Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Ondas Holdings Inc. | ea125644-8k_ondas.htm |

| EX-10.1 - FORM OF SECURITIES PURCHASE AGREEMENT - Ondas Holdings Inc. | ea125644ex10-1_ondas.htm |

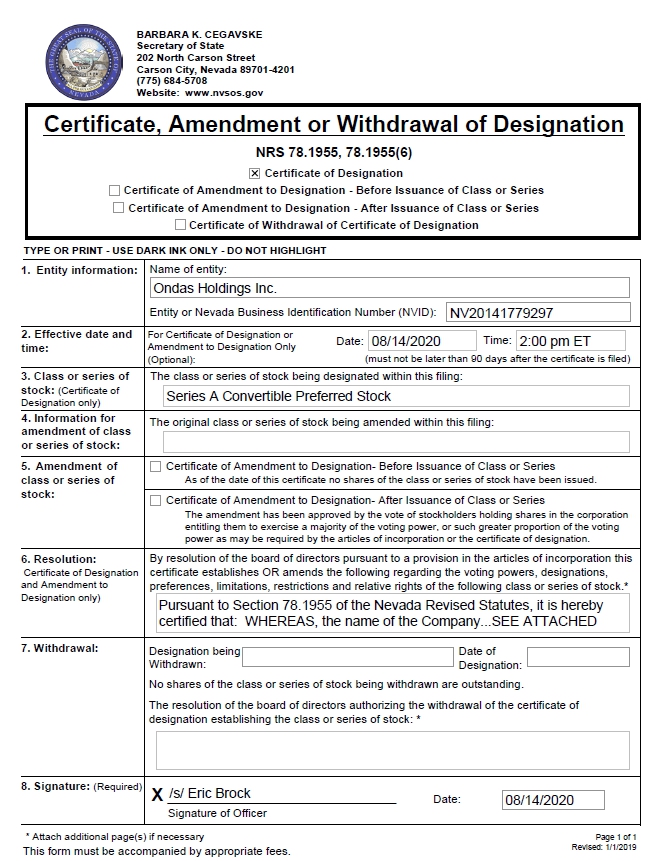

Exhibit 3.1

CERTIFICATE OF DESIGNATION, PREFERENCES AND RIGHTS

OF

THE SERIES A CONVERTIBLE PREFERRED STOCK

OF

ONDAS HOLDINGS INC.

Pursuant to Section 78.1955 of the Nevada Revised Statutes, it is hereby certified that:

WHEREAS, the name of the Company (hereinafter called the “Company”) is Ondas Holdings Inc., a Nevada corporation.

WHEREAS, the Articles of Incorporation of the Company, as amended (the “Articles of Incorporation ”), authorizes the issuance of 10 million (10,000,000) shares of preferred stock, $0.0001 par value per share, and expressly authorizes the Board of Directors of the Company (the “Board”) to designate, out of the undesignated shares of preferred stock, one or more series, and to determine or change by resolution for each such series its designation, the number of shares of such series, the powers, preferences and rights and the qualifications, limitations, or restrictions for the shares of such series.

WHEREAS, the Board, pursuant to the authority expressly vested in it as aforesaid, has adopted the following resolutions designating a new series of preferred stock as Series A Convertible Preferred Stock (the “Series A Preferred”).

RESOLVED, that the Board deems it advisable to, and hereby does, designate a Series A Convertible Preferred Stock and fixes and determines the preferences, rights, qualifications, limitations and restrictions relating to the Series A Convertible Preferred Stock as follows, in addition to any set forth in the Articles of Incorporation:

Section 1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Business Day” means any day except Saturday, Sunday, and any day which shall be a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close. Whenever any payment or other obligation hereunder shall be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day.

“Common Stock” means the Company’s common stock, $0.0001 par value per share.

“Holder” means any owner of shares of Series A Preferred (as defined below).

“Person” means an individual, entity, corporation, partnership, association, limited liability company, limited liability partnership, joint–stock company, trust or unincorporated organization.

“Purchase Price” means $2.00 per share as may be adjusted as provided for in this Certificate of Designation.

Section 2. Designation and Amount. The series of preferred stock designated by this Certificate of Designation shall be designated as the Company’s Series A Preferred, with five million (5,000,0000) shares designated as Series A Preferred.

Section 3. Dividend Provisions: The Series A Preferred, (x) accrues a non-cumulative as, when, and if declared dividend at a rate of five percent (5%) per annum to be paid in kind upon conversion of the Series A Preferred and (y) participates in any dividend paid on the Common Stock on an as-if-converted basis. The participation rights in clause (y) do not apply to repurchases of stock from service providers at or below cost upon termination of employment or engagement; to acquisitions of Common Stock by the Company pursuant to its exercise of a right of first refusal to repurchase shares; to distributions in connection with a Liquidation Event (as defined below); or to repurchases approved by the Company’s Board of Directors.

| 2 |

Section 4. Liquidation Preference: In the event of any liquidation, dissolution or winding up of the Company (a “Liquidation Event”), the Series A Preferred will be entitled, in preference to the Common Stock, to an amount equal to the Purchase Price per share plus all declared but unpaid dividends. To the extent that the assets of the Company are insufficient to pay the Holders of the Series A Preferred in full, the proceeds of any Liquidation Event shall be distributed ratably among the Holders of the Series A Preferred on a pro rata basis.

A merger, sale of substantially all assets, reorganization or other transaction to which the Company is a party in which control of the Company is transferred will be treated as a “Liquidation Event,” provided that in connection therewith, the Series A Preferred will be entitled to the greater of the amount of liquidation proceeds described in the preceding paragraph or the proceeds that would be payable with respect to the shares of Common Stock into which the Series A Preferred is then convertible.

No transaction or series of transactions principally for bona fide equity financing purposes in which cash is received by the Company or any successor or indebtedness of the Company is cancelled or converted or any combination thereof shall be considered a Liquidation Event.

Section 5. Conversion. The Series A Preferred may be convertible at a Holder’s election any time beginning six months from the date of closing of a definitive agreement regarding the offering of Series A Preferred (the “Offering”) into shares of Common Stock of the Company at an initial conversion price equal to the Purchase Price so that, initially, each share of Series A Preferred shall be convertible into one (1) share of Common Stock. The Purchase Price will be subject to adjustment as provided in Sections 7 and 8 below.

Section 6. Mandatory Conversion. The Series A Preferred will be automatically converted into Common Stock (a “Mandatory Conversion”), at the then applicable conversion price, in the event of an equity offering of shares of Common Stock resulting in the Company uplisting to any of the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market, the NYSE Euronext, or the New York Stock Exchange (each a “National Securities Exchange”, (provided that if the per share offering price in such offering is less than the then applicable conversion price for the Series A Preferred, the Series A Preferred will automatically convert based on the offering price in such offering).

Section 7. Anti-dilution Provisions. In the event of any stock split, stock dividend, or stock combination, the number of shares deliverable and the Purchase Price of the Series A Preferred will be appropriately adjusted.

Section 8. Additional Anti-dilution Provisions. In the event a Mandatory Conversion is triggered, if the offering price on the date such Mandatory Conversion is triggered is less than a 25% premium to the Purchase Price, the Company will issue additional shares of Common Stock for each outstanding share of Series A Preferred to ensure the effective conversion price equals a 25% discount to the Purchase Price.

Section 9. Voting Rights. Consent of the Holders of at least a majority of the then outstanding Series A Preferred will be required for (i) the creation of, or increase in the authorized amount of, any new class or series of stock or any other securities convertible into equity securities of the Company ranking on a parity with or senior to the Series A Preferred, (ii) any redemption, repurchase, payment or declaration of dividends or other distributions with respect to Common Stock or the Series A Preferred (subject to the exceptions in the second sentence under “Dividend Provisions” above); or (iii) any Liquidation Event (or transaction that is treated as a Liquidation Event as described in Section 4 above) pursuant to which the Holders of the Series A Preferred are not entitled to receive cash or securities traded on a national securities exchange in the United States in an amount not less than the applicable original issue price plus declared and unpaid dividends. Consent of the Holders of at least a majority of the then outstanding Series A Preferred will also be required for (x) any increase or decrease in the authorized number of shares of Series A Preferred or (y) any change to the powers, preferences or special rights of the Series A Preferred so as to affect them adversely. Other than as expressly set forth above, the Series A Preferred has no voting rights.

| 3 |

Section 10. Resale Restrictions. For a period of one year from the date of a definitive agreement with respect to the Offering, if the Company undertakes an underwritten public equity offering, the Holders of Series A Preferred will enter into a lock-up agreement with respect to the sale of the Series A Preferred and the Common Stock underlying such Series A Preferred as may be reasonably requested by the Company or the Company’s underwriter for such public equity offering.

Section 11. Miscellaneous.

(a) Notices. Any and all notices or other communications or deliveries to be provided by the Holders hereunder shall be in writing and delivered personally, by facsimile, electronic mail, or sent by a nationally recognized overnight courier service, addressed to the Company, at the address of its principal office or such other address as the Company may specify for such purposes by notice to the Holders delivered in accordance with this Section. Any and all notices or other communications or deliveries to be provided by the Company hereunder shall be in writing and delivered personally, by facsimile, electronic mail, or sent by a nationally recognized overnight courier service addressed to each Holder at the address of such Holder appearing on the books of the Company, or if no such address appears on the books of the Company, at the principal place of business of such Holder. Any notice or other communication or deliveries hereunder shall be deemed given and effective on the earliest of the Business Day following the date of mailing, if sent by nationally recognized overnight courier service, or upon actual receipt by the party to whom such notice is required to be given.

(b) Book Entry Form; Series A Preferred Certificates; Lost or Mutilated Series A Preferred Certificate. The Series A Preferred shall be issued in book entry form and, at the request of the Holder, in certificated form. If a Holder’s Series A Preferred certificate, if any, becomes mutilated, lost, stolen or destroyed, the Company shall execute and deliver, in exchange and substitution for and upon cancellation of a mutilated certificate, or in lieu of or in substitution for a lost, stolen or destroyed certificate, a new certificate for the shares of Series A Preferred so mutilated, lost, stolen or destroyed, but only upon receipt of evidence of such loss, theft or destruction of such certificate, and of the ownership thereof reasonably satisfactory to the Company and any of additional documentation the transfer agent of the Company may require.

(c) Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Certificate of Designation will be governed by and construed and enforced in accordance with the internal laws of the State of Nevada, without regard to the principles of conflict of laws thereof. The Company and, by accepting Series A Preferred, each Holder agree that all legal proceedings concerning the interpretation, enforcement and defense of the transactions contemplated by this Certificate of Designation (whether brought against the Company or a Holder or their respective affiliates, directors, officers, shareholders, employees or agents) may be commenced only in the state and federal courts sitting in the State of Nevada. The Company and, by accepting Series A Preferred, each Holder hereby irrevocably submit to the exclusive jurisdiction of such courts for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waive, and agree not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such courts, or such courts are improper or inconvenient venue for such proceeding. The Company and, by accepting Series A Preferred, each Holder hereby irrevocably waive personal service of process and consent to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Certificate of Designation and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by applicable law. The Company and, by accepting Series A Preferred, each Holder hereby irrevocably waive, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Certificate of Designation or the transactions contemplated hereby. If the Company or any Holder shall commence an action or proceeding to enforce any provisions of this Certificate of Designation, then the prevailing party in such action or proceeding shall be reimbursed by the other party for its attorneys’ fees and other costs and expenses incurred in the investigation, preparation and prosecution of such action or proceeding.

| 4 |

(d) Waiver. Any waiver by the Company or a Holder of a breach of any provision of this Certificate of Designation shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Certificate of Designation or a waiver by any other Holders. The failure of the Company or a Holder to insist upon strict adherence to any term of this Certificate of Designation on one or more occasions shall not be considered a waiver or deprive that party (or any other Holder) of the right thereafter to insist upon strict adherence to that term or any other term of this Certificate of Designation. Any waiver by the Company or a Holder must be in writing.

(e) Severability. If any provision of this Certificate of Designation is invalid, illegal or unenforceable, the balance of this Certificate of Designation shall remain in effect, and if any provision is inapplicable to any Person or circumstance, it shall nevertheless remain applicable to all other Persons and circumstances.

(f) Status of Converted Series A Preferred. If any shares of Series A Preferred shall be converted or reacquired by the Company, such shares shall resume the status of authorized but unissued preferred stock of the Company.

(g) Non-circumvention. The Company hereby covenants and agrees that the Company will not, by amendment of its Articles of Incorporation, bylaws or through any reorganization, transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Certificate of Designation, and will at all times in good faith carry out all the provisions of this Certificate of Designation and take all action as may be required to protect the rights of the Holders.

(h) Amendment. The terms of this Certificate of Designation shall not be amended except with the consent of the Holders of a majority of the outstanding Series A Preferred voting as one class.

[Signature on next page.]

| 5 |

IN WITNESS WHEREOF, this Certificate of Designation has been executed by a duly authorized officer of the Company as of this 14th day of August, 2020.

| ONDAS HOLDINGS INC. | ||

| By: | /s/ Eric Brock | |

| Name: Eric Brock | ||

| Title: Chief Executive Officer | ||

6