Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - DYCOM INDUSTRIES INC | dyfy2021q2non-gaapreco.htm |

| EX-99.1 - EX-99.1 - DYCOM INDUSTRIES INC | dyfy2021q28kearningsre.htm |

| 8-K - 8-K - DYCOM INDUSTRIES INC | dy-20200826.htm |

Exhibit 99.2 Dycom Q2 2021 Results August 26, 2020

Participants Agenda Steven E. Nielsen • Q2 2021 Overview President & Chief Executive Officer • Industry Update H. Andrew DeFerrari Chief Financial Officer • Financial & Operational Highlights Ryan F. Urness General Counsel • Outlook • Closing Remarks • Q&A 2

Important Information Caution Concerning Forward-Looking Statements This presentation contains forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act. These statements include those related to the outlook for the quarter ending October 24, 2020 found within this presentation. These statements are subject to change. Forward looking statements are based on management’s current expectations, estimates and projections. These statements are subject to risks and uncertainties that may cause actual results for completed periods and periods in the future to differ materially from the results projected or implied in any forward-looking statements contained in this presentation. The most significant of these risks and uncertainties are described in the Company’s Form 10-K, Form 10-Q, and Form 8-K reports (including all amendments to those reports) and include the projected impact of COVID-19 on the Company’s business operating results, cash flows and/or financial condition and the impacts of the measures the Company has taken in response to COVID-19, the Company’s ability to effectively execute its business and capital plans, business and economic conditions and trends in the telecommunications industry affecting the Company’s customers, customer capital budgets and spending priorities, the adequacy of the Company’s insurance and other reserves and allowances for doubtful accounts, whether the carrying value of the Company’s assets may be impaired, preliminary purchase price allocations of acquired businesses, expected benefits and synergies of acquisitions, the future impact of any acquisitions or dispositions, adjustments and cancellations of the Company’s projects, the related impact to the Company’s backlog from project cancellations, weather conditions, the anticipated outcome of other contingent events, including litigation, liquidity and other financial needs, the availability of financing, the Company’s ability to generate sufficient cash to service its indebtedness, restrictions imposed by the Company’s credit agreement, and the other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update forward-looking statements. Non-GAAP Financial Measures This presentation includes certain “Non-GAAP” financial measures as defined by Regulation G of the SEC. As required by the SEC, an explanation of the Non-GAAP financial measures and a reconciliation of those measures to the most directly comparable GAAP financial measures are provided in the Company’s Form 8-K filed with the SEC on August 26, 2020 and on the Company’s Investor Center website at https://ir.dycomind.com. Non-GAAP financial measures should be considered in addition to, but not as a substitute for, the Company’s reported GAAP results. 3

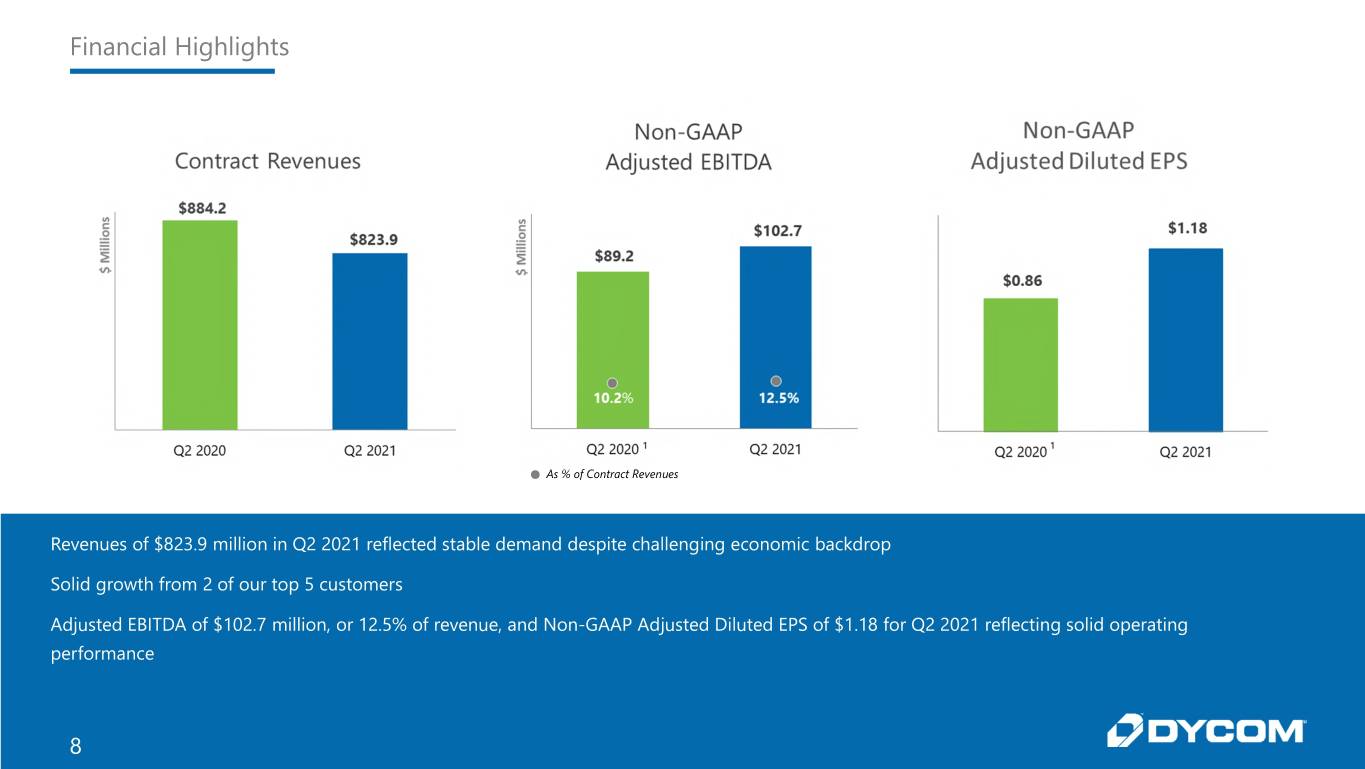

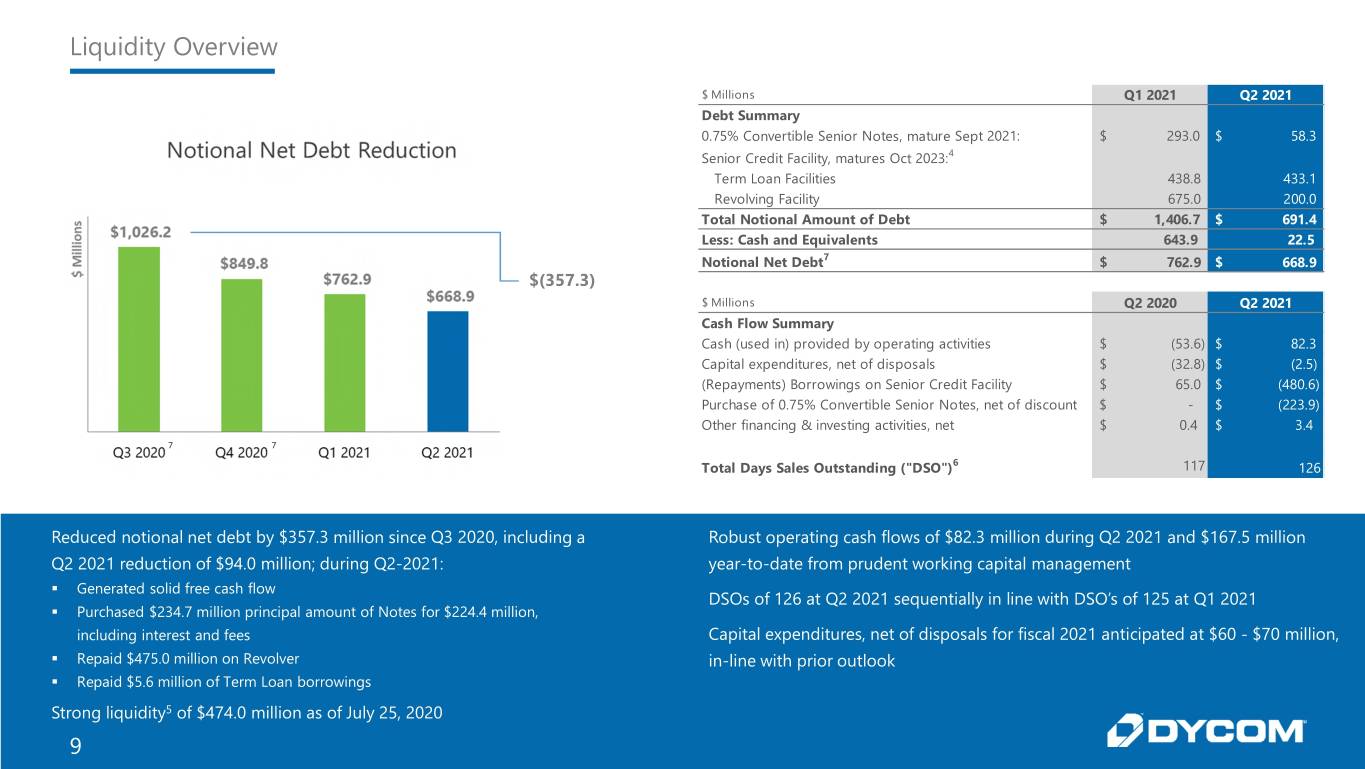

Contract Revenues Q2 2021 Overview Contract Revenues Q2 2021 revenues reflected stable demand despite challenging economic backdrop Strong growth from 2 of the Company’s top 5 customers Operating performance Non-GAAP Adjusted EBITDA for Q2 2021 of $102.7 million, or 12.5% of contract revenues, compared to $89.2 million, or 10.2% of contract revenues, for Q2 20201 Non-GAAP Adjusted Non-GAAP Adjusted Diluted Earnings per Common Share of $1.18 for Q2 2021, compared to $0.86 for Diluted EPS Q2 20201 Liquidity Strong liquidity of $474.0 million at Q2 2021 Reduced notional net debt by $94.0 million during Q2 2021 and by $357.3 million since Q3 2020 Authorized $100 million for share repurchases through February 2022 4

Industry Update Industry Increasing Network Bandwidth Dramatically Major industry participants constructing or upgrading significant wireline networks across broad sections of the country generally designed to provision 1 gigabit network speeds directly to consumers or wirelessly using 5G technologies Industry effort to deploy high capacity fiber networks continues to meaningfully broaden Dycom’s set of opportunities Access to high capacity telecommunications increasingly crucial to society in the time of the COVID-19 pandemic, especially in rural America where dramatically increased rural network investment will be required to support work from home, telemedicine, distance learning and other newly essential applications Dycom’s scale and financial strength position it well to deliver valuable services to its customers Dycom is currently providing services for 1 gigabit full deployments and converged wireless/wireline multi-use network deployments across the country in dozens of metropolitan areas to several customers, including customers with recently stated aspirations to initiate broad fiber deployments as well as customers who appear to be contemplating the resumption of broad deployments Potential fiber network deployment opportunities are increasing in rural America as new industry participants respond to emerging societal incentives Dycom’s ability to provide integrated planning, engineering and design, procurement and construction and maintenance services is of particular value to several industry participants COVID-19 Near Term Impacts Macro-economic effects and uncertainty may influence some customer plans Customers continue to be focused on the possible macro-economic effects of the pandemic on their business with particular focus on SMB dislocations and overall consumer confidence and credit worthiness Some uncertainty may be expected in the overall municipal environment as authorities continue to manage the general effects of the pandemic on permitting and inspection processes, increasing levels of overall activity as states and municipalities re-open and the impacts of business limitations due to COVID-19 flare-ups 5

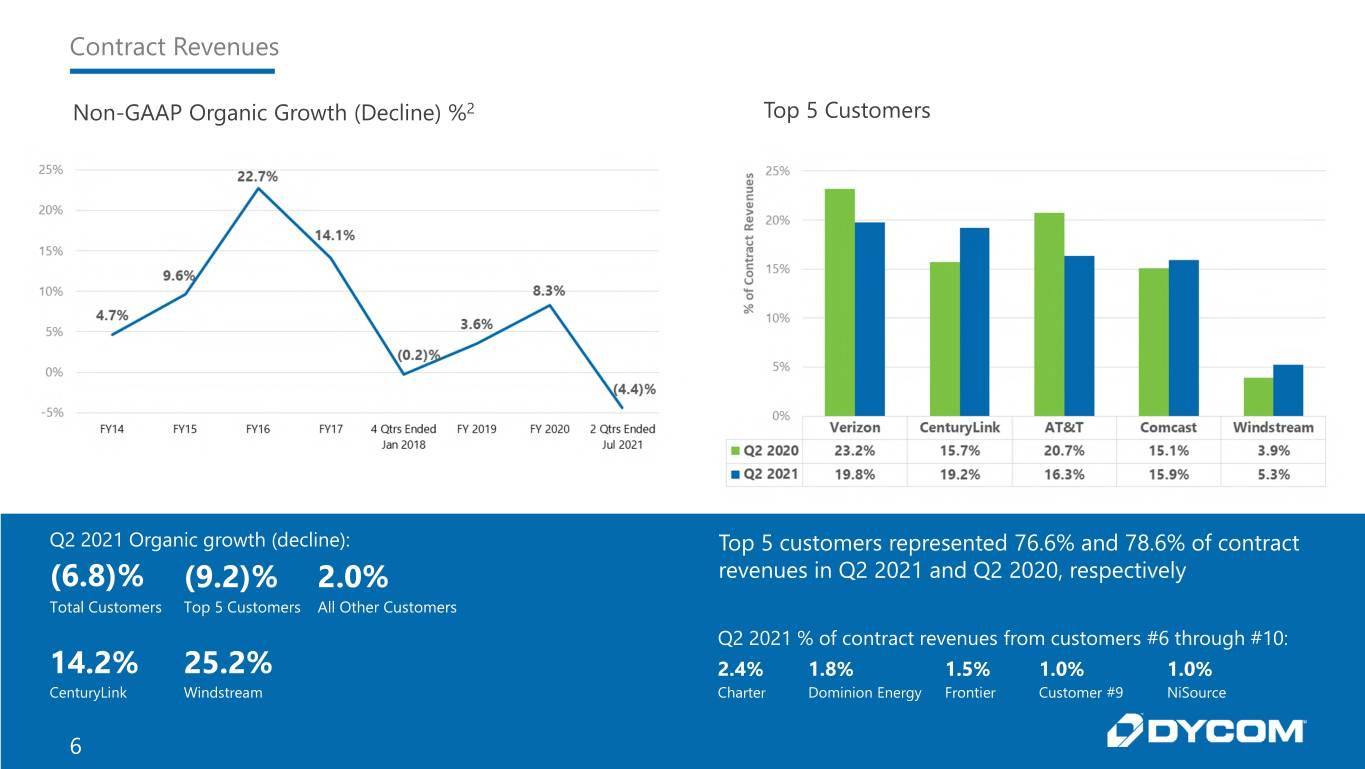

Contract Revenues Non-GAAP Organic Growth (Decline) %2 Top 5 Customers Q2 2021 Organic growth (decline): Top 5 customers represented 76.6% and 78.6% of contract (6.8)% (9.2)% 2.0% revenues in Q2 2021 and Q2 2020, respectively Total Customers Top 5 Customers All Other Customers Q2 2021 % of contract revenues from customers #6 through #10: 14.2% 25.2% 2.4% 1.8% 1.5% 1.0% 1.0% CenturyLink Windstream Charter Dominion Energy Frontier Customer #9 NiSource 6

Backlog and Awards Backlog3 Employee Headcount Selected Q2 2021 Awards and Extensions: Customer Description Area Term AT&T Wireless Construction Services TX, LA, KY, TN, NC, SC, AL, GA, FL 3 years Construction & Maintenance Services MS 3 years Charter Construction & Maintenance Services CA, MO, AL 2 years Comcast Fulfillment Services WA, MI, IL, PA, NJ 1 year Verizon Engineering & Construction Services NY, PA 1 year 7

Financial Highlights As % of Contract Revenues Revenues of $823.9 million in Q2 2021 reflected stable demand despite challenging economic backdrop Solid growth from 2 of our top 5 customers Adjusted EBITDA of $102.7 million, or 12.5% of revenue, and Non-GAAP Adjusted Diluted EPS of $1.18 for Q2 2021 reflecting solid operating performance 8

Liquidity Overview $ Millions Q1 2021 Q2 2021 Debt Summary 0.75% Convertible Senior Notes, mature Sept 2021: $ 293.0 $ 58.3 Senior Credit Facility, matures Oct 2023:4 Term Loan Facilities 438.8 433.1 Revolving Facility 675.0 200.0 Total Notional Amount of Debt $ 1,406.7 $ 691.4 Less: Cash and Equivalents 643.9 22.5 Notional Net Debt7 $ 762.9 $ 668.9 $(357.3) $ Millions Q2 2020 Q2 2021 Cash Flow Summary Cash (used in) provided by operating activities $ (53.6) $ 82.3 Capital expenditures, net of disposals $ (32.8) $ (2.5) (Repayments) Borrowings on Senior Credit Facility $ 65.0 $ (480.6) Purchase of 0.75% Convertible Senior Notes, net of discount $ - $ (223.9) Other financing & investing activities, net $ 0.4 $ 3.4 7 7 Total Days Sales Outstanding ("DSO")6 117 126 Reduced notional net debt by $357.3 million since Q3 2020, including a Robust operating cash flows of $82.3 million during Q2 2021 and $167.5 million Q2 2021 reduction of $94.0 million; during Q2-2021: year-to-date from prudent working capital management . Generated solid free cash flow DSOs of 126 at Q2 2021 sequentially in line with DSO’s of 125 at Q1 2021 . Purchased $234.7 million principal amount of Notes for $224.4 million, including interest and fees Capital expenditures, net of disposals for fiscal 2021 anticipated at $60 - $70 million, . Repaid $475.0 million on Revolver in-line with prior outlook . Repaid $5.6 million of Term Loan borrowings Strong liquidity5 of $474.0 million as of July 25, 2020 9

Outlook The Company continues to closely monitor the impact of the COVID-19 pandemic on all aspects of its business Based on current conditions, the Company anticipates contract revenues and margins to range from in-line to modestly lower on a sequential basis for Q3 2021 as compared to Q2 2021 The Company believes the impact of the COVID-19 pandemic on its operating results, cash flows and financial condition is uncertain, unpredictable and may be outside of its control 10

Closing Remarks Solid end market activity despite challenging economic backdrop Fiber deployments enabling new wireless technologies are underway in many regions of the country Telephone companies are deploying FTTH to enable 1 gigabit high speed connections Fiber deep deployments to expand capacity as well as new build opportunities are underway Dramatically increased speeds to consumers are being provisioned and consumer data usage is growing, particularly upstream Customers are consolidating supply chains creating opportunities for market share growth and increasing the long- term value of Dycom’s maintenance and operations business Dycom is increasingly providing integrated planning, engineering and design, procurement and construction and maintenance services for wired and converged wireless/wireline networks Remain encouraged that Dycom’s major customers continue to be committed to multi-year capital spending initiatives 11

Notes 1) During the quarter ended July 27, 2019, the Company entered into a contract modification that increased revenue produced by a large customer program. As a result, the Company recognized $11.8 million of contract revenues for services performed in prior periods, $0.8 million of related performance-based compensation expense, and $1.0 million of stock-based compensation. On an after-tax basis, these items contributed approximately $7.2 million to net income, or $0.23 per common share diluted, for the quarter and six months ended July 27, 2019. These amounts are excluded from the calculation of Non-GAAP Adjusted EBITDA, Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Diluted Earnings per Common Share for the quarter and six months ended July 27, 2019. 2) Organic growth (decline) % adjusted for revenues from acquired businesses and storm restoration services, when applicable. 3) The Company’s backlog represents an estimate of services to be performed pursuant to master service agreements and other contractual agreements over the terms of those contracts. These estimates are based on contract terms and evaluations regarding the timing of the services to be provided. In the case of master service agreements, backlog is estimated based on the work performed in the preceding 12 month period, when available. When estimating backlog for newly initiated master service agreements and other long and short-term contracts, the Company also considers the anticipated scope of the contract and information received from the customer during the procurement process. A significant majority of the Company’s backlog comprises services under master service agreements and other long-term contracts. Backlog is not a measure defined by United States generally accepted accounting principles (“GAAP”) and should be considered in addition to, but not as a substitute for, GAAP results. Participants in the Company’s industry often disclose a calculation of their backlog; however, the Company’s methodology for determining backlog may not be comparable to the methodologies used by others. Dycom utilizes the calculation of backlog to assist in measuring aggregate awards under existing contractual relationships with its customers. The Company believes its backlog disclosures will assist investors in better understanding this estimate of the services to be performed pursuant to awards by its customers under existing contractual relationships. 4) As of both July 25, 2020 and April 25, 2020, the Company had $52.2 million of standby letters of credit outstanding under the Senior Credit Facility. The Senior Credit Facility matures in October 2023. 5) As of both July 25, 2020 and April 25, 2020, Liquidity represents the sum of the Company’s availability on its revolving facility, including the incremental amount of eligible cash and equivalents above $50 million as permitted by the Company’s Senior Credit Facility and other available cash and equivalents. 6) DSO is calculated as the summation of current and non-current accounts receivable (including unbilled receivables), net of allowance for doubtful accounts, plus current contract assets, less contract liabilities (formerly referred to as billings in excess of costs and estimated earnings) divided by average revenue per day during the respective quarter. Long-term contract assets are excluded from the calculation of DSO, as these amounts represent payments made to customers pursuant to long-term agreements and are recognized as a reduction of contract revenues over the period for which the related services are provided to the customers. 7) Notional net debt as of Q3 2020 consisted of $485.0 million 0.75% Convertible Senior Notes due September 2021, $450.0 million Term Loan Facilities and $103.0 million Revolving Facility, offset by $11.8 million in cash and equivalents. Notional net debt as of Q4 2020 consisted of $460.0 million 0.75% Convertible Senior Notes due September 2021 and $444.4 million Term Loan Facilities, offset by $54.6 million in cash and equivalents. Notional net debt is a Non-GAAP financial measure. 12