Attached files

| file | filename |

|---|---|

| 8-K - 8-K - XOMA Corp | d89703d8k.htm |

Exhibit 99.1 CORPORATE PRESENTATION A ROYALTY AGGREGATION COMPANY AUGUST 2020 NASDAQ: XOMA 1Exhibit 99.1 CORPORATE PRESENTATION A ROYALTY AGGREGATION COMPANY AUGUST 2020 NASDAQ: XOMA 1

DISCLAIMERS Certain statements in this presentation are forward-looking Potential risks to XOMA meeting these expectations are statements within the meaning of Section 27A of the Securities described in more detail in XOMA's most recent filing on Form Act of 1933 and Section 21E of the Securities Exchange Act of 10-K and in other SEC filings. Consider such risks carefully when 1934, including statements regarding: future potential considering XOMA's prospects. Any forward-looking statements monetization opportunities, active transactions with significant represent XOMA’s views only as of the date of this presentation financial implications, collaborations poised for significant and should not be relied upon as representing its views as of any financial contribution, our library of potentially value-generating subsequent date. XOMA disclaims any obligation to update any assets, future potential for milestone and royalty payments, the forward-looking statement, except as required by law. potential of our antibody discovery engine, potential out-licensing of our internal compounds and products, the ability of our NOTE: All references to “portfolio” in this presentation are to partners and their licensees to successfully develop their pipeline milestone and/or royalty rights associated with a basket of drug programs, the productivity of acquired assets, our revenue products in development. All references to “assets” in this forecasts, upcoming internal milestones and value catalysts, our presentation are to milestone and/or royalty rights associated future cash needs, our strategy for value creation, and other with individual drug product candidates in development. statements that relate to future periods. These statements are References to royalties or royalty rates contained herein refer to not guarantees of future performance and undue reliance should future potential payment streams regardless of whether or not not be placed on them. They are based on assumptions that may they are technically defined as royalties in the underlying not prove accurate, and actual results could differ materially from contractual agreement; further, any rates referenced herein are those anticipated due to certain risks inherent in the subject to potential future contractual adjustments. biotechnology industry and for companies engaged in the development of new products in a regulated market. 2DISCLAIMERS Certain statements in this presentation are forward-looking Potential risks to XOMA meeting these expectations are statements within the meaning of Section 27A of the Securities described in more detail in XOMA's most recent filing on Form Act of 1933 and Section 21E of the Securities Exchange Act of 10-K and in other SEC filings. Consider such risks carefully when 1934, including statements regarding: future potential considering XOMA's prospects. Any forward-looking statements monetization opportunities, active transactions with significant represent XOMA’s views only as of the date of this presentation financial implications, collaborations poised for significant and should not be relied upon as representing its views as of any financial contribution, our library of potentially value-generating subsequent date. XOMA disclaims any obligation to update any assets, future potential for milestone and royalty payments, the forward-looking statement, except as required by law. potential of our antibody discovery engine, potential out-licensing of our internal compounds and products, the ability of our NOTE: All references to “portfolio” in this presentation are to partners and their licensees to successfully develop their pipeline milestone and/or royalty rights associated with a basket of drug programs, the productivity of acquired assets, our revenue products in development. All references to “assets” in this forecasts, upcoming internal milestones and value catalysts, our presentation are to milestone and/or royalty rights associated future cash needs, our strategy for value creation, and other with individual drug product candidates in development. statements that relate to future periods. These statements are References to royalties or royalty rates contained herein refer to not guarantees of future performance and undue reliance should future potential payment streams regardless of whether or not not be placed on them. They are based on assumptions that may they are technically defined as royalties in the underlying not prove accurate, and actual results could differ materially from contractual agreement; further, any rates referenced herein are those anticipated due to certain risks inherent in the subject to potential future contractual adjustments. biotechnology industry and for companies engaged in the development of new products in a regulated market. 2

XOMA SNAPSHOT ▪ Acquire pre-commercial drug royalties ₋ Use portfolio approach to expand number of royalty positions ₋ Differentiate by focusing on development-stage assets with blockbuster potential licensed to large-cap partners ▪ Provide exposure, through royalties, to the upside potential of biotech ₋ Capital-efficient model where R&D costs are borne by partners ₋ Cash inflows from interim milestone payments ₋ Exposure risk mitigated through portfolio effects ▪ Expected value appreciation driven by: ₋ Advancement of assets by partners who spend hundreds of millions of dollars to develop XOMA royalty assets ₋ Acquisition of additional assets by XOMA to expand revenue potential and further mitigate risk ▪ Portfolio of 65+ assets in >30 disclosed indications today and growing 3 3XOMA SNAPSHOT ▪ Acquire pre-commercial drug royalties ₋ Use portfolio approach to expand number of royalty positions ₋ Differentiate by focusing on development-stage assets with blockbuster potential licensed to large-cap partners ▪ Provide exposure, through royalties, to the upside potential of biotech ₋ Capital-efficient model where R&D costs are borne by partners ₋ Cash inflows from interim milestone payments ₋ Exposure risk mitigated through portfolio effects ▪ Expected value appreciation driven by: ₋ Advancement of assets by partners who spend hundreds of millions of dollars to develop XOMA royalty assets ₋ Acquisition of additional assets by XOMA to expand revenue potential and further mitigate risk ▪ Portfolio of 65+ assets in >30 disclosed indications today and growing 3 3

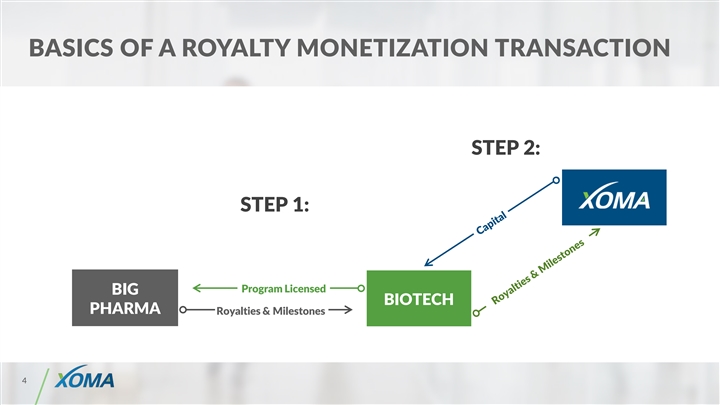

BASICS OF A ROYALTY MONETIZATION TRANSACTION STEP 2: STEP 1: Program Licensed BIG BIOTECH PHARMA Royalties & Milestones 4 4BASICS OF A ROYALTY MONETIZATION TRANSACTION STEP 2: STEP 1: Program Licensed BIG BIOTECH PHARMA Royalties & Milestones 4 4

ROYALTY FINANCINGS CAN HELP COMPANIES RAISE CAPITAL MORE EFFICIENTLY THAN EQUITY AND IS LESS ONEROUS THAN DEBT Equity Equity Debt Royalty Financing Debt Cost of Capital High Medium to High Low to Medium Dilution High Low NA Royalty Financing Medium High Low Covenants/Restrictions High Medium to High Low Transaction Cost Control High Low to Medium NA Diligence/Disruption High Medium to High Low N/A All Assets Limited to Royalty Asset(s) Collateral 5 COST OF CAPITALROYALTY FINANCINGS CAN HELP COMPANIES RAISE CAPITAL MORE EFFICIENTLY THAN EQUITY AND IS LESS ONEROUS THAN DEBT Equity Equity Debt Royalty Financing Debt Cost of Capital High Medium to High Low to Medium Dilution High Low NA Royalty Financing Medium High Low Covenants/Restrictions High Medium to High Low Transaction Cost Control High Low to Medium NA Diligence/Disruption High Medium to High Low N/A All Assets Limited to Royalty Asset(s) Collateral 5 COST OF CAPITAL

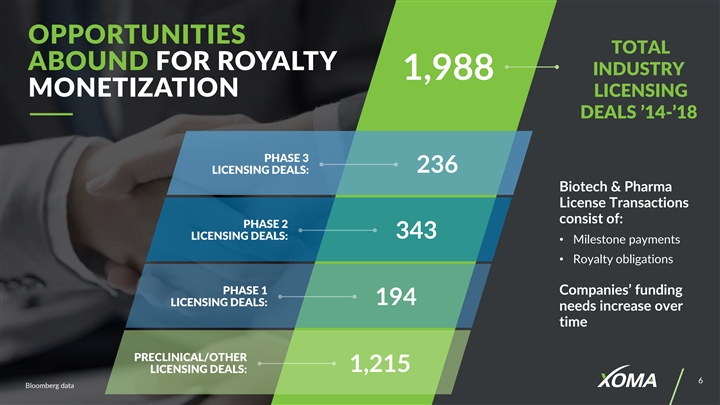

OPPORTUNITIES TOTAL ABOUND FOR ROYALTY INDUSTRY 1,988 MONETIZATION LICENSING DEALS ’14-’18 PHASE 3 236 LICENSING DEALS: Biotech & Pharma License Transactions consist of: PHASE 2 343 LICENSING DEALS: • Milestone payments • Royalty obligations PHASE 1 Companies’ funding 194 LICENSING DEALS: needs increase over time PRECLINICAL/OTHER 1,215 LICENSING DEALS: 6 Bloomberg dataOPPORTUNITIES TOTAL ABOUND FOR ROYALTY INDUSTRY 1,988 MONETIZATION LICENSING DEALS ’14-’18 PHASE 3 236 LICENSING DEALS: Biotech & Pharma License Transactions consist of: PHASE 2 343 LICENSING DEALS: • Milestone payments • Royalty obligations PHASE 1 Companies’ funding 194 LICENSING DEALS: needs increase over time PRECLINICAL/OTHER 1,215 LICENSING DEALS: 6 Bloomberg data

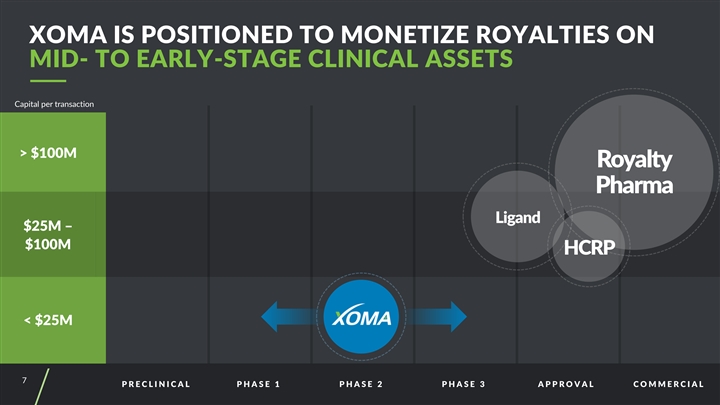

XOMA IS POSITIONED TO MONETIZE ROYALTIES ON MID- TO EARLY-STAGE CLINICAL ASSETS Capital per transaction > $100M Royalty Pharma Ligand $25M – $100M HCRP < $25M 7 P R E C L I N I C A L P H A S E 1 P H A S E 2 P H A S E 3 A P P R O V A L C O M M E R C I A LXOMA IS POSITIONED TO MONETIZE ROYALTIES ON MID- TO EARLY-STAGE CLINICAL ASSETS Capital per transaction > $100M Royalty Pharma Ligand $25M – $100M HCRP < $25M 7 P R E C L I N I C A L P H A S E 1 P H A S E 2 P H A S E 3 A P P R O V A L C O M M E R C I A L

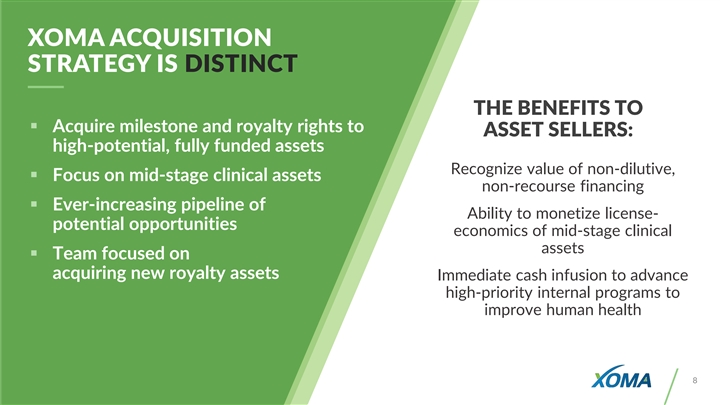

XOMA ACQUISITION STRATEGY IS DISTINCT THE BENEFITS TO ▪ Acquire milestone and royalty rights to ASSET SELLERS: high-potential, fully funded assets Recognize value of non-dilutive, ▪ Focus on mid-stage clinical assets non-recourse financing ▪ Ever-increasing pipeline of Ability to monetize license- potential opportunities economics of mid-stage clinical assets ▪ Team focused on acquiring new royalty assets Immediate cash infusion to advance high-priority internal programs to improve human health 8XOMA ACQUISITION STRATEGY IS DISTINCT THE BENEFITS TO ▪ Acquire milestone and royalty rights to ASSET SELLERS: high-potential, fully funded assets Recognize value of non-dilutive, ▪ Focus on mid-stage clinical assets non-recourse financing ▪ Ever-increasing pipeline of Ability to monetize license- potential opportunities economics of mid-stage clinical assets ▪ Team focused on acquiring new royalty assets Immediate cash infusion to advance high-priority internal programs to improve human health 8

KEY ATTRIBUTES OF XOMA TARGET ASSETS STRONG DEVELOPER/MARKETER Assets partnered with high-quality pharma / biopharma companies PRE-COMMERCIAL THERAPEUTIC ASSETS R x Therapeutic area agnostic LONG DURATION OF MARKET EXCLUSIVITY Patent expiration or regulatory exclusivity HIGH REVENUE POTENTIAL High unmet need or clear clinical benefit over alternatives 9 9KEY ATTRIBUTES OF XOMA TARGET ASSETS STRONG DEVELOPER/MARKETER Assets partnered with high-quality pharma / biopharma companies PRE-COMMERCIAL THERAPEUTIC ASSETS R x Therapeutic area agnostic LONG DURATION OF MARKET EXCLUSIVITY Patent expiration or regulatory exclusivity HIGH REVENUE POTENTIAL High unmet need or clear clinical benefit over alternatives 9 9

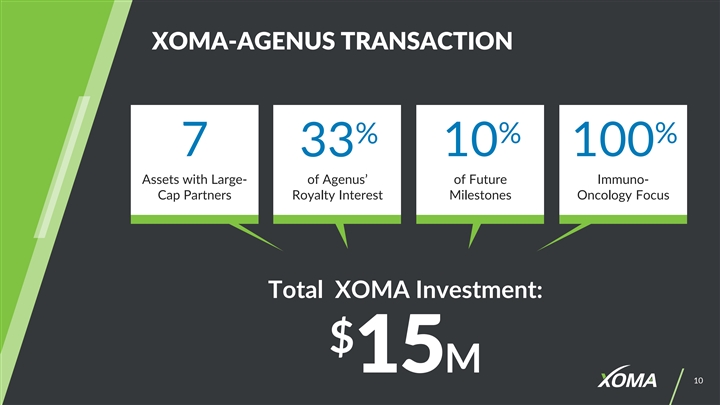

XOMA-AGENUS TRANSACTION % % % 7 10 100 33 Assets with Large- of Agenus’ of Future Immuno- Cap Partners Royalty Interest Milestones Oncology Focus Total XOMA Investment: $ 15M 10XOMA-AGENUS TRANSACTION % % % 7 10 100 33 Assets with Large- of Agenus’ of Future Immuno- Cap Partners Royalty Interest Milestones Oncology Focus Total XOMA Investment: $ 15M 10

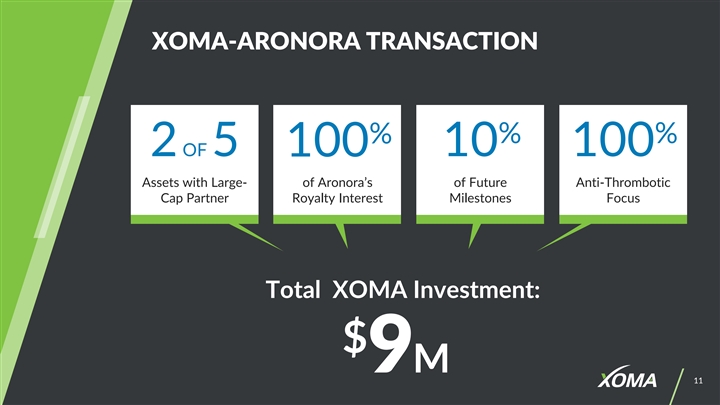

XOMA-ARONORA TRANSACTION % % % 2 OF 5 10 100 100 Assets with Large- of Aronora’s of Future Anti-Thrombotic Cap Partner Royalty Interest Milestones Focus Total XOMA Investment: $ 9M 11XOMA-ARONORA TRANSACTION % % % 2 OF 5 10 100 100 Assets with Large- of Aronora’s of Future Anti-Thrombotic Cap Partner Royalty Interest Milestones Focus Total XOMA Investment: $ 9M 11

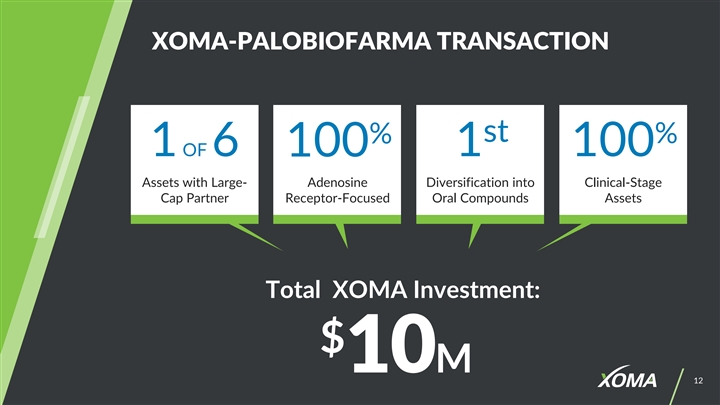

XOMA-PALOBIOFARMA TRANSACTION st % % 1 OF 6 1 100 100 Assets with Large- Adenosine Diversification into Clinical-Stage Cap Partner Receptor-Focused Oral Compounds Assets Total XOMA Investment: $ 10M 12XOMA-PALOBIOFARMA TRANSACTION st % % 1 OF 6 1 100 100 Assets with Large- Adenosine Diversification into Clinical-Stage Cap Partner Receptor-Focused Oral Compounds Assets Total XOMA Investment: $ 10M 12

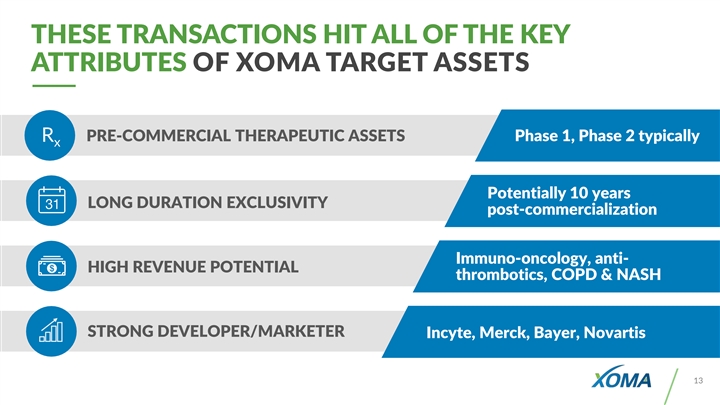

THESE TRANSACTIONS HIT ALL OF THE KEY ATTRIBUTES OF XOMA TARGET ASSETS PRE-COMMERCIAL THERAPEUTIC ASSETS Phase 1, Phase 2 typically R x Potentially 10 years LONG DURATION EXCLUSIVITY post-commercialization Immuno-oncology, anti- HIGH REVENUE POTENTIAL thrombotics, COPD & NASH STRONG DEVELOPER/MARKETER Incyte, Merck, Bayer, Novartis 13THESE TRANSACTIONS HIT ALL OF THE KEY ATTRIBUTES OF XOMA TARGET ASSETS PRE-COMMERCIAL THERAPEUTIC ASSETS Phase 1, Phase 2 typically R x Potentially 10 years LONG DURATION EXCLUSIVITY post-commercialization Immuno-oncology, anti- HIGH REVENUE POTENTIAL thrombotics, COPD & NASH STRONG DEVELOPER/MARKETER Incyte, Merck, Bayer, Novartis 13

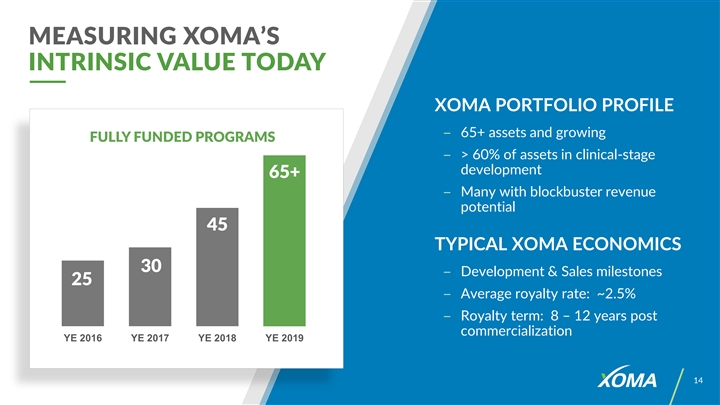

MEASURING XOMA’S INTRINSIC VALUE TODAY XOMA PORTFOLIO PROFILE ‒ 65+ assets and growing FULLY FUNDED PROGRAMS ‒ > 60% of assets in clinical-stage development 65+ ‒ Many with blockbuster revenue potential 45 TYPICAL XOMA ECONOMICS 30 ‒ Development & Sales milestones 25 ‒ Average royalty rate: ~2.5% ‒ Royalty term: 8 – 12 years post commercialization YE 2016 YE 2017 YE 2018 YE 2019 14MEASURING XOMA’S INTRINSIC VALUE TODAY XOMA PORTFOLIO PROFILE ‒ 65+ assets and growing FULLY FUNDED PROGRAMS ‒ > 60% of assets in clinical-stage development 65+ ‒ Many with blockbuster revenue potential 45 TYPICAL XOMA ECONOMICS 30 ‒ Development & Sales milestones 25 ‒ Average royalty rate: ~2.5% ‒ Royalty term: 8 – 12 years post commercialization YE 2016 YE 2017 YE 2018 YE 2019 14

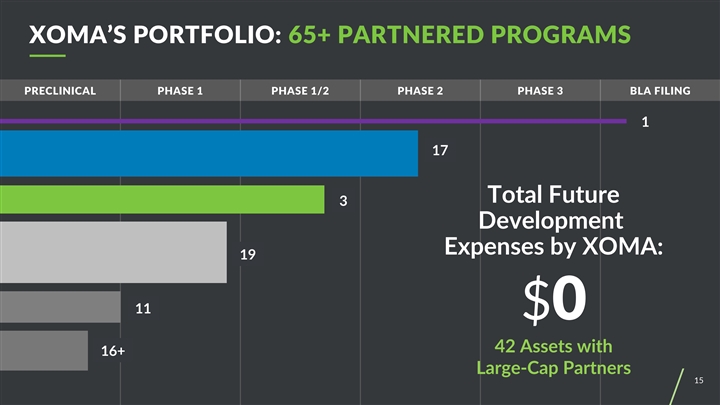

XOMA’S PORTFOLIO: 65+ PARTNERED PROGRAMS PRECLINICAL PHASE 1 PHASE 1/2 PHASE 2 PHASE 3 BLA FILING 1 17 Total Future 3 Development Expenses by XOMA: 19 11 $0 42 Assets with 16+ Large-Cap Partners 15XOMA’S PORTFOLIO: 65+ PARTNERED PROGRAMS PRECLINICAL PHASE 1 PHASE 1/2 PHASE 2 PHASE 3 BLA FILING 1 17 Total Future 3 Development Expenses by XOMA: 19 11 $0 42 Assets with 16+ Large-Cap Partners 15

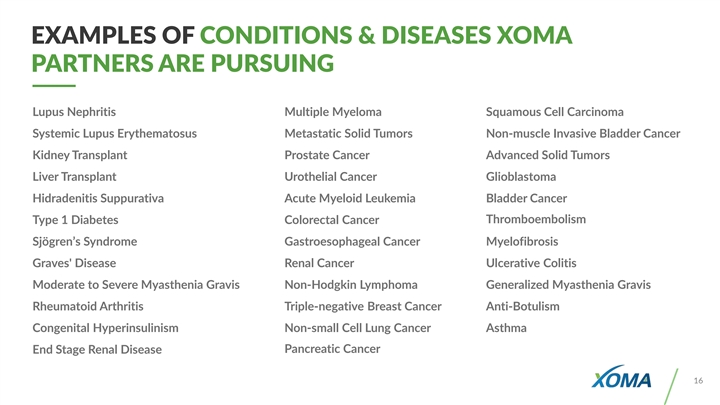

EXAMPLES OF CONDITIONS & DISEASES XOMA PARTNERS ARE PURSUING Lupus Nephritis Multiple Myeloma Squamous Cell Carcinoma Systemic Lupus Erythematosus Metastatic Solid Tumors Non-muscle Invasive Bladder Cancer Kidney Transplant Prostate Cancer Advanced Solid Tumors Liver Transplant Urothelial Cancer Glioblastoma Hidradenitis Suppurativa Acute Myeloid Leukemia Bladder Cancer Thromboembolism Type 1 Diabetes Colorectal Cancer Sjögren’s Syndrome Gastroesophageal Cancer Myelofibrosis Graves' Disease Renal Cancer Ulcerative Colitis Moderate to Severe Myasthenia Gravis Non-Hodgkin Lymphoma Generalized Myasthenia Gravis Rheumatoid Arthritis Triple-negative Breast Cancer Anti-Botulism Congenital Hyperinsulinism Non-small Cell Lung Cancer Asthma Pancreatic Cancer End Stage Renal Disease 16EXAMPLES OF CONDITIONS & DISEASES XOMA PARTNERS ARE PURSUING Lupus Nephritis Multiple Myeloma Squamous Cell Carcinoma Systemic Lupus Erythematosus Metastatic Solid Tumors Non-muscle Invasive Bladder Cancer Kidney Transplant Prostate Cancer Advanced Solid Tumors Liver Transplant Urothelial Cancer Glioblastoma Hidradenitis Suppurativa Acute Myeloid Leukemia Bladder Cancer Thromboembolism Type 1 Diabetes Colorectal Cancer Sjögren’s Syndrome Gastroesophageal Cancer Myelofibrosis Graves' Disease Renal Cancer Ulcerative Colitis Moderate to Severe Myasthenia Gravis Non-Hodgkin Lymphoma Generalized Myasthenia Gravis Rheumatoid Arthritis Triple-negative Breast Cancer Anti-Botulism Congenital Hyperinsulinism Non-small Cell Lung Cancer Asthma Pancreatic Cancer End Stage Renal Disease 16

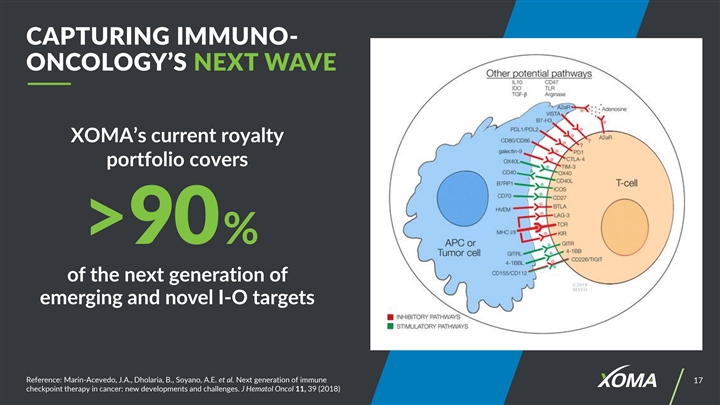

CAPTURING IMMUNO- ONCOLOGY’S NEXT WAVE XOMA’s current royalty portfolio covers >90% of the next generation of emerging and novel I-O targets Reference: Marin-Acevedo, J.A., Dholaria, B., Soyano, A.E. et al. Next generation of immune 17 checkpoint therapy in cancer: new developments and challenges. J Hematol Oncol 11, 39 (2018)CAPTURING IMMUNO- ONCOLOGY’S NEXT WAVE XOMA’s current royalty portfolio covers >90% of the next generation of emerging and novel I-O targets Reference: Marin-Acevedo, J.A., Dholaria, B., Soyano, A.E. et al. Next generation of immune 17 checkpoint therapy in cancer: new developments and challenges. J Hematol Oncol 11, 39 (2018)

(Does not include all assets, including XOMA’S PORTFOLIO: KEY HIGHLIGHTS certain assets subject to confidentiality agreements) PARTNER ASSET NAME TARGET ROYALTY RATE PARTNER ASSET NAME TARGET ROYALTY RATE Bayer BAY1213790 (osocimab) Factor XIa Low single-digit Alligator Bioscience (Janssen) JNJ-64457107 (mitazalimab) CD40 0.75% Bayer BAY1831865 Factor XI Low single-digit Aronora AB002 (ProCase) E-WE thrombin Low single-digit Incyte INCAGN1876 GITR Mid-single-digit Aronora AB023 (xisomab 3G3) Factor XI Low single-digit Incyte INCAGN1949 OX-40 Mid-single-digit Aronora AB054 Factor XII Low single-digit Incyte INCAGN02390 TIM-3 Low to mid-single-digit AVEO AV-299 (ficlatuzumab) Anti-HGF Low single-digit Incyte INCAGN2385 LAG-3 Low to mid-single-digit Compugen COM902 TIGIT Low single-digit Janssen Biotech JNJ-63723283 (cetrelimab) PD-1 0.75% Margaux Biologics rBPI-21 (XOMA 629) BPI Low to mid-single-digit Janssen Biotech JNJ-55920839 IFN 0.75% NTM-1631, NTM-1632, Ology Bioservices Botulinum neurotoxins 15% NTM-1633, NTM-1634 Janssen Biotech JNJ-63709178 CD123xCD3 0.75% Palobiofarma PBF-680 adenosine A1 Low single-digit Janssen Biotech JNJ-63898081 PSMA 0.75% Palobiofarma PBF-677 adenosine A3 Low single-digit Janssen Biotech JNJ-64232025 CD154 0.75% adenosine A2A / Janssen Biotech undisclosed GPRC5DxCD3 0.75% Palobiofarma PBF-999 Low single-digit Phosphodiesterase 10 (PDE-10) Merck MK-4830 ILT-4 Low single-digit Palobiofarma PBF-1129 adenosine A2B Low single-digit Novartis CFZ533 (iscalimab) CD-40 Mid-single-digit to low-teens Palobiofarma PBF-1650 adenosine A3 Low single-digit Novartis VPM087 (gevokizumab) IL-1ß High single-digit to mid-teens Rezolute RZ358 INSR High single-digit to mid-teens Novartis NIS793 TGFß Mid-single digit to low teens Rezolute RZ402 Kallikrein Inhibitor Low single-digit Novartis NIR178 adenosine A2A Low single-digit Sesen Bio (Formerly Eleven Bio & Vicineum™ EpCAM antigens 0.875% Takeda TAK-079 CD-38 4% Viventia) Takeda (Molecular TAK-169 CD-38 4% Templates) > $1 billion in potential milestones 18(Does not include all assets, including XOMA’S PORTFOLIO: KEY HIGHLIGHTS certain assets subject to confidentiality agreements) PARTNER ASSET NAME TARGET ROYALTY RATE PARTNER ASSET NAME TARGET ROYALTY RATE Bayer BAY1213790 (osocimab) Factor XIa Low single-digit Alligator Bioscience (Janssen) JNJ-64457107 (mitazalimab) CD40 0.75% Bayer BAY1831865 Factor XI Low single-digit Aronora AB002 (ProCase) E-WE thrombin Low single-digit Incyte INCAGN1876 GITR Mid-single-digit Aronora AB023 (xisomab 3G3) Factor XI Low single-digit Incyte INCAGN1949 OX-40 Mid-single-digit Aronora AB054 Factor XII Low single-digit Incyte INCAGN02390 TIM-3 Low to mid-single-digit AVEO AV-299 (ficlatuzumab) Anti-HGF Low single-digit Incyte INCAGN2385 LAG-3 Low to mid-single-digit Compugen COM902 TIGIT Low single-digit Janssen Biotech JNJ-63723283 (cetrelimab) PD-1 0.75% Margaux Biologics rBPI-21 (XOMA 629) BPI Low to mid-single-digit Janssen Biotech JNJ-55920839 IFN 0.75% NTM-1631, NTM-1632, Ology Bioservices Botulinum neurotoxins 15% NTM-1633, NTM-1634 Janssen Biotech JNJ-63709178 CD123xCD3 0.75% Palobiofarma PBF-680 adenosine A1 Low single-digit Janssen Biotech JNJ-63898081 PSMA 0.75% Palobiofarma PBF-677 adenosine A3 Low single-digit Janssen Biotech JNJ-64232025 CD154 0.75% adenosine A2A / Janssen Biotech undisclosed GPRC5DxCD3 0.75% Palobiofarma PBF-999 Low single-digit Phosphodiesterase 10 (PDE-10) Merck MK-4830 ILT-4 Low single-digit Palobiofarma PBF-1129 adenosine A2B Low single-digit Novartis CFZ533 (iscalimab) CD-40 Mid-single-digit to low-teens Palobiofarma PBF-1650 adenosine A3 Low single-digit Novartis VPM087 (gevokizumab) IL-1ß High single-digit to mid-teens Rezolute RZ358 INSR High single-digit to mid-teens Novartis NIS793 TGFß Mid-single digit to low teens Rezolute RZ402 Kallikrein Inhibitor Low single-digit Novartis NIR178 adenosine A2A Low single-digit Sesen Bio (Formerly Eleven Bio & Vicineum™ EpCAM antigens 0.875% Takeda TAK-079 CD-38 4% Viventia) Takeda (Molecular TAK-169 CD-38 4% Templates) > $1 billion in potential milestones 18

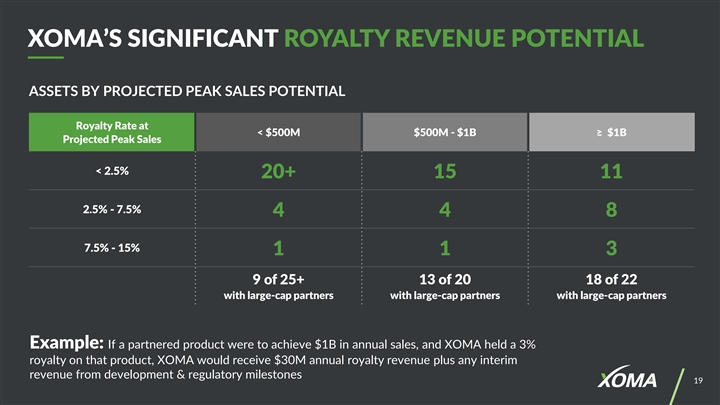

XOMA’S SIGNIFICANT ROYALTY REVENUE POTENTIAL ASSETS BY PROJECTED PEAK SALES POTENTIAL Royalty Rate at < $500M $500M - $1B ≥ $1B Projected Peak Sales < 2.5% 20+ 15 11 2.5% - 7.5% 4 4 8 7.5% - 15% 1 1 3 9 of 25+ 13 of 20 18 of 22 with large-cap partners with large-cap partners with large-cap partners Example: If a partnered product were to achieve $1B in annual sales, and XOMA held a 3% royalty on that product, XOMA would receive $30M annual royalty revenue plus any interim revenue from development & regulatory milestones 19XOMA’S SIGNIFICANT ROYALTY REVENUE POTENTIAL ASSETS BY PROJECTED PEAK SALES POTENTIAL Royalty Rate at < $500M $500M - $1B ≥ $1B Projected Peak Sales < 2.5% 20+ 15 11 2.5% - 7.5% 4 4 8 7.5% - 15% 1 1 3 9 of 25+ 13 of 20 18 of 22 with large-cap partners with large-cap partners with large-cap partners Example: If a partnered product were to achieve $1B in annual sales, and XOMA held a 3% royalty on that product, XOMA would receive $30M annual royalty revenue plus any interim revenue from development & regulatory milestones 19

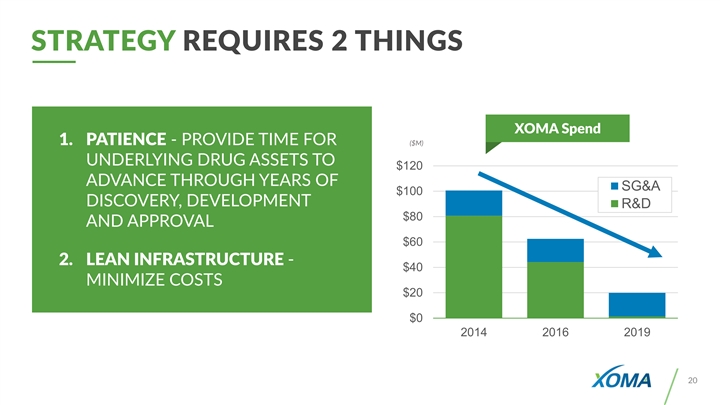

STRATEGY REQUIRES 2 THINGS XOMA Spend 1. PATIENCE - PROVIDE TIME FOR ($M) UNDERLYING DRUG ASSETS TO $120 ADVANCE THROUGH YEARS OF SG&A $100 DISCOVERY, DEVELOPMENT R&D $80 AND APPROVAL $60 2. LEAN INFRASTRUCTURE - $40 MINIMIZE COSTS $20 $0 2014 2016 2019 20STRATEGY REQUIRES 2 THINGS XOMA Spend 1. PATIENCE - PROVIDE TIME FOR ($M) UNDERLYING DRUG ASSETS TO $120 ADVANCE THROUGH YEARS OF SG&A $100 DISCOVERY, DEVELOPMENT R&D $80 AND APPROVAL $60 2. LEAN INFRASTRUCTURE - $40 MINIMIZE COSTS $20 $0 2014 2016 2019 20

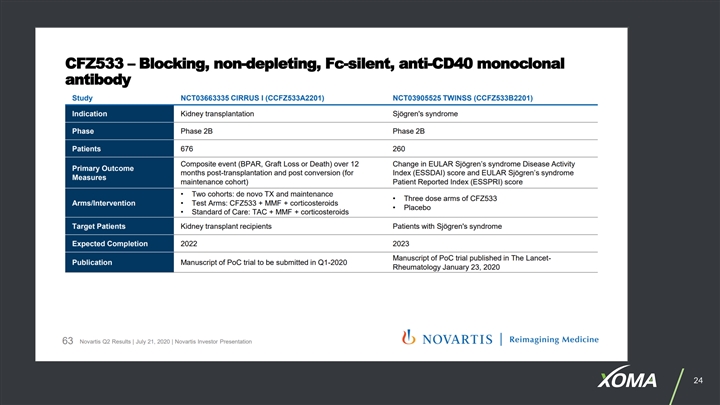

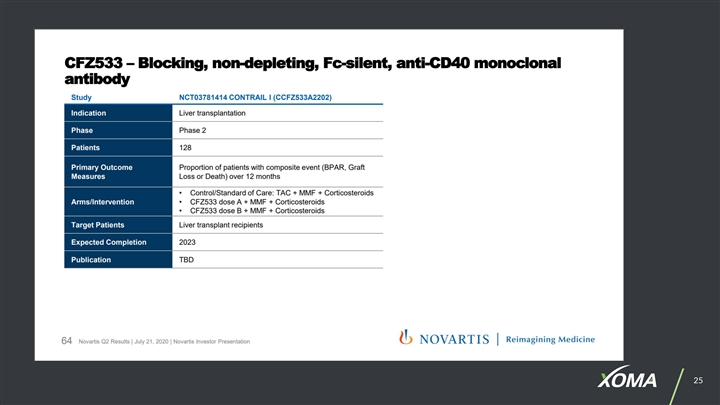

RECENT HIGHLIGHTS OPERATIONAL PARTNERS & PARTNERED ASSETS ▪ Increased number of royalty licenses by 40% since 3Q18 ▪ Novartis ₋ Oncology clinical studies with gevokizumab ▪ Acquired milestone & royalty interests in: started ‒ 2 Bayer assets & 3 unpartnered assets from Aronora ₋ Iscalimab (CFZ533) data presentations - American Transplant Congress, European College of ‒ 1 Novartis asset & 5 unpartnered assets from Rheumatology, 2019 R&D Day Palobiofarma ₋ Multiple Phase 2 trials initiated with iscalimab ‒ Future assets from 2 technology platform companies ▪ Sesen Bio & Vicineum™ for the treatment of BCG- ▪ Added 9 Janssen Biotech assets to royalty interest unresponsive non-muscle invasive bladder cancer portfolio ₋ Rolling BLA initiated Dec 2019 ▪ Licensed XOMA’s IL-2 mAb to Zydus for development and commercialization rights in India, Mexico, and Brazil ▪ Takeda ▪ Received $15.8M from partners during 2019 ‒ TAK-079 & TAK-169 Data presentations at American Society of Hematology (ASH) Annual ▪ Completed $22M Rights Offering; backstopped by BVF Meeting 2019 Partners ▪ Ology Bioservices ▪ Added Natasha A. Hernday to Board of Directors ₋ DoD award to advance anti-botulinum neurotoxin 21 21 monoclonal antibodiesRECENT HIGHLIGHTS OPERATIONAL PARTNERS & PARTNERED ASSETS ▪ Increased number of royalty licenses by 40% since 3Q18 ▪ Novartis ₋ Oncology clinical studies with gevokizumab ▪ Acquired milestone & royalty interests in: started ‒ 2 Bayer assets & 3 unpartnered assets from Aronora ₋ Iscalimab (CFZ533) data presentations - American Transplant Congress, European College of ‒ 1 Novartis asset & 5 unpartnered assets from Rheumatology, 2019 R&D Day Palobiofarma ₋ Multiple Phase 2 trials initiated with iscalimab ‒ Future assets from 2 technology platform companies ▪ Sesen Bio & Vicineum™ for the treatment of BCG- ▪ Added 9 Janssen Biotech assets to royalty interest unresponsive non-muscle invasive bladder cancer portfolio ₋ Rolling BLA initiated Dec 2019 ▪ Licensed XOMA’s IL-2 mAb to Zydus for development and commercialization rights in India, Mexico, and Brazil ▪ Takeda ▪ Received $15.8M from partners during 2019 ‒ TAK-079 & TAK-169 Data presentations at American Society of Hematology (ASH) Annual ▪ Completed $22M Rights Offering; backstopped by BVF Meeting 2019 Partners ▪ Ology Bioservices ▪ Added Natasha A. Hernday to Board of Directors ₋ DoD award to advance anti-botulinum neurotoxin 21 21 monoclonal antibodies

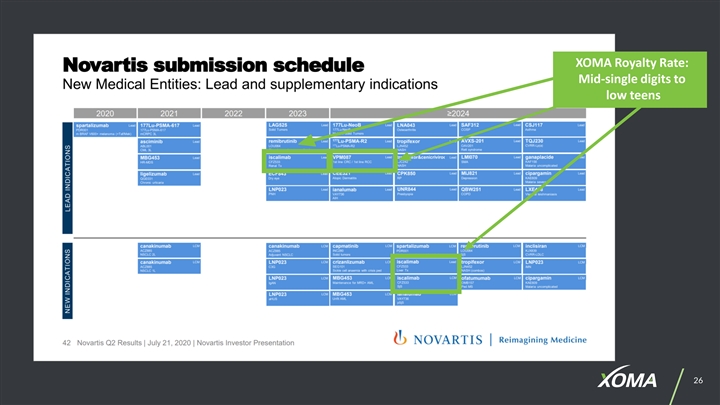

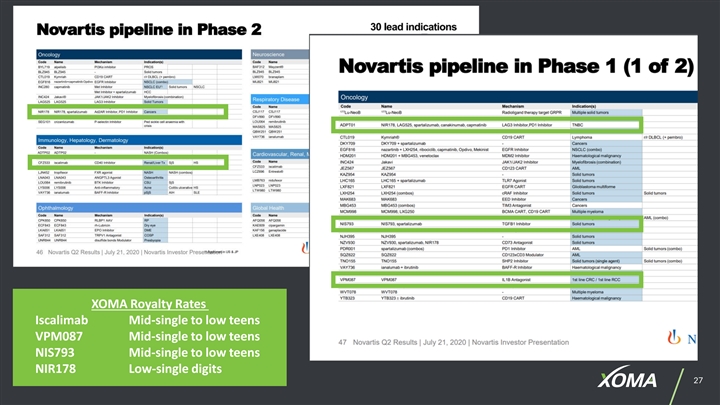

PARTNERS & LOOKING AHEAD PARTNERED ASSETS OPERATIONAL NOVARTIS Iscalimab data readouts – multiple Phase 2 studies ▪ Acquire additional milestone NOVARTIS TGFβ advancing to Phase 2 and royalty interest assets to continue to grow the portfolio NOVARTIS Gevokizumab advancing to Phase 2 ▪ Maintain lean cost MERCK infrastructure and financial MK-4830 advancing to Phase 2 discipline TAKEDA TAK-079 advancing to Phase 2 ‒ Current balance sheet sufficient to fund operations for multiple years SESEN BIO Completed BLA Filing / PDUFA date ‒ ~$1M per month core G&A expense 22PARTNERS & LOOKING AHEAD PARTNERED ASSETS OPERATIONAL NOVARTIS Iscalimab data readouts – multiple Phase 2 studies ▪ Acquire additional milestone NOVARTIS TGFβ advancing to Phase 2 and royalty interest assets to continue to grow the portfolio NOVARTIS Gevokizumab advancing to Phase 2 ▪ Maintain lean cost MERCK infrastructure and financial MK-4830 advancing to Phase 2 discipline TAKEDA TAK-079 advancing to Phase 2 ‒ Current balance sheet sufficient to fund operations for multiple years SESEN BIO Completed BLA Filing / PDUFA date ‒ ~$1M per month core G&A expense 22

2323

2424

2525

XOMA Royalty Rate: Mid-single digits to low teens 26XOMA Royalty Rate: Mid-single digits to low teens 26

XOMA Royalty Rates Iscalimab Mid-single to low teens VPM087 Mid-single to low teens NIS793 Mid-single to low teens NIR178 Low-single digits 27XOMA Royalty Rates Iscalimab Mid-single to low teens VPM087 Mid-single to low teens NIS793 Mid-single to low teens NIR178 Low-single digits 27

WHY XOMA’S PORTFOLIO IS VALUABLE ▪ XOMA holds 65+ current assets; pharmaceutical partners fund research & development and cover 100% of costs ▪ XOMA sources royalty rights through deep industry network ▪ XOMA constructs an increasingly diverse and expanding portfolio to increase odds of success and mitigate binary risk ▪ XOMA has low-cost infrastructure; future potential revenues largely fall to bottom line 28WHY XOMA’S PORTFOLIO IS VALUABLE ▪ XOMA holds 65+ current assets; pharmaceutical partners fund research & development and cover 100% of costs ▪ XOMA sources royalty rights through deep industry network ▪ XOMA constructs an increasingly diverse and expanding portfolio to increase odds of success and mitigate binary risk ▪ XOMA has low-cost infrastructure; future potential revenues largely fall to bottom line 28