Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒

QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2020

☐

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period

from to

Commission File Number: 001-32986

General Moly, Inc.

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

|

91-0232000

|

|

(State

or other jurisdiction

|

|

(I.R.S.

Employer

|

|

of

incorporation or organization)

|

|

Identification

No.)

|

1726 Cole Blvd., Suite 115

Lakewood, CO 80401

Telephone: (303) 928-8599

(Address

and telephone number of principal executive offices)

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name of

each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

GMO

|

NYSE American and Toronto Stock Exchange

|

Indicate by check

mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Exchange Act of

1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past

90 days. YES ☒ NO ☐

Indicate by check

mark whether the registrant has submitted electronically, every

Interactive Data File required to be submitted pursuant to

Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the

registrant was required to submit such files). YES ☒ NO ☐

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the

Exchange Act.

|

|

|

|

|

Large

accelerated filer ☐

|

|

Accelerated

filer ☐

|

|

|

|

|

|

Non-accelerated

filer ☒

|

|

Smaller

reporting company ☒

|

|

|

|

|

|

|

|

Emerging

growth company ☐

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check

mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The

number of shares outstanding of issuer’s common stock as of

August 17, 2020, was 152,932,971.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

GENERAL MOLY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value amounts)

|

|

June 30,

|

December 31,

|

|

|

2020

|

2019

|

|

|

(unaudited)

|

|

|

ASSETS:

|

|

|

|

CURRENT

ASSETS

|

|

|

|

Cash

and cash equivalents

|

$2,528

|

$4,614

|

|

Deposits,

prepaid expenses and other current assets

|

506

|

272

|

|

Total

Current Assets

|

3,034

|

4,886

|

|

Mining

properties, land and water rights

|

44,345

|

244,137

|

|

Deposits

on project property, plant and equipment

|

30,342

|

87,972

|

|

Restricted

cash held at EMLLC

|

2,829

|

3,388

|

|

Restricted

cash and investments held for reclamation bonds

|

708

|

708

|

|

Non-mining

property and equipment, net

|

—

|

32

|

|

Other

assets

|

484

|

3,104

|

|

TOTAL

ASSETS

|

$81,742

|

$344,227

|

|

LIABILITIES, CRNCI, AND EQUITY (DEFICIT):

|

|

|

|

CURRENT

LIABILITIES

|

|

|

|

Accounts

payable and accrued liabilities

|

$775

|

$1,223

|

|

Return

of Contributions Payable to POS-Minerals, current

portion

|

33,641

|

33,641

|

|

Accrued

advance royalties

|

500

|

500

|

|

Current

portion of debt

|

365

|

—

|

|

Total

Current Liabilities

|

35,281

|

35,364

|

|

Provision

for post closure reclamation and remediation costs

|

2,027

|

1,953

|

|

Accrued

advance royalties

|

6,888

|

6,388

|

|

Accrued

payments to Agricultural Sustainability Trust

|

5,500

|

5,500

|

|

Accrued

water rights payments

|

14,000

|

14,000

|

|

Senior

Promissory Notes

|

8,847

|

7,883

|

|

Other

accrued liabilities

|

2,891

|

3,447

|

|

Total

Liabilities

|

75,434

|

74,535

|

|

|

|

|

|

COMMITMENTS

AND CONTINGENCIES - NOTE 12

|

|

|

|

|

|

|

|

CONTINGENTLY

REDEEMABLE NONCONTROLLING INTEREST ("CRNCI")

|

120,617

|

172,239

|

|

CONVERTIBLE

PREFERRED SHARES

|

1,300

|

1,300

|

|

|

|

|

|

EQUITY

(DEFICIT)

|

|

|

|

Common

stock, $0.001 par value; 650,000,000 and 650,000,000 shares

authorized, respectively, 152,685,255 and 152,033,515 outstanding,

respectively

|

152

|

152

|

|

Additional

paid-in capital

|

295,655

|

295,005

|

|

Accumulated

deficit during exploration and development stage

|

(411,416)

|

(199,004)

|

|

Total

Equity (Deficit)

|

(115,609)

|

96,153

|

|

TOTAL LIABILITIES, CRNCI, AND EQUITY

|

$81,742

|

$344,227

|

The

accompanying notes are an integral part of these consolidated

financial statements.

2

GENERAL MOLY, INC.

(“GMI”)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(Unaudited — In thousands, except per share

amounts)

|

|

Three Months Ended

|

Six Months Ended

|

||

|

|

June 30,

|

June 30,

|

June 30,

|

June 30,

|

|

|

2020

|

2019

|

2020

|

2019

|

|

REVENUES

|

$—

|

$—

|

$—

|

$—

|

|

|

|

|

|

|

|

OPERATING

EXPENSES:

|

|

|

|

|

|

Exploration

and evaluation

|

132

|

102

|

305

|

206

|

|

General

and administrative expense

|

1,699

|

1,962

|

3,191

|

3,260

|

|

Gain

on sale of non-core properties

|

(57)

|

—

|

(604)

|

—

|

|

Loss

on impairment charge

|

260,553

|

—

|

260,553

|

—

|

|

TOTAL

OPERATING EXPENSES

|

262,327

|

2,064

|

263,445

|

3,466

|

|

|

|

|

|

|

|

(LOSS)

FROM OPERATIONS

|

(262,327)

|

(2,064)

|

(263,445)

|

(3,466)

|

|

|

|

|

|

|

|

OTHER

INCOME/(EXPENSE):

|

|

|

|

|

|

Interest

expense

|

(367)

|

(387)

|

(1,126)

|

(442)

|

|

Other

income/(expense)

|

(215)

|

|

537

|

|

|

TOTAL

OTHER (EXPENSE)/INCOME, NET

|

(582)

|

(387)

|

(589)

|

(442)

|

|

|

|

|

|

|

|

(LOSS)

BEFORE INCOME TAXES

|

(262,909)

|

(2,451)

|

(264,034)

|

(3,908)

|

|

|

|

|

|

|

|

Income

Taxes

|

—

|

—

|

—

|

—

|

|

|

|

|

|

|

|

CONSOLIDATED

NET (LOSS)

|

$(262,909)

|

$(2,451)

|

$(264,034)

|

$(3,908)

|

|

Less:

Net loss (income) attributable to CRNCI

|

51,697

|

(25)

|

51,622

|

11

|

|

NET

LOSS ATTRIBUTABLE TO GMI

|

$(211,212)

|

$(2,476)

|

$(212,412)

|

$(3,897)

|

|

Basic

and diluted net loss attributable to GMI per share of common

stock

|

$(1.39)

|

$(0.02)

|

$(1.39)

|

$(0.03)

|

|

Weighted

average number of shares outstanding — basic and

diluted

|

152,316

|

137,797

|

153,038

|

137,635

|

|

|

|

|

|

|

|

COMPREHENSIVE

(LOSS)

|

$(211,212)

|

$(2,476)

|

$(212,412)

|

$(3,897)

|

The

accompanying notes are an integral part of these consolidated

financial statements.

3

GENERAL MOLY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY (DEFICIT)

(Unaudited — In thousands, except number of shares and per

share amounts)

|

|

Common

|

Preferred

|

|

Additional

|

Accumulated

|

|

|

|

Shares

|

Shares

|

Amount

|

Paid-In Capital

|

Deficit

|

Total

|

|

Balances,

December 31, 2018

|

137,114,804

|

—

|

$137

|

$291,266

|

$(191,126)

|

$100,277

|

|

Issuance

of Units of Common Stock:

|

|

|

|

|

|

|

|

Issued

pursuant to stock awards

|

135,000

|

—

|

—

|

—

|

—

|

—

|

|

Stock-based

compensation

|

—

|

—

|

—

|

25

|

—

|

25

|

|

Restricted

stock net share settlement

|

276,328

|

—

|

—

|

(1)

|

—

|

(1)

|

|

Net

loss for the period ended March 31, 2019

|

—

|

—

|

—

|

—

|

(1,421)

|

(1,421)

|

|

Balances,

March 31, 2019

|

137,526,132

|

|

$137

|

$291,290

|

$(192,547)

|

$98,880

|

|

Issuance

of Units of Common Stock:

|

|

|

|

|

|

|

|

Stock-based

compensation

|

—

|

—

|

—

|

21

|

—

|

21

|

|

Warrant

Exercise

|

694,200

|

—

|

1

|

247

|

—

|

248

|

|

Net

loss for the period ended June 30, 2019

|

—

|

—

|

—

|

—

|

(2,476)

|

(2,476)

|

|

Balances,

June 30, 2019

|

138,220,332

|

—

|

$138

|

$291,558

|

$(195,023)

|

$96,673

|

|

|

Common

|

Preferred

|

|

Additional

|

Accumulated

|

|

|

|

Shares

|

Shares

|

Amount

|

Paid-In Capital

|

Deficit

|

Total

|

|

Balances,

December 31, 2019

|

152,316,255

|

1,300

|

$152

|

$295,005

|

$(199,004)

|

$96,153

|

|

Issuance

of Units of Common Stock:

|

|

|

|

|

|

|

|

Issued

pursuant to stock awards

|

369,000

|

—

|

—

|

—

|

—

|

—

|

|

Stock-based

compensation

|

—

|

—

|

—

|

382

|

—

|

382

|

|

Net

loss for the period ended March 31, 2020

|

—

|

—

|

—

|

—

|

(1,201)

|

(1,201)

|

|

Balances,

March 31, 2020

|

152,685,255

|

1,300

|

$152

|

$295,387

|

$(200,205)

|

$95,334

|

|

Issuance

of Units of Common Stock:

|

|

|

|

|

|

|

|

Stock-based

compensation

|

—

|

—

|

—

|

268

|

—

|

268

|

|

Net

loss for the period ended June 30, 2020

|

—

|

—

|

—

|

—

|

(211,211)

|

(211,211)

|

|

Balances,

June 30, 2020

|

152,685,255

|

1,300

|

$152

|

$295,655

|

$(411,416)

|

$(115,609)

|

4

GENERAL MOLY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited — In thousands)

|

|

Six Months Ended

|

|

|

|

June 30,

|

June 30,

|

|

|

2020

|

2019

|

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

Consolidated

net loss

|

$(264,034)

|

$(3.908)

|

|

Adjustments

to reconcile net loss to net cash used by operating

activities:

|

|

|

|

Depreciation

and amortization

|

48

|

67

|

|

Non-cash

interest expense

|

964

|

78

|

|

Gain

on decrease in warrant liability

|

(556)

|

—

|

|

Income

realized on lease of water rights

|

—

|

(13)

|

|

Gain

on sale of non-core assets

|

(547)

|

—

|

|

Stock-based

compensation for employees and directors

|

528

|

47

|

|

Decrease

(increase) in deposits, prepaid expenses and other

|

(234)

|

(177)

|

|

Decrease

in accounts payable and accrued liabilities

|

(131)

|

301

|

|

(Decrease)

increase in post closure reclamation and remediation

costs

|

20

|

35

|

|

Loss

on impairment charge

|

260,553

|

|

|

Net

cash used by operating activities

|

(3,388)

|

(3,570)

|

|

|

|

|

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

Purchase

and development of mining properties, land and water

rights

|

58

|

(822)

|

|

Deposits

on property, plant and equipment

|

—

|

152

|

|

Proceeds

from sale of non-core assets

|

685

|

—

|

|

Increase

in investments for reclamation bonds

|

—

|

(16)

|

|

Net

cash provided by (used in) investing activities

|

743

|

(686)

|

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

Stock

proceeds, net of issuance costs

|

—

|

1,643

|

|

Net

cash provided/(used) by financing activities:

|

—

|

1,643

|

|

Net

(decrease) in cash, cash equivalents and restricted

cash

|

(2,645)

|

(2,613)

|

|

Cash,

cash equivalents and restricted cash, beginning of

period

|

8,002

|

8,617

|

|

Cash,

cash equivalents and restricted cash, end of period

|

$5,357

|

$6,004

|

|

|

|

|

|

SUPPLEMENTAL

CASH FLOW INFORMATION:

|

|

|

|

Cash

paid for interest, net of capitalized

|

$537

|

$365

|

|

|

|

|

|

NON-CASH

INVESTING AND FINANCING ACTIVITIES:

|

|

|

|

Equity

compensation capitalized as development

|

$122

|

$3

|

|

Accrued

portion of advance royalties

|

500

|

—

|

The

accompanying notes are an integral part of these consolidated

financial statements.

5

GENERAL MOLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 — DESCRIPTION OF BUSINESS

General

Moly, Inc. (“we,” “us,”

“our,” “Company,” ”GMI,” or

“General Moly”) is a Delaware corporation originally

incorporated as General Mines Corporation on November 23,

1925. We have gone through several name changes and on

October 5, 2007, we reincorporated in the State of Delaware

(“Reincorporation”) through a merger involving Idaho

General Mines, Inc. and General Moly, Inc., a Delaware

corporation that was a wholly owned subsidiary of Idaho General

Mines, Inc. The Reincorporation was effected by merging Idaho

General Mines, Inc. with and into General Moly, with General

Moly being the surviving entity. For purposes of the

Company’s reporting status with the United States Securities

and Exchange Commission (“SEC”), General Moly is deemed

a successor to Idaho General Mines, Inc.

The

Company conducted exploration and evaluation activities from

January 1, 2002 until October 4, 2007, when our Board of

Directors (“Board”) approved the development of the Mt.

Hope molybdenum property (“Mt. Hope Project”) in Eureka

County, Nevada. The Mt. Hope Project is leased and operated by

Eureka Moly, LLC, an indirectly held 80% subsidiary of the Company

(“EMLLC” or the “LLC”). The Company is

continuing its efforts to both obtain financing for and develop the

Mt. Hope Project. However, the combination of ongoing depressed

molybdenum prices, challenges to our permits and current liquidity

concerns have further delayed development at the Mt. Hope

Project.

Additionally, in

late 2018 we completed a 9-hole drill program on the Mt. Hope

property, focused on the area where previously identified

copper-silver-zinc-mineralized skarns have been identified,

immediately adjacent to the Mt. Hope molybdenum

deposit.

We also

continue to evaluate our Liberty molybdenum and copper property

(“Liberty Project”) in Nye County, Nevada.

Going Concern and Risk of Bankruptcy

At June

30, 2020, we had cash and cash equivalents of $2.5 million and our

current working capital is negative. Based on our current operating

forecast, which takes into consideration the fact that we currently

do not generate any revenue, we believe ourexisting capital

resources are only adequate to sustain our operations through

September 30, 2020. In particular, we have insufficient cash to

make required interest payments on our outstanding Exchange Notes

and Supplemental Notes through the remainder of 2020. These

conditions raise substantial doubt about the Company’s

ability to continue as a going concern. If we are unable to find an

additional source of funding before the end of September 2020, we

will be forced to cease operations and pursue restructuring or

liquidation alternatives, including the filing for bankruptcy

protection, in which event our common stock would likely become

worthless and investors would likely lose their entire investment

in our Company. In addition, holders of our outstanding convertible

preferred stock and senior notes would likely receive significantly

less than the principal amount of their claims and possibly, no

recovery at all. As of the date of the filing of this report, the

Company has no commitments for additional funding and there can be

no assurance that the Company will be successful in obtaining the

financing required to complete the Mt. Hope Project, or in raising

additional financing in the future on terms acceptable to the

Company, or at all.

The

Company is currently pursuing a number of options to extend its

liquidity beyond the third quarter of 2020 and into 2021. The

Company’s Board of Directors (the “Board”)

retained on March 13, 2019 XMS Capital Partners, Headwall Partners,

and Odinbrook Global Advisors (collectively, the

“Advisors”), as financial advisors to assist the Board

and management with evaluating and recommending strategic

alternatives. The Company has engaged the Advisors to assist in

securing interim financing and negotiating with potential

stakeholders.

The

range of strategic alternatives being evaluated include the

potential addition of new Mt. Hope Project partners, additional

Corporate strategic investors, merger opportunities, and/or the

possible sale or privatization of the Company. The Advisors

assisted the Company in successfully restructuring the Convertible

and Non-Convertible Promissory Notes issued in a 2014 private

placement, extending maturity until December 2022 as well as

providing an additional $1.3 million in interim funding. The

Company has engaged the Advisors to assist in securing interim

financing and negotiating with potential stakeholders.

Additional

potential funding sources for the Company include public or private

equity offerings, including the sale of other assets wholly-owned

by the Company or with EMLLC joint-venture partner POS-Minerals

Corporation at the Mt. Hope Project. However, there is no assurance

that the Company will be successful in securing additional funding

in the future on terms acceptable to the Company, or at all. This

could result in further cost reductions, contract cancellations,

and potential delays which ultimately may jeopardize the

development of the Mt. Hope Project.

6

Beginning in early

2020, there has been an outbreak of coronavirus (COVID-19),

initially in China and which has spread to other jurisdictions,

including locations where the Company has offices and personnel.

The full extent of the outbreak, related business and travel

restrictions and changes to behavior intended to reduce its spread

continues to evolve globally. COVID–19 has had a direct

impact on the Company’s financing efforts and potential

solutions to its liquidity position. Currently, the Company

believes that it will be able to sustain its corporate and Liberty

Project operations only through the third quarter of 2020.

Management continues to seek financing opportunities

notwithstanding the impacts associated with the COVID-19 pandemic,

however the Company anticipates that its financing efforts and

liquidity may continue to be materially impacted by the coronavirus

outbreak.

Due to

the Company’s inability to obtain financing to date and

inadequate cash to continue operations past the third quarter of

2020, the impact of COVID-19 on capital markets during the second

quarter of 2020, and the decrease in the current and forecasted

price of molybdenum, among other factors, the Company recognized an

impairment charge reducing the carrying value of the Mt. Hope

assets by $260.6 million as of June 30, 2020. The impairment charge

does not alter the Company’s underlying assets or rights and

the Company continues to pursue strategic alternatives as discussed

above. Further information regarding the impairment is provided in

Note 2.

On

April 24, 2020, the Company received funding under a Paycheck

Protection Program (“PPP”) loan (the “PPP

Loan”) from U.S. Bank, National Association (the

“Lender”). The principal amount of the PPP Loan is

$365,034. The PPP was established under the Coronavirus Aid,

Relief, and Economic Security Act (the “CARES Act”) and

is administered by the U.S. Small Business Administration (the

“SBA”). The Company applied for the PPP Loan primarily

because its potential to access other sources of capital has been

greatly reduced by the ongoing COVID-19 pandemic.

The

PPP Loan has a two-year term, maturing on April 23, 2022. The

interest rate on the PPP Loan is 1.0% per annum. Principal and

interest are payable in 18 monthly installments, beginning on

November 23, 2020, until maturity with respect to any portion of

the PPP Loan which is not forgiven as described below. The Company

did not provide any collateral or guarantees for the PPP Loan, nor

did the Company pay any facility charge to obtain the PPP Loan. The

PPP Loan provides for customary events of default, including, among

others, those relating to failure to make payment, bankruptcy,

breaches of representations and material adverse effects. The

Company is permitted to prepay or partially prepay the PPP Loan at

any time with no prepayment penalties.

The

PPP Loan may be partially or fully forgiven if the Company complies

with the provisions of the CARES Act, including the use of PPP Loan

proceeds for payroll costs, rent, utilities and other expenses,

provided that such amounts are incurred during the 24-week period

that commenced on April 24, 2020 and at least 60% of any forgiven

amount has been used for covered payroll costs as defined by the

CARES Act. Any forgiveness of the PPP Loan will be subject to

approval by the SBA and the Lender and will require the Company to

apply for such treatment in the future.

Other Financing Actions Taken

On

April 12, 2017, the Company filed a prospectus supplement in both

Canada and the United States which enabled the Company, at its

discretion from time to time, to sell up to $20 million worth of

common shares by way of an “at-the-market” offering

(the “ATM”). Since the effectiveness of the prospectus

supplement by the SEC on April 26, 2017 to September 30, 2019, a

total of 1,168,300 common shares have been sold under the ATM, for

net proceeds to the Company of $0.5 million. In October 2018, the

Company completed a public offering of 9,125,000 units consisting

of one share of common stock and one warrant to purchase one share

of common stock resulting in net proceeds to the Company of

$1,900,000. In conjunction with the public offering in October

2018, the Company agreed to suspend the ATM facility for a period

of 2 years.

Additionally,

on March 28, 2019, the Company executed a Securities Purchase

Agreement (the “Series A Purchase Agreement”) with

Bruce D. Hansen, the Company’s Chief Executive Officer, and

Robert I. Pennington, the Company’s Chief Operating Officer

(collectively the “Investors”), effective as of March

21, 2019. Pursuant to the Series A Purchase Agreement, the

Investors agreed to purchase up to $900,000 of convertible shares

of Series A Preferred Stock, par value $0.001 per share (the

“Series A Convertible Preferred Shares”), of the

Company. The Company requested three separate closings of sales of

Series A Convertible Preferred Shares to the Investors between the

date of the Series A Purchase Agreement and June 30, 2019. Each

closing was in the amount of $300,000 of Series A Convertible

Preferred Shares.

The

Series A Convertible Preferred Shares were priced at

$100.00/preferred share, convertible at any time at the

holder’s discretion into common shares whereby one preferred

share converts at a price of $0.27/common share to 370.37 common

shares. The conversion price was set as the closing price of the

common stock on March 12, 2019, which was the day before

announcement of the private placement. The Series A Convertible

Preferred Shares carry a 5% annual dividend, which may be paid, in

the Company’s sole discretion, in cash, additional shares or

a combination thereof. Upon maturity or full repayment of the $7.2

million Convertible Note debt, described below, currently

outstanding, there will be mandatory redemption of the Series A

Convertible Preferred Shares into equivalent cash for the principal

invested, plus any accrued and unpaid dividends.

7

On

May 2, 2019, the Company also executed a Securities Purchase

Agreement (the “MHMI Series A Purchase Agreement”) with

Mount Hope Mines, Inc. (“MHMI”), later assigned in

part to members of MHMI individually. Pursuant to the MHMI

Series A Purchase Agreement, MHMI agreed to purchase $500,000

of Series A Convertible Preferred Shares, as described above. These

shares were fully converted into shares of common stock of the

Company in the fourth quarter of 2019.

On

August 5, 2019, the Company executed a Securities Purchase

Agreement (the “Series B Purchase Agreement”) with the

Investors. Pursuant to the Series B Purchase Agreement, the

Investors agreed to purchase up to $400,000 of convertible shares

of Series B Preferred Stock, par value $0.001 per share (the

“Series B Convertible Preferred Shares”), of the

Company. This transaction closed on August 7, 2019.

The

Series B Convertible Preferred Shares were issued at a price of

$100.00 per share, and each Series B Convertible Preferred Share

will be convertible at any time at the holder’s discretion

into 500 shares of common stock of the Company. The Series B

Convertible Preferred Shares carry a 5% annual dividend, which may

be paid, in the Company’s sole discretion, in cash,

additional shares of Series B Convertible Preferred Shares or a

combination thereof. The Series B Convertible Preferred Shares,

like the Series A Convertible Preferred Shares, are mandatorily

redeemable upon maturity or full repayment of the Exchange Note and

Supplemental Note debt discussed in Note 5 below.

In

December 2019, the Company completed an exchange offer with the

holder of $5 million of the Company’s Senior Convertible

Promissory Notes and certain other holders of Senior Convertible

Notes and Senior Promissory Notes (collectively, the “Old

Notes”) to exchange the Old Notes for new units consisting of

new senior non-convertible promissory notes having a principal

amount equal to the original principal amount of the Old Notes

exchanged plus accrued and unpaid interest (including deferred

interest), bearing an interest rate between 12-14% and otherwise

providing for similar terms (the “Exchange Notes”) and

a three-year warrant to purchase Company common stock exercisable

at $0.35 per share (each a “Unit”). The Exchange

Notes extend the maturity date until December 2022. A majority of

the remaining holders also agreed to the terms of the Exchange

Notes.

In

addition to the exchange of Old Notes, the largest holder of the

Old Notes, as well as the Company’s CEO/CFO, Bruce Hansen and

other noteholders, purchased new 13% Senior Promissory Notes due

2022 in the principal amount of $1.3 million (representing

approximately 20% of the original principal amount of the Old Notes

to be exchanged) providing additional capital to the

Company.

The

Company paid at maturity the unpaid principal and all accrued and

unpaid interest in the approximate amount of $368,000 to those

eligible holders that elected not to participate in the Exchange

Offer. The original principal amount of Old Notes paid at

maturity represented approximately 5% of the total

outstanding. The maturity date was December 26, 2019. The

Warrants issued in connection with the Old Notes expired by their

terms on December 26, 2019.

These

transactions have assisted with very near-term liquidity necessary

for the Company to operate through the third quarter of 2020.

However, this does not alleviate the substantial doubt about our

ability to continue to operate as a going concern. If we are unable

to acquire additional cash resources prior to the end of September

2020, we will likely be forced to enter into bankruptcy and/or

cease operations.

The Mt. Hope Project

From

October 2005 to January 2008, we owned the rights to 100%

of the Mt. Hope Project. Effective as of January 1, 2008, we

contributed all of our interest in the assets related to the Mt.

Hope Project, including the Mt. Hope Lease, into EMLLC, and in

February 2008 entered into a joint venture agreement

(“LLC Agreement”) for the development and operation of

the Mt. Hope Project with POS-Minerals Corporation

(“POS-Minerals”). Under the LLC Agreement, POS-Minerals

owns a 20% interest in the LLC and General Moly, through Nevada

Moly, LLC (“Nevada Moly”), a wholly-owned subsidiary,

owns an 80% interest. The ownership interests and/or required

capital contributions under the LLC Agreement can change as

discussed below.

In

addition, under the terms of the LLC Agreement, since commercial

production at the Mt. Hope Project was not achieved by

December 31, 2011, the LLC will be required to return to

POS-Minerals $36.0 million, since reduced to $33.6 million as

discussed below, of its capital contributions (“Return of

Contributions”), with no corresponding reduction in

POS-Minerals’ ownership percentage. Effective January 1,

2015, as part of a comprehensive agreement concerning the release

of the reserve account described below, Nevada Moly and

POS-Minerals agreed that the Return of Contributions will be

payable to POS-Minerals on December 31, 2020; provided that,

at any time on or before November 30, 2020, Nevada Moly and

POS-Minerals may agree in writing to extend the due date to

December 31, 2021; and if the due date has been so extended,

at any time on or before November 30, 2021, Nevada Moly and

POS-Minerals may agree in writing to extend the due date to

December 31, 2022. If the repayment date is extended, the

unpaid amount will bear interest at a rate per annum of LIBOR plus

5%, which interest shall compound quarterly, commencing on

December 31, 2020 through the date of payment in full.

Payments of accrued but unpaid interest, if any, shall be made on

the repayment date. Nevada Moly may elect, on behalf of the

Company, to cause the Company to prepay, in whole or in part, the

Return of Contributions at any time, without premium or penalty,

along with accrued and unpaid interest, if any.

8

The

original Return of Contributions amount due to POS-Minerals is

reduced, dollar for dollar, by the amount of capital contributions

for equipment payments required from POS-Minerals under approved

budgets of the LLC, as discussed further below. During the period

January 1, 2015 to March 31, 2020, this amount has been reduced by

$2.4 million, consisting of 20% of an $8.4 million principal

payment made on milling equipment in March 2015, a $2.2

million principal payment made on electrical transformers in

April 2015, and a $1.2 million principal payment made on

milling equipment in April 2016, such that the remaining amount due

to POS-Minerals is $33.6 million. If Nevada Moly does not fund its

additional capital contribution in order for the LLC to make the

required Return of Contributions to POS-Minerals set forth above,

POS-Minerals has an election to either make a secured loan to the

LLC to fund the Return of Contributions, or receive an additional

interest in the LLC estimated to be 5%. In the latter case, Nevada

Moly’s interest in the LLC is subject to dilution by a

percentage equal to the ratio of 1.5 times the amount of the unpaid

Return of Contributions over the aggregate amount of deemed capital

contributions (as determined under the LLC Agreement) of both

parties to the LLC (“Dilution Formula”). At June 30,

2020, the aggregate amount of deemed capital contributions of both

parties was $1,091.2 million.

Furthermore, the

LLC Agreement authorizes POS-Minerals to put/sell its interest in

the LLC to Nevada Moly after a change of control of Nevada Moly or

the Company, as defined in the LLC Agreement, followed by a failure

by us or our successor company to use standard mining industry

practice in connection with the development and operation of the

Mt. Hope Project as contemplated by the parties for a period of

twelve (12) consecutive months. If POS-Minerals exercises its

option to put or sell its interest, Nevada Moly or its transferee

or surviving entity would be required to purchase the interest for

120% of POS-Minerals’ total contributions to the LLC, which,

if not paid timely, would be subject to 10% interest per

annum.

Effective

January 1, 2015, Nevada Moly and POS-Minerals signed an

amendment to the LLC Agreement under which a separate $36.0 million

owed to Nevada Moly, held by the LLC in a reserve account

established in December 2012, is being released for the mutual

benefit of both members related to the jointly approved Mt. Hope

Project expenses through 2021. In January 2015, the reserve

account funded a reimbursement of contributions made by the members

during the fourth quarter of 2014, inclusive of $0.7 million to

POS-Minerals and $2.7 million to Nevada Moly. The remaining reserve

account funds are now being used to pay ongoing jointly approved

expenses of the LLC until the Company obtains full financing for

its portion of the Mt. Hope Project construction cost, or until the

reserve account is exhausted. Any remaining funds after financing

is obtained will be returned to the Company. The balance of the

reserve account was $2.8 million and $3.4 million at June 30, 2020

and December 31, 2019, respectively.

As the

cash needs for the development of the Mt. Hope Project are

significant, we and/or the LLC will be required to arrange for

financing to be combined with funds anticipated to be received from

POS-Minerals in order to retain its 20% LLC membership interest. If

we are unsuccessful in obtaining financing, we will not be able to

proceed with the development of the Mt. Hope Project. Additional

funding for the Mt. Hope Project would allow us to restart

equipment procurement and agreements that were suspended or

terminated would be renegotiated under current market terms and

conditions, as necessary. In the event of an extended delay related

to availability of the Company’s portion of full financing

for the Mt. Hope Project, the Company will continue using its best

efforts to work with its LLC joint venture partner POS-Minerals to

revise procurement and construction commitments including Mt. Hope

Project equipment deposits and pricing structures. There can be no

assurance that additional funding will be obtained.

Purchase Commitments

We

continue to work with our long-lead vendors to manage the timing of

contractual payments for milling equipment. The following table

sets forth the LLC’s remaining cash commitments under these

equipment contracts (collectively, “Purchase

Contracts”) at June 30, 2020 (in millions):

|

|

As of

|

|

|

June 30,

|

|

Year

|

2020 *

|

|

2020

|

$—

|

|

2021

|

0.6

|

|

Total

|

$0.6

|

*

All amounts are

commitments of the LLC, and as a result of the agreement between

Nevada Moly and POS-Minerals are to be funded by the reserve

account, now $2.8 million, until such time that the Company obtains

financing for its portion of construction costs at the Mt. Hope

Project or until the reserve account balance is exhausted, and

thereafter are to be funded 80% by Nevada Moly and 20% by

POS-Minerals. POS-Minerals remains obligated to make capital

contributions for its 20% portion of equipment payments required by

approved budgets of the LLC, and such amounts contributed by the

reserve account on behalf of POS-Minerals will reduce, dollar for

dollar, the amount of capital contributions that the LLC is

required to return to POS-Minerals.

9

If the

LLC does not make the payments contractually required under these

purchase contracts, it could be subject to claims for breach of

contract or to cancellation of the respective purchase contract. In

addition, the LLC may proceed to selectively suspend, cancel or

attempt to renegotiate additional purchase contracts, if necessary,

to further conserve cash. If the LLC cancels or breaches any

contracts, the LLC will take all appropriate action to minimize any

losses, but could be subject to liability under the contracts or

applicable law. The cancellation of certain key contracts could

cause a delay in the commencement of operations, and could add to

the cost to develop the Company’s interest in the Mt. Hope

Project.

Through

June 30, 2020, the LLC has made deposits and/or final payments of

$88.0 million on equipment orders. Of these deposits, $71.7 million

relate to fully fabricated items, primarily milling equipment, for

which the LLC has additional contractual commitments of $0.6

million noted in the table above. The remaining $16.3 million

reflects both partially fabricated milling equipment, and

non-refundable deposits on mining equipment. As discussed in Note

11, the mining equipment agreements remain cancellable with no

further liability to the LLC. The underlying value and

recoverability of these deposits and our mining properties in our

consolidated balance sheets are dependent on the LLC’s

ability to fund development activities that would lead to

profitable production and positive cash flow from operations, or

proceeds from the sale of these assets. There can be no assurance

that the LLC will be successful in generating future profitable

operations, selling these assets or that the Company will secure

additional funding in the future on terms acceptable to us or at

all. Our consolidated financial statements do not include any

adjustments relating to recoverability and classification of

recorded assets or liabilities.

All Mt.

Hope Project related funding is payable out of the reserve account

until exhausted, the balance of which was $2.8 million and $3.4

million at June 30, 2020 and December 31, 2019, respectively.

Corporate general and administrative expenses and costs associated

with the maintenance of the Liberty Project are not covered by the

Reserve Account. Additional potential funding sources include

public or private equity offerings or sale of other assets owned by

the Company and/or the LLC.

Agreement with AMER International Group

(“AMER”)

Private Placement

As

announced in April 2015, the Company and AMER entered into a

private placement for 40.0 million shares of the Company’s

common stock and warrants to purchase 80.0 million shares of the

Company’s common stock, priced using the trailing 90-day

volume weighted average price (“VWAP”) of $0.50 on

April 17, 2015, the date the Investment and Securities

Purchase Agreement (“AMER Investment Agreement”) was

signed. General Moly received stockholder approval of the

transaction at its 2015 Annual Meeting, and of material amendments

to the transaction at a special meeting held in December

2017.

On

November 2, 2015, the Company and AMER entered into an amendment to

the AMER Investment Agreement, utilizing a three-tranche

investment. The first tranche of the amended AMER Investment

Agreement closed on November 24, 2015 for a $4.0 million private

placement representing 13.3 million shares, priced at $0.30 per

share, and warrants (“the AMER Warrants”) to purchase

80.0 million shares of common stock at $0.50 per share, which would

have become exercisable upon availability of an approximately

$700.0 million senior secured loan (“Bank Loan”). The

funds received from the $4.0 million private placement were divided

evenly between general corporate purposes and an expense

reimbursement account available to both AMER and the Company to

cover anticipated Mt. Hope financing costs and other jointly

sourced business development opportunities. In addition, AMER and

General Moly entered into a Stockholder Agreement allowing AMER to

nominate a director to the General Moly Board of Directors and

additional directors following the close of Tranche 3, discussed

below, and drawdown of the Bank Loan. The Stockholder Agreement

also governed AMER’s acquisition and transfer of General Moly

shares. Prior to closing the first tranche the parties agreed to

eliminate certain conditions to closing. Following the closing,

AMER nominated Tong Zhang to serve as a director of the Company,

and he was appointed by the Board of Directors on December 3, 2015.

Mr. Zhang was nominated by the Board of Directors to stand for

election at the 2018 General Meeting of Stockholders and was

elected by the stockholders to serve as a Class II director for a

three (3) year term expiring in 2021, subject to re-election. On

July 29, 2019, Mr. Zhang resigned from the Board of Directors. AMER

nominated Mr. Siong Tek (“Terry”) Lee, a Chartered

Accountant based in Singapore, to serve the remaining term of Mr.

Zhang expiring at the Company’s annual meeting in 2021. AMER

may nominate a second director to the Board so long as its

shareholding exceeds 20% of the Company’s shares

outstanding.

On

October 16, 2017, the Company and AMER announced the closure of the

second tranche of the parties’ three-tranche financing

agreement. At the close of the second tranche, General Moly issued

14.6 million shares to AMER, priced at the volume weighted average

price (“VWAP”) for the 30-day period ending August 7,

2017 (the date of the parties’ Amendment No. 2 to the AMER

Investment Agreement) of $0.41 per share for a private placement of

$6.0 million by AMER. $5.5 million of the equity sale proceeds were

available for general corporate purposes, while $0.5 million was

held in the expense reimbursement account established at the close

of the first tranche to cover costs related to the Mt. Hope Project

financing and other jointly sourced business development

opportunities.

10

The

third tranche of the amended investment agreement was to include a

$10.0 million private placement representing 20.0 million shares,

priced at $0.50 per share (“Tranche 3”). Closing of

Tranche 3 was conditioned upon the earlier of the reissuance of

water permits for the Mt. Hope Project or completion of a joint

business opportunity involving use of 10.0 million shares of

General Moly stock.

The

issuance of shares in connection with the third tranche of the AMER

Investment Agreement was approved by General Moly stockholders in

December 2017 at a Special Meeting of Stockholders.

AMER Disputes Obligation to Close Tranche 3

The

last closing conditions for Tranche 3 under the AMER Investment

Agreement included issuance of water permits for the Mt. Hope

Project. The water permits were issued by the Nevada State Engineer

on July 24, 2019. On July 26, 2019, the Company provided formal

notice to AMER that the conditions to closing of Tranche 3 had been

satisfied, and that AMER would have two business days (until the

close of business on Tuesday, July 30, 2019) to close the

transaction. On July 31, 2019, the Company sent a Notice of

Default, as AMER failed to fund and close Tranche 3 by the July 30,

2019 deadline.

On

August 1, 2019, the Company received a letter from AMER dated July

30, 2019, purporting to terminate the AMER Investment Agreement,

referencing its earlier letter received by the Company on July 18,

2019, in which AMER has alleged uncured material adverse effects

and alleged breaches of the AMER Investment Agreement by the

Company (which included concerns related to US/China relations,

concerns regarding the delay in obtaining environmental permits and

solvency concerns). The Company believed that such assertions were

inaccurate and wholly without merit under the terms of the AMER

Investment Agreement. Additionally, as AMER disputed its obligation

to fund the close of Tranche 3, the Company believed that

AMER’s attempted termination of the AMER Investment Agreement

was ineffective. With AMER’s failure to fund Tranche 3, the

Company had inadequate cash to continue operations and was forced

to evaluate its options, including pursuing asset sales, short-term

financing options and, if unsuccessful in obtaining sufficient

financing, the possibility of seeking bankruptcy

protection.

On

August 28, 2019, the Company engaged King & Spalding, an

international arbitration and litigation firm, to represent the

Company in its dispute against AMER for AMER’s default. The

Company formally notified AMER that a dispute, as defined by the

AMER Investment Agreement existed between the parties as a result

of AMER’s failure to close Tranche 3. The notification

required that one representative of each of the executive

management of the parties be designated and authorized to attempt

to settle the Dispute and the representatives were to meet in good

faith to resolve the Dispute.

On

October 14, 2019, the Company announced that it had entered into a

Dispute Negotiation Extension Agreement with AMER to extend the

dispute negotiation period (“Extension Agreement”).

Under the terms of the Extension Agreement, the Company received

$300,000 from AMER in exchange for an extension of the negotiation

period to November 15, 2019, on which date the Company’s CEO

Bruce Hansen and AMER Chairman Wang Wen Yin met to discuss

settlement options. With the payment, AMER had the right, at its

option, to credit the Extension Fee among the following: (1) credit

against a final negotiated settlement; (2) credit against any AMER

payment obligation to the Company, pursuant to an arbitration

award; or (3) apply the Extension Fee as consideration for the

purchase of the Company’s common stock, priced at the 30-day

volume weighted average price, as of the date immediately prior to

the date that AMER demands delivery of such shares.

On December 9, 2019, the Company and an affiliate

of AMER announced the closure of a $4 million private placement at

a price of $0.40 per common share of General Moly under a new

Securities Purchase Agreement (“SPA”) and amended and

restated warrant agreement (“New AMER Warrant”),

resolving the Dispute. Additionally, the parties agreed to a

mutual release, terminating the previous AMER Investment Agreement,

the prior Warrant, and the Extension Agreement. The

parties’ previous Stockholder Agreement expired by its terms

on November 24, 2019. In addition to the 10.0 million shares issued

by General Moly to AMER in the private placement, AMER also

received 1.1 million General Moly common shares priced at

$0.27/share, the 30-day volume weighted average price of the

Company’s shares on the NYSE American on December 6, 2019

utilizing the Extension Fee, pursuant to the terms of the Extension

Agreement. Additionally, for every $100 million of sourced

Chinese bank lending that AMER has assisted in contributing to a

completed $700 million project debt financing, AMER may exercise 12

million warrants issued under the New AMER Warrant at an exercise

price of $0.50 per share, up to 80 million warrants.

Supply Agreement

Furthermore, upon

closing of a minimum of $100 million from AMER’s efforts

toward the completion of a Chinese bank $700 million project

financing, AMER has the option to enter into a molybdenum supply

agreement with General Moly to purchase Mt. Hope Project sourced

molybdenum at a small discount to spot pricing when the Mt. Hope

Project achieves full commercial production. The saleable amount of

molybdenum to AMER escalates from an aggregate 3 million pounds per

year to 20 million pounds per year over the first five years of

mine production based on the level of project financing assisted by

AMER towards the $700 million project financing.

11

Exploring Other Potential Joint Opportunities

The

Company and AMER have jointly evaluated other potential

opportunities, ranging from outright acquisitions and

privatizations, or significant minority interest investments with a

focus on base metal and ferro-alloy prospects, where the Company

would benefit from management fees, minority equity interests, or

the acquisition of both core and non-core assets. The Company and

AMER have considered but not completed any such transactions to

date and we are not currently evaluating potential opportunities

with AMER. From commencement of the AMER Investment Agreement in

2015 to December 31, 2019, the Company and AMER spent approximately

$2.5 million from the expense reimbursement account described above

in connection with such evaluations. There have been no further

joint evaluations and no further expenses incurred.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

The

interim consolidated financial statements (“interim

statements”) of the Company are unaudited. In the opinion of

management, all adjustments and disclosures necessary for a fair

statement of these interim statements have been included. All such

adjustments are, in the opinion of management, of a normal

recurring nature. The results reported in these interim statements

are not necessarily indicative of the results that may be presented

for the entire year. These interim statements should be read in

conjunction with the consolidated financial statements included in

our Annual Report on Form 10-K for the year ended

December 31, 2019, filed with the Securities and Exchange

Commission (“SEC”) on May 4, 2020.

This

summary of significant accounting policies is presented to assist

in understanding the financial statements. The financial statements

and notes are representations of the Company’s management,

which is responsible for their integrity and objectivity. These

accounting policies conform to accounting principles generally

accepted in the United States of America (“GAAP”) and

have been consistently applied in the preparation of the financial

statements.

Accounting Method

Our

financial statements are prepared using the accrual basis of

accounting in accordance with GAAP. With the exception of the LLC,

all of our subsidiaries are wholly owned. In February 2008, we

entered into the LLC Agreement, which established our ownership

interest in the LLC at 80%. The consolidated financial statements

include all of our wholly owned subsidiaries and the LLC. The

POS-Minerals contributions attributable to their 20% interest are

shown as Contingently Redeemable Noncontrolling Interest on the

Consolidated Balance Sheet. The net loss attributable to

contingently redeemable noncontrolling interest is reflected

separately on the Consolidated Statement of Operations and reduces

the Contingently Redeemable Noncontrolling Interest on the

Consolidated Balance Sheet. Net losses of the LLC are attributable

to the members of the LLC based on their respective ownership

percentages in the LLC. During the three months ended June 30,

2020, the LLC had a $176,000 loss, primarily associated with the

sale of non-core assets offset by accretion of its reclamation

obligations and care and maintenance costs incurred which do not

qualify for capitalization under U.S. GAAP, of which $35,000, was

attributed to the Contingently Redeemable Noncontrolling

Interest.

Contingently Redeemable Noncontrolling Interest

(“CRNCI”)

Under

GAAP, certain noncontrolling interests in consolidated entities

meet the definition of mandatorily redeemable financial instruments

if the ability to redeem the interest is outside of the control of

the consolidating entity. As described in

Note 1 — “Description of Business”, the

LLC Agreement permits POS-Minerals the option to put its interest

in the LLC to Nevada Moly upon a change of control, as defined in

the LLC Agreement, followed by a failure by us to use standard

mining industry practice in connection with the development and

operation of the Mt. Hope Project as contemplated by the parties

for a period of 12 consecutive months. As such, the CRNCI has

continued to be shown as a separate caption between liabilities and

equity based on accounting standards which require equity

instruments with redemption features that are not solely within the

control of the issuer to be classified outside of permanent equity

(referred to as mezzanine equity). The carrying value of the

CRNCI has historically included the Return of Contributions, now

$33.6 million, that will be returned to POS-Minerals in 2020,

unless further extended by the members of the LLC as discussed

above. The expected Return of Contributions to POS-Minerals was

carried at redemption value as we believed redemption of this

amount was probable. Effective January 1, 2015, Nevada Moly

and POS-Minerals agreed that the Return of Contributions will be

due to POS-Minerals on December 31, 2020, unless further

extended by the members of the LLC as discussed above. As a result,

we have reclassified the Return of Contributions payable to

POS-Minerals from CRNCI to a current liability at redemption value,

and subsequently reduced it by $2.4 million, consisting of 20% of

an $8.4 million principal payment made on milling equipment in

March 2015, a $2.2 million principal payment made on

electrical transformers in April 2015, and a $1.2 million

principal payment made on milling equipment in April 2016, such

that the remaining amount due to POS-Minerals is $33.6

million.

12

The

remaining carrying value of the CRNCI has not been adjusted to its

redemption value as the contingencies that may allow POS-Minerals

to require redemption of its noncontrolling interest are not

probable of occurring. Under GAAP, until such time as that

contingency has been eliminated and redemption is no longer

contingent upon anything other than the passage of time, no

adjustment to the CRNCI balance should be made. Future changes in

the redemption value will be recognized immediately as they occur

and the Company will adjust the carrying amount of the CRNCI to

equal the redemption value at the end of each reporting

period.

Estimates

The

process of preparing consolidated financial statements requires the

use of estimates and assumptions regarding certain types of assets,

liabilities, revenues, and expenses. Such estimates primarily

relate to unsettled transactions and events as of the date of the

financial statements. Accordingly, upon settlement, actual results

may differ from estimated amounts.

Asset Impairments

We

evaluate the carrying value of long-lived assets to be held and

used, using a fair-value based approach when events and

circumstances indicate that the related carrying amount of our

assets may not be recoverable. Significant declines in the overall

economic environment, molybdenum and copper prices may be

considered as impairment indicators for the purposes of these

impairment assessments. Additionally, failure to secure our mining

permits, including our water rights, or revocation of our permits,

may be considered as impairment indicators for the purposes of

these impairment assessments. In accordance with U.S. GAAP, the

carrying value of a long-lived asset is considered impaired when

the anticipated undiscounted cash flows from such asset is less

than its carrying value. In that event, an impairment charge will

be recorded in our Consolidated Statement of Operations and

Comprehensive Loss based on the difference between book value and

the estimated fair value of the asset computed using discounted

future cash flows, or the application of an expected fair value

technique in the absence of an observable market price. Future cash

flows include estimates of recoverable quantities to be produced

from estimated proven and probable mineral reserves, commodity

prices (considering current and historical prices, price trends and

related factors), production quantities and capital expenditures,

all based on life-of-mine plans and projections. In estimating

future cash flows, assets are grouped at the lowest level for which

identifiable cash flows exist that are largely independent of cash

flows from other asset groups. Generally, in estimating future cash

flows, all assets are grouped at a particular mine for which there

are identifiable cash flows.

Management

evaluated the circumstances of the July 30, 2019 AMER default and

concluded the default was a triggering event in the third quarter

of 2019 which continues to exist at June 30, 2020. As of June 30,

2020, we evaluated and determined the carrying value of the asset

group for the Liberty project was recoverable as the

probability-weighted undiscounted cash flows exceeded the carrying

value of that asset group. We determined the carrying value of the

asset group for the Mt. Hope project was not recoverable as the

carrying value exceeded the probability-weighted undiscounted cash

flows of that asset group. The Company has recorded an impairment

charge of $260.6 million which represents the difference between

the book value and the estimated fair value of the assets utilizing

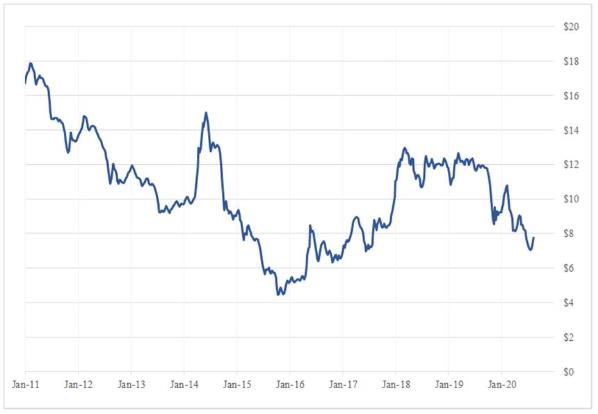

estimated market prices. Factors leading to the impairment include,

but are not limited to, the Company’s inability to obtain

financing to date and inadequate cash to continue operations past

the third quarter of 2020, the impact of COVID-19 on capital

markets and demand for molybdenum during the second quarter of

2020, and the decrease in the current and forecasted price of

molybdenum.

In the

calculation of the impairment charge, management estimated the fair

value of the asset group using the estimated salvage value using a

range based on an immediate sale model and a sale in an improved

commodity market model, basing the estimated fair value of the

asset group on the midpoint of these two estimates. Given current

market conditions and considering our need for near-term liquidity,

management determined that the midpoint was the most appropriate

point in the range for the fair value estimate. The estimated range

of fair values was approximately $28 million to $53 million.

Salvage values were used to determine fair value of the Mt. Hope

asset group because the current discounted cash flows was negative

due to current molybdenum prices. The carrying value of the Mt.

Hope asset group, which includes directly associated liabilities,

prior to impairment was approximately $299.3 million. During the

third quarter of 2020, management will continue to refine the

calculation using formal appraisals of tangible assets which could

materially change the impairment calculation.

13

The

impairment charge by asset type was as follows:

|

|

Asset Impairment Charges

|

|

|

(In thousands)

|

|

Mining

properties, land and water rights

|

$200,303

|

|

Deposits

on project property, plant and equipment

|

57,630

|

|

Other

assets

|

2,620

|

|

Total

|

$260,553

|

While

at June 30, 2020, we have not identified any impairment of our

long-lived assets for the Liberty project, there can be no

assurance that there will not be asset impairments for the Liberty

project or additional impairments for the Mt. Hope project if

commodity prices experience a sustained decline and/or if there are

significant downward adjustments to estimates of recoverable

quantities to be produced from proven and probable mineral reserves

or production quantities, and/or upward adjustments to estimated

operating costs and capital expenditures, all based on life-of-mine

plans and projections. Additionally, should we be unable to secure

additional financing, we may be required to modify our

probability-weighted undiscounted cash flow projections which could

result in additional impairment to our assets.

Cash and Cash Equivalents and Restricted Cash

We

consider all highly liquid investments with original maturities of

three months or less to be cash equivalents. The Company’s

cash equivalent instruments are classified within Level 1 of the

fair value hierarchy established by FASB guidance for Fair Value

Measurements because they are valued based on quoted market prices

in active markets.

We

consider all restricted cash, inclusive of the reserve account

discussed above and reclamation surety bonds, to be

long-term.

|

|

|

June 30, 2020

|

|

December 31, 2019

|

||

|

|

|

(in thousands)

|

||||

|

Cash and cash equivalents

|

|

$

|

2,528

|

|

$

|

4,614

|

|

Restricted cash held at EMLLC

|

|

|

2,829

|

|

|

3,388

|

|

Total cash, cash equivalents and restricted cash shown in the

statement of cash flows

|

|

$

|

5,357

|

|

$

|

8,002

|

As of

June 30, 2020, the LLC had $0.3 million in cash deposits associated

with reclamation bonds, which are accounted for as restricted cash.

Another $0.1 million in cash collateral is associated with surety

bonds at the Liberty Project. These amounts are considered

investments and are not included in cash and cash equivalents for

purposes of the Statement of Cash Flows.

Basic and Diluted Net Loss Per Share

Net

loss per share was computed by dividing the net loss attributable

to the Company by the weighted average number of shares outstanding

during the period. The weighted average number of shares was

calculated by taking the number of shares outstanding and weighting

them by the amount of time that they were outstanding. Outstanding

awards as of June 30, 2020 and December 31, 2019,

respectively, were as follows:

|

|

June 30,

2020

|

December 31,

2019

|

|

Warrants

|

98,013,256

|

98,013,256

|

|

Unvested

Stock Awards

|

421,268

|

421,268

|

|

Stock

Appreciation Rights

|

909,837

|

909,837

|

These

awards were not included in the computation of diluted loss per

share for the three and six months ended June 30, 2020 and December

31, 2019, respectively, because to do so would have been

anti-dilutive. Therefore, basic loss per share is the same as

diluted loss per share.

Mineral Exploration and Development Costs

All

exploration expenditures are expensed as incurred. If no economic

ore body is discovered, previously capitalized costs are expensed

in the period the property is abandoned. Expenditures to develop

new mines, to define further mineralization in existing ore bodies,

and to expand the capacity of operating mines, are capitalized and

amortized on a units-of-production basis over proven and probable

reserves.

14

Should

a property be abandoned, its capitalized costs are charged to

operations. The Company charges to the consolidated statement of

operations the allocable portion of capitalized costs attributable

to properties sold. Capitalized costs are allocated to properties

sold based on the proportion of claims sold to the claims remaining

within the project area.

Mining Properties, Land and Water Rights

Costs

of acquiring and developing mining properties, land and water

rights are capitalized as appropriate by project area. Exploration

and related costs and costs to maintain mining properties, land and

water rights are expensed as incurred while the property is in the

exploration and evaluation stage. Development and related costs and

costs to maintain mining properties, land and water rights are

capitalized as incurred while the property is in the development

stage. When a property reaches the production stage, the related

capitalized costs are amortized using the units-of-production basis

over proven and probable reserves. Mining properties, land and

water rights are periodically assessed for impairment of value, and

any subsequent losses are charged to operations at the time of

impairment. If a property is abandoned or sold, a gain or loss is

recognized and included in the consolidated statement of

operations.

The

Company has capitalized royalty payments made to Mt. Hope

Mines, Inc. (“MHMI”) (discussed in Note 11 below)

during the development stage. The amounts will be applied to

production royalties owed upon the commencement of

production.

Depreciation and Amortization

Property and

equipment are recorded at cost and depreciated using the

straight-line method over the estimated useful lives of the assets.

Property and equipment are depreciated using the following

estimated useful lives:

|

Field equipment

|

|

Four to ten years

|

|

|

Office furniture, fixtures, and equipment

|

|

Five to seven years

|

|

|

Vehicles

|

|

Three to five years

|

|

|

Leasehold improvements

|

|

Three years or the term of the lease, whichever is

shorter

|

|

|

Residential trailers

|

|

Ten to twenty years

|

|

|

Buildings and improvements

|

|

Ten to twenty seven and one-half years

|

|

Provision for Taxes

Income

taxes are provided based upon the asset and liability method of

accounting. Under this approach, deferred income taxes are recorded

to reflect the tax consequences in future years of differences

between the tax basis of assets and liabilities and their financial

reporting amounts at each year-end. In accordance with

authoritative guidance under Accounting Standards Codification

(“ASC”) 740, Income Taxes, a valuation allowance is

recorded against the deferred tax asset if management does not

believe the Company has met the “more likely than not”

standard to allow recognition of such an asset.

Reclamation and Remediation

Expenditures for

ongoing compliance with environmental regulations that relate to

current operations are expensed or capitalized as appropriate.

Future obligations to retire an asset, including reclamation, site

closure, dismantling, remediation and ongoing treatment and

monitoring, are recorded as a liability at fair value at the time

of construction or development. The fair value determination is

based on estimated future cash flows, the current credit-adjusted

risk-free discount rate and an estimated inflation factor. The

value of asset retirement obligations is evaluated on a quarterly

basis or as new information becomes available on the expected

amounts and timing of cash flows required to discharge the

liability. The fair value of the liability is added to the carrying

amount of the associated asset and this additional carrying amount

will be depreciated or amortized over the estimated life of the

asset upon the commencement of commercial production. An accretion

cost, representing the increase over time in the present value of

the liability, will also be recorded each period as accretion

expense. As reclamation work is performed or liabilities are

otherwise settled, the recorded amount of the liability is reduced.