Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Charah Solutions, Inc. | chraex991063020.htm |

| 8-K - 8-K - Charah Solutions, Inc. | chra-063020208xk.htm |

Exhibit 99.2 Q2 2020 Earnings Call Presentation August 12, 2020

Forward-Looking Statements Forward-Looking Statements This presentation and our accompanying comments include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about future financial and operating results, the Company’s plans, objectives, estimates, expectations, and intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on our current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward- looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 filed on March 27, 2020 with the Securities and Exchange Commission (“SEC”) and in our other reports filed from time to time with the SEC including our Quarterly Report on Form 10-Q filed on May 12, 2020. There may be other factors of which we are not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. We do not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statements. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with GAAP because management believes such measures are useful to investors. The non-GAAP financial measures are not determined in accordance with GAAP and should not be considered a substitute for performance measures determined in accordance with GAAP. The calculations of the non-GAAP financial measures are subjective, based on management’s belief as to which items should be included or excluded in order to provide the most reasonable and comparable view of the underlying operating performance of the business. We may, from time to time, modify the amounts used to determine our non-GAAP financial measures. Reconciliation of non-GAAP financial measures are included in the supplemental slides in the Appendix of this presentation. Market & Industry Data This presentation includes industry and trade data, forecasts and information that was prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also are based on the Company’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. The Company has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. 2

Agenda . Business Highlights (Scott Sewell, President and CEO) – Business update – Our significant accomplishments – Second quarter 2020 financial highlights – Regulatory and legislative update . Financial Overview (Roger Shannon, CFO and Treasurer) – Second quarter 2020 financial review o Revenue, gross profit, and Adjusted EBITDA comparison o Business segment performance o Cash flow update – Debt and leverage – 2020 guidance . Conclusion (Scott Sewell) . Appendix – Non-GAAP Reconciliations 3

Business Highlights 4

COVID-19 Update The foundation of Charah Solutions business model is built on consistent, mission-critical services for its customers and an unwavering commitment to safety Resilience of operations amidst economic uncertainty – Coal-fired generation plant operators have only 2-3 days of onsite ash storage capacity – Routine nuclear reactor maintenance is non-discretionary, specialized, and predictable – Remediation market driven by environmental regulation, less influenced by macroeconomic conditions – 80% of customers are investment grade-rated regulated utilities – Charah Solutions grew business during the Great Recession in 2008 No Significant Work Stoppages to Date 5

Significant Accomplishments Second Quarter 2020 Actively bidding on more work than any other time in the Company’s history – Proposals in various stages for projects at three major Southeastern utilities that have announced intentions to proceed with large ash pond remediation projects Projecting to exceed full-year 2019 award levels of $583 million – $232 million in new awards on a project revenue basis through Q2 – $367 million in new awards on a project revenue basis YTD through August 11th $28 million in cash flow from operating activities and $27 million in free cash flow1 in the quarter Material reduction in Net Leverage multiple Increased diversification of customer base and broadened geographic reach Significant Pickup in Business Development Activities compared to 2019 6 1. Free cash flow is a non-GAAP measure. Please refer to the supplemental slides in the Appendix for a reconciliation of free cash flow to the nearest GAAP financial measure

Q2 2020 Financial Highlights . Revenues increased 10.1% to $133.1 million as compared to Q2 2019 – Driven by: . (i) absence of the $10.0 million revenue reversal associated with the Brickhaven deemed termination; and, . (ii) additional spring nuclear outage work – Partially offset by project completions in 2019 and a net overall decrease in byproduct sales . Gross profit increased by $12.8 million and Adjusted EBITDA1 increased by $9.9 million – Primarily due to: . (i) absence of the $10.0 million revenue reversal associated with the Brickhaven deemed termination . (ii) net overall increase in margin within our remediation and compliance component; and, . (iii) lower general and administrative expenses 7 1. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure

Second Quarter Financial Overview 8

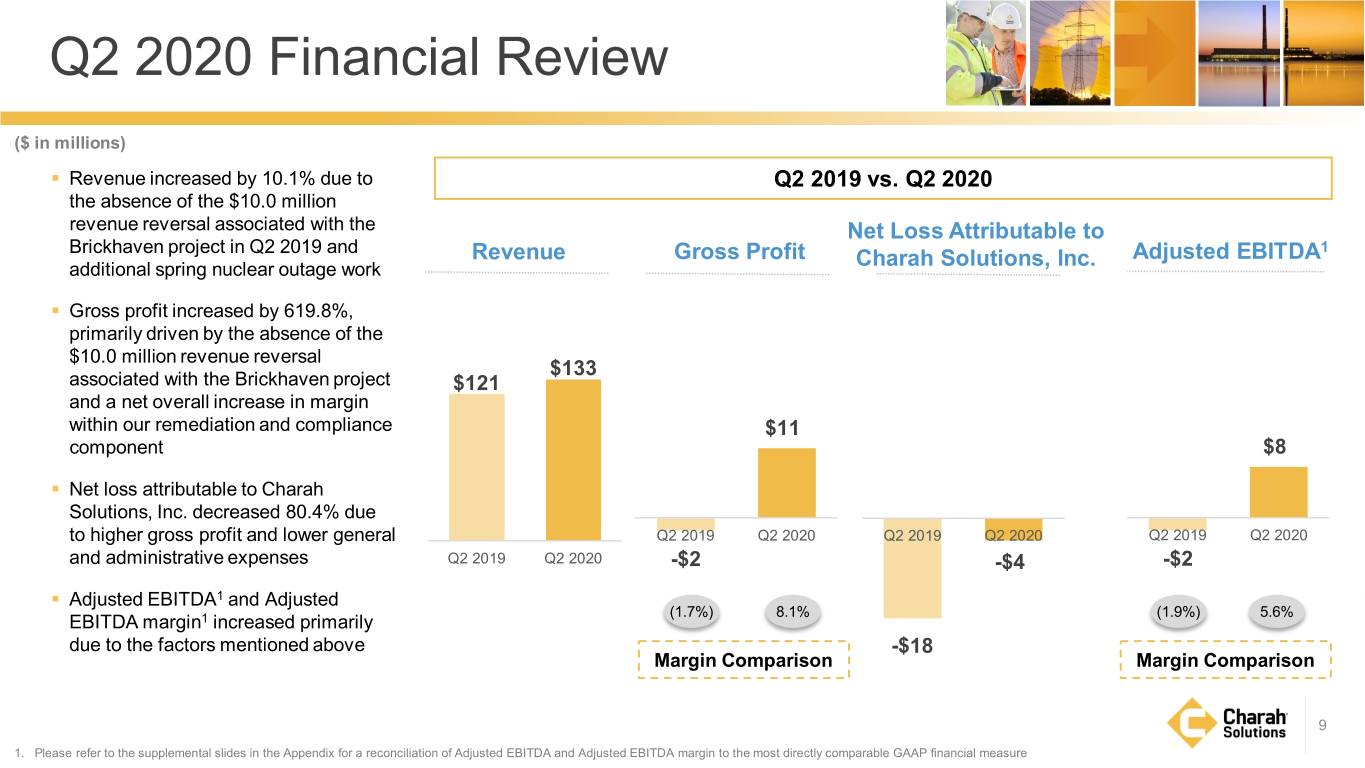

Q2 2020 Financial Review ($ in millions) . Revenue increased by 10.1% due to Q2 2019 vs. Q2 2020 the absence of the $10.0 million revenue reversal associated with the Net Loss Attributable to Brickhaven project in Q2 2019 and Revenue Gross Profit Adjusted EBITDA1 additional spring nuclear outage work Charah Solutions, Inc. . Gross profit increased by 619.8%, primarily driven by the absence of the $10.0 million revenue reversal $133 associated with the Brickhaven project $121 and a net overall increase in margin within our remediation and compliance $11 component $8 . Net loss attributable to Charah Solutions, Inc. decreased 80.4% due to higher gross profit and lower general Q2 2019 Q2 2020 Q2 2019 Q2 2020 Q2 2019 Q2 2020 and administrative expenses Q2 2019 Q2 2020 -$2 -$4 -$2 . Adjusted EBITDA1 and Adjusted (1.7%) 8.1% (1.9%) 5.6% EBITDA margin1 increased primarily due to the factors mentioned above -$18 Margin Comparison Margin Comparison 9 1. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA and Adjusted EBITDA margin to the most directly comparable GAAP financial measure

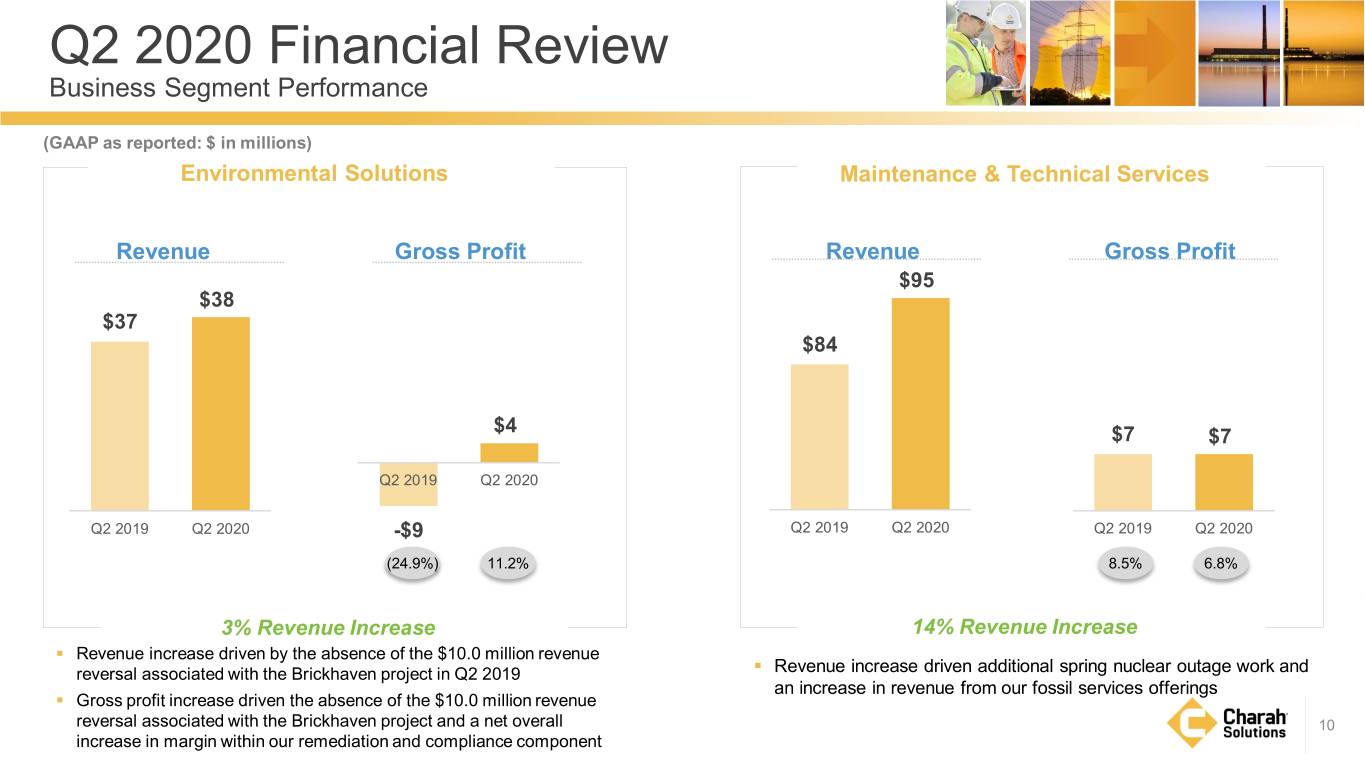

Q2 2020 Financial Review Business Segment Performance (GAAP as reported: $ in millions) Environmental Solutions Maintenance & Technical Services Revenue Gross Profit Revenue Gross Profit $95 $38 $37 $84 $4 $7 $7 Q2 2019 Q2 2020 Q2 2019 Q2 2020 -$9 Q2 2019 Q2 2020 Q2 2019 Q2 2020 (24.9%) 11.2% 8.5% 6.8% 3% Revenue Increase 14% Revenue Increase . Revenue increase driven by the absence of the $10.0 million revenue . reversal associated with the Brickhaven project in Q2 2019 Revenue increase driven additional spring nuclear outage work and an increase in revenue from our fossil services offerings . Gross profit increase driven the absence of the $10.0 million revenue reversal associated with the Brickhaven project and a net overall 10 increase in margin within our remediation and compliance component

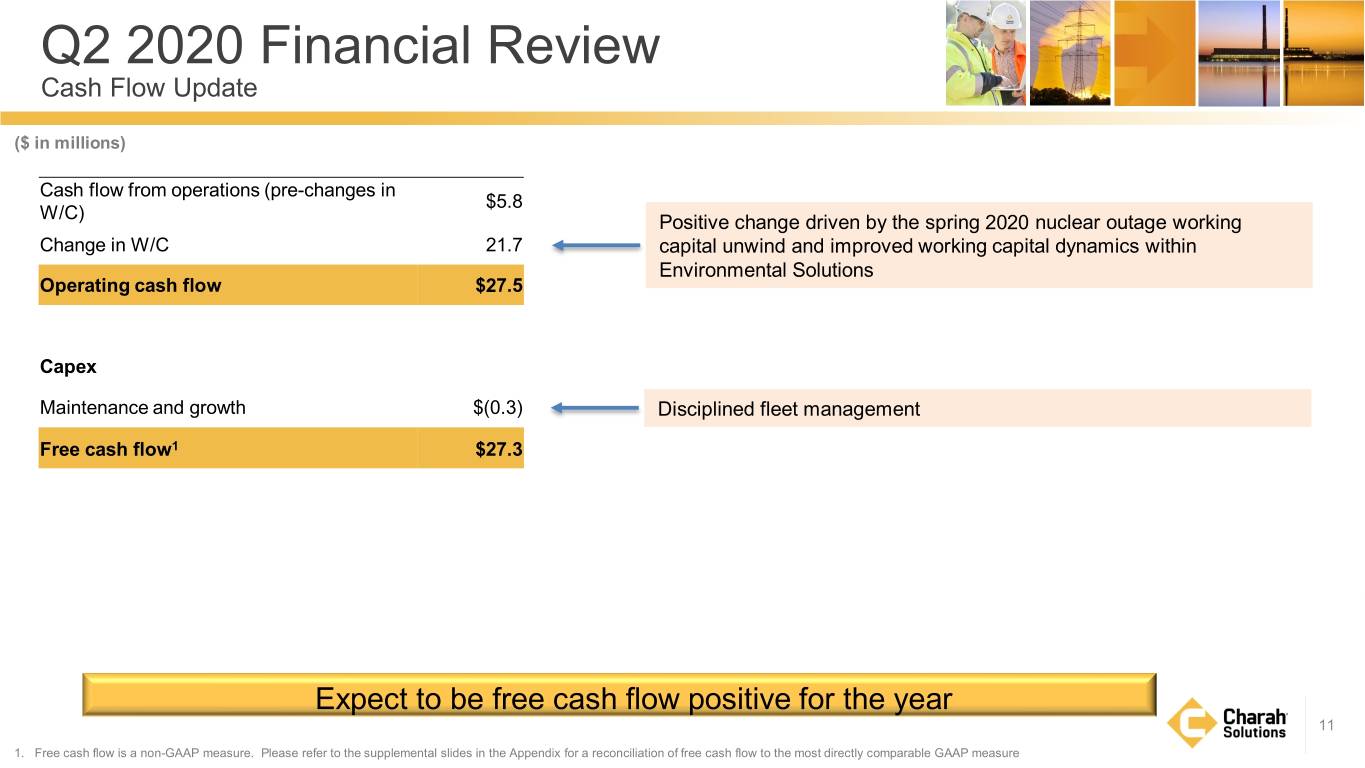

Q2 2020 Financial Review Cash Flow Update ($ in millions) Cash flow from operations (pre-changes in $5.8 W/C) Positive change driven by the spring 2020 nuclear outage working Change in W/C 21.7 capital unwind and improved working capital dynamics within Environmental Solutions Operating cash flow $27.5 Capex Maintenance and growth $(0.3) Disciplined fleet management Free cash flow1 $27.3 Expect to be free cash flow positive for the year 11 1. Free cash flow is a non-GAAP measure. Please refer to the supplemental slides in the Appendix for a reconciliation of free cash flow to the most directly comparable GAAP measure

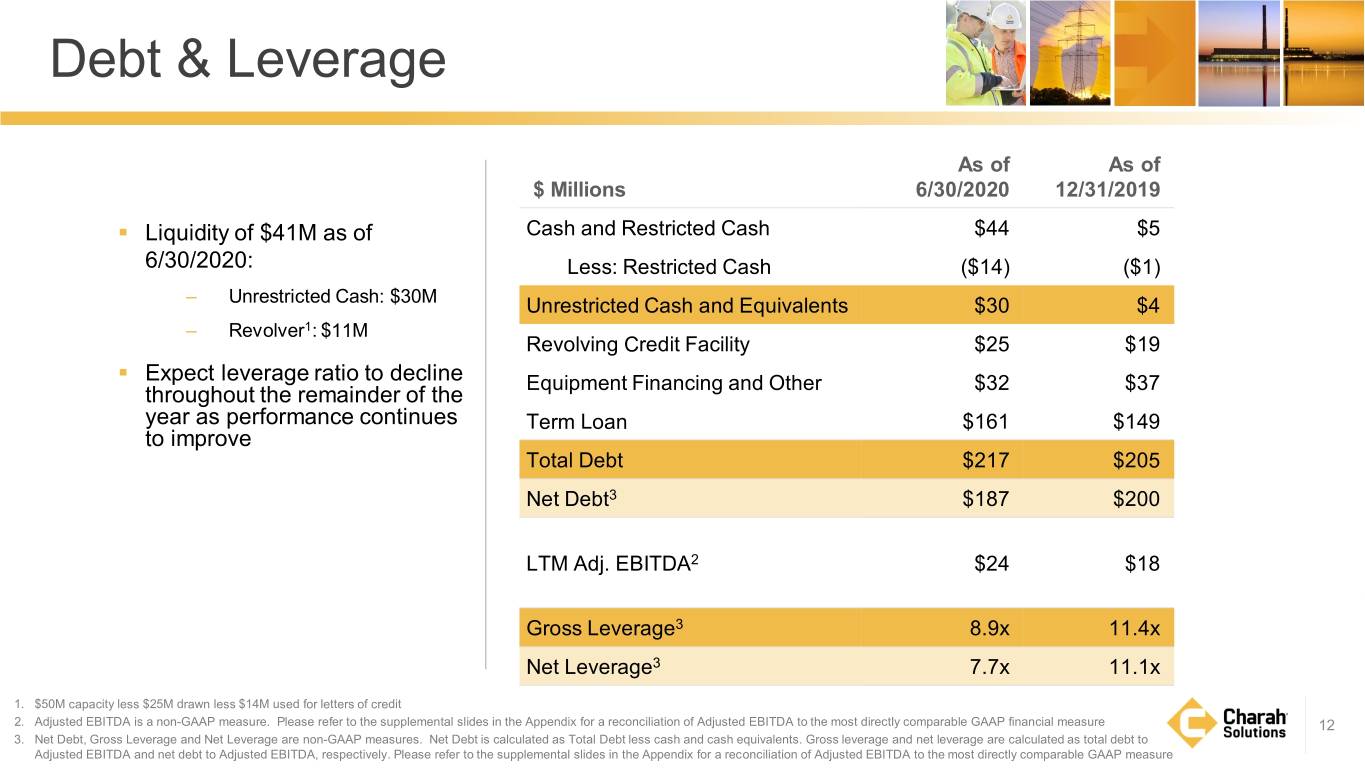

Debt & Leverage As of As of $ Millions 6/30/2020 12/31/2019 . Liquidity of $41M as of Cash and Restricted Cash $44 $5 6/30/2020: Less: Restricted Cash ($14) ($1) – Unrestricted Cash: $30M Unrestricted Cash and Equivalents $30 $4 – Revolver1: $11M Revolving Credit Facility $25 $19 . Expect leverage ratio to decline Equipment Financing and Other $32 $37 throughout the remainder of the year as performance continues Term Loan $161 $149 to improve Total Debt $217 $205 Net Debt3 $187 $200 LTM Adj. EBITDA2 $24 $18 Gross Leverage3 8.9x 11.4x Net Leverage3 7.7x 11.1x 1. $50M capacity less $25M drawn less $14M used for letters of credit 2. Adjusted EBITDA is a non-GAAP measure. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure 12 3. Net Debt, Gross Leverage and Net Leverage are non-GAAP measures. Net Debt is calculated as Total Debt less cash and cash equivalents. Gross leverage and net leverage are calculated as total debt to Adjusted EBITDA and net debt to Adjusted EBITDA, respectively. Please refer to the supplemental slides in the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure

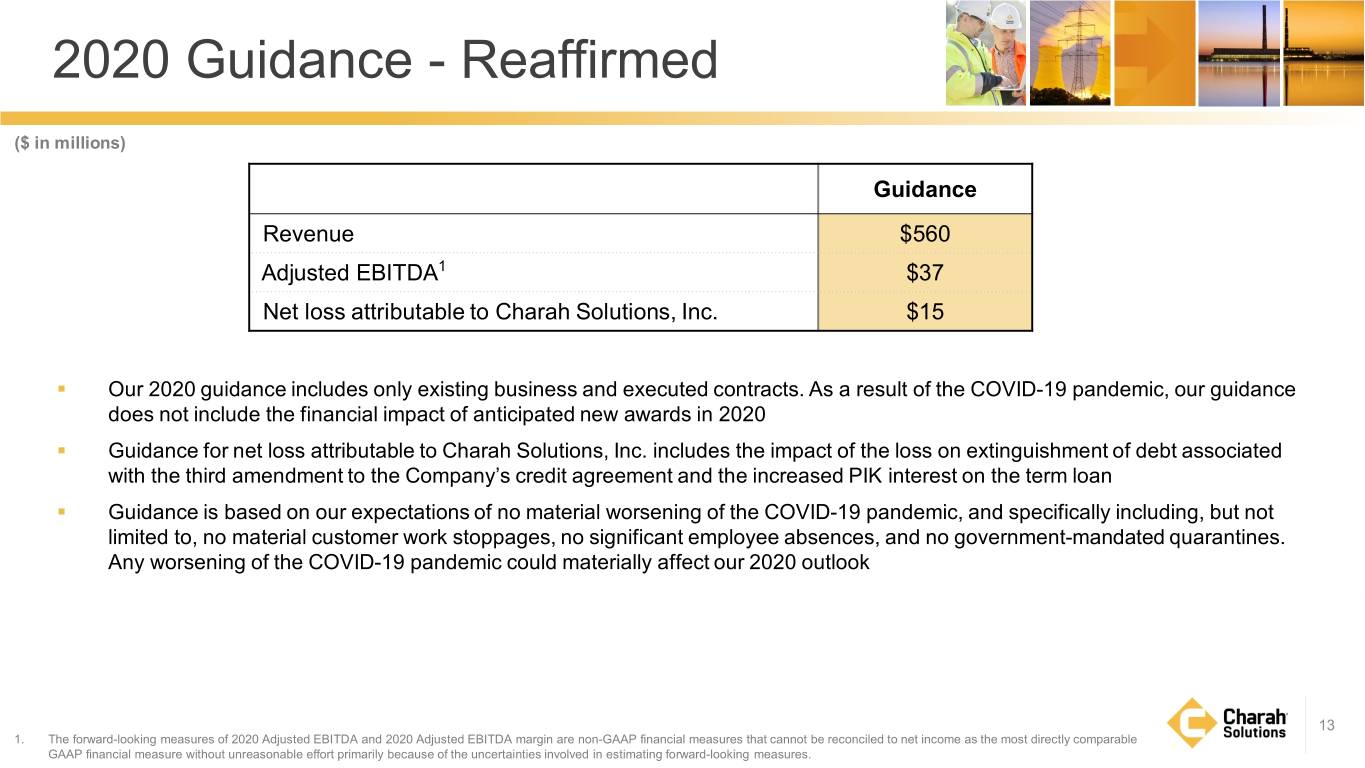

2020 Guidance - Reaffirmed ($ in millions) Guidance Revenue $560 Adjusted EBITDA1 $37 Net loss attributable to Charah Solutions, Inc. $15 . Our 2020 guidance includes only existing business and executed contracts. As a result of the COVID-19 pandemic, our guidance does not include the financial impact of anticipated new awards in 2020 . Guidance for net loss attributable to Charah Solutions, Inc. includes the impact of the loss on extinguishment of debt associated with the third amendment to the Company’s credit agreement and the increased PIK interest on the term loan . Guidance is based on our expectations of no material worsening of the COVID-19 pandemic, and specifically including, but not limited to, no material customer work stoppages, no significant employee absences, and no government-mandated quarantines. Any worsening of the COVID-19 pandemic could materially affect our 2020 outlook 13 1. The forward-looking measures of 2020 Adjusted EBITDA and 2020 Adjusted EBITDA margin are non-GAAP financial measures that cannot be reconciled to net income as the most directly comparable GAAP financial measure without unreasonable effort primarily because of the uncertainties involved in estimating forward-looking measures.

APPENDIX 14

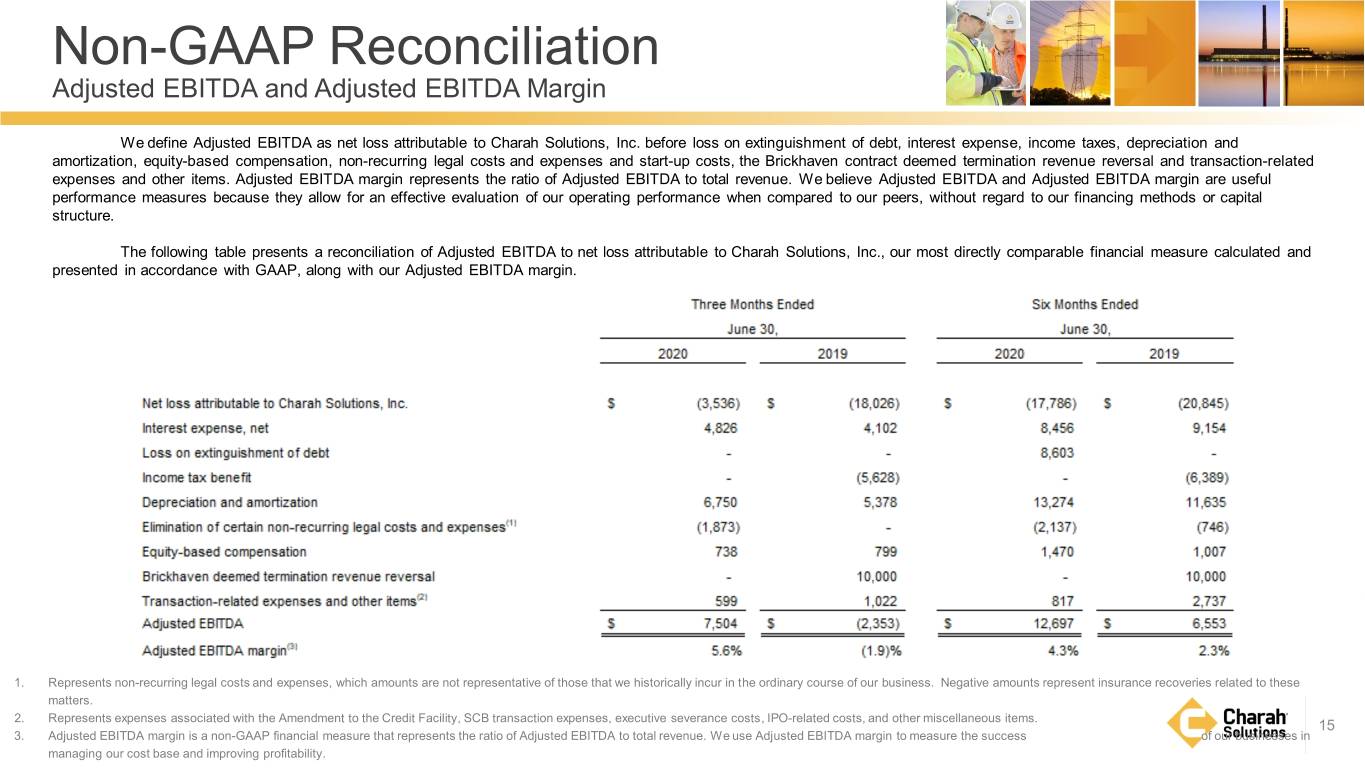

Non-GAAP Reconciliation Adjusted EBITDA and Adjusted EBITDA Margin We define Adjusted EBITDA as net loss attributable to Charah Solutions, Inc. before loss on extinguishment of debt, interest expense, income taxes, depreciation and amortization, equity-based compensation, non-recurring legal costs and expenses and start-up costs, the Brickhaven contract deemed termination revenue reversal and transaction-related expenses and other items. Adjusted EBITDA margin represents the ratio of Adjusted EBITDA to total revenue. We believe Adjusted EBITDA and Adjusted EBITDA margin are useful performance measures because they allow for an effective evaluation of our operating performance when compared to our peers, without regard to our financing methods or capital structure. The following table presents a reconciliation of Adjusted EBITDA to net loss attributable to Charah Solutions, Inc., our most directly comparable financial measure calculated and presented in accordance with GAAP, along with our Adjusted EBITDA margin. 1. Represents non-recurring legal costs and expenses, which amounts are not representative of those that we historically incur in the ordinary course of our business. Negative amounts represent insurance recoveries related to these matters. 2. Represents expenses associated with the Amendment to the Credit Facility, SCB transaction expenses, executive severance costs, IPO-related costs, and other miscellaneous items. 15 3. Adjusted EBITDA margin is a non-GAAP financial measure that represents the ratio of Adjusted EBITDA to total revenue. We use Adjusted EBITDA margin to measure the success of our businesses in managing our cost base and improving profitability.

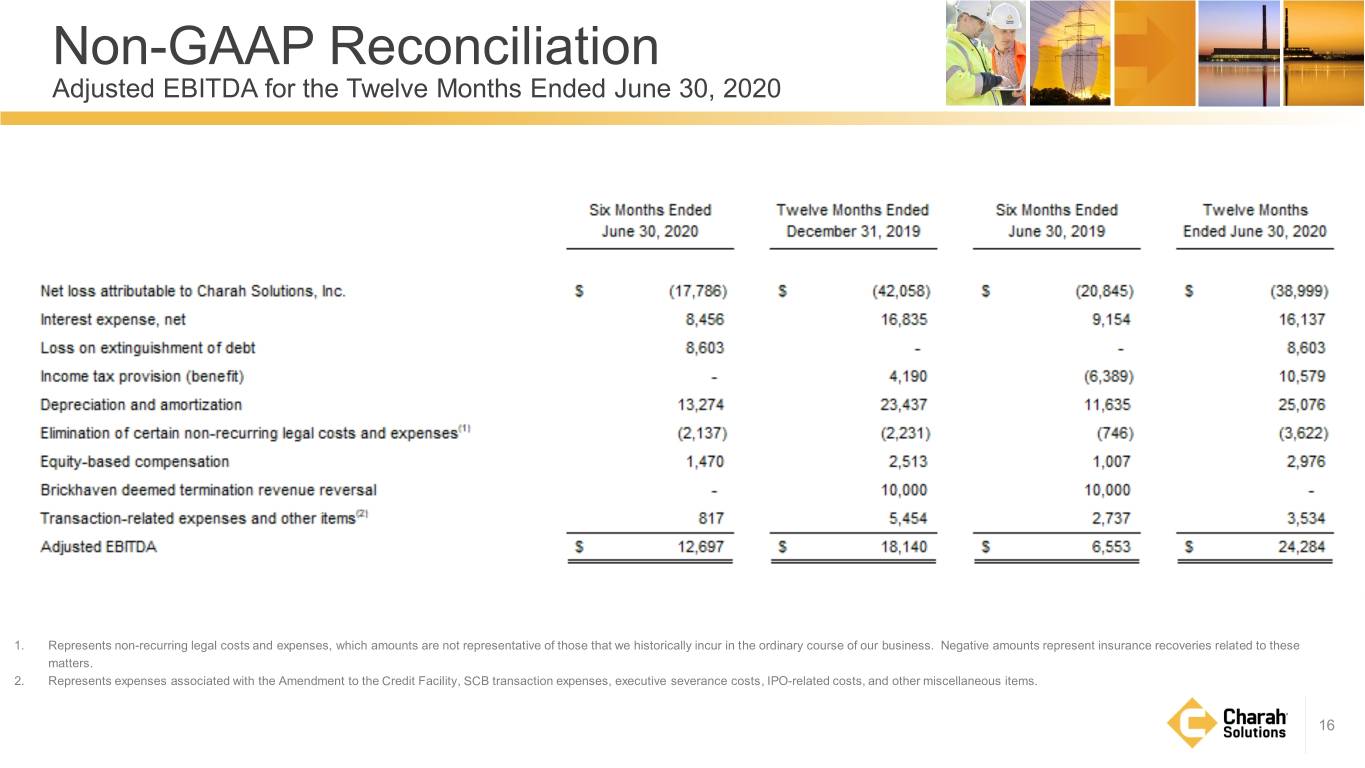

Non-GAAP Reconciliation Adjusted EBITDA for the Twelve Months Ended June 30, 2020 1. Represents non-recurring legal costs and expenses, which amounts are not representative of those that we historically incur in the ordinary course of our business. Negative amounts represent insurance recoveries related to these matters. 2. Represents expenses associated with the Amendment to the Credit Facility, SCB transaction expenses, executive severance costs, IPO-related costs, and other miscellaneous items. 16

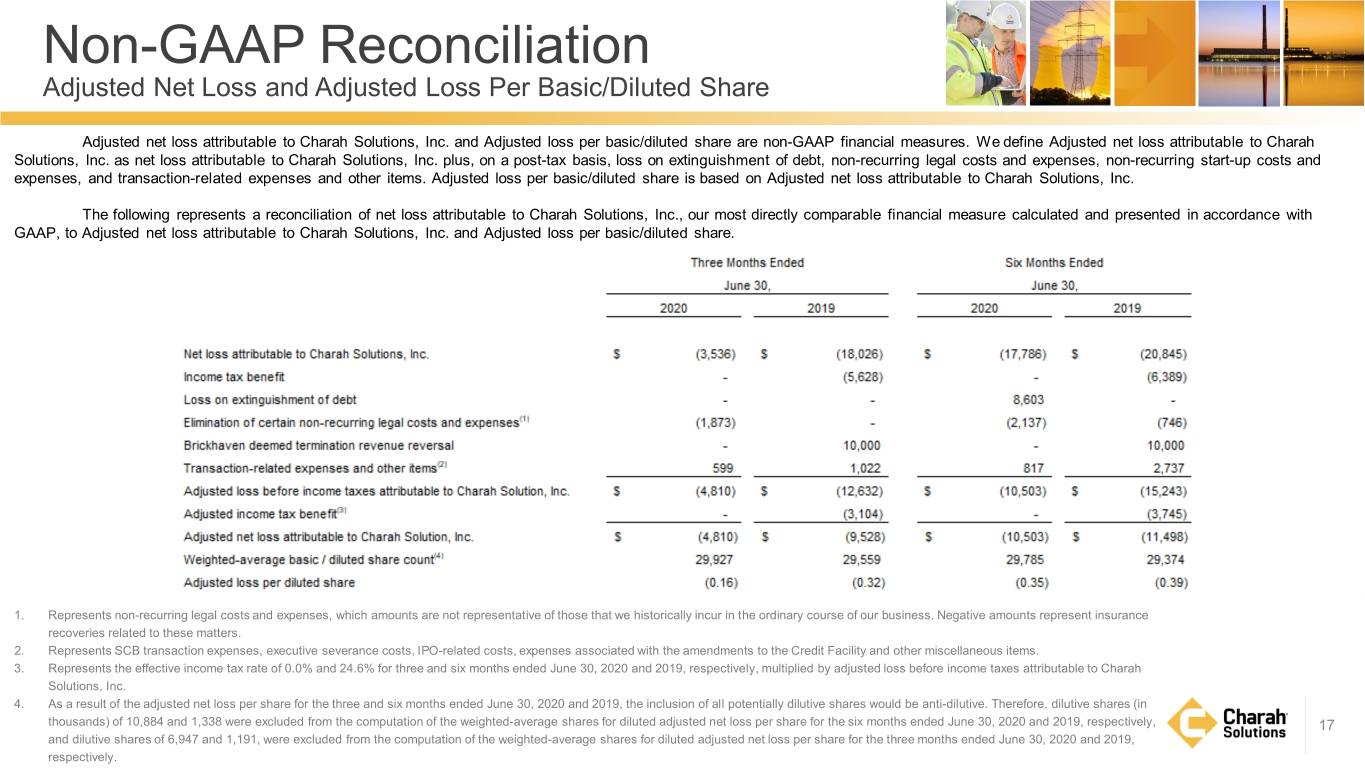

Non-GAAP Reconciliation Adjusted Net Loss and Adjusted Loss Per Basic/Diluted Share Adjusted net loss attributable to Charah Solutions, Inc. and Adjusted loss per basic/diluted share are non-GAAP financial measures. We define Adjusted net loss attributable to Charah Solutions, Inc. as net loss attributable to Charah Solutions, Inc. plus, on a post-tax basis, loss on extinguishment of debt, non-recurring legal costs and expenses, non-recurring start-up costs and expenses, and transaction-related expenses and other items. Adjusted loss per basic/diluted share is based on Adjusted net loss attributable to Charah Solutions, Inc. The following represents a reconciliation of net loss attributable to Charah Solutions, Inc., our most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted net loss attributable to Charah Solutions, Inc. and Adjusted loss per basic/diluted share. 1. Represents non-recurring legal costs and expenses, which amounts are not representative of those that we historically incur in the ordinary course of our business. Negative amounts represent insurance recoveries related to these matters. 2. Represents SCB transaction expenses, executive severance costs, IPO-related costs, expenses associated with the amendments to the Credit Facility and other miscellaneous items. 3. Represents the effective income tax rate of 0.0% and 24.6% for three and six months ended June 30, 2020 and 2019, respectively, multiplied by adjusted loss before income taxes attributable to Charah Solutions, Inc. 4. As a result of the adjusted net loss per share for the three and six months ended June 30, 2020 and 2019, the inclusion of all potentially dilutive shares would be anti-dilutive. Therefore, dilutive shares (in thousands) of 10,884 and 1,338 were excluded from the computation of the weighted-average shares for diluted adjusted net loss per share for the six months ended June 30, 2020 and 2019, respectively, 17 and dilutive shares of 6,947 and 1,191, were excluded from the computation of the weighted-average shares for diluted adjusted net loss per share for the three months ended June 30, 2020 and 2019, respectively.

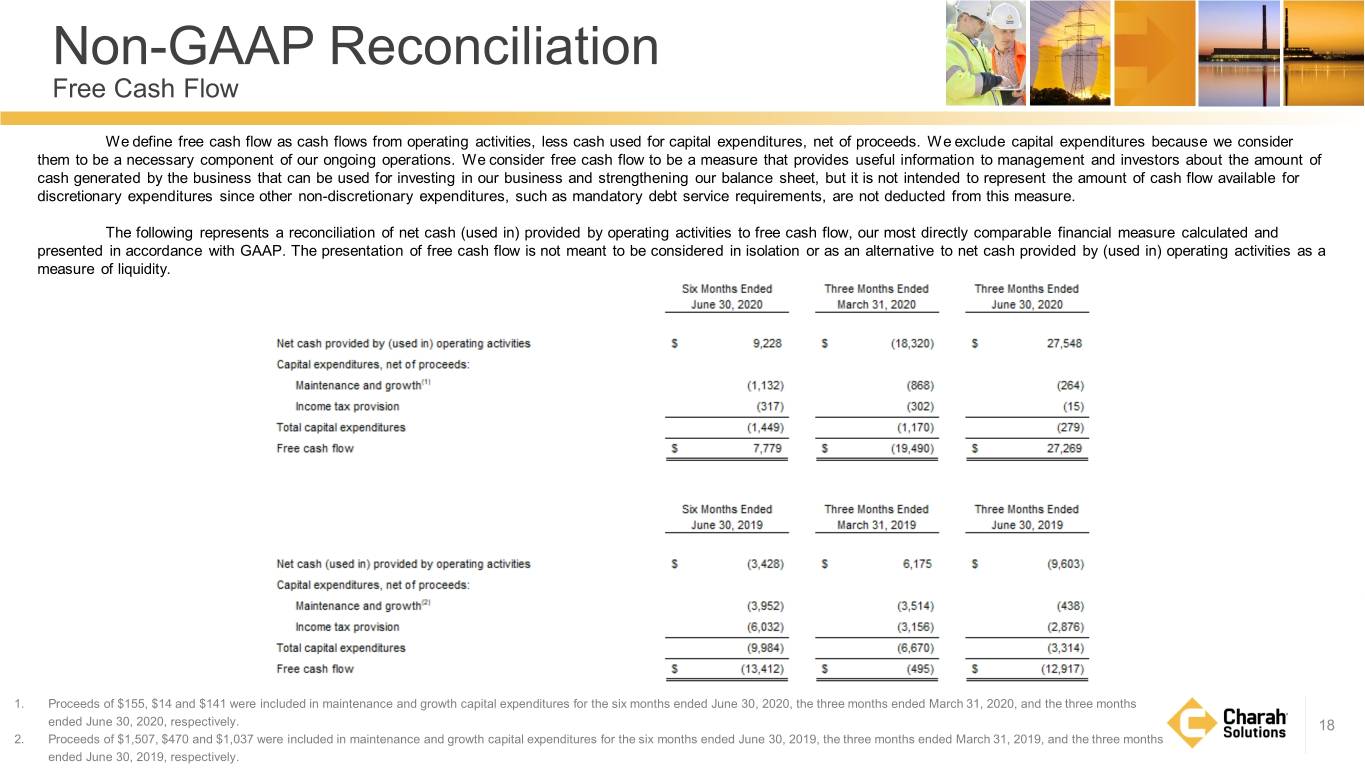

Non-GAAP Reconciliation Free Cash Flow We define free cash flow as cash flows from operating activities, less cash used for capital expenditures, net of proceeds. W e exclude capital expenditures because we consider them to be a necessary component of our ongoing operations. We consider free cash flow to be a measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for investing in our business and strengthening our balance sheet, but it is not intended to represent the amount of cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from this measure. The following represents a reconciliation of net cash (used in) provided by operating activities to free cash flow, our most directly comparable financial measure calculated and presented in accordance with GAAP. The presentation of free cash flow is not meant to be considered in isolation or as an alternative to net cash provided by (used in) operating activities as a measure of liquidity. 1. Proceeds of $155, $14 and $141 were included in maintenance and growth capital expenditures for the six months ended June 30, 2020, the three months ended March 31, 2020, and the three months ended June 30, 2020, respectively. 18 2. Proceeds of $1,507, $470 and $1,037 were included in maintenance and growth capital expenditures for the six months ended June 30, 2019, the three months ended March 31, 2019, and the three months ended June 30, 2019, respectively.