Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PINNACLE WEST CAPITAL CORP | a8-kpnw06302020exhibit.htm |

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | a8-k063020earnings.htm |

POWERING GROWTH DELIVERING VALUE Second Quarter 2020 Results August 6, 2020 Second Quarter 2020 | 0

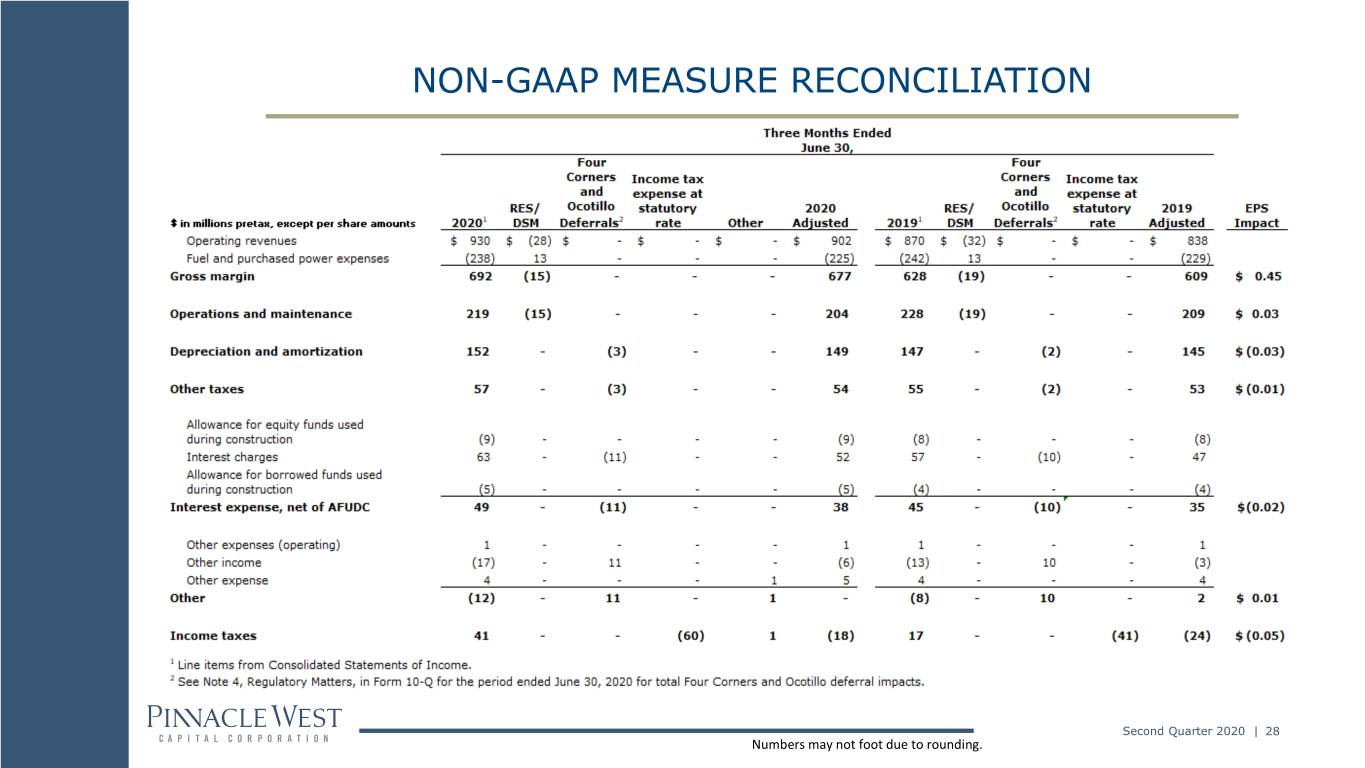

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: the potential effects of the continued COVID-19 pandemic, including, but not limited to, demand for energy, economic growth, our employees and contractors, supply chain, expenses, capital markets, capital projects, operations and maintenance activities, uncollectable accounts, liquidity, cash flows, or other unpredictable events; our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather seasonality, the general economy or social conditions, customer and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, droughts, or other catastrophic events, such as fires, explosions, pandemic health events, or similar occurrences; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or continue or discontinue power plant operations consistent with our corporate interests; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2019, in Part II, Item 1A in of the Pinnacle West/APS Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and in Part II, Item 1A in the Pinnacle West/APS Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. We present “gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power expenses. Gross margin is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this non-GAAP financial measure to the referenced revenue and expense line items on our Consolidated Statements of Income, which are the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States of America (GAAP). We view gross margin as an important performance measure of the core profitability of our operations and is used by our management in analyzing the operations of our business. We believe that investors benefit from having access to the same financial measures that management uses. We present “adjusted gross margin” and “adjusted operations and maintenance” that have been adjusted to exclude costs and offsetting operating revenues associated with renewable energy and demand side management programs. We also present “adjusted D&A,” “adjusted interest, net of AFUDC,” adjusted other taxes,” and “adjusted other, net” that have been adjusted for the deferral impacts of the Ocotillo Modernization Project. We also present “adjusted income taxes" that shows the impact of tax reform. Adjusted gross margin, adjusted operations and maintenance, adjusted D&A, adjusted interest, net of AFUDC, adjusted other, net, adjusted income taxes and adjusted other taxes are “non-GAAP financial measures,” as defined in accordance with SEC rules. The appendix contains a reconciliation to show the exclusion of costs and offsetting operating revenues associated with renewable energy and demand side management programs, the deferral impacts of the Ocotillo Modernization Project, and the impact of tax reform. We believe the information provided in the reconciliation provides investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis, such as the Ocotillo Modernization Project and tax reform impacts, and exclude the effects of programs that overstate our gross margin. Second Quarter 2020 | 1

EPS VARIANCES 2nd Quarter 2020 vs. 2nd Quarter 2019 Adjusted Adjusted Pension & Adjusted Adjusted Adjusted Adjusted O&M1 D&A2 OPEB Interest, Income Other Other, net2 $0.03 $(0.03) Non-service net of Taxes Taxes2 $0.01 Credits, net 2 Adjusted AFUDC $(0.05) $(0.01) $0.05 Gross $(0.02) Margin1 $0.45 Gross Margin Weather $ 0.43 $1.28 $1.71 Federal Tax Reform $ 0.09 LFCR $ 0.02 Other $ 0.02 Sales / Usage $(0.10) 2Q 2019 Transmission $(0.01) 2Q 2020 1 Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs. 2 Driver adjusted for the deferral impacts of the Ocotillo Modernization Project. See non-GAAP reconciliation in Appendix. Second Quarter 2020 | 2

2020 EPS GUIDANCE Key Factors & Assumptions as of August 6, 2020 2020 Adjusted gross margin1,2 (operating revenues, net of fuel and purchased power expenses) $2.41 – $2.47 billion • Retail customer growth about 1.5-2.5% • Weather-normalized retail electricity sales volume flat to negative 1% compared to prior year (excludes potential data center load growth) • Assumes normal weather Adjusted operating and maintenance (O&M)1,2 $820 – $840 million Other operating expenses (depreciation and amortization, deferrals, and taxes other than income taxes) $830 – $850 million Other income (pension and other post-retirement non-service credits, other income and other expense) $80 – $90 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC ~$45 million) $200 – $210 million Net income attributable to noncontrolling interests $20 million Effective tax rate 13% Average diluted common shares outstanding 112.8 million EPS Guidance $4.75 – $4.95 1 Excludes O&M of $70 million, and offsetting revenues, associated with renewable energy and demand side management programs. 2 The Covid-19 disconnect suspension and summer disconnection moratorium and revised policies are currently estimated to result in a decrease of approximately $20 million to $30 million of pre-tax income in 2020 depending on certain assumptions, including customer behavior. Second Quarter 2020 | 3

FINANCIAL OUTLOOK Key Factors & Assumptions as of August 6, 2020 Gross Margin – Customer and Sales Growth (2020-2022) Assumption Impact Retail customer growth • Expected to average about 1.5-2.5% annually • Strength in Arizona and U.S. economic conditions Weather-normalized retail electricity sales volume growth • About 0.5%–1.5% (excludes potential data center load growth) Gross Margin – Related to 2017 Rate Review Order Assumption Impact Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge (EIS) • Ability to recover up to $14 million annually of carrying costs for government- mandated environmental capital expenditures (cumulative per kWh cap rate of $0.00050) Power Supply Adjustor (PSA) • 100% recovery • Includes certain environmental chemical costs and third-party battery storage Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Transmission revenue is accrued each month as it is earned APS Solar Communities • Additions to flow through RES until next base rate case Property Tax Rate Deferral: APS is allowed to defer for future recovery (or credit to customers) the Arizona property tax expense above (or below) the 2015 test year caused by changes to the applicable composite property tax rate. Outlook Through 2020: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized) Second Quarter 2020 | 4

COVID-19 RESPONSE HIGHLIGHTS ✓ Suspending power disconnects and waiving penalties, late fees and interest payments ✓ Simplifying access to existing customer support programs ✓ Committing to provide our communities with support by contributing $8 million to assist customers and non-profits affected by Covid-19 ✓ Supplying the Navajo Nation with PPE and sanitation supplies ✓ Implementing our long-standing pandemic response plan to maintain operations ✓ Transitioning non-field employees to work from home ✓ Installing safety enhancements and enacting new procedures to ensure physical distancing in our facilities Second Quarter 2020 | 5

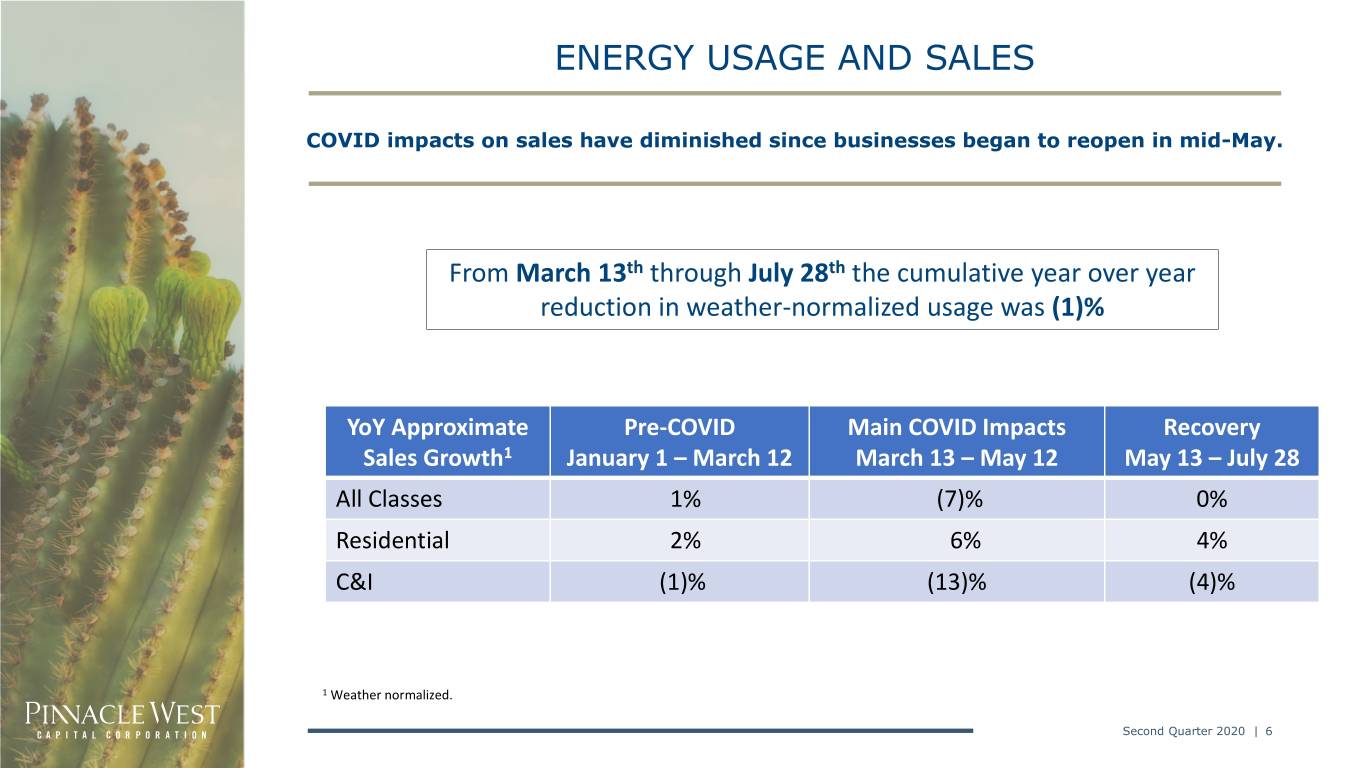

ENERGY USAGE AND SALES COVID impacts on sales have diminished since businesses began to reopen in mid-May. From March 13th through July 28th the cumulative year over year reduction in weather-normalized usage was (1)% YoY Approximate Pre-COVID Main COVID Impacts Recovery Sales Growth1 January 1 – March 12 March 13 – May 12 May 13 – July 28 All Classes 1% (7)% 0% Residential 2% 6% 4% C&I (1)% (13)% (4)% 1 Weather normalized. Second Quarter 2020 | 6

PRELIMINARY WEATHER-NORMALIZED ENERGY TREND Daily Energy Normalized Actual: 2020 vs 2019 March 1 - July 28, 2020 Week of May 11th businesses began reopening and stay-at-home guidelines expired March 1 March 15 March 29 April 12 April 26 May 10 May 24 June 7 June 21 July 5 July 19 Normalized Actual 2020 Normalized Actual 2019 Second Quarter 2020 | 7

ARIZONA COVID-19 RESPONSE TIMELINE • May 4th – Retail establishments permitted to reopen • May 8th – Hair salons permitted to reopen • May 11th – Dine-in restaurants permitted to reopen • May 13th – Pools, gyms and spas permitted to reopen • May 15th – Stay Home, Stay Healthy, Stay Connected guideline expired • May 16th – Professional sports may resume without fans • May 28th – Governor announced schools will reopen in the fall; summer school, summer camp and youth activities may begin • June 29th – Bars, nightclubs, gyms, movie theaters and waterparks closed through August 10th and the first day of in-person school delayed until August 17th • July 9th – Indoor dining limited to less than 50% occupancy Second Quarter 2020 | 8

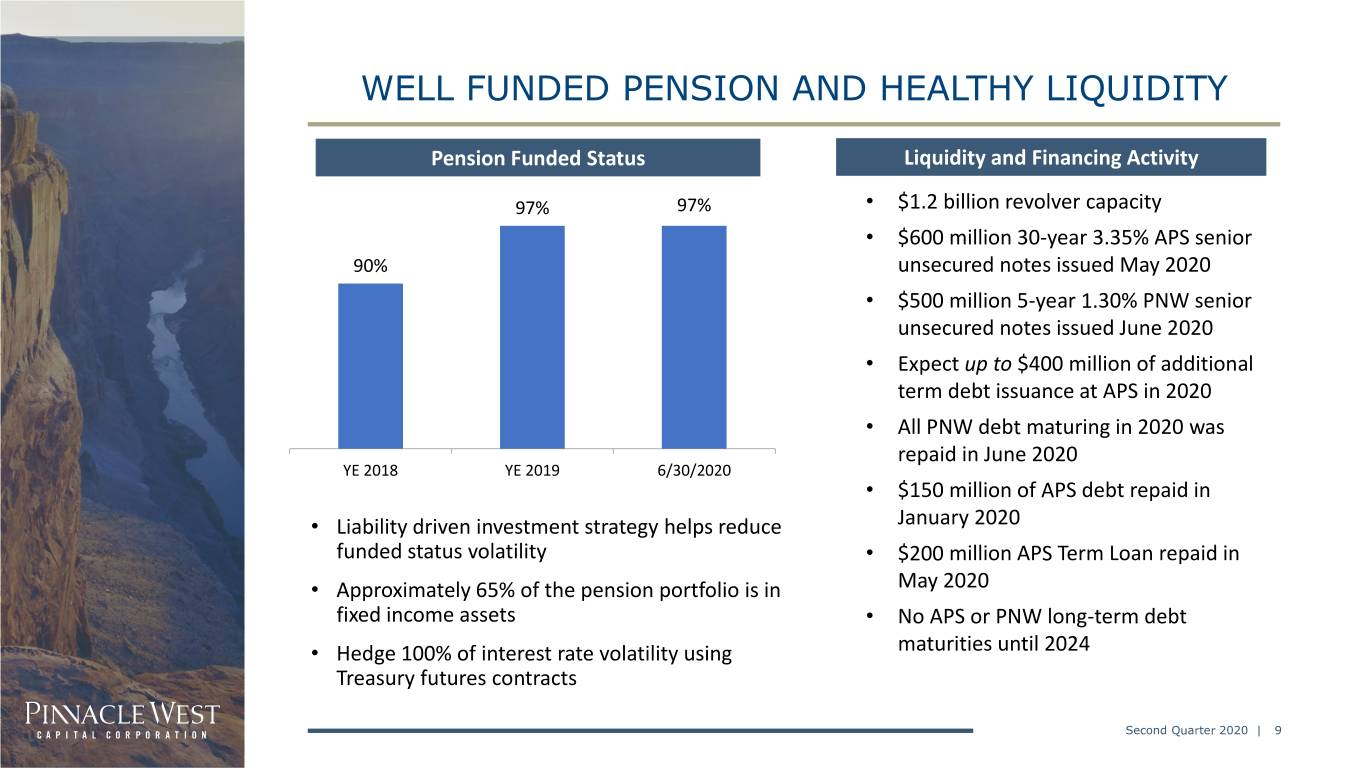

WELL FUNDED PENSION AND HEALTHY LIQUIDITY Pension Funded Status Liquidity and Financing Activity 97% 97% • $1.2 billion revolver capacity • $600 million 30-year 3.35% APS senior 90% unsecured notes issued May 2020 • $500 million 5-year 1.30% PNW senior unsecured notes issued June 2020 • Expect up to $400 million of additional term debt issuance at APS in 2020 • All PNW debt maturing in 2020 was repaid in June 2020 YE 2018 YE 2019 6/30/2020 • $150 million of APS debt repaid in • Liability driven investment strategy helps reduce January 2020 funded status volatility • $200 million APS Term Loan repaid in • Approximately 65% of the pension portfolio is in May 2020 fixed income assets • No APS or PNW long-term debt • Hedge 100% of interest rate volatility using maturities until 2024 Treasury futures contracts Second Quarter 2020 | 9

ECONOMIC INDICATORS Monthly Year-over-Year Employment Growth Ending May 2020 Taylor Morrison reports June 2020 as best U.S. Phoenix 1 5% month in Scottsdale homebuilder’s history 0% -5% Custom home lot sales going strong in metro 2 -10% Phoenix despite COVID-19 -15% Jan-18 Jan-19 Jan-20 Valley high-end homes listings make rapid comeback after tepid spring 3 Single Family & Multifamily Housing Permits Maricopa County Single Family Multifamily Projected 40,000 30,000 20,000 1 10,000 www.bizjournals.com/phoenix July 9, 2020 2 www.bizjournals.com/phoenix July 11, 2020 3 www.bizjournals.com/phoenix July 10, 2020 0 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 Second Quarter 2020 | 10

ECONOMIC DEVELOPMENT FUTURE EXPANSIONS OUR APPROACH FOCUSES ON FOUR MAIN AREAS o Stack Infrastructure plans to build a 1 million-square-foot Business Attraction & Expansion - constructive engagement data center on 79 acres in the West Valley less than half a with economic development community partners and timely, mile from one of Microsoft’s data centers. strategic engagement with economic development prospects, o White Claw/Mark Anthony Brewing Inc. announced plans site selectors, and local developers to build a 916,000-square-foot facility co-located next to Red Bull in Glendale creating an estimated 200 jobs. o Red Bull announced a 700,000-square-foot distribution Community Development - provide financial and strategic center, in addition to the 700,000 square foot facility economic development support in both rural and metro announced in 2019, adding an estimated 115 new jobs and communities an additional $84 million in capital investment. o Nacero Inc. made public plans to build a $3.3 billion natural gas to gasoline manufacturing facility in Casa Grande. The Entrepreneurial Support - advance the entrepreneurial project is expected to encompass a total of 1,038 acres. ecosystem by supporting the strategies of organizations that are making an impact, whether through job creation, capital o Ball Corporation announced plans to build a second location raised, quality programming or helping to change the within the Phoenix metropolitan area next to the Red Bull perception of the region and White Claw manufacturing facilities in Glendale. Ball plans to invest $300 million and create 190 jobs. This is in addition to their current 500,000-square-foot facility located Infrastructure Support - drive commercial real estate in Goodyear. development by working closely with developers and the Arizona State Land Department to make large commercial land parcels “shovel ready” What others are saying: • Census report ranks Arizona 3rd in percentage growth rate; AZ Business Magazine, Jan. 2, 2020 • Arizona gaining as top state for newcomers, study says; Arizona Republic, Jan. 2, 2020 • Electric-car maker breaks ground in Casa Grande as competition grows; Capitol Media Services (AZ Capitol Times), Dec. 3, 2019 Second Quarter 2020 | 11

RATE BASE APS’s revenues come from a regulated retail rate base and meaningful transmission business APS Rate Base Growth Total Approved Rate Base Year-End Generation & Distribution Transmission ACC FERC Long-term Rate Base Guidance: 19% 6-7% Average Annual Growth $2.3 81% ACC FERC $1.6 Rate Effective Date 8/19/2017 6/1/2020 Test Year Ended 12/31/20151, 2 12/31/2019 $10.7 Rate Base $6.8B $1.7B $7.7 Equity Layer 55.8% 53% Allowed ROE 10.0% 10.75% 1 2018 2019 2020 2021 2022 Adjusted to include post test-year plant in service through 12/31/2016 2 On 10/31/19 APS filed an ACC general rate case with a proposed $8.9B rate base for an Projected adjusted test year ended 6/30/19 Rate base $ in billions, rounded Second Quarter 2020 | 12

OPERATIONS & MAINTENANCE Goal is to keep O&M per kWh flat, adjusted for planned outages $ in millions $933 74 $856 $858 $820 - $840 48 63 40 - 50 795 859 808 780 - 790 2017 2018 2019 2020E PNW Consolidated ex RES/DSM1 Planned Fleet Outages 1 Excludes RES/DSM of $91 million in 2017, $104 million in 2018, $86 million in 2019, and $70 million in 2020E. Second Quarter 2020 | 13

2020 PLANNED OUTAGE SCHEDULE Coal, Nuclear, and Large Gas Planned Outages Q1 Q2 Q4 Estimated Estimated Estimated Plant Unit Duration Plant Unit Duration in Plant Unit Duration in Days Days in Days Four Four 5 46 5 36 Palo Verde 1 44 Corners* Corners* Palo Verde 2 30 *Outage duration spans Q1-Q2. Number of days noted per quarter. Second Quarter 2020 | 14

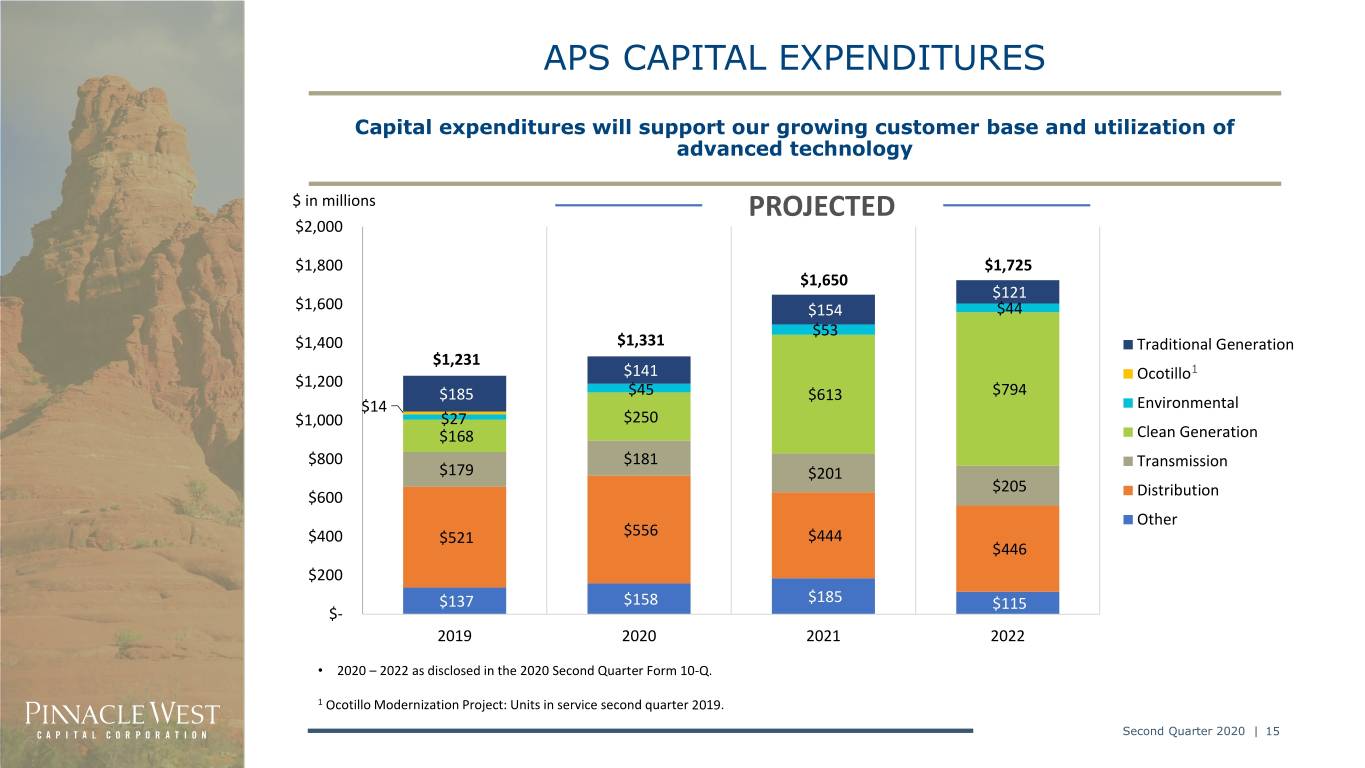

APS CAPITAL EXPENDITURES Capital expenditures will support our growing customer base and utilization of advanced technology $ in millions PROJECTED $2,000 $1,800 $1,725 $1,650 $121 $1,600 $154 $44 $53 $1,400 $1,331 Traditional Generation $1,231 $141 1 $1,200 Ocotillo $185 $45 $613 $794 $14 Environmental $1,000 $27 $250 $168 Clean Generation $800 $181 Transmission $179 $201 $205 $600 Distribution Other $400 $521 $556 $444 $446 $200 $137 $158 $185 $115 $- 2019 2020 2021 2022 • 2020 – 2022 as disclosed in the 2020 Second Quarter Form 10-Q. 1 Ocotillo Modernization Project: Units in service second quarter 2019. Second Quarter 2020 | 15

INTEGRATED RESOURCE PLAN A plan to power our customers’ future needs with clean energy 2020-2024 Additions Megawatts • Approximately 2,500 megawatts of renewable energy, demand response, energy efficiency and Demand Side Management 575 energy storage needed between 2020 and 2024. Demand Response 193 • We expect the renewable energy additions will Distributed Energy 408 include wind and solar generation, with the exact mix determined through all-source RFP Renewable Energy 962 procurement processes. Energy Storage 750 Merchant PPA/ Hydrogen- 0 • Approximately 1,400 megawatts of coal are scheduled to be retired, and another 1,600 ready CTs megawatts of gas purchase agreements are Microgrid 6 scheduled to expire over the next decade. Total 2,894 • Resource retirements, contract roll-offs and peak demand growth result in capacity needs of IRP forecast does not include the uncertain approximately 6,000 megawatts by 2035. impacts of COVID-19 Second Quarter 2020 | 16

APPENDIX Second Quarter 2020 | 17

CREDIT RATINGS AND METRICS APS Pinnacle West 2017 2018 2019 Corporate Credit Ratings1 APS FFO / Debt 29.4% 24.5% 22.5% Moody’s A2 A3 FFO / Interest 7.5x 6.5x 6.4x S&P A- A- Debt / 46.8% 47.0% 47.7% Fitch A- A- Capitalization Pinnacle West Senior Unsecured1 FFO / Debt 26.4% 22.1% 19.5% Moody’s A2 A3 FFO / Interest 7.1x 6.2x 5.9x S&P A- BBB+ Debt / 50.0% 51.4% 52.1% Fitch A A- Capitalization S&P rates the outlooks for APS and Pinnacle West as Source: Standard & Poor’s Stable. Fitch & Moody’s rate the outlooks for both as Negative. 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Second Quarter 2020 | 18

GROSS MARGIN EFFECTS OF WEATHER $ in millions pretax Variances vs. Normal $25 $20 $15 37 $10 12 $5 7 $0 $(5) (13) (1) $(10) $(15) (35) $(20) $(25) $(30) $(35) Q1 Q2 Q3 Q4 Q1 Q2 2019 2020 $(28) Million $36 Million All periods recalculated to current 10-year rolling average (2008 – 2017). Numbers may not foot due to rounding. Second Quarter 2020 | 19

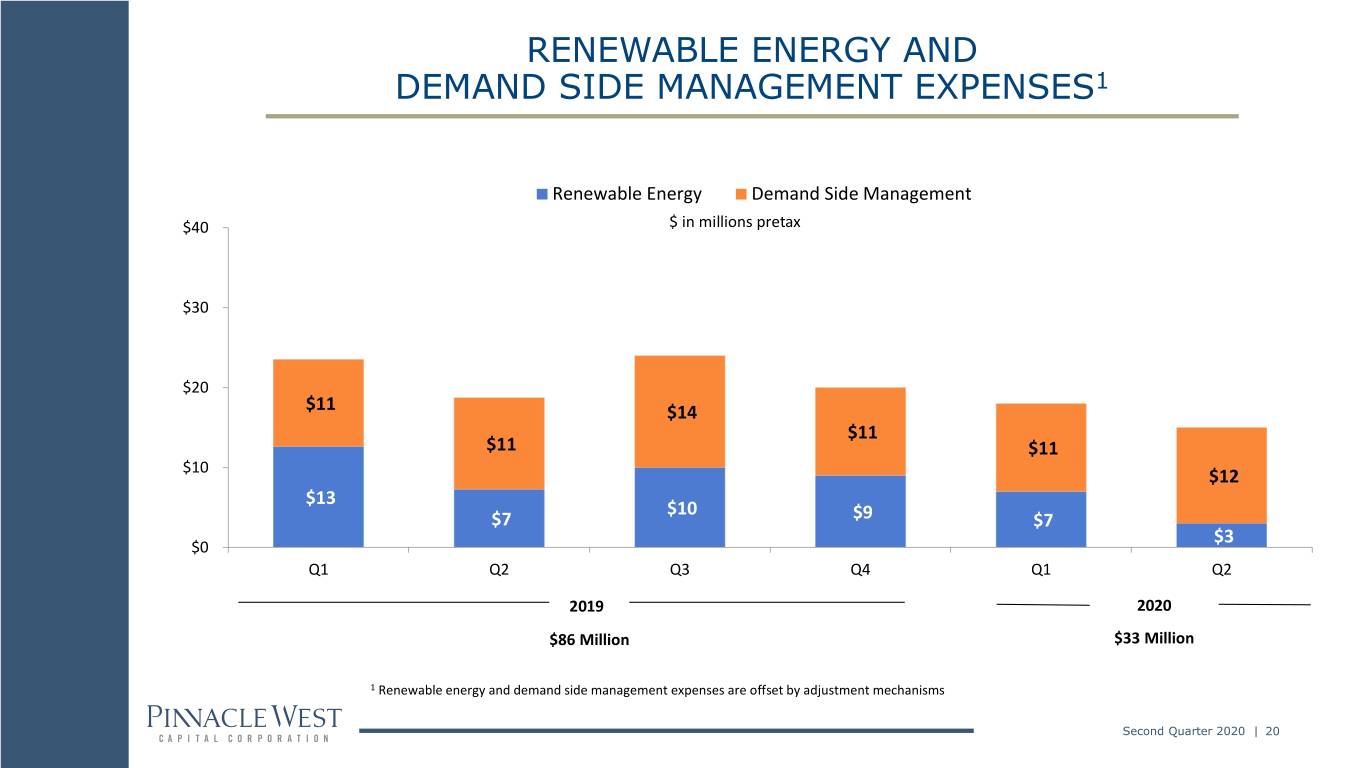

RENEWABLE ENERGY AND DEMAND SIDE MANAGEMENT EXPENSES1 Renewable Energy Demand Side Management $40 $ in millions pretax $30 $20 $11 $14 $11 $11 $11 $10 $12 $13 $10 $7 $9 $7 $3 $0 Q1 Q2 Q3 Q4 Q1 Q2 2019 2020 $86 Million $33 Million 1 Renewable energy and demand side management expenses are offset by adjustment mechanisms Second Quarter 2020 | 20

RESIDENTIAL PV APPLICATIONS1 4,000 Residential DG (MWdc) Annual Additions 151 133 133 122 3,500 64 3,000 2016 2017 2018 2019 2020 2,500 2,000 1,500 1,000 500 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2017 Applications 2018 Applications 2019 Applications 2020 Applications 1 Monthly data equals applications received minus cancelled applications. As of June 30, 2020, approximately 110,792 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 900 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site but are not included in the chart above. Second Quarter 2020 | 21

2020 KEY DATES ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Power Supply Adjustor (PSA): E-01345A-16-0036 Effective: Feb 1 Lost Fixed Cost Recovery: E-01345A-16-0036 Filed: Feb 14 Effective: May 1 Filed: May 15 Transmission Cost Adjustor: E-01345A-16-0036 Effective: Jun 1 Amended Plan Filed: 2020 DSM/EE Implementation Plan: E-01345A-19-0148 May 15, 2020 2020 RES Implementation Plan: E-01345A-19-0088 Hearing Begins: 2019 Rate Case: E-01345A-19-0236 Dec 14 Resource Planning and Procurement: E-00000V-19-0034 IRP Filed: Jun 26 Resource Comparison Proxy (RCP): E-01345A-20-0113 Filed: May 1 Possible Modification to Commission’s Energy Rules: RU-00000A- Workshops Mar 10, 11 Open Meeting: July 30 18-0284 Modification to Retail Competition Rules: RE-00000A-18-0405 Workshops Feb 25, 26 Proposed Termination of Service Rule Modifications: RU-00000A- Workshop Jan 30 19-0132 Second Quarter 2020 | 22

2019 APS RATE CASE APPLICATION Filed October 31, 2019 Docket Number: E-01345A-19-0236 Additional details, including filing, can be found at http://www.pinnaclewest.com/investors Adjustor Changes and New Mechanisms Overview Formula Rate - Proposed as an alternative to existing adjustor mechanisms Deferral of Costs for Limited - Allows for growth of program without requiring estimation of future Income Program enrollment Property Tax Deferral - Deferral of any increase or decrease in Arizona property taxes attributable to tax rate changes Rate Design Overview Residential Rate Design - Extend super off peak to residential demand rates - Subscription rate pilot Commercial and Industrial Rate - Propose AG-Y (access to market index pricing) program for medium Design and large general service customers Customer Support Programs - More ways to enroll in the program - Propose increasing funding of Crisis Bill from $1.25M to $2.5M Second Quarter 2020 | 23

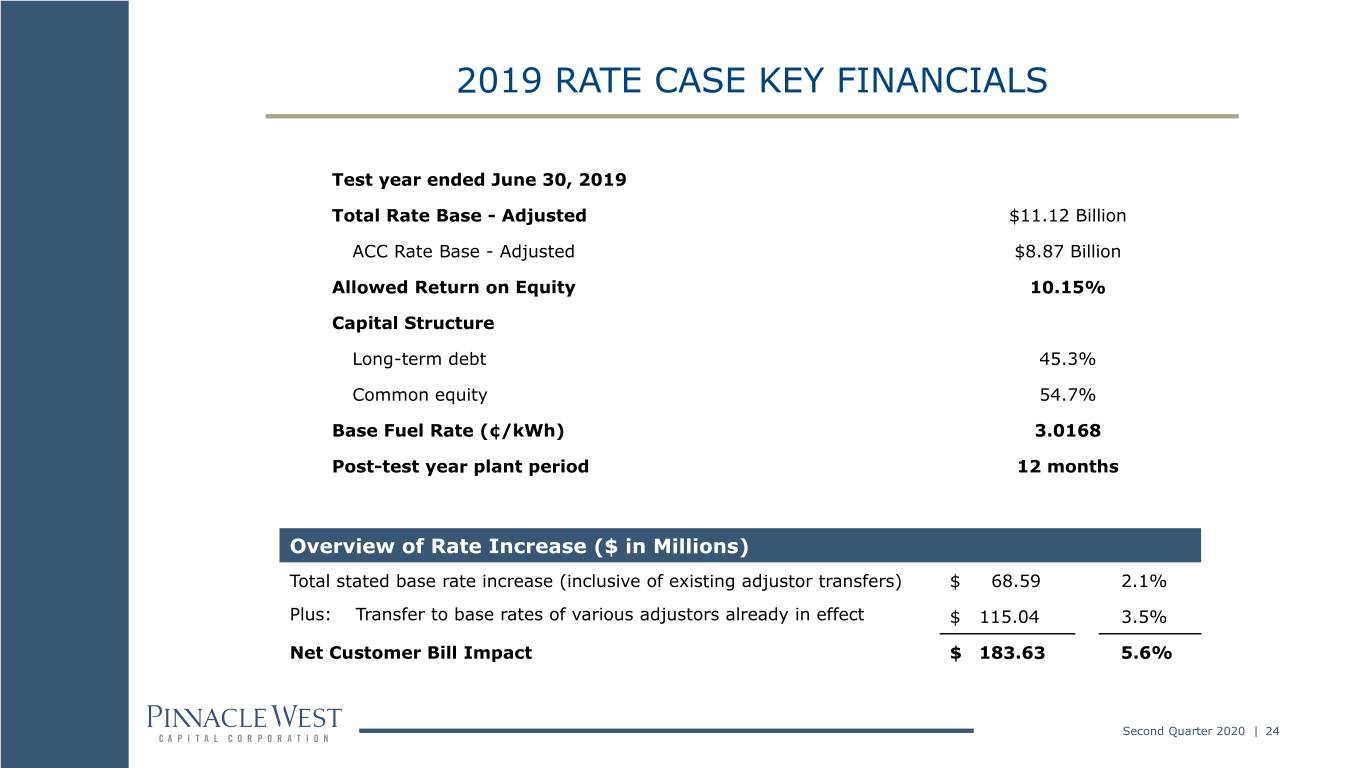

2019 RATE CASE KEY FINANCIALS Test year ended June 30, 2019 Total Rate Base - Adjusted $11.12 Billion ACC Rate Base - Adjusted $8.87 Billion Allowed Return on Equity 10.15% Capital Structure Long-term debt 45.3% Common equity 54.7% Base Fuel Rate (¢/kWh) 3.0168 Post-test year plant period 12 months Overview of Rate Increase ($ in Millions) Total stated base rate increase (inclusive of existing adjustor transfers) $ 68.59 2.1% Plus: Transfer to base rates of various adjustors already in effect $ 115.04 3.5% Net Customer Bill Impact $ 183.63 5.6% Second Quarter 2020 | 24

2019 RATE CASE KEY FINANCIALS Overview of Rate Increase ($ in Millions) - Key Components Four Corners SCRs $ 73 Ocotillo Modernization Project 100 Post-Test Year Plant Additions 66 Net Change in Other Items 64 Tax Expense Adjustor Termination (119) Total Revenue Request $ 184 Second Quarter 2020 | 25

APS RATE CASE PROCEDURAL SCHEDULE Arizona Public Service Company Docket # E-01345A-19-0236 Application Filed October 31, 2019 Staff/Intervenor Direct Testimony (October 2, 2020) Staff/Intervenor Direct Testimony (Rate Design) (October 9, 2020) APS Rebuttal Testimony (November 6, 2020) Staff/Intervenor Surrebuttal Testimony (November 20, 2020) APS Rejoinder Testimony (December 2, 2020) Pre-Hearing Conference (December 10, 2020) Hearing Commences (December 14, 2020) Second Quarter 2020 | 26

ARIZONA UTILITIES GENERAL RATE CASES Tucson Electric Power Company Southwest Gas Docket # E-01933A-19-0028 Docket # G-01551A-19-0055 Application Filed April 1, 2019 Application Filed May 1, 2019 Hearing Commenced (Jan 16, 2020) Staff /Intervenor Direct Testimony (Revenue) (Feb 5, Staff’s late-filed testimony (April 10, 2020) 2020) Staff/Intervenor Direct (Rate Design) (Feb 19, 2020) Responsive testimony (May 8, 2020) SWG Rebuttal Testimony (March 11, 2020) Additional hearing dates (June 24-25, 2020) Initial post-hearing briefs (July 14, 2020) Staff/Intervenor Surrebuttal Testimony (April 3, 2020) SWG Rejoinder Testimony (April 14, 2020) Final post-hearing briefs (Aug 4, 2020) Prehearing Conference (June 23, 2020) Hearing Commenced (June 30, 2020) Second Quarter 2020 | 27

NON-GAAP MEASURE RECONCILIATION Second Quarter 2020 | 28 Numbers may not foot due to rounding.

NON-GAAP MEASURE RECONCILIATION 2020 Guidance $ in millions pretax Operating revenues1 $ 3,455 - $ 3,525 Fuel and purchased power expenses1 (975) - (985) Gross margin 2,480 - 2,540 Adjustments: Renewable energy and demand side management programs (70) - (70) Adjusted gross margin $ 2,410 - $ 2,470 Operations and maintenance1 $ 890 - $ 910 Adjustments: Renewable energy and demand side management programs 70 - 70 Adjusted operations and maintenance $ 820 - $ 840 1 Line items from Consolidated Statements of Income. Second Quarter 2020 | 29

CONSOLIDATED STATISTICS 3 Months Ended June 30, 6 Months Ended June 30, 2020 2019 Incr (Decr) 2020 2019 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Retail Residential $ 515 $ 433 83 $ 840 $ 784 $ 56 Business 381 396 (15) 684 729 (44) Total Retail 896 828 68 1,525 1,513 12 Sales for Resale (Wholesale) 16 22 (6) 31 58 (28) Transmission for Others 15 15 (0) 31 30 0 Other Miscellaneous Services 2 3 (1) 3 7 (3) Total Electric Operating Revenues $ 929 $ 868 60 $ 1,589 $ 1,608 $ (19) ELECTRIC SALES (GWH) Retail Residential 3,670 2,994 676 6,180 5,571 609 Business 3,489 3,593 (104) 6,650 6,790 (140) Total Retail 7,159 6,587 572 12,830 12,362 469 Sales for Resale (Wholesale) 796 1,015 (219) 1,602 1,861 (259) Total Electric Sales 7,954 7,602 353 14,432 14,223 210 RETAIL SALES (GWH) - WEATHER NORMALIZED Residential 3,420 3,239 181 5,908 5,707 201 Business 3,405 3,673 (269) 6,608 6,851 (243) Total Retail Sales 6,825 6,912 (88) 12,516 12,558 (42) Retail sales (GWH) (% over prior year) (1.3)% (0.4)% (0.3)% 0.2% AVERAGE ELECTRIC CUSTOMERS Retail Customers Residential 1,145,060 1,117,422 27,638 1,144,899 1,118,865 26,034 Business 138,101 135,318 2,783 138,062 135,131 2,932 Total Retail 1,283,161 1,252,740 30,421 1,282,961 1,253,995 28,966 Wholesale Customers 44 46 (3) 45 50 (5) Total Customers 1,283,205 1,252,786 30,419 1,283,006 1,254,045 28,961 Total Customer Growth (% over prior year) 2.4% 1.8% 2.3% 1.8% RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) Residential 2,987 2,899 88 5,160 5,101 60 Business 24,653 27,145 (2,492) 47,863 50,701 (2,838) Second Quarter 2020 | 30 Numbers may not foot due to rounding.

CONSOLIDATED STATISTICS 3 Months Ended June 30, 6 Months Ended June 30, 2020 2019 Incr (Decr) 2020 2019 Incr (Decr) ENERGY SOURCES (GWH) Generation Production Nuclear 2,217 2,200 18 4,622 4,712 (89) Coal 1,250 1,965 (715) 2,657 3,738 (1,082) Gas, Oil and Other 2,722 1,626 1,096 4,804 3,474 1,330 Renewables 180 185 (6) 294 304 (10) Total Generation Production 6,369 5,976 393 12,377 12,228 149 Purchased Power - Conventional 1,103 1,267 (164) 1,315 1,491 (175) Resales 99 98 1 105 122 (17) Renewables 690 620 71 1,226 1,080 146 Total Purchased Power 1,893 1,985 (92) 2,646 2,692 (47) Total Energy Sources 8,262 7,960 301 15,022 14,920 102 POWER PLANT PERFORMANCE Capacity Factors - Owned Nuclear 89% 88% 1% 92% 95% (2)% Coal 42% 54% (12)% 45% 51% (7)% Gas, Oil and Other 33% 25% 8% 29% 26% 3% Renewable 36% 37% (1)% 30% 31% (1)% System Average 45% 45% (1)% 43% 46% (2)% 3 Months Ended June 30, 6 Months Ended June 30, 2020 2019 Incr (Decr) 2020 2019 Incr (Decr) WEATHER INDICATORS - RESIDENTIAL Actual Cooling Degree-Days 560 357 203 560 357 203 Heating Degree-Days 3 - 3 528 605 (77) Average Humidity 15% 21% (6)% 15% 21% (6)% 10-Year Averages (2008 - 2017) Cooling Degree-Days 491 491 - 491 491 - - Heating Degree-Days 9 9 - 450 450 - Average Humidity 17% 17% - 17% 17% - Second Quarter 2020 | 31 Numbers may not foot due to rounding.