Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Regional Management Corp. | d80311dex991.htm |

| 8-K - 8-K - Regional Management Corp. | d80311d8k.htm |

Exhibit 99.2

2Q 2020 Earnings Call Supplemental Presentation August 5, 2020

Legal Disclosures This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: changes in general economic conditions, including levels of unemployment and bankruptcies; the impact of the recent outbreak of a novel coronavirus (COVID-19), including on the Company’s access to liquidity and the credit risk of the Company’s finance receivable portfolio; risks associated with the Company’s ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support its operations and initiatives; risks associated with the Company’s loan origination and servicing software system, including the risk of prolonged system outages; risks related to opening new branches, including the ability or inability to open new branches as planned; risks inherent in making loans, including credit risk, repayment risk, and value of collateral, which risks may increase in light of adverse or recessionary economic conditions; risks associated with the implementation of new underwriting models and processes, including as to the effectiveness of new custom scorecards; risks relating to the Company’s asset-backed securitization transactions; changes in interest rates; the risk that the Company’s existing sources of liquidity become insufficient to satisfy its needs or that its access to these sources becomes unexpectedly restricted; changes in federal, state, or local laws, regulations, or regulatory policies and practices, and risks associated with the manner in which laws and regulations are interpreted, implemented, and enforced; changes in accounting standards, rules, and interpretations, and the failure of related assumptions and estimates, including those associated with the implementation of current expected credit loss (CECL) accounting; the impact of changes in tax laws, guidance, and interpretations; the timing and amount of revenues that may be recognized by the Company; changes in current revenue and expense trends (including trends affecting delinquencies and credit losses); changes in the Company’s markets and general changes in the economy (particularly in the markets served by the Company); changes in the competitive environment in which the Company operates or a decrease in the demand for its products; risks related to acquisitions; changes in operating and administrative expenses; and the departure, transition, or replacement of key personnel. The foregoing factors and others are discussed in greater detail in the Company’s filings with the SEC. The COVID-19 pandemic may also magnify many of these risks and uncertainties. The Company cannot guarantee future events, results, actions, levels of activity, performance, or achievements. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. This presentation also contains certain non-GAAP measures. Please refer to the Appendix accompanying this presentation for a reconciliation of non-GAAP measures to the most comparable GAAP measures.

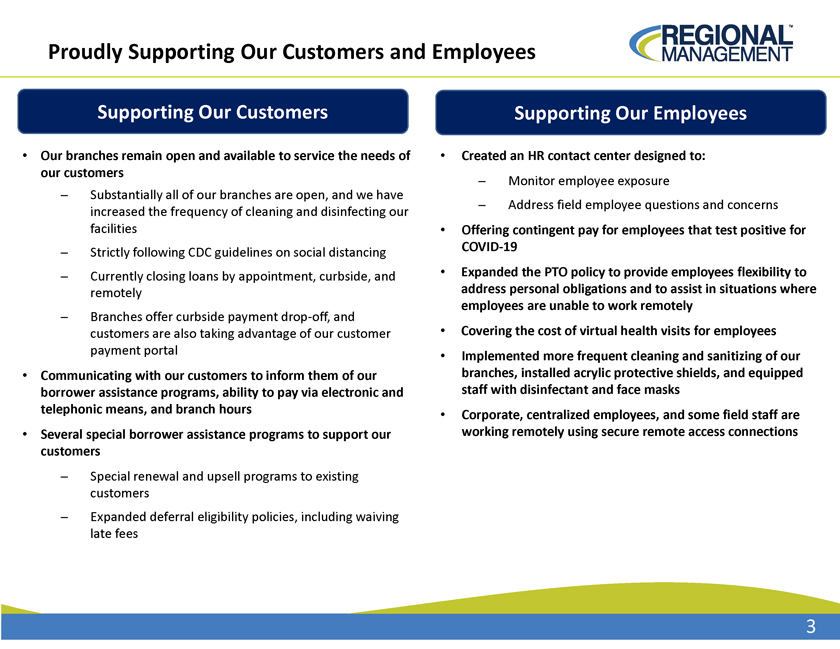

Proudly Supporting Our Customers and Employees Supporting Our Customers Our branches remain open and available to service the needs of our customers ̶ Substantially all of our branches are open, and we have increased the frequency of cleaning and disinfecting our facilities ̶ Strictly following CDC guidelines on social distancing ̶ Currently closing loans by appointment, curbside, and remotely ̶ Branches offer curbside payment drop-off, and customers are also taking advantage of our customer payment portal Communicating with our customers to inform them of our borrower assistance programs, ability to pay via electronic and telephonic means, and branch hours Several special borrower assistance programs to support our customers ̶ Special renewal and upsell programs to existing customers ̶ Expanded deferral eligibility policies, including waiving late fees Supporting Our Employees Created an HR contact center designed to: ̶ Monitor employee exposure ̶ Address field employee questions and concerns Offering contingent pay for employees that test positive for COVID-19 Expanded the PTO policy to provide employees flexibility to address personal obligations and to assist in situations where employees are unable to work remotely Covering the cost of virtual health visits for employees Implemented more frequent cleaning and sanitizing of our branches, installed acrylic protective shields, and equipped staff with disinfectant and face masks Corporate, centralized employees, and some field staff are working remotely using secure remote access connections

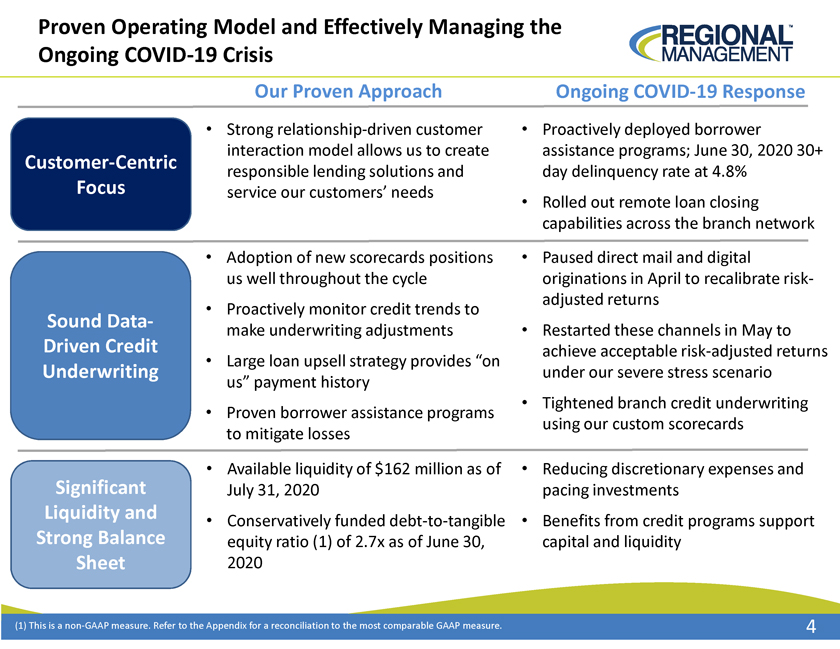

Proven Operating Model and Effectively Managing the Ongoing COVID-19 Crisis Our Proven Approach Customer-Centric Focus Sound Data-Driven Credit Underwriting Significant Liquidity and Strong Balance Sheet Strong relationship-driven customer interaction model allows us to create responsible lending solutions and service our customers’ needs Adoption of new scorecards positions us well throughout the cycle Proactively monitor credit trends to make underwriting adjustments Large loan upsell strategy provides “on us” payment history Proven borrower assistance programs to mitigate losses Available liquidity of $162 million as of July 31, 2020 Conservatively funded debt-to-tangible equity ratio (1) of 2.7x as of June 30, 2020 Ongoing COVID-19 Response Proactively deployed borrower assistance programs; June 30, 2020 30+ day delinquency rate at 4.8% Rolled out remote loan closing capabilities across the branch network Paused direct mail and digital originations in April to recalibrate risk-adjusted returns Restarted these channels in May to achieve acceptable risk-adjusted returns under our severe stress scenario Tightened branch credit underwriting using our custom scorecards Reducing discretionary expenses and pacing investments Benefits from credit programs support capital and liquidity (1) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure.

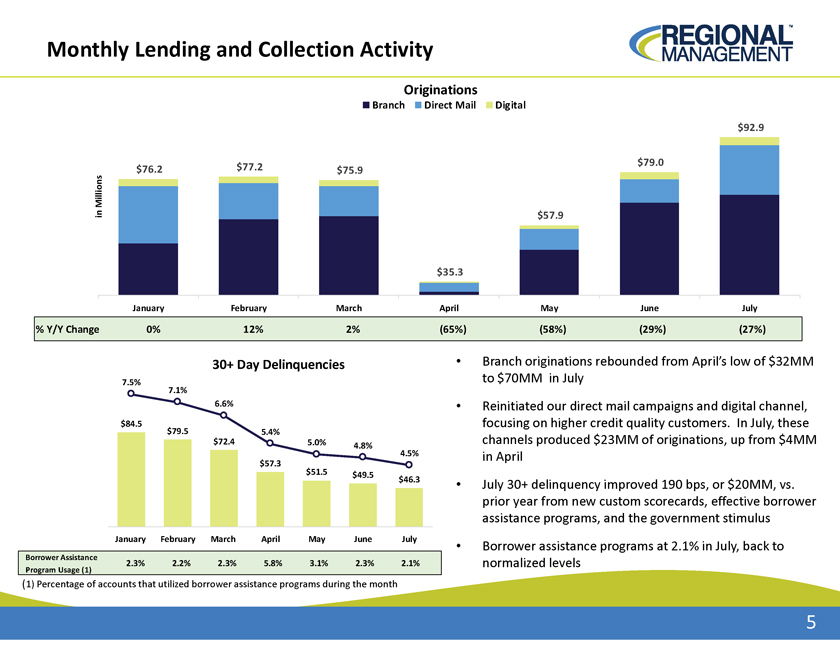

Monthly Lending and Collection Activity $76.2 $77.2 $75.9 Millions in Originations Branch Direct Mail Digital $92.9 $79.0 $57.9 $35.3 January February March April May June July % Y/Y Change 0% 12% 2% (65%) (58%) (29%) (27%) 30+ Day Delinquencies $120.0 7.5% 8 7.1% $110.0 6.6% 7 $100.0 $90.0 $84.5 $79.5 5.4% 6 $80.0 $72.4 5.0% 4.8% $70.0 4.5% 5 $57.3 $60.0 $51.5 $49.5 4 $50.0 $46.3 $40.0 3 $30.0 $20.0 2 January February March April May June July Borrower Assistance 2.3% 2.2% 2.3% 5.8% 3.1% 2.3% 2.1% Program Usage (1) Branch originations rebounded from April’s low of $32MM to $70MM in July Reinitiated our direct mail campaigns and digital channel, focusing on higher credit quality customers. In July, these channels produced $23MM of originations, up from $4MM in April July 30+ delinquency improved 190 bps, or $20MM, vs. prior year from new custom scorecards, effective borrower assistance programs, and the government stimulus Borrower assistance programs at 2.1% in July, back to normalized levels (1) Percentage of accounts that utilized borrower assistance programs during the month

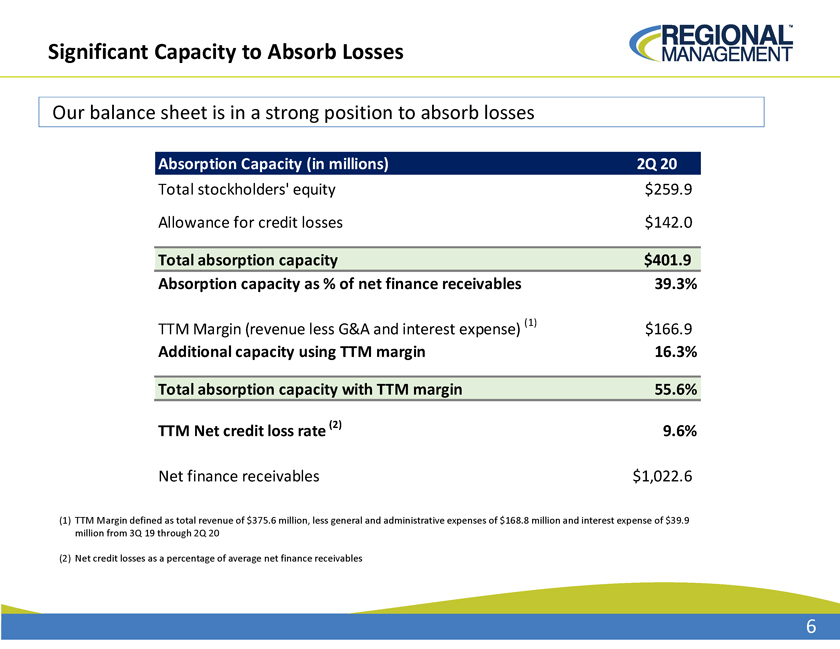

Significant Capacity to Absorb Losses Our balance sheet is in a strong position to absorb losses Absorption Capacity (in millions) 2Q 20 Total stockholders’ equity $259.9 Allowance for credit losses $142.0 Total absorption capacity $401.9 Absorption capacity as % of net finance receivables 39.3% TTM Margin (revenue less G&A and interest expense) (1) $166.9 Additional capacity using TTM margin 16.3% Total absorption capacity with TTM margin 55.6% TTM Net credit loss rate (2) 9.6% Net finance receivables $1,022.6 (1) TTM Margin defined as total revenue of $375.6million, less general and administrative expenses of $168.8million and interest expense of $39.9 million from 3Q 19 through 2Q 20 (2) Net credit losses as a percentage of average net finance receivables

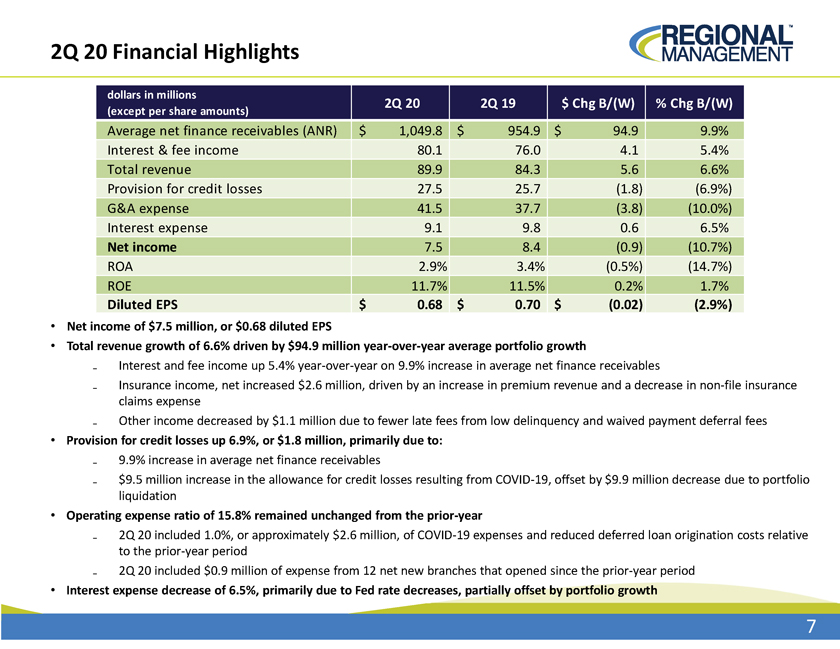

2Q 20 Financial Highlights dollars in millions 2Q 20 2Q 19 $ Chg B/(W) % Chg B/(W) (except per share amounts) Average net finance receivables (ANR) $ 1,049.8 $ 954.9 $ 94.9 9.9% Interest & fee income 80.1 76.0 4.1 5.4% Total revenue 89.9 84.3 5.6 6.6% Provision for credit losses 27.5 25.7 (1.8) (6.9%) G&A expense 41.5 37.7 (3.8) (10.0%) Interest expense 9.1 9.8 0.6 6.5% Net income 7.5 8.4 (0.9) (10.7%) ROA 2.9% 3.4% (0.5%) (14.7%) ROE 11.7% 11.5% 0.2% 1.7% Diluted EPS $ 0.68 $ 0.70 $ (0.02) (2.9%) Net income of $7.5 million, or $0.68 diluted EPS Total revenue growth of 6.6% driven by $94.9 million year-over-year average portfolio growth â,‹ Interest and fee income up 5.4% year-over-year on 9.9% increase in average net finance receivables â,‹ Insurance income, net increased $2.6 million, driven by an increase in premium revenue and a decrease in non-file insurance claims expense â,‹ Other income decreased by $1.1 million due to fewer late fees from low delinquency and waived payment deferral fees Provision for credit losses up 6.9%, or $1.8 million, primarily due to: â,‹ 9.9% increase in average net finance receivables â,‹ $9.5 million increase in the allowance for credit losses resulting from COVID-19, offset by $9.9 million decrease due to portfolio liquidation Operating expense ratio of 15.8% remained unchanged from the prior-year â,‹ 2Q 20 included 1.0%, or approximately $2.6 million, of COVID-19 expenses and reduced deferred loan origination costs relative to the prior-year period â,‹ 2Q 20 included $0.9million of expense from 12 net new branches that opened since the prior-year period Interest expense decrease of 6.5%, primarily due to Fed rate decreases, partially offset by portfolio growth

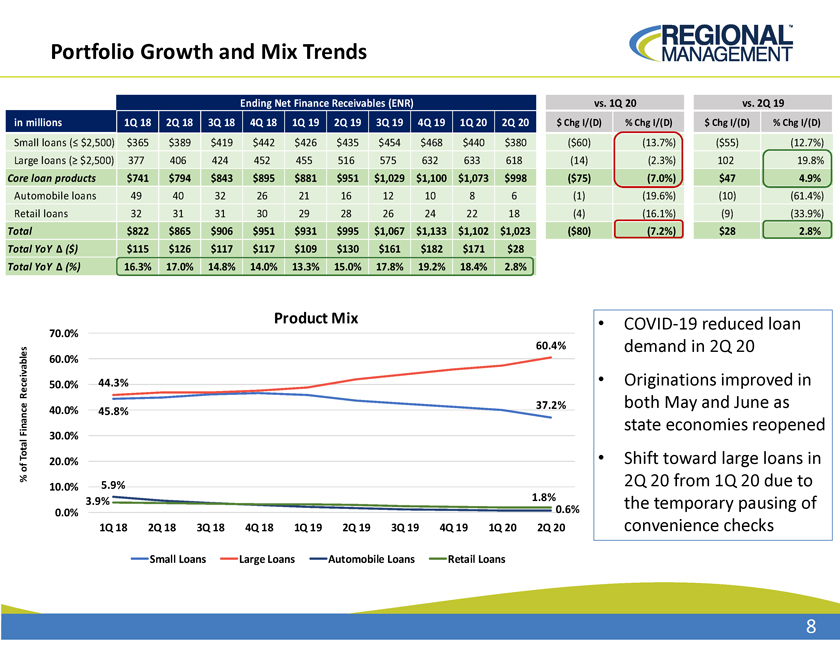

Portfolio Growth and Mix Trends Ending Net Finance Receivables (ENR) in millions 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Small loans (£ $2,500) $365 $389 $419 $442 $426 $435 $454 $468 $440 $380 Large loans (³ $2,500) 377 406 424 452 455 516 575 632 633 618 Core loan products $741 $794 $843 $895 $881 $951 $1,029 $1,100 $1,073 $998 Automobile loans 49 40 32 26 21 16 12 10 8 6 Retail loans 32 31 31 30 29 28 26 24 22 18 Total $822 $865 $906 $951 $931 $995 $1,067 $1,133 $1,102 $1,023 Total YoY Ä ($) $115 $126 $117 $117 $109 $130 $161 $182 $171 $28 Total YoY Ä (%) 16.3% 17.0% 14.8% 14.0% 13.3% 15.0% 17.8% 19.2% 18.4% 2.8% vs. 1Q 20 vs. 2Q 19 $ Chg I/(D) % Chg I/(D) $ Chg I/(D) % Chg I/(D) ($60) (13.7%) ($55) (12.7%) (14) (2.3%) 102 19.8% ($75) (7.0%) $47 4.9% (1) (19.6%) (10) (61.4%) (4) (16.1%) (9) (33.9%) ($80) (7.2%) $28 2.8% % of Total Finance Receivables Product Mix 70.0% 60.4% 60.0% 50.0% 44.3% 40.0% 37.2% 45.8% 30.0% 20.0% 10.0% 5.9% 3.9% 1.8% 0.0% 0.6% 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Small Loans Large Loans Automobile Loans Retail Loans COVID-19 reduced loan demand in 2Q 20 Originations improved in both May and June as state economies reopened Shift toward large loans in 2Q 20 from 1Q 20 due to the temporary pausing of convenience checks

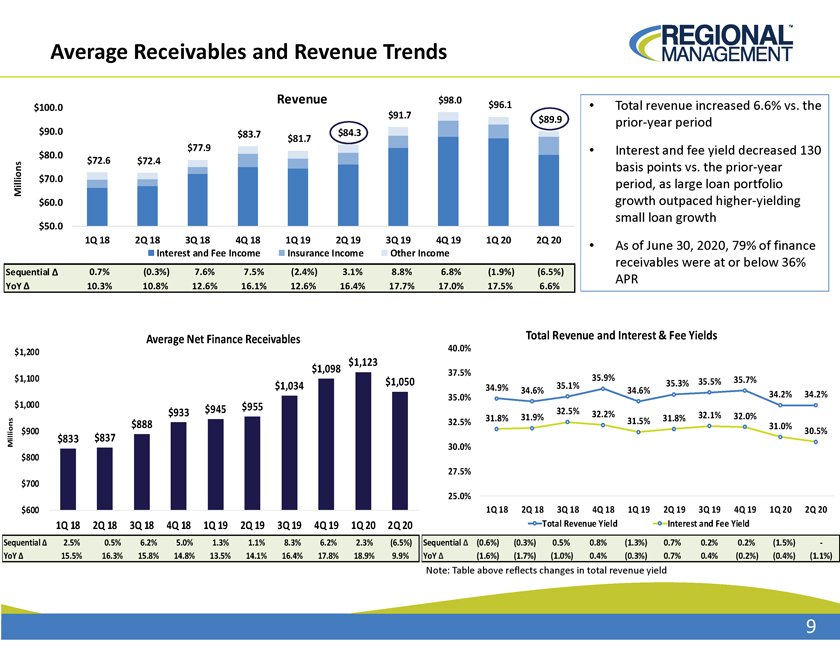

Average Receivables and Revenue Trends Revenue $98.0 $96.1 $100.0 $91.7 $89.9 $90.0 $83.7 $84.3 $81.7 $77.9 $80.0 $72.6 $72.4 Millions $70.0 $60.0 $50.0 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Interest and Fee Income Insurance Income Other Income Sequential Ä 0.7% (0.3%) 7.6% 7.5% (2.4%) 3.1% 8.8% 6.8% (1.9%) (6.5%) YoY Ä 10.3% 10.8% 12.6% 16.1% 12.6% 16.4% 17.7% 17.0% 17.5% 6.6% Total revenue increased 6.6% vs. the prior-year period Interest and fee yield decreased 130 basis points vs. the prior-year period, as large loan portfolio growth outpaced higher-yielding small loan growth As of June 30, 2020, 79% of finance receivables were at or below 36% APR Average Net Finance Receivables $1,200 $1,123 $1,098 $1,100 $1,050 $1,034 $1,000 $945 $955 $888 $933 $900 Millions $833 $837 $800 $700 $600 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Sequential Ä 2.5% 0.5% 6.2% 5.0% 1.3% 1.1% 8.3% 6.2% 2.3% (6.5%) YoY Ä 15.5% 16.3% 15.8% 14.8% 13.5% 14.1% 16.4% 17.8% 18.9% 9.9% Total Revenue and Interest & Fee Yields 40.0% 37.5% 35.9% 35.3% 35.5% 35.7% 34.9% 35.1% 34.6% 34.6% 34.2% 34.2% 35.0% 32.5% 32.2% 32.1% 31.8% 31.9% 31.5% 31.8% 32.0% 32.5% 31.0% 30.5% 30.0% 27.5% 25.0% 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Total Revenue Yield Interest and Fee Yield Sequential Ä (0.6%) (0.3%) 0.5% 0.8% (1.3%) 0.7% 0.2% 0.2% (1.5%) -YoY Ä (1.6%) (1.7%) (1.0%) 0.4% (0.3%) 0.7% 0.4% (0.2%) (0.4%) (1.1%) Note: Table above reflects changes in total revenue yield

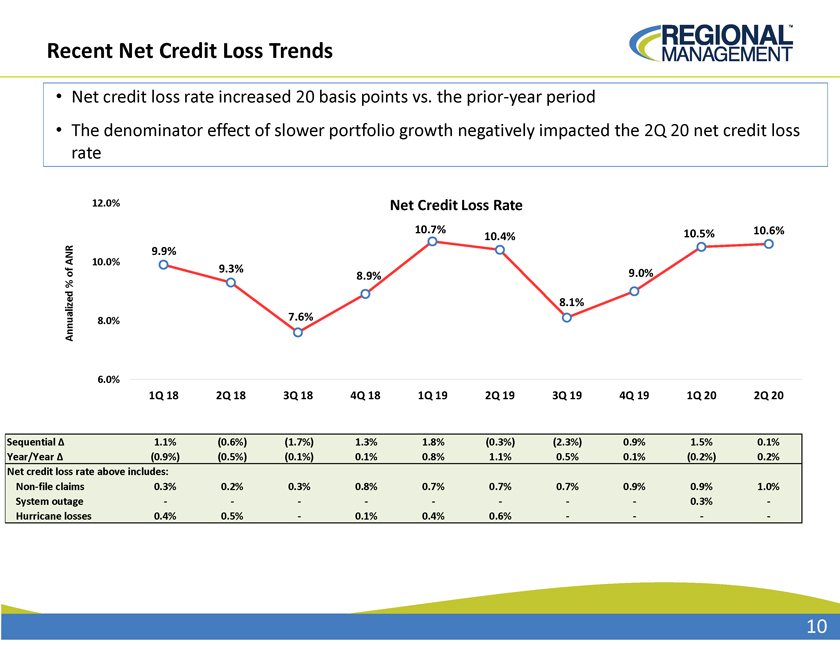

Recent Net Credit Loss Trends Net credit loss rate increased 20 basis points vs. the prior-year period The denominator effect of slower portfolio growth negatively impacted the 2Q 20 net credit loss rate 12.0% Net Credit Loss Rate 10.7% 10.5% 10.6% 10.4% ANR 10.0% 9.9% of 9.3% 8.9% 9.0% % 8.1% Annualized 8.0% 7.6% 6.0% 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Sequential Ä 1.1% (0.6%) (1.7%) 1.3% 1.8% (0.3%) (2.3%) 0.9% 1.5% 0.1% Year/Year Ä (0.9%) (0.5%) (0.1%) 0.1% 0.8% 1.1% 0.5% 0.1% (0.2%) 0.2% Net credit loss rate above includes: Non-file claims 0.3% 0.2% 0.3% 0.8% 0.7% 0.7% 0.7% 0.9% 0.9% 1.0% System outage 0.3% -Hurricane losses 0.4% 0.5% 0.1% 0.4% 0.6%

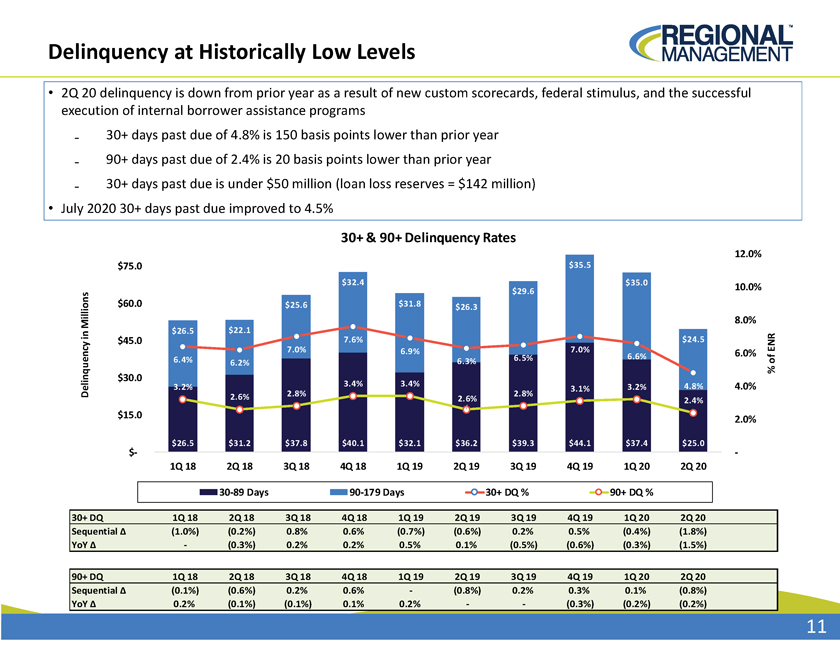

Delinquency at Historically Low Levels 2Q 20 delinquency is down from prior year as a result of new custom scorecards, federal stimulus, and the successful execution of internal borrower assistance programs â,‹ 30+ days past due of 4.8% is 150 basis points lower than prior year â,‹ 90+ days past due of 2.4% is 20 basis points lower than prior year â,‹ 30+ days past due is under $50 million (loan loss reserves = $142 million) July 2020 30+ days past due improved to 4.5% 30+ & 90+ Delinquency Rates 12.0% $75.0 $35.5 $32.4 $29.6 $35.0 10.0% $60.0 $25.6 $31.8 $26.3 Millions 8.0% in $26.5 $22.1 $45.0 7.6% $24.5 ENR 7.0% 6.9% 7.0% 6.5% 6.6% 6.0% 6.4% 6.3% of 6.2% % $30.0 3.2% 3.4% 3.4% 3.2% 4.8% 4.0% 3.1% Delinquency 2.6% 2.8% 2.8% 2.6% 2.4% $15.0 2.0% $26.5 $31.2 $37.8 $40.1 $32.1 $36.2 $39.3 $44.1 $37.4 $25.0 $ 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 30-89 Days 90-179 Days 30+ DQ % 90+ DQ % 30+ DQ 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Sequential Ä (1.0%) (0.2%) 0.8% 0.6% (0.7%) (0.6%) 0.2% 0.5% (0.4%) (1.8%) YoY Ä (0.3%) 0.2% 0.2% 0.5% 0.1% (0.5%) (0.6%) (0.3%) (1.5%) 90+ DQ 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Sequential Ä (0.1%) (0.6%) 0.2% 0.6% (0.8%) 0.2% 0.3% 0.1% (0.8%) YoY Ä 0.2% (0.1%) (0.1%) 0.1% 0.2% (0.3%) (0.2%) (0.2%)

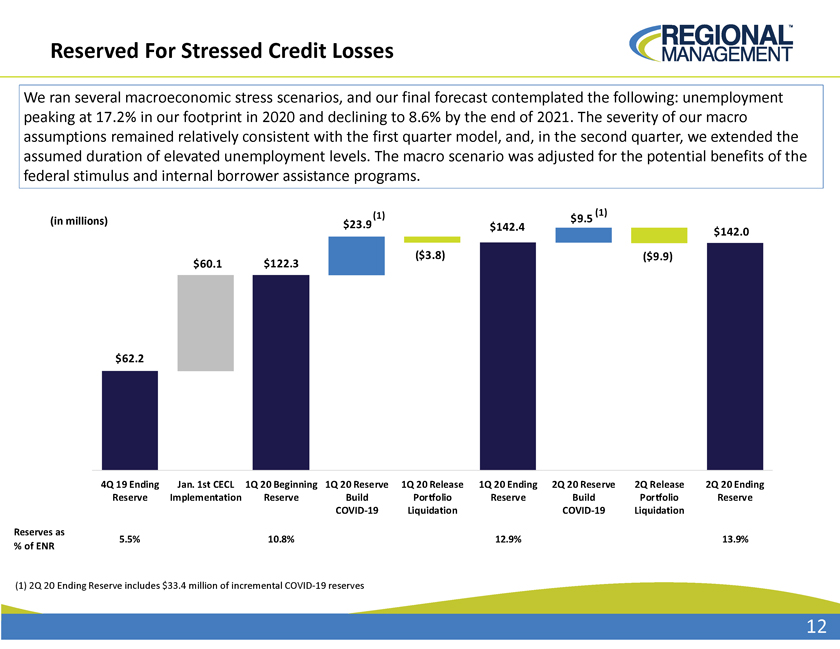

Reserved For Stressed Credit Losses We ran several macroeconomic stress scenarios, and our final forecast contemplated the following: unemployment peaking at 17.2% in our footprint in 2020 and declining to 8.6% by the end of 2021. The severity of our macro assumptions remained relatively consistent with the first quarter model, and, in the second quarter, we extended the assumed duration of elevated unemployment levels. The macro scenario was adjusted for the potential benefits of the federal stimulus and internal borrower assistance programs. (1) $9.5(1) (in millions) $23.9 $142.4 $142.0 ($3.8) ($9.9) $60.1 $122.3 $62.2 4Q 19 Ending Jan. 1st CECL 1Q 20 Beginning 1Q 20 Reserve 1Q 20 Release 1Q 20 Ending 2Q 20 Reserve 2Q Release 2Q 20 Ending Reserve Implementation Reserve Build Portfolio Reserve Build Portfolio Reserve COVID-19 Liquidation COVID-19 Liquidation Reserves as 5.5% 10.8% 12.9% 13.9% % of ENR (1) 2Q 20 Ending Reserve includes $33.4 million of incremental COVID-19 reserves

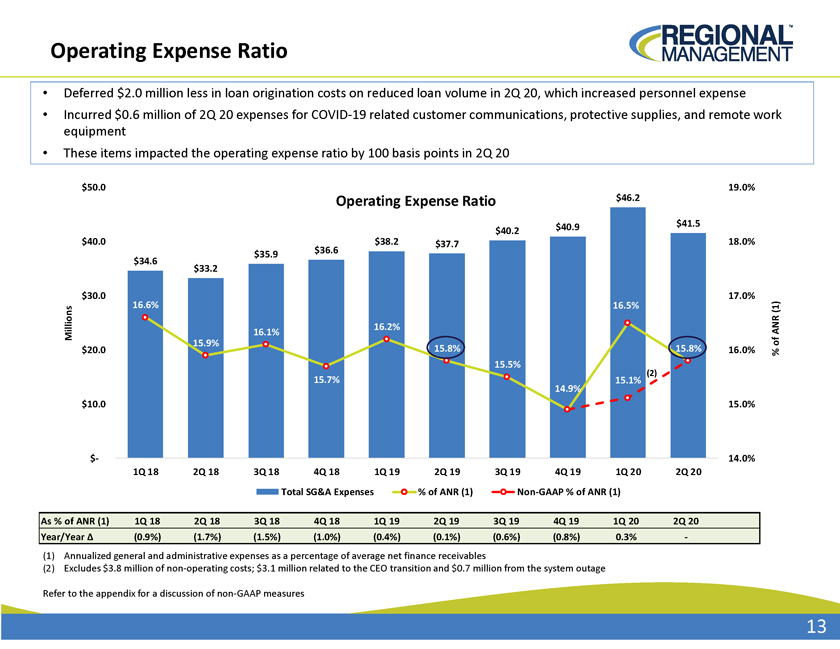

Operating Expense Ratio Deferred $2.0 million less in loan origination costs on reduced loan volume in 2Q 20, which increased personnel expense Incurred $0.6 million of 2Q 20 expenses for COVID-19 related customer communications, protective supplies, and remote work equipment These items impacted the operating expense ratio by 100 basis points in 2Q 20 $50.0 19.0% Operating Expense Ratio $46.2 $40.9 $41.5 $40.2 $40.0 $38.2 $37.7 18.0% $35.9 $36.6 $34.6 $33.2 $30.0 17.0% 16.6% 16.5% (1) 16.2% ANR 16.1% Millions of 15.9% $20.0 15.8% 15.8% 16.0% % 15.5% (2) 15.7% 15.1% 14.9% $10.0 15.0% $- 14.0% 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Total SG&A Expenses % of ANR (1) Non-GAAP % of ANR (1) As % of ANR (1) 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Year/Year Ä (0.9%) (1.7%) (1.5%) (1.0%) (0.4%) (0.1%) (0.6%) (0.8%) 0.3% (1) Annualized general and administrative expenses as a percentage of average net finance receivables (2) Excludes $3.8 million of non-operating costs; $3.1 million related to the CEO transition and $0.7 million from the system outage Refer to the appendix for a discussion of non-GAAP measures

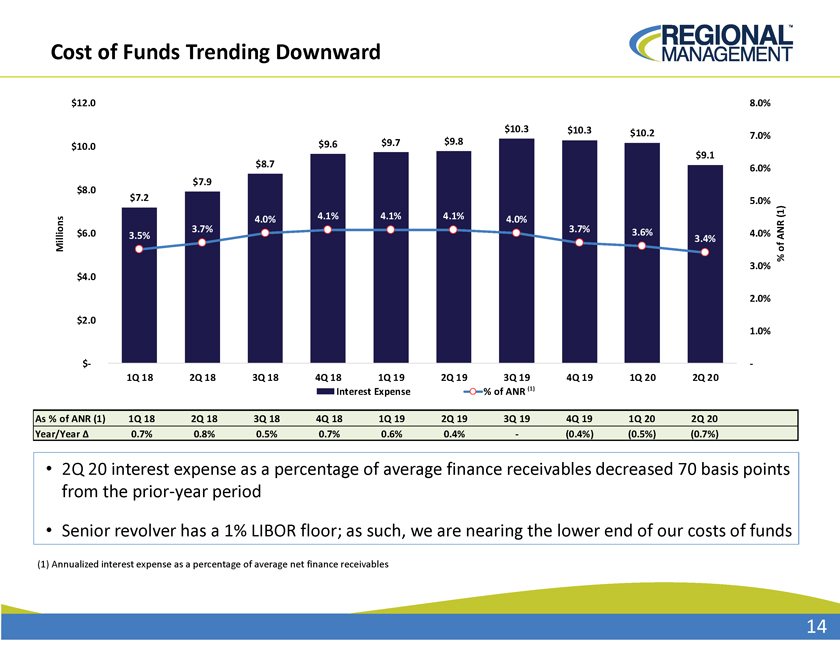

Cost of Funds Trending Downward $12.0 8.0% $10.3 $10.3 $10.2 7.0% $10.0 $9.6 $9.7 $9.8 $9.1 $8.7 6.0% $7.9 $8.0 $7.2 5.0% 4.0% 4.1% 4.1% 4.1% 4.0% (1) $6.0 3.7% 3.7% 3.6% 4.0% 3.5% 3.4% ANR Millions of % 3.0% $4.0 2.0% $2.0 1.0% $ 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Interest Expense % of ANR(1) As % of ANR (1) 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Year/Year Ä 0.7% 0.8% 0.5% 0.7% 0.6% 0.4% (0.4%) (0.5%) (0.7%) 2Q 20 interest expense as a percentage of average finance receivables decreased 70 basis points from the prior-year period Senior revolver has a 1% LIBOR floor; as such, we are nearing the lower end of our costs of funds

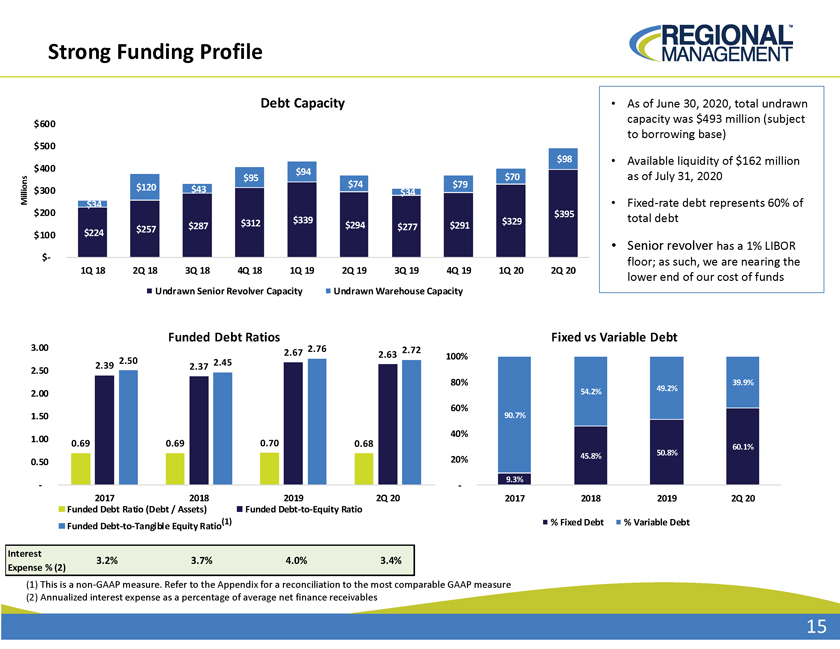

Strong Funding Profile Debt Capacity As of June 30, 2020, total undrawn $600 capacity was $493 million (subject to borrowing base) $500 $98 Available liquidity of $162 million $400 $94 $95 $70 as of July 31, 2020 $120 $43 $74 $79 Millions $300 $34 $34 Fixed-rate debt represents 60% of $200 $395 total debt $312 $339 $294 $329 $257 $287 $277 $291 $100 $224 Senior revolver has a 1% LIBOR $- floor; as such, we are nearing the 1Q 18 2Q 18 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 lower end of our cost of funds Undrawn Senior Revolver Capacity Undrawn Warehouse Capacity 3.00 Funded Debt Ratios Fixed vs Variable Debt 2.67 2.76 2.72 2.63 100% 2.50 2.45 2.50 2.39 2.37 80% 39.9% 2.00 54.2% 49.2% 60% 1.50 90.7% 40% 1.00 0.69 0.69 0.70 0.68 60.1% 45.8% 50.8% 0.50 20% 9.3% 2017 2018 2019 2Q 20 2017 2018 2019 2Q 20 Funded Debt Ratio (Debt / Assets) Funded Debt-to-Equity Ratio Funded Debt-to-Tangible Equity Ratio(1) % Fixed Debt % Variable Debt Interest 3.2% 3.7% 4.0% 3.4% Expense % (2) (1) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure (2) Annualized interest expense as a percentage of average net finance receivables

Appendix

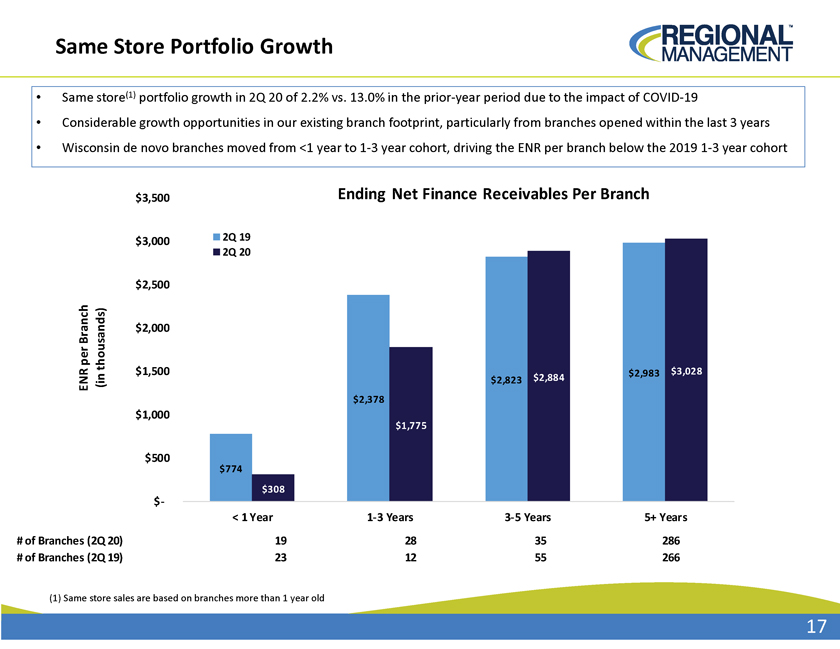

Same Store Portfolio Growth Same store(1) portfolio growth in 2Q 20 of 2.2% vs. 13.0% in the prior-year period due to the impact of COVID-19 Considerable growth opportunities in our existing branch footprint, particularly from branches opened within the last 3 years Wisconsin de novo branches moved from <1 year to 1-3 year cohort, driving the ENR per branch below the 2019 1-3 year cohort $3,500 Ending Net Finance Receivables Per Branch $3,000 2Q 19 2Q 20 $2,500 Branch $2,000 per thousands) ENR (in $1,500 $2,823 $2,884 $2,983 $3,028 $2,378 $1,000 $1,775 $500 $774 $308 $-< 1 Year 1-3 Years 3-5 Years 5+ Years # of Branches (2Q 20) 19 28 35 286 # of Branches (2Q 19) 23 12 55 266 (1) Same store sales are based on branches more than 1 year old

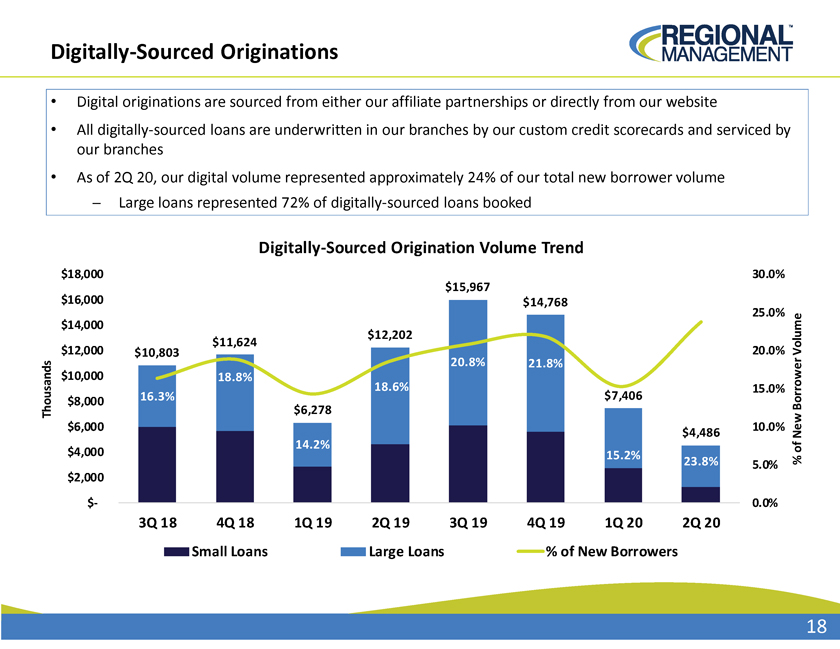

Digitally-Sourced Originations Digital originations are sourced from either our affiliate partnerships or directly from our website All digitally-sourced loans are underwritten in our branches by our custom credit scorecards and serviced by our branches As of 2Q 20, our digital volume represented approximately 24% of our total new borrower volume Large loans represented 72% of digitally-sourced loans booked Digitally-Sourced Origination Volume Trend $18,000 $15,967 30.0% $16,000 $14,768 25.0% $14,000 $12,202 $11,624 $12,000 $10,803 20.0%Volume 20.8% 21.8% $10,000 18.8% 18.6% 15.0% $8,000 16.3% $7,406 Borrower Thousands $6,278 $6,000 $4,486 10.0% New 14.2% of $4,000 15.2% 23.8% 5.0% % $2,000 $- 0.0% 3Q 18 4Q 18 1Q 19 2Q 19 3Q 19 4Q 19 1Q 20 2Q 20 Small Loans Large Loans % of New Borrowers

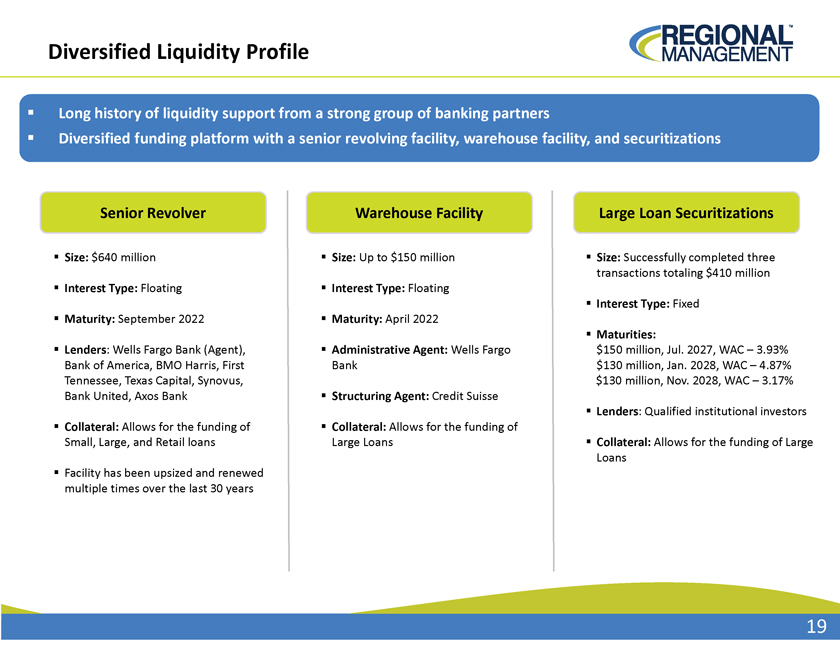

Diversified Liquidity Profile ï,§ Long history of liquidity support from a strong group of banking partners ï,§ Diversified funding platform with a senior revolving facility, warehouse facility, and securitizations Senior Revolver Warehouse Facility Large Loan Securitizations ï,§ Size:$640 millionï,§ Size: Up to $150 millionï,§ Size: Successfully completed three transactions totaling $410 million ï,§ Interest Type: Floatingï,§ Interest Type: Floating ï,§ Interest Type: Fixed ï,§ Maturity: September 2022ï,§ Maturity: April 2022 ï,§ Maturities: ï,§ Lenders: Wells Fargo Bank (Agent), ï,§ Administrative Agent: Wells Fargo $150 million, Jul. 2027, WAC –3.93% Bank of America, BMO Harris, First Bank $130 million, Jan. 2028, WAC –4.87% Tennessee, Texas Capital, Synovus, $130 million, Nov. 2028, WAC –3.17% Bank United, Axis Bankï,§ Structuring Agent: Credit Suisseï,§ Lenders: Qualified institutional investorsï,§ Collateral: Allows for the funding of ï,§ Collateral: Allows for the funding of Small, Large, and Retail loans Large Loans ï,§ Collateral: Allows for the funding of Large Loans ï,§ Facility has been upsized and renewed multiple times over the last 30 years

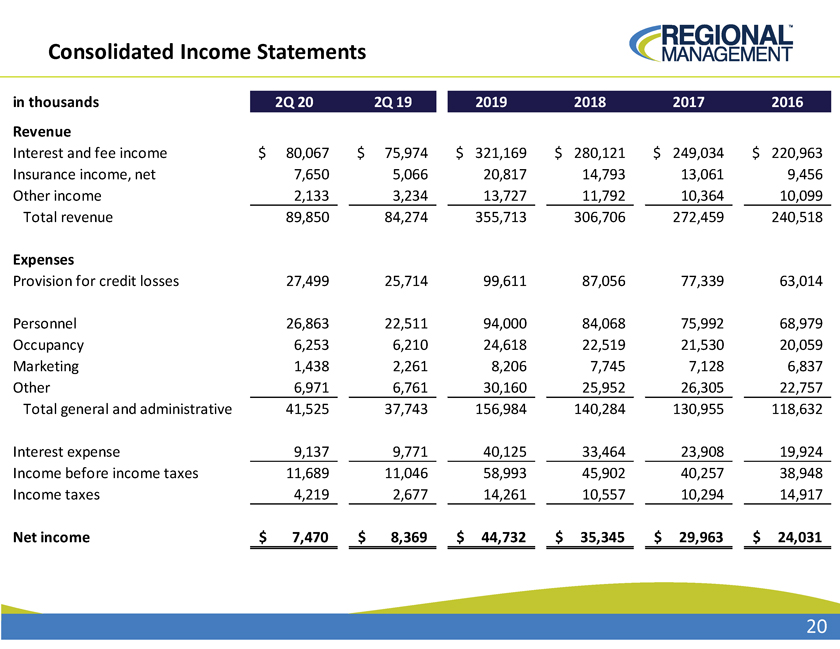

Consolidated Income Statements in thousands 2Q 20 2Q 19 2019 2018 2017 2016 Revenue Interest and fee income $ 80,067 $ 75,974 $ 321,169 $ 280,121 $ 249,034 $ 220,963 Insurance income, net 7,650 5,066 20,817 14,793 13,061 9,456 Other income 2,133 3,234 13,727 11,792 10,364 10,099 Total revenue 89,850 84,274 355,713 306,706 272,459 240,518 Expenses Provision for credit losses 27,499 25,714 99,611 87,056 77,339 63,014 Personnel 26,863 22,511 94,000 84,068 75,992 68,979 Occupancy 6,253 6,210 24,618 22,519 21,530 20,059 Marketing 1,438 2,261 8,206 7,745 7,128 6,837 Other 6,971 6,761 30,160 25,952 26,305 22,757 Total general and administrative 41,525 37,743 156,984 140,284 130,955 118,632 Interest expense 9,137 9,771 40,125 33,464 23,908 19,924 Income before income taxes 11,689 11,046 58,993 45,902 40,257 38,948 Income taxes 4,219 2,677 14,261 10,557 10,294 14,917 Net income $ 7,470 $ 8,369 $ 44,732 $ 35,345 $ 29,963 $ 24,031

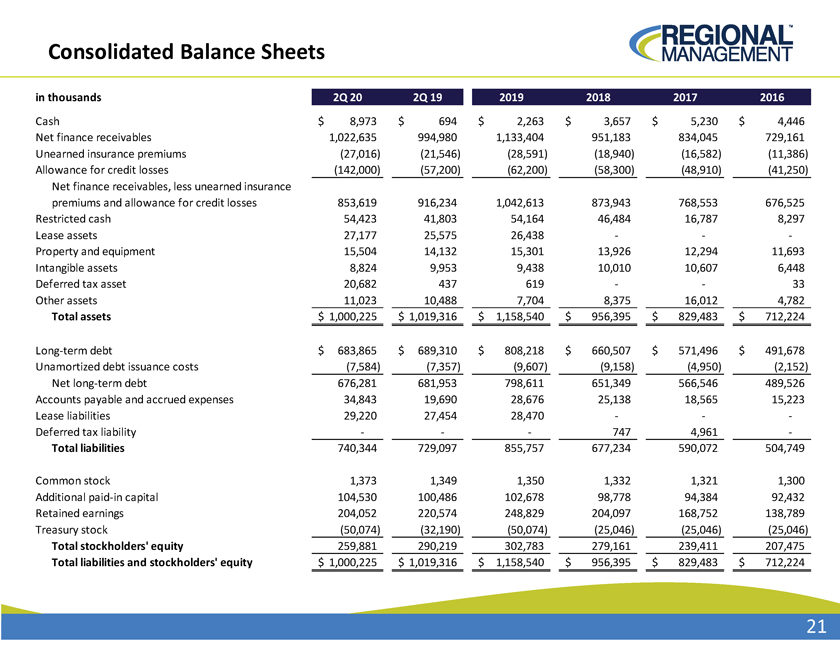

Consolidated Balance Sheets in thousands 2Q 20 2Q 19 2019 2018 2017 2016 Cash $ 8,973 $ 694 $ 2,263 $ 3,657 $ 5,230 $ 4,446 Net finance receivables 1,022,635 994,980 1,133,404 951,183 834,045 729,161 Unearned insurance premiums (27,016) (21,546) (28,591) (18,940) (16,582) (11,386) Allowance for credit losses (142,000) (57,200) (62,200) (58,300) (48,910) (41,250) Net finance receivables, less unearned insurance premiums and allowance for credit losses 853,619 916,234 1,042,613 873,943 768,553 676,525 Restricted cash 54,423 41,803 54,164 46,484 16,787 8,297 Lease assets 27,177 25,575 26,438 -Property and equipment 15,504 14,132 15,301 13,926 12,294 11,693 Intangible assets 8,824 9,953 9,438 10,010 10,607 6,448 Deferred tax asset 20,682 437 619 33 Other assets 11,023 10,488 7,704 8,375 16,012 4,782 Total assets $ 1,000,225 $ 1,019,316 $ 1,158,540 $ 956,395 $ 829,483 $ 712,224 Long-term debt $ 683,865 $ 689,310 $ 808,218 $ 660,507 $ 571,496 $ 491,678 Unamortized debt issuance costs (7,584) (7,357) (9,607) (9,158) (4,950) (2,152) Net long-term debt 676,281 681,953 798,611 651,349 566,546 489,526 Accounts payable and accrued expenses 34,843 19,690 28,676 25,138 18,565 15,223 Lease liabilities 29,220 27,454 28,470 -Deferred tax liability 747 4,961 -Total liabilities 740,344 729,097 855,757 677,234 590,072 504,749 Common stock 1,373 1,349 1,350 1,332 1,321 1,300 Additional paid-in capital 104,530 100,486 102,678 98,778 94,384 92,432 Retained earnings 204,052 220,574 248,829 204,097 168,752 138,789 Treasury stock (50,074) (32,190) (50,074) (25,046) (25,046) (25,046) Total stockholders’ equity 259,881 290,219 302,783 279,161 239,411 207,475 Total liabilities and stockholders’ equity $ 1,000,225 $ 1,019,316 $ 1,158,540 $ 956,395 $ 829,483 $ 712,224

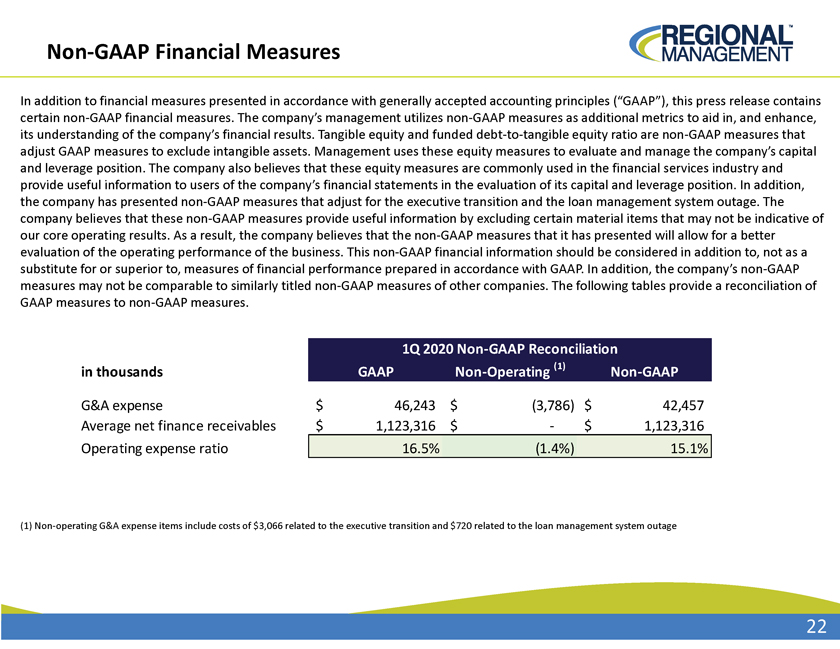

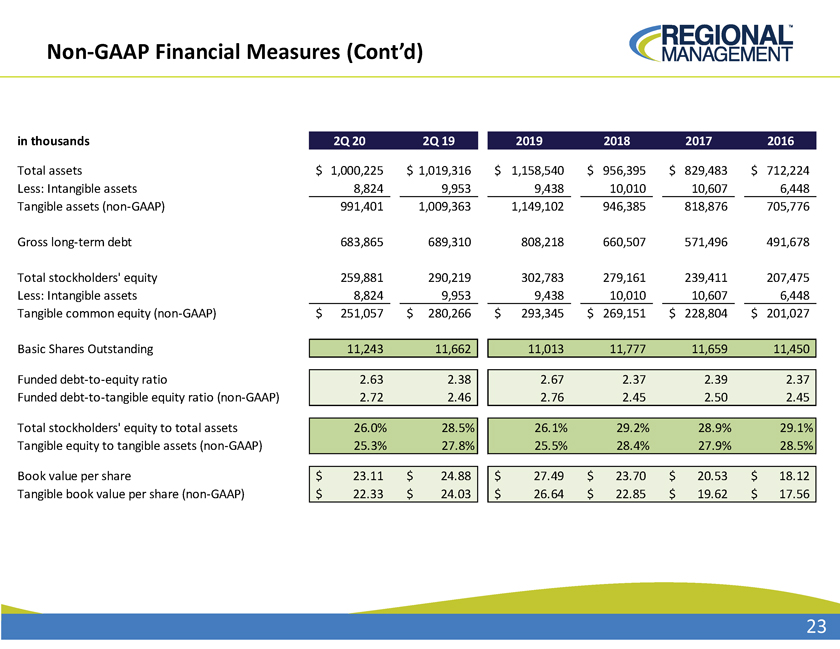

In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), this press release contains certain non-GAAP financial measures. The company’s management utilizes non-GAAP measures as additional metrics to aid in, and enhance, its understanding of the company’s financial results. Tangible equity and funded debt-to-tangible equity ratio are non-GAAP measures that adjust GAAP measures to exclude intangible assets. Management uses these equity measures to evaluate and manage the company’s capital and leverage position. The company also believes that these equity measures are commonly used in the financial services industry and provide useful information to users of the company’s financial statements in the evaluation of its capital and leverage position. In addition, the company has presented non-GAAP measures that adjust for the executive transition and the loan management system outage. The company believes that these non-GAAP measures provide useful information by excluding certain material items that may not be indicative of our core operating results. As a result, the company believes that the non-GAAP measures that it has presented will allow for a better evaluation of the operating performance of the business. This non-GAAP financial information should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. In addition, the company’s on-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies. The following tables provide a reconciliation of GAAP measures to non-GAAP measures. 1Q 2020 Non-GAAP Reconciliation in thousands GAAP Non-Operating (1) Non-GAAP G&A expense $ 46,243 $ (3,786) $ 42,457 Average net finance receivables $ 1,123,316 $ $ 1,123,316 Operating expense ratio 16.5% (1.4%) 15.1% (1) Non-operating G&A expense items include costs of $3,066 related to the executive transition and $720 related to the loan management system outage

Non-GAAP Financial Measures (Cont’d) in thousands 2Q 20 2Q 19 2019 2018 2017 2016 Total assets $ 1,000,225 $ 1,019,316 $ 1,158,540 $ 956,395 $ 829,483 $ 712,224 Less: Intangible assets 8,824 9,953 9,438 10,010 10,607 6,448 Tangible assets (non-GAAP) 991,401 1,009,363 1,149,102 946,385 818,876 705,776 Gross long-term debt 683,865 689,310 808,218 660,507 571,496 491,678 Total stockholders’ equity 259,881 290,219 302,783 279,161 239,411 207,475 Less: Intangible assets 8,824 9,953 9,438 10,010 10,607 6,448 Tangible common equity (non-GAAP) $ 251,057 $ 280,266 $ 293,345 $ 269,151 $ 228,804 $ 201,027 Basic Shares Outstanding 11,243 11,662 11,013 11,777 11,659 11,450 Funded debt-to-equity ratio 2.63 2.38 2.67 2.37 2.39 2.37 Funded debt-to-tangible equity ratio (non-GAAP) 2.72 2.46 2.76 2.45 2.50 2.45 Total stockholders’ equity to total assets 26.0% 28.5% 26.1% 29.2% 28.9% 29.1% Tangible equity to tangible assets (non-GAAP) 25.3% 27.8% 25.5% 28.4% 27.9% 28.5% Book value per share $ 23.11 $ 24.88 $ 27.49 $ 23.70 $ 20.53 $ 18.12 Tangible book value per share (non-GAAP) $ 22.33 $ 24.03 $ 26.64 $ 22.85 $ 19.62 $ 17.56

REGIONAL MANAGEMENT RM NYSE