Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Recro Pharma, Inc. | d21450d8k.htm |

| EX-99.2 - EX-99.2 - Recro Pharma, Inc. | d21450dex992.htm |

| EX-99.1 - EX-99.1 - Recro Pharma, Inc. | d21450dex991.htm |

Investor Presentation August 2020 Exhibit 99.3

Forward Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "predict", "project", "will" and similar terms and phrases may be used to identify forward-looking statements in this presentation. Our operations involve risks and uncertainties, many of which are outside our control, and any one of which, or a combination of which, could materially affect our results of operations and whether the forward-looking statements ultimately prove to be correct. These forward-looking statements are subject to risks and uncertainties including, among other things, the extent to which the ongoing COVID-19 pandemic continues to disrupt the Company’s operations and financial condition and the operations and financial condition of its customers; the Company’s ability to manage costs and execute on its operational and budget plans, the Company’s ability to achieve its financial goals; the Company’s ability to operate under increased leverage and associated lending covenants; to pay its debt under its credit agreement; the Company’s ability to maintain relationships with commercial partners and diversify its business with new customers; customers’ changing inventory requirements and manufacturing plans; customer and prospective customers decisions to move forward with our manufacturing services; average profitability, or mix, of the products we manufacture; or customers facing increasing or new competition. These forward-looking statements should be considered together with the risks and uncertainties that may affect our business and future results included in our filings with the Securities and Exchange Commission at www.sec.gov. These forward-looking statements are based on information currently available to us, and we assume no obligation to update any forward-looking statements except as required by applicable law

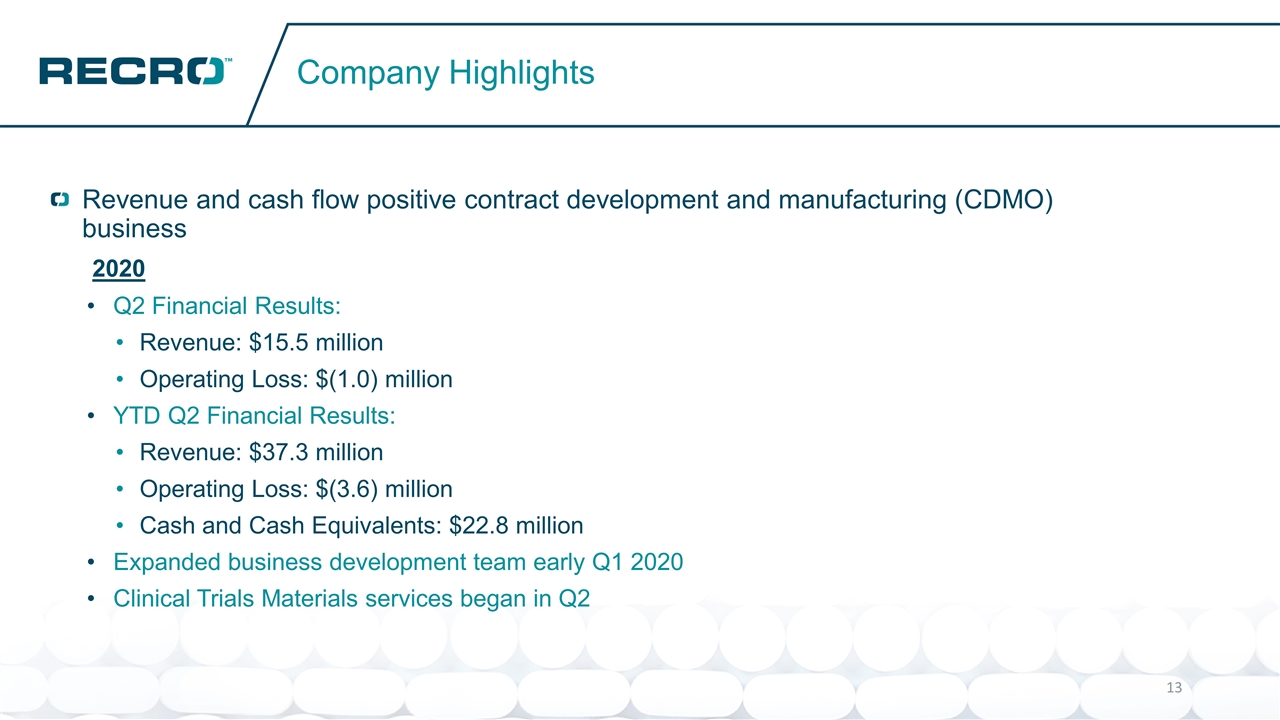

Revenue and cash flow positive contract development and manufacturing (CDMO) business 2020 Q2 Financial Results: Revenue: $15.5 million Operating Loss: $(1.0) million YTD Q2 Financial Results: Revenue: $37.3 million Operating Loss: $(3.6) million Cash and Cash Equivalents: $22.8 million Expanded business development team early Q1 2020 Clinical Trials Materials services began in Q2 Company Highlights

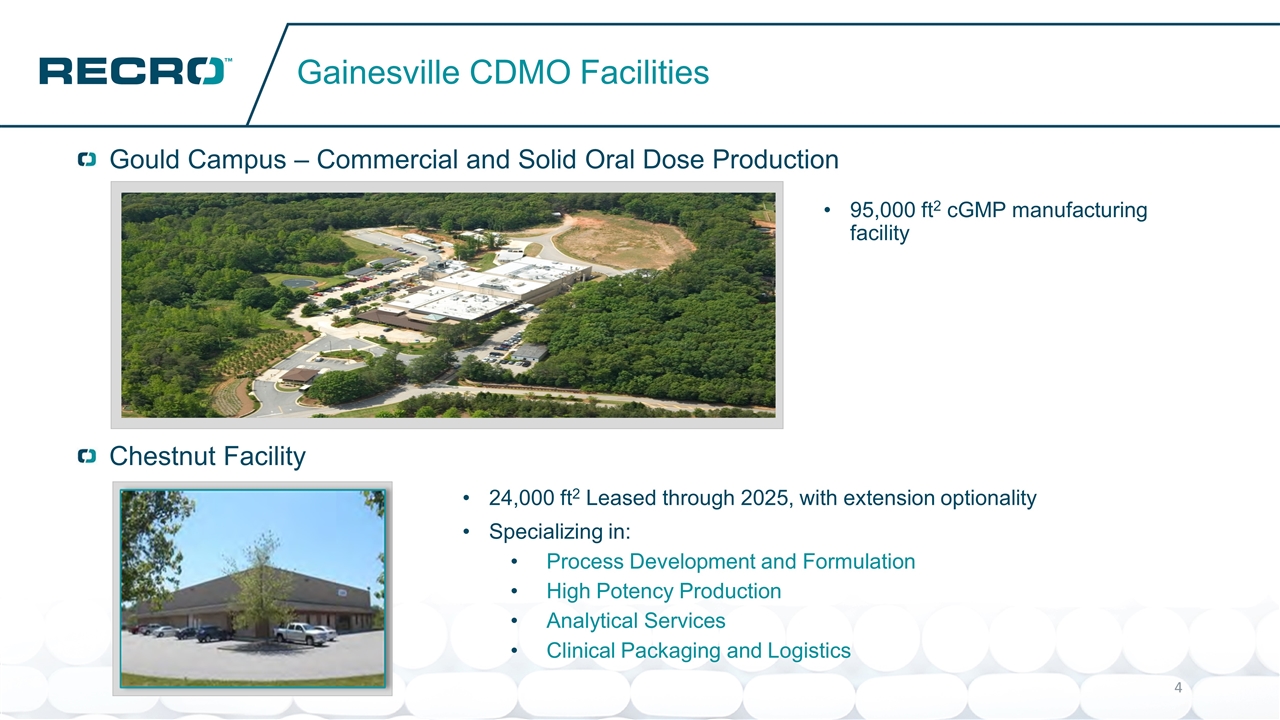

Gould Campus – Commercial and Solid Oral Dose Production Chestnut Facility Gainesville CDMO Facilities 24,000 ft2 Leased through 2025, with extension optionality Specializing in: Process Development and Formulation High Potency Production Analytical Services Clinical Packaging and Logistics 95,000 ft2 cGMP manufacturing facility

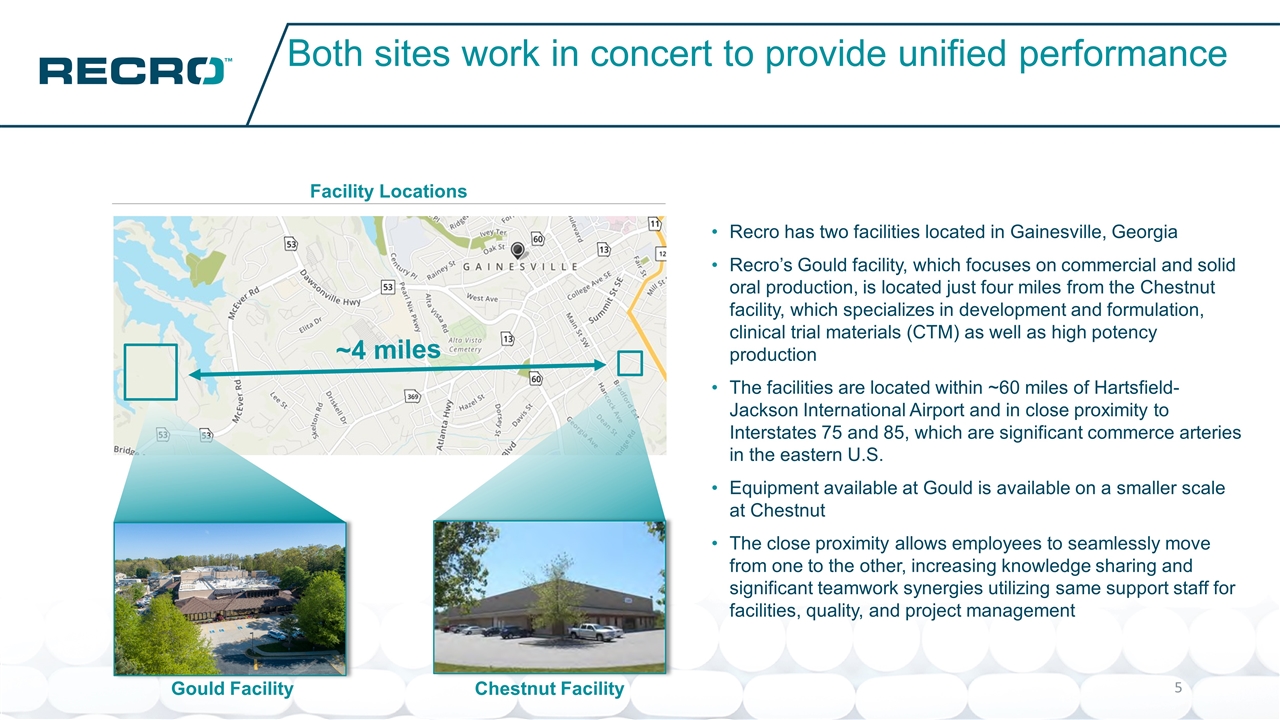

Both sites work in concert to provide unified performance Recro has two facilities located in Gainesville, Georgia Recro’s Gould facility, which focuses on commercial and solid oral production, is located just four miles from the Chestnut facility, which specializes in development and formulation, clinical trial materials (CTM) as well as high potency production The facilities are located within ~60 miles of Hartsfield-Jackson International Airport and in close proximity to Interstates 75 and 85, which are significant commerce arteries in the eastern U.S. Equipment available at Gould is available on a smaller scale at Chestnut The close proximity allows employees to seamlessly move from one to the other, increasing knowledge sharing and significant teamwork synergies utilizing same support staff for facilities, quality, and project management 435 Facility Locations Gould Facility Chestnut Facility ~4 miles

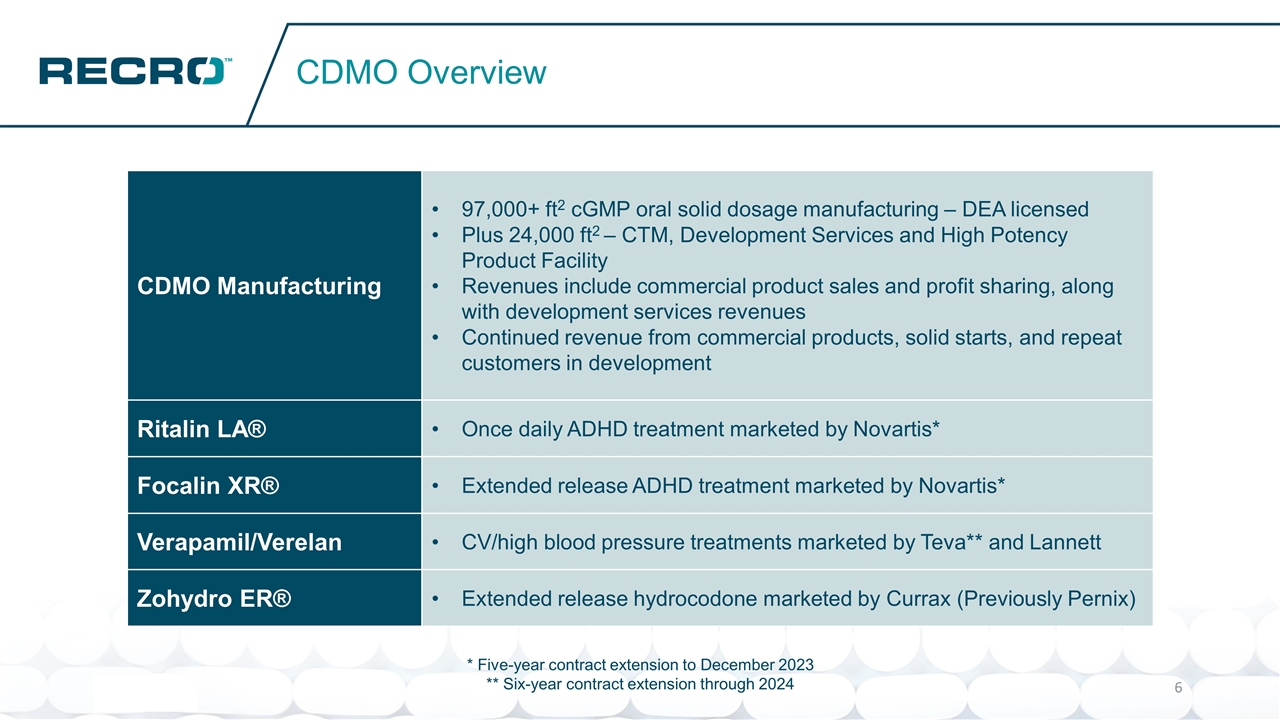

CDMO Overview CDMO Manufacturing 97,000+ ft2 cGMP oral solid dosage manufacturing – DEA licensed Plus 24,000 ft2 – CTM, Development Services and High Potency Product Facility Revenues include commercial product sales and profit sharing, along with development services revenues Continued revenue from commercial products, solid starts, and repeat customers in development Ritalin LA® Once daily ADHD treatment marketed by Novartis* Focalin XR® Extended release ADHD treatment marketed by Novartis* Verapamil/Verelan CV/high blood pressure treatments marketed by Teva** and Lannett Zohydro ER® Extended release hydrocodone marketed by Currax (Previously Pernix) * Five-year contract extension to December 2023 ** Six-year contract extension through 2024

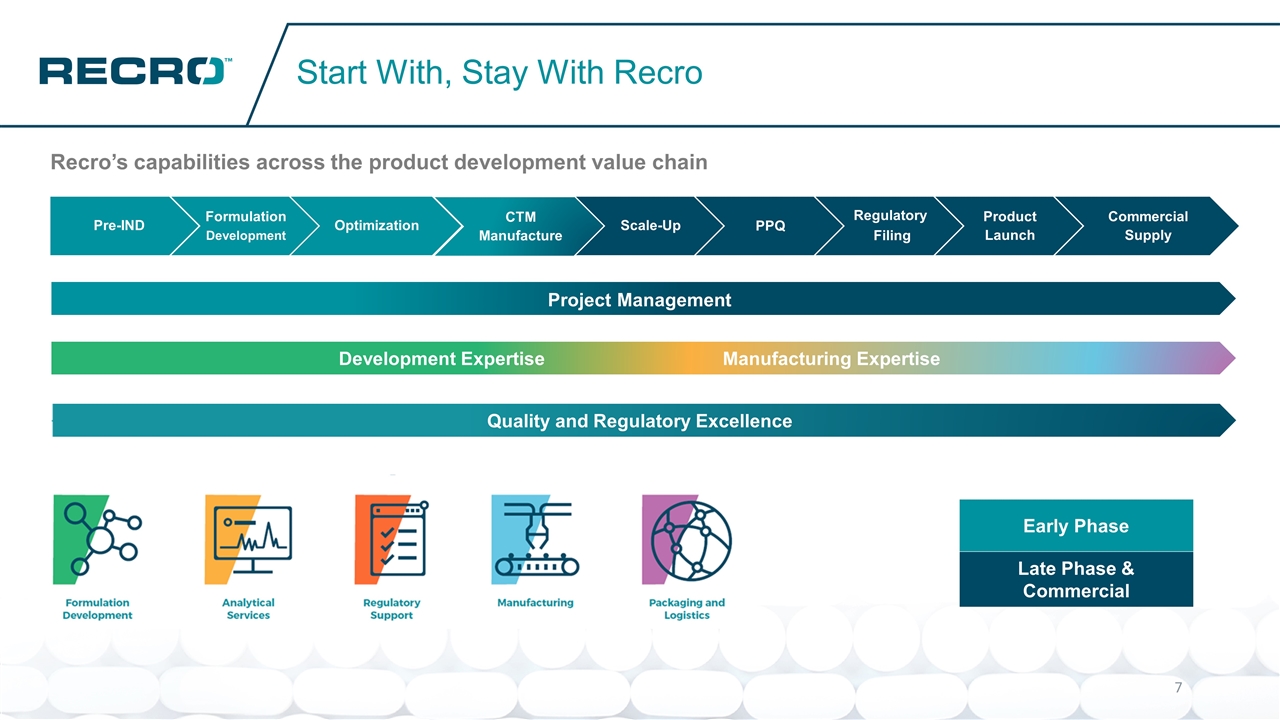

Development ExpertiseManufacturing Expertise Recro’s capabilities across the product development value chain Start With, Stay With Recro Quality and Regulatory Excellence Project Management Early Phase Late Phase & Commercial Formulation Development Optimization Scale-Up Commercial Supply Product Launch CTM Manufacture PPQ Regulatory Filing Pre-IND

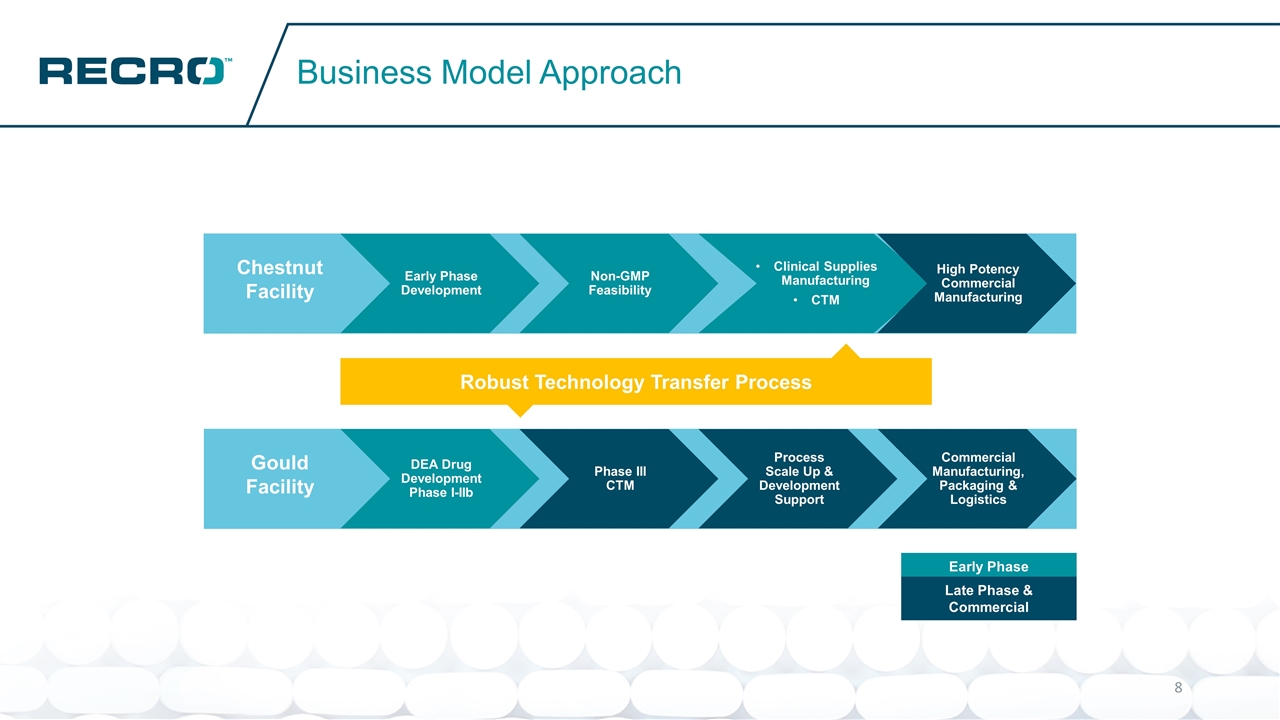

Business Model Approach Gould Facility Chestnut Facility DEA Drug Development Phase I-IIb Phase III CTM Process Scale Up & Development Support Commercial Manufacturing, Packaging & Logistics Early Phase Development Non-GMP Feasibility Clinical Supplies Manufacturing CTM High Potency Commercial Manufacturing Robust Technology Transfer Process Early Phase Late Phase & Commercial

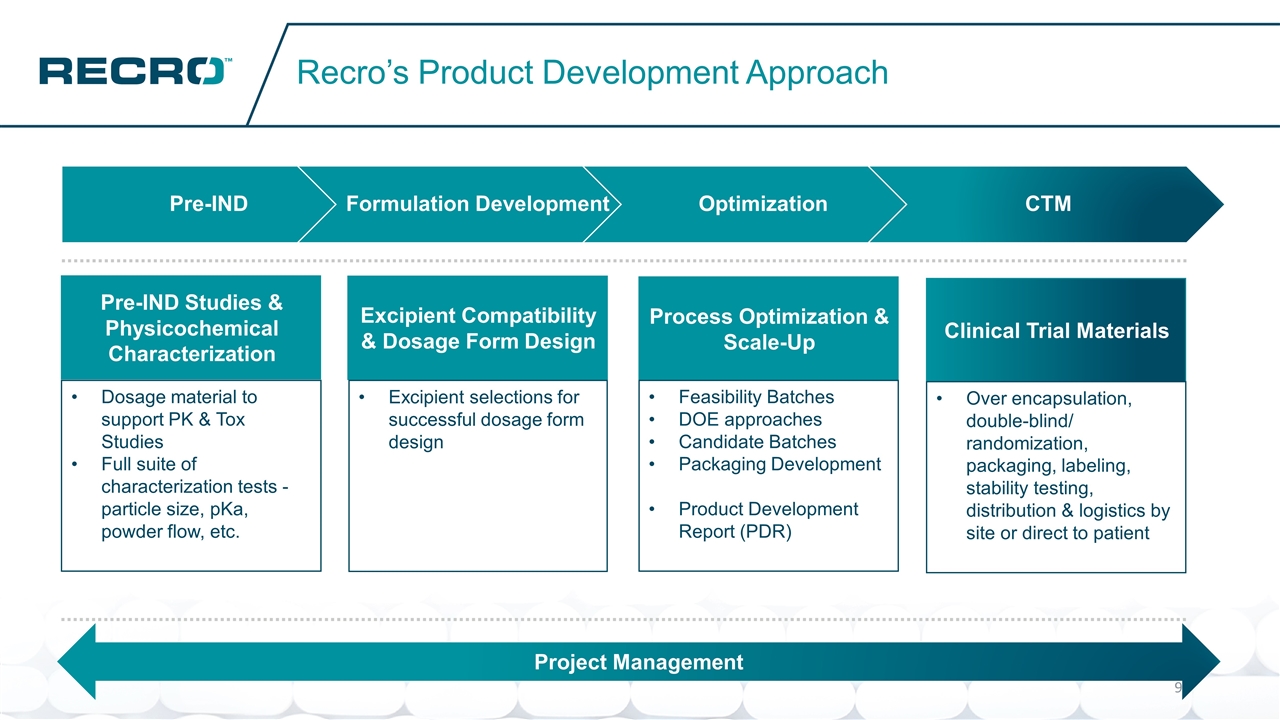

Recro’s Product Development Approach Excipient Compatibility & Dosage Form Design Excipient selections for successful dosage form design Pre-IND Studies & Physicochemical Characterization Dosage material to support PK & Tox Studies Full suite of characterization tests - particle size, pKa, powder flow, etc. Process Optimization & Scale-Up Feasibility Batches DOE approaches Candidate Batches Packaging Development Product Development Report (PDR) Clinical Trial Materials Over encapsulation, double-blind/ randomization, packaging, labeling, stability testing, distribution & logistics by site or direct to patient Project Management Pre-IND Formulation Development Optimization CTM

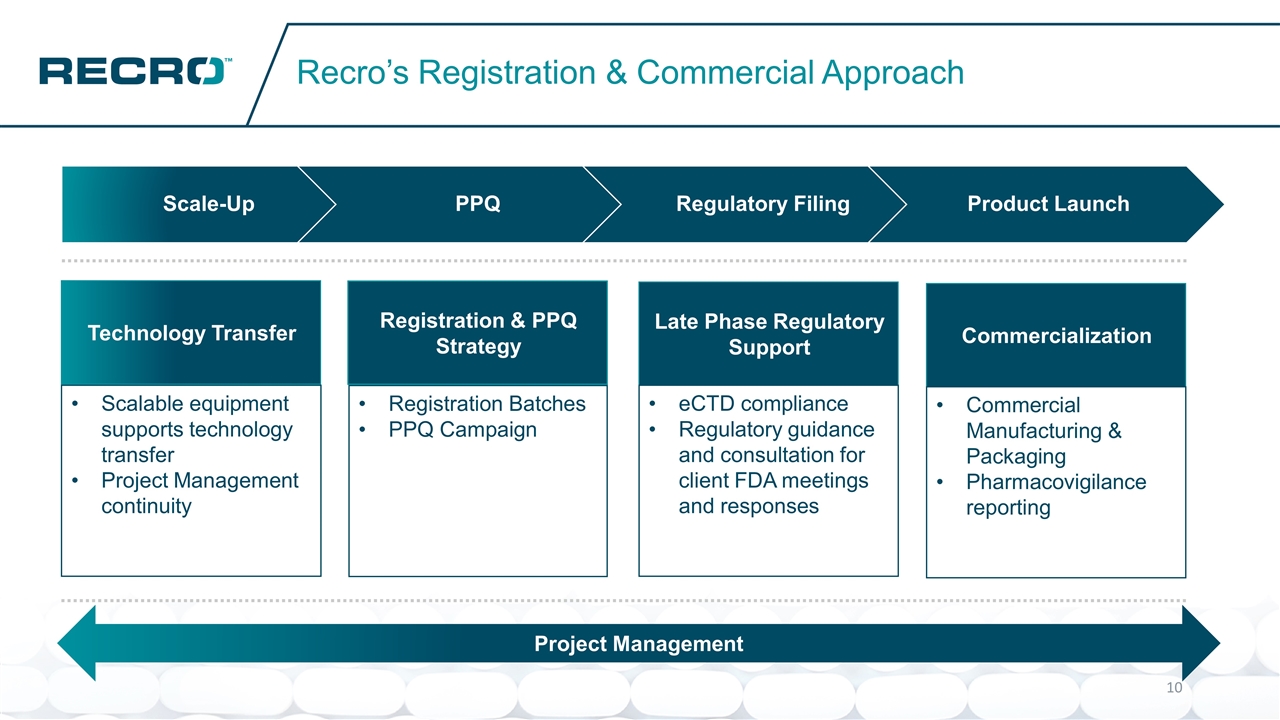

Recro’s Registration & Commercial Approach Registration & PPQ Strategy Registration Batches PPQ Campaign Technology Transfer Scalable equipment supports technology transfer Project Management continuity Late Phase Regulatory Support eCTD compliance Regulatory guidance and consultation for client FDA meetings and responses Commercialization Commercial Manufacturing & Packaging Pharmacovigilance reporting Project Management Scale-Up PPQ Regulatory Filing Product Launch

Scalable Equipment Streamlines Technology Transfer Oral Solid Dosage Unit Operations Milling Compression (Bi-Layer Capable) Tablet Coating (Solvent Capable) Oven Drying (Temp & Humidity Control) Encapsulation Key Unit Operations for Oral Solid Dosage Forms Granulation Rotor Processing Roller Compaction Fluid Bed Processing Blending

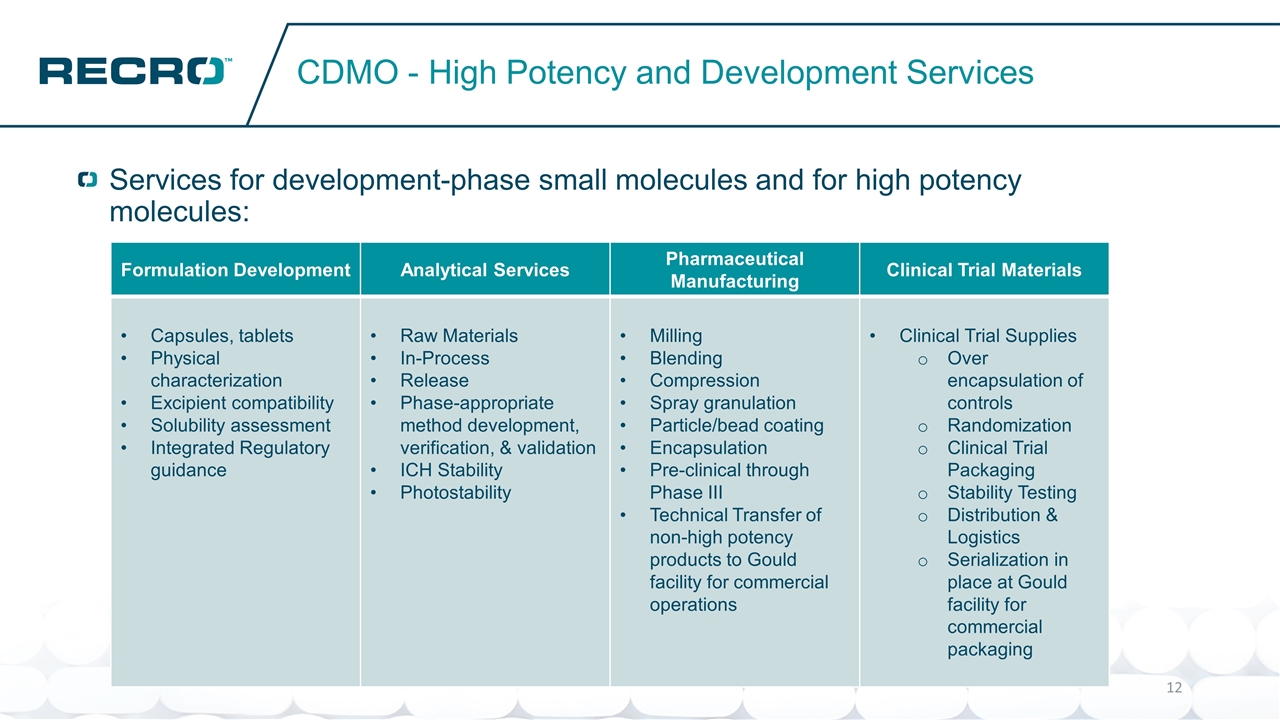

Services for development-phase small molecules and for high potency molecules: CDMO - High Potency and Development Services Formulation Development Analytical Services Pharmaceutical Manufacturing Clinical Trial Materials Capsules, tablets Physical characterization Excipient compatibility Solubility assessment Integrated Regulatory guidance Raw Materials In-Process Release Phase-appropriate method development, verification, & validation ICH Stability Photostability Milling Blending Compression Spray granulation Particle/bead coating Encapsulation Pre-clinical through Phase III Technical Transfer of non-high potency products to Gould facility for commercial operations Clinical Trial Supplies Over encapsulation of controls Randomization Clinical Trial Packaging Stability Testing Distribution & Logistics Serialization in place at Gould facility for commercial packaging

Revenue and cash flow positive contract development and manufacturing (CDMO) business 2020 Q2 Financial Results: Revenue: $15.5 million Operating Loss: $(1.0) million YTD Q2 Financial Results: Revenue: $37.3 million Operating Loss: $(3.6) million Cash and Cash Equivalents: $22.8 million Expanded business development team early Q1 2020 Clinical Trials Materials services began in Q2 Company Highlights

Investor Presentation August 2020