Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Coronado Global Resources Inc. | tm2027081-4_8k.htm |

Exhibit 99.1

|

Coronado Global Resources Inc. Equity Raising Presentation 18 August 2020 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

Important Notices and Disclaimer This investor presentation (Presentation) is dated 18 August 2020 and has been prepared by Coronado Global Resources Inc. ARBN 628 199 468 (Coronado or the Company). By attending the meeting where this Presentation is made, or by reading the Presentation materials, you agree to be bound by the following limitations. This Presentation has been prepared in relation to: prevent any New CDIs from being sold on ASX during the Distribution Compliance Period to persons that are in the United States or to, or for the account or benefit of, US Persons, in each case that are not QIBs. Investors should note that it is possible that the Distribution Compliance Period could be extended beyond the initial six months, and therefore Coronado cannot provide any assurances as to when this designation will be lifted from the New CDIs. • a placement of new CHESS Depository Interests (New CDIs) each of which represents a beneficial interest of 1/10 fully paid share of common stock of Coronado (each a Share) to institutional investors and other selected investors under section 708A of the Corporation Act 2001 (Cth) (Corporations Act) as modified by Australian Securities and Investments Commission (ASIC) Class Order [14/827] (Placement); a pro rata non-renounceable entitlement offer of New CDIs in the Company to eligible existing securityholders (Entitlement Offer) under section 708AA of the Corporations Act as modified by ASIC Corporations (Non-Traditional Rights Issues) Instrument 2016/84 and ASIC Class Order [CO 14/827]; and Refer to Appendix B and Appendix C of this Presentation for further details about international offer restrictions. Investment risk • An investment in securities in Coronado is subject to investment and other known and unknown risks, some of which are beyond the control of Coronado and its directors. Coronado does not guarantee the performance of Coronado or any return on any securities of Coronado nor does it guarantee any particular tax treatment. You should have regard to the risk factors outlined in Appendix A of this Presentation when making your investment decision. Cooling off rights do not apply to the acquisition of New CDIs. (the Placement and Entitlement Offer together, the Offer, as the context requires). Financial information Summary information All dollar values in this Presentation are in Australian dollars or U.S. dollars, as specified. This Presentation incudes certain pro forma financial information (to reflect the impact of the Offer and transaction costs). The pro forma historical financial information provided in this Presentation is for illustrative purposes only and is not represented as being indicative of Coronado’s views on its, nor anyone else’s, future financial position and/or performance. The pro forma financial information has been prepared by Coronado in accordance with the measurement and recognition requirements, but not the disclosure requirements, of applicable accounting standards and other mandatory requirements in the United States or Australia. The pro forma financial information included in this Presentation is not prepared in accordance with the requirements of Regulation S-X. Neither the assumptions underlying the pro forma adjustments nor the resulting pro forma financial information have been audited or reviewed in accordance with generally accepted auditing standards or the standards of the Public Company Accounting Oversight Board. Please note that all financial data as at 30 June 2020 has been reviewed but has not been audited. The material contained in this Presentation is intended to be summary information on Coronado and its activities, which is current as at the date of this Presentation (unless otherwise stated). The information in this Presentation is of a general nature and does not purport to be complete. Certain market and industry data used in this Presentation may have been obtained from research, surveys or studies conducted by third parties, including industry or general publications such as W ood Mackenzie, W orldsteel.org and Ministry of Steel. Neither Coronado nor its advisors or representatives have independently verified any such market or industry data provided by third parties or industry or general publications. This Presentation should be read in conjunction with Coronado’s most recent financial report and Coronado’s other periodic and continuous disclosure information lodged with the Australian Securities Exchange (ASX), which is available at www.asx.com.au/asx/share-price-research/company/CRN. Reliance should not be placed on information or opinions contained in this Presentation and, subject only to any legal obligation to do so, Coronado does not have any obligation to correct or update the content of this Presentation. The information in this Presentation remains subject to change without notice. The presentation of certain financial information may not be compliant with Coronado’s financial statements disclosed in its Form 10-K for the financial year ended December 31, 2020 prepared under US GAAP. In addition, this Presentation contains certain “non-GAAP financial measures” under Regulation G of the U.S. Securities Exchange Act of 1934, as amended (Exchange Act). The disclosure of such a non-GAAP financial measures in the manner included in this Presentation may not be permissible in filings made with the SEC. Non-GAAP financial measures do not have a standardized meaning prescribed by US GAAP or IFRS and therefore may not be comparable to similarly titled measures presented by other entities, nor should they be construed as an alternative to other financial measures determined in accordance with US GAAP or IFRS. The Non-GAAP financial measures in this Presentation include: Adjusted EBITDA, Segment Adjusted EBITDA, LTM EBITDA, Net Gearing, Mining Costs per tonne, and Metallurgical Realised Price per tonne sold. Not financial product advice nor an offer This Presentation does not contain or purport to contain all information necessary to make an investment decision and is not intended as investment or financial advice (nor tax, accounting or legal advice), and must not be relied upon as advice to investors or potential investors, who should consider seeking independent professional advice depending upon their specific investment objectives, financial situation or particular needs. Certain figures, amounts, percentages, estimates, calculations of value and fractions provided in this Presentation are subject to the effect of rounding. Accordingly, the actual calculation of these figures may differ from the figures set out in this Presentation. Any investment decision should be made solely on the basis of the investors’ or potential investors’ own enquiries. Neither Coronado nor its advisors or representatives shall have any responsibility or liability whatsoever (for negligence or otherwise) for any loss howsoever arising from any use of this Presentation or its contents or otherwise arising in connection with this Presentation. Past performance This Presentation is for information purposes only and is not a prospectus, product disclosure statement or other offering document under Australian law or any other law (and will not be lodged with ASIC or any other regulator). This Presentation is not, and does not constitute an offer, advertisement or invitation in any place which, or to any person to whom, it would not be lawful to make such an offer, advertisement or invitation. Past performance information provided in this Presentation is given for illustrative purposes only and should not be relied upon as (and is not) a promise, representation, warranty or guarantee as to the past, present or future performance of Coronado. Future performance and forward-looking statements International restrictions This Presentation contains “forward-looking statements” concerning Coronado’s business, operations, financial performance and condition, the coal, steel and other industries, as well as Coronado’s plans, objectives and expectations for Coronado’s business, operations, financial performance and condition. Forward-looking statements may be identified by words such as “may,” “could,” “believes,” “estimates,” “expects,” “intends,” “likely,” “considers,” “forecasts,” “targets” and other similar words. Forward-looking statements provide management’s current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that Coronado expects or anticipates will occur in the future are forward-looking statements. They may include estimates of revenues, income, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volume, or other financial items, descriptions of management’s plans or objectives for future operations, or descriptions of assumptions underlying any of the above. All forward-looking statements speak only as of the date they are made and reflect Coronado’s good faith beliefs, assumptions and expectations, but they are not a guarantee of future performance or events. Furthermore, Coronado disclaims any obligation to publicly update or revise any forward-looking statement, except as required by law. The distribution of this Presentation in jurisdictions outside Australia may be restricted by law and you should observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. In particular, this Presentation may not be released or distributed to, or relied upon by, any person in the ‘United States’ or any ‘US Person’, each as defined in Regulation S (Regulation S) under the United States Securities Act of 1933, as amended (US Securities Act). This Presentation does not constitute an offer to sell, or a solicitation of any offer to buy, any securities in the United States or to any person who is acting for the account or benefit of any person in the United States (to the extent such person is acting for the account or benefit of a person in the United States), or in any other jurisdiction in which such an offer would be illegal. The offer and sale of the New CDIs and underlying Shares have not been, and will not be, registered under the US Securities Act or the securities laws of any state or other jurisdiction of the United States. Accordingly, the New CDIs in the Placement and the Entitlement Offer may not be offered or sold, directly or indirectly, in the United States or to, or for the account or benefit of, any US Persons unless they are registered under the US Securities Act and any applicable United States state securities laws (which Coronado is not obligated to do), or are offered and sold pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the US Securities Act and any applicable United States state securities laws. Investors are strongly cautioned not to place undue reliance on forward-looking statements, particularly in light of the current economic climate and the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. The New CDIs to be issued under the Offer and the underlying Shares will be ‘restricted securities’ under Rule 144 under the US Securities Act, and offers and sales of the New CDIs and the underlying Shares will be subject to an initial six month distribution compliance period (Distribution Compliance Period) from the date of allotment of the New CDIs under the Offer, which period could be extended. This means that, during such period, which may be extended longer than six months, you will not be permitted to sell the New CDIs sold to you under the Offer or the underlying Shares to persons in the United States or to, or for the account or benefit of, a US Person, unless the resale of the New CDIs or the underlying Shares is registered under the US Securities Act (which Coronado is not obligated to do) or an exemption from such registration is available (including resales to QIBs pursuant to Rule 144A). However, during the Distribution Compliance Period, the New CDIs may be reoffered and resold in standard (regular) way brokered transactions on the ASX where neither the seller nor any person acting on its behalf knows, or has reason to know, that the sale has been prearranged with, or that the purchaser is, a person in the United States or is, or is acting for the account or benefit of, a US Person in accordance with Regulation S, unless, in either case, that person is a QIB acquiring the New CDIs in a transaction exempt from registration under the US Securities Act pursuant to Rule 144A thereunder (if available). By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expected or suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive and regulatory factors, many of which are beyond Coronado’s control, that are described in Appendix A of this Presentation, Coronado’s Annual Report on Form 10-K filed with the ASX and SEC on 25 February 2020 (Sydney time) as updated by its Quarterly Report on Form 10-Q for the quarter ending 31 March 2020 filed with the ASX and SEC on 11 May 2020 (Sydney time), Quarterly Report on Form 10-Q for the quarter ending 30 June 2020 filed with the ASX and SEC on 11 August 2020 (Sydney time), as well as additional factors Coronado may describe from time to time in other filings with the ASX and SEC. You may get such filings for free at ASX’s website at www.asx.com.au SEC’s website at www.sec.gov. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties. There can be no assurance that actual outcomes will not differ materially from forward-looking statements. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including Coronado or any of its advisers). To enforce the above transfer restrictions, Coronado will be implementing restrictions that prohibit transfers of the New CDIs except in accordance with Regulation S, or pursuant to an available exemption from registration, and requiring that any Shares into which New CDIs have been transmuted contain a legend to that effect. Furthermore, hedging transactions involving the New CDIs, or any Shares into which the New CDIs may be transmuted, may not be conducted during the Distribution Compliance Period unless in compliance with the US Securities Act. In addition, during the Distribution Compliance Period all New CDIs issued under the Offer will bear a designation on ASX that is intended to 2 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

Important Notices and Disclaimer (cont.) and the discretion of Coronado and the Joint Lead Managers (and their respective related bodies corporate, affiliates, officers, directors, employees, representatives, agents, 2019 JORC Resource and Reserve Statements You acknowledge and agree that determination of eligibility of investors for the purposes of the Offer is determined by reference to a number of matters, including legal requirements In this Presentation, references to ore reserves and mineral resources (Reserves and Resources) are compliant with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves 2012 (JORC Code) and are measured in accordance with the JORC Code. consultants or advisers) and each of Coronado and the Joint Lead Managers disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent permitted by law. Information in this Presentation relating to Reserves and Resources is extracted from information previously published by Coronado and available on the Coronado and ASX websites (2019 JORC Statement located in the appendix of the ASX Release 2019 Full Year Results) (2019 JORC Statement). For details of the Reserves and Resources estimates and the “Competent Persons” statements, refer to relevant Australian and US Operations sections in the 2019 JORC Statement. Coronado confirms that it is not aware of any new information or data that materially affects the information included in the 2019 JORC Statement, and that all assumptions and technical parameters underpinning the estimates in the 2019 JORC Statement continue to apply and have not materially changed. Coronado confirms that the context in which the Competent Persons’ findings are presented have not been materially modified from the 2019 JORC Statement. You acknowledge and agree that Coronado is required by the terms of the ASX Class W aiver Decision – Temporary Extra Placement Capacity dated 9 July 2020 to announce to the market reasonable details of the approach it took in identifying investors to participate in the Placement and how it determined their respective allocations in the Placement, and Coronado must within 5 business days of completing the Placement supply to ASIC and ASX (but not for public release) an allocation spread sheet showing full details of the persons to whom the Placement was allocated, including the name, existing holding, number of New CDIs they applied for or were offered in the Placement and the number of New CDIs they were allocated in the Placement (including any zero allocations) and this will necessitate disclosing your application and allocation. You acknowledge and agree that your existing holding will be estimated by reference to Coronado’s beneficial register on 20 August 2020 for the Entitlement Offer which shows historical holdings as at that date and is not up to date. There will be no verification or reconciliation of the holdings as shown in the historical beneficial register and accordingly this may not truly reflect your actual holding. Coronado and the Joint Lead Managers do not have any obligation to reconcile assumed holdings (e.g. for recent trading or swap positions) when determining allocations nor do they have any obligation to allocate pro rata on the basis of existing securityholdings. If you do not reside in a permitted offer jurisdiction you will not be able to participate in the Offer. Coronado and the Joint Lead Managers disclaim any duty or liability (including for negligence) in respect of the determination of your allocation using your assumed holdings. Investors should note that while the information in this Presentation relating to Reserves and Resources complies with the JORC Code, it may not comply with the relevant guidelines in other countries such as SEC Industry Guide 7. In particular, SEC Industry Guide 7 does not recognize classifications other than ‘proven (measured)’ and ‘probable (indicated)’ reserves and, as a result, the SEC generally does not permit mining companies to disclose their mineral resources in SEC filings. Accordingly, when Coronado reports in accordance with SEC Industry Guide 7, Coronado is not permitted to report any mineral resources, and the amount of reserves may be lower. Investors should note that Resource information is reported as inclusive of Resources that have been converted into Reserves (i.e. Resources are not additional to Reserves). In addition, investors should not assume that quantities reported as “resources” will be converted to reserves under the JORC Code or any other reporting regime or that Coronado will be able to legally and economically extract them. Estimates of coal reserves, resources, recoveries and operating costs are largely dependent on the interpretation of geological data obtained from drill holes and other sampling techniques, actual production experience and feasibility studies which derive estimates of operating costs based on anticipated tonnage, expected recovery rates, equipment operating costs, prevailing market prices and other factors, which are all subject to uncertainties. No assurance can be given that the Reserves and Resources presented in this Presentation will be recovered at the quality or yield presented. You further acknowledge and agree that allocations are at the sole discretion of the Joint Lead Managers and/or Coronado. The Joint Lead Managers and Coronado disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent permitted by law. Furthermore, the Joint Lead Managers and Coronado reserve the right to change the timetable in their absolute discretion including by closing the institutional bookbuild early or extending the institutional bookbuild closing time (generally or for particular investor(s)) in their absolute discretion (but have no obligation to do so), without recourse to them or notice to you. Furthermore, communications that a transaction is “covered” (i.e. aggregate demand indications exceed the amount of the security offered) are not an assurance that the transaction will be fully distributed. Disclaimer The Placement and Entitlement Offer will be joint lead managed and underwrittena by the Joint Lead Managers. To the maximum extent permitted by law, Coronado and the Joint Lead Managers and each of their respective related bodies corporate, shareholders and affiliates, and their respective officers, directors, partners, employees, representatives, affiliates, agents, consultants and advisers (each a Limited Party): (i) expressly disclaim any and all responsibility and liability (including, without limitation, any liability arising from fault, negligence or negligent misstatement) for any direct, indirect, consequential or contingent loss or damage arising from this Presentation or reliance on anything contained in or omitted from it or otherwise arising in connection with this Presentation; (ii) disclaim any obligations or undertaking to release any updates or revision to the information in this Presentation to reflect any change in expectations or assumptions; and (iii) do not make any representation or warranty, express or implied, as to the accuracy, reliability, completeness or fairness of the information, opinions and conclusions contained in this Presentation or that this Presentation contains all material information about Coronado or that a prospective investor or purchaser may require in evaluating a possible investment in Coronado or acquisition of securities in Coronado, or likelihood of fulfilment of any forward-looking statement or any event or results expressed or implied in any forward-looking statement. None of the Joint Lead Managers nor any of their respective Limited Parties have independently verified the information, opinions or conclusions contained in this Presentation and take no responsibility for any part of this Presentation or the Offer. Further, none of the Joint Lead Managers nor any of their respective Limited Parties accept any fiduciary obligations to or relationship with you, any investor or potential investor in connection with the Offer or otherwise. The Joint Lead Managers and their respective Limited Parties make no recommendation as to whether you or your related parties should participate in the Offer nor do they make any representations or warranties to you concerning the Offer, and you represent, warrant and agree that you have not relied on any statements made by the Joint Lead Managers or any of their respective Limited Parties in relation to the Offer. None of the Joint Lead Managers nor any of their respective Limited Parties have authorized, permitted or caused the issue, lodgement, submission, dispatch or provision of this Presentation and, for the avoidance of doubt, and except for references to their name, none of them makes or purports to make any statement in this Presentation and there is no statement in this Presentation which is based on any statement by any of them. In connection with the institutional bookbuild, one or more investors may elect to acquire an economic interest in the New CDIs (Economic Interest), instead of subscribing for or acquiring the legal or beneficial interest in those New CDIs. One or more of the Joint Lead Managers (or their affiliates) may, for their own account, write derivative transactions with those investors relating to the New CDIs to provide the Economic Interest, or otherwise acquire securities in Coronado in connection with the writing of such derivative transactions in the bookbuild and/or the secondary market. As a result of such transactions, one or more of the Joint Lead Managers (or their affiliates) may be allocated, subscribe for or acquire the New CDIs or securities of Coronado in the bookbuild and/or the secondary market, including to hedge those derivative transactions, as well as hold long or short positions in such securities. These transactions may, together with other securities in Coronado acquired by the Joint Lead Managers or its affiliates in connection with its ordinary course sales and trading, principal investing and other activities, result in the Joint Lead Managers or its affiliates disclosing a substantial holding and earning fees. Each of the Joint Lead Managers and their respective affiliates are full service financial institutions engaged in various activities, which may include trading, financing, corporate advisory, financial advisory, investment management, investment research, principal investment, hedging, market making, brokerage and other financial and non-financial activities and services. Each of the Joint Lead Managers and their respective affiliates have provided, and may in the future provide, financial advisory, financing services and other services to Coronado and to persons and entities with relationships with Coronado, for which they received or will receive customary fees and expenses. In the ordinary course of its various business activities, the Joint Lead Managers and its affiliates may purchase, sell or hold a broad array of investments and actively trade securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments for their own account and for the accounts of their customers, and such investment and trading activities may involve or relate to assets, securities and/or instruments of Coronado, and/or persons and entities with relationships with Coronado. Each of the Joint Lead Managers and their respective affiliates may also communicate independent investment recommendations, market colour or trading ideas and/or publish or express independent research views in respect of such assets, securities or instruments and may at any time hold, or recommend to clients that they should acquire, long and/or short positions in such assets, securities and instruments. a. The underwriting agreement dated 18 August 2020 between Coronado and the Joint Lead Managers provides that a Joint Lead Manag er will not be issued any CDIs that would either cause it to breach the Foreign Acquisitions and Takeovers Act 1975 (Cth) or published Foreign Investment Review Board policy. The issue size is approximately 417 million CDIs or 43% of the existing CDIs on issue. If a Joint Lead Manager was required to take up CDIs on issue which would otherwise cause it, or an affiliate of it, to breach or notify under these provisions then, for the purposes of ASIC Report 612 (March 2019), (i) it will still fund the entire amount of its respective proportion of the underwritten proceeds in accordance with and subject to the terms of the underwriting agreement by the completion date, (ii) the number of excess shortfall CDIs would be up to the number of CDIs offered under the Offer less the number of CDIs that have been sub-underwritten and the number of CDIs that the relevant Joint Lead Manager is able to take up without causing it to breach or notify under these provisions when aggregated with any additional interests the Joint Lead Manager and its affiliates hold at the relevant settlement dates other than through its underwriting commitment; and (iii) it would enter into an arrangement for any excess shortfall CDIs to be issued to it, or to third party investors, after close of the Offer at the same price as the Offer price. No material impact on control is expected to arise as a consequence of these arrangements or from any shareholder taking up their entitlement under the Entitlement Offer where there is an excess shortfall. 3 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

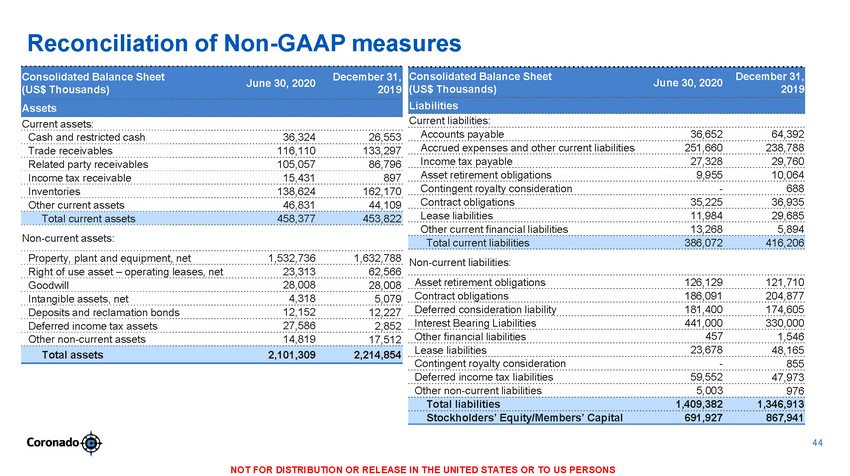

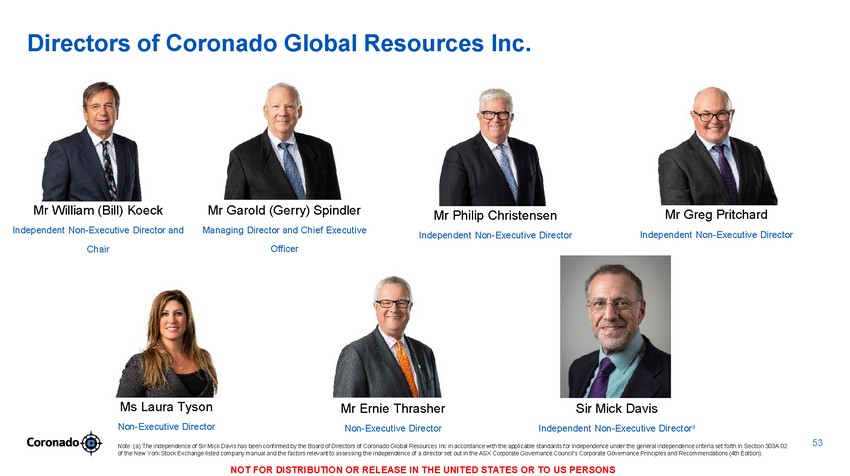

Table of Contents 1. Half Year Results Recap 2. Response to the Current Environment 3. Equity Raising Overview 4. Well Positioned for Recovery in Met Coal Prices Appendices A. Risk Factors B. International Offer Restrictions C. Regulation S Restrictions D. Reconciliation of Non-GAAP measures E. Board of Directors 6 11 16 19 24 36 39 43 53 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

Section 1 Half Year Results Recap 5 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

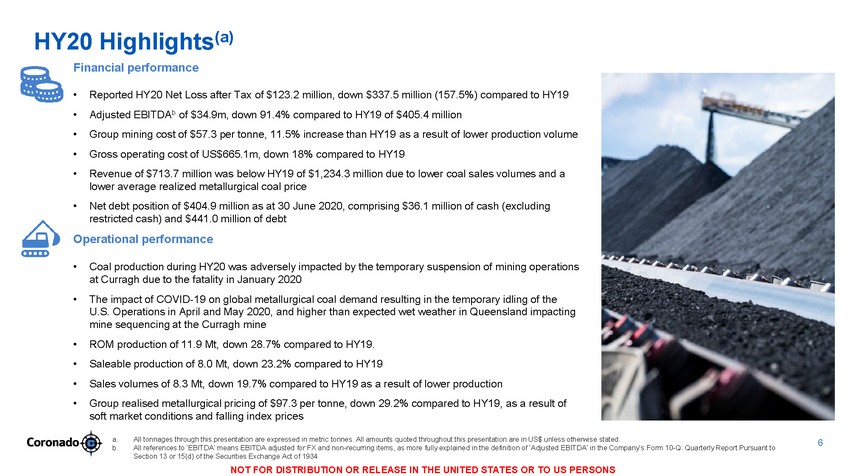

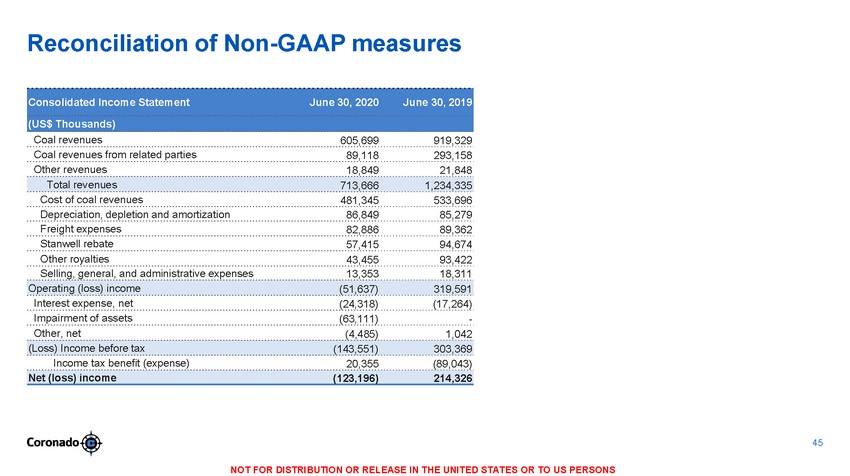

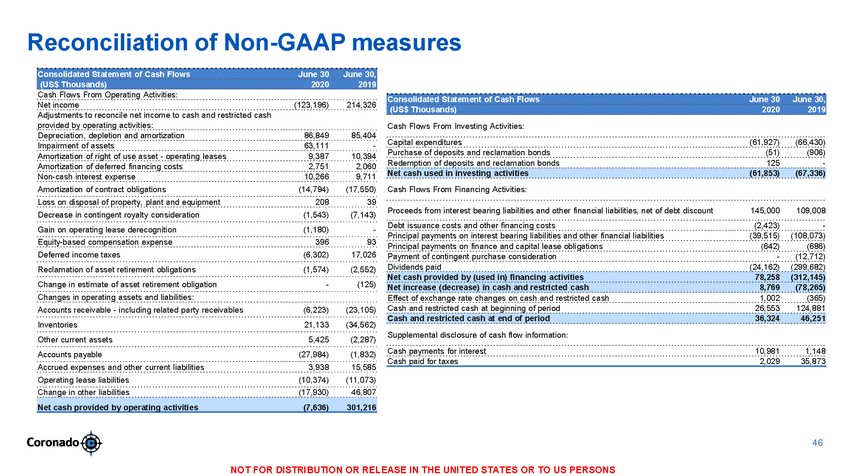

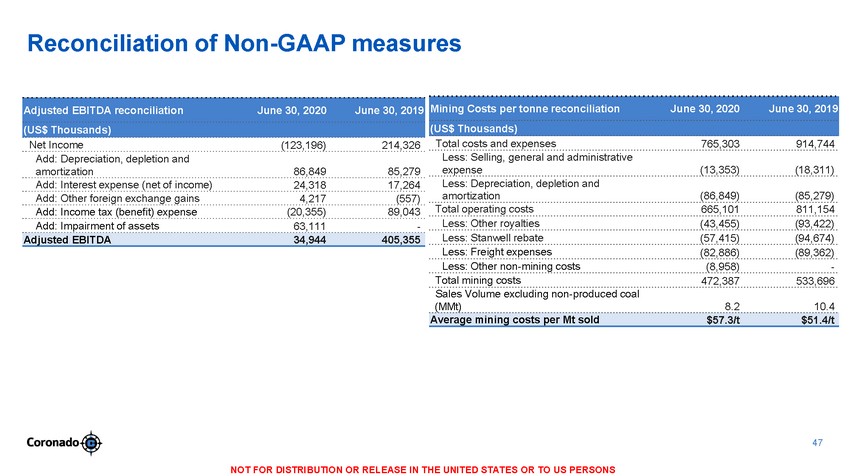

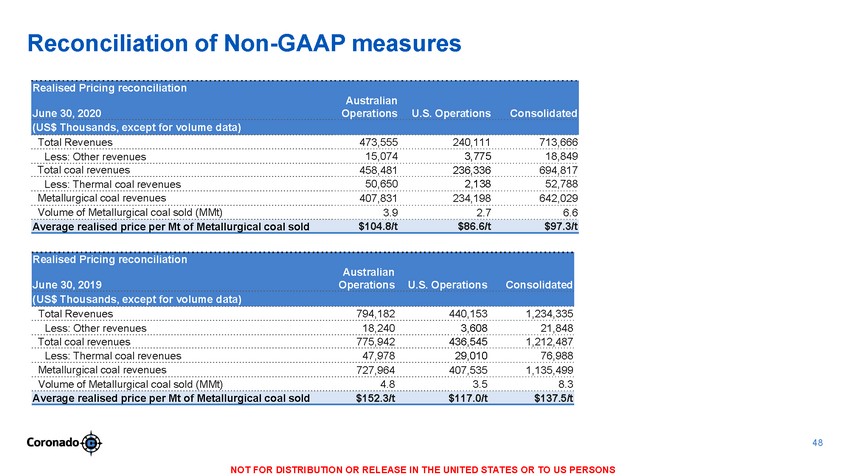

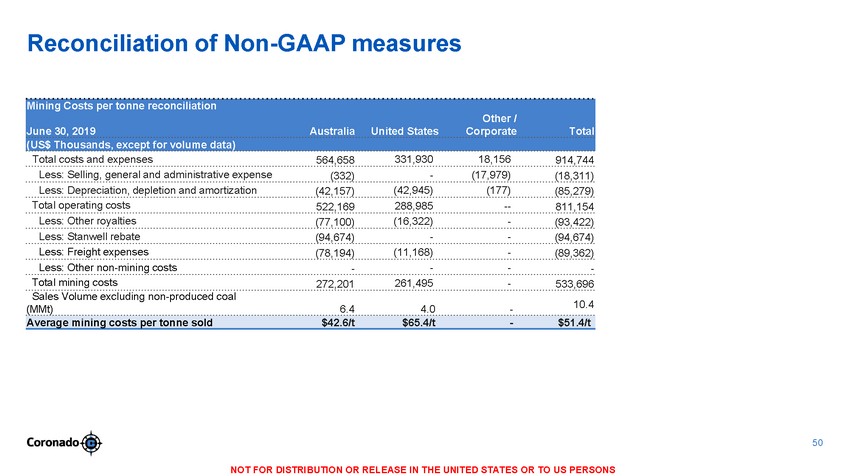

HY20 Highlights(a) Financial performance • • • • • Reported HY20 Net Loss after Tax of $123.2 million, down $337.5 million (157.5%) compared to HY19 Adjusted EBITDAb of $34.9m, down 91.4% compared to HY19 of $405.4 million Group mining cost of $57.3 per tonne, 11.5% increase than HY19 as a result of lower production volume Gross operating cost of US$665.1m, down 18% compared to HY19 Revenue of $713.7 million was below HY19 of $1,234.3 million due to lower coal sales volumes and a lower average realized metallurgical coal price Net debt position of $404.9 million as at 30 June 2020, comprising $36.1 million of cash (excluding restricted cash) and $441.0 million of debt • Operational performance • Coal production during HY20 was adversely impacted by the temporary suspension of mining operations at Curragh due to the fatality in January 2020 The impact of COVID-19 on global metallurgical coal demand resulting in the temporary idling of the U.S. Operations in April and May 2020, and higher than expected wet weather in Queensland impacting mine sequencing at the Curragh mine ROM production of 11.9 Mt, down 28.7% compared to HY19. Saleable production of 8.0 Mt, down 23.2% compared to HY19 Sales volumes of 8.3 Mt, down 19.7% compared to HY19 as a result of lower production Group realised metallurgical pricing of $97.3 per tonne, down 29.2% compared to HY19, as a result of soft market conditions and falling index prices • • • • • a. b. All tonnages through this presentation are expressed in metric tonnes. All amounts quoted throughout this presentation are in US$ unless otherwise stated. All references to ‘EBITDA’ means EBITDA adjusted for FX and non-recurring items, as more fully explained in the definition of ‘Adjusted EBITDA’ in the Company’s Form 10-Q: Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS 6 |

|

HY20 Highlights (Cont.) Distributions •No distributions have been declared for HY20 Corporate • In May 2020 the Company concluded an agreement with lenders of the Syndicated Facility Agreement (SFA) to waive the compliance with financial covenants until February 2021 (refer page 13 for details on waiver extension). • The Company has taken further steps to safeguard its operations, strengthen its balance sheet and increase liquidity by reducing capital expenditures and managing operating costs in a disciplined manner. 7 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

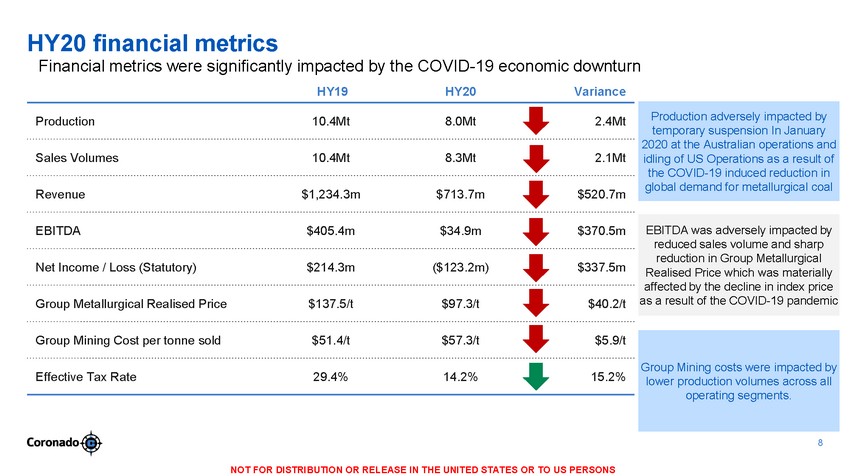

HY20 financial metrics Financial metrics were significantly impacted by the COVID-19 economic downturn HY19 HY20 Variance temporary suspension In January EBITDA $405.4m $34.9m $370.5m Net Income / Loss (Statutory) $214.3m ($123.2m) $337.5m Group Metallurgical Realised Price $137.5/t $97.3/t $40.2/t Group Mining Cost per tonne sold $51.4/t $57.3/t $5.9/t Effective Tax Rate 29.4% 14.2% 15.2% 8 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS Group Mining costs were impacted by lower production volumes across all operating segments. EBITDA was adversely impacted by reduced sales volume and sharp reduction in Group Metallurgical Realised Price which was materially affected by the decline in index price as a result of the COVID-19 pandemic Production10.4Mt8.0Mt2.4Mt Sales Volumes10.4Mt8.3Mt2.1Mt Revenue$1,234.3m$713.7m$520.7m Production adversely impacted by 2020 at the Australian operations and idling of US Operations as a result of the COVID-19 induced reduction in global demand for metallurgical coal |

|

Segment performance HY20 EBITDAa performance 500 500 EBITDA (US$m): 271.7 250 250 151.6 0 0 HY19 HY20 HY19 HY20 17.4% 1.32% EBITDA Margin (%): • EBITDA for the HY20 was $6.3 million, a decrease of $265.4 million (97.7%) compared to HY19. Lower coal revenues contributed to the lower EBITDA result. • EBITDA decreased by $109.9 million for the HY20 compared to HY19. This decrease was driven by a lower average realized met coal price per tonne sold and lower sales volumes. The reduction in EBITDA partially offset by a decrease in operating costs of $90.5 million. Performance drivers: • • 9 a. Only includes EBITDA generated from the operating segment and no corporate adjustments, as more fully explained in the defini tion of ‘Segment Adjusted EBITDA’ in the Company’s Form 10-Q: Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS 41.7 6.3 US Operations Australian Operations |

|

Section 2 Response to Environment the Current Roadshow presentation 10 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

Managing the Downturn 11 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS Production Right Sizing Production rates are currently being analyzed to ensure operations can continue if the current low price environment is prolonged See Page 14 Other Liquidity Levers Potential liquidity levers have been identified if the current low price environment is prolonged See Page 14 Inventory Management Inventory levels are actively managed to achieve balance between stockpiling costs and meeting customers’ demand, as well as positioning for a recovery in met coal prices Further Bank Covenant Waiver Further agreed with SFA lending syndicate to waive compliance with the financial covenants until 30 September 2021 and to release certain assets from existing security package See Page 13 Bank Covenant Waiver Agreed with SFA lending syndicate to waive compliance with the financial covenants until 28 February 2021 Equity Raising Provides additional liquidity, improves credit metrics and increases free float (which sets the company up for potential index inclusion in the future) See Page 12 COVID-19 Safety Protocols Preventative measures implemented across all mines in Australia and the US to protect the health of our workforce 2020 Capex Review 2020 capex reduced by 40% from original guidance range of US$190 – 210 million. Curragh Expansion deferred until met coal prices normalize Restart US Operations Buchanan and Logan resumed operation on 1 June after being idled on 30 March. Operating at lower levels that meet domestic and export contracts. Greenbrier remains idle Legend: Implemented Initiatives New Initiatives Potential Future Initiatives |

|

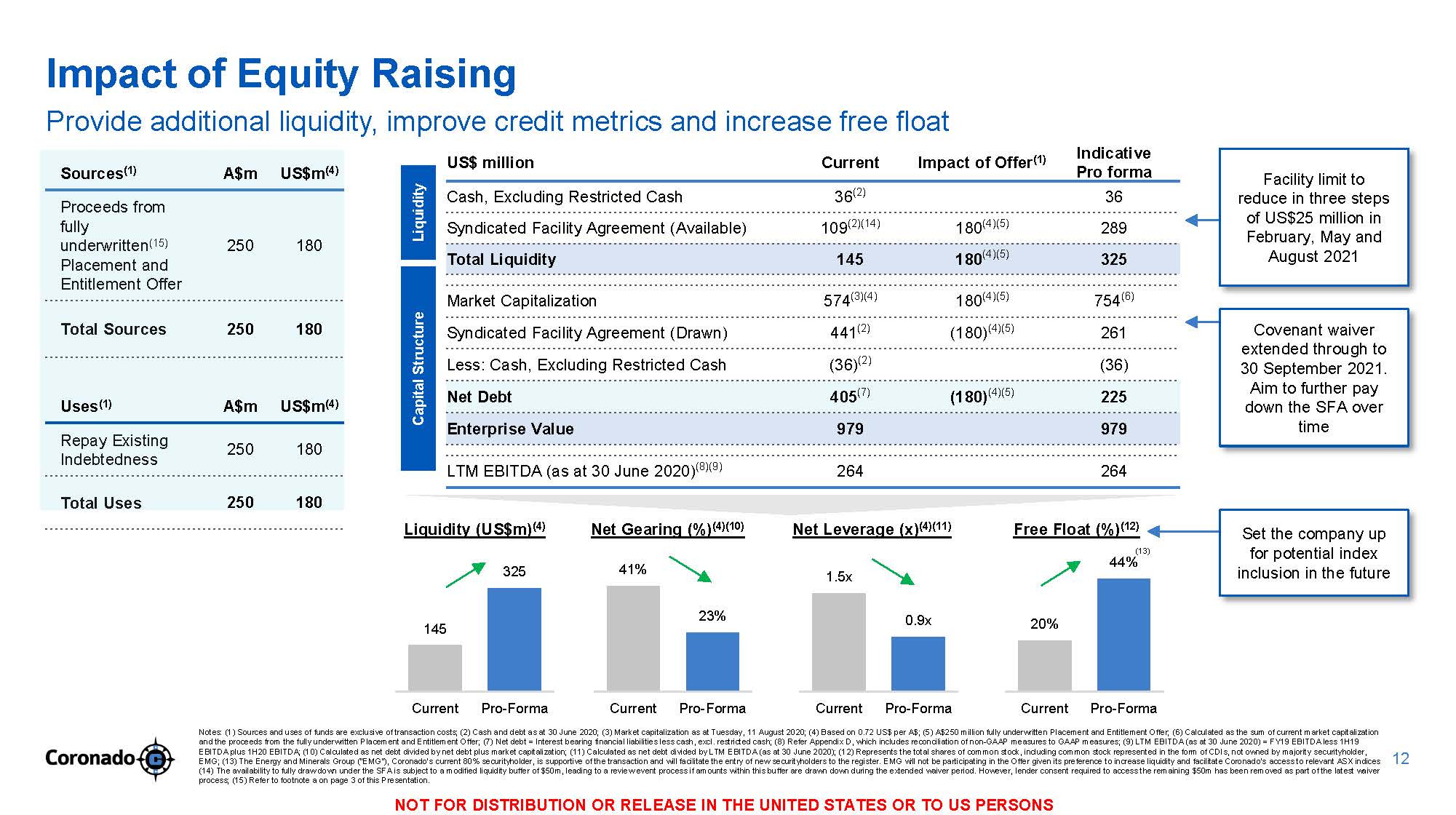

Impact of Equity Raising Provide additional liquidity, improve credit metrics and increase free float US$ million Current Impact of Offer(1) IndicativeSources(1) A$m US$m(4)Proceeds from fullyPro forma Cash, Excluding Restricted Cash 36(2) 36Syndicated Facility Agreement (Available) 109(2)(14) 180(4)(5) 289Facility limit to reduce in three steps of US$25 million inunderwritten(15) Placement and Entitlement Offer250 180Total Liquidity 145 180(4)(5) 325Market Capitalization 574(3)(4) 180(4)(5) 754(6)February, May and August 2021Total Sources 250 180Uses(1) A$m US$m(4)Syndicated Facility Agreement (Drawn) 441(2) (180)(4)(5) 261Less: Cash, Excluding Restricted Cash (36)(2) (36)Net Debt 405(7) (180)(4)(5) 225Enterprise Value 979 979Covenant waiver extended through to 30 September 2021. Aim to further pay down the SFA over timeRepay Existing Indebtedness250 180LTM EBITDA (as at 30 June 2020)(8)(9) 264 264Total Uses 250 180Liquidity (US$m)(4) Net Gearing (%)(4)(10)Net Leverage (x)(4)(11)Free Float (%)(12) (13) 44%Set the company up for potential index14532541%23%1.5x0.9x20%inclusion in the futureCurrent Pro-FormaCurrent Pro-FormaCurrent Pro-FormaCurrent Pro-FormaNotes: (1) Sources and uses of funds are exclusive of transaction costs; (2) Cash and debt as at 30 June 2020; (3) Market capitalization as at Tuesday, 11 August 2020; (4) Based on 0.72 US$ per A$; (5) A$250 million fully underwritten Placement and Entitlement Offer; (6) Calculated as the sum of current market capitalization and the proceeds from the fully underwritten Placement and Entitlement Offer; (7) Net debt = Interest bearing financial liabilities less cash, excl. restricted cash; (8) Refer Appendix D, which includes reconciliation of non-GAAP measures to GAAP measures; (9) LTM EBITDA (as at 30 June 2020) = FY19 EBITDA less 1H19 EBITDA plus 1H20 EBITDA; (10) Calculated as net debt divided by net debt plus market capitalization; (11) Calculated as net debt divided by LTM EBITDA (as at 30 June 2020); (12) Represents the total shares of common stock, including common stock represented in the form of CDIs, not owned by majority securityholder, EMG; (13) The Energy and Minerals Group (“EMG”), Coronado’s current 80% securityholder, is supportive of the transaction and will facilitate the entry of new securityholders to the register. EMG will not be participating in the Offer given its preference to increase liquidity and facilitate Coronado’s access to relevant ASX indices (14) The availability to fully draw down under the SFA is subject to a modified liquidity buffer of $50m, leading to a review event process if amounts within this buffer are drawn down during the extended waiver period. However, lender consent required to access the remaining $50m has been removed as part of the latest waiver process; (15) Refer to footnote a on page 3 of this Presentation. NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

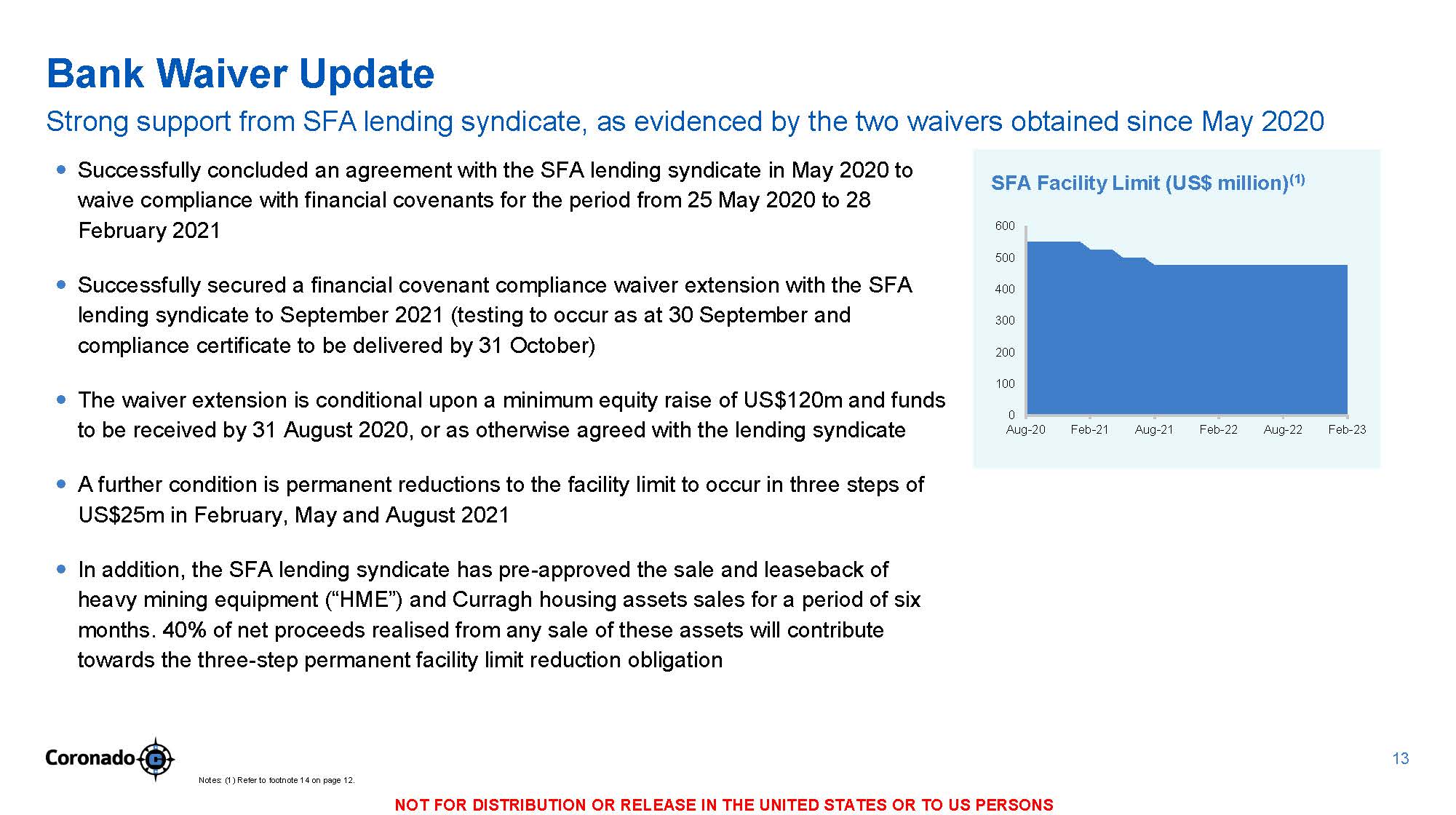

Bank Waiver Update Strong support from SFA lending syndicate, as evidenced by the two waivers obtained since May 2020 Successfully concluded an agreement with the SFA lending syndicate in May 2020 to waive compliance with financial covenants for the period from 25 May 2020 to 28 February 2021 Successfully secured a financial covenant compliance waiver extension with the SFA lending syndicate to September 2021 (testing to occur as at 30 September and compliance certificate to be delivered by 31 October) The waiver extension is conditional upon a minimum equity raise of US$120m and funds to be received by 31 August 2020, or as otherwise agreed with the lending syndicate A further condition is permanent reductions to the facility limit to occur in three steps of US$25m in February, May and August 2021 In addition, the SFA lending syndicate has pre-approved the sale and leaseback of heavy mining equipment (“HME”) and Curragh housing assets sales for a period of six months. 40% of net proceeds realised from any sale of these assets will contribute towards the three-step permanent facility limit reduction obligation 13 Notes: (1) Refer footnote 15 on page 12. NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS SFA Facility Limit (US$ million)(1) 600 500 400 300 200 100 0 Aug-20Feb-21Aug-21Feb-22Aug-22Feb-23 |

|

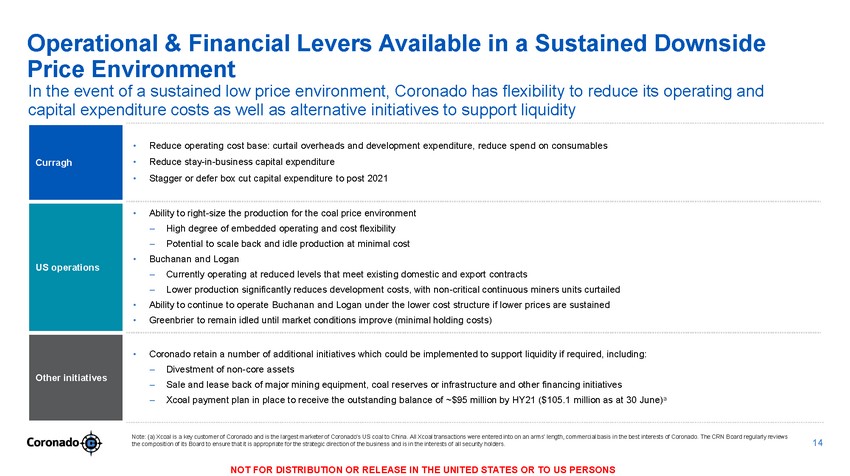

Operational & Financial Levers Available in a Sustained Downside Price Environment In the event of a sustained low price environment, Coronado has flexibility to reduce its operating and capital expenditure costs as well as alternative initiatives to support liquidity Note: (a) Xcoal is a key customer of Coronado and is the largest marketer of Coronado’s US coal to China. All Xcoal transactions were entered into on an arms’ length, commercial basis in the best interests of Coronado. The CRN Board regularly reviews the composition of its Board to ensure that it is appropriate for the strategic direction of the business and is in the interests of all security holders. 14 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS Curragh •Reduce operating cost base: curtail overheads and development expenditure, reduce spend on consumables •Reduce stay-in-business capital expenditure •Stagger or defer box cut capital expenditure to post 2021 US operations •Ability to right-size the production for the coal price environment ‒ High degree of embedded operating and cost flexibility ‒ Potential to scale back and idle production at minimal cost •Buchanan and Logan ‒ Currently operating at reduced levels that meet existing domestic and export contracts ‒ Lower production significantly reduces development costs, with non-critical continuous miners units curtailed •Ability to continue to operate Buchanan and Logan under the lower cost structure if lower prices are sustained •Greenbrier to remain idled until market conditions improve (minimal holding costs) Other initiatives •Coronado retain a number of additional initiatives which could be implemented to support liquidity if required, including: ‒ Divestment of non-core assets ‒ Sale and lease back of major mining equipment, coal reserves or infrastructure and other financing initiatives ‒ Xcoal payment plan in place to receive the outstanding balance of ~$95 million by HY21 ($105.1 million as at 30 June)a |

|

Section 3 Equity Raising Overview Roadshow presentation 15 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

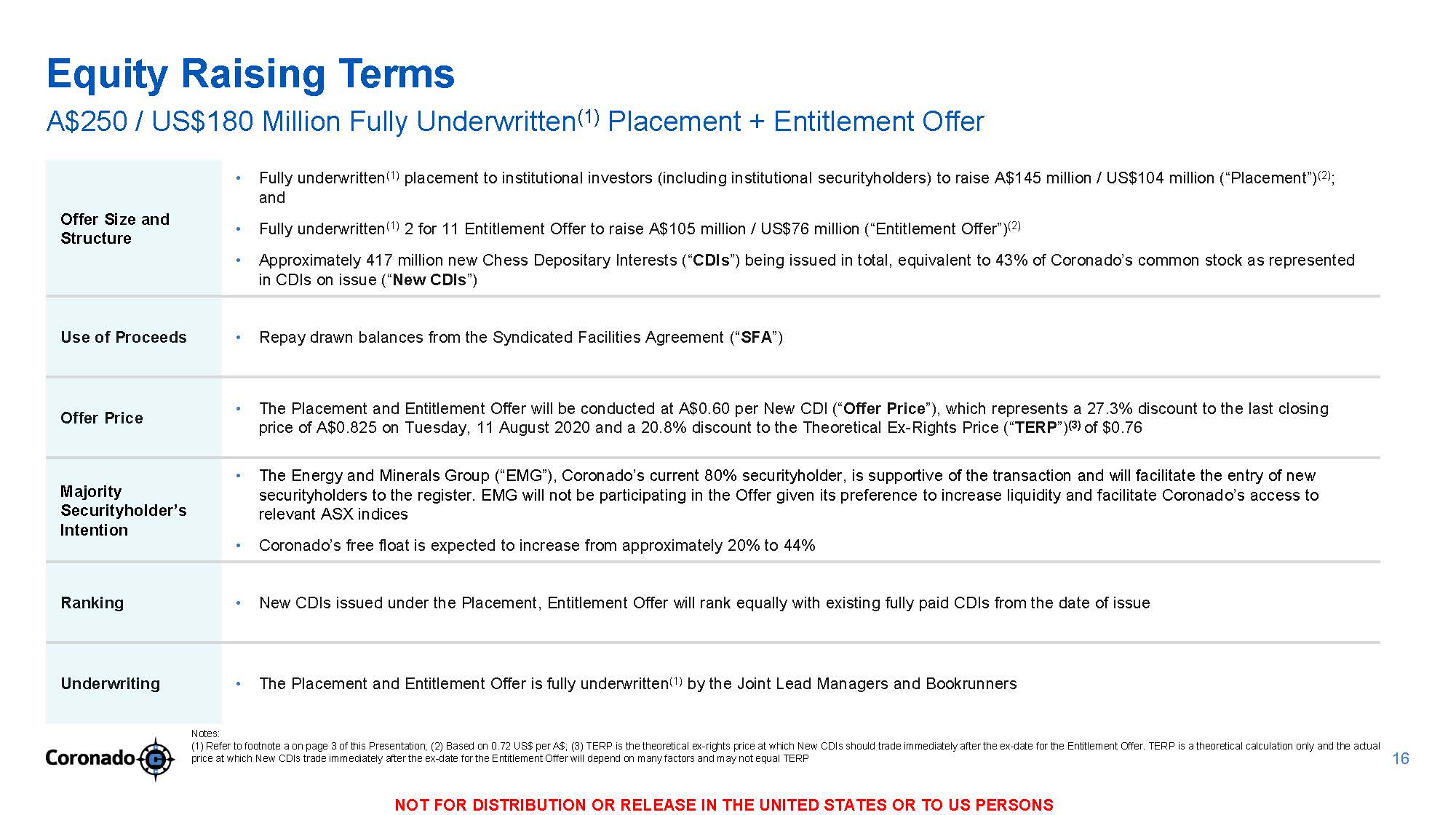

Equity Raising Terms A$250 / US$180 Million Fully Underwritten(1) Placement + Entitlement Offer price of A$0.825 on Monday, 17 August 2020 and a 20.8% discount to the Theoretical Ex-Rights Price (“TERP”)(3) of $0.76 securityholders to the register. EMG will not be participating in the Offer given its preference to increase liquidity and facilitate Coronado’s access to Notes: (1) Refer to footnote a on page 3 of this Presentation; (2) Based on 0.72 US$ per A$; (3) TERP is the theoretical ex-rights price at which New CDIs should trade immediately after the ex-date for the Entitlement Offer. TERP is a theoretical calculation only and the actual price at which New CDIs trade immediately after the ex-date for the Entitlement Offer will depend on many factors and may not equal TERP 16 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS Offer Size and Structure • Fully underwritten(2) placement to institutional investors (including institutional securityholders) to raise A$145 million / US$104 million (“Placement”)(2); and • Fully underwritten(2) 2 for 11 Entitlement Offer to raise A$105 million / US$76 million (“Entitlement Offer”)(2) • Approximately 417 million new Chess Depositary Interests (“CDIs”) being issued in total, equivalent to 43% of Coronado’s common stock as represented in CDIs on issue (“New CDIs”) Use of Proceeds • Repay drawn balances from the Syndicated Facilities Agreement (“SFA”) Offer Price • The Placement and Entitlement Offer will be conducted at A$0.60 per New CDI (“Offer Price”), which represents a 27.3% discount to the last closing Majority Securityholder’s Intention • The Energy and Minerals Group (“EMG”), Coronado’s current 80% securityholder, is supportive of the transaction and will facilitate the entry of new relevant ASX indices • Coronado’s free float is expected to increase from approximately 20% to 44% Ranking • New CDIs issued under the Placement, Entitlement Offer will rank equally with existing fully paid CDIs from the date of issue Underwriting • The Placement and Entitlement Offer is fully underwritten(2) by the Joint Lead Managers and Bookrunners |

|

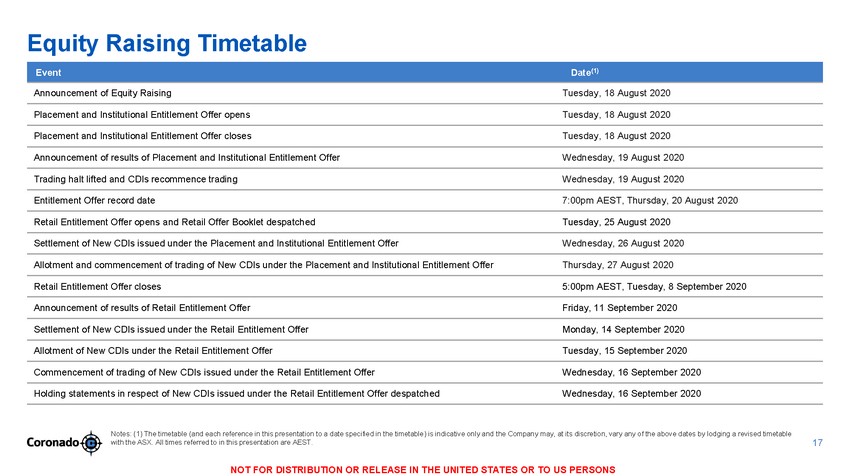

Equity Raising Timetable Announcement of Equity Raising Tuesday, 18 August 2020 Placement and Institutional Entitlement Offer opens Tuesday, 18 August 2020 Placement and Institutional Entitlement Offer closes Tuesday, 18 August 2020 Announcement of results of Placement and Institutional Entitlement Offer Wednesday, 19 August 2020 Trading halt lifted and CDIs recommence trading Wednesday, 19 August 2020 Entitlement Offer record date 7:00pm AEST, Thursday, 20 August 2020 Retail Entitlement Offer opens and Retail Offer Booklet despatched Tuesday, 25 August 2020 Settlement of New CDIs issued under the Placement and Institutional Entitlement Offer Wednesday, 26 August 2020 Allotment and commencement of trading of New CDIs under the Placement and Institutional Entitlement Offer Thursday, 27 August 2020 Retail Entitlement Offer closes 5:00pm AEST, Tuesday, 8 September 2020 Announcement of results of Retail Entitlement Offer Friday, 11 September 2020 Settlement of New CDIs issued under the Retail Entitlement Offer Monday, 14 September 2020 Allotment of New CDIs under the Retail Entitlement Offer Tuesday, 15 September 2020 Commencement of trading of New CDIs issued under the Retail Entitlement Offer Wednesday, 16 September 2020 Holding statements in respect of New CDIs issued under the Retail Entitlement Offer despatched Wednesday, 16 September 2020 Notes: (1) The timetable (and each reference in this presentation to a date specified in the timetable) is indicative only and the Company may, at its discretion, vary any of the above dates by lodging a revised timetable with the ASX. All times referred to in this presentation are AEST. 17 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS EventDate(1) |

|

Section 4 Well Positioned for Recovery Prices in Met Coal Roadshow presentation 18 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

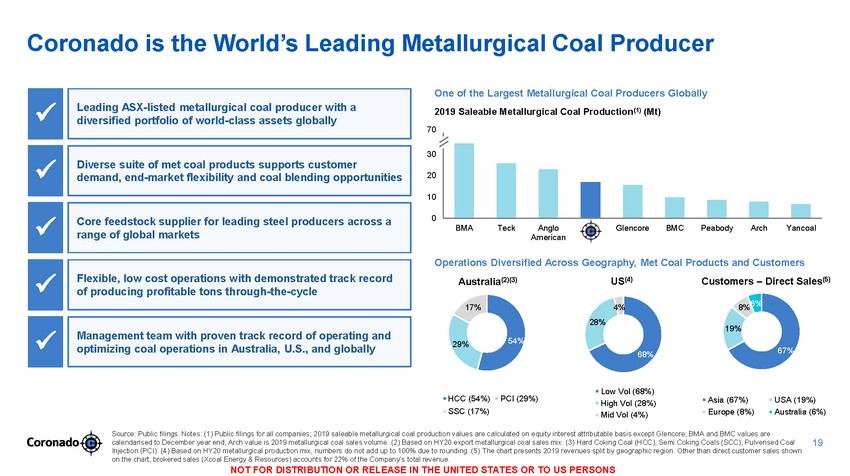

Coronado is the World’s Leading Metallurgical Coal Producer One of the Largest Metallurgical Coal Producers Globally 2019 Saleable Metallurgical Coal Production(1) (Mt) 470 30 20 10 0 BMA Teck Anglo American Glencore BMC Peabody Arch Yancoal Operations Diversified Across Geography, Met Coal Products and Customers Australia(2)(3) US(4) Customers – Direct Sales(5) 8%6% 17% 4% 28% 19% 54% 29% 67% 68% Low Vol (68%) High Vol (28%) Mid Vol (4%) HCC (54%) SSC (17%) PCI (29%) Asia (67%) Europe (8%) USA (19%) Australia (6%) Source: Public filings. Notes: (1) Public filings for all companies; 2019 saleable metallurgical coal production values are c alculated on equity interest attributable basis except Glencore; BMA and BMC values are calendarised to December year end; Arch value is 2019 metallurgical coal sales volume. (2) Based on HY20 export metallurgical coal sales mix. (3) Hard Coking Coal (HCC), Semi Coking Coals (SCC), Pulverised Coal Injection (PCI). (4) Based on HY20 metallurgical production mix, numbers do not add up to 100% due to rounding. (5) The chart presents 2019 revenues split by geographic region. Other than direct customer sales shown on the chart, brokered sales (Xcoal Energy & Resources) accounts for 22% of the Company’s total revenue. NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS 19 x Management team with proven track record of operating and optimizing coal operations in Australia, U.S., and globally x Flexible, low cost operations with demonstrated track record of producing profitable tons through-the-cycle x Core feedstock supplier for leading steel producers across a range of global markets x Diverse suite of met coal products supports customer demand, end-market flexibility and coal blending opportunities x Leading ASX-listed metallurgical coal producer with a diversified portfolio of world-class assets globally |

|

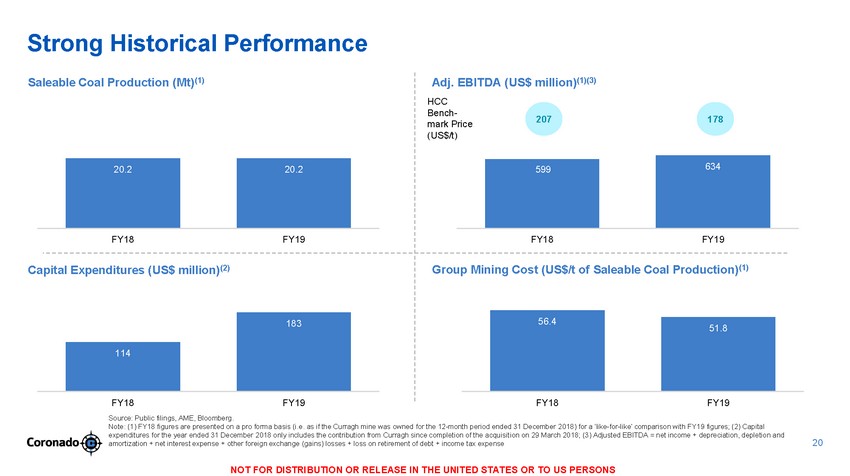

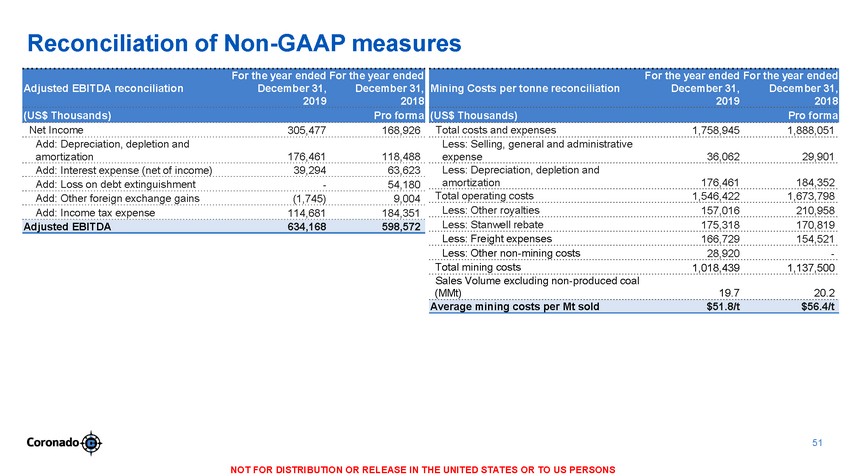

Strong Historical Performance Saleable Coal Production (Mt)(1) 207 178 mark Price Capital Expenditures (US$ million)(2) FY18 Source: Public filings, AME, Bloomberg. FY19 FY18 FY19 Note: (1) FY18 figures are presented on a pro forma basis (i.e. as if the Curragh mine was owned for the 12-month period ended 31 December 2018) for a ‘like-for-like’ comparison with FY19 figures; (2) Capital expenditures for the year ended 31 December 2018 only includes the contribution from Curragh since completion of the acquisit ion on 29 March 2018; (3) Adjusted EBITDA = net income + depreciation, depletion and amortization + net interest expense + other foreign exchange (gains) losses + loss on retirement of debt + income tax expense 20 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS FY18FY19 Adj. EBITDA (US$ million)(1)(3) HCC Bench-(US$/t) FY18FY19 183 114 Group Mining Cost (US$/t of Saleable Coal Production)(1) 56.451.8 20.2 20.2 634 599 |

|

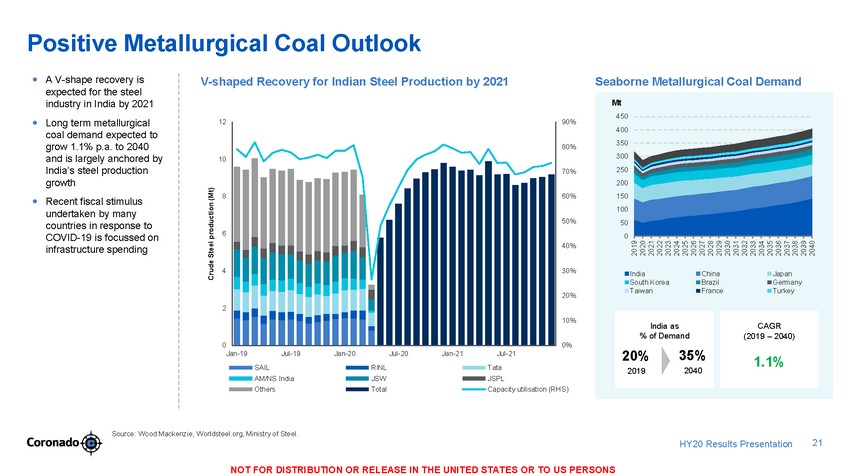

Positive Metallurgical Coal Outlook A V-shape recovery is expected for the steel industry in India by 2021 Long term metallurgical coal demand expected to grow 1.1% p.a. to 2040 and is largely anchored by India’s steel production growth Recent fiscal stimulus undertaken by many countries in response to COVID-19 is focussed on infrastructure spending V-shaped Recovery for Indian Steel Production by 2021 Seaborne Metallurgical Coal Demand 12 90% 80% 10 70% 8 60% 50% 6 40% 4 30% 20% 2 10% 0 0% Jan-19 Jul-19 Jan-20 Jul-20 Jan-21 Jul-21 Tata JSPL Capacity utilisation (RHS) SAIL AM/NS India Others RINL JSW Total Source: Wood Mackenzie, Worldsteel.org, Ministry of Steel. 21 HY20 Results Presentation NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS Crude Steel production (Mt) 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 Mt 450 400 350 300 250 200 150 100 50 0 IndiaChinaJapan South KoreaBrazilGermany TaiwanFranceTurkey CAGR (2019 – 2040) 1.1% India as % of Demand 20%35% 20192040 |

|

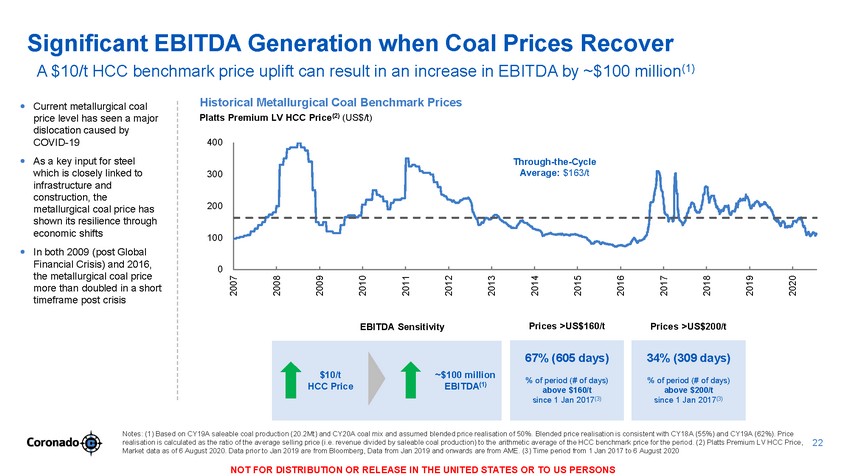

Significant EBITDA Generation when Coal Prices Recover A $10/t HCC benchmark price uplift can result in an increase in EBITDA by ~$100 million(1) Historical Metallurgical Coal Benchmark Prices Platts Premium LV HCC Price(2) (US$/t) Current metallurgical coal price level has seen a major dislocation caused by COVID-19 As a key input for steel which is closely linked to infrastructure and construction, the metallurgical coal price has shown its resilience through economic shifts In both 2009 (post Global Financial Crisis) and 2016, the metallurgical coal price more than doubled in a short timeframe post crisis 400 300 200 100 0 EBITDA Sensitivity Prices >US$160/t Prices >US$200/t above $160/t Notes: (1) Based on CY19A saleable coal production (20.2Mt) and CY20A coal mix and assumed blended price realisation of 50%. Blended price realisation is consistent with CY18A (55%) and CY19A (62%). Price realisation is calculated as the ratio of the average selling price (i.e. revenue divided by saleable coal production) to the arithmetic average of the HCC benchmark price for the period. (2) Platts Premium LV HCC Price, Market data as of 6 August 2020. Data prior to Jan 2019 are from Bloomberg, Data from Jan 2019 and onwards are from AME. (3) Time period from 1 Jan 2017 to 6 August 2020 22 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 67% (605 days) % of period (# of days) since 1 Jan 2017(3) 34% (309 days) % of period (# of days) above $200/t since 1 Jan 2017(3) $10/t~$100 million HCC PriceEBITDA(1) Through-the-Cycle Average: $163/t |

|

THE UNITED STATES OR TO US PERSONS |

|

Risk Factors This section discusses some of the key risks associated with any investment in Coronado, which may affect the value of Coronado's securities. The risks set out below do not constitute an exhaustive list of all risks involved with an investment in Coronado. Before investing in Coronado, you should be aware that an investment in Coronado has a number of risks, some of which are specific to Coronado and some of which relate to listed securities generally, and many of which are beyond the control of Coronado. 1.2 Volatility of coal prices Coronado generates revenue from the sale of coal and its financial results are materially impacted by the prices it receives. Prices and quantities under metallurgical coal sales contracts in North America are generally based on expectations of the next year's coal prices at the time the contract is entered into, renewed, extended or re-opened. Pricing in the global seaborne market is typically set on a rolling quarterly average benchmark price. Sales by the U.S. Operations to the export market are typically priced with reference to a benchmark index. Sales by the Australian Operations have typically been contracted on an annual basis and are priced with reference to benchmark indices or bilaterally negotiated term prices and spot indices. As a result, a significant portion of Coronado's revenue is exposed to movements in coal prices and any weakening in metallurgical or thermal coal prices would have an adverse impact on its financial condition and results of operations. The risks detailed below may change after the date of this document and other risks relevant to Coronado and the New CDIs may emerge which may have an adverse impact on Coronado and the price of the New CDIs. In particular, investors should note that the unprecedented uncertainties and risks created by the COVID-19 pandemic could materially change Coronado's risk profile at any point after the date of this Presentation and adversely impact the financial position and prospects of Coronado in the future. 1 Risks relating to an investment in Coronado The expectation of future prices for coal depends upon many factors beyond Coronado's control, including the current market price of coal; overall domestic and global economic conditions, including the supply of and demand for domestic and foreign coal, coke and steel; the consumption pattern of industrial consumers, electricity generators and residential users; weather conditions in Coronado's markets that affect the ability to produce metallurgical coal or affect the demand for thermal coal; competition from other coal suppliers; technological advances affecting the steel production process and/or energy consumption; the costs, availability and capacity of transportation infrastructure; and the impact of domestic and foreign governmental laws and regulations, including the imposition of tariffs, environmental and climate change regulations and other regulations affecting the coal mining industry, including regulations and measures introduced in response to the COVID-19 pandemic. 1.1 Impact of COVID-19 The ongoing COVID-19 pandemic has had a significant impact on the Australian and global economy and the ability of businesses to operate. Coronado's business has been and will continue to be adversely affected by the global outbreak of COVID-19 and the impact may be material. The pandemic continues to evolve rapidly, as do the measures and recommendations introduced by governments in the countries in which Coronado operates and Coronado's customers and suppliers are located, such as orders restricting movement and public gatherings and the implementation of social distancing protocols, orders for residents to stay at home with a limited range of exceptions, orders restricting travelling overseas or across borders (including interstate), and orders for all non-essential businesses to close, including certain mine sites, factories and office shutdowns. These restrictions have caused disruptions to mining operations (including Coronado's operations), manufacturing operations and supply chains around the world. Metallurgical coal has been a volatile commodity over the past ten years. The metallurgical coal industry faces concerns with oversupply from time to time. There are no assurances that oversupply will not occur, that demand will not decrease or that overcapacity will not occur, which could cause declines in the prices of coal, which could have a material adverse effect on Coronado’s financial condition and results of operations. The key impacts of the COVID-19 pandemic on Coronado include the following: In addition, coal prices are highly dependent on the outlook for coal consumption in large Asian economies, such as China, India, South Korea and Japan, as well as any changes in government policy regarding coal or energy in those countries. Seaborne metallurgical coal import demand can also be significantly impacted by the availability of local coal production, particularly in the leading metallurgical coal import countries of China and India, among others, and the competitiveness of seaborne metallurgical coal supply, including from the leading metallurgical coal exporting countries of Australia, the United States, Russia, Canada and Mongolia, among others. Metallurgical and thermal coal indices have also substantially declined resulting from the impact of the COVID-19 pandemic. 1.3 Competition risk • The COVID-19 pandemic is affecting all of the key markets to which Coronado sells its products, including Japan, South Korea, Taiwan, India, Europe and Brazil. For example, seaborne metallurgical coal exports from the U.S. Operations have decreased due to the measures and recommendations implemented by United States, European and Brazilian governments in response to the impact of COVID-19.The pandemic has also impacted the steel industry and resulted in a reduction of demand for steel, particularly in the automotive and construction sectors, which has in turn impacted the demand for Coronado's metallurgical coal. • The nature of Coronado's business is such that much of its work cannot be done remotely. As a result of the government measures and recommendations, Coronado temporarily idled its operations at its Buchanan and Logan mines from March 30, 2020 to June 1, 2020 and from March 30, 2020 for the remainder of 2020 for its Greenbrier mine. Coronado may need to extend the temporary idling of operations at its Greenbrier mine or need to temporarily idle certain other operations as a result of government imposed shutdowns or restrictions in the future. The Australian Operations remain operational but have experienced operational disruption. A prolonged shutdown or reduction of operations will materially adversely impact Coronado's financial performance and profitability. Competition in the coal industry is based on many factors, including, among others, world supply, price, production capacity, coal quality and characteristics, transportation capability and costs, blending capability, brand name and diversified operations. Coronado is subject to competition from metallurgical coal producers from Australia, the United States, Canada, Russia, Mongolia and other metallurgical coal producing countries. Should those competitors obtain a competitive advantage in comparison to Coronado (whether by way of an increase in production capacity, higher realised prices, lower operating costs, export/import tariffs, being comparatively less impacted as a result of COVID-19 or otherwise), such competitive advantage may have an adverse impact on Coronado's ability to sell, or the prices at which Coronado is able to sell coal products. In addition, some of Coronado's competitors may have more production capacity as well as greater financial, marketing, distribution and other resources than Coronado does. • Even after Coronado's operations are fully operational again, a single case of COVID-19 linked to a mine site or corporate office in which Coronado operates, or nearby community could result in further restrictions, closures, additional costs and negative public perceptions at any of Coronado's sites. If Coronado does not respond appropriately to the COVID-19 pandemic, or if Coronado customers or the relevant regulatory and governmental bodies do not perceive Coronado's response to be adequate, Coronado could suffer damage to its reputation, which could further adversely affect its business. The consolidation of the global metallurgical coal industry in recent years has contributed to increased competition, and Coronado's competitive position may be adversely impacted by further consolidation among market participants or by further competitors entering into and exiting bankruptcy proceedings under a lower cost structure. Similarly, potential changes to international trade agreements, trade concessions or other political and economic arrangements may benefit coal producers operating in countries other than the United States and Australia. Other coal producers may also develop or acquire new projects to increase their coal production, which may adversely impact Coronado's competitiveness. Some of Coronado's global competitors have significantly greater financial resources, such that increases in their coal production may affect domestic and foreign metallurgical coal supply into the seaborne market and associated prices and impact Coronado's ability to retain or attract metallurgical coal customers. In addition, Coronado's ability to ship its metallurgical coal to non U.S. and non Australian customers depends on port and transportation capacity. Increased competition within the metallurgical coal industry for international sales could result in Coronado not being able to obtain throughput capacity at port facilities, as well as transport capacity, and could cause the rates for such services to increase to a point where it is not economically feasible to export Coronado's metallurgical coal. • Coronado's customers or suppliers may seek to excuse their performance under existing contracts by claiming that the ongoing COVID-19 pandemic, and government measures and recommendations, constitute a force majeure event. • Coronado's customers’ ability to pay may be impacted by the COVID-19 pandemic as such customers may have to curtail or shutdown their operations, potentially leading to increased credit risks if the current economic downturn and the measures to curb the spread of the pandemic continue for an extended period of time. • Uncertainty about the effects of COVID-19 has resulted in significant disruption to the capital and securities markets, which, if continued, may affect Coronado's ability to raise new capital and refinance its existing debt. Increased competition, or a failure to compete effectively, in the markets in which Coronado participates may result in a loss of market share and could adversely affect Coronado's financial condition and results of operations. Further, there have been and may be other changes in the domestic and global macroeconomic environment associated with the events relating to COVID-19 that are beyond the control of Coronado and may be exacerbated in an economic recession or downturn. These include, but are not limited to, changes in inflation, interest rates, foreign currency exchange rates, increased unemployment and labour costs, changes in aggregate investment and economic output and changes in customer and consumer behaviours to those that existed prior to the pandemic. In light of COVID-19, Coronado has taken steps to strengthen its financial position and maintain financial flexibility, including reviewing operating and corporate expenditure, reducing capital expenditure and ensuring there is sufficient available liquidity via a number of strategic initiatives. Coronado is not able to predict how long the current disruption caused by the COVID-19 pandemic will last or whether additional restrictions on Coronado's operations will be required. Although Coronado remains optimistic that its industry will rebound as the restrictive measures and recommendations introduced by governments in the countries in which it operates are lifted, Coronado cannot guarantee that it will recover as rapidly as other industries or at the same rate as any of its competitors, or that its industry will recover to pre-pandemic levels. Further, events such as those experienced in Victoria, Australia, in early July 2020 demonstrate that the easing of restrictions can be reversed quickly and without warning. There can also be no assurance that Coronado's plans to address existing and potential disruptions in operations will partially or completely mitigate the adverse impacts related to COVID-19, if at all. Addressing the disruptions has also required Coronado's staff, senior management team and Board of Directors to devote extensive resources which is likely to continue into the near future and which may negatively affect Coronado's ability to implement its business plan and respond to other issues and opportunities. To the extent the COVID-19 pandemic adversely affects Coronado's business and results of operations, it may also have the effect of heightening the materiality of the other risks described in this “Risk factors” section. 24 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|

Risk Factors (cont.) 1.4 Operational risk means that: Coronado's mining operations, including exploration, development, preparation, product handling and accessing transport infrastructure, may be affected by various operational difficulties that could impact the amount of coal produced at Coronado's coal mines, cause delays or suspend coal deliveries, or increase the cost of mining for a varying length of time. Coronado's financial performance is dependent on its ability to sustain or increase coal production and maintain or increase operating margins. Coronado's coal production and production costs are, in many respects, subject to conditions and events beyond its control, which could disrupt its operations and have a significant impact on its financial results. Adverse operating conditions and events that Coronado may have experienced in the past or may experience in the future include: Coronado does not bear the credit risk of international customers associated with the marketing of U.S. coal and is not exposed to the credit risk of international customers for its U.S. operations; o o Coronado has not been required to procure additional infrastructure capacity to support its US operations; o Xcoal’s storage capacity provides Coronado with flexibility in stockpile management; and • a failure to achieve the metallurgical qualities anticipated from exploration activities; o Coronado typically does not need to manage transportation logistics to the port and beyond. • variations in mining and geological conditions from those anticipated, such as variations in coal seam thickness and quality, and geotechnical conclusions; If Coronado's arrangements with Xcoal were to cease or materially decrease, Coronado might be required to procure additional infrastructure capacity to support some of its U.S. operations, and develop greater capability to transport coal to market and manage international customer relationships and risk. • operational and technical difficulties encountered in mining, including equipment failure, delays in moving longwall equipment, drag lines and other equipment and maintenance or technical issues; 1.6 Demand for metallurgical coal • adverse weather conditions or natural or man made disasters, including hurricanes, cyclones, tornadoes, floods, droughts, bush fires, seismic activities, ground failures, rock bursts, structural cave ins or slides and other catastrophic events (such as the current COVID-19 pandemic that has caused significant disruption across nearly all industries and markets, including global supply chain shortages, the impact of which, continues to be uncertain); The majority of the coal that Coronado produces is metallurgical coal that is sold, directly or indirectly, to steel producers and is consumed in a blast furnace for steel production. Metallurgical coal, specifically high quality hard coking coal (HCC) (which is produced at most of Coronado's assets), and pulverised coal injection (PCI) coal (which is produced at some of Coronado's assets) both have specific physical and chemical properties which are necessary for efficient blast furnace operation. Therefore, demand for Coronado's metallurgical coal is correlated to demands of the steel industry. The steel industry’s demand for metallurgical coal is influenced by a number of factors, including: the cyclical nature of that industry’s business; general economic and regulatory conditions and demand for steel; and the availability and cost of substitutes for steel, such as aluminum, composites and plastics, all of which may impact the demand for steel products. Similarly, if new steelmaking technologies or practices are developed that can be substituted for metallurgical coal in the integrated steel mill process, then demand for metallurgical coal would be expected to decrease. Although conventional blast furnace technology has been the most economic large scale steel production technology for a number of years, there can be no assurance that over the longer term, competitive technologies not reliant on metallurgical coal would not emerge, which could reduce the demand and price premiums for metallurgical coal. A significant reduction in the demand for steel products would reduce the demand for metallurgical coal, which could have a material adverse effect on Coronado's financial condition and results of operations. • insufficient or unreliable infrastructure, such as power, water and transport; • industrial and environmental accidents, such as releases of mine affected water and diesel spills (both of which have affected the Australian Operations in the past); • • industrial disputes and labour shortages; mine safety accidents, including fires and explosions from methane and other sources; • competition and conflicts with other natural resource extraction and production activities within overlapping operating areas, such as natural gas extraction or oil and gas development (including potential conflicts with gas extraction undertaken by a third party at Buchanan); Additionally, tariffs imposed by the United States on the import of certain steel products may impact foreign steel producers to the extent their production is imported into the United States. On March 8, 2018, the President of the United States, Donald Trump, signed an executive order establishing a 25% tariff on imports of steel into the United States. The establishment of this tariff adversely impacted the economic value of coal, which had previously been sourced for sale in China. This tariff could reduce imports of steel and increase U.S. metallurgical coal demand. This additional U.S. metallurgical coal demand could be met by reducing exports of metallurgical coal and redirecting that volume to domestic consumption. • unexpected shortages, or increases in the costs, of consumables, spare parts, plant and equipment; • cyber attacks that disrupt Coronado's operations or result in the dissemination of proprietary or confidential information about Coronado to its customers or other third parties; and • security breaches or terrorist acts. On May 17, 2019 the Trump administration agreed to lift the steel and aluminium tariffs on Mexico and Canada. Currently, Argentina, Australia, Brazil, Canada, Mexico and South Korea are exempt from the additional tariffs on derivative steel products, while Argentina, Australia, Canada and Mexico are exempt from the additional duties on derivative aluminium products. If any of the foregoing conditions or events occurs and is not mitigated or excusable as a force majeure event under Coronado's coal sales contracts, any resulting failure on Coronado's part to deliver coal to the purchaser under such contracts could result in economic penalties, demurrage costs, suspension or cancellation of shipments or ultimately termination of such contracts, which could have a material adverse effect on Coronado's financial condition and results of operations. The U.S. Operations are concentrated in a small number of mines in the CAPP and the Australian Operations include one mine in the Bowen Basin of Australia. As a result, the effects of any of these conditions or events may be exacerbated and may have a disproportionate impact on Coronado's results of operations and assets. Any such operational conditions or events could also result in disruption to key infrastructure (including infrastructure located at or serving Coronado's mining activities, as well as the infrastructure that supports freight and logistics). These conditions and events could also result in the partial or complete closure of particular railways, ports or significant inland waterways or sea passages, potentially resulting in higher costs, congestion, delays or cancellations on some transport routes. Any of these conditions or events could adversely impact Coronado's business and results of operations. The tariffs established by the United States have prompted retaliatory tariffs from key trading partners, notably Europe and China. Any further retaliatory tariffs by these or other countries to these tariffs may limit international trade and adversely impact global economic conditions. As at the date of this Presentation, U.S. metallurgical coal is subjected to a total of 30.5% tariffs and duties from China. The total tariff comprises a 3% import duty and an imposition of a 25% tariff. An additional 5% tariff was also imposed on September 1, 2019, but this has since been reduced to 2.5% following China’s tariff adjustment that took effect on February 14, 2020. See item 1.37 regarding the impact of restricted access to international markets, including the impact of tariffs. Coronado anticipate that steel production in Japan, Korea, Taiwan, India, Europe and Brazil will be adversely impacted as a result of the COVID-19 pandemic. A significant reduction in steel production would reduce the demand for metallurgical coal, which could have a material adverse effect on Coronado's financial condition and results of operations. 1.5 Reliance on key customers For the half year ended June 30, 2020, Coronado's top ten customers comprised 68.4% of its total revenue and its top five customers comprised 46.3% of its total revenue. For the half year ended June 30, 2020, sales to Xcoal Energy & Resources, LLC (Xcoal), a related party, and Tata Steel Limited (Tata Steel) represented approximately 15.9% and 12.9%, respectively, of Coronado's total revenue. The majority of Coronado's sales are made on a spot basis or under contracts with terms of typically one year. The failure to obtain additional customers or the loss of all or a portion of the revenues attributable to any customer as a result of competition, creditworthiness, inability to negotiate extensions, replacement of contracts or the impact of the current COVID-19 pandemic or otherwise, may adversely affect Coronado's business, financial condition and results of operations. As a result of the COVID-19 pandemic, some of Coronado's customers have delayed and/or revised their shipping orders. The loss of, or deterioration of, the relationship with Xcoal could materially and adversely affect Coronado's business, financial condition and results of operations or cause a material disruption to the U.S. Operations. This is because Coronado derives the following benefits from the Xcoal relationship: • Historically, Xcoal has extensively marketed Coronado’s US coal in international markets. Purchase orders with Xcoal are entered into primarily on an ad hoc (shipment by shipment) basis (as is customary for U.S. operations) and there is a risk that, in the future, the number of sales to Xcoal could decrease, which would require Coronado to procure alternative brokers or market the coal directly to the export market. Currently, Coronado has a domestically focussed coal marketing team for the US operations and has not to date focused on bringing international relationships for the marketing of its U.S. coal into its existing international marketing capabilities. • Xcoal provides a combination of U.S. domestic rail and port logistics, as well as seaborne logistics, which in turn supports the operations of Coronado’s U.S. mines, given their limited ability to access domestic storage options. Xcoal purchases coal from Coronado upon landing into the rail car, or free-on-rail (FOR), at its US operations, which 25 NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES OR TO US PERSONS |

|