Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Amcor plc | amcr-20200818.htm |

| EX-99.1 - EX-99.1 - Amcor plc | amcor4q2020exhibit991-.htm |

Exhibit 99.2 FY20 Full Year Results Ron Delia CEO Michael Casamento CFO August 18, 2020 US & Australia NYSE: AMCR | ASX: AMC

Disclaimers Cautionary Statement Regarding Forward-Looking Statements This document contains certain statements that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like “believe,” “expect,”, “target”, “project”, “may,” “could,” “would,” “approximately,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Such statements are based on the current expectations of the management of Amcor and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. None of Amcor or any of its respective directors, executive officers or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause actual results to differ from expectations include, but are not limited to: the continued financial and operational impacts of the COVID-19 pandemic on Amcor and its customers, suppliers, employees and the geographic markets in which it and its customers operate; fluctuations in consumer demand patterns; the loss of key customers or a reduction in production requirements of key customers; significant competition in the industries and regions in which Amcor operates; failure to realize the anticipated benefits of the acquisition of Bemis Company, Inc. (“Bemis”), and the cost synergies related thereto; failure to successfully integrate Bemis’ business and operations in the expected time frame or at all; integration costs related to the acquisition of Bemis; failure by Amcor to expand its business; the potential loss of intellectual property rights; various risks that could affect our business operations and financial results due to the international operations; price fluctuations or shortages in the availability of raw materials, energy and other inputs; disruptions to production, supply and commercial risks, including counterparty credit risks, which may be exacerbated in times of economic downturn; the possibility of labor disputes; fluctuations in our credit ratings; disruptions to the financial or capital markets; and other risks and uncertainties identified from time to time in Amcor’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including without limitation, those described under Item 1A. “Risk Factors” of Amcor’s annual report on Form 10-K for the fiscal year endedJune 30, 2019 as supplemented by the risk factor contained in Amcor’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. You can obtain copies of Amcor’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and Amcor does not undertake any obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. Basis of Preparation of Supplemental Unaudited Combined Financial Information The fiscal 2018 unaudited combined financial information presented in the release gives effect to Amcor's acquisition of Bemis as if the combination had been consummated on July 1, 2018. The Supplemental Unaudited Combined Financial Information includes adjustments for (1) accounting policy alignment, (2) elimination of the effect of events that are directly attributable to the combination (e.g., one-time transaction costs), (3) elimination of the effect of consummated and identifiable divestitures agreed to with certain regulatory agencies as a condition of approval for the transaction, and (4) items which management considers are not representative of ongoing operations. The Supplemental Unaudited Combined Financial Information does not include the preliminary purchase accounting impact, which has not been finalized at the date of the release and does not reflect any cost or growth synergies that Amcor may achieve as a result of the transaction, future costs to combine the operations of Amcor and Bemis or the costs necessary to achieve any cost or growth synergies. The Supplemental Unaudited Combined Financial Information has been presented for informational purposes only and is not necessarily indicative of what Amcor’s results of operations actually would have been had the combination been completed as of July 1, 2018, nor is it indicative of the future operating results of Amcor. The Supplemental Unaudited Combined Financial Information should be read in conjunction with the separate historical financial statements and accompanying notes contained in each of the Amcor and Bemis periodic reports, as available. For avoidance of doubt, the Supplemental Unaudited Combined Financial Information is not intended to be, and was not, prepared on a basis consistent with the unaudited condensed combined financial information in Amcor’s Registration Statement on Form S-4 filed March 25, 2019 with the SEC (the “S-4 Pro Forma Statements”), which provides the pro forma financial information required by Article 11 of Regulation S-X. For instance, the Supplemental Unaudited Combined Financial Information does not give effect to the combination under the acquisition method of accounting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 805, Business Combinations (“ASC Topic 805”), with Amcor treated as the legal and accounting acquirer. The Supplemental Unaudited Combined Financial Information has not been adjusted to give effect to pro forma events that are (1) directly attributable to the combination, (2) factually supportable, or (3) expected to have a continuing impact on the combined results of Amcor and Bemis. More specifically, other than excluding Amcor’s divested plants and one-time transaction costs, the Supplemental Unaudited Combined Financial Information does not reflect the types of pro forma adjustments set forth in S-4 Pro Forma Statements. Consequently, the Supplemental Unaudited Combined Financial Information is intentionally different from, but does not supersede, the pro forma financial information set forth in S-4 Pro Forma Statements. Reconciliations of non-GAAP combined measures to their most comparable GAAP measures and reconciliations of pro forma net income in accordance with Article 11 of Regulation S-X to combined net income is included in the "Reconciliation of Non-GAAP Measures" section of this release. Presentation of non-GAAP financial information Included in this release are measures of financial performance that are not calculated in accordance with U.S. GAAP. These measures include adjusted EBIT (calculated as earnings before interest and tax), adjusted net income, adjusted earnings per share, adjusted free cash flow before dividends, adjusted cash flow after dividends, net debt and the Supplemental Unaudited Combined Financial Information including adjusted earnings before interest, tax, amortization and depreciation, adjusted earnings before interest and tax, and adjusted earnings per share and any ratios related thereto. In arriving at these non-GAAP measures, we exclude items that either have a non-recurring impact on the income statement or which, in the judgment of our management, are items that, either as a result of their nature or size, could, were they not singled out, potentially cause investors to extrapolate future performance from an improper base. While not all inclusive, examples of these items include: • material restructuring programs, including associated costs such as employee severance, pension and related benefits, impairment of property and equipment and other assets, accelerated depreciation, termination payments for contracts and leases, contractual obligations and any other qualifying costs related to the restructuring plan; • earnings from discontinued operations and any associated profit on sale of businesses or subsidiaries; • consummated and identifiable divestitures agreed to with certain regulatory agencies as a condition of approval for Amcor’s acquisition of Bemis; • impairments in goodwill and equity method investments; • material acquisition compensation and transaction costs such as due diligence expenses, professional and legal fees and integration costs; • material purchase accounting adjustments for inventory; • amortization of acquired intangible assets from business combinations; • impact of economic net investment hedging activities not qualifying for hedge accounting; • payments or settlements related to legal claims; and • impacts from hyperinflation accounting. Management has used and uses these measures internally for planning, forecasting and evaluating the performance of the company’s reporting segments and certain of the measures are used as a component of Amcor’s board of directors’ measurement of Amcor’s performance for incentive compensation purposes. Amcor also evaluates performance on a constant currency basis, which measures financial results assuming constant foreign currency exchange rates used for translation based on the rates in effect for the comparable prior-year period. In order to compute constant currency results, we multiply or divide, as appropriate, current-year U.S. dollar results by the current-year average foreign exchange rates and then multiply or divide, as appropriate, those amounts by the prior-year average foreign exchange rates. Amcor believes that these non-GAAP measures are useful to enable investors to perform comparisons of current and historical performance of the company. For each of these non-GAAP financial measures, a reconciliation to the most directly comparable U.S. GAAP financial measure has been provided herein. These non-GAAP financial measures should not be construed as an alternative to results determined in accordance with U.S. GAAP. The company provides guidance on a non-GAAP basis as we are unable to predict with reasonable certainty the ultimate outcome and timing of certain significant items without unreasonable effort. These items include but are not limited to the impact of foreign exchange translation, restructuring program costs, asset impairments, possible gains and losses on the sale of assets and certain tax related events. These items are uncertain, depend on various factors and could have a material impact on U.S. GAAP earnings and cash flow measures for the guidance period. 2

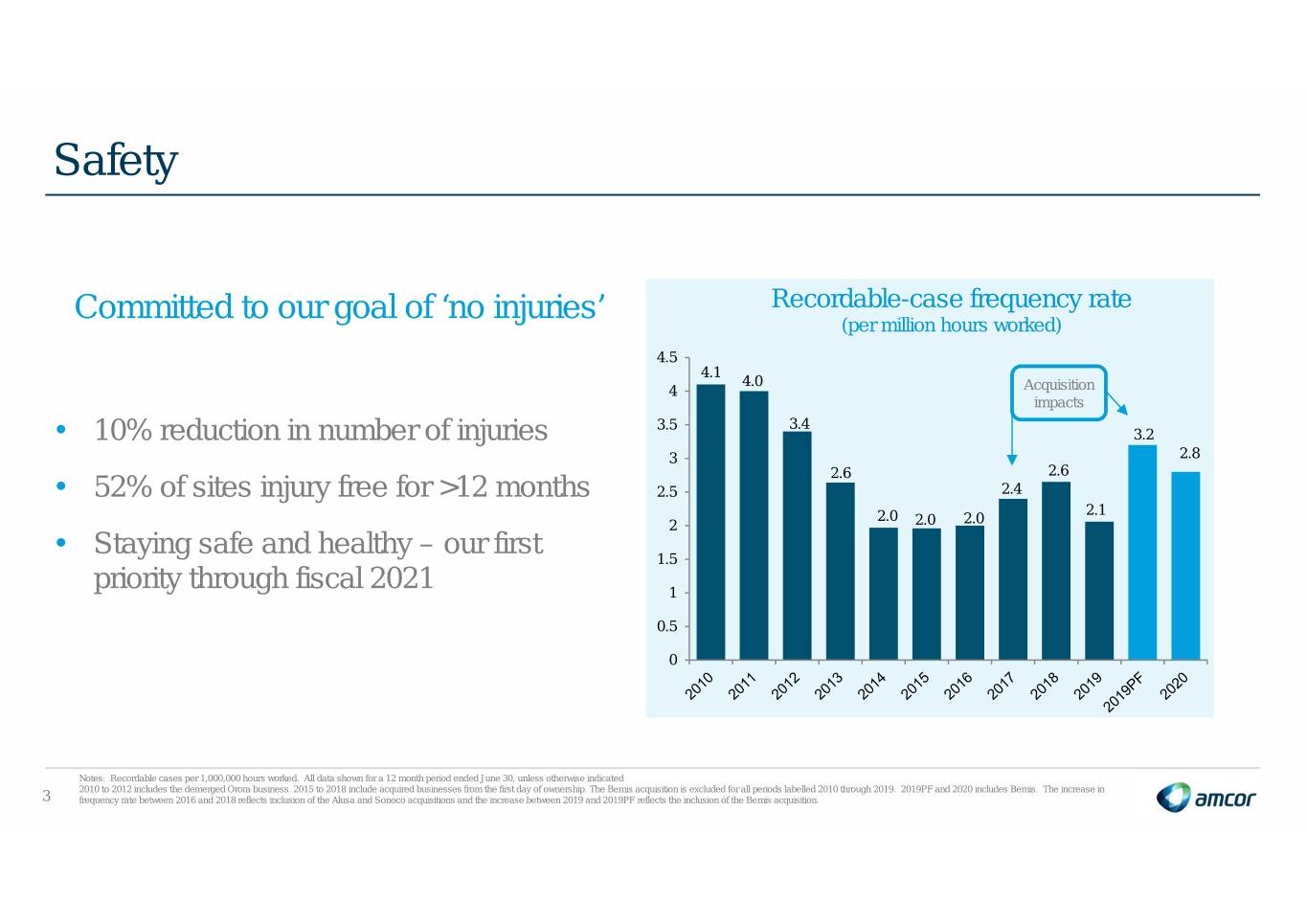

Safety Committed to our goal of ‘no injuries’ Recordable-case frequency rate (per million hours worked) 4.5 4.1 4.0 4 Acquisition impacts 3.5 3.4 • 10% reduction in number of injuries 3.2 3 2.8 2.6 2.6 • 52% of sites injury free for >12 months 2.5 2.4 2.0 2.1 2 2.0 2.0 • Staying safe and healthy – our first 1.5 priority through fiscal 2021 1 0.5 0 Notes: Recordable cases per 1,000,000 hours worked. All data shown for a 12 month period ended June 30, unless otherwise indicated 2010 to 2012 includes the demerged Orora business. 2015 to 2018 include acquired businesses from the first day of ownership. The Bemis acquisition is excluded for all periods labelled 2010 through 2019. 2019PF and 2020 includes Bemis. The increase in 3 frequency rate between 2016 and 2018 reflects inclusion of the Alusa and Sonoco acquisitions and the increase between 2019 and 2019PF reflects the inclusion of the Bemis acquisition.

Rising to the challenges of the current environment Employees Operations Communities Working safely and ensuring Safeguarding supply and Delivering essential products to health and well-being responding to new demand trends people in need Preserve. Protect. Promote. The role of packaging has never been clearer 4

Key messages for today Milestone 2020 financial year 1. Strong financial results, demonstrating resilience 2. Bemis acquisition ahead of expectations and enhancing performance 3. Visibility to drivers of near-term value for shareholders 4. Continued progress on advancing sustainability agenda 5. Substantial opportunities to create value over the long-term 5

Strong full year FY20 results Organic growth and synergy benefits Outperforming on controllables • Safety 64.2¢ $1,220m • Cost performance EPS Free Cash Flow • Working capital +13% yoy +26% yoy • Integration • Synergies $1,497m 12% EBIT EBIT +7% yoy Margin Notes: EPS, Free Cash Flow, EBIT and EBIT margins presented on an Adjusted basis. Adjusted non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further 6 details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section. EPS and EBIT growth rates expressed in constant currency terms.

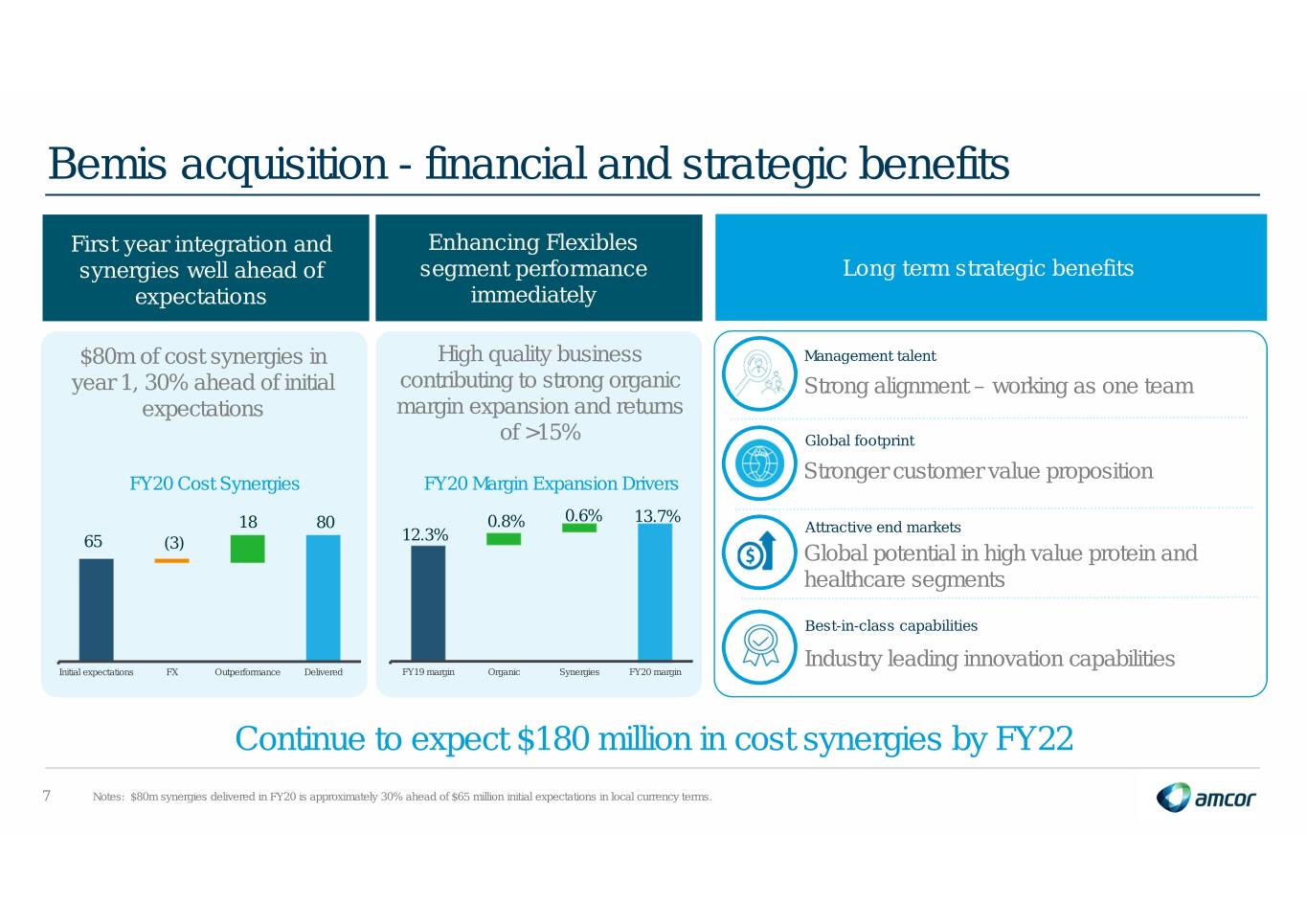

Bemis acquisition - financial and strategic benefits First year integration and Enhancing Flexibles synergies well ahead of segment performance Long term strategic benefits expectations immediately $80m of cost synergies in High quality business Management talent year 1, 30% ahead of initial contributing to strong organic Strong alignment – working as one team expectations margin expansion and returns of >15% Global footprint Stronger customer value proposition FY20 Cost Synergies FY20 Margin Expansion Drivers 0.6% 13.7% 18 80 0.8% Attractive end markets 65 12.3% (3) Global potential in high value protein and healthcare segments Best-in-class capabilities Industry leading innovation capabilities Initial expectations FX Outperformance Delivered FY19 margin Organic Synergies FY20 margin Continue to expect $180 million in cost synergies by FY22 7 Notes: $80m synergies delivered in FY20 is approximately 30% ahead of $65 million initial expectations in local currency terms.

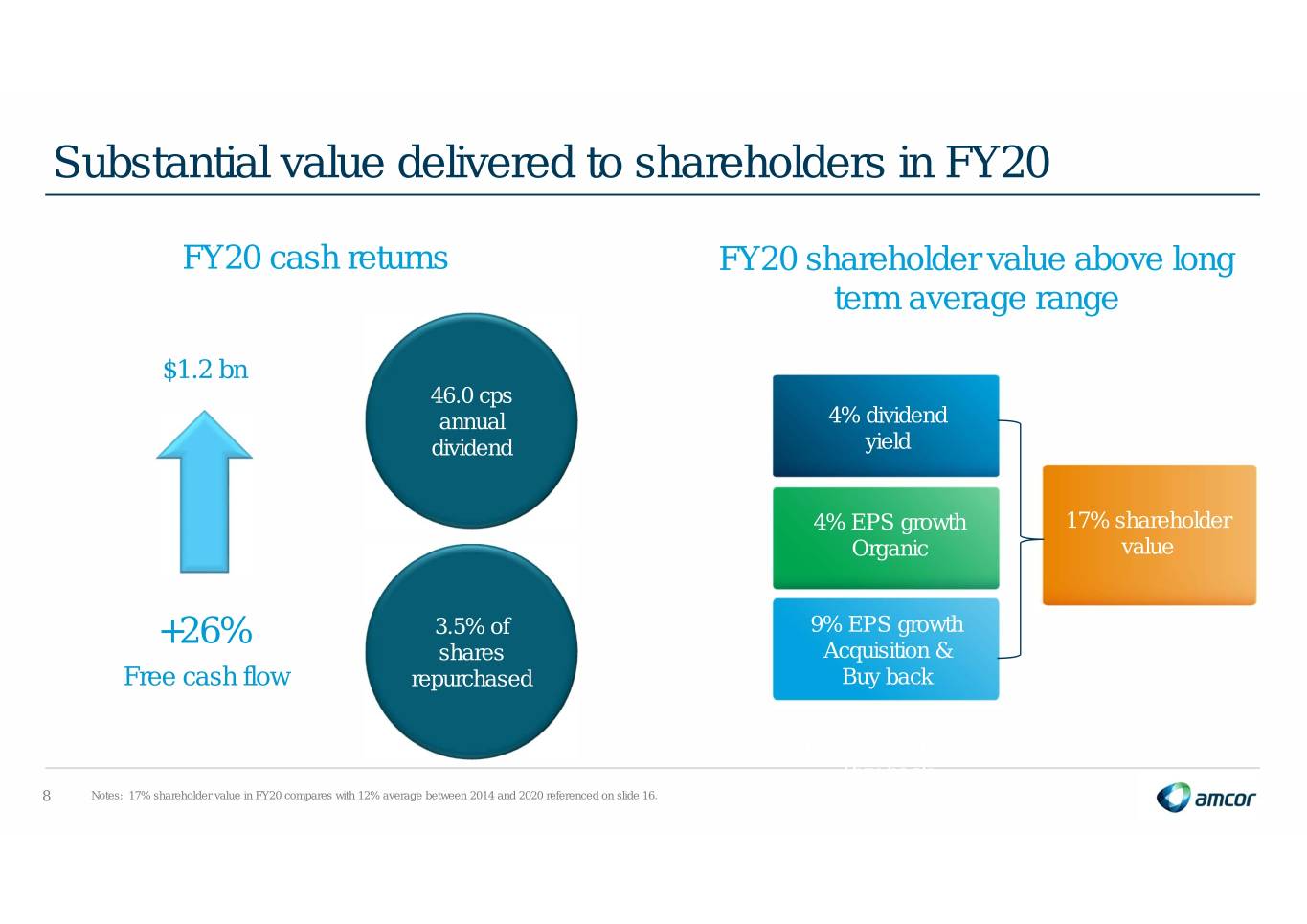

Substantial value delivered to shareholders in FY20 FY20 cash returns FY20 shareholder value above long term average range $1.2 bn 46.0 cps annual 4% dividend dividend yield 4% EPS growth 17% shareholder Organic value +26% 3.5% of 9% EPS growth shares Acquisition & Free cash flow repurchased Buy back 1.6% EPS growth Buy back 8 Notes: 17% shareholder value in FY20 compares with 12% average between 2014 and 2020 referenced on slide 16.

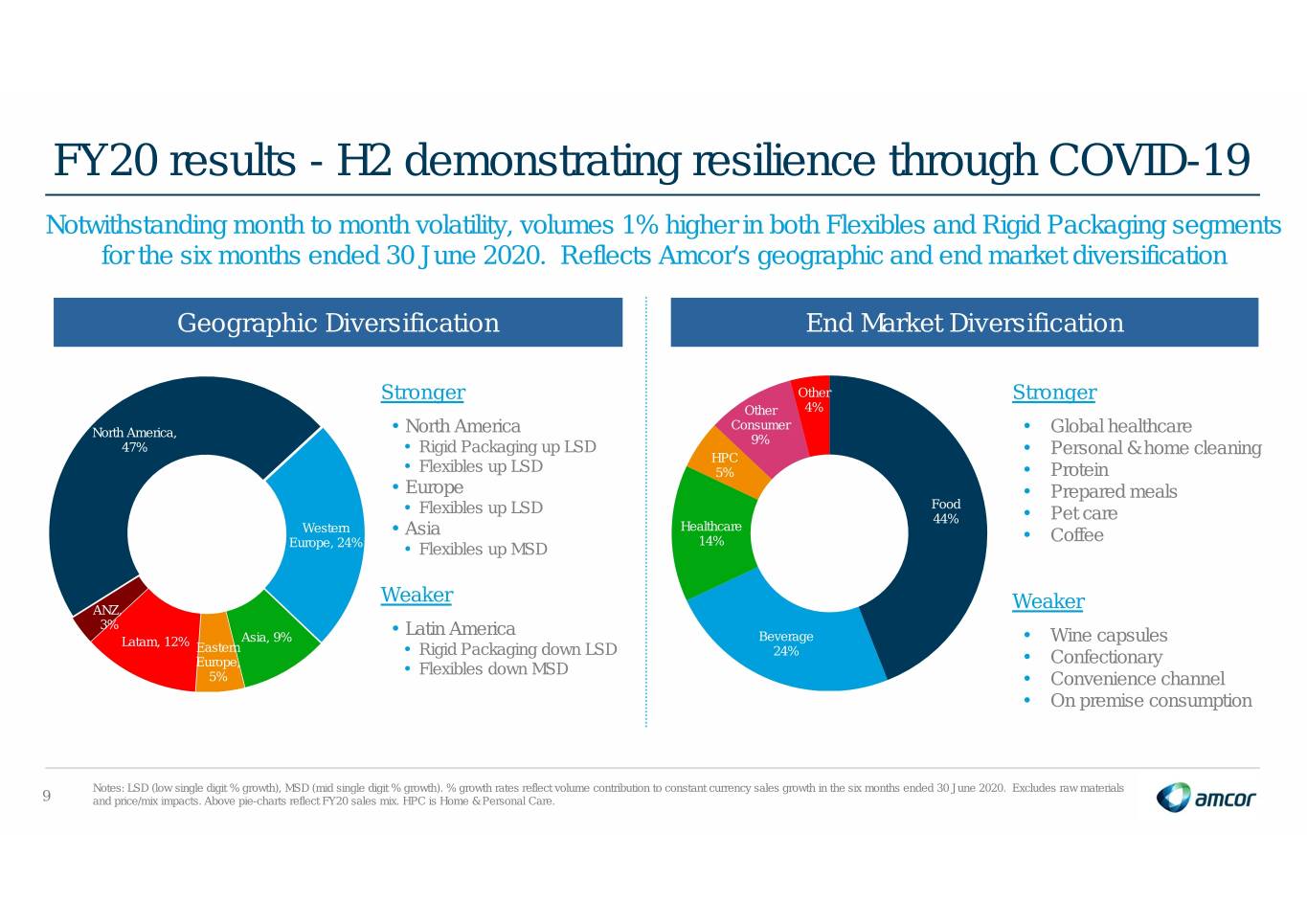

FY20 results - H2 demonstrating resilience through COVID-19 Notwithstanding month to month volatility, volumes 1% higher in both Flexibles and Rigid Packaging segments for the six months ended 30 June 2020. Reflects Amcor’s geographic and end market diversification Geographic Diversification End Market Diversification Stronger Other Stronger Other 4% Consumer North America, • North America • Global healthcare 9% 47% • Rigid Packaging up LSD • Personal & home cleaning HPC • Flexibles up LSD 5% • Protein • Europe • Prepared meals • Flexibles up LSD Food 44% • Pet care Western • Asia Healthcare 14% • Coffee Europe, 24% • Flexibles up MSD Weaker ANZ, Weaker 3% Asia, 9% • Latin America Beverage • Wine capsules Latam, 12% Eastern • Rigid Packaging down LSD 24% • Confectionary Europe, • Flexibles down MSD 5% • Convenience channel • On premise consumption Notes: LSD (low single digit % growth), MSD (mid single digit % growth). % growth rates reflect volume contribution to constant currency sales growth in the six months ended 30 June 2020. Excludes raw materials 9 and price/mix impacts. Above pie-charts reflect FY20 sales mix. HPC is Home & Personal Care.

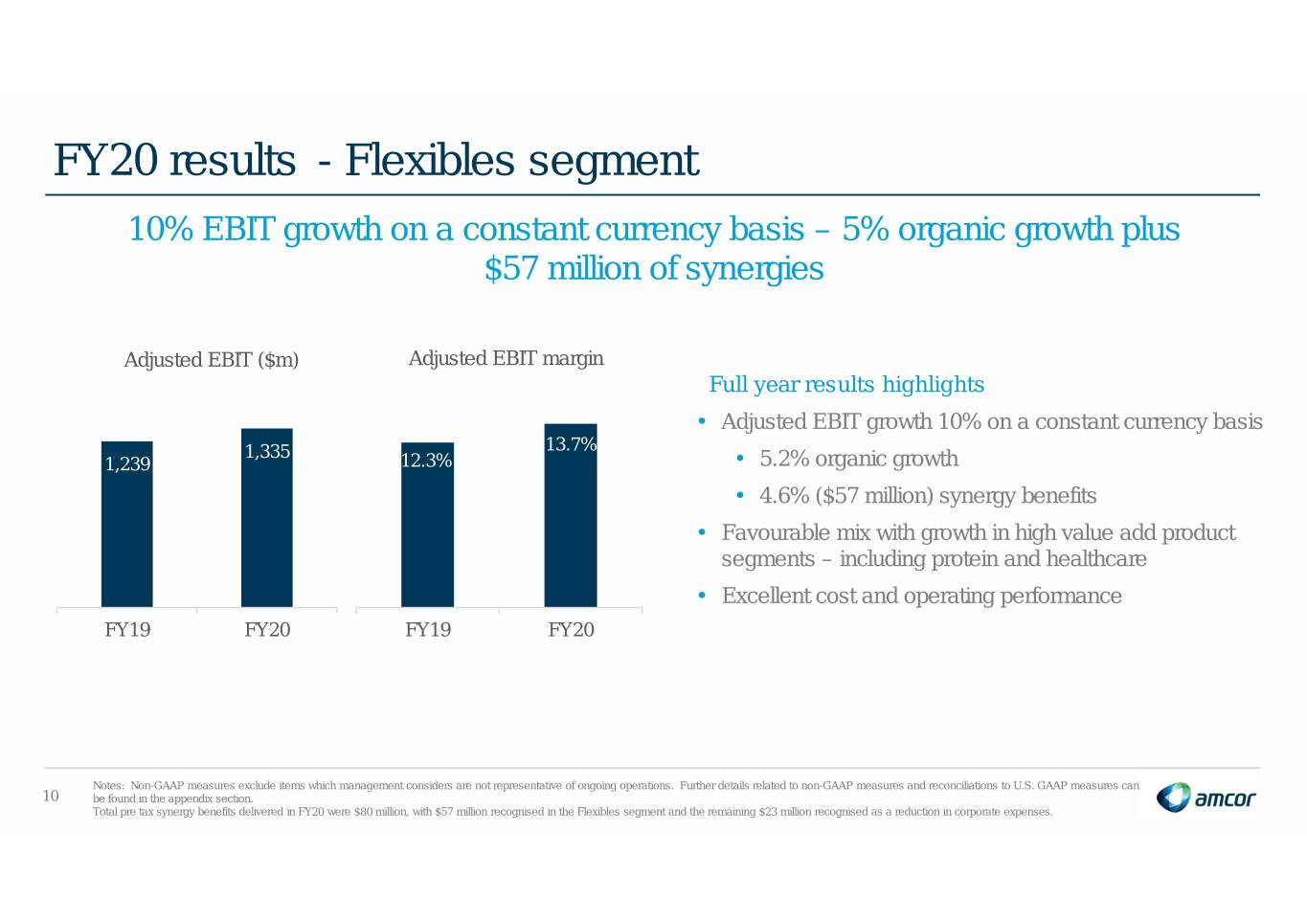

FY20 results - Flexibles segment 10% EBIT growth on a constant currency basis – 5% organic growth plus $57 million of synergies Adjusted EBIT ($m) Adjusted EBIT margin Full year results highlights • Adjusted EBIT growth 10% on a constant currency basis 1,335 13.7% 1,239 12.3% • 5.2% organic growth • 4.6% ($57 million) synergy benefits • Favourable mix with growth in high value add product segments – including protein and healthcare • Excellent cost and operating performance FY19 FY20 FY19 FY20 Notes: Non-GAAP measures exclude items which management considers are not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can 10 be found in the appendix section. Total pre tax synergy benefits delivered in FY20 were $80 million, with $57 million recognised in the Flexibles segment and the remaining $23 million recognised as a reduction in corporate expenses.

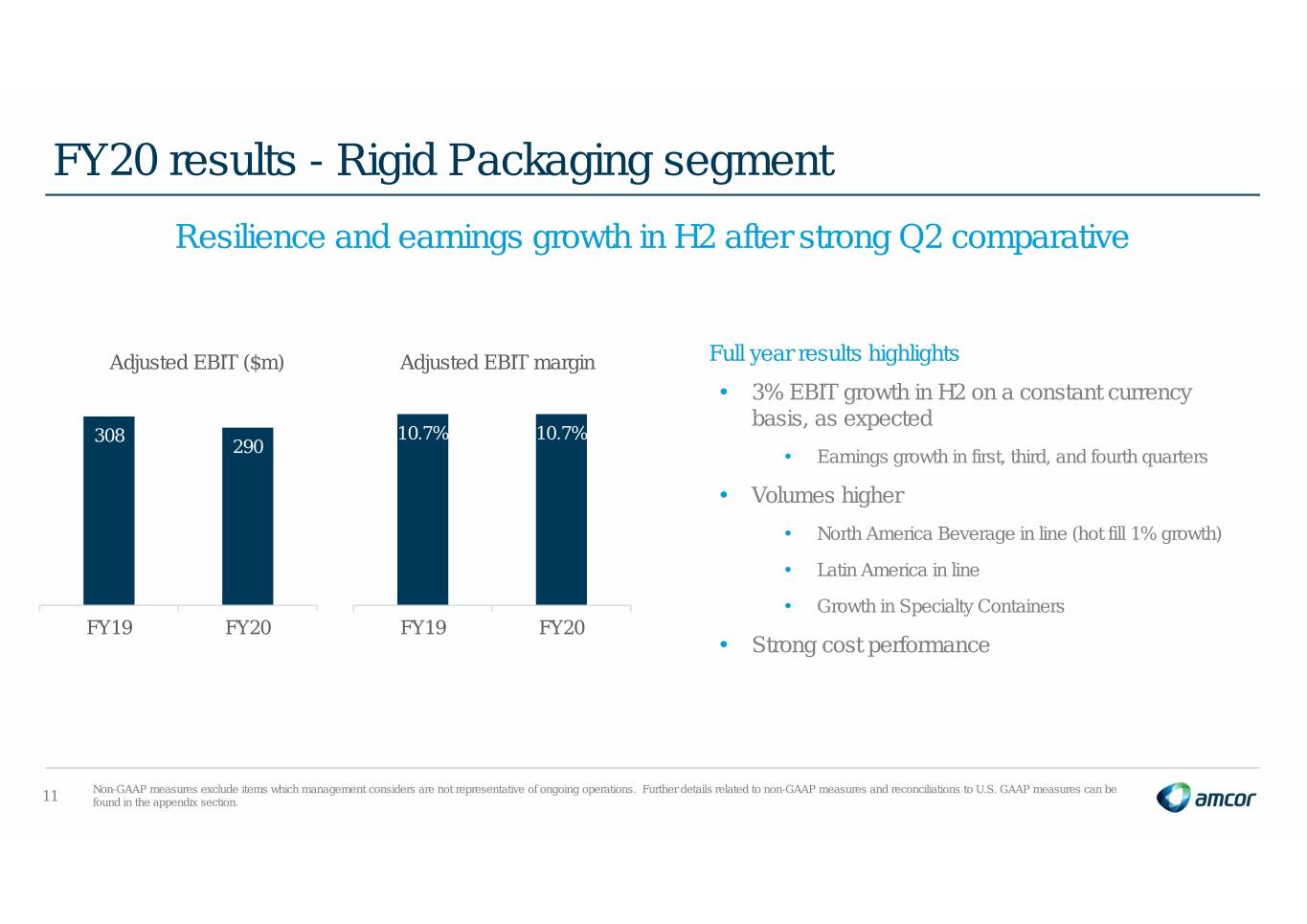

FY20 results - Rigid Packaging segment Resilience and earnings growth in H2 after strong Q2 comparative Adjusted EBIT ($m) Adjusted EBIT margin Full year results highlights • 3% EBIT growth in H2 on a constant currency basis, as expected 308 10.7% 10.7% 290 • Earnings growth in first, third, and fourth quarters • Volumes higher • North America Beverage in line (hot fill 1% growth) • Latin America in line • Growth in Specialty Containers FY19 FY20 FY19 FY20 • Strong cost performance Non-GAAP measures exclude items which management considers are not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be 11 found in the appendix section.

FY20 results - $1.2bn free cash flow, up 26% Outstanding working capital performance, continuing to invest and return capital to shareholders Year to date cash flow FY19 FY20 ($ million) • Disciplined capex spending in light of Bemis Adjusted EBITDA 1,394 1,913 integration and COVID-19 Interest and tax payments (368) (396) • Excellent working capital performance Capital expenditure (332) (400) - $150 million cash release funds Bemis integration costs Movement in working capital 53 213 Other (14) (110) Average working capital to sales (%) Adjusted free cash flow(1)(2) 733 1,220 Legacy Amcor (3) Pro Forma adjustments 237 - Combined Amcor and Bemis 10.7% 9.5% Pro Forma adjusted free cash flow(1)(2) 970 1,220 10.6% 9.6% (4) 9.0% Dividends (767) (761) 8.7% 8.9% 8.6% 8.3% Adjusted free cash flow after 203 459 dividends(1)(2) Jun 13 Jun 14 Jun 15 Jun 16 Jun 17 Jun 18 Jun 19 Jun-20 (1) Non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section. (2) Adjusted free cash flow excludes material transaction related costs because these cash flows are not considered to be directly related to the underlying business. 12 (3) Includes Bemis and remedy adjustments. (4) FY19 includes dividends paid to former Bemis shareholders of $87 million.

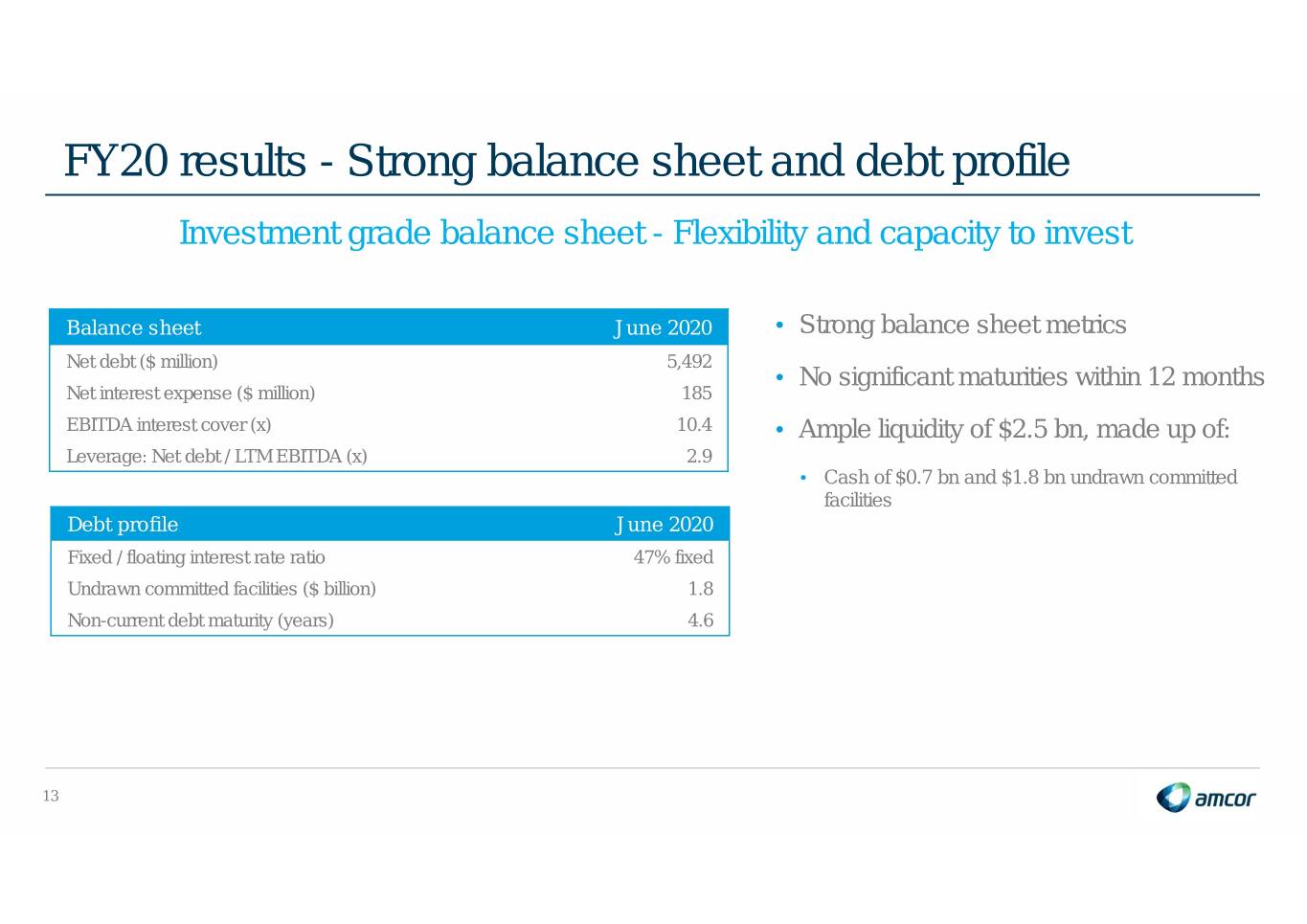

FY20 results - Strong balance sheet and debt profile Investment grade balance sheet - Flexibility and capacity to invest Balance sheet June 2020 • Strong balance sheet metrics Net debt ($ million) 5,492 • No significant maturities within 12 months Net interest expense ($ million) 185 EBITDA interest cover (x) 10.4 • Ample liquidity of $2.5 bn, made up of: Leverage: Net debt / LTM EBITDA (x) 2.9 • Cash of $0.7 bn and $1.8 bn undrawn committed facilities Debt profile June 2020 Fixed / floating interest rate ratio 47% fixed Undrawn committed facilities ($ billion) 1.8 Non-current debt maturity (years) 4.6 13

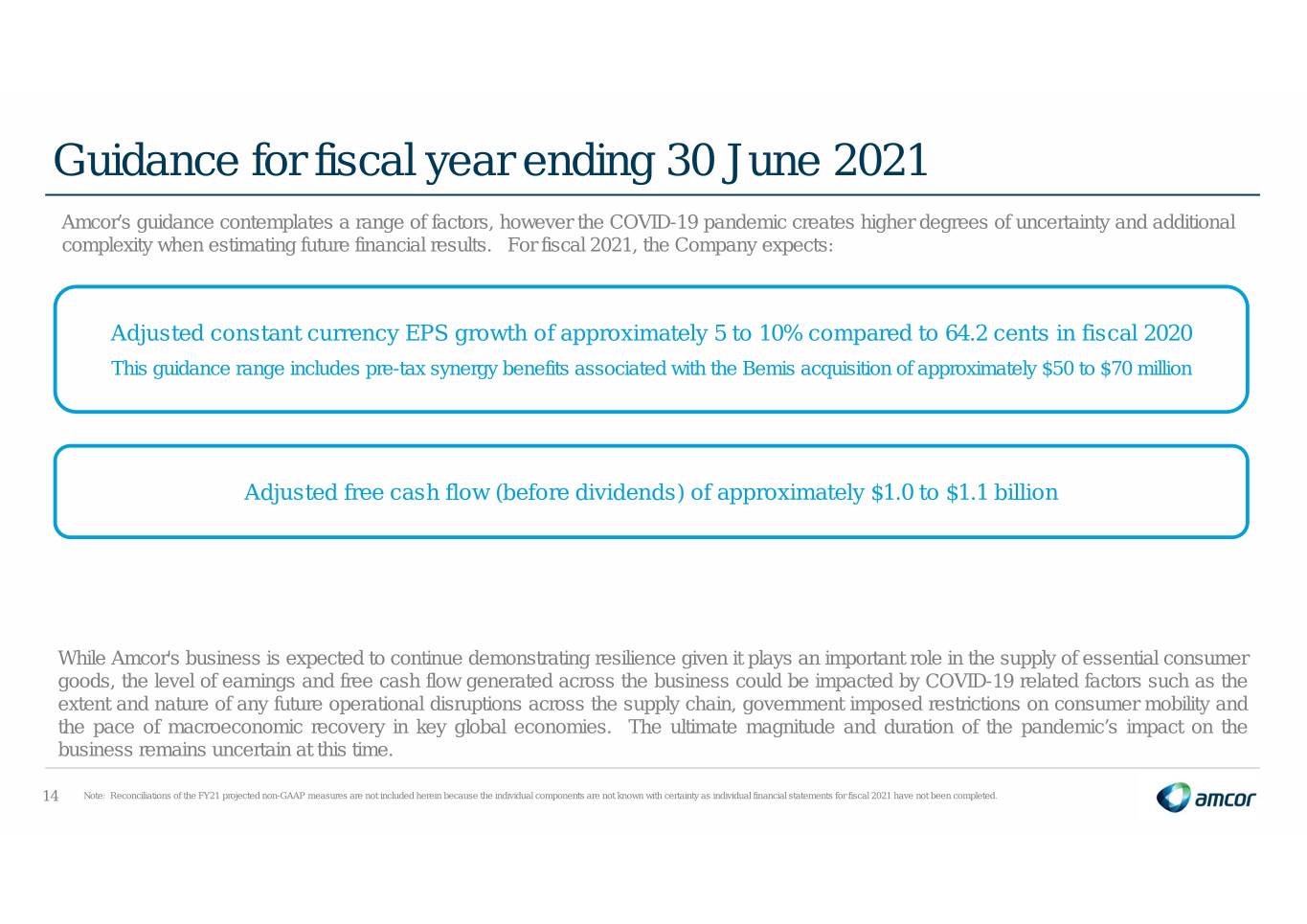

Guidance for fiscal year ending 30 June 2021 Amcor’s guidance contemplates a range of factors, however the COVID-19 pandemic creates higher degrees of uncertainty and additional complexity when estimating future financial results. For fiscal 2021, the Company expects: Adjusted constant currency EPS growth of approximately 5 to 10% compared to 64.2 cents in fiscal 2020 This guidance range includes pre-tax synergy benefits associated with the Bemis acquisition of approximately $50 to $70 million Adjusted free cash flow (before dividends) of approximately $1.0 to $1.1 billion While Amcor's business is expected to continue demonstrating resilience given it plays an important role in the supply of essential consumer goods, the level of earnings and free cash flow generated across the business could be impacted by COVID-19 related factors such as the extent and nature of any future operational disruptions across the supply chain, government imposed restrictions on consumer mobility and the pace of macroeconomic recovery in key global economies. The ultimate magnitude and duration of the pandemic’s impact on the business remains uncertain at this time. 14 Note: Reconciliations of the FY21 projected non-GAAP measures are not included herein because the individual components are not known with certainty as individual financial statements for fiscal 2021 have not been completed.

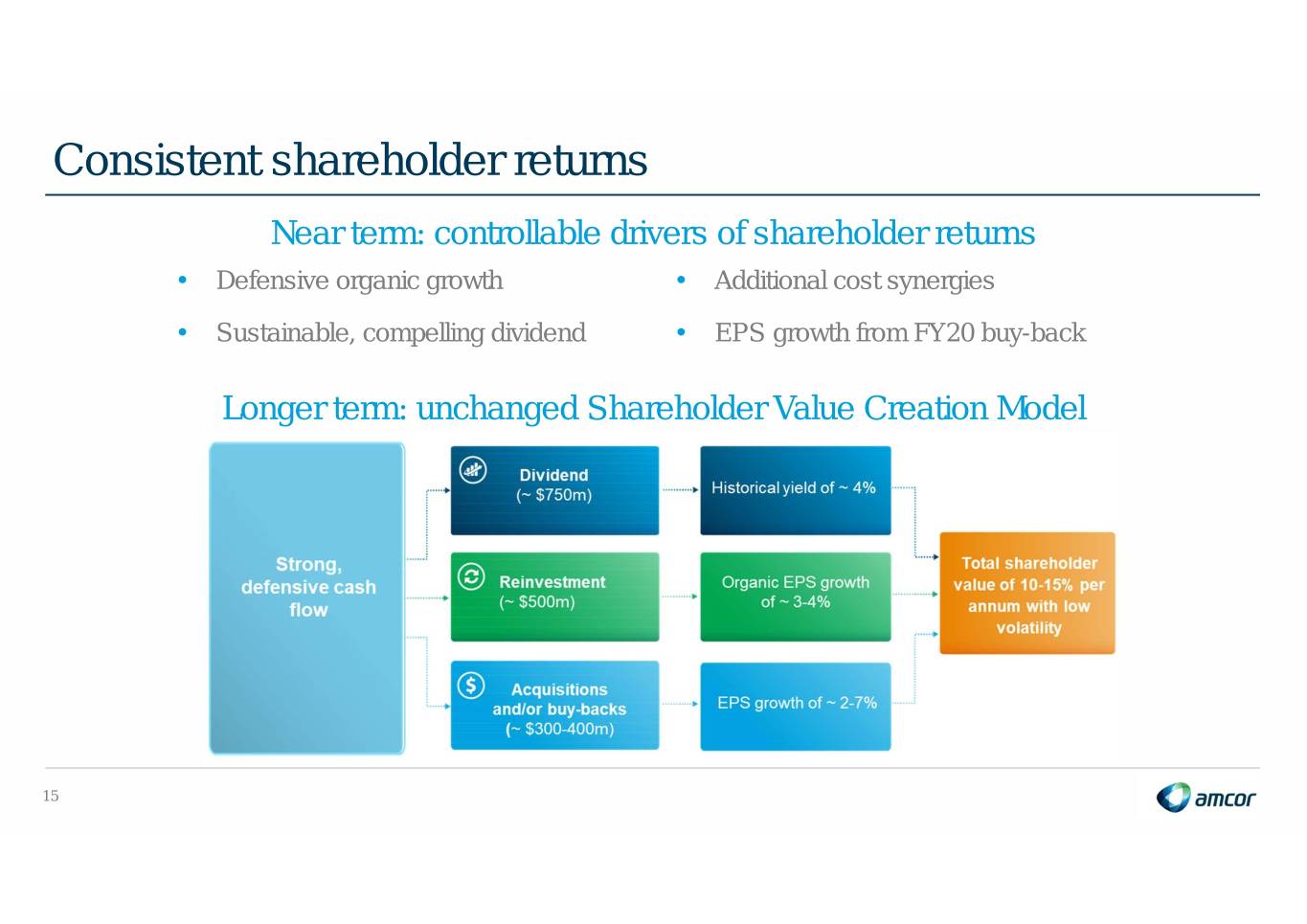

Consistent shareholder returns Near term: controllable drivers of shareholder returns • Defensive organic growth • Additional cost synergies • Sustainable, compelling dividend • EPS growth from FY20 buy-back Longer term: unchanged Shareholder Value Creation Model 15

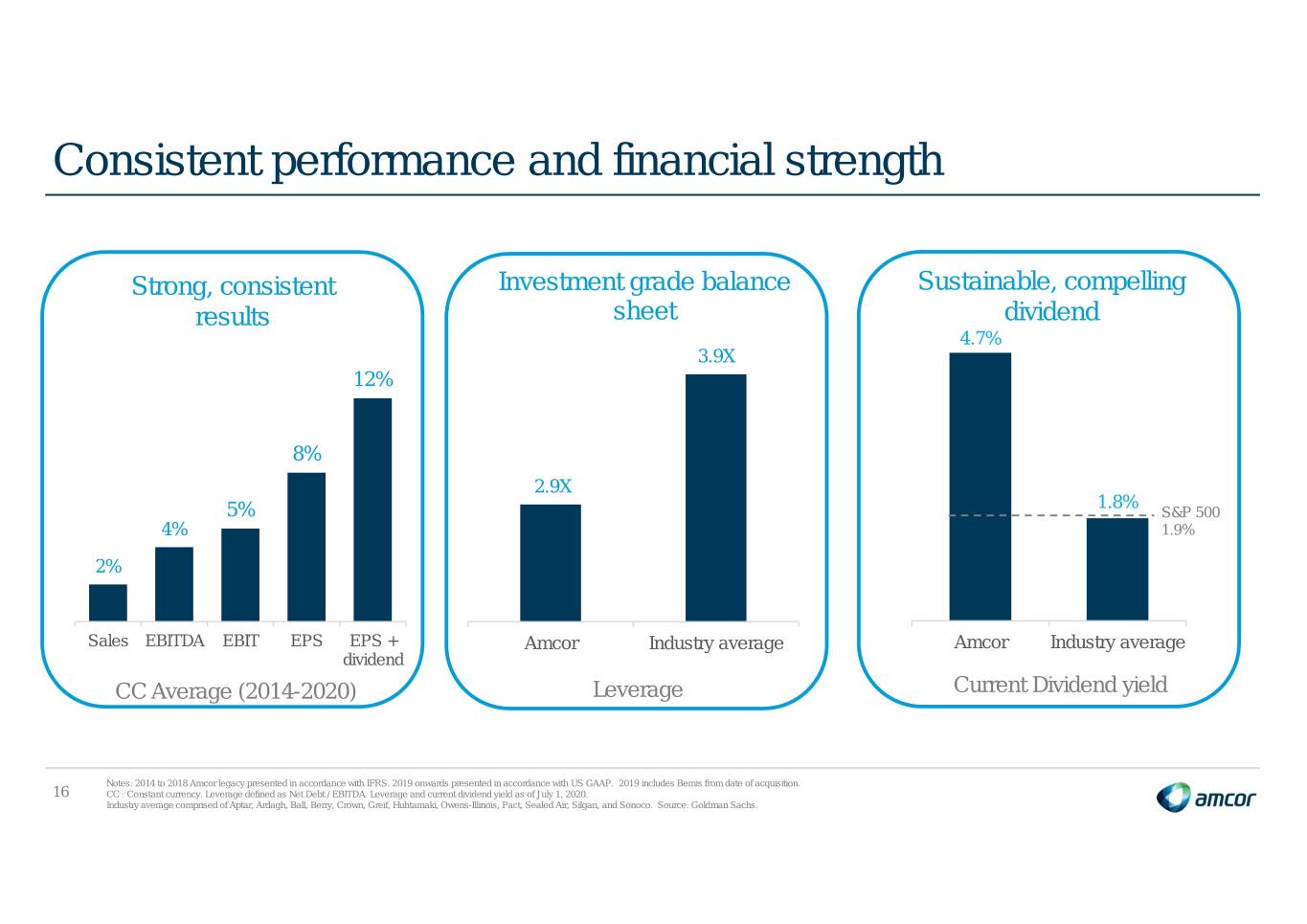

Consistent performance and financial strength Strong, consistent Investment grade balance Sustainable, compelling results sheet dividend 4.7% 3.9X 12% 8% 2.9X 1.8% 5% S&P 500 4% 1.9% 2% Sales EBITDA EBIT EPS EPS + Amcor Industry average Amcor Industry average dividend CC Average (2014-2020) Leverage Current Dividend yield Notes: 2014 to 2018 Amcor legacy presented in accordance with IFRS. 2019 onwards presented in accordance with US GAAP. 2019 includes Bemis from date of acquisition. 16 CC : Constant currency. Leverage defined as Net Debt / EBITDA. Leverage and current dividend yield as of July 1, 2020. Industry average comprised of Aptar, Ardagh, Ball, Berry, Crown, Greif, Huhtamaki, Owens-Illinois, Pact, Sealed Air, Silgan, and Sonoco. Source: Goldman Sachs.

Sustainability remains our most significant growth opportunity Responsible packaging is the answer Consumer Packaging design Waste management infrastructure participation Amcor is uniquely positioned as industry leader with Scale, Resources and Capabilities 17

Responsible packaging – Amcor uniquely positioned to lead Making progress through meaningful actions Innovating Collaborating Informing Packaging design taking into account full Partner of choice with scale to maximise Technical expertise to inform and educate lifecycle environmental impacts reach and impact consumers . Good progress increasing number of . Flexible packaging recycling: . Proprietary survey research on Amcor products designed to be successful Phase 1 MRFF pilot in US European consumer purchasing habits recycled. On track to meet 2025 pledge . Only packaging company in ReSource: . “Choosing PET” campaign, and . 41% increase in Post Consumer Resin Plastic: improving measurement of educational content across social (PCR) used in FY20 - 1.7 million pounds collection and recycling rates media platforms . Initiated and convened NGO’s and customers behind the first packaging sustainability statement in China 2025 18

Summary Milestone 2020 financial year 1. Strong financial results, demonstrating resilience 2. Bemis acquisition ahead of expectations and enhancing performance 3. Visibility to drivers of near-term value for shareholders 4. Continued progress on advancing sustainability agenda 5. Substantial opportunities to create value over the long-term 19

Appendix slides FY20 Full year results – supplementary schedules and reconciliations

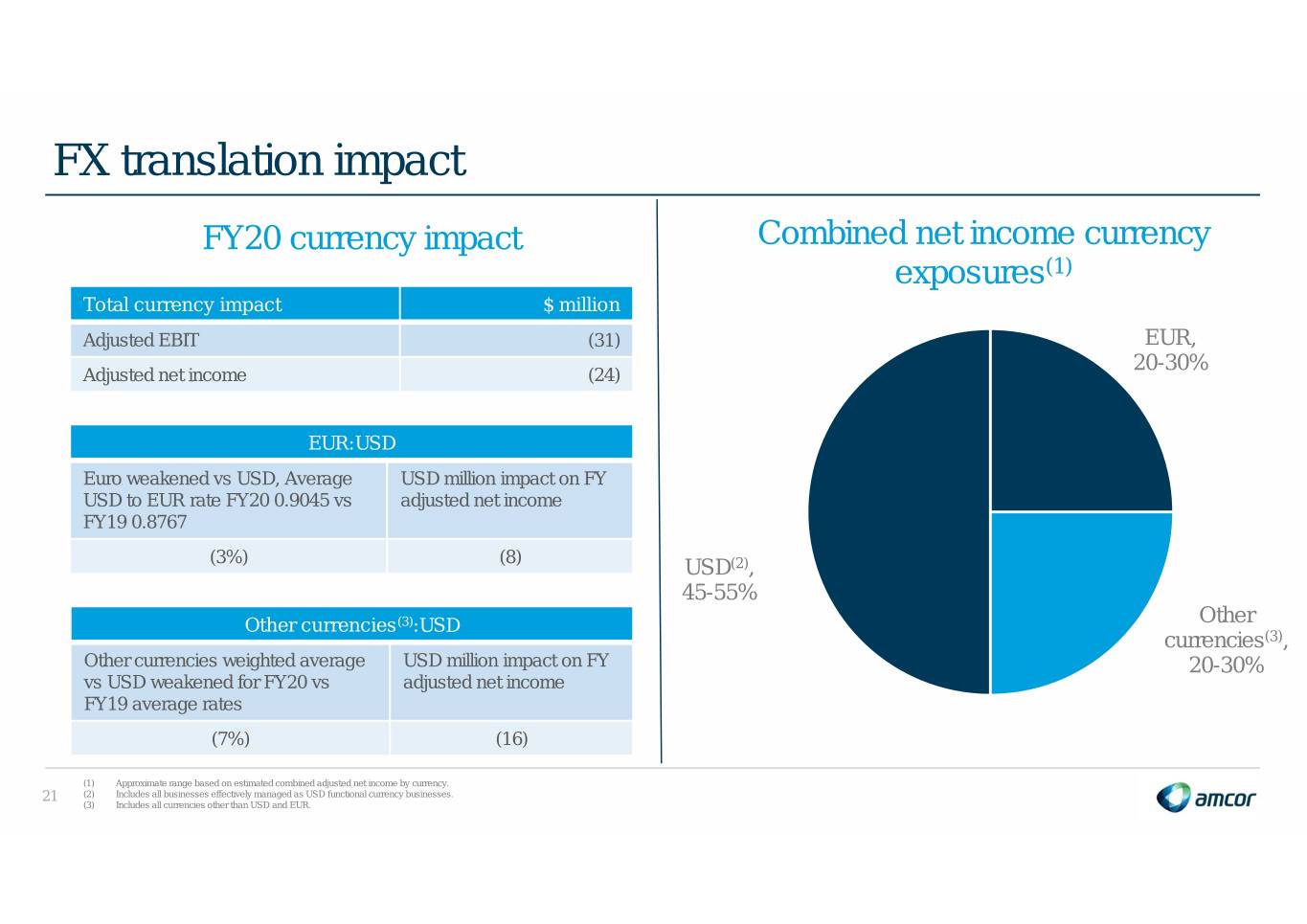

FX translation impact FY20 currency impact Combined net income currency exposures(1) Total currency impact $ million Adjusted EBIT (31) EUR, 20-30% Adjusted net income (24) EUR:USD Euro weakened vs USD, Average USD million impact on FY USD to EUR rate FY20 0.9045 vs adjusted net income FY19 0.8767 (3%) (8) USD(2), 45-55% Other currencies(3):USD Other currencies(3), Other currencies weighted average USD million impact on FY 20-30% vs USD weakened for FY20 vs adjusted net income FY19 average rates (7%) (16) (1) Approximate range based on estimated combined adjusted net income by currency. 21 (2) Includes all businesses effectively managed as USD functional currency businesses. (3) Includes all currencies other than USD and EUR.

Reconciliations of non-GAAP financial measures (1) Includes costs associated with the Bemis acquisition. The twelve months ended June 30, 2020 and 2019 includes $58 million and $16 million respectively of acquisition related inventory fair value step-up costs. 22 (2) The twelve months ended June 30, 2020 and 2019 includes $26 million and $5 million respectively of sales backlog amortization related to the Bemis acquisition. (3) Includes Bemis and remedy adjustments. EPS also adjusts for new shares issued to complete the Bemis combination.

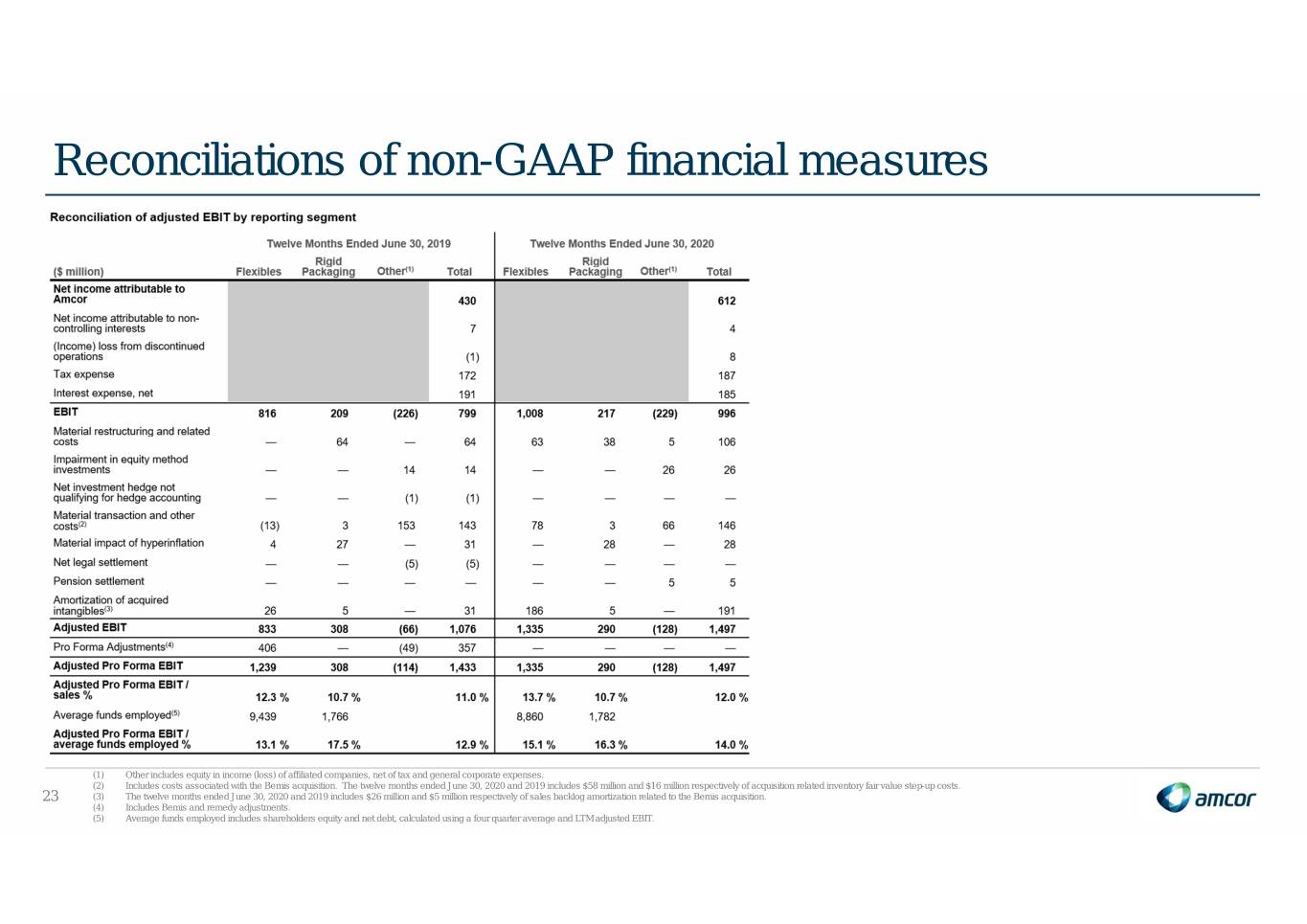

Reconciliations of non-GAAP financial measures (1) Other includes equity in income (loss) of affiliated companies, net of tax and general corporate expenses. (2) Includes costs associated with the Bemis acquisition. The twelve months ended June 30, 2020 and 2019 includes $58 million and $16 million respectively of acquisition related inventory fair value step-up costs. 23 (3) The twelve months ended June 30, 2020 and 2019 includes $26 million and $5 million respectively of sales backlog amortization related to the Bemis acquisition. (4) Includes Bemis and remedy adjustments. (5) Average funds employed includes shareholders equity and net debt, calculated using a four quarter average and LTM adjusted EBIT.

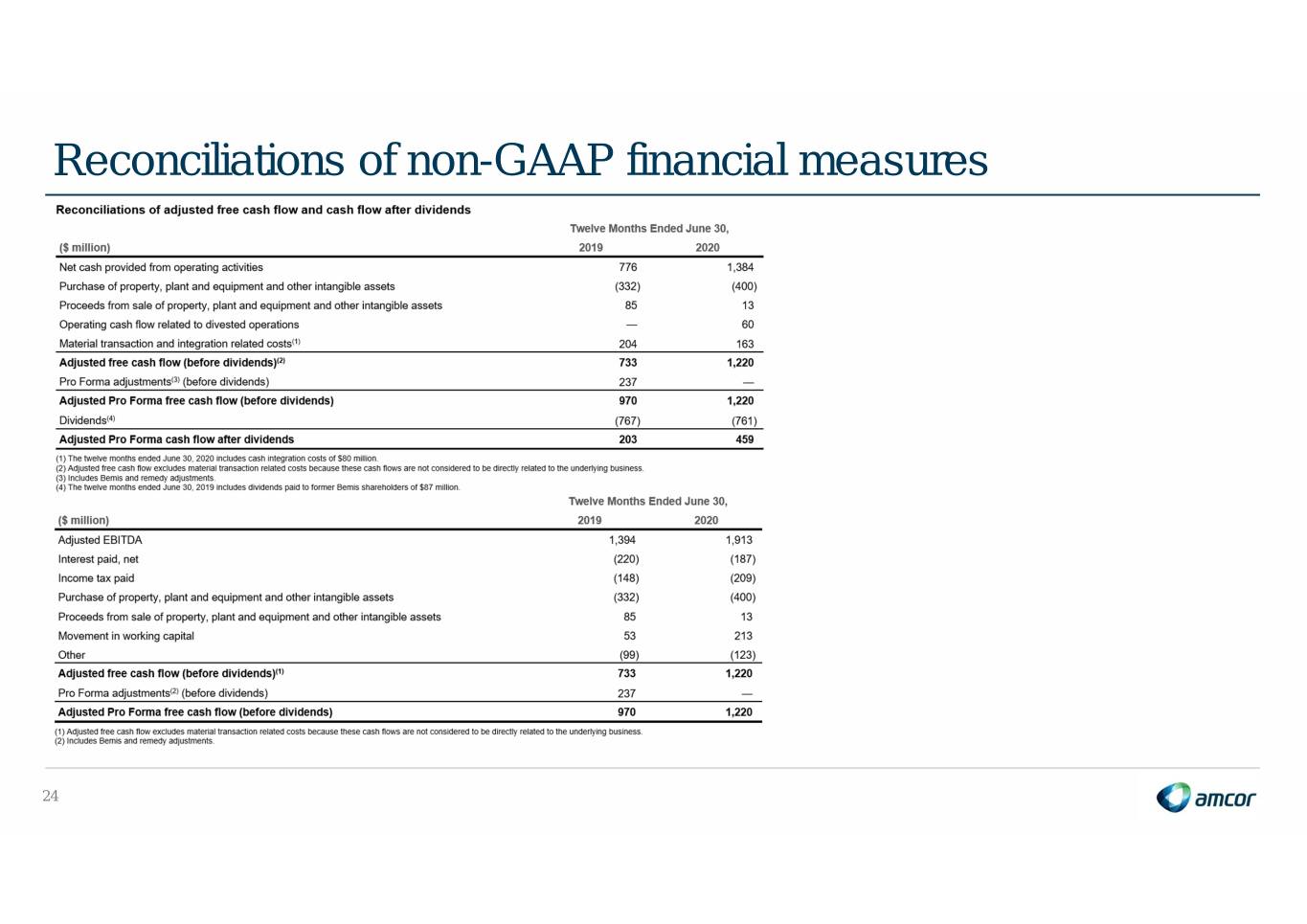

Reconciliations of non-GAAP financial measures 24

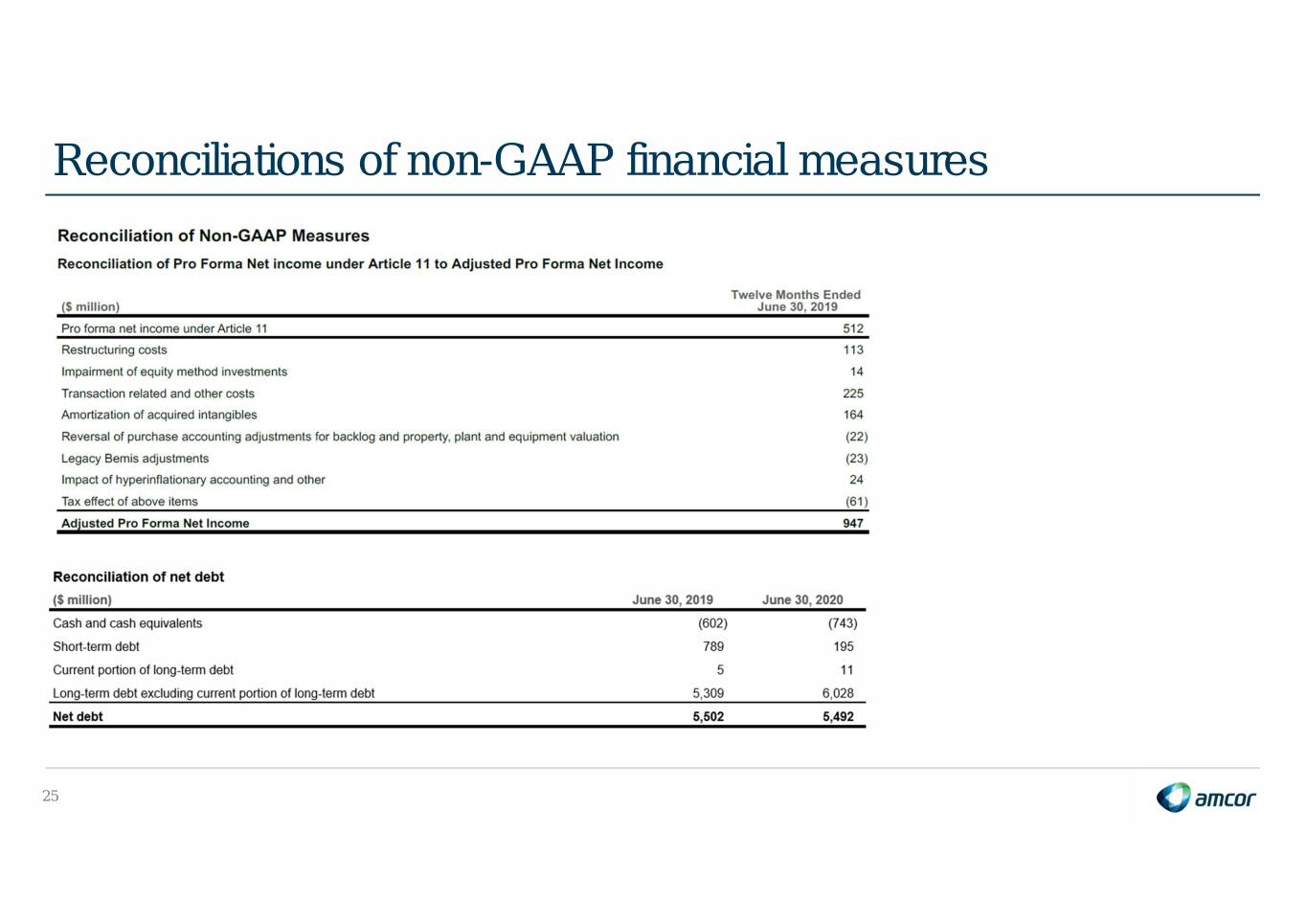

Reconciliations of non-GAAP financial measures 25