Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - KBS Real Estate Investment Trust III, Inc. | kbsriii8k-webinaraug20.htm |

Exhibit 99.1 Portfolio & Strategic Plan Update August 20, 2020

The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Real Estate Investment Trust III’s (the “Company” or “KBS REIT III”) Annual Report on Form 10-K for the year ended December 31, 2019 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 (the “Quarterly Report”), including the “Risk Factors” contained Important therein. For a full description of the limitations, methodologies and assumptions used to value the Company’s assets and liabilities in connection with the calculation of the Company’s estimated value per share, see the Company’s Current Report on Form 8-K, filed with the Disclosures SEC on December 12, 2019. Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. You should interpret many of the risks identified in this presentation, in our Annual Report and in our Quarterly Report as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. The COVID-19 pandemic, together with the resulting measures imposed to help control the spread of the virus, including quarantines, “shelter in place” and “stay at home” orders, travel restrictions, restrictions on businesses and school closures, has had a negative impact on the economy and business activity globally. The extent to which the COVID-19 pandemic impacts the Company’s operations and those of its tenants and the Company’s investments in Prime US REIT and a real estate loan receivable depends on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. If tenants default on their rent and vacate, the ability to re-lease this space is likely to be more difficult if the economic slowdown continues and any long term impact of this situation, even after an economic rebound, remains unclear. Further, significant reductions in rental revenue in the future related to the impact of the COVID-19 pandemic may limit our ability to draw on our revolving credit facilities or exercise our extension options due to covenants described in our loan agreements. WWW. KBS.COM 2

Forward-Looking Statements Important The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through June 30, 2020 have been funded with cash flow from operating activities, debt financing and proceeds from asset sales. There are no guarantees that the Company will continue to pay distributions or that distributions at the current rate are sustainable. No assurances can be Disclosures given with respect to distributions. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the estimated NAV per share, the appraisal methodology used for the appraised properties assumed the properties realize the projected net operating income and expected exit cap rates and that investors would (cont.) be willing to invest in such properties at yields equal to the expected discount rates. The valuation for the Company’s investment in units of Prime US REIT assumed a discount for the holding period risk attributable to transfer restrictions and blockage due to the quantity of units held by the Company and such discount is driven by trading volume in Prime US REIT’s units in the public market and expected future volatility. Though the appraisals of the appraised properties and the valuation of the Company’s investment in units of Prime US REIT, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, were the respective party’s best estimates as of September 30, 2019, December 3, 2019 or December 4, 2019, as applicable, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties, the valuation of the Company’s investment in units of Prime US REIT and the estimated value per share. Further, the Company can make no assurances with respect to the future value appreciation of its properties and ultimate returns to investors. The estimated NAV per share does not reflect the impact of the COVID-19 pandemic on portfolio values. Stockholders may have to hold their shares for an indefinite period of time. The Company can give no assurance that it will be able to provide additional liquidity to stockholders. The Company’s conflicts committee, which is composed of all of its independent directors, has approved the pursuit of the Company’s conversion to a perpetual-life NAV REIT. However, the Company’s conversion to an NAV REIT remains subject to further approval of the conflicts committee and board of directors, and regulatory, market or business considerations, including the impact of the COVID-19 pandemic on the markets and the Company’s operations, may influence the Company to delay the implementation of the NAV REIT conversion or abandon the Company’s conversion to an NAV REIT. Even if the Company converts to an NAV REIT, there is no assurance that the Company will successfully implement its strategy. The statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain and/or improve occupancy levels and rental rates at its real estate properties; and other risks identified in Part I, Item IA of the Company’s Annual Report and in Part II, Item 1A of the Company’s Quarterly Report. WWW. KBS.COM 3

Transactional volume in excess of $42.7 billion1, AUM About KBS of $8.0 billion1 and 23.2 million square feet under management1. Formed by Peter Bren and Buyer and seller of well-located, yield-generating office Chuck Schreiber in 1992. and industrial properties. Over 27 years of investment and Advisor to public and private pension plans, management experience with extensive endowments, foundations, sovereign wealth funds and publicly registered non-traded REITs. long-term investor relationships. A trusted landlord to thousands of office and industrial tenants nationwide. A preferred partner with the nation’s largest lenders. A development partner for office, mixed-use and multi-family developments. 1 As of June 30, 2020. WWW. KBS.COM 4

Regional Focus Map Gateway Target First-tier Target Strong Employment / Growth KBS Offices WWW. KBS.COM 5

The Impact of COVID-19 on Capital Markets and US Real Estate Investments WWW. KBS.COM 6

COVID-19:The Economy • The Department of Commerce reported that U.S. gross domestic product (GDP), the broadest measure of the nation's economic output, fell by an annualized rate of 5% in the first quarter followed by an even steeper decline of 33% in the second quarter based on initial estimates. Almost 13 million jobs were lost in the second quarter, despite strong job gains in May and June. 1 • On the whole, the US Office market remains relatively resilient, though not immune to the economic downturn. The US shed about 4 million office-using jobs between the first and second quarters, but a far cry from the 40 million-plus jobless claims filed since mid-March. 1 • As restrictions are substantially lifted, there is potential for a strong economic recovery taking hold in the second half of 2020 and lasting into 2021. Auto and air travel are increasing and customers are returning to those restaurants that have reopened for dining. Continued momentum will depend on further fiscal stimulus and a vaccine for COVID-19.2 1 CoStar, US Office National Report, 2Q 2020 2 CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 7 7

• According to CoStar, the full impact of the coronavirus outbreak on the US Office COVID-19: sector remains unclear, but expectations are for a drop-off in leasing and transaction Office Market volume to continue beyond the second quarter. The vacancy rate is still below the historical average of about 11%, and well below the 13%-plus rates following the Demand Great Recession.1 • The US had strong fundamentals heading into this downturn which has mitigated some of the pain. Additionally, there hasn't been a large spike in sublease space which would compound any vacancy rate increases. 1 • Some loss of office-using employment will lower leasing demand this year, dropping absorption into negative territory. Most of the negative impacts on demand and values should be confined to this year, with the potential for a robust bounce back in 2021.2 • New supply is delivering into a stagnant leasing environment. But, many of the major projects delivering by the end of this year broke ground well before the pandemic hit and had secured significant pre-lease commitments. 1 1CoStar, U.S. Office National Report, 2Q 2020 2CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 8

• The office market likely will see several quarters of subdued activity until a clearer timeline for reopening COVID-19: appears and a vaccine is developed. This will allow occupiers to effectively plan reopening of workplaces and accurately forecast future needs. CBRE projects that a recovery for most commercial real estate Office Market – the sectors—aside from industrial and multifamily—will not start in earnest until 2021. A full recovery of office demand is not expected until late 2022, and not until 2024 for retail. Hotels should see a full recovery in Road to Recovery demand by late 2023.1 • A recovery is already underway, aided by an unprecedented level of fiscal and monetary stimulus, as well as pent-up demand. The recession is expected to depress interest rates for at least two years, which could support capital flows to commercial real estate. Companies likely will wait until the economic recovery appears firm and sustainable before they lease more space, meaning that a recovery for commercial real estate could lag the economic recovery by at least six months.2 What we've seen in the course of the crisis is just the rapid growth of the digital economy, in particular, the rapid adoption of technologies around meetings. I think it just gives more scope for people working from one or two or three locations. I remain convinced that the office sector is viable in the long term. It's where people meet. It's where creativity happens. It's where clients get helped. That's where we train and bring in younger people into the workforce. And all those things are going to need to reestablish themselves. I think the office sector will bounce back."3 1 CBRE, U.S. Economic Watch, “Q2 GDP Contracts by 32.9%”, July 30, 2020 2 CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 Richard Barkham, CBRE Chief Global Economist 3 CBRE, Richard Barkham, CBRE Global Chief Economist, The Weekly Take, “The Outlook for Commercial Real Estate’s Recovery”, August 10, 2020 WWW. KBS.COM 9

COVID-19: • Most firms appear to be in no hurry to make major real estate decisions right now. This point is underscored by the spread between renewal deals and new deals. If tenants aren't facing an imminent Space Planning and lease expiration, real estate decisions are on the back burner.1 • The work-from-home experiment has proven technically possible, but at a potential cost to corporate Facilities culture, collaboration and innovation. A pure work-from-home approach has its drawbacks, as company culture suffers, collaboration is challenged and the chance of employee burnout increases. 2 Management • Any increase in remote-working represents a headwind to office demand, with wider ramifications in terms of location priorities for investors and occupiers, though we believe that such headwinds will be offset by the need for companies to lower workplace density long term. 2 • The need to maintain low workplace density and ensure adequate social distancing is requiring employers to institute schedules that have a combination of some employees working in the physical office and others at home.2 • An enhanced focus on health and safety is expected this year and KBS is on the forefront implementing new HVAC air cleaning and filtration systems including heavier-duty HVAC filters that block microbes. Other new concepts include UV light or electrically charged particles in the ductwork to kill the virus. KBS is helping many tenants to reconfigure spaces to maintain safer distances, management of foot flow, scheduling and sanitation protocols. • We believe office space is critical for companies not only for collaboration and results, but also in attracting and training new talent. 1CoStar, U.S. Office National Report, 2Q 2020 2CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 10

• Cash payment for office rents bottomed in May at 82% of pre-COVID levels and recovered to 95% in June. COVID-19: Primary markets saw significant declines in cash payments but are now recovering.1 • In the U.S., average rents are expected to fall by more than 6% this year—the first annual decline since Rent Collections, 2010.2 Renewals and the • As current leases expire, many occupiers are choosing short-term renewals due to economic uncertainty. The process of portfolio rebalancing will take at least three years before occupiers achieve an equilibrium Capital Markets that satisfies lower density for social distancing and higher levels of remote working.2 • Rent growth varies by market. In general, the strongest performers remain sunbelt markets such as Charlotte, Raleigh, Palm Beach and Atlanta. Additionally, growth in some tech and bio-tech hubs such as San Diego, Seattle and Boston has been holding up relatively well.3 • Demand for financing is down due to fewer sales transactions, but the refinancing market remains active. New loans have more restrictive credit standards, such as lower loan-to-value ratios, and the cost of borrowing has increased slightly. Nevertheless, the private equity world has ample liquidity. 2 • Capital available for real estate investment is estimated at $328 billion globally according to the Preqin 2020 Global Real Estate Report. Risk-averse institutional investors, such as pension funds and insurance companies, will continue to invest in core and income-driven assets.2 1 CBRE US Marketflash, August 10, 2020, “COVID & Collections: Are Occupiers Paying their Bills?” 2 CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 3 CoStar, U.S. Office National Report, 2Q 2020 WWW. KBS.COM 11

COVID-19: Depending upon the duration of the various measures imposed to help control the spread of the virus and the corresponding economic slowdown, some of the Company’s tenants have or will seek rent deferrals or become unable to Rent Collections pay their rent. Through August 7th, rent collections are as follows: Period of Rent Collected % of Rent Collected Q2 2020 97% July 2020 93% The Company has received short-term rent relief requests from tenants who have been directly impacted by mandated closures. The Company evaluates each request on an individual basis. From the start of the COVID-19 crisis through July 2020, the Company has provided temporary deferrals of base rent of approximately 2.2% of total rent billings that primarily will be paid back over a range of 12 to 24 months. In addition, the Company has given short-term rent abatements to a number of tenants within the portfolio’s minor population of retail and restaurant tenants. In most cases, it is in the Company’s best interest to help its tenants remain in business and reopen when shelter-in-place orders or other mandated closures are lifted. Rent relief requests to date may not be indicative of collections or requests in any future period. WWW. KBS.COM 12

COVID-19 Capital Management Capital Markets The impact of COVID-19 has placed significant constraints on corporate liquidity in the financial markets. As a result, we are slightly delaying the timing of refinancings and certain asset sales. We believe the Company’s low leverage and liquidity position with the ability to tap into available credit facilities enhances our ability to manage portfolio cash needs through this pandemic. JUNE 30, 2020 Total Debt $1.5 billion Loan-to-Value 42.3% Average cost of debt 3.07% per annum Average term to initial maturity 1.7 years Average term to fully extended maturity 3.6 years Total unhedged variable rate debt $331 million WWW. KBS.COM 13

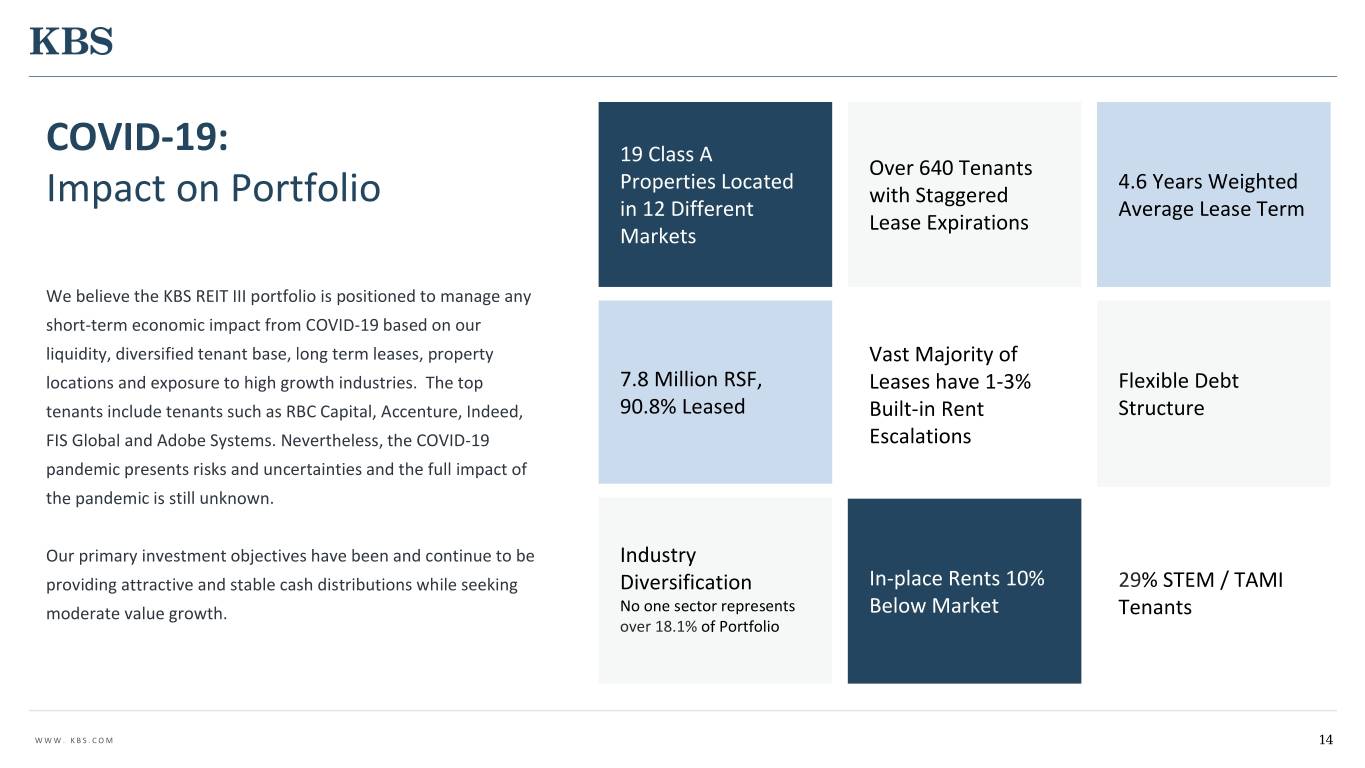

COVID-19: 19 Class A Over 640 Tenants Properties Located 4.6 Years Weighted with Staggered Impact on Portfolio in 12 Different Average Lease Term Lease Expirations Markets We believe the KBS REIT III portfolio is positioned to manage any short-term economic impact from COVID-19 based on our liquidity, diversified tenant base, long term leases, property Vast Majority of locations and exposure to high growth industries. The top 7.8 Million RSF, Leases have 1-3% Flexible Debt tenants include tenants such as RBC Capital, Accenture, Indeed, 90.8% Leased Built-in Rent Structure FIS Global and Adobe Systems. Nevertheless, the COVID-19 Escalations pandemic presents risks and uncertainties and the full impact of the pandemic is still unknown. Our primary investment objectives have been and continue to be Industry providing attractive and stable cash distributions while seeking Diversification In-place Rents 10% 29% STEM / TAMI moderate value growth. No one sector represents Below Market Tenants over 18.1% of Portfolio WWW. KBS.COM 14

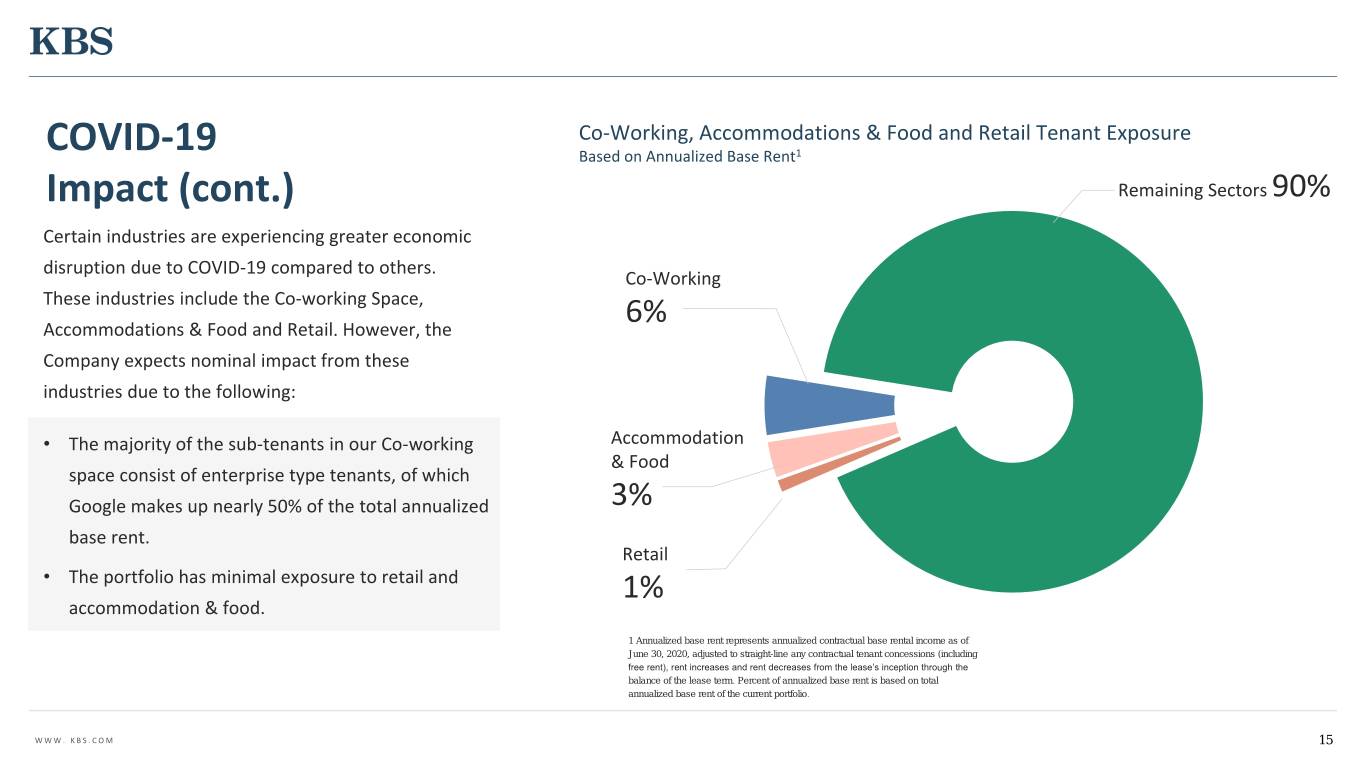

Co-Working, Accommodations & Food and Retail Tenant Exposure COVID-19 Based on Annualized Base Rent1 Industry Comparison1 Impact (cont.) Remaining Sectors 90% Certain industries are experiencing greater economic disruption due to COVID-19 compared to others. Co-Working These industries include the Co-working Space, 6% Accommodations & Food and Retail. However, the Company expects nominal impact from these industries due to the following: • The majority of the sub-tenants in our Co-working Accommodation & Food space consist of enterprise type tenants, of which Google makes up nearly 50% of the total annualized 3% base rent. Retail • The portfolio has minimal exposure to retail and 1% accommodation & food. 1 Annualized base rent represents annualized contractual base rental income as of June 30, 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. WWW. KBS.COM 15

COVID-19 Distribution History: Impact (cont.) Special Dividend Distributions December 2019 $0.80/share While there is some near term impact to Distributions revenues, our exposure to the industries January 1, 2019 – $0.65/share* that are currently most impacted by COVID- December 31, 2019 January 2020 – 19 is limited. Based on rent collections $0.60/share* September 20201,2 through July 2020, the Company’s Board of Directors has maintained the same distribution rate from April through *On an annualized basis September compared to the distribution rate for the first three months of 2020. The 1 Decrease in annualized distribution rate per share is due to a special dividend of $0.80/share that was paid to stockholders in December 2019 (the “Special ability to maintain a consistent dividend Dividend”). The Special Dividend was paid in the form of cash and stock and the decrease in distribution per share to a stockholder would be fully or partially offset by the increase in total shares outstanding as a result of the Special Dividend from April to September (during the COVID- depending on whether the stockholder elected all stock or received part of the distribution in cash. If an investor elected to receive 100% of the Special Dividend 19 crisis) illustrates the strength and in stock, the total distribution received per month during January through September of 2020 would be comparable to the monthly distribution received prior diversity of the tenant base within the real to 2020. 2 Distributions for August and September 2020 have been declared but not yet estate portfolio. paid. WWW. KBS.COM 16

Fund and Portfolio Overview 17

Fund and Portfolio December 2019 Estimated Value of Current Portfolio of Properties1 $3.2 billion Overview1 June 30, 2020 Value of Investment in units of PRIME US REIT 2 As of June 30, 2020, unless otherwise noted. $225.9 million June 30, 2020 Carrying Value of Loan Receivable 3 $147.6 million Rentable Square Feet 7.8 million Total Leased Occupancy4 1 Current portfolio of properties as of June 30, 2020, value based solely on the appraised values 90.8% as of September 30, 2019 as reflected in the December 2019 estimated share value and does not reflect the impact of the COVID-19 pandemic on portfolio values. The appraised values do not consider estimated disposition costs and fees. 5 2 The estimated value of KBS REIT III's investment in Prime US REIT units was based on the Total Leverage (Loan-to-Value) closing price of the units on the SGX of $0.78 per unit as of June 30, 2020 and does not take into account potential blockage due to the quantity of units KBS REIT III owns. 3 The carrying value of the loan receivable is based on amortized cost, net of allowances for credit 42.3% losses (if any) as of June 30, 2020. 4 Includes future leases that had been executed but had not yet commenced as June 30, 2020. 5 Calculated as total debt as of June 30, 2020, divided by the December 2019 estimated value of 6 the portfolio of properties of $3.2 billion, current value of investment in PRIME US REIT as of June Annualized Monthly Distribution Rate – Q1 & Q2 2020 30, 2020 and carrying value of loan receivable as of June 30, 2020. 6 On an annualized basis. During Q1 and Q2 2020, KBS REIT III declared monthly distributions at a rate of $0.04983333/share $0.60/share ordinary distributions WWW. KBS.COM 18

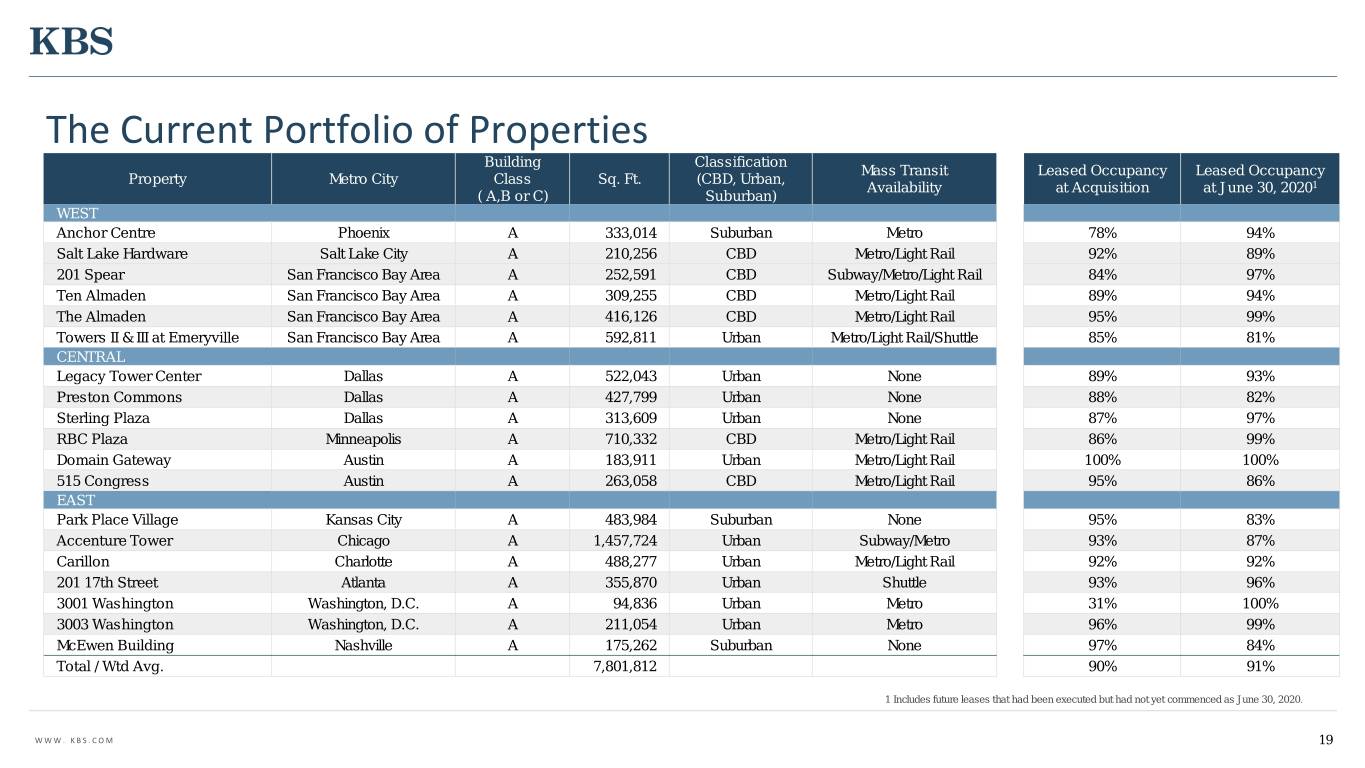

The Current Portfolio of Properties Building Classification Mass Transit Leased Occupancy Leased Occupancy Property Metro City Class Sq. Ft. (CBD, Urban, Availability at Acquisition at June 30, 20201 ( A,B or C) Suburban) WEST Anchor Centre Phoenix A 333,014 Suburban Metro 78% 94% Salt Lake Hardware Salt Lake City A 210,256 CBD Metro/Light Rail 92% 89% 201 Spear San Francisco Bay Area A 252,591 CBD Subway/Metro/Light Rail 84% 97% Ten Almaden San Francisco Bay Area A 309,255 CBD Metro/Light Rail 89% 94% The Almaden San Francisco Bay Area A 416,126 CBD Metro/Light Rail 95% 99% Towers II & III at Emeryville San Francisco Bay Area A 592,811 Urban Metro/Light Rail/Shuttle 85% 81% CENTRAL Legacy Tower Center Dallas A 522,043 Urban None 89% 93% Preston Commons Dallas A 427,799 Urban None 88% 82% Sterling Plaza Dallas A 313,609 Urban None 87% 97% RBC Plaza Minneapolis A 710,332 CBD Metro/Light Rail 86% 99% Domain Gateway Austin A 183,911 Urban Metro/Light Rail 100% 100% 515 Congress Austin A 263,058 CBD Metro/Light Rail 95% 86% EAST Park Place Village Kansas City A 483,984 Suburban None 95% 83% Accenture Tower Chicago A 1,457,724 Urban Subway/Metro 93% 87% Carillon Charlotte A 488,277 Urban Metro/Light Rail 92% 92% 201 17th Street Atlanta A 355,870 Urban Shuttle 93% 96% 3001 Washington Washington, D.C. A 94,836 Urban Metro 31% 100% 3003 Washington Washington, D.C. A 211,054 Urban Metro 96% 99% McEwen Building Nashville A 175,262 Suburban None 97% 84% Total / Wtd Avg. 7,801,812 90% 91% 1 Includes future leases that had been executed but had not yet commenced as June 30, 2020. WWW. KBS.COM 19

The Current Portfolio of Properties This map shows the markets where the current portfolio of properties is located. The Company’s Properties are: • In prime locations within the markets, via proximity to urban centers, an educated workforce, attractive live/work/play amenities, and/or mass transit. • In top tech markets. WWW. KBS.COM 20

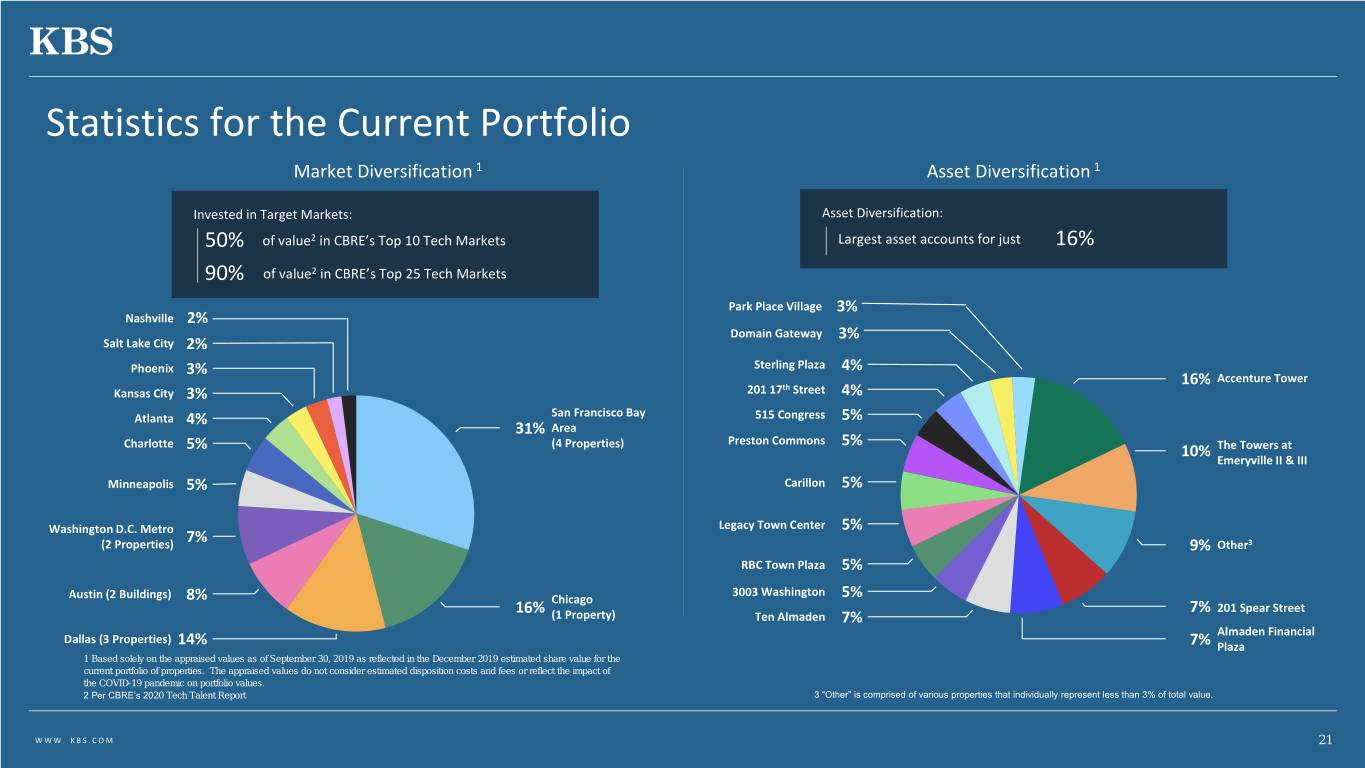

Statistics for the Current Portfolio Market Diversification 1 Asset Diversification 1 Invested in Target Markets: Asset Diversification: 50% of value2 in CBRE’s Top 10 Tech Markets Largest asset accounts for just 16% 90% of value2 in CBRE’s Top 25 Tech Markets Park Place Village 3% Nashville 2% Domain Gateway 3% Salt Lake City 2% Phoenix 3% Sterling Plaza 4% Accenture Tower th 16% Kansas City 3% 201 17 Street 4% Atlanta 4% San Francisco Bay 515 Congress 5% 31% Area Preston Commons 5% Charlotte 5% (4 Properties) 10% The Towers at Emeryville II & III Minneapolis 5% Carillon 5% Legacy Town Center 5% Washington D.C. Metro 7% (2 Properties) 9% Other3 RBC Town Plaza 5% 3003 Washington Austin (2 Buildings) 8% Chicago 5% 16% 7% 201 Spear Street (1 Property) Ten Almaden 7% Almaden Financial Dallas (3 Properties) 14% 7% Plaza 1 Based solely on the appraised values as of September 30, 2019 as reflected in the December 2019 estimated share value for the current portfolio of properties. The appraised values do not consider estimated disposition costs and fees or reflect the impact of the COVID-19 pandemic on portfolio values. 2 Per CBRE’s 2020 Tech Talent Report 3 “Other” is comprised of various properties that individually represent less than 3% of total value. WWW. KBS.COM 21

Statistics for the Current Portfolio Over 640 Tenants with Staggered Lease Expirations and Industry Diversification Tenant Industries 1 Lease Expirations 1 Communications Equipment Manufacturing 1% $40000 15.1% 15.6% Scientific Research & Development 1% STEM/TAMI2 Healthcare & Social Assistance 4% 29% $30000 12.5% Computer Systems Design & Related Services 6% 18% 9.8% Information 6% Finance 8.6% $20000 8.0% 7.6% 6.7% 6.5% 5.8% Professional, Scientific, & $10000 3.8% Technical Services 11% 13% Annualized Rent Base($000) Other3 Accommodation and Food Services 3% $0 Transportation & Warehousing 3% Real Estate & Rental Administrative & Support & Waste 3% & Leasing Management & Remediation Services 12% Insurance Carriers & Related Activities 4% 9% Management Consulting Services 6% Legal Services 1 Annualized base rent represents annualized contractual base rental income as of June 30, 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. • Industry diversification provides downside protection from any single industry. No 2 STEM is an industry abbreviation which stands for science, technology, engineering, and math, and TAMI stands for one sector represents over 18% of the total portfolio. technology, advertising, media, and information. 3 “Other” is comprised of various industries that individually represent less than 3.0% of total annualized base rent, excluding 2 • STEM/TAMI , the fastest growing sector, represents 29% of the total portfolio. STEM/TAMI industries. WWW. KBS.COM 22

Top 10 Tenants 1 Statistics for the WEIGHTED % OF NLA TOP 10 TENANTS INDUSTRY SECTOR PROPERTY AVERAGE LEASE ANNUALIZED (SQ. FT) Current Portfolio TERM (YRS) BASE RENT 2 CNA Corporation Management Consulting 3003 Washington 152,414 8.9 4.0% Real Estate and Rental and 201 Spear Street, WeWork3 132,645 10.7 3.5% Accenture will become the 2nd largest Leasing Legacy Town Center tenant based on SF, once its expansion Professional, Scientific, and Indeed.com Domain Gateway 183,911 12.7 3.3% Technical Services lease commences in 2022. RBC Plaza, Signed an expansion lease in July 2019, increasing RBC Capital Markets, LLC Finance 304,120 2.3 3.1% The Almaden space to 263,718 SF for 15 years ZOOM Video of term Computer Systems Design The Almaden 87,025 8.7 2.3% Communications American Multi-Cinema, Inc Arts & Entertainment Park Place Village 150,340 9.6 2.2% WorldPay US, Inc. Finance 201 17th Street 130,088 6.8 1.7% Gracenote, Inc. Information Tower II & III at Emeryville 54,903 3.5 1.4% Expedia Inc. Travel Accenture Tower 115,604 8.7 1.4% 1 As of June 30, 2020. 2 Annualized base rent represents annualized contractual base rental income as of June 30, Nelson Mullins Riley & Legal 201 17th Street 120,249 8.5 1.4% 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent Scarborough increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. 3 Of the total WeWork leased space, approximately 78,000 square feet is leased to Google at TOTAL / WEIGHTED AVG. 1,431,229 8.4 24.3% 201 Spear on a multi-year agreement. WWW. KBS.COM 23

1 Capital Management As of June 30, 2020, unless otherwise noted Initial Debt Maturities 1 3 $800,000 $731,966 Total Debt1 $1.5 billion $600,000 $379,245 $400,000 $294,623 $200,000 Loan-to-Value2 42.3% $93,000 $0 $0 $0 Average cost of debt 3.07% per annum Interest Rate Exposure (in millions) Fixed Interest Rate Variable Interest Debt Average term to initial maturity 1.7 years Rate (Unswapped) $93 $331 6% 22% Average term to fully extended maturity 3.6 years Variable Interest Rate (Swapped) 1 Based on total debt as of June 30, 2020. 2 Loan-to-Value equals the total debt as of June 30, 2020 divided by the December 2019 estimated value of the portfolio of properties $1,075 of $3.2 billion, current value of investment in PRIME US REIT as of June 30, 2020 and carrying value of loan receivable as of June 30, 2020. 72% 3 All of the debt initially maturing in 2020 has extension options. WWW. KBS.COM 24

Property Updates 25

Hardware Village Sale A two building multi-family apartment complex SALE PRICE $178.0 million Hardware Village was sold on May 7, 2020 for a gross sale price of $178.0 million. The cost basis at disposition was $128.3 million. In connection with the sale, KBS REIT III provided short-term seller financing to the purchaser in the form of a promissory note for $150.2M, which will mature May 6, 2021. The promissory note is secured by Hardware Village. The sale was completed at a price above the December 2019 appraised value of the property. WWW. KBS.COM 26

Key Statistics Preston Commons Current Market Rent/ Weighted-Avg. Lease Term Rentable SF Leased Occupancy1 Dallas, TX In - Place Rent2 (Yrs.) $44.66 NNN / $39.27 NNN 427,799 81.8% 4.8 (13.7% Mark-to-Market) Key Tenants Tenant Sq. Ft. % of Property RSF Recent Leasing JP Morgan Bank 41,906 9.8% Sunflower Bank to lease 5,905 SF Regus 24,927 5.8% Wells Fargo 21,374 5.0% Asset Attributes Diverse rent roll with distinguished tenant roster, industry diversification, and staggered lease expirations. Currently completing a $12 million modernization to create a best-in-class, highly amenitized work environment, including renovating the lobbies and ground floor corridors, transforming the exterior courtyards into outdoor working, collaborating and socializing environments, a new conference and training center, and a new on-site café. The project is scheduled to be completed late November 2020, and is attracting positive interest from the real estate community and prospective tenants. Market Analysis Preston Center is located in one of Dallas’ most highly coveted and sought-after submarkets, surrounded by prestigious neighborhoods and schools and offering upscale retail, dining, hotel, residential and Class A offices. 1 As of June 30, 2020. Leased occupancy includes leases that are signed but High barriers to entry commencing in the future. • Only one developable site remaining with height restrictions. 2 A triple-net (NNN) lease is one in which the tenant is responsible for ongoing expenses of the property, including real estate taxes, maintenance and insurance. WWW. KBS.COM 27

201 17th Street Key Statistics Atlanta, GA Current Market Rent/ Weighted-Avg. Lease Term Rentable SF Leased Occupancy1 In - Place Rent (Yrs.) $40.00 / $30.82 355,870 96.4% 6.6 (29.8% Mark-to-Market) Key Tenants Tenant Sq. Ft. % of Property RSF WorldPay US Inc. 130,088 36.5% Nelson Mullins 117,517 33.0% Experity 9,122 2.6% Key Highlights The Midtown submarket has benefited from a wave of new tech-oriented tenants, as employers are drawn to the highly educated labor force flocking to the urban core. Midtown rents rank at the top of the Atlanta market and are now about 50% above their pre-recession peak, the best mark in the metro. Purchasing Power signed a 76-month new lease for a full floor spec suite (21,681 SF) starting 9/1/20, $42.00/SF, $5.00 TI. As of June 30, 2020, the property was 96.4% leased and remains fully stabilized with no rollover greater than 5.5% through the end of 2025. The property features a state-of-the-art conference center with seven collaborative meeting spaces that accommodate 1 As of June 30, 2020. Leased occupancy includes leases that are signed but commencing in the groups of 7-75. 201 17th Street has excellent access with 10 means of ingress and 8 means of egress and exposure off I- future. 85 and I-75. The property is part of Atlantic Station, one of the Southeast’s premier mixed-use communities. WWW. KBS.COM 28

Strategic Plan Update NAV Conversion 29

NAV Conversion Conversion to an NAV REIT fulfills certain key The Company’s Board of Directors finalized objectives of the Company including the current a review of strategic alternatives in an portfolio size and performance, shareholder desire for effort to further enhance shareholder liquidity as well as their desire to stay invested and liquidity and maximize shareholder current market environments. value. Based on their analysis, the board has determined to pursue a conversion into an NAV REIT. On May 7, 2020, at the NAV REITs at a Glance annual shareholders’ meeting, the Perpetual Life Investment Vehicle Company’s shareholders approved two proposals related to the Company’s pursuit Potential enhanced liquidity, up to 20% of equity per year to convert to an NAV REIT. Frequent valuations Lower up-front fees WWW. KBS.COM 30

The impact of COVID-19 has altered the landscape of the real NAV Conversion estate market in its entirety. The disruption has reduced Update on Timing cashflows and halted leasing activity resulting in reductions of real estate values. Specific to the REIT III portfolio, the Company’s rent collections remain strong although the Company has granted short-term rent relief to a number of tenants, mostly in the form of rent deferrals. Additionally, the COVID-19 crisis has caused us to delay certain asset sales and potential refinancing opportunities which would have further increased the strength of the REIT’s liquidity position and our ability to provide increased liquidity to shareholders. However, we have recently seen increased lending activity in the credit market and are currently in discussion with a few lenders to refinance certain loans in the portfolio. While we continue to believe we are well-positioned to successfully respond to the pandemic, the impact of COVID-19 on our operations and the capital and financial markets has delayed the implementation of the NAV REIT conversion. WWW. KBS.COM 31

REIT III Goals & Objectives Distribute operating cash flows to stockholders Efficiently manage the real estate portfolio throughout the COVID-19 crisis in order to maximize the long-term portfolio value to stockholders Carefully evaluate all tenant rent deferral requests to make sure we are providing rent relief where it is necessary, while being repaid on such deferrals either over time or through a longer term lease extension Constantly review the liquidity needs of the portfolio in order to retain capital to enhance asset values while continuing to monitor and address the need for ongoing stockholder liquidity Continue to monitor the properties in the portfolio for any beneficial sale opportunities in order to maximize value Pursue NAV REIT Conversion WWW. KBS.COM 32

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 33