Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek Logistics Partners, LP | dkl-20200901.htm |

Exhibit 99.1 Investor Presentation Delek Logistics Partners September 2020

Disclaimers Forward Looking Statements: Delek US Holdings, Inc. (“Delek US”) and Delek Logistics Partners, LP (“Delek Logistics”; and collectively with Delek US, “we” or “our”) are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL”, respectively. These slides and any accompanying oral and written presentations contain forward-looking statements within the meaning of federal securities laws that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning current estimates, expectations and projections about future results, performance, prospects, opportunities, plans, actions and events and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under the federal securities laws. These forward-looking statements include, but are not limited to, the statements regarding the following: financial and operating guidance for future and uncompleted financial periods; financial strength and flexibility; potential for and projections of growth; return of cash to unitholders, unit repurchases and the payment of distributions, including the amount and timing thereof; projections of distribution coverage, leverage ratios, financial flexibility and borrowing capacity; crude oil throughput; crude oil market trends, including production, quality, pricing, demand, imports, exports and transportation costs; pipeline takeaway capacity and projects related thereto; the ability to add flexibility and increase margin potential at the Krotz Springs refinery; the performance of our joint venture investments, including Red River and Wink to Webster, and the benefits, flexibility, returns and EBITDA therefrom; our ability to execute on the Big Spring Gathering System and the benefits, flexibility, returns and EBITDA therefrom; the potential for, and estimates of cost savings and other benefits from, acquisitions, divestitures, dropdowns and financing activities; retail growth and the opportunities and value derived therefrom; long-term value creation from capital allocation; execution of strategic initiatives and the benefits therefrom; and access to crude oil and the benefits therefrom. Words such as "may," "will," "should," "could," "would," "predicts," "potential," "continue," "expects," "commits," "anticipates," "future," "intends," "plans," "believes," "estimates," "appears," "projects" and similar expressions, as well as statements in future tense, identify forward-looking statements. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements: Delek Logistics’ substantial dependence on Delek US, thereby subjecting Delek Logistics to Delek US’ business risks; risks and costs relating to the age and operational hazards of our assets including, without limitation, costs, penalties, regulatory or legal actions and other effects related to releases, spills and other hazards inherent in transporting and storing crude oil and intermediate and finished petroleum products; the impact of adverse market conditions affecting the utilization of Delek Logistics’ assets and business performance, including margins generated by its wholesale fuel business; uncertainty relating to the impact of the COVID-19 outbreak on the demand for crude oil, refined products and transportation and storage services; uncertainties regarding future decisions by OPEC regarding production and pricing disputes between OPEC members and Russia; an inability of Delek US to grow as expected as it relates to our potential future growth opportunities, including dropdowns and other potential benefits; risks related to Delek US’ exposure to Permian Basin crude oil, such as supply, pricing, production and transportation capacity; gains and losses from derivative instruments; the results of our investments in joint ventures; the ability of the Wink to Webster joint venture to construct the long-haul pipeline; the ability of the Red River joint venture to expand the Red River pipeline; the ability to grow the Big Spring Gathering System; general economic and business conditions affecting the geographic areas in which we operate; adverse changes in laws including with respect to tax and regulatory matters; and other risks contained in Delek US’ and Delek Logistics’ filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results, and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics undertakes any obligation to update or revise any such forward-looking statements. Non-GAAP Disclosures: Delek US and Delek Logistics believe that the presentation of distributable cash flow (“DCF”), earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted EBITDA provide useful information to investors in assessing their financial condition, results of operations and cash flow their business is generating. DCF, EBITDA and adjusted EBITDA should not be considered as alternatives to net income, operating income, cash from operations or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. DCF, EBITDA and adjusted EBITDA have important limitations as analytical tools because they exclude some, but not all, items that affect net cash provided by operating activities and net income. Additionally, because DCF, EBITDA and adjusted EBITDA may be defined differently by other companies in its industry, Delek US' and Delek Logistics’ definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. Please see reconciliations of DCF, EBITDA and adjusted EBITDA to their most directly comparable financial measures calculated and presented in accordance with U.S. GAAP in the appendix. 2

Investment Overview • Current Distribution: $0.90/LP unit qtr.; $3.60/LP unit annualized (1); ~11% current yield (2) • Committed to growing distribution 5% year-over-year Overview (NYSE: DKL) • Improving outlook into second half of 2020; asset drop downs, asset optimization and business initiatives (example Jefferson Energy agreement) • Net Income of $44.4 million, Net cash from operating activities $37.5 million • Distributable Cash Flow $36.0 million; DCF coverage ratio 1.58x (3); already exceeded YE 2Q20 Highlights target range of 1.4 – 1.5x • EBITDA of $64.8 million (3) increased 44.9% year-over-year • Quarterly distribution increased by 5.9% year-over-year • $100 million credit available at June 30, 2020 ($45 million used in IDR simplification in 3Q) Balance Sheet • Leverage ratio below 4.1x as of June 30, 2020 (targeting below 4.0x by YE20) • Strategic focus on organic projects, supporting coverage and reducing leverage • Red River joint venture with Plains in May 2019; $128.0 million investment + approx. $16.0 million for expansion Growth Provided by Red River • Expected annualized adjusted EBITDA of $13.5 to $15.5 million pre-expansion and Business Initiatives growing to $20.0 to $25.0 million post-expansion (second half 2020) (3) • Supports additional crude flexibility in the Delek US refining system • Jefferson Energy Agreement expands Paline pipeline’s reach and visibility in supply • DK dropped Big Spring Gathering System on March 31, 2020 Recent Dropdowns of Big Spring • Expected $30 - $32 million Annual EBITDA underpinned by MVC DK to DKL(3) • DK dropped trucking assets to DKL effective May 1, 2020 Gathering and Trucking Assets • Expected $8-9 million Annual EBITDA underpinned by MRC DK to DKL(3) (1) Annualized distribution based on quarterly distribution for quarter ended June 30, 2020 paid on August 12, 2020 to unitholders of record on August 7, 2020. (2) Pricing as of 8/7/2020. (3) For reconciliation to U.S. GAAP please refer to pages 23 for distributable cash flow (“DCF”) coverage ratio, 24 for DKL EBITDA, 25 for Paline EBITDA, 26 for Red River, 27 for Big Spring Gathering, and 28 for Trucking Assets. 4

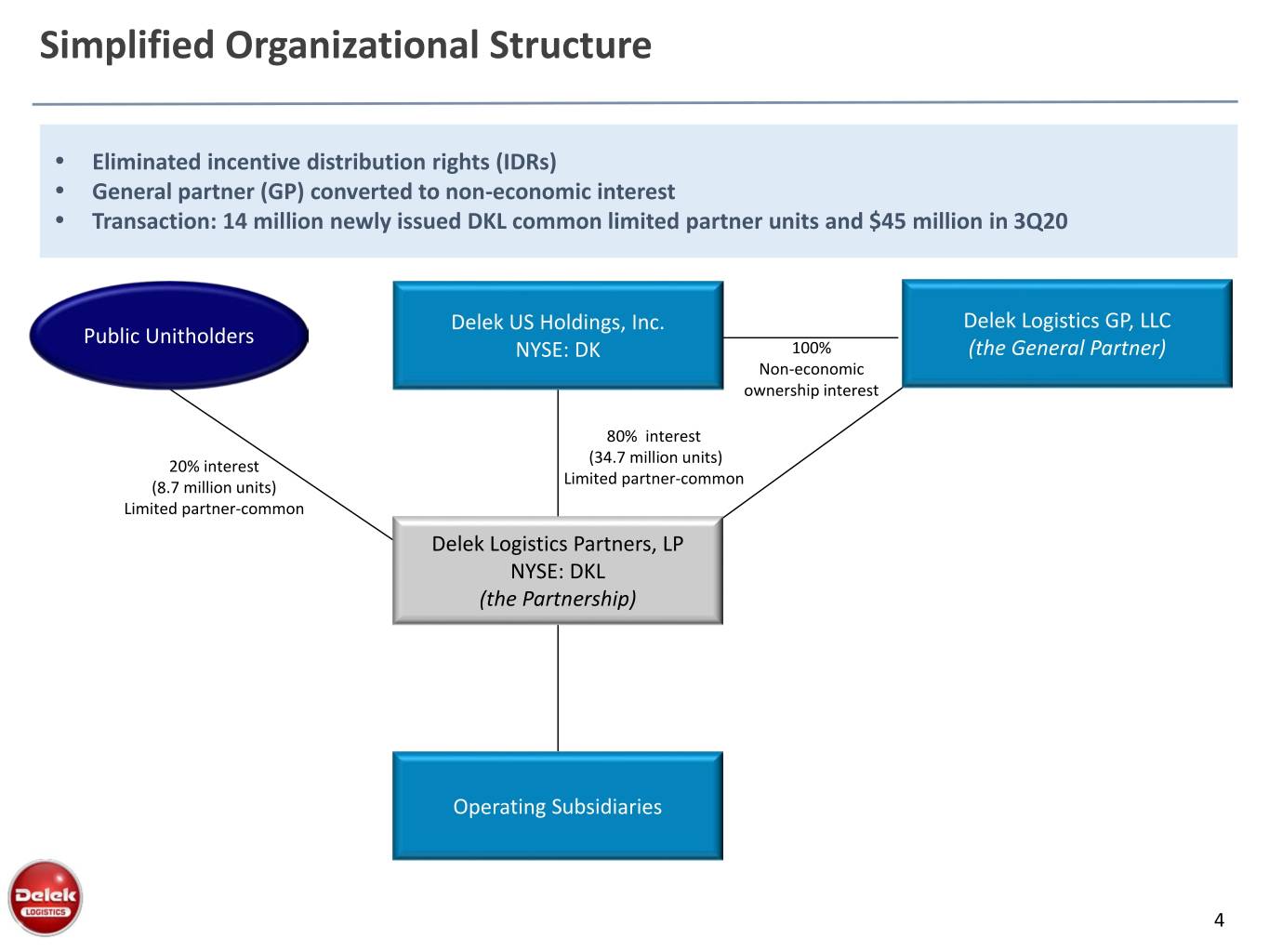

Simplified Organizational Structure • Eliminated incentive distribution rights (IDRs) • General partner (GP) converted to non-economic interest • Transaction: 14 million newly issued DKL common limited partner units and $45 million in 3Q20 Delek US Holdings, Inc. Delek Logistics GP, LLC Public Unitholders NYSE: DK 100% (the General Partner) Non-economic ownership interest 80% interest (34.7 million units) 20% interest Limited partner-common (8.7 million units) Limited partner-common Delek Logistics Partners, LP NYSE: DKL (the Partnership) Operating Subsidiaries 4

Delek US – A Growth Oriented, Financially Strong Partner Source 207,000 bpd from Permian Basin Access to Cushing; 35,000 bpd • Growing gathering system increasing to 100,000 bpd second half • Wink to Webster JV Crude oil 2020 Pipeline CADDO RIO Refining Logistics (1) Asphalt Retail Renewables 302,000 bpd in total 10 terminals 6 asphalt terminals located Approximately 253 Approximately 40m gallons . El Dorado, AR Approximately 1,550 in: stores Biodiesel production . Tyler, TX miles of pipeline 1) El Dorado, AR Southwest US locations capacity: . Big Spring, TX 10.2 million bbls of 2) Muskogee, OK West Texas wholesale 1) Crossett, AR . Krotz Springs, LA storage capacity 3) Memphis, TN marketing business 2) Cleburne, TX Crude oil supply: 262,000 West Texas wholesale 4) Big Spring, TX 3) New Albany, MS bpd WTI linked currently JV crude oil pipelines: 5) Henderson, TX Increasing crude oil RIO / Caddo/ Red River 6) Richmond Beach, optionality through Red Own ~80% of DKL WA River expansion 1) Consists of ownership in Delek Logistics. 5

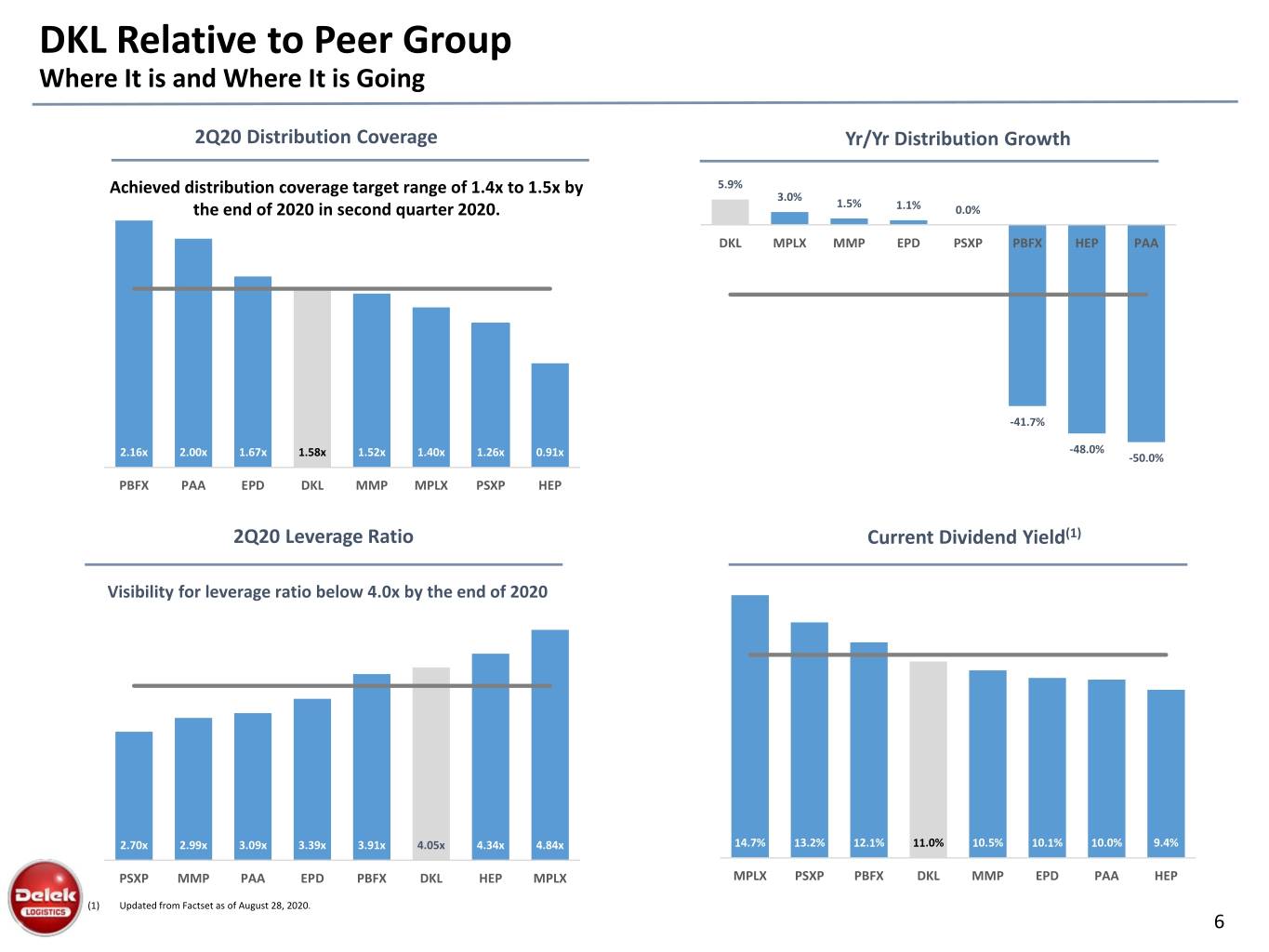

DKL Relative to Peer Group Where It is and Where It is Going 2Q20 Distribution Coverage Yr/Yr Distribution Growth 5.9% Achieved distribution coverage target range of 1.4x to 1.5x by 3.0% 1.5% the end of 2020 in second quarter 2020. 1.1% 0.0% DKL MPLX MMP EPD PSXP PBFX HEP PAA -41.7% -48.0% 2.16x 2.00x 1.67x 1.58x 1.52x 1.40x 1.26x 0.91x -50.0% PBFX PAA EPD DKL MMP MPLX PSXP HEP 2Q20 Leverage Ratio Current Dividend Yield(1) Visibility for leverage ratio below 4.0x by the end of 2020 2.70x 2.99x 3.09x 3.39x 3.91x 4.05x 4.34x 4.84x 14.7% 13.2% 12.1% 11.0% 10.5% 10.1% 10.0% 9.4% PSXP MMP PAA EPD PBFX DKL HEP MPLX MPLX PSXP PBFX DKL MMP EPD PAA HEP (1) Updated from Factset as of August 28, 2020. 6

Delek Logistics Partners, LP Overview

Logistics Assets Positioned to Benefit from Permian Basin Activity Growing logistics assets support crude sourcing and product marketing for customers Pipelines/Transportation Segment • ~805 miles (1) of crude and product transportation pipelines, including the 195 mile crude oil pipeline from Longview to Nederland, TX • ~ 600 mile crude oil gathering system in AR • Storage facilities with 10 million barrels of active shell capacity • Rail offloading facility Wholesale/Terminalling Segment • Wholesale and marketing business in west Texas • 10 light product terminals: in TX, TN, AR • Approx. 1.4 million barrels of active shell capacity (1) Includes approximately 240 miles of leased pipeline capacity. 8

Delek Permian Gathering East System Equipment DPG East System Lease Automatic Custody 45 Installations Transfer Units (LACTS) Pipeline 60 miles Tanks (bbl) 2 (50M, 300M) 9

Delek Permian Gathering West System DPG West System Equipment Lease Automatic Custody 6 Transfer Units (LACTS) Installations Pipeline 70 miles Tanks (bbl) 1 (50M) 10

Multi-Year Contracts with Firm Commitments / MVCs Duration of Contracts as of 2Q20 (1) Contract Highlights 7% 1% < 1 Year • The Lion Pipeline System and SALA Gathering System are 1 to 3 Years 36% supported by a long-term contract that includes three take- 3 to 5 Years or-pay commitments 56% > 5 Years • Initial term of 5 years, maximum term of 15 years (2) 78% of 2Q20 Gross Margin from Minimum Volume • Crude oil transportation throughput of 76 MBbl/d in Commitments (MVCs) first six months of 2020, supported by a MVC of 46 MBbl/d (3) $74 $70 $5 • Refined products transportation throughput of 55 $64 $65 $62 $60 $12 $59 $58 MBbl/d in first six months of 2020, supported by a $60 $56 $57 $13 $13 $11 $14 $11 (3) $49 $11 MVC of 40 MBbl/d $11 $11 $50 $45 $8 $8 $9 $42 $5 $4 $41 $5 $2 $3 $39 $12 $37 $37 • Crude oil gathering throughput of 13 MBbl/d in first $40 $36 $7 $13 $ in millions $1 $3 $34 $9 $3 $5 $4 $4 $4 $2 $5 six months of 2020, supported by a MVC of 14 $30 $4 $4 $3 $5 $5 MBbl/d $20 • East Texas Wholesale Marketing: contractual agreement with $10 $32 $31 $28 $28 $29 $30 $28 $27 $32 $42 $43 $43 $43 $43 $43 $44 $42 $57 DK with MVC of 50 MBbl/d $0 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 • Big Spring marketing agreement: contractual agreement with (4) (5) (6) Contracted Min Gross Margin Contracted Excess Gross Margin Uncontracted Gross Margin DK with MVC of 65 MBbl/d 1) Based on percentage of 2Q20 gross margin earned from contracts. Duration excludes automatic renewal at Delek US’ option in future periods. 2) Maximum term assumes an extension of the commercial agreement pursuant to terms thereof. Please note that some terms began as early as November 7, 2012. 3) Volumes gathered on the SALA Gathering System will not be subject to an additional fee for transportation on the Lion Pipeline System. 4) Gross margin generated from the minimum volume commitment provisions of each contract. 5) Gross margin generated by throughput volumes above the minimum volume commitment provision of each contract. 6) Gross margin generated by assets without contracts. 11

Financial Flexibility and Growing Distributable Cash Flow Solid Net Income and EBITDA performance(1) $200.0 $208.3 $178.9 $150.0 $164.0 $100.0 $115.0 $124.4 $97.3 $96.8 $in millions $90.2 $50.0 $62.8 $69.4 $0.0 (3) 2016 2017 2018 2019 2020 LTM Net Income EBITDA DCF supports distribution growth(2) Financial Flexibility to support continued growth $180.0 $1,200 $160.0 $1,100 $159.2 $1,000 $165.0 $100.0 $140.0 $316.8 $253.0 $253.7 $261.6 $900 $393.3 $388.8 $120.0 $800 $205.3 $206.1 $121.6 $126.9 $100.0 $700 $511.1 $600 $750.0 $597.7 $685.0 $80.0 $533.2 $596.3 $588.4 $83.0 $85.0 $500 $494.7 $493.9 $456.7 $461.2 $in millions $60.0 $in millions $400 $179.9 $40.0 $300 $200 $20.0 $100 $242.7 $243.0 $243.3 $243.5 $243.7 $244.0 $253.3 $244.5 $244.7 $245.0 $245.2 $0.0 $0 (3) 2016 2017 2018 2019 2020 LTM Distributable Cash Flow Revolver Excess Capacity Revolver Borrowings $250 million 6.75% Sr. Notes (net of discount/fees) 1) Reconciliation of EBITDA to Net Income provided on page 24. Excluded are predecessor costs related to the crude oil storage tank and rail offloading racks acquired in March 2015. 2) Reconciliation of distributable cash flow to net cash from operating activities on page 23. 3) Last 12 months as of June 30, 2020. 12

Increased Distribution with Conservative Coverage and Leverage Distribution per unit has increased twenty-nine consecutive times since the IPO $0.385 $0.395 $0.405 $0.415 $0.425 $0.475 $0.490 $0.510 $0.530 $0.550 $0.570 $0.590 $0.610 $0.630 $0.655 $0.680 $0.690 $0.705 $0.715 $0.725 $0.750 $0.770 $0.790 $0.810 $0.820 $0.850 $0.880 $0.885 $0.890 $0.900 (1) 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Distributable Cash Flow Coverage Ratio (2)(3)(4) Avg. 1.68x in 2014 Avg. 1.35x in 2015 Avg. 1.35x in 2013 Avg. 1.11x in 2016 Avg. 1.19x in 2018 Avg. 0.97x in 2017 Avg. 1.08x in 2019 1.39x 1.32x 1.35x 1.30x 1.61x 2.02x 1.42x 1.67x 1.25x 1.49x 1.47x 1.18x 1.20x 1.29x 0.98x 1.00x 0.88x 1.06x 0.97x 0.96x 1.14x 1.34x 1.25x 1.03x 1.06x 1.08x 1.11x 1.08x 1.15x 1.58x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Leverage Ratio (4) 1.70x 1.58x 2.28x 2.40x 3.21x 2.69x 2.55x 2.56x 3.00x 3.14x 3.11x 3.49x 3.48x 3.47x 3.70x 3.85x 3.83x 3.88x 3.72x 3.77x 4.60x 4.44x 4.53x 4.08x 4.17x 4.60x 4.60x 4.43x 4.15x 4.05x 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 1) MQD = minimum quarterly distribution set pursuant to the Partnership Agreement. 2) Distribution coverage based on distributable cash flow divided by distribution amount in each period. Please see reconciliations starting on page 23. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 4) Leverage ratio based on LTM EBITDA as defined by credit facility covenants for respective periods. 13

DKL Asset & Joint Venture Detail

Joint Venture Pipeline Projects Create platforms for future growth; Ability to leverage Permian position RIO Pipeline (Delaware Basin) • MPLX (67%)/ Delek Logistics (33%) • Cost: $119 million • Capacity: 80,000 Bbl/d • Length: 109 miles • Completed: September 2016 • Benefiting from increased drilling activity in the area; offers connection to Midland takeaway pipelines Caddo Pipeline • Delek Logistics (50%)/Plains Pipeline L.P. (50%) • Cost: $123 million • Capacity: 80,000 Bbl/d • Length: 80 miles • Completed: January 2017 • Provides additional logistics support to El Dorado refinery with third crude supply source • Delek US is an anchor shipper on both projects 15

Midstream: Red River Pipeline Joint Venture Red River Pipeline JV DKL purchased 33% interest in May 2019 Planned expansion from 150 kbpd to 235 kbpd . Approx. $128.0 million initial investment; Financed with revolver Expected completion in second half of 2020 . DKL will contribute $20.0 million to the expansion, of which $3.5 Delek US is a major shipper on pipeline; increased million was included in initial investment in May 2019 crude oil optionality Expected annualized adjusted EBITDA . Expected $13.5 to $15.5 million annualized adjusted EBITDA(1) pre- expansion . Increases to $20.0 to $25.0 million annualized adjusted EBITDA(1) post-expansion second half 2020 Delek US is a major shipper on pipeline; increased crude oil optionality . Increasing by 65,000 bpd to 100,000 bpd following expansion; . Incremental 24 million bbls/yr of Cushing crude oil into Longview, TX . From Longview, TX DKL access to: Delek US refining system; Ability to reduce dependence on Midland crude oil at Tyler, El Dorado and Krotz Springs Gulf Coast markets through Paline and other third party pipelines Longview Increases potential WTI-Brent exposure with limited cost to the company 1) Please see page 26 for a reconciliation of forecast incremental annualized net income to forecast incremental annualized adjusted EBITDA. 16

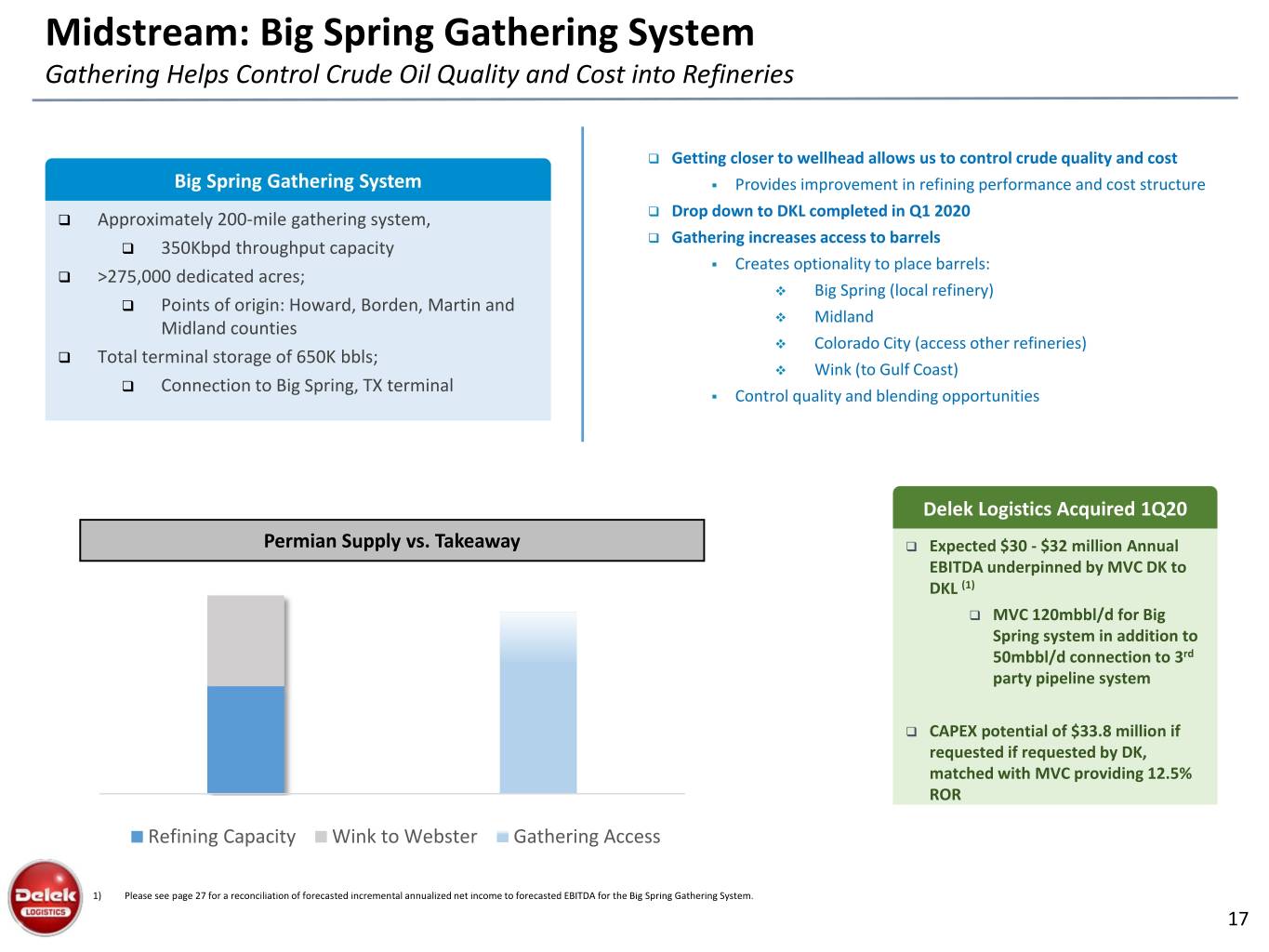

Midstream: Big Spring Gathering System Gathering Helps Control Crude Oil Quality and Cost into Refineries Getting closer to wellhead allows us to control crude quality and cost Big Spring Gathering System . Provides improvement in refining performance and cost structure Approximately 200-mile gathering system, Drop down to DKL completed in Q1 2020 Gathering increases access to barrels 350Kbpd throughput capacity . Creates optionality to place barrels: >275,000 dedicated acres; Big Spring (local refinery) Points of origin: Howard, Borden, Martin and Midland Midland counties Colorado City (access other refineries) Total terminal storage of 650K bbls; Wink (to Gulf Coast) Connection to Big Spring, TX terminal . Control quality and blending opportunities Delek Logistics Acquired 1Q20 Permian Supply vs. Takeaway Expected $30 - $32 million Annual EBITDA underpinned by MVC DK to DKL (1) MVC 120mbbl/d for Big Spring system in addition to 50mbbl/d connection to 3rd party pipeline system CAPEX potential of $33.8 million if requested if requested by DK, matched with MVC providing 12.5% ROR Refining Capacity Wink to Webster Gathering Access 1) Please see page 27 for a reconciliation of forecasted incremental annualized net income to forecasted EBITDA for the Big Spring Gathering System. 17

MidstreamMidstream:: UtilizingUtilizing Free Free Cash Cash Flow Flow & Strong & Strong Balance Balance Sheet toSheet Fund toGrowth Fund Growth Supports goal to generate approximately $370 million to $395 million of annualized midstream adjusted EBITDA by ’23 Supports goal to generate approximately $370 million to $395 million of annualized midstream adjusted EBITDA by ’23 Strong Adjusted EBITDA Growth Profile from Midstream Initiatives (1) ($ in millions) $95-$110 $370-$395 Delek US announced goal to achieve midstream target by 2023 $30-$34 $8.0 – $9.0 $22.5-$24.5 $6.5 – $9.5 $208 Delek Logistics provides platform to unlock logistics value LTM EBITDA LTM JV River Red Gathering Trucking Springs Krotz Midstream Adj. EBITDA Adj. Big Spring Big Annualized Midstream Expansion Potential projects growth 6/30/20 Other Assets Total Post (2) (2) (2) (4) (3) (4) (2) (2) Red River Joint Venture (2) Big Spring Gathering Trucking Krotz Springs Midstream Midstream Growth Projects •Post Expansion: Increases to •$30 - $32 million EBITDA •$8 to $9 million EBITDA / year (2) Assets by 2023: (2) $20.0 to $25.0 million annualized underpinned by MVC DK to DKL •$30 to $34 million EBITDA / year(2) •Other organic midstream growth adjusted EBITDA (second half •MVC 120mbbl/d for Big Spring projects being invested in by 2020 completion) system in addition to 50mbbl/d strong sponsor DK rd connection to 3 party pipeline •Wink to Webster Long Haul system •Other organic growth 1) Information for illustrative purposes only to show potential based on estimated dropdown assets listed. Actual amounts will vary based on market conditions, which assets are dropped, timing of dropdowns, actual performance of the assets and Delek Logistics in the future. Expected amounts adjusted for what is captured in the LTM period. 2) Please see pages 26, 27, and 29 for a reconciliation of forecasted EBITDA or adjusted EBITDA to forecasted net income for the Red River joint venture, Big Spring Gathering, trucking and Krotz Springs midstream assets, respectively. 3) Please see page 24 for reconciliation of Delek Logistics net income to EBITDA. 4) We are unable to provide a reconciliation of this forward-looking estimate of adjusted EBITDA because certain information needed to make a reasonable forward-looking estimate of net income is difficult to estimate and dependent on future events, which are uncertain or outside of our control, including with respect to unknown construction timing, unanticipated construction costs and other potential variables. Accordingly, a reconciliation to net income as the most comparable GAAP measure is not available without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of EBITDA 18 adjusted projected.

Several Visible Pathways for Growth Focused around developing Permian platform; Growing logistics asset base at sponsor Ability to Leverage Relationship with Delek US • Permian-based refining system with 207,000 bpd of Permian crude access (1) Midstream • Big Spring Gathering System in the Permian Basin (asset dropped to DKL end of 1Q20) Growth • Wink to Webster long haul crude oil pipelines joint venture investment Initiatives • Krotz Springs midstream assets Benefit from • High utilization rates at refineries support DKL volumes; Potential improvement in throughput capability Operations and/or flexibility at Delek US’ refineries can be supported by DKL logistics assets Financial Flexibility provides ability to be opportunistic to develop platform • $100 million of availability at June 30, 2020 on $850 million revolving credit facility Balance Sheet • Leverage ratio was 4.1x at end of 2Q20 Supportive • Focus on organic growth and supporting coverage after recent drops and IDR simplification • Acquired 33% interest in Red River pipeline joint venture from Plains Pipeline, L.P. in May 2019 Acquisitions • Connects platform to Cushing, Oklahoma into Longview, Texas; increases Delek US crude flexibility • Expanding Red River pipeline 2H20; Evaluate Paline Pipeline capacity Organic Growth • Focus on incremental improvements in existing asset base Opportunities • Delek US’ Midstream buildout provides future growth opportunities Focus on continued distribution growth Distribution • Driven by organic growth at DKL and potential increased drop down inventory at sponsor (1) Please see page 4 for additional information related to Delek US’ position in the Permian. 19

2021 Valuation Below Peer EV-to-EBITDA DKL’s financial flexibility and growth initiatives of strong sponsor DK positions it for growth EV/EBITDA 12.0x 10.0x 8.0x 6.0x 4.0x 2.0x 0.0x DKL HEP MPLX PBFX PSXP PAA NS MMP ET EPD 2020 2021 20 Avg 21 Avg (1) Based on Factset as of August 28, 2020. 20

Majority of assets support Primarily traditional, stable Delek US’ strategically MLP assets with limited located inland refining commodity price exposure system Balance sheet positioned Inflation-indexed fees for to grow with strong most contracts sponsor DK Majority of all margin Agreements with Delek US generated by long term, related to capex/opex fee-based contracts with reimbursement volume minimums

Appendix

DKL: Reconciliation of Distributable Cash Flow (dollars in millions, except coverage) 2013 (2) 1Q14 (2) 2Q14(2) 3Q14(2) 4Q14(2) 2014 (2) 1Q15(2) 2Q15 3Q15 4Q15 2015 (2)(3) 1Q16 2Q16 3Q16 4Q16 2016 (3) Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $49.4 $14.4 $31.2 $20.1 $20.8 $86.6 $15.8 $30.8 $20.2 $1.3 $68.0 $26.4 $31.2 $29.2 $13.9 $100.7 Accretion of asset retirement obligations (0.2) (0.1) (0.1) (0.1) 0.0 (0.2) (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.3) Deferred income taxes (0.3) 0.0 (0.1) (0.0) 0.2 0.1 (0.2) 0.2 0.0 0.0 (0.0) - - - 0.2 0.2 Gain (Loss) on asset disposals (0.2) - (0.1) - (0.0) (0.1) (0.0) 0.0 - (0.1) (0.1) 0.0 - (0.0) - 0.0 Changes in assets and liabilities 8.3 3.4 (6.0) (1.6) 3.0 (1.2) 3.3 (7.3) 3.6 20.5 20.1 (5.4) (7.1) (10.0) 7.7 (14.9) Distributions from equity method investments Maint. & Reg. Capital Expenditures (5.1) (0.8) (1.0) (0.8) (3.9) (6.5) (3.3) (3.9) (3.5) (2.7) (13.4) (0.7) (0.9) (0.7) (3.6) (5.9) Reimbursement for Capital Expenditures 0.8 - - - 1.6 1.6 1.6 1.8 2.0 0.2 5.5 0.2 0.2 0.4 2.4 3.3 Distributable Cash Flow $52.9 $17.0 $24.0 $17.7 $21.8 $80.3 $17.1 $21.4 $22.2 $19.0 $79.8 $20.4 $23.3 $18.8 $20.6 $83.0 Distribution Coverage Ratio (1) 1.35x 1.61x 2.02x 1.42x 1.67x 1.68x 1.25x 1.49x 1.47x 1.18x 1.35x 1.20x 1.29x 0.98x 1.00x 1.11x Total Distribution (1) $39.3 $10.5 $11.9 $12.4 $13.1 $47.9 $13.7 $14.4 $15.1 $16.1 $59.3 $17.1 $18.1 $19.3 $20.5 $75.0 (dollars in millions, except coverage) 1Q17 2Q17 3Q17 4Q17 (3) 2017(3) 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 3Q19 4Q19 2019 1Q20 2Q20 Reconciliation of Distributable Cash Flow to net cash from operating activities Net cash provided by operating activities $23.5 $23.9 $30.5 $9.8 $87.7 $23.7 $28.0 $6.0 $90.4 $148.0 $26.2 $24.1 $34.3 $45.8 $130.4 $34.8 $37.5 Accretion of asset retirement obligations (0.1) (0.1) (0.1) (0.1) (0.3) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) (0.1) (0.1) (0.4) (0.1) (0.1) Deferred income taxes - (0.1) (0.0) 0.3 0.1 - - - (0.2) (0.2) - - (0.1) (0.6) (0.7) (1.3) (0.9) Gain (Loss) on asset disposals (0.0) 0.0 0.0 0.0 0.0 (0.1) 0.1 (0.7) (0.2) (0.9) (0.0) 0.0 0.1 0.1 0.2 0.1 - Changes in assets and liabilities (3.6) 0.9 (8.5) 14.6 3.4 3.7 6.2 28.1 (59.9) (21.9) 3.2 7.8 3.2 (14.8) (0.6) 5.6 19.3 Non-cash lease expense - - - - - (1.0) (0.4) (1.1) 2.4 (0.2) (2.9) (0.4) Distributions from equity method investments 0.3 0.2 1.2 0.8 - - - 0.8 0.1 1.6 Maint. & Reg. Capital Expenditures (2.2) (2.1) (0.7) (4.4) (9.4) (0.3) (1.0) (2.4) (3.5) (7.2) (0.8) (1.0) (3.7) (2.9) (8.5) (0.9) (0.1) Reimbursement for Capital Expenditures 0.9 0.5 0.4 1.7 3.5 0.4 0.3 1.3 0.9 2.9 0.7 0.7 1.2 3.2 5.8 0.0 0.0 Distributable Cash Flow $18.4 $23.0 $21.6 $21.9 $85.0 $27.3 $33.5 $32.4 $27.6 $121.5 $29.0 $31.2 $33.7 $33.0 $126.9 $35.5 $57.0 Distribution Coverage Ratio (1) 0.88x 1.06x 0.97x 0.96x 0.97x 1.14x 1.34x 1.25x 1.02x 1.19x 1.06x 1.08x 1.11x 1.08x 1.08x 1.15x 1.58x Total Distribution (1) $21.0 $21.8 $22.3 $22.8 $87.9 $24.0 $25.0 $26.0 $26.9 $101.9 $27.4 $28.9 $30.3 $30.6 $117.3 $30.9 $36.0 1) Distribution based on actual amounts distributed during the periods; does not include LTIP accrual. Coverage is defined as cash available for distribution divided by total distribution. 2) Results in 2013, 2014 and 2015 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 3) In 4Q17, the reimbursed capital expenditure amounts in the determination of distributable cash flow were revised to reflect the accrual of reimbursed capital expenditures from Delek US rather than the cash amounts received for reimbursed capital expenditures during the years ended December 31, 2017, 2016 and 2015. 23 Note: May not foot due to rounding and annual adjustments that occurred in year-end reporting.

DKL: Income Statement and Non-GAAP EBITDA Reconciliation 2013(1) 1Q14(1) 2Q14 3Q14 4Q14 2014 (1) 1Q15(2) 2Q15 3Q15 4Q15 2015(2) 1Q16 2Q16 3Q16 4Q16 2016 Net Revenue $907.4 $203.5 $236.3 $228.0 $173.3 $841.2 $143.5 $172.1 $165.1 $108.9 $589.7 $104.1 $111.9 $107.5 $124.7 $448.1 Cost of Sales (811.4) (172.2) (196.6) (194.1) (134.3) (697.2) (108.4) (132.5) (124.4) (71.0) (436.3) (66.8) (73.1) ($73.5) ($88.8) (302.2) Operating Expenses (excluding depreciation and amortization presented below) (25.8) (8.5) (9.5) (10.2) (9.7) (38.0) (10.6) (10.8) (11.6) (11.7) (44.8) (10.5) (8.7) ($9.3) ($8.8) (37.2) Depreciation and Amortization Contribution Margin $70.3 $22.8 $30.2 $23.7 $29.3 $106.0 $24.5 $28.8 $29.1 $26.2 $108.6 $26.8 $30.0 $24.7 $27.2 $108.7 Operating Expenses (excluding depreciation and amortization presented below) Depreciation and Amortization (10.7) (3.4) (3.5) (3.7) (3.9) (14.6) (4.0) (4.7) (4.5) (5.9) (19.2) (5.0) (4.8) ($5.4) ($5.6) (20.8) General and Administration Expense (6.3) (2.6) (2.2) (2.5) (3.3) (10.6) (3.4) (3.0) (2.7) (2.3) (11.4) (2.9) (2.7) ($2.3) ($2.3) (10.3) Gain (Loss) on Asset Disposal (0.2) - (0.1) - - (0.1) - - - (0.1) (0.1) 0.0 - ($0.0) $0.0 0.0 Operating Income $53.2 $16.8 $24.4 $17.5 $22.1 $80.8 $17.1 $21.1 $21.8 $17.9 $77.9 $19.0 $22.5 $17.0 $19.2 $77.7 Interest Expense, net (4.6) (2.0) (2.3) (2.2) (2.1) (8.7) (2.2) (2.6) (2.8) (3.0) (10.7) (3.2) (3.3) ($3.4) ($3.7) (13.6) (Loss) Income from Equity Method Invesments (0.1) (0.3) (0.1) (0.6) (0.2) (0.2) ($0.3) ($0.4) (1.2) Income Taxes (0.8) (0.1) (0.3) (0.2) 0.5 (0.1) (0.3) (0.1) (0.1) 0.6 0.2 (0.1) (0.129) ($0.1) $0.3 (0.1) Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 EBITDA: Net Income $47.8 $14.7 $21.8 $15.1 $20.5 $72.0 $14.6 $18.3 $18.6 $15.3 $66.8 $15.4 $18.9 $13.2 $15.3 $62.8 Income Taxes 0.8 0.1 0.3 0.2 (0.5) 0.1 0.3 0.1 0.1 (0.6) (0.2) 0.1 0.1 0.13 (0.28) 0.1 Depreciation and Amortization 10.7 3.4 3.5 3.7 3.9 14.6 4.0 4.7 4.5 5.9 19.2 5.0 4.8 5.4 5.6 20.8 Amortization of customer contract intangible assets - - - - - - - - - - - - - - - - Interest Expense, net 4.6 2.0 2.3 2.2 2.1 8.7 2.2 2.6 2.8 3.0 10.7 3.2 3.3 3.4 3.7 13.6 EBITDA $63.8 $20.2 $27.9 $21.2 $26.1 $95.4 $21.1 $25.7 $26.1 $23.6 $96.5 $23.7 $27.1 $22.0 $24.4 $97.3 1Q17 2Q17 3Q17 4Q17 2017 1Q18 2Q18 3Q18 4Q18 2018 1Q19 2Q19 3Q19 4Q19 2019 1Q20 2Q20 Net Revenue $129.5 $126.8 $130.6 $151.2 $538.1 $167.9 $166.3 $164.1 $159.3 $657.6 $152.5 $155.3 $137.6 $138.6 $584.0 $163.4 $117.6 Cost of Sales (92.6) (85.0) ($89.1) ($106.1) (372.9) (119.0) (106.0) ($105.6) ($98.4) (429.1) ($96.3) ($93.9) ($72.6) ($73.8) (336.5) ($101.3) ($43.9) Operating Expenses (excluding depreciation and amortization presented below) (10.4) (10.0) (10.7) (12.3) (43.3) (12.6) (14.9) (14.5) (15.4) (57.4) (15.3) (16.5) (17.5) (22.0) (71.3) (14.0) (11.6) Depreciation and Amortization (6.3) (5.8) (12.1) (6.1) (6.2) (6.1) (6.4) (24.9) (5.8) (8.2) Contribution Margin $26.5 $31.8 $30.8 $32.8 $121.9 $36.3 $45.3 $37.8 $39.6 $159.1 $34.8 $38.8 $41.3 $36.4 $151.3 $42.4 $53.9 Operating Expenses (excluding depreciation and amortization presented below) (0.9) (0.4) (1.3) (0.8) (0.8) (0.9) (0.3) (2.8) (0.8) (0.8) Depreciation and Amortization (5.2) (5.7) (5.5) (5.5) (21.9) (6.0) (7.0) (0.5) (0.4) (13.9) (0.5) (0.5) (0.5) (0.5) (1.8) (0.5) (0.5) General and Administration Expense (2.8) (2.7) (2.8) (3.6) (11.8) (3.0) (3.7) (3.1) (7.4) (17.2) (4.5) (5.3) (5.3) (5.8) (20.8) (6.1) (4.7) Gain (Loss) on Asset Disposal 0.0 0.0 (0.0) (0.0) (0.0) - 0.1 (0.7) (0.2) (0.8) (0.0) 0.0 0.1 (0.1) (0.0) 0.1 - Operating Income $18.5 $23.4 $22.6 $23.7 $88.1 $27.3 $34.7 $32.6 $31.1 $125.8 $29.1 $32.3 $34.7 $29.7 $125.8 $35.0 $47.9 Interest Expense, net (4.1) (5.5) (7.1) (7.3) (23.9) (8.1) (10.9) (11.1) (11.2) (41.3) (11.3) (11.4) (12.5) (12.2) (47.3) (11.8) (10.7) (Loss) Income from Equity Method Invesments 0.2 1.2 1.6 1.9 5.0 0.8 1.9 1.9 1.5 6.2 2.0 4.5 8.4 5.0 19.8 5.6 6.5 Other (Expense) Income - - - - - - - - - - - (0.5) - (0.1) (0.6) - 0.0 Income Taxes (0.1) (0.1) (0.2) 0.6 0.2 (0.1) (0.1) (0.1) (0.2) (0.5) (0.1) (0.1) (0.1) (0.7) (1.0) (1.0) 0.7 Net Income $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 $30.5 $21.7 $96.8 $27.8 $44.4 EBITDA: Net Income $14.6 $19.0 $16.9 $18.9 $69.4 $20.0 $25.6 $23.3 $21.3 $90.2 $19.7 $24.9 $30.5 $21.7 $96.8 $27.8 $44.4 Income Taxes 0.1 0.1 0.2 ($0.6) (0.2) 0.1 0.1 0.1 $0.2 0.5 0.1 0.1 0.1 0.7 1.0 1.0 (0.7) Depreciation and Amortization 5.2 5.7 5.5 5.5 21.9 6.0 7.0 6.7 6.3 26.0 6.6 6.6 6.6 6.9 26.7 6.3 8.7 Amortization of customer contract intangible assets - - - - - 0.6 1.8 1.8 1.8 6.0 1.8 1.8 1.8 1.8 7.2 1.8 1.8 Interest Expense, net 4.1 5.5 7.1 7.3 23.9 8.1 10.9 11.1 11.2 41.3 11.3 11.4 12.5 12.2 47.3 11.8 10.7 EBITDA $23.9 $30.3 $29.7 $31.1 $115.0 $34.7 $45.4 $43.0 $40.7 $163.9 $39.4 $44.8 $51.5 $43.3 $178.9 $48.7 $64.8 1) Results in 2013 and 2014 are as reported excluding predecessor costs related to the dropdown of the tank farms and product terminals at both Tyler and El Dorado during the respective periods. 2) Results for 1Q15 are as reported excluding predecessor costs related to the 1Q15 dropdowns. 24 Note: May not foot due to rounding.

Non-GAAP Reconciliation of Increased Paline Pipeline Tariff EBITDA Reconciliation of Forecast Incremental U.S. GAAP Net Income (Loss) to Forecast Incremental EBITDA for Paline Pipeline Tariff Increase ($ in millions) Annual Monthly Forecasted Incremental Net Income $ 10.8 $ 0.9 Add Forecasted Incremental Amounts for: Interest Expense, net $ - $ - Depreciation and amortization $ - $ - Forecasted Incremental EBITDA $ 10.8 $ 0.9 1) Based on projected potential future performance from the Paline Pipeline using 36,000 bpd and the tariff change from an incentive rate of $0.75/bbl to the FERC rate of $1.57/bbl. Amounts of EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. Based on rates prior to July 1, 2019 FERC adjustment. 25

Non-GAAP Reconciliation of Red River Joint Venture Adjusted EBITDA Delek Logistics Partners, LPReconciliation of Forecasted Incremental U.S. GAAP Net Income (Loss) to Forecasted Incremental Adjusted EBITDA for the Red River Pipeline Joint Venture ($ in millions) Pre-Expansion Range Post-Expansion Range Forecasted Incremental Net Income $5.6 $7.6 $10.1 $15.1 Add Forecasted Incremental Amounts for: Interest Expense, net 6.6 6.6 7.6 7.6 Depreciation and amortization - - - - Forecasted Incremental EBITDA $12.2 $14.2 $17.7 $22.7 Adjustments: Add Forecasted incremental distributions from operations 1.3 1.3 2.3 2.3 of non-controlled entities in excess of earnings Forecasted Incremental Adjusted EBITDA $13.5 $15.5 $20.0 $25.0 1) Based on projected potential future performance from the Red River joint venture. Amounts of adjusted EBITDA and net income will vary. Actual amounts will be based on market conditions and pipeline operations. 26

Non-GAAP Reconciliations of Big Spring Gathering System Forecasted EBITDA 27

Non-GAAP Reconciliations of Trucking Forecasted EBITDA 28

Non-GAAP Reconciliation of Krotz Springs Potential Dropdown EBITDA Krotz Springs Logistics Drop Down Reconciliation of Forecasted Annualized Net Income to Forecast Incremental EBITDA ($ in millions) Forecasted Range Forecasted Incremental Net Income $ 2.9 $ 3.3 Add Forecasted Incremental Amounts for: Depreciation and amortization 15.6 17.7 Interest and financing costs, net 11.5 13.0 Forecated EBITDA $ 30.0 $ 34.0 1) Based on projected range of potential future logistics assets that could be dropped to Delek Logistics from Delek US in the future. Amounts of EBITDA, net income and timing will vary, which will affect the potential future EBITDA and associated deprecation and interest at DKL. Actual amounts will be based on timing, performance of the assets, DKL’s growth plans and valuation multiples for such assets at the time of any transaction. 29

Investor Relations Contacts: Blake Fernandez, SVP IR/Market Intelligence 615-224-1312