Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EXPRESS, INC. | expr-20200826.htm |

| EX-99.1 - PRESS RELEASE - EXPRESS, INC. | exhibit991q22020earnin.htm |

SECOND QUARTER 2020 EARNINGS

Cautionary Statement REGARDING FORWARD-LOOKING STATEMENTS Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to (1) guidance and expectations, including statements regarding expected operating margins, comparable sales, effective tax rates, interest income, net income, diluted earnings per share, and capital expenditures, (2) statements regarding expected store openings, store closures, store conversions, and SECOND QUARTER 2020 EARNINGS gross square footage, and (3) statements regarding the Company’s strategy, plans, and initiatives, including, but not limited to, results expected from such strategy, plans, and initiatives. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company’s control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes in consumer spending and general economic conditions; (2) the COVID-19 impact and its continued impact on our business operations, store traffic, employee availability, financial condition, liquidity and cash flow; (3) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (4) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (5) customer traffic at malls, shopping centers, and at our stores; (6) competition from other retailers; (7) our dependence on a strong brand image; (8) our ability to adapt to changing consumer behavior and develop and maintain a relevant and reliable omni-channel experience for our customers; (9) the failure or breach of information systems upon which we rely; (10) our ability to protect customer data from fraud and theft; (11) our dependence upon third parties to manufacture all of our merchandise; (12) changes in the cost of raw materials, labor, and freight; (13) supply chain or other business disruption, including as a result of the coronavirus; (14) our dependence upon key executive management; (15) our ability to execute our growth strategy, EXPRESSway Forward, including engaging our customers and acquiring new ones, executing with precision to accelerate sales and profitability, creating great product and reinvigorating our brand; (16) our substantial lease obligations; (17) our reliance on third parties to provide us with certain key services for our business; (18) impairment charges on long- lived assets; (19) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (20) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (21) restrictions imposed on us under the terms of our asset-based loan facility, including restrictions on the ability to effect share repurchases; (22) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate; (23) changes in tariff rates; and (24) natural disasters, extreme weather, public health issues, including pandemics, fire, acts of terrorism or war and other events that cause business interruption. Additional information concerning these and other factors can be found in Express, Inc.’s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. 2

SECOND QUARTER 2020 EARNINGS ABOUT EXPRESS Express is a modern, Launched in 1980 with the Express aims to Create Express operates over Sales Profile1,2 versatile, dual gender idea that style, quality and Confidence & Inspire 500 retail and factory apparel and accessories value should all be found Self-Expression outlet stores in the brand that helps people in one place, Express has through a design & United States and 40% get dressed for every day always been a brand of the merchandising view Puerto Rico, as well as Men and any occasion with $2 now, offering some of the that brings forward The an online store. 60% billion1 in annual sales. most important and Best of Now for Real Express, Inc. is traded Women enduring fashion trends. Life Versatility. on the NYSE under the symbol EXPR. 3 1 For the fiscal year ended February 1, 2020 2 Excludes “other revenue” of $66 million

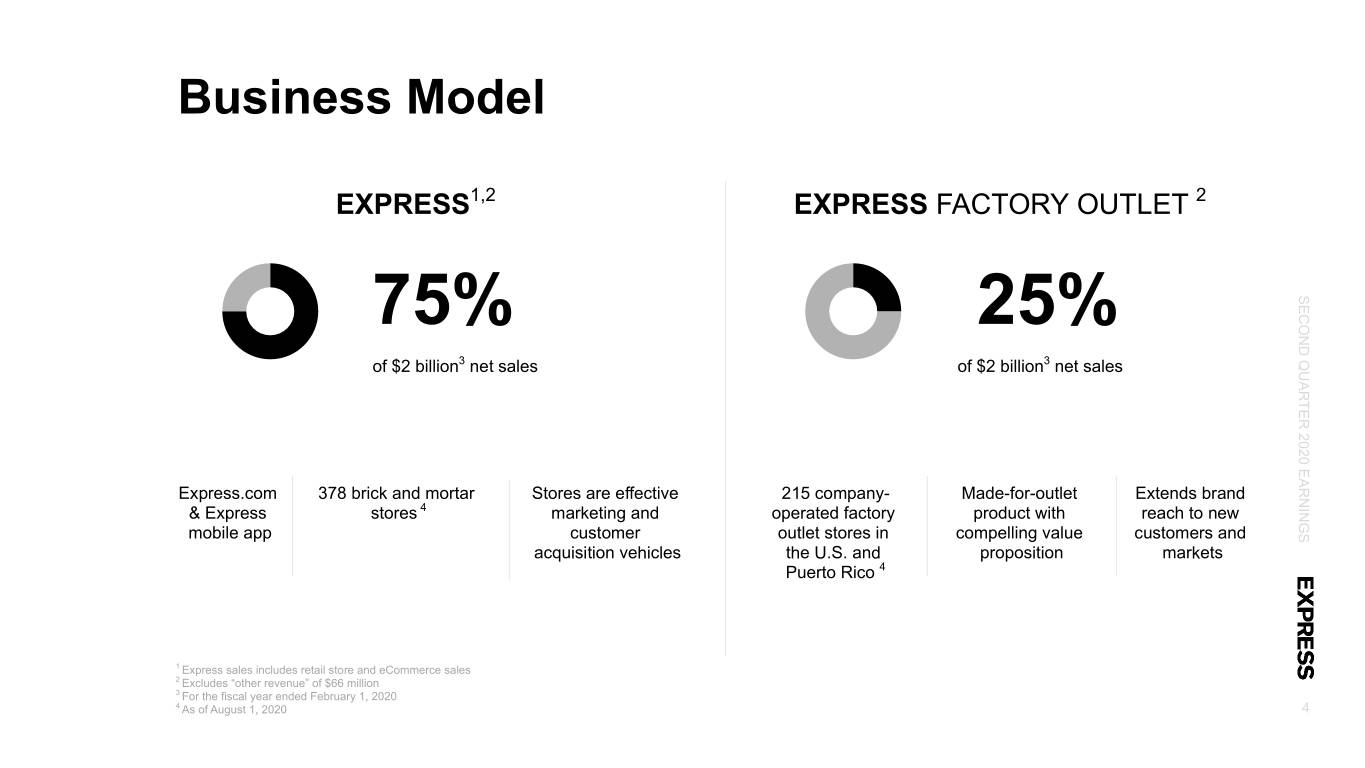

Business Model EXPRESS1,2 EXPRESS FACTORY OUTLET 2 75% 25% SECOND QUARTER 2020 EARNINGS of $2 billion3 net sales of $2 billion3 net sales Express.com 378 brick and mortar Stores are effective 215 company- Made-for-outlet Extends brand & Express stores 4 marketing and operated factory product with reach to new mobile app customer outlet stores in compelling value customers and acquisition vehicles the U.S. and proposition markets Puerto Rico 4 1 Express sales includes retail store and eCommerce sales 2 Excludes “other revenue” of $66 million 3 For the fiscal year ended February 1, 2020 4 As of August 1, 2020 4

RESULTS SECOND QUARTER 2020

Covid-19 Liquidity Actions Expects to realize $425 million of liquidity benefits in 2020, which is an increase from the previously announced $385 million, from the following actions: $425M SECOND QUARTER 2020 EARNINGS $165M $100M $95M $25M $20M $20M Accessed $165 million from its $250 million asset based credit facility Cut second quarter inventory receipts by over $100 million Identified cost savings of approximately $95 million Lowered expected annual capital expenditures by $25 million Negotiated $20 million in rent abatements with a number of landlords Anticipated cash benefits in 2020 from the Coronavirus Aid Relief and Economic Security (CARES) Act of approximately $20 million Approximately $80 million of additional cash benefits from the CARES Act are also expected to be realized in 2021 6

Financial Performance (48)% $(1.67) $(1.48) Net Sales Decrease Diluted EPS Adjusted Diluted EPS 1 SECOND QUARTER 2020 EARNINGS Net Sales Diluted EPS Adjusted Diluted EPS (In Millions) $(0.14) $(0.11) $473 $246 $(1.48) $(1.67) Q2 2019 Q2 2020 Q2 2019 Q2 2020 Q2 2019 Q2 2020 7 1 Adjusted Diluted EPS is a non-GAAP financial measure. Refer to pages 13-16 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures.

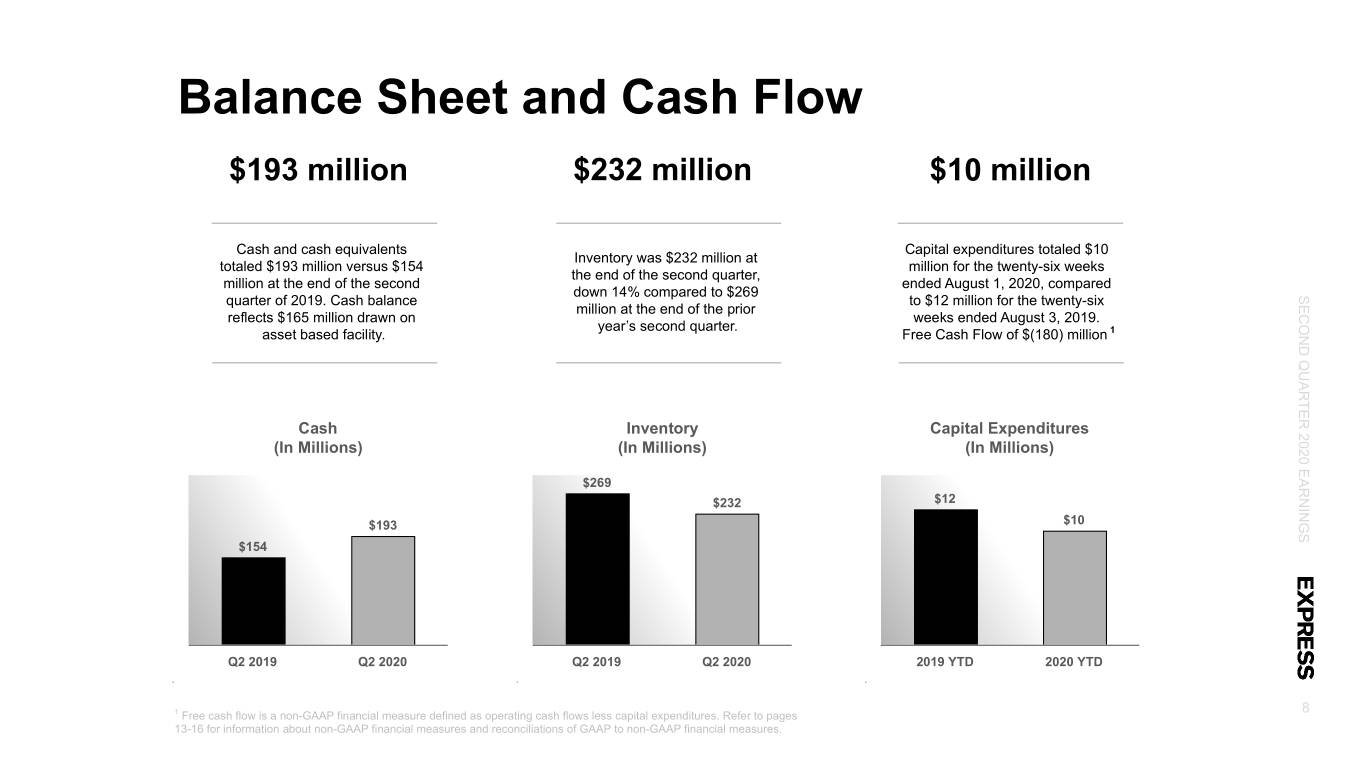

Balance Sheet and Cash Flow $193 million $232 million $10 million Cash and cash equivalents Capital expenditures totaled $10 Inventory was $232 million at totaled $193 million versus $154 million for the twenty-six weeks the end of the second quarter, million at the end of the second ended August 1, 2020, compared down 14% compared to $269 SECOND QUARTER 2020 EARNINGS quarter of 2019. Cash balance to $12 million for the twenty-six million at the end of the prior reflects $165 million drawn on weeks ended August 3, 2019. year’s second quarter. asset based facility. Free Cash Flow of $(180) million 1 Cash Inventory Capital Expenditures (In Millions) (In Millions) (In Millions) $269 $232 $12 $193 $10 $154 Q2 2019 Q2 2020 Q2 2019 Q2 2020 2019 YTD 2020 YTD 8 1 Free cash flow is a non-GAAP financial measure defined as operating cash flows less capital expenditures. Refer to pages 13-16 for information about non-GAAP financial measures and reconciliations of GAAP to non-GAAP financial measures.

FINANCIAL GUIDANCE THIRD QUARTER 2020

Third Quarter 2020 Guidance SECOND QUARTER 2020 EARNINGS Due to the continued uncertainty surrounding the potential impacts of COVID-19, we will not provide guidance for the third $20M to $25M quarter, or the year at this time, with the exception of capital expenditures, which are expected to be in the range of $20 Capital Expenditures million to $25 million for the full year 2020. for the full year 2020 10

Projected 2020 Real Estate Activity Second Quarter 2020 - Actual August 1, 2020 - Actual Company-Operated Stores Opened Closed Conversion Store Count Gross Square Footage United States - Retail Stores — (2) — 378 SECOND QUARTER 2020 EARNINGS United States - Outlet Stores 1 — — 215 Total 1 (2) — 593 5.0 million Third Quarter 2020 - Projected October 31, 2020 - Projected Company-Operated Stores Opened Closed Conversion Store Count Gross Square Footage United States - Retail Stores 1 (2) — 377 United States - Outlet Stores — (1) — 214 Total 1 (3) — 591 5.0 million Full Year 2020 - Projected January 30, 2021 - Projected Company-Operated Stores Opened Closed Conversion Store Count Gross Square Footage United States - Retail Stores 1 (26) — 356 United States - Outlet Stores 1 (9) — 206 Total 2 (35) — 562 4.8 million 11

NON-GAAP RECONCILIATIONS SECOND QUARTER 2020

CAUTIONARY STATEMENT REGARDING NON-GAAP FINANCIAL MEASURES This presentation contains references to Adjusted Diluted Earnings per Share (EPS) and Free Cash Flow which are non-GAAP financial measures. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles (GAAP) included in Express, Inc.’s filings with the Securities and Exchange Commission and may differ from similarly titled measures used by others. Please refer to slide 14-15 in this presentation for additional information and reconciliation of Adjusted Diluted EPS to the SECOND QUARTER 2020 EARNINGS most directly comparable financial measures calculated in accordance with GAAP and slide 16 for additional information and reconciliation of Free Cash Flow to the most directly comparable financial measures calculated in accordance with GAAP. Management believes that Adjusted Diluted EPS provides useful information because it excludes items that may not be indicative of or are unrelated to our underlying business results, and may provide a better baseline for analyzing trends in our underlying business. In addition, Adjusted Diluted EPS is used as a performance measure in our executive compensation program for purposes of determining the number of equity awards that are ultimately earned. 13

Q2 2020 Adjusted Diluted EPS Thirteen Weeks Ended August 1, 2020 Income Tax Diluted Earnings Weighted Average Diluted (in thousands, except per share amounts) Operating Loss Impact Net Loss per Share Shares Outstanding Reported GAAP Measure $ (136,294) $ (107,770) $ (1.67) 64,645 Impairment of property, equipment and lease assets 6,805 (1,830) 4,975 0.08 Valuation allowance on deferred taxes (a) — 16,244 16,244 0.25 Tax impact of the CARES Act (b) — (9,084) (9,084) (0.14) SECOND QUARTER 2020 EARNINGS Adjusted Non-GAAP Measure $ (129,489) $ (95,635) $ (1.48) a. Valuation allowance provided against incurred and forecasted 2020 losses and previously recognized deferred tax assets, less net operating losses utilized within the CARES Act. b. The Company recognized an income tax benefit of $9.1 million primarily due to a net operating loss carryback under the CARES Act. Twenty-Six Weeks Ended August 1, 2020 Income Tax Diluted Earnings Weighted Average Diluted (in thousands, except per share amounts) Operating Loss Impact Net Loss per Share Shares Outstanding Reported GAAP Measure $ (281,573) $ (261,820) $ (4.07) 64,338 Impairment of property, equipment and lease assets 21,483 (5,686) 15,797 0.25 Equity method investment impairment (a) — (642) 2,091 0.03 Valuation allowance on deferred taxes (b) — 77,319 77,319 1.20 Tax impact of the CARES Act (c) — (28,557) (28,557) (0.44) Tax impact of executive departures (d) — 111 111 — Adjusted Non-GAAP Measure $ (260,090) $ (195,059) $ (3.03) a. Impairment before tax was $2.7 million and was recorded in other expense, net. b. Valuation allowance provided against incurred and forecasted 2020 losses and previously recognized deferred tax assets, less net operating losses utilized within CARES Act. c. The Company recognized an income tax benefit of $28.6 million primarily due to a net operating loss carryback under the CARES Act. d. Represents the tax impact related to the expiration of former executive non-qualified stock options. 14

Q2 2019 Adjusted Diluted EPS Thirteen Weeks Ended August 3, 2019 Income Tax Diluted Earnings Weighted Average Diluted (in thousands, except per share amounts) Operating Loss Impact Net Loss per Share Shares Outstanding Reported GAAP Measure $ (9,760) $ (9,703) $ (0.14) 67,253 Impairment of property, equipment and lease assets 2,281 (593) 1,688 0.03 Impact of CEO departure — 822 (a) 822 0.01 SECOND QUARTER 2020 EARNINGS Adjusted Non-GAAP Measure $ (7,479) $ (7,193) $ (0.11) a. Represents the tax impact of the expiration of our former CEO's non-qualified stock options. Twenty-Six Weeks Ended August 3, 2019 Income Tax Diluted Earnings Weighted Average Diluted (in thousands, except per share amounts) Operating Loss Impact Net Loss per Share Shares Outstanding Reported GAAP Measure $ (21,314) $ (19,637) $ (0.29) 67,049 Impairment of property, equipment and lease assets 2,281 (593) 1,688 0.03 Impact of CEO departure — 822 (a) 822 0.01 Adjusted Non-GAAP Measure $ (19,033) $ (17,127) $ (0.26) a. Represents the tax impact of the expiration of our former CEO's non-qualified stock options. 15

Free Cash Flow Thirteen Weeks Ended Twenty-Six Weeks Ended SECOND QUARTER 2020 EARNINGS (in millions) August 1, 2020 (in millions) August 1, 2020 Net cash used in operating Net cash used in operating $(39) $(170) activities activities Less: Less: Capital expenditures 6 Capital expenditures 10 Free Cash Flow $(45) Free Cash Flow $(180) 16

INVESTOR CONTACT MEDIA CONTACT Dan Aldridge Alysa Spittle VP, Investor Relations Director, Communications (614) 474-4890 (614) 474-4745