Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - UNIT CORP | d69025dex991.htm |

| 8-K - 8-K - UNIT CORP | d69025d8k.htm |

Exhibit 2.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

| In re:

UNIT CORPORATION, et al.,

Debtors.1 |

§ § § § § § |

Case No. 20-32740 (DRJ)

(Chapter 11)

(Jointly Administered) |

DEBTORS’ AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION

| Harry A. Perrin (TX 15796800) Paul E. Heath (TX 09355050) Matthew J. Pyeatt (TX 24086609) 1001 Fannin Street, Suite 2500 Houston, TX 77002-6760 |

David S. Meyer (admitted pro hac vice) Lauren R. Kanzer (admitted pro hac vice) 1114 Avenue of the Americas, 32nd Floor New York, NY 10036 | |

| VINSON & ELKINS LLP COUNSEL FOR THE DEBTORS AND DEBTORS IN POSSESSION

Dated: August 3, 2020 |

| 1 | The Debtors in these chapter 11 cases and the last four digits of their respective federal tax identification numbers are: 8200 Unit Drive, L.L.C. (1376); Unit Corporation (3193); Unit Drilling Colombia, L.L.C. (1087); Unit Drilling Company (5145); Unit Drilling USA Colombia, L.L.C. (0882); and Unit Petroleum Company (5963). The location of the Debtors’ U.S. corporate headquarters and the Debtors’ service address is: 8200 South Unit Drive, Tulsa, Oklahoma 74132. |

TABLE OF CONTENTS

| ARTICLE I. | ||||||

| DEFINED TERMS, RULES OF INTERPRETATION, | ||||||

| COMPUTATION OF TIME, AND GOVERNING LAW | ||||||

| A. |

Defined Terms | 1 | ||||

| B. |

Rules of Interpretation | 25 | ||||

| C. |

Computation of Time | 26 | ||||

| D. |

Governing Law | 26 | ||||

| E. |

Reference to Monetary Figures | 26 | ||||

| F. |

Reference to the Debtors or the Reorganized Debtors | 26 | ||||

| G. |

Controlling Document | 27 | ||||

| H. |

Consent Rights of Consenting RBL Lenders and Consenting Noteholders | 27 | ||||

| ARTICLE II. | ||||||

| ADMINISTRATIVE EXPENSE CLAIMS, PROFESSIONAL | ||||||

| FEE CLAIMS, AND PRIORITY CLAIMS | ||||||

| A. |

Administrative Expense Claims | 27 | ||||

| B. |

Professional Compensation | 28 | ||||

| C. |

DIP Facility Claims | 29 | ||||

| D. |

RBL Lender Adequate Protection Claims | 30 | ||||

| E. |

Priority Tax Claims | 30 | ||||

| F. |

Statutory Fees | 30 | ||||

| ARTICLE III. | ||||||

| CLASSIFICATION AND TREATMENT OF CLAIMS AND INTERESTS | ||||||

| A. |

Summary of Classification | 30 | ||||

| B. |

Treatment of Claims and Interests | 32 | ||||

| C. |

Special Provision Governing Unimpaired or Reinstated Claims | 46 | ||||

| D. |

Confirmation Pursuant to Section 1129(b) of the Bankruptcy Code | 46 | ||||

| E. |

Elimination of Vacant Classes | 46 | ||||

| F. |

Voting Classes; Presumed Acceptance by Non-Voting Classes | 46 | ||||

| G. |

Subordinated Claims | 46 | ||||

| ARTICLE IV. | ||||||

| MEANS FOR IMPLEMENTATION OF THE PLAN | ||||||

| A. |

Restructuring | 47 | ||||

| B. |

Sources of Consideration for Plan Distributions | 47 | ||||

| C. |

Distributions to Holders of Allowed UDC GUC Claims and Allowed Other GUC Claims | 49 | ||||

| D. |

Corporate Existence | 49 | ||||

| E. |

Vesting of Assets in the Reorganized Debtors | 49 | ||||

| F. |

Cancellation of Existing Securities and Agreements | 50 | ||||

| G. |

Corporate Action | 51 | ||||

| H. |

New Organizational Documents | 52 | ||||

| I. |

Shareholders Agreement | 52 | ||||

i

| J. |

Directors and Officers of the Reorganized Debtors | 52 | ||||

| K. |

Effectuating Documents; Further Transactions | 53 | ||||

| L. |

Exemption from Certain Taxes and Fees | 53 | ||||

| M. |

Exemption from Registration Requirements | 54 | ||||

| N. |

Preservation of Causes of Action | 54 | ||||

| O. |

Director and Officer Liability Insurance | 55 | ||||

| P. |

Payment of the Restructuring Expenses | 55 | ||||

| Q. |

Payment of Subordinated Notes Indenture Trustee Expenses | 55 | ||||

| R. |

Preservation of Debtor Royalty and Working Interests | 56 | ||||

| ARTICLE V. | ||||||

| COMPENSATION, SEVERANCE AND BENEFITS PROGRAMS | ||||||

| A. |

Management Incentive Plan | 56 | ||||

| B. |

Employment Agreements | 56 | ||||

| C. |

Deferred Compensation Plan | 57 | ||||

| D. |

Employee and Retiree Benefits | 57 | ||||

| E. |

Reorganized Unit Corp. Separation Benefit Plan | 57 | ||||

| F. |

Amended Separation Benefit Plan | 57 | ||||

| G. |

Separation Settlement | 57 | ||||

| ARTICLE VI. | ||||||

| TREATMENT OF EXECUTORY CONTRACTS AND UNEXPIRED LEASES | ||||||

| A. |

Assumption and Rejection of Executory Contracts and Unexpired Leases | 59 | ||||

| B. |

Pass-Through | 60 | ||||

| C. |

Claims Based on Rejection of Executory Contracts or Unexpired Leases | 60 | ||||

| D. |

Cure of Defaults for Assumed Executory Contracts and Unexpired Leases | 61 | ||||

| E. |

Oil and Gas Leases | 62 | ||||

| F. |

Indemnification Obligations | 63 | ||||

| G. |

Insurance Policies | 63 | ||||

| H. |

Modifications, Amendments, Supplements, Restatements, or Other Agreements | 63 | ||||

| I. |

Reservation of Rights | 63 | ||||

| J. |

Nonoccurrence of Effective Date | 64 | ||||

| K. |

Contracts and Leases Entered into After the Petition Date | 64 | ||||

| ARTICLE VII. | ||||||

| PROVISIONS GOVERNING DISTRIBUTIONS | ||||||

| A. |

Timing and Calculation of Amounts to Be Distributed | 64 | ||||

| B. |

Delivery of Distributions and Undeliverable or Unclaimed Property | 64 | ||||

| C. |

Registration or Private Placement Exemption | 67 | ||||

| D. |

Registration Rights Agreement | 68 | ||||

| E. |

Compliance with Tax Requirements | 68 | ||||

| F. |

Surrender of Cancelled Instruments or Securities | 69 | ||||

| G. |

Allocations | 69 | ||||

| H. |

No Postpetition Interest on Claims | 69 | ||||

| I. |

Setoffs and Recoupment | 69 | ||||

| J. |

Claims Paid or Payable by Third Parties | 70 | ||||

ii

| ARTICLE VIII. | ||||||

| PROCEDURES FOR RESOLVING CONTINGENT, | ||||||

| UNLIQUIDATED, AND DISPUTED CLAIMS | ||||||

| A. |

Allowance of Claims | 71 | ||||

| B. |

Claims and Interests Administration Responsibilities | 71 | ||||

| C. |

Estimation of Claims | 71 | ||||

| D. |

Adjustment to Claims or Interests Without Objection | 72 | ||||

| E. |

Disputed Claims Reserves | 72 | ||||

| F. |

Time to File Objections to Claims | 75 | ||||

| G. |

Disallowance of Claims | 75 | ||||

| H. |

Amendments to Claims | 75 | ||||

| I. |

No Distributions Pending Allowance | 76 | ||||

| J. |

Single Satisfaction of Claims | 76 | ||||

| ARTICLE IX. | ||||||

| SETTLEMENT, RELEASE, INJUNCTION, AND RELATED PROVISIONS | ||||||

| A. |

Compromise and Settlement of Claims, Interests, and Controversies | 76 | ||||

| B. |

Discharge of Claims and Termination of Interests | 76 | ||||

| C. |

Term of Injunctions or Stays | 77 | ||||

| D. |

Release of Liens | 77 | ||||

| E. |

Releases by the Debtors | 77 | ||||

| F. |

Releases by Holders of Claims and Interests | 79 | ||||

| G. |

Exculpation | 80 | ||||

| H. |

Injunction | 81 | ||||

| I. |

Protection Against Discriminatory Treatment | 81 | ||||

| J. |

Recoupment | 82 | ||||

| K. |

Subordination Rights | 82 | ||||

| L. |

Reimbursement or Contribution | 82 | ||||

| ARTICLE X. | ||||||

| CONDITIONS PRECEDENT TO CONFIRMATION | ||||||

| AND CONSUMMATION OF THE PLAN | ||||||

| A. |

Conditions Precedent to the Effective Date | 82 | ||||

| B. |

Waiver of Conditions | 83 | ||||

| C. |

Substantial Consummation | 84 | ||||

| D. |

Effect of Non-Occurrence of Conditions to the Confirmation Date or the Effective Date | 84 | ||||

| ARTICLE XI. | ||||||

| MODIFICATION, REVOCATION, OR WITHDRAWAL OF THE PLAN | ||||||

| A. |

Modification and Amendments | 84 | ||||

| B. |

Effect of Confirmation on Modifications | 84 | ||||

| C. |

Revocation or Withdrawal of the Plan | 84 | ||||

iii

| ARTICLE XII. | ||||||

| RETENTION OF JURISDICTION | ||||||

| ARTICLE XIII. | ||||||

| MISCELLANEOUS PROVISIONS | ||||||

| A. |

Immediate Binding Effect | 87 | ||||

| B. |

Additional Documents | 87 | ||||

| C. |

Reservation of Rights | 88 | ||||

| D. |

Successors and Assigns | 88 | ||||

| E. |

Service of Documents | 88 | ||||

| F. |

Term of Injunctions or Stays | 89 | ||||

| G. |

Entire Agreement | 89 | ||||

| H. |

Exhibits | 89 | ||||

| I. |

Nonseverability of Plan Provisions | 90 | ||||

| J. |

Votes Solicited in Good Faith | 90 | ||||

| K. |

Request for Expedited Determination of Taxes | 90 | ||||

| L. |

Closing of Chapter 11 Cases | 90 | ||||

| M. |

No Stay of Confirmation Order | 90 | ||||

| N. |

Waiver or Estoppel | 91 | ||||

iv

INTRODUCTION

Unit Corp. and its affiliated debtors, as Debtors and debtors in possession in the above-captioned chapter 11 cases, jointly propose this chapter 11 plan of reorganization for the resolution of outstanding Claims against, and Interests in, the Debtors. Although proposed jointly for administrative purposes, the Plan constitutes a separate Plan for each Debtor for the resolution of outstanding Claims against, and Interests in, such Debtor. Capitalized terms used but not otherwise defined herein shall have the meanings ascribed to such terms in Article I.A hereof or the Bankruptcy Code or Bankruptcy Rules. Holders of Claims and Interests should refer to the Disclosure Statement for a discussion of the Debtors’ history, businesses, assets, results of operations, historical financial information, and projections of future operations, as well as a summary and description of the Plan. The Debtors are the proponents of the Plan within the meaning of section 1129 of the Bankruptcy Code.

ALL HOLDERS OF CLAIMS WHO ARE ELIGIBLE TO VOTE ARE ENCOURAGED TO READ THE PLAN AND THE DISCLOSURE STATEMENT IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

ARTICLE I.

DEFINED TERMS, RULES OF INTERPRETATION,

COMPUTATION OF TIME, AND GOVERNING LAW

| A. | Defined Terms |

As used in the Plan, capitalized terms have the meanings set forth below.

1. “8200 Unit” means 8200 Unit Drive, L.L.C., an Oklahoma limited liability company.

2. “Ad Hoc Group” means the ad hoc group of Holders of Subordinated Notes represented by the Consenting Noteholder Advisors.

3. “Administrative Expense Claim” means a Claim (other than any adequate protection claims (including, for the avoidance of doubt, RBL Lender Adequate Protection Claims) and DIP Claims) for costs and expenses of administration of the Debtors’ Estates pursuant to sections 503(b), 507(a)(2), 507(b), or 1114(e)(2) of the Bankruptcy Code, including: (a) the actual and necessary costs and expenses incurred after the Petition Date and through the Effective Date of preserving the Estates and operating the Debtors’ businesses; (b) Allowed Professional Fee Claims; (c) all Allowed requests for compensation or expense reimbursement for making a substantial contribution in the Chapter 11 Cases pursuant to sections 503(b)(3), (4), and (5) of the Bankruptcy Code; and (d) Restructuring Expenses.

4. “Administrative Expense Claims Bar Date” means the deadline for Filing requests for payment of Administrative Expense Claims, which: (a) with respect to Administrative Expense Claims other than Professional Fee Claims, shall be 30 days after the Effective Date; and (b) with respect to Professional Fee Claims, shall be 60 days after the Effective Date.

1

5. “Affiliate” shall have the meaning set forth in section 101(2) of the Bankruptcy Code.

6. “Allowed” means (i) with respect to any Claim, (a) a Claim that is evidenced by a Proof of Claim or request for payment of an Administrative Expense Claim Filed by the Claims Bar Date, the Administrative Expense Claims Bar Date, the Governmental Bar Date, or the deadline for filing Proofs of Claim based on the Debtors’ rejection of the Executory Contracts or Unexpired Leases, as applicable (or for which Claim under the Plan, the Bankruptcy Code, or pursuant to a Final Order a Proof of Claim is not or shall not be required to be Filed); (b) a Claim that is listed in the Schedules as not contingent, not unliquidated, and not disputed, and for which no Proof of Claim, as applicable, has been timely Filed; or (c) a Claim Allowed pursuant to the Plan or a Final Order of the Court; provided that with respect to a Claim described in clauses (a) and (b) above, such Claim shall be considered Allowed only if and to the extent that (1) such Claim is not otherwise a Disputed Claim and (2) with respect to such Claim no objection to the allowance thereof has been interposed and the applicable period of time fixed by the Plan to file an objection has passed, or such an objection is so interposed and the Claim, as applicable, shall have been Allowed by a Final Order; and (ii) with respect to any Interest, any Intercompany Interest that is Reinstated pursuant to the terms hereof. Except as otherwise provided in the Plan or an order of the Court or with respect to Priority Tax Claims, the amount of an Allowed Claim shall not include interest on such Claim from and after the Petition Date. Any Claim that has been or is hereafter listed in the Schedules as contingent, unliquidated, or disputed, and for which no Proof of Claim is or has been timely Filed, is considered Disallowed and shall be expunged without further action by the Debtors or the Reorganized Debtors, as applicable, and without further notice to any party or action, approval, or order of the Court. Notwithstanding anything to the contrary herein, no Claim of any Entity subject to section 502(d) of the Bankruptcy Code shall be deemed Allowed unless and until such Entity pays in full the amount that it owes such Debtor or Reorganized Debtor, as applicable. For the avoidance of doubt, a Proof of Claim or request for allowance and payment of an Administrative Expense Claim Filed after the Claims Bar Date, Administrative Expense Claims Bar Date, Governmental Bar Date, or the deadline for filing Proofs of Claim based on the Debtors’ rejection of the Executory Contracts or Unexpired Leases, as applicable, shall not be Allowed for any purposes whatsoever absent entry of a Final Order allowing such late-filed Claim. “Allow” and “Allowing” shall have correlative meanings.

7. “Allowed Subordinated Notes Claims” means the Allowed amount of the Subordinated Notes Claims, equal to $650,000,000 in principal amount, plus unpaid interest, fees, and other expenses arising and payable pursuant to the Subordinated Notes Indenture.

8. “Amended Separation Benefit Plan” means the Separation Benefit Plan as amended by the Debtors to provide Holders of Separation Claims who opt in to the Separation Settlement the Separation Settlement Treatment pursuant to Article V.A of this Plan. The Amended Separation Benefit Plan will be in form and substance acceptable to the Debtors and the Majority Consenting Noteholders, included in the Plan Supplement, and adopted by the Reorganized Debtors on the Effective Date. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Amended Separation Benefit Plan before it is filed with the Plan Supplement.

2

9. “Avoidance Actions” means any and all actual or potential Claims and Causes of Action to avoid a transfer of property or an obligation incurred by the Debtors arising under chapter 5 of the Bankruptcy Code, including sections 544, 545, 547 through 553, and 724(a) of the Bankruptcy Code or under similar or related state or federal statutes and common law, including fraudulent transfer and preference laws.

10. “Ballots” means the ballots distributed to certain Holders of Impaired Claims entitled to vote on the Plan upon which such Holders shall, among other things, indicate their acceptance or rejection of the Plan in accordance with the Plan and the procedures governing the solicitation process.

11. “Bankruptcy Code” means title 11 of the United States Code, as amended and in effect during the pendency of the Chapter 11 Cases.

12. “Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure, as applicable to the Chapter 11 Cases, promulgated under section 2075 of the Judicial Code and the general, local, and chambers rules of the Court other than the Local Rules.

13. “Bar Date Order” means the order entered by the Court setting the Claims Bar Date and the Governmental Bar Date [Docket No. 170].

14. “Borrowers” means Unit Corp., UDC, and UPC, collectively in their capacity as borrowers under the RBL Credit Agreement.

15. “Business Day” means any day other than a Saturday, Sunday, or “legal holiday” (as defined in Bankruptcy Rule 9006(a)).

16. “Cash” means the legal tender of the United States of America or the equivalent thereof.

17. “Cause of Action” means any action, claim, cause of action, controversy, third-party claim, dispute, demand, right, action, Lien, indemnity, contribution, guaranty, suit, obligation, liability, loss, debt, fee or expense, damage, interest, judgment, account, defense, remedy, power, privilege, license, and franchise of any kind or character whatsoever, whether known, unknown, foreseen or unforeseen, existing or hereafter arising, contingent or non-contingent, matured or unmatured, suspected or unsuspected, liquidated or unliquidated, Disputed or undisputed, Secured or Unsecured, assertable directly or derivatively, whether arising before, on, or after the Petition Date, in contract, in tort, in law, or in equity or pursuant to any other theory of law. For the avoidance of doubt, a “Cause of Action” includes: (a) any right of setoff, counterclaim, or recoupment and any claim for breach of contract or for breach of duties imposed by law or in equity; (b) the right to object to Claims or Interests; (c) any Claim pursuant to section 362 or chapter 5 of the Bankruptcy Code (including Avoidance Actions); (d) any claim or defense including fraud, mistake, duress, and usury; and any other defenses set forth in section 558 of the Bankruptcy Code; and (e) any state or foreign law fraudulent transfer or similar claim.

18. “Chapter 11 Cases” means (a) when used with reference to a particular Debtor, the case pending for that Debtor under chapter 11 of the Bankruptcy Code in the Court and (b) when used with reference to all of the Debtors, the jointly administered chapter 11 cases pending for the Debtors in the Court.

3

19. “Claim” shall have the meaning set forth in section 101(5) of the Bankruptcy Code, against any Debtor.

20. “Claims Bar Date” means July 17, 2020 at 5:00 p.m. (prevailing Central Time), the date established pursuant to the Bar Date Order by which Proofs of Claim (other than for Administrative Expense Claims and Claims held by Governmental Units), must be Filed.

21. “Claims Objection Deadline” means the deadline for objecting to a Claim against a Debtor, which shall be on the date that is the later of (a) 180 days after the Effective Date and (b) such other period of limitation as may be fixed by the Debtors or the Reorganized Debtors, as applicable, or by an order of the Court for objecting to such Claims.

22. “Claims Register” means the official register of Claims against and Interests in the Debtors maintained by the Noticing and Claims Agent.

23. “Class” means a category of Claims against or Interests in the Debtors as set forth in Article III hereof pursuant to section 1122(a) of the Bankruptcy Code.

24. “Confirmation” means the entry of the Confirmation Order on the docket of the Chapter 11 Cases.

25. “Confirmation Date” means the date upon which the Court enters the Confirmation Order on the docket of the Chapter 11 Cases, within the meaning of Bankruptcy Rules 5003 and 9021.

26. “Confirmation Hearing” means the hearing held by the Court to consider Confirmation of the Plan pursuant to section 1128(a) of the Bankruptcy Code, as such hearing may be adjourned or continued from time to time.

27. “Confirmation Order” means the Order of the Court confirming the Plan pursuant to section 1129 of the Bankruptcy Code.

28. “Consenting Noteholders” is used as defined in the Restructuring Support Agreement.

29. “Consenting Noteholder Advisors” means, collectively, the Consenting Noteholder Counsel and Greenhill & Co., LLC, as financial advisor to the Ad Hoc Group.

30. “Consenting Noteholder Counsel” means Weil, Gotshal & Manges LLP, as counsel to the Ad Hoc Group.

31. “Consenting RBL Lenders” is used as defined in the Restructuring Support Agreement.

32. “Consummation” means the occurrence of the Effective Date.

4

33. “Court” means the United States Bankruptcy Court for the Southern District of Texas, Houston Division, having jurisdiction over the Chapter 11 Cases, and, to the extent of the withdrawal of any reference under 28 U.S.C. § 157 and/or the General Order of the District Court pursuant to section 151 of title 28 of the United States Code, the United States District Court for the Southern District of Texas.

34. “Cure Claim” means a monetary Claim based upon a Debtor’s defaults under an Executory Contract or Unexpired Lease at the time such contract or lease is assumed by such Debtor pursuant to section 365 of the Bankruptcy Code.

35. “D&O Liability Insurance Policies” means all unexpired directors’, managers’, and officers’ liability insurance policies (including any “tail policy”) maintained by any of the Debtors with respect to directors, managers, officers, and employees of the Debtors.

36. “Debtors” means, collectively, the following: Unit Corp., UDC, Unit Colombia, Unit USA Colombia, UPC, and 8200 Unit. Except as otherwise specifically provided in the Plan to the contrary, references in the Plan to the Debtors shall mean the Reorganized Debtors to the extent context requires.

37. “Debtor Royalty and Working Interest” means any Royalty and Working Interest of a Debtor.

38. “Definitive Documentation” is used as defined in the Restructuring Support Agreement.

39. “DIP Agent” means BOKF NA dba Bank of Oklahoma, as administrative agent under the DIP Credit Agreement, and any successors in such capacity.

40. “DIP Credit Agreement” means that certain Superpriority Senior Secured Debtor-in-Possession Credit Agreement (as amended, supplemented, or otherwise modified from time to time in accordance with the terms thereof) dated as of May 27, 2020 between Unit Corp., UDC, and UPC, as borrowers, the Other Debtors, as guarantors, the DIP Agent, the DIP Lenders, and the other secured parties thereunder.

41. “DIP Facility” means the debtor-in-possession financing facility provided by the DIP Lenders on the terms and conditions set forth in the DIP Credit Agreement and the DIP Orders.

42. “DIP Facility Claim” means any Claim held by a DIP Lender arising on account of any loans provided to the Debtors pursuant to the DIP Facility Documents.

43. “DIP Facility Documents” means the DIP Credit Agreement and all other agreements, documents, instruments, and amendments related thereto, including the DIP Orders, any Lender Swap Agreement (as defined in the DIP Credit Agreement) and any guaranty agreements, pledge and collateral agreements, UCC financing statements, or other perfection documents, subordination agreements, fee letters, and any other security agreements.

5

44. “DIP Lender” means each lender party to the DIP Credit Agreement in its capacity as such.

45. “DIP Orders” means, collectively, the Interim DIP Order and the Final DIP Order.

46. “Disallowed” means, with respect to any Claim, or any portion thereof, that such Claim, or such portion thereof, is not Allowed; provided, however, that a Disputed Claim shall not be considered Disallowed until so determined by entry of a Final Order.

47. “Disbursing Agent” means, on the Effective Date, the Debtors or the Reorganized Debtors, as applicable, their respective agent(s), or any Entity or Entities designated by the Debtors or the Reorganized Debtors, as applicable, to make or facilitate distributions that are to be made on or after the Initial Distribution Date pursuant to the Plan.

48. “Disclosure Statement” means the Disclosure Statement for the Debtors’ Joint Chapter 11 Plan of Reorganization, dated as of June 19, 2020, as may be amended, supplemented, or modified from time to time, including all exhibits and schedules thereto and references therein that relate to the Plan, that is prepared and distributed in accordance with the Bankruptcy Code, the Bankruptcy Rules, and any other applicable law.

49. “Disclosure Statement and Solicitation Motion” is used as defined in the Restructuring Support Agreement.

50. “Disputed” means, with respect to any Claim or Interest, that such Claim or Interest (a) is not yet Allowed, (b) is not Disallowed by the Plan, the Bankruptcy Code, or a Final Order, as applicable, (c) as to which a dispute is being adjudicated by a court of competent jurisdiction in accordance with non-bankruptcy law, or (d) is or is hereafter listed in the Schedules as contingent, unliquidated, or disputed and for which a Proof of Claim is or has been timely Filed in accordance with the Bar Date Order.

51. “Disputed Claims Reserve” means, collectively, the Unit Corp. Disputed Claims Reserve and the UPC Disputed Claims Reserve.

52. “Distribution Record Date” means the record date for purposes of making distributions under the Plan on account of Allowed Claims, other than with respect to publicly held securities, which date shall be the Confirmation Date or such other date as designated in an order of the Court.

53. “DTC” means The Depository Trust Company, a limited-purpose trust company and securities depository organized under the laws of the State of New York.

54. “Effective Date” means the date selected by the Debtors on which: (a) no stay of the Confirmation Order is in effect; (b) all conditions precedent specified in Article X.A have been satisfied or waived (in accordance with Article X.B); and (c) the Plan becomes effective; provided, however, that if such date does not occur on a Business Day, the Effective Date shall be deemed to occur on the first Business Day after such date.

6

55. “Employment Agreements” means, collectively, (a) that certain new employment agreement to be entered into between Reorganized Unit Corp. and David T. Merrill as President and Chief Executive Officer of Reorganized Unit Corp. on the Effective Date, and (b) that certain new employment agreement to be entered into between Reorganized Unit Corp. and Mark E. Schell as Senior Vice President, Corporate Secretary, and General Counsel to Reorganized Unit Corp., each of which will include provisions governing severance, subject to the consent of the Majority Consenting Noteholders, and in each case consistent with and subject to the terms and conditions of the respective employment agreement term sheets attached as Exhibit 3 and Exhibit 4, respectively, to the Restructuring Term Sheet. The Employment Agreements will be in form and substance acceptable to the Debtors and the Majority Consenting Noteholders, included in the Plan Supplement, and entered into by Reorganized Unit Corp. and the respective executive on the Effective Date. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Employment Agreements before such documents are filed with the Plan Supplement.

56. “Entity” shall have the meaning set forth in section 101(15) of the Bankruptcy Code.

57. “Equity Exit Fee” means an amount of Reorganized Unit Corp. Interests equal to 5% of the total Reorganized Unit Corp. Interests, subject to dilution solely by the MIP Equity and the Warrant Package.

58. “Estate” means, as to each Debtor, the estate created for the Debtor in its Chapter 11 Case pursuant to section 541 of the Bankruptcy Code.

59. “Exchange Act” means the Securities Exchange Act of 1934, 15 U.S.C. §§ 78(a) – 78(pp).

60. “Exculpated Party” means each of the following solely in its capacity as such: (a) the Debtors; (b) the Reorganized Debtors; (c) the Debtors’ Professionals; (d) the Released Parties; and (e) with respect to each of the foregoing Entities in clauses (a) through (d), such Entity’s current and former Affiliates, and such Entity’s and its current and former Affiliates’ current and former directors, managers, officers, managed accounts and funds, predecessors, successors, and assigns, subsidiaries, and each of their respective current and former officers, directors, managers, principals, members, employees, subcontractors, agents, advisory board members, financial advisors, partners, attorneys, accountants, investment bankers, consultants, representatives, management companies, fund advisors, and other professionals, each solely in their capacity as such.

61. “Executory Contract” means a contract to which one or more of the Debtors is a party that is subject to assumption or rejection under sections 365 or 1123 of the Bankruptcy Code.

62. “Exit Facility” means a new credit facility to be provided by the Exit Facility Lenders on the Effective Date pursuant to the Exit Facility Documents consisting of (a) a senior secured revolving credit facility in an amount equal to $140 million and (b) a senior secured term loan facility in an amount equal to $40 million, as set forth in and consistent with and subject to the terms and conditions of the Exit Facility Term Sheet.

7

63. “Exit Facility Agent” means BOKF, NA dba Bank of Oklahoma, the administrative agent and collateral agent under the Exit Facility, or any successor thereto, solely in its capacity as such.

64. “Exit Facility Credit Agreement” means the credit agreement in respect of the Exit Facility to be entered into by Reorganized Unit Corp., Reorganized UDC, and Reorganized UPC, as borrowers, the Exit Facility Agent, the Exit Facility Lenders, and the other secured parties thereunder on the Effective Date. A substantially final form of the Exit Facility Credit Agreement, in form and substance reasonably acceptable to the Debtors, the Majority Consenting Noteholders, and the Majority Consenting RBL Lenders, will be included in the Plan Supplement.

65. “Exit Facility Documents” means the Exit Facility Credit Agreement and all other agreements, documents, instruments, and amendments related thereto, including any guaranty agreements, pledge and collateral agreements, UCC financing statements, or other perfection documents, subordination agreements, fee letters, and any other security agreements. The Exit Facility Documents shall be in form and substance reasonably acceptable to the Debtors, the Majority Consenting Noteholders, and the Majority Consenting RBL Lenders.

66. “Exit Facility Lender” means each lender party to the Exit Facility Credit Agreement.

67. “Exit Facility Term Sheet” means that certain term sheet attached as Exhibit 2 to the Restructuring Term Sheet and incorporated herein by reference.

68. “Face Amount” means, with respect to a Disputed Claim: (a) the full stated amount claimed by the Holder of such Claim in a Proof of Claim Filed by the Claims Bar Date (if the Proof of Claim specifies a liquidated amount); (b) the full amount of such Claim listed on the Debtors’ Schedules if the applicable Proof of Claim does not specify a liquidated amount; or (c) the amount of such Claim estimated by the Court for purposes of allowance pursuant to section 502(c) of the Bankruptcy Code; provided that, with respect to such a Claim, the amount estimated by the Court for purposes of allowance pursuant to section 502(c) shall control notwithstanding that such Holder has Filed a Proof of Claim or the amount of such Claim is listed on the Debtors’ Schedules; provided further that, with respect to Disputed Claims for which the applicable Proofs of Claim do not specify a liquidated amount and such Claims are not listed on the Debtors’ Schedules, the “Face Amount” shall mean the aggregate amount established by the Court for such Claims in the Order Establishing Disputed Claims Reserve Amount.

69. “Federal Judgment Rate” means the federal judgment rate in effect as of the Petition Date, compounded annually.

70. “File,” “Filed,” or “Filing” means file, filed, or filing in the Chapter 11 Cases with the Court or, with respect to the filing of a Proof of Claim or proof of Interest, the Noticing and Claims Agent or the Court through the PACER or CM/ECF website.

8

71. “Final DIP Order” means the Final Order (I) Authorizing the Debtors to (A) Obtain Senior Secured Superpriority Postpetition Financing and (B) Utilize Cash Collateral of the RBL Secured Parties, (II) Granting Adequate Protection to the RBL Secured Parties, (III) Modifying the Automatic Stay, and (IV) Granting Related Relief [Docket No. 173], as amended from time to time.

72. “Final Order” means (a) an order or judgment of the Court, as entered on the docket in any Chapter 11 Case (or any related adversary proceeding or contested matter) or the docket of any other court of competent jurisdiction, or (b) an order or judgment of any other court having jurisdiction over any appeal from (or petition seeking certiorari or other review of) any order or judgment entered by the Court (or any other court of competent jurisdiction, including in an appeal taken) in the Chapter 11 Cases (or in any related adversary proceeding or contested matter), in each case that has not been reversed, stayed, modified, or amended, and as to which the time to appeal, or seek certiorari or move for a new trial, reargument, or rehearing has expired according to applicable law and no appeal or petition for certiorari or other proceedings for a new trial, reargument, or rehearing has been timely taken, or as to which any appeal that has been taken or any petition for certiorari that has been or may be timely Filed has been withdrawn or resolved by the highest court to which the order or judgment was appealed or from which certiorari was sought or the new trial, reargument, or rehearing shall have been denied, resulted in no modification of such order, or has otherwise been dismissed with prejudice; provided, however, that the possibility a motion under Rule 60 of the Federal Rules of Civil Procedure, or any analogous rule under the Bankruptcy Rules or the Local Rules, may be filed relating to such order shall not prevent such order from being a Final Order.

73. “General Unsecured Claim” means any Unsecured Claim against any Debtor (including, for the avoidance of doubt, (a) a Separation Claim, and (b) any Claim arising from the rejection of an Executory Contract or Unexpired Lease) that is not otherwise paid in full or otherwise satisfied during the Chapter 11 Cases pursuant to an order of the Court, other than an Administrative Expense Claim, an Intercompany Claim, an Other Priority Claim, a Priority Tax Claim, a Professional Fee Claim, a Section 510(b) Claim, or a Subordinated Notes Claim.

74. “Governmental Bar Date” means November 18, 2020 at 5:00 p.m. (prevailing Central Time), the date established pursuant to the Bar Date Order by which Proofs of Claim of Governmental Units must be Filed.

75. “Governmental Unit” shall have the meaning set forth in section 101(27) of the Bankruptcy Code.

76. “Holder” means a Person or Entity holding a Claim against or Interest in a Debtor, as applicable.

77. “Impaired” means, with respect to a Class of Claims or Interests, a Class of Claims or Interests that is not Unimpaired.

78. “Indemnification Obligations” means each of the Debtors’ indemnification obligations, whether in the bylaws, certificates of incorporation or formation, limited liability company agreements, other organizational or formation documents, board resolutions, management or indemnification agreements, or employment contracts, for the current and former directors and the officers of the Debtors.

9

79. “Initial Distribution Date” means the date on which the Disbursing Agent shall make initial distributions to Holders of Claims or Interests pursuant to the Plan, which shall be a date selected by the Reorganized Debtors consistent with the terms of this Plan and the Definitive Documentation.

80. “Insider” has the meaning set forth in section 101(31) of the Bankruptcy Code.

81. “Intercompany Claim” means any Claim held by one Debtor against another Debtor.

82. “Intercompany Interest” means an Interest in one Debtor held by another Debtor.

83. “Interest” means any equity security (as defined in section 101(16) of the Bankruptcy Code) in a Person (including any Debtor or Reorganized Debtor), including any ordinary share, unit, common stock, preferred stock, membership interest, partnership interest, or other instrument, evidencing any fixed or contingent ownership interest, whether or not transferable, including any option, warrant, or other right, contractual or otherwise, to acquire any such interest that existed immediately before the Effective Date, including any Claim that is subject to subordination pursuant to section 510(b) of the Bankruptcy Code arising from or related to any of the foregoing.

84. “Interim Compensation Order” means the order entered by the Court establishing procedures for compensation of Professionals pursuant to the Debtors’ Motion for Entry of an Order Establishing Procedures for Interim Compensation and Reimbursement of Expenses of Professionals [Docket No. 148].

85. “Interim DIP Order” means the Interim Order Authorizing the Debtors to (A) Obtain Senior Superpriority Postpetition Financing and (B) Utilize Cash Collateral of the RBL Secured Parties, (II) Granting Adequate Protection to the RBL Secured Parties, (III) Modifying the Automatic Stay, (IV) Scheduling a Final Hearing, and (V) Granting Related Relief [Docket No. 62], as amended by the Amended Interim Order Authorizing the Debtors to (A) Obtain Senior Superpriority Postpetition Financing and (B) Utilize Cash Collateral of the RBL Secured Parties, (II) Granting Adequate Protection to the RBL Secured Parties, (III) Modifying the Automatic Stay, (IV) Scheduling a Final Hearing, and (V) Granting Related Relief [Docket No. 70], and as further amended from time to time.

86. “Internal Revenue Code” means the Internal Revenue Code of 1986, as amended.

87. “IRS” means the Internal Revenue Service.

88. “Judicial Code” means title 28 of the United States Code, 28 U.S.C. §§ 1–4001.

89. “Lender Professional Fees” is used as defined in the DIP Orders.

10

90. “Lien” shall have the meaning set forth in section 101(37) of the Bankruptcy Code.

91. “List of Retained Causes of Action” means the schedule of certain Causes of Action of the Debtors that are not released, waived, or transferred pursuant to the Plan, which shall be included in the Plan Supplement. For the avoidance of doubt, the List of Retained Causes of Action shall not include any Causes of Action against any Released Parties.

92. “Local Rules” means the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the Southern District of Texas.

93. “Majority Consenting Noteholders” is used as defined in the Restructuring Support Agreement.

94. “Majority Consenting RBL Lenders” is used as defined in the Restructuring Support Agreement.

95. “Majority Restructuring Support Parties” is used as defined in the Restructuring Support Agreement.

96. “Management Incentive Plan” means that certain post-Effective Date management incentive plan of the Reorganized Debtors to be adopted by the New Board and governed by the MIP Documents, pursuant to which the MIP Equity shall be reserved for grants made from time to time to directors, officers, or other management and employees of the Reorganized Debtors, in a form, amounts, and at times to be determined by the New Board. A substantially final form of the Management Incentive Plan, in form and substance acceptable to the Debtors and the Majority Consenting Noteholders, will be included in the Plan Supplement. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Management Incentive Plan before it is Filed with the Plan Supplement.

97. “MIP Documents” means the documents governing the Management Incentive Plan.

98. “MIP Equity” means equity-based awards (including stock options, restricted stock units, Reorganized Unit Corp. Interests, or other rights exercisable, exchangeable, or convertible into Reorganized Unit Corp. Interests) representing 7% of the Reorganized Unit Corp. Interests on a fully diluted basis to be reserved under the Management Incentive Plan for grants made from time to time to directors, officers, or other management and employees of the Reorganized Debtors, in a form, amounts, and times to be determined by the New Board.

99. “New Board” means, (a) with respect to Reorganized Unit Corp., the initial board of directors of Reorganized Unit Corp. and (b) with respect to each other Reorganized Debtor, the initial board of directors, board of managers, or other governing body of such Reorganized Debtor, in each case as determined pursuant to Article IV.J of this Plan and the Plan Supplement. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the composition of the New Board before such New Board is disclosed in the Plan Supplement.

11

100. “New Organizational Documents” means all applicable material governance documents of Reorganized Unit Corp. and the form of the certificates or articles of incorporation, charters, bylaws, or such other applicable formation documents of each of the Reorganized Debtors. Substantially final forms of the New Organizational Documents, in form and substance acceptable to the Debtors and the Majority Consenting Noteholders, will be included in the Plan Supplement. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the New Organizational Documents before they are Filed with the Plan Supplement.

101. “Non-Debtor Royalty and Working Interest” any Royalty and Working Interest of an Entity other than a Debtor.

102. “Non-Debtor Subsidiary” means SPC Midstream Operating, L.L.C., an Oklahoma limited liability company.

103. “Noticing and Claims Agent” means Prime Clerk LLC, the noticing, claims, and solicitation agent retained by the Debtors in the Chapter 11 Cases pursuant to the Order Authorizing the Employment and Retention of Prime Clerk LLC as Claims, Noticing, and Solicitation Agent entered by the Court on May 25, 2020 [Docket No. 34].

104. “Oil and Gas Leases” means any and all unexpired instruments in which any of the Debtors or Reorganized Debtors, as the case may be, were granted or hold an existing leasehold, working interest, or similar interest in oil and gas and/or other liquid or gaseous hydrocarbons, including methane, as of the Effective Date, including, without limitation, any leases set forth in the Plan Supplement. The term “Oil and Gas Leases” specifically includes oil and gas leases issued by any department, branch, bureau, or division of the United States government in which the Debtors or Reorganized Debtors, as the case may be, hold an existing leasehold, working interest, or similar interest as of the Effective Date.

105. “Order Establishing Disputed Claims Reserve Amount” means an order of the Court establishing the total Face Amount of all Disputed Unit Corp. GUC Claims and the total Face Amount of all Disputed UPC GUC Claims for purposes of calculating the Unit Corp. Disputed Claims Reserve Equity Pool and the UPC Disputed Claims Reserve Equity Pool, respectively.

106. “Ordinary Course Professionals” means the various Professionals the Debtors employ in the ordinary course of their business and retained by the Debtors pursuant to, and who are subject to, the Ordinary Course Professionals Order.

107. “Ordinary Course Professionals Order” means the order entered by the Court establishing the procedures for retaining and compensating the Ordinary Course Professionals [Docket No. 151].

108. “Other Debtors” means 8200 Unit, Unit USA Colombia, and Unit Colombia.

109. “Other GUC Claim” means a General Unsecured Claim against an Other Debtor.

110. “Other Interest” means an Interest in an Other Debtor.

12

111. “Other Priority Claim” means any Claim against a Debtor other than an Administrative Expense Claim or a Priority Tax Claim entitled to priority in right of payment under section 507(a) of the Bankruptcy Code, to the extent such Claim has not already been paid during the Chapter 11 Cases.

112. “Other Secured Claim” means any Secured Claim other than a DIP Claim, an RBL Secured Claim, or an RBL Lender Adequate Protection Claim.

113. “Other Subordinated Notes Claim” means a Subordinated Notes Claim against an Other Debtor.

114. “Person” shall have the meaning set forth in section 101(41) of the Bankruptcy Code.

115. “Petition Date” means May 22, 2020, the date on which each Debtor Filed its voluntary petition for relief commencing the Chapter 11 Cases.

116. “Plan” means this chapter 11 plan, as it may be altered, amended, modified, or supplemented from time to time in accordance with the Bankruptcy Code, the Bankruptcy Rules, Restructuring Support Agreement, and the terms hereof, including the Plan Supplement and all exhibits, supplements, appendices, and schedules to the Plan.

117. “Plan Supplement” means the compilation of documents and forms of documents, and all schedules, exhibits, attachments, agreements, and instruments referred to therein, ancillary or otherwise, including: the Management Incentive Plan, the Exit Facility, the New Organizational Documents, the Warrant Agreement, the Employment Agreements, the Registration Rights Agreement, the Schedule of Assumed Executory Contracts and Unexpired Leases, the Schedule of Rejected Executory Contracts and Unexpired Leases, the Reorganized Unit Corp. Separation Benefit Plan, and the Amended Separation Benefit Plan, all of which shall be incorporated by reference into, and are an integral part of, the Plan, as all of the same may be amended, modified, replaced and/or supplemented from time to time, which shall be filed with the Bankruptcy Court on or before seven (7) Business Days prior to the Voting Deadline.

118. “Priority Tax Claim” means any Claim entitled to priority, whether Secured or Unsecured, against a Debtor of a Governmental Unit of the kind specified in sections 502(i) and 507(a)(8) of the Bankruptcy Code.

119. “Pro Rata” means, unless indicated otherwise, the proportion that an Allowed Claim or an Allowed Interest bears to the aggregate amount of Allowed Claims, Allowed Interests, or other matter so referenced, as the context requires, provided that with respect to the fees (including the Equity Exit Fee), revolving loans, term loans, and letter of credit participations under the Exit Facility, “Pro Rata” shall mean the proportion that an Allowed DIP Facility Claim, Allowed Unit Corp. RBL Secured Claim, Allowed UDC RBL Secured Claim, or Allowed UPC RBL Secured Claim bears to the aggregate amount of all of such Allowed Claims.

120. “Professional” means an Entity employed pursuant to a Court order in accordance with sections 327 or 1103 of the Bankruptcy Code and to be compensated for services rendered before or on the Effective Date, pursuant to sections 327, 328, 329, 330, or 331 of the Bankruptcy Code.

13

121. “Professional Fee Claims” means all Administrative Expense Claims for the compensation of Professionals and the reimbursement of expenses incurred by such Professionals through and including the Effective Date to the extent such fees and expenses have not been paid pursuant to the Interim Compensation Order or any other order of the Court. To the extent the Court denies or reduces by a Final Order any amount of a Professional’s requested fees and expenses, then the amount by which such fees or expenses are reduced or denied shall reduce the applicable Allowed Professional Fee Claim.

122. “Professional Fee Escrow Account” means an interest-bearing account funded by the Debtors on the Effective Date in an amount equal to the Professional Fee Reserve Amount, pursuant to Article II.B.

123. “Professional Fee Reserve Amount” means the total amount of Professional Fee Claims estimated in accordance with Article II.B.3.

124. “Proof of Claim” means a proof of Claim Filed against any of the Debtors in the Chapter 11 Cases.

125. “Quarterly Distribution Date” means the twentieth day of the month following the end of each calendar quarter after the Effective Date (including, for the avoidance of doubt, the calendar quarter in which the Effective Date occurs), or as soon as reasonably practicable thereafter.

126. “RBL Agent” means BOKF, NA dba Bank of Oklahoma, as administrative agent under the RBL Credit Agreement in its capacity as such, and any successors in such capacity.

127. “RBL Agent Advisors” means, collectively, the RBL Agent Counsel and Huron Consulting Group Inc., as financial advisor to the RBL Agent.

128. “RBL Agent Counsel” means, collectively, Frederic Dorwart, Lawyers PLLC and Bracewell LLP, as counsel to the RBL Agent.

129. “RBL Credit Agreement” means that certain Senior Credit Agreement, dated as of September 13, 2011 (as amended, restated, modified, supplemented, or replaced from time to time prior to the Petition Date), between the Borrowers, the RBL Agent, the RBL Lenders from time to time party thereto, and the other secured parties thereunder.

130. “RBL Facility” means the reserve-based lending revolving credit facility pursuant to the RBL Credit Agreement.

131. “RBL Facility Documents” means the RBL Credit Agreement and all other agreements, documents, instruments, and amendments related thereto, including any guaranty agreements, pledge and collateral agreements, UCC financing statements, or other perfection documents, subordination agreements, fee letters, and any other security agreements.

14

132. “RBL Lender” means each lender party to the RBL Credit Agreement in its capacity as such.

133. “RBL Lender Adequate Protection Claim” means all adequate protection claims arising in favor of the RBL Lenders under applicable law or pursuant to the DIP Orders.

134. “RBL Secured Claims” means, collectively, Claims against the Debtors arising under or in connection with the RBL Facility, plus any liability with respect to any letters of credit issued under the RBL Credit Agreement which are drawn as of the Petition Date, plus accrued and unpaid interest, fees, costs, and expenses, including attorney’s fees, agent’s fees, other professional fees, and disbursements, in each case, in accordance with the terms of the RBL Credit Agreement, but only to the extent such Claims are not refinanced into the DIP Facility pursuant to a roll-up in accordance with the DIP Orders. For the avoidance of doubt, all letters of credit issued under the RBL Facility as of the Petition Date are deemed to be issued under the DIP Facility pursuant to the Final DIP Order.

135. “Registration Rights Agreement” means an agreement to be entered into by the Reorganized Debtors and the Registration Rights Beneficiaries on the Effective Date in accordance with Article VII.D of the Plan and in a customary form consistent with the Restructuring Term Sheet and in form and substance acceptable to the Debtors and the Majority Consenting Noteholders. A substantially final form of the Registration Rights Agreement will be included in the Plan Supplement. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Registration Rights Agreement before it is Filed with the Plan Supplement.

136. “Registration Rights Beneficiaries” means (a) each Consenting Noteholder and (b) any other Holder of 10% or more of the Reorganized Unit Corp. Interests.

137. “Reinstated” or “Reinstatement” means, with respect to Claims and Interests, the treatment provided for in section 1124 of the Bankruptcy Code.

138. “Release Opt-Out” means the election, to be made solely through a properly submitted Ballot or Release Opt-Out Form, to opt out of the release provisions set forth in Article IX.F.

139. “Release Opt-Out Form” means the form upon which certain Holders of Interests not entitled to vote on the Plan may indicate their election with respect to the Release Opt-Out, in each case in accordance with the Plan and the procedures governing the solicitation process.

140. “Released Party” means each of the following solely in its capacity as such: (a) the Debtors; (b) the Reorganized Debtors; (c) the DIP Agent; (d) the DIP Lenders; (e) the RBL Agent; (f) the RBL Lenders; (g) the Consenting Noteholders; (h) the Exit Facility Agent; (i) the Exit Facility Lenders; (j) Subordinated Notes Indenture Trustee, and (k) with respect to each of the foregoing parties under (a) through (j) such Entity and its current and former Affiliates, and such Entity’s and its current and former Affiliates’ current and former directors, managers, officers, managed accounts and funds, predecessors, successors, and assigns, subsidiaries, and each of their respective current and former equity holders, officers, directors, managers, principals, members, employees, subcontractors, agents, advisory board members,

15

financial advisors, partners, attorneys, accountants, investment bankers, consultants, representatives, management companies, fund advisors, and other professionals, each solely in their capacity as such. Notwithstanding the foregoing, any Person or Entity that opts out of the releases set forth in Article IX.F of the Plan shall not be a Released Party.

141. “Releasing Party” means each of the following solely in its capacity as such: (a) all Released Parties; (b) all Holders of Claims and Interests that are deemed to accept the Plan; (c) all Holders of Claims and Interests who vote to accept the Plan; (d) each Holder of a Claim or Interest whose vote to accept or reject the Plan is solicited but who does not vote either to accept or reject the Plan; (e) each Holder of a Claim or Interest who votes, or is deemed, to reject the Plan and who does not elect the Release Opt-Out on its Ballot or Release Opt-Out Form, as applicable; and (f) the Holders of all Claims and Interests that were given notice of the opportunity to opt out of granting the releases set forth herein but did not opt out.

142. “Reorganized” means, in relation to a Debtor, such Debtor (or any successor thereto, by merger, consolidation, or otherwise), as reorganized on or after the Effective Date.

143. “Reorganized Unit Corp.” means Unit Corp., as Reorganized on the Effective Date, which will hold, directly or indirectly, substantially all of the assets of Unit Corp., including the Intercompany Interests in the Subsidiaries, as Reorganized on or after the Effective Date.

144. “Reorganized Unit Corp. Equity Pool” means the total number of Reorganized Unit Corp. Interests to be issued under the Plan.

145. “Reorganized Unit Corp. Interest” means an Interest in Reorganized Unit Corp. that will be issued by the Disbursing Agent on the Effective Date (or such other date as set forth herein or in the Plan Supplement).

146. “Reorganized Unit Corp. Separation Benefit Plan” means a comprehensive severance plan for employees of the Reorganized Debtors, including each employee of the Debtors that is retained by the Reorganized Debtors whose severance did not vest prior to the Petition Date pursuant to the Separation Benefit Plan and each Vested Retained Employee. The Reorganized Unit Corp. Separation Benefit Plan shall provide, among other things, that employees entitled to participate in the Reorganized Unit Corp. Separation Benefit Plan will be entitled to two weeks of severance pay per year of service, with a minimum of four weeks and a maximum of 13 weeks of severance pay, with eligibility and vesting terms acceptable to the Debtors and the Majority Consenting Noteholders. The Reorganized Unit Corp. Separation Benefit Plan will be included in the Plan Supplement and adopted by the Reorganized Debtors on the Effective Date. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Reorganized Unit Corp. Separation Benefit Plan before it is Filed with the Plan Supplement.

147. “Restructuring” means all actions that may be necessary or appropriate to effectuate the transactions described in, approved by, contemplated by, or necessary to effectuate, the Restructuring Support Agreement and the Plan.

16

148. “Restructuring Expenses” means the reasonable and documented professional fees and expenses incurred by the Consenting Noteholder Advisors, the RBL Agent Advisors, and the RBL Lenders pursuant to the terms of the respective fee and engagement letters entered into by such Persons, as applicable, and in each case, in connection with or arising as a result of the Restructuring, the Plan, or the Chapter 11 Cases.

149. “Restructuring Support Agreement” means that certain Restructuring Support Agreement, dated May 22, 2020, by and among the Debtors and the Restructuring Support Parties, as may be further amended, restated, modified, supplemented, or replaced from time to time in accordance with the terms thereof.

150. “Restructuring Support Parties” is used as defined in the Restructuring Support Agreement.

151. “Restructuring Term Sheet” means that certain term sheet for the Restructuring attached as Exhibit A to the Restructuring Support Agreement.

152. “Royalty and Working Interest” means any working interest granting the right to exploit oil and gas, and certain other royalty or mineral interests including but not limited to, landowner’s royalty interests, overriding royalty interests, net profit interests, and non-participating royalty interests.

153. “Royalty Order” means the Order (I) Authorizing the Debtors to Make or Honor Mineral Payments, Working Interest Disbursements, and Joint Interest Billings and (II) Granting Related Relief entered by the Court on May 26, 2020 [Docket No. 54].

154. “Salary Deferral Plan” means the Unit Corporation Salary Deferral Plan, as amended from time to time.

155. “Schedule of Assumed Executory Contracts and Unexpired Leases” means the schedule of Executory Contracts and Unexpired Leases to be assumed by the Debtors pursuant to the Plan, as set forth in the Plan Supplement, as may be amended from time to time prior to the Effective Date.

156. “Schedule of Rejected Executory Contracts and Unexpired Leases” means the schedule of Executory Contracts and Unexpired Leases to be rejected by the Debtors pursuant to the Plan, as set forth in the Plan Supplement, as may be amended from time to time prior to the Effective Date. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding the Schedule of Rejected Contracts before it is Filed with the Plan Supplement.

157. “Schedules” means, collectively, the schedules of assets and liabilities, schedules of Executory Contracts and Unexpired Leases, and statements of financial affairs Filed by the Debtors pursuant to section 521 of the Bankruptcy Code and in substantial conformance with the Official Bankruptcy Forms, as the same may have been amended, modified, or supplemented from time to time.

158. “SEC” means the United States Securities and Exchange Commission.

17

159. “Section 510(b) Claim” means any Claim against a Debtor arising from (a) rescission of a purchase or sale of a Security in any Debtor or an Affiliate of any Debtor, (b) purchase or sale of such a Security, or (c) reimbursement or contribution allowed under section 502 of the Bankruptcy Code on account of such a Claim.

160. “Secured” means a Claim: (a) secured by a Lien on property in which the applicable Estate has an interest, which Lien is valid, perfected, and enforceable pursuant to applicable law or by reason of a Court order, or that is subject to setoff pursuant to section 553 of the Bankruptcy Code, to the extent of the value of the creditor’s interest in such Estate’s interest in such property or to the extent of the amount subject to setoff, as applicable, as determined pursuant to section 506(a) of the Bankruptcy Code; or (b) otherwise Allowed pursuant to the Plan as a Secured Claim.

161. “Secured Tax Claim” means any Secured Claim against a Debtor that, absent its secured status, would be entitled to priority in right of payment under section 507(a)(8) of the Bankruptcy Code (determined irrespective of time limitations), including any related Secured Claim for penalties.

162. “Securities Act” means the Securities Act of 1933, 15 U.S.C. §§ 77a–77aa, as amended, or any similar federal, state or local law.

163. “Security” shall have the meaning set forth in section 101(49) of the Bankruptcy Code.

164. “Separation Benefit Plan” means, collectively, (a) the Separation Benefit Plan of Unit Corporation and Participating Subsidiaries, as amended and restated effective as of December 8, 2015, and (b) the Special Separation Benefit Plan of Unit Corporation and Participating Subsidiaries, as amended and restated effective as of December 8, 2015.

165. “Separation Claim” means a Class A-5 Unit Corp. GUC Claim held by a Vested Retained Employee or a Vested Former Employee on account of vested severance obligations, and in the case of a Vested Former Employee, excluding any Separation Minimum Claim.

166. “Separation Installment Payment” means, with respect to a Vested Former Employee or a Vested Retained Employee, the maximum amount of each installment payment that would be payable to such individual on account of vested severance obligations pursuant to the terms of the Separation Benefit Plan (as in effect immediately prior to the Petition Date).

167. “Separation Minimum Claim” means a Claim for severance held by a Vested Former Employee in an amount up to $13,650, less the amount, if any, payable to such individual under section 507(a)(4) of the Bankruptcy Code for wages, salaries, or commissions other than severance.

168. “Separation Settlement” means the settlement pursuant to sections 363 and 1123 of the Bankruptcy Code and Bankruptcy Rule 9019 between Unit Corp. and certain Holders of Separation Claims, as more fully set forth in Article V.G of this Plan.

18

169. “Separation Settlement Opt-In” means the election of a Holder of a Separation Claim, to be made solely through a properly submitted Ballot, to opt in to the Separation Settlement.

170. “Separation Settlement Treatment” means, collectively, the treatment for Separation Claims of (a) Vested Former Employees pursuant to Article V.G.1 of this Plan and (b) Vested Retained Employees pursuant to Article V.G.2. of this Plan.

171. “Severance Fund” means Cash in an amount equal to (a) $7,500,000 less (b) the aggregate amount of all Separation Minimum Claims paid to Vested Former Employees prior to the Effective Date.

172. “Shareholders Agreement” means the shareholders agreement that may (if determined by the Majority Consenting Noteholders) be entered into on the Effective Date by Reorganized Unit Corp., the Consenting Noteholders, and all or certain other Holders of Reorganized Unit Corp. Interests, containing customary terms, and which may include terms (as determined by the Majority Consenting Noteholders) regarding governance (including implementing the terms of the New Board in accordance with Article IV.J and the Plan Supplement), transfer rights, and/or other matters regarding Reorganized Unit Corp. and the Reorganized Unit Corp. Interests, in each case consistent with the Restructuring Term Sheet. A substantially final form of the Shareholders Agreement, if any, in form and substance acceptable to the Debtors and the Majority Consenting Noteholders, will be included in the Plan Supplement. The Debtors and the Consenting Noteholders will reasonably consult in good faith with the Consenting RBL Lenders regarding any Shareholders Agreement before it is Filed with the Plan Supplement, as applicable.

173. “Solicitation Materials” is used as defined in the Restructuring Support Agreement.

174. “Subordinated Notes” means Unit Corp.’s 6.625% senior subordinated notes due 2021 issued pursuant to the Subordinated Notes Indenture.

175. “Subordinated Notes Claims” means any Claim against any Debtor on account of the Subordinated Notes, including any guarantee of any Claim, arising under the Subordinated Notes Indenture.

176. “Subordinated Notes Indenture” means that certain Indenture, dated as of May 18, 2011 (as amended, restated, modified, supplemented, or replaced from time to time), among Unit Corp., each of the guarantors party thereto, and the Subordinated Notes Indenture Trustee, as supplemented by that certain First Supplemental Indenture, dated as of May 18, 2011 (as amended, restated, modified, supplemented, or replaced from time to time), among Unit Corp., each of the guarantors party thereto, and the Subordinated Notes Indenture Trustee, and as further supplemented by that certain Second Supplemental Indenture, dated as of January 7, 2013 (as amended, restated, modified, supplemented, or replaced from time to time), among Unit Corp., each of the guarantors party thereto, and the Subordinated Notes Indenture Trustee.

19

177. “Subordinated Notes Indenture Trustee” means Wilmington Trust, National Association (as successor to Wilmington Trust FSB), in its capacity as trustee under the Subordinated Notes Indenture, and any successors in such capacity.

178. “Subordinated Notes Indenture Trustee Charging Lien” means any Lien or other priority in payment to which the Subordinated Notes Indenture Trustee is entitled pursuant to the Subordinated Notes Indenture or any ancillary documents, instruments or agreements.

179. “Superior” means Superior Pipeline Company, L.L.C., a Delaware limited liability company.

180. “Subsidiaries” means UDC, Unit Colombia, Unit USA Colombia, UPC, and 8200 Unit.

181. “Total Enterprise Value” or “TEV” means, with respect to a Debtor, the total enterprise value of such Debtor as of the date and in the amount set forth in the valuation analysis disclosed in the Disclosure Statement (as may be amended, modified, or otherwise supplemented from time to time).

182. “UDC” means Unit Drilling Company, an Oklahoma corporation.

183. “UDC Equity Allocation” means the number of Reorganized Unit Corp. Interests equal to: (i)(a) the Reorganized Unit Corp. Equity Pool less (b) the Equity Exit Fee less (c) the MIP Equity; times (ii)(a) the Total Enterprise Value of UDC, divided by (b) the Total Enterprise Value of the Debtors, as reflected in the following formula:

184. “UDC GUC Claim” means a General Unsecured Claim against UDC.

185. “UDC Intercompany Claim” means an Intercompany Claim against UDC.

186. “UDC Intercompany Claim Allocation” means the total number of Reorganized Unit Corp. Interests recoverable on behalf of UDC on account of Intercompany Claims held by UDC.

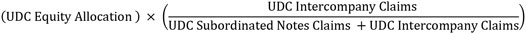

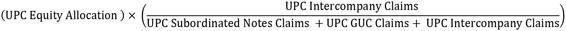

187. “UDC Intercompany Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i) the UDC Equity Allocation times (ii)(a) the total UDC Intercompany Claims divided by (b)(1) the total UDC Subordinated Notes Claims plus (2) the total UDC Intercompany Claims, as reflected in the following formula:

188. “UDC Interest” means an Interest in UDC.

189. “UDC RBL Secured Claim” means an RBL Secured Claim against UDC.

20

190. “UDC Subordinated Notes Claim” means a Subordinated Notes Claim against UDC.

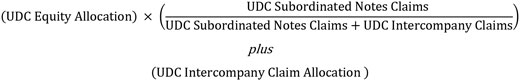

191. “UDC Subordinated Notes Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i)(a) the UDC Equity Allocation times (b)(1) the total UDC Subordinated Notes Claims divided by (2)(A) the total UDC Subordinated Notes Claims plus (B) the total UDC Intercompany Claims, plus (ii) the UDC Intercompany Claim Allocation, as reflected in the following formula:

192. “Unclaimed Property” means any distribution under the Plan on account of an Allowed Claim whose holder has not: (a) accepted such distribution or, in the case of distributions made by check, negotiated such check; (b) given notice to the Reorganized Debtors of an intent to accept such distribution; (c) responded to the Debtors’ or Reorganized Debtors’ requests for information necessary to facilitate such distribution; or (d) taken any other action necessary to facilitate such distribution.

193. “Unexpired Lease” means a lease of nonresidential real property to which one or more of the Debtors is a party that is subject to assumption or rejection under sections 365 or 1123 of the Bankruptcy Code.

194. “Unimpaired” means, with respect to a Class of Claims or Interests, a Class consisting of Claims or Interests that are not “impaired” within the meaning of section 1124 of the Bankruptcy Code, including through payment in full in Cash or Reinstatement.

195. “Unit Colombia” means Unit Drilling Colombia, L.L.C., a Delaware limited liability company.

196. “Unit Corp.” means Unit Corporation, a Delaware corporation.

197. “Unit Corp. Disputed Claims Reserve” means a reserve of Reorganized Unit Corp. Interests to be funded on or before the Effective Date for Disputed Unit Corp. GUC Claims in accordance with Article VIII.E.

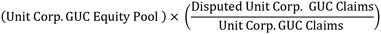

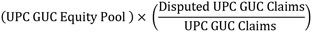

198. “Unit Corp. Disputed Claims Reserve Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i) the Unit Corp. GUC Equity Pool times (ii)(a) the total Face Amount of all Disputed Unit Corp. GUC Claims divided by (b) the total amount of all Unit Corp. GUC Claims, as reflected in the following formula:

199. “Unit Corp. Equity Allocation” means the number of Reorganized Unit Corp. Interests equal to (i)(a) the Reorganized Unit Corp. Equity Pool less (b) the Equity Exit Fee less

21

(c) the MIP Equity; times (ii)(a) the Total Enterprise Value of Unit Corp. divided by (b) the Total Enterprise Value of the Debtors, as reflected in the following formula:

200. “Unit Corp. GUC Claim” means a General Unsecured Claim against Unit Corp.

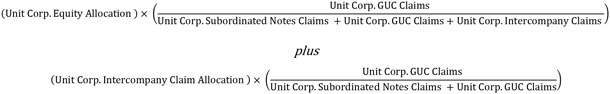

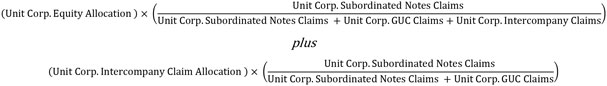

201. “Unit Corp. GUC Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i)(a) the Unit Corp. Equity Allocation times (b)(1) the total Unit Corp. GUC Claims divided by (2)(A) the total Unit Corp. Subordinated Notes Claims plus (B) the total Unit Corp. GUC Claims plus (C) the total Unit Corp. Intercompany Claims, plus (ii)(a) the Unit Corp. Intercompany Claim Allocation times (b)(1) the total Unit Corp. GUC Claims divided by (2)(A) the total Unit Corp. Subordinated Notes Claims, plus (B) the total Unit Corp. GUC Claims, as reflected in the following formula:

The Unit Corp. GUC Equity Pool may be reduced by the Unit Corp. Disputed Claims Reserve Equity Pool.

202. “Unit Corp. Intercompany Claim” means an Intercompany Claim against Unit Corp.

203. “Unit Corp. Intercompany Claim Allocation” means the total number of Reorganized Unit Corp. Interests recoverable on behalf of Unit Corp. or 8200 Unit on account of Intercompany Claims held by Unit Corp. or 8200 Unit, respectively.

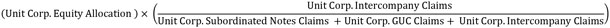

204. “Unit Corp. Intercompany Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i) the Unit Corp. Equity Allocation times (ii)(a) the total Unit Corp. Intercompany Claims divided by (b)(1) the total Unit Corp. Subordinated Notes Claims plus (2) the total Unit Corp. GUC Claims plus (3) the total Unit Corp. Intercompany Claims, as reflected in the following formula:

205. “Unit Corp. Interest” means an Interest in Unit Corp.

206. “Unit Corp. RBL Secured Claim” means an RBL Secured Claim against Unit Corp.

207. “Unit Corp. Subordinated Notes Claim” means a Subordinated Notes Claim against Unit Corp.

22

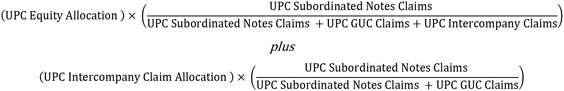

208. “Unit Corp. Subordinated Notes Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i)(a) the Unit Corp. Equity Allocation times (b)(1) the total Unit Corp. Subordinated Notes Claims divided by (2)(A) the total Unit Corp. Subordinated Notes Claims plus (B) the total Unit Corp. GUC Claims plus (C) the total Unit Corp. Intercompany Claims, plus (ii)(a) the Unit Corp. Intercompany Claim Allocation times (b)(1) the total Unit Corp. Subordinated Notes Claims divided by (2)(A) the total Unit Corp. Subordinated Notes Claims, plus (B) the total Unit Corp. GUC Claims, as reflected in the following formula:

209. “Unit USA Colombia” means Unit Drilling USA Colombia, L.L.C., a Delaware limited liability company.

210. “Unsecured” means, with respect to a Claim, not Secured.

211. “UPC” means Unit Petroleum Company, an Oklahoma corporation.

212. “UPC Disputed Claims Reserve” means a reserve of Reorganized Unit Corp. Interests to be funded on or before the Effective Date for Disputed UPC GUC Claims in accordance with Article VIII.E.

213. “UPC Disputed Claims Reserve Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i) the UPC GUC Equity Pool times (ii)(a) the total Face Amount of all Disputed UPC GUC Claims divided by (b) the total amount of all UPC GUC Claims, as reflected in the following formula:

214. “UPC Equity Allocation” means the number of Reorganized Unit Corp. Interests equal to: (i)(a) the Reorganized Unit Corp. Equity Pool less (b) the Equity Exit Fee less (c) the MIP Equity; times (ii)(a) the Total Enterprise Value of UPC divided by (b) the Total Enterprise Value of the Debtors, as reflected in the following formula:

215. “UPC GUC Claim” means a General Unsecured Claim against UPC.

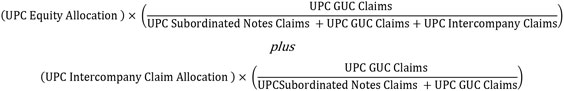

216. “UPC GUC Equity Pool” means the number of Reorganized Unit Corp. Interests equal to (i)(a) the UPC Equity Allocation times (b)(1) the total UPC GUC Claims divided by (2)(A) the total UPC Subordinated Notes Claims plus (B) the total UPC GUC Claims, plus (C) the total UPC Intercompany Claims, plus (ii)(a) the UPC Intercompany Claim Allocation times (b)(1) the total UPC GUC Claims divided by (2)(A) the total UPC Subordinated Notes Claims, plus (B) the total UPC GUC Claims, as reflected in the following formula:

23

The UPC GUC Equity Pool may be reduced by the UPC Disputed Claims Reserve Equity Pool.

217. “UPC Intercompany Claim” means an Intercompany Claim against UPC.

218. “UPC Intercompany Claim Allocation” means the total number of Reorganized Unit Corp. Interests recoverable on behalf of UPC on account of Intercompany Claims held by UPC.

219. UPC Intercompany Equity Pool” means the number of Reorganized Unit Corp. Interests equal to: (i) the UPC Equity Allocation times (ii)(a) the total UPC Intercompany Claims divided by (b)(1) the total UPC Subordinated Notes Claims plus (2) the total UPC GUC Claims plus (3) the total UPC Intercompany Claims, as reflected in the following formula:

220. “UPC Interest” means an Interest in UPC.

221. “UPC Subordinated Notes Claim” means a Subordinated Notes Claim against UPC.

222. “UPC Subordinated Notes Equity Pool” means the number of Reorganized Unit Corp. Interests equal to (i)(a) the UPC Equity Allocation times (b)(1) the total UPC Subordinated Notes Claims divided by (2)(A) the total UPC Subordinated Notes Claims plus (B) the total UPC GUC Claims plus (C) the total UPC Intercompany Claims, plus (ii)(a) the UPC Intercompany Claim Allocation times (b)(1) the total UPC Subordinated Notes Claims divided by (2)(A) the total UPC Subordinated Notes Claims, plus (B) the total UPC GUC Claims, as reflected in the following formula:

223. “UPC RBL Secured Claim” means an RBL Secured Claim against UPC.

224. “U.S. Trustee” means the Office of the United States Trustee for the Southern District of Texas.

225. “U.S. Trustee Fees” means fees arising under 28 U.S.C. § 1930(a)(6) and, to the extent applicable, accrued interest thereon arising under 31 U.S.C. § 3717.

24

226. “Vested Former Employee” means a former employee of a Debtor or the Non-Debtor Subsidiary with vested benefits under the Separation Benefit Plan as of the Petition Date, who has commenced receiving benefits or is entitled to commence receiving benefits under the Separation Benefit Plan as of the Petition Date.

227. “Vested Retained Employee” means an employee of a Debtor (a) with vested benefits under the Separation Benefit Plan as of the Petition Date or (b) whose severance benefits vest under the Separation Benefit Plan during the Chapter 11 Cases as a result of termination.

228. “Voting Deadline” means, the deadline for submitting votes to accept or reject the Plan, which deadline is July 29, 2020 at 5:00 p.m. (prevailing Central Time), unless extended by the Debtors.

229. “Voting Procedures” means the procedures and instructions for voting on the Plan and related deadlines as set forth in the Court order conditionally approving the Disclosure Statement and the solicitation procedures [Docket No. 175].

230. “Wages Order” means the Order (I) Authorizing the Debtors to (A) Pay Prepetition Wages, Salaries, Other Compensation, and Reimbursable Expenses and (B) Continue Employee Benefit Programs, and (II) Granting Related Relief entered by the Court on May 26, 2020 [Docket No. 52].