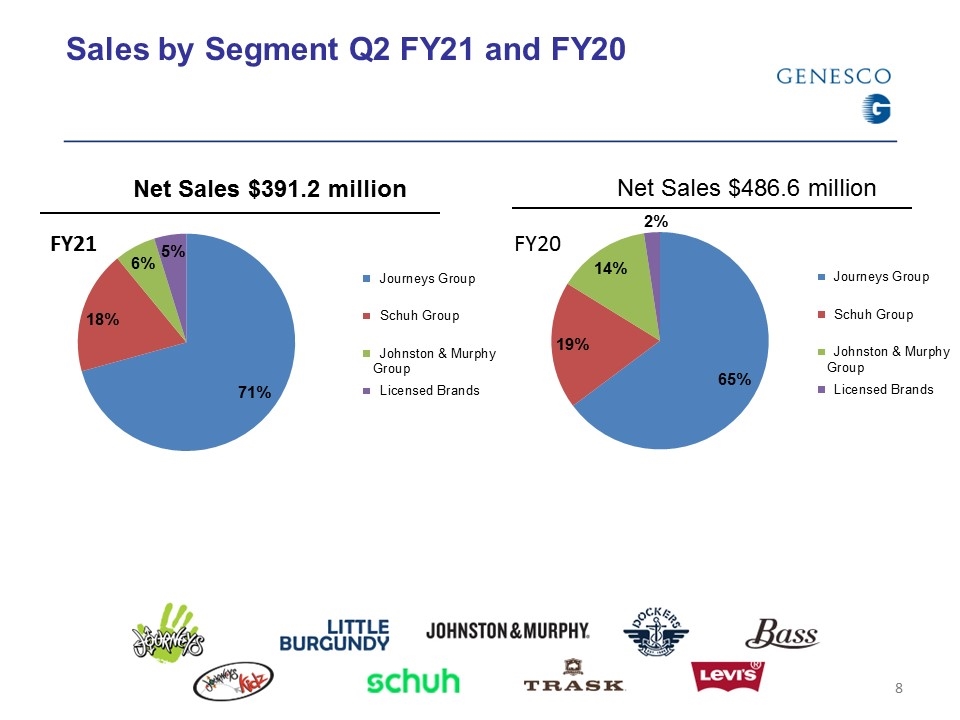

Sales by Segment Q2 FY21 and FY20 FY21 FY20

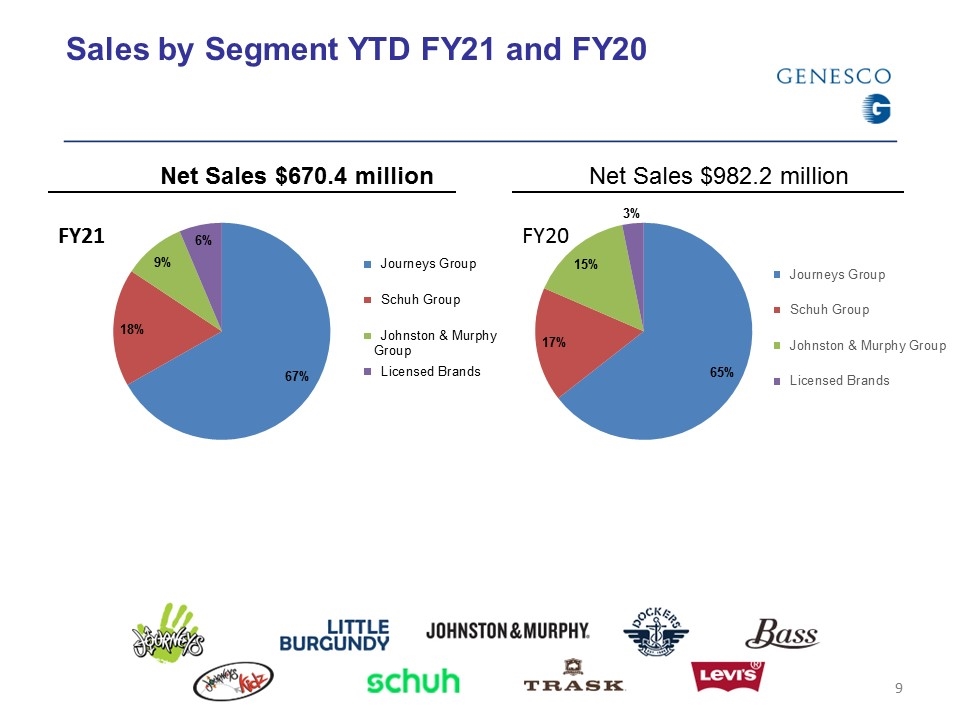

Sales by Segment YTD FY21 and FY20 FY21 FY20

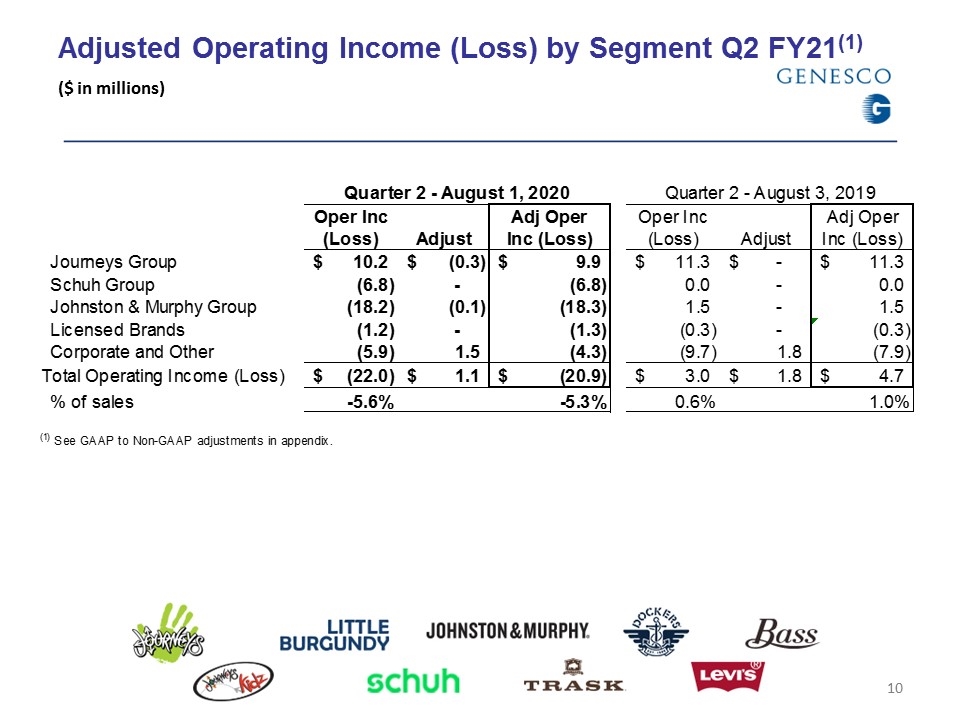

Adjusted Operating Income (Loss) by Segment Q2 FY21(1) ($ in millions)

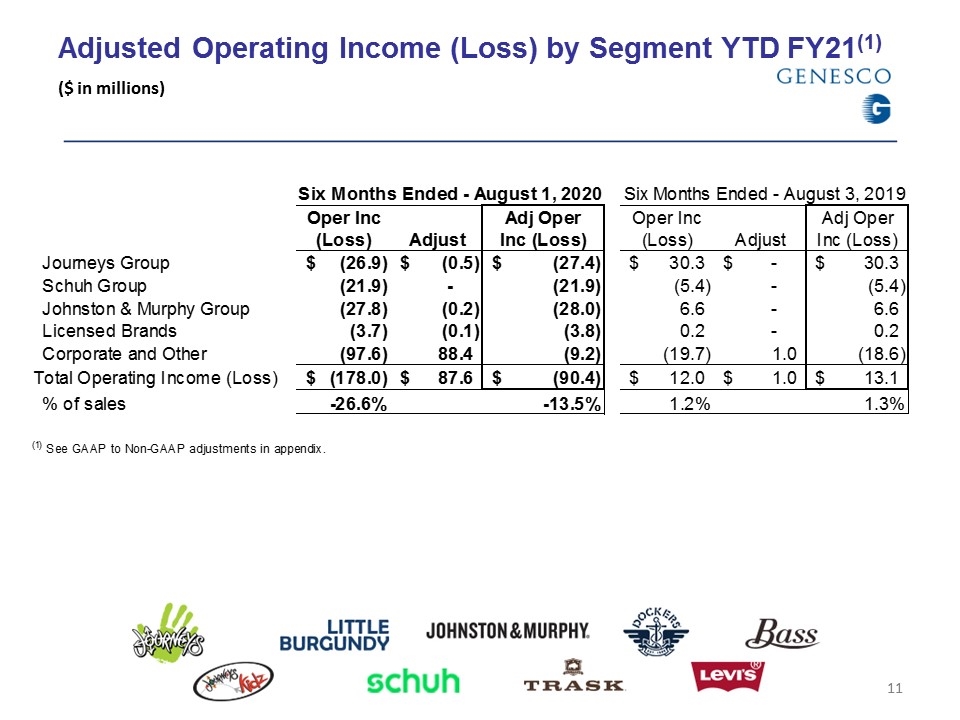

Adjusted Operating Income (Loss) by Segment YTD FY21(1) ($ in millions)

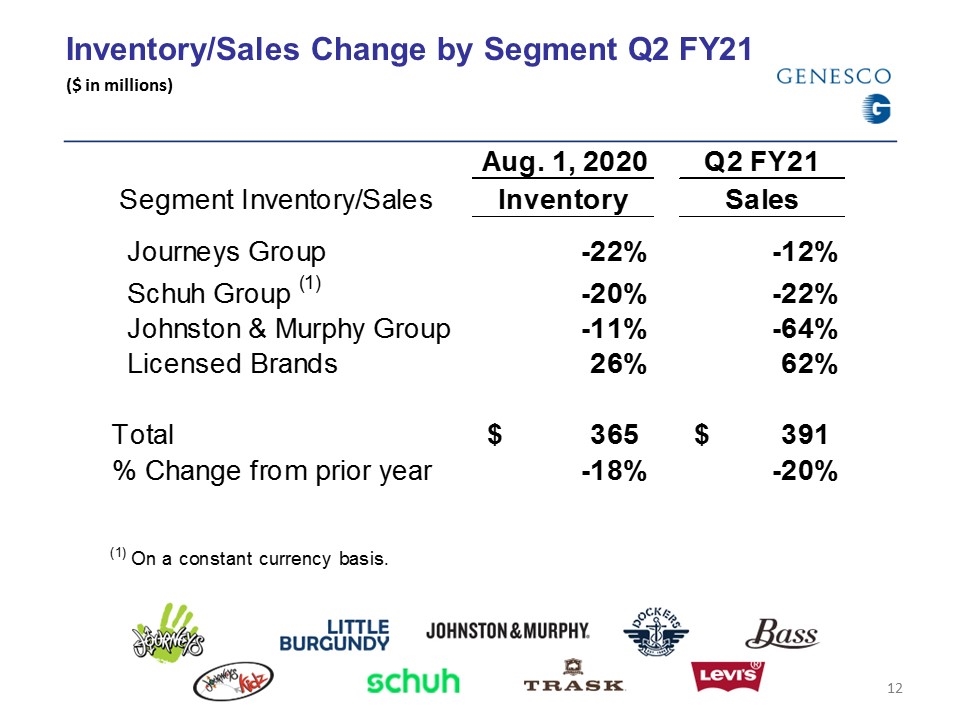

Inventory/Sales Change by Segment Q2 FY21 ($ in millions)

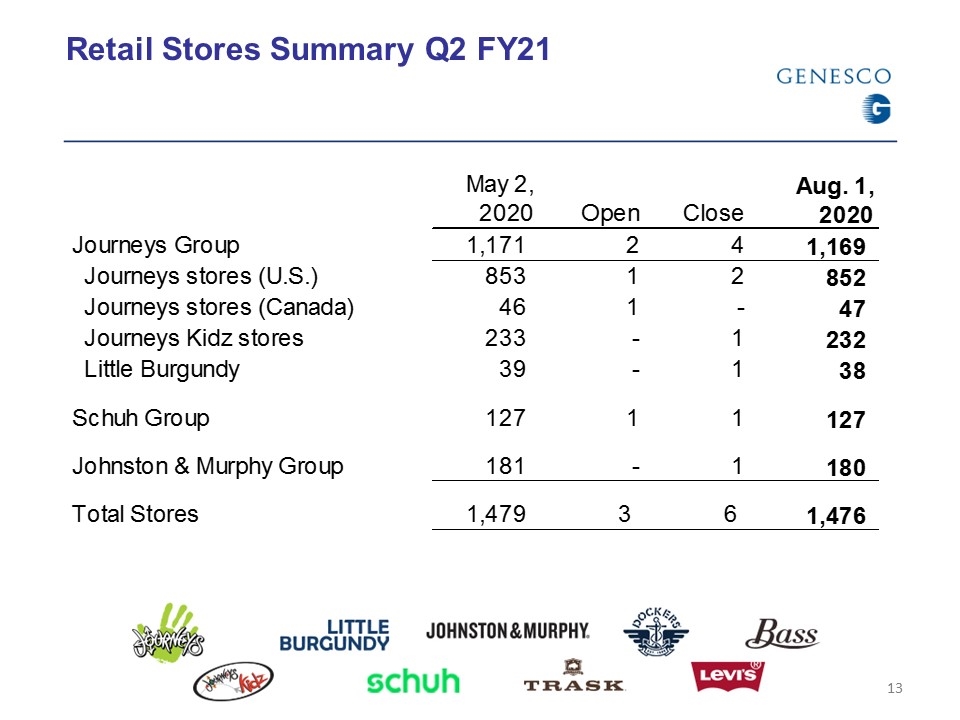

Retail Stores Summary Q2 FY21

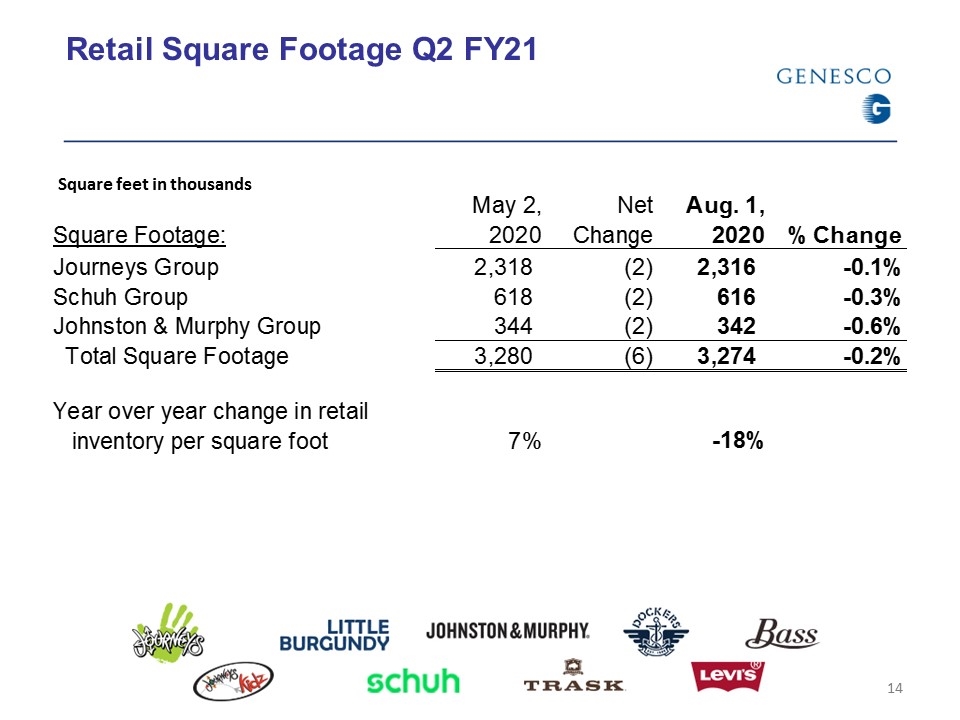

Retail Square Footage Q2 FY21 Square feet in thousands

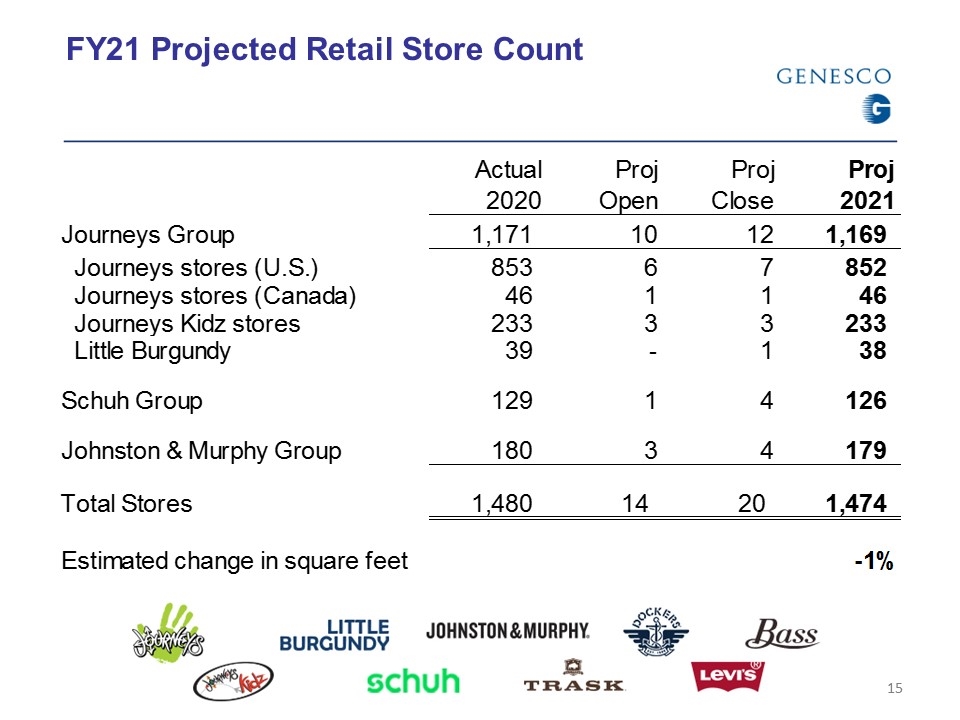

FY21 Projected Retail Store Count

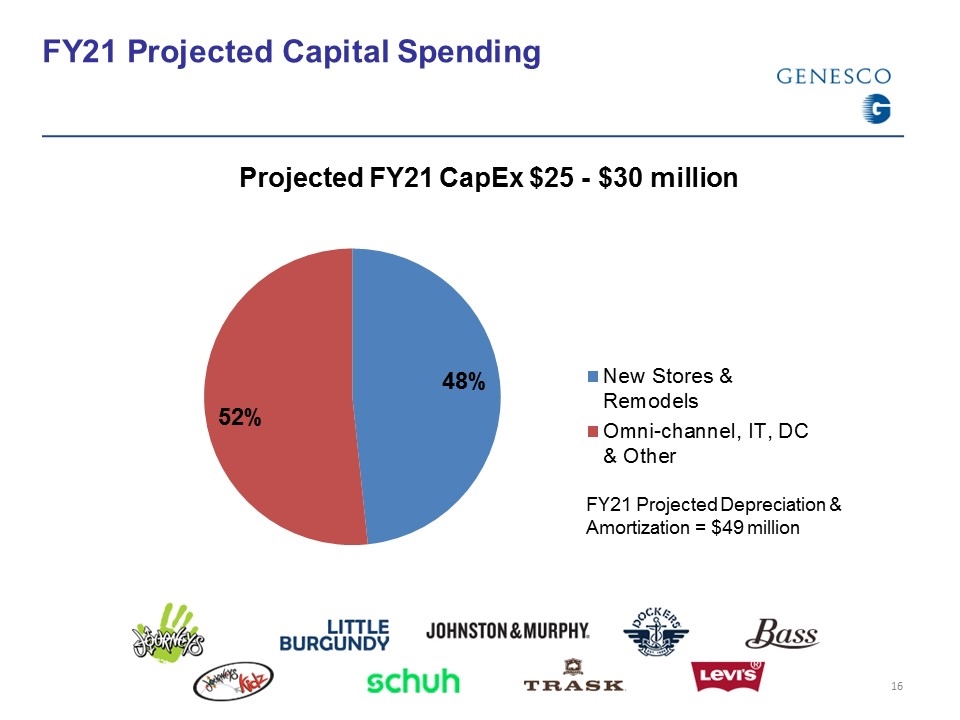

FY21 Projected Capital Spending

Appendix

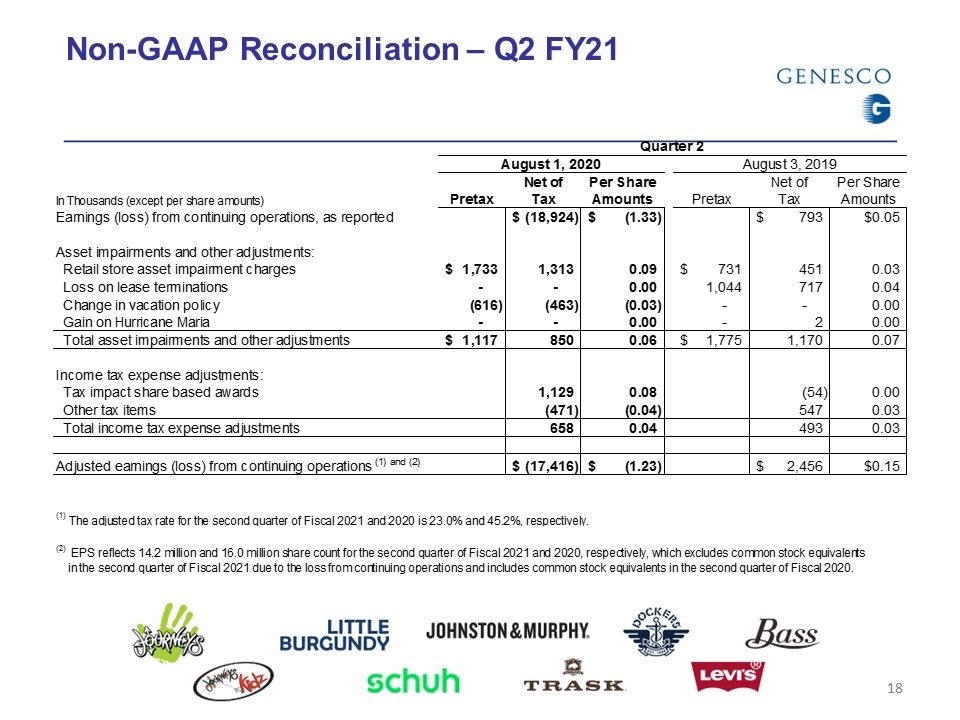

Non-GAAP Reconciliation – Q2 FY21

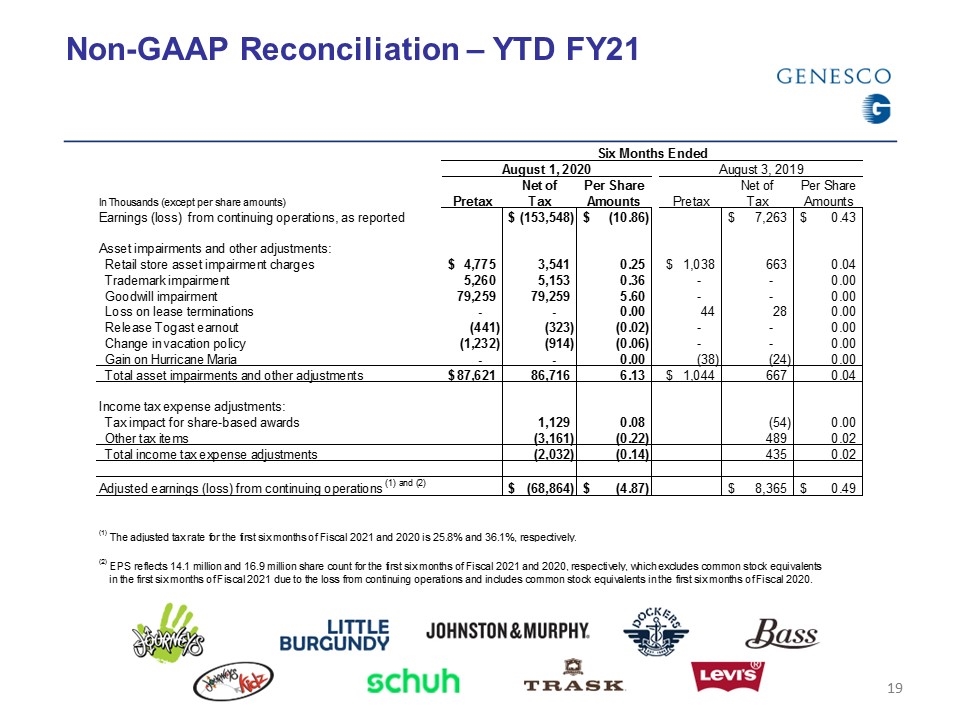

Non-GAAP Reconciliation – YTD FY21