Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELA Bio, Inc. | tm2026521d2_ex99-1.htm |

| 8-K - FORM 8-K - TELA Bio, Inc. | tm2026521d2_8k.htm |

Exhibit 99.2

|

TELA Bio: Advancing Soft Tissue Reconstruction August 2020 Nasdaq: TELA 1 |

|

Forward Looking Statements This presentation contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this document, including but not limited to statements regarding possible or assumed future results of operations, business strategies, development plans, regulatory activities, market opportunity competitive position, potential growth opportunities, and the effects of competition, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause TELA Bio, Inc.’s (the “Company”) actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “aim,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this presentation are only predictions. The Company has based these forward-looking statements largely on its current expectations and projections about future events and financial trends that it believes may affect the Company’s business, financial condition and results of operations. These forward-looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions, some of which cannot be predicted or quantified and some of which are beyond the Company’s control, including, among others: the impact to the Company's business of the ongoing COVID-19 pandemic, including any impact on the Company's ability to market its products, demand for the Company's products due to deferral of procedures using the Company's products or disruption in the Company's supply chain, the Company's ability to achieve or sustain profitability, the Company's ability to gain market acceptance for the Company's products and to accurately forecast and meet customer demand, the Company's ability to compete successfully, the Company's ability to enhance the Company's product offerings, development and manufacturing problems, capacity constraints or delays in production of the Company's products, maintenance of coverage and adequate reimbursement for procedures using the Company's products, product defects or failures. These and other risks and uncertainties are described more fully in the "Risk Factors" section and elsewhere in the Company's filings with the Securities and Exchange Commission and available at www.sec.gov. You should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in the Company’s forward-looking statements may not be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. Moreover, the Company operates in a dynamic industry and economy. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties that the Company may face. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. 2 |

|

TELA Bio Snapshot A commercial stage medical technology company marketing a new category of tissue reinforcement materials to address unmet needs in soft tissue reconstruction ▫ Differentiated portfolio of advanced reinforced tissue matrices addressing hernia repair, abdominal wall reconstruction and plastic and reconstructive surgery ▫ Headquartered: Malvern, Pennsylvania 3 1. Management estimate. $2B total equals $1.5B hernia & abdominal wall reconstruction and $0.5B plastic reconstructive surgery. Reduce Overall Costs of Care Improve Clinical Outcomes Innovative Products ~$2B U.S Market Opportunity1 |

|

OviTex: ~$1.5 Billion Annual U.S. Total Addressable Hernia Market Opportunity ~$350 million US market(1) ~58,000 total procedures per year ~$500 million US market(1) ~326,000 total procedures per year OviTex ~$1.5 Billion TAM Opportunity ~$650 million US market(1) ~711,000 total procedures per year ~$40 million US market(1) ~40,000 total procedures per year Source: Millennium Research Group Reports, IMS Health Data 1)Management estimate. Market size based volume weighted average selling price for OviTex 4 Hiatal Hernia Repair Inguinal Hernia Repair Simple Ventral Hernia Repair Complex, Moderate Ventral / Abdominal Wall Reconstruction |

|

Hernias Occur Throughout the Abdomen What is a hernia? ▫Occurs when an internal part of the body pushes through a weakness or hole in the muscle or surrounding tissue ▫ ▫ Natural occurring weakness Weakness from previous surgical incision ▫Likelihood of developing a hernia increases with age & obesity Treating a hernia ▫ Surgical repair of a hernia with a reinforcing material (mesh) is standard of care ~90% of hernia patients receive a mesh repair1 Mesh intended to reinforce the defect and provide long-term support ▫ ▫ 5 1 Funk LM, Perry KA, Narula VK, Mikami DJ, Melvin W S. Current national practice patterns for inpatient management of ventral abdominal wall hernia in the United States. Surg Endosc. 2013;27(11):4104-4112. |

|

Ventral Hernia: Complex Patient Population Ventral Hernia Complexity SIMPLE MODERATE COMPLEX • • CDC Wound Class I (clean) Healthier patients - no co-morbidities Primary hernia repair • CDC Wound Class II (clean-contaminated) Patient co-morbidities (i.e. obesity, diabetes, COPD) May have prior hernia repair failure • CDC Wound Class III (contaminated) & IV (infected) Large defects Infected synthetic mesh removals Multiple prior hernia repair failures • • • • • • Objective is to give patient the best repair the first time to prevent the simple patient from becoming the complex 6 |

|

Current Ventral Hernia Treatment Options: No Perfect Product Natural Repair Products Gentrix® Ventralight™ ProGrip™ PHASIX™ Mesh Strattice™ PROCEED® SurgiMend® Parietex™ XenMatrix™ GORE® BIO-A® Simple Ventral Hernia Complex, Moderate Ventral Repair / Abdominal Wall Reconstruction Inguinal Hernia Hiatal Hernia Repair 7 PERMANENT SYNTHETIC MESH RESORBABLE SYNTHETIC MESH BIOLOGIC MESH |

|

Limitations of Reconstruction Materials Used in Hernia Repair ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ ▫ Persistent inflammatory response Inflammatory response until absorbed Lack of strength or durability Encapsulation of implant Prone to laxity and stretching ▫ Encapsulation of implant or until absorbed Chronic post operative pain Difficulty in surgeon handling ▫ ▫ ▫ ▫ Scar tissue / lack of remodeling Difficult using in robotic surgery / LAP Scar tissue / lack of remodeling Mesh infections Mesh infection until resorbed ▫ ▫ High costs Significant costs of re-operation Organ erosion or perforation RICH study: recurrence rates of 22% and 33% at 12-months and 24-months follow-up, respectively3 Organ erosion or perforation Lack of mid-term and long-term reinforcement 6,000 related U.S. lawsuits ▫ Recurrence rate of 12% at 18-months follow-up2 Danish Hernia Database: ~17% reintervention at five years1 1. Kokotovic, Bisgaard and Helgstrand, Long-term Recurrence and Complications Associated With Elective Incisional Hernia Repair. JAMA. 2016;316(15):1575-1582. doi:10.1001/jama.2016.15217 (on-line) 2. Roth, JS et. al, (2017) “Prospective evaluation of poly-4-hydroybutyrate mesh in CDC class I/high-risk ventral and incisional hernia repair: 18-month follow-up.” Surgical Endoscopy. 3. Itani, KMF et. al, (2012) “Prospective study of single-stage repair of contaminated hernias using a biologic porcine tissue matrix: The RICH Study” Surgery 8 BIOLOGIC MATRICES RESORBABLE SYNTHETIC MESH PERMANENT SYNTHETIC MESH |

|

Our Solution: New Category of Tissue Reinforcement Materials Hernia & Ab Wall Biologic Tissue Reconstruction 9 Purposefully Designed Biologic & Polymer Solutions for Specific Clinical Needs Innovative Textile Engineering derived from sheepPolymer fibersReconstruction interwoven through layers of biologic material in unique Polymer Fibersembroidered patternsPlastic Surgeon Collaboration |

|

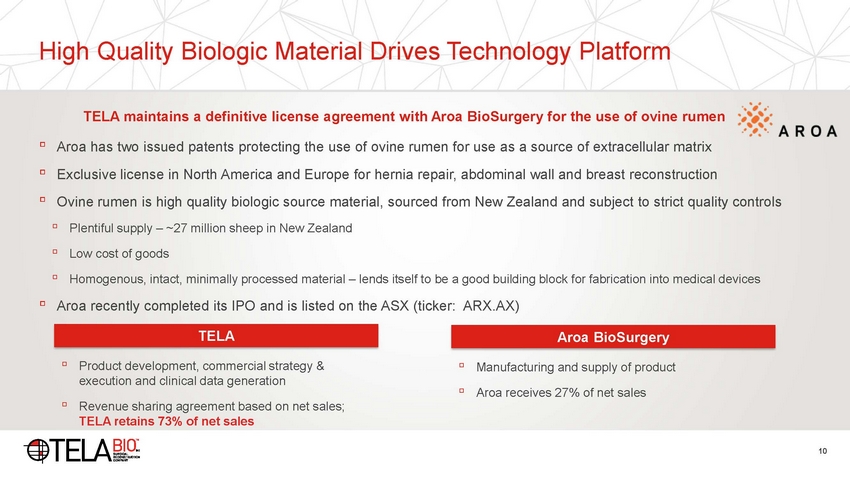

High Quality Biologic Material Drives Technology Platform TELA maintains a definitive license agreement with Aroa BioSurgery for the use of ovine rumen ▫ ▫ ▫ Aroa has two issued patents protecting the use of ovine rumen for use as a source of extracellular matrix Exclusive license in North America and Europe for hernia repair, abdominal wall and breast reconstruction Ovine rumen is high quality biologic source material, sourced from New Zealand and subject to strict quality controls ▫ ▫ ▫ Plentiful supply – ~27 million sheep in New Zealand Low cost of goods Homogenous, intact, minimally processed material – lends itself to be a good building block for fabrication into medical devices ▫ Aroa recently completed its IPO and is listed on the ASX (ticker: ARX.AX) ▫ ▫ ▫ Product development, commercial strategy & execution and clinical data generation Manufacturing and supply of product Aroa receives 27% of net sales ▫ Revenue sharing agreement based on net sales; TELA retains 73% of net sales 10 Aroa BioSurgery TELA |

|

Our Solution: A New Category of Soft Tissue Reinforcement Materials ▫ ▫ ▫ ▫ ▫ ▫ ▫ Designed in close collaboration with more than 100 surgeons Products designed with over 95% biologic material (<5% polymer/synthetic content) Benefits of both biologic materials and polymer materials Supports range of surgical techniques Reduced foreign body inflammatory response Improved outcomes of soft tissue reconstructions Enhanced remodeling of soft tissue and rate of healing ▫ ▫ Customers realize ~20% to 40% cost-savings over leading biologic materials and resorbable synthetic mesh Provides benefits of advanced biologic repair to more patients 11 Lower Upfront Costs Improved Biologic Response Improve Performance Over Existing Reconstruction Materials |

|

OviTex: a New Approach to Soft Tissue Reconstruction for Hernia Repair and Abdominal Wall Reconstruction An innovative reinforced tissue matrix designed to reduce stretch compared to biologic matrices and long-term complications experienced with resorbable and permanent synthetic meshes Unique permeable design facilitates rapid fluid transfer and movement of cells through the device Lockstitch embroidery pattern creates a ripstop effect and prevents unraveling when cut Layers of biologic material enable functional tissue remodeling Interwoven polymer for added strength and improved handling 12 |

|

Comprehensive Portfolio for a Range of Hernia Types & Surgical Techniques Each configuration is available with either permanent (polypropylene) polymer or resorbable (polyglycolic reinforcing the same biologic material. acid) polymer OviTex 4-layer device, not intended for intraperitoneal placement Strength*: + Common Procedures: Moderate ventral hernia (pre-peritoneal placement), inguinal hernia, hiatal hernia OviTex 1S 6-layer device, with “smooth side” suitable for intraperitoneal placement Strength*: ++ Common Procedures: Moderate to complex ventral hernia OviTex 2S 8-layer device, with 2 “smooth sides” suitable for intraperitoneal placement Strength*: +++ Common Procedures: Complex ventral hernia and abdominal wall reconstruction and can be used for bridging Images represent permanent polymer OviTex products. Resorbable polymer products have clear polymer. * Biomechanical data on file. 13 CONFIGURATION |

|

OviTex LPR for Laparoscopic & Robotic-Assisted Repair ▫ OviTex LPR is specifically tailored for robotic-assisted hernia surgical repairs ▫ ▫ Significant increase in robotic hernia repairs in last few years Robotic-assisted hernia repair provides the benefits of laparoscopic repair ▫ Designed for improved surgical handling, access, and primary closure of hernia Designed for use with a trocar ▫ ▫ 4 total SKUs available, following commercial introduction of 3 additional SKUs in December 2019 Products expected to be used most frequently in simple-moderate ventral hernia patients ▫ 14 |

|

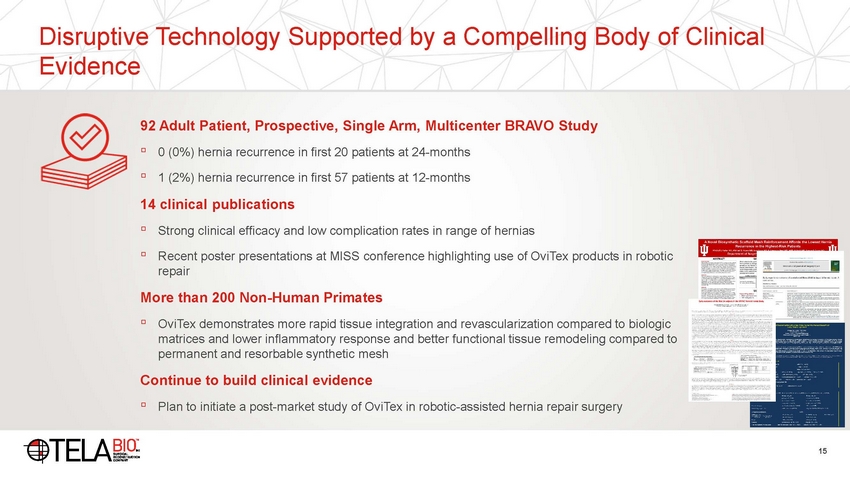

Disruptive Technology Supported by a Compelling Body Evidence of Clinical 92 Adult Patient, Prospective, Single Arm, Multicenter BRAVO Study ▫ ▫ 0 (0%) hernia recurrence in first 20 patients at 24-months 1 (2%) hernia recurrence in first 57 patients at 12-months 14 clinical publications ▫ ▫ Strong clinical efficacy and low complication rates in range of hernias Recent poster presentations at MISS conference highlighting use of OviTex products in robotic repair More than 200 Non-Human Primates ▫ OviTex demonstrates more rapid tissue integration and revascularization compared to biologic matrices and lower inflammatory response and better functional tissue remodeling compared to permanent and resorbable synthetic mesh Continue to build clinical evidence ▫ Plan to initiate a post-market study of OviTex in robotic-assisted hernia repair surgery 15 |

|

Multiple Future Analyses of BRAVO Data Planned for 2020 • 20-patients at 24-months • ~75 patients at 12-months • 57-patients at 12-months • ~50-patients at 24-months • 84-patients at 3-months ▫ Primary focus is hernia recurrence rate at each time point ▫ Additional information on surgical site occurrence rate will also be analyzed ▫ Study design allows for robotic, laparoscopic and open implantation of OviTex 1S, allowing for sub-analyses by surgical technique Data will be submitted to medical journals and for presentation at key medical conferences throughout the year ▫ 16 Q1 2020 Q2 2020 Q3 2020 Q4 2020 BRAVO Study is fully enrolled (n=91) and characterizes OviTex performance in moderate-to-complex ventral hernia patients |

|

OviTex BRAVO Study Shows Low Recurrence Rate at 12 and 24-months OviTex BRAVO Study Number of Patients who Completed Follow-up Follow-up Period in Months Number of Hernia Recurrence Product Name Tissue Reinforcement Material Hernia Recurrence Rate Results from Post-Market Clinical Studies of Competitive Materials Number of Patients who Completed Follow-up1 Follow-up Period in Months Number of Hernia Recurrence1 Hernia Recurrence Rate1 Product Name Tissue Reinforcement Material 1) Hernia Recurrence Rate based on number of hernia recurrences reported in patients who completed follow up and patients who reported recurrent hernia before the specified follow up period. Clinical literature and conference presentations included hernia recurrence rates based on number of hernia recurrences in patients who comprised the initial intent-to-treat population (including those who did not complete the follow up period and did not report a hernia recurrence). 17 Phasix Resorbable Synthetic Mesh 5%59512 Phasix Resorbable Synthetic Mesh 12%119518 Phasix Resorbable Synthetic Mesh 23%198236 StratticeBiologic Matrix 22%156912 StratticeBiologic Matrix 33%226724 OviTexReinforced Tissue Matrix OviTexReinforced Tissue Matrix 2%15712 0%02024 |

|

We believe Plastic and Reconstructive Significant Market Opportunity Surgery Represents a ▫ Use of biologic matrices validated by growing clinical literature Biologics provide the following clinical benefits: ~$500 Million Annual U.S. Market Opportunity ▫ ▫ ▫ ▫ ▫ Ability to define shape and position Soft tissue reinforcement Improvement of tissue quality Aids in defining the pocket and allows for more immediate tissue expansion Reduced inflammatory response ▫ ▫ ▫ ▫ ▫ Breast reconstruction Head and neck surgery Chest wall reconstruction Pelvic reconstruction Extremities reconstruction ▫ ▫Existing biologics are costly, prone to excessive stretch over time, and difficult for surgeons to handle 18 Note: Management estimate. Market size based on sales of current biologics Uses |

|

OviTex PRS: Surgery Purposely Designed for Plastic and Reconstructive An innovative reinforced tissue matrix designed to improve outcomes by facilitating controlling degree and direction of stretch fluid management and material enable functional 19 Expanded commercial launch in June 2020 following limited launch initiated in 2019 Fenestrations and slits facilitate fluid management, allow for rapid cellular infiltration, and create a directional bias to the stretch Layers of biologic tissue remodeling Corner-lock diamond embroidery pattern allows the product to stretch while maintaining its shape |

|

Commercial Organization ▫ 41 sales territories at June 30, 2020 ▫ OR-based Account Managers call on General, Plastic Recon, Colorectal & Trauma surgeons ▫ Carry full OviTex & OviTex PRS portfolio ▫ 6 sales regions ▫ Plan to scale existing regions until each region has ~8 territories ▫ Territories supported by Clinical Development and Strategic Customer Relations teams 20 |

|

Focused on Driving Utilization within Accessed Accounts Contracts in place (GPOs) with multiple national and regional Group Purchasing Organizations Current GPO contracts provide access to ~1,900 hospitals across the U.S., estimated to perform over ~135,000 addressable soft tissue reconstruction procedures per year1 Data-driven, targeted implementation strategy Account Manager hiring for new territories focused on accessed accounts areas with high concentrations of 21 1. Data based on estimates from Definitive Healthcare and IQVIA Hospital Procedure and Diagnosis data. |

|

Growth Strategy 22 Long-Term systems under GPO contracts •U.S. sales force expansion •Surgeon education •Target high-decile hernia and plastic and recon. surgeons Current •Drive adoption within health •Publish BRAVO clinical and health economics data •Pursue additional contracts with large GPOs and IDNs Near-Term •New product features and designs for OviTex and OviTex PRS •OviTex LPR clinical study data •Support investigator-led clinical studies for OviTex PRS |

|

Revenue Growth ($ millions) $4.8 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q1 2020 quarterly revenue impacted by COVID-19 pandemic beginning mid-March 2020 and continued throughout Q2 2020 23 Y/Y Growth80%100%13%6% $4.0 $3.7$3.5 Quarterly Results |

|

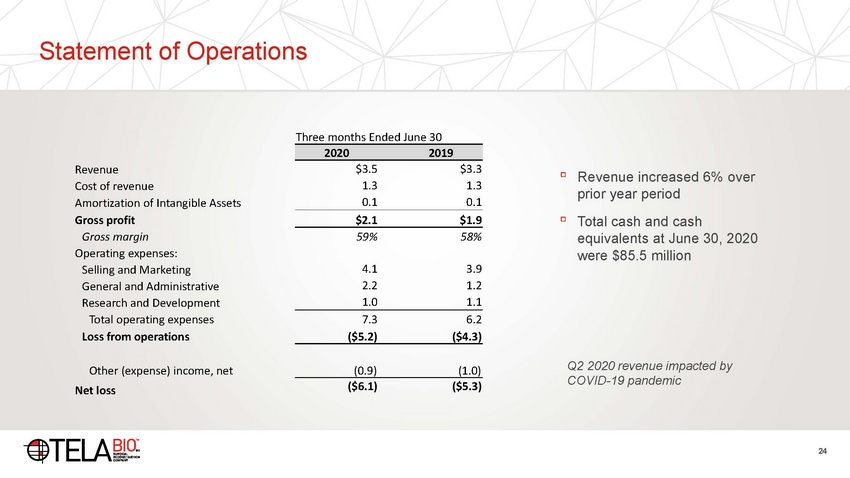

Statement of Operations Three months Ended June 30 $3.5 1.3 0.1 $3.3 1.3 0.1 Revenue Cost of revenue Amortization of Intangible Assets Gross profit Gross margin Operating expenses: Selling and Marketing General and Administrative Research and Development Total operating expenses Loss from operations ▫ Revenue increased 6% over prior year period Total cash and cash equivalents at June 30, 2020 were $85.5 million ▫ $2.1 $1.9 59% 58% 4.1 2.2 1.0 3.9 1.2 1.1 7.3 6.2 ($5.2) ($4.3) Q2 2020 revenue impacted by COVID-19 pandemic Other (expense) income, net Net loss (0.9) (1.0) ($6.1) ($5.3) 24 20202019 |

|

Investment Highlights Advanced reinforced tissue matrix portfolio supported by compelling clinical evidence Focused on ~$2.0 billion annual U.S. total addressable markets Well-defined high-decile surgeon customers targeted by growing direct sales force Long-term supply agreement that provides pricing flexibility—cost savings to healthcare systems Established DRG-based reimbursement pathway for hernia repair Recent product launches in growing categories: robotic hernia surgery + plastic and reconstructive surgery Broad intellectual property portfolio Industry leading executive team with proven track record 25 |