Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Phillips Edison & Company, Inc. | peco_20200630earnings8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Phillips Edison & Company, Inc. | pecoearningsreleaseq22020e.htm |

Second Quarter 2020 Results Presentation Thursday, August 13, 2020

Agenda Prepared Remarks Jeff Edison - Chairman and CEO • Overview • Q2 2020 Highlights John Caulfield - CFO • Financial Results • Balance Sheet and Debt Profile Jeff Edison - Chairman and CEO • COVID-19 Update • 2020 Outlook Question and Answer Session www.phillipsedison.com/investors 2

Forward-Looking Statement Disclosure Certain statements contained in this presentation for Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those Acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “hope,” “continue,” “likely,” “outlook,” “focus,” “seek,” “objective,” “goal,” “plan,” “potential,” “future,” “could,” “would,” “uncertainty,” “long term,” “expectations,” “look,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the U.S. Securities and Exchange Commission (“SEC”). Such statements include, but are not limited to, statements about our plans, strategies, initiatives, and prospects; statements about the global pandemic of a novel coronavirus (“COVID-19”), including its duration and potential or expected impact on our tenants and our business; statements about the duration or extent of the suspension of our distributions, share repurchase program, and dividend reinvestment program; and statements about our future results of operations, capital expenditures, and liquidity. Such statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those projected or anticipated, including, without limitation, (i) changes in national, regional, or local economic climates; (ii) local market conditions, including an oversupply of space in, or a reduction in demand for, properties similar to those in our portfolio; (iii) vacancies, changes in market rental rates, and the need to periodically repair, renovate, and re-let space; (iv) changes in interest rates and the availability of permanent mortgage financing; (v) competition from other available properties and the attractiveness of properties in our portfolio to our tenants; (vi) the financial stability of tenants, including the ability of tenants to pay rent; (vii) changes in tax, real estate, environmental, and zoning laws; (viii) the concentration of our portfolio in a limited number of industries, geographies, or investments; (ix) the effects of the COVID-19 pandemic, including on the demand for consumer goods and services and levels of consumer confidence in the safety of visiting shopping centers as a result of the COVID-19 pandemic; (x) the measures taken by federal, state, and local government agencies and tenants in response to the COVID-19 pandemic, including mandatory business shutdowns, stay-at-home orders and social distancing guidelines; (xi) the impact of the COVID-19 pandemic on our tenants and their ability to pay rent on time or at all, or to renew their leases and, in the case of non-renewal, our ability to re-lease the space at the same or more favorable terms or at all; (xii) the length and severity of the COVID-19 pandemic in the United States; (xiii) the pace of recovery following the COVID-19 pandemic given the current severe economic contraction and increase in unemployment rates; (xiv) our ability to implement cost containment strategies; (xv) our and our tenants’ ability to obtain loans under the CARES Act or similar state programs; (xvi) our ability to pay down, refinance, restructure, or extend our indebtedness as it becomes due; (xvii) to the extent we were seeking to dispose of properties in the near term, significantly greater uncertainty regarding our ability to do so at attractive prices; (xviii) the impact of the COVID-19 pandemic on our business, results of operations, financial condition, and liquidity; and (xix) supply chain disruptions due to the COVID-19 pandemic. Additional important factors that could cause actual results to differ are described in the filings made from time to time by the Company with the SEC and include the risk factors and other risks and uncertainties described in our 2019 Annual Report on Form 10-K, filed with the SEC on March 12, 2020 and those included in our Quarterly Reports on Form 10-Q, in each case as updated from time to time in our periodic and/or current reports filed with the SEC, which are accessible on the SEC’s website at www.sec.gov. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise. www.phillipsedison.com/investors 3

PECO’s National Portfolio 284 Our broad national footprint of grocery- Wholly-owned Properties anchored shopping centers is complemented by 97.0% local market expertise. Grocery-anchored 31 States 31.8 million Square Feet 95.6% Total Occupancy 90.3% In-line Occupancy 76.6% Grocer, national & regional neighbor rent* Atlanta, Chicago, Tampa/St. Petersburg, 77.0% Dallas, & Minneapolis/St. Paul Service & necessity-based neighbor rent* Top 5 markets by property count All Statistics as of June 30, 2020. *Annualized Base Rent (“ABR”) includes wholly-owned properties and the prorated share www.phillipsedison.com/investors owned through our joint ventures. Necessity-based neighbors include grocers, service providers, and restaurants. 4

Diverse Roster of Necessity- and Service-based Neighbors Top 5 Grocery-Anchors & Percent of Total ABR* Top 5 In-line Neighbors & Percent of In-line ABR* 6.8% 5.6% 4.5% 4.1% 2.3% 1.5% 1.3% 1.0% 1.0% 0.9% ABR by Neighbor Industry* ABR by Neighbor Type* Retail Grocery Grocery 23.0% National & Anchor Anchor Regional 35.5% 35.5% 41.1% Services Local Restaurant 26.2% 23.4% 15.3% www.phillipsedison.com/investors *Annualized base rent (“ABR”) equals monthly contractual rent as of June 30, 2020, multiplied by 12 months. Includes wholly-owned properties and the 5 prorated share owned through our joint ventures.

Highlights Second Quarter 2020 (vs. Second Quarter 2019) • 97% of neighbor spaces are open for business as of August 10, 2020 • Rent and recovery collections totaled 86% of monthly billings for the quarter • Reported net loss of $6.4 million • Same-center net operating income (“NOI”) decreased 5.2% • Core funds from operations (“Core FFO”) decreased 6.1% to $51.7 million, and decreased to $0.16 from $0.17 per diluted share • Expense reductions at the corporate level and lower interest partially mitigated the declines from lower collections at the property level • Paid off the outstanding balance on the $500 million revolving credit facility www.phillipsedison.com/investors 6

Same-Center NOI Six Months Ended June 30, 2020 Six Months Ended Favorable June 30, (Unfavorable) (in thousands) 2020 2019 $ Change % Change Revenues:(1) Rental income(2) $ 175,422 $ 179,696 $ (4,274) (2.4)% Tenant recovery income 58,372 56,005 2,367 4.2 % Other property income 1,465 1,059 406 38.3 % Total Revenues 235,259 236,760 (1,501) (0.6)% Operating Expenses:(1) Property operating expenses 34,971 34,213 (758) (2.2)% Real estate taxes 33,284 33,383 99 0.3 % Total Operating Expenses 68,255 67,596 (659) (1.0)% Total Same-Center NOI $ 167,004 $ 169,164 $ (2,160) (1.3)% (1) Same-Center represents 278 same-center properties. For additional information, see our reconciliation from Net Income (Loss) to NOI for real estate investments and Same-Center NOI in the appendix of this presentation. (2) Excludes straight-line rental income, net amortization of above- and below-market leases, and lease buyout income. www.phillipsedison.com/investors 7

Financial Results Six Months Ended June 30, 2020 Six Months Ended Favorable June 30, (Unfavorable) (in thousands, except per share amounts) 2020 2019 $ Change % Change Net Income (Loss) $ 4,786 $ (47,960) $ 52,746 110.0 % Adjustments(1) 113,421 152,106 (38,685) (25.4)% FFO Attributable to Stockholders and Convertible 118,207 104,146 14,061 13.5 % Noncontrolling Interests(2) Adjustments(3) (6,259) 6,507 (12,766) NM Core FFO $ 111,948 $ 110,653 $ 1,295 1.2 % Diluted FFO Attributable to Stockholders and Convertible $ 0.35 $ 0.32 $ 0.03 9.4 % Noncontrolling Interests(2)/Share Diluted Core FFO/Share $ 0.34 $ 0.34 $ — — % (1) Adjustments include depreciation and amortization of real estate assets, adjustments for impairment losses on depreciable real estate, net gain/loss on disposal of property, adjustments related to unconsolidated joint ventures, and noncontrolling interests not convertible into common stock. (2) Convertible noncontrolling interests = Phillips Edison Grocery Center Operating Partnership I, L.P. operating partnership units (“OP units”) (3) Adjustments include depreciation and amortization of corporate assets; change in fair value of earn-out liability; loss on extinguishment or modification of debt, net; amortization of unconsolidated joint venture basis differences; other impairment charges; and transaction and acquisition expenses. * See Appendix for a complete reconciliation of Net Income (Loss) to FFO and Core FFO www.phillipsedison.com/investors 8

Same-Center NOI and Core FFO Quarterly and YTD 2020 2019 % Change Same-Center NOI - Q1 $ 86,732 $ 84,492 2.7 % Same Center NOI - Q2 80,272 84,672 (5.2)% Same-Center NOI - YTD $ 167,004 $ 169,164 (1.3)% 2020 2019 % Change Q1 Core FFO $ 60,242 $ 55,594 8.4 % Core FFO per share - diluted $ 0.18 $ 0.17 5.9 % Q2 Core FFO $ 51,706 $ 55,059 (6.1)% Core FFO per share - diluted $ 0.16 $ 0.17 (5.9)% YTD Core FFO $ 111,948 $ 110,653 1.2 % Core FFO per share - diluted $ 0.34 $ 0.34 — % * See Appendix for a complete reconciliation of Net Income (Loss) to FFO and Core FFO and Net Income (Loss) to Same-Center NOI www.phillipsedison.com/investors 9

Debt Profile and Maturity Ladder June 30, 2020 Net Debt to Total Enterprise Value(1) 44.4% Net Debt to Adjusted EBITDAre(2) 7.1x Weighted-Average Interest Rate 3.1% Weighted-Average Years to Maturity(3) 4.5 Fixed-Rate Debt 75.2% Approximate Availability Remaining on $500M Line of Credit(4) $490M 600 500 400 ) s n o i l l i 300 M ( $ 200 100 0 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter Secured Property Debt Unsecured Term Loans (1) Inclusive of our prorated portion of net debt and cash and cash equivalents owned through our joint ventures. Total equity value is calculated as the number of common shares and OP units outstanding multiplied by the EVPS as of June 30, 2020. There were 333.1 million diluted shares outstanding with an EVPS of $8.75 as of June 30, 2020. (2) Adjusted EBITDAre is annualized based on the trailing twelve months. See our reconciliation from Net Income (Loss) to Adjusted EBITDAre in the appendix of this presentation. (3) Excludes any extension options available. (4) Availability reduced by outstanding letters of credit. www.phillipsedison.com/investors 10

Impact of the COVID-19 Pandemic • Second Quarter 2020 U.S. GDP decreased 32.9%, the largest quarterly decrease ever(1) • July 2020 unemployment rate of 10.2%(2) • Initial unemployment claims have been over 1 million for the 20th consecutive week(3) • Concerns about retail - 23 major retailers (both public and private) have filed for bankruptcy(4) • Uncertainty around consumer discretionary spending during and after the pandemic (1) Bureau of Economic Analysis (2) Bureau of Labor Statistics (3) As of August 6, 2020. https://www.cnbc.com/2020/08/06/weekly-jobless-claims.html www.phillipsedison.com/investors (4) As of July 30, 2020. https://www.retaildive.com/news/the-running-list-of-2020-retail-bankruptcies/571159/ 11

PECO Portfolio Neighbor Details by ABR Essential Retail & Services represents businesses generally deemed essential under most state and local stay-at-home orders. ABR = Annualized Base www.phillipsedison.com/investors Rent. Statistics reflect percentage of ABR, including pro rata ownership through our joint ventures. Statistics as of June 30, 2020 12

Portfolio Impact as a Result of the COVID-19 Pandemic 100% of our centers have remained open and operating throughout the COVID-19 pandemic. However, our revenue and collections have been negatively impacted. Total Neighbor Spaces Open(1) Rent and Recoveries Collected(1,2) As a % of total ABR As a % of monthly billings As a % of total spaces 89% 90% 84% 86% 97% 98% 91% 97% 97% 89% 75% 65% April 2020 May 2020 June 2020 July 2020 April 2020 May 2020 June 2020 July 2020 (1) Statistics are approximate and include our pro rata ownership through joint ventures and exclude statistics related to properties that have since been disposed. The total number of neighbor spaces that are or were temporarily closed in connection with COVID-19 is approximately 2,100. (2) Collections include monthly billings for rent and recoveries that were received through August 10, 2020. www.phillipsedison.com/investors 13

Current Response to COVID-19 The following steps have been implemented to maximize financial flexibility and preserve cash given the uncertainty and fluidity of the COVID-19 pandemic: 1. Temporary reductions to the 2020 base salary of the CEO (25%) and executive management team (10%), and a temporary 10% reduction to board members’ base compensation for the 2020-2021 term. 2. Monthly distributions have been temporarily suspended. 3. Capital investments are being prioritized to support the reopening of our neighbors and new leasing, or delayed to the extent possible. 4. Expense reductions have been implemented at the property and corporate levels. 5. The Share Repurchase Program for DDI (death, qualifying disability or determination of incompetence) has been suspended. The Share Repurchase Program for standard requests remains suspended. www.phillipsedison.com/investors 14

Alignment with Stockholders • Temporary executive and board salary/compensation reductions Internal Management Structure • Total compensation for PECO’s CEO and executive management team is highly incentive-based and In 2017, we merged with dependent on Company performance: our external advisor to become a fully internally- • Approximately 83% of total CEO compensation managed REIT. • Approximately 65% of President, CFO, COO, and General Counsel compensation No asset management fees, or any other • The distribution suspension affects executives as well management fees, are (Company’s largest stockholder at ~8% combined) being paid to a third party. www.phillipsedison.com/investors 15

Distributions & Total Return Distributions PECO Total Return Distributions for original PECO stockholders total between and $4.17/ Original PECO investors have seen a total share and $6.32/share.(1) return between 29% and 65% on their original investment.(2) Over $1.3 Billion returned to stockholders in the form of monthly distributions between PECO and REIT II. REIT II Total Return Distributions were temporarily suspended following the April 1, 2020 Former REIT II investors (now PECO payment. investors) have seen a total return between -2% and 10% on their original investment.(3) (1) Depending on timing of investment. Distributions are not guaranteed and are made at the discretion of PECO's board of directors. Distribution rate increased from $0.65 annualized to $0.67 annualized in February 2013. (2) Assumes investment in Phillips Edison & Company, Inc. at $10.00 per share at the end of the initial public offering, assuming distributions are taken in cash; and at the beginning of the offering, assuming distributions are reinvested. (3) Assumes investment in Phillips Edison Grocery Center REIT II, Inc. at $25.00 per share at the end of the initial public offering, assuming distributions are taken in cash; and at the beginning of the offering, assuming distributions are reinvested. www.phillipsedison.com/investors 16

2020 Outlook 1.Focus on preservation of capital and net asset value a. Conserve cash and liquidity during this time of uncertainty b. Support our neighbors in reopening and implement plans to collect missed rent 2.Prepare for future strategic opportunities a. Acquisition opportunities b. Investment management growth c. Liquidity options - partial and full www.phillipsedison.com/investors 17

Question and Answer Session If you are logged in to the webcast presentation you can submit a question by typing it into the text box and clicking “Submit Question” www.phillipsedison.com/investors 18

Thank you for joining us For More Information: InvestorRelations@PhillipsEdison.com www.phillipsedison.com/investors Investors and NIGO Servicing: (888) 518-8073 Phillips Edison Advisor Services: (833) 347-5717 www.phillipsedison.com/investors 19

Appendix

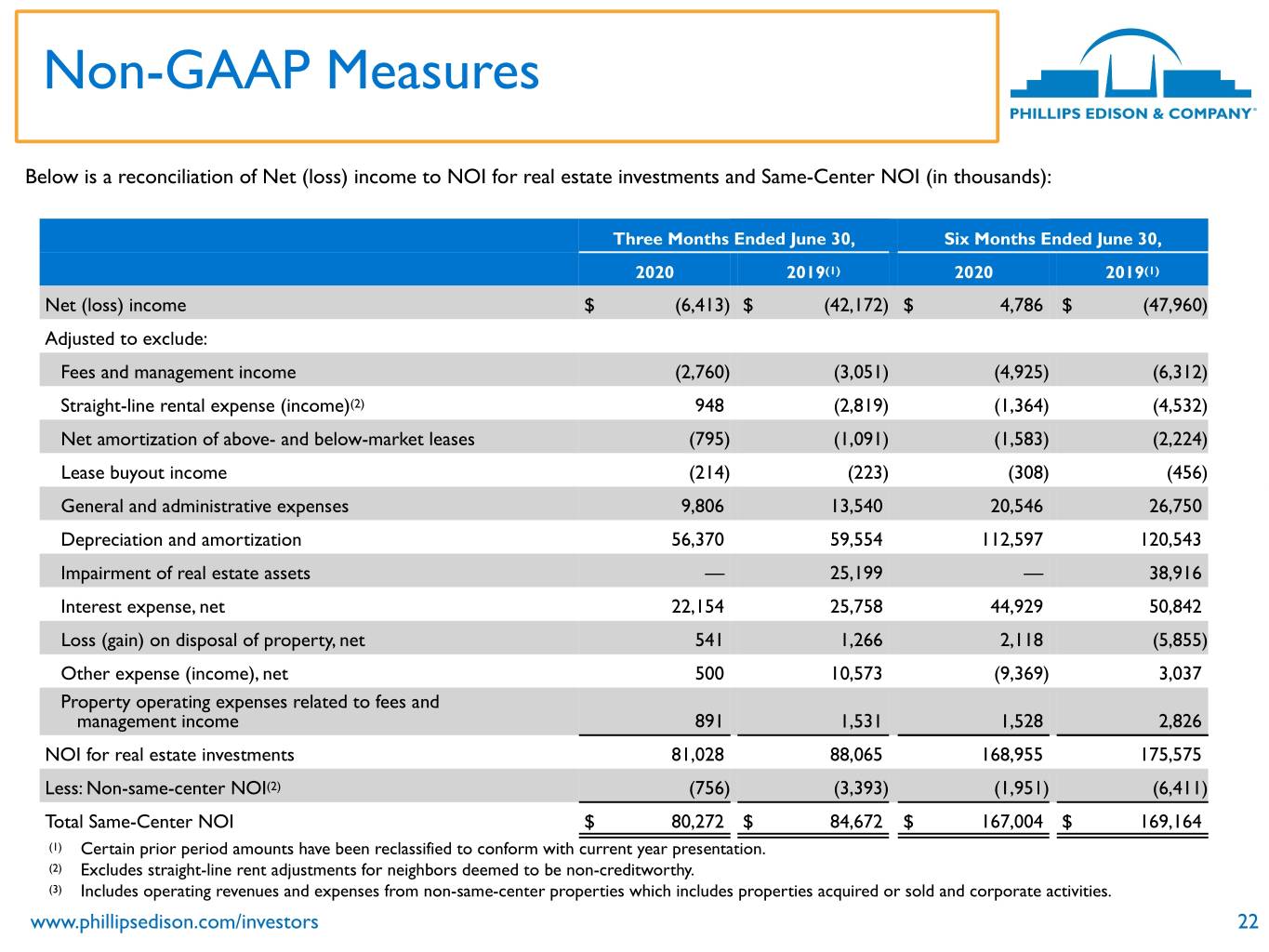

Non-GAAP Measures We present Same-Center NOI as a supplemental measure of our performance. We define NOI as total operating revenues, adjusted to exclude non-cash revenue items, less property operating expenses and real estate taxes. For the three and six months ended June 30, 2020 and 2019, Same-Center NOI represents the NOI for the 278 properties that were wholly-owned and operational for the entire portion of both comparable reporting periods. We believe Same-Center NOI provides useful information to our investors about our financial and operating performance because it provides a performance measure of the revenues and expenses directly involved in owning and operating real estate assets and provides a perspective not immediately apparent from net income (loss). Because Same-Center NOI excludes the change in NOI from properties acquired or disposed of after December 31, 2018, it highlights operating trends such as occupancy levels, rental rates, and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Same-Center NOI, and accordingly, our Same-Center NOI may not be comparable to other REITs. Same-Center NOI should not be viewed as an alternative measure of our financial performance as it does not reflect the operations of our entire portfolio, nor does it reflect the impact of general and administrative expenses, depreciation and amortization, interest expense, other income (expense), or the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties that could materially impact our results from operations. www.phillipsedison.com/investors 21

Non-GAAP Measures Below is a reconciliation of Net (loss) income to NOI for real estate investments and Same-Center NOI (in thousands): Three Months Ended June 30, Six Months Ended June 30, 2020 2019(1) 2020 2019(1) Net (loss) income $ (6,413) $ (42,172) $ 4,786 $ (47,960) Adjusted to exclude: Fees and management income (2,760) (3,051) (4,925) (6,312) Straight-line rental expense (income)(2) 948 (2,819) (1,364) (4,532) Net amortization of above- and below-market leases (795) (1,091) (1,583) (2,224) Lease buyout income (214) (223) (308) (456) General and administrative expenses 9,806 13,540 20,546 26,750 Depreciation and amortization 56,370 59,554 112,597 120,543 Impairment of real estate assets — 25,199 — 38,916 Interest expense, net 22,154 25,758 44,929 50,842 Loss (gain) on disposal of property, net 541 1,266 2,118 (5,855) Other expense (income), net 500 10,573 (9,369) 3,037 Property operating expenses related to fees and management income 891 1,531 1,528 2,826 NOI for real estate investments 81,028 88,065 168,955 175,575 Less: Non-same-center NOI(2) (756) (3,393) (1,951) (6,411) Total Same-Center NOI $ 80,272 $ 84,672 $ 167,004 $ 169,164 (1) Certain prior period amounts have been reclassified to conform with current year presentation. (2) Excludes straight-line rent adjustments for neighbors deemed to be non-creditworthy. (3) Includes operating revenues and expenses from non-same-center properties which includes properties acquired or sold and corporate activities. www.phillipsedison.com/investors 22

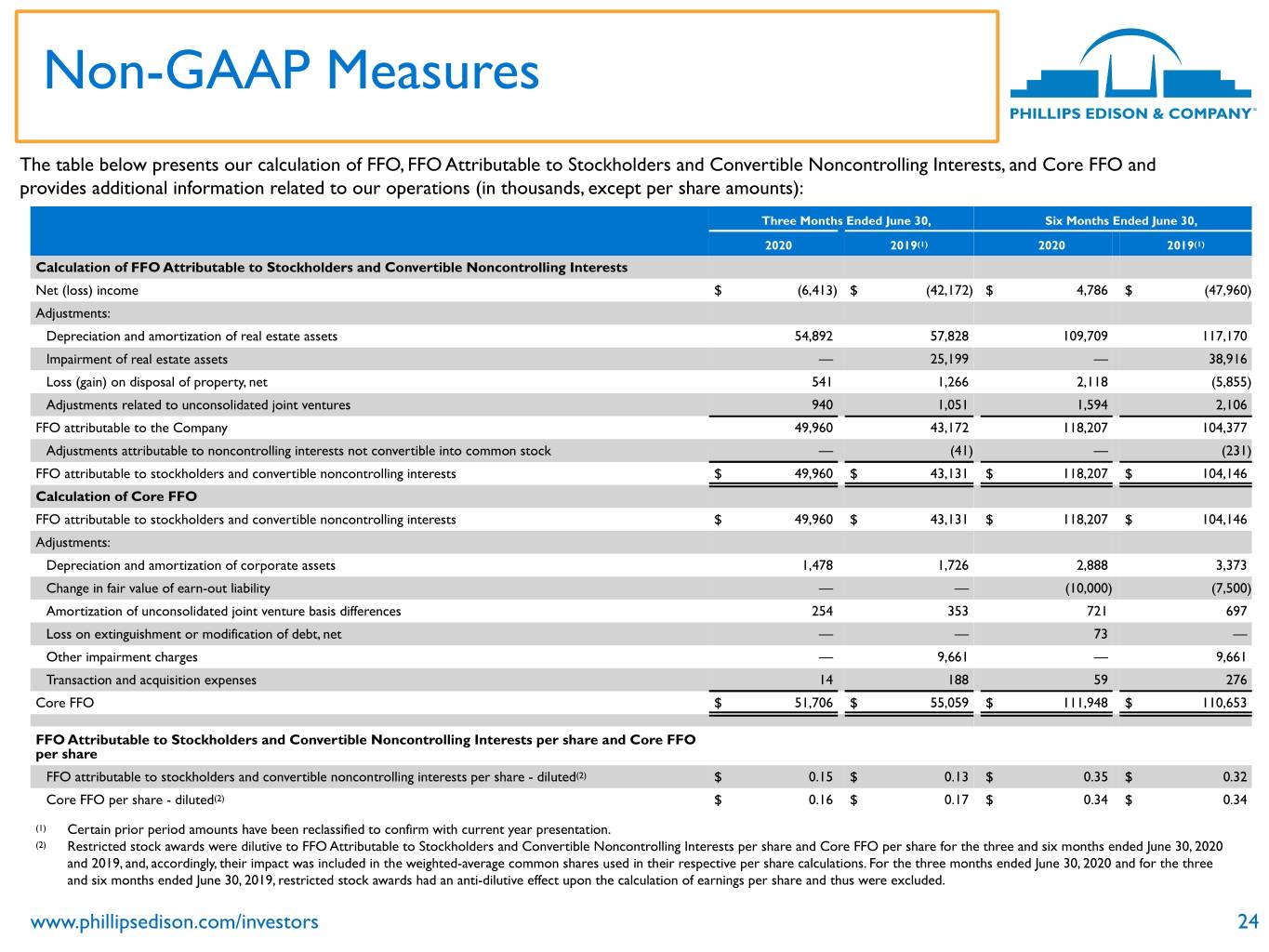

Non-GAAP Measures Funds from Operations and Core Funds from Operations FFO is a non-GAAP performance financial measure that is widely recognized as a measure of REIT operating performance. The National Association of Real Estate Investment Trusts (“Nareit”) defines FFO as net income (loss) computed in accordance with GAAP, excluding gains (or losses) from sales of property and gains (or losses) from change in control, plus depreciation and amortization, and after adjustments for impairment losses on real estate and impairments of in-substance real estate investments in investees that are driven by measurable decreases in the fair value of the depreciable real estate held by the unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect FFO on the same basis. We calculate FFO Attributable to Stockholders and Convertible Noncontrolling Interests in a manner consistent with the Nareit definition, with an additional adjustment made for noncontrolling interests that are not convertible into common stock. Core FFO is an additional performance financial measure used by us as FFO includes certain non-comparable items that affect our performance over time. We believe that Core FFO is helpful in assisting management and investors with the assessment of the sustainability of operating performance in future periods. We believe it is more reflective of our core operating performance and provides an additional measure to compare our performance across reporting periods on a consistent basis by excluding items that may cause short-term fluctuations in net income (loss). To arrive at Core FFO, we adjust FFO attributable to stockholders and convertible noncontrolling interests to exclude certain recurring and non- recurring items including, but not limited to, depreciation and amortization of corporate assets, changes in the fair value of the earn-out liability, amortization of unconsolidated joint venture basis differences, gains or losses on the extinguishment or modification of debt, other impairment charges, and transaction and acquisition expenses. FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO should not be considered alternatives to net income (loss) or income (loss) from continuing operations under GAAP, as an indication of our liquidity, nor as an indication of funds available to cover our cash needs, including our ability to fund distributions. Core FFO may not be a useful measure of the impact of long-term operating performance on value if we do not continue to operate our business plan in the manner currently contemplated. Accordingly, FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. Our FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO, as presented, may not be comparable to amounts calculated by other REITs. www.phillipsedison.com/investors 23

Non-GAAP Measures The table below presents our calculation of FFO, FFO Attributable to Stockholders and Convertible Noncontrolling Interests, and Core FFO and provides additional information related to our operations (in thousands, except per share amounts): Three Months Ended June 30, Six Months Ended June 30, 2020 2019(1) 2020 2019(1) Calculation of FFO Attributable to Stockholders and Convertible Noncontrolling Interests Net (loss) income $ (6,413) $ (42,172) $ 4,786 $ (47,960) Adjustments: Depreciation and amortization of real estate assets 54,892 57,828 109,709 117,170 Impairment of real estate assets — 25,199 — 38,916 Loss (gain) on disposal of property, net 541 1,266 2,118 (5,855) Adjustments related to unconsolidated joint ventures 940 1,051 1,594 2,106 FFO attributable to the Company 49,960 43,172 118,207 104,377 Adjustments attributable to noncontrolling interests not convertible into common stock — (41) — (231) FFO attributable to stockholders and convertible noncontrolling interests $ 49,960 $ 43,131 $ 118,207 $ 104,146 Calculation of Core FFO FFO attributable to stockholders and convertible noncontrolling interests $ 49,960 $ 43,131 $ 118,207 $ 104,146 Adjustments: Depreciation and amortization of corporate assets 1,478 1,726 2,888 3,373 Change in fair value of earn-out liability — — (10,000) (7,500) Amortization of unconsolidated joint venture basis differences 254 353 721 697 Loss on extinguishment or modification of debt, net — — 73 — Other impairment charges — 9,661 — 9,661 Transaction and acquisition expenses 14 188 59 276 Core FFO $ 51,706 $ 55,059 $ 111,948 $ 110,653 FFO Attributable to Stockholders and Convertible Noncontrolling Interests per share and Core FFO per share FFO attributable to stockholders and convertible noncontrolling interests per share - diluted(2) $ 0.15 $ 0.13 $ 0.35 $ 0.32 Core FFO per share - diluted(2) $ 0.16 $ 0.17 $ 0.34 $ 0.34 (1) Certain prior period amounts have been reclassified to confirm with current year presentation. (2) Restricted stock awards were dilutive to FFO Attributable to Stockholders and Convertible Noncontrolling Interests per share and Core FFO per share for the three and six months ended June 30, 2020 and 2019, and, accordingly, their impact was included in the weighted-average common shares used in their respective per share calculations. For the three months ended June 30, 2020 and for the three and six months ended June 30, 2019, restricted stock awards had an anti-dilutive effect upon the calculation of earnings per share and thus were excluded. www.phillipsedison.com/investors 24

Non-GAAP Measures Three Months Ended Favorable June 30, (Unfavorable (in thousands, except per share amounts) 2020 2019 $ Change % Change Net Loss $ (6,413) $ (42,172) $ 35,759 (84.8)% Adjustments(1) 56,373 85,303 (28,930) (33.9)% FFO Attributable to Stockholders and Convertible Noncontrolling Interests(2) 49,960 43,131 6,829 15.8 % Adjustments(3) 1,746 11,928 (10,182) (85.4)% Core FFO $ 51,706 $ 55,059 $ (3,353) (6.1)% Diluted FFO Attributable to Stockholders and Convertible Noncontrolling Interests(2)/Share $ 0.15 $ 0.13 $ 0.02 15.4 % Diluted Core FFO/Share $ 0.16 $ 0.17 $ (0.01) (5.9)% (1) Adjustments include depreciation and amortization of real estate assets, adjustments for impairment losses on depreciable real estate, net gain/loss on disposal of property, adjustments related to unconsolidated joint ventures, and noncontrolling interests not convertible into common stock. (2) Convertible noncontrolling interests = Phillips Edison Grocery Center Operating Partnership I, L.P. OP units. (3) Adjustments include depreciation and amortization of corporate assets; change in fair value of earn-out liability; loss on extinguishment or modification of debt, net; amortization of unconsolidated joint venture basis differences; other impairment charges; and transaction and acquisition expenses. www.phillipsedison.com/investors 25

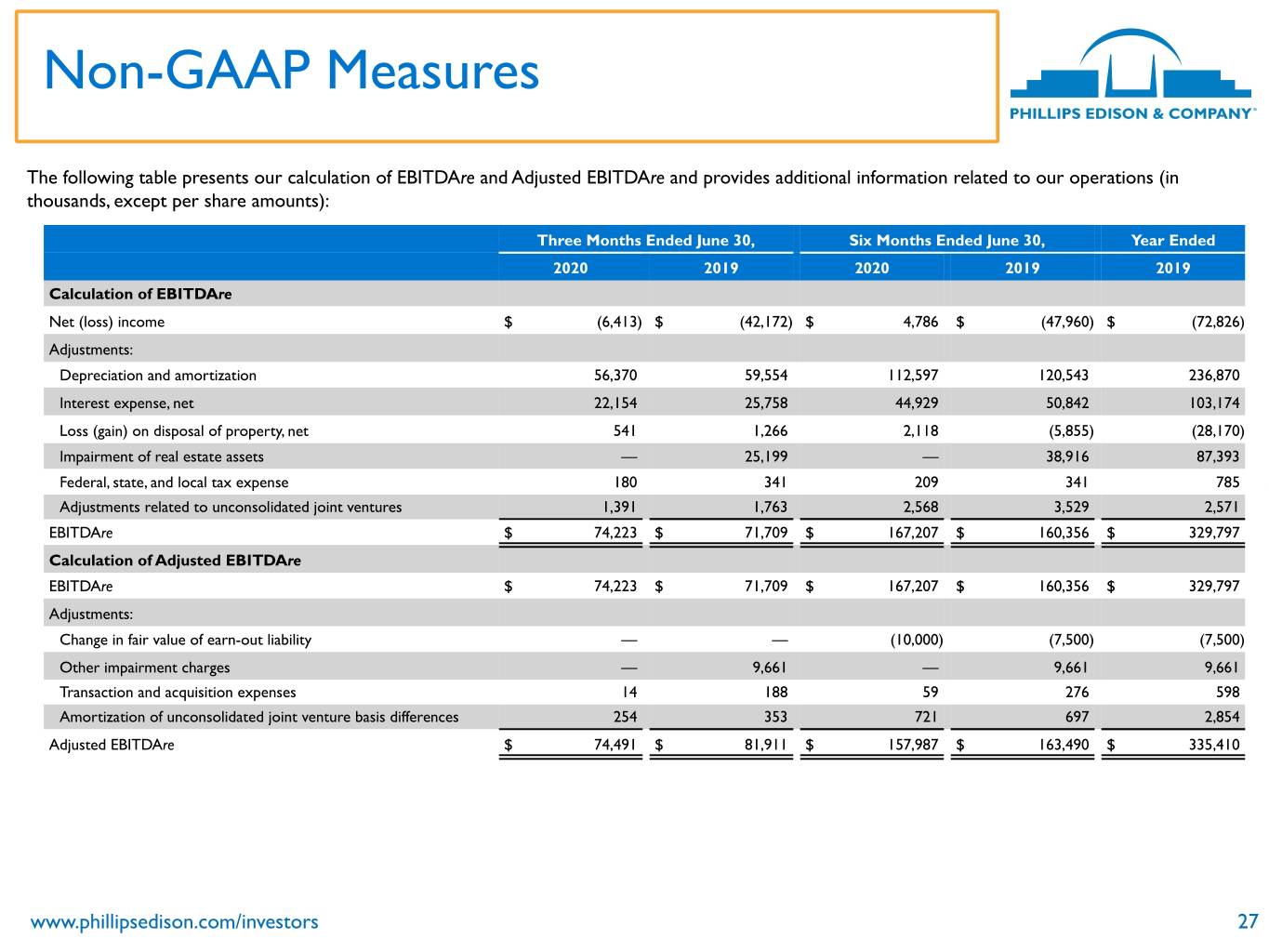

Non-GAAP Measures Earnings Before Interest, Taxes, Depreciation, and Amortization for Real Estate (“EBITDAre”) and Adjusted EBITDAre We have included the calculation of EBITDAre to better align with publicly traded REITs. Additionally, we believe that, as another important earnings metric, it is a useful indicator of our ability to support our debt obligations. Nareit defines EBITDAre as net income (loss) computed in accordance with GAAP before (i) interest expense, (ii) income tax expense, (iii) depreciation and amortization, (iv) gains or losses from disposition of depreciable property, and (v) impairment write-downs of depreciable property. Adjustments for unconsolidated partnerships and joint ventures are calculated to reflect EBITDAre on the same basis. Adjusted EBITDAre is an additional performance measure used by us as EBITDAre includes certain non-comparable items that affect our performance over time. To arrive at Adjusted EBITDAre, we exclude certain recurring and non-recurring items from EBITDAre, including, but not limited to: (i) changes in the fair value of the earn-out liability; (ii) other impairment charges; (iii) amortization of basis differences in our investments in our unconsolidated joint ventures; and (iv) transaction and acquisition expenses. We use EBITDAre and Adjusted EBITDAre as additional measures of operating performance which allow us to compare earnings independent of capital structure, determine debt service and fixed cost coverage, and measure enterprise value. EBITDAre and Adjusted EBITDAre should not be considered as alternatives to net income (loss), as an indication of our liquidity, nor as an indication of funds available to cover our cash needs, including our ability to fund distributions. Accordingly, EBITDAre and Adjusted EBITDAre should be reviewed in connection with other GAAP measurements, and should not be viewed as more prominent measures of performance than net income (loss) or cash flows from operations prepared in accordance with GAAP. Our EBITDAre and Adjusted EBITDAre, as presented, may not be comparable to amounts calculated by other REITs. www.phillipsedison.com/investors 26

Non-GAAP Measures The following table presents our calculation of EBITDAre and Adjusted EBITDAre and provides additional information related to our operations (in thousands, except per share amounts): Three Months Ended June 30, Six Months Ended June 30, Year Ended 2020 2019 2020 2019 2019 Calculation of EBITDAre Net (loss) income $ (6,413) $ (42,172) $ 4,786 $ (47,960) $ (72,826) Adjustments: Depreciation and amortization 56,370 59,554 112,597 120,543 236,870 Interest expense, net 22,154 25,758 44,929 50,842 103,174 Loss (gain) on disposal of property, net 541 1,266 2,118 (5,855) (28,170) Impairment of real estate assets — 25,199 — 38,916 87,393 Federal, state, and local tax expense 180 341 209 341 785 Adjustments related to unconsolidated joint ventures 1,391 1,763 2,568 3,529 2,571 EBITDAre $ 74,223 $ 71,709 $ 167,207 $ 160,356 $ 329,797 Calculation of Adjusted EBITDAre EBITDAre $ 74,223 $ 71,709 $ 167,207 $ 160,356 $ 329,797 Adjustments: Change in fair value of earn-out liability — — (10,000) (7,500) (7,500) Other impairment charges — 9,661 — 9,661 9,661 Transaction and acquisition expenses 14 188 59 276 598 Amortization of unconsolidated joint venture basis differences 254 353 721 697 2,854 Adjusted EBITDAre $ 74,491 $ 81,911 $ 157,987 $ 163,490 $ 335,410 www.phillipsedison.com/investors 27

Non-GAAP Measures The following table presents our calculation of net debt to Adjusted EBITDAre and net debt to total enterprise value as of June 30, 2020 and December 31, 2019 (dollars in thousands): June 30, 2020 December 31, 2019 Net debt to Adjusted EBITDAre - annualized: Net debt $ 2,329,659 $ 2,403,144 Adjusted EBITDAre - annualized(1) 329,907 335,410 Net debt to Adjusted EBITDAre - annualized 7.1x 7.2x Net debt to total enterprise value Net debt $ 2,329,659 $ 2,403,144 Total enterprise value 5,244,590 6,085,305 Net debt to total enterprise value 44.4% 39.5% (1) Adjusted EBITDAre is annualized based on trailing twelve months. www.phillipsedison.com/investors 28