Attached files

| file | filename |

|---|---|

| EX-99.2 - TRANSCRIPT OF AUGUST 20, 2020 PORTFOLIO UPDATE - KBS Growth & Income REIT, Inc. | kbsgi8kexhibit992.htm |

| 8-K - FORM 8-K - KBS Growth & Income REIT, Inc. | kbsgi8k-webinaraug2020.htm |

Exhibit 99.1 Portfolio Update Meeting August 20, 2020

The information contained herein should be read in conjunction with, and is qualified by, the information in KBS Growth & Income Real Estate Investment Trust’s (the “Company or KBS Growth & Important Income REIT or KBS G&I REIT”) Annual Report on Form 10-K for the year ended December 31, 2019 (the “Annual Report”), and in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 (the “Quarterly Report”), including the “Risk Factors” contained therein. For a full description of the limitations, methodologies and assumptions used to value KBS G&I REIT’s assets and Disclosures liabilities in connection with the calculation of KBS G&I REIT’s estimated value per share, see KBS G&I REIT’s Current Report on Form 8-K dated December 4, 2019 (the “Valuation 8-K”). ADDITIONAL INFORMATION AND WHERE TO FIND IT This filing is made in relation to the proposed plan of liquidation. Once developed and approved by the board of directors of the Company the proposed plan of liquidation and certain other proposals to be voted on, will be submitted to the Company’s stockholders for their consideration at the Company’s Annual Meeting of Stockholders (the “Annual Meeting”). In connection with the proposed plan of liquidation and certain other proposals to be voted on, the Company will file a proxy statement for the Annual Meeting with the SEC. The definitive proxy statement will be sent or given to the Company’s stockholders and will contain information about the proposals to be voted on by the Company’s stockholders at the Annual Meeting, including information relating to the plan of liquidation referenced in this filing. This filing does not constitute a solicitation of any vote or proxy from any stockholder of the Company. STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT CAREFULLY AND IN ITS ENTIRETY WHEN IT IS AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS OR MATERIALS FILED OR TO BE FILED WITH THE SEC OR INCORPORATED BY REFERENCE IN THE DEFINITIVE PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSALS TO BE VOTED ON BY THE COMPANY’S STOCKHOLDERS AT THE ANNUAL MEETING OF STOCKHOLDERS, INCLUDING THE PLAN OF LIQUIDATION. Stockholders will be able to obtain a copy of the definitive proxy statement and other relevant documents, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (which also has been or will be sent to the Company’s stockholders), free of charge at the SEC’s website, www.sec.gov, on the Investor Information page of the Company’s website at www.kbsgireit.com, or by directing a request by mail to KBS Growth & Income REIT, Inc., c/o DST Systems, Inc., P.O. Box 219015, Kansas City, MO 64121-9015 or KBS Growth & Income REIT, Inc., c/o DST Systems, Inc., 430 W. 7th Street, Kansas City, MO 64105. PARTICIPANTS IN THIS SOLICITATION The Company, its directors and executive officers, KBS Capital Advisors LLC, the Company’s external advisor (the “Advisor”), and the Advisor’s officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders with respect to the proposals to be voted on at the Annual Meeting of Stockholders, including the plan of liquidation. Information regarding the Company, its directors and executive officers and the Advisor is detailed in the proxy statements and Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q previously filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Additional information regarding the Company, its directors and executive officers and the Advisor, including detailed information regarding the interests of such entities or persons in the plan of liquidation, will be included in the Company’s proxy statement in connection with the Annual Meeting when it becomes available. Stockholders may obtain the definitive proxy statement and other relevant documents free of charge as described above. WWW. KBS.COM 2

Forward-Looking Statements Certain statements contained herein may be deemed to be forward-looking statements within the meaning of the Federal Private Securities Litigation Reform Act of 1995. The Company Important intends that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent, belief or current expectations of the Company and members of its management team, as well as the Disclosures assumptions on which such statements are based, and generally are identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “intends,” “should” or similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law. Such statements are subject to known and unknown risks and uncertainties which could cause actual results to differ materially from those contemplated by such forward-looking statements. The Company makes no representation or warranty (express or implied) about the accuracy of any such forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. If the proposed plan of liquidation is approved by the stockholders of the Company, there are many factors that may affect the amount of liquidating distributions the Company will ultimately pay to its stockholders, including, among other things, the ultimate sale price of each asset, changes in market demand for office properties during the liquidation process, the amount of taxes, transaction fees and expenses relating to the liquidation and dissolution, and unanticipated or contingent liabilities arising hereafter. No assurance can be given as to the amount of liquidating distributions the Company will ultimately pay to its stockholders. If the Company underestimated its existing obligations and liabilities or if unanticipated or contingent liabilities arise, the amount of liquidating distributions ultimately paid to the stockholders of the Company could be less than estimated. The COVID-19 pandemic, together with the resulting measures imposed to help control the spread of the virus, including quarantines, “shelter in place” and “stay at home” orders, travel restrictions on businesses and school closures, has had a negative impact on the economy and business activity globally. The extent to which the COVID-19 pandemic impacts the Company’s operations and those of its tenants and the Company’s proposed implementation of a plan of liquidation, will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. If tenants default on their rent and vacate, the ability to re-lease this space is likely to be more difficult if the economic slowdown continues and any long term impact of this situation, even after an economic rebound, remains unclear. Further, reductions in property values related to the impact of the COVID- 19 pandemic may limit the Company’s ability to draw on the revolving commitment under its term loan due to covenants described in the loan agreement. In addition, given the uncertainty and current business disruptions as a result of the outbreak of COVID-19, the Company’s proposed implementation of the plan of liquidation may be materially and adversely impacted and this may have a material effect on the ultimate amount and timing of liquidating distributions received by stockholders. WWW. KBS.COM 3

The Company may fund distributions from any source including, without limitation, from offering proceeds or borrowings. Distributions paid through June 30, 2020 have been Important funded in part with cash flow from operating activities, from the proceeds from the sale of real estate and in part with debt financing, including advances from the Company’s advisor. In addition, distributions have been funded with cash resulting from the advisor’s waiver and deferral of its asset management fee. There are no guarantees that the Disclosures Company will continue to pay distributions or that distributions at the current rate are sustainable. Actual events may cause the value and returns on the Company’s investments to be less than that used for purposes of the Company’s estimated NAV per share. With respect to the NAV per share, the appraisal methodology used for the appraised properties assumes the properties realize the projected net operating income and expected exit cap rates and that investors would be willing to invest in such properties at yields equal to the expected discount rates. Though the appraisals of the appraised properties, with respect to Duff & Phelps, and the valuation estimates used in calculating the estimated value per share, with respect to Duff & Phelps, the Company’s advisor and the Company, are the respective party’s best estimates as of September 30, 2019, the Company can give no assurance in this regard. Even small changes to these assumptions could result in significant differences in the appraised values of the appraised properties and the estimated value per share. These statements herein also depend on factors such as: future economic, competitive and market conditions; the Company’s ability to maintain occupancy levels and rental rates at its real estate properties; the Company’s ability to sell its real estate properties at the times and at the prices it expects; and other risks identified in Part I, Item IA of the Company’s Annual Report and in Part II, Item 1A of the Company’s Quarterly Report. Moreover, the estimated NAV per share does not take into account developments in the portfolio since December 4, 2019 and the estimated NAV per share does not take into account the outbreak of the COVID-19 pandemic and its impact on the Company’s portfolio. Further, you should interpret many of the risks that may impact the forward-looking statements herein as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic. WWW. KBS.COM 4

The Impact of COVID-19 on Capital Markets and US Real Estate Investments WWW. KBS.COM 5

COVID-19:The Economy • The Department of Commerce reported that U.S. gross domestic product (GDP), the broadest measure of the nation's economic output, fell by an annualized rate of 5% in the first quarter followed by an even steeper decline of 33% in the second quarter based on initial estimates. Almost 13 million jobs were lost in the second quarter, despite strong job gains in May and June. 1 • On the whole, the US Office market remains relatively resilient, though not immune to the economic downturn. The US shed about 4 million office-using jobs between the first and second quarters, but a far cry from the 40 million-plus jobless claims filed since mid-March. 1 • As restrictions are substantially lifted, there is a potential for a strong economic recovery taking hold in the second half of 2020 and lasting into 2021. Auto and air travel are increasing and customers are returning to those restaurants that have reopened for dining. Continued momentum will depend on further fiscal stimulus and a vaccine for COVID-19.2 1CoStar, US Office National Report, 2Q 2020 2CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 6 6

• According to CoStar, the full impact of the coronavirus outbreak on the US Office COVID-19: sector remains unclear, but expectations are for a drop-off in leasing and transaction Office Market volume to continue beyond the second quarter. The vacancy rate is still below the historical average of about 11%, and well below the 13%-plus rates following the Demand Great Recession. 1 • The US had strong fundamentals heading into this downturn which has mitigated some of the pain. Additionally, there hasn't been a large spike in sublease space which would compound any vacancy rate increases. 1 • Some loss of office-using employment will lower leasing demand this year, dropping absorption into negative territory. Most of the negative impacts on demand and values should be confined to this year, with the potential for a robust bounce back in 2021.2 • New supply is delivering into a stagnant leasing environment. But, many of the major projects delivering by the end of this year broke ground well before the pandemic hit and had secured significant pre-lease commitments. 1 1CoStar, U.S. Office National Report, 2Q 2020 2CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 7

• The office market likely will see several quarters of subdued activity until a clearer timeline for reopening COVID-19: appears and a vaccine is developed. This will allow occupiers to effectively plan reopening of workplaces and accurately forecast future needs. CBRE projects that a recovery for most commercial real estate Office Market – the sectors—aside from industrial and multifamily—will not start in earnest until 2021. A full recovery of office demand is not expected until late 2022, and not until 2024 for retail. Hotels should see a full recovery in Road to Recovery demand by late 2023.1 • A recovery is already underway, aided by an unprecedented level of fiscal and monetary stimulus, as well as pent-up demand. The recession is expected to depress interest rates for at least two years, which could support capital flows to commercial real estate. Companies likely will wait until the economic recovery appears firm and sustainable before they lease more space, meaning that a recovery for commercial real estate could lag the economic recovery by at least six months.2 What we've seen in the course of the crisis is just the rapid growth of the digital economy, in particular, the rapid adoption of technologies around meetings. I think it just gives more scope for people working from one or two or three locations. I remain convinced that the office sector is viable in the long term. It's where people meet. It's where creativity happens. It's where clients get helped. That's where we train and bring in younger people into the workforce. And all those things are going to need to reestablish themselves. I think the office sector will bounce back."3 1 CBRE, US Economic Watch, “Q2 GDP Contracts by 32.9%”, July 30, 2020 2 CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 Richard Barkham, CBRE Chief Global Economist 3 CBRE, Richard Barkham, CBRE Global Chief Economist, The Weekly Take, “The Outlook for Commercial Real Estate’s Recovery”, August 10, 2020 WWW. KBS.COM 8

COVID-19: • Most firms appear to be in no hurry to make major real estate decisions right now. This point is underscored by the spread between renewal deals and new deals. If tenants aren't facing an imminent Space Planning and lease expiration, real estate decisions are on the back burner.1 • The work-from-home experiment has proven technically possible, but at a potential cost to corporate Facilities culture, collaboration and innovation. A pure work-from-home approach has its drawbacks, as company culture suffers, collaboration is challenged and the chance of employee burnout increases. 2 Management • Any increase in remote-working represents a headwind to office demand, with wider ramifications in terms of location priorities for investors and occupiers, though we believe that such headwinds will be offset by the need for companies to lower workplace density long term. 2 • The need to maintain low workplace density and ensure adequate social distancing is requiring employers to institute schedules that have a combination of some employees working in the physical office and others at home.2 • An enhanced focus on health and safety is expected this year and KBS is on the forefront implementing new HVAC air cleaning and filtration systems including heavier-duty HVAC filters that block microbes. Other new concepts include UV light or electrically charged particles in the ductwork to kill the virus. KBS is helping many tenants to reconfigure spaces to maintain safer distances, management of foot flow, scheduling and sanitation protocols. • We believe office space is critical for companies not only for collaboration and results, but also in attracting and training new talent. 1CoStar, U.S. Office National Report, 2Q 2020 2CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 WWW. KBS.COM 9

• Cash payment for office rents bottomed in May at 82% of pre-COVID levels and recovered to 95% in June. COVID-19: Primary markets saw significant declines in cash payments but are now recovering.1 • In the U.S., average rents are expected to fall by more than 6% this year—the first annual decline since Rent Collections, 2010.2 Renewals and the • As current leases expire, many occupiers are choosing short-term renewals due to economic uncertainty. The process of portfolio rebalancing will take at least three years before occupiers achieve an equilibrium Capital Markets that satisfies lower density for social distancing and higher levels of remote working.2 • Rent growth varies by market. In general, the strongest performers remain sunbelt markets such as Charlotte, Raleigh, Palm Beach and Atlanta. Additionally, growth in some tech and bio-tech hubs such as San Diego, Seattle and Boston has been holding up relatively well.3 • Demand for financing is down due to fewer sales transactions, but the refinancing market remains active. New loans have more restrictive credit standards, such as lower loan-to-value ratios, and the cost of borrowing has increased slightly. Nevertheless, the private equity world has ample liquidity. 2 • Capital available for real estate investment is estimated at $328 billion globally according to the Preqin 2020 Global Real Estate Report. Risk-averse institutional investors, such as pension funds and insurance companies, will continue to invest in core and income-driven assets.2 1 CBRE US Marketflash, August 10, 2020, “COVID & Collections: Are Occupiers Paying their Bills?” 2 CBRE, Midyear Review, Global Real Estate Market Conditions Outlook 2020 3 CoStar, U.S. Office National Report, 2Q 2020 WWW. KBS.COM 10

Depending upon the duration of quarantines and the corresponding economic slowdown, some of Company’s tenants COVID-19 have or will seek rent deferrals or become unable to pay their rent. Through August 7th, rent collections is as follows: Rent Collections Period of Rent Collected % of Rent Collected Q2 2020 95% July 2020 86% Over the course of the COVID-19 crisis, the Company has received short-term rent relief requests from tenants who have been directly impacted by mandated closures. Rent relief arrangements are expected to be structured as temporary deferrals of base rent that will be paid back over a range of 12 to 24 months. In most cases, it is in the Company’s best interest to help its tenants remain in business and reopen when shelter-in-place orders or other mandated closures are lifted. Rent relief requests to date may not be indicative of collections or requests in any future period. WWW. KBS.COM 11

COVID-19 Impact (cont.) Distribution History: Distributions Distributions Paid January 2020 – June 2020 $0.25/share* *on an annualized basis The Advisor continues to defer the collection of asset management fees, which results in more cash available to pay distributions. Through June, the Company's Board of Directors has declared a monthly distribution equal to a 3% annualized rate based on the December 2019 net asset value per share. However, the Board has determined to adjust the distribution policy in response to the uncertainty caused by the ongoing public health crisis of the COVID-19 pandemic and its uncertain impact on the Company’s operations and those of its tenants. Going forward, the Company’s Board expects to consider and declare quarterly distributions based on a single quarterly record date commencing with the third quarter of 2020. WWW. KBS.COM 12

Portfolio Highlights 13 13

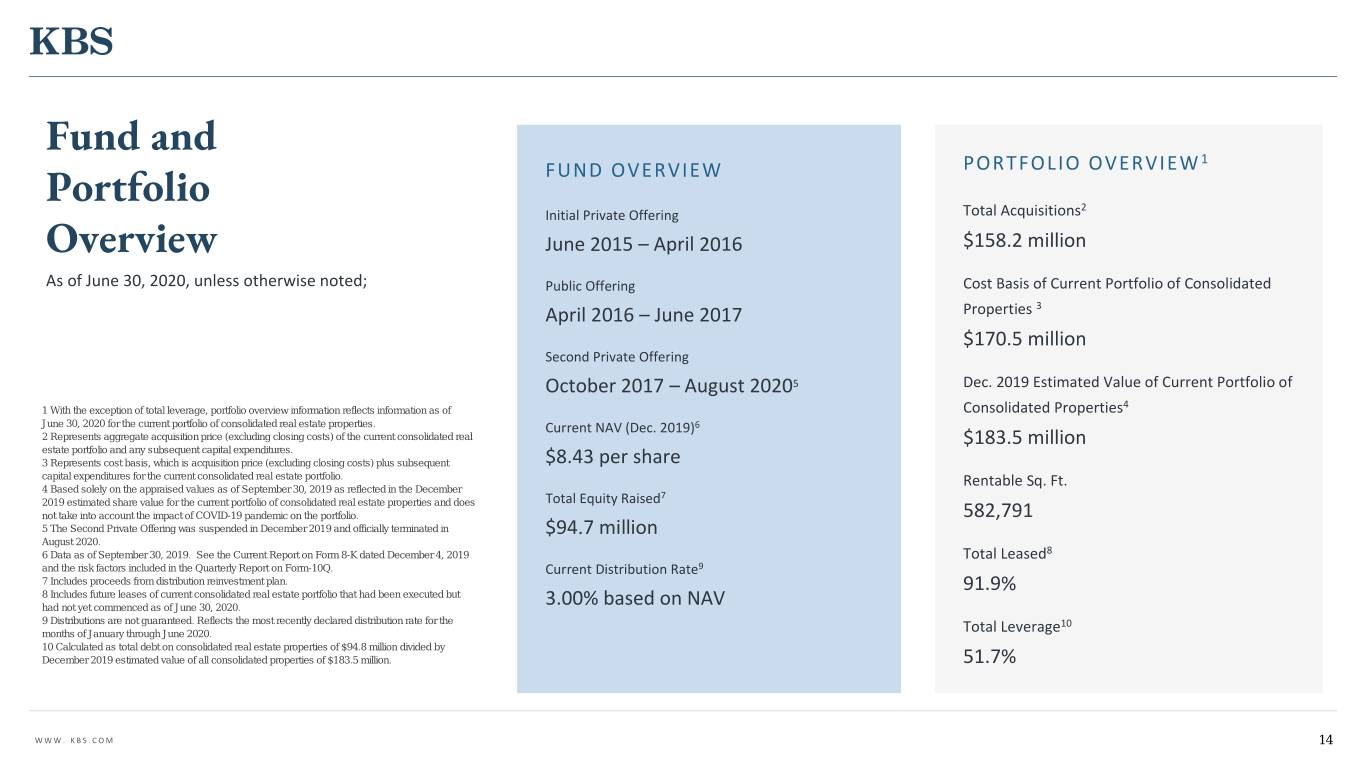

Fund and 1 FUND OVERVIEW PORTFOLIO OVERVIEW Portfolio 2 Initial Private Offering Total Acquisitions Overview June 2015 – April 2016 $158.2 million As of June 30, 2020, unless otherwise noted; Public Offering Cost Basis of Current Portfolio of Consolidated April 2016 – June 2017 Properties 3 $170.5 million Second Private Offering October 2017 – August 20205 Dec. 2019 Estimated Value of Current Portfolio of 4 1 With the exception of total leverage, portfolio overview information reflects information as of Consolidated Properties June 30, 2020 for the current portfolio of consolidated real estate properties. Current NAV (Dec. 2019)6 2 Represents aggregate acquisition price (excluding closing costs) of the current consolidated real $183.5 million estate portfolio and any subsequent capital expenditures. 3 Represents cost basis, which is acquisition price (excluding closing costs) plus subsequent $8.43 per share capital expenditures for the current consolidated real estate portfolio. Rentable Sq. Ft. 4 Based solely on the appraised values as of September 30, 2019 as reflected in the December 7 2019 estimated share value for the current portfolio of consolidated real estate properties and does Total Equity Raised not take into account the impact of COVID-19 pandemic on the portfolio. 582,791 5 The Second Private Offering was suspended in December 2019 and officially terminated in $94.7 million August 2020. 6 Data as of September 30, 2019. See the Current Report on Form 8-K dated December 4, 2019 Total Leased8 and the risk factors included in the Quarterly Report on Form-10Q. Current Distribution Rate9 7 Includes proceeds from distribution reinvestment plan. 8 Includes future leases of current consolidated real estate portfolio that had been executed but 91.9% had not yet commenced as of June 30, 2020. 3.00% based on NAV 9 Distributions are not guaranteed. Reflects the most recently declared distribution rate for the 10 months of January through June 2020. Total Leverage 10 Calculated as total debt on consolidated real estate properties of $94.8 million divided by December 2019 estimated value of all consolidated properties of $183.5 million. 51.7% WWW. KBS.COM 14

Portfolio LEASED % PROPERTY NAME PROPERTY TYPE / ACQUISITION OCCUPANCY % SIZE (SF) PURCHASE PRICE1 AS OF CITY, STATE NO. OF BUILDINGS DATE AT ACQUISITION Highlights 6/30/202 Commonwealth Building Office 6/30/2016 224,122 68,545,000 96% 87% As of June 30, 2020 Portland, OR 1 Building The Offices at Greenhouse Office 11/14/2016 203,284 46,489,000 95% 100% Houston, TX 1 Building Institute Property Office 11/9/2017 155,385 43,155,000 92% 88% Chicago, IL 1 Building TOTAL / WEIGHTED AVG. 582,791 $158,189,000 95% 92% 1 Purchase price reflects contractual purchase price, net of closing credits, and excludes acquisition fees and expenses. 2 Total leased percentage includes future leases that have been executed but have not yet commenced as of June 30, 2020. WWW. KBS.COM 15

Capital Management As of June 30, 2020 Initial Debt Maturities $60,000 $49,150 3 Total Debt $94.8 million $45,681 $40,000 Loan-to-Value1 51.7% $20,000 Average cost of debt2 3.9% per annum $0 $0 $0 $0 2020 2021 2022 2023 Thereafter Interest Rate Exposure ($ in millions) Average term to initial maturity 1.44 years Floating-Rate Debt (Unswapped) $16.3 Average term to fully extended maturity 3.44 years 17% Floating-Rate Debt (Fixed through Swap) 1 Calculated as total debt on properties of $94.8 million divided by December 2019 estimated value of consolidated properties of $78.5 $183.5 million. 2 Average cost of debt as of June 30, 2020. 83% 3 As of June 30, 2020, all of the debt maturing in 2020 has the option to extend to 2022. WWW. KBS.COM 16

Portfolio Overview1 As of June 30, 2020 Key Statistics Geographic Diversification3 No. of Consolidated Held for Investment Assets 3 Total Rentable Sq. Ft. 582,791 IL 24% OR Wtd Avg Lease Term 3.3 years 37% Economic Occupancy 90.1% Leased Occupancy2 91.9% TX No. of Tenants 60 39% Leased Occupancy2 Occupied SF Expirations as of June 30, 2020 100.0% 100% 200,000 36.6% 97% 180,000 94% 160,000 91% 87.1% 88.1% 88% 140,000 85% 120,000 82% 17.8% 79% 100,000 15.0% 76% 80,000 Square Feet Square 9.0% 73% 60,000 70% 40,000 4.2% 4.2% 5.4% Commonwealth Offices at Greenhouse Institute Property 2.8% 3.4% 20,000 0.0% 1.6% 0.0% 0 1 All information in the property overview excludes an investment in unconsolidated JV. 2 Leased % includes future leases that had been executed but had not yet commenced as of June 30, 2020. 3 Based on occupied square feet as of June 30, 2020. WWW. KBS.COM 17

Tenancy Overview1 As of June 30, 2020 2 Top 10 Tenants Industry Property % of Portfolio Industry Diversification3 Professional, Scientific and Offices at AECOM 25.8% Technical Greenhouse Offices at Computer Systems J. Connor Consulting, Inc. Management Consulting 6.1% Greenhouse Design and Related Computer Systems Design Services 10% Galois, Inc Commonwealth 5.9% & Programming Professional, Information Scientific and 8% Professional, Scientific and Quantum Spatial Commonwealth 4.6% Technical Technical Services 38% Public Administration City of Portland Commonwealth 3.9% Management Consulting 6% (Government) NEEA Educational Services Commonwealth 3.8% Accommodation and Food Services Accommodation and Food 6% Downtown Entertainment LLC Institute Property 3.7% Services Cushing and Company Other Institute Property 3.6% Public Administration 5% Infogroup, Inc. Information Commonwealth 2.6% Professional, Scientific and Healthcare & Social Kennedy Jenks Consult, Inc Commonwealth 2.5% Technical Assistance 4% 4 TOTAL (based on total occupied square feet) 62.5% Other Manufacturing 4% 9% Weighted Average Lease Term (Top 10 Tenants) 3.63 years Arts, Entertainment, and 1 All information in the tenancy overview excludes an investment in an unconsolidated JV. Educational Services 3% Recreation 4% 2 Based on occupied square feet as of June 30, 2020. 3 Annualized base rent represents annualized contractual base rental income as of June 30, 2020, adjusted to straight-line any contractual tenant concessions (including free rent), rent increases and rent decreases from the lease’s inception through the balance of the lease term. Percent of annualized base rent is based on total annualized base rent of the current portfolio. Finance 3% 4 ”Other” is comprised of various industries with less than 3% of total annualized base rent. WWW. KBS.COM 18

Update on Strategic Due to the minimal amount of capital raise in the REIT, which had been substantially impacted early on by regulatory changes, and the inability to significantly improve its size and scale in order to help offset Alternatives the sizeable G&A costs of operating a non-traded REIT, the Board formed a special committee to evaluate strategic alternatives for the REIT. Based upon the special committee’s assessment and recommendation, the Board has determined that it is in the best interests of the Company and its stockholders to pursue a liquidation strategy through asset sales. The special committee has directed our advisor, with the assistance of the independent financial advisor of the special committee, to develop a plan of liquidation for approval by the board and submission to our stockholders. We currently expect to be in a position to present a plan of liquidation for a vote of the stockholders of the Company within the next three to six months, with the goal of completing the liquidation of the Company no later than the end of 2022. We caution however that we currently have no agreements in place to sell any of our assets and economic and market conditions that arise in the future including the potential adverse effect of the ongoing pandemic related to COVID-19 could impact this process and could influence us to either accelerate or delay the implementation of a plan of liquidation. WWW. KBS.COM 19

2020 Goals Improve property cash flow through strategic leasing renewals with existing tenants and new leases for current vacant space Continue value enhancing capital projects to maintain the high level of occupancy Solicit shareholder vote for plan of liquidation WWW. KBS.COM 20

Q&A For additional questions, contact KBS Capital Markets Group Investor Relations (866) 527-4264 21