Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Atkore Inc. | atkr3q20exhibit991.htm |

| 8-K - 8-K - Atkore Inc. | atkr-20200804.htm |

Third Quarter 2020 Earnings Presentation August 4, 2020 1

Cautionary Statements This presentation contains forward-looking statements that are subject to known and unknown risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact included in this presentation are forward-looking statements. Forward-looking statements appearing throughout this presentation include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, financial position; results of operations; cash flows; prospects; growth strategies or expectations; customer retention; the outcome (by judgment or settlement) and costs of legal, administrative or regulatory proceedings, investigations or inspections, including, without limitation, collective, representative or any other litigation; and the impact of prevailing economic conditions. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” and other comparable terms. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K and the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Because of these risks, we caution that you should not place undue reliance on any of our forward-looking statements. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Further, any forward-looking statement speaks only as of the date on which it is made. We undertake no obligation to revise the forward-looking statements in this presentation after the date of this presentation. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys, forecasts and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations which we believe to be reasonable, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties. We present Adjusted EBITDA, Adjusted EBITDA margin (Adjusted EBITDA over Net Sales), Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio (net debt or total debt less cash and cash equivalents, over Adjusted EBITDA on trailing twelve month (“TTM”) basis) to help us describe our operating and financial performance. Adjusted EBITDA, Adjusted EBITDA margin, Net debt (total debt less cash and cash equivalents), Adjusted Net Income Per Share, and Leverage ratio are non-GAAP financial measures commonly used in our industry and have certain limitations and should not be construed as alternatives to net income, net sales and other income data measures (as determined in accordance with generally accepted accounting principles in the United States, or GAAP), or as better indicators of operating performance. Adjusted EBITDA, Adjusted EBITDA margin, Net debt, Adjusted Net Income Per Share, and Leverage ratio, as defined by us may not be comparable to similar non-GAAP measures presented by other issuers. Our presentation of such measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. See the appendix to this presentation for a reconciliation of Adjusted EBITDA to net income, Adjusted EBITDA Margin, Adjusted Net Income Per Share to Net Income Per Share, net debt to total debt, and Leverage Ratio. Fiscal Periods - The Company has a fiscal year that ends on September 30th. It is the Company's practice to establish quarterly closings using a 4-5-4 calendar. The Company's fiscal quarters end on the last Friday in December, March and June. 2

Financial Results & Business Update Strong operating results and excellent cash generation in the third quarter 2020 Key Items Delivered Net Income of $24.1M and Adjusted EBITDA1 of $63.7M in the quarter Net sales declined 22.0%, and decremental margin impacts performed better than expectations Ended Q3 with a very strong cash balance of $237.3M; net leverage ratio2 improved to 1.9x Ratified a new four year labor agreement with the United Steelworkers at our Harvey, IL manufacturing site in July Given continued market volatility and uncertainty, we expect our FY2020 Net Sales, Adjusted EBITDA and Adjusted EPS to be down approximately 10% relative to FY2019 1. See non-GAAP reconciliation in appendix. 2. Leverage ratio and TTM Adjusted EBITDA reconciliations can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020. 3

Q3 Income Statement Summary Y/Y % Q3 2020 Q3 2019 Y/Y Change ($’s in millions) Change Net Sales $384.9 $493.5 ($108.6) (22.0%) Operating Income $41.6 $59.2 ($17.6) (29.7%) Net Income $24.1 $36.6 ($12.5) (34.1%) Adjusted EBITDA1 $63.7 $88.5 ($24.8) (28.0%) Adjusted EBITDA Margin2 16.6% 17.9% (130 bps) - Net Income per Share (Diluted) $0.49 $0.75 ($0.26) (34.7%) Adjusted Net Income per Share1 (Diluted) $0.67 $1.04 ($0.37) (35.6%) 1. See non-GAAP reconciliation in appendix 2. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of Net sales 4

Consolidated Atkore Q3 2020 Bridges Q3 Net Sales Bridge Net Sales Growth $494M Volume/Mix (20.7%) $5 $385M Price (1.8%) $103 $10 $1 Acquisitions/Divestitures +1.0% FX/Other (0.5%) Total (22.0%) 2019 Volume/Mix Price M&A FX/Other 2020 Q3 Adjusted EBITDA Bridge Highlights $88M Decremental adjusted EBITDA margin of ~23% $10 $2 $64M supported by strong cost control $0 $35 $1 Excellent commercial execution in a challenging market environment 2019 Volume/Mix Price M&A Productivity/ FX/Other 2020 vs. Cost Investment/ Inflation 5

Electrical Raceway Q3 Highlights Solid execution and performance with Adjusted Q3 Q3 Y/Y EBITDA margins of 20.1% in the quarter 2020 2019 Change ($’s in millions) Volume declines were mixed between different Net Sales $286.0 $373.2 (23.4%) product categories and geographies; experienced better than expected volumes in our Focused Product Adjusted EBITDA $57.5 $76.7 (25.1%) Categories Adjusted EBITDA Margin 20.1% 20.6% (50 bps) Expanded our dedicated schedule delivery program across our network of regional distribution centers in Q3 Net Sales Bridge the U.S. $373M $5 $0 $286M $88 $4 2019 Volume/Mix Price M&A FX/Other 2020 6

Mechanical Products & Solutions Q3 Highlights Net sales declined 17.5%; large renewable energy Q3 Q3 Y/Y projects and demand for recreational equipment, 2020 2019 Change ($’s in millions) partially offset declines in volume associated with overall market conditions Net Sales $99.5 $120.6 (17.5%) Adjusted EBITDA margins were 12.3%; down 480 bps Adjusted EBITDA $12.2 $20.6 (40.6%) vs. prior year which had several higher margin Adjusted EBITDA Margin 12.3% 17.1% (480 bps) security projects Launched Unistrut Seismic Bracing Solution in our Q3 Net Sales Bridge metal framing product line $121M $0 $99M $15 $6 $1 2019 Volume/Mix Price M&A FX/Other 2020 7

Key Balance Sheet & Cash Flow Metrics ($’s in millions) As of 6/26/2020 Debt & Liquidity Review Cash and cash equivalents $237.3 Senior secured term loan of $846.1M (net of Total Debt $846.1 deferred financing costs) due in December 2023 Net Debt $608.8 No scheduled principal payments prior to maturity YTD Net cash from operating activities $156.0 Asset Based Loan (ABL) capacity of $247.8M as YTD Capital expenditures $25.6 of June 26th; facility expires in December 2021 Facility was undrawn during the quarter YTD Free cash flow1 $130.4 TTM Adjusted EBITDA2 $317.2 YTD Stock repurchases $15.0 Leverage Ratio1 Total debt / TTM Adjusted EBITDA2 2.7 Net debt / TTM Adjusted EBITDA2 1.9 1. Free Cash Flow defined as Net cash from operating activities less capital expenditures. 2. Leverage ratio and TTM Adjusted EBITDA reconciliations can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020 8

Cash and Leverage Ratio Trends Cash & Cash Equivalents, $M +$137M vs. Prior Year 237.3 164.1 123.4 137.2 100.7 75.9 51.5 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Leverage Ratio1: Net Debt to TTM Adj. EBITDA Reduced by 0.7x 2.9 2.8 2.6 2.2 2.1 2.1 1.9 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 1. Leverage ratio and TTM Adjusted EBITDA reconciliations for all periods above can be found either in the appendix, or in Exhibit 99.1 to form 8-K filed on August 4, 2020, May 5, 2020, February 4, 2020, November 22, 2019, August 8, 2019, May 7, 2019, or February 6, 2019. 9

Financial Outlook Summary Given continued uncertainty and challenging market conditions, our primary operating assumption for Q4 is a net sales decline of approximately 15% versus prior year Outlook Summary Outlook Items for Changes to Prior FY2020 YTD FY2020 FY2020 Outlook – Note / Comment Consolidated Atkore Actual Results Outlook Favorable / (Unfavorable) Net Sales $1,288.0M Anticipating Net Sales, Adjusted EBITDA and Adjusted EPS to each be Down +0 to 500 bps 1 $228.4M down approximately 10% vs. prior year; however, estimate may vary due to Adjusted EBITDA ~10% vs. FY2019 vs. prior estimate changes in assumptions or market conditions Adjusted EPS1 $2.60 Interest Expense $30.6M $40 – $42M $0M / $3M Outlook based on amounts related to term loan Tax Rate 22.9% ~24% – Capital Expenditures $25.6M $28 – $32M ($8M) / ($7M) Up from prior estimate of $20 – $25M Diluted Shares Outstanding2 48.1 ~48 – 1. Reconciliation of the forward-looking full-year 2020 outlook for Adjusted EBITDA and Adjusted EPS is not being provided as the Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation. 10 2. Represents weighted-average shares outstanding in millions used in calculation of Adjusted EPS outlook.

Our New Logo and Tagline Building Better Together. It’s more than a tagline. It’s how we think, how we conduct business and is a true commitment to our employees, customers, suppliers, shareholders and society that we will build better together. 11

Appendix

SegmentAdjusted Information Earnings Per Share Reconciliation Three months ended June 26, 2020 June 28, 2019 Adjusted Adjusted Adjusted EBITDA Adjusted EBITDA (in thousands) Net sales EBITDA Margin Net sales EBITDA Margin Electrical Raceway $ 286,046 $ 57,455 20.1 % $ 373,229 $ 76,721 20.6 % Mechanical Products & Solutions 99,487 12,243 12.3 % 120,596 20,595 17.1 % Eliminations (634) (334) Consolidated operations $ 384,899 $ 493,491 13

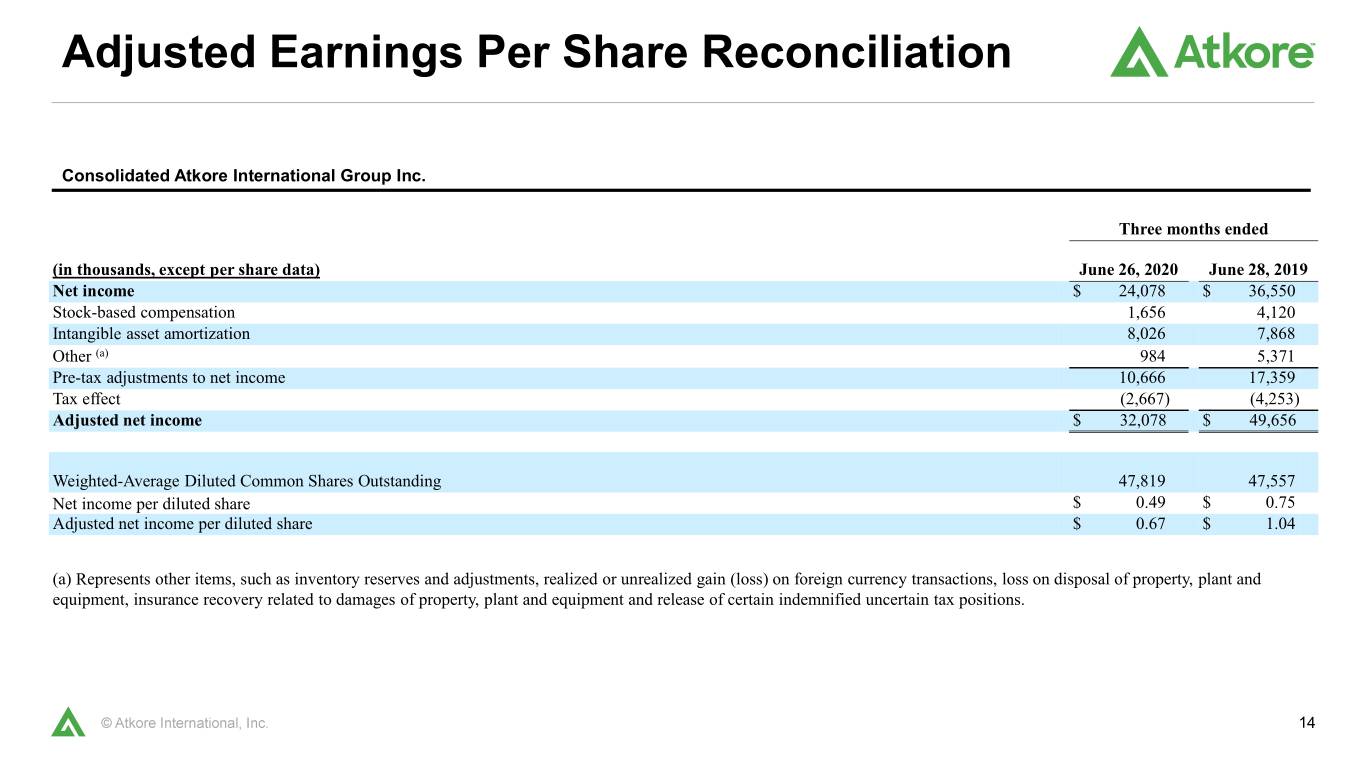

Adjusted Earnings Per Share Reconciliation Consolidated Atkore International Group Inc. Three months ended (in thousands, except per share data) June 26, 2020 June 28, 2019 Net income $ 24,078 $ 36,550 Stock-based compensation 1,656 4,120 Intangible asset amortization 8,026 7,868 Other (a) 984 5,371 Pre-tax adjustments to net income 10,666 17,359 Tax effect (2,667) (4,253) Adjusted net income $ 32,078 $ 49,656 Weighted-Average Diluted Common Shares Outstanding 47,819 47,557 Net income per diluted share $ 0.49 $ 0.75 Adjusted net income per diluted share $ 0.67 $ 1.04 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 14

Net Income to Adjusted EBITDA Reconciliation Consolidated Atkore International Group Inc. Three months ended (in thousands) June 26, 2020 June 28, 2019 Net income $ 24,078 $ 36,550 Interest expense, net 9,421 12,789 Income tax expense 8,672 11,106 Depreciation and amortization 18,316 17,760 Restructuring charges 474 709 Stock-based compensation 1,656 4,120 Transaction costs 122 76 Other (a) 984 5,371 Adjusted EBITDA $ 63,723 $ 88,481 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 15

Trailing Twelve Month Adjusted EBITDA Consolidated Atkore International Group Inc. TTM Three months ended June 26, June 26, March 27, December September (in thousands) 2020 2020 2020 27, 2019 30, 2019 Net income $ 144,058 $ 24,078 $ 39,193 $ 34,790 $ 45,997 Interest expense, net 42,801 9,421 10,564 10,620 12,196 Income tax expense 45,217 8,672 13,100 7,340 16,105 Depreciation and amortization 73,810 18,316 18,478 18,730 18,286 Restructuring charges 3,962 474 2,645 220 623 Stock-based compensation 12,164 1,656 4,523 3,123 2,862 Transaction costs 1,016 122 6 51 837 Gain on purchase of a business (7,384) — — — (7,384) Other(a) 1,605 984 (1,503) 2,836 (712) Adjusted EBITDA $ 317,249 $ 63,723 $ 87,006 $ 77,710 $ 88,810 (a) Represents other items, such as inventory reserves and adjustments, realized or unrealized gain (loss) on foreign currency transactions, loss on disposal of property, plant and equipment, insurance recovery related to damages of property, plant and equipment and release of certain indemnified uncertain tax positions. 16

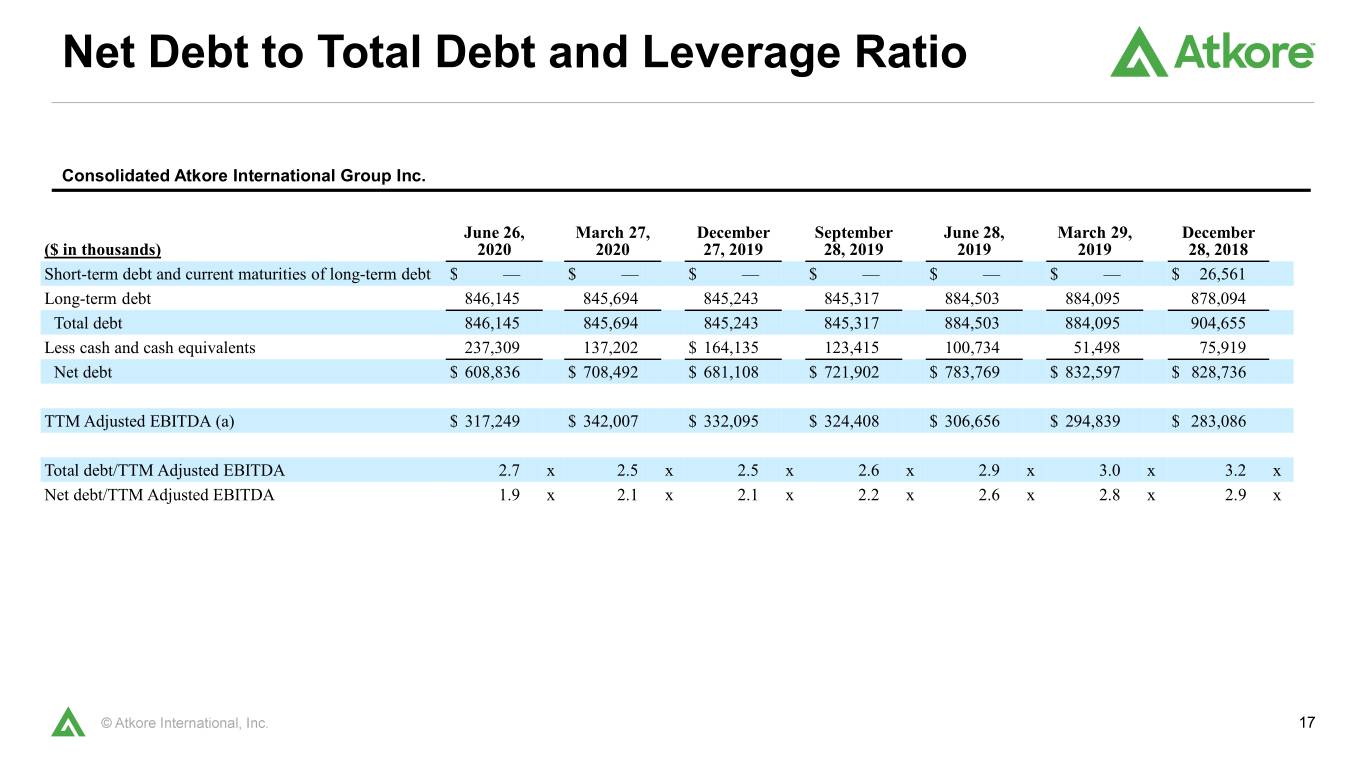

Net DebtAdjusted to Total Earnings Debt Per and Share Leverage Reconciliation Ratio Consolidated Atkore International Group Inc. June 26, March 27, December September June 28, March 29, December ($ in thousands) 2020 2020 27, 2019 28, 2019 2019 2019 28, 2018 Short-term debt and current maturities of long-term debt $ — $ — $ — $ — $ — $ — $ 26,561 Long-term debt 846,145 845,694 845,243 845,317 884,503 884,095 878,094 Total debt 846,145 845,694 845,243 845,317 884,503 884,095 904,655 Less cash and cash equivalents 237,309 137,202 $ 164,135 123,415 100,734 51,498 75,919 Net debt $ 608,836 $ 708,492 $ 681,108 $ 721,902 $ 783,769 $ 832,597 $ 828,736 TTM Adjusted EBITDA (a) $ 317,249 $ 342,007 $ 332,095 $ 324,408 $ 306,656 $ 294,839 $ 283,086 Total debt/TTM Adjusted EBITDA 2.7 x 2.5 x 2.5 x 2.6 x 2.9 x 3.0 x 3.2 x Net debt/TTM Adjusted EBITDA 1.9 x 2.1 x 2.1 x 2.2 x 2.6 x 2.8 x 2.9 x 17

Free Cash Flow Reconciliation Consolidated Atkore International Group Inc. Nine months ended (in thousands) June 26, 2020 June 28, 2019 Net cash provided by operating activities $ 156,019 $ 120,179 Capital expenditures $ (25,590) $ (21,611) Free Cash Flow: $ 130,429 $ 98,568 18

Thank You! atkore.com 16100 South Lathrop Avenue, Harvey, IL 60426