Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hilton Grand Vacations Inc. | d948245d8k.htm |

| EX-99.2 - EX-99.2 - Hilton Grand Vacations Inc. | d948245dex992.htm |

Exhibit 99.1 2Q20 INVESTOR UPDATE Q U A R T E R L Y R E S U L T S A N D U P D A T E J U LY 3 0 , 2 0 2 0 0Exhibit 99.1 2Q20 INVESTOR UPDATE Q U A R T E R L Y R E S U L T S A N D U P D A T E J U LY 3 0 , 2 0 2 0 0

This slide presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements convey management’s expectations as to HGV’s future, and are based on management’s beliefs, expectations, assumptions and such plans, estimates, projections and other information available to management at the time HGV makes such statements. Forward-looking statements include all statements that are not historical facts, including those related to HGV’s revenues, earnings, cash flow and operations, and may be identified by terminology such as the words “outlook,” “believe,” “expect,” “potential,” “goal,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” predicts,” “intends,” “plans,” “estimates,” “anticipates” “future,” “guidance,” “target,” or the negative version of these words or other comparable words. HGV cautions you that forward-looking statements involve known and unknown risks, uncertainties and other factors, including those that are beyond HGV’s control, that may cause its actual results, performance or achievements to be materially different from the future results. Factors that could cause HGV’s actual results to differ materially from those contemplated by HGV’s forward-looking statements include: the material impact of the COVID-19 pandemic on HGV’s business, operating results, and financial condition; the extent and duration of the impact of the COVID-19 pandemic on global economic conditions; HGV’s ability to meet its liquidity needs; risks related to HGV’s indebtedness; inherent business risks, market trends and competition within the timeshare and hospitality industries; HGV’s ability to successfully source inventory and market, sell and finance VOIs; default rates on HGV’s financing receivables; the reputation of and HGV’s ability to access Hilton brands and programs, including the risk of a breach or termination of its license agreement with Hilton; compliance with and changes to United States and global laws and regulations, including those related to anti- corruption and privacy; risks related to HGV’s acquisitions, joint ventures, and other partnerships; HGV’s dependence on third-party development activities to secure just-in-time inventory; the performance of HGV’s information technology systems and its ability to maintain data security; regulatory proceedings or litigation; HGV’s ability to attract and retain key executives and employees with skills and capacity to meet its needs; and natural disasters or adverse geo-political conditions. Any one or more of the foregoing factors could adversely impact HGV’s operations, revenue, operating margins, financial condition and/or credit rating. For additional information regarding factors that could cause HGV’s actual results to differ materially from those expressed or implied in the forward-looking statements in this slide presentation, please see the risk factors discussed in “Part I—Item 1A. Risk Factors” of HGV’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as supplemented and updated by the risk factors discussed in “Part II-Item 1A. Risk Factors” of HGV’s subsequent Quarterly Reports on Form 10-Q, as well as those described from time to time other periodic reports that it files with the SEC. Except for HGV’s ongoing obligations to disclose material information under the federal securities laws, HGV undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, changes in management’s expectations, or otherwise. 1This slide presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements convey management’s expectations as to HGV’s future, and are based on management’s beliefs, expectations, assumptions and such plans, estimates, projections and other information available to management at the time HGV makes such statements. Forward-looking statements include all statements that are not historical facts, including those related to HGV’s revenues, earnings, cash flow and operations, and may be identified by terminology such as the words “outlook,” “believe,” “expect,” “potential,” “goal,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” predicts,” “intends,” “plans,” “estimates,” “anticipates” “future,” “guidance,” “target,” or the negative version of these words or other comparable words. HGV cautions you that forward-looking statements involve known and unknown risks, uncertainties and other factors, including those that are beyond HGV’s control, that may cause its actual results, performance or achievements to be materially different from the future results. Factors that could cause HGV’s actual results to differ materially from those contemplated by HGV’s forward-looking statements include: the material impact of the COVID-19 pandemic on HGV’s business, operating results, and financial condition; the extent and duration of the impact of the COVID-19 pandemic on global economic conditions; HGV’s ability to meet its liquidity needs; risks related to HGV’s indebtedness; inherent business risks, market trends and competition within the timeshare and hospitality industries; HGV’s ability to successfully source inventory and market, sell and finance VOIs; default rates on HGV’s financing receivables; the reputation of and HGV’s ability to access Hilton brands and programs, including the risk of a breach or termination of its license agreement with Hilton; compliance with and changes to United States and global laws and regulations, including those related to anti- corruption and privacy; risks related to HGV’s acquisitions, joint ventures, and other partnerships; HGV’s dependence on third-party development activities to secure just-in-time inventory; the performance of HGV’s information technology systems and its ability to maintain data security; regulatory proceedings or litigation; HGV’s ability to attract and retain key executives and employees with skills and capacity to meet its needs; and natural disasters or adverse geo-political conditions. Any one or more of the foregoing factors could adversely impact HGV’s operations, revenue, operating margins, financial condition and/or credit rating. For additional information regarding factors that could cause HGV’s actual results to differ materially from those expressed or implied in the forward-looking statements in this slide presentation, please see the risk factors discussed in “Part I—Item 1A. Risk Factors” of HGV’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as supplemented and updated by the risk factors discussed in “Part II-Item 1A. Risk Factors” of HGV’s subsequent Quarterly Reports on Form 10-Q, as well as those described from time to time other periodic reports that it files with the SEC. Except for HGV’s ongoing obligations to disclose material information under the federal securities laws, HGV undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, changes in management’s expectations, or otherwise. 1

EXECUTED ON KEY INITIATIVES WITHIN OUR STRATEGIC PRIORITIES 2 3 4 1 Streamline Protect Grow Safeguard spending to maintain our recurring revenue streams demand and implement our owners, guests and strong liquidity position and and embedded value opportunities to create team members optimize inventory assets incremental value Implemented HGV Enhanced Executed a $300 million term Recurring Finance and Club & Expanded our virtual sales Care Guidelines to protect our securitization at favorable terms Resort EBITDA stable vs. prior and work-from-home owners, guests, and team to bolster our liquidity year capabilities members Re-opened properties in Florida, Amended credit agreement and Launched targeted offers to Launched sales of our new Nevada, Utah, Colorado, South warehouse lending agreement to members to highlight efforts and Maui Bay Villas project Carolina, Washington DC, Las enhance our financial flexibility promote visitation Vegas, and Southern California Continued to optimize our cost Began reactivating vacation structure and improve efficiency packages to drive tour flow over the coming quarters Priorities to win the fight today… …and in the future 2 2EXECUTED ON KEY INITIATIVES WITHIN OUR STRATEGIC PRIORITIES 2 3 4 1 Streamline Protect Grow Safeguard spending to maintain our recurring revenue streams demand and implement our owners, guests and strong liquidity position and and embedded value opportunities to create team members optimize inventory assets incremental value Implemented HGV Enhanced Executed a $300 million term Recurring Finance and Club & Expanded our virtual sales Care Guidelines to protect our securitization at favorable terms Resort EBITDA stable vs. prior and work-from-home owners, guests, and team to bolster our liquidity year capabilities members Re-opened properties in Florida, Amended credit agreement and Launched targeted offers to Launched sales of our new Nevada, Utah, Colorado, South warehouse lending agreement to members to highlight efforts and Maui Bay Villas project Carolina, Washington DC, Las enhance our financial flexibility promote visitation Vegas, and Southern California Continued to optimize our cost Began reactivating vacation structure and improve efficiency packages to drive tour flow over the coming quarters Priorities to win the fight today… …and in the future 2 2

Protect 3 1 GUESTS HAVE RESPONDED POSITIVELY TO OUR ENHANCED CARE INITIATIVE “ This Ocean Oak HGV property had possibly the cleanest hotel room I've ever seen upon arrival…social distancing was handled well in all pool areas, while still allowing all guests fair access. High-touch surfaces were constantly being cleaned everywhere, including pool gates and pool entry ladders. Pool chairs and tables were sprayed and disinfected between each guest. It was impressive. And the staff performed all these functions while treating the guests very warmly, talking with folks, and not making anyone feel uncomfortable or unwelcome – in other words without breaking the ‘vacation vibe.’ We were impressed with the thoughtfulness of the protocols, the level of diligence of the HGV staff, and the friendly non- intrusive manner in which it was all implemented. Well done. We just booked another HGV property for August. ” HGV Owner Notes: 3 1. For more information, see https://www.hiltongrandvacations.com/en/news/press-releases/enhanced-care-guidelines 3 Protect 3 1 GUESTS HAVE RESPONDED POSITIVELY TO OUR ENHANCED CARE INITIATIVE “ This Ocean Oak HGV property had possibly the cleanest hotel room I've ever seen upon arrival…social distancing was handled well in all pool areas, while still allowing all guests fair access. High-touch surfaces were constantly being cleaned everywhere, including pool gates and pool entry ladders. Pool chairs and tables were sprayed and disinfected between each guest. It was impressive. And the staff performed all these functions while treating the guests very warmly, talking with folks, and not making anyone feel uncomfortable or unwelcome – in other words without breaking the ‘vacation vibe.’ We were impressed with the thoughtfulness of the protocols, the level of diligence of the HGV staff, and the friendly non- intrusive manner in which it was all implemented. Well done. We just booked another HGV property for August. ” HGV Owner Notes: 3 1. For more information, see https://www.hiltongrandvacations.com/en/news/press-releases/enhanced-care-guidelines 3

Safeguard & Protect 1 3 WE HAVE COMMENCED THE REOPENING OF RESORTS Reopening Highlights: • Properties reopened in late May: o South Carolina o Orlando o Utah o Washington, D.C. • Properties reopened during June: o Nevada o California o Colorado Sales Cycle to Ramp Over Time: • Opened on-site sales centers subsequent to resorts, ramping operations in proportion to market travel volume • Resorts in locations representing ~30% of 2019 tour flow remain closed due to government restrictions • Resorts in locations representing ~45% of Reopened 2019 tour flow in markets seeing lower Unopened occupancy levels Notes: Map licensed under CC BY-SA 4 1. Domestic resorts, as of July 15 4Safeguard & Protect 1 3 WE HAVE COMMENCED THE REOPENING OF RESORTS Reopening Highlights: • Properties reopened in late May: o South Carolina o Orlando o Utah o Washington, D.C. • Properties reopened during June: o Nevada o California o Colorado Sales Cycle to Ramp Over Time: • Opened on-site sales centers subsequent to resorts, ramping operations in proportion to market travel volume • Resorts in locations representing ~30% of 2019 tour flow remain closed due to government restrictions • Resorts in locations representing ~45% of Reopened 2019 tour flow in markets seeing lower Unopened occupancy levels Notes: Map licensed under CC BY-SA 4 1. Domestic resorts, as of July 15 4

Streamline 2 ENHANCED BALANCE SHEET FLEXIBILITY 1 Solid Liquidity Metrics Recent Balance Sheet Actions 1. Additional Near-Term Security: Through the end of 2020, our First-Lien $836M Net Leverage covenant has been expanded to 3.5x from 2.0x prior, and 2 Available liquidity 3.25x in the first half of 2021 from a prior 2.0x. 2. Enhanced Long-Term Flexibility: After June 30, 2021, our First-Lien Net 22 months 2 Leverage covenant has been expanded to 3.0x from 2.0x prior. Available liquidity 3. Liquidity Position Strengthened With Securitization: On June 10, we 8.54x completed a $300 million term securitization at a 91% advance rate and Interest coverage ratio a funding rate of 3.66%, paying down our Warehouse Credit Facility and further strengthening our liquidity position, with $733 million of 2 unrestricted cash and $836 million of available liquidity. 1.53x Total net leverage 4. Financing Flexibility Reaffirmed: Our term securitization was 14x oversubscribed underscoring the strong demand in the public markets, 0.69x and continued interest from private securitization markets can provide First-lien net leverage Note: further flexibility. 1. All figures on bank covenant basis and subject to final certification and calculation 2. Under a zero real estate and rental revenue scenario. Includes $63mm of liquidity from available collateral to borrow against the currently undrawn $450mm warehouse facility 5 5Streamline 2 ENHANCED BALANCE SHEET FLEXIBILITY 1 Solid Liquidity Metrics Recent Balance Sheet Actions 1. Additional Near-Term Security: Through the end of 2020, our First-Lien $836M Net Leverage covenant has been expanded to 3.5x from 2.0x prior, and 2 Available liquidity 3.25x in the first half of 2021 from a prior 2.0x. 2. Enhanced Long-Term Flexibility: After June 30, 2021, our First-Lien Net 22 months 2 Leverage covenant has been expanded to 3.0x from 2.0x prior. Available liquidity 3. Liquidity Position Strengthened With Securitization: On June 10, we 8.54x completed a $300 million term securitization at a 91% advance rate and Interest coverage ratio a funding rate of 3.66%, paying down our Warehouse Credit Facility and further strengthening our liquidity position, with $733 million of 2 unrestricted cash and $836 million of available liquidity. 1.53x Total net leverage 4. Financing Flexibility Reaffirmed: Our term securitization was 14x oversubscribed underscoring the strong demand in the public markets, 0.69x and continued interest from private securitization markets can provide First-lien net leverage Note: further flexibility. 1. All figures on bank covenant basis and subject to final certification and calculation 2. Under a zero real estate and rental revenue scenario. Includes $63mm of liquidity from available collateral to borrow against the currently undrawn $450mm warehouse facility 5 5

Streamline 2 NO NEAR-TERM DEBT MATURITIES 1,000 157.5 800 No material debt maturities until 2022 600 10.0 400 800.0 450.0 200 300.0 10.0 5.0 0 2020 2021 2022 2023 2024 2025 Term Loan A Credit Facility Warehouse Senior Unsecured Bonds 6 6Streamline 2 NO NEAR-TERM DEBT MATURITIES 1,000 157.5 800 No material debt maturities until 2022 600 10.0 400 800.0 450.0 200 300.0 10.0 5.0 0 2020 2021 2022 2023 2024 2025 Term Loan A Credit Facility Warehouse Senior Unsecured Bonds 6 6

Protect 3 TIMESHARE OFFERING IS WELL POSITIONED TO LEAD OUT OF THE CRISIS Properties conducive to social Limited exposure to volatility in Minimal focus on rental income distancing generally feature in- asset values focus on selling out available inventory primarily used room full kitchen, washer/dryer projects vs. long-term asset to support sales with tour guests, and more square footage, speculation rather than rental reducing reliance on common areas Low observed price elasticity vs. Limited maintenance capital Dedicated focus on leisure traditional lodging expenditures by timeshare travelers insulated from exposure developer; funded in full by to business travel Owners each year 7 7Protect 3 TIMESHARE OFFERING IS WELL POSITIONED TO LEAD OUT OF THE CRISIS Properties conducive to social Limited exposure to volatility in Minimal focus on rental income distancing generally feature in- asset values focus on selling out available inventory primarily used room full kitchen, washer/dryer projects vs. long-term asset to support sales with tour guests, and more square footage, speculation rather than rental reducing reliance on common areas Low observed price elasticity vs. Limited maintenance capital Dedicated focus on leisure traditional lodging expenditures by timeshare travelers insulated from exposure developer; funded in full by to business travel Owners each year 7 7

Protect 3 SIGNIFICANT EMBEDDED VALUE REMAINS EVEN IN A TOPLINE PAUSE 1 SCENARIO 2 FINANCING– 69% MARGIN ▪ Profits from existing loans and future owner upgrades ▪ 66% of buyers finance their purchases ▪ Typically 10-year fixed-rate secured loans with average coupon rates of approximately 12.5% 2 CLUB AND RESORT MANAGEMENT – 76% MARGIN +$1.4B ▪ Profits from current owners ▪ 2019 average Club and Resort Management revenue per member is $586 2 +$1.2B REAL ESTATE – 29% MARGIN ▪ Profits from current owners’ future upgrades +$1.0B ▪ For each $1 of initial purchase, on average owners will purchase another $1.17 in additional upgrades over 20 years Total: $3.6B THE EMBEDDED VALUE OF OUR OWNER BASE HAS INCREASED BY 3.5X (10% CAGR) SINCE 2007 Note: Ten-year cumulative margin, not discounted Source: HGV internal data Notes: Embedded value considers total expected nominal margin over 10-year period, not discounted; Does not account for license fees, taxes, perpetuity of Club dues, assumes current cost of securitization 1. Assumes contract sales remain at zero for the remainder of 2020 8 2. Represents 2019 margin for line of business 8Protect 3 SIGNIFICANT EMBEDDED VALUE REMAINS EVEN IN A TOPLINE PAUSE 1 SCENARIO 2 FINANCING– 69% MARGIN ▪ Profits from existing loans and future owner upgrades ▪ 66% of buyers finance their purchases ▪ Typically 10-year fixed-rate secured loans with average coupon rates of approximately 12.5% 2 CLUB AND RESORT MANAGEMENT – 76% MARGIN +$1.4B ▪ Profits from current owners ▪ 2019 average Club and Resort Management revenue per member is $586 2 +$1.2B REAL ESTATE – 29% MARGIN ▪ Profits from current owners’ future upgrades +$1.0B ▪ For each $1 of initial purchase, on average owners will purchase another $1.17 in additional upgrades over 20 years Total: $3.6B THE EMBEDDED VALUE OF OUR OWNER BASE HAS INCREASED BY 3.5X (10% CAGR) SINCE 2007 Note: Ten-year cumulative margin, not discounted Source: HGV internal data Notes: Embedded value considers total expected nominal margin over 10-year period, not discounted; Does not account for license fees, taxes, perpetuity of Club dues, assumes current cost of securitization 1. Assumes contract sales remain at zero for the remainder of 2020 8 2. Represents 2019 margin for line of business 8

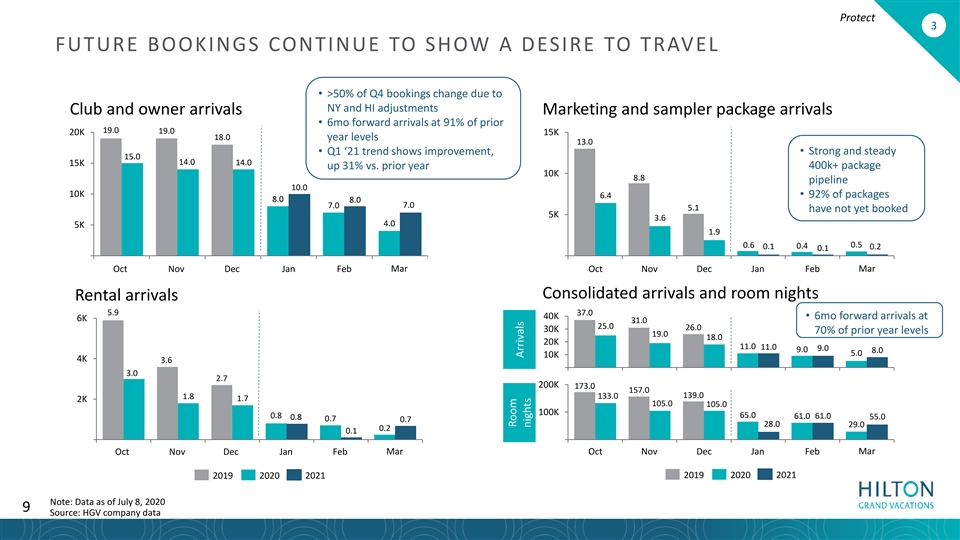

Protect 3 FUTURE BOOKINGS CONTINUE TO SHOW A DESIRE TO TRAVEL • >50% of Q4 bookings change due to NY and HI adjustments Club and owner arrivals Marketing and sampler package arrivals • 6mo forward arrivals at 91% of prior 19.0 19.0 20K 15K 18.0 year levels 13.0 • Q1 ‘21 trend shows improvement, • Strong and steady 15.0 14.0 14.0 15K up 31% vs. prior year 400k+ package 10K 8.8 pipeline 10.0 10K 6.4• 92% of packages 8.0 8.0 7.0 7.0 5.1 have not yet booked 5K 3.6 4.0 5K 1.9 0.5 0.6 0.1 0.4 0.2 0.1 Oct Nov Dec Jan Feb Mar Oct Nov Dec Jan Feb Mar Consolidated arrivals and room nights Rental arrivals 5.9 37.0 40K• 6mo forward arrivals at 6K 31.0 25.0 26.0 30K 70% of prior year levels 19.0 18.0 20K 11.0 11.0 9.0 9.0 8.0 5.0 10K 4K 3.6 3.0 2.7 200K 173.0 157.0 139.0 1.8 133.0 1.7 2K 105.0 105.0 100K 0.8 65.0 61.0 61.0 55.0 0.8 0.7 0.7 28.0 29.0 0.2 0.1 Mar Oct Nov Dec Jan Feb Mar Oct Nov Dec Jan Feb 2019 2020 2021 2019 2020 2021 Note: Data as of July 8, 2020 9 Source: HGV company data 9 Room Arrivals nightsProtect 3 FUTURE BOOKINGS CONTINUE TO SHOW A DESIRE TO TRAVEL • >50% of Q4 bookings change due to NY and HI adjustments Club and owner arrivals Marketing and sampler package arrivals • 6mo forward arrivals at 91% of prior 19.0 19.0 20K 15K 18.0 year levels 13.0 • Q1 ‘21 trend shows improvement, • Strong and steady 15.0 14.0 14.0 15K up 31% vs. prior year 400k+ package 10K 8.8 pipeline 10.0 10K 6.4• 92% of packages 8.0 8.0 7.0 7.0 5.1 have not yet booked 5K 3.6 4.0 5K 1.9 0.5 0.6 0.1 0.4 0.2 0.1 Oct Nov Dec Jan Feb Mar Oct Nov Dec Jan Feb Mar Consolidated arrivals and room nights Rental arrivals 5.9 37.0 40K• 6mo forward arrivals at 6K 31.0 25.0 26.0 30K 70% of prior year levels 19.0 18.0 20K 11.0 11.0 9.0 9.0 8.0 5.0 10K 4K 3.6 3.0 2.7 200K 173.0 157.0 139.0 1.8 133.0 1.7 2K 105.0 105.0 100K 0.8 65.0 61.0 61.0 55.0 0.8 0.7 0.7 28.0 29.0 0.2 0.1 Mar Oct Nov Dec Jan Feb Mar Oct Nov Dec Jan Feb 2019 2020 2021 2019 2020 2021 Note: Data as of July 8, 2020 9 Source: HGV company data 9 Room Arrivals nights

Grow 4 NEW INVENTORY OFFERINGS AND MARKETING PACKAGE PIPELINE REBOUND • 92% of packages WILL BE A DRIVER OF FUTURE TOURS still un-booked vs 77% in prior year Stable Package Pipeline Maui Bay Villas 400K 40k tours 300K 200K 100K Booked Un-booked Package Sales Regaining Momentum Percent of Prior Year Levels 50% • Demand for vacation 40% packages has continued through pandemic 30% 20% 10% Apr'20 May'20 Jun'20 Jul'20 (1) Source: HGV company data 10 1. Data through July 20, 2020 10Grow 4 NEW INVENTORY OFFERINGS AND MARKETING PACKAGE PIPELINE REBOUND • 92% of packages WILL BE A DRIVER OF FUTURE TOURS still un-booked vs 77% in prior year Stable Package Pipeline Maui Bay Villas 400K 40k tours 300K 200K 100K Booked Un-booked Package Sales Regaining Momentum Percent of Prior Year Levels 50% • Demand for vacation 40% packages has continued through pandemic 30% 20% 10% Apr'20 May'20 Jun'20 Jul'20 (1) Source: HGV company data 10 1. Data through July 20, 2020 10

Protect 3 OUR DEFERRAL REQUESTS HAVE DECLINED MATERIALLY SINCE THE START O F THE PANDEMIC, AND REPRESENT ONLY 2% OF OUR PORTFOLIO BALANCE Requests Per Week Cumulative Deferral Requests 600 4,000 3,500 500 3,000 400 2,500 300 2,000 1,500 200 1,000 100 500 4/20 4/27 5/4 5/11 5/18 5/25 6/1 6/8 6/15 6/22 6/29 7/6 11 11Protect 3 OUR DEFERRAL REQUESTS HAVE DECLINED MATERIALLY SINCE THE START O F THE PANDEMIC, AND REPRESENT ONLY 2% OF OUR PORTFOLIO BALANCE Requests Per Week Cumulative Deferral Requests 600 4,000 3,500 500 3,000 400 2,500 300 2,000 1,500 200 1,000 100 500 4/20 4/27 5/4 5/11 5/18 5/25 6/1 6/8 6/15 6/22 6/29 7/6 11 11

1212