Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BASIC ENERGY SERVICES, INC. | ex991irpresentation.pdf |

| 8-K - 8-K - BASIC ENERGY SERVICES, INC. | a2020-q28xkearningsrel.htm |

Exhibit 99.1 2Q 2020 Earnings Summary August 6, 2020

Legal Disclaimer This communication contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are subject to risks and uncertainties. These statements may relate to, but are not limited to, information or assumptions about Basic Energy Services, Inc. (“Basic”), its capital and other expenditures, dividends, financing plans, capital structure, cash flows, pending legal or regulatory proceedings and claims, future economic performance, operating income, costs savings and management's plans, strategies, goals and objectives for future operations and goals. These forward-looking statements are based largely upon Basic’s managements’ current expectations and projections about future events and financial trends affecting the financial condition of Basic’s business. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, most of which are beyond Basic’s control. Although Basic believes that the forward-looking statements contained in this presentation are based upon reasonable assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Additional important risk factors that could cause actual results to differ materially from expectations are disclosed in Item 1A of Basic’s Form 10-K for the year ended December 31, 2019, subsequent Form 10-Qs and other filings filed with the SEC. While Basic makes these statements and projections in good faith, neither Basic nor its management can guarantee that anticipated future results will be achieved. Basic’s forward-looking statements speak only as of the date of this presentation. Unless otherwise required by law, Basic undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that may affect Basic’s expectations, estimates or projections include: • local and global impacts of the COVID-19 pandemic; • a sustained decline in or substantial volatility of oil and gas prices, and any related changes in expenditures by its customers; • the effects of future acquisitions or dispositions on its business; • changes in customer requirements in markets or industries it serves; • competition within its industry, its ability to maintain acceptable pricing for its services, and its ability to reduce administrative and capital expenses; • general economic and market conditions; • its access to current or future financing arrangements including ability to raise funds in the capital markets or from other financing sources; • its ability to successfully execute, manage and integrate acquisitions, including the recent acquisition of C&J Well Services, Inc. (“C&J”); • its ability to satisfy its liquidity needs, including ability to generate sufficient liquidity or cash flow or to obtain sufficient financing to fund its operations or otherwise meet its obligations as they come due in the future; • its ability to replace or add workers at economic rates; • environmental and other governmental regulations; • uncertainties about its ability to execute successfully its business and financial plans and strategies; • negative impacts of the delisting of the Company’s common stock from the NYSE; and • impacts from the divestment of the Company’s pressure pumping assets and other asset sales. Non-GAAP Measures This presentation contains certain non-GAAP financial measures. A reconciliation of each such measure to the most comparable GAAP measure is presented in the Appendix hereto. We use “EBITDA” and “Adjusted EBITDA“ non-GAAP financial measures, for internal reporting and providing guidance on future results. These measures are not measures of financial performance under GAAP. We strongly advise investors to review our financial statements and publicly filed reports in their entirety and not rely on any single financial measure. See the Appendix for a reconciliation of these measures to GAAP. 1

Table of Contents • 2Q20 Financial Recap • Equity Capital Structure Overview • 2Q20 Operational Highlights • Operational Update • Capex and Liquidity • Business Segment Review - Well Servicing - Water Logistics - Completion & Remedial Services • Outlook Summary • Non-GAAP Reconciliation 2

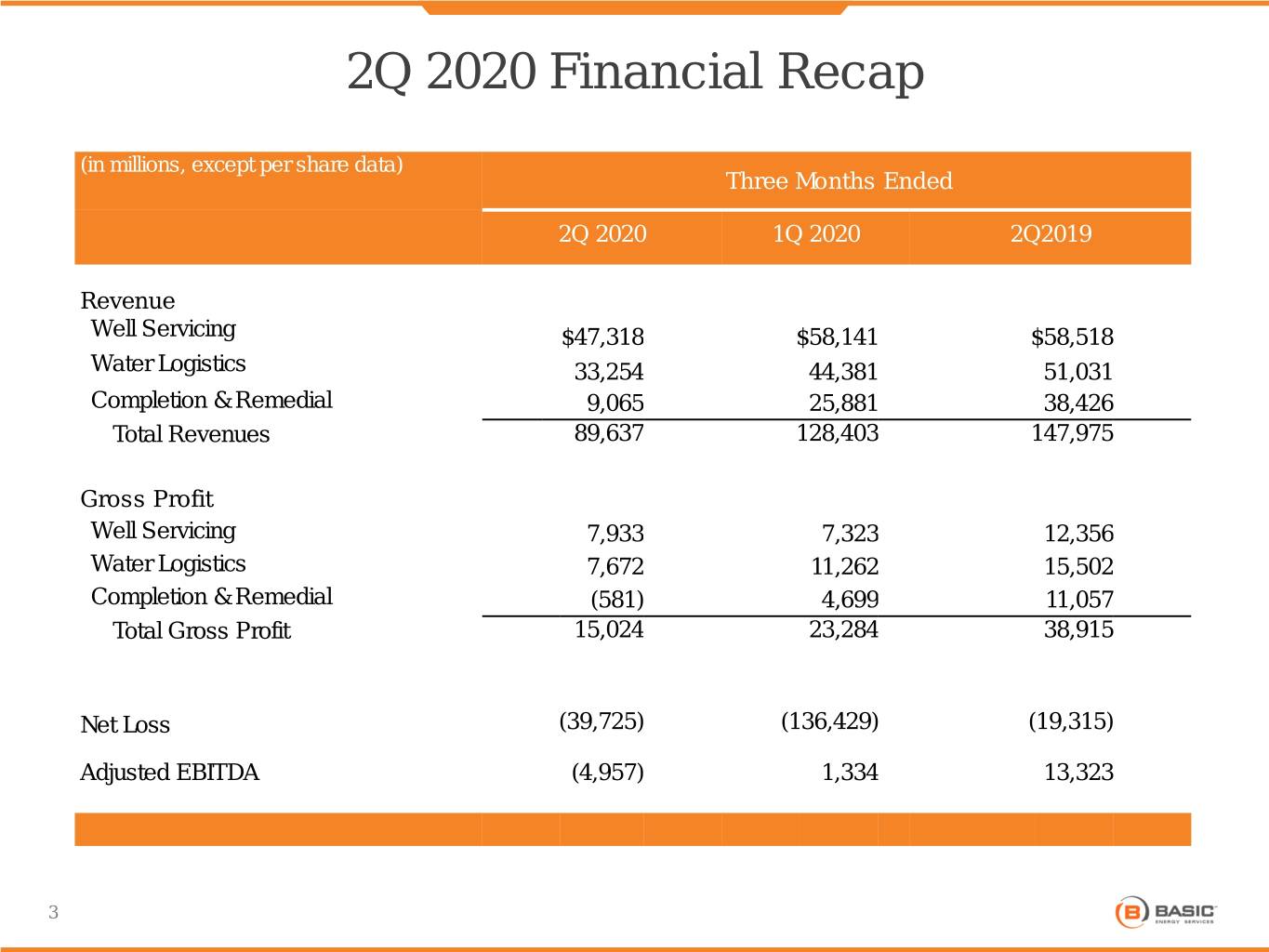

2Q 2020 Financial Recap (in millions, except per share data) Three Months Ended 2Q 2020 1Q 2020 2Q2019 Revenue Well Servicing $47,318 $58,141 $58,518 Water Logistics 33,254 44,381 51,031 Completion & Remedial 9,065 25,881 38,426 Total Revenues 89,637 128,403 147,975 Gross Profit Well Servicing 7,933 7,323 12,356 Water Logistics 7,672 11,262 15,502 Completion & Remedial (581) 4,699 11,057 Total Gross Profit 15,024 23,284 38,915 Net Loss (39,725) (136,429) (19,315) Adjusted EBITDA (4,957) 1,334 13,323 3

Equity Capital Structure Overview Market-implied valuation of Basic including common stock equivalents (CSEs) Market Cap Build (as of 8/4/2020; in millions except share price) • 118,805 shares of Series A Common shares 24.9 Preferred Stock issued in conjunction with the acquisition of C&J Well Services Common stock equivalents 118.8 • Each share of Series A Adjusted fully diluted shares Preferred Stock has economic 143.7 and voting rights equivalent to outstanding 1,000 common shares Share price $0.19 Market capitalization (common shares) $4.7 Adjusted market capitalization (common $27.4 shares and CSEs on a fully converted basis) 4

2Q 2020 Operational Highlights • Activity levels continued to decline through the quarter due to the impact of COVID-19 and general industry conditions - Q2 revenues from continued operations decreased sequentially by $38.8 million to $89.6 million during the quarter ended June 30, 2020 • Q2 Well Servicing segment margins increased 420 basis points sequentially to 16.8% as a result of cost-cutting measures and increased scale from the acquisition of C&J - Rig hours decreased 34% sequentially to 91,900, with average utilization in Q2 of 22% - Average of 14 of our 24-hour rig packages working, down from an average of 19 in 1Q20 • Q2 Water Logistics segment margins decreased 230 basis points sequentially to 23% due largely to lower water volumes and trucking hours - Total water disposal volumes at Agua Libre Midstream were 7.4 million barrels compared to 9.4 million barrels in Q1 - Pipeline volumes represented 45% of the total disposal volumes • Revenues in Completion & Remedial Services decreased 65% sequentially in Q2, as completion activity dropped severely 5

Operational Update 2Q2020 1Q2020 2Q2019 Well servicing rig hours 91,900 139,100 155,200 Well servicing utilization rate (average) 22% 49% 70% Number of well servicing rigs (average) 576 396 308 Revenue per rig hour1 $490 $397 $353 Fluid services truck hours 301,500 374,300 403,200 Number of fluid service trucks (average) 1,416 908 814 Total Disposal Water Volumes (in thousands) 7,352 9,445 9,952 Pipeline Water Volumes (in thousands) 3,275 3,620 3,174 Notes: 1 Rig-only revenue, not inclusive of package equipment or manufacturing. 6

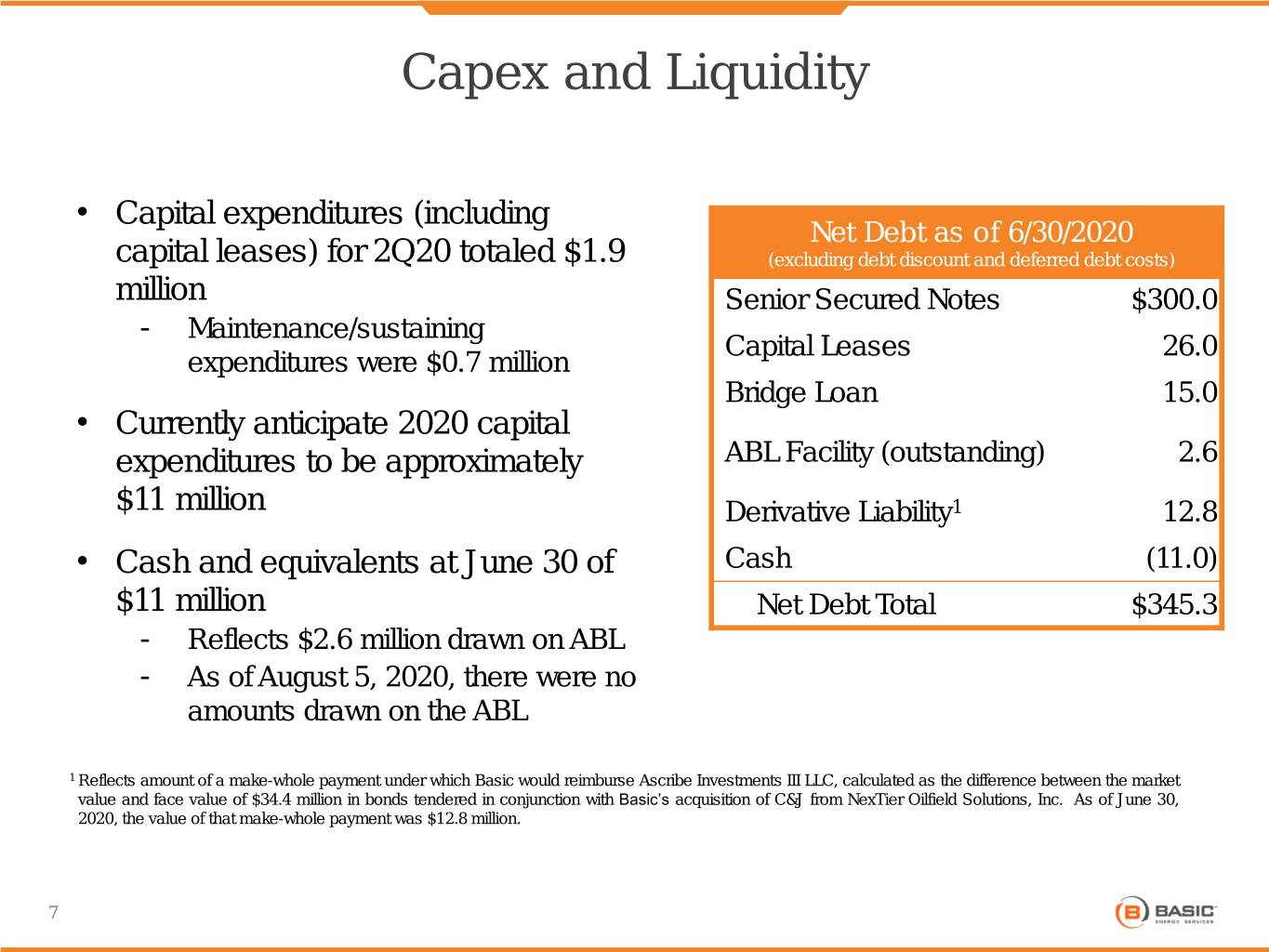

Capex and Liquidity • Capital expenditures (including Net Debt as of 6/30/2020 capital leases) for 2Q20 totaled $1.9 (excluding debt discount and deferred debt costs) million Senior Secured Notes $300.0 - Maintenance/sustaining Capital Leases 26.0 expenditures were $0.7 million Bridge Loan 15.0 • Currently anticipate 2020 capital expenditures to be approximately ABL Facility (outstanding) 2.6 $11 million Derivative Liability1 12.8 • Cash and equivalents at June 30 of Cash (11.0) $11 million Net Debt Total $345.3 - Reflects $2.6 million drawn on ABL - As of August 5, 2020, there were no amounts drawn on the ABL 1 Reflects amount of a make-whole payment under which Basic would reimburse Ascribe Investments III LLC, calculated as the difference between the market value and face value of $34.4 million in bonds tendered in conjunction with Basic’s acquisition of C&J from NexTier Oilfield Solutions, Inc. As of June 30, 2020, the value of that make-whole payment was $12.8 million. 7

Well Servicing Operational Highlights Segment Operating Stats • Segment margin increased to 17% in Q2 from 13% in 2Q20 1Q20 2Q19 Q1 • Rig hours down 34% with steady utilization at 22% Rig Hours (000s) 91.9 139.1 155.2 • Average revenue per rig hour increased to $490, as a Utilization 22% 49% 70% result of the inclusion of the C&J well service fleet, where revenue per rig hour trends higher Revenue/Hour1 $490 $397 $353 • Weighted average rig count for Q2 was 576, up from 396 for Q1 2020 Segment Margin 17% 13% 22% Segment Outlook • We are seeing significant increases in activity, with active rig count in the first week of August up over 70% to 158 rigs working, from the trough in May of 93 rigs working • Our cost-cutting effort is resulting in significantly improved margins for the Well Servicing business segment • Recent customer indications are that completion- related and 24-hour work will likely increase over the next several weeks 1Rig-only revenue, not inclusive of package equipment or manufacturing. 8

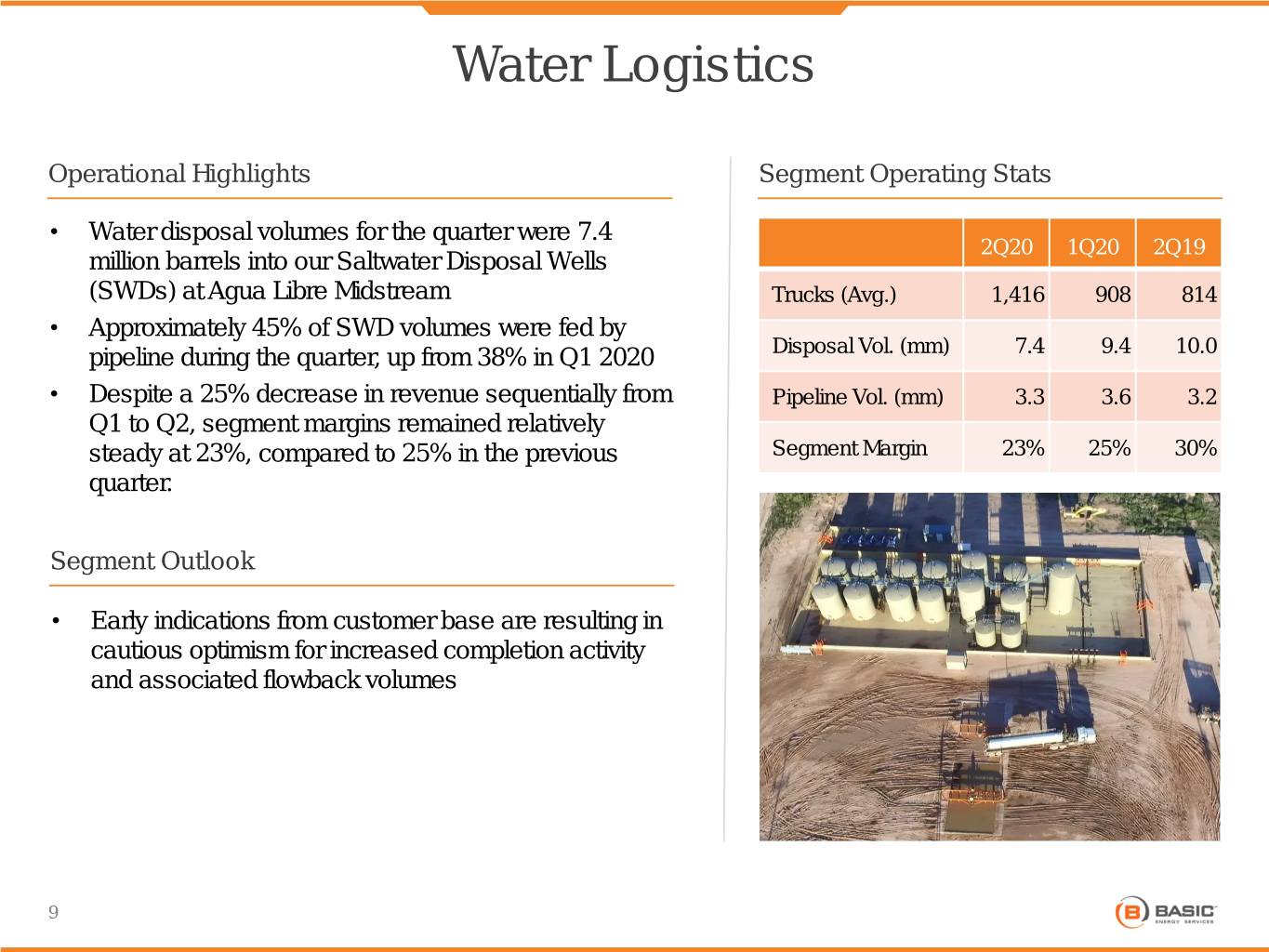

Water Logistics Operational Highlights Segment Operating Stats • Water disposal volumes for the quarter were 7.4 2Q20 1Q20 2Q19 million barrels into our Saltwater Disposal Wells (SWDs) at Agua Libre Midstream Trucks (Avg.) 1,416 908 814 • Approximately 45% of SWD volumes were fed by pipeline during the quarter, up from 38% in Q1 2020 Disposal Vol. (mm) 7.4 9.4 10.0 • Despite a 25% decrease in revenue sequentially from Pipeline Vol. (mm) 3.3 3.6 3.2 Q1 to Q2, segment margins remained relatively steady at 23%, compared to 25% in the previous Segment Margin 23% 25% 30% quarter. Segment Outlook • Early indications from customer base are resulting in cautious optimism for increased completion activity and associated flowback volumes 9

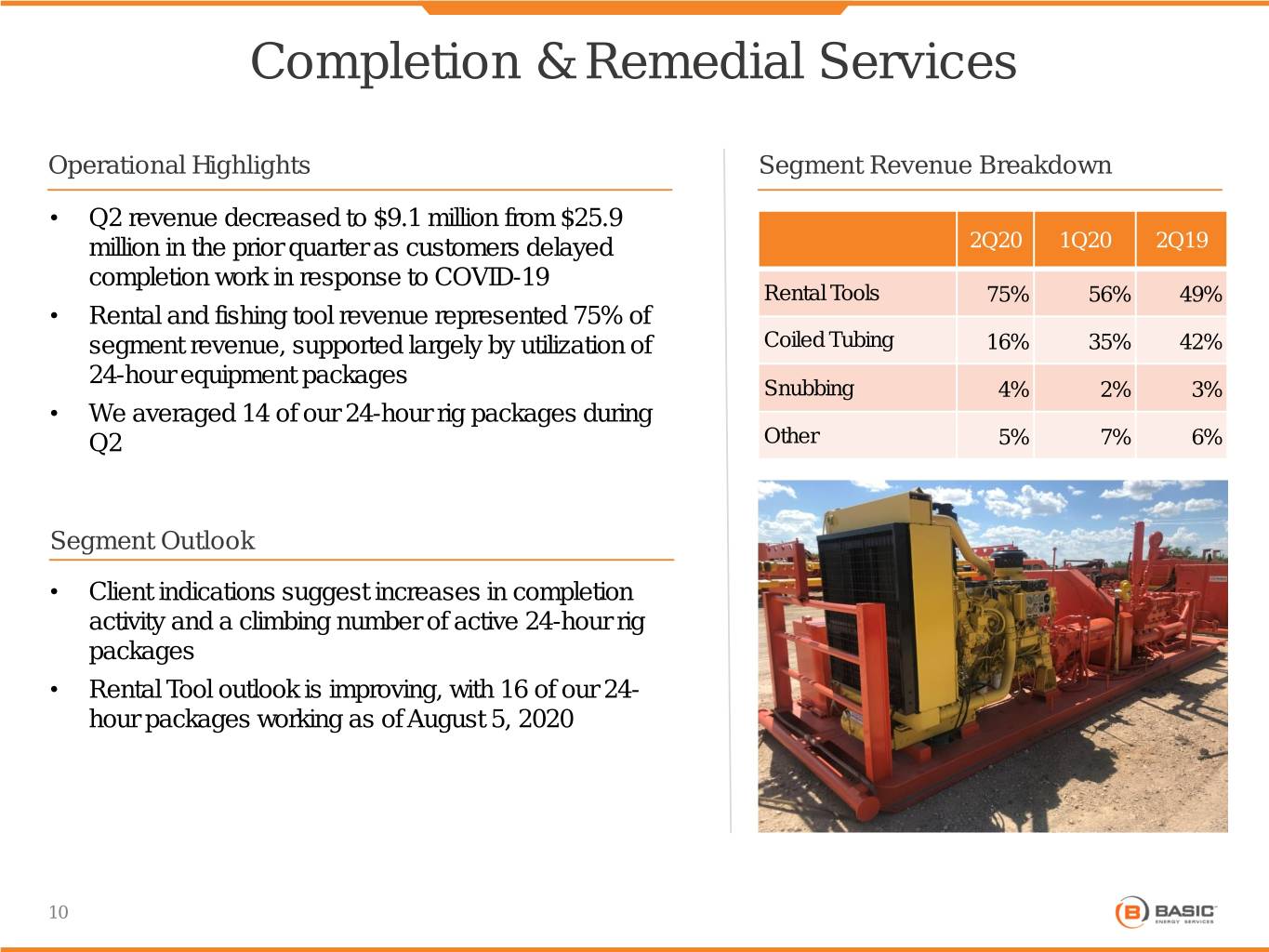

Completion & Remedial Services Operational Highlights Segment Revenue Breakdown • Q2 revenue decreased to $9.1 million from $25.9 million in the prior quarter as customers delayed 2Q20 1Q20 2Q19 completion work in response to COVID-19 Rental Tools 75% 56% 49% • Rental and fishing tool revenue represented 75% of segment revenue, supported largely by utilization of Coiled Tubing 16% 35% 42% 24-hour equipment packages Snubbing 4% 2% 3% • We averaged 14 of our 24-hour rig packages during Q2 Other 5% 7% 6% Segment Outlook • Client indications suggest increases in completion activity and a climbing number of active 24-hour rig packages • Rental Tool outlook is improving, with 16 of our 24- hour packages working as of August 5, 2020 10

Outlook Summary • As activity levels dropped with unprecedented severity and speed amid the COVID-19 pandemic and general industry conditions, May 2020 marked the lowest activity and revenue for the quarter: - June 2020 revenues were up 18% sequentially with expanding margins and positive Adjusted EBITDA - Significant increases in activity occurring since May 2020: • The active rig count in the first week of August 2020 up nearly 70% to 158 from the trough in May 2020 of 93 • Basic trucked water volumes were up 22% in June 2020 compared to May 2020 • Agua Libre Midstream disposal water volumes were up 8% in June 2020 relative to May 2020 - Expecting sequential monthly increases in revenue through the third quarter across all business segments: • The 24-hour rig count is expected to increase with completions activity from Q2 levels 11

Appendix

Supplemental Non-GAAP Financial Measures EBITDA and Adjusted EBITDA This earnings release presentation contains references to the non-GAAP financial measure of earnings (net income/loss) before interest, taxes, depreciation and amortization, or “EBITDA.” This earnings release presentation also contains references to the non-GAAP financial measure of earnings (net income/loss) before interest, taxes, depreciation and amortization, inventory write-downs, impairment expenses, the gain or loss on disposal of assets, non-cash stock compensation, severance costs, professional fees incurred in association with completed or contemplated transactions, tax consulting, bad debt, transition services, and contemplated deal costs or “Adjusted EBITDA.” EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income, net income or loss, cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. However, the Company believes EBITDA and Adjusted EBITDA are useful supplemental financial measures used by its management and directors and by external users of its financial statements, such as investors, to assess: • The financial performance of its assets without regard to financing methods, capital structure or historical cost basis; • The ability of its assets to generate cash sufficient to pay interest on its indebtedness; and • Its operating performance and return on invested capital as compared to those of other companies in the oilfield services industry. EBITDA and Adjusted EBITDA each have limitations as an analytical tool and should not be considered an alternative to net income, operating income, cash flow from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. EBITDA and Adjusted EBITDA exclude some, but not all, items that affect net income and operating income, and these measures may vary among other companies. Limitations to using EBITDA as an analytical tool include: • EBITDA does not reflect its current or future requirements for capital expenditures or capital commitments; • EBITDA does not reflect changes in, or cash requirements necessary, to service interest or principal payments on, its debt; • EBITDA does not reflect income taxes; • Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements; and • Other companies in the industry may calculate EBITDA differently than Basic does, limiting its usefulness as a comparative measure. In addition to each of the limitations with respect to EBITDA noted above, the limitations to using Adjusted EBITDA as an analytical tool include: • Adjusted EBITDA does not reflect Basic’s gain or loss on disposal of assets; • Adjusted EBITDA does not reflect Basic’s gain or loss on derivative instruments; • Adjusted EBITDA does not reflect Basic’s non-cash stock compensation; • Adjusted EBITDA does not reflect Basic’s inventory write-downs; • Adjusted EBITDA does not reflect Basic’s impairment expenses; • Adjusted EBITDA does not reflect Basic’s professional and legal fees related to one-time costs incurred for completed or contemplated mergers and acquisitions that we did not pursue during the three months ended June 30, 2019; Adjusted EBITDA does not reflect Basic's strategic consulting fees; • Adjusted EBITDA does not reflect Basic’s fees related to one-time costs incurred for transition and consulting services to integrate completed acquisitions; • Adjusted EBITDA does not reflect the write-off of certain bad debt incurred from certain customers that filed for bankruptcy during the three months ended June 30, 2020; and • Other companies in the industry may calculate Adjusted EBITDA differently than Basic does, limiting its usefulness as a comparative measure. 13

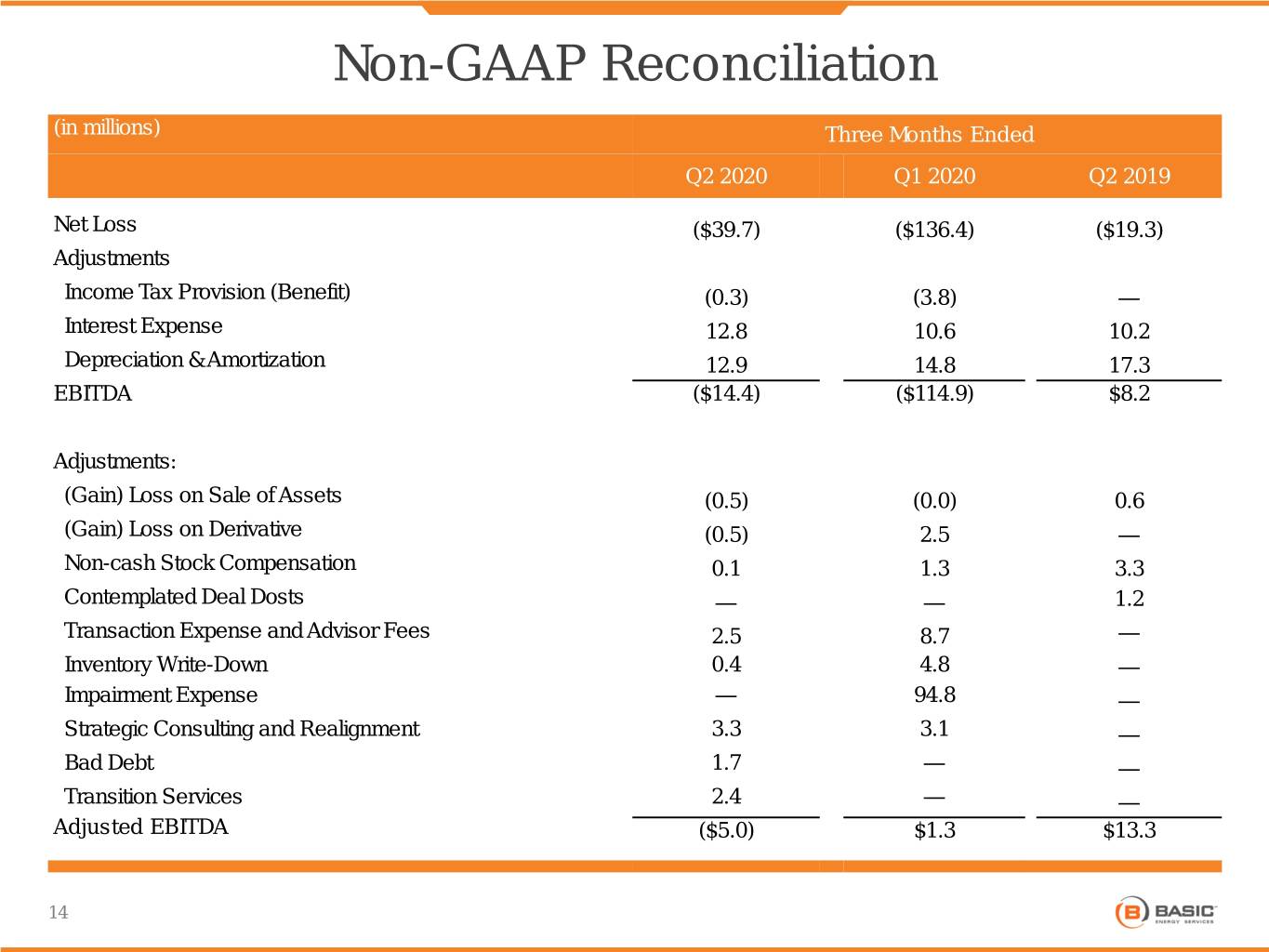

Non-GAAP Reconciliation (in millions) Three Months Ended Q2 2020 Q1 2020 Q2 2019 Net Loss ($39.7) ($136.4) ($19.3) Adjustments Income Tax Provision (Benefit) (0.3) (3.8) — Interest Expense 12.8 10.6 10.2 Depreciation & Amortization 12.9 14.8 17.3 EBITDA ($14.4) ($114.9) $8.2 Adjustments: (Gain) Loss on Sale of Assets (0.5) (0.0) 0.6 (Gain) Loss on Derivative (0.5) 2.5 — Non-cash Stock Compensation 0.1 1.3 3.3 Contemplated Deal Dosts — — 1.2 Transaction Expense and Advisor Fees 2.5 8.7 — Inventory Write-Down 0.4 4.8 — Impairment Expense — 94.8 — Strategic Consulting and Realignment 3.3 3.1 — Bad Debt 1.7 — — Transition Services 2.4 — — Adjusted EBITDA ($5.0) $1.3 $13.3 14

THE TRUSTED PRODUCTION SERVICES COMPANY IN THE UNITED STATES